Gulf Resources Announces Audited Financial Results for Fiscal 2019

SHOUGUANG, China, April 14, 2020 (GLOBE NEWSWIRE) -- Gulf Resources, Inc. (NASDAQ:GURE) ("Gulf Resources," the "Company," or “we”), a leading manufacturer of bromine, crude salt and specialty chemical products in China today announced its audited financial results for the fiscal year ended December 31, 2019.

|

|||||

The past 30 months have been difficult for our company. During this time, we closed our facilities for rectification, were impacted by the second most destructive Typhoon in Chinese history, and had to close our facilities for longer than expected because of COVID-19. However, all of these difficulties are now largely behind us and we have optimism about the future.

On September 1, 2017, our company and its competitors received letters from the government instructing us to close our bromine and chemical facilities so they could go through rectification to improve the environment. We were also informed that our chemical factories would have to be closed and then relocated.

We immediately began the lengthy and complex rectification program. In September 2018, we were informed that three of our bromine factories (#3,#4, #11) were too close to where people were living and would not be allowed to resume production.

On May 29, 2019, the Company received a verbal notice from the governments in Sichuan Province that the company needed to obtain project approval for its well located in Daying, including the natural gas and brine water project, and approvals for safety production inspection, environmental protection assessment, and to solve the related land issue. We had to temporarily halt production at our natural gas well until these approvals are received.

In August 2019, Typhoon Lekima, the second most destructive Typhoon to impact China, hit Shandong Province. Lekima dumped 15.22 inches of rain in Weifang city, flooding all of our factories and salt ponds and causing very significant damage. This forced us to do more rectification and delayed some of our approvals.

On November 25, 2019, the government of Shouguang City issued a notice ordering all bromine facilities in Shouguang City to temporarily stop production from December 16, 2019 to February 10, 2020 for environmental reasons. Winter is a time of the greatest air pollution in Shouguang City. Fortunately, it is also the slowest production time for bromine and crude salt.

Subsequently, because of the coronavirus outbreak, the closures were extended until February 29, 2020.

The company has struggled through this difficult period. In 2019 and 2018, we spent $60,611,949 and $35,954,282 performing rectification, drilling new wells, upgrading our facilities, repairing our facilities from the floods, and leasing land.

Below is the highlights of the Company’s plans and business developments in 2020 and key results for fiscal 2019.

- On March 5, 2020, we received governmental approval to resume production at bromine Factories No. 1, No. 4, No, 7, and No, 9.

- In the middle of March 2020, we began trial production in Factories No. 1 and No. 7.

- On April 3, 2020, we began commercial production in Factories No. 1 and No. 7.

- In middle of April we commenced trial production in Factories No. 4 and No. 9.

- In May 2020, we expect to commence commercial production in Factories No. 4 and No. 9.

- We have completed major rectification on our facilities for Factories No. 2, No. 8, and No. 10, and expect to receive approvals for Factories No. 2, No. 8, and No. 10 to begin trial production in the near future.

- During 2019, we spent $60 million on property plant and equipment. A large percentage of these funds were spent on performing rectification, drilling new wells, upgrading our facilities, and repairing our facilities from the floods. This will enable us to operate more efficiently in the future.

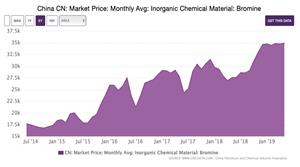

- The chart below has shown that the average price of bromine has almost doubled in the past 6 years. Given the fact that our smaller competitors are unable to resume their production, we believe our products have less competition and strong market demand. https://www.globenewswire.com/NewsRoom/AttachmentNg/818d90e6-b175-4fdf-9751-81745d226342

- We expect to commence construction on our new chemical factory in May 2020. We expect this factory will be operational by the end of the first half of 2021. We expect our new factory will have less competition and more profitability.

- We continue to work with the town, county, and provincial governments in Sichuan and believe we will receive all approvals to restart our natural gas and brine production in Sichuan.

As our bromine factories have commenced production and the new chemical factory will start construction, we believe the Company will be positioned to become profitable.

2019 Financial Results

For 2019, revenues were $10,596,521 compared to $2,594,941, an increase of 308%. Gross profit was $5,166,252 compared to $1,284,669, an increase of 302%. Direct labor and factory overheads incurred during plant shutdown were $15,175,280 compared to $21,081,692, an improvement of 28%. In 2018, we write off $4,004,788 in impairment on prepaid land and $27,966,050 in goodwill for our chemical plants. In 2019, we did not incur any write-offs. General & Administrative expenses increased 18% to $13,272,921. Loss from operations was $23,294,383 compared to $83,552,531. The loss before taxes was $22,993,058 compared to $83,051,841. We incurred an income tax expense of $2,806,987 compared to an income tax credit of $13,087,855. Our net loss was $25,800,045 compared to $69,963,986. In 2019, the company recorded net loss of $2.71* per share compared to a loss of $7.35* per share in the previous year.

Operational Results by Segment

Bromine Segment

Net revenue from our bromine segment increased to $10,022,027 for the year ended December 31, 2019 compared to $0 for the year ended December 31, 2018. We opened factories #1 and #7 in April 2019, began test production, and then began commercial production. On August 12, 2019, Thypoon Lekima hit Shandong Province. Over 15 inches of rain fell in Weifang city. All of our bromine mines were flooded. We had to close the two factories that were open and postpone opening other factories while we conducted repairs.

For the year ended December 31, 2019, the gross profit margin for our bromine segment was 52%. This was a very acceptable level of gross margins. In 2016, gross margins in bromine were 45.6%. In addition, the second largest component to Costs of Goods Sold was depreciation and amortization. In 2019, since we only had a few months of operation, the depreciation and amortization had to be allocated over lower level of sales. Had our factories and mines remained open for the full year, gross margin would have been much higher.

Loss from operations from our bromine segment was $ 15,609,979 for the fiscal year 2019, compared to a loss of $40,504,752 in the same period in 2018. This loss was impacted by direct factory labor, since we had to keep our workers employed, start-up expenses, and clean-up costs from Typhoon Lakima, as well as overhead from the crude salt segment. Since overhead between the crude salt and bromine segments is allocated based on sales and since we had relatively low levels of crude salt sales, more of the overhead than normal was allocated to the bromine segment.

For the fiscal year 2019, we used approximately $60 million to acquire property, plant and equipment. Most of these expenditures were related to our bromine and crude salt segments. Our expenditures for drilling new wells should enable our mines and factories to operate more efficiently in the future.

Crude salt segment

Net revenue from our crude salt segment decreased to $522,758 for the year ended December 31, 2019 compared $1,981,573 for the same period in 2018. In 2018, all of the revenue came from selling off crude salt inventory that was produced in 2017. In 2019, we opened two plants in April. Production was disrupted by Typhoon Lekima in August. The factories were closed in early December in 2019. As a result, we produced limited capacity of crude salt in 2019. Loss from operations from our crude salt segment was $4,446,900 for fiscal year 2019, compared to a loss of $8,336,305 in the same period in 2018.

Chemical Segment

During 2019, the chemical division had no revenues as the company awaited government approval of its new factory. The approval was delayed because of the rectification of other businesses, the disruption caused by Typhoon Lekima, and the COVID-19 pandemic. The Company did receive approval in January 2020 and expects to begin construction in May 2020. Operations should begin in Spring 2021. The company has already incurred relocation costs of $10,320,017, including prepayment for the land lease. Total costs for the new chemical factory, including the already incurred relocation costs, are expected to be $60 million. Loss from operations from our chemical products segment was $2,823,298 for the fiscal year 2019, compared to a loss of $34,757,750 in the same period in 2018. $27,966,050 of the loss in 2018 was from a write-down of goodwill.

Natural gas segment

For the year ended December 31, 2019, the net revenue for the natural gas was $51,736. Loss from operations from our natural gas segment was $188,949 for the fiscal year 2019, compared to a loss of $204,517 in the same period in 2018. On May 29, 2019, the Company received a verbal notice from the government of Tianbao Town, Daying County, Sichuan Province, whereby the Company is required to obtain project approval for its well located in Daying, including the whole natural gas and brine water project, and approvals for safety production inspection, environmental protection assessment, and to solve the related land issue. Until these approvals have been received, the Company has to temporarily halt trial production at its natural gas well in Daying. The company is currently working with officials on the town, county, and provincial levels to obtain these approvals. The company is optimistic that these approvals will be received.

Balance Sheet

The company ended 2019 with cash of $100,301,986. Cash per share was $10.54* based on 9,516,614 shares issued and outstanding. Current assets were $107,202,708. Property, plant, and equipment was $137,994,949 up from $82,282,630, reflecting the investment in new wells and rectification. With its current cash position, the company has enough cash to build its new chemical factory, drill more bromine wells, and expand its business in Sichuan province, and pursue other growth opportunities. Total assets were $279,250,985.

Current liabilities were $6,306,264. Working capital was $100,896,444. Working capital per share was $10.60*. Net net cash (cash minus all liabilities) was $93,995,772. Net net cash per share was $9.88*. Shareholders’ Equity was $263,107,100. Shareholders’ equity per share was $27.65*.

Cash Flow

In 2019, net cash used in operating activities was $15,309,112 compared to net cash provided by operating activities of $17,340,671 in the previous year. In 2018, the company collected $30,241,680 in accounts receivable, whereas in 2019, receivables grew by $5,070,180. All outstanding receivables were collected in the first quarter of 2020.

Additions to property, plant, and equipment were $60,611,949 compared to $35,273,307. In total, the company has invested $95,885,256 in property plant, and equipment in the past two years. The company expects a substantial return on these investments in coming years.

(*These calculations are not audited and based on the number of shares outstanding of 9,516,614 as of December 30, 2019)

Conference Call

Gulf Resources' management will host a conference call on Wednesday, April 15, 2020 at 08:30 Eastern Time to discuss its financial results for the fiscal year 2019 ended December 31, 2019.

Mr. Xiaobin Liu, CEO of Gulf Resources, will be hosting the call. The Company's management team will be available for investor questions following the prepared remarks.

To participate in this live conference call, please dial +1 (877) 407-8031 five to ten minutes prior to the scheduled conference call time. International callers should dial +1 (201)689-8031, and please reference to “Gulf Resources” while dial in.

The webcasting is also available then, just simply click on the link below: http://www.gulfresourcesinc.com/events.html

A replay of the conference call will be available two hours after the call's completion during 04/15/2020 13:00 ET - 04/22/2020 13:00 ET. To access the replay, call +1 (877) 481-4010. International callers should call +1 (919) 882-2331. The Replay Passcode is 34130.

About Gulf Resources, Inc.

Gulf Resources, Inc. operates through three wholly-owned subsidiaries, Shouguang City Haoyuan Chemical Company Limited ("SCHC"), ShouguangYuxin Chemical Industry Co., Limited ("SYCI"), and Daying County Haoyuan Chemical Company Limited (“DCHC”). The company believes that it is one of the largest producers of bromine in China. Elemental Bromine is used to manufacture a wide variety of compounds utilized in industry and agriculture. Through SYCI, the Company manufactures chemical products utilized in a variety of applications, including oil and gas field explorations and papermaking chemical agents, and materials for human and animal antibiotics. DCHC was established to further explore and develop natural gas and brine resources (including bromine and crude salt) in China. For more information, visit www.gulfresourcesinc.com.

Forward-Looking Statements

Certain statements in this news release contain forward-looking information about Gulf Resources and its subsidiaries business and products within the meaning of Rule 175 under the Securities Act of 1933 and Rule 3b-6 under the Securities Exchange Act of 1934, and are subject to the safe harbor created by those rules. The actual results may differ materially depending on a number of risk factors including, but not limited to, the general economic and business conditions in the PRC, future product development and production capabilities, shipments to end customers, market acceptance of new and existing products, additional competition from existing and new competitors for bromine and other oilfield and power production chemicals, changes in technology, the ability to make future bromine asset purchases, and various other factors beyond its control. All forward-looking statements are expressly qualified in their entirety by this Cautionary Statement and the risks factors detailed in the company's reports filed with the Securities and Exchange Commission. Gulf Resources undertakes no duty to revise or update any forward-looking statements to reflect events or circumstances after the date of this release.

CONTACT: Gulf Resources, Inc.

| Web: | http://www.gulfresourcesinc.com |

| Director of Investor Relations | |

| Helen Xu (Haiyan Xu) | |

| [email protected] |

| GULF RESOURCES, INC. |

| AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF LOSS AND COMPREHENSIVE LOSS |

| (Expressed in U.S. dollars) |

| Years Ended December 31, | ||||||||

| 2019 | 2018 | |||||||

| NET REVENUE | ||||||||

| Net revenue | $ | 10,596,521 | $ | 2,594,941 | ||||

| OPERATING EXPENSE | ||||||||

| Cost of net revenue | (5,430,269 | ) | (1,310,272 | ) | ||||

| Sales, marketing and other operating expenses | (12,434 | ) | (66,111 | ) | ||||

| Write-off/Impairment on property, plant and equipment | — | (1,397,313 | ) | |||||

| Loss on demolition of factory | — | (18,644,473 | ) | |||||

| Direct labor and factory overheads incurred during plant shutdown | (15,175,280 | ) | (21,081,692 | ) | ||||

| Write-off of prepaid land lease | — | (4,004,788 | ) | |||||

| Impairment for goodwill | — | (27,966,050 | ) | |||||

| General and administrative expenses | (13,272,921 | ) | (11,268,800 | ) | ||||

| Other operating loss | — | (407,973 | ) | |||||

| (33,890,904 | ) | (86,147,472 | ) | |||||

| LOSS FROM OPERATIONS | (23,294,383 | ) | (83,552,531 | ) | ||||

| OTHER INCOME (EXPENSE) | ||||||||

| Interest expense | (145,445 | ) | (160,422 | ) | ||||

| Interest income | 446,770 | 661,112 | ||||||

| LOSS BEFORE INCOME TAXES | (22,993,058 | ) | (83,051,841 | ) | ||||

| INCOME TAX (EXPENSE) BENEFIT | (2,806,987 | ) | 13,087,855 | |||||

| NET LOSS | $ | (25,800,045 | ) | $ | (69,963,986 | ) | ||

| COMPREHENSIVE LOSS: | ||||||||

| NET LOSS | $ | (25,800,045 | ) | $ | (69,963,986 | ) | ||

| OTHER COMPREHENSIVE LOSS | ||||||||

| - Foreign currency translation adjustments | (5,013,759 | ) | (18,641,006 | ) | ||||

| COMPREHENSIVE LOSS | $ | (30,813,804 | ) | $ | (88,604,992 | ) | ||

| LOSS PER SHARE: | ||||||||

| BASIC AND DILUTED | $ | (2.73 | ) | $ | (7.45 | ) | ||

| WEIGHTED AVERAGE NUMBER OF SHARES: | ||||||||

| BASIC AND DILUTED | 9,465,432 | 9,360,758 | ||||||

| GULF RESOURCES, INC. |

| AND SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS |

| (Expressed in U.S. dollars) |

| December 31, 2019 | December 31, 2018 | |||||||

| Current Assets | ||||||||

| Cash | $ | 100,301,986 | $ | 178,998,935 | ||||

| Accounts receivable | 4,877,106 | — | ||||||

| Inventories, net | 690,087 | — | ||||||

| Prepayments and deposits | 1,332,970 | 8,096,636 | ||||||

| Prepaid land leases | — | 235,459 | ||||||

| Other receivables | 559 | 12,506 | ||||||

| Total Current Assets | 107,202,708 | 187,343,536 | ||||||

| Non-Current Assets | ||||||||

| Property, plant and equipment, net | 137,994,949 | 82,282,630 | ||||||

| Finance lease right-of use assets | 179,526 | 250,757 | ||||||

| Operating lease right-of –use assets | 8,817,884 | — | ||||||

| Prepaid land leases, net of current portion | 9,115,276 | 9,639,009 | ||||||

| Deferred tax assets | 15,940,642 | 19,030,858 | ||||||

| Total non-current assets | 172,048,277 | 111,203,254 | ||||||

| Total Assets | $ | 279,250,985 | $ | 298,546,790 | ||||

| Commitment and Contingencies | ||||||||

| Liabilities and Stockholders’ Equity | ||||||||

| Current Liabilities | ||||||||

| Payable and accrued expenses | $ | 1,106,048 | $ | 905,258 | ||||

| Retention payable | 3,805,483 | 332,416 | ||||||

| Taxes payable-current | 779,623 | 1,188,687 | ||||||

| Finance lease liability, current portion | 198,506 | 197,480 | ||||||

| Operating lease liabilities, current portion | 416,604 | — | ||||||

| Total Current Liabilities | 6,306,264 | 2,623,841 | ||||||

| Non-Current Liabilities | ||||||||

| Finance lease liability, net of current portion | 1,905,772 | 2,069,545 | ||||||

| Operating lease liabilities, net of current portion | 7,931,849 | — | ||||||

| Total Non-Current Liabilities | $ | 9,837,621 | $ | 2,069,545 | ||||

| Total Liabilities | $ | 16,143,885 | $ | 4,693,386 | ||||

| Commitment and Contingencies | ||||||||

| Stockholders’ Equity | ||||||||

| PREFERRED STOCK; $0.001 par value; 1,000,000 shares authorized; none outstanding | ||||||||

| COMMON STOCK; $0.0005 par value; 80,000,000 shares authorized; 9,562,444 and 9,410,588 shares issued; and 9,516,614 and 9,360,758 shares outstanding as of December 31, 2019 and December 31, 2018 | $ | 23,904 | $ | 23,525 | ||||

| Treasury stock; 45,830 and 49,830 shares as of December 31, 2019 and December 31, 2018 at cost | (510,329 | ) | (554,870 | ) | ||||

| Additional paid-in capital | 95,043,388 | 95,020,808 | ||||||

| Retained earnings unappropriated | 159,808,400 | 185,608,445 | ||||||

| Retained earnings appropriated | 24,233,544 | 24,233,544 | ||||||

| Accumulated other comprehensive loss | (15,491,807 | ) | (10,478,048 | ) | ||||

| Total Stockholders’ Equity | 263,107,100 | 293,853,404 | ||||||

| Total Liabilities and Stockholders’ Equity | $ | 279,250,985 | $ | 298,546,790 | ||||

| GULF RESOURCES, INC. |

| AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (Expressed in U.S. dollars) |

| Years Ended December 31, | ||||||||

| 2019 | 2018 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net loss | $ | (25,800,045 | ) | $ | (69,963,986 | ) | ||

| Adjustments to reconcile net income to net cash (used in) provided by operating activities: | ||||||||

| Interest on capital lease obligation | 144,881 | 159,839 | ||||||

| Amortization of prepaid land leases | — | 761,713 | ||||||

| Depreciation and amortization | 14,060,927 | 17,443,318 | ||||||

| Allowance for obsolete and slow-moving inventories | — | 21,248 | ||||||

| Write-off / Impairment loss on property, plant and equipment | — | 1,397,313 | ||||||

| Write-off of Prepaid land lease | — | 4,004,788 | ||||||

| Loss on demolition of factories | — | 18,644,473 | ||||||

| Impairment for goodwill | — | 27,966,050 | ||||||

| Unrealized translation difference | (421,657 | ) | (1,315,454 | ) | ||||

| Deferred tax asset | 2,746,770 | (13,087,855 | ) | |||||

| Stock-based compensation expense-options | 45,900 | 496,200 | ||||||

| Shares issued from treasury stock for services | 21,600 | — | ||||||

| Changes in assets and liabilities | ||||||||

| Accounts receivable | (5,070,180 | ) | 30,241,680 | |||||

| Other receivables | 11,794 | (11,289 | ) | |||||

| Inventories | (700,476 | ) | 1,192,262 | |||||

| Prepayment and deposits | 14,166 | (81,469 | ) | |||||

| Payable and accrued expenses | (102,963 | ) | (106,163 | ) | ||||

| Retention payable | — | (597,991 | ) | |||||

| Taxes payable | (374,575 | ) | 175,994 | |||||

| Operating lease | 114,746 | — | ||||||

| Net cash (used in) provided by operating activities | (15,309,112 | ) | 17,340,671 | |||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Additions of prepaid land leases | — | (680,975 | ) | |||||

| Purchase of property, plant and equipment | (60,611,949 | ) | (35,273,307 | ) | ||||

| Net cash used in investing activities | (60,611,949 | ) | (35,954,282 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Repayment of finance lease obligation | (275,509 | ) | (294,295 | ) | ||||

| Net cash used in financing activities | (275,509 | ) | (294,295 | ) | ||||

| EFFECTS OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS | (2,500,379 | ) | (10,999,918 | ) | ||||

| NET DECREASE IN CASH AND CASH EQUIVALENTS | (78,696,949 | ) | (29,907,824 | ) | ||||

| CASH AND CASH EQUIVALENTS - BEGINNING OF YEAR | 178,998,935 | 208,906,759 | ||||||

| CASH AND CASH EQUIVALENTS - END OF YEAR | $ | 100,301,986 | $ | 178,998,935 | ||||

| GULF RESOURCES, INC. | ||||||||

| AND SUBSIDIARIES | ||||||||

| CONSOLIDATED STATEMENTS OF CASH FLOWS (CONTINUED) | ||||||||

| (Expressed in U.S. dollars) | ||||||||

| Years Ended December 31, | ||||||||

| 2019 | 2018 | |||||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | ||||||||

| Cash paid during the year for: | ||||||||

| Income taxes | $ | — | $ | — | ||||

| Operating right-of-use assets obtained in exchange for lease obligations | $ | 8,241,818 | $ | — | ||||

| SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING ACTIVITIES | ||||||||

| Purchase of Property, plant and equipment included in Retention payable | $ | 3,515,132 | $ | — | ||||

| Par value of common stock issued upon cashless exercise of options | $ | 379 | $ | — | ||||

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Sony/Apollo bid for Paramount could be worth as much as $29 billion - Source

- Progress Software Corporation (PRGS) Issues Statement on a Possible Offer for MariaDB

- ROSEN, TRUSTED INVESTOR COUNSEL, Encourages Autodesk, Inc. Investors to Inquire About Securities Class Action Investigation – ADSK

Create E-mail Alert Related Categories

Globe Newswire, Press ReleasesRelated Entities

Crude Oil, Earnings, Definitive AgreementSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share