Form 497 GOLDMAN SACHS TRUST

Oakmark Units

Financial Square Treasury Solutions Fund

A Cash Management Vehicle for

Existing and Prospective Shareholders of

PROSPECTUS

December 29, 2020

Oakmark Funds

111 South Wacker Drive

Chicago, Illinois 60606-4319

Beginning on January 1, 2022, as permitted by

regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the

reports will be made available on Oakmark.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports

electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a

broker-dealer or bank) or, if you hold your shares directly with the Fund, by calling 1-800-OAKMARK (625-6275) or visiting Oakmark.com.

You may elect to receive all future reports in paper

free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you hold your shares directly with the Fund, you can

call 1-800-OAKMARK (625-6275) to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds you hold directly or all funds you hold through your

financial intermediary, as applicable.

Prospectus

THE SECURITIES AND EXCHANGE

COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| AN INVESTMENT IN THE FUND IS NOT A BANK DEPOSIT AND IS NOT INSURED OR GUARANTEED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY OTHER GOVERNMENT AGENCY. |

Table of Contents

Financial Square Treasury Solutions Fund—Summary

| Investment Objective |

The Financial

Square Treasury Solutions Fund (the “Fund”) seeks to maximize current income to the extent consistent with the preservation of capital and the maintenance of liquidity by investing exclusively in high quality money market

instruments.

| Fees and Expenses of the Fund |

This table describes the fees and expenses that you

may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below.

Shareholder Fees

(fees paid directly from your investment)

| Treasury

Solutions Fund | |

| Maximum Sales Charge (Load) Imposed on Purchases | None |

| Maximum Deferred Sales Charge (Load) | None |

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends | None |

| Redemption Fees | None |

| Exchange Fees | None |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your

investment)

| Management Fees | 0.18% |

| Other Expenses | 0.27% |

| Administration Fees | 0.25% |

| All Other Expenses | 0.02% |

| Total Annual Fund Operating Expenses | 0.45% |

| Expense Example |

This Example is

intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in

Administration Shares (also referred to as “Oakmark Units”) of the Fund for the time periods indicated and then redeem all of your Administration Shares at the end of those periods. The Example also assumes that your investment has a 5%

return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Administration Shares | $46 | $144 | $252 | $567 |

| Principal Strategy |

The Fund pursues

its investment objective by investing only in U.S. Treasury Obligations, which include securities issued or guaran- teed by the U.S. Treasury where the payment of principal and interest is backed by the full faith and credit of the U.S. government

(“U.S. Treasury Obligations”), and repurchase agreements with the Federal Reserve Bank of New York collateralized by U.S. Treasury Obligations.

The Fund intends to be a “government money

market fund,” as such term is defined in or interpreted under Rule 2a-7 under the Investment Company Act of 1940, as amended (“Investment Company Act”). “Government money market funds” are money market funds that invest

at least 99.5% of their total assets in cash, securities issued or guaranteed by the United States or certain U.S. government agencies or instrumentalities (“U.S. Government Securities”), and/or repurchase agreements that are

collateralized fully by

1

cash or U.S.

Government Securities. “Government money market funds” are exempt from requirements that permit money market funds to impose a “liquidity fee” and/or “redemption gate” that temporarily restricts redemptions. As a

“government money market fund,” the Fund values its securities using the amortized cost method. The Fund seeks to maintain a stable net asset value (“NAV”) of $1.00 per share.

Under Rule 2a-7, the Fund may invest only in U.S.

dollar-denominated securities that meet certain risk-limiting conditions relating to portfolio quality, maturity and liquidity.

| Principal Risks of the Fund |

You could

lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the

Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at

any time. The Fund should not be relied upon as a complete investment program. There can be no assurance that the Fund will achieve its investment objective. The Fund's principal risks are presented below in alphabetical order, and not in the order

of importance or potential exposure.

Credit/Default Risk. An issuer or guarantor of a security held by the Fund, or a bank or other financial institution that has entered into a repurchase agreement with the Fund, may default on its obligation to pay

interest and repay principal or default on any other obligation. Additionally, the credit quality of securities may deteriorate rapidly, which may impair the Fund’s liquidity and cause significant deterioration in NAV.

Interest Rate Risk. When interest rates increase, the Fund’s yield will tend to be lower than prevailing market rates, and the market value of its investments will generally decline. The risks associated with

changing interest rates may have unpredictable effects on the markets and the Fund’s investments. A low or negative interest rate environment poses additional risks to the Fund, because low or negative yields on the Fund’s portfolio

holdings may have an adverse impact on the Fund’s ability to provide a positive yield to its shareholders, pay expenses out of current income, or, at times, maintain a stable $1.00 share price and/or achieve its investment objective.

Fluctuations in interest rates may also affect the liquidity of the Fund’s investments.

Large Shareholder Transactions Risk. The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions, which may occur rapidly or

unexpectedly, may cause the Fund to sell portfolio securities at times when it would not otherwise do so, which may negatively impact the Fund's NAV and liquidity. Similarly, large Fund share purchases may adversely affect

the Fund's performance to the extent that the Fund is delayed in investing new cash or otherwise maintains a larger cash position than it ordinarily would. These transactions may also accelerate the realization of taxable income to

shareholders if such sales of investments resulted in gains, and may also increase transaction costs. In addition, a large redemption could result in the Fund's current expenses being allocated over a smaller asset base, leading to an

increase in the Fund's expense ratio.

Liquidity Risk.

The Fund may make investments that are illiquid or that may become less liquid in response to market developments or adverse investor perceptions. Illiquid investments may be more difficult

to value. The liquidity of portfolio securities can deteriorate rapidly due to credit events affecting issuers or guarantors, such as a credit rating downgrade, or due to general market conditions or a lack of willing buyers. An inability to sell

one or more portfolio positions, or selling such positions at an unfavorable time and/or under unfavorable conditions, can adversely affect the Fund’s ability to maintain a stable $1.00 share price. Liquidity risk may also refer to the risk

that the Fund will not be able to pay redemption proceeds within the allowable time period because of unusual market conditions, an unusually high volume of redemption requests, or other reasons. Liquidity risk may be the result of, among other

things, the reduced number and capacity of traditional market participants to make a market in fixed income securities or the lack of an active market. The potential for liquidity risk may be magnified by a rising interest rate environment or other

circumstances where investor redemptions from money market and other fixed income mutual funds may be higher than normal, potentially causing increased supply in the market due to selling activity.

Market Risk. The market value of the securities in which the Fund invests may go up or down in response to the prospects of governments and/or general economic conditions throughout the world due to increasingly

interconnected global economies and financial markets. Events such as war, acts of terrorism, social unrest, natural disasters, the spread of infectious illness or other public health threats could also significantly impact the Fund and its

investments.

Stable NAV Risk. The Fund may not be able to maintain a stable $1.00 share price at all times. If any money market fund that intends to maintain a stable NAV fails to do so (or if there is a perceived threat of

such a failure), other such money market funds, including the Fund, could be subject to increased redemption activity, which could adversely affect the Fund’s NAV. Shareholders of the Fund should not rely on or expect the Investment Adviser or

an affiliate to purchase distressed assets from the Fund, make capital infusions into the Fund, enter into capital support agreements with the Fund or take other actions to help the Fund maintain a stable $1.00 share price.

2

| Performance |

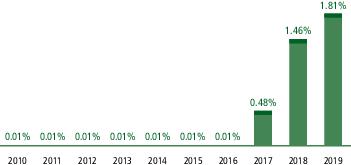

The bar chart and table

below provide an indication of the risks of investing in the Fund by showing: (a) changes in the performance of the Fund’s Administration Shares from year to year; and (b) the average annual total returns of the Fund’s Administration

Shares. The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. Performance reflects fee waivers and/or expense limitations in effect during the periods shown. Updated performance information is

available at no cost at www.gsamfunds.com/performance or by calling 1-800-OAKMARK (625-6275).

CALENDAR YEAR

The

total return illustrated in the table above for the 9-month period ended September 30, 2020 was 0.27%.

| During the periods shown in the chart above: | Returns | Quarter ended |

| Best Quarter Return | 0.50% | June 30, 2019 |

| Worst Quarter Return | 0.00% | June 30, 2016 |

| AVERAGE ANNUAL TOTAL RETURN |

| For the period ended December 31, 2019 | 1 Year | 5 Years | 10 Years |

| Administration Shares (Inception 4/1/1997) | 1.81% | 0.75% | 0.38% |

| Portfolio Management |

Goldman Sachs

Asset Management, L.P. is the investment adviser for the Fund (the “Investment Adviser” or “GSAM”).

| Buying and Selling Fund Shares |

Administration Shares of the Fund designated as

Oakmark Units (“Oakmark Units”) may only be purchased through Harris Associates L.P. (“Harris Associates”), in its capacity as an intermediary that has a relationship with Goldman Sachs & Co. LLC (“Goldman

Sachs”) (“Intermediary”) and has agreed to provide account administration services to its customers who are the beneficial owners of the Oakmark Units. Harris Associates is not the distributor of the Fund. The minimum initial

investment requirement for Oakmark Units is generally $1,000. You may purchase and redeem (sell) Oakmark Units of the Fund on any business day through Harris Associates.

| Tax Information |

The

Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Investments made through

tax-deferred arrangements may become taxable upon withdrawal from such arrangements.

| Payments

to Broker-Dealers and Other Financial Intermediaries |

If you purchase the Fund through an Intermediary,

the Fund and/or its related companies may pay the Intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the Intermediary and your salesperson to recommend the Fund over another

investment. Ask your salesperson or visit your Intermediary’s website for more information.

3

Investment Management Approach

| INVESTMENT OBJECTIVE |

The Fund seeks

to maximize current income to the extent consistent with the preservation of capital and the maintenance of liquidity by investing exclusively in high quality money market instruments.

The investment objective of the Fund cannot be

changed without approval of a majority of the outstanding shares of the Fund.

| PRINCIPAL INVESTMENT STRATEGIES |

The

Fund pursues its investment objective by investing only in U.S. Treasury Obligations and repurchase agreements with the Federal Reserve Bank of New York collateralized by U.S. Treasury Obligations. Shareholders will be provided with sixty

days’ notice in the manner prescribed by the Securities and Exchange Commission (“SEC”) before any change in the Fund’s policy to invest at least 80% of its net assets plus any borrowings for investment purposes (measured at

the time of investment) in the particular type of investment suggested by its name.

Under normal circumstances, the cash positions of the

Fund will not exceed 20% of the Fund’s net assets plus any borrowings for investment purposes (measured at the time of investment). The Fund may hold uninvested cash in lieu of appropriate money market instruments at the Fund’s custodian

bank under certain circumstances, including adverse market conditions or the prevailing interest rate environment, or when the Investment Adviser believes there is an insufficient supply of appropriate money market instruments in which to invest, or

in the case of unusually large cash inflows, anticipated redemptions or pending investments. The Fund may earn custodial credits or interest on these cash positions. However, these cash positions may not produce income or may produce low income. As

a result, the Fund’s current yield may be adversely affected during such periods when cash is held uninvested. Cash positions may also subject the Fund to additional risks and costs, such as increased exposure to the Fund’s custodian

bank and any fees imposed for large cash balances or for maintaining the Fund’s account at the custodian bank.

Goldman Sachs Money Market Team’s Investment

Philosophy:

Goldman Sachs Asset Management,

L.P. (“GSAM®”) serves as investment adviser to the Fund. GSAM is referred to in the Prospectus as the “Investment

Adviser.”

The Fund is managed to seek

preservation of capital, daily liquidity and maximum current income. The Investment Adviser follows a conservative, risk-managed investment process that seeks to:

| ■ | Manage credit risk |

| ■ | Manage interest rate risk |

| ■ | Manage liquidity |

INVESTMENT PROCESS

| 1. | Managing Credit Risk |

The Investment

Adviser’s process for managing credit risk emphasizes:

| ■ | Intensive research—The Credit Department, a separate operating entity of Goldman Sachs, approves all money market fund eligible securities for the Fund. Sources for the Credit Department’s analysis include third-party inputs, such as financial statements and media sources, ratings releases and company meetings, as well as the Investment Research, Legal and Compliance departments of Goldman Sachs. |

| ■ | Timely updates—A Credit Department-approved list of securities is continuously communicated on a “real-time” basis to the portfolio management team via computer link. |

The Result: An

“approved” list of high-quality credits—The Investment Adviser’s portfolio management team uses this approved list to construct portfolio which offers the best available

risk-return trade-off within the “approved” credit universe. If a security is removed from the “approved” list, the Investment Adviser may not purchase that security for the Fund, although it is not required to sell that

security.

4

Investment Management

Approach

| 2. | Managing Interest Rate Risk |

Three main steps

are followed in seeking to manage interest rate risk:

| ■ | Establish weighted average maturity (“WAM”) and weighted average life (“WAL”) targets—WAM (the weighted average time until the yield of a portfolio reflects any changes in the current interest rate environment) and WAL (designed to more accurately measure “spread risk”) are constantly revisited and adjusted as market conditions change. An overall strategy is developed by the Investment Adviser based on insights gained from weekly meetings with both Goldman Sachs economists and economists from outside the firm. |

| ■ | Implement optimum portfolio structure—Proprietary models that seek the optimum balance of risk and return, in conjunction with the Investment Adviser’s analysis of factors such as market events, short-term interest rates and the Fund’s asset volatility, are used to identify the most effective portfolio structure. |

| ■ | Conduct rigorous analysis of new securities—The Investment Adviser’s five-step process includes legal, credit, historical index and liquidity analysis, as well as price stress testing to determine the suitability of potential investments for the Fund. |

| 3. | Managing Liquidity |

Factors that the

Investment Adviser’s portfolio managers continuously monitor and that affect liquidity of a money market portfolio include:

| ■ | The Fund’s investors and other factors that influence the asset volatility of the Fund; |

| ■ | Technical events that influence the trading range of federal funds and other short-term fixed income markets; and |

| ■ | Bid-ask spreads associated with securities in the portfolio. |

Reference in the Prospectus to the Fund’s

benchmark is for informational purposes only, and unless otherwise noted is not an indication of how the Fund is managed.

Additional Fund Characteristics and Restrictions

| ■ | The Fund: The Fund will use the amortized cost method of valuation, as permitted by Rule 2a-7 under the Investment Company Act, to seek to maintain a stable NAV of $1.00 per share. Under Rule 2a-7, the Fund may invest only in U.S. dollar-denominated securities that are either (i) U.S. Government Securities, (ii) issued by other investment companies that are money market funds, or (iii) determined by the Investment Adviser to present minimal credit risks to the Fund. Permissible investments must also meet certain risk-limiting conditions relating to portfolio maturity, diversification, and liquidity. These operating policies may be more restrictive than the fundamental policies set forth in the Statement of Additional Information (the “SAI”). In order to maintain a rating from a rating organization, the Fund may be subject to additional investment restrictions. |

| ■ | The Investors: The Fund is generally designed for investors seeking a higher rate of return and convenient liquidation privileges. In addition, the Fund is designed for investors seeking a stable NAV per share. The Fund is particularly suitable for banks, corporations and other financial institutions that seek investment of short-term funds for their own accounts or for the accounts of their customers. |

| ■ | Investment Restrictions: The Fund is subject to certain investment restrictions that are described in detail under “Investment Restrictions” in the SAI. Fundamental investment restrictions and the investment objective of the Fund cannot be changed without approval of a majority of the outstanding units of the Fund. All investment objectives and policies not specifically designated as fundamental are non-fundamental and may be changed by the Board of Trustees without unitholder approval. |

| ■ | Maximum Remaining Maturity of Portfolio Investments: 13 months (as determined pursuant to Rule 2a-7) at the time of purchase. |

| ■ | Dollar-Weighted Average Portfolio Maturity: Not more than 60 days (as required by Rule 2a-7). |

| ■ | Dollar-Weighted Average Portfolio Life: Not more than 120 days (as required by Rule 2a-7). |

| ■ | Portfolio Diversification: Diversification can help the Fund reduce the risks of investing. In accordance with Rule 2a-7, the Fund may not invest more than 5% of the value of its total assets at the time of purchase in the securities of any single issuer and certain affiliates of that issuer. However, the Fund may invest up to 25% of the value of its total assets in the securities of a single issuer for up to three business days. These limitations do not apply to cash, certain repurchase agreements, U.S. Government Securities or securities of other investment companies that are money market funds. Securities subject to demand features and guarantees are subject to additional diversification requirements as described in the SAI. |

| ■ | Portfolio Liquidity: The Fund is required to maintain a sufficient degree of liquidity necessary to meet reasonably foreseeable redemption requests. In addition, the Fund must hold at least 10% of its total assets in “daily liquid assets” and 30% of its total assets in “weekly liquid assets”. For these purposes, daily and weekly liquid assets are calculated as of the end of each business day. Daily liquid assets generally include: (a) cash; (b) direct obligations of the U.S. Government; (c) securities that will mature or are subject to a demand feature that is exercisable and payable within one business day; or (d) amounts receivable and due unconditionally within one business day on pending sales of portfolio securities. Weekly liquid assets generally include: (a) cash; (b) direct obligations of the U.S. Government; (c) certain U.S. Government agency discount notes with remaining maturities of 60 days or less; (d) securities that will mature or are subject to a demand feature that is exercisable and payable within five business |

5

| days; or (e) amounts receivable and due unconditionally within five business days on pending sales of portfolio securities. In addition, the Fund may not acquire an illiquid security if, after the purchase, more than 5% of the Fund’s total assets would consist of illiquid assets. |

| INVESTMENT PRACTICES AND SECURITIES |

Although the Fund’s principal investment

strategies are described in the Summary—Principal Strategy section of the Prospectus, the following table identifies some of the investment techniques that may (but are not required to) be used by the Fund in seeking to achieve its investment

objective. Numbers in the table show allowable usage only; for actual usage, consult the Fund’s annual/ semi-annual report. For more information about these and other investment practices and securities, see Appendix A.

The Fund publishes on its website

(http://www.gsamfunds.com) the following:

| ■ | A schedule of its portfolio holdings (and certain related information as required by Rule 2a-7, including the Fund’s WAM and WAL) as of the last business day of each month, no later than five business days after the end of the prior month. This information will be available on the Fund’s website for at least six months. |

| ■ | A schedule of its portfolio holdings on a weekly basis, with no lag required between the date of the information and the date on which the information is disclosed. This weekly holdings information will be available on the website until the next publish date. |

| ■ | A link to an SEC website where you may obtain the Fund’s most recent 12 months of publicly available portfolio holdings information, as filed with the SEC on Form N-MFP no later than five business days after the end of each month. |

| ■ | A graph depicting the Fund’s daily and weekly liquid assets and daily net inflows and outflows as of each business day for the preceding six months, as of the end of the preceding business day. |

| ■ | A graph depicting the Fund’s current market-based NAV per share (rounded to the fourth decimal place), as of each business day for the preceding six months, as of the end of the preceding business day. The Fund’s current market-based NAV is based on available market quotations of the Fund’s portfolio securities as provided by a third party pricing vendor or broker on the preceding business day. The mark-to-market valuation methodology includes marking to market all securities of the Fund, including securities with remaining maturities of 60 days or less. This market value NAV report is for informational purposes only with respect to the Fund, which seeks to maintain a stable NAV of $1.00 per share based on the amortized cost method of valuation. |

| ■ | In the event that the Fund files information regarding certain material events with the SEC on Form N-CR, the Fund will disclose on its website certain information that the Fund is required to report on Form N-CR. Such material events include the provision of any financial support by an affiliated person of the Fund or a decline in weekly liquid assets below 10% of the Fund’s total assets. This information will appear on the Fund’s website no later than the same business day on which the Fund files Form N-CR with the SEC and will be available on the Fund’s website for at least one year. |

In addition, certain portfolio statistics (other than

portfolio holdings information) are available on a daily basis by calling 1-800-621-2550. A description of the Fund’s policies and procedures with respect to the disclosure of the Fund’s portfolio holdings is available in the

Fund’s SAI.

6

Investment Policies Matrix

| Treasury Solutions Fund | |

| U.S. Treasury Obligations1 | ■ |

| Repurchase Agreements | ■ 2 |

| Credit Quality | First Tier3 |

| Summary of Taxation for Distributions4 | Taxable federal and state.5 |

| Miscellaneous | Reverse repurchase agreements (i.e., where the Fund is the borrower of cash) not permitted. |

Note: See Appendix A for a description of, and

certain criteria applicable to, each of these categories of investments.

| 1 | Issued or guaranteed by the U.S. Treasury. |

| 2 | The Fund may only enter into repurchase agreements with the Federal Reserve Bank of New York. |

| 3 | First Tier Securities are (a) securities rated in the highest short-term rating category by at least two NRSROs, or if only one NRSRO has assigned a rating, by that NRSRO; (b) securities issued or guaranteed by, or otherwise allow the Fund under certain conditions to demand payment from, an entity with such ratings; or (c) securities subject to repurchase agreements that are collateralized by First Tier Securities. U.S. Government Securities are considered First Tier Securities. Securities without short-term ratings may be purchased if they are deemed to be of comparable quality by the Investment Adviser to First Tier Securities. In addition, the Fund may generally rely on the credit quality of the guarantee or demand feature in determining the credit quality of a security supported by a guarantee or demand feature. |

| 4 | See “Taxation” for an explanation of the tax consequences summarized in the table above. |

| 5 | Taxable in many states except for interest income distributions from U.S. Treasury Obligations and certain U.S. Government Securities. |

7

Risks of the Fund

You could lose money by investing in the Fund (which,

for the remainder of this Prospectus, refers to one or more of the Funds offered in this Prospectus). An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other

government agency. The principal risks of the Fund are discussed in the Summary section of the Prospectus. The following section provides additional information on the risks that apply to the Fund, which may result in a loss of your investment. The

risks applicable to the Fund are presented below in alphabetical order, and not in the order of importance or potential exposure. The Fund should not be relied upon as a complete investment program. There can be no assurance that the Fund will

achieve its investment objective.

| ✓ Principal

Risk • Additional Risk |

Treasury

Solutions Fund |

| Credit/Default | ✓ |

| Floating and Variable Rate Obligations | • |

| Interest Rate | ✓ |

| Large Shareholder Transactions | ✓ |

| Liquidity | ✓ |

| Management | • |

| Market | ✓ |

| Stable NAV | ✓ |

| ■ | Credit/Default Risk—An issuer or guarantor of a security held by the Fund, or a bank or other financial institution that has entered into a repurchase agreement with the Fund, may default on its obligation to pay interest and repay principal or default on any other obligation. Even if such an entity does not default on a payment, an instrument’s value may decline if the market believes that the entity has become less able or willing to make timely payments. The credit quality of the Fund’s portfolio securities or instruments may meet the Fund’s credit quality requirements at the time of purchase but then deteriorate thereafter, and such a deterioration can occur rapidly. In certain instances, the downgrading or default of a single holding or guarantor of the Fund’s holdings may impair the Fund’s liquidity and have the potential to cause significant NAV deterioration. |

| ■ | Floating and Variable Rate Obligations Risk—Floating rate and variable rate obligations are debt instruments issued by companies or other entities with interest rates that reset periodically (typically, daily, monthly, quarterly, or semi-annually) in response to changes in the market rate of interest on which the interest rate is based. For floating and variable rate obligations, there may be a lag between an actual change in the underlying interest rate benchmark and the reset time for an interest payment of such an obligation, which could harm or benefit the Fund, depending on the interest rate environment or other circumstances. In a rising interest rate environment, for example, a floating or variable rate obligation that does not reset immediately would prevent the Fund from taking full advantage of rising interest rates in a timely manner. However, in a declining interest rate environment, the Fund may benefit from a lag due to an obligation’s interest rate payment not being immediately impacted by a decline in interest rates. |

| Certain floating and variable rate obligations have an interest rate floor feature, which prevents the interest rate payable by the security from dropping below a specified level as compared to a reference interest rate (the “reference rate”), such as LIBOR. Such a floor protects the Fund from losses resulting from a decrease in the reference rate below the specified level. However, if the reference rate is below the floor, there will be a lag between a rise in the reference rate and a rise in the interest rate payable by the obligation, and the Fund may not benefit from increasing interest rates for a significant amount of time. | |

| The London InterBank Offered Rate (“LIBOR”) is the average interest rate at which a selection of large global banks borrow from one another, and has been widely used as a benchmark rate for adjustments to floating and variable rate obligations. In 2017, the United Kingdom’s Financial Conduct Authority (“FCA”) warned that LIBOR may cease to be available or appropriate for use by 2021. The unavailability or replacement of LIBOR may affect the value, liquidity or return on certain Fund investments and may result in costs incurred in connection with closing out positions and entering into new trades. Any pricing adjustments to the Fund’s investments resulting from a substitute reference rate may adversely affect the Fund’s performance and/or NAV. | |

| ■ | Interest Rate Risk—During periods of rising interest rates, the Fund’s yield (and the market value of its investments) will tend to be lower than prevailing market rates; in periods of falling interest rates, the Fund’s yield will tend to be higher. The risks associated with changing interest rates may have unpredictable effects on the markets and the Fund’s investments. A low interest rate environment poses additional risks to the Fund, which are heightened in a very low or negative interest rate environment. Low or negative interest rates may continue for the foreseeable future. Low or negative yields on the Fund’s portfolio holdings may have an adverse impact on the Fund’s ability to provide a positive yield to its shareholders, pay expenses out of current income, or, at times, |

8

Risks of the Fund

| maintain a stable $1.00 share price or minimize the volatility of the Fund’s NAV per share, as applicable, and/or achieve its investment objective. A wide variety of market factors can cause interest rates to rise or fall, including central bank monetary policy, inflationary or deflationary pressures and changes in general market and economic conditions. Fluctuations in interest rates may also affect the liquidity of the Fund’s investments. | |

| Interest rates in the United States are currently at historically low levels. Certain countries have experienced negative interest rates on certain fixed-income instruments. Very low or negative interest rates may magnify interest rate risk. Changing interest rates, including rates that fall below zero, may have unpredictable effects on markets, may result in heightened market volatility and may detract from Fund performance to the extent the Fund is exposed to such interest rates and/or volatility. | |

| ■ | Large Shareholder Transactions Risk—The Fund may experience adverse effects when certain large shareholders, such as other funds, institutional investors (including those trading by use of non-discretionary mathematical formulas), financial intermediaries (who may make investment decisions on behalf of underlying clients and/or include the Fund in their investment model), individuals, accounts and Goldman Sachs affiliates, purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions, which may occur rapidly or unexpectedly, may cause the Fund to sell portfolio securities at times when it would not otherwise do so, which may negatively impact the Fund’s NAV and liquidity. Similarly, large Fund share purchases may adversely affect the Fund’s performance to the extent that the Fund is delayed in investing new cash or otherwise maintains a larger cash position than it ordinarily would. These transactions may also accelerate the realization of taxable income to shareholders if such sales of investments resulted in gains, and may also increase transaction costs. In addition, a large redemption could result in the Fund’s current expenses being allocated over a smaller asset base, leading to an increase in the Fund’s expense ratio. |

| ■ | Liquidity Risk—The Fund may make investments that are illiquid or that may become less liquid in response to market developments or adverse investor perceptions. While the Fund endeavors to maintain a high level of liquidity in its portfolio, the liquidity of portfolio securities can deteriorate rapidly due to credit events affecting issuers or guarantors, such as a credit rating downgrade, or due to general market conditions and a lack of willing buyers. When there is no willing buyer and investments cannot be readily sold at the desired time or price, the Fund may have to accept a lower price or may not be able to sell the instrument at all. An inability to sell one or more portfolio positions can adversely affect the Fund’s ability to maintain a stable $1.00 share price or increase the volatility of the Fund’s NAV per share, as applicable, or prevent the Fund from being able to take advantage of other investment opportunities. Investments that are illiquid or that trade in lower volumes may be more difficult to value. |

| To the extent that the traditional dealer counterparties that engage in fixed income trading do not maintain inventories of bonds (which provide an important indication of their ability to “make markets”) that keep pace with the growth of the bond markets over time, relatively low levels of dealer inventories could lead to decreased liquidity and increased volatility in the fixed income markets. Additionally, market participants other than the Fund may attempt to sell fixed income holdings at the same time as the Fund, which could cause downward pricing pressure and contribute to illiquidity. | |

| Liquidity risk may also refer to the risk that the Fund will not be able to pay redemption proceeds within the allowable time period because of unusual market conditions, an unusually high volume of redemption requests, or other reasons. While the Fund reserves the right to meet redemption requests through in-kind distributions, the Fund may instead choose to raise cash to meet redemption requests through sales of portfolio securities or permissible borrowings. If the Fund is forced to sell securities at an unfavorable time and/or under unfavorable conditions, such sales may adversely affect the Fund’s ability to maintain a stable $1.00 share price or minimize the volatility of the Fund’s NAV per share, as applicable. | |

| Certain shareholders, including clients or affiliates of the Investment Adviser and/or other funds managed by the Investment Adviser, may from time to time own or control a significant percentage of the Fund’s shares. These shareholders may include, for example, institutional investors, funds of funds, discretionary advisory clients, and other shareholders whose buy-sell decisions are controlled by a single decision maker. Redemptions by these shareholders of their shares of the Fund, or a high volume of redemption requests generally, may further increase the Fund’s liquidity risk and may impact the Fund’s NAV. | |

| ■ | Management Risk—A strategy used by the Investment Adviser may fail to produce the intended results. |

| ■ | Market Risk—The value of the securities in which the Fund invests may go up or down in response to the prospects of individual companies, particular sectors or governments and/or general economic conditions throughout the world. Price changes may be temporary or last for extended periods. The Fund's investments may be overweighted from time to time in one or more sectors, which will increase the Fund's exposure to risk of loss from adverse developments affecting those sectors. |

| Global economies and financial markets are becoming increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market. Furthermore, local, regional and global events such as war, acts of terrorism, social unrest, natural disasters, the spread of infectious illness or other public health threats could also adversely impact issuers, markets and economies, including in ways that cannot necessarily be |

9

| foreseen. The Fund could be negatively impacted if the value of a portfolio holding were harmed by such political or economic conditions or events. In addition, governmental and quasi-governmental organizations have taken a number of unprecedented actions designed to support the markets. Such conditions, events and actions may result in greater market risk. | |

| ■ | Stable NAV Risk—The Fund may not be able to maintain a stable $1.00 share price at all times. If any money market fund that intends to maintain a stable NAV fails to do so (or if there is a perceived threat of such a failure), other such money market funds, including the Fund, could be subject to increased redemption activity, which could adversely affect the Fund’s NAV. The Fund may, among other things, reduce or withhold any income and/or gains generated from its investments to the extent necessary to maintain a stable $1.00 share price. Shareholders of the Fund should not rely on or expect the Investment Adviser or an affiliate to purchase distressed assets from the Fund, make capital infusions into the Fund, enter into capital support agreements with the Fund or take other actions to help the Fund maintain a stable $1.00 share price. |

More information about the Fund’s portfolio

securities and investment techniques, and their associated risks, is provided in Appendix A. You should consider the investment risks discussed in this section and in Appendix A. Both are important to your investment choice.

10

Service Providers

| INVESTMENT ADVISER |

GSAM has been

registered as an investment adviser with the SEC since 1990 and is an indirect, wholly-owned subsidiary of The Goldman Sachs Group, Inc. and an affiliate of Goldman Sachs. Founded in 1869, The Goldman Sachs Group, Inc. is a publicly-held financial

holding company and a leading global investment banking, securities and investment management firm. As of September 30, 2020, GSAM, including its investment advisory affiliates, had assets under supervision of approximately $1.6 trillion.

The Investment Adviser provides day-to-day advice

regarding the Fund’s portfolio transactions. The Investment Adviser makes the investment decisions for the Fund and places purchase and sale orders for the Fund’s portfolio transactions in U.S. and foreign markets. As permitted by

applicable law and exemptive relief obtained by the Investment Adviser, Goldman Sachs and the Fund, these orders may be directed to any broker-dealers, including Goldman Sachs and its affiliates. While the Investment Adviser is ultimately

responsible for the management of the Fund, it is able to draw upon the research and expertise of its asset management affiliates for portfolio decisions and management with respect to certain portfolio securities. In addition, the Investment

Adviser has access to the research and certain proprietary technical models developed by Goldman Sachs (subject to legal, internal, regulatory and Chinese Wall restrictions) and will apply quantitative and qualitative analysis in determining the

appropriate allocations among categories of issuers and types of securities.

The Investment Adviser also performs the following

additional services for the Fund (to the extent not performed by others pursuant to agreements with the Fund):

| ■ | Supervises all non-advisory operations of the Fund |

| ■ | Provides personnel to perform necessary executive, administrative and clerical services to the Fund |

| ■ | Arranges for the preparation of all required tax returns, reports to shareholders, prospectuses and statements of additional information and other reports filed with the SEC and other regulatory authorities |

| ■ | Maintains the records of the Fund |

| ■ | Provides office space and all necessary office equipment and services |

An investment in the Fund may be negatively impacted

because of the operational risks arising from factors such as processing errors and human errors, inadequate or failed internal or external processes, failures in systems and technology, changes in personnel, and errors caused by third-party service

providers or trading counterparties. Although the Fund attempts to minimize such failures through controls and oversight, it is not possible to identify all of the operational risks that may affect the Fund or to develop processes and controls that

completely eliminate or mitigate the occurrence of such failures. The Fund and its shareholders could be negatively impacted as a result.

Pursuant to SEC exemptive orders, the Fund may enter

into principal transactions in certain money market instruments, including repurchase agreements, with Goldman Sachs.

| MANAGEMENT FEES AND OTHER EXPENSE INFORMATION |

As compensation for its services and its assumption

of certain expenses, the Investment Adviser is entitled to the following fees, computed daily and payable monthly, at the annual rate listed below (as a percentage of the Fund’s average daily net assets):

| Fund | Contractual

Rate |

Actual

Rate For the Fiscal Year Ended August 31, 2020* |

| Treasury Solutions | 0.18% | 0.18% |

| * | The Actual Rate may not correlate to the Contractual Rate as a result of management fee waivers that may be in effect from time to time. |

The Investment Adviser may waive a portion of its

management fee, including fees earned as the Investment Adviser to any of the affiliated funds in which the Fund invests, from time to time, and may discontinue or modify any such waivers in the future, consistent with the terms of any fee waiver

arrangements in place. The Investment Adviser may voluntarily waive a portion of its management fees, and this fee waiver may exceed what is stipulated in any fee waiver arrangement. This temporary waiver may be modified or terminated at any time at

the option of the Investment Adviser, without shareholder approval.

The Investment Adviser has agreed to reduce or limit

the Fund’s “Other Expenses” (excluding acquired fund fees and expenses, administration fees, transfer agency fees and expenses, taxes, interest, brokerage fees, expenses of shareholder meetings, litigation and indemnification, and

extraordinary expenses) equal on an annualized basis to [0.014%] of the Fund’s average daily net assets through at least December 29, 2021, and prior to such date the Investment Adviser may not terminate this expense limitation

arrangement

11

without the approval

of the Board of Trustees. The expense limitation arrangement may be modified or terminated at any time at the option of the Investment Adviser without shareholder approval after such date, although the Investment Adviser does not presently intend to

do so. The Fund’s “Other Expenses” may be further reduced by any custody and transfer agency fee credits received by the Fund.

A discussion regarding the basis for the Board of

Trustees’ approval of the Management Agreement for the Fund in 2020 is available in the Fund's Annual Report dated August 31, 2020.

| DISTRIBUTOR AND TRANSFER AGENT |

Goldman Sachs, 200 West Street, New York, NY 10282,

serves as the exclusive distributor (the “Distributor”) of the Fund’s units. Goldman Sachs, 71 S. Wacker Drive, Chicago, IL 60606, also serves as the Fund’s transfer agent (the “Transfer Agent”) and, as such,

performs various unitholder servicing functions.

For its transfer agency services, Goldman Sachs is

entitled to receive a transfer agency fee equal, on an annualized basis, to 0.01% of average daily net assets of the Fund. Goldman Sachs may voluntarily agree to waive all or a portion of the Fund’s transfer agency fees. This temporary waiver

may be modified or terminated at any time at the option of Goldman Sachs, without shareholder approval.

From time to time, Goldman Sachs or any of its

affiliates may purchase and hold units of the Fund. Goldman Sachs and its affiliates reserve the right to redeem at any time some or all of the units acquired for their own account.

| ACTIVITIES

OF GOLDMAN SACHS AND ITS AFFILIATES AND OTHER ACCOUNTS MANAGED BY GOLDMAN SACHS |

The involvement of the Investment Adviser, Goldman

Sachs and their affiliates in the management of, or their interest in, other accounts and other activities of Goldman Sachs will present conflicts of interest with respect to the Fund and will, under certain circumstances, limit the Fund’s

investment activities. Goldman Sachs is a worldwide, full service investment banking, broker dealer, asset management and financial services organization and a major participant in global financial markets that provides a wide range of financial

services to a substantial and diversified client base that includes corporations, financial institutions, governments and individuals. As such, it acts as a broker-dealer, investment adviser, investment banker, underwriter, research provider,

administrator, financier, adviser, market maker, trader, prime broker, derivatives dealer, clearing agent, lender, counterparty, agent, principal, distributor, investor or in other commercial capacities for accounts or companies or affiliated or

unaffiliated investment funds (including pooled investment vehicles and private funds) in which one or more accounts, including the Fund, invest. In those and other capacities, Goldman Sachs and its affiliates advise and deal with clients and third

parties in all markets and transactions and purchase, sell, hold and recommend a broad array of investments, including securities, derivatives, loans, commodities, currencies, credit default swaps, indices, baskets and other financial instruments

and products for their own accounts or for the accounts of their customers and have other direct and indirect interests in the global fixed income, currency, commodity, equities, bank loans and other markets in which the Fund may directly and

indirectly invest. Thus, it is expected that the Fund will have multiple business relationships with and will invest in, engage in transactions with, make voting decisions with respect to, or obtain services from entities for which Goldman Sachs and

its affiliates perform or seek to perform investment banking or other services. The Investment Adviser and/or certain of its affiliates are the managers of the Goldman Sachs Funds. The Investment Adviser and its affiliates earn fees from this and

other relationships with the Fund. Although management fees paid by the Fund to the Investment Adviser and certain other fees paid to the Investment Adviser’s affiliates are based on asset levels, the fees are not directly contingent on Fund

performance, and the Investment Adviser and its affiliates will still receive significant compensation from the Fund even if shareholders lose money. Goldman Sachs and its affiliates engage in proprietary trading and advise accounts and funds which

have investment objectives similar to those of the Fund and/or which engage in and compete for transactions in the same types of securities, currencies and instruments as the Fund. Goldman Sachs and its affiliates will not have any obligation to

make available any information regarding their proprietary activities or strategies, or the activities or strategies used for other accounts managed by them, for the benefit of the management of the Fund. The results of the Fund’s investment

activities, therefore, will likely differ from those of Goldman Sachs, its affiliates, and other accounts managed by Goldman Sachs, and it is possible that the Fund could sustain losses during periods in which Goldman Sachs and its affiliates and

other accounts achieve significant profits on their trading for Goldman Sachs or other accounts. In addition, the Fund may enter into transactions in which Goldman Sachs and its affiliates or their other clients have an adverse interest. For

example, the Fund may take a long position in a security at the same time that Goldman Sachs and its affiliates or other accounts managed by the Investment Adviser or its affiliates take a short position in the same security (or vice versa). These

and other transactions undertaken by Goldman Sachs, its affiliates or Goldman Sachs-advised clients may, individually or in the aggregate, adversely impact the Fund. Transactions by one or more Goldman Sachs-advised clients or the Investment Adviser

may have the effect of diluting or otherwise disadvantaging the values, prices or investment strategies of the Fund. The Fund’s activities will, under certain circumstances, be limited because of regulatory restrictions applicable to Goldman

Sachs and its affiliates, and/or their internal policies designed to comply with such restrictions. As a global financial services firm, Goldman Sachs and its affiliates also provide a wide range of investment banking and financial services to

issuers of securities and investors in securities. Goldman Sachs, its affiliates and others

12

Service Providers

associated with it are expected to create markets or specialize in,

have positions in and/or effect transactions in, securities of issuers held by the Fund, and will likely also perform or seek to perform investment banking and financial services for one or more of those issuers. Goldman Sachs and its affiliates are

expected to have business relationships with and purchase or distribute or sell services or products from or to distributors, consultants or others who recommend the Fund or who engage in transactions with or for the Fund. For more information about

conflicts of interest, see the section entitled “Potential Conflicts of Interest” in the SAI.

13

Distributions

All or substantially all of the Fund’s net

investment income will be declared as a dividend daily. Distributions will normally, but not always, be declared as of 3:00 p.m. Eastern Time as a dividend and distributed monthly. You may choose to have dividends and distributions paid in:

| ■ | Cash |

| ■ | Additional Oakmark Units of the Fund |

Special restrictions may apply. See the SAI.

You may indicate your election on your New Account

Registration Form. Any changes may be submitted in writing to Harris Associates at any time. If you do not indicate any choice, dividends and distributions will be reinvested automatically in the Fund.

The election to reinvest distributions in additional

shares will not affect the tax treatment of such distributions, which will be treated as received by you and then used to purchase shares.

Distributions will be reinvested as of the last

calendar day of each month. Cash distributions normally will be paid on or about the first business day of each month. Net short-term capital gains, if any, will be distributed in accordance with federal income tax requirements and may be reflected

in the Fund’s daily declared dividends. Net short-term capital gains may at times represent a significant component of the Fund’s daily declared dividends (e.g., during periods of extremely low interest rates). The Fund may distribute at

least annually other realized capital gains, if any, after reduction by available realized capital losses.

In order to avoid excessive fluctuations in the

amount of monthly capital gains distributions, the Fund may defer or accelerate the timing of the distributions of short-term capital gains (or any portion thereof). In addition, the Fund may reduce or withhold any income and/or realized gains

generated from its investments to the extent necessary to maintain a stable $1.00 share price.

The realized gains and losses are not expected to be

of an amount which would affect a Fund’s NAV of $1.00 per unit.

14

Unitholder Guide

The following section will provide you with answers

to some of the most frequently asked questions regarding buying and selling the Fund’s Oakmark Units.

| Eligibility to Buy Units |

Oakmark

Units are generally available for purchase only by residents of the U.S., Puerto Rico, Guam, and the U.S. Virgin Islands.

Types of Accounts

You may set up your account in any of the following

ways:

Individual or Joint Ownership. Individual accounts are owned by one person. Joint accounts can have two or more owners, and provide for rights of survivorship.

Gift or Transfer to a Minor (UGMA, UTMA). These gift or transfer accounts let you give money to a minor for any purpose. The gift is irrevocable and the minor gains control of the account once he/she reaches the age of majority. Your

application should include the minor’s social security number.

Trust for Established Employee Benefit or

Profit-Sharing Plan. The trust or plan must be established before you can open an account and you must include the date of establishment of the trust or plan on your application.

Business or Organization. You may invest money on behalf of a corporation, association, partnership or similar institution. You should include a resolution with your application that indicates which officers are

authorized to act on behalf of the entity.

Retirement. A qualified retirement account enables you to defer taxes on investment income and capital gains. Your contributions may be tax-deductible. For detailed information on the tax advantages and

consequences of investing in individual retirement accounts (IRAs) and retirement plan accounts, please consult your tax advisor. The types of IRAs available to you are: Traditional IRA, Roth IRA, Rollover IRA, SIMPLE IRA, SEP IRA, and Coverdell

Education Savings Account (CESA). For detailed information on these accounts, see the Oakmark IRA Booklet and Coverdell Education Savings Booklet.

Oakmark Units may be used as an investment in other

kinds of retirement plans, including, but not limited to, Keogh plans maintained by self-employed individuals or owner-employees, traditional pension plans, corporate profit-sharing and money purchase pension plans, section 403(b)(7) custodial

tax-deferred annuity plans, other plans maintained by tax-exempt organizations, cash balance plans and any and all other types of retirement plans. All of these accounts need to be established by the plan’s trustee and the plan’s trustee

should contact Harris Associates or its designee regarding the establishment of an investment relationship.

Investment Minimums

The Fund’s initial investment minimums

generally are set forth in the tables below. Once your account is open, subsequent investments may be made in any amount.

| Type of Account | Initial Investment |

| Regular investing account | $1,000 |

| Traditional or Roth IRA | 1,000 |

| SIMPLE

IRA |

Determined

on a case by case basis |

| Coverdell Education Savings Account | 500 |

| Account with an automatic investment plan or payroll deduction plan | 500 |

15

How Are Units

Priced?

The price you pay when you buy Oakmark

Units is the Fund’s next determined NAV per unit after the Transfer Agent (or an Authorized Institution, as defined below) has received and accepted your order in proper form. The price you receive when you sell Oakmark Units is the

Fund’s next determined NAV per unit after the Transfer Agent (or an Authorized Institution, as defined below) has received and accepted your order in proper form, with the redemption proceeds reduced by any applicable charges. The Fund

generally calculates NAV as follows:

| NAV = | (Value

of Assets of the Class) – (Liabilities of the Class) |

| Number of Outstanding Units of the Class |

The Fund seeks to maintain a stable NAV per unit of

$1.00 based on the amortized cost method of valuation. This method involves valuing an instrument at its cost and thereafter applying a constant amortization to maturity of any discount or premium, regardless of the impact of fluctuating interest

rates on the market value of the investment. Amortized cost will normally approximate market value. There can be no assurance that the Fund will be able at all times to maintain a stable NAV per unit of $1.00.

Please note the following with respect to the price

at which your transactions are processed:

| ■ | NAV per unit is generally calculated by the Fund’s accounting agent on each business day as of 3:00 p.m. Eastern Time. Units will also generally be priced periodically throughout the day by the Fund’s accounting agent for the purpose of fulfilling intraday purchase or redemption orders. Except as provided below, Fund units will be priced on any day the New York Stock Exchange is open, including days on which the Federal Reserve Bank is closed for local holidays (i.e., Columbus Day and Veterans Day). Oakmark Units will generally not be priced on any day the New York Stock Exchange is closed, although Oakmark Units may be priced on days when the New York Stock Exchange is closed if the Securities Industry and Financial Markets Association (“SIFMA”) recommends that the bond markets remain open for all or part of the day. |

| ■ | On any business day when the SIFMA recommends that the bond markets close early, the Fund reserves the right to close at or prior to the SIFMA recommended closing time. If the Fund does so, it will cease granting same business day credit for purchase and redemption orders received after the Fund’s closing time and credit will be given on the next business day. |

| ■ | The Trust reserves the right to advance the time by which purchase and redemption orders must be received for same business day credit as otherwise permitted by the SEC. |

Most money market securities settle on the same day

as they are traded and are required to be recorded and factored into the Fund’s NAV on the trade date (T). Investment transactions not settling on the same day as they are traded may be recorded and factored into the Fund’s first

scheduled NAV calculation on the business day following trade date (T+1), consistent with industry practice. The use of T+1 accounting generally does not, but may, result in a NAV that differs materially from the NAV that would result if all

transactions were reflected on their trade dates.

Note: The time at which transactions and units are

priced and the time by which orders must be received may be changed in case of an emergency or if regular trading on the New York Stock Exchange and/or the bond markets stopped at a time other than its regularly scheduled closing time. In the event

the New York Stock Exchange and/or the bond markets do not open for business, the Trust may, but is not required to, open the Fund for purchase, redemption and exchange transactions if the Federal Reserve wire payment system is open. To learn

whether the Fund is open for business during this situation, please call the appropriate phone number found on the back cover of the Prospectus.

Each Fund relies on various sources to calculate its

NAV. The ability of the Fund’s accounting agent to calculate the NAV per unit of each share class of the Fund is subject to operational risks associated with processing or human errors, systems or technology failures, and errors caused by

third party service providers, data sources, or trading counterparties. Such failures may result in delays in the calculation of the Fund’s NAV and/or the inability to calculate NAV over extended time periods. The Fund may be unable to recover

any losses associated with such failures, and it may be necessary for alternative procedures to be followed to price portfolio securities when determining the Fund’s NAV.

| Purchase/Redemption Price and Effective Date |

Generally, Oakmark Units may only be purchased

through Harris Associates in its capacity as an intermediary that has a relationship with the Transfer Agent. Harris Associates has been authorized to accept purchase, redemption or exchange orders on behalf of the Fund (i.e., to act as an “Authorized Institution”).

Customers of certain intermediaries (such as banks,

trust companies, brokers, registered investment advisers and other financial institutions), including Harris Associates or its designee (“Intermediaries”), will normally give their order instructions to their Intermediary, and the

Intermediary will, in turn, place the order with the Transfer Agent. Intermediaries are responsible for

16

Unitholder Guide

transmitting accepted orders and payments to the Transfer Agent

within the time period agreed upon by them and will set times by which orders and payments must be received by them from their customers. The Trust, Transfer Agent, Investment Adviser and their affiliates will not be responsible for any loss in

connection with orders that are not transmitted to the Transfer Agent by an Intermediary on a timely basis.

The Fund will be deemed to have received an order for

purchase, redemption or exchange of Fund shares when the order is accepted in “proper form” by the Transfer Agent (or by an Authorized Institution) on a business day, and the order will be priced at the Fund’s current NAV per share

next determined after acceptance by the Transfer Agent (or by an Authorized Institution). For shareholders that place trades directly with the Fund’s Transfer Agent, proper form generally means that specific trade details and customer

identifying information must be received by the Transfer Agent at the time an order is submitted. For an order to be in proper form, Harris Associates or its designee must have received an application or appropriate instruction along with the

intended investment, if applicable, and any other required documentation. For a redemption to be in proper form, Harris Associates or its designee must have received appropriate instruction and any other required documentation. The redemption

proceeds may be reduced by any applicable charges.

Dividends

Units Purchased by Federal Funds Wire or ACH Transfer: If a purchase order in proper form is received by the Transfer Agent (or an Authorized Institution) before the Fund closes, units will be issued on the day the order is received and dividends

will generally begin to accrue on the purchased shares on the business day after payment is received. If a purchase order in proper form is received by the Transfer Agent (or an Authorized Institution) and settles through the National Securities

Clearing Corporation (the “NSCC”), the purchase order will begin accruing on the NSCC settlement date.

Units Purchased by Check: If a purchase order in proper form is received by the Transfer Agent (or an Authorized Institution) before the Fund closes, units will be issued on the day the order is received and dividends

will generally begin to accrue on the purchased shares within two business days of the Transfer Agent’s (or an Authorized Institution’s) receipt of the check.

| Purchasing |

General Purchasing Policies

Purchases by check are effective as soon as a check

is converted to federal funds. A purchase by check is deemed to be effective prior to the Fund’s closing time on the date such purchase proceeds convert to federal funds. It is expected that checks will ordinarily be converted to federal funds

within two business days after receipt.

Harris

Associates or its designee reserves the right, under limited circumstances, to cancel any purchase or exchange order it receives.

Once Harris Associates or its designee accepts your

purchase order, you may not cancel or revoke it; however, you may redeem the shares or Oakmark Units. Harris Associates or its designee may withhold redemption proceeds until it is reasonably satisfied it has received your payment. This confirmation

process may take up to 10 days.

If your order

to purchase Oakmark Units of the Fund is cancelled because your check does not clear, you will be responsible for any resulting loss incurred by Harris Associates or its designee.

The Board has not adopted policies and procedures

with respect to frequent purchases and redemptions of Fund shares in light of the nature and high quality of the Fund’s investments. Restrictions on frequent transactions may apply with respect to funds of the Harris Associates Investment

Trust (“Oakmark Funds”).

Shares of

the Fund are only registered for sale in the United States and certain of its territories. Generally, shares of the Fund will only be offered or sold to “U.S. persons” and all offerings or other solicitation activities will be conducted

within the United States, in accordance with the rules and regulations of the Securities Act of 1933, as amended (“Securities Act”).

You may be allowed to purchase units with securities

instead of cash if consistent with the Fund’s investment policies and operations and approved by the Investment Adviser.

Notwithstanding the foregoing, the Trust and Goldman

Sachs reserve the right to reject or restrict purchase or exchange requests from any investor. The Trust and Goldman Sachs will not be liable for any loss resulting from rejected purchase or exchange orders.

How to Purchase Oakmark Units

By Internet To Open an Account: Visit Oakmark.com, and follow instructions under Investing with Us. Please refer to the table above for Investment Minimums. The maximum initial investment via Oakmark.com is $5,000,000.

To Add to an

Account: Visit Oakmark.com and log in to your account to make subsequent investments.

17

If you

have not established bank information, you may add it online during the purchase process or under the Account Profile tab.

By Mail To Open an Account: Complete and sign the New Account Registration Form, IRA Application or Coverdell Education Savings Account (ESA) Application, enclose a check made payable to the Oakmark Funds and mail the form and

your check to the Oakmark Funds, P.O. Box 219558, Kansas City, MO 64121-9558. PLEASE NOTE: Harris Associates or its designee does not accept cash, starter checks, travelers checks, credit card convenience checks, checks made payable to a party other

than the Oakmark Funds, checks drawn on banks outside of the U.S. or purchase orders specifying a particular purchase date or price per share. Harris Associates or its designee will withhold redemption proceeds for up to 10 days after purchase of

shares or Oakmark Units by check.

To Add to an Account: Mail your check made payable to the Oakmark Funds with either the investment stub included as part of your confirmation or quarterly account statement or a note with the amount of the

purchase, your account number, and the name in which your account is registered.

By Electronic Transfer To Open an Account: Visit Oakmark.com, and follow instructions under Investing with Us. The maximum initial investment via electronic transfer is $5,000,000. Harris Associates or its designee will withhold redemption

proceeds for up to 10 days after purchase of shares of Oakmark Units by electronic transfer.

To Add to an

Account: Visit Oakmark.com, log in to your account and then follow the instructions. If you established bank information, call an investor service representative or use the Oakmark Funds’ Voice Recognition System at 1-800-OAKMARK

(625-6275). If you did not establish bank information on your New Account Registration Form, you may add by visiting Oakmark.com or by completing the Shareholder Services Form. When completing the form a Medallion Signature Guarantee will be

required.

Confirm with your bank or credit

union that it is a member of the Automated Clearing House (ACH) system.

By Wire Transfer To Open an Account: Generally, you may not open an account by wire transfer.

To Add to an

Account: Instruct your bank to transfer funds to State Street Bank and Trust Co., ABA#011000028, DDA#9904-632-8. Specify the Fund name, your account number and the registered account name(s) in the instructions.

By Exchange To Open an Account: Visit Oakmark.com or call an investor service representative at 1-800-OAKMARK (625-6275). The new account into which you are making the exchange will have exactly the same registration as the account

from which you are exchanging shares or Oakmark Units. Obtain a current prospectus for the Oakmark Funds by visiting Oakmark.com or calling an investor service representative at 1-800-OAKMARK (625-6275).

To Add to an

Account: Visit Oakmark.com, use the Oakmark Funds’ Voice Recognition System at 1-800-OAKMARK (625-6275) and choose menu option 1 and follow the instructions, or call an investor service representative at 1-800-OAKMARK (625-6275). Send a

letter of instruction, indicating your name, the name of the Fund, and the Fund account number from which you wish to redeem shares or Oakmark Units, and the name of the Fund and the Fund account number into which you wish to buy shares or Oakmark

Units to: Oakmark Funds, P.O. Box 219558, Kansas City, MO 64121-9558.

Harris Associates or its designee may refuse at any

time any exchange request it considers detrimental to an Oakmark Fund.

An exchange transaction is a redemption of Oakmark

Fund shares or Oakmark Units and a simultaneous purchase of different Oakmark Fund shares or Oakmark Units in that, for federal income tax purposes, may result in a capital gain or loss.

By Automatic Investment To Open an Account: Choose the automatic investment plan on your New Account Registration Form. Your initial investment must be at least $500 and be made by check payable to Oakmark Funds.

To Add to an

Account: If you chose the automatic investment plan when you opened your account, subsequent purchases of shares or Oakmark Units will be made automatically, by electronic transfer from your bank account in the dollar amount and based on the

schedule you specified. If you did not establish the electronic transfer privilege on your New Account Registration Form, you may add the privilege by visiting Oakmark.com or by completing the Shareholder Services Form. When completing the form a

Medallion Signature Guarantee will be required.

| Redeeming |

General Redemption Policies

Harris Associates or its designee cannot accept a

redemption request that specifies a particular redemption date or price.

Once Harris Associates or its designee accepts your

redemption order, you may not cancel or revoke it.

Harris Associates or its designee generally will mail

redemption proceeds within seven days after receipt of your redemption request regardless of payment type. If you recently made a purchase, Harris Associates or its designee may withhold redemption proceeds until it is reasonably satisfied it has

received your payment. This confirmation process may take up to 10 days from the purchase date.

18

Unitholder Guide

Redemption requests or payments may only be postponed

or suspended for longer than one day only for periods during which there is a non-routine closure of the Fedwire or applicable Federal Reserve Banks or as permitted under those circumstances specifically enumerated under Section 22(e) of the

Investment Company Act and Rule 22e-3 thereunder, namely if (i) the New York Stock Exchange is closed for trading or trading is restricted; (ii) an emergency exists which makes the disposal of securities owned by the Fund or the fair determination

of the value of the Fund’s net assets not reasonably practicable; (iii) the SEC, by order or regulation, permits the suspension of the right of redemption; or (iv) the Fund, as part of a liquidation of the Fund, has suspended redemption of

shares.

Harris Associates or its designee

reserves the right at any time without prior notice to suspend, limit, modify or terminate any privilege, including the telephone exchange privilege, or its use in any manner by any person or class.

Harris Associates or its designee generally intends

to pay all redemptions in cash.

Neither the

Trust, the Investment Adviser, or Goldman Sachs will be responsible for any loss in an investor’s account or tax liability resulting from an involuntary redemption.

How to redeem Oakmark Units

By Internet Log into your account at Oakmark.com and then follow the instructions.

By Mail Your redemption request must identify the Fund and give your account number, specify the number of shares or Oakmark Units or dollar amount to be redeemed, and be signed in ink by all account

owners exactly as their names appear on the account registration. Some transactions require a Medallion Signature Guarantee. See section titled “Signature Guarantee” in this prospectus for additional information. Mail to: Oakmark Funds,

P.O. Box 219558, Kansas City, MO 64121-9558. Express delivery or courier to: Oakmark Funds, 330 West 9th Street, Kansas City, MO 64105-1514 (Phone: 617-483-8327).

By Telephone You may redeem shares from your account by calling an investor service representative or using the Oakmark Funds’ Voice Recognition System at 1-800-OAKMARK (625-6275).

A check for the proceeds will be sent to your address