Form SC TO-I Corporate Capital Trust, Filed by: Corporate Capital Trust, Inc.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1) OF

THE SECURITIES EXCHANGE ACT OF 1934

CORPORATE CAPITAL TRUST, INC.

(Name of Subject Company (Issuer))

CORPORATE CAPITAL TRUST, INC.

(Names of filing Person (Offeror and Issuer))

Common Stock, Par Value $0.001 per share

(Title of Class of Securities)

219880 101

(CUSIP Number of Class of Securities)

Todd C. Builione

Chief Executive Officer

Corporate Capital Trust, Inc.

555 California Street

50th Floor

San Francisco, California 94104

Tel: (415) 315-3620

(Name, address and telephone number of person authorized to

receive notices and communications on behalf of filing person)

Copy to:

Kenneth E. Young, Esq.

William J. Bielefeld, Esq.

Dechert LLP

Cira Centre

2929 Arch Street

Philadelphia, PA 19104

Telephone: (215) 994-4000

CALCULATION OF FILING FEE

| Transaction Valuation(l) | Amount of Filing Fee(2) |

| $185,000,000 | $23,032.50 |

| (1) | Calculated solely for purposes of determining the amount of the filing fee. This amount is based upon the offer to purchase up to $185,000,000 in value of shares of common stock, par value $0.001 per share, of Corporate Capital Trust, Inc. |

| (2) | The amount of the filing fee, calculated in accordance with Rule 0-11 under the Securities Exchange Act of 1934, as amended, as modified by Fee Rate Advisory No. 1 for fiscal year 2018, equals $124.50 per million dollars of the value of the transaction. |

| ☐ | Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

Amount

Previously Paid: Not Applicable

Form or Registration No.: Not Applicable

Filing Party: Not Applicable

Date Filed: Not Applicable

| ☐ | Check the box if filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| ☐ | Third-party tender offer subject to Rule 14d-1. | |

| ☒ | Issuer tender offer subject to Rule 13e-4. | |

| ☐ | Going-private transaction subject to Rule 13e-3. | |

| ☐ | Amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

This Tender Offer Statement on Schedule TO (this “Schedule TO”) relates to the offer by Corporate Capital Trust, Inc., an externally managed, non-diversified, closed-end management investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended (“CCT” or the “Company”), to purchase for cash up to $185,000,000 in value of the Company’s shares of common stock, par value $0.001 per share (the “Shares”), at a price per Share equal to $20.01, which price was our net asset value per Share as of September 30, 2017 (as adjusted for the Company’s 1-for-2.25 reverse split of the Shares completed on October 31, 2017), net to the seller in cash, less any applicable withholding taxes and without interest, upon the terms and subject to the conditions described in the Offer to Purchase, dated November 14, 2017 (the “Offer to Purchase”), a copy of which is filed herewith as Exhibit (a)(1)(A), and the related Letter of Transmittal (the “Letter of Transmittal,” which, together with the Offer to Purchase, as each may be amended or supplemented from time to time, constitute the “Offer”), a copy of which is filed herewith as Exhibit (a)(1)(B). This Schedule TO is intended to satisfy the reporting requirements of Rule 13e-4(c)(2) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The information contained in the Offer to Purchase and the Letter of Transmittal, respectively, as each may be amended or supplemented from time to time, is hereby incorporated by reference in response to certain items of this Schedule TO.

| ITEM 1. | SUMMARY TERM SHEET. |

The information under the heading “Summary Term Sheet” included in the Offer to Purchase is incorporated herein by reference.

| ITEM 2. | SUBJECT COMPANY INFORMATION. |

| (a) | Name and Address. The name of the issuer is Corporate Capital Trust, Inc. The address and telephone number of the issuer’s principal executive offices are: 555 California Street, 50th Floor, San Francisco, California 94104 and (415) 315-3620. |

| (b) | Securities. The subject securities are CCT’s shares of common stock, par value $0.001 per share. Immediately after the listing of the Shares on the New York Stock Exchange LLC on November 14, 2017, there were 136,375,966 Shares issued and outstanding. |

| (c) | Trading Market and Price. Information regarding the trading market and price of the Shares is incorporated herein by reference from the Offer to Purchase under the heading “Section 7—Price Range of Shares; Distributions.” |

| ITEM 3. | IDENTITY AND BACKGROUND OF FILING PERSON. |

| (a) | Name and Address. The filing person and subject company to which this Schedule TO relates is Corporate Capital Trust, Inc. The address and telephone number of CCT is set forth under Item 2(a) above. The names of the directors and executive officers of CCT are as set forth in the Offer to Purchase under the heading “Section 10—Interests of Directors, Executive Officers and Affiliates; Transactions and Arrangements Concerning the Shares,” and such information is incorporated herein by reference. The business address and business telephone number of each director and executive officer of CCT are: c/o Corporate Capital Trust, Inc., 555 California Street, 50th Floor, San Francisco, California 94104 and (415) 315-3620. |

| ITEM 4. | TERMS OF THE TRANSACTION. |

| (a) | Material Terms. The material terms of the transaction are incorporated herein by reference from the Offer to Purchase under the headings “Summary Term Sheet,” “Introduction,” “Section 1—Number of Shares; Purchase Price; Proration,” “Section 2—Purpose of the Offer; Certain Effects of the Offer; Plans or Proposals,” “Section 3—Procedures for Tendering Shares,” “Section 4—Withdrawal Rights,” “Section 5—Purchase of Shares and Payment of Purchase Price,” “Section 6—Conditions of the Offer,” “Section 8—Source and Amount of Funds,” “Section 10—Interests of Directors, Executive Officers and Affiliates; Transactions and Arrangements Concerning the Shares,” “Section 13—Material U.S. Federal Income Tax Consequences,” and “Section 14—Extension of the Offer; Termination; Amendment.” There will be no material differences in the rights of the remaining security holders of the Company as a result of this transaction. |

- 1 -

| (b) | Purchases. None of our directors, executive officers or, to our knowledge, any of our affiliates intend to tender any of their Shares in the Offer. Therefore, the Offer will increase the proportional holdings of our directors, executive officers and affiliates. See “Section 2—Purpose of the Offer; Certain Effects of the Offer; Plans or Proposals” of the Offer to Purchase. |

| ITEM 5. | PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS. |

| (e) | Agreements Involving the Subject Company’s Securities. Information regarding agreements involving CCT’s securities is incorporated herein by reference from the Offer to Purchase under the heading “Section 10—Interests of Directors, Executive Officers and Affiliates; Transactions and Arrangements Concerning the Shares.” Except as set forth therein, the Company does not know of any agreement, arrangement or understanding, whether or not legally enforceable, between the Company and any other person with respect to the Company’s securities. |

| ITEM 6. | PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS. |

| (a) | Purposes. Information regarding the purpose of the transaction is incorporated herein by reference from the Offer to Purchase under the heading “Section 2—Purpose of the Offer; Certain Effects of the Offer; Plans or Proposals.” |

| (b) | Use of Securities Acquired. Information regarding the treatment of Shares acquired pursuant to the Offer is incorporated herein by reference from the Offer to Purchase under the heading “Section 2—Purpose of the Offer; Certain Effects of the Offer; Plans or Proposals.” |

| (c) | Plans. Information regarding any plans or proposals is incorporated herein by reference from the Offer to Purchase under the headings “Section 2—Purpose of the Offer; Certain Effects of the Offer; Plans or Proposals,” “Section 7—Price Range of Shares; Distributions,” and “Section 10—Interests of Directors, Executive Officers and Affiliates; Transactions and Arrangements Concerning the Shares.” |

| ITEM 7. | SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION. |

| (a) | Source of Funds. Information regarding the source of funds is incorporated herein by reference from the Offer to Purchase under the heading “Section 8—Source and Amount of Funds.” |

| ITEM 8. | INTEREST IN SECURITIES OF THE SUBJECT COMPANY. |

| (a) | Securities Ownership. The information under the heading “Section 10—Interests of Directors, Executive Officers and Affiliates; Transactions and Arrangements Concerning the Shares” in the Offer to Purchase is incorporated herein by reference. |

| (b) | Securities Transactions. The information under the heading “Section 10—Interests of Directors, Executive Officers and Affiliates; Transactions and Arrangements Concerning the Shares” in the Offer to Purchase is incorporated herein by reference. |

| ITEM 9. | PERSONS/ASSETS, RETAINED, EMPLOYED, COMPENSATED OR USED. |

| (a) | Solicitations or Recommendations. The information under the headings “Summary Term Sheet” and “Section 15—Fees and Expenses” in the Offer to Purchase is incorporated herein by reference. |

- 2 -

| ITEM 10. | FINANCIAL STATEMENTS. |

| (a) | Financial Information. Not applicable. The consideration offered to security holders consists solely of cash. The Offer is not subject to any financing condition, and CCT is a public reporting company under Section 13(a) of the Exchange Act that files reports electronically on EDGAR. |

| (b) | Pro Forma Financial Information. Not applicable. |

| ITEM 11. | ADDITIONAL INFORMATION. |

| (a) | Agreements, Regulatory Requirements and Legal Proceedings. |

| (1) | The information under the heading “Section 10—Interests of Directors, Executive Officers and Affiliates; Transactions and Arrangements Concerning the Shares” in the Offer to Purchase is incorporated herein by reference. The Company will amend this Schedule TO to reflect material changes to information incorporated by reference in the Offer to Purchase to the extent required by Rule 13e-4(d)(2) promulgated under the Exchange Act. |

| (2) | The information under the heading “Section 12—Certain Legal Matters; Regulatory Approvals” in the Offer to Purchase is incorporated herein by reference. |

| (3) | Not applicable. |

| (4) | Not applicable. |

| (5) | None. |

| (c) | Other Material Information. The information set forth in the Offer to Purchase and the Letter of Transmittal, copies of which are filed herewith as Exhibits (a)(1)(A) and (a)(1)(B), respectively, as each may be amended or supplemented from time to time, is incorporated herein by reference. The Company will amend this Schedule TO to include documents that the Company may file with the Securities and Exchange Commission after the date of the Offer to Purchase pursuant to Sections 13(a), 13(c), or 14 of the Exchange Act and prior to the expiration of the Offer to the extent required by Rule 13e-4(d)(2) promulgated under the Exchange Act. |

- 3 -

| ITEM 12. | EXHIBITS. |

| (a)(1)(A) | Offer to Purchase, dated November 14, 2017. |

| (a)(1)(B) | Letter of Transmittal. |

| (a)(1)(C) | Notice of Guaranteed Delivery. |

| (a)(1)(D) | Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees, dated November 14, 2017. |

| (a)(1)(E) | Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees, dated November 14, 2017. |

| (a)(1)(F) | Notice of Withdrawal of Tender for Individual Investors (other than DTC Participants). |

| (a)(1)(G) | Notice of Withdrawal of Tender for Brokers, Dealers, Banks, Trust Companies and other Nominees and DTC Participants. |

| (a)(5)(A) | Press release issued November 14, 2017. |

| (b)(1) | Amended and Restated Senior Secured Revolving Credit Agreement, dated as of April 15, 2016, among the Company, as borrower, the lenders from time to time party thereto, JPMorgan Chase Bank, N.A., as administrative agent, and ING Capital LLC as syndication agent (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on April 18, 2016). |

| ITEM 13. | INFORMATION REQUIRED BY SCHEDULE 13E-3. |

Not applicable.

- 4 -

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: November 14, 2017

| CORPORATE CAPITAL TRUST, INC. | ||

| By: | /s/ Todd C. Builione | |

| Name: | Todd C. Builione | |

| Title: | Chief Executive Officer | |

- 5 -

EXHIBIT INDEX

| (a)(1)(A) | Offer to Purchase, dated November 14, 2017. |

| (a)(1)(B) | Letter of Transmittal. |

| (a)(1)(C) | Notice of Guaranteed Delivery. |

| (a)(1)(D) | Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees, dated November 14, 2017. |

| (a)(1)(E) | Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees, dated November 14, 2017. |

| (a)(1)(F) | Notice of Withdrawal of Tender for Individual Investors (other than DTC Participants). |

| (a)(1)(G) | Notice of Withdrawal of Tender for Brokers, Dealers, Banks, Trust Companies and other Nominees and DTC Participants. |

| (a)(5)(A) | Press release issued November 14, 2017. |

- 6 -

Corporate Capital Trust, Inc. SC TO-I

Exhibit (a)(1)(A)

Corporate Capital Trust, Inc.

Offer

to Purchase for Cash

Up to $185,000,000 in Value of

Shares of its Common Stock

at a Purchase Price Per Share of Common Stock Equal to

$20.01, which price was our Net Asset Value per Share as of September 30, 2017, as adjusted for the Company’s 1-for-2.25 reverse split of the Shares completed on October 31, 2017

THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT 5:00 P.M., NEW YORK CITY TIME, ON DECEMBER 12, 2017, UNLESS THE OFFER IS EXTENDED OR WITHDRAWN (SUCH TIME AND DATE, AS THEY MAY BE EXTENDED, THE “EXPIRATION DATE”).

Corporate Capital Trust, Inc., an externally managed, non-diversified, closed-end management investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended (the “Company,” “CCT,” “we” or “us”), is offering to purchase for cash up to $185,000,000 in value of its shares of common stock, par value $0.001 per share (the “Shares”), at a price per Share equal to $20.01 (the “Purchase Price”), which price was our net asset value per Share as of September 30, 2017 (as adjusted for the Company’s 1-for-2.25 reverse split of the Shares completed on October 31, 2017), net to the seller in cash, less any applicable withholding taxes and without interest, on the terms and subject to the conditions described in this Offer to Purchase, dated November 14, 2017 (this “Offer to Purchase”), and the related Letter of Transmittal (the “Letter of Transmittal,” which, together with the Offer to Purchase, as each may be amended or supplemented from time to time, constitute the “Offer”).

The Offer will expire at 5:00 p.m., New York City time, on December 12, 2017, unless the Offer is extended or withdrawn. To tender your Shares you must follow the procedures described in the Offer to Purchase, the Letter of Transmittal and the other documents related to the Offer.

Immediately after the listing of the Shares on the New York Stock Exchange (the “NYSE”) on November 14, 2017, there were 136,375,966 issued and outstanding Shares.

Because of the proration provisions described in this Offer to Purchase, all of the Shares properly tendered and not properly withdrawn may not be purchased if those Shares have an aggregate purchase price in excess of $185,000,000. Shares tendered but not purchased pursuant to the Offer will be returned promptly following the Expiration Date. See Sections 3 and 4.

We will not accept Shares subject to conditional tenders, such as acceptance of all or none of the Shares tendered by any tendering stockholder. No fractional Shares will be purchased in the Offer. If any tendered Shares are not purchased for any reason, the Letter of Transmittal with respect to such Shares not purchased will be of no force or effect and Shares tendered through The Depository Trust Company’s (“DTC”) Automated Tender Offer Program (“ATOP”) (pursuant to Section 3) will be credited to the account maintained with DTC by the participant who delivered the Shares at our expense.

We reserve the right, in our sole discretion, to change the Purchase Price and to increase or decrease the value of Shares sought in the Offer, subject to applicable law. In accordance with the rules promulgated by the Securities and Exchange Commission (the “SEC”), we may increase the number of Shares accepted for payment in the Offer by up to 2% of the outstanding Shares without amending or extending the Offer. See Sections 1, 3 and 4.

On November 14, 2017, the Shares were listed on the NYSE and began trading under the symbol “CCT.” Because November 14, 2017 was the first day on which the Shares were traded on the NYSE, we cannot provide a market price for the Shares. Tendering stockholders whose Shares are accepted for payment will lose the opportunity to trade such Shares and the chance to participate in any future market upside and future growth of the Company. The trading price of our Shares on the NYSE may be higher or lower than the Purchase Price. Stockholders are urged to obtain current market quotations for the Shares before deciding whether to tender their Shares. See Section 7.

Based on the Purchase Price of $20.01, we could purchase approximately 9,250,000 Shares if the Offer is fully subscribed, which would represent approximately 6.8% of the issued and outstanding Shares as of immediately after the listing of the Shares on the NYSE on November 14, 2017.

| - 1 - |

Subject to the applicable rules and regulations promulgated by the SEC, we expressly reserve the right, in our sole discretion, at any time and from time to time, (a) to extend the period of time during which the Offer is open and thereby delay acceptance for payment of, and the payment for, any Shares, subject to the restrictions below, (b) to increase or decrease the value of Shares sought in the Offer, (c) to amend the Offer in any respect prior to the Expiration Date and (d) if any condition specified in Section 6 is not satisfied or waived prior to the Expiration Date, to terminate the Offer and not accept any Shares for payment. Notice of any such extension, amendment or termination will be distributed promptly to stockholders in a manner reasonably designed to inform them of such change in compliance with Rule 13e-4(e)(3) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In the case of an extension of the Offer, such extension will be followed by a press release or other public announcement, which will be issued no later than 9:00 a.m., New York City time, on the next business day after the scheduled Expiration Date, in accordance with Rule 14e-1(d) promulgated under the Exchange Act. See Sections 1, 3, 4 and 14.

The Offer is not conditioned upon the receipt of financing or any minimum number of Shares being tendered. The Offer is, however, subject to a number of other terms and conditions. See Section 6.

We expect to use available cash and/or borrowings under the Company’s senior secured revolving credit facility to fund any purchases of Shares in the Offer and to pay all related fees and expenses. See Section 8.

ALTHOUGH OUR BOARD OF DIRECTORS HAS AUTHORIZED THE OFFER, NONE OF THE COMPANY, ANY MEMBER OF OUR BOARD OF DIRECTORS, KKR CREDIT, THE PAYING AGENT, THE DEPOSITARY, THE INFORMATION AGENT (EACH AS DEFINED HEREIN) OR ANY OF THEIR RESPECTIVE AFFILIATES HAS MADE, OR IS MAKING, ANY RECOMMENDATION TO YOU AS TO WHETHER TO TENDER OR REFRAIN FROM TENDERING YOUR SHARES. YOU MUST MAKE YOUR OWN DECISION AS TO WHETHER TO TENDER YOUR SHARES AND HOW MANY SHARES TO TENDER. IN DOING SO, YOU SHOULD READ CAREFULLY THE INFORMATION IN OR INCORPORATED BY REFERENCE IN THIS OFFER TO PURCHASE AND THE LETTER OF TRANSMITTAL, INCLUDING THE PURPOSES AND EFFECTS OF THE OFFER. SEE SECTION 2. YOU ARE URGED TO DISCUSS YOUR DECISION WITH YOUR TAX ADVISOR, FINANCIAL ADVISOR AND/OR BROKER.

IF YOUR TENDERED SHARES ARE ACCEPTED AND YOU ARE A U.S. HOLDER (AS DEFINED IN SECTION 13), THE RECEIPT OF CASH FOR YOUR TENDERED SHARES WILL BE A TAXABLE TRANSACTION FOR U.S. FEDERAL INCOME TAX PURPOSES AND GENERALLY WILL BE TREATED FOR U.S. FEDERAL INCOME TAX PURPOSES EITHER AS A (A) SALE OR EXCHANGE ELIGIBLE FOR CAPITAL GAIN OR LOSS TREATMENT, OR (B) DISTRIBUTION TAXABLE AS ORDINARY INCOME TO THE EXTENT IT IS OUT OF OUR CURRENT OR ACCUMULATED EARNINGS AND PROFITS (AND NOT DESIGNATED BY US AS A CAPITAL GAIN DIVIDEND OR QUALIFIED DIVIDEND INCOME). IF YOU ARE A NON-U.S. HOLDER (AS DEFINED IN SECTION 13), WE WILL WITHHOLD ON THE PAYMENT OF CASH FOR YOUR TENDERED SHARES. SEE SECTION 13. WE URGE YOU TO CONSULT YOUR TAX ADVISORS AS TO THE PARTICULAR TAX CONSEQUENCES TO YOU TENDERING YOUR SHARES.

NONE OF THE SEC, ANY STATE SECURITIES COMMISSION NOR ANY OTHER REGULATORY BODY HAS APPROVED OR DISAPPROVED OF THIS TRANSACTION, PASSED UPON THE MERITS OR FAIRNESS OF THIS TRANSACTION OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE INFORMATION INCLUDED OR INCORPORATED BY REFERENCE IN THIS OFFER TO PURCHASE AND ANY RELATED DOCUMENTS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Questions and requests for assistance by stockholders may be directed to Broadridge, Inc., the information agent for the Offer (the “Information Agent”), at the telephone number and address set forth below. Stockholders may also contact their broker, dealer, commercial bank, trust company or other nominee for assistance concerning the Offer.

| - 2 - |

You may request additional copies of this Offer to Purchase, the Letter of Transmittal and the other documents related to the Offer from the Information Agent at the telephone number and address set forth below. The Information Agent will promptly furnish to stockholders additional copies of these materials at the Company’s expense.

The Information Agent for the Offer is:

Broadridge, Inc.

51 Mercedes Way

Edgewood, NY 11717

Call Toll Free: (855) 793-5068

Offer to Purchase dated November 14, 2017

IMPORTANT

WE HAVE NOT AUTHORIZED ANY PERSON TO MAKE ANY RECOMMENDATION ON OUR BEHALF AS TO WHETHER YOU SHOULD TENDER OR REFRAIN FROM TENDERING YOUR SHARES IN THE OFFER. YOU SHOULD RELY ONLY ON THE INFORMATION IN, OR INCORPORATED BY REFERENCE IN, THIS OFFER TO PURCHASE AND THE LETTER OF TRANSMITTAL OR IN THE OTHER DOCUMENTS TO WHICH WE HAVE REFERRED YOU. OUR DELIVERY OF THIS OFFER TO PURCHASE SHALL NOT UNDER ANY CIRCUMSTANCES CREATE ANY IMPLICATION THAT THE INFORMATION IN THIS OFFER TO PURCHASE IS CORRECT AS OF ANY TIME OTHER THAN THE DATE OF THIS OFFER TO PURCHASE OR THAT THERE HAVE BEEN NO CHANGES IN THE INFORMATION IN OR INCORPORATED BY REFERENCE HEREIN OR IN THE AFFAIRS OF CCT OR ANY OF ITS SUBSIDIARIES SINCE THE DATE HEREOF. WE HAVE NOT AUTHORIZED ANYONE TO PROVIDE YOU WITH INFORMATION IN CONNECTION WITH THE OFFER OTHER THAN THE INFORMATION IN THIS OFFER TO PURCHASE OR THE LETTER OF TRANSMITTAL. IF ANYONE MAKES ANY RECOMMENDATION OR GIVES ANY INFORMATION, YOU MUST NOT RELY UPON THAT RECOMMENDATION OR INFORMATION AS HAVING BEEN AUTHORIZED BY US, ANY MEMBER OF OUR BOARD OF DIRECTORS, KKR CREDIT ADVISORS (US) LLC, THE COMPANY’S INVESTMENT ADVISER (“KKR CREDIT”), THE PAYING AGENT, THE DEPOSITARY, THE INFORMATION AGENT OR ANY OF OUR OR THEIR RESPECTIVE AFFILIATES.

THIS OFFER TO PURCHASE AND THE LETTER OF TRANSMITTAL CONTAIN IMPORTANT INFORMATION, AND YOU SHOULD CAREFULLY READ BOTH IN THEIR ENTIRETY BEFORE MAKING A DECISION WITH RESPECT TO THE OFFER.

If you want to tender all or any portion of your Shares, you must do one of the following prior to 5:00 p.m. New York City time on December 12, 2017, or any later time and date to which the Offer may be extended:

| ● | Holders whose Shares are Held by Brokers: if your Shares are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, contact the nominee and have the nominee tender your Shares for you according to the procedures described in Section 3 of this Offer to Purchase; |

| ● | Registered Holders: if you hold Shares in book-entry form as a registered holder in your own name, complete and sign the Letter of Transmittal (or an originally signed photocopy of the Letter of Transmittal (facsimile signatures will not be accepted)) according to its instructions and deliver it (by regular mail, overnight courier or hand delivery), together with any required signature guarantees and any other documents required by the Letter of Transmittal, to Broadridge, Inc., the depositary for the Offer (the “Depositary”), at the address shown on the Letter of Transmittal; or |

| ● | DTC Participants: if you are an institution participating in DTC, tender your Shares according to the procedure for book-entry transfer described in Section 3 of this Offer to Purchase. |

If a nominee holds your Shares, it is likely that they will have an earlier deadline for you to act to instruct them to accept the Offer on your behalf. We urge you to contact the nominee that holds your Shares to find out its deadline.

We recommend that you consult your broker and your financial advisor to determine the status of your account and the best way to tender your Shares. If you have any questions related to the status of the Shares in your registered account, or need to confirm the number of Shares held in your registered account, please call the Company’s transfer agent, DST Systems, Inc., at 844-857-4557 or contact your financial advisor. If you have any questions related to how that status impacts how you may tender your Shares, please contact the Information Agent, Broadridge, Inc., at (855) 793-5068.

| - 3 - |

Notwithstanding anything contained in this Offer to Purchase, the Letter of Transmittal or any other ancillary documents relating to the Offer, brokers, dealers, commercial banks, trust companies and other nominees and DTC participants are not required to, and should not, submit the written Letter of Transmittal to the Depositary or DTC in connection with any tender submitted through DTC’s ATOP system. DTC participants should submit any documentation required for processing through the ATOP system. Similarly, notwithstanding anything contained in this Offer to Purchase, the Letter of Transmittal or any other ancillary documents relating to the Offer, brokers, dealers, commercial banks, trust companies and other nominees and DTC participants are not required to, and should not, submit a written notice of withdrawal in connection with the withdrawal of any tender submitted through DTC’s ATOP system. DTC participants should submit any documentation required for processing through the ATOP system. All tenders and withdrawals through DTC’s ATOP system must be completed in accordance with the terms and conditions of the ATOP system.

If you want to tender your Shares but you cannot comply with the procedure for book-entry transfer by the Expiration Date or your other required documents cannot be delivered to the Depositary prior to the Expiration Date, you may still tender your Shares if you comply with the guaranteed delivery procedure described in Section 3 of this Offer to Purchase.

Stockholders properly tendering can reasonably expect to have at least a portion of such Shares purchased if any Shares are purchased pursuant to the Offer (subject to the provisions relating to proration).

We are not aware of any jurisdiction where the making of the Offer is prohibited by any administrative or judicial action pursuant to any valid state statute. If we become aware of any valid state statute prohibiting the making of the Offer or the acceptance of the Shares, we will make a good faith effort to comply with that state statute or seek to have such statute declared inapplicable to the Offer. If, after a good faith effort, we cannot comply with the state statute, we will not make the Offer to, nor will we accept tenders from or on behalf of, the holders of Shares in that state. In any jurisdiction where the securities, blue sky or other laws require the Offer to be made by a licensed broker or dealer, the Offer shall be deemed to be made by one or more registered brokers or dealers licensed under the laws of that jurisdiction.

| - 4 - |

TABLE OF CONTENTS

| Page | |||

| SUMMARY TERM SHEET | 1 | ||

| FORWARD-LOOKING STATEMENTS | 8 | ||

| INTRODUCTION | 9 | ||

| THE OFFER | 11 | ||

| 1. | NUMBER OF SHARES; PURCHASE PRICE; PRORATION | 11 | |

| 2. | PURPOSE OF THE OFFER; CERTAIN EFFECTS OF THE OFFER; PLANS OR PROPOSALS | 12 | |

| 3. | PROCEDURES FOR TENDERING SHARES | 14 | |

| 4. | WITHDRAWAL RIGHTS | 17 | |

| 5. | PURCHASE OF SHARES AND PAYMENT OF PURCHASE PRICE | 18 | |

| 6. | CONDITIONS OF THE OFFER | 18 | |

| 7. | PRICE RANGE OF SHARES; DISTRIBUTIONS | 20 | |

| 8. | SOURCE AND AMOUNT OF FUNDS | 21 | |

| 9. | CERTAIN INFORMATION CONCERNING THE COMPANY | 22 | |

| 10. | INTERESTS OF DIRECTORS, EXECUTIVE OFFICERS AND AFFILIATES; TRANSACTIONS AND ARRANGEMENTS CONCERNING THE SHARES | 23 | |

| 11. | EFFECTS OF THE OFFER ON THE MARKET FOR SHARES; REGISTRATION UNDER THE EXCHANGE ACT | 24 | |

| 12. | CERTAIN LEGAL MATTERS; REGULATORY APPROVALS | 25 | |

| 13. | MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES | 25 | |

| 14. | EXTENSION OF THE OFFER; TERMINATION; AMENDMENT | 28 | |

| 15. | FEES AND EXPENSES | 29 | |

| 16. | MISCELLANEOUS | 29 | |

| -i- |

SUMMARY TERM SHEET

We are providing this summary term sheet for your convenience. This summary term sheet highlights certain material information in this Offer to Purchase (as defined below), but you should realize that it does not describe all of the details of the Offer (as defined below) to the same extent described elsewhere in this Offer to Purchase. To understand the Offer fully and for a more complete description of the terms and conditions of the Offer, you should read carefully this entire Offer to Purchase, the Letter of Transmittal (as defined below) and the other documents related to the Offer. We have included in this summary term sheet references to the sections of this Offer to Purchase where you will find a more complete description of the topics in this summary term sheet.

Who is offering to purchase my Shares?

Corporate Capital Trust, Inc., which we refer to as the “Company,” “CCT,” “we” or “us.”

What will be the purchase price for the Shares and what will be the form of payment?

We are offering to purchase for cash up to $185,000,000 in value of our shares of common stock, par value $0.001 per share (the “Shares”), pursuant to tenders at a price per Share equal to $20.01 (the “Purchase Price”), which price was our net asset value per Share as of September 30, 2017 (as adjusted for the Company’s 1-for-2.25 reverse split of the Shares completed on October 31, 2017), net to the seller in cash, less any applicable withholding taxes and without interest, upon the terms and subject to the conditions described in this Offer to Purchase, dated November 14, 2017 (this “Offer to Purchase”), and the related Letter of Transmittal (the “Letter of Transmittal,” which together, as they may be amended or supplemented from time to time, constitute the “Offer”).

We will not accept Shares subject to conditional tenders, such as acceptance of all or none of the Shares tendered by any tendering stockholder. No fractional Shares will be purchased in the Offer.

How many Shares is CCT offering to purchase?

We are offering to purchase, at the Purchase Price, Shares properly tendered in the Offer and not properly withdrawn up to a maximum aggregate purchase price of $185,000,000. Based on the Purchase Price of $20.01, we could purchase approximately 9,250,000 Shares if the Offer is fully subscribed, which would represent approximately 6.8% of the issued and outstanding Shares as of immediately after the listing of the Shares on the New York Stock Exchange (the “NYSE”) on November 14, 2017.

We expressly reserve the right to purchase additional Shares in the Offer, subject to applicable law. In accordance with the rules promulgated by the Securities and Exchange Commission (the “SEC”), we may increase the number of Shares accepted for payment in the Offer by up to 2% of the outstanding Shares without amending or extending the Offer. See Section 1.

The Offer is not conditioned upon the receipt of financing or any minimum number of Shares being tendered. The Offer is, however, subject to a number of other terms and conditions. See Section 6.

How was the Purchase Price under the Offer determined?

We determined the Purchase Price under the Offer based on consultations among our management, our professional advisors and our Board of Directors. Based on such consultations, we concluded that $20.01, which price was our net asset value per Share as of September 30, 2017 (as adjusted for the Company’s 1-for-2.25 reverse split of the Shares completed on October 31, 2017), is representative of the per share value of the Shares and within the range at which (a) our stockholders might sell their Shares to us and (b) we can prudently affect repurchases for the benefit of the Company. The actual value and trading price of our Shares following the listing of our Shares on the NYSE may be lower or higher than the Purchase Price.

Stockholders are urged to obtain current market quotations for the Shares before deciding whether to tender their Shares. See Section 7.

How will CCT pay for the Shares?

We will pay for your properly tendered and not properly withdrawn Shares by depositing the Purchase Price in cash, less any applicable withholding taxes and without interest, with Broadridge, Inc., the paying agent for the Offer (the “Paying Agent”), which will act as your agent for the purpose of receiving payments from us and transmitting such payments to you. In all cases, payment for properly tendered Shares will be made only after timely (a) receipt by Broadridge, Inc., the depositary for the Offer (the “Depositary”), of a properly completed and duly executed Letter of Transmittal, and any required signature guarantees and other documents required by the Letter of Transmittal, or (b) if you are tendering Shares through the Automated Tender Offer Program (“ATOP”) of The Depository Trust Company (“DTC”), confirmation of book-entry transfer of the Shares into the Paying Agent’s account at DTC. See Sections 3 and 5.

| - 1 - |

We reserve the right, in our sole discretion, to change the Purchase Price and to increase or decrease the value of Shares sought in the Offer, subject to applicable law. See Sections 1, 3 and 4.

We expect to fund any purchases of Shares pursuant to the Offer, including related fees and expenses, from available cash and/or borrowings under our senior secured revolving credit facility. The Offer is not conditioned upon the receipt of financing. See Section 8.

How long do I have to tender my Shares?

You may tender your Shares until the Offer expires at 5:00 p.m., New York City time, on December 12, 2017, unless the Offer is extended or withdrawn (such time and date, as they may be extended, the “Expiration Date”). If a broker, dealer, commercial bank, trust company or other nominee holds your Shares, it is likely that they will have an earlier deadline for you to act to instruct them to accept the Offer on your behalf. We urge you to immediately contact your broker, dealer, commercial bank, trust company or other nominee to find out their deadline. See Sections 1 and 3.

Can the Offer be extended, amended or terminated and, if so, under what circumstances?

We can extend the Offer, in our sole discretion, at any time, subject to applicable laws. We may, however, decide not to extend the Offer. If we were to extend the Offer, we cannot indicate, at this time, the length of any extension that we may provide. If we extend the Offer, we will delay the acceptance of any Shares that have been tendered. We can also amend or terminate the Offer under certain circumstances. See Sections 6 and 14.

How will I be notified if the Offer is extended, amended or terminated?

If the Offer is extended, we will issue a press release announcing the extension and the new expiration date no later than 9:00 a.m., New York City time, on the first business day after the previously scheduled expiration date. We will announce any other amendment to or termination of the Offer by promptly issuing a press release announcing the amendment or termination. See Section 14.

What is the purpose of the Offer?

In considering the Offer, our Board of Directors reviewed, with the assistance of management and professional advisors, the Company’s results of operations, financial position and capital requirements, general business conditions, legal, regulatory, rating agency and contractual constraints and restrictions and other factors our Board of Directors deemed relevant. Following such review, our Board of Directors determined that the Offer is a prudent use of the Company’s financial resources.

The Company believes that Offer represents an efficient way to return capital to stockholders who wish to receive cash for all or a portion of their Shares. The Offer provides stockholders with an opportunity to obtain liquidity with respect to all or a portion of their Shares. The Offer also provides stockholders with an efficient way to sell their Shares without incurring most broker’s fees or commissions associated with open market sales. In addition, stockholders who wish to achieve a greater percentage of equity ownership in the Company will be able to do so by not tendering their Shares in the Offer. If the Company completes the Offer, stockholders who retain all or a portion of their Shares will have a greater percentage ownership in CCT and the potential to share in its future earnings and assets, while also bearing the attendant risks associated with owning Shares. See Section 2.

After completing the Offer, we may consider from time to time, subject to approval by our Board of Directors, various forms of stock repurchases after taking into account the results of the Offer, our results of operations, financial position and capital requirements, general business conditions, legal, regulatory, rating agency and contractual constraints and restrictions and other factors our Board of Directors deems relevant. These purchases may be made from time to time on the open market, through privately negotiated transactions or other self-tender offers, and may be on the same terms or on terms and prices that are more or less favorable to stockholders than the terms of the Offer. See Section 2.

How does the listing of the Shares on the NYSE affect the Shares?

Because the Shares are now listed on the NYSE, stockholders who choose not to tender their Shares will generally be able to freely liquidate their investment in the Company; however, their Shares will be subject to market volatilities. Tendering stockholders whose Shares are accepted for payment will lose the opportunity to trade such Shares and the chance to participate in any future market upside and future growth of the Company. The Offer will reduce our “public float” (the number of Shares owned by non-affiliated stockholders and available for trading in the securities markets), and may reduce the number of our stockholders. See Sections 2 and 7.

| - 2 - |

What are the conditions to the Offer?

Our obligation to accept for payment and pay for Shares tendered in the Offer depends upon a number of conditions that must be satisfied or waived (to the extent permitted by law) on or prior to the Expiration Date, including that:

| ● | no action, suit, proceeding or application by any government or governmental, regulatory or administrative agency, authority or tribunal or by any other person, domestic, foreign or supranational, before any court, authority, agency, other tribunal or arbitrator or arbitration panel shall have been instituted or shall be pending, nor shall we have received notice of any such action, that directly or indirectly (1) challenges or seeks to challenge, restrain, prohibit, delay or otherwise affect the making of the Offer, the acquisition by us of some or all of the Shares pursuant to the Offer or otherwise relates in any manner to the Offer or seeks to obtain damages in respect of the Offer, (2) seeks to make the purchase of, or payment for, some or all of the Shares pursuant to the Offer illegal or may result in a delay in our ability to accept for payment or pay for some or all of the Shares, (3) otherwise could reasonably be expected to materially adversely affect the business, properties, assets, liabilities, capitalization, stockholders’ equity, financial condition, operations, results of operations or prospects of us or any of our subsidiaries or affiliates, or (4) otherwise, in our reasonable judgment, could reasonably be expected to adversely affect us or any of our subsidiaries or affiliates or the value of our Shares; |

| ● | our acceptance for payment, purchase or payment for any Shares tendered in the Offer shall not violate or conflict with, or otherwise be contrary to, any applicable law, statute, rule, regulation, decree or order; |

| ● | no action shall have been taken nor any statute, rule, regulation, judgment, decree, injunction or order (preliminary, permanent or otherwise) shall have been proposed, sought, enacted, entered, promulgated, enforced or deemed to be applicable to the Offer or us or any of our subsidiaries by any court, other tribunal, government or governmental agency or other regulatory or administrative authority or body, domestic or foreign, which (1) indicates that any approval, waiver or other action of any such court, other tribunal, agency, authority or body may be required in connection with the Offer or the purchase of Shares thereunder and which has not been obtained or taken, as applicable, (2) is reasonably likely to make the purchase of, or payment for, some or all of the Shares pursuant to the Offer illegal or to prohibit, restrict or delay consummation of the Offer, (3) materially impairs, in our reasonable judgment, the contemplated benefits to us of the Offer, (4) seeks to impose limitations on our or our affiliates’ ability to acquire or hold or to exercise full rights of ownership, including, but not limited to, the right to vote their Shares on all matters validly presented to our stockholders, or (5) otherwise could reasonably be expected to materially adversely affect the business, properties, assets, liabilities, capitalization, stockholders’ equity, condition (financial or otherwise), operations, licenses, franchises, permits, permit applications, results of operations or prospects of us or any of our subsidiaries or affiliates; |

| ● | no general suspension of trading in, or limitation on prices for, securities on any U.S. national securities exchange or in the over-the-counter market, declaration of a banking moratorium or any suspension of payments in respect of banks in the United States, whether or not mandatory, or any limitation, whether or not mandatory, by any governmental, regulatory or administrative agency, authority or body on, or any event that is likely, in our reasonable judgment, to materially adversely affect, the extension of credit by banks or other lending institutions in the United States (or if existing at the time of commencement of the Offer, a material worsening thereof) shall have occurred; |

| ● | no commencement or escalation, on or after November 14, 2017, of war, armed hostilities or other international or national calamity, including, but not limited to, an act of terrorism directly or indirectly involving the United States or any other jurisdiction in which CCT or any of its subsidiaries maintains an office or conducts business (or if existing at the time of commencement of the Offer, a material worsening thereof) shall have occurred; |

| ● | no change, condition, event or development or any condition, event or development involving a prospective change, in general political, market, economic, financial or industry conditions in the United States or internationally that, in our reasonable judgment, has, or could reasonably be expected to have, a material adverse effect on the business, properties, assets, liabilities, capitalization, stockholders’ equity, condition (financial or otherwise), operations, licenses, franchises, permits, permit applications, results of operations or prospects of CCT and its subsidiaries, taken as a whole, on the value of or trading in the Shares, on our ability to consummate the Offer or on the benefits of the Offer to us (or if existing at the time of commencement of the Offer, a material worsening thereof), shall have occurred; |

| ● | no change, condition, event or development (including any act of nature or man-made disaster) or any condition, event or development involving a prospective change, in the business, properties, assets, liabilities, capitalization, stockholders’ equity, condition (financial or otherwise), operations, licenses, franchises, permits, permit applications, results of operations or prospects of CCT or any of its subsidiaries that, in our reasonable judgment, has, or could reasonably be expected to have, a material adverse effect on CCT and its subsidiaries, taken as a whole, on the value of or trading in the Shares, on our ability to consummate the Offer or on the benefits of the Offer to us (or if existing at the time of commencement of the Offer, a material worsening thereof), shall have occurred; |

| - 3 - |

| ● | no decrease or increase of more than 10% in the market price for the Shares or in the Dow Jones Industrial Average, New York Stock Exchange Index, NASDAQ Composite Index, the Standard and Poor’s 500 Composite Index or the Wells Fargo Business Development Company Index measured from the close of trading on November 14, 2017 shall have occurred; |

| ● | no tender or exchange offer for any or all of the outstanding Shares, or any merger, acquisition, business combination or other similar transaction with or involving CCT or any of its subsidiaries, shall have been proposed, announced or made by any person or entity or shall have been publicly disclosed, nor shall we have entered into a definitive agreement or an agreement in principle with any person with respect to a merger, acquisition, business combination or other similar transaction, in each case, other than the Offer or otherwise described herein; |

| ● | we shall not have become aware that any entity, “group” (as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) or person (1) has acquired or proposes to acquire beneficial ownership of more than 5% of the outstanding Shares, whether through the acquisition of stock, the formation of a group, the grant of any option or right (options for and other rights to acquire Shares that are acquired or proposed to be acquired being deemed to be immediately exercisable or convertible for purposes of this clause), or otherwise (other than by virtue of consummation of the Offer or anyone who publicly disclosed such ownership in a filing with the SEC on or before November 14, 2017), (2) who has filed a Schedule 13D or Schedule 13G with the SEC on or before November 14, 2017, has acquired or proposes to acquire, whether through the acquisition of Shares, the formation of a group, the grant of any option or right (options for and other rights to acquire Shares that are acquired or proposed to be acquired being deemed to be immediately exercisable or convertible for purposes of this clause), or otherwise (other than by virtue of consummation of the Offer), beneficial ownership of an additional 1% or more of the outstanding Shares or (3) shall have filed a Notification and Report Form under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, reflecting an intent to acquire us or any of our subsidiaries or any of our or any of our subsidiaries’ assets or securities; |

| ● | no approval, permit, authorization, favorable review or consent or waiver of or filing with any domestic or foreign governmental or regulatory authority, agency or body or any third party consent or notice, required to be obtained or made in connection with the Offer shall not have been obtained or made on terms and conditions satisfactory to us in our reasonable judgment; |

| ● | we shall not have determined that the consummation of the Offer and the purchase of the Shares pursuant to the Offer is likely, in our reasonable judgment, to cause the Shares to be (1) held of record by less than 300 persons, (2) delisted from the NYSE or (3) eligible for deregistration under the Exchange Act; or |

| ● | we shall not determine, in our reasonable judgment, that the consummation of the Offer or the purchase of Shares from any stockholder could jeopardize our qualification and taxation as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended, for U.S. federal income tax purposes. |

The Offer is subject to these conditions, all of which are also described in Section 6. Each of these conditions is for our sole benefit and may be asserted or waived by us, in whole or in part, at any time and from time to time in our discretion prior to the Expiration Date. In certain circumstances, if we waive any of the conditions described above, we may be required to extend the Expiration Date. The Offer is not conditioned upon the receipt of financing or any minimum number of Shares being tendered.

How do I tender my Shares?

If you want to tender all or any portion of your Shares, you must do one of the following prior to the Expiration Date:

| ● | Holders whose Shares are Held by Brokers: if your Shares are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, contact the nominee and have the nominee tender your Shares for you; |

| ● | Registered Holders: if you hold Shares in book-entry form as a registered holder in your own name, complete and sign the Letter of Transmittal according to its instructions and deliver it, together with any required signature guarantees and any other documents required by the Letter of Transmittal, to the Depositary at the address shown on the Letter of Transmittal; or |

| ● | DTC Participants: if you are an institution participating in DTC, tender your Shares according to the procedure for book-entry transfer described in Section 3 of this Offer to Purchase. |

If a nominee holds your Shares, it is likely that they will have an earlier deadline for you to act to instruct them to accept the Offer on your behalf. We urge you to contact the nominee that holds your Shares to find out their deadline.

| - 4 - |

We recommend that you consult your broker and your financial advisor to determine the status of your account and the best way to tender your Shares. If you have any questions related to the status of the Shares in your registered account, or need to confirm the number of Shares held in your registered account, please call the Company’s transfer agent, DST Systems, Inc., at 844-857-4557 or contact your financial advisor. If you have any questions related to how that status impacts how you may tender your Shares, please contact the Information Agent, Broadridge, Inc. (the “Information Agent”), at (855) 793-5068 (toll-free).

Brokers, dealers, commercial banks, trust companies and other nominees and DTC participants are not required to, and should not, submit the written Letter of Transmittal to the Depositary or DTC in connection with any tender submitted through ATOP. DTC participants should submit any documentation required for processing through the ATOP system.

If you want to tender your Shares but you cannot comply with the procedure for book-entry transfer by the Expiration Date or your other required documents cannot be delivered to the Depositary prior to the Expiration Date, you may still tender your Shares if you comply with the guaranteed delivery procedure described in Section 3.

You may contact the Information Agent or your broker for assistance. The contact information for the Information Agent is set forth on the back cover page of this Offer to Purchase. See Section 3 and the instructions to the Letter of Transmittal.

The method of delivery of all documents, including the Letter of Transmittal and any other required documents, including delivery through DTC, is at the sole election and risk of the tendering stockholder. Shares will be deemed delivered only when actually received by the Depositary (including by book-entry confirmation). If delivery is by mail, then registered mail with return receipt requested, properly insured, is recommended. In all cases, sufficient time should be allowed to ensure timely delivery.

IF YOU ARE A REGISTERED HOLDER AND WANT TO TENDER ALL OR A PORTION OF YOUR SHARES, YOU MUST DELIVER THE LETTER OF TRANSMITTAL AND OTHER REQUIRED DOCUMENTS TO THE DEPOSITARY. ANY DOCUMENTS DELIVERED TO US, THE INFORMATION AGENT, THE TRANSFER AGENT, DTC OR ANY OTHER PERSON WILL NOT BE FORWARDED TO THE DEPOSITARY AND WILL NOT BE DEEMED TO BE PROPERLY TENDERED.

Has the Board of Directors or CCT adopted a position on the Offer?

Our Board of Directors has authorized the Offer. However, none of the Company, any member of our Board of Directors, KKR Credit Advisors (US) LLC, the Company’s investment adviser (“KKR Credit”), the Information Agent, the Depositary, the Paying Agent or any of their respective affiliates has made, or is making, any recommendation to you as to whether you should tender or refrain from tendering your Shares. You must make your own decision as to whether to tender your Shares and how many Shares to tender. In doing so, you should read carefully the information in or incorporated by reference in this Offer to Purchase and the Letter of Transmittal, including the purposes and effects of the Offer. You are urged to discuss your decision with your tax advisor, financial advisor and/or broker. See Section 2.

What happens if the number of Shares tendered in the Offer would result in an aggregate purchase price of more than $185,000,000?

If the number of Shares properly tendered and not properly withdrawn prior to the Expiration Date would result in an aggregate purchase price of more than $185,000,000, we will purchase Shares from all stockholders who properly tender Shares, on a pro rata basis, with appropriate adjustments to avoid the purchase of fractional Shares, until we have purchased Shares resulting in an aggregate purchase price of up to $185,000,000. See Sections 1, 3, 4 and 5.

Because of the proration provisions described above, it is possible that we will not purchase all of the Shares that you tender.

Once I have tendered Shares in the Offer, can I withdraw my tender?

Yes. You may withdraw your tendered Shares at any time prior to the Expiration Date, or such later time and date to which we may extend the Offer. In addition, unless we have already accepted your tendered Shares for payment, you may withdraw your tendered Shares at any time at or after 12:01 a.m., New York City time, on January 11, 2018. See Section 4.

| - 5 - |

How do I withdraw Shares previously tendered?

To properly withdraw your previously tendered Shares, you must deliver (by regular mail, overnight courier or hand delivery), prior to the Expiration Date, a properly completed and duly executed Notice of Withdrawal (“Notice of Withdrawal”) (attached as Exhibit (a)(1)(F) to the Tender Offer Statement on Schedule TO (the “Schedule TO”) for individual investors (other than custodians and DTC participants), and Exhibit (a)(1)(G) to the Schedule TO for custodians and DTC participants). Custodians and DTC participants who tendered Shares through DTC must comply with DTC’s procedures for withdrawal of tenders. Brokers, dealers, banks, trust companies and other nominees and DTC participants are not required to, and should not, submit the written Notice of Withdrawal in connection with the withdrawal of any tender submitted through DTC’s ATOP system, but need to submit any documentation required for processing through the ATOP system. If you have tendered your Shares by giving instructions to a broker, dealer, commercial bank, trust company or other nominee, you must instruct that person to arrange for the timely withdrawal of your Shares. To obtain a Notice of Withdrawal, please contact the Information Agent, Broadridge, Inc., at (855) 793-5068. See Section 4.

What will happen if I do not tender my Shares?

Stockholders who do not participate in the Offer will retain their Shares and, if the Company completes the Offer, their relative ownership interest in the Company will automatically increase. See Section 2.

When and how will CCT pay for my tendered Shares that are accepted for payment pursuant to the Offer?

We will announce the preliminary results of the Offer, including preliminary information about any expected proration, and pay the Purchase Price in cash, less any applicable withholding taxes and without interest, for the Shares we accepted for payment promptly after the Expiration Date. In the event of proration, the Paying Agent will determine the proration factor and pay for those tendered Shares accepted for payment promptly after the Expiration Date. We will pay for the Shares accepted for payment by depositing the aggregate purchase price in cash with the Paying Agent promptly after the Expiration Date. The Paying Agent will act as your agent and will transmit to you the payment for all of your Shares accepted for payment pursuant to the Offer. See Section 5.

What is the market price for the Shares?

On November 14, 2017, the Shares were listed on the NYSE and began trading under the symbol “CCT.” Because November 14, 2017 was the first day on which the Shares were traded on the NYSE, we cannot provide a market price for the Shares. Tendering stockholders whose Shares are accepted for payment will lose the opportunity to trade such Shares and the chance to participate in any future market upside and future growth of the Company. The trading price of our Shares on the NYSE may be higher or lower than the Purchase Price. Stockholders are urged to obtain current market quotations for the Shares before deciding whether to tender their Shares. See Section 7.

We can give no assurance as to the price at which stockholders may be able to sell Shares in the future. On the other hand, Shares properly tendered and accepted for payment and paid for will no longer entitle the former owners to participate in the performance of the Company as evidenced by any Share price appreciation (or depreciation) and any payment of distributions on the Shares.

Will I have to pay brokerage fees and commissions if I tender my Shares?

If you are a holder of record of your Shares and you tender your Shares directly to the Depositary, you will not incur any brokerage fees or commissions. If you hold your Shares through a broker, dealer, commercial bank, trust company or other nominee and that person tenders Shares on your behalf, that person may charge you a fee for doing so. We urge you to consult your broker, dealer, commercial bank, trust company or other nominee to determine whether any such charges will apply. See Section 3.

What is the accounting treatment of the Offer?

The purchase of Shares pursuant to the Offer will result in a reduction of our stockholders’ equity in an amount equal to the aggregate purchase price of the Shares we purchase and a corresponding increase in liabilities and/or reduction in total cash and cash equivalents depending on the source of funding. See Section 15.

Are there any governmental or regulatory approvals, consents or filings to be made or obtained in connection with the Offer?

We are not aware of any approval or other action by any governmental, administrative or regulatory authority, agency or body, domestic, foreign or supranational, that would be required for our acquisition or ownership of Shares as contemplated by the Offer. Should any such approval or other action or notice filings be required, we presently contemplate that we will seek that approval or other action and make or cause to be made such notice filings. We cannot predict whether we will be required to delay the acceptance for payment of or payment for Shares tendered in the Offer pending the outcome of any such approval or other action. There can be no assurance that any such approval or other action, if needed, would be obtained or would be obtained without substantial cost or conditions or that the failure to obtain the approval or other action might not result in adverse consequences to our business and financial condition. Our obligations pursuant to the Offer to accept for payment and pay for Shares are subject to the satisfaction of certain conditions. See Sections 6 and 12.

| - 6 - |

What are the material U.S. federal income tax consequences if I tender my Shares?

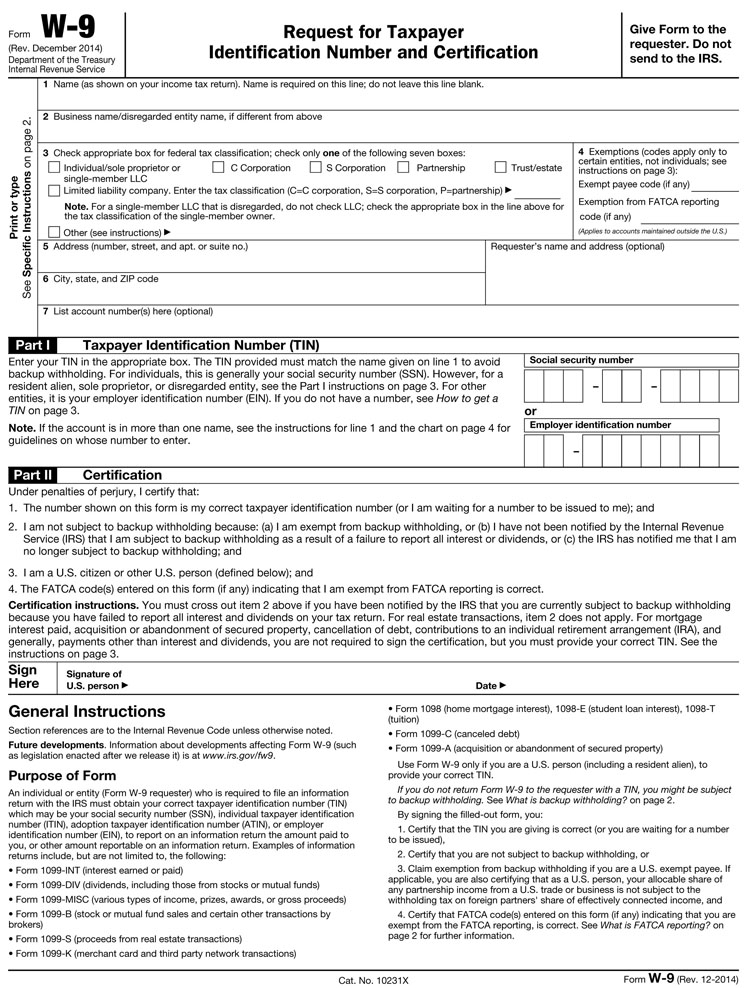

Generally, if you are a U.S. Holder (as defined in Section 13), the receipt of cash from us in exchange for the Shares you tender in the Offer will be a taxable event for U.S. federal income tax purposes. The receipt of cash for your tendered Shares will generally be treated for U.S. federal income tax purposes either as (1) proceeds from a sale or exchange generally eligible for capital gain or loss treatment or (2) a distribution in respect of stock from the Company. If you are a U.S. Holder, you should complete the IRS (“Internal Revenue Service”) Form W-9 included as part of the Letter of Transmittal. Any tendering stockholder or other payee who is a U.S. Holder and who fails to timely complete, sign and return to the Depositary the IRS Form W-9 included in the Letter of Transmittal (or such other IRS form as may be applicable) may be subject to U.S. backup withholding tax. See Section 3. Non-U.S. Holders (as defined in Section 13) are urged to consult their tax advisors regarding the applicability of U.S. federal income tax withholding, including eligibility for a withholding tax reduction or exemption and the refund procedure, upon the cash received in exchange for Shares. All stockholders should review the discussion in Sections 3 and 13 regarding material U.S. federal income tax consequences and consult their tax advisor regarding the tax consequences of the Offer.

Will I have to pay a stock transfer tax if I tender my Shares?

If you instruct the Depositary in the Letter of Transmittal to make the payment for the tendered Shares to the registered holder, you will not incur any stock transfer tax for any Shares that are accepted in the Offer. See Section 5.

Following the Offer, will the Company continue as a listed, public company?

Yes. The Offer is conditioned upon, among other things, our having determined in our reasonable judgment that the consummation of the Offer will not cause the Shares to be delisted from the NYSE or to be eligible for deregistration under the Exchange Act. See Sections 2, 6 and 11.

Whom do I contact if I have questions about the Offer?

Questions and requests for assistance by stockholders may be directed to the Information Agent at the telephone number and address set forth on the back cover page of this Offer to Purchase. You may request additional copies of this Offer to Purchase, the Letter of Transmittal and the other documents related to the Offer from the Information Agent at the telephone number and address set forth on the back cover page of this Offer to Purchase. The Information Agent will promptly furnish to stockholders additional copies of these materials at the Company’s expense. Stockholders may also contact their broker, dealer, commercial bank, trust company or other nominee for assistance concerning the Offer.

| - 7 - |

FORWARD-LOOKING STATEMENTS

Cautionary Note Regarding Forward-Looking Statements

This Offer to Purchase may include forward-looking statements. Words like “anticipate,” “believe,” “expect” and “intend” indicate a forward-looking statement, although not all forward-looking statements include these words. Although we believe that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, our actual results could differ materially from those set forth in the forward-looking statements. These beliefs, expectations and assumptions are subject to risks and uncertainties and can change as a result of many possible events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. You should carefully consider these risks before you make an investment decision with respect to our Shares, along with the following factors that could cause actual results to vary from our forward-looking statements:

| ● | changes in the economy; |

| ● | risks associated with possible disruption in our operations or the economy generally due to terrorism or natural disasters; |

| ● | future changes in laws or regulations and conditions in our industry; |

| ● | the ability to complete the Offer; and |

| ● | the price at which our Shares may trade on the NYSE, which may be higher or lower than the Purchase Price. |

Except as required by the federal securities laws, we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to consult any additional disclosures that we may make directly to you or through reports that we may file in the future with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. The forward-looking statements and projections contained in this Offer to Purchase are excluded from the safe harbor protection provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act.

| - 8 - |

INTRODUCTION

To the Stockholders of Corporate Capital Trust, Inc.:

Corporate Capital Trust, Inc. (the “Company,” “CCT,” “we” or “us”) invites its stockholders to tender their shares of its common stock, par value $0.001 per share (the “Shares”), for purchase by the Company. Upon the terms and subject to the conditions of this Offer to Purchase, dated November 14, 2017 (this “Offer to Purchase”), and the related Letter of Transmittal (the “Letter of Transmittal,” which, together with the Offer to Purchase, as each may be amended or supplemented from time to time, constitute the “Offer”), we are offering to purchase up to $185,000,000 in value of Shares pursuant to tenders at a price per Share equal to $20.01 (the “Purchase Price”), which price was our net asset value per Share as of September 30, 2017 (as adjusted for the Company’s 1-for-2.25 reverse split of the Shares completed on October 31, 2017), net to the seller in cash, less any applicable withholding taxes and without interest.

The Offer will expire on December 12, 2017, at 5:00 p.m., New York City time, unless the Offer is extended or withdrawn (such date and time, as they may be extended, the “Expiration Date”). To tender your Shares you must follow the procedures described in this Offer to Purchase, the Letter of Transmittal and the other documents related to the Offer.

Only Shares properly tendered, and not properly withdrawn, will be eligible to be purchased. Shares tendered but not purchased pursuant to the Offer will be returned promptly following the Expiration Date. No fractional shares will be purchased in the Offer. See Sections 3 and 4.

We will not accept Shares subject to conditional tenders, such as acceptance of all or none of the Shares tendered by any tendering stockholder.

Subject to the applicable rules and regulations promulgated by the Securities and Exchange Commission (the “SEC”), we expressly reserve the right, in our sole discretion, at any time and from time to time, (a) to extend the period of time during which the Offer is open and thereby delay acceptance for payment of, and the payment for, any Shares, subject to the restrictions below, (b) to increase or decrease the value of Shares sought in the Offer, (c) to amend the Offer in any respect prior to the Expiration Date and (d) if any condition specified in Section 6 is not satisfied or waived prior to the Expiration Date, to terminate the Offer and not accept any Shares for payment. Notice of any such extension, amendment or termination will be distributed promptly to stockholders in a manner reasonably designed to inform them of such change in compliance with Rule 13e-4(e) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In the case of an extension of the Offer, such extension will be followed by a press release or other public announcements which will be issued no later than 9:00 a.m., New York City time, on the next business day after the scheduled Expiration Date, in accordance with Rule 14e-1(d) promulgated under the Exchange Act. See Sections 1, 3, 4 and 14.

THE OFFER IS NOT CONDITIONED UPON THE RECEIPT OF FINANCING OR ANY MINIMUM NUMBER OF SHARES BEING TENDERED. THE OFFER IS, HOWEVER, SUBJECT TO A NUMBER OF OTHER TERMS AND CONDITIONS. SEE SECTION 6.

ALTHOUGH OUR BOARD OF DIRECTORS HAS AUTHORIZED THE OFFER, NONE OF THE COMPANY, ANY MEMBER OF OUR BOARD OF DIRECTORS, KKR CREDIT, THE PAYING AGENT, THE DEPOSITARY, THE INFORMATION AGENT (EACH AS DEFINED HEREIN) OR ANY OF THEIR RESPECTIVE AFFILIATES HAS MADE, OR IS MAKING, ANY RECOMMENDATION TO YOU AS TO WHETHER TO TENDER OR REFRAIN FROM TENDERING YOUR SHARES. YOU MUST MAKE YOUR OWN DECISION AS TO WHETHER TO TENDER YOUR SHARES AND HOW MANY SHARES TO TENDER. IN DOING SO, YOU SHOULD READ CAREFULLY THE INFORMATION IN OR INCORPORATED BY REFERENCE IN THIS OFFER TO PURCHASE AND THE LETTER OF TRANSMITTAL, INCLUDING THE PURPOSES AND EFFECTS OF THE OFFER. SEE SECTION 2. YOU ARE URGED TO DISCUSS YOUR DECISION WITH YOUR TAX ADVISOR, FINANCIAL ADVISOR AND/OR BROKER.

Upon the terms and subject to the conditions of the Offer, if the number of Shares properly tendered and not properly withdrawn prior to the Expiration Date would result in an aggregate purchase price of more than $185,000,000, we will purchase Shares from all stockholders who properly tender Shares, on a pro rata basis, with appropriate adjustments to avoid the purchase of fractional Shares, until we have purchased Shares resulting in an aggregate purchase price of up to $185,000,000. See Sections 1, 3, 4 and 5. Because of the proration provisions described above, we may not purchase all of the Shares that you tender. See Section 1.

The Purchase Price will be paid in cash, less any applicable withholding taxes and without interest, to tendering stockholders for all Shares purchased. Tendering stockholders who hold Shares registered in their own name and who tender their Shares directly to Broadridge, Inc., the depositary for the Offer (the “Depositary”), will not be obligated to pay brokerage commissions, solicitation fees or, except as set forth in Section 5, stock transfer taxes on the purchase of Shares by us pursuant to the Offer. Stockholders holding Shares in a brokerage account or otherwise through a broker, dealer, commercial bank, trust company or other nominee are urged to consult their broker, dealer, commercial bank, trust company or other nominee to determine whether any charges may apply if stockholders tender Shares through such nominees and not directly to the Depositary. See Section 3.

| - 9 - |

Also, any tendering stockholder or other payee who is a U.S. Holder (as defined in Section 13) and who fails to timely complete, sign and return to the Depositary the Internal Revenue Service (“IRS”) Form W-9 included with the Letter of Transmittal (or such other IRS form as may be applicable) may be subject to U.S. federal backup withholding tax on the gross proceeds paid to the U.S. Holder pursuant to the Offer. See Section 3. Also, see Section 13 regarding the material U.S. federal income tax consequences of the Offer.

We will pay the reasonable and customary fees and expenses incurred in connection with the Offer by Broadridge, Inc., the Depositary and paying agent for the Offer (the “Paying Agent”), and the information agent for the Offer (the “Information Agent”). See Section 15.

On November 14, 2017, the Shares were listed on the New York Stock Exchange (the “NYSE”) and began trading under the symbol “CCT.” Because November 14, 2017 was the first day on which the Shares were traded on the NYSE, we cannot provide a market price for the Shares. Tendering stockholders whose Shares are accepted for payment will lose the opportunity to trade such Shares and the chance to participate in any future market upside and future growth of the Company. The trading price of our Shares on the NYSE may be higher or lower than the Purchase Price. Stockholders are urged to obtain current market quotations for the Shares before deciding whether to tender their Shares. See Section 7.

Immediately after the listing of the Shares on the NYSE on November 14, 2017, there were 136,375,966 issued and outstanding Shares. Based on the Purchase Price of $20.01, we could purchase approximately 9,250,000 Shares if the Offer is fully subscribed, which would represent approximately 6.8% of the issued and outstanding Shares as of immediately after the listing of the Shares on the NYSE on November 14, 2017. See Section 1.

References in this Offer to Purchase to “dollars” and “$” are to the lawful currency of the United States of America.

This Offer to Purchase and Letter of Transmittal contain important information, and you should carefully read both in their entirety before you make a decision with respect to the Offer.

| - 10 - |

THE OFFER

1. Number of Shares; Purchase Price; Proration

General. Upon the terms and subject to the conditions of the Offer, we are offering to purchase up to $185,000,000 in value of Shares pursuant to tenders at a price per Share equal to $20.01 (the “Purchase Price”), which price was our net asset value per Share as of September 30, 2017 (as adjusted for the Company’s 1-for-2.25 reverse split of the Shares completed on October 31, 2017), net to the seller in cash, less any applicable withholding taxes and without interest.

The Offer will expire on the Expiration Date, unless the Offer is extended or withdrawn. To tender your Shares you must follow the procedures described in this Offer to Purchase, the Letter of Transmittal and the other documents related to the Offer.

Only Shares properly tendered, and not properly withdrawn, will be purchased. However, because of the proration provisions described in this Offer to Purchase, all of the Shares properly tendered and not properly withdrawn may not be purchased if those Shares have an aggregate purchase price in excess of $185,000,000. All Shares tendered and not purchased in the Offer, including Shares not purchased because of proration, will be returned to the tendering stockholders at our expense promptly following the Expiration Date.

We will not accept Shares subject to conditional tenders, such as acceptance of all or none of the Shares that are tendered by any tendering stockholder.

If we (a) increase or decrease the Purchase Price, (b) increase the maximum number of Shares that we may purchase in the Offer by more than 2% of our outstanding Shares or (c) decrease the number of Shares that we may purchase in the Offer, then the Offer must remain open for at least 10 business days following the date that notice of the increase or decrease is first published, sent or given in the manner specified in Section 14.

Stockholders properly tendering can reasonably expect to have at least a portion of such Shares purchased if any Shares are purchased pursuant to the Offer (subject to provisions relating to proration described in this Offer to Purchase).

Shares acquired pursuant to the Offer will be acquired by CCT free and clear of all liens, charges, encumbrances, security interests, claims, restrictions and equities whatsoever, together with all rights and benefits arising therefrom, provided that any distributions which may be declared, paid, issued, distributed, made or transferred on or in respect of such Shares to stockholders of record on or prior to the date on which the Shares are accepted for payment pursuant to the Offer shall be for the account of such stockholders.

The Offer is not conditioned upon the receipt of financing or any minimum number of Shares being tendered. The Offer is, however, subject to a number of other terms and conditions. See Section 6.