Form PRE 14A NOVAVAX INC For: Jun 17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

NOVAVAX, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which the transaction applies: | |

| (2) | Aggregate number of securities to which the transaction applies: | |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of the transaction: | |

| (5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials. | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

2021

proxy statement

2021

proxy statement

| NOVAVAX FYE 2020 AT A GLANCE | ||

| $476M | revenue | |

| $747M | invested in R&D | |

| 450+ | U.S. patents and pending patent applications | |

| 691 | employees, of which 83% are engaged in R&D | |

| 438,700 | total sq.ft. in U.S., Swedish, and Czech facilities | |

| DEVELOPMENT PIPELINE | |

Coronavirus ● NVX-CoV2373 ● Variant Strain (Booster and/or Bivalent) |

|

| Seasonal Influenza | |

● NanoFlu™ vaccine (Older Adults) |

|

| Combination Vaccines | |

● NanoFlu vaccine/NVX-CoV2373 |

|

● NanoFlu vaccine/RSV |

|

● NanoFlu vaccine/NVX-CoV2373/RSV |

|

Novavax, Inc. (Nasdaq: NVAX), together with our wholly-owned subsidiaries, Novavax AB and Novavax CZ, is a biotechnology company promoting improved global health through the discovery, development and commercialization of innovative vaccines to prevent serious infectious diseases and address urgent, global health needs.

We have more than a decade of experience contending with some of the world’s most devastating diseases, including COVID-19, seasonal influenza, RSV, Ebola, MERS, and SARS. Hard-won lessons and significant advances illustrate that our proven technology has tremendous potential to make a substantial contribution to public health worldwide.

Our vaccine candidates, including both our coronavirus vaccine candidate, (“NVX-CoV2373”) and our nanoparticle seasonal quadrivalent influenza vaccine candidate (“NanoFluTM” vaccine), are genetically engineered, three-dimensional nanostructures of recombinant proteins critical to disease pathogenesis.

We are also developing proprietary immune-stimulating saponin-based adjuvants at Novavax AB, our wholly-owned Swedish subsidiary. Matrix-M™ adjuvant has been shown to enhance immune responses and has been well tolerated in multiple clinical trials.

|

| LETTER FROM OUR CEO |

|

DEAR NOVAVAX STOCKHOLDER:

You are cordially invited to our Annual Meeting of Stockholders on Thursday, June 17, 2021, beginning at 8:30 a.m. Eastern Time. Due to the public health impact of the coronavirus pandemic (“COVID-19”) and to support the health and well-being of our stockholders, this year’s Annual Meeting of Stockholders will be held in a virtual meeting format only. You can virtually attend the live webcast of the Annual Meeting of Stockholders at www.virtualshareholdermeeting.com/NVAX2021. We are pleased to also provide a copy of our 2020 Annual Report to Stockholders with this Proxy Statement.

Your vote is important, and we hope you will be able to attend the Annual Meeting. You may vote over the Internet, by telephone, or, if you requested printed proxy materials, by mailing a proxy card or voting instruction form. Please review the instructions for each of your voting options described in this Proxy Statement. Also, please let us know if you plan to attend the live virtual webcast of our Annual Meeting by marking the appropriate box on the proxy card, if you requested printed proxy materials, or, if you vote by telephone or over the Internet, by indicating your plans when prompted.

We look forward to seeing you at our 2021 Annual Meeting.

|

At Novavax, our dedication to our mission necessitates that we focus efforts on a vaccine that can help global health authorities address, control, and potentially eradicate SARS-CoV-2, the virus responsible for COVID-19. We are seeking to fulfill our mission with NVX-CoV2373.

|

|

Yours truly,

[Signature] STANLEY C. ERCK President and Chief Executive Officer

, 2021

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON THURSDAY, JUNE 17, 2021 |

TO THE STOCKHOLDERS OF NOVAVAX, INC.:

NOTICE IS HEREBY GIVEN that the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of Novavax, Inc., a Delaware corporation (the “Company,” “Novavax,” “we,” or “us”), will be held:

|

WHEN |  |

VIRTUAL WEBCAST |  |

RECORD DATE | ||

Thursday, June 17, 2021 8:30 a.m. Eastern Time |

www.virtualshareholdermeeting.com/NVAX2021 | Stockholders of record at the close of business on April 20, 2021 are entitled to notice of and to vote |

Matters to Be Voted on at the Annual Meeting

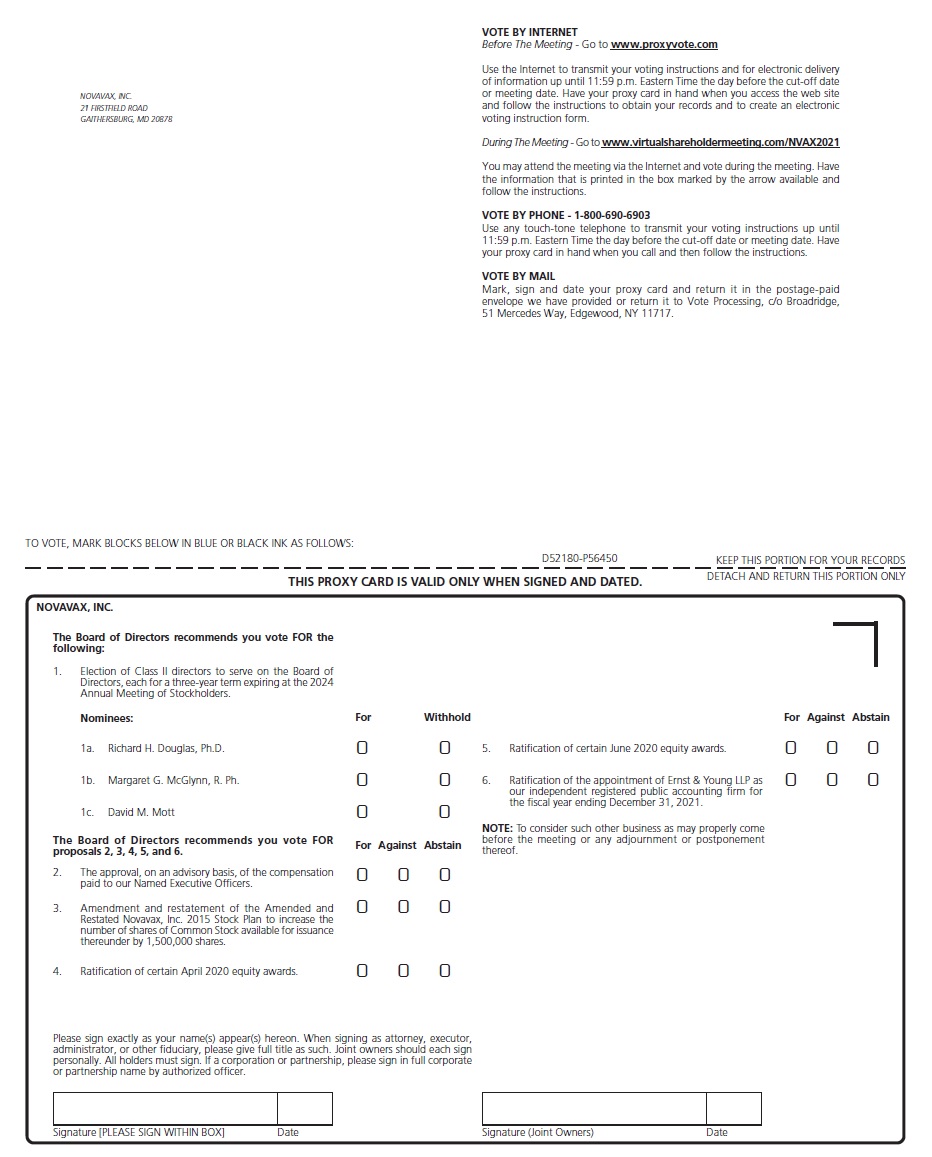

| Proposal | |

| 1 | Election of three directors as Class II directors to serve on the board of directors, each for a three-year term expiring at the 2024 Annual Meeting of Stockholders |

| 2 | Advisory vote to approve the compensation of our Named Executive Officers |

| 3 | Amendment and restatement of the Novavax, Inc. Amended and Restated 2015 Stock Incentive Plan, as amended (the “2015 Stock Plan”) to increase the number of shares of the Company’s common stock, par value $0.01 (our “Common Stock”), available for issuance thereunder by 1,500,000 shares |

| 4 | Ratification of certain April 2020 equity awards |

| 5 | Ratification of certain June 2020 equity awards |

| 6 | Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021 |

| 7 | Transaction of such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof |

The board of directors has fixed the close of business on April 20, 2021 (the “Record Date”) as the record date for determining stockholders of the Company entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof.

The following Proxy Statement is included with the Company’s Annual Report to Stockholders for the fiscal year ended December 31, 2020, which contains financial statements and other information of interest to stockholders.

|

By Order of the Board of Directors,

[Signature] JOHN A. HERRMANN III Executive

Vice President, Chief Legal Officer |

Gaithersburg, Maryland

, 2021

| Whether or not you plan to attend the virtual webcast of the annual meeting, please promptly vote over the Internet or by telephone as per the instructions on the enclosed proxy or complete, sign and date the enclosed proxy and mail it promptly in the accompanying envelope. Postage is not needed if mailed in the United States. | IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDERS ANNUAL MEETING TO BE HELD ON JUNE 17, 2021 Our Notice of Annual Meeting, Proxy Statement, and Annual Report are available free of charge at www.virtualshareholdermeeting.com/NVAX2021 | |

| PROXY STATEMENT | ||

Table of Contents

| PROXY SUMMARY |

This summary represents only selected information. You should review the entire proxy statement before voting.

Novavax, Inc. 2021 Annual Meeting of Stockholders

|

WHEN |  |

VIRTUAL WEBCAST |  |

RECORD DATE | ||

Thursday, June 17, 2021 8:30 a.m. Eastern Time |

www.virtualshareholdermeeting.com/NVAX2021 | Stockholders of record at the close of business on April 20, 2021 are entitled to notice of and to vote |

MATTERS TO BE VOTED ON AT THE ANNUAL MEETING

| Proposal | Board Recommendation | See Page | ||

| 1 | Election of three directors as Class II directors to serve on the board of directors, each for a three-year term expiring at the 2024 Annual Meeting of Stockholders |  |

FOR

all nominees |

7 |

| 2 | Advisory vote to approve the compensation of our Named Executive Officers |  |

FOR | 25 |

| 3 | Amendment and restatement of the Novavax, Inc. 2015 Stock Plan to increase the number of shares of Common Stock available for issuance thereunder by 1,500,000 shares |  |

FOR

|

52 |

| 4 | Ratification of certain April 2020 equity awards |  |

FOR | 63 |

| 5 | Ratification of certain June 2020 equity awards |  |

FOR | 63 |

| 6 | Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021 |  |

FOR | 71 |

| 7 | Transaction of such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof | |||

HOW TO VOTE

Have your Notice of Internet Availability, proxy card, or voting instruction form in hand, with your 16-digit control number available. Even if you plan to attend the virtual meeting, please vote as soon as possible to ensure your shares are represented.

1

|

|

|

|

| |

| Internet | Telephone | Virtual Device | During the Meeting | ||

| Registered Holders | Visit, 24/7 www.proxyvote.com |

Dial toll-free, 24/7 1-800-690-6903 |

Scan the QR code available on your proxy card | Return a properly executed proxy card (if received by mail) in the postage-paid envelope provided | Attend the virtual meeting at www.virtualshareholder meeting.com/NVAX2021 and follow the instructions provided during the Annual Meeting |

| Beneficial Owners (holders in street name) | The availability of telephone and Internet voting for beneficial owners will depend on the voting processes of your broker, bank, or other nominee, so please follow the voting instructions in the materials you receive | Scan the QR code if one is provided by your broker, bank, or other nominee | Return a properly executed voting instruction form by mail, depending upon the methods your broker, bank, or other nominee makes available | Contact your broker, bank, or other nominee to request a legal proxy and voting instructions | |

| Deadline | 11:59 p.m. Eastern Time on June 16, 2021 | Before the polls close at the Annual Meeting on June 17, 2021 | |||

Board of Directors

| Name and Principal Occupation | Age (1) |

Director

|

Other

Current Public Company Boards |

Independent | Committee Membership | ||||

| Audit | Compensation | Nominating

& Corporate Governance |

Research & Development | ||||||

| CLASS I DIRECTORS, FOR TERMS EXPIRING AT THE 2023 ANNUAL MEETING | |||||||||

|

Stanley C. Erck President

and Chief |

72 | 2009 | — | — | — | — | — | — |

|

Rajiv I. Modi, Ph.D. Chairman

and Managing |

60 | 2009 | — | — | — | — | — | — |

|

Gregg H. Alton, Ph.D. Former

Interim Chief |

55 | 2020 | 1 |  |

|

— | — | — |

| CLASS II DIRECTORS, FOR TERMS EXPIRING AT THE 2021 ANNUAL MEETING | |||||||||

|

Richard H. Douglas, Ph.D. Former

Senior Vice |

68 | 2010 | 1 |  |

|

|

— |  |

|

Margaret G. McGlynn, R. Ph. Former President, |

61 | 2020 | 2 |  |

— |  |

|

— |

|

Gary C. Evans Chairman

of the Board and |

63 | 1998 | 1 |  |

|

— |  |

— |

|

David M. Mott Private

Investor, |

55 | 2020 | 5 |  |

— |  |

— |  |

2

| CLASS III DIRECTORS, FOR TERMS EXPIRING IN 2022 | |||||||||

|

Rachel K. King Founder

and Chief |

61 | 2018 | 1 |  |

— |  |

|

— |

|

Michael A. McManus, Jr., J.D. Former

President and |

78 | 1998 | 1 |  |

|

|

— | — |

|

James F. Young, Ph.D. Former

Chairman of the |

68 | 2010;

since 2011 |

— |  |

— | — |  |

|

| Number of meetings in 2020 | Board―14 | Audit - 5 | Comp. - 8 | Nom. & Corp. Gov. - 9 |

— | ||||

(1) As of April 19, 2021

|

Committee Chair |  |

Committee Member |  |

Chairman of the Board |  |

Audit Committee Financial Expert |

BOARD ATTRIBUTES

|

|

|

| |||

| Independence | Diversity | Age | Tenure | |||

|

|

|

|

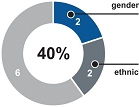

BOARD REFRESHMENT

We have added four new independent directors to our Board since 2018, including three in 2020.

3

BOARD EXPERTISE

| Audit & Accounting | Biotechnology

& Medicine |

Corporate

Governance |

Executive Leadership | Financial

Services & Investments | ||||

|

|

|

|

| ||||

| Operations | Public

Company Board Experience |

Risk Management | Strategic Planning | Technology

& Innovation | ||||

|

|

|

|

| ||||

1

ISG Stewardship Principles

Our Board and executive leaders are stewards of our stockholders’ interests, believing that strong and effective corporate governance is essential to our success. As a cornerstone of our corporate governance program, we provide transparent disclosure to our stockholders on a consistent basis. Our approach integrates all components of effective governance, including a strong ethical culture, an ongoing stockholder engagement program, sound financial, regulatory and legal compliance functions. Novavax supports and follows the Investor Stewardship Group’s (“ISG”) Corporate Governance Framework for U.S. Listed Companies. Below is an illustration how certain of our governance practices directly support each of the six ISG principles.

| ISG Principle | Novavax’s Practice |

| Boards are accountable to stockholders |

ü Separate CEO and Board Chairman roles |

| Stockholders should be entitled to voting rights in proportion to their economic interest |

ü One class of voting stock; we believe in a “one share, one vote” standard ü No “poison pill” |

| Boards should be responsive to stockholders and be proactive in order to understand their perspectives |

ü Proactive year-round engagement with stockholders ü All Directors attended at least 75% of Board and committee meetings in 2020 ü All of the then-current Board members attended the 2020 Annual Meeting ü Directors are expected to devote sufficient time and effort necessary to fulfill their respective responsibilities |

| Boards should have a strong, independent leadership structure |

ü 8 of 10 directors are independent ü Independent Board Chairman ü Regular executive sessions of independent directors ü Four fully independent standing Board committees – Audit, Compensation, Nominating and Corporate Governance, and Research and Development |

| Boards should adopt structures and practices that enhance their effectiveness |

ü 40% of directors are gender, racially, or ethnically diverse ü Average age of director nominees is 64 years ü Balance of new and experienced directors, with three new independent directors added in 2020 and average director tenure of 9.8 years ü Annual Board and committee self-evaluations |

| Boards should develop management incentive structures that are aligned with the long-term strategy of the company |

ü Annual Say-on-Pay advisory vote ü Active Board oversight of risk management ü Clawback policy ü Anti-hedging and anti-pledging policy |

5

Executive Compensation Highlights

STOCKHOLDER ENGAGEMENT

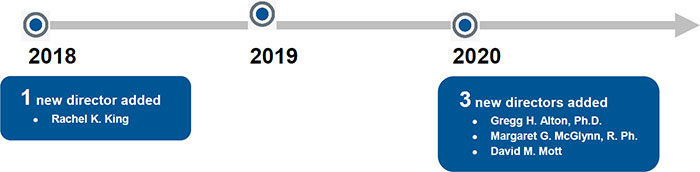

Stockholder Engagement Highlights ● We received 88% Say-on-Pay approval in 2020, up from 70% in 2019 ● We continued our Stockholder Outreach program in 2020 ● Topics discussed in connection with our Stockholder Outreach program included matters relating to our business, corporate governance, and executive compensation ● In response to stockholder feedback, in April 2020 the Compensation Committee awarded performance-vesting (as compared to time-vesting) awards to our executive officers |

|

STOCKHOLDER OUTREACH In

2020, we contacted our top of shares outstanding | |

|

SAY-ON-PAY VOTE Stockholder

approval |

COMPENSATION PHILOSOPHY AND OBJECTIVES

Our compensation program is designed to attract, retain, and reward a high-performance workforce in an extremely competitive recruitment and retention market to achieve Novavax’s mission, vision, and goals.

|

|

|

| |||

| Attract and retain highly qualified employees | Reward executives for meeting the strategic goals and objectives | Reward strong individual performance | Align executives’ interests with those of our stockholders |

COMPENSATION PROGRAM BEST PRACTICES

|

What We Do |  |

What We Do NOT Do | |||||

|

Link what we pay our Named Executive Officers (“NEOs”) to our short- and long-term performance |  |

No incentivizing excessive risk-taking that would have a material adverse effect on our business and operations | |||||

|

Base pay increases on merit |  |

No excise tax gross ups | |||||

|

Have a Compensation Committee made up of 100% independent directors |  |

Our equity plan prohibits repricing of underwater stock options or stock appreciation rights without stockholder approval | |||||

|

Engage an independent compensation consultant for competitive analysis, based on a combination of survey data and peer group data |  |

No guarantee of salary increases or bonuses | |||||

|

Have a clawback policy |  |

No single-trigger change in control provisions | |||||

|

No hedging or pledging | |||||||

6

Auditors

Ernst & Young LLP has served as our independent auditors since 2014. We are asking our stockholders to ratify the selection of Ernst & Young as our independent auditors for the fiscal year ending December 31, 2021. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting and will have an opportunity to address the Annual Meeting if they desire to do so. They will also be available to respond to appropriate questions from stockholders.

| BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

Proposal 1―Election of Directors

In accordance with the Company’s charter, the Board of Directors (the “Board”) may consist of no fewer than three directors, with the specific number to be authorized by the Board from time to time at its discretion. The Board is presently authorized to consist of ten members, and currently includes the following ten individuals.

| Class I Directors | Class II Directors | Class III Directors | ||

| Terms expiring at the 2023 Annual Meeting | Terms expiring at the 2021 Annual Meeting | Terms expiring at the 2022 Annual Meeting | ||

● Gregg H. Alton, Ph.D. ● Stanley C. Erck ● Rajiv I. Modi, Ph.D. |

● Richard H. Douglas, Ph.D. ● Margaret G. McGlynn, R. Ph. ● David M. Mott ● Gary C. Evans* |

● Rachel K. King ● Michael A. McManus, Jr., J.D. ●

James F. Young, Ph.D., | ||

* Mr. Evans will not be standing for election at the Annual Meeting.

Members of the Board are divided into three classes, designated as Class I, Class II, and Class III, each serving staggered three-year terms. The term of the Class II directors expires at the 2021 Annual Meeting. The terms of the Class III and Class I directors will expire at the 2022 and 2023 Annual Meetings of Stockholders, respectively. A director of any class who is elected by the Board to fill a vacancy resulting from an increase in the number of directors holds office for the remaining term of the class to which he or she is elected. A director who is elected by the Board to fill a vacancy arising in any other manner holds office for the remaining term of his or her predecessor. Directors elected by the stockholders at an annual meeting to succeed those whose terms expire at the meeting are of the same class as the directors they succeed and are elected for a term to expire at the third Annual Meeting of Stockholders after their election and until their successors are duly elected and qualified.

In the event of any increase or decrease in the authorized number of directors, the newly created or eliminated directorships must be apportioned by the Board among the three classes to ensure that no one class has more than one director more than any other class, unless otherwise determined by a resolution of the Board. However, since existing directors cannot move across classes, the number of directors continuing in office following the Annual Meeting, as well as the nominees for election at the Annual Meeting, including their ages and positions as of April 19, 2021, are reflected below followed by biographical information for each such director and nominee.

|

The Board recommends that stockholders vote FOR the election of the nominees. |

7

Nominees for Election as Class II Directors

After recommendation by the Nominating and Corporate Governance Committee, the Board has designated Richard H. Douglas, Ph.D., Margaret G. McGlynn, R. Ph., and David M. Mott as nominees for election as Class II directors of the Company at the Annual Meeting. If elected, each such nominee will serve until the expiration of his or her term at the 2024 Annual Meeting of Stockholders and until his or her successor is elected and qualified. Dr. Douglas, Ms. McGlynn, and Mr. Mott have consented to being named in this Proxy Statement and to serve if elected. The Board has no reason to believe that Dr. Douglas, Ms. McGlynn, and Mr. Mott will be unable or unwilling to serve if elected. If any nominee becomes unavailable to serve as a director, the persons named in the proxy will vote the proxy for a substitute nominee or nominees as they, in their discretion, shall determine. Gary C. Evans will not be standing for election at the Annual Meeting.

Information on the nominees follows.

AGE 68

INDEPENDENT

DIRECTOR SINCE COMMITTEES ● Audit ● Compensation ● Research and Development |

RICHARD H. DOUGLAS, PH.D. | |

CAREER HIGHLIGHTS Genzyme Corporation ● Former Senior Vice President, Corporate Development (1989 to 2011) ● Dr. Douglas led Genzyme Corporation’s Corporate Development team, and was involved in numerous acquisitions, licenses, financings, joint ventures, and strategic alliances

Integrated Genetics ● Dr. Douglas served in science and corporate development capacities (1982 until its merger with Genzyme Corporation in 1989, now Sanofi Genzyme) |

OTHER CURRENT PUBLIC COMPANY BOARDS ● Aldeyra Therapeutics (Nasdaq: ALDX)

OTHER CURRENT DIRECTORSHIPS ● University of Michigan Technology Transfer National Advisory Board ● MaxCyte, Inc. (LSE: MXCT)

EDUCATION

● Postdoctoral fellow, Dr. Leroy Hood’s laboratory at the California Institute of Technology ● Ph.D. in Biochemistry, University of California, Berkeley ● Bachelor of Science in Chemistry, University of Michigan

KEY SKILLS AND QUALIFICATIONS Dr. Douglas is well-suited to serve on our Board due to his significant business experience and scientific background. | |

AGE 61

INDEPENDENT

DIRECTOR SINCE

COMMITTEES ● Compensation ● Nominating and Corporate Governance

|

MARGARET G. MCGLYNN, R. PH. | |

CAREER HIGHLIGHTS International AIDS Vaccine Initiative ● President and Chief Executive Officer, leading extensive partnership efforts to advance the development, global launch and access to a broadly effective HIV vaccine (2011 to 2015)

Merck ● Served in leadership roles of increasing responsibility for more than two decades (1983 to 2009) including: ● President, U.S. Hospital and Specialty Products Division ● President of Merck Vaccines and Infectious Diseases

OTHER PUBLIC COMPANY BOARDS ● Amicus Therapeutics (Nasdaq: FOLD) ● Vertex Pharmaceuticals (Nasdaq: VRTX)

OTHER CURRENT DIRECTORSHIPS ● HCU Network America, a patient advocacy organization; Ms. McGlynn founded HCU Network America in 2016 which is focused on the rare genetic disease homocystinuria (HCU) and related disorders |

● Hilleman Institute for Developing World Vaccine Research ● Gavi, The Vaccine Alliance ● The Biotechnology Innovation Organization ● Life Science Cares Philadelphia, a non-profit organization

EDUCATION ● Honorary Doctorate, the State University of New York at Buffalo ● Master’s in Business Administration and Marketing, The State University of New York at Buffalo ● Bachelor of Science in Pharmacy, The State University of New York at Buffalo

KEY SKILLS AND QUALIFICATIONS Ms. McGlynn is well-suited to serve on the Novavax Board due to her extensive experience in the pharmaceutical and vaccine industries. In addition, her experience in for-profit and non-profit vaccine organizations and deep experience in vaccine commercialization and understanding of global public health make Ms. McGlynn an ideal board member. | |

8

Board of Directors and Corporate Governance

|

AGE 55

INDEPENDENT

DIRECTOR SINCE

COMMITTEES ●

Compensation ● Research and Development

|

DAVID M. MOTT | |

CAREER HIGHLIGHTS Mott Family Capital ● Private investor

New Enterprise Associates ● General Partner (2008 to 2020)

MedImmune ● President and Chief Executive Officer, Vice Chairman (2000 to 2008), during which he led the sale of the company to AstraZeneca in June 2007 for $15.6 billion ● Served in various senior roles, including Chief Operating Officer and Chief Financial Officer (1992 to 2000)

During the course of his career, Mr. Mott has been involved in more than $40 billion in corporate acquisitions, fundraising, partnerships and other capital formation ventures. He has supported more than 35 initial public offerings or corporate acquisitions, overseen more than a dozen new drugs from development to commercialization, and served on 25 corporate boards. |

OTHER PUBLIC COMPANY BOARDS ● Chairman, Adaptimmune Therapeutics (Nasdaq: ADAP) ● Chairman, Ardelyx (Nasdaq: ARDX) ● Chairman, Epizyme (Nasdaq: EPZM) ● Chairman, Imara (Nasdaq GS: IMRA) ● Chairman, Mersana Therapeutics (Nasdaq GS: MRSN)

EDUCATION ● Bachelor of Arts, Dartmouth College

KEY SKILLS AND QUALIFICATIONS Mr. Mott is well-suited to serve on our Board. His more than three decades of global management, board and investment experience across numerous private and public biopharmaceutical companies, as well as his extensive experience building, leading and financing biopharmaceutical companies adds significant value to our Board. | |

NOVAVAX, INC. 2021 PROXY STATEMENT | 7

9

Board of Directors and Corporate Governance

Directors Continuing as Class III Directors

AGE 61

INDEPENDENT

DIRECTOR SINCE

COMMITTEES ● Compensation ● Nominating and Corporate Governance |

RACHEL K. KING | |

CAREER HIGHLIGHTS GlycoMimetics, Inc.

● Founder and Chief Executive Officer (2003 to present)

New Enterprise Associates ● Executive in Residence (2001 to 2003)

Novartis Corporation ● Senior Vice President (1999 to 2001)

Genetic Therapy, Inc. ● Manager of Laboratory Operations from 1989 to 1993 and Vice President for Product Planning from 1993 to 1996 including early-stage development, initial public offering and acquisition by Novartis; Chief Executive Officer of GTI, a wholly owned subsidiary of Novartis from 1996 to 1998.

Mrs. King worked previously at ALZA Corporation and Bain and Company

OTHER CURRENT PUBLIC COMPANY BOARDS ● GlycoMimetics (Nasdaq: GLYC) |

OTHER CURRENT DIRECTORSHIPS ● Executive Committee of the Biotechnology Innovation Organization ● University of Maryland BioPark

EDUCATION ● M.B.A., Harvard Business School ● Bachelor of Arts, Dartmouth College

KEY SKILLS AND QUALIFICATIONS Mrs. King is well-suited to serve on our Board due to her successful growth and development of businesses and products, her experience as a chief executive officer of a public company, and her significant experience in governance, legal, finance and risk management.

| |

AGE 78

INDEPENDENT

DIRECTOR SINCE

COMMITTEES ● Audit ● Compensation

|

MICHAEL A. MCMANUS, JR., J.D. | |

CAREER HIGHLIGHTS Misonix, Inc. ● President and Chief Executive Officer (1999 to 2016)

New York Bancorp Inc. ● President, Chief Executive Officer and Director (1991 to March 1998) ● President and Chief Executive Officer, Home Federal Savings Bank, the principal subsidiary of New York Bancorp Inc. (February 1995 to March 1998)

Jamcor Pharmaceuticals Inc. ● President and Chief Executive Officer (1990 to November 1991)

Office of the President of the United States ● Assistant to the President of the United States (1982 to 1985)

Mr. McManus held previous positions at Pfizer Inc. and Revlon Group |

Mr. McManus served in the U.S. Army Infantry (1968 to 1970)

Mr. McManus is the recipient of the Ellis Island Medal of Honor

OTHER CURRENT PUBLIC COMPANY BOARDS ● The Eastern Company (Nasdaq: EML)

EDUCATION ● J.D., Georgetown University Law Center ● Bachelor of Arts in Economics, University of Notre Dame

KEY SKILLS AND QUALIFICATIONS Mr. McManus’s successful growth and development of businesses and products, his experience as a chief executive officer of a public company, and his extensive experience in governance, legal, finance and risk management make him a well-qualified member of our Board.

| |

8 | ir.novavax.com

10

Board of Directors and Corporate Governance

AGE 68

INDEPENDENT DIRECTOR SINCE 2010

CHAIRMAN OF THE BOARD SINCE 2011

COMMITTEES ● Nominating and Corporate Governance ●

Research and Development

|

JAMES F. YOUNG, PH.D. | |

CAREER HIGHLIGHTS Targeted Microwave Solutions, Inc. ● Former Chairman of the Board and Chief Executive Officer (2016 to 2018)

MedImmune, Inc. ● Former President, Research and Development (2000 to 2008) ● Executive Vice President, Research and Development (1999 to 2000) ● Senior Vice President (1995 to 1999) ● Senior Vice President, Research and Development (1989 to 1995)

OTHER CURRENT DIRECTORSHIPS ● Sagimet Biosciences, a privately-held biopharmaceutical company |

EDUCATION ● Ph.D. in Microbiology and Immunology, Baylor College of Medicine ● Bachelor of Science degrees in General Science and Biology, Villanova University

KEY SKILLS AND QUALIFICATIONS Dr. Young is well-suited to serve on our Board due to his years of experience in the fields of molecular genetics, microbiology, immunology, and pharmaceutical development. In addition, Dr. Young brings extensive scientific background and experiences, particularly in the areas of vaccine research and development. | |

Directors Continuing as Class I Directors

AGE 55

INDEPENDENT DIRECTOR SINCE 2020

COMMITTEES ● Audit

|

GREGG ALTON | |

CAREER HIGHLIGHTS Gilead Sciences ● Served in an array of leadership roles across a portfolio of responsibilities for more than 20 years from 1999 to 2019, including: ● Interim Chief Executive Officer ● Chief Patent Officer, responsible for Gilead’s government affairs, public affairs, patient outreach and engagement initiatives, as well as efforts to facilitate access to its medicines globally ● Oversight for commercial operations in Europe, Asia, Latin America and Africa, as well as government affairs, public affairs and global medical affairs ● General Counsel and Chief Compliance Officer

Cooley Godward, LLP ● Attorney, specializing in corporate finance transactions for healthcare and information technology companies (1993 to 1996 and 1998 to 1999) |

OTHER PUBLIC COMPANY BOARDS ● Corcept Therapeutics (Nasdaq: CORT) ● Enochian Biosciences (Nasdaq: ENOB)

OTHER CURRENT DIRECTORSHIPS ● Several non-profit organizations, including Black Women’s Health Imperative, AIDSVu and the Boys and Girls Clubs of Oakland

EDUCATION ● J.D., Stanford University ● Bachelor of Science in Legal Studies, University of California, Berkeley

KEY SKILLS AND QUALIFICATIONS Mr. Alton is well-suited to serve on the Novavax Board. His extensive industry experience and broad global experience across multiple business areas, as well as his deep insight in infectious disease will contribute to the Board’s understanding of our mission and corporate goals. | |

NOVAVAX, INC. 2021 PROXY STATEMENT | 9

11

Board of Directors and Corporate Governance

AGE 72

DIRECTOR SINCE June 2009

COMMITTEES ● None

|

STANLEY C. ERCK | |

CAREER HIGHLIGHTS Novavax, Inc. ● President and Chief Executive Officer of Novavax, Inc. (April 2011 to present) ● Interim Chief Financial Officer (November 2017 to March 2018) ● Executive Chairman (February 2010 to April 2011)

Iomai Corporation ● President and Chief Executive Officer (2000 to 2008, when it was acquired by Intercell AG)

Mr. Erck previously held leadership positions at Procept, a publicly traded immunology company, Integrated Genetics, now Sanofi Genzyme, and Baxter International |

OTHER CURRENT DIRECTORSHIPS ● MaxCyte, Inc. (LSE: MXCT) ● MDBio Foundation

EDUCATION ● M.B.A., University of Chicago ● Bachelor of Science in Economics, University of Illinois

KEY SKILLS AND QUALIFICATIONS Mr. Erck is well-suited to serve on our Board due to his leadership experience in the biotechnology industry, having held chief executive officer positions for several companies, and his extensive experience of serving on other public company boards. | |

AGE 60

DIRECTOR SINCE 2009

COMMITTEES ● None

|

RAJIV I. MODI, PH.D. | |

CAREER HIGHLIGHTS Cadila Pharmaceuticals, Ltd. ● Chairman and Managing Director (1995 to present)

OTHER CURRENT DIRECTORSHIPS ● Cadila Pharmaceuticals, Ltd. ● Numerous other private companies and foreign public companies

EDUCATION ● Ph.D. in Biological Science, University of Michigan ● Bachelor’s degree of Technology in Chemical Engineering, University College, London

|

ELECTION TO NOVAVAX BOARD Dr. Modi was elected to our Board based on his relationship with the Company’s largest stockholder in 2009. As of April 19, 2021, Satellite Overseas (Holdings) Limited, a subsidiary of Cadila Pharmaceuticals, Ltd., holds less than one percent of the Company’s outstanding Common Stock. Dr. Modi serves as a member of the boards of other Cadila group companies.

KEY SKILLS AND QUALIFICATIONS Dr. Modi is well-suited to serve on our Board due to his extensive leadership experience, as well as technical expertise in the development and manufacturing of pharmaceutical products. He also brings broad experience in international joint ventures and pharmaceutical sales.

| |

10 | ir.novavax.com

12

Information Regarding the Board and Corporate Governance Matters

On March 18, 2021, the Board determined, upon the recommendation by the Nominating and Corporate Governance Committee, that all of the members of the Board are “independent” directors as defined in the Nasdaq listing standards, except Dr. Modi and Mr. Erck.

Mr. Erck is currently the President and Chief Executive Officer of the Company. Dr. Modi is not an “independent” director due to his interest in Cadila Pharmaceuticals, Ltd. and the joint venture it has with the Company. These relationships are described in detail in the section titled “Certain Relationships and Related Transactions.”

During 2020, the Board met 14 times and acted by written consent in lieu of a meeting five times and the non-employee directors met four times in executive session during the same period. As the year progressed and the severity of the COVID-19 global pandemic became more clear, the directors convened an additional 17 times during 2020 during which management provided operational updates. Each of our incumbent directors attended at least 75% of the aggregate of the total number of meetings of the Board they were eligible to attend, as well as the total number of meetings held by all committees on which they served.

Recognizing that director attendance at the Company’s Annual Meeting of Stockholders provides stockholders with an opportunity to communicate with members of the Board, the Company strongly encourages (but does not require) members of the Board to attend such meetings. All of the then-current Board members attended the 2020 Annual Meeting of Stockholders.

Leadership Structure and Risk Oversight

One of the most critical roles of our Chief Executive Officer and board members is managing risk. Today’s environment consists of ongoing disruption, innovation, and technological change. Increasing disruption leads to greater risks, which may become greater still because they are often interconnected. The Board separates the positions of Chairman of the Board and Chief Executive Officer thereby allowing our Chief Executive Officer to focus on our day-to-day business, while allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to and independent oversight of management. The Board recognizes the commitment that our Chief Executive Officer is required to devote to his position, as well as the commitment required to serve as our Chairman of the Board, particularly as the Board’s oversight responsibilities continue to grow. Mr. Erck and Dr. Young each are responsible for:

| PRESIDENT AND CHIEF EXECUTIVE OFFICER | |

|

Stanley C. Erck

● general charge and supervision of the business of the Company ● managing the risks the company faces in the ordinary course of operating the business including reputation risk, culture risk, cybersecurity risk and extended enterprise risk |

| CHAIRMAN OF THE BOARD | |

|

James F. Young, Ph.D.

● presiding at all meetings of the Board ● advising Board committee chairs in fulfilling their roles ● serving as a liaison between the Board and senior management team ● mentoring and advising the senior scientific team ● providing an extensive network of contacts ● reporting regularly to the Board |

13

Our Chief Executive Officer and Chairman work closely together to execute our strategic plan. Our Chairman leads our Board, serves as a liaison between the Board and senior management team, mentors and advises the senior scientific team, provides an extensive network of contacts, and reports regularly to the Board. We believe the combination of Mr. Erck as the President and Chief Executive Officer and Dr. Young as the Chairman of the Board is an effective leadership structure. The additional avenues of communication between the Board and management associated with having Dr. Young serve as Chairman provides the basis for the proper functioning of the Board and its oversight of management.

Our Chief Executive Officer and senior management team are primarily responsible for managing the risks Novavax faces in the ordinary course of operating the business. The Board actively oversees potential risks and risk management activities by receiving operational and strategic presentations from management, which include discussions of key risks to the business. In addition, the Board delegates risk oversight to each of its key committees within their areas of responsibility.

For example:

The AUDIT COMMITTEE |

The |

The

NOMINATING |

The

RESEARCH AND DEVELOPMENT COMMITTEE | ||||||

|

● Reviews and discusses with management the system of disclosure controls and internal controls over financial reporting and discusses the key risks facing the Company and the processes or actions being taken to mitigate those risks ● Reviews specific risk areas, such as cybersecurity risk, on a regular basis with input from management ● Reviews and discusses with the Senior Vice President, Information Technology the current cybersecurity risks and our cybersecurity risk management program and activities |

● Oversees incentive compensation programs and strategies, as well as key employee retention issues |

● Periodically reviews the current Directors’ skill sets and the Company’s anticipated future needs. ● Oversees the Company’s corporate governance structure. |

● Periodically reviews and assesses our research and development programs ● Oversees strategies and investments specific to research and development programs |

Board committees are chaired by independent directors and at each Board meeting the committee chairs deliver reports to the full Board on the activities and decisions made by the committees at recent meetings. In addition, there is significant cross-over of members of the various committees allowing information to flow freely outside of a full board meeting.

Our Board currently maintains four standing committees: Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and Research and Development Committee. In addition to the descriptions below, please refer to the “Compensation Committee Report” and “the Audit Committee Report” included in this Proxy Statement. The members of the committees are shown below.

| Committee Memberships | |||||

| Director | Independent | Audit | Compensation | Nominating

and Corporate Governance |

Research

and |

| Gregg H. Alton |  |

|

|||

| Richard H. Douglas, Ph.D. |  |

|

|

| |

| Stanley C. Erck | |||||

| Gary C. Evans |  |

|

|

||

| Rachel K. King |  |

|

|

||

| Margaret G. McGlynn, R. Ph. |  |

|

|

|

|

| Michael A. McManus, Jr., J.D. |  |

|

|||

| Rajiv I. Modi, Ph.D. | |||||

| David M. Mott |  |

|

| ||

James

F. Young, Ph.D.  |

|

|

| ||

|

Committee Chair |  |

Committee Member |  |

Chairman of the Board |  |

Audit Committee Financial Expert |

14

| Audit Committee | Meetings in 2020 5 |

|

MEMBERS ● Michael

A. McManus, Jr., J.D. ● Gregg H. Alton |

● Richard H. Douglas, Ph.D. ● Gary C. Evans |

| During 2020, the Audit Committee met five times and did not act by written consent in lieu of a meeting. | ||

|

PRINCIPAL RESPONSIBILITIES The Audit Committee is responsible for: ● the appointment, compensation, retention, and oversight of the work of any independent registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attestation services; the Audit Committee meets with our independent registered public accounting firm to discuss the scope and results of its examination and reviews the financial statements and reports contained in the Company’s periodic and other financial filings

The Audit Committee’s role is to also: ● review the adequacy and efficacy of all accounting, auditing, and financial control systems, as well as disclosure controls and procedures ● monitor the adequacy of our accounting and financial reporting processes and practices ● consider any issues raised by its members, the independent registered public accounting firm, and employees ● oversee the Company’s compliance with applicable federal and state laws and regulations, and the implementation and operation of the Company’s corporate compliance program ● annually review the Company’s corporate compliance program with the Company’s Chief Legal Officer and Chief Compliance Officer, and monitor the program’s progress and results during the year

The Audit Committee is authorized to investigate any matter brought to its attention, retain the services of independent advisors (including legal counsel, auditors, and other experts), and receive and respond to concerns and complaints relating to accounting, internal accounting controls, and auditing matters.

|

The Audit Committee meets regularly with both the Company’s management team and its independent auditor. At times, the Audit Committee meets in executive session without management or the independent auditor present.

CHARTER ● The Audit Committee acts pursuant to a written charter as adopted by the Board. A current copy of the charter is available on the Company’s website at www.novavax.com. ● The Audit Committee reviews and evaluates its charter annually to ensure its adequacy and accuracy, and is charged with performing an annual self-evaluation with the goal of continuing improvement.

AUDIT COMMITTEE REPORT ● The Audit Committee Report is on page 82 of this Proxy Statement.

QUALIFICATIONS ● Each Audit Committee member is an “independent director,” as defined by the listing standards of the Nasdaq. ● The Board has determined that each of Mr. McManus, Mr. Alton, and Mr. Evans qualifies as an “audit committee financial expert” as defined by the rules and regulations of the Securities and Exchange Commission, and is financially sophisticated as required by the listing standards of the Nasdaq.

| |

15

| Compensation Committee | Meetings in 2020 8 | |

|

MEMBERS ●

David M. Mott ● Richard H. Douglas, Ph.D. ● Rachel K. King |

● Margaret G. McGlynn, R. Ph. ● Michael A. McManus, Jr., J.D. |

| During 2020, the Compensation Committee met eight times and acted by written consent in lieu of a meeting four times. | ||

|

PRINCIPAL RESPONSIBILITIES The Compensation Committee is responsible for: ● assisting the Board with its responsibilities relating to the compensation of the Company’s officers and directors and the development, administration and oversight of the Company’s compensation and benefits plans ● reviews and recommends salaries and other compensatory benefits for employees, executive officers, and directors

The Compensation Committee’s authority and responsibilities include, but are not limited to: ● review and recommend to the Board the goals and objectives relevant to our Chief Executive Officer and other executive officers; annually evaluate the performance of the Chief Executive Officer and other executive officers; approve or recommend to the Board the compensation levels and annual awards for the Chief Executive Officer and other executive officers ● oversee our overall compensation philosophy, policies, and programs ● make recommendations to the Board about the compensation of directors ● approve and administer our equity-based plans and awards and management incentive compensation plans ● review and approve employment agreements, severance arrangements, retirement arrangements, change in control provisions, and any supplemental benefits or perquisites for executive officers and senior management

The Compensation Committee has the authority to engage independent compensation consultants or advisors, as it may deem appropriate in its sole discretion, and to approve related fees and retention terms.

The Compensation Committee routinely holds meetings, some of which management attends, as well as executive sessions without management, where compensation is discussed. The chair of the Compensation Committee is responsible for leadership of the Compensation Committee and sets meeting agendas. |

The Compensation Committee may request that any executive officer or employee, outside counsel, or consultant attend Compensation Committee meetings or confer with any members of, or consultants to, the Compensation Committee. The Compensation Committee is supported in its efforts by our Legal and Human Resources teams, to which the Compensation Committee delegates authority for certain administrative functions. The Chief Executive Officer gives performance assessments and compensation recommendations for each executive officer (other than himself). The Chairman gives performance assessments and compensation recommendations for the Chief Executive Officer. The Compensation Committee considers the Chief Executive Officer’s and the Chairman’s recommendations and the information provided by the Human Resources team in its deliberations regarding executive compensation. The compensation of the executive officers is based on these deliberations. The Chief Executive Officer and the Executive Vice President, Chief Human Resources Officer generally attend Compensation Committee meetings but are not present for executive sessions or any discussion of their own compensation.

CHARTER ● The Compensation Committee acts pursuant to a written charter as adopted by the Board; a current copy of the charter is available on the Company’s website at www.novavax.com ● The Compensation Committee reviews and evaluates its charter annually to ensure its adequacy and accuracy, and is charged with performing an annual self-evaluation with the goal of continuing improvement

COMPENSATION COMMITTEE REPORT ● The Compensation Committee Report is on page 45 of this Proxy Statement

QUALIFICATIONS ● Each Compensation Committee member is a “non-employee director,” as defined by Rule 16b-3 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”) and an “independent director,” as defined by the listing standards of the Nasdaq, including the heightened standards that apply to compensation committee members

| |

16

| Nominating and Corporate Governance Committee | Meetings in 2020 9 |

|

MEMBERS ●

Gary Evans ● Rachel K. King |

● Margaret G. McGlynn, R. Ph. ● James F. Young, Ph.D. |

| During 2020, the Nominating and Corporate Governance Committee met nine times and did not act by written consent in lieu of a meeting. | ||

|

PRINCIPAL RESPONSIBILITIES The primary function of the Nominating and Corporate Governance Committee is to: ● review and make recommendations to the Board regarding the Board’s size, structure, and composition ● establish criteria for Board membership ● identify and evaluate candidates qualified to become members of the Board, including candidates proposed by stockholders ● select, or recommend for selection, director nominees to be presented for approval at the Annual Meeting of Stockholders and to fill vacancies on the Board ● oversee the Company’s corporate governance guidelines ● evaluate Company policies relating to the recruitment of Board members ● develop and recommend to the Board corporate governance policies and practices ● oversee management’s plans for succession to senior management positions |

The Nominating and Corporate Governance Committee’s goal is to contribute to the effective representation of the Company’s stockholders and to play a leadership role in shaping the Company’s corporate governance.

In reviewing and evaluating director candidates, including candidates submitted by stockholders, the Nominating and Corporate Governance Committee does not differentiate between candidates based on the proposing constituency, but rather applies the same criteria to each candidate.

CHARTER ● The Nominating and Corporate Governance Committee acts pursuant to a written charter as adopted by the Board; a current copy of the charter is available on the Company’s website at www.novavax.com. ● The Nominating and Corporate Governance Committee reviews and evaluates its charter annually to ensure its adequacy and accuracy, and is charged with performing an annual self-evaluation with the goal of continuing improvement

QUALIFICATIONS ● Each Nominating and Corporate Governance Committee member is an “independent director,” as defined by the listing standards of the Nasdaq.

| |

17

| Research and Development Committee | Meetings in 2020 - |

|

MEMBERS ●

James F. Young, Ph.D. ● David M. Mott |

● Richard H. Douglas, Ph.D. |

| The Research and Development Committee was formed in December 2020 and did not meet or act by written consent in lieu of a meeting in 2020. | ||

|

PRINCIPAL RESPONSIBILITIES The primary function of the Research and Development Committee is to: ● review and assess the Company’s research and development programs, with the Committee Chair playing a day-to-day role providing input on key aspects of such research and development programs ● evaluate the Company’s progress in achieving research and development goals and objectives, and make recommendations to the Board on modifications to the Company’s research and development goals and objectives ● review and assess the Company’s intellectual property portfolio and strategy ● review the Company’s regulatory efforts and strategy ● oversee management’s exercise of its responsibility to assess and manage risks associated with the Company’s research and development programs and regulatory matters ● select, retain, and supervise any advisors as the Committee deems necessary, in its discretion, to fulfill its mandates under its Charter, and compensate, at the expense of the Company, such advisors

The Research and Development Committee’s goal is to contribute to the Company’s development of a robust intellectual property portfolio, and to play a leadership role in shaping the Company’s research and development programs and strategies.

|

CHARTER ● The Research and Development Committee acts pursuant to a written charter as adopted by the Board; a current copy of the charter is available on the Company’s website at www.novavax.com. ● The Research and Development Committee reviews and evaluates its charter annually to ensure its adequacy and accuracy, and is charged with performing an annual self-evaluation with the goal of continuing improvement

QUALIFICATIONS

● Each Research and Development Committee member is an “independent director,” as defined by the listing standards of the Nasdaq.

| |

18

Stockholders who wish to nominate qualified candidates to serve as directors may do so in accordance with the procedures set forth in the Company’s Amended and Restated By-Laws (“By-Laws”), which procedures did not change during the last fiscal year. As stated in the By-Laws, a stockholder must notify the Company in writing, by notice delivered to the attention of the Secretary of the Company at the address of the Company’s principal executive offices, of a proposed nominee.

In order to ensure meaningful consideration of such candidates, notice must be received not less than 60 days nor more than 90 days prior to the anniversary date of the applicable year’s Annual Meeting of Stockholders. However, in the event the date of the applicable year’s Annual Meeting of Stockholders is more than 30 days before or after the anniversary date of the prior year’s Annual Meeting of Stockholders, notice by the stockholder to be timely it must be received not later than the close of business on the 10th day following the day on which such notice of the date of the meeting was mailed or public disclosure of the date of such meeting was made, whichever occurs first.

The notice must include the following information for each proposed nominee:

| ● | name, age, business and residence address; |

| ● | his or her principal occupation or employment; |

| ● | the class and number of shares of capital stock and other securities of the Company, if any, which are beneficially owned by such nominee and whether and the extent to which any hedging or other transaction or series of transactions has been entered into by or on behalf of, or any other agreement, arrangement or understanding has been made, the effect or intent of which is to increase or decrease the voting power or economic interest of, such person with respect to the Company’s securities; and |

| ● | any other information concerning the nominee that must be disclosed as to nominees in proxy solicitations, or is otherwise required, in each case pursuant to applicable law. |

The notice must also include with respect to the stockholder giving the notice and each Stockholder Associated Person:

| ● | the name and address, as they appear on the Company’s books, of such stockholder; |

| ● | a description of all direct and indirect compensation and other material monetary arrangements, agreements or understandings during the past three years, and any other material relationship, if any, between or concerning such stockholder and each Stockholder Associated Person, on the one hand, and each proposed nominee, and his or her respective affiliates and associates, on the other hand; |

| ● | the class and number of shares of capital stock and other securities of the Company that are owned by such person; and |

| ● | any derivative positions held of record or beneficially by such person and whether and the extent to which any hedging or other transaction or series of transactions has been entered into by or on behalf of, or any other agreement, arrangement or understanding has been made, the effect or intent of which is to increase or decrease the voting power or economic interest of, such person, with respect to the Company’s securities. |

For purposes of this Proxy Statement, a “Stockholder Associated Person” of any stockholder means:

| (i) | any “affiliate” or “associate” (as those terms are defined in Rule 12b-2 under the Exchange Act) of the stockholder who owns beneficially or of record any capital stock or other securities of the Company or, through one or more derivative positions, has an economic interest (whether positive or negative) in the price of securities of the Company, and |

| (ii) | any person acting in concert with such stockholder or any affiliate or associate of such stockholder with respect to the capital stock or other securities of the Company. |

In addition, any nominee proposed by a stockholder shall complete a questionnaire, in a form provided by the Company. The completed questionnaire shall be submitted within ten days after the Company provides the questionnaire. The Company may require any proposed nominee to furnish other information as may reasonably be required to determine the eligibility of the nominee to serve as a director. Nominations received through this process will be forwarded to the Nominating and Corporate Governance Committee for review.

19

The Nominating and Corporate Governance Committee strives to maintain a board of directors with a diverse set of skills and qualifications to ensure the board of directors is adequately serving the needs of the Company’s stockholders. Before evaluating director candidates, the Nominating and Corporate Governance Committee reviews the skills and qualifications of the directors currently serving on the Board and identifies any areas of weakness or skills of particular importance. On the basis of that review, the Nominating and Corporate Governance Committee will evaluate director candidates with those identified skills. While the Nominating and Corporate Governance Committee does not have a formal policy on Board diversity, the committee takes into account a broad range of diversity considerations when assessing director candidates, including individual backgrounds and skill sets, professional experiences, underrepresented classes, and other factors that contribute to the Board having an appropriate range of expertise, talents, diversity, experiences, and viewpoints. The Nominating and Corporate Governance Committee considers the following skills and experiences necessary to the Board: industry knowledge, clinical development expertise, commercialization expertise, manufacturing expertise, financial expertise and capital raising experience, and scientific or medical education and experience, particularly in vaccine-related fields.

While there are no set minimum requirements, a candidate should:

| ● | be intelligent, thoughtful, and analytical |

| ● | have excelled in both academic and professional settings |

| ● | possess superior business-related knowledge, skills, and experience |

| ● | demonstrate achievement in his or her chosen field |

| ● | reflect the highest integrity, ethics, and character |

| ● | be free of actual or potential conflicts of interest |

| ● | have the ability to devote sufficient time to the business and affairs of the Company |

| ● | demonstrate the capacity and desire to represent the best interests of our stockholders as a whole |

In addition to the above criteria (which may be modified from time to time), the Nominating and Corporate Governance Committee may consider such other factors as it deems in the best interests of the Company and its stockholders and that may enhance the effectiveness and responsiveness of the Board and its committees. Finally, the Nominating and Corporate Governance Committee must consider a candidate’s independence to make certain the Board includes at least a majority of “independent” directors to satisfy all applicable independence requirements, as well as a candidate’s financial sophistication and special competencies.

The Nominating and Corporate Governance Committee identifies potential candidates through referrals and recommendations, including by incumbent directors, management, and stockholders, as well as through business and other organizational networks. To date, the Nominating and Corporate Governance Committee has not retained or paid any third party to identify or evaluate, or assist in identifying or evaluating, potential director nominees, although it reserves the right to engage executive search firms and other third parties to assist in finding suitable candidates.

Current members of the Board with the requisite skills and experience are considered for re-nomination, balancing the value of the member’s continuity of service with that of obtaining a new perspective, and considering each individual’s contributions, performance and level of participation, the current composition of the Board, and the Company’s needs. The Nominating and Corporate Governance Committee also must consider the age and length of service of incumbent directors.

The Board adopted a policy in 2005 not to re-nominate a director for re-election if such director has served ten years as a director or has reached 75 years of age, unless circumstances exist which cause the Nominating and Corporate Governance Committee to believe that despite such factors, such a nomination was in the best interest of the Company and its stockholders.

In accordance with this policy, although Dr. Douglas will have served on our Board for more than ten years, the Nominating and Corporate Governance Committee determined to nominate him for reelection to the Board at the Annual Meeting due to his extensive knowledge of our corporate history, operations and strategy, and the Company’s urgent objective in developing its NVAX-CoV2373 vaccine against the SARS-CoV-2 virus. If any existing members do not wish to continue in service or if it is decided not to re-nominate a director, new candidates are identified in accordance with those skills, experience, and characteristics deemed necessary for new nominees, and are evaluated based on the qualifications set forth above. In every case, the Nominating and Corporate Governance Committee meets (in person or telephonically) to discuss each candidate and may require personal interviews before final approval. Once a slate of nominees is selected, the Nominating and Corporate Governance Committee presents it to the full Board.

20

Corporate Governance Guidelines

The Board has adopted corporate governance guidelines that are available on the Company’s website at www.novavax.com.

Code of Business Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics (“Code of Ethics”) that applies to each employee, officer, and director, including but not limited to, the Chief Executive Officer and Chief Financial Officer. The Code of Ethics is reviewed at least annually by the Nominating and Corporate Governance Committee. A current copy of the Code Ethics, is available on the Company’s website at www.novavax.com. The Company intends to disclose on its website any future amendments to and waivers of the Code of Ethics that apply to its Chief Executive Officer, Principal Financial Officer and Principal Accounting Officer, and persons performing similar functions.

Stockholder Communications with the Board of Directors

The Board welcomes communications from stockholders and has adopted a procedure for receiving and addressing such communications. Stockholders may send written communications to the entire Board or individual directors, addressing them to:

|

Novavax, Inc. Attention: Corporate Secretary 21 Firstfield Road Gaithersburg, Maryland 20878 |

|

Mark “Attention: Corporate Secretary” in the “Subject” field |

|||||

All such communications will be forwarded to the full Board or to any individual director or directors to whom the communication is directed unless the communication is clearly of a marketing nature or is unduly hostile, threatening, illegal, or similarly inappropriate, in which case the Company has the authority to discard the communication or take appropriate legal action.

Certain Relationships and Related Transactions

The Company’s Code of Ethics provides that the Audit Committee is responsible for approving all transactions or business relationships involving Novavax and any director or executive officer, including any transactions between Novavax and either the director or officer personally, members of their immediate families, or entities in which they have an interest. In evaluating related party transactions, the Audit Committee members apply the same standards of good faith and fiduciary duty they apply to their general responsibilities as a committee of the Board and as individual directors. The Audit Committee will approve a related party transaction when, in its good faith judgment, the transaction is in the best interest of the Company.

Dr. Modi, a director of Novavax, is also the managing director of Cadila Pharmaceuticals, Ltd. (“Cadila”). Novavax and Cadila have formed a joint venture called CPL Biologicals Private Limited, of which Novavax owns 20% and Cadila owns the remaining 80%. As of April 19, 2021, a subsidiary of Cadila owns 125,000 shares of Novavax’s outstanding Common Stock.

In June 2020, in advance of David M. Mott joining the Company’s Board of Directors, the Company agreed to sell 32,916 shares of Common Stock to him in a sale exempt from the registration requirements of the Securities Act of 1933, as amended, pursuant Section 4(a)(2) thereunder, at a purchase price of $45.57 per share, reflecting the closing price of the Company’s Common Stock on the trading date prior to the date of the parties’ agreement regarding the sale, for total gross proceeds of $1.5 million. Mr. Mott joined the Company’s Board of Directors later in the same month.

21

There are no family relationships among any of the directors or executive officers (or any board member nominee) of Novavax. No director, executive officer, nominee, or any associate of any of the foregoing has any interest, direct or indirect, in any proposal to be considered and acted upon at the Annual Meeting (other than the election of directors)

Compensation Committee Interlocks and Insider Participation

During 2020, Dr. Douglas, Ms. King, Mr. McManus, Mr. Mott and Dr. Young served as members of the Compensation Committee. None of the members of the Compensation Committee were at any time during 2020 an employee or executive officer of Novavax.

No executive officer of the Company currently serves, or during 2020 served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of the Company’s Board or Compensation Committee.

Compensation paid to our non-employee directors is comprised of two components: (i) cash compensation and (ii) equity awards.

CASH COMPENSATION

Our non-employee director cash compensation arrangement for 2020 was as follows:

| Non-Employee Director Service | 2020 Cash Retainer ($) |

| Board member | 40,000 |

| Supplemental cash retainers: | |

| Chairperson: | |

| Board | 35,000 |

| Audit Committee | 20,000 |

| Compensation Committee | 15,000 |

| Nominating and Corporate Governance Committee | 10,000 |

| Research and Development Committee | — |

| Member: | |

| Audit Committee | 10,000 |

| Compensation | 7,500 |

| Nominating and Corporate Governance Committee | 5,000 |

| Research

and Development Committee *beginning 2021 |

5,000*

|

| Board and Committee meetings: | |

| Directors do not receive compensation for attending meetings. Directors are reimbursed for reasonable costs and expenses incurred in connection with attending any Board or committee meetings or any other Company related business activities. | |

NON-EMPLOYEE DIRECTOR DEFERRED FEE POLICY

The Company’s Director Deferred Fee Policy for its non-employee directors permits an eligible director to defer receipt of all or part of the director’s cash retainer. To defer fees payable during any calendar year, a director must make an election by the end of the preceding calendar year. A director can elect to have 100% of deferred amounts credited to a “cash account” or a “Company common stock account,” or, alternatively, a director may elect to have deferred amounts credited 50% to each account. Cash accounts are credited with interest quarterly at the IRS Applicable Federal Rate for short-term debt instruments for the last month of such calendar quarter. Company Common Stock accounts are credited as if amounts were invested in notional stock units based upon the market price

22

of Common Stock and are credited with additional notional units if dividends are paid on Common Stock. Payment of deferred amounts is to be made in cash upon the occurrence of certain events, including the director’s separation from service, death of the director, or a change in control of the Company. The director may also elect to receive payment of the deferred amounts in a specified year that is not more than ten years from the year in which the director’s fees were earned. A director may elect to receive payment in either a lump sum or in up to ten annual installments.

Dr. Douglas has elected to defer fees earned in the fiscal year ending December 31, 2020. The following table shows how he currently has his deferred fees credited.

| Name | Annual Retainer | |

| Richard H. Douglas, Ph.D. | Cash account | 0% |

| Company Common Stock account | 100% | |

EQUITY AWARDS

Annual Equity Awards

On June 25, 2020, the Compensation Committee granted options to purchase 6,900 shares of Common Stock to each of Dr. Douglas, Ms. King, and Messrs. Evans and McManus, and options to purchase 4,400 shares of Common Stock to Mr. Mott. In recognition of his service as our Chairman of the Board, Dr. Young was granted an option to purchase 15,180 shares of Common Stock. All of the aforementioned options have an exercise price of $83.54 per share and will vest in full one year from the date of grant subject to continued service on the Company’s Board of Directors through the vesting date.

On June 25, 2020, the Compensation Committee granted time-vesting restricted stock units (“RSUs”) representing a right to receive 3,450 shares of Common Stock to each of Dr. Douglas, Mr. Evans, Ms. King and Mr. McManus. In recognition of his service as our Chairman of the Board, Dr. Young received RSUs representing a right to receive 7,590 shares of Common Stock. All of the aforementioned RSUs will vest in full one year from the date of grant subject to continued service on the Company's Board through the vesting date.

Equity Awards upon Appointment to the Board or a Committee

On June 13, 2020, the Board granted an option to purchase 8,000 shares of Common Stock, effective as of June 16, 2020, to Mr. Mott in connection with his appointment to the Board. The option has an exercise price of $52.15 per share and will vest in full on June 16, 2021 subject to continued service on the Company’s Board through the vesting date.

On October 31, 2020, the Board granted an option to purchase 7,700 shares of Common Stock to Mr. Alton in connection with his appointment to the Board. The option has an exercise price of $80.71 per share and will vest in full one year from the date of grant, subject to continued service on the Company’s Board through the vesting date.

On December 5, 2020, the Board granted an option to purchase 7,700 shares of Common Stock, effective as of December 7, 2020, to Ms. McGlynn in connection with her appointment to the Board. The option has an exercise price of $123.12 per share and will vest in full on December 7, 2021 subject to continued service on the Company's Board through the vesting date.

On December 5, 2020, the Board granted time-vesting RSUs representing the contingent right to receive 20,000 shares of Common Stock to Dr. Young, in connection with the appointment of Dr. Young as Chair of the newly established standing Research and Development Committee of the Board. The Board, upon recommendation of the Compensation Committee, with Dr. Young recused from both meetings, determined the size of the award based on Dr. Young’s substantial time commitment and impact providing Board oversight of the Company’s research and development efforts, including process development, manufacturing scale-up, technology transfer and other activities related to the Company’s regulatory efforts and strategy. Fifty percent (50%) of the RSUs subject to this grant vested on January 1, 2021, and the remaining fifty percent (50%) of the RSUs subject to this grant will vest on July 1, 2021, in each case subject to continued service on the Company's Board through the vesting date. Dr. Young’s prior experience has provided substantial value to the Board and management team, as Dr. Young provides oversight of efforts to resolve innumerable obstacles developing its COVID-19 vaccine at an accelerated pace. The December 2020 award made to Dr. Young reflected a unique situation related to accelerated activity and demands connected to developing the Company’s COVID-19 vaccine. The Board plans to evaluate new director compensation limits later in 2021, when it will be evaluating corporate governance provisions more generally.

23

DIRECTOR COMPENSATION TABLE

The Company does not pay employee directors additional compensation for service on the Board. The following table sets forth information concerning the compensation paid by the Company to each individual who served as a non-employee director at any time during fiscal year 2020:

| Name | Fees

Earned or Paid in ($) |

Option Awards(2) ($) |

Stock

Awards ($) (3) |

Total |

| Gregg H. Alton(4) | 7,151 | 557,362 | ― | 564,513 |

| Richard H. Douglas, Ph.D.(5) | 57,500 | 515,767 | 288,213 | 861,480 |

| Gary C. Evans | 60,000 | 515,767 | 288,213 | 863,980 |

| Rachel K. King | 52,500 | 515,767 | 288,213 | 856,480 |

| Margaret G. McGlynn, R. Ph.(6) | 3,528 | 851,389 | ― | 854,917 |

| Michael A. McManus, Jr., J.D. | 72,272 | 515,767 | 288,213 | 876,252 |

| Rajiv I. Modi, Ph.D.(7) | ― | ― | ― | ― |

| David M. Mott(8) | 26,294 | 701,038 | ― | 727,332 |

| James F. Young, Ph.D. | 93,952 | 1,134,687 | 3,159,069 | 4,387,708 |

| (1) | Represents fees earned in 2020, pro-rated as applicable for a partial year of service. |

| (2) | Represents options granted in 2020 in respect of 2020 service on the Board. The grant date fair value was calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification (“FASB ASC”) Topic 718. Assumptions used in the calculation of this amount are included in Note 13 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 filed with the SEC on March 1, 2021. As of December 31, 2020, the aggregate number of stock options held by each non-employee director is as follows: |

| Mr. Alton | 7,770 | Mr. McManus | 34,900 | |

| Dr. Douglas, Ph.D. | 45,900 | Dr. Modi | - | |

| Mr. Evans | 34,990 | Mr. Mott | 12,400 | |

| Ms. King | 32,900 | Dr. Young | 103,930 | |

| Ms. McGlynn | 7,770 |

| (3) | Represents restricted stock units granted in 2020 in respect of 2020 service on the Board. The grant date fair value was calculated in accordance with FASB ASC Topic 718. Assumptions used in the calculation of this amount are included in Note 13 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 filed with the SEC on March 1, 2021. As of December 31, 2020, the aggregate number of restricted stock units held by each non-employee director is as follows: |

| Mr. Alton | - | Mr. McManus | 3,450 | |

| Dr. Douglas, Ph.D. | 3,450 | Dr. Modi | - | |

| Mr. Evans | 3,450 | Mr. Mott | - | |

| Ms. King | 3,450 | Dr. Young | 27,590 | |

| Ms. McGlynn | - |

(4) |

Mr. Alton was appointed to the Board on October 31, 2020. |

| (5) | Dr. Douglas’ fees in respect of 2020 were deferred in accordance with the Non-Employee Director Deferred Fee Policy, described above. |

| (6) | Ms. McGlynn was appointed to the Board on December 5, 2020. |