Form 6-K Ternium S.A. For: Dec 31

FORM 6 - K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

As of 3/18/2021

Ternium S.A.

(Translation of Registrant's name into English)

Ternium S.A.

26, Boulevard Royal - 4th floor

L-2449 Luxembourg

(352) 2668-3152

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or 40-F.

Form 20-F a Form 40-F __

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12G3-2(b) under the Securities Exchange Act of 1934.

Yes __ No a

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

Not applicable

2

The attached material is being furnished to the Securities and Exchange Commission pursuant to Rule 13a-16 and Form 6-K under the Securities Exchange Act of 1934, as amended.

This report contains Ternium S.A.’s Consolidated Management Report for the year ended on December 31, 2020.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TERNIUM S.A.

By: /s/ Pablo Brizzio By: /s/ Máximo Vedoya

Name: Pablo Brizzio Name: Máximo Vedoya

Title: Chief Financial Officer Title: Chief Executive Officer

Dated: March 18, 2021

Consolidated Management Report

for the year ended on December 31, 2020

26 Boulevard Royal, 4th floor

L – 2449 Luxembourg

R.C.S. Luxembourg: B 98 668

| TERNIUM S.A. | ||

| Consolidated Management Report 2020 | ||

INDEX TO THE CONSOLIDATED MANAGEMENT REPORT FOR THE YEAR 2020

| Page | |||||

| About our Company | 4 | ||||

| Management’s Report | 7 | ||||

| Risks Factors | 18 | ||||

| Consolidated Financial Statements | 35 | ||||

| Annex: Audited Annual Accounts of Ternium S.A. Société Anonyme | |||||

Ternium S.A. is a Luxembourg company and its American Depositary Shares, or ADSs, are listed on the New York Stock Exchange (NYSE: TX). |  | The financial and operational information contained in this annual report is based on Ternium’s operational data and on the Company’s consolidated financial statements, which were prepared in accordance with IFRS and IFRIC interpretations as issued by the IASB and adopted by the European Union and presented in U.S. dollars ($) and metric tons. | ||||||

| This annual report contains “forward-looking statements”, including with respect to certain of our plans and current goals and expectations relating to Ternium’s future financial condition and performance, which are provided to allow potential investors the opportunity to understand management’s beliefs and opinions in respect of the future so that they may use such beliefs and opinions as one factor in evaluating an investment in Ternium’s securities. All forward-looking statements are based on management’s present expectations of future events and are subject to a number of factors and uncertainties that cause actual results, performance or events to differ materially from those expressed or implied by those statements. These risks include but are not limited to risks relating to the steel industry and mining activities, risks relating to countries in which we operate, risks relating to our business, including uncertainties as to gross domestic product, related market demand, global production capacity, tariffs, cyclicality in the industries that purchase steel products, risks relating to the Company’s structure and regulatory risks, as well as other factors beyond Ternium’s control. | For a detailed description of Ternium’s main risks and uncertainties, please see the section "Risk Factors" included in this annual report. By their nature, certain disclosures relating to these and other risks are only estimates and could be materially different from what actually occurs in the future. As a result, actual future gains or losses that may affect Ternium’s financial condition and results of operations could differ materially from those that have been estimated. You should not place undue reliance on the forward-looking statements, which speak only as of the date of this annual report. Except as required by law, we are not under any obligation, and expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of changes of circumstances or management’s estimates or opinions, new information, future events or otherwise. | |||||||

2

| TERNIUM S.A. | ||

| Consolidated Management Report 2020 | ||

Certain Defined Terms

In this consolidated management report, unless otherwise specified or if the context so requires:

- References to “annual report” are to this consolidated management report;

- References to “ADSs” are to the American Depositary Shares, which are evidenced by American Depositary Receipts, or ADRs;

- References to the “Company” are exclusively to Ternium S.A., a Luxembourg public limited liability company (société anonyme);

- References to “billions” are to thousands of millions, or 1,000,000,000;

- References to “EBITDA” are to operating income adjusted to exclude depreciation and amortization and, in 2020, a $186.0 million non-cash gain related to the derecognition of a contingency on certain tax benefits at Ternium Brasil;

- References to “San Faustin” are to San Faustin S.A., a Luxembourg corporation and the Company’s indirect controlling shareholder;

- References to “Techgen” are to Techgen S.A. de C.V., a Mexican corporation, 48% owned by Ternium, 22% owned by Tenaris and 30% owned by Tecpetrol International S.A., a wholly owned subsidiary of San Faustin;

- References to “Tenaris” are to Tenaris S.A., a Luxembourg public limited liability company (société anonyme) and a significant shareholder of the Company;

- References to “Tenigal” are to Tenigal S.R.L. de C.V., a Mexican company, 51% owned by Ternium and 49% owned by Nippon Steel Corporation, or NSC;

- References to “Ternium,” “we,” “us” or “our” are to Ternium S.A. and its consolidated subsidiaries;

- References to the “Ternium companies” are to the Company’s manufacturing subsidiaries, namely Ternium México S.A. de C.V., or “Ternium Mexico,” a Mexican corporation; Ternium Brasil Ltda., or “Ternium Brasil” (formerly, CSA Siderúrgica do Atlântico Ltda.), a Brazilian corporation; Ternium Argentina S.A., or “Ternium Argentina”, (formerly Siderar S.A.I.C.), an Argentine corporation; Ternium Colombia S.A.S., or “Ternium Colombia”, (formerly Ferrasa S.A.S.), a Colombian corporation; Ternium del Atlántico S.A.S., a Colombian corporation; Ternium Internacional Guatemala S.A., a Guatemalan corporation; Ternium USA Inc., a Delaware corporation; Las Encinas S.A. de C.V., or “Las Encinas,” a Mexican corporation; and Consorcio Minero Benito Juárez Peña Colorada S.A. de C.V., or “Consorcio Peña Colorada,” a Mexican corporation, and their respective subsidiaries;

- References to “Ternium Investments” are to Ternium Investments S.à r.l., a Luxembourg private limited liability company (société à responsabilité limitée), and a wholly owned subsidiary of the Company;

- References to “tons” are to metric tons; one metric ton is equal to 1,000 kilograms, 2,204.62 pounds or 1.102 U.S. (short) tons; and

- References to “Usiminas” are to Usinas Siderúrgicas de Minas Gerais S.A. – USIMINAS, a Brazilian corporation in which we own a total of 242.6 million ordinary shares and 8.5 million preferred shares, representing 20.5% of Usiminas’ capital.

3

| TERNIUM S.A. | ||

| About Our Company | ||

Profile

Ternium is Latin America’s leading flat steel producer with an annual crude steel production capacity of 12.4 million tons. It operates in Mexico, Brazil, Argentina, Colombia, the southern United States and Central America through regional manufacturing facilities, service centers and its own distribution network. In addition, Ternium participates in the control group of Usiminas, a leading flat steel company in the Brazilian market. Our customers range from small businesses to large global companies in the automotive, home appliances, heat, ventilation and air conditioning (HVAC), construction, capital goods, container, food and energy industries across the Americas. Ternium’s industrial system has various production technologies that provide a diversified cost structure, based on different types of raw material and energy sources, and a flexible production configuration. The industrial system includes proprietary iron ore mines and processing facilities, steelmaking facilities, finishing facilities, service centers and a broad distribution network to offer slabs, billets, hot-rolled products, cold-rolled products, galvanized and electro-galvanized sheets, pre-painted sheets, tinplate, welded pipes, rebars and wire rods as well as slit and cut-to-length products.

Ternium's innovative culture, industrial expertise and long-term view enable us to continuously achieve new breakthroughs in industrial excellence, competitiveness and customer service. Ternium is the leading supplier of flat steel products in Mexico and Argentina, has a significant position as supplier of steel products in Colombia and in other Latin American countries, and is a competitive player in the international steel market for steel products. Through its network of commercial offices in several countries in Latin America, the United States and Europe, Ternium maintains an international presence that allows it to reach customers outside its local markets, achieves improved effectiveness in the supply of products and in the procurement of semi-finished steel, and maintains a fluent commercial relationship with its customers by providing continuous services and assistance. We operate with a broad and long-term perspective, and we work towards improving the quality of life of our employees, their families and the local communities.

Environment, Health and Safety

We devote significant resources to environment, and occupational health and safety (EHS), as we believe they are key to our long-term sustainability. We have standardized EHS management systems. Our employees are well trained in EHS and our management is accountable for EHS performance. Ternium's occupational health and safety system is certified under OHSAS 18001, and its environment and energy system is certified under ISO 14001 and ISO 50001. We regularly invest in state-of-the-art technologies to reduce our environmental footprint and minimize safety risks.

Integrity

We believe integrity is key to Ternium's long term sustainability. The Company’s board of directors has an audit committee solely composed of independent directors and an internal audit department, which reports to the Chairman of the board of directors and, with respect to internal control over financial reporting, to the audit committee and meets organizational independence and objectivity standards. Ternium has a Business Conduct Compliance Officer reporting to the CEO and a compliance department that oversees, among other things, certifications required under the SEC applicable regulation and related party transactions. Our employees are trained and accountable for ensuring a transparent behavior. The Company has established different policies, codes and procedures for this purpose. In addition, the Company has put in place confidential channels to report alleged breaches of the Code of Conduct and its principles.

Communities

We believe that developing strong ties to our communities is also fundamental to Ternium's long- term sustainability. We are having a significant positive impact on Ternium's communities, both from a human perspective as well as in terms of economic development. We work together with local institutions to enhance the communities' education and welfare. We provide scholarships, internships, teachers' training and infrastructure funding. We also organize and fund volunteering programs and health prevention campaigns, and sponsor sports, social and arts events.

Steel Industry Value Chain

We support approximately 1,800 small and medium-sized enterprises (SMEs), customers and suppliers through our ProPymes program to strengthen the steel value chain in our markets. ProPymes provides training, industrial and business consultancy, institutional assistance, commercial support and financial aid. The program plays an active role at universities, business schools, government agencies and industrial associations. ProPymes has helped create an industrial network that encourages the professionalization and quest for excellence of SMEs.

4

| TERNIUM S.A. | ||

| About Our Company | ||

Performance Highlights

2020(1) | 2019 | 2018 | 2017 | 2016 | |||||||||||||||||||||||||

| Steel Sales Volume (Thousand Tons) | |||||||||||||||||||||||||||||

| Mexico | 5,912.7 | 6,305.0 | 6,544.8 | 6,622.8 | 6,405.2 | ||||||||||||||||||||||||

| Southern Region | 1,923.6 | 1,938.3 | 2,301.1 | 2,456.0 | 2,220.8 | ||||||||||||||||||||||||

| Other Markets | 3,523.2 | 4,268.0 | 4,105.2 | 2,517.7 | 1,138.1 | ||||||||||||||||||||||||

| Total | 11,359.5 | 12,511.3 | 12,951.1 | 11,596.6 | 9,764.0 | ||||||||||||||||||||||||

| Financial Indicators ($ million) | |||||||||||||||||||||||||||||

| Net sales | 8,735.4 | 10,192.8 | 11,454.8 | 9,700.3 | 7,224.0 | ||||||||||||||||||||||||

| Operating income | 1,079.5 | 864.6 | 2,108.4 | 1,456.8 | 1,141.7 | ||||||||||||||||||||||||

EBITDA (2) | 1,524.5 | 1,525.7 | 2,697.7 | 1,931.1 | 1,548.6 | ||||||||||||||||||||||||

| Equity in earnings of non-consolidated companies | 57.6 | 61.0 | 102.8 | 68.1 | 14.6 | ||||||||||||||||||||||||

| Profit before income tax expense | 1,159.4 | 826.6 | 2,031.6 | 1,359.8 | 1,118.5 | ||||||||||||||||||||||||

| Profit for the year attributable to: | |||||||||||||||||||||||||||||

| Owners of the Parent | 778.5 | 564.3 | 1,506.6 | 886.2 | 595.6 | ||||||||||||||||||||||||

| Non-controlling interest | 89.4 | 65.8 | 155.5 | 136.7 | 111.3 | ||||||||||||||||||||||||

| Profit for the year | 867.9 | 630.0 | 1,662.1 | 1,022.9 | 706.9 | ||||||||||||||||||||||||

| Capital expenditures | 560.0 | 1,052.3 | 520.3 | 409.4 | 435.5 | ||||||||||||||||||||||||

Free cash flow(3) | 1,201.2 | 595.4 | 1,219.0 | (25.5) | 664.1 | ||||||||||||||||||||||||

| Balance Sheet ($ Million) | |||||||||||||||||||||||||||||

| Total assets | 12,856.2 | 12,935.5 | 12,547.9 | 12,122.6 | 8,322.9 | ||||||||||||||||||||||||

| Financial debt | 1,722.9 | 2,188.7 | 2,037.0 | 3,221.9 | 1,218.6 | ||||||||||||||||||||||||

Net financial debt(4) | 371.5 | 1,453.4 | 1,734.9 | 2,748.3 | 884.3 | ||||||||||||||||||||||||

| Total liabilities | 4,413.1 | 5,220.7 | 5,063.3 | 6,269.8 | 3,156.3 | ||||||||||||||||||||||||

| Capital and reserves attributable to the owners of the parent | 7,286.1 | 6,611.7 | 6,393.3 | 5,010.4 | 4,391.3 | ||||||||||||||||||||||||

| Non-controlling interest | 1,157.0 | 1,103.2 | 1,091.3 | 842.3 | 775.3 | ||||||||||||||||||||||||

Stock Data ($ per Share/ADS(5) | |||||||||||||||||||||||||||||

| Basic earnings per share | 0.40 | 0.29 | 0.77 | 0.45 | 0.30 | ||||||||||||||||||||||||

| Basic earnings per ADS | 3.97 | 2.87 | 7.67 | 4.51 | 3.03 | ||||||||||||||||||||||||

| Proposed dividends per ADS | 2.10 | — | 1.20 | 1.10 | 1.00 | ||||||||||||||||||||||||

Weighted average number of shares outstanding(6) (million shares) | 1,963.1 | 1,963.1 | 1,963.1 | 1,963.1 | 1,963.1 | ||||||||||||||||||||||||

(1) The functional currency of Ternium Argentina has changed from the Argentine Peso to the U.S. dollar. This change is prospective from January 1, 2020, and does not affect the balances at December 31, 2019, 2018, 2017 and 2016, nor results or cash flows for the years then ended.

(2) EBITDA equals operating income adjusted to exclude depreciation and amortization and, in 2020, a $186.0 million non-cash gain related to the derecognition of a contingency on certain tax benefits at Ternium Brasil.

(3) Free cash flow equals net cash provided by operating activities less capital expenditures.

(4) Net financial debt equals total financial debt less cash and cash equivalents plus other investments.

(5) Each ADS represents 10 shares.

(6) The Company has an authorized share capital of a single class of 3.5 billion shares having a nominal value of $1.00 per share. As of December 31, 2020, there were 2,004,743,442 shares issued. All issued shares are fully paid. In addition, as of December 31, 2020, the Company held 41,666,666 shares as treasury shares, representing 3% of the subscribed capital.

5

| TERNIUM S.A. | ||

| About Our Company | ||

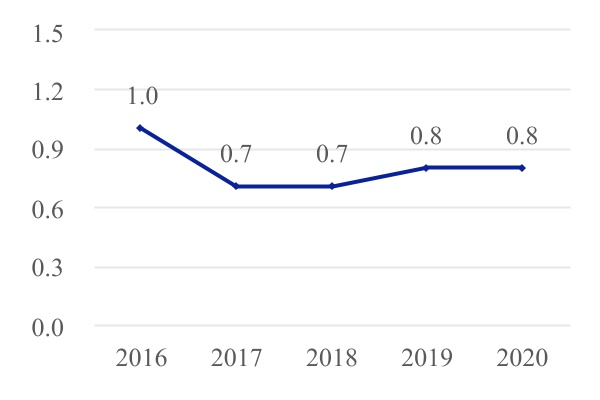

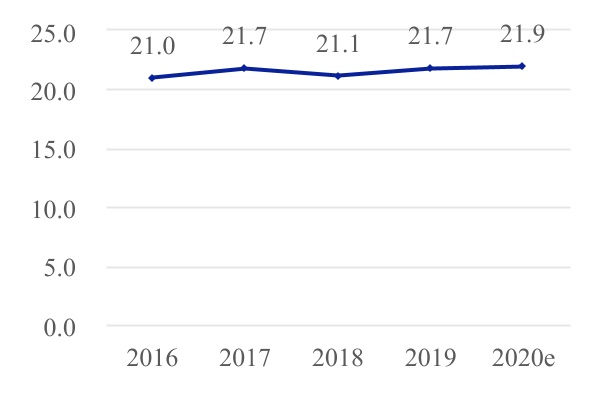

Lost Time Injuries Frequency Rate

Quantity of day-loss injuries per million hours worked

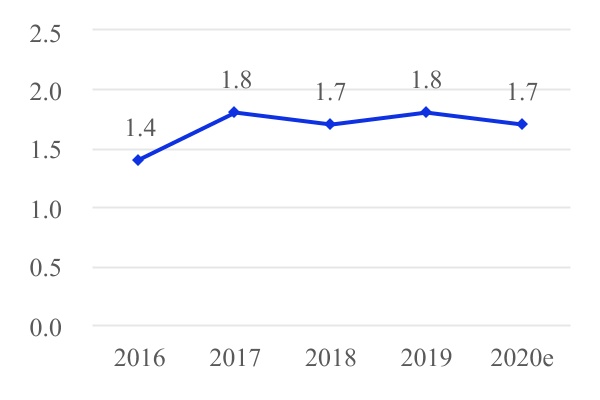

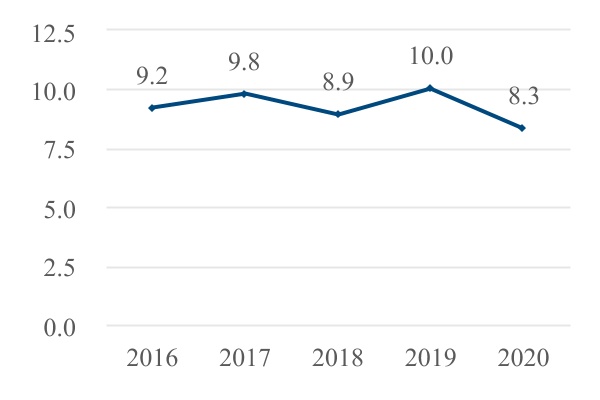

Emission Intensity

Carbon dioxide tons emitted per ton of steel produced. Year-end.

The increased emission intensity in 2017 reflected the incorporation of the Rio de Janeiro unit (blast furnace-based) in Ternium's crude steel production mix.

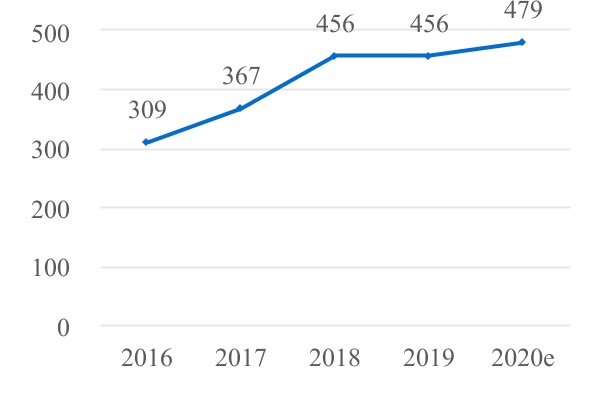

Co-Products

Kilograms per ton of steel produced

Co-products mainly include blast furnace and steel shop slag, iron ore fines and chemical substances. Figures include the Rio de Janeiro unit since September 2017.

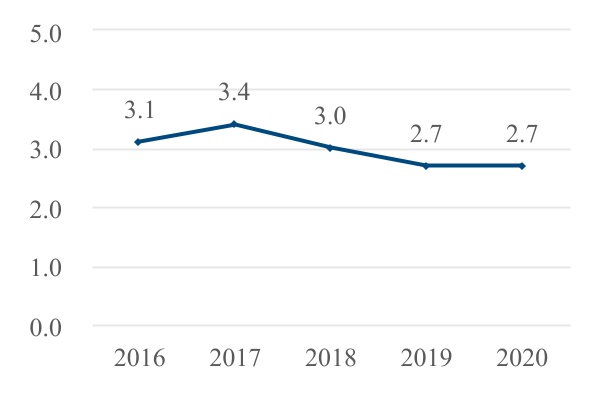

Injuries Frequency Rate

Total quantity of injuries per million hours worked

Energy Intensity

Gigajoules consumed per ton of steel produced. Year-end

Investment in Product Research and Development

$ million

6

| TERNIUM S.A. | ||

Management’s Report | ||

This review of Ternium’s financial condition and results of operations is based on, and should be read in conjunction with, the Company’s consolidated financial statements as of December 31, 2020 and 2019 and for the years ended December 31, 2020, 2019 and 2018 (including the notes thereto), which are included elsewhere in this annual report. For a detailed description of Ternium's main risks and uncertainties, see the section "Risk Factors" included in this annual report. For information related to the holding of Company's own shares, see "Performance Highlights" in the section "About Our Company" included in this annual report.

Impact Of The COVID-19 Pandemic On Our Operations

During 2020, the global economy was deeply affected by the COVID-19 pandemic and the measures taken around the world to contain the spread of the SARS-CoV-2 virus, which resulted in a global crisis with a unprecedented speed and severity in recent history. Although activity levels around the globe improved steadily during the second half of 2020 from a slump in the second quarter, new waves of infection have been spreading in various regions triggering new preventive measures to contain it. There remains considerable uncertainty about the future duration and extent of the pandemic with new and more contagious variants of the virus appearing and the vaccination programs yet in their early stages.

At the start of the COVID-19 outbreak, Ternium took prompt action to mitigate the impact of the pandemic and the crisis, and adapted its operations on a country-by-country basis to comply with applicable rules and requirements. These actions included:

- Occupational health and safety. Ternium prioritizes the occupational health and safety of its employees, customers and suppliers, and has adopted new protocols to ensure a safe working environment involving the use of face masks, temperature checks, strict social distancing and workplace disinfection policies including the company transportation, site entry and common working areas. In addition, we have implemented remote working where possible and procedures to track individuals showing compatible COVID-19 symptoms and their close contacts. Along the pandemic, Ternium operated all facilities under strict sanitary protocols, which included daily temperature checks for all on-site workers and prompt testing of all individuals to ensure proactive contagion prevention. The company also conducted an extensive communications program across its facilities to promote health and wellness protocols at both work and home. The company's digital sales portal, Webservice, contributed with safe working practices by channeling approximately 77% of total orders placed by commercial customers in 2020, with a year-over-year participation increase compared to the 70% achieved before the COVID-19 outbreak. As of the date of this annual report, remote work and other work arrangements have not adversely affected Ternium’s ability to conduct operations. In addition, these alternative working arrangements have not adversely affected our financial reporting systems, internal control over financial reporting or disclosure controls and procedures.

- Operations. Ternium has adjusted its operations to continue to supply steel products to essential sectors and other customers and, at the same time, observe lockdowns and operating restrictions imposed in several jurisdictions. Ternium's training programs were reinforced with webinars and online workshops.

- Liquidity. During the second quarter 2020, Ternium took steps to ensure the continued strength of its financial position, including the optimization of operations and overhead costs, and the reduction of working capital. In order to mitigate the impact of the then expected lower sales, Ternium reduced its capital expenditure commitments for 2020 by slowing down or postponing investment projects, such as the new hot-rolling mill in Pesquería, Mexico, which is now expected to start-up during mid 2021. Moreover, in that context, on April 28, 2020, Ternium's Board of Directors withdrew its annual dividend proposal for 2019. Ternium's net debt position decreased during 2020, from $1.5 billion at the end of December 2019 to $371.5 million at the end of December 2020.

- Support to third parties. To support our small and medium-sized customers and suppliers, we reinforced the financial help provided under the ProPymes program and the assistance granted to obtain loans from local financial institutions. In addition, new tools were incorporated to ensure the continuity of ProPymes advisory and training activities, on remote and online formats, respectively.

- To support nearby communities, Ternium contributed to strengthen medical response capabilities through a special funding program mainly focused on the supply of medical equipment and personal protection gear to community health centers. Reinforcement plans were designed in cooperation with hospital authorities in each of the communities near Ternium's facilities, taking into consideration local population age and available healthcare infrastructure. Under this program, Ternium provided infrastructure and equipment to 14 hospitals and healthcare facilities in four countries, including equipment for intensive care units. In addition, we provided support to health centers in the process of adapting their infrastructure; we manufactured face masks at our facilities and supported local entrepreneurs' initiatives for ventilator manufacturing. In addition,

7

| TERNIUM S.A. | ||

Management’s Report | ||

in Monterrey, Mexico, Ternium constructed and operated a field hospital with 100 beds and 10 intensive care units for the community.

- To foster knowledge sharing on COVID-19 disease treatments, we created a network of medical professionals together with our affiliate Tenaris. Seventy doctors from local communities in Mexico, Argentina and Brazil participated in a virtual meeting with their colleagues at Humanitas, an Italian network of hospitals controlled by the Techint Group. Through this platform, Humanitas' know-how on dealing with the COVID-19 outbreak in Italy was made available at a public virtual campus.

- Alongside the Fundación Hermanos Agustín y Enrique Rocca (Agustín and Enrique Rocca Brothers Foundation), and Tenaris, Ternium contributed food for vulnerable families through the #SeamosUno project in Argentina. In addition, Ternium provided food support for families of children participating at its educational programs in Rio de Janeiro, Brazil, and for families of students at the Roberto Rocca Technical School in Pesquería, Mexico.

With net debt to last twelve months EBITDA ratio of 0.2 times at the end of December 2020, Ternium exhibits a solid overall liquidity position with adequate capital and financial resources. Ternium has in place non-committed credit facilities and management believes it has adequate access to the credit markets. Considering our financial position and the funds provided by operating activities, management believes that we have sufficient resources to satisfy our current working capital needs, service our debt and pay dividends. Management also believes that our liquidity and capital resources give us adequate flexibility to manage our planned capital spending programs and to address short-term changes in business conditions.

Management does not expect to disclose or incur in any material COVID-19-related contingency, and it considers its allowance for doubtful accounts sufficient to cover risks that could arise from credits with customers in accordance with IFRS 9.

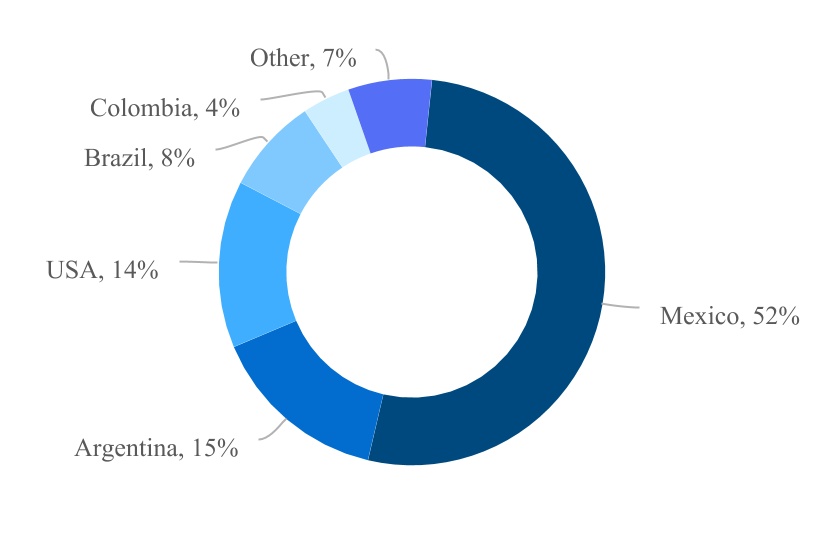

Successful Performance in a Challenging Year

Ternium produces flat and/or long steel products in Mexico, Brazil, Argentina, the United States, Colombia and Guatemala. We report steel shipments under three geographical regions: Mexico, the Southern Region (encompassing the steel markets of Argentina, Bolivia, Chile, Paraguay and Uruguay) and Other Markets. During 2020, shipments in the Mexican market were 5.9 million tons, representing 52% of Ternium’s total steel shipments. Shipments in the Southern Region reached 1.9 million tons in 2020, or 17% of Ternium’s consolidated shipments in the steel segment, most of which are destined for the Argentine market. Shipments in the Other Markets region reached 3.5 million tons in 2020, or 31% of Ternium’s consolidated shipments in the steel segment. Our major shipment destinations in the Other Markets region are usually the United States, Brazil, Colombia and Central America.

Steel Shipments by Country in 2020

Net sales in 2020 were $8.7 billion, including steel products net sales of $8.5 billion on steel shipments of 11.4 million tons, other products net sales of $177.7 million and iron ore products net sales of $390.5 million on iron ore shipments of 3.8 million tons. The majority of the iron ore production was consumed in our steel operations. Steel revenue per ton was $748 in 2020,

8

| TERNIUM S.A. | ||

Management’s Report | ||

lower than revenue per ton in 2019, mainly reflecting a weak steel price environment during the first half of 2020, particularly at the start of the COVID-19 outbreak, partially offset by a significant recovery in prices during the second half of the year.

EBITDA reached $1.5 billion in 2020 with EBITDA margin of 17% and EBITDA per ton of $134.2. Equity holders' net income in 2020 was $778.5 million, equivalent to earnings per ADS of $3.97, including a non-cash gain related to the derecognition of a contingency on certain tax benefits at Ternium Brasil, equivalent to $0.95 per ADS. Net cash provided by operating activities was $1.8 billion, including a working capital reduction of $352.8 million. In 2020, Ternium’s capital expenditures were $560.0 million, down 47% year-over-year reflecting the conclusion of some expansion projects and Ternium's decision to slow or postpone several other projects across its facilities, including its new hot-rolling mill in the company’s Pesquería industrial center in Mexico. The main investments carried out during 2020 included those made for the new hot-rolling mill, the capacity expansion of the pulverized coal injection system in our Rio de Janeiro unit in Brazil, and projects aimed at further improving environmental and safety conditions throughout our main facilities.

With free cash flow of $1.2 billion in 2020, Ternium's net debt position reached $371.5 million at the end of December 2020, down from $1.5 billion at the end of December 2019, with a net debt to last twelve months EBITDA ratio of 0.2 times.

Summary Results

| 2020 | 2019 | Dif. | |||||||||||||||||||||||||||

| Steel shipments (tons) | 11,360,000 | 12,511,000 | -9 | % | |||||||||||||||||||||||||

| Iron ore shipments (tons) | 3,797,000 | 3,576,000 | 6 | % | |||||||||||||||||||||||||

| Net sales ($ million) | 8,735.4 | 10,192.8 | -14 | % | |||||||||||||||||||||||||

| Operating income ($ million) | 1,079.5 | 864.6 | 25 | % | |||||||||||||||||||||||||

| EBITDA ($ million) | 1,524.5 | 1,525.7 | — | ||||||||||||||||||||||||||

| EBITDA margin (% of net sales) | 17% | 15% | 250 bps | ||||||||||||||||||||||||||

| EBITDA per ton ($) | 134.2 | 121.9 | 10 | % | |||||||||||||||||||||||||

| Financial result, net ($ million) | 22.3 | (99.0) | -123 | % | |||||||||||||||||||||||||

| Income tax expense ($ million) | (291.5) | (196.5) | 48 | % | |||||||||||||||||||||||||

| Profit for the year ($ million) | 867.9 | 630.0 | 38 | % | |||||||||||||||||||||||||

| Profit attributable to owners of the parent ($ million) | 778.5 | 564.3 | 38 | % | |||||||||||||||||||||||||

| Basic earnings per ADS ($) | 3.97 | 2.87 | 38 | % | |||||||||||||||||||||||||

Ternium's main steel markets stepped back in 2020, negatively affected by the impact of the COVID-19 pandemic on economic activity. A trough in steel demand during the second quarter, however, gave way to a steady recovery during the second half of the year, helped by a gradual rebuilt of inventories and certain shift in consumption patterns toward consumer durables and housing. Consequently, total steel shipments in 2020 were 11.4 million tons, down 1.2 million tons compared to 2019, mainly reflecting lower shipments of slabs to third parties and of finished steel in the Mexican market.

Shipments in Mexico, Ternium's main steel market, decreased 6% year-over-year to 5.9 million tons. The country's manufacturing industries gradually ramped up production during the second half of 2020, following a trough in the second quarter, and achieved pre-pandemic levels during the fourth quarter.

Ternium's shipments in the Southern Region reached 1.9 million tons in 2020, down 1% year-over-year. Activity in the construction and industrial sectors recovered during the second half of 2020, supported by increased demand of durable goods and construction materials in Argentina. This shift in consumption patterns led to a high level of shipments in the fourth quarter, above those prevailing before the COVID-19 outbreak.

In the Other Markets region, Ternium's finished steel shipments in 2020 were slightly down year-over-year with lower shipments in Colombia, due to the impact of the pandemic, and higher shipments in the U.S. market. During the second half of 2020, our slab facility in Brazil returned to full capacity from minimum utilization rates in April, and increased its integration with other Ternium's mills.

9

| TERNIUM S.A. | ||

Management’s Report | ||

EBITDA per ton increased $12 year-over-year to $134, mainly reflecting lower purchased slab, raw material and energy costs, and the positive impact on costs of weak local currencies vis-a-vis the U.S. dollar, partially offset by lower revenue per ton and the negative impact on costs of lower mill utilization rates.

The Company’s consolidated net income in 2020 was $867.9 million on operating income of $1.1 billion. Operating income in 2020 included a $186.0 million non-cash gain related to the derecognition of a contingency on certain tax benefits at Ternium Brasil.

Net Sales

Net sales in 2020 were $8.7 billion, 14% lower than net sales in 2019. The following table outlines Ternium’s consolidated net sales for 2020 and 2019.

| Net Sales ($ million) | Shipments (thousand tons) | Revenue/Ton ($/ton) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | 2019 | Dif. | 2020 | 2019 | Dif. | 2020 | 2019 | Dif. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Mexico | 4,568.3 | 5,326.7 | -14 | % | 5,913 | 6,305 | -6 | % | 773 | 845 | -9 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Southern Region | 1,761.9 | 1,696.6 | 4 | % | 1,924 | 1,938 | -1 | % | 916 | 875 | 5 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Other Markets | 2,171.6 | 2,866.7 | -24 | % | 3,523 | 4,268 | -17 | % | 616 | 672 | -8 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total steel products | 8,501.8 | 9,890.1 | -14 | % | 11,360 | 12,511 | -9 | % | 748 | 790 | -5 | % | ||||||||||||||||||||||||||||||||||||||||||||

Other products (7) | 177.7 | 296.1 | -40 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Steel reporting segment | 8,679.5 | 10,186.2 | -15 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mining reporting segment | 390.5 | 364.0 | 7 | % | 3,797 | 3,576 | 6 | % | 103 | 102 | 1 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Intersegment eliminations | (334.6) | (357.4) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net sales | 8,735.4 | 10,192.8 | -14 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

(7) The item “Other products” primarily includes Ternium Brasil's and Ternium Mexico's electricity sales.

Cost of Sales

Cost of sales was $7.1 billion in 2020, a decrease of $1.4 billion compared to 2019. This was principally due to a $1.2 billion, or 18%, decrease in raw material and consumables used, mainly reflecting a 9% decrease in steel shipment volumes and lower purchased slabs, raw material and energy costs; and to a $186.9 million decrease in other costs, mainly including a $95.7 million decrease in maintenance expenses, a $65.6 million decrease in labor costs and a $38.4 million decrease in services and fees partially compensated by $18.3 increase in depreciation of property, plant and equipment.

Selling, General and Administrative (SG&A) Expenses

SG&A expenses in 2020 were $762.9 million, or 9% of net sales, a decrease of $134.6 million compared to SG&A expenses in 2019 mainly due to $45.1 million decrease in amortization of intangible assets, a $34.7 million decrease in services and fees and office expenses, a $22.6 million decrease in labor costs, a $22.0 million decrease in freight and transportation and a $6.9 million decrease in taxes.

Other Operating Income, Net

Other operating income in 2020 was $206.8 million, compared to other operating income of $21.7 million in 2019. Other operating income in 2020 included a $186.0 million non-cash gain related to the derecognition of a contingency on ICMS tax benefits at Ternium Brasil (imposto sobre circulação de mercadorias e prestação de serviços). For more information, see note 8 “Other operating income (expenses), net" and 24(i) (g) "Contingencies, commitments and restrictions on the distribution of profits” to our consolidated financial statements included in this consolidated management report.

Operating Income

Operating income in 2020 was $1.1 billion, or 12% of net sales, compared to operating income of $864.6 million, or 8% of net sales in 2019. The following table outlines Ternium’s operating income by segment for 2020 and 2019:

10

| TERNIUM S.A. | ||

Management’s Report | ||

| Steel Segment | Mining Segment | Intersegment Eliminations | Total | |||||||||||||||||||||||||||||||||||||||||||||||

| $ million | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||||||||||||||||||||||||||

| Net Sales | 8,679.5 | 10,186.2 | 390.5 | 364.0 | (334.6) | (357.4) | 8,735.4 | 10,192.8 | ||||||||||||||||||||||||||||||||||||||||||

| Cost of sales | (7,172.6) | (8,552.5) | (268.9) | (259.5) | 341.6 | 359.6 | (7,099.9) | (8,452.4) | ||||||||||||||||||||||||||||||||||||||||||

| SG&A expenses | (740.1) | (885.1) | (22.8) | (12.3) | — | — | (762.9) | (897.5) | ||||||||||||||||||||||||||||||||||||||||||

| Other operating income (expense), net | 209.0 | 21.9 | (2.1) | (0.3) | — | — | 206.8 | 21.7 | ||||||||||||||||||||||||||||||||||||||||||

| Operating income | 975.8 | 770.5 | 96.7 | 91.9 | 7.0 | 2.2 | 1,079.5 | 864.6 | ||||||||||||||||||||||||||||||||||||||||||

| EBITDA | 1,370.6 | 1,383.2 | 146.9 | 140.3 | 7.0 | 2.2 | 1,524.5 | 1,525.7 | ||||||||||||||||||||||||||||||||||||||||||

Net Financial Results

Net financial results were a $22.3 million gain in 2020, mainly reflecting investment returns on Ternium's liquidity position. In 2019, net financial results were a loss of $99.0 million.

Equity in Results of Non-Consolidated Companies

Equity in results of non-consolidated companies was a gain of $57.6 million in 2020, compared to a gain of $61.0 million in 2019 mainly due to a lower result of Ternium's investment in Usiminas partially offset by a higher result of Ternium's investment in Techgen.

Income Tax Expense

Income tax expense in 2020 was $291.5 million or an effective tax rate of 25%, compared to $196.5 million in 2019, or an effective tax rate of 24%.

Net Income Attributable to Non-controlling Interest

Net gain attributable to non-controlling interest in 2020 was $89.4 million, higher than a net gain of $65.8 million in 2019 mainly reflecting improved results at Ternium Argentina.

Liquidity and Capital Resources

We obtain funds from our operations, as well as from short-term and long-term borrowings from financial institutions. These funds are primarily used to finance our working capital and capital expenditures requirements, as well as our acquisitions and dividend payments. We hold money market investments, time deposits and variable-rate or fixed-rate securities. Our net financial indebtedness decreased in 2020, to $371.5 million at the end of 2020 from $1.5 billion at the end of 2019. The following table shows the changes in our cash and cash equivalents for each of the periods indicated below:

| In $ million | For the year ended December 31, | |||||||||||||||||||

| 2020 | 2019 | |||||||||||||||||||

| Net cash provided by operating activities | 1,761.2 | 1,647.6 | ||||||||||||||||||

| Net cash used in investing activities | (1,176.9) | (1,196.6) | ||||||||||||||||||

| Net cash used in financing activities | (506.3) | (150.5) | ||||||||||||||||||

| Increase in cash and cash equivalents | 78.1 | 300.5 | ||||||||||||||||||

| Effect of exchange rate changes | (60.2) | (31.1) | ||||||||||||||||||

| Cash and cash equivalents at the beginning of the year | 520.0 | 250.5 | ||||||||||||||||||

| Cash and cash equivalents at the end of the year | 537.9 | 520.0 | ||||||||||||||||||

During 2020, Ternium’s primary source of funding was cash provided by operating activities. Cash and cash equivalents as of December 31, 2020 was $537.9 million, a $17.9 million increase from $520.0 million at the end of the previous year. In

11

| TERNIUM S.A. | ||

Management’s Report | ||

addition to cash and cash equivalents, as of December 31, 2020, we held other investments with maturity of more than three months for a total amount of $816.4 million, increasing $600.9 million compared to December 31, 2019.

Operating Activities

Net cash provided by operating activities in 2020 was $1.8 billion. Working capital decreased by $352.8 million in 2020 as a result of an aggregate $237.9 million increase in accounts payable and other liabilities and $156.5 million decrease in inventories, partially offset by an aggregate $41.6 million increase in trade and other receivables. The inventory value decrease in 2020 was due to a $88.7 million lower steel volume, a $39.8 million inventory value decrease in raw materials, supplies and other, and a $28.0 million lower cost of steel.

| $ million | Change in inventory Dec´20 / Dec´19 | ||||||||||||||||||||||||||||

| Price | Volume | Total | |||||||||||||||||||||||||||

| Finished steel goods | (1.1) | (63.0) | (64.1) | ||||||||||||||||||||||||||

| Steel goods in process | (26.9) | (25.7) | (52.6) | ||||||||||||||||||||||||||

| Total steel goods | (28.0) | (88.7) | (116.7) | ||||||||||||||||||||||||||

| Raw materials, supplies and allowances | (39.8) | ||||||||||||||||||||||||||||

| Total inventory | (156.5) | ||||||||||||||||||||||||||||

Investing Activities

Net cash used in investing activities in 2020 was $1.2 billion, primarily attributable to capital expenditures of $560.0 million and an increase of $600.9 million in financial investments with maturities of more than three months. The main investments carried out during 2020 included those made for the new hot-rolling mill in Pesquería, Mexico, the capacity expansion of the pulverized coal injection system in our Rio de Janeiro unit in Brazil, and projects aimed at further improving environmental and safety conditions throughout our main facilities.

Financing Activities

Net cash used in financing activities was $506.3 million in 2020, primarily attributable to net repayment of borrowings of $464.1 million and financial lease payments of $42.1 million.

Principal Sources of Funding

Funding Policy

Management’s policy is to maintain a high degree of flexibility in operating and investment activities by maintaining adequate liquidity levels and ensuring access to readily available sources of financing. We obtain financing primarily in U.S. dollars, Argentine pesos and Colombian pesos. Whenever feasible, management bases its financing decisions, including the election of currency, term and type of the facility, on the intended use of proceeds for the proposed financing and on costs. For information on our financial risk management, see note 28 “Financial risk management” to our consolidated financial statements included in this annual report.

Ternium has in place non-committed credit facilities and management believes it has adequate access to the credit markets. Considering our financial position and the funds provided by operating activities, management believes that we have sufficient resources to satisfy our current working capital needs, service our debt and pay dividends. Management also believes that our liquidity and capital resources give us adequate flexibility to manage our planned capital spending programs and to address short-term changes in business conditions.

Financial Liabilities

Our financial liabilities consist mainly of loans with financial institutions. As of December 31, 2020, these facilities were mainly denominated in U.S. dollars (97% of total financial liabilities). Total financial debt (inclusive of principal and interest accrued thereon) decreased by $465.8 million in the year, from $2.2 billion as of December 31, 2019, to $1.7 billion as of December 31, 2020. As of December 2020, current borrowings were 23% of total borrowings, none of which corresponded to borrowings with related parties.

12

| TERNIUM S.A. | ||

Management’s Report | ||

Net financial debt (total financial debt less cash and cash equivalents plus other investments) decreased by $1.1 billion in 2020, from $1.5 billion as of December 31, 2019, to $371.5 million as of December 31, 2020. Net financial debt as of December 31, 2020 equaled 0.2 times 2020 EBITDA.

Ternium’s weighted average interest rate for 2020 was 1.4%, compared to a 2.9% average interest rate in 2019. This rate was calculated using the rates set for each instrument in its corresponding currency and weighted using the U.S. dollar-equivalent outstanding principal amount of each instrument as of December 31, 2020. Such rates do not include the effect of derivative financial instruments, nor fluctuations in the exchange rate between the instrument’s currencies and the U.S. dollar.

Most Significant Borrowings and Financial Commitments

Our most significant borrowings as of December 31, 2020, were those outstanding under Ternium Mexico’s 2018 syndicated loan facility, Ternium Brasil’s 2019 syndicated loan facility, Ternium Investments’ 2017 syndicated loan facility to finance the acquisition of Ternium Brasil and related transactions, and Tenigal’s 2012 syndicated loan facility.

| $ million | ||||||||||||||||||||||||||||||||

| Date | Borrower | Type | Original principal amount | Outstanding principal amount as of December 31, 2020 | Maturity | |||||||||||||||||||||||||||

| 2012/2013 | Tenigal | Syndicated loan | 200 | 50 | July 2022 | |||||||||||||||||||||||||||

| September 2017 | Ternium Investments | Syndicated loan | 1,500 | 400 | September 2022 | |||||||||||||||||||||||||||

| June 2018 | Ternium Mexico | Syndicated loan | 1,000 | 500 | June 2023 | |||||||||||||||||||||||||||

| August 2019 | Ternium Brasil | Syndicated loan | 500 | 500 | August 2024 | |||||||||||||||||||||||||||

The main covenants in our syndicated loan agreements are limitations on liens and encumbrances, limitations on the sale of certain assets, and compliance with financial ratios (e.g., leverage ratio). As of December 31, 2020, we were in compliance with all covenants under our loan agreements. Our most significant financial commitments as of December 31, 2020, were the following:

- Two stand-by letters of credit covering 48% of the funding of a debt service reserve account under a syndicated loan agreement between Techgen and several banks. Proceeds from the syndicated loan were used by Techgen to refinance in full all amounts owed under a previous syndicated loan between Techgen and several banks for the construction of its facilities. As of December 31, 2020, the amount guaranteed was approximately $21.4 million.

- A corporate guarantee covering 48% of the outstanding value of transportation capacity agreements among Techgen, Kinder Morgan Gas Natural de Mexico, S. de R.L. de C.V., Kinder Morgan Texas Pipeline LLC and Kinder Morgan Tejas Pipeline LLC, ending during the second half of 2036. As of December 31, 2020, the outstanding value of this commitment was approximately $221.8 million, and our exposure under the guarantee issued in connection with these agreements amounted to $106.5 million.

- A guarantee letter issued by Ternium Mexico covering up to approximately $62.5 million of the obligations of Techgen under the Clean Energy Certificates trading agreement between Techgen and Enel Green Power S.A. de C.V. The amount of the guarantee equals the amount payable by Techgen in the event it decides to terminate the agreement prior to its expiration (and, accordingly, the guaranteed amount decreases progressively). The trading agreement was signed on May 25, 2018 and terminates on June 30, 2041.

- A guarantee letter issued by Ternium Mexico covering up to approximately $25 million of the obligations of Corporativo Empresarial GIMSA, S.A. de C.V., or GIMSA, under the natural gas trading agreement between GIMSA and BP Energía México, or BPEM. The credit line granted by BPEM in connection with this natural gas trading agreement amounted to approximately $25 million. As of December 31, 2020, the outstanding amount under the natural gas trading agreement was $9.5 million, which is lower than the amount of the guarantee letter issued by Ternium Mexico.

In addition, Ternium has various off-balance sheet commitments to purchase raw materials, energy (natural gas and electricity), supplies (air, oxygen, nitrogen and argon), production equipment and logistic services. Off-balance sheet commitments are discussed in note 24 (ii) to our consolidated financial statements included elsewhere in this annual report.

13

| TERNIUM S.A. | ||

Management’s Report | ||

For further information on our derivative financial instruments, financial leases, borrowings, commitments and financial risk management, see notes 21, 22, 23, 24 and 28 to our consolidated financial statements included in this annual report.

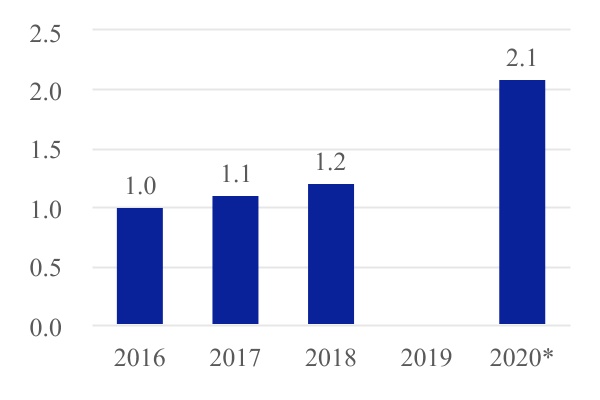

Recent Developments - Annual Dividend Proposal

On February 23, 2021, the Company’s board of directors proposed that an annual dividend of $0.21 per share ($2.10 per ADS), or approximately $412.2 million in the aggregate, be approved at the Company’s annual general shareholders’ meeting, which is scheduled to be held on May 3, 2021. If approved, the dividend will be paid on May 11, 2021.

Declared Dividends

$ per ADS

*Subject to approval by the Annual General Meeting of Shareholders to be held on May 3, 2021.

Research and Development Activities

Ternium’s business strategy is based on offering a complete range of value-added, high-end products, with an emphasis on creating and manufacturing increasingly sophisticated steel products for new applications and industries.

A Collaborative Approach to Product Research and Development

At Ternium, we carry out applied research efforts in different ways. We develop steel products through in-house programs, joint projects with leading industrial customers, joint efforts with recognized universities or research centers, and through our participation in international consortia. Ternium has identified synergies in collaborating with its customers in the early stages of their projects. Anticipating our customers' upcoming steel product requirements through our participation in joint development projects is key not only to build customer relationships but also to plan and develop new processes, which may sometimes require the adoption of new equipment and technology.

Ternium’s research programs are developed at its own facilities, complemented with the participation of a broad-based international network of industry consortia, universities and research laboratories. Ternium's research facilities include laboratories in Mexico, Brazil and Argentina, to test product performance and simulate production processes. Ternium has recently reinforced its research infrastructure with the incorporation of a new coking pilot plant in Argentina and the upgrade of a steel corrosion testing laboratory in Mexico. In addition, we have launched the construction of a new research and development center in Mexico. The new state-of-the-art facilities, expected to be inaugurated in 2021, will incorporate new equipment to test product performance. The ongoing pandemic has disrupted our collaboration with universities and research laboratories that used to involve over 50 institutions from both the public and private sectors. We expect to resume such efforts once the pandemic ends. The goal is to design and develop the best solutions to support an agenda aimed at achieving better and more sustainable steel. Research spans the entire production cycle, from primary steel making and metallurgy, to rolling and coating. Ternium is a member of WorldAutoSteel, an organization comprising some of the world’s major steel producers. Under the auspices of worldsteel, the group regularly updates the automotive industry on upcoming new steel capabilities available to meet their design and manufacturing requirements.

Ternium is engaged in several product development projects in partnership with industrial customers, and in-house projects as well. Ternium promotes the participation of university researchers and students from some of the world’s most prestigious institutions at projects' early stages. We engage universities in our research efforts in order to expand and further diversify Ternium’s research network and capabilities. This initiative fosters the development of fundamental knowledge and know-how

14

| TERNIUM S.A. | ||

Management’s Report | ||

at participating universities while enabling the optimization of Ternium’s in-house research resources. Approximately thirty undergraduate and postgraduate students pursuing degrees in engineering, materials science and metallurgy take part in the program.

Investing in New Equipment and Technologies

The inauguration of the Ternium Industrial Center in Pesquería, Mexico, in 2013, gave way to an intensive product development period. We broadened our product portfolio with sophisticated high-end steel products for the manufacturing industry, particularly automotive manufacturers. These developments were made possible with the addition of new production technologies to Ternium's industrial system at the Pesquería unit, such as cold-rolled steel and galvanized products that provide corrosion resistance to external vehicle parts.

The installation in 2015 of state-of-the-art cooling technology in the hot strip mill of Ternium's Churubusco unit in Mexico, has allowed developing and processing new advanced high-strength steel grades, including dual phase, ferrite-bainite, martensitic and complex phase grades. Based on these new capabilities, we have further widened Ternium's high-end product portfolio for customers in the automotive, metalmechanic, home appliance, oil & gas and electric motors industries.

More recently, with the inauguration of new galvanizing and painting lines in Ternium's Industrial Center in Pesquería in 2019, we widened our product portfolio for automotive and home-appliance manufactures, and other industrial sectors. In 2020, through Ternium's new steel bar and coil mill in Palmar de Varela, Colombia, we will soon be able to offer leading anti-seismic steel products for the Colombian construction sector, with improved resistance and toughness compared to those currently available in the market.

Next Steps

In 2021, Ternium expects to complete its new hot-rolling mill in its Pesquería unit in Mexico, which will enable us to expand Ternium's presence in Mexico with cutting edge new products and should allow us to substitute high-value-added steel imports targeting the demanding and innovative automotive industry, as well as the home appliance, machinery, energy and construction sectors. The new mill, combined with our service center and distribution capabilities in Mexico, will enable us to enhance customer service and reduce lead-times in the value chain.

This technological leap forward in the country's steel production capacity has been accompanied by additional product research and development capabilities to increase our range of product offering. Ternium will broaden its dimensional offerings with the most advanced steel grades to fulfill all industry requirements. The new high-end hot-rolling mill in Mexico was a logical next step after the acquisition of our slab facility in Brazil, which has an annual production capacity of 5 million tons of high-end steel slabs, a deep-water harbor and a 490 MW combined cycle power plant. Ternium's new hot-rolling mill will source high-end slabs from Ternium Brasil and from third parties.

With the completion of the new mill, the industrial center in Pesquería will reach an annual production capacity of 4.4 million tons of hot-rolled products, 1.6 million tons of cold-rolled products, 830,000 tons of hot-dipped galvanized products and 120,000 tons of pre-painted products.

Ternium is progressing with the ramp-up of its new steel bar and coil mill in Palmar de Varela, Colombia. With annual production capacity of 520,000 tons, the new steel bar and coil mill has increased our upstream integration in the country. The new mill will enable Ternium to expand its market share in Colombia's dynamic construction sector by offering an alternative to imports in the country's northern region. In addition, we expect to make progress with several projects aimed at improving environmental and safety conditions throughout Ternium's facilities. The Company has launched a new environmental investment plan to be developed in seven years, for an amount of approximately $460 million.

Uncertainties persist regarding the effects of the COVID-19 pandemic on economic activity, which may affect Ternium's markets and results of operations. For more information on the risks associated to the COVID-19 pandemic, see the section "Risk Factors" included in this annual report.

Roadmap to Decarbonization

Ternium has adopted a new decarbonization strategy with a medium-term target to reduce Ternium’s carbon dioxide emissions intensity rate by 20% in 2030, compared to its 2018 base rate of 1.7 tons of carbon dioxide per ton of steel. The company’s

15

| TERNIUM S.A. | ||

Management’s Report | ||

strategy to achieve this 2030 reduction target is based upon a multi-faceted approach, including the intensified use of renewable energy at our facilities, increasing the participation of scrap in the metallic mix, increasing carbon capture capacity at our DRI facilities in Mexico, partially replacing coking coal with charcoal at our operations in Brazil and Argentina, developing energy efficiency strategies and prioritizing lower specific-emission steelmaking technologies.

The Company will continue analyzing and developing measures to decarbonize its operations over the longer term, based upon current and emerging steel-making technologies, prospects for the availability of raw materials and other inputs, renewable energy and required infrastructure, and appropriate government regulations to promote fair trade, among other guiding factors.

The board of directors has nominated its Vice-Chairman, Mr. Daniel Agustín Novegil, to oversee, on a quarterly basis, Ternium’s climate change strategy.

Corporate Governance

Board of Directors

The Company’s corporate governance practices are governed by the Luxembourg law of August 10, 1915, on commercial companies, as amended (the Luxembourg Company Law), and the Company’s articles of association. Management of the Company is vested in a board of directors with the broadest power to act on behalf of the Company and accomplish or authorize all acts and transactions of management and disposal that are within its corporate purpose and not specifically reserved in the articles of association or by applicable law to the general shareholders’ meeting. The Company’s articles of association provide for a board of directors consisting of a minimum of three and a maximum of fifteen directors; however, for as long as the Company’s shares are listed on at least one regulated market, the minimum number of directors must be five. The Company’s current board of directors is composed of eight directors. The board of directors is required to meet as often as required by the interests of the Company and at least four times per year. In 2020, the Company’s board of directors met nine times.

A majority of the members of the board of directors in office present or represented at the board of directors’ meeting constitutes a quorum, and resolutions may be adopted by the vote of a majority of the directors present or represented. In case of a tie, the chairman is entitled to cast the deciding vote. Directors are elected at the annual ordinary general shareholders’ meeting to serve one-year renewable terms, as determined by the general shareholders’ meeting. The general shareholders’ meeting may dismiss all or any one member of the board of directors at any time, with or without cause, by resolution passed by a simple majority vote.

On June 5, 2020, the Company’s annual general shareholders’ meeting resolved to increase the number of directors from eight to nine; approved the re-election of the eight current board members, Mr. Ubaldo José Aguirre, Mr. Roberto Bonatti, Mr. Carlos Alberto Condorelli, Mr. Vincent Robert Gilles Decalf, Mr. Adrian Lajous Vargas, Mr. Gianfelice Mario Rocca, Mr. Paolo Rocca and Mr. Daniel Agustín Novegil, and appointed Ms. Gioia Ghezzi as new board member, each board member to hold office until the meeting that will be convened to decide on the 2020 accounts. The board of directors subsequently reappointed Paolo Rocca as its chairman, Daniel Novegil as its vice-chairman and Máximo Vedoya as chief executive officer of the Company.

Audit Committee

Pursuant to the Company’s articles of association, as supplemented by the audit committee’s charter, for as long as the Company’s shares are listed on at least one regulated markets, the Company must have an audit committee composed of at least three members, the majority of whom must qualify as independent directors, provided, however, that the composition and membership of the audit committee shall satisfy such requirements as are applicable to, and mandatory for, audit committees of issuers such as the Company under any law, rule or regulation applicable to the Company (including, without limitation, the applicable laws, rules and regulations of such regulated market or markets).

The audit committee of the Company’s board of directors currently consists of three members, Ubaldo José Aguirre, Adrián Lajous Vargas and Vincent Robert Gilles Decalf, who were appointed to the audit committee by the Company’s board of directors on June 5, 2020. All of them qualify as independent directors for purposes of the U.S. Securities Exchange Act Rule 10A-3(b)(1) and under the Company’s articles of association. Mr. Decalf serves as chairman of the Audit Committee.

The Company’s audit committee operates under a charter that was amended and restated by the board of directors on February 20, 2018. The audit committee assists the board of directors in fulfilling its oversight responsibilities with respect to the integrity of the Company’s financial statements, including periodically reporting to the board of directors on its activity; and the

16

| TERNIUM S.A. | ||

Management’s Report | ||

adequacy of the Company’s systems of internal control over financial reporting. The audit committee is also responsible for making recommendations regarding the appointment, dismissal, compensation, retention and oversight of, and for assessing the independence of, the Company’s external auditors. The audit committee also performs other duties imposed by applicable laws, rules and regulations of the regulated market or markets on which the shares of the Company are listed, as well as any other duty entrusted to it by the Company’s board of directors. In addition, the audit committee is required by the Company’s articles of association and audit committee’s charter to review “Material Transactions” (as such term is defined by the Company’s articles of association and audit committee’s charter), to be entered into by the Company or its subsidiaries with “Related Parties,” as such term is defined by the Company’s articles of association (other than transactions that were reviewed and approved by the independent members of the board of directors or other governing body of any subsidiary of the Company or through any other procedures as the board of directors may deem substantially equivalent to the foregoing), in order to determine whether their terms are consistent with market conditions or are otherwise fair to the Company and/or its subsidiaries.

The audit committee has the authority to conduct any investigation appropriate to the fulfillment of its responsibilities and has direct access to the Company’s external auditors as well as anyone in the Company and, subject to applicable laws and regulations, its subsidiaries. In addition, the audit committee may engage, at the Company’s expense, independent counsel and other internal or external advisors to review, investigate or otherwise advise on, any matter as the committee may determine to be necessary to carry out its purposes and responsibilities.

Auditors

The Company’s articles of association require the appointment of an independent audit firm in accordance with applicable law. Auditors are appointed by the general shareholders’ meeting, on the audit committee’s recommendation, through a resolution passed by a simple majority vote. The primary responsibility of the auditor is to audit the Company’s annual accounts and consolidated financial statements and to submit a report on each set of accounts to shareholders at the annual shareholders’ meeting. In accordance with applicable law, auditors are chosen from among the members of the Luxembourg Institute of Independent Auditors (Institut des réviseurs d’entreprises) and approved by the Luxembourg Financial Sector Supervisory Commission (Commission de Surveillance du Secteur Financier).

The annual shareholders’ meeting held on June 5, 2020, re-appointed PwC Luxembourg as the Company’s independent approved statutory auditor for the fiscal year ended December 31, 2020. At the next annual general shareholders’ meeting scheduled to be held on May 3, 2021, it will be proposed that PwC Luxembourg be re-appointed as the Company’s independent approved statutory auditors for the fiscal year ending December 31, 2021.

Code of Ethics

The Company has adopted a general code of conduct incorporating guidelines and standards of integrity and transparency applicable to all of our directors, officers and employees. As far as the nature of each relation permits, all principles detailed in the code of conduct also apply to relations with our contractors, subcontractors, suppliers and associated persons. In addition, the Company has adopted a code of ethics for financial officers, which is intended to supplement the Company’s code of conduct, and applies specifically to the principal executive officer, the principal financial officer, the principal accounting officer or controller, or persons performing similar functions.

17

| TERNIUM S.A. | ||

| Risk Factors | ||

You should carefully consider the risks and uncertainties described below, together with all other information contained in this annual report, before making any investment decision. Any of these risks and uncertainties could have a material adverse effect on Ternium's business, financial condition and results of operations, which could in turn affect the price of the Company’s shares and ADSs.

Risks Relating to the Steel Industry

A downturn in global or regional economic activity would cause a reduction in worldwide or regional demand for steel and would have a material adverse effect on the steel industry and Ternium.

Steel demand is sensitive to trends in cyclical industries, such as the construction, automotive, appliance and machinery industries, which are significant markets for Ternium’s products and are also affected by national, regional or global economic conditions. A downturn in economic activity would reduce demand for steel products. This would have a negative effect on Ternium’s business and results of operations. A recession or depression affecting developed economies, or slower growth or recessionary conditions in emerging economies would exact a heavy toll on the steel industry and adversely affect our business and results of operations.

A novel strain of coronavirus (“COVID-19”) surfaced in China in December 2019, and subsequently spread to the rest of the world in early 2020. The rapid expansion of the virus, the surfacing of new strains of the SARS-CoV-2 virus in several countries, and the containment measures adopted by governmental authorities triggered a severe fall in global economic activity and precipitated an unprecedented worldwide crisis. Global activity levels started to improve during the second half of 2020; however, there remains considerable uncertainty about the future duration and extent of the pandemic with new and more contagious variants of the virus appearing and the vaccination programs yet in their early stages. Although restrictions imposed in connection with the COVID-19 pandemic have been lifted or relaxed in the countries where Ternium operates, it is currently not possible to predict whether such measures will be further relaxed, reinstated or made more stringent. We took prompt action to mitigate the impact of the crisis and to adapt our operations on a country-by-country basis to comply with applicable rules and requirements. Although such measures proved to be successful, if the virus continues to spread and new preventive measures are imposed in the future, our operations could again be affected and adversely impact our results. For further information, see the section "impact of the COVID-19 pandemic on our operations" in this annual report.

A protracted fall in steel prices would have a material adverse effect on the results of Ternium, as could price volatility.

Steel prices are volatile and are sensitive to trends in steel demand and raw material costs, such as steel scrap, iron ore and metallurgical coal costs. Historically, the length and nature of business cycles affecting steel demand and raw material costs have been unpredictable. For example, U.S. steel prices trended down during most of 2018 and 2019, after peaking during the first half of 2018, as a result of softer steel consumption, increased steel production and, in 2019, lower costs of steel scrap. Steel prices decreased further in 2020 during the early stages of the COVID-19 pandemic reflecting a depression in steel consumption. However, after an initial slump, steel prices increased steadily during the rest of 2020 and reached very high levels in the first quarter of 2021, as the speed of the recovery in steel production and in the production of steelmaking raw materials fell short of steel demand. A fall in steel prices could adversely affect Ternium’s operating results by means of lower revenues and could also lead to inventory write-downs.

Even if raw material costs were to accompany the decrease in steel prices, the resulting reduction in steel production costs would take several months to be reflected in Ternium's operating results as Ternium would first consume older inventories acquired prior to such raw material cost decrease. In addition, Ternium may be unable to recover, in whole or in part, increased costs of raw materials and energy through increased selling prices on its products, or it may take an extended period of time to do so.

Regional or worldwide excess steel production capacity may lead to unfair trade practices in the international steel markets and/or to intense competition, hampering Ternium’s ability to sustain adequate profitability.

In addition to economic cycles, the steel industry can also be affected by regional or worldwide production overcapacity. Historically, the steel industry has suffered, especially on downturn cycles, from substantial over-capacity. As a result of a slowdown in steel demand growth and a protracted increase in steel production capacity in the last decade, there are signs of over-capacity in all steel markets, particularly in China, which impacted the profitability of the steel industry and Ternium. Currently, global steel production capacity exceeds global steel demand, which has affected, and could affect again in the future, global steel prices. Moreover, there are several new steel making and steel processing facilities under construction or

18

| TERNIUM S.A. | ||

| Risk Factors | ||

with announced construction both in Mexico and the United States, which could contribute to a significant increase in excess steel production capacity in North America in the coming years.

Excess steel production capacity may require several years to be absorbed by demand and, as a consequence, may contribute to an extended period of depressed margins and industry weakness. International trade of steel products conducted under unfair conditions increases particularly during downturn cycles and as a result of production over-capacity. Unfair trade practices may result in the imposition by some countries (that are significant producers and consumers of steel) of antidumping and countervailing duties or other trade measures, and may cause fluctuations in international steel trade. The imposition of such trade remedies or temporary tariffs on major steel exporters in significant steel producing countries could in turn exacerbate pressures in other markets, including those in which Ternium operates, as exporters target such other markets to compensate, at least partially, for the loss of business resulting from the imposition of trade remedies or tariffs.

China is the largest steel producing country in the world, accounting for approximately 60% of worldwide steel production, and Chinese exports of steel products, including exports to Europe, the United States and Mexico, were subject to the imposition of antidumping and countervailing duties and other trade measures. A decrease in steel consumption in China in the future, including as a result of new waves of COVID-19 infections, could stimulate aggressive Chinese steel export offers, exerting downward pressure on sales and margins of steel companies operating in other markets and regions, including those in which Ternium operates. Similarly, a downturn in global or regional economic activity could stimulate unfair steel trade practices and, accordingly, may adversely affect Ternium's business and results of operations.

Sales may fall as a result of fluctuations in industry inventory levels.

Inventory levels of steel products held by companies that purchase Ternium’s products can vary significantly from period to period. These fluctuations can temporarily affect the demand for, and price of, Ternium’s products, as customers draw from existing inventory during periods of low investment in construction and other industry sectors that purchase Ternium’s products and accumulate inventory during periods of high investment and, as a result, such companies may not purchase additional steel products or maintain their regular purchasing volume. Accordingly, Ternium may not be able to increase or maintain its levels of sales volumes or prices.

Intense competition could cause Ternium to lose its share in certain markets and adversely affect its revenues.

The market for Ternium’s steel products is highly competitive, particularly with respect to price, quality and service. In both global and regional markets, Ternium competes against other global and local producers of steel products, which in some cases have greater financial and operating resources, or direct and indirect governmental support. Competition from such steel producers could result in declining margins and reductions in shipments. Ternium’s competitors could use their resources in a variety of ways that may affect Ternium negatively, including by making additional acquisitions, implementing modernization programs, expanding their production capacity, investing more aggressively in product development, and displacing demand for Ternium’s products in certain markets. To the extent that these producers become more efficient, Ternium could confront stronger competition and could fail to preserve its current share of the relevant geographic or product markets. In addition, there has been a trend in the past toward steel industry consolidation among Ternium’s competitors, and current competitors in the steel market could become larger competitors in the future.

Moreover, Ternium and other steel makers compete against suppliers of alternative materials, including aluminum, wood, concrete, plastic and ceramics. In particular, certain customers, such as the automotive industry, are increasing their consumption of lighter-weight materials, such as aluminum, composites and carbon fiber, sometimes as a result of regulatory requirements. Competition from these alternative materials could adversely affect the demand for, and consequently the market prices of, certain steel products and, accordingly, could affect Ternium’s sales volumes and revenues.

Price fluctuations or shortages in the supply of raw materials, energy and other inputs could adversely affect Ternium’s profitability.

Like other manufacturers of steel-related products, Ternium’s operations require substantial amounts of raw materials, energy and other inputs from domestic and foreign suppliers. In particular, the Ternium companies consume large quantities of iron ore, metallurgical coal, slabs, scrap, ferroalloys, natural gas, electricity, oxygen and other gases in operating their blast and electric arc furnaces. The prices of these raw materials, energy and other inputs can be volatile. Also, the availability and price of a significant portion of such raw materials, energy and other inputs used in Ternium’s operations are subject to market

19

| TERNIUM S.A. | ||

| Risk Factors | ||

conditions, government regulations or other events affecting supply and demand, including wars, natural disasters and public health epidemics. For example, strong iron ore demand from Chinese steel producers coupled with certain supply restrictions, due to the COVID-19 pandemic and the wet season in Australia and Brazil among other factors, contributed to a recent surge in iron ore prices in the international markets. In Argentina, shortages of natural gas in the past resulted in supply restrictions that, if repeated in the future, could lead to higher costs of production or production cutbacks at Ternium’s facilities in Argentina. Extreme weather conditions in the southern United States and northern Mexico disrupted the stable provision of natural gas and energy in these markets, negatively affecting production in the first quarter of 2021 for approximately 80,000 tons. In addition, in the past, Ternium has usually been able to procure sufficient supplies of raw materials, energy and other inputs to meet its production needs; however, it could be unable to procure adequate supplies in the future. Any protracted interruption, discontinuation or other disruption of the supply of principal inputs to the Ternium companies (including as a result of strikes, lockouts, trade restrictions, accidents or natural disasters, worldwide price fluctuations, the availability and cost of transportation, global epidemics such as COVID-19 or other problems) would result in lost sales and would have a material adverse effect on Ternium’s business and results of operations.

Ternium depends on a limited number of key suppliers.