Form 6-K New Frontier Health Corp For: Mar 26

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of March, 2020

Commission File Number: 001-38562

NEW FRONTIER

HEALTH CORPORATION

(Translation of Registrant’s Name into English)

10 Jiuxianqiao Road,

Hengtong Business Park

B7 Building, 1/F

Chaoyang District, 100015,

Beijing, China

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file

annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant

is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant

is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Attached as Exhibits 99.1 and 99.2 hereto are the earnings release issued by New Frontier Health Corporation (the “Company”) announcing its financial results for the fourth quarter and year ended December 31, 2019 and associated investor presentation, respectively.

EXHIBIT INDEX

| Exhibit | Description of Exhibit |

| 99.1 | Earnings Release. |

| 99.2 | Investor Presentation. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| New Frontier Health Corporation | ||

| By: | /s/ Roberta Lipson | |

| Name: Roberta Lipson | ||

| Title: Chief Executive Officer | ||

Date: March 26, 2020

Exhibit 99.1

New Frontier Health Corporation Announces Fourth Quarter and Fiscal 2019 Financial Results

New Frontier Health Corporation (“NFH” or “the Company”) (NYSE: NFH), operator of the premium healthcare services provider United Family Healthcare (“UFH"), today announced the unaudited financial results of Healthy Harmony Holdings, L.P. and its subsidiaries (“Healthy Harmony”) for the fourth quarter and fiscal year ended December 31, 20191.

For management purposes, the Company is organized into business units based on the category and stage of development of the Company’s healthcare facilities and geographic locations, and has three reportable operating segments as follows:

(a) Tier 1 Operating Assets: the existing general healthcare facilities located in tier 1 cities in China, such as Beijing United Family Hospital and Shanghai Puxi United Family Hospital, and their associated clinics.

(b) Tier 2 Operating and Other Assets: the existing general healthcare facilities located in tier 2 cities in China, such as Tianjin United Family Hospital, Qingdao United Family Hospital, and other assets, such as a Beijing United Family Rehabilitation Hospital and other clinic assets.

(c) Expansion Assets: the facilities recently opened or about to open including Pudong United Family Hospital, Guangzhou United Family Hospital, and Beijing Datun United Family Hospital.

Financial and Operating Highlights2

For the Quarter Ended December 31, 2019:

| · | Revenue increased by 13.9% to RMB639.7 million from RMB561.5 million. |

| · | Net loss increased to RMB223.2 million from RMB4.1 million, mainly resulted from one-time transaction related costs3 of RMB147.5 million and an expanded cost basis partially due to the two new hospitals in Guangzhou and Shanghai Pudong, as well as one-off relocation costs related to the move to the expanded facility for PXU. |

| · | Pro-forma adjusted EBITDA4 increased by 218.2% to RMB27.6 million. |

| · | Tier 1 Operating Assets: revenue increased by 6.4% to RMB462.2 million from RMB434.4 million, pro-forma adjusted EBITDA decreased by 5.8% to RMB109.5 million due to an increase in full time medical staff headcounts to support the expanding service lines, as well as additional one-off year-end bonuses awarded for over-achieving 2019 full year budget targets. |

| · | Tier 2 Operating and Other Assets: revenue increased by 8.6% to RMB95.9 million from RMB88.3 million and adjusted EBITDA5 (before IFRS 16 adoption) increased by 117.9% to RMB0.6 million from RMB(3.2) million due to increases in patient volume and continued ramping up at tier 2 operating facilities. |

| · | Expansion Assets: revenue increased by 98.9% to RMB81.6 million from RMB38.8 million and adjusted EBITDA (before IFRS 16 adoption) improved to RMB(37.0) million from RMB(64.4) million due to the continued ramp-up of expansion assets. |

For the Fiscal Year Ended December 31, 2019:

| · | Revenue increased by 19.0% to RMB2,449.2 million from RMB2,058.8 million. |

| · | Net loss increased to RMB430.3 million from RMB154.0 million, mainly resulted from one-time transaction related costs2 of RMB160.1 million and an expanded cost basis partially due to the two new hospitals in Guangzhou and Shanghai Pudong, as well as costs related to the move to the expanded Shanghai Puxi facility. |

| · | Pro-forma adjusted EBITDA increased by 93.0% to RMB162.9 million. |

1 The Company acquired UFH in a business combination that closed on December 18, 2019. The financial results presented herein are those of the Company’s wholly owned subsidiary, Healthy Harmony Holdings, L.P., and do not include the results of the parent entity, NFH, for the 13 day period from December 19, 2019 to December 31, 2019

2 All comparisons made on a year-over-year (“yoy”) basis. As a result of the adoption of International Financial Reporting Standard (“IFRS”) 16, effective January 1, 2019, related lease expenses have been reflected in depreciation and amortization expenses and finance costs. Segment revenue, Pro-forma Adjusted EBITDA, and Adjusted EBITDA before IFRS 16 adoption are presented for comparison purposes. The financial statements of Healthy Harmony have been translated into United States dollars for convenience purposes at a rate of RMB6.9618 to US$1.00, the exchange rate on December 31, 2019 set forth in the H.10 statistical release of the Federal Reserve Board.

3 One time transaction related costs include transaction cost in other operating expenses and transaction bonus included in salaries, wages and benefits expenses

4 Pro-forma Adjusted EBITDA is a non-IFRS performance measures. See “Non-IFRS Financial Measures” for a reconciliation of Pro Forma Adjusted EBITDA to its most comparable financial measure calculated in accordance with IFRS.

5 Adjusted EBITDA is a non-IFRS performance measures. See “Non-IFRS Financial Measures” for a reconciliation of Adjusted EBITDA to its most comparable financial measure calculated in accordance with IFRS.

| · | Tier 1 Operating Assets: revenue increased by 9.1% to RMB1,810.7 million from RMB1,659.9 million, pro-forma adjusted EBITDA increased by 15.0% from RMB419.9 million, demonstrating stable growth for both outpatient and inpatient volume as well as improved cost efficiency in tier 1 operating assets. |

| · | Tier 2 Operating and Other Assets: revenue increased by 17.7% to RMB358.8 million from RMB304.9 million and adjusted EBITDA (before IFRS 16 adoption) improved to RMB(0.2) million from RMB(9.4) million, with tier 2 operating and other assets approaching breakeven as a group. |

| · | Expansion asset revenue increased by 187.6% to RMB279.6 million from RMB94.1 million and adjusted EBITDA (before IFRS 16 adoption) improved to RMB(161.4) million from RMB(185.3) million, achieving significant progress and is in line with the strong ramp up expectation. |

| · | Outpatient visits increased by 11.7% to 632,664 from 566,337. |

| · | Inpatient admissions increased by 22.1% to 10,805 from 8,849. |

| · | Bed utilization rate* increased to 38.3% from 29.3%. |

* Bed utilization is calculated based on the weighted average maximum bed capacity of the year.

Mr. Antony Leung, Chairman of NFH said: “New Frontier Health successfully completed the acquisition of United Family Healthcare in December and delivered strong financial results for 2019. We are delighted to see that UFH has continued its growth in operating assets and ramp up speed of its expansion assets. Looking forward, we remain committed to building and growing our integrated healthcare platform to provide world-class, quality healthcare services to patients in China.”

Ms. Roberta Lipson, Chief Executive Officer of NFH and founder of UFH, commented, “A number of operating achievements helped drive our growth this quarter. Revenue in operating assets continued to grow based on ever-wider recognition of our brand and consumers’ continued confidence in our services, as well as continued expansion of service lines. We moved our original Shanghai Puxi hospital to its new, larger quarters at the end of the year, tripling the capacity of the hospital in a newer and more attractive space. Our Tier 2 Operating Assets also experience strong growth and our expansion assets continued to ramp up as well.”

“As we began 2020, the coronavirus outbreak in China had an impact on China as a whole and on our operations,” she continued. “Looking beyond the outbreak, we see many opportunities to grow our business. As we continue to deliver premium, high-quality services, we are focused on growing our business and shareholder value by driving patient volume, promoting growth within our practice verticals, and growing our network.”

Key Operating Metrics

| 2018 | 2019 | Y-o-Y Growth % | ||||||||||||||||||||||

| Outpatient Volume | Inpatient Admission | Outpatient Volume | Inpatient Admission | Outpatient Volume | Inpatient Admission | |||||||||||||||||||

| Tier 1 Operating Assets(1) | 447,174 | 6,470 | 473,471 | 6,924 | 5.9 | % | 7.0 | % | ||||||||||||||||

| Tier 2 Operating and Other Assets(2) | 77,159 | 2,177 | 87,511 | 2,374 | 13.4 | % | 9.0 | % | ||||||||||||||||

| Operating Assets Subtotal | 524,333 | 8,647 | 560,982 | 9,298 | 7.0 | % | 7.5 | % | ||||||||||||||||

| Expansion Assets(3) | 42,004 | 202 | 71,682 | 1,507 | 70.7 | % | 646.0 | % | ||||||||||||||||

| Total UFH | 566,337 | 8,849 | 632,664 | 10,805 | 11.7 | % | 22.1 | % | ||||||||||||||||

| (1) | Tier 1 Operating Assets:: The increase in outpatient volume was driven by several key departments including family medicine, demonstrating Chinese patients’ continued acceptance of the family medicine and primary care, a cornerstone of UFH’s clinical philosophy. Inpatient volume was driven by partially by growth in paediatrics and orthopaedics. |

| (2) | Tier 2 Operating and Other Assets: The strong growth of outpatient volume was due to the ramp up of current service lines and newly added specialties, including ophthalmology, dermatology and hydrotherapy. The increase of both inpatient admissions and bed utilization was driven by pediatrics, neurorehabilitation, and other specialties. |

| (3) | Expansion Assets: Shanghai Pudong Hospital (“PDU”) and Guangzhou United Family Hospital (“GZU”) saw fast ramp-up in both outpatient and inpatient volume across all specialties. Furthermore, both hospitals have also made early progress in developing higher acuity / complex specialties, including internal medicine, emergency services, and orthopaedics, during 2019. Hospitals in the Expansion Assets group have started executing a number of more complex surgeries such as breast cancer surgery, complicated endoscopic gastrointestinal surgery, intestinal massive tumor removal, kidney surgery, thyroid cancer surgery, knee and shoulder joint arthroscopies. |

Fourth Quarter and Fiscal Year 2019 Results (RMB mm)

| 2019 Actual | Y-o-y Change % | |||||||||||||||

| Revenue | Q4 | FY2019 | Q4 | FY2019 | ||||||||||||

| BJU (incl. clinics)(1) | 333.3 | 1,302.1 | 6.9 | % | 11.5 | % | ||||||||||

| PXU (incl. clinics)(2) | 129.0 | 508.6 | 5.1 | % | 3.3 | % | ||||||||||

| Tier 2 (TJU, QDU, Rehab) & Other Assets(3) | 95.9 | 358.8 | 8.6 | % | 17.7 | % | ||||||||||

| Operating Asset(4) | 558.1 | 2,169.6 | 6.8 | % | 10.4 | % | ||||||||||

| Tier 1 (GZU, PDU, DTU) | 79.5 | 272.3 | 94.6 | % | 181.6 | % | ||||||||||

| Shenzhen (mgmt. contract) | 1.8 | 5.8 | ||||||||||||||

| Tier 2 | 0.4 | 1.6 | ||||||||||||||

| Expansion Assets(5) | 81.6 | 279.6 | 110.4 | % | 197.3 | % | ||||||||||

| Total(6) | 639.7 | 2,449.2 | 13.9 | % | 19.0 | % | ||||||||||

| (1) | BJU: Revenue of Beijing United Family Hospital (“BJU”) and its associated clinics grew 11.5% yoy in 2019 compared to 2018. BJU’s strong revenue growth in 2019 was primarily driven by an increase in volume in BJU’s family medicine, internal medicine, and emergency services departments, as well as the development of higher acuity departments such as orthopaedics. BJU was one of the first hospitals in China to use the Mako Robot, an orthopaedic surgical system that helps surgeons to achieve greater precision in joint replacement surgeries. In addition, BJU was one of a few private hospitals during 2019 to receive Good Clinical Practice (GCP) approval from the China Food and Drug Administration (CFDA), which allows the hospital to conduct clinical drug trials, providing an excellent opportunity for additional growth as well as for gaining enhanced recognition as a clinical research institution. Oncology service also grew 28% yoy. Moreover, UFH’s Beijing clinical network added two international school nursing clinics in 2019. |

| (2) | PXU: Shanghai Puxi United Family Hospital (“PXU”) and its associated clinics recorded 3.3% yoy revenue growth in 2019 compared to 2018, which was primarily driven by an increase in volume in PXU’s orthopaedics and surgery departments. The growth for most of 2019 was somewhat impeded by space constraints of the aging facility (in operation since 2005). PXU successfully relocated its business operations to its new, more spacious facility in the second week of October 2019. The new facility is approximately three times larger in size and boasts new, advanced equipment such as 3.0T MRI and hybrid operating theaters, which are expected to contribute further to its revenue growth in fiscal 2020. The management team had previously assumed that PXU would relocate in the second quarter of 2019, however, the move was delayed to the fourth quarter of 2019 due to a delay in receiving necessary medical licensing approvals. the Shanghai network was further enhanced in 2019 with the addition of five international school nursing clinics. |

| (3) | Tier 2 operating and other assets: Revenue from UFH’s tier two facilities and other assets, as a group, grew at 17.7% yoy in 2019. This growth was primarily driven by the continued ramp-up of Qingdao United Family Hospital (“QDU”) and an increase in postpartum patient volume at Beijing United Family Rehabilitation Hospital (“Rehab”), a result of increased recognition by patients of the benefits of medically-based postpartum care, a service line pioneered by UFH. Moreover, Tianjin United Family Hospital (“TJU”) continued to grow in 2019, adding new video incubator technology to the IVF clinic. Furthermore, Rehab opened a new High Dependency Unit (HDU) in 2019, adding a new, high-margin service line to this facility and is already supporting a number of acute patients with ventilator-based 24-hour intensive care. |

| (4) | Total operating assets as a group grew 10.4% yoy in 2019. |

| (5) | Expansion assets: UFH’s Guangzhou United Family Hospital (“GZU”) and Shanghai Pudong United Family Hospital (“PDU”) formally launched with complete practicing licenses6 in the fourth quarter of 2018. As a result of the strong ramp up, driven by increased brand recognition and new patient uptake, of GZU and PDU in 2019, revenue for UFH’s expansion assets, as a group, increased from RMB94.1 million in 2018 to RMB279.6 million in 2019. GZU and its associated clinics and PDU have generated an annualized revenue of RMB331.9 million based on December 2019 monthly revenue. |

| (6) | Despite the delay in the relocation to the new expanded PXU facility, UFH’s facilities, as a whole, achieved organic revenue growth of 19.0% yoy in 2019 compared to 2018, which demonstrated strong performance across the group. |

6 Formal launch with complete practicing licenses: after receiving the formal approval of practicing license for medical institutions and obstetrics operating license.

Fourth Quarter and Fiscal Year 2019 Results (RMB mm)

| EBITDA | 2019 Actual | Y-o-y Change % | ||||||||||||||

| Q4 | FY2019 | Q4 | FY2019 | |||||||||||||

| Adjusted EBITDA before IFRS 16 adoption | ||||||||||||||||

| Tier 1 Operating Assets (BJM, PXU)(1) | 107.6 | 463.8 | (7.5 | %) | 10.4 | % | ||||||||||

| Tier 2 Operating (TJU, QDU, Rehab) & Other Assets(3) | 0.6 | (0.2 | ) | 117.9 | % | 97.4 | % | |||||||||

| Operating Assets(4) | 108.1 | 463.5 | (4.4 | %) | 12.9 | % | ||||||||||

| Expansion Assets(5) | (37.0 | ) | (161.4 | ) | 42.5 | % | 12.9 | % | ||||||||

| HQ | (45.4 | ) | (158.5 | ) | (13.3 | %) | (12.6 | %) | ||||||||

| Total EBITDA before IFRS 16 adoption(6) | 25.7 | 143.6 | 196.0 | % | 70.1 | % | ||||||||||

| Pro-forma Adjusted EBITDA: | ||||||||||||||||

| Pro-forma Adjustments for PXU(2) | 1.9 | 19.3 | ||||||||||||||

| Tier 1 Operating Pro-forma Adjusted EBITDA(2) | 109.5 | 483.1 | (5.8 | %) | 15.0 | % | ||||||||||

| Operating Assets Pro-forma Adjusted EBITDA(4) | 110.1 | 482.8 | (2.7 | %) | 17.6 | % | ||||||||||

| Total Pro-forma Adjusted EBITDA(6) | 27.6 | 162.9 | 218.2 | % | 93.0 | % | ||||||||||

| (1) | Tier 1 operating assets: As a result of improved physician productivity and increased efficiencies in selling, general and administrative expenses, BJU, PXU, and their associated clinics (together, “Tier 1 operating assets”) achieved adjusted EBITDA (before IFRS 16 adoption) growth of 10.4% yoy in 2019 compared to 2018. Adjusted EBITDA (before IFRS 16 adoption) was impacted by the “double rent” effect of PXU, where UFH paid rent for both the old site and new site in 2019. Despite the impact of the double rent burden, adjusted EBITDA margin (before IFRS 16 adoption) for Tier 1 Operating Assets increased to 25.6% in 2019 compared to 25.3% in 2018, primarily due to cost controls and operational improvements. |

| (2) | Pro-forma adjustments: PXU successfully completed its relocation to its new, more spacious facility in the second week of October 2019. The adjustments include (i) giving a pro forma effect to annual rent reimbursement of approximately RMB15 million which took effect in November 2019 as if such reimbursement commenced on January 1, 2019, (ii) adding back RMB 3.7 million for additional rental expenses incurred prior to the PXU relocation due to space constraints, and (iii) RMB 3.7 million of ongoing net savings on fees payable to our business partner for this property in accordance with the rental reimbursement. Tier 1 Operating Assets recorded 15.0% yoy pro-forma adjusted EBITDA growth in 2019 and EBITDA margin improved to 26.7% in 2019, compared to 25.3% in 2018. |

| (3) | Tier 2 operating and other assets: TJU, Rehab, QDU, and other clinics in 2nd tier cities achieved adjusted EBITDA of (0.2) million in 2019, compared to (9.4) million in 2018, due to increase in patient volume and bed utilization rates. This group is expected to generate positive EBITDA from 2020 onwards. Rehab has reached break even in 2019 mostly due to the increase in inpatient volume. In addition, the adjusted EBITDA margin of TJU has continued to grow mainly due to the development of higher acuity departments such as surgical and emergency services. |

| (4) | Total operating assets: UFH’s operating assets, as a group, achieved adjusted EBITDA (before IFRS 16 adoption) growth of 12.9% yoy as of 2019 at 21.4% adjusted EBITDA margin. With pro-forma adjustment, total operating assets achieved 17.6% yoy pro-forma adjusted EBITDA growth in 2019 at 22.3% pro-forma adjusted EBITDA margin. |

| (5) | Expansion assets: Expansion assets, as a group, experienced a decrease in total adjusted EBITDA loss (before IFRS 16 adoption) from RMB(126.6) million (or -220.9% of revenue) in the second half of 2018 to RMB(77.0) million (or -49.5% of revenue) in the same period of 2019. This decrease was primarily due to the strong ramp up in specialties where UFH has established strong brand recognition for the past 22 year of operation, such as the OB/GYN, paediatrics, family medicine, and post-partum rehabilitation practices at both GZU and PDU. In addition, the management contract of the asset light model at the Shenzhen facility started to generate adjusted EBITDA in 2019. UFH is currently overseeing the planning and renovation process of the Shenzhen hospital, and is in return receiving a branding/management fee. |

| (6) | UFH’s total adjusted EBITDA (before IFRS 16 adoption) for 2019 was RMB143.6 million, or 70.1% yoy growth. With the above-mentioned pro-forma rental related adjustments made for PXU, total pro-forma adjusted EBITDA (before IFRS 16 adoption) in 2019 was RMB162.9 million, or 93.0% yoy growth. |

FINANCIAL RESULTS

Unaudited Fourth Quarter of 2019 Results

Revenues were RMB639.7 million ($91.9 million) in the fourth quarter, representing an increase of 13.9% yoy from RMB561.5 million in the fourth quarter of 2018. The increase was primarily driven by growth in both operating assets and expansion assets.

| · | Tier 1 Operating Assets: revenue increased by 6.4% yoy to RMB462.2 million from RMB434.4 million, pro-forma adjusted EBITDA decreased by 5.8% to RMB109.5 million, and adjusted EBITDA (before IFRS 16 adoption) decreased by 7.5% to RMB107.6 million from RMB116.3 million, due to an increase in medical staff headcounts to support expanding service line and additional year-end bonuses accrued for achieving 2019 full year targets. |

| · | Tier 2 operating and Other Assets: revenue increased by 8.6% yoy to RMB95.9 million from RMB88.3 million and adjusted EBITDA (before IFRS 16 adoption) increased by 117.9% to RMB0.6 million from RMB(3.2) million due to increases in patient volume and continued ramping up at tier 2 operating facilities. |

| · | Expansion Assets: revenue increased by 98.9% yoy to RMB81.6 million from RMB38.8 million, and adjusted EBITDA (before IFRS 16 adoption) improved to RMB(37.0) million from RMB(64.4) million, due to the strong ramp-up of expansion assets. |

Operating expenses were RMB802.8 million ($115.3 million) in the fourth quarter, representing an increase of 40.0% yoy from RMB573.3 million.

| · | Salaries, wages and benefits expenses increased 24.4% yoy to RMB375.6 million from RMB302.0 million due to new hiring in both operating and expansion assets in tier 1 cities. |

| · | Supplies and purchased medical services expenses increased 19.6% yoy to RMB111.6 million from RMB93.3 million due to expansion of labor, delivery, recovery, postpartum, and vaccination related services. |

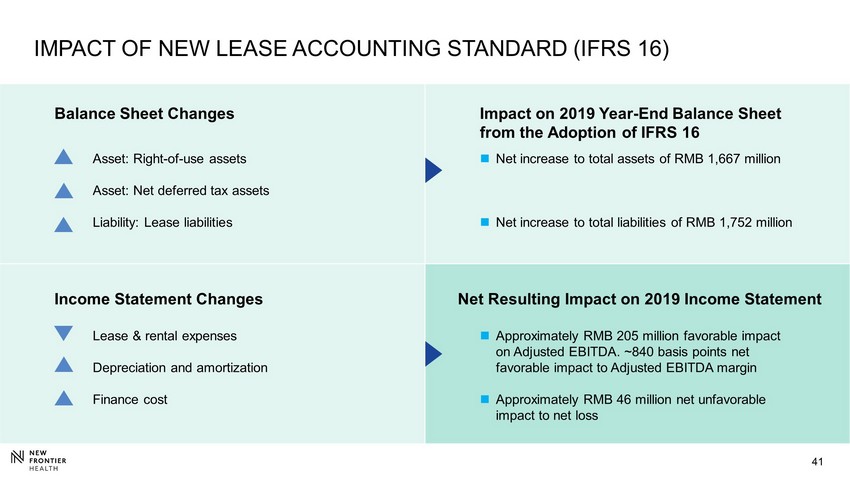

| · | Depreciation and amortization expenses increased 339.7% yoy to RMB88.2 million from RMB20.1 million due to the adoption of IFRS 16 and the expanded new PXU facility. |

| · | Lease and rental expenses decreased 93.5% yoy to RMB3.3 million from RMB51.3 million due to adoption of IFRS 16. |

| · | Impairment of trade receivables remained at the same level as compared to the prior year period. |

| · | Other operating expenses increased 114.5% yoy to RMB220.1 million from RMB102.6 million mainly due to transaction costs of RMB133.5 million. |

As a result of the above, loss from operations in the fourth quarter of 2019 was RMB163.1 million ($23.4 million) compared to RMB11.8 million in the prior year period. Loss before income taxes in the fourth quarter of 2019 was RMB215.8 million ($31.0 million) compared to income before income taxes of RMB41.3 million in the prior year period. Net loss in the fourth quarter of 2019 was RMB223.2 million ($32.1 million) compared to RMB4.1 million in the prior year period. Increased losses in the fourth quarter of 2019 mainly resulted from transaction related costs of RMB147.5 million and an expanded cost basis partially due to the two new hospitals in Guangzhou and Shanghai Pudong, as well as costs related to the move to the expanded facility for PXU.

Full Year 2019 Results

Revenues were RMB2,449.2 million ($351.8 million) in fiscal 2019, representing an increase of 19.0% yoy from RMB2,058.8 million in fiscal 2018. The increase was primarily driven by growth in both operating assets and expansion assets.

| · | Tier 1 Operating Assets: revenue increased by 9.1% yoy to RMB1,810.7 million from RMB1,659.9 million, pro-forma adjusted EBITDA increased by 15.0% to RMB483.1 million, and Adjusted EBITDA (before IFRS 16 adoption) increased by 10.4% yoy to RMB463.8 million from RMB419.9 million, demonstrating stable growth for both outpatient and inpatient volume as well as improved cost efficiency in tier 1 operating assets. |

| · | Tier 2 Operating and Other Assets: revenue increased by 17.7% yoy to RMB358.8 million from RMB304.9 million, and adjusted EBITDA (before IFRS 16 adoption) increased to RMB(0.2) million from RMB(9.4) million, with tier 2 operating and other assets approaching break-even as a group. |

| · | Expansion Assets: revenue increased by 187.6% yoy to RMB279.6 million from RMB94.1 million, and adjusted EBITDA (before IFRS 16 adoption) improved to RMB(161.4) million from RMB(185.3) million, achieving significant progress and are on track of the strong ramp up expectation. |

Operating expenses were RMB2,647.1 million ($380.2 million) in fiscal 2019, representing an increase of 24.0% yoy from RMB2,135.1 million in fiscal 2018.

| · | Salaries, wages and benefits expenses increased 19.1% yoy to RMB1,415.2 million from RMB1,187.7 million. As a percentage of revenues, salaries, wages and benefits expenses were controlled at a stable level (57.8% in 2019 compared to 57.7% in 2018), despite increased service needs as evidenced by the significant revenue growth contributed from the ramping up of new facilities such as PXU, GZU, and PDU. |

| · | Supplies and purchased medical services expenses increased 31.8% yoy to RMB400.2 million from RMB303.6 million due to expansion of labor, delivery, recovery, postpartum, and vaccination related services. |

| · | Depreciation and amortization expenses increased 146.6% yoy to RMB341.9 million from RMB138.6 million due to adoption of IFRS 16 and the new, expanded PXU facility. |

| · | Lease and rental expenses decreased 93.2% yoy to RMB13.7 million from RMB201.7 million due to adoption of IFRS 16. |

| · | Impairment of trade receivables decreased from RMB16.3 million to RMB7.0 million due to an improved collection rate. |

| · | Other operating expenses increased 63.4% yoy to RMB469.0 million from RMB287.1 million due to transaction costs of RMB146.0 million. As a percentage of revenues, other operating expenses excluding transaction costs decreased to 13.2% from 13.9% in fiscal 2018. |

As a result of the above, loss from operations increased 159.3% yoy to RMB197.9 million ($28.4 million) in fiscal 2019 compared to RMB76.3 million in fiscal 2018. Loss before income taxes in fiscal 2019 was RMB367.6 million ($52.8 million) compared to RMB94.3 million in fiscal 2018. Net loss in fiscal 2019 was RMB430.3 million ($61.8 million) compared to RMB154.0 million in fiscal 2018. Increased losses in the fiscal 2019 mainly resulted from transaction related costs of RMB160.1 million, and an expanded cost basis partially due to the two new hospitals in Guangzhou and Shanghai Pudong, as well as costs related to the move to the expanded Puxi facility.

RECONCILIATON OF NON-IFRS FINANCIAL MEASURES

(RMB mm)

| For the quarter ended 31 December | For the year ended 31 December | |||||||||||||||

| 2018 | 2019 | 2018 | 2019 | |||||||||||||

| Net loss | (4 | ) | (223 | ) | (154 | ) | (430 | ) | ||||||||

| Less: Finance income | (1 | ) | (3 | ) | (2 | ) | ||||||||||

| Add: Finance costs | (20 | ) | 54 | 19 | 157 | |||||||||||

| Add: Other losses (gains) | (28 | ) | (13 | ) | 8 | 9 | ||||||||||

| Add: Other expense (income), net | (5 | ) | 13 | (7 | ) | 6 | ||||||||||

| Add: Income tax expense | 45 | 7 | 60 | 63 | ||||||||||||

| Operating loss | (12 | ) | (163 | ) | (76 | ) | (198 | ) | ||||||||

| Add: Share-based compensation | (1 | ) | 2 | 18 | 34 | |||||||||||

| Add: Depreciation and amortization | 20 | 88 | 139 | 342 | ||||||||||||

| Add: Discontinued monitoring fee payable to Fosun Pharma and TPG | 1 | 1 | 4 | 4 | ||||||||||||

| Add: One-off transaction related costs | - | 147 | - | 160 | ||||||||||||

| Add: Relocation costs of New Puxi Hospital | - | 3 | - | 6 | ||||||||||||

| Adjusted EBITDA | 9 | 79 | 84 | 349 | ||||||||||||

| Less: Lease expense adjustments as a result of IFRS 16 adoption | - | (53 | ) | - | (205 | ) | ||||||||||

| Adjusted EBITDA (before IFRS 16 adoption)7 | 9 | 26 | 84 | 144 | ||||||||||||

| Add: PXU Pro-forma Adjustments | - | 2 | - | 19 | ||||||||||||

| Pro-forma Adjusted EBITDA8 | 9 | 28 | 84 | 163 | ||||||||||||

7 Adjusted EBITDA (before IFRS 16 adoption) was approximately RMB25.7 million when restoring rent expense under IAS 17 with the amount of RMB53.6 million for the fourth quarter and RMB143.6 million when restoring rent expense under IAS 17 with the amount of RMB205.1 million for fiscal year 2019, respectively.

8 Pro-forma Adjusted EBITDA (before IFRS 16 adoption) was approximately RMB25.7 million when further restoring rent expense under IAS 17 with the amount of RMB53.6 million for the fourth quarter and RMB143.6 million when restoring rent expense under IAS 17 with the amount of RMB205.1 million for fiscal year 2019, respectively.

RECENT DEVELOPMENTS

New Frontier Corporation Acquisition of United Family Healthcare

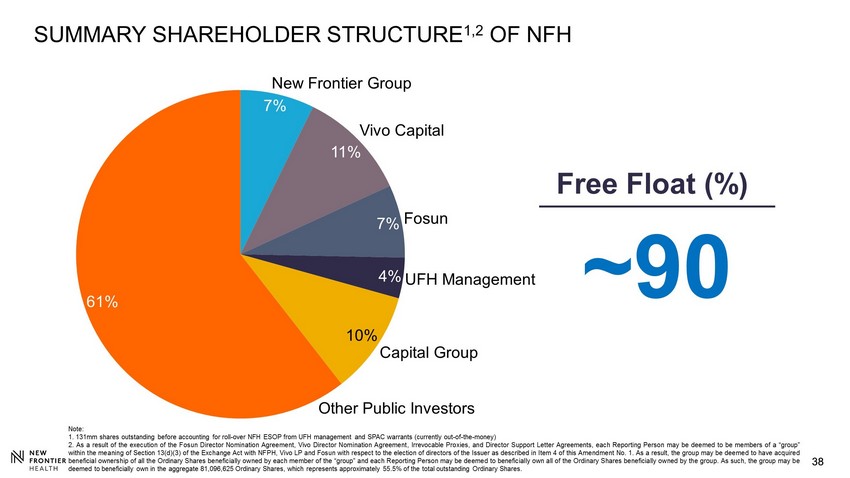

On December 18, 2019, New Frontier Corporation (NFC), a public investment vehicle sponsored by New Frontier Group, completed the acquisition of UFH (the “Business Combination”). In connection with the closing, NFC changed its name to New Frontier Health Corporation and its ordinary shares and warrants continued to be listed on the New York Stock Exchange, under the new ticker symbols “NFH” and “NFH WS,” respectively.

NFC acquired UFH from its existing limited partnership and general partnership interests holders, including affiliates of TPG and Fosun Pharma. The acquisition was funded through a combination of cash in NFC’s trust account, borrowings, and proceeds from the private placement of ordinary shares of NFH, led by New Frontier and its strategic partners and institutional investors. Fosun Pharma remains as an important long-term strategic partner.

The transaction provided NFH with approximately $165 million of additional capital, which is expected to be used for general corporate purposes, including for working capital and growth initiatives.

Coronavirus

Since January 2020, the 2019 novel coronavirus (COVID-19) outbreak in China has had an impact on the Company’s operations. In order to protect its staff, the Company has been following government guidelines of 14-day quarantines for staff returning to work from other cities, establishing flexible work arrangements, requiring temperature checks and personal protective equipment at UFH facilities, and providing epidemic control education and training to all staff. As of the date of this press release, the Company has had no confirmed cases of COVID-19 among its staff or patients, and its quarantine and hygiene policies have ensured appropriate levels of staffing throughout UFH’s facilities while ensuring safety.

To protect its patients, the Company has established temperature check stations at all entry points in its hospital facilities, restricted non-patient foot traffic at all facilities, established social distancing policies for patients inside its facilities, and provided free educational literature, in multiple languages, to patients.

In addition, the Company continues to support its patients through free online and telephone consultation services. The services cover over 30 specialties and have reached hundreds of patients, with public health talks on live-broadcasting video platforms reaching more than 1.2 million people. Through these online and telephone consultations, UFH has stayed engaged with patients while helping a broader swath of customers experience its high quality services.

As previously announced, several UFH hospitals have been designated by the government to operate fever care centers, allowing patients to be screened and, if necessary, transferred to designated COVID-19 treatment hospitals. These fever screening centers are separated by air flows and work flows from standard patient clinics, emergency rooms, and inpatient facilities to keep any potentially infected patients from impacting other patients or visitors. As such, nearly all UFH facilities and departments continue to offer services as needed for both inpatients and outpatients during the coronavirus outbreak.

NFH raised charity funds from New Frontier Group, the investment group that sponsored the entity that created NFH, and several strategic partners, and leveraged on its global supply chain network to source urgently needed medical supplies to Leishenshan Hospital, Zhongnan Hospital of Wuhan University, and other institutions at the front lines of the fight against COVID-19. The donation of medical equipment and consumables includes 29 ICU ventilators with 750 breathing circuits and 32 breathing masks, 155,000 pairs of medical examination gloves, 50,000 N95 masks, 3,960 goggles, and 185 reusable face shields. These medical supplies have been sourced across China and around the globe by UFH’s experienced supply chain team and will be directly shipped to the recipient hospitals.

Regional Market Re-Organization

In order to maximise operating efficiencies and synergies among regional facilities, the Company has decided to consolidate its operations in its three major markets, each with a unified leadership team.

The Beijing Market includes all operating facilities, including hospitals and clinics, in Beijing as well as the Bo’ao clinic in Hainan Province.

The Shanghai Market consists of PXU and PDU, as well as the East China clinic network.

The Guangzhou Market consists of GZU and its affiliated clinic network.

UFH was founded with one standalone facility, and as the Company built more hospitals and clinics, it centralized certain policy development and shared service functions in order to achieve standard levels of service, branding, and quality, as well as to achieve economies of scale to eliminate redundant costs. By re-organizing the standalone facilities into unified regional market leadership, the Company aims to realize further efficiencies within each geography, allowing patients to experience the true value of its life cycle of care and seamless experience between clinics and hospitals.

BUSINESS OUTLOOK

The beginning of 2020 was challenging for all industries in China due to the outbreak of the novel coronavirus. As a result of the impact of the coronavirus outbreak, the Company has lowered its expectations for growth in the first quarter of 2020. Based on current market and operating conditions, the Company expects revenues to decrease by approximately 25% to 28% for the first quarter of 2020 year over year. The Company is experiencing positive patient volume trends in March which it believes can continue, and as the epidemic situation continues to improve in China, the Company hopes to return to more normalized growth volumes by summer. This forecast reflects the Company’s current and preliminary views, which is subject to change.

CONFERENCE CALL

A conference call and webcast to discuss New Frontier Healthcare’s financial results and guidance will be held at 8:00 a.m. U.S. Eastern Time on Thursday, March 26, 2020 (or Thursday, March 26, 2020, at 8:00 pm Beijing Time). Interested parties may listen to the conference call by dialing numbers below:

United States: 1-888-204-4368

International: 1-720-543-0214

China Domestic: 400 120 8590

Hong Kong: 800 961 384

Conference ID: 6225395

The replay will be accessible through April 2, 2020, by dialing the following numbers:

United States: 1-844-512-2921

International: 1-412-317-6671

Conference ID: 6225395

The webcast will be available on the Company’s investor relations website at www.nfh.com.cn and will be archived on the site shortly after the call has concluded. A presentation to accompany the call will also be available for download on the website.

About New Frontier Health Corporation

New Frontier Health Corporation (NYSE: NFH) is the operator of United Family Healthcare (UFH), a leading private healthcare provider offering comprehensive premium healthcare services in China through a network of private hospitals and affiliated ambulatory clinics. UFH currently has nine hospitals and in total in operation or under construction in all four 1st tier cities and selected 2nd tier cities. Additional information may be found at www.nfh.com.cn.

Forward-Looking Statements

Certain statements made in this release are "forward looking statements" within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this press release, the words "estimates," "projected," "expects," "anticipates," "forecasts," "plans," "intends," "believes," "seeks," "may," "will," "should," "future," "propose" and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements include, without limitation, UFH’s preparedness to address the outbreak; UFH’s ability to manage patient inflows; and UFH’s ability to prevent the spread of COVID-19 within its facilities; UFH’s ability to grow its business manage its growth; the benefits and synergies of the Business Combination, including anticipated cost savings, results of operations, financial condition, liquidity, prospects, growth, strategies and the markets in which the Company operates. Such forward-looking statements are based on available current market material and management’s expectations, beliefs and forecasts concerning future events impacting NFH. These forward-looking statements are not guarantees of future results and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside NFH’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. For a discussion of such risks, please refer to NFH’s Form 20-F filed with the U.S. Securities and Exchange Commission on December 26, 2019 and subsequent Form 20-Fs filed by NFH. NFH undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Non-IFRS Measures

The discussion and analysis includes certain measures, including adjusted EBITDA (before IFRS 16 adoption), adjusted EBITDA margin, pro-forma adjusted EBITDA, and pro-forma adjusted EBITDA margin, which have not been prepared in accordance with IFRS. These measures do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. These measures should be considered as supplemental in nature and not as a substitute for the related financial information prepared in accordance with IFRS. We use these measures our operating results and for financial and operational decision-making purposes. We believe that adjusted EBITDA and pro-forma adjusted EBITDA helps compare our performance over various reporting periods on a consistent basis by removing from operating results the impact of items that do not reflect core operating performance, and helps identify underlying operating results and trends.

Adjusted EBITDA (before IFRS 16 adoption), is calculated as net loss plus (i) depreciation and amortization, (ii) finance expense/(income), (iii) other gains or losses, (iv) other expenses (such as share based compensation), (v) provision for income taxes, as further adjusted for (vi) certain monitoring fees paid to certain shareholders prior to the Business Combination, (vii) lease expense adjustments as a result of adoption of IFRS 16, and (viii) transaction related costs, was RMB25.7 million ($3.6 million) in the fourth quarter of 2019 compared to RMB8.7 million in the prior year period. UFH adopted IFRS 16 on January 1, 2019, and recognized lease liabilities and corresponding “right-of-use” assets for all applicable leases, and recognized interest expense accrued on the outstanding balance of the lease liabilities and depreciation of right-of-use assets. As a result, the adoption of IFRS 16 caused depreciation and amortization and finance costs to increase in 2019, and excluded all applicable lease expenses in adjusted EBITDA. For ease of comparison to prior periods, the Company eliminated the impact of IFRS 16 on adjusted EBITDA.

Pro-forma adjusted EBITDA, is calculated as net loss plus (i) depreciation and amortization, (ii) finance expense/(income), (iii) other gains or losses, (iv) other expenses (such as share based compensation), (v) provision for income taxes, as further adjusted for (vi) certain monitoring fees paid to certain shareholders prior to the Business Combination, (vii) lease expense adjustment as a result of adoption of IFRS 16, (viii) transaction related costs, and (ix) Pro-forma adjustments in PXU that reflects the ongoing reduced rental obligations was RMB19.3 million ($2.8 million) in fiscal 2019. The adjustments include (i) giving a pro forma effect to annual rent reimbursement of approximately RMB15 million which took effect in November 2019 as if such reimbursement commenced on January 1, 2019, (ii) adding back RMB 3.7 million for additional rental expenses incurred prior to the PXU relocation due to space constraints, and (iii) RMB 3.7 million of ongoing net savings on fees payable to our business partner for this property in accordance with the rental reimbursement.

Adjusted EBITDA Margin is calculated by dividing adjusted EBITDA (before IFRS 16 adoption), by total revenue and pro-forma adjusted EBITDA margin is calculated by dividing pro-forma adjusted EBITDA by total revenue.

Please see the table captioned “Reconciliations non-IFRS Financial Measures.”

Exchange Rate Information

The translations from Renminbi to U.S. dollars for purposes of convenience were made at a rate of RMB6.9618 to US$1.00, the exchange rate set forth in the H.10 statistical release of the Federal Reserve Board on December 31, 2019.

Contacts

Media

Harry Chang

Tel: +852-9822-1806

Email: [email protected]

Wenjing Liu

Tel: +86-186-1151-5796

Email: [email protected]

Investors

ICR, LLC

William Zima/Rose Zu

Tel: +1-203-682-8200

Email: [email protected]/[email protected]

Source: New Frontier Health Corporation

HEALTHY HARMONY HOLDINGS, L.P.

UNAUDITED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(All amounts in thousands)

| For the quarter ended December 31, | For the year ended December 31, | |||||||||||||||||||||||

| 2018 | 2019 | 2018 | 2019 | |||||||||||||||||||||

| RMB | RMB | US$ | RMB | RMB | US$ | |||||||||||||||||||

| Revenues | 561,547 | 639,740 | 91,893 | 2,058,779 | 2,449,202 | 351,806 | ||||||||||||||||||

| Operating expenses | ||||||||||||||||||||||||

| Salaries, wages and benefits | -301,999 | -375,573 | -53,948 | -1,187,738 | -1,415,179 | -203,278 | ||||||||||||||||||

| Supplies and purchased medical services | -93,310 | -111,605 | -16,031 | -303,578 | -400,196 | -57,485 | ||||||||||||||||||

| Depreciation and amortization expense | -20,057 | -88,193 | -12,668 | -138,640 | -341,932 | -49,115 | ||||||||||||||||||

| Lease and rental expenses | -51,298 | -3,322 | -477 | -201,670 | -13,723 | -1,971 | ||||||||||||||||||

| Bad debt expense | -4,035 | -3,980 | -572 | -16,329 | -7,040 | -1,011 | ||||||||||||||||||

| Other operating expenses | -102,603 | -220,117 | -31,618 | -287,128 | -469,025 | -67,371 | ||||||||||||||||||

| Expense total | -573,302 | -802,790 | -115,314 | -2,135,083 | -2,647,095 | -380,231 | ||||||||||||||||||

| Operating loss | -11,755 | -163,050 | -23,421 | -76,304 | -197,893 | -28,426 | ||||||||||||||||||

| Finance income | 479 | 528 | 76 | 2,543 | 2,267 | 326 | ||||||||||||||||||

| Finance costs | 20,177 | -53,675 | -7,710 | -19,420 | -156,817 | -22,525 | ||||||||||||||||||

| Foreign currency gain (loss) | 1,265 | 13,199 | 1,896 | -34,190 | -9,496 | -1,364 | ||||||||||||||||||

| Gain on liquidation of a foreign operation | 26,429 | - | - | 26,429 | - | - | ||||||||||||||||||

| Other income (expense), net | 4,673 | -12,846 | -1,845 | 6,644 | -5,626 | -808 | ||||||||||||||||||

| Loss before income taxes | 41,268 | -215,844 | -31,004 | -94,298 | -367,565 | -52,797 | ||||||||||||||||||

| Income tax expense | -45,393 | -7,380 | -1,060 | -59,749 | -62,776 | -9,017 | ||||||||||||||||||

| Loss for the year | -4,125 | -223,224 | -32,064 | -154,047 | -430,341 | -61,815 | ||||||||||||||||||

| Attributable to | ||||||||||||||||||||||||

| Owners of the parent | 5,536 | -216,203 | -31,056 | -130,000 | -400,983 | -57,598 | ||||||||||||||||||

| Non-controlling interests | -9,661 | -7,021 | -1,009 | -24,047 | -29,358 | -4,217 | ||||||||||||||||||

| Other comprehensive income (loss) | ||||||||||||||||||||||||

| Items to be reclassified to profit or loss in subsequent periods (net of tax): | ||||||||||||||||||||||||

| Currency translation differences | -27,769 | -8,323 | -1,196 | -2,159 | 7,567 | 1,087 | ||||||||||||||||||

| Other comprehensive income (loss) | ||||||||||||||||||||||||

| Comprehensive income (loss) for the year | -47,091 | -231,547 | -33,260 | -156,205 | # | -417,798 | -60,013 | |||||||||||||||||

| Comprehensive income (loss) attributable to | ||||||||||||||||||||||||

| Owners of the parent | -37,430 | -224,526 | -32,251 | -132,157 | -388,440 | -55,796 | ||||||||||||||||||

| Non-controlling interests | -9,661 | -7,021 | -1,009 | -24,048 | -29,358 | -4,217 | ||||||||||||||||||

HEALTHY HARMONY HOLDINGS, L.P.

UNAUDITED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(All amounts in thousands)

| As of December 31, | ||||||||||||

| 2018 | 2019 | |||||||||||

| RMB | RMB | US$ | ||||||||||

| Non-current assets | ||||||||||||

| Plant and equipment | 1,894,925 | 1,891,305 | 271,669 | |||||||||

| Goodwill | 1,121,138 | 1,121,138 | 161,041 | |||||||||

| Intangible assets | 1,092,913 | 1,087,814 | 156,255 | |||||||||

| Right-of-use assets | - | 1,660,299 | 238,487 | |||||||||

| Deferred tax assets | 55,732 | 60,812 | 8,735 | |||||||||

| Restricted cash | 350 | 350 | 50 | |||||||||

| Other non-current assets | 77,444 | 95,426 | 13,707 | |||||||||

| Total non-current assets | 4,242,502 | 5,917,144 | 849,945 | |||||||||

| Current assets | - | |||||||||||

| Inventories | 57,310 | 56,592 | 8,129 | |||||||||

| Trade receivable | 181,127 | 215,376 | 30,937 | |||||||||

| Due from related parties | 32,670 | 156,851 | 22,530 | |||||||||

| Prepayments and other current assets | 35,968 | 32,824 | 4,715 | |||||||||

| Restricted cash | 26,272 | - | - | |||||||||

| Cash and cash equivalents | 596,613 | 442,159 | 63,512 | |||||||||

| Total current assets | 929,960 | 903,802 | 129,823 | |||||||||

| TOTAL ASSETS | 5,172,462 | 6,820,946 | 979,768 | |||||||||

| Current liabilities | - | |||||||||||

| Trade payables | 76,107 | 99,082 | 14,232 | |||||||||

| Contract liabilities | 262,733 | 270,196 | 38,811 | |||||||||

| Accrued expenses and other current liabilities | 750,230 | 804,100 | 115,502 | |||||||||

| Due to related parties | 2,541 | 4,045 | 581 | |||||||||

| Tax payable | 21,194 | 15,278 | 2,195 | |||||||||

| Long-term borrowings | 20,205 | 394,310 | 56,639 | |||||||||

| Lease liabilities | - | 90,521 | 13,002 | |||||||||

| Total current liabilities | 1,133,010 | 1,677,532 | 240,962 | |||||||||

| NET CURRENT LIABILITIES | -203,050 | -773,730 | -111,139 | |||||||||

| TOTAL ASSETS LESS CURRENT LIABILITIES | 4,039,452 | 5,143,414 | 738,805 | |||||||||

| Non-current liabilities | ||||||||||||

| Long-term borrowings | 387,387 | - | - | |||||||||

| Contract liabilities | 39,086 | 67,873 | 9,749 | |||||||||

| Deferred tax liabilities | 264,698 | 263,210 | 37,808 | |||||||||

| Lease liabilities | - | 1,661,182 | 238,614 | |||||||||

| Other long-term liabilities | 8,633 | 9,358 | 1,344 | |||||||||

| Total non-current liabilities | 699,804 | 2,001,624 | 287,515 | |||||||||

| Net assets | 3,339,648 | 3,141,790 | 451,290 | |||||||||

| EQUITY | ||||||||||||

| Equity attributable to the equity holders of the Company | ||||||||||||

| Partnership Capital | 150,550 | 149,514 | 21,476 | |||||||||

| Capital surplus | 3,485,320 | 3,711,274 | 533,091 | |||||||||

| Translation reserves | 68,397 | 75,963 | 10,911 | |||||||||

| Accumulated deficit | -396,235 | -797,220 | -114,513 | |||||||||

| 3,308,032 | 3,139,532 | 450,965 | ||||||||||

| Non-controlling interests | 31,616 | 2,259 | 324 | |||||||||

| Total equity | 3,339,648 | 3,141,790 | 451,290 | |||||||||

HEALTHY HARMONY HOLDINGS, L.P.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(All amounts in thousands)

| For the quarters ended December 31, | For the years ended December 31, | |||||||||||||||||||||||

| 2018 | 2019 | 2018 | 2019 | |||||||||||||||||||||

| Cash generated from (used for): | RMB | RMB | US$ | RMB | RMB | US$ | ||||||||||||||||||

| Operating activities | 48,032 | 7,721 | 1,109 | 130,980 | 273,788 | 39,327 | ||||||||||||||||||

| Investing activities | (96,672 | ) | (130,107 | ) | (18,689 | ) | (534,948 | ) | (422,499 | ) | (60,688 | ) | ||||||||||||

| Financing activities | (4,142 | ) | 148,426 | 21,320 | 103,635 | (9,501 | ) | (1,365 | ) | |||||||||||||||

| Net increase/(decrease) in cash and cash equivalents | (52,782 | ) | 26,040 | 3,740 | (300,333 | ) | (158,212 | ) | (22,726 | ) | ||||||||||||||

Exhibit 99.2

1 1 New Frontier Health Q4 2019 Results 26 th March 2020

2 2 DISCLAIMER Forward - Looking Statements This presentation includes “forward - looking statements” within the meaning of the “safe harbor” provisions of the Private Securi ties Litigation Reform Act of 1995. The actual results of New Frontier Health Corporation (the “Company”) may differ from the Company’s expectations, estimates and projections and consequently, you should not rely on the se forward - looking statements as predictions of future events. Words such as “expect”, “estimate”, “project”, “budget”, “forecast”, “anticipate”, “intend”, “plan”, “may”, “will”, “could”, “should”, “believes”, “predicts”, “p ote ntial”, “continue”, and similar expressions are intended to identify such forward - looking statements. These forward - looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results, including, but not limited to, the Company’s ability to manage growth; the Company’s ability to execute its business plan, including its planned expansions, and meet its projections; rising costs adve rse ly affecting the Company’s profitability; potential litigation involving the Company; general economic and market conditions impacting demand for the Company’s services, and in particular economic and market conditions in the Chines e h ealthcare industry and changes in the rules and regulations that apply to such business, including as it relates to foreign investments in such businesses; and other risks and uncertainties indicated from time to time in the Co mpany’s filings with the U.S. Securities and Exchange Commission (the “SEC”). Most of these factors are outside of the Company’s control and are difficult to predict. The Company cautions readers not to place undue reliance upon any forward - looking statements, which speak only as of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward - looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based, except as required by law. Financial Information The Company acquired UFH in a business combination that closed on December 18, 2019. The financial results presented herein a re those of the Company’s wholly owned subsidiary, Healthy Harmony, and do not include the results of the parent entity, NFH, for the 12 day period from December 19, 2019 to December 31, 2019. Industry and Market Data In this presentation, we rely on and refer to information and statistics regarding market participants in the sectors in whic h t he Company competes and other industry data. The Company obtained this information and statistics from third - party sources, including reports by market research firms and company filings. Use of Non - IFRS Financial Matters The discussion and analysis includes certain measures, including Adjusted EBITDA (before IFRS 16 adoption), Adjusted EBITDA M arg in, Free Cash Flow and Pro - forma Adjusted EBITDA, and Pro - forma Adjusted EBITDA Margin, which have not been prepared in accordance with IFRS. These measures do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. These measures should be considered as supplemental in nature and not as a substitute for the related financial information p rep ared in accordance with IFRS. We use these measures to evaluate our operating results and for financial and operational decision - making purposes. We believe that Adjusted EBITDA and Pro - forma Adjusted EBITDA helps compare our performance over various reporting periods on a consistent basis by removing from operating results the impact of items that do not reflect core operating performance and helps identify underlying operating res ults and trends. Adjusted EBITDA (before IFRS 16 adoption), is calculated as net loss plus ( i ) depreciation and amortization, (ii) finance expense/(income), (iii) other gains or losses, (iv) other expenses (such as sha re based compensation), (v) provision for income taxes, as further adjusted for (vi) certain monitoring fees paid to certain shareholders prior to the Bu sin ess Combination, (vii) lease expense adjustments as a result of adoption of IFRS 16, and (viii) transaction related costs. UFH adopted IFRS 16 on January 1, 2019, and recognized lease liabilities and corresponding “right - of - use” assets for all applicable leases, and recognized interest expense accrued on the outstanding balance of the lease liabilities and depreciation of right - of - use assets. As a result, the adoption of IFRS 16 caused depreciation and amortiza tion and finance costs to increase in 2019 and excluded all applicable lease expenses in Adjusted EBITDA . For ease of comparison to prior periods, the Company eliminated the impact of IFRS 16 on Adjusted EBITDA. Pro - forma Adjusted EBITDA, is calculated as net loss plus ( i ) depreciation and amortization, (ii) finance expense/(income), (iii) other gains or losses, (iv) other expenses (such as sha re based compensation), (v) provision for income taxes, as further adjusted for (vi) certain monitoring fees paid to certain shareholders prior to the Business Combination, ( vii ) lease expense adjustment as a result of adoption of IFRS 16, (viii) transaction related costs, and (ix) Pro - forma adjustments in PXU. See slide 42 for further information on these pro - forma adjustments. Adjusted EBITDA margin is calculated by dividing Adjusted EBITDA (before IFRS 16 adoption), by total revenue and Pro - forma Adjus ted EBITDA margin is calculated by dividing Pro - forma Adjusted EBITDA by total revenue. Free cash flow is calculated as 1) operating cash flow 2) minus capital lease payments, 3) add interest expense paid, 4) add one - off transaction expense related to the business combination, 5) minus capital expenditure on existing operations of the facilities A reconciliation of non - IFRS forward looking information to their corresponding IFRS measures are not included in this presentat ion as they cannot be provided without unreasonable effort because of the inherent difficulty of accurately forecasting the occurrence and financial impact of the various adjusting items necessary for such reconciliation t hat have not yet occurred, are out of our control, or cannot be reasonably predicted.

3 3 OVERVIEW Q4 2019 & FULL YEAR RESULTS GROWTH INITIATIVES APPENDIX A - INDUSTRY OVERVIEW APPENDIX B – ADDITIONAL MATERIALS TABLE OF CONTENTS

4 4 Beijing United Family Hospital North ( 2020 ) OVERVIEW

5 5 LEADING PRIVATE HEALTHCARE SERVICES PROVIDER IN CHINA COMPREHENSIVE SERVICE OFFERING covering 30+ specialties 9 hospitals 1 14 clinics 1 1,000+ licensed beds 800+ physician staff 1000+ physician consultants 2019 A outpatient visits: ~ 6 32 ,000 2019 A inpatient visits: ~ 11, 000 Operating Assets 2 2019A Pro - Forma Adjusted EBITDA: RMB 483mm 2015A - 201 9 A CAGR: 30 .4 % Source: Company; As of Dec 31, 2019 1 . I ncludes 2 hospitals under construction, 14 directly operated clinics 2 . Operating assets include Beijing, Shanghai Puxi , Tianjin, Qingdao and Beijing Rehab Hospitals as well as B o’Ao and Hangzhou Clinics and post - partum care worker business 3 . All hospital and clinics with at least 3 years of operating experience are accredited or re - accredited on a 3 - year cycle . The newest Qingdao and Shanghai Pudong hospitals were not yet eligible in the 2017 audit, but Qingdao will be included in the 2020 audit and Pudong will be eligible in the next cycle . One of the LARGEST private healthcare services providers in China by revenue 2019 A total revenue : RMB ~ 2. 45 bn 2015A - 201 9 A CAGR: 1 5.1 % 1 1 TOP - RANKED brand among high - end private hospitals ALL 3 JCI accredited Beijing United Family ONLY JCI and CAP accredited hospital FIRST da Vinci and MAKO in private hospital GCP certification from CFDA for conducting clinical drug trials

6 6 5 Hospitals Hub Spoke 8 Clinics Hub - and - Spoke Model 2 Hospitals Hub Spoke 4 Clinics Hub - and - Spoke Model 2 Hospitals Hub Spoke 2 Clinics Hub - and - Spoke Model Beijing Tianjin Qingdao Guangzhou Hangzhou Hainan Shenzhen 2 Shanghai Hong Kong 3 Source: Company 1. 5 hospitals in Beijing Cluster including Qingdao United Family 2. UFH is expected to be given the exclusive right to manage New Frontier Group’s 64,000 sq. meter flagship Shenzhen city cen ter hospital as part of the transaction Broad geographic coverage across all four Tier 1 cities Strategic opportunity for expansion into Tier 2 cities GREATER BAY CLUSTER SHANGHAI CLUSTER + EAST CHINA BEIJING CLUSTER + NORTH CHINA 1 NATIONWIDE GEOGRAPHIC FOOTPRINT

7 7 Expat 46% Local 54% BROADER ADDRESSABLE MARKET WITH MORE LOCAL PATIENTS 3 Commercial Insurance 37% Self - pay 63% DIVERSIFIED FOUNDATION FOR FUTURE GROWTH Expat 29% Local 71% MULTI - SPECIALTY SERVICE OFFERING 1 2019A Source: Company 1. OB/GYN: Obstetrics and Gynecology; Peds: Pediatrics; Ortho: Orthopaedics; FM: Family Medicine; IM: Internal Medicine; ER: Eme rgency Room; PPR: Post - Partum Rehab 2. Split by revenue from insurance / self - pay patients 3. Split by volume of expat and local Chinese patients REVENUE MIX BETWEEN SERVICE & PHARMACY 2019A OB/GYN 22% Peds 14% Surgery 7% Ortho 7% FM 10% IM 8% ER 7% PPR 5% Others 19% 2014 2019A DIVERSIFIED PAYER STRUCTURE 2 Pharmacy 10% Service 90% 2019A

8 8 Revenue driven by high acuity departments including Orthopedics & Surgery High Acuity 163 351 2014 2019A Surgery Orthopedics Potential for Dermatology, ENT 1 , Ophthalmology & New Hope Oncology Centre New Specialties 51 138 2014 2019A Ophthalmology ENT Dermatology COMPREHENSIVE PROVIDER WITH ENTIRE "LIFECYCLE" COVERAGE HUB - AND - SPOKE MODEL CREATES COMPREHENSIVE HEALTHCARE SERVICES PLATFORM WITH MULTIPLE PATIENT TOUCHPOINTS Clinics Home Health Attracting traffic with OB/GYN and Pediatrics 483 902 2014 2019A Pediatrics OB/GYN Revenue (RMB mm) Prenatal Care Pediatrics OB/ GYN 1 Expanding differentiated services complemented by Rehabilitation and PPR PPR 1 Rehabilitation 35 2014 2019A PPR Rehabilitation Broader patient base built up by Family Medicine 112 252 2014 2019A Family Medicine Family Medicine Dental Source: Company 1. OB/GYN: Obstetrics and Gynecology; ENT: Ear, Nose and Throat; PPR: Post - Partum Rehabilitation Hospitals 169

9 9 UFH A B C D E 1.85 1.55 1.53 1.50 1.08 1.48 UFH A B C D E 1.75 1.64 1.55 1.38 1.30 1.38 ONE OF THE MOST REPUTABLE PRIVATE HEALTHCARE BRANDS IN CHINA RANKS TOP FOR MEDICAL QUALITY AMONG HIGH - END PRIVATE HOSPITALS BY PATIENTS, DOCTORS AND GOVERNMENT REGULATORS Source: Company, Company Analysis 1. Survey Question 4: Please rank the following private hospital brands’ medical quality. Screening criteria: Have had any ki nd of medical treatment in private hospital in past 36 months 2. Scoring methods: a) Score 5 for brand ranked 1 st ; Score 3 for brand ranked 2 nd ; Score 1 for brand ranked 3 rd ; b) Divide summed score by the number of respondents 3. Sample size for Beijing, Shanghai and Guangzhou were 105, 110 and 62 respondents, respectively RANKING SCORE OF PRIVATE BRANDS AMONG MONTHLY HOUSEHOLDS INCOME >RMB 27K 1,2,3 BEIJING UFH A B C D E SHANGHAI GUANGZHOU 1.64 1.37 1.30 1.28 1.03 1.25 2003 – The designated healthcare institution for foreigners during the SARS period 2010 – Official designated medical institutions for the Shanghai World Expo 2015 - Named as Most Investment - Worthy Healthcare Company 2016 – Ranked No.1 in China Top 100 Private Hospitals 2016 – Ranked No.2 in China Private Hospital Valuable Brands 2016 – Ranked No.18 in China Private Hospital Conglomerates Top 50 League 2018 – The designated Well - Known Trademark 2018 - Ranked No.1 repeatedly as The Best Employer among all private hospitals

10 10 Operating Stats 4 Open Date 1997/2014 2004 2019 2012 2015 2013 2018 2018 2020 2021 Signed MoU & framework agreement in major Tier 2 locations (lease / operate and management contract model) Gross Floor Area (sqm) 34,448 2 7,559 2 20,844 2 6,900 30,057 3 16,145 69,008 2 28,471 22,834 64,000 # of Beds 4 93 41 71 23 100 3 83 99 85 200 250 - 350 # of Consultation Rooms 237 3 71 3 97 3 31 31 32 123 5 41 5 37 5 TBC # of Satellite Clinics 8 2 0 0 0 1 1 N/A TBC TIER 1 Shanghai Puxi 1 (new) Shanghai Puxi (old) ASSET OVERVIEW Source: Company Note: 1. New Shanghai Puxi is the expansion of the old Shanghai Puxi 2. Includes satellite clinics associated with hospitals UFH Beijing City Cluster Shanghai City Cluster Greater Bay Cluster OPERATING ASSETS EXPANSION ASSETS (TIER 1 ONLY) JCI - Accredited Beijing Chaoyang Shanghai Pudong Beijing Datun Shenzhen Management Contract Guangzhou Qingdao Beijing Rehab Tianjin TIER 2 EXPANSION ASSETS (TIER 2) 3. Includes Building A and additional capacity from Building B expansion; Revenue per sqm only accounts for the 20,057 sqm cu rre ntly in use 4. Stands for the maximum bed capacity as of fiscal year - end 5. Stands for the maximum number of consultation rooms designed

11 11 Shanghai United Family Pudong Hospital Q4 2019 AND FULL YEAR RESULTS

12 12 Financial Highlights Outpatient Volume +11.7 % YoY Growth 632,664 Visits Inpatient Admission +22.1 % YoY Growth Utilization Rate Comparing to 29.3 % of FY18 38.3 % Total Revenue +19.0 % YoY Growth RMB 2,449.2 mn Pro - forma Adjusted EBITDA 1 +93.0 % YoY Growth RMB 162.9 mn Operational Highlights 10,805 Admissions 2019 FINANCIAL YEAR HIGHLIGHTS Notes: 1.See slide 42 for a reconciliation of net loss to Pro - forma Adjusted EBITDA

13 13 Financial Highlights Outpatient Volume +10.7 % YoY Growth 163,436 Visits Inpatient Admission +19.8 % YoY Growth Utilization Rate Comparing to 34.9 % of 4Q18 40.1 % Operational Highlights Pro - forma Adjusted EBITDA 1 +218.2 % YoY Growth RMB 27.6 mn Total Revenue +13.9 % YoY Growth RMB 639.7 mn 2,912 Admissions Q4 2019 HIGHLIGHTS Notes: 1.See slide 42 for a reconciliation of net loss to Pro - forma Adjusted EBITDA

14 2019 BUSINESS HIGHLIGHTS Tier 1 Operating Assets 1 Beijing Hospital grew its capabilities as a Surgical Robotics Center by becoming one of the first users in China of the Mako Orthopedic Robot, completing several ground - breaking robotic surgeries and live demonstrations The Hospital also celebrated the recovery of an ultra - early premature baby born at only 25 weeks of gestation, weighing only 590 grams. Beijing Hospital received GCP (Good Clinical Practice) approval from the CFDA allowing the hospital to conduct clinical drug trials and enhance its reputation as a clinical research institution. Shanghai Puxi Hospital completed relocation in 19Q4 more than tripling the capacity of the old facility, making room for new patients and new and more advanced equipment and technology. Grew partnerships with international schools with 5 new nursing clinics in Shanghai and 2 in Beijing. Tier 2 Operating & Other Assets 2 IVF services in Tianjin Hospital expanded capabilities with the addition of a video incubator , which is expected to further improve pregnancy success rates and allow prospective parents to watch the development of their embryos visually. Beijing Rehabilitation Hospital established a new High Dependency Unit expanding the capability to care for patients requiring ventilator - based 24 - hour intensive care. Tier 2 Operating and Other Assets approached EBITDA break - even as a group. Expansion Assets 3 Strong ramp up of Expansion Assets driven by increased brand recognition and new patient uptake after official operations starting in Q4 2018 Guangzhou Hospital and its associated clinics and Shanghai Pudong Hospital reached RMB331.9 million of revenue on an annualized basis based on December 2019 monthly revenue. Notes: 1.Tier 1 Operating Assets mainly include Beijing United Family Hospital, Shanghai Puxi United Family Hospital and associated clinics 2.Tier 2 Operating & Other Assets mainly include Tianjin United Family Hospital, Beijing United Family Rehabilitation Hospita l, Qingdao United Family Hospital and other clinics in tier 2 cities 3.Expansion Assets mainly include Guangzhou United Family Hospital, Shanghai Pudong United Family Hospital and associated cli nic s as well as Beijing Datun United Family Hospital (under construction) and Shenzhen United Family Hospitl (Management contract)

15 Online Consultations Launched online and telephone consultation services Public health talks on live - broadcasting video platforms covering over 30 specialties that have reached more than 1 . 2 million people Sustained engagement with individual patients while enabling a broader swath of customers experience high - quality services COVID - 19 IMPACT Staff & Patient Protection Temperature check stations at all entry points in hospital facilities 14 - day quarantines for staff returning to work from other cities and flexible work arrangements Personal protective equipment stocking and epidemic control education / training for all staff Restricted non - patient foot traffic and social distancing policies for patients inside all facilities Free educational literature in multiple languages to patients As of the date of earning release, no confirmed cases of COVID - 19 among staff or patients Operations Several hospitals have been designated by the government to operate fever care centers, allowing patients to be screened and, if necessary, transferred to designated COVID - 19 treatment hospitals Separated by air flows and work flows from standard patient clinics, emergency rooms, and inpatient facilities to keep any potentially infected patients from impacting other patients or visitors Nearly all facilities and departments continue to offer inpatients and outpatients services as needed Charity NFH raised charity funds from New Frontier Group and several strategic partners, and leveraged on its global supply chain network to source urgently needed medical supplies to Leishenshan Hospital, Zhongnan Hospital of Wuhan University, and other institutions at the front lines of the fight against COVID - 19 .

16 STRONG REVENUE GROWTH ACROSS SEGMENTS 18 20 23 43 55 69 74 82 61 71 79 84 87 83 93 96 435 470 604 520 19Q4 18Q2 437 405 434 19Q1 477 628 19Q2 562 19Q3 462 18Q4 391 577 18Q1 18Q3 507 429 640 Operating Tier 1 Operating Tier 2 & Other Assets Expansion 104 280 295 359 FY18 FY19 1,660 1,811 2,059 2,449 Revenue (in million RMB) 23% 21% 19% 14% 19% Y - o - y Growth 9% 21% 170% Y - o - y Growth

17 DRIVEN BY OUTPATIENT AND INPATIENT VOLUME GROWTH Outpatient Volume Inpatient Admission 521 163 291 378 392 446 561 514 581 616 528 614 616 2,430 1,687 19Q2 1,597 1,575 19Q4 2,594 18Q2 1,612 2,912 1,686 18Q3 18Q1 2,695 2,604 0 19Q1 1,789 19Q3 1,598 1,850 2 2,096 2,175 18Q4 37 2,148 9,030 9,753 9,837 13,384 15,499 18,657 17,259 20,267 16,425 18,431 20,770 21,533 21,139 21,552 21,782 23,038 115,687 163,436 164,010 153,667 140,239 112,771 19Q4 123,801 19Q3 114,626 151,551 109,084 120,131 18Q2 18Q1 109,632 19Q2 18Q3 18Q4 114,913 19Q1 134,539 143,871 147,688 1,507 2,177 2,374 6,924 6,470 202 FY18 FY19 8,849 10,805 42,004 71,682 77,159 87,511 447,174 FY18 473,471 FY19 566,337 632,664 13% 14% 10% 11% 12% 24% 24% 21% 20% 22% 6% 13% 71% Y - o - y Growth 7% 9% 646% Y - o - y Growth Y - o - y Growth Expansion Operating Tier 1 Operating Tier 2 & Other Assets

18 ASP 1 REMAINS STABLE DURING RAMP UP Outpatient ASP Inpatient ASP 79,807 89,969 86,379 86,847 81,965 87,019 89,755 83,932 19Q3 19Q2 18Q1 18Q3 18Q2 18Q4 19Q4 19Q1 2,341 2,390 2,383 19Q2 2,358 18Q1 18Q2 18Q3 18Q4 19Q1 19Q3 19Q4 2,226 2,240 2,267 2,377 85,833 85,633 FY18 FY19 2,270 2,377 FY18 FY19 7% 6% 4% 2% 5% Y - o - y Growth 3% - 3% 4% - 3% 0% Y - o - y Growth Y - o - y Growth Y - o - y Growth Y - o - y Growth Notes: 1.Average selling price

19 ADJUSTED AND PRO - FORMA ADJUSTED EBITDA 1 Tier 1 Operating Assets Tier 2 Operating and Other Assets Expansion Assets Total (incl. HQ Expenses which are not shown above) 52.8 143.6 5.8 5.8 5.8 1.9 18Q4 8.8 18Q1 19Q1 18Q2 19Q4 18Q3 30.9 19Q2 19Q3 19.3 27.6 25.7 FY18 FY19 35.9 50.5 - 10.9 36.7 58.6 40.0 84.4 162.9 34.2 - 24.1 - 37.5 - 60.6 - 63.8 - 43.6 - 40.8 - 40.0 - 37.0 - 185.9 - 161.4 19Q1 18Q1 18Q2 19Q3 18Q3 18Q4 19Q2 19Q4 FY18 FY19 - 4.2 - 1.4 - 0.7 - 3.7 0.4 - 3.5 2.3 0.6 - 10.0 19Q3 19Q1 18Q2 18Q1 18Q3 19Q4 18Q4 19Q2 FY19 FY18 - 0.2 110.5 135.8 109.9 107.6 5.8 5.8 5.8 1.9 483.1 18Q2 18Q1 19.3 97.3 18Q3 18Q4 19Q1 19Q3 115.7 19Q2 19Q4 FY18 463.8 FY19 119.4 88.0 116.3 116.3 141.6 109.5 421.0 15% n/a n/a 93% Y - o - y Growth Pro - forma Adjustments 1 Notes: 1. See slide 42 for a reconciliation of net loss to Adjusted EBITDA (before IFRS 16 Adoption) and Pro - forma Adjusted EBITDA.

20 ADJUSTED EBITDA MARGIN 1 (BEFORE CORPORATE OVERHEAD) Tier 1 Operating Assets Tier 2 Operating and Other Assets Expansion Assets 29.7% 19Q1 18Q1 18Q3 25.4% 18Q2 26.7% 18Q4 19Q2 26.5% 19Q3 23.7% 19Q4 FY18 26.7% FY19 23.3% 24.9% 25.4% 28.5% 27.8% 21.7% 26.8% 25.2% 25.6% FY19 - 6.9% - 4.4% 19Q2 - 2.0% 18Q1 18Q4 18Q2 - 0.9% 18Q3 FY18 0.5% 19Q1 - 4.2% 2.5% 19Q3 0.6% 19Q4 - 3.4% - 0.1% FY19 - 205.2% 18Q2 - 54.5% 18Q1 - 142.9% 18Q3 - 58.1% - 255.9% - 149.3% 18Q4 - 79.4% 19Q1 - 59.6% 19Q2 19Q3 - 45.5% 19Q4 - 183.2% FY18 *Pro - forma Adjusted EBITDA Margin 1 Notes: 1. See slide 42 for a reconciliation of net loss to Adjusted EBITDA (before IFRS 16 Adoption) and Pro - forma Adjusted EBITDA.

21 21 OPERATING EXPENSES 1,187.7 1,401.1 FY2018 14.1 FY2019 1,415.2 SWB Transaction Cost 58% As % of Revenue 58% Salary, Wages & Benefits (in million RMB) 287.1 146.0 323.0 201.7 138.6 303.6 341.9 400.2 7.0 947.3 FY2018 16.3 1,231.8 0.0 13.7 FY2019 Others Supplies & Purchased Medical Service Depreciation and Amortization 1 Impairment of Trade Receivable Lease & Rental 1 Transaction Cost 2 46% As % of Revenue (excl. Transaction Cost) 44% Other SG&A (in million RMB) Notes: 1. Significant amount of rental payment are re - categorized from lease & rental expenses to depreciation and amortization according to newly adopted IFRS 16 in 2019, please see P41 in Appendix B for more details on the impact of IFRS 16 adoption 2. T he transaction cost is one - time cost associated with the business combination with New Frontier Corporation

22 CAPEX, CASH FLOW AND CASH POSITION (RMB million) FY2019 Maintenance CAPEX (1) 71 Expansionary CAPEX (2) 316 Total CAPEX 387 Cash G enerated from Operating Activities 274 Less: Capital Lease Payments (3) 178 Add: Interest Expense Paid 30 Add: One - off Transaction Expense Paid 11 Less: Maintenance CAPEX 71 Free Cash Flow 66 Total Cash (4) 1,730 Less: Total Debt (4) 2,461 Net Debt (731) Notes: (1) Expansionary capex is defined as capex spent for building new facilities including the new site of Shanghai Puxi Hospital, Shanghai Pudong Hospital, Guangzhou Hospital and Beijing Datun Hospital. (2) Maintenance capex is defined as all capex spent for existing operations of the facilities. (3) Due to IFRS 16 adoption, capital lease payments is categorized as cash used for financing activities. (4) As of December 31, 2019 on the Balance Sheet Statement of NFH. Expansion assets which are still ramping up and incurred RMB 161 million of Adjusted EBITDA loss in 2019.

23 FY2019 Revenue (in million RMB) FY2019 Pro - forma Adjusted EBITDA (in million RMB) 2019 REVENUE / PRO - FORMA ADJUSTED EBITDA SUMMARY 483 163 161 159 Tier 1 Operating Assets 0 HQ Tier 2 Operating & Other Assets Expansion Assets Total 1,811 359 280 Tier 1 Operating Assets Tier 2 Operating & Other Assets Total Expansion Assets 2,449 9% Y - o - y Growth 19% 21% 170% Pro - Forma Adjusted EBITDA Margin % 27% n.m. 0% - 58% 7% Revenue per Bed 1 Notes: 1.Revenue per bed is calculated based on the weighted average maximum bed capacity of the fiscal year 2.Refferring to Beijing United Family Hospital in Chaoyang as its associated clinics 3.Referring to Shanghai Puxi United Family Hospital and its associated clinics. Maximum bed capacity for Shanghai Puxi United Family Hospital increased with the relocation to new site in Q4 2019 Beijing 2 14.0 1.7 1.5 4.6 Shanghai 3 10.8

24 24 HOSPITALS: LONG TERM MATURITY CYCLE 0 50 100 150 200 250 300 350 400 450 500 550 600 650 700 750 800 850 900 950 1,000 1,050 1,100 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 QDU (20,057 sqm 3 ) BJU (24,959 sqm) PXU (previously 7,559 sqm; 20,844 sqm after relocation) TJU (6,900 sqm) Rehab (16,145 sqm) Hospital Revenue (mm RMB) Due to capacity bottleneck with only 5,886 sqm, Shanghai hospital struggled to take on additional patient volume and develop higher acuity services. Capacity issue was solved in October 2019 when Shanghai hospital moved to a new site with 19,172 sqm of facility size GZM (69,008 sqm) Dec - 19 (Month 15 1 ) Run Rate Revenue 2 (RMB 200mm) PDU (28,471 sqm) Dec - 19 (Month 13 1 ) Run Rate Revenue 2 (RMB 131mm) Source: Company ( Unaudited) 1. Since the hospital obtained its OB license 2. Run - rate revenue is defined as monthly revenue * 12 3. Only 20,057 sqm Building A is currently in use and contributes revenue for now; total GFA is 30,057 sqm which includes Bui ldi ng A and additional capacity from Building B expansion

25 STRATEGIC PRIORITIES IN 2020 Geographic Market Reorganization and Consolidation Ramp - up of Newly Opened Facilities (Shanghai Puxi , Shanghai Pudong and Guangzhou) Invest in Core Markets and Expand Capabilities in Selected Specialties Expand Tier 1 City Outpatient Network Implement Cost Control / Business Recovery post Coronavirus Prepare for the launch of Beijing Datun Hospital and Shenzhen Hospital

26 26 Shanghai United Family Hospital GROWTH INITIATIVES

27 SIGNIFICANT WHITE SPACE FOR GROWTH IN EXISTING TIER 1 CITIES Tier 1 Cities # of UFH Patients 1 ~200,000 Beijing, Shanghai & Guangzhou Target Addressable Market 2 ~3.3 million Beijing, Shanghai & Guangzhou Total Resident Population 3 ~ 62 million ~5% ~0.3% Significant white space within Tier 1 Cities for future growth Source: Company Analysis, National Bureau of Statistics 1. Number of unique UFH patients in Tier 1 cities in 2019 2. Addressable market includes target expatriate population, local population with out - of - pocket payment and local population with premium hea lthcare insurance coverage as of 2018 3. Number of residents in Beijing, Shanghai, Guangzhou and Shenzhen as of 2018

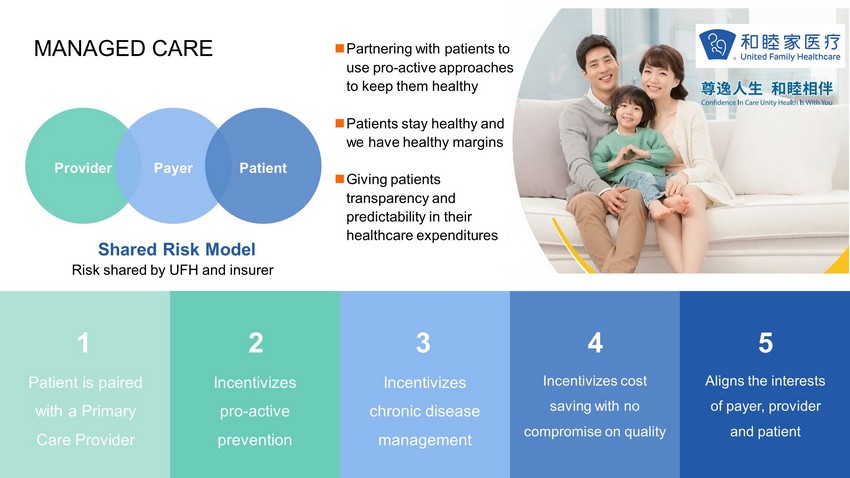

28 28 MANAGED CARE Patient is paired with a Primary Care Provider Incentivizes pro - active prevention Aligns the interests of payer, provider and patient I ncentivizes chronic disease management I ncentivizes cost saving with no compromise on quality 1 2 3 4 5 Provider Patient Payer Shared Risk Model Partnering with patients to use pro - active approaches to keep them healthy Patients stay healthy and we have healthy margins Giving patients transparency and predictability in their healthcare expenditures Risk shared by UFH and insurer

29 29 ENHANCE CLINIC NETWORKS IN EXISTING MARKETS Integrated Healthcare Services Model Generating Significant Synergies. Continue to Replicate Outpatient Networks in Existing Mar kets Significant Referral Revenue from Beijing Clinics (RMB mm) SUCCESSFUL HUB & SPOKE BUSINESS MODEL Source: Company Hospitals Clinic Clinic Clinic Clinic Clinic Clinic 79 88 93 89 9.4% 9.7% 9.2% 8.4% 2019 2016 2017 2018 Beijing Hospital referral revenue from clinics C ontribution to hospital revenue