Form DEFA14A DTS, INC.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| x | Soliciting Material Pursuant to §240.14a-12 | |

DTS, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Tessera® (TSRA) to Acquire DTS® (DTSI) September 20, 2016

SAFE Harbor Forward-Looking Statements This material or any statements incorporated by reference herein, including, for example, the expected date of closing of the transaction and the potential benefits of the transaction, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on DTS’ current expectations, estimates and projections about its business and industry, management’s beliefs and certain assumptions made by Tessera and DTS, all of which are subject to change. In addition, forward-looking statements also consist of statements involving trend analyses and statements including such words as “will,” “may,” “anticipate,” “believe,” “could,” “would,” “might,” “potentially,” “estimate,” “continue,” “plan,” “expect,” “intend,” and similar expressions or the negative of these terms or other comparable terminology that convey uncertainty of future events or outcomes are intended to identify forward-looking statements. All forward-looking statements address matters that involve risks and uncertainties, many of which are beyond our control, and are not guarantees of future results. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements and caution must be exercised in relying on forward-looking statements. We believe that these factors include, but are not limited to, the following: (i) uncertainty as to whether DTS will be able to enter into or consummate the proposed transaction and the timing to consummate the proposed transaction; (ii) uncertainty as to the long-term value of DTS; (iii) the ability and timing to obtain required regulatory approvals and satisfy or waive other closing conditions; (iv) unpredictability and severity of natural disasters; (v) the outcome of any legal proceedings that may be instituted in connection with the transaction; (vi) that there may be a material adverse change affecting DTS or Tessera, or the respective businesses of DTS or Tessera may suffer as a result of uncertainty surrounding the transaction; (vii) intense competition from a number of sources; (vii) future regulations and policies affecting Tessera’s and DTS’s businesses; (viii) general economic and market conditions; (ix) the evolving legal, regulatory and tax regimes under which we operate; (x) failure to receive the approval of the stockholders of DTS; and (xi) other developments in the markets Tessera and DTS operate, as well as management’s response to any of the aforementioned factors. This list of important factors is not intended to be exhaustive. Additional risks and factors are discussed in DTS’ Annual Report on Form 10-K for the year ended December 31, 2015, which was filed with the SEC on March 7, 2016, under the heading "Item 1A. Risk Factors" and in subsequent reports on Forms 10-Q and 8-K and other filings made with the SEC. DTS does not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

In connection with the proposed transaction, DTS will file a proxy statement with the SEC. Additionally, DTS will file other relevant materials with the SEC in connection with the proposed acquisition of DTS by Tessera pursuant to the terms of an Agreement and Plan of Merger by and among DTS, Tessera and the other parties thereto. The materials to be filed by DTS with the SEC may be obtained free of charge at the SEC’s web site at www.sec.gov. Investors and security holders of DTS are urged to read DTS’s proxy statement and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed transaction because they will contain important information about the transaction and the parties to the transaction. DTS, Tessera and their respective directors, executive officers and other members of their management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of DTS stockholders in connection with the proposed transaction. Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of certain of DTS’s executive officers and directors in the solicitation by reading DTS’ proxy statement for its 2016 annual meeting of stockholders and the proxy statement and other relevant materials filed with the SEC in connection with the transaction when they become available. Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of certain of Tessera’s executive officers and directors in the solicitation by reading Tessera’s proxy statement for its 2016 annual meeting of stockholders. Information concerning the interests of DTS’ participants in the solicitation, which may, in some cases, be different than those of DTS’ stockholders generally, will be set forth in the proxy statement relating to the transaction when it becomes available. Additional information regarding DTS directors and executive officers is also included in DTS’ proxy statement for its 2016 annual meeting of stockholders. Additional Information and Where to Find It

Tessera to Acquire DTS Compelling Rationale and Value Proposition New Strategic Platform and Combined Company Profile Transaction Highlights Who is Tessera? Note on Sharing Information Next Steps Q&A agenda

TESSERA TO ACQUIRE DTS Why?

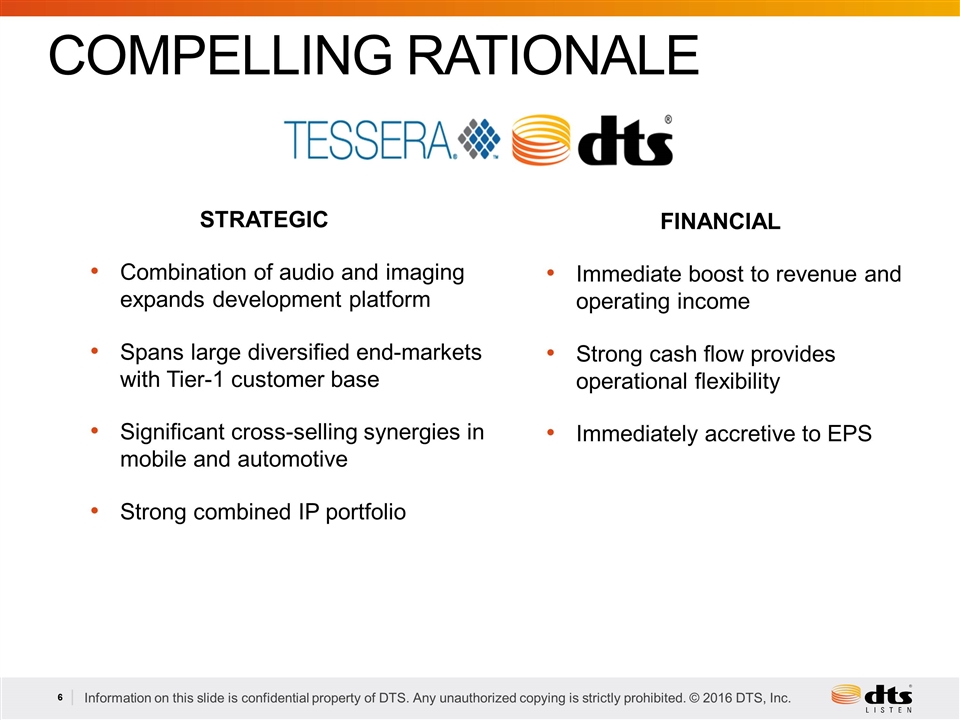

STRATEGIC Combination of audio and imaging expands development platform Spans large diversified end-markets with Tier-1 customer base Significant cross-selling synergies in mobile and automotive Strong combined IP portfolio FINANCIAL Immediate boost to revenue and operating income Strong cash flow provides operational flexibility Immediately accretive to EPS Compelling rationale

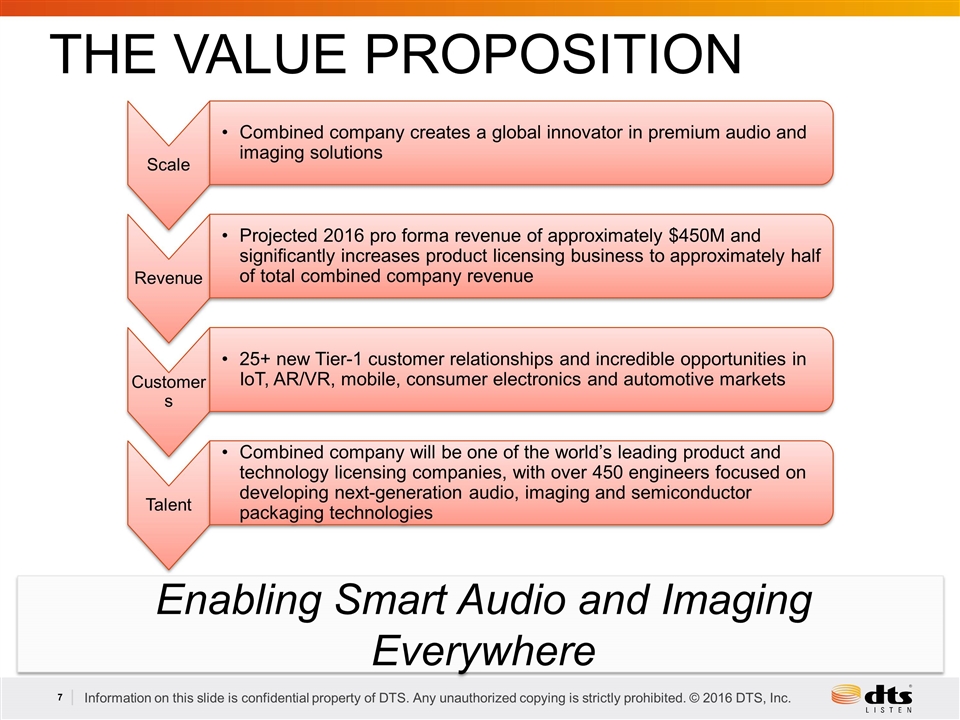

THE VALUE PROPOSITION Scale Combined company creates a global innovator in premium audio and imaging solutions Revenue Projected 2016 pro forma revenue of approximately $450M and significantly increases product licensing business to approximately half of total combined company revenue Customers 25+ new Tier-1 customer relationships and incredible opportunities in IoT, AR/VR, mobile, consumer electronics and automotive markets Talent Combined company will be one of the world’s leading product and technology licensing companies, with over 450 engineers focused on developing next-generation audio, imaging and semiconductor packaging technologies Enabling Smart Audio and Imaging Everywhere

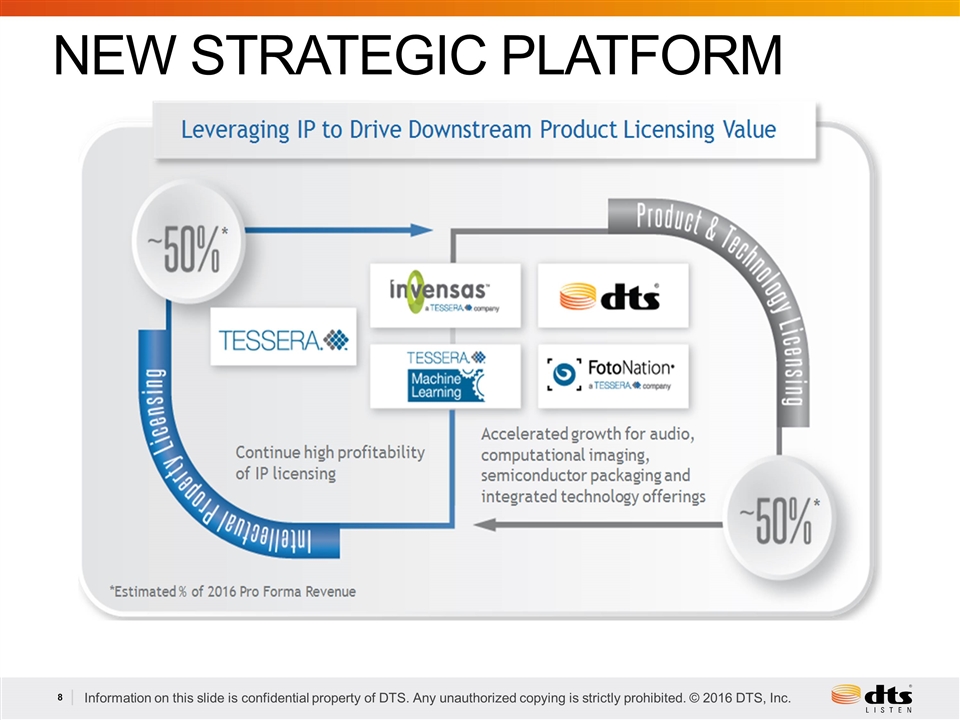

New Strategic Platform

DTS’ innovative audio solutions include, among others, DTS-HD®, DTS:X™, DTS Headphone:X®, DTS Play-Fi® and HD Radio™ Tessera’s world-class FotoNation®, Invensas and intellectual property businesses, which have developed and licensed technologies that ship globally in billions of devices A major technology presence in the consumer electronics, mobile, automotive and semiconductor markets A superior R&D team made up of over 450 imaging, audio and semiconductor packaging engineers Significant sales channel leverage with immediate mobile and automotive customer cross-selling opportunities Combined company profile

Transaction highlights

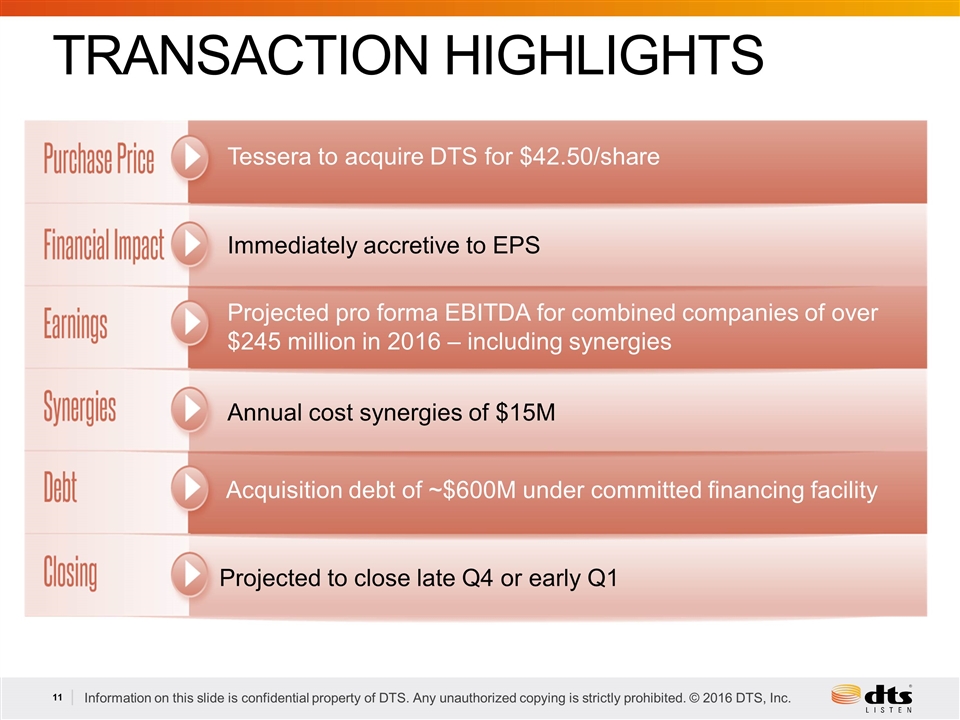

Transaction highlights Tessera to acquire DTS for $42.50/share Projected pro forma EBITDA for combined companies of over $245 million in 2016 – including synergies Immediately accretive to EPS Annual cost synergies of $15M Acquisition debt of ~$600M under committed financing facility Projected to close late Q4 or early Q1

Who is Tessera?

Mission: Invent, develop, and commercialize electronic interconnect, imaging, and learning technologies to enable efficient, intelligent devices everywhere. Tessera has a global employee base of over 250, of which approximately 200 hold graduate-level science or engineering degrees.

Creates, develops and licenses innovative computational imaging, computer vision, and semiconductor packaging and interconnect technologies Innovates and delivers the next generation of computational imaging algorithms Develops and licenses advanced semiconductor packaging and 3D interconnect solutions that enable the next generation of electronics products to be smaller, faster, lower power and contain more functionality Tessera Profile

Who is Tom Lacey? Tom Lacey is the company’s chief executive officer and member of its board of directors Previous Roles: Tom has held a variety of roles, including Chairman and CEO of Components Direct; president, CEO and a director of Phoenix Technologies Ltd.; president of Intel Americas and vice president and general manager of Intel’s Flash business unit Tom currently serves on the board of directors of publicly traded DSP Group, Inc., where he is the chairman of the audit committee Tom holds a B.A. in computer science from the University of California, Berkeley, and an MBA from the Leavey School of Business at Santa Clara University CEO, Tessera Technologies “Our acquisition of DTS’s talented team and industry-leading products will represent a transformational step in the execution of Tessera’s strategic vision, with exciting new product development and marketing opportunities.“

Please forward all inquiries directly to Geri Weinfeld Do not post anything regarding this transaction on social media Antitrust laws apply to companies and their communication/interaction with one another The type and amount of information can be exchanged or share is limited until the transaction is closed Employees should not share DTS’s confidential and proprietary information or communicate directly with employees of Tessera Consult with Blake Welcher, General Counsel, who will work with the business leaders to determine what, if any, response is appropriate A Note on Sharing Information

The transaction has been unanimously approved by both companies’ respective Boards of Directors Closing of the transaction is expected by December of 2016 or during the first quarter of 2017, and is subject to regulatory approval as well as the approval of DTS’s stockholders It’s business as usual for both companies DTS management will support the change process Additional information will be forthcoming as we get it and as we can share it Any questions from vendors, customers, refer them to Geir Skaaden [email protected] What’s Next?

Q&A

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Forbes Magazine Recognizes RTI International As One Of The Best Employers For Diversity

- AM Best and IMCA to Host Marketing Leader Webinar Featuring Lisa Rowland of Berkley Select

- Gateway First Bank Receives National Certification by Banking Advocates as Offering a Safe, Affordable Personal Checking Account

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share