Form DEF 14A ALLEGHENY TECHNOLOGIES For: May 20

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant To Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement | |||

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☒ |

Definitive Proxy Statement | |||

| ☐ |

Definitive Additional Materials | |||

| ☐ |

Soliciting Material Pursuant to §240.14a-12 | |||

| Allegheny Technologies Incorporated | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

|

| ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☒ |

No fee required. | |||

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

|

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

|

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

|

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

|

| ||||

| (5) | Total fee paid:

| |||

|

| ||||

| ☐ |

Fee paid previously with preliminary materials. | |||

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

|

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

|

| ||||

| (3) | Filing Party:

| |||

|

| ||||

| (4) | Date Filed:

| |||

|

| ||||

Table of Contents

2021 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Table of Contents

Our Vision Solving the World's Challenges through Materials Science ATI competes by serving customers in: Strategic Markets Aerospace Defense Diversified Applications Specialty Energy Medical Electronics Materials Science Advanced, Integrated Process Technologies Relentless, Innovative People Our Commitment Creating long-term shareholder value through Relentless Innovation(R)

Table of Contents

|

ATI 2021 Proxy Statement |

1 |

|

Allegheny Technologies Incorporated 1000 Six PPG Place Pittsburgh, PA 15222 |

DEAR STOCKHOLDERS

|

| ||

Table of Contents

|

2 |

|

ATI 2021 Proxy Statement |

|

Allegheny Technologies Incorporated 1000 Six PPG Place Pittsburgh, PA 15222 |

DEAR STOCKHOLDERS

|

| ||

Table of Contents

|

ATI 2021 Proxy Statement |

3 |

Notice of Annual Meeting of Stockholders

Table of Contents

|

4 |

|

ATI 2021 Proxy Statement |

Table of Contents

|

ATI 2021 Proxy Statement |

5 |

This summary highlights information that is contained elsewhere in this Proxy Statement. You should carefully read this Proxy Statement in its entirety before voting, as this summary does not contain all of the information that you should consider.

|

ANNUAL MEETING OF STOCKHOLDERS |

| DATE & TIME: Thursday, May 20, 2021 11:00 a.m. Eastern Time |

VIRTUAL MEETING SITE: www.meetingcenter.io/271914418 |

RECORD DATE AND VOTING: March 22, 2021

ATI stockholders as of the record date are entitled to vote on the matters presented at the meeting. Each share of common stock of the Company is entitled to one vote for each director nominee and one vote on each other matter presented. |

MEETING AGENDA AND VOTING MATTERS

| Proposal | Board’s recommendation | Page reference | ||||

| 1. Election of three directors

|

FOR

FOR |

12

|

||||

| 2. Advisory vote to approve the compensation of our named executive officers

|

FOR

FOR |

40

|

||||

| 3. Ratification of Ernst & Young LLP as our independent auditors for 2021

|

FOR

FOR |

75

|

||||

DIRECTOR NOMINEES – CLASS I – TERM TO EXPIRE IN 2024

| Name | Director Since | Experience and Qualifications | Board Committees | |||||

| Herbert J. Carlisle | 2018 | • Leadership/Governance |

• Audit | |||||

| • Finance |

• Finance | |||||||

| • Industry/Manufacturing |

• Technology | |||||||

| • Operations • Technical |

||||||||

|

• Government/Environmental |

||||||||

| David P. Hess | 2019 | • Leadership/Governance |

• Finance | |||||

| • Finance |

• Nominating & Governance | |||||||

| • Industry/Manufacturing |

• Personnel & Compensation | |||||||

| • Operations • Technical • Labor/HR |

||||||||

|

• International/M&A |

||||||||

| Marianne Kah | 2019 | • Leadership/Governance |

• Audit | |||||

| • Finance |

• Technology | |||||||

| • Industry/Manufacturing |

||||||||

| • Government/Environmental |

||||||||

|

• International/M&A |

||||||||

Table of Contents

|

6 |

ATI 2021 Proxy Statement |

Proxy Statement Summary |

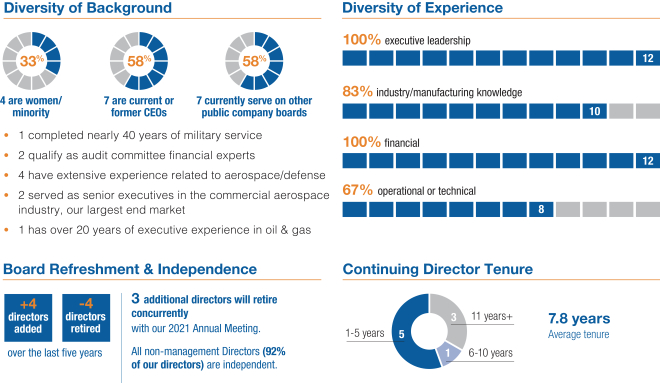

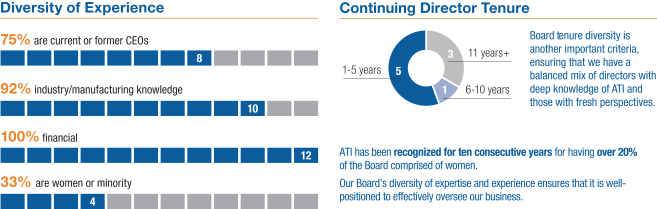

BOARD COMPOSITION

ATI has a diverse, highly credentialed and highly experienced Board. Our directors possess a variety of tenure, qualifications, backgrounds, skills and experiences contributing to a Board that is well-rounded and well-positioned to effectively oversee our business and promote the interests of our stakeholders.

Highly Engaged Board Guides the Strategic Direction of Our Company

| • | Actively oversees long-term strategic planning and capital allocation decisions, including through an annual, multi-day strategic planning meeting in addition to regular quarterly and other Board meetings. |

| • | Regularly assesses and oversees management and mitigation of known and emergent risks to our business. |

| • | Conducts site visits at our facilities throughout the United States. Though our recent ability to conduct these visits has been curtailed by the ongoing COVID-19 pandemic, they are a valuable component of our normal governance practices; visiting our facilities allows our directors to meet with management and other employees and to gain both firsthand exposure to the technologies that drive our success and deeper knowledge of the strengths and challenges of our business and how they tie to our near and long-term strategic goals. |

| • | Actively and continuously engages in robust Board and senior management succession planning. |

| • | 100% overall attendance rate for Board and Committee meetings during 2020, and more than 96% over the last three years. |

| • | Market-driven stock ownership guidelines. |

Focused and Thoughtful Board Refreshment

| • | Our Board routinely engages in succession planning and adds new members on an opportunistic basis when it identifies candidates whom it believes have experience, skill sets and other characteristics that will enhance Board effectiveness. |

| • | We have a mandatory retirement age, and our Board engages in recruitment as appropriate to support its refreshment efforts. |

| • | Our annual Board evaluation process assesses the Board’s existing skill sets and the need or desirability of adding members; the Board can appoint new members when presented with candidates who fill a particular need or otherwise would serve as an asset to the Board. |

Table of Contents

|

Proxy Statement Summary |

ATI 2021 Proxy Statement |

7 |

GOVERNANCE HIGHLIGHTS

Our commitment to good corporate governance is illustrated by the following practices:

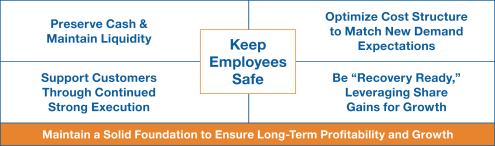

OUR COVID-19 RESPONSE

When the potential impact of the COVID-19 pandemic on our people and business began to emerge in early 2020, we recognized that the urgency of the situation required significant and comprehensive action. Beginning in the first quarter of 2020, ATI immediately developed responsive plans and strategies that centered on the key leadership priorities illustrated below.

Ensuring the Health and Safety of Our Team

Consistent with our values and past practices, the safety and well-being of our employees is our top concern. As a critical manufacturing sector business, we have been able to continue operating throughout the pandemic, which required an immediate focus on the measures necessary to maintain employee safety.

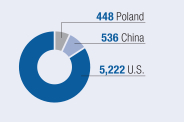

Our Global Rapid Response Team. During the first quarter of 2020, we convened a cross-functional and global rapid response team comprised of leaders across various disciplines from within our organization, including environmental health and safety, human resources, benefits, legal and communications. The team was tasked with helping to develop our response and monitoring the rapidly evolving nature and impact of the pandemic. The response team quickly established pandemic-related safety policies and guidelines for our business and implemented uniform safety protocols, such as mandatory masking, social distancing requirements and signage, deep cleaning procedures as appropriate and mandatory quarantining in cases of direct exposure, across all of our operating facilities, worldwide. At the same time, our procurement team members worked to ensure that employees at all of our facilities were well supplied with personal protective equipment and other materials necessary for them to meet our safety protocols.

Our Remote Work Force. Since March 2020, members of our workforce who were able, given the nature of their job responsibilities, have been strongly encouraged to work remotely. At the outset of the pandemic, our digital technology team rapidly accelerated the implementation of new tools and security measures across our business to provide highly reliable and highly secure remote access for much of our global workforce. These efforts have enabled secure and seamless remote work and interaction among members of our leadership and other team members, helping to minimize in-person interaction and mitigate the risk of virus spread within our own ATI community.

As a result of these efforts, although we have not been spared from infections among our employees, ATI’s instances of known workplace transmission have been very limited.

Table of Contents

|

8 |

ATI 2021 Proxy Statement |

Proxy Statement Summary |

Maintaining the Health of Our Business

In tandem with our efforts to ensure continued safe working conditions for our employees, we swiftly adjusted our production levels and cost profile to match declining customer demand. We aggressively implemented measures to improve our operational efficiency and enacted other cost reductions to limit the impact of rapidly changing market conditions on our bottom line. These efforts included rolling facility idlings, targeted adjustments to crewing levels and work schedules, staffing reductions through furloughs, and layoffs. We reduced compensation and benefits for our leadership and nearly all of our salaried workforce for a portion of 2020.

Our compensation actions included:

Additionally, we curtailed planned capital expenditures for the year and reduced inventory, yielding meaningful improvements in working capital levels.

Through these difficult but necessary actions, ATI has ensured ongoing production capabilities for our customers, preserved jobs for employees and maintained a strong balance sheet to ensure that we are recovery and growth ready when changing market conditions present opportunities for our business.

Ensuring Appropriate Risk Oversight. Our response team met frequently and regularly throughout 2020 to monitor and assess the health of our employee population, the impact of evolving federal, state and local actions and requirements in response to the pandemic and other matters. The team also reported regularly to our executive management. Additionally, updates regarding ATI’s response to the pandemic were a central point of reporting and discussion at every meeting of our Board throughout 2020, helping to ensure Board-level oversight of the pandemic’s inherent risks and impacts to our business.

|

Cybersecurity Program. Throughout 2020, special attention was and continues to be given to improving and implementing Cybersecurity Maturity Model Certification controls in support of protecting ATI’s technology and customer data. For more information, see “Corporate Governance, Cybersecurity Risk Oversight” on page 34.

|

BUSINESS TRANSFORMATION

Effective January 1, 2020, we re-aligned our senior management reporting structure and financial reporting segments. Our new Advanced Alloys and Solutions (“AA&S”) segment includes the operations that comprised our former Flat Rolled Products segment, as well as our Specialty Alloys and Components business and certain other assets that formerly were managed as part of our HPMC segment.

|

In December 2020, we announced plans to exit production of low-margin standard stainless sheet products during 2021, streamline the operations of our AA&S segment and redeploy capital to invest in our specialty capabilities, sharpening our focus on higher-margin opportunities, including in aerospace and defense.

|

These changes align with and will help drive our corporate strategy by sharpening the focus of our business and optimizing key assets.

| High Performance Materials & Components (HPMC)

• Forged Products: broad range of forging capabilities for aerospace & defense, plus other high-performance applications including isothermal, hot-die and closed-die forging.

• Specialty Materials: broad range of nickel-based, cobalt-based and titanium-based alloy mill products and powers, and additive parts primarily for aero-engine and airframe applications.

|

Advanced Alloys & Solutions (AA&S)

• Specialty Alloys & Components: (formerly part of HPMC segment) specialty alloys and refractory metals in all conventional product forms, including custom shapes and near-net shape components.

• Specialty Rolled Products: (formerly part of Flat Rolled Products segment) specialty-grade flat products formed through unique process capabilities.

• Standard Stainless Sheet Products: (formerly part of Flat Rolled Products segment) standard stainless sheet products for the North American market

• Joint Ventures – STAL: precision-rolled stainless strip – Uniti Titanium: commercially pure titanium products for target markets – A&T Stainless: stainless steel products (idled)

| |||

Table of Contents

|

Proxy Statement Summary |

ATI 2021 Proxy Statement |

9 |

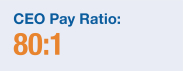

2020 BUSINESS PERFORMANCE

ATI’s business and financial performance was significantly affected in 2020 by the sudden onset of widespread uncertainty and sweeping challenges to the global community and economy. Some of our most important end markets — such as the commercial aerospace industry — are among those most deeply impacted by the onset of the COVID-19 pandemic and its many repercussions. As a result, our business witnessed marked declines in customer demand for our products and, consequently, its financial performance.

In response to these challenges, we aggressively implemented cost reductions and other measures to limit the impact of rapidly changing market conditions on our bottom line. We also were able to leverage our customer relationships and reputation for operational excellence to grow our future market share in the industries and with the customers we serve. While we experienced significant losses in 2020, we believe that the comprehensive actions we took helped to mitigate those losses, improve the efficiency of our business and, importantly, position our business for recovery and growth.

|

“ Our customers continue to count on us to deliver the mission-critical materials and components to keep their planes flying, vehicles moving, energy flowing and medical equipment and electronics working flawlessly, and we’ve been rewarded with more of our customers’ business as a result of our efforts.”

— Robert S. Wetherbee, President and CEO

| ||

Table of Contents

|

10 |

ATI 2021 Proxy Statement |

Proxy Statement Summary |

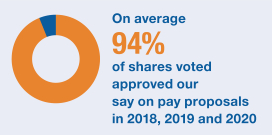

STOCKHOLDER ENGAGEMENT

We value the input we receive from our stockholders. As part of our investor relations program, we regularly communicate with our investors and actively engage with them throughout the year. We solicit their feedback on environmental, social and governance — or “ESG” — topics and ATI’s executive compensation program. Our goal is to be responsive to our stockholders and to ensure that we understand and address their concerns and observations. As a result of our stockholder engagement, we have sharpened our ESG reporting and have made significant changes to our corporate governance practices and executive compensation program since 2015.

| 2020 Say On Pay Vote

Last year, our Say On Pay proposal received the support of approximately 87% of the shares voted at our 2020 Annual Meeting. Approximately 99% and 96% of the shares voted at our 2019 and 2018 annual meetings, respectively, were voted in favor of our Say On Pay proposal. Our Board believes this continued support from our stockholders is a result of our commitment to ensure a strong link between pay and performance. |

|

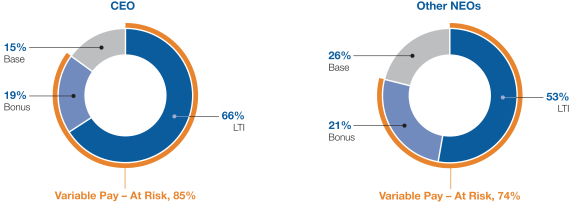

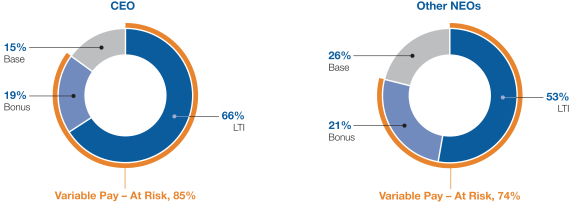

OUR COMPENSATION PHILOSOPHY—PAY FOR PERFORMANCE

ATI’s executive compensation program is designed to support our long-term strategic vision and to align with our pay-for-performance philosophy. The goals of our program are to compensate executive management based on performance, create long-term stockholder value and attract and retain key employees. Paying for performance is a key attribute of ATI’s compensation philosophy. As such, a significant portion of the compensation of each named executive officer (“NEO”) is subject to the achievement of rigorous performance goals and, therefore, is “at risk.”

2020 Target Pay Mix

Table of Contents

|

Proxy Statement Summary |

ATI 2021 Proxy Statement |

11 |

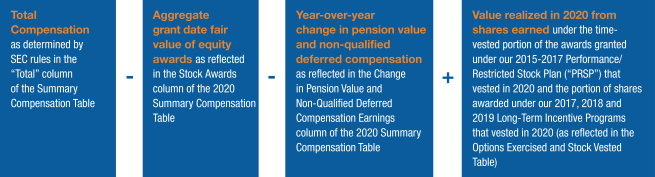

TOTAL REALIZED COMPENSATION

When making determinations and awards under our incentive plans, the Personnel and Compensation Committee looks to the actual dollar value of awards to be delivered to the NEOs in any given year, as illustrated by the Total Realized Compensation figures below.

The comparison of 2020 target compensation to realized compensation for our NEOs reflects the significant and unanticipated negative impact on our business of the COVID-19 pandemic, in contrast to our successful performance in 2019 and 2018. Similar to 2020, total realized compensation was meaningfully lower than target for each of our NEOs in 2016 and 2017, when our business performed below our expectations.

2016-2020 Total Realized Compensation as % of Target

CEO Other NEOs (Average)

These multi-year trends demonstrate our ongoing commitment to compensating our leadership based on the Company’s performance and placing a significant portion of senior executive compensation “at risk.”

2020 Target Compensation Comparison to Total Realized Compensation

| Named Executive Officer* | 2020 Target Compensation |

2020 Total Realized Compensation |

% of Target Realized |

|||||||||||||

|

Wetherbee |

|

$6,081,250 |

|

|

$2,437,085 |

|

|

|

|

|

40% |

| ||||

|

Newman |

|

$2,242,000 |

|

|

$1,784,722 |

|

|

|

|

|

80% |

| ||||

|

Fields |

|

$2,090,000 |

|

|

$1,040,992 |

|

|

|

|

|

50% |

| ||||

|

Sims |

|

$2,090,000 |

|

|

$1,474,348 |

|

|

|

|

|

71% |

| ||||

|

Kramer |

|

$1,938,000 |

|

|

$1,476,072 |

|

|

|

|

|

76% |

| ||||

| * | Mr. Newman joined the Company in January 2020. Patrick J. DeCourcy, who served as the Company’s Chief Financial Officer for a portion of January 2020 and retired in April 2020, received nominal compensation during 2020. Mr. Sims retired effective February 28, 2021. See Summary Compensation Table for 2020 on page 63 for more information. |

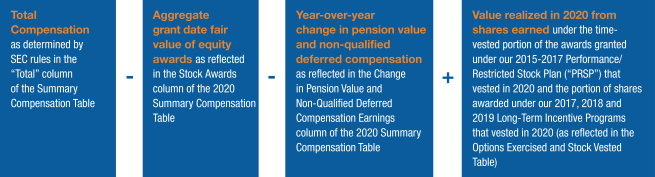

Total Realized Compensation is calculated as follows:

Table of Contents

|

12 |

|

ATI 2021 Proxy Statement |

Item 1: Election Of Directors Director Terms |

Election Of Directors

Our Board of Directors has nominated three directors for election. Herbert J. Carlisle, David P. Hess and Marianne Kah are standing for election to the Board as Class I directors for three-year terms expiring in 2024.

Plurality Voting: Directors are elected by a plurality of the votes cast. This means that the three individuals nominated for election to the Board who receive the most “FOR” votes (among votes properly cast in person, electronically, telephonically or by proxy) will be elected.

Director Resignation Policy: While directors are elected by a plurality of the votes cast, our Bylaws include a director resignation policy. This policy states that, in an uncontested election, if any director nominee receives a greater number of votes “WITHHELD” from his or her election, as compared to votes “FOR” such election, the director nominee must tender his or her resignation. The Nominating and Governance Committee of the Board is required to make recommendations to the Board regarding any such tendered resignation. The Board will act on the tendered resignation within 90 days from the certification of the vote and will publicly disclose its decision, including its rationale.

Only votes “FOR” or “WITHHELD” are counted in determining whether a plurality has been cast in favor of a director nominee; abstentions are not counted for purposes of the election of directors. If you withhold authority to vote with respect to the election of some or all of the nominees, your shares will not be voted with respect to those nominees indicated. For a “WITHHOLD” vote, your shares will be counted for purposes of determining whether there is a quorum and will have a similar effect as a vote against that director nominee for purposes of our director resignation policy.

If a nominee becomes unable or unwilling to serve, the proxies will vote for a Board-designated substitute or the Board may reduce the number of directors. The Company has no reason to believe that any of the nominees for election will be unable or unwilling to serve.

Our directors currently are divided into three classes, and the directors in each class generally serve for three-year terms unless unable to serve due to death, retirement or disability. The term of one class of directors currently expires each year at our annual meeting of stockholders. The Board may fill a vacancy by electing a new director to the same class as the director being replaced or by effectively reassigning a director from another class. The Board may also create a new director position in any class and elect a director to hold the newly created position.

Mandatory Retirement Policy: Our Corporate Governance Guidelines include a mandatory retirement requirement that applies to our directors. Under this policy, an ATI director is expected to retire from the Board no later than the conclusion of the term of office that follows his or her 72nd birthday. If a director will reach his or her 72nd birthday during his or her next upcoming term, the Nominating and Governance Committee takes that fact into account in determining whether to recommend nomination of the director for reelection.

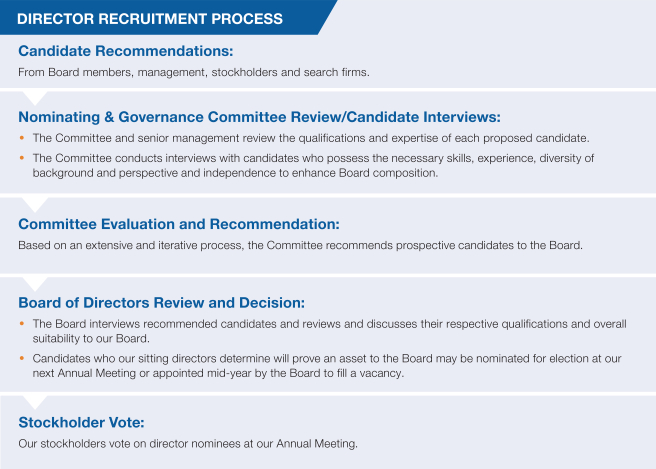

OUR DIRECTOR NOMINATION PROCESS

The Board is responsible for recommending director nominees to the stockholders and for selecting directors to fill vacancies between stockholder meetings. The Nominating and Governance Committee recommends candidates to the Board.

The Committee considers director candidates suggested by sitting directors, senior management and stockholders, among other sources. Additionally, the Board has, at times, engaged an external search firm to facilitate nationwide candidate searches as part of its refreshment efforts. The Committee believes that a wide-ranging and robust search is the best way to identify those candidates who most aptly meet the experience, skill and other criteria established by the Committee as necessary or desirable additions to the Board.

Table of Contents

|

Item 1: Election Of Directors Our Director Nomination Process |

ATI 2021 Proxy Statement |

13 |

Director Criteria for Nominees

Director candidates are generally selected on the basis of the following criteria:

Board Diversity is one of many criteria considered by the Board when evaluating candidates. A key factor in determining director nominees is our interest in building a cognitively diverse board representing a wide breadth of experience and perspectives.

Table of Contents

|

14 |

|

ATI 2021 Proxy Statement |

Item 1: Election Of Directors Our Director Nomination Process |

In evaluating the needs of the Board, the Nominating and Governance Committee considers the qualifications and past contributions to the Board of sitting directors and consults with other members of the Board (including as part of the Board’s annual self-evaluation), our President and Chief Executive Officer, and other members of executive management. At a minimum, all recommended candidates must exemplify the highest standards of personal and professional integrity, meet any required independence standards, and be willing and able to constructively participate in and contribute to Board and committee meetings. Our Board engages, as appropriate, in refreshment efforts that focus on these and other more specific criteria, including ensuring that the Board continues to include key skill sets. In 2019, the Board appointed: David P. Hess, who has extensive executive leadership experience in the aerospace industry, our most significant end market; Marianne Kah, an acknowledged expert on global energy markets who led a more than 25-year career in the oil & gas industry, another key end market for ATI, and has deep expertise in strategic planning; and Leroy M. Ball, who possesses characteristics that the Board viewed as valuable additions to its overall composition (including his experience as a sitting CEO), and has been designated as a second “Audit Committee Financial Expert” under applicable SEC and New York Stock Exchange (“NYSE”) rules, in addition to John R. Pipski, who currently chairs our Audit Committee.

Director Skills Summary

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| CEO EXPERIENCE gives our Board strong leadership and experience across a range of corporate governance, strategic planning, finance, operational and management and succession planning matters. | ∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

| ||||||||||||||||

| INDUSTRY/MANUFACTURING KNOWLEDGE provides valuable, in-depth knowledge of our industry and/or the end markets we serve, with a detailed understanding of our business challenges and opportunities. | ∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

| ||||||||||||||

| OPERATIONS/PRODUCTION experience gives our Board a practical understanding of the development and implementation of our business plan and of the risks and opportunities that can impact our operations and strategies. | ∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

| ||||||||||||||||

| FINANCIAL EXPERTISE provides our Board with the financial acumen necessary to inform its oversight of our financial performance and reporting, internal controls and long-term strategic planning. | ∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

| ||||||||||||

| TECHNICAL OR LEGAL experience brings important perspectives for our business to develop innovative products and technologies and to the Board’s risk management function. | ∎

|

∎

|

∎

|

∎

|

∎

|

∎

| ||||||||||||||||||

| LABOR/HUMAN RESOURCES experience enables directors to make important contributions to our efforts to engage in robust succession planning, to attract, motivate and retain high-performing employees and to interact effectively with our workforce. | ∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

| ||||||||||||||||

| MARKETING/COMMUNICATIONS experience helps guide our strategic efforts to develop new and existing markets and to communicate effectively with our stakeholders. | ∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

| ||||||||||||||||

| GOVERNMENT/ENVIRONMENTAL backgrounds and experience gives directors a deep understanding of the regulatory environment in which we operate. | ∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

||||||||||||||||||

| INTERNATIONAL/M&A experience is relevant to the global nature of our business and to our long-term strategic planning.

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

| ||||||||||||||

| CORPORATE GOVERNANCE/CORPORATE RESPONSIBILITY experience supports our emphasis on strong Board and management accountability, transparency, protection of shareholder interests and long-term value creation. | ∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

|

∎

| ||||||||||||

Table of Contents

|

Item 1: Election Of Directors Our 2021 Director Nominees and Continuing Directors |

ATI 2021 Proxy Statement |

15 |

OUR 2021 DIRECTOR NOMINEES AND CONTINUING DIRECTORS

Our Board determined that each of the three director nominees qualifies for election under the criteria for evaluation of directors. The Board determined that Ms. Kah and Messrs. Carlisle and Hess qualify as independent directors under applicable rules and regulations and our categorical Board independence standards.

All of our directors bring to our Board a wealth of leadership experience derived from their service in executive and managerial roles, as well as extensive board experience. Background information about the nominees and the continuing directors, including their business experience and directorships held during the past five years, and certain individual qualifications and skills of our directors that contribute to the Board’s effectiveness as a whole, is provided below.

Consistent with our mandatory retirement policy, three of our current Class I directors, including Diane Creel, John Pipski and James Rohr, are not standing for re-election and will retire from our Board at the conclusion of the 2021 Annual Meeting. Ms. Kah, who currently serves as a Class II director, is standing for re-election as a Class I director, prior to what otherwise would be the conclusion of her current term as a Class II director. Concurrently with the adjournment of the 2021 Annual Meeting, our Board will be reduced in size to nine directors.

Nominees – Class I – Term to Expire at the 2024 Annual Meeting

|

Herbert J. Carlisle

|

|||||

|

Director since 2018

Age 65 |

| General Carlisle has been President and Chief Executive Officer of the National Defense Industrial Association (NDIA) since March 2017, when he retired from the United States Air Force as a four-star general following a 39-year military career. His last Air Force assignment was as Commander, Air Company Command at Langley Air Force Base in Virginia. Prior to that, he was the Commander of the Pacific Air Forces, the air component Commander for the U.S. Pacific Command, and served as executive director of Pacific Air Combat Operations staff, Joint Base Harbor in Hawaii, following various operational and staff assignments throughout the Air Force, including as chief of air operations, U.S. Central Command Forward in Riyadh, Saudi Arabia and as director of legislative liaison at the Office of the Secretary of the Air Force. |

|

|

Board Committees: Member, Audit, Finance and Technology Committees.

Skills and Qualifications The Board believes that General Carlisle’s qualifications include his executive leadership experience as a senior military official, his legislative and government experience and his experience and knowledge in the aerospace and defense fields.

Current Directorships: • IAP Worldwide Services, Inc. • The Entwistle Company |

Table of Contents

|

16 |

|

ATI 2021 Proxy Statement |

Item 1: Election Of Directors Our 2021 Director Nominees and Continuing Directors |

|

David P. Hess

|

|||||

|

Director since 2019

Age 65 |

| Mr. Hess has 40 years of experience in the aerospace industry, including 38 at United Technologies Corporation where he most recently served as Executive Vice President and Chief Customer Officer for UTC Aerospace from January 2015 until his retirement in January 2017. From 2009 to 2014 he was President of Pratt & Whitney, a subsidiary of UTC, responsible for the company’s global operations in the design, manufacture and service of engines for commercial and military aircraft. Most recently, Mr. Hess served as a board member for Arconic Corporation from March 2017 to May 2019, and as Arconic’s Chief Executive Officer from April 2017 to January 2018. | Board Committees: Member, Finance, Nominating & Governance and Personnel & Compensation Committees.

Skills and Qualifications The Board believes that Mr. Hess’s qualifications include his extensive aerospace background and leadership experience, including his recent service as a Chief Executive Officer.

Current Directorships: • Woodward, Inc.

Past Directorships: • Arconic Corporation |

|

Marianne Kah

|

|||||

|

Director since 2019

Age 67 |

| Ms. Kah is a global energy and raw materials markets expert with experience in board-level strategic planning and risk analysis. She served as Chief Economist for ConocoPhillips, an oil and gas exploration and production company, for more than 20 years until her retirement in 2017, developing market outlooks, risk assessments and scenario plans that drove corporate strategy. She currently serves as an adjunct senior research scholar and Advisory Board member of Columbia University’s Center on Global Energy Policy, with a current focus on the impact of disruptive technologies, such as electrification, automation and shared mobility, on energy demand and transportation. | Board Committees: Member, Audit and Technology Committees.

Skills and Qualifications The Board believes that Ms. Kah’s qualifications include her energy markets experience and expertise, her leadership skills and past role as a senior leader of a global public company, and her extensive strategic planning background.

Current Directorships: • PGS ASA |

Table of Contents

|

Item 1: Election Of Directors Our 2021 Director Nominees and Continuing Directors |

ATI 2021 Proxy Statement |

17 |

Continuing Directors – Class II – Term to Expire at the 2022 Annual Meeting

|

Leroy M. Ball, Jr.

|

|||||

|

Director since 2019

Age 52; Audit Committee Financial Expert |

| Mr. Ball has been the President and Chief Executive Officer of Koppers Holdings Inc., a leading integrated global provider of treated wood products, wood treatment chemicals and carbon compounds, since January 2015, having served as its Chief Operating Officer from August 2014 through December 2014, as both its Chief Operating Officer and Chief Financial Officer from May 2014 to August 2014, and as its Chief Financial Officer from 2010 to May 2014. Before joining Koppers, Mr. Ball served as the Senior Vice President and Chief Financial Officer of Calgon Carbon, Inc., a provider of services, products and solutions for purifying water and air, from 2002 to 2010.

|

Board Committees: Member, Audit, Personnel & Compensation, and Technology Committees.

Skills and Qualifications The Board believes that Mr. Ball’s qualifications include his experience in senior leadership positions and his operational, financial and public company accounting expertise.

Current Directorships: • Koppers Holdings Inc. • Koppers, Inc. (a subsidiary of Koppers Holdings Inc.) |

|

Carolyn Corvi

|

|||||

|

Director since 2012

Age 69 |

| Upon her retirement in 2008, Ms. Corvi concluded a 34-year career with The Boeing Company, a diversified aerospace company, where she most recently served as Vice President, General Manager of Airplane Programs, Boeing Commercial Airplanes, a position she held from 2005 until her retirement.

Board Committees: Chair, Technology Committee and member, Nominating & Governance and Personnel & Compensation Committees. |

Skills and Qualifications The Board believes that Ms. Corvi’s qualifications include her extensive experience in the aerospace industry (ATI’s largest end market) and her knowledge of and experience in manufacturing.

Current Directorships • Hyster-Yale Materials Handling, Inc. • United Continental Holdings, Inc.

Past Directorships: • Goodrich Corporation and Continental Airlines, Inc. |

|

Robert S. Wetherbee

|

|||||

|

Director since 2019 and Chairman Elect

Age 61 |

| Mr. Wetherbee was appointed to serve as ATI’s President and Chief Executive Officer effective January 1, 2019, when he was also appointed to the Board. He served as Executive Vice President, ATI Flat Rolled Products Group, from January 2015 to December 2018, and prior to that, was the President of ATI Flat Rolled Products from April 2014 to January 2015. From March 2013 to February 2014, Mr. Wetherbee was President and Chief Executive Officer of Minerals Technologies, Inc. He served as President of ATI’s tungsten business from 2010 through 2012, following a 29-year career with Alcoa Inc.

|

Skills and Qualifications The Board believes that Mr. Wetherbee’s qualifications include his experience in senior leadership positions both at ATI and at other publicly traded manufacturers and his intimate knowledge of the industry and of ATI’s business given his tenure with the Company and his past long-tenured experience with another major metals producer. |

Table of Contents

|

18 |

|

ATI 2021 Proxy Statement |

Item 1: Election Of Directors Our 2021 Director Nominees and Continuing Directors |

Continuing Directors – Class III – Term to Expire at the 2023 Annual Meeting

|

James C. Diggs

|

|||||

|

Director since 2001

Age 72 |

| From 1997 until his retirement in 2010, Mr. Diggs was Senior Vice President and General Counsel of PPG Industries, Inc., a manufacturer and distributor of a broad range of paints, coatings and specialty materials. He held the position of Secretary from 2004 to 2009.

Board Committees: Chair, Finance Committee and member, Audit and Nominating & Governance Committees. |

|

Skills and Qualifications The Board believes that Mr. Diggs’s qualifications include his experience with industry and legal matters, his senior leadership at a global public company, and his experience with domestic and international operations.

Current Directorships: • Brandywine Realty Trust |

|

J. Brett Harvey

|

|||||

|

Director since 2007, Lead Independent Director Elect

Age 70 |

| Mr. Harvey previously served as Chairman Emeritus of CONSOL Energy Inc., a leading diversified energy company in the United States, from May 2016 to May 2017. He served as Chairman of CONSOL from 2010 until his retirement in May 2016 and was Executive Chairman from May 2014 to January 2015. Mr. Harvey was Chief Executive Officer of CONSOL from 1998 until May 2014. He also served as President from 1998 until 2011. Mr. Harvey was Chairman of CNX Gas Corporation, a subsidiary of CONSOL, from 2009 to 2010 and was a Director of CNX from 2005 to 2014.

Board Committees: Member, Finance, Nominating & Governance and Personnel & Compensation Committees |

|

|

Skills and Qualifications The Board believes that Mr. Harvey’s qualifications include his significant oversight experience from serving as the chief executive officer of public companies, his industry experience in the oil and gas market (a large end market for ATI), and his operational expertise.

Current Directorships: • Barrick Gold Corporation (Lead Director since 2013) • Warrior Met Coal (Lead Independent Director since 2018)

Past Directorships: • CONSOL Energy Inc. (Chairman from 2010 to 2016) and CNX Gas Corporation (Chairman from 2009 to 2010) |

|

David J. Morehouse

|

|||||

|

Director since 2015

Age 60 |

| Mr. Morehouse is Chief Executive Officer and President of Pittsburgh Penguins LLC, which owns and operates the Pittsburgh Penguins National Hockey League team. He was named President of the Pittsburgh Penguins in 2007 and has also served as Chief Executive Officer since 2010. He joined the Pittsburgh Penguins in 2004 as a consultant for special projects, including the construction of the team’s current arena. | Board Committees: Member, Audit and Technology Committees.

Skills and Qualifications The Board believes that Mr. Morehouse’s qualifications include his leadership, strategic planning and development, operations, branding and marketing, and government experience. |

Table of Contents

|

Our Corporate Governance Our Commitment to Integrity, Corporate Governance and Sustainability |

ATI 2021 Proxy Statement |

19 |

We are committed to a strong self-governance program. Our corporate governance practices are designed to maintain high standards of oversight, compliance, integrity and ethics, while promoting growth in long-term stockholder value. The role of our Board of Directors is to ensure that ATI is managed for the long-term benefit of our stockholders and other stakeholders.

Each year, we review our corporate governance and compensation policies and practices and engage with our stockholders. In our ongoing effort to ensure that our governance policies and practices consistently reflect best practices, we take suggestions from our stockholders into consideration, along with developments and evolving trends reflected in the standards established by proxy advisory firms, as well as in the policies, practices and disclosures of other public companies. In this way, we affirm our commitment to RELENTLESS INNOVATION™ by continually evolving our programs to benefit all of our stakeholders.

OUR COMMITMENT TO INTEGRITY, CORPORATE GOVERNANCE AND SUSTAINABILITY

Corporate Governance Information on Our Website

The following governance documents are available on our website atimetals.com, at “Investors – Corporate Governance”:

| • | Corporate Governance Guidelines |

| • | Corporate Guidelines for Business Conduct and Ethics (including Financial Code of Ethics) |

| • | Board Committee Charters |

| • | Certificate of Incorporation and Bylaws |

Paper copies can be obtained by writing to the Corporate Secretary, Allegheny Technologies Incorporated, 1000 Six PPG Place, Pittsburgh, PA 15222-5479.

Additionally, our current Sustainability Report is available at ATImetals.com/aboutati/sustainability-report. For more information, see page 22 of this Proxy Statement.

Table of Contents

|

20 |

|

ATI 2021 Proxy Statement |

Our Corporate Governance ATI Corporate Governance at a Glance |

ATI CORPORATE GOVERNANCE AT A GLANCE

Presented below are some highlights of the ATI corporate governance program. You can find details about these and other corporate governance policies and practices within this Proxy Statement.

| Board Independence |

• 11 of our 12 current directors, and 8 of our 9 continuing directors, are independent. | |

| Independent Board Chair/ Lead Independent Director |

• Diane C. Creel currently serves as our Independent Board Chair. Following Ms. Creel’s retirement, J. Brett Harvey will serve as our Lead Independent Director

• Our independent directors meet in regularly scheduled executive sessions without the presence of management.

• Stockholders can communicate with the independent directors through the Board Chair or Lead Independent Director. | |

| Board Composition |

• Currently, the Board has fixed the number of directors at 12. Concurrently with the adjournment of the 2021 Annual Meeting, the Board will be reduced in size to nine directors.

• Our Board regularly assesses its performance and can adjust the number of directors according to need or as the opportunity arises to enhance the overall mix of skills and experience represented on our Board. It is anticipated that our Board will consist of nine directors immediately following the 2021 Annual Meeting.

• As shown under Item 1 – Election of Directors, our Board has a diverse mix of skills, experience and background. We also have a mandatory retirement age, as described elsewhere in this Proxy Statement. | |

| Accountability to Stockholders |

• Engagement with Stockholders. We actively reach out to our stockholders through our annual engagement program and communicate with them on important compensation, governance and environmental and social sustainability issues. Also, stockholders can contact our Board, Board Chair or management by email or regular mail.

• Proxy Access. We allow a stockholder or group of up to 20 stockholders owning an aggregate of 3% or more of our outstanding common stock for at least three years to nominate and include in our proxy materials director nominees constituting up to 20% of the number of directors then in office or two nominees, whichever is greater, provided the stockholders and nominees otherwise satisfy the requirements of our Bylaws.

• Majority Voting/Director Resignation Policy. Our director resignation policy provides that any nominee for director in an uncontested election who receives a greater number of votes “withheld” than votes “for” his or her election must promptly tender his or her resignation to the Board for the Board’s consideration. | |

| Independent Board Committees |

• We have five Board committees: Audit; Finance; Nominating & Governance; Personnel & Compensation; and Technology.

• All of the Board committees are composed entirely of independent directors, and each has a written charter that is reviewed and reassessed annually and is posted on our website. | |

| Risk Oversight |

• Our full Board is responsible for risk oversight, and has designated committees to have particular oversight of certain key risks. Our Board oversees management as it fulfills its responsibilities for the assessment and mitigation of risks and for taking appropriate risks. | |

| Succession Planning |

• The Board actively monitors our management succession plans and receives regular updates on employee engagement, diversity and retention matters. At least annually, the Board reviews senior management succession and development plans.

• Additionally, the Board evaluates matters related to Board succession and the processes by which additional directors with strong and diverse experience can be attracted and selected for future Board seats. | |

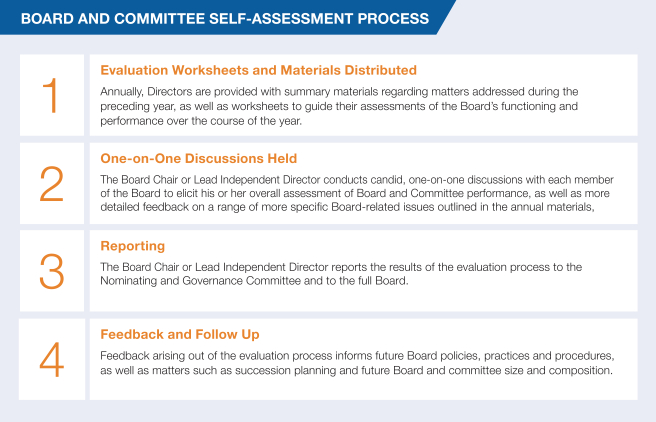

| Self-Evaluations |

• We have an annual self-evaluation process for the Board and for each standing committee of the Board. | |

| Director and NEO Stock Ownership |

• Each director is expected to own at least 10,000 shares of our common stock.

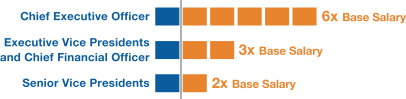

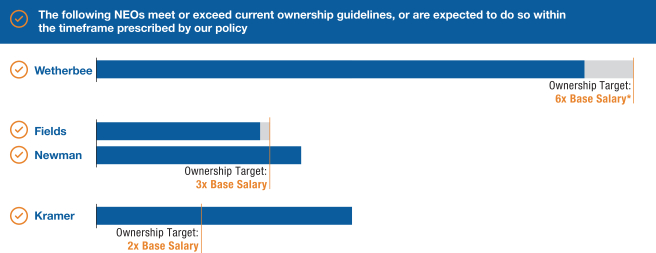

• Executives are expected to own ATI common stock with a value equivalent to:

– CEO: six times base salary;

– Executive Vice Presidents and the Chief Financial Officer: three times base salary; and

– Senior Vice Presidents: two times base salary. | |

| Ethics/Corporate Responsibility |

• Our Corporate Guidelines for Business Conduct and Ethics, as well as the Company’s attention to environmental, social and governance issues, are disclosed on our website.

• The Company has an active ethics and compliance program, which includes regular employee training. | |

Table of Contents

|

Our Corporate Governance Corporate Governance Guidelines |

ATI 2021 Proxy Statement |

21 |

CORPORATE GOVERNANCE GUIDELINES

ATI’s Board of Directors has adopted Corporate Governance Guidelines that are designed to assist the Board in the exercise of its duties and responsibilities to the Company. The Guidelines reflect the Board’s commitment to monitor the effectiveness of decision making at the Board and management levels, with a view to achieving ATI’s strategic objectives. The Guidelines are subject to modification by the Board at any time.

CORPORATE GUIDELINES FOR BUSINESS CONDUCT AND ETHICS

Our Corporate Guidelines for Business Conduct and Ethics (our “Code of Ethics”) apply to all directors, officers and employees, including our principal executive officer, our principal financial officer, and our controller and principal accounting officer. We require all directors, officers and employees to adhere to our Code of Ethics in addressing legal and ethical issues encountered in their work.

Our Code of Ethics requires that our directors, officers and employees avoid conflicts of interest, comply with applicable laws, conduct business in an honest and ethical manner, and otherwise act with integrity and honesty in all of their actions by or on behalf of the Company. It includes a financial code of ethics specifically for our Chief Executive Officer, our Chief Financial Officer, and all other financial officers and employees, which supplements the general principles in the Code of Ethics and is intended to promote honest and ethical conduct, full and accurate reporting, and compliance with laws, as well as other matters.

Only the Audit Committee of the Board can amend or grant waivers from the provisions of the Code of Ethics relating to the Company’s executive officers and directors, and any such amendments or waivers will be promptly posted on our website at ATImetals.com. To date, no such amendments have been made or waivers granted.

Mandatory Employee Training

All employees are provided with a copy of the Code of Ethics. Each year, we require all officers and managers to certify as to their understanding of and compliance with the Code of Ethics. In addition, all directors, officers and other employees must annually complete an interactive online ethics course addressing the Code of Ethics. This course is part of ATI’s broader ethics and compliance program, which includes online ethics training that is administered by a third party. In 2020, ATI’s online ethics courses addressed:

| • | anti-corruption/anti-bribery |

| • | cybersecurity |

| • | protecting intellectual property |

| • | sexual harassment |

| • | diversity and inclusion, and |

| • | reporting ethical concerns. |

We encourage employees to communicate concerns before they become problems. We believe that building and maintaining trust, respect and communication between employees and management and between fellow employees is critical to the overarching goal of efficiently producing high quality products, providing the maximum level of customer satisfaction, and ultimately fueling profitability and growth.

The ATI Ethics Helpline provides for confidential, secure, and anonymous reporting and is available 24 hours a day. Additionally, our Chief Compliance Officer and ethics officers at our operating companies also provide confidential resources for employees to surface their concerns without fear of reprisal.

Table of Contents

|

22 |

|

ATI 2021 Proxy Statement |

Our Corporate Governance Environmental and Social Sustainability |

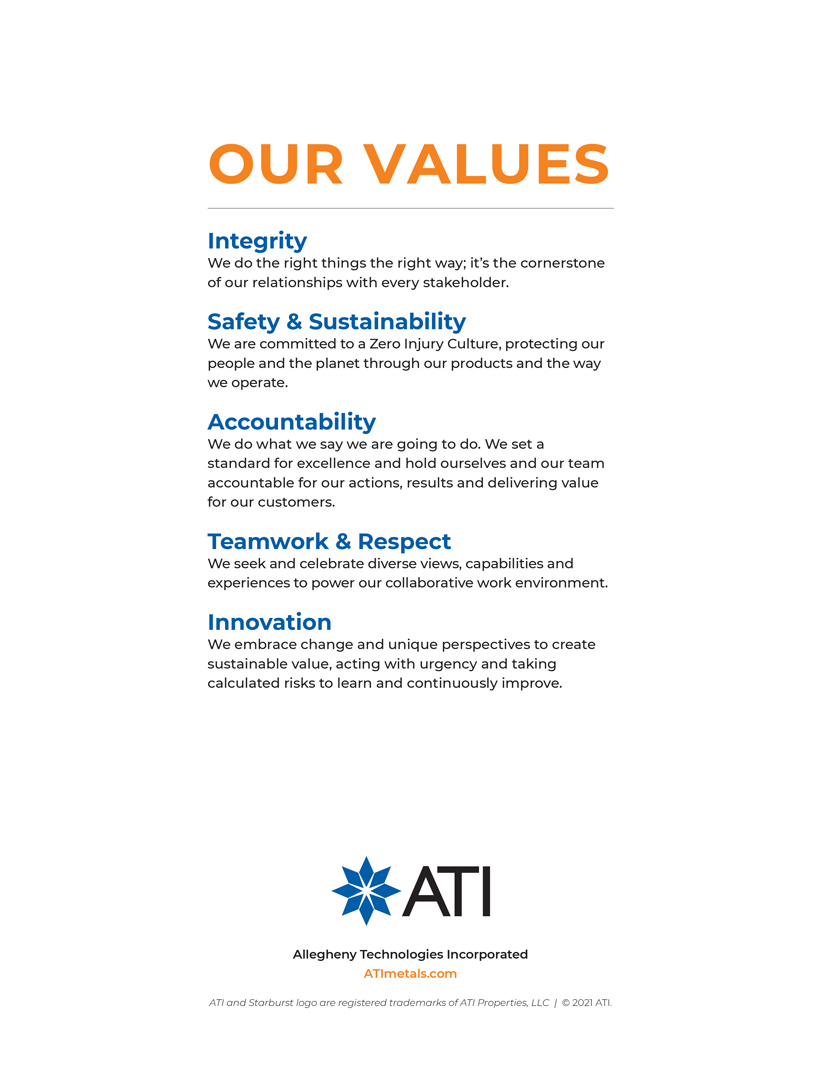

ENVIRONMENTAL AND SOCIAL SUSTAINABILITY

At ATI, we recognize that long-term excellence and profitability require sustainable practices. Sustainability can mean many things, and for ATI it is an evolving and developing effort. Our core values emphasize the safety and sustainability of our products, people and the communities in which we operate, and we continually review and refine our efforts to enrich those communities, improve the health and safety of our employees, ensure the sustainability and quality of our workforce and lessen our environmental impact. Recently, we were pleased to be named by Newsweek as one of America’s Most Responsible Companies for 2021.

The following discussion highlights some of our key sustainability initiatives and areas of current focus.

|

Under our short-term incentive program, the Personnel and Compensation Committee of our Board has expressly reserved the broad discretion to reduce or eliminate any annual cash incentive award that may otherwise be payable to one or more participants, including each NEO, if any facet of our financial or operational performance, especially in relation to the Committee’s expectations for workplace safety, the environmental impact of our business or other aspects of our annual performance with the potential to affect the sustainability of our business, is sub-standard in the view of the Committee.

|

Sustainability Report Highlights

ATI published its most recent Sustainability Report in August 2020. Recognizing that “sustainability” can mean many things, the Report provides an overview of environmental, workforce health and safety and community sustainability efforts and achievements across our business. We also report specific environmental sustainability goals that ATI will pursue through 2030, using our 2018 results as the baseline against which we will measure our achievement. We intend to publish our report and update our stakeholders on our progress toward these goals annually.

ATI’s Sustainability Report is available at ATImetals.com/aboutati/Pages/safety-sustainability.aspx

All ATI operations are committed to:

| • | Reducing their energy intensity through conservation efforts and energy efficiency; |

| • | Reducing greenhouse gas emissions through operational efforts, energy conservation and procurement strategies; |

| • | Reducing consumption of water withdrawal through conservation, reuse, and equipment modification; and |

| • | Increasing the amount of recycled materials used in our processes to eliminate waste in all phases of our manufacturing processes. Approximately 77% of the raw materials that ATI uses to manufacture specialty metals start from scrap material, which is either purchased or internally generated by our own manufacturing processes. |

|

2018 Environmental Performance Benchmarks:

• 3.02GJ/ton produced energy intensity

• 877,390 tons CO2e emissions

• 1.12kgal/ton produced water intensity

• Approximately 75% of raw materials used to manufacture specialty metals sourced from scrap material

• Approximately 42% of ATI operations operate according to an ISO 14001 certified Environmental Management System |

|

2022 Goals:

• All facilities to be included in metrics

• All facilities ISO 14001 and 45001 certified

2025 Goals:

• Reduce Energy Intensity 5%

• Reduce CO2e Emissions 5%

• Reduce Freshwater Intake 5%

• Increase Recycled Materials to 80%

2030 Goals:

• Reduce Energy Intensity 7%

• Reduce CO2e Emissions 7%

• Reduce Freshwater Intake 3%

• Increase Recycled Materials to 83%

|

Table of Contents

|

Our Corporate Governance Environmental and Social Sustainability |

ATI 2021 Proxy Statement |

23 |

|

|

Products that Promote Sustainability |

Our materials enable our customers to do amazing things, from operating jet engines at 2,800º F, to equipping our nation’s defense, to safely and efficiently transporting corrosive liquids and exhaust streams and enabling life-changing medical insights.

The materials that we produce improve quality of life by reducing air pollution, providing advanced medical solutions, enabling clean water and eliminating waste.

Our alloys are used in products and equipment that:

|

|

Environmental Stewardship |

We are also committed to sound environmental practices in our own business operations.

|

|

Health and Safety |

As part of our continuous improvement culture, we are committed to making our operations the safest in the industry for our employees and the communities surrounding our plant locations.

|

|

Community |

We support local communities and contribute to their sustainability through measures such as locally sourcing goods and services and charitable giving. Examples include:

Table of Contents

|

24 |

|

ATI 2021 Proxy Statement |

Our Corporate Governance Environmental and Social Sustainability |

We believe that world-class leadership and fostering a culture that enables us to build and grow a talented team through career development and opportunities is foundational to our vision. Attracting, retaining and developing members of our workforce is key to the sustainability of our business. As the economy and our business grow, so do both demand for qualified candidates and the retirement rate for older workers; hence we are always competing for talent in an environment of increasingly challenged supply. To that end, we have developed — and continue to enhance and refine — a robust and comprehensive talent management program that spans from recruitment and selection to performance management, career development and retention of our top talent and, ultimately, to succession planning across our organization.

Talent Acquisition

| • | Partner closely with a targeted number of colleges and universities specifically known for programs that are relevant to our business in order to identify materials science, STEM expertise and other relevant talent, and have developed similar partnerships with high schools and relevant trade schools. |

| • | Engage with external professional recruiting firms to enhance our recruiting efforts for key positions. |

| • | Use pre-employment assessment tools to identify candidates who we believe would adapt well to our culture and be most suited to a particular opportunity. |

| • | Actively engage with campus and professional diversity groups. |

Professional Development

| • | Global Leadership Development Program (GLDP). The GLDP is our Company-wide, flagship program designed to build the skills of our employees across each level of leadership. It includes a series of multi-day training programs tailored to reach and serve a broad range of current and potential leaders across the ATI organization. |

| • | Business Acumen Series. This more narrowly focused leadership education program is designed to develop skills in key areas, such as finance. The purpose of this program is to facilitate a common framework and understanding of financial business acumen to improve decision making critical to the sustainable success of our business. |

| • | Early Career Leadership Development Program. Our selective Early Career Leadership Program is designed for high-potential and motivated college graduates. This five-year program, which is designed to prepare our future leaders, accelerates participants’ professional development by rotating them through a variety of business-critical assignments and development opportunities. |

| • | Insights Discovery Program. This program, which we incorporate as an element of our other professional development programs, is designed to support employees in exploring and developing targeted competencies such as self-awareness, communication, conflict management, giving and receiving feedback, influencing others and other skills. |

Engagement and Performance Management

| • | Senior Leader Communication and Transparency. We actively seek opportunities for regular engagement and communication by our CEO and other senior executive leaders with our broader employee population. For example, we hold a quarterly CEO Review that follows the release of our quarterly earnings and is accessible to hundreds of employees across the Company. These reviews provide an opportunity for our CEO and other senior leaders to communicate their perspectives on our recent financial results, as well as financial education and enterprise-level education on topics such as global commercial and other growth initiatives, cybersecurity, ethics and compliance, talent and development programs, opportunities for community engagement and safety. |

| • | Annual Employee Engagement Surveys. Annually, we conduct a confidential company-wide employee engagement survey. Feedback from these surveys provides our management team with valuable information about our workplace culture. It is reviewed with our Board and used to develop and refine other aspects of our overall human capital management and other growth strategies. |

| • | Performance Management Framework. We maintain a robust annual performance management process across the organization. Together with their supervisors, employees identify annual goals and, at the end of the year, provide their own self assessments as to goal achievement and defined core competencies. Employees are reviewed based on the same criteria by both their managers and a second-level reviewer. The results of each annual assessment inform short term incentive compensation and career advancement decisions and are reviewed with employees in one-on-one sessions with their managers. |

Succession Planning

We maintain a formal succession planning process and career mapping framework that is designed to work in concert with our performance management processes and ensure a systematic and ongoing dialog regarding career development and succession planning at both the individual employee level and more broadly at an enterprise level. We believe that the robust and systematic nature of these programs is critical to optimizing our talent management and ensuring sustainably high-quality management of our business over the long term.

Table of Contents

|

Our Corporate Governance Environmental and Social Sustainability |

ATI 2021 Proxy Statement |

25 |

Ultimately, continuing ATI’s long tradition of relentless innovation and operational excellence demands the contributions of leaders and other team members with a wide array of characteristics, backgrounds, experiences, knowledge and skills. One of the principal aspirations of our comprehensive human capital management effort is the cultivation of a workforce that is diverse in every sense and a climate of inclusion that promotes the development, advancement and well-being of our key talent. Simply put, for our business to continue thriving, we must attract, coach and retain the best, and that requires a commitment to workforce diversity.

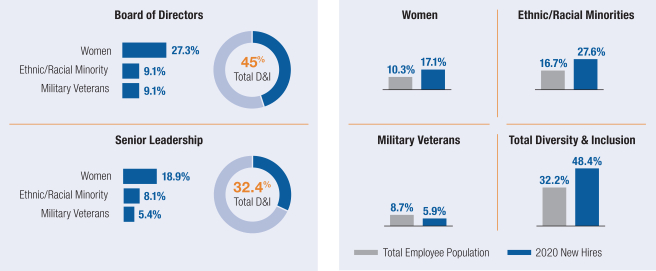

To identify opportunities to improve our recruiting efforts and enhance the inclusiveness of our workplace culture, we collect and regularly review with our senior leadership various diversity statistics relating to gender, ethnicity, age, military service and other attributes, some of which are illustrated below. We also use our annual Employee Engagement Survey to solicit employee perceptions of the diversity and inclusiveness of our corporate culture. Quantitative analysis of our employee population, coupled with a more qualitative understanding of how we are perceived and of the particular challenges we may face as a manufacturing company in the specific regions in which we operate, helps to inform our policy decisions and initiatives related to workforce diversity.

Gender and Ethnic Diversity

We recognize that the proportions of women and ethnic and racial minorities included in our leadership and total workforce do not reflect the composition of the general population. However, we have long benefited from gender diversity on our Board, and women contribute to our business at the highest levels of senior leadership. In fact, we have been recognized for at least ten consecutive years by 2020 Women on Boards for having a Board comprised at least 20% of women, and in 2019, appointed Diane Creel as our Independent Board Chair, following her multi-year service as our Lead Independent Director. Additionally, two of the seven current members of our Executive Council, including our Executive Vice President, AA&S and HPMC and our Chief Human Resources Officer, are women.

Our most recent employee engagement survey results demonstrated year-over-year improvement in employee perceptions of the diversity and inclusiveness of our corporate culture. A majority of respondents agreed that as an organization we value diversity and cultivate a work environment that is accepting of individual differences. However, our ultimate goal is that all respondents take a positive view of our efforts to promote diversity and inclusion.

Veterans

Understanding that we have many opportunities to improve our diversity initiatives, we believe that ATI stands out in its efforts to support and provide career opportunities to veterans of the U.S. armed forces. More than 5% of our senior leadership and nearly 9% of our total employee population are military veterans. The defense market is critical to ATI and a growing component of our business, and we have a formal company-wide strategy and commitment to the recruitment, career development and retention of veterans and the extended military community. We value the contributions of our military community members and recognize the technical and leadership skills earned through the devotion to our company and country.

| Diversity & Inclusion in Leadership | Employee and New Hire Diversity & Inclusion |

| • | We are committed to increasing the representation of women and of racial and ethnic minorities and military veterans of all backgrounds among our employee ranks. To support this objective, we have an enterprise-wide target for 80% of all job candidate slates to include a minimum of 30% diverse candidates. |

Table of Contents

|

26 |

|

ATI 2021 Proxy Statement |

Our Corporate Governance |

| • | Additionally, we are making extensive efforts to identify and attract diverse candidates through comprehensive recruiting strategies that include, among other initiatives, campus partnerships with female and minority student chapters of targeted professional groups, such as the Society of Women Engineers, Society of Hispanic Engineers, and Society of Asian Scientists and Engineers at our partner universities and increased outreach through engagement with additional networking groups, such as the National Society of Black Engineers, the National Association of Black Accountants and the Association of Latino Professions in Accounting and Finance. |

| • | We believe that we are seeing the impact of our diversity initiatives. Notably, our 2020 new hires statistics outpace the composition of our existing employee base for both women and ethnic minorities. While military veterans as a proportion of our total workforce exceeds the percentage of veteran new hires in 2020, at 5.9% of 2020 new hires, our success in recruiting veterans during 2020 is consistent with the representation of military veterans in the general U.S. population. Military veterans comprise nearly 9% of our total workforce, or nearly 50% higher than their proportion of the general U.S. population. |

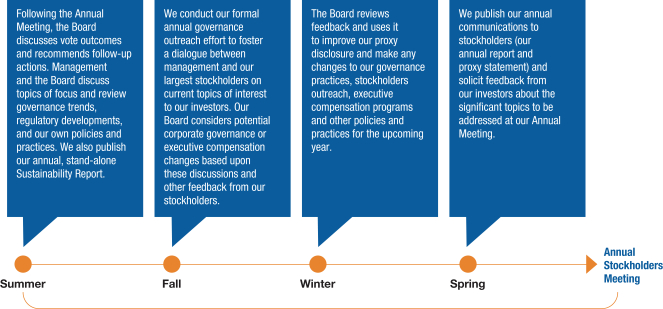

INVESTOR OUTREACH AND STOCKHOLDER ENGAGEMENT

We value the input we receive from our stockholders. As part of our investor relations program, we engage in a structured communication program with certain investors, actively engaging with them throughout the year. We solicit their feedback on a variety of relevant matters, which may include corporate governance topics, our executive compensation program and sustainability initiatives, among other matters. Our goal is to be responsive to our stockholders and to ensure that we understand and address their concerns and observations.

Stockholder Engagement Cycle

Table of Contents

|

Our Corporate Governance Board Information |

ATI 2021 Proxy Statement |

27 |

|

INVESTOR OUTREACH—CREATING A COLLABORATIVE DIALOGUE |

||||||||

|

Throughout the year, management conducts regular meetings and discussions with investors. Each Fall, we offer our largest stockholders a more structured opportunity for one-on-one discussions with representatives of our management team. As a result, during the fourth quarter of 2020, we conducted outreach sessions with several of our largest investors, covering topics of discussion including, among others:

|

||||||||

|

• key current corporate governance policies and practices;

• our COVID-19 pandemic response;

• recent key leadership changes;

• continuing Board refreshment efforts and our Board’s focus on diversity of background, experience, skill and other characteristics; |

• our Sustainability program; and

• the ongoing success of our redesigned executive compensation. |

|||||||||

|

Our 2020 outreach dialogue generally solicited very positive feedback from our investors, in particular with regard to the best practices reflected in our executive compensation programs.

|

||||||||||

The Board does not consider Robert S. Wetherbee, President and Chief Executive Officer of ATI, to be independent. At its February 26, 2021 meeting, the Board determined that the remaining eight continuing directors are independent in accordance with NYSE listing standards, our own Board independence standards and applicable SEC rules.

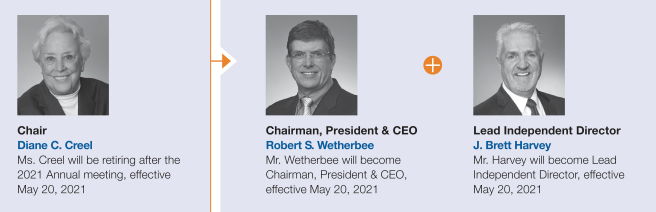

Board Leadership Structure and 2021 Changes

Currently, our Board operates under the leadership of an Independent Board Chair. Our Board has the flexibility to determine whether it is in the best interests of ATI and its stockholders to separate or combine the roles of Chairman and Chief Executive Officer at any given time. In making that determination, the Board assesses whether the roles should be separated or combined based on its evaluation of the existing composition of the Board and the circumstances at the time.

In 2018 as part of its succession planning process, the Board considered the roles and responsibilities of the Chairman and the Chief Executive Officer in connection with the Company’s CEO transition and determined that the Company and its stockholders would be best served by separating the two roles. The Board made this decision to support Mr. Wetherbee’s ability to focus his attention and efforts exclusively on the development and execution of the Company’s near and longer-term strategies as he transitioned to his new role. The Board also determined that appointing an Independent Board Chair would enhance its level of independent oversight during this time of leadership transition.

In view of Mr. Wetherbee’s success in assuming his duties and responsibilities as our Chief Executive Officer and his well-established leadership capabilities, and given Ms. Creel’s pending retirement as Independent Board Chair, our Board reassessed its leadership structure. After careful consideration, the Board determined that the Company and its stockholders will be best served by re-combining the roles of Board Chair and Chief Executive Officer. Accordingly, it is anticipated that concurrently with the conclusion of the 2021 Annual Meeting, Mr. Wetherbee will assume the role of Chairman, President and Chief Executive Officer, and J. Brett Harvey will become our Board’s Lead Independent Director.

Why the transition to a combined Board Chair and CEO role is best for ATI and our stockholders at this time

Our Board believes that combining the roles of Board Chair and Chief Executive Officer will promote unified leadership and direction for the Company and will facilitate the efficient implementation of our strategies to create shareholder value over the long-term. Additionally, the Board believes that Mr. Wetherbee, serving in both capacities, will effectively bridge communication between the Board and our management.

Our Board’s ability to maintain appropriate independent oversight of our business strategies and activities is enhanced by ATI’s existing strong governance structures and policies, such as:

| • | establishing a Lead Independent Director; |

| • | appointing only independent directors to the standing committees of the Board; and |

| • | regularly scheduling executive sessions of the independent directors. |

Table of Contents

|

28 |

|

ATI 2021 Proxy Statement |

Our Corporate Governance Board Information |

|

OUR NEW LEAD INDEPENDENT DIRECTOR |

||||||||

|

First elected to the Board in 2007, J. Brett Harvey will now also serve as our Lead Independent Director. The Lead Independent Director is the principal liaison between the independent directors and the Board Chair on Board-wide issues.

Role and Responsibilities:

|

||||||||

| • Preside, in the absence of the Chairman, at meetings of the Board, including executive sessions of the independent directors;

• Call meetings of the independent directors when necessary and appropriate;

• Facilitate communication with, and among, independent directors between meetings, when appropriate;

• Advise the Chairman regarding schedules, agendas and the quantity, quality and timeliness of information for Board and committee meetings;

|

• Serve as a contact for stockholders wishing to communicate with the Board other than through the Chairman, when appropriate;

• Communicate with other external constituencies, as needed; and

• Advise and consult with the Chairman on matters related to corporate governance and Board performance and generally serve as a resource for, and counsel to, the Chairman. |

|

“ With his deep background in ATI’s business and service on your Board and his past experience serving as a public company chairman and chief executive, Brett is well-positioned to continue ATI’s long tradition of independent Board leadership and oversight.”

— Diane C. Creel, Retiring Board Chair

| ||

Table of Contents

|

Our Corporate Governance Board Information |

ATI 2021 Proxy Statement |

29 |

Board and Committee Membership—Director Attendance at Meetings

During 2020, the Board of Directors held eight meetings, including a multi-day strategy meeting. In 2020, our current directors attended 100% of all Board meetings and meetings of Board committees of which they were members.

The independent, non-management directors meet separately in regularly scheduled executive sessions without members of management (except to the extent that the non-management directors request the attendance of a member of management). The Board Chair currently presides over meetings of the independent directors. Following the 2021 Annual Meeting, our Lead Independent Director will preside over such meetings.

A Board meeting is typically scheduled in conjunction with our Annual Meeting of Stockholders, and it is expected that our directors will attend the Annual Meeting absent good reason. In 2020, all directors attended our Annual Meeting of Stockholders, which was conducted virtually, due to the COVID-19 pandemic.

The table below provides information about the Board committee memberships that our independent directors currently hold. The table also shows the number of meetings held by each Board committee in 2020.

The Board has five standing committees: Audit Committee; Finance Committee; Nominating and Governance Committee; Personnel and Compensation Committee; and Technology Committee. All of the standing committees of the Board are comprised entirely of independent directors.

Each committee has a written charter that describes its responsibilities. Each of the Audit Committee, the Nominating and Governance Committee and the Personnel & Compensation Committee has the authority, as it deems appropriate, to independently engage outside legal, accounting or other advisors or consultants. In addition, each committee annually conducts a review and evaluation of its performance and reviews and reassesses its charter.

| Director | Audit | Finance | Nominating and Governance |

Personnel and Compensation |

Technology | |||||

|

| ||||||||||

| L. M. Ball | ∎ | ∎ | ∎ | |||||||

|

| ||||||||||

| H. J. Carlisle | ∎ | ∎ | ∎ | |||||||

|

| ||||||||||

| C. Corvi | ∎ | ∎ | CHAIR | |||||||

|

| ||||||||||

| D. C. Creel(1) | CHAIR | ∎ | ||||||||

|