Form DEF 14A TORO CO For: Mar 16

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

The Toro Company

(Name of registrant as specified in its charter)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

(3) |

Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

(5) |

|

Total fee paid: |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

Amount Previously Paid: |

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

(3) |

Filing Party: |

|

|

(4) |

Date Filed: |

The Toro Company

NOTICE OF 2021

ANNUAL MEETING AND

PROXY STATEMENT

FOR MARCH 16, 2021

|

|

|

|

|

|

|

Worldwide Headquarters |

|

|

8111 Lyndale Avenue South |

|

|

Bloomington, MN 55420-1196 |

|

|

952-888-8801 |

Fiscal 2020 was a successful year for The Toro Company (“TTC”), despite challenges as a result of the global COVID-19 pandemic. We achieved growth in our professional segment, primarily from incremental contributions from the Charles Machine Works and Venture Products acquisitions, and record performance from our residential segment. In addition, we saw the successful introduction of our new battery-powered products for residential and professional applications, the expansion of our mass retail channel, increased investment in research and development in key technology areas, strong free cash flow, the continued return of value to shareholders via dividends, and the launch of our first sustainability platform, Sustainability Endures. We owe our successful performance to our team and channel partners, who demonstrated resilience, perseverance and ingenuity in this challenging year. I am beyond proud of what we have accomplished and will remember this year as one that highlighted the way we lived in accordance with the long-standing values of The Toro Company, while caring for one another, working safely, and serving our customers with determination. While the year ahead may hold more uncertainty than in the past, we’ll continue to execute and adapt to changing environments as we maintain a balance of focusing on the short term while never losing sight of our long-term strategic priorities, and we look forward to capitalizing on many exciting growth opportunities in fiscal 2021 and beyond.

It is my pleasure to invite you to join us for The Toro Company 2021 Annual Meeting of Shareholders to be held virtually on Tuesday, March 16, 2021, at 1:30 p.m., Central Daylight Time. Details about the annual meeting, nominees for election to the Board of Directors and other matters to be acted on at the annual meeting are presented in the notice and proxy statement that follow. The annual meeting will be held virtually; information regarding attending the virtual annual meeting can be found on page 1 of the proxy statement. It is important that your shares be represented at the annual meeting, regardless of the number of shares you hold. Accordingly, please exercise your right to vote by following the instructions for voting contained in the Notice Regarding the Availability of Proxy Materials, or the paper or electronic copy of our proxy materials you received for the meeting.

On behalf of your TTC Board of Directors and Management, thank you for your continued support for our company.

Sincerely,

|

|

|

Richard M. Olson |

|

Chairman of the Board, President and CEO |

You can help us make a difference by eliminating paper proxy mailings. With your

consent, we will provide all future proxy materials electronically. Instructions for

consenting to electronic delivery can be found on your proxy card or at

www.proxyvote.com. Your consent to receive shareholder materials electronically will

remain in effect until canceled.

i

|

Date: |

Tuesday, March 16, 2021 |

|

Time: |

1:30 p.m., Central Daylight Time |

|

Location: |

Virtual www.virtualshareholdermeeting.com/TTC2021 |

|

|

|

|

|

|

|

1. To elect as directors the three nominees named in the attached proxy statement, each to serve for a term of three years ending at the 2024 Annual Meeting of Shareholders; |

|

|

|

2. To ratify the selection of KPMG LLP as our independent registered public accounting firm for our fiscal year ending October 31, 2021; |

|

|

3. To approve, on an advisory basis, our executive compensation; and |

|

|

4. To transact any other business properly brought before the annual meeting or any adjournment or postponement of the annual meeting. |

We currently are not aware of any other business to be brought before the annual meeting. Shareholders of record at the close of business on January 19, 2021, the record date, will be entitled to vote at the annual meeting or at any adjournment or postponement of the annual meeting. A shareholder list will be made available at our principal executive offices during ordinary business hours beginning March 5, 2021, for examination by any shareholder registered on our stock ledger as of the record date for any purpose germane to the annual meeting.

Your vote is important. A majority of the outstanding shares of our common stock must be present either by attending the virtual meeting or by proxy to constitute a quorum for the conduct of business. Please promptly vote your shares by following the instructions for voting contained in the Notice Regarding the Availability of Proxy Materials or, if you received a paper or electronic copy of our proxy materials, by completing, signing, dating and returning your proxy card or by Internet, telephone or mobile device voting as described on your proxy card.

February 3, 2021

|

BY ORDER OF THE BOARD OF DIRECTORS |

|

|

|

|

|

Amy E. Dahl Vice President, Human Resources and General Counsel and Corporate Secretary |

|

iii

iv

|

PROPOSAL TWO—RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

|

24 |

|

|

24 |

|

|

|

24 |

|

|

|

24 |

|

|

|

24 |

|

|

|

25 |

|

|

PROPOSAL THREE—ADVISORY APPROVAL OF OUR EXECUTIVE COMPENSATION |

|

26 |

|

|

27 |

|

|

|

28 |

|

|

|

28 |

|

|

|

28 |

|

|

|

43 |

|

|

|

44 |

|

|

|

45 |

|

|

|

46 |

|

|

|

49 |

|

|

|

51 |

|

|

|

51 |

|

|

|

55 |

|

|

|

60 |

|

|

|

60 |

|

|

|

61 |

|

|

|

61 |

|

|

|

62 |

|

|

|

64 |

|

|

|

64 |

|

|

|

65 |

|

|

|

65 |

|

|

Shareholder Proposals and Director Nominations for the 2022 Annual Meeting |

|

65 |

|

|

66 |

|

|

|

66 |

|

|

|

66 |

FORWARD-LOOKING INFORMATION

Statements in this proxy statement not based on historical facts are intended to constitute “forward-looking” statements in connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified in this proxy statement by using words such as "expect," "strive," "look forward," "outlook," "guidance," "forecast," "goal," "optimistic," "anticipate," "continue," "plan," "estimate," "project," "believe," "should," "could," "will," "would," "possible," "may," "likely," "intend," "can," "seek," "potential," "pro forma," or the negative thereof and similar expressions or future dates. Although such statements have been made in good faith and are based on reasonable assumptions, there is no assurance that the expected results will be achieved. Accordingly, such statements involve risks and uncertainties that could cause actual results to differ materially from those projected or implied. Reference is made to our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, or SEC, on December 18, 2020, and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K filed with the SEC, for a list of such factors.

v

Business Overview

The Toro Company (the “Company,” “TTC,” “we,” “us” and “our”), is a leading worldwide provider of innovative solutions for the outdoor environment including turf and landscape maintenance, snow and ice management, underground utility construction, rental and specialty construction, and irrigation and outdoor lighting solutions. The Toro Company’s global presence extends to more than 125 countries through a family of brands that includes Toro, Ditch Witch, Exmark, BOSS Snowplow, Ventrac, American Augers, Subsite Electronics, HammerHead, Trencor, Unique Lighting Systems, Irritrol, PERROT, Hayter, Pope, Lawn-Boy and Radius HDD. Through constant innovation and caring relationships built on trust and integrity, The Toro Company and its family of brands have built a legacy of excellence by helping customers care for golf courses, sports fields, construction sites, public green spaces, commercial and residential properties and agricultural operations.

|

To help our beauty, productivity and sustainability of the land. |

|

OUR VISION To be the most trusted leader in solutions for the outdoor environment. Every day. Everywhere. |

|

OUR MISSION To deliver superior innovation and to deliver superior customer care. |

|

|

|

|

|

|

|

OUR GUIDING PRINCIPLES The Toro Company’s success is founded on a long history of caring relationships based on trust and integrity. These relationships are the foundation on which we build market leadership with the best in innovative products and solutions to make outdoor environments beautiful, productive, |

||||

Quick Facts About The Toro Company

|

Founded 1914 |

|

Fiscal 2020 Net Sales $3.38 billion |

|

Worldwide Headquarters Bloomington, Minnesota, U.S.A. |

|

Fiscal 2020 Net Earnings $329.7 million |

|

Fiscal 2020 Net Sales U.S.A. – 80% International – 20% |

|

Fiscal 2020 % Net Sales from New Products 32% |

|

|

|

|

|

|

|

Fiscal 2020 Products Equipment – 88% Irrigation – 12% |

|

Fiscal 2020 Segments Professional – 75% Residential – 24% Other – 1% |

|

Manufacturing Locations U.S.A. – 17 International – 10 |

The Toro Company’s Commitment to Sustainability

|

✓ Launched first sustainability platform, Sustainability Endures ✓ Deeply rooted in our purpose and strategic business priorities ✓ Continue to advance efforts by focusing on our pillars of Products, Process, and People, with transparency facilitated by our Planning Pillar |

|

|

PRODUCTS: Persistent drive to develop innovative, safe and high-quality products and emerging technologies that are designed to yield performance, productivity and environmental benefits for our customers. |

|

PROCESS: Maximize resource efficiency and reduce environmental impacts across our operations.

|

|

PEOPLE: Committed to fostering a culture that embraces workplace safety and diversity, equity and inclusion; continuing our strong legacy of giving back to our communities; and conducting business with integrity and according to the highest standards of ethical behavior.

|

|

PLANNING: Enhance transparency and disclosure of sustainability focus, goals and achievements. |

vi

2021 Annual Meeting of Shareholders

|

Date and Time Tuesday, March 16, 2021 |

|

Location Virtual at: www.virtualshareholdermeeting.com/TTC2021 |

|

Record Date January 19, 2021 |

Meeting Agenda Voting Matters and Recommendations

|

To elect as directors the three nominees named in this proxy statement, each to serve for a term of three years ending at the 2024 Annual Meeting of Shareholders. |

each nominee |

Page 5 |

|

|

|

|

|

Proposal Two To ratify the selection of KPMG LLP as our independent registered public accounting firm for our fiscal year ending October 31, 2021. |

☑FOR |

Page 24 |

|

|

|

|

|

Proposal Three To approve, on an advisory basis, our executive compensation. |

☑FOR |

Page 26 |

Your vote is important! Please vote your shares promptly using one of the methods listed below. See page 2 for additional voting information.

|

By Internet Go to www.proxyvote.com |

|

By Phone Call 800-690-6903 |

|

By Mobile Device Scan the QR code |

|

By Mail Return your proxy card |

|

By Attending the Meeting Virtually Visit www.virtualshareholdermeeting.com/TTC2021 |

Corporate Governance Highlights

Our Board provides oversight of critical matters such as our strategic plans, financial and other controls, risk management, merger and acquisition related activities, and management succession planning. The Board reviews our major governance documents, policies and processes regularly and thoughtfully determines the structures that are appropriate for our Company at the time.

vii

|

Average Age 60.2 |

|

Average Tenure 9.3 years |

|

New Directors in the 5 |

|

% of Directors who are 10% |

|

% of Directors who are 30% |

|

|

Information About our Board of Directors

|

|

|

|

|

|

|

|

|

|

|

Committee Memberships |

|

Other |

|

Racial/ |

|||||||

|

Name and Title |

|

Age |

|

|

Director Since |

|

Independent |

|

A |

|

F |

|

N&G |

|

C&HR |

|

Public Boards |

|

Gender Diversity |

||

|

Director Nominees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Janet K. Cooper |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retired Senior Vice President and Treasurer, Qwest Communications International Inc. |

|

|

67 |

|

|

1994 |

|

Yes |

|

C E |

|

✓ |

|

|

|

|

|

|

1 |

|

✓ |

|

Gary L. Ellis - Lead Independent Director |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retired Executive Vice President and Chief Financial Officer, Medtronic plc |

|

|

64 |

|

|

2006 |

|

Yes |

|

✓ E |

|

C |

|

|

|

|

|

|

2 |

|

|

|

Michael G. Vale, Ph.D. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive Vice President, Safety & Industrial Business Group, 3M Company |

|

|

54 |

|

|

2018 |

|

Yes |

|

✓ |

|

✓ |

|

|

|

|

|

|

0 |

|

✓ |

|

Continuing Directors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Richard M. Olson |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chairman, President and Chief Executive Officer, The Toro Company |

|

|

57 |

|

|

2016 |

|

No |

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

James C. O’Rourke |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

President and Chief Executive Officer, The Mosaic Company |

|

|

60 |

|

|

2012 |

|

Yes |

|

|

|

|

|

✓ |

|

C |

|

|

1 |

|

|

|

Jeffrey M. Ettinger |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retired Chairman and Chief Executive Officer, Hormel Foods Corporation |

|

|

62 |

|

|

2010 |

|

Yes |

|

|

|

|

|

C |

|

✓ |

|

|

1 |

|

|

|

Katherine J. Harless |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retired President and Chief Executive Officer, Idearc Inc. |

|

|

69 |

|

|

2000 |

|

Yes |

|

✓ |

|

✓ |

|

|

|

|

|

|

0 |

|

✓ |

|

D. Christian Koch |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chairman, President and Chief Executive Officer, Carlisle Companies Incorporated |

|

|

56 |

|

|

2016 |

|

Yes |

|

|

|

|

|

✓ |

|

✓ |

|

|

1 |

|

|

|

Jeffrey L. Harmening |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chairman and Chief Executive Officer, General Mills, Inc. |

|

53 |

|

|

2019 |

|

Yes |

|

✓ |

|

✓ |

|

|

|

|

|

|

1 |

|

|

|

|

Joyce A. Mullen |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

President, North America Businesses, Insight Enterprises, Inc. |

|

58 |

|

|

2019 |

|

Yes |

|

|

|

|

|

✓ |

|

✓ |

|

|

0 |

|

✓ |

|

|

A: Audit |

|

N&G: |

Nominating & Governance |

|

✓: Member |

|

E |

: Audit Committee Financial Expert |

|

F: Finance |

|

C&HR: |

Compensation & Human Resources |

|

C: Chair |

|

|

|

|

|

|

|

|

|

|

|

|

|

viii

|

Executive Compensation Program Objectives Our executive compensation philosophy is to maintain a program that allows us to attract, retain, motivate and reward highly qualified and talented executive officers. |

|

Align interests of executive officers with shareholder interests |

|

Link pay to performance |

|

Provide competitive target total direct compensation opportunities |

2020 Executive Compensation Summary

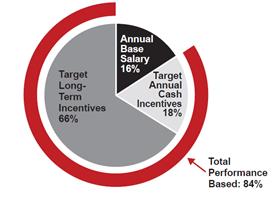

A significant portion of our executive officers’ target total direct compensation is comprised of short- and long-term variable performance-based, or at risk, compensation to directly link their pay to performance. Short-term variable compensation is in the form of annual cash incentive awards. Long-term variable compensation is in the form of stock options that vest over three years and three-year performance share awards. For fiscal 2020:

|

Chairman and CEO Target Total Direct Compensation Mix |

Other Named Executive Officers Target Total Direct Compensation Mix |

|

|

|

|

What we do |

✓ |

Link a substantial portion of total executive compensation directly to performance and require that minimum, or threshold, levels of performance be met in order for there to be any payout |

|

✓ |

Utilize a mix of earnings, revenue and asset-based performance measures for our annual cash incentive awards and long-term performance share awards |

|

|

✓ |

Utilize three-year performance share awards, the payouts of which vary based on performance and are contingent upon the achievement of three-year performance goals |

|

|

✓ |

Utilize stock options, the value of which is contingent upon long-term stock price performance |

|

|

✓ |

Include clawback provisions within our annual cash incentive and long-term incentive awards |

|

|

What we |

|

No individual employment agreements with our CEO or any other executive officer |

|

|

No excessive perquisites |

|

|

|

No gross-up payments to cover personal income taxes or excise taxes that pertain to executive or severance benefits |

|

Our fiscal 2020 financial performance resulted in the following: |

|

|

|

|

|

Annual cash incentives were paid at 30.7% of target. |

Page 31 |

|

|

|

|

Three-year performance awards for the fiscal 2018 to fiscal 2020 performance period were paid at 68.6% of target. |

Page 31 |

ix

8111 Lyndale Avenue South

Bloomington, Minnesota 55420-1196

2021 ANNUAL MEETING OF SHAREHOLDERS

TUESDAY, MARCH 16, 2021

1:30 p.m. Central Daylight Time

The Toro Company Board of Directors is using this proxy statement to solicit your proxy for use at The Toro Company 2021 Annual Meeting of Shareholders. We intend to send a Notice Regarding the Availability of Proxy Materials for the annual meeting and make proxy materials available to shareholders (or for certain shareholders and for those who request, a paper copy of this proxy statement and the form of proxy) on or about February 3, 2021.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting To Be Held on Tuesday, March 16, 2021.

This proxy statement and our 2020 Annual Report, which includes our Annual Report on Form 10-K for the fiscal year ended October 31, 2020, or fiscal 2020, are available at www.thetorocompany.com/proxy.

Pursuant to rules adopted by the SEC, we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice Regarding the Availability of Proxy Materials to some of our shareholders. Shareholders have the ability to access our proxy materials on the website referred to in the Notice Regarding the Availability of Proxy Materials (www.proxyvote.com) or request to receive a printed set of our proxy materials. Instructions on how to access our proxy materials over the Internet or request a printed copy of our proxy materials may be found in the Notice Regarding the Availability of Proxy Materials. In addition, shareholders may request to receive proxy materials in printed form by mail or electronically by e-mail on an ongoing basis.

When and Where Will the Annual Meeting Be Held?

The annual meeting will be held virtually, on Tuesday, March 16, 2021 at 1:30 p.m. Central Daylight Time, at www.virtualshareholdermeeting.com/TTC2021. In addition to providing a platform that facilitates the safe execution of the annual meeting in the current COVID-19 environment, the Board believes that holding the annual meeting of stockholders in a virtual format provides the opportunity for participation by a broader group of shareholders, while reducing the costs and environmental impact associated with planning, holding and arranging logistics for an in-person meeting.

How Can I Attend the Virtual Annual Meeting?

Shareholders at the close of business on the record date may attend the annual meeting by visiting www.virtualshareholdermeeting.com/TTC2021 and logging in with the 16-digit control number included on your proxy card, voting instruction form or Notice Regarding the Availability of Proxy Materials. On the day of our annual meeting, we recommend that you log into our virtual meeting at least 15 minutes before the scheduled start time to ensure that you can access the meeting. If you have any questions about accessing the virtual meeting website for the annual meeting, please contact Broadridge VSM support at 844-986-0822 / International: 303-562-9302. If you encounter any technical difficulties with the virtual meeting during the log in or meeting time, please call the technical support number that will be posted on the virtual meeting log in page. Rules governing the conduct of the annual meeting will be posted on the virtual meeting platform along with an agenda.

What Are the Purposes of the Annual Meeting?

The purposes of the 2021 Annual Meeting of Shareholders are to vote on the following items described in this proxy statement:

|

Proposal One |

Election of Directors |

1

|

Ratification of Selection of Independent Registered Public Accounting Firm |

|

|

Proposal Three |

Advisory Approval of our Executive Compensation |

Are There Any Matters To Be Voted On at the Annual Meeting that Are Not Included in this Proxy Statement?

We currently are not aware of any business to be acted upon at the annual meeting other than as described in this proxy statement. If, however, other matters are properly brought before the annual meeting, or any adjournment or postponement of the annual meeting, your proxy includes discretionary authority on the part of the individuals appointed to vote your shares or act on those matters according to their best judgment.

Who Is Entitled to Vote and How Many Shares Must Be Present to Hold the Annual Meeting?

Shareholders of record at the close of business on January 19, 2021, the record date, will be entitled to vote at the annual meeting or any adjournment or postponement of the annual meeting. As of January 19, 2021, there were 108,023,811 outstanding shares of our common stock. Each share of our common stock is entitled to one vote on each matter to be voted on at the annual meeting. Shares of our common stock that are held by us in our treasury are not counted as outstanding shares and will not be voted.

Shareholders entitled to vote at least a majority of the outstanding shares of our common stock as of the record date must be present at the virtual annual meeting or by proxy in order for us to have a quorum for the transaction of business at the annual meeting. Your shares will be counted toward the quorum if you submit a proxy or vote at the annual meeting. Shares represented by proxies marked “abstain” and “broker non-votes” also are counted in determining whether a quorum is present.

How Do I Vote My Shares?

If your shares are registered in your name, you may vote your shares by one of the four following methods:

|

Vote by Internet |

|

Go to www.proxyvote.com and follow the instructions for Internet voting shown on your Notice Regarding the Availability of Proxy Materials or proxy card. |

|

Vote by Telephone |

|

Call 800-690-6903 and follow the instructions for telephone voting shown on your proxy card. |

|

Vote by Mail |

|

Complete, sign, date and mail your proxy card in the envelope provided if you received a paper copy of these proxy materials. If you vote by Internet, telephone or mobile device, please do not mail your proxy card. |

|

Vote by Mobile Device |

|

Scan the QR code on your Notice Regarding the Availability of Proxy Materials or proxy card and follow the links. |

|

Vote at the Virtual Meeting |

|

Attend our virtual meeting and vote your shares electronically by visiting www.virtualshareholdermeeting.com/TTC2021. This year's meeting will be virtual which makes participation and engagement safe and convenient for all our shareholders. You will need the 16-digit control number included on your proxy card voting instruction form or Notice Regarding the Availability of Proxy Materials to enter the annual meeting. |

If you hold shares as a participant in certain TTC employee benefit plans, you may vote your shares by one

of the four methods noted above. If your shares are held in “street name,” you may receive a separate voting instruction form with this proxy statement or you may need to contact your broker, bank or other nominee to determine whether you will be able to vote electronically using the Internet, telephone or mobile device. On the day of the annual meeting, you may go to www.virtualshareholdermeeting.com/TTC2021, and log in by entering the 16-digit control number found on your voting instruction form. If you do not have your control number, you will be able register as a guest; however, you will not be able to vote or submit questions during the meeting.

2

How Does the Board Recommend that I Vote and What Vote is Required for Each Proposal?

|

Proposal |

Board Recommendation |

Available Voting Selections |

Voting Approval Standard |

Effect of Withhold or Abstention |

Effect of Broker Non- Vote |

|||||

|

1. Election of three directors, each to serve for a term of three years ending at the 2024 Annual Meeting of Shareholders |

FOR all three nominees |

FOR all three nominees; WITHHOLD from all three nominees; or WITHHOLD from one or more nominees |

Plurality: the individuals who receive the greatest number of votes cast “for” are elected as directors(1) |

Counted as a vote against |

No effect |

|||||

|

2. Ratification of the selection of KPMG LLP as our independent registered public accounting firm for our fiscal year ending October 31, 2021 |

FOR |

FOR; AGAINST; or ABSTAIN |

Majority of shares present and entitled to vote |

Counted as a vote against |

Not applicable |

|||||

|

3. Approval of, on an advisory basis, our executive compensation(2) |

FOR |

FOR; AGAINST; or ABSTAIN |

Majority of shares present and entitled to vote |

Counted as a vote against |

No effect |

|||||

|

|

|

|

|

|

||||||

|

(1) |

Under our Amended and Restated Bylaws, if any nominee for director in an uncontested election as to whom a majority of the votes of the shares present at the virtual meeting or represented by proxy at the annual meeting and entitled to vote on the election of directors are designated to be “withheld” or are voted “against,” that director must tender his or her resignation for consideration by our Nominating & Governance Committee. Our Nominating & Governance Committee then must evaluate the best interests of our Company and shareholders and recommend the action to be taken by the Board with respect to such tendered resignation. |

|

(2) |

While an advisory vote, our Compensation & Human Resources Committee and Board expect to take into account the outcome of the vote when considering future executive compensation. |

|

How Your Shares are Held |

How Your Shares will be Voted If You Specify How to Vote |

How Your Shares will be Voted If You |

|||

|

Shares registered in your name |

The named proxies will vote your shares as you direct |

The named proxies will vote FOR all proposals |

|||

|

Shares held in street name |

Your broker will vote your shares as you direct |

Your broker may vote only on routine items in the absence of your instruction how to vote(1) |

|||

|

Shares held in certain TTC employee benefit plans |

The plan trustee will vote your shares confidentially as you direct |

The plan trustee will vote your shares in the same proportion as the votes actually cast by participants |

|||

|

|

|

|

|||

|

(1) |

If your shares are held in “street name” and you do not indicate how you wish to vote, under the New York Stock Exchange, or NYSE, rules, your broker is permitted to exercise its discretion to vote your shares only on certain “routine” matters. Proposal One—Election of Directors and Proposal Three—Advisory Approval of our Executive Compensation are not “routine” matters. Accordingly, if you do not direct your broker how to vote on those proposals, your broker may not exercise discretionary voting authority and may not vote your shares on these proposals. This is called a “broker non-vote” and although your shares will be considered to be represented by proxy at the annual meeting for purposes of establishing quorum, as discussed on page 2, they are not considered to be shares “entitled to vote” at the annual meeting and will not be counted as having been voted on the applicable proposal. Proposal Two—Ratification of Selection of Independent Registered Public Accounting Firm is a “routine” matter, and your broker is permitted to exercise discretionary voting authority to vote your shares “for” or “against” the proposal in the absence of your instruction. |

3

What Does It Mean If I Receive More Than One Notice or Set of Proxy Materials?

If you hold your shares in more than one account, you may receive multiple copies of the Notice Regarding the Availability of Proxy Materials and/or electronic or paper copies of our proxy materials. If you are a participant in the dividend reinvestment feature of our Direct Stock Purchase Plan, shares registered in your name are combined with shares you hold in that plan. Similarly, where possible, shares registered in your name are combined with shares you hold, if any, as a participant in certain TTC employee benefit plans. However, shares you hold in “street name” (through a broker, bank or other nominee) are not combined with shares registered in your name or held as a participant in TTC employee benefit plans. If you receive more than one Notice Regarding the Availability of Proxy Materials and/or electronic or paper copies of our proxy materials, you must vote separately for each notice, e-mail notification or proxy and/or voting instruction card having a unique control number to ensure that all of your shares are voted.

How Can I Revoke or Change My Vote?

You may revoke your proxy or change your vote at any time before your shares are voted at the annual meeting by one of the following methods:

|

How Your Shares are Held |

Method to Revoke or Change Your Vote |

|

Shares registered in your name |

•Submit another proper proxy with a more recent date than that of the proxy first given by following the Internet, telephone or mobile device voting instructions or complete, sign, date and mail a proxy card; •Attend the annual meeting virtually and vote electronically at the meeting; or •Send written notice of revocation to our General Counsel. |

|

Shares held in street name |

Follow instructions provided by your broker, bank or other nominee |

|

Shares held in certain TTC employee benefit plans |

Submit another proper proxy with a more recent date than that of the proxy first given by following the Internet, telephone or mobile device voting instructions or complete, sign, date and mail a proxy card |

Broadridge Financial Solutions, Inc. has been engaged to tabulate shareholder votes. An agent of Broadridge Financial Solutions, Inc. will act as our independent inspector of elections for the annual meeting.

How Will Business Be Conducted at the Annual Meeting?

The presiding officer at the annual meeting will determine how business at the meeting will be conducted. Only nominations and other proposals brought before the annual meeting in accordance with the advance notice and information requirements of our Amended and Restated Bylaws will be considered, and no such nominations or other proposals were received.

How Can I Ask Questions During the Annual Meeting?

Shareholders may submit questions during a portion of the meeting. If you wish to submit a question during the meeting, log into the virtual meeting platform at www.virtualshareholdermeeting.com/TTC2021 using the 16-digit control number included on your proxy card, voting instruction form or Notice Regarding the Availability of Proxy Materials and follow the instructions to submit a question. Questions pertinent to meeting matters will be answered during the meeting, subject to time limitations.

4

Number of Directors; Board Structure

Our Restated Certificate of Incorporation provides that our Board of Directors may be comprised of between eight and twelve directors. As provided in our Restated Certificate of Incorporation, our Board is divided into three staggered classes of directors of the same or nearly the same number, with each class elected in a different year for a term of three years. Our current directors and their respective current terms are as follows:

|

Current Term Ending at 2021 Annual Meeting |

Current Term Ending at 2022 Annual Meeting |

Current Term Ending at 2023 Annual Meeting |

|

Janet K. Cooper |

Jeffrey L. Harmening |

Jeffrey M. Ettinger |

|

Gary L. Ellis |

Joyce A. Mullen |

Katherine J. Harless |

|

Gregg W. Steinhafel |

Richard M. Olson |

D. Christian Koch |

|

Michael G. Vale |

James C. O’Rourke |

|

After almost 22-years of distinguished service on our Board, Mr. Steinhafel has decided to retire from the Board at the expiration of his term and not stand for reelection at the annual meeting. The Board thanks Mr. Steinhafel for his many years of dedicated service to the Company. In light of Mr. Steinhafel’s retirement from the Board, the Board has voted to reduce its size from eleven to ten directors effective immediately prior to the annual meeting, and thereafter our Board will be comprised of ten directors.

Nominees for Director

The Board has nominated each of Janet K. Cooper, Gary L. Ellis, and Michael G. Vale for election to the Board to serve for a three-year term ending at the 2024 Annual Meeting of Shareholders. Each of the director nominees has consented to serve if elected. Proxies only can be voted for the number of persons named as nominees in this proxy statement, which is three.

If prior to the annual meeting the Board learns that any nominee will be unable to serve for any reason, the proxies that otherwise would have been voted for that nominee will be voted for a substitute nominee as selected by the Board. Alternatively, at the Board’s discretion, the proxies may be voted for that fewer number of nominees as results from the inability of any nominee to serve. The Board has no reason to believe that any of the nominees will be unable to serve.

Information About Director Nominees and Continuing Directors

The following pages provide information about each nominee for election to the Board at the annual meeting and each other continuing member of the Board. We believe that all of our director nominees and continuing directors display:

|

|

• |

personal and professional integrity; |

|

|

• |

appropriate levels of education and business experience; |

|

|

• |

strong business acumen; |

|

|

• |

an appropriate level of understanding of our business, industries and other industries relevant to our business; |

|

|

• |

the ability and willingness to devote adequate time to the work of our Board and its committees; |

|

|

• |

a fit of skills and personality with those of our other directors that helps build a Board that is effective, collegial and responsive to the needs of our Company; |

|

|

• |

strategic thinking and a willingness to share ideas; |

|

|

• |

a diversity of experiences, expertise and backgrounds, including but not limited to, racial, ethnic and gender diversity; and |

|

|

• |

the ability to represent the interests of all of our shareholders. |

5

All of our continuing directors and director nominees bring to our Board a wealth of executive leadership experience, particularly at companies with international manufacturing operations. The following chart summarizes each continuing director and director nominee’s key experience, qualifications and other attributes.

|

Experience and Attributes |

Janet Cooper |

Gary Ellis |

Jeffrey Ettinger |

Katherine Harless |

Jeffrey Harmening |

D. Christian Koch |

Joyce Mullen |

Richard Olson |

James O'Rourke |

Michael Vale |

|

Current/Former CEO |

|

|

✓ |

✓ |

✓ |

✓ |

|

✓ |

✓ |

|

|

Finance/Financial Oversight |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

✓ |

✓ |

✓ |

|

Public Company Board |

✓ |

✓ |

✓ |

|

✓ |

✓ |

|

|

✓ |

|

|

Manufacturing/Supply Chain/Operations |

|

|

✓ |

|

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

Distribution Channel |

|

|

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

✓ |

|

Strategic Planning |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

Regulatory/Government |

|

✓ |

✓ |

✓ |

✓ |

|

✓ |

✓ |

✓ |

✓ |

|

Health and Safety |

|

|

✓ |

✓ |

✓ |

✓ |

|

✓ |

✓ |

✓ |

|

Mergers & Acquisitions |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

International Operations |

|

✓ |

✓ |

|

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

Information Systems/ Cybersecurity |

✓ |

✓ |

|

|

✓ |

✓ |

✓ |

✓ |

✓ |

|

|

Previously Resided Outside the United States |

|

✓ |

|

|

✓ |

✓ |

✓ |

|

✓ |

✓ |

|

Female |

✓ |

|

|

✓ |

|

|

✓ |

|

|

|

|

Racially and/or Ethnically Diverse |

|

|

|

|

|

|

|

|

|

✓ |

The information presented on the following pages regarding each director nominee or continuing director also sets forth specific experience, qualifications, attributes and skills that led our Board to conclude that he or she should serve as a director in light of our business and structure.

6

Director Nominees for Election to the Board for a Term Ending at the 2024 Annual Meeting

|

Janet K. Cooper |

|

Background |

|

|

Janet K. Cooper retired from Qwest Communications International Inc., Denver, Colorado (a U.S. telecommunications company that merged with and now does business as CenturyLink). She held the following positions: •Senior Vice President and Treasurer, Qwest (September 2002 – June 2008) •Chief Financial Officer and Senior Vice President, McDATA Corporation (January 2001 – June 2002) •Senior Vice President, Finance, Qwest (July 2000 – January 2001) •Prior positions at U.S. West Inc. include Vice President, Finance and Controller, and Vice President and Treasurer Ms. Cooper is a National Association of Corporate Directors (“NACD”) Board Leadership Fellow. |

|||

|

Age 67 |

|

Qualifications |

|

|

Director since 1994 |

|

Ms. Cooper brings to our Board substantial financial and accounting knowledge and expertise. Ms. Cooper’s experience as a public company director and audit committee member, financial expertise and acumen in capital markets, audit, tax, accounting, treasury and risk-management, including related to information systems and cybersecurity, and her commitment to diversity, equity and inclusion assists our Board in providing oversight to Management on these matters. Ms. Cooper’s senior leadership experience also enables her to provide strategic input to our Board, in addition to her financial expertise, discipline and oversight. Other Public Company Boards |

|

|

Independent |

|

||

|

Committees |

|

||

|

•Audit (Chair) •Finance |

|

||

|

|

|||

|

|

|||

|

|

|||

|

|

|

Current |

Past 5 Years |

|

|

|

Lennox International Inc.

|

Resonant Inc. CPI Aerostructures, Inc. |

|

|

|

|

|

|

|

|

Background |

|

|

Gary L. Ellis retired from Medtronic plc, Dublin, Ireland (a global medical technology company). He held the following positions: •Executive Vice President, Global Operations, Information Technology and Facilities & Real Estate, Medtronic plc (June 2016 – December 2016) •Executive Vice President and Chief Financial Officer, Medtronic, Inc. (April 2014 – June 2016) •Senior Vice President and Chief Financial Officer, Medtronic, Inc. (May 2005 – April 2014) •Vice President, Corporate Controller and Treasurer, Medtronic, Inc. (October 1999 – May 2005) |

|||

|

Gary L. Ellis |

|

Qualifications |

|

|

Age 64 |

|

Mr. Ellis brings extensive financial leadership experience and expertise to the lead independent director role and generally to our Board which provides oversight regarding capital structure, financial condition and policies, long-range financial objectives, tax strategies, financing requirements and arrangements, capital budgets and expenditures, risk-management, insurance coverage, and strategic planning matters. As a former executive of a public company and an experienced public company director, Mr. Ellis contributes enhanced knowledge of public company requirements and issues. Additionally, Mr. Ellis contributes his experience managing worldwide financial operations and analyzing financial implications of merger and acquisition transactions, as well as aligning business strategies and financial decisions. |

|

|

Director since 2006 |

|

||

|

Lead Independent Director |

|

||

|

Committees |

|

||

|

•Finance (Chair) |

|

||

|

•Audit |

|

||

|

|

|

||

|

|

|

Other Public Company Boards |

|

|

|

|

Current |

Past 5 Years |

|

|

|

Hill-Rom Holdings, Inc. Inspire Medical Systems, Inc. |

None |

|

|

|

|

|

7

|

|

Background |

||

|

Michael G. Vale, Ph.D., is the Executive Vice President, Safety & Industrial Business Group of 3M Company, St. Paul, Minnesota (a global diversified technology company). He holds or has held the following positions, all at 3M: •Executive Vice President, Safety & Industrial Business Group (since May 2019) •Executive Vice President, Health Care Business Group (July 2016 – April 2019) •Executive Vice President, Consumer Business Group (August 2011 – July 2016) •Prior positions include product development engineer; manufacturing director; managing director, 3M Spain; and managing director, 3M Brazil

Qualifications |

|||

|

Michael G. Vale, Ph.D. |

|

Dr. Vale brings to our Board extensive global business experience and expertise in research and development, technology and manufacturing. Dr. Vale also contributes substantial knowledge of consumer marketing, distribution channels, supply chain, mergers and acquisitions and managing customer relationships, all of which provide valuable management insight with respect to our strategic planning and assist our Board in providing oversight to our businesses. Born and raised in South Texas and of Mexican-American descent, Dr. Vale champions diversity and inclusion initiatives as the Executive Sponsor of 3M’s Latino Resource Network and as a member of our Board. Other Public Company Boards |

|

|

Age 54 |

|

||

|

Director since 2018 |

|

||

|

Independent |

|

||

|

Committees |

|

||

|

•Audit |

|

||

|

•Finance |

|

||

|

|

|

Current |

Past 5 Years |

|

|

|

None |

None |

Continuing Members of the Board – Current Term Ending at the 2022 Annual Meeting

|

|

|

Background |

|

|

Jeffrey L. Harmening is the Chairman and Chief Executive Officer of General Mills, Inc., Minneapolis, Minnesota (a global manufacturer, marketer and supplier of food products). He holds or has held the following positions, all at General Mills: •Chairman and Chief Executive Officer (since January 2018) •Chief Executive Officer (June 2017 – January 2018) •President and Chief Operating Officer (July 2016 – May 2017) •Executive Vice President, Chief Operating Officer, U.S. Retail (May 2014 – June 2016) •Senior Vice President, Chief Executive Officer, Cereal Partners Worldwide (July 2012 – April 2014) |

|||

|

Jeffrey L. Harmening |

|||

|

Age 53 |

|

Qualifications |

|

|

Director since 2019 |

|

With over 20 years of service at General Mills in a variety of senior leadership roles across several business categories, including as its current Chairman and Chief Executive Officer, Mr. Harmening brings to our Board experience as a seasoned executive with strong business acumen and experience implementing the strategic direction for a publicly traded company with extensive distribution channels and supply chain operations. Furthermore, he brings experience in driving growth through customer-valued products and acquisitions and advancing diversity, equity and inclusion matters. In addition, he has significant experience managing operations around the world, including having lived in Europe for six years during his tenure at General Mills. |

|

|

Independent |

|

||

|

Committees |

|

||

|

•Audit |

|

||

|

•Finance |

|

||

|

|

|

||

|

|

|

Other Public Company Boards |

|

|

|

|

Current |

Past 5 Years |

|

|

|

General Mills, Inc. |

None

|

|

|

|

|

|

8

|

|

|

Background |

|

|

Joyce A. Mullen is the President, North America Businesses of Insight Enterprises, Inc., Tempe, Arizona (an information technology company), a role she has held since October 2020. Previously, she held the following positions at Dell Technologies (a digital technology solutions company): •President, Global Channel, OEM and IoT (November 2017-August 2020) •Senior Vice President and General Manager, Global OEM and IoT Solutions (February 2015 – November 2017) •Vice President and General Manager, Global OEM Solutions (February 2012 – February 2015) •Prior positions include vice president–level leadership for sales operations, global strategy and planning, global alliances and services solutions Ms. Mullen also spent 10 years in various leadership positions at Cummins Engine Company, including distribution, manufacturing and international business development. Qualifications |

|||

|

Joyce A. Mullen |

|

||

|

Age 58 |

|

||

|

Director since 2019 |

|

||

|

Independent |

|

||

|

Committees |

|

Ms. Mullen brings to our Board significant executive leadership skills, technology and smart-connected products expertise, strategic and innovative thinking and strong international business experience. She also contributes substantial knowledge of worldwide manufacturing, distribution channels, and supply chain strategies, including improving efficiencies in manufacturing operations using Six Sigma, Kaizen, and Lean techniques. |

|

|

•Compensation & |

|

||

|

•Nominating & Governance |

|

||

|

|

|

||

|

|

|

Other Public Company Boards |

|

|

|

|

Current |

Past 5 Years |

|

|

|

None |

None |

|

|

|

Background |

|

|

Richard M. Olson is our Chairman of the Board, President and Chief Executive Officer. He holds or has held the following positions, all at The Toro Company: •Chairman (since November 2017) •Chief Executive Officer (since November 2016) •President (since September 2015) •Chief Operating Officer (September 2015 – October 2016) •Group Vice President, International Business, Micro Irrigation Business and Distributor Development (June 2014 – September 2015) •Vice President, International Business (March 2013 – June 2014) •Vice President, Exmark (March 2012 – March 2013)

Qualifications |

|||

|

Richard M. Olson |

|

||

|

Age 57 |

|

||

|

Director since 2016 |

|

In his more than 34 years with our Company, Mr. Olson has developed and brings to our Board rich knowledge of the Company, including, in particular, our global businesses and operations, manufacturing processes, supply chain, distribution and channel development, and product development strategies. In addition, the broad experience he has gained through his past leadership of our various businesses and manufacturing operations provides him with a unique perspective regarding our growth initiatives and strategic direction. He contributes a deep commitment to quality, technological advancements, innovation, sustainability, diversity, ethical values and business conduct, and focus on customer service. As a result of his dual role as Chairman and CEO, Mr. Olson provides unique insight into our Company’s future strategies, opportunities and challenges and serves as a unifying element between our Board and Management. |

|

|

Committees |

|

||

|

None |

|

||

|

|

|

Other Public Company Boards |

|

|

|

|

Current |

Past 5 Years |

|

|

|

None |

None

|

|

|

|

|

|

9

|

|

|

Background |

|

|

James C. O’Rourke is the President and Chief Executive Officer of The Mosaic Company, Tampa, Florida (a global producer and marketer of combined concentrated phosphate and potash crop nutrients for the global agriculture industry). He holds or has held the following positions, all at The Mosaic Company: •President and Chief Executive Officer (since August 2015) •Executive Vice President—Operations and Chief Operating Officer (August 2012 – August 2015) •Executive Vice President—Operations (January 2009 – August 2012) Qualifications |

|||

|

James C. O’Rourke |

|

Mr. O’Rourke brings to our Board significant leadership skills, strategic and innovative thinking and strong international business expertise. He also contributes substantial knowledge of worldwide manufacturing, distribution and supply chain strategies and environmental, health and safety matters. In addition, as a public company director and executive, Mr. O’Rourke contributes a solid understanding of executive compensation and corporate governance matters. Other Public Company Boards |

|

|

Age 60 |

|

||

|

Director since 2012 |

|

||

|

Independent |

|

||

|

Committees |

|

||

|

•Compensation & •Nominating & |

|

||

|

Current |

Past 5 Years |

||

|

|

The Mosaic Company |

None |

|

Continuing Members of the Board – Current Term Ending at the 2023 Annual Meeting

|

|

|

Background |

|

|

Jeffrey M. Ettinger retired from Hormel Foods Corporation, Austin, Minnesota (a multinational manufacturer and marketer of consumer-branded food and meat products). He held the following positions, all at Hormel Foods: •Chairman of the Board (October 2016 – November 2017) •Chairman of the Board and Chief Executive Officer (November 2006 – October 2016) •President (July 2004 – October 2015)

Qualifications |

|||

|

Jeffrey M. Ettinger |

|

Mr. Ettinger brings to our Board strong business acumen, significant executive leadership attributes and relevant experience of driving growth through innovation and strategic acquisitions. Mr. Ettinger provides relevant insight and guidance with respect to numerous issues important to our Company, including, in particular, our strategy of driving growth in our business through the development of innovative, customer-valued products, expansion of our global presence through targeted acquisitions, and sustainability. Additionally, as an experienced public company director and former executive, he contributes knowledge of public company requirements and issues, including those related to corporate governance and executive compensation matters. |

|

|

Age 62 |

|

||

|

Director since 2010 |

|

||

|

Independent |

|

||

|

Committees |

|

||

|

•Nominating & •Compensation & |

|

||

|

|

|

Other Public Company Boards |

|

|

|

|

Current |

Past 5 Years |

|

|

|

Ecolab Inc. (Lead Director) |

Hormel Foods Corporation |

|

|

|

|

|

10

|

|

Background |

||

|

Katherine J. Harless retired from Idearc Inc., Dallas/Fort Worth, Texas (a provider of sales, publishing and related services including Verizon Yellow Pages and SuperPages.com). She held the following positions: •Director, Idearc (November 2006 – May 2008) •President and Chief Executive Officer, Idearc (November 2006 – February 2008) •President, Verizon Information Services Inc. (spun off by Verizon Communications, Inc. to become Idearc Inc., June 2000 – November 2006) Ms. Harless retired as a director of the North Texas Chapter of the NACD (in 2020) and is an NACD Board Leadership Fellow. |

|||

|

Katherine J. Harless |

|

Qualifications |

|

|

Age 69 |

|

Ms. Harless brings to our Board executive leadership experience, management skills and knowledge of financial, executive compensation, corporate governance and other issues applicable to public companies. She provides a seasoned business perspective and valuable business, leadership and management insights with respect to our strategic direction. |

|

|

Director since 2000 |

|

||

|

Independent |

|

||

|

Committees |

|

||

|

•Audit •Finance |

|

||

|

|

Other Public Company Boards |

||

|

|

|

Current |

Past 5 Years |

|

|

|

None |

None |

|

|

|

Background |

|

|

D. Christian Koch is the Chairman, President and Chief Executive Officer of Carlisle Companies Incorporated, Scottsdale, Arizona (a diversified manufacturing company that produces and distributes a broad range of products). He holds or has held the following positions, all at Carlisle: •President and Chief Executive Officer (since January 2016) and Chairman (since May 2020) •President and Chief Operating Officer (May 2014 – January 2016) •Group President, Carlisle Diversified Products (June 2012 – May 2014) •President, Carlisle Brake & Friction (January 2009 – June 2012) •President, Carlisle Asia-Pacific (February 2008 – January 2009) |

|||

|

D. Christian Koch |

|

Qualifications |

|

|

Age 56 |

|

Mr. Koch brings to our Board his experience as a seasoned executive with strong business acumen and significant experience managing distribution, supply chain, manufacturing and sales operations around the world as well as with mergers and acquisitions. In addition, as a public company director and executive, Mr. Koch contributes a solid understanding of financial oversight, strategic planning, executive compensation and corporate governance. |

|

|

Director since 2016 |

|

||

|

Independent |

|

||

|

Committees |

|

||

|

•Compensation & •Nominating & |

|

||

|

|

Other Public Company Boards |

||

|

|

Current |

Past 5 Years |

|

|

|

Carlisle Companies Inc. |

Arctic Cat Inc. |

|

|

|

|

|

|

11

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines, which describe our corporate governance practices and policies and provide a framework for our Board governance. The topics addressed in our Corporate Governance Guidelines include: director qualifications and responsibilities; Board committees; director board limits; director access to officers and employees; director compensation; director independence; related party transactions; director orientation and continuing education; CEO evaluation and management succession; and Board annual self-evaluation. Our Corporate Governance Guidelines provide, among other things, that:

|

|

• |

The Board will have a majority of directors who meet the criteria for independence required by law, the SEC and the NYSE listing standards; |

|

|

• |

No director that is either a CEO or other executive officer of another public company shall sit on the board of directors of more than two publicly held companies and no other director shall sit on the board of more than four publicly held companies, each without the approval of the Nominating & Governance Committee; |

|

|

• |

No director who is an active, full-time employee of our Company shall serve as a director of more than one other publicly held company and there shall be no interlocking board memberships without the approval of the Nominating & Governance Committee; |

|

|

• |

While the Board does not believe it should establish age limits, any director who has attained the age of 70 should volunteer not to stand for re-election; |

|

|

• |

The CEO will annually review with the Board top management succession plans, including development plans for succession candidates, and will periodically review with the Board an emergency leadership preparedness plan applicable in the event the CEO unexpectedly becomes incapacitated or otherwise is unable to serve; and |

|

|

• |

The Board will conduct an annual self-evaluation to determine whether it and its committees are functioning effectively. |

From time to time the Board, upon recommendation of the Nominating & Governance Committee, reviews and updates our Corporate Governance Guidelines as it deems necessary and appropriate. Our Corporate Governance Guidelines can be found on our website at www.thetorocompany.com/corporategovernance.

Our Corporate Governance Guidelines provide that (i) our Board has no policy with respect to the separation of the offices of the Chairman and the CEO; (ii) our Board believes that this issue is part of the succession planning process and will be reviewed as the Nominating & Governance Committee deems it appropriate; and (iii) (a) if the offices of Chairman and CEO are held by the same person, or (b) the Chairman does not meet the criteria for “independence” as established by applicable law, the rules and regulations of the SEC or the NYSE listing standards, then the Board, upon recommendation of the Nominating & Governance Committee, shall appoint a Lead Independent Director, who shall have such duties as are described in the Corporate Governance Guidelines or otherwise determined by the Board. The Board believes it is appropriate not to have a policy requiring the separation of the offices of the Chairman and the CEO so that the Board may make this determination based on what it believes is best under the current circumstances. However, the Board endorses the concept of an independent, non-employee director being in a position of leadership and, thus, our Corporate Governance Guidelines require a Lead Independent Director when the Chairman is not independent.

Our Board is currently chaired by Richard M. Olson, our Chairman and CEO. Our Lead Independent Director, selected by the Board, is Gary L. Ellis. Our Nominating & Governance Committee and Board believe that our current Board leadership structure ensures a strong and independent Board of Directors, provides effective governance, creates appropriate oversight for the long-term benefit of our shareholders and is appropriate for several reasons, including: (i) Mr. Olson’s extensive knowledge of our Company, our business, operations and industry, obtained through his more than 34 years of service to our Company, which benefit Board leadership and the Board’s decision-making process through his active role as Chairman; (ii) unification of Board leadership and strategic direction as implemented by our Management; and (iii) appropriate balance of risks relating to concentration of authority through the oversight of our independent and engaged Lead Independent Director and Board.

12

As our Lead Independent Director, Mr. Ellis (i) assists Mr. Olson in establishing the agendas for Board meetings and the schedule of agenda subjects to be discussed during the year, to the extent such subjects can be foreseen; (ii) presides at regularly scheduled executive sessions of the non-employee directors without Management present; (iii) together with the Chair of the Compensation & Human Resources Committee, communicates to Mr. Olson the results of his annual performance review and compensation; and (iv) together with the Chair of the Nominating & Governance Committee, leads the Board’s annual self-evaluation. With more than 14 years of continuous service on our Board, Mr. Ellis has developed considerable knowledge of our Company, our business and our industry. Mr. Ellis also has significant public company experience. In addition to serving as our Lead Independent Director, Mr. Ellis serves as the Chair of our Finance Committee.

The Board, following consideration of all relevant facts and circumstances and upon recommendation of the Nominating & Governance Committee, has affirmatively determined that each director who served as a member of our Board during fiscal 2020 (Janet K. Cooper, Gary L. Ellis, Jeffrey M. Ettinger, Katherine J. Harless, Jeffrey L. Harmening, D. Christian Koch, Joyce A. Mullen, James C. O’Rourke, Gregg W. Steinhafel and Michael G. Vale) other than Richard M. Olson, our Chairman and CEO, is independent. These determinations were made because each such person has no material relationship with our Company, our Management, our independent registered public accounting firm, or external auditor, our independent external compensation consultant or our external compensation legal advisers, and otherwise meets the independence requirements as established by applicable law, the rules and regulations of the SEC and the NYSE listing standards. The Board based its independence determinations, in part, upon a review by the Nominating & Governance Committee and the Board of certain transactions between us and the employers of certain of our directors, each of which was deemed to be pre-approved under our Corporate Governance Guidelines in that each such transaction was made in the ordinary course of business, at arm’s length, at prices and on terms customarily available to unrelated third party vendors or customers generally, in amounts that are not material to us or such unaffiliated corporation, and in which the director had no direct or indirect personal interest, nor received any personal benefit.

Director Attendance; Executive Sessions

The Board held nine meetings during fiscal 2020. Each incumbent director attended at least 75% of the aggregate total number of meetings held by the Board and all committees on which he or she served. Our Corporate Governance Guidelines provide that the non-employee directors will meet in regularly scheduled executive sessions without Management. At each regular Board meeting held during fiscal 2020 our non-employee directors met in executive session without Management present and such meetings were presided over by our Lead Independent Director.

We expect all of our directors and our director nominees to attend our annual meeting of shareholders and we customarily schedule a regular Board meeting on the same day as our annual meeting. Seven of the ten non-employee directors serving at the time of our 2020 Annual Meeting of Shareholders held on March 17, 2020 were in attendance.

The Board has four committees, the Audit Committee, Compensation & Human Resources Committee, Nominating & Governance Committee, and Finance Committee. Each committee has a charter that is posted on our website at www.thetorocompany.com/corporategovernance. The charter of each committee describes the principal functions of the committee. As provided in their respective charters, each of the Compensation & Human Resources Committee, Nominating & Governance Committee, and Finance Committee may form and delegate authority to subcommittees when appropriate. Additionally, the Compensation & Human Resources Committee may delegate to one or more executive officers of the Company the authority to approve equity compensation awards under established equity compensation plans of the Company to employees other than the executive officers of the Company. On an annual basis the Audit Committee, Nominating & Governance Committee and Compensation & Human Resources Committee review the adequacy of their charter and their performance. The Finance Committee periodically reviews its charter and performance, with such review historically conducted on an annual basis. The Chair of each Board committee provides a summary of the matters discussed in their committee meeting to the full Board.

13

The Board has determined that each of the members of the Audit Committee, Compensation & Human Resources Committee and Nominating & Governance Committee meets the independence and other requirements established by applicable law, the rules and regulations of the SEC, the NYSE listing standards and the Internal Revenue Code of 1986, as amended, or Code, as applicable.

The current membership of each committee, the number of times each committee met, including by executive session, during fiscal 2020 and key functions of each committee are noted in the following table. Mr. Olson is not a member of any Board committee. In fiscal 2020 Mr. Olson attended, and currently may attend, various committee meetings, or portions of such meetings as appropriate, as a member of Management at the invitation of such Board committees.

|

Compensation |

Key Committee Functions • Approves the compensation levels, salaries, incentive opportunities and other compensation arrangements for the CEO and executive officers • Reviews compensation policies and practices as they affect all employees and relate to risk management practices and risk-taking incentives • Evaluates the CEO’s performance • Oversees human capital management activities |

• Approves performance goals for performance based awards • Reviews with Management the Compensation Discussion and Analysis, the Committee report on executive compensation, and any compensation-related proposals, including say-on-pay and frequency of say-on-pay proposals • Reviews non-employee director compensation components and amounts |

Committee Members(2) Mr. O’Rourke (Chair) Mr. Ettinger Mr. Koch Ms. Mullen Mr. Steinhafel

During Fiscal 2020 Number of Meetings: 4 Number of Executive Sessions: 3 |

|

(2) |

As a result of Gregg Steinhafel’s retirement prior to the annual meeting, the Compensation & Human Resources Committee will consist of four members at the time of the annual meeting. |

|

Nominating & Governance Committee |

Key Committee Functions • Reviews and recommends to the Board the size and composition of the Board and its committees • Identifies individuals qualified to become Board members • Recommends to the Board director nominees for election at the annual meeting • Oversees the annual evaluation of the Board |

• Reviews and recommends to the Board any proposed amendments or changes to Restated Certificate of Incorporation or Amended and Restated Bylaws • Reviews Corporate Governance Guidelines and recommends to the Board any changes • Reviews sustainability activities • Monitors corporate governance trends |

Committee Members(3) Mr. Ettinger (Chair) Mr. Koch Ms. Mullen Mr. O’Rourke Mr. Steinhafel

During Fiscal 2020 Number of Meetings: 2 Number of Executive Sessions: 2 |

|

(3) |

As a result of Gregg Steinhafel’s retirement prior to the annual meeting, the Nominating & Governance Committee will consist of four members at the time of the annual meeting. |

14

|

Finance |

Key Committee Functions • Reviews, and recommends to the Board as required, capital structure and related financial policies and long-range objectives, capital expenditures, tax strategies and restructuring projects, financing arrangements and cash or any special dividends • Reviews and recommends to the Board the authorization for the issuance or repurchase of equity or long-term debt |

• Reviews use of derivative, hedging and similar instruments to manage financial, currency and interest rate exposure • Evaluates, and recommends to the Board as required, financing implications of certain proposed merger, acquisition, divestiture, joint venture and other business combination transactions or investments |

Committee Members Mr. Ellis (Chair) Ms. Cooper Ms. Harless Mr. Harmening Dr. Vale

During Fiscal 2020 Number of Meetings: 4 Number of Executive Sessions: 2

|

Board’s Role in Risk Oversight