Form FWP GS Finance Corp. Filed by: GS Finance Corp.

Free Writing Prospectus pursuant to Rule 433 dated December 10, 2020

Registration Statement No. 333-239610

,

|

|

Leveraged Basket-Linked Notes due |

OVERVIEW

The notes do not bear interest. The amount that you will be paid on your notes on the stated maturity date is based on the performance of an unequally-weighted basket comprised of the common stock, common shares or ordinary shares (basket stocks) of 31 companies as measured from the trade date to and including the determination date.

The initial basket level is 100 and the final basket level will equal the sum of the products, as calculated for each basket stock, of: (i) its final stock price on the determination date divided by its initial stock price multiplied by (ii) its initial weighted value.

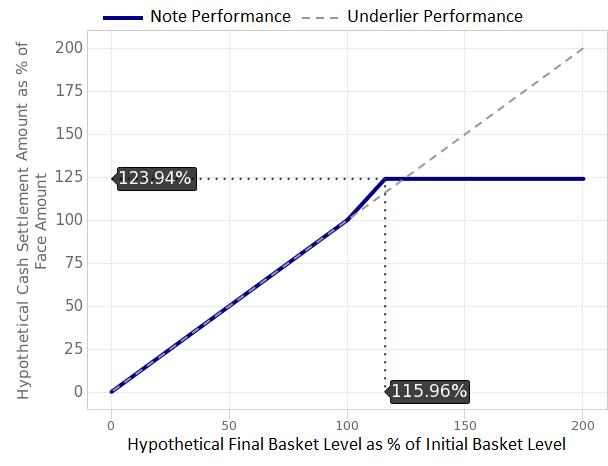

If the final basket level on the determination date is greater than the initial basket level, the return on your notes will be positive and will equal 1.5 times the basket return, subject to the maximum settlement amount (expected to be between $1,239.4 and $1,280.95 for each $1,000 face amount of your notes).

If the final basket level is less than the initial basket level, the return on your notes will be negative and will equal the basket return.

You should read the accompanying preliminary prospectus supplement dated December 10, 2020, which we refer to herein as the accompanying preliminary prospectus supplement, to better understand the terms and risks of your investment, including the credit risk of GS Finance Corp. and The Goldman Sachs Group, Inc.

|

Key Terms |

|

|

CUSIP/ISIN: |

40057EUN5 / US40057EUN56 |

|

Company (Issuer): |

GS Finance Corp. |

|

Guarantor: |

The Goldman Sachs Group, Inc. |

|

Basket: |

an unequally weighted basket comprised of the common stock, common shares or ordinary shares of 31 companies |

|

Basket Stocks |

the 31 common stocks, common shares or ordinary shares listed under “About the Basket” below. |

|

Basket stock issuer: |

the issuer of a basket stock |

|

Trade date: |

|

|

Settlement date: |

expected to be the fifth scheduled business day following the trade date |

|

Determination date: |

a specified date that is expected to be between 24 and 27 months following the trade date |

|

Stated maturity date: |

a specified date that is expected to be the second scheduled business day after the determination date |

|

Hypothetical Payment amount AT Maturity* |

||

|

|

||

|

|

Hypothetical Final |

Hypothetical Payment Amount at Maturity |

|

175.000% |

123.940% |

|

|

150.000% |

123.940% |

|

|

125.000% |

123.940% |

|

|

115.960% |

123.940% |

|

|

108.000% |

112.000% |

|

|

104.000% |

106.000% |

|

|

100.000% |

100.000% |

|

|

90.000% |

90.000% |

|

|

75.000% |

75.000% |

|

|

50.000% |

50.000% |

|

|

25.000% |

25.000% |

|

|

0.000% |

0.000% |

|

|

*assumes a cap level of 115.96% of the initial basket level |

||

This document does not provide all of the information that an investor should consider prior to making an investment decision. You should not invest in the notes without reading the accompanying preliminary prospectus supplement and related documents for a more detailed description of the underlier, the terms of the notes and certain risks.

|

|

●if the basket return is positive (the final basket level is greater than the initial basket level), the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) 1.5 times (c) the basket return, subject to the maximum settlement amount; or ●if the basket return is zero or negative (the final basket level is equal to or less than the initial basket level), the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the basket return. |

|

Initial basket level: |

100 |

|

Initial weighted value: |

for each of the basket stocks, the product of the initial weight of such basket stock in the basket times the initial basket level. |

|

Final basket level: |

the closing level of the basket on the determination date |

|

Closing level of the basket: |

on any trading day, the sum of, for each of the basket stocks: the product of (i) the quotient of (a) the closing price of such basket stock on such trading day divided by (b) the initial stock price of such basket stock times (ii) the initial weighted value of such basket stock |

|

Initial stock price: |

for each of the basket stocks, set on the trade date and may be higher or lower than the actual closing price of the basket stock on that date, as determined by the calculation agent in its sole discretion |

|

Final stock price: |

for each of the basket stocks, the closing price of such basket stock on the determination date |

|

Basket return: |

the quotient of (i) the final basket level minus the initial basket level divided by (ii) the initial basket level, expressed as a percentage |

|

Cap Level: |

expected to be between 115.96% and 118.73% |

|

Maximum settlement amount: |

expected to be between $1,239.4 and $1,280.95 |

|

Estimated value range: |

$940 to $970 (which is less than the original issue price; see accompanying preliminary prospectus supplement) |

|

About the Basket |

|

The following table lists the basket stocks and related information, including their corresponding Bloomberg tickers, primary listings, initial weights in the basket, initial weighted values and initial stock prices. The initial stock prices will not be determined until the trade date. Each of the basket stock issuers faces its own business risks and other competitive factors. All of those factors may affect the basket return, and, consequently, the amount payable on your notes, if any, on the stated maturity date. Our offering of the notes does not constitute our recommendation or the recommendation of our affiliates to invest in the basket, any basket stock or the notes. You should make your own investigation of the basket stocks and the basket stock issuers and whether to obtain exposure to the basket through an investment in the notes. |

|

Basket Stock |

Current Bloomberg Ticker |

Type of Security |

Current Primary Listing |

Initial Weight in the Basket |

Initial Weighted Value |

Initial Stock Price (USD) |

|

Aramark |

ARMK |

Common Stock |

New York Stock Exchange |

3.23% |

3.23 |

|

|

American Express Company |

AXP |

Common Share |

New York Stock Exchange |

3.23% |

3.23 |

|

|

Bloomin’ Brands, Inc. |

BLMN |

Common Stock |

The Nasdaq Global Select Market |

3.22% |

3.22 |

|

|

Cracker Barrel Old Country Store, Inc. |

CBRL |

Common Stock |

The Nasdaq Global Select Market |

3.22% |

3.22 |

|

|

Chipotle Mexican Grill, Inc. |

CMG |

Common Stock |

New York Stock Exchange |

3.23% |

3.23 |

|

|

Capital One Financial Corporation |

COF |

Common Stock |

New York Stock Exchange |

3.23% |

3.23 |

|

|

Delta Air Lines, Inc. |

DAL |

Common Stock |

New York Stock Exchange |

3.23% |

3.23 |

|

|

Discover Financial Services |

DFS |

Common Stock |

New York Stock Exchange |

3.23% |

3.23 |

|

|

Darden Restaurants, Inc. |

DRI |

Common Stock |

New York Stock Exchange |

3.22% |

3.22 |

|

|

Foot Locker, Inc. |

FL |

Common Stock |

New York Stock Exchange |

3.23% |

3.23 |

|

|

The Home Depot, Inc. |

HD |

Common Stock |

New York Stock Exchange |

3.22% |

3.22 |

|

|

Hilton Worldwide Holdings Inc. |

HLT |

Common Stock |

New York Stock Exchange |

3.23% |

3.23 |

|

|

Nordstrom, Inc. |

JWN |

Common Stock |

New York Stock Exchange |

3.23% |

3.23 |

|

|

Lennar Corporation |

LEN |

Class A Common Stock |

New York Stock Exchange |

3.22% |

3.22 |

|

|

Lowe’s Companies, Inc. |

LOW |

Common Stock |

New York Stock Exchange |

3.22% |

3.22 |

|

|

lululemon athletica inc. |

LULU |

Common Stock |

The Nasdaq Global Select Market |

3.23% |

3.23 |

|

|

Southwest Airlines Co. |

LUV |

Common Stock |

New York Stock Exchange |

3.22% |

3.22 |

|

|

Las Vegas Sands Corp. |

LVS |

Common Stock |

New York Stock Exchange |

3.23% |

3.23 |

|

|

Mastercard Incorporated |

MA |

Class A Common Stock |

New York Stock Exchange |

3.22% |

3.22 |

|

|

Marriott International, Inc. |

MAR |

Class A Common Stock |

The Nasdaq Global Select Market |

3.23% |

3.23 |

|

This document does not provide all of the information that an investor should consider prior to making an investment decision. You should not invest in the notes without reading the accompanying preliminary prospectus supplement and related documents for a more detailed description of the underlier, the terms of the notes and certain risks.

|

MGM |

Common Stock |

New York Stock Exchange |

3.23% |

3.23 |

|

|

|

MGIC Investment Corporation |

MTG |

Common Stock |

New York Stock Exchange |

3.22% |

3.22 |

|

|

Norwegian Cruise Line Holdings Ltd. |

NCLH |

Ordinary Share |

New York Stock Exchange |

3.23% |

3.23 |

|

|

NVR, Inc. |

NVR |

Common Stock |

New York Stock Exchange |

3.22% |

3.22 |

|

|

PennyMac Financial Services, Inc. |

PFSI |

Common Stock |

New York Stock Exchange |

3.22% |

3.22 |

|

|

PulteGroup, Inc. |

PHM |

Common Share |

New York Stock Exchange |

3.22% |

3.22 |

|

|

Planet Fitness, Inc. |

PLNT |

Class A Common Stock |

New York Stock Exchange |

3.23% |

3.23 |

|

|

Radian Group Inc. |

RDN |

Common Stock |

New York Stock Exchange |

3.23% |

3.23 |

|

|

Royal Caribbean Cruises Ltd. |

RCL |

Common Stock |

New York Stock Exchange |

3.23% |

3.23 |

|

|

Synchrony Financial |

SYF |

Common Stock |

New York Stock Exchange |

3.23% |

3.23 |

|

|

Toll Brothers, Inc. |

TOL |

Common Stock |

New York Stock Exchange |

3.22% |

3.22 |

|

This document does not provide all of the information that an investor should consider prior to making an investment decision. You should not invest in the notes without reading the accompanying preliminary prospectus supplement and related documents for a more detailed description of the underlier, the terms of the notes and certain risks.

GS Finance Corp. and The Goldman Sachs Group, Inc. have filed a registration statement (including a prospectus, as supplemented by the prospectus supplement and preliminary prospectus supplement listed below) with the Securities and Exchange Commission (SEC) for the offering to which this communication relates. Before you invest, you should read the prospectus, prospectus supplement and preliminary prospectus supplement, and any other documents relating to this offering that GS Finance Corp. and The Goldman Sachs Group, Inc. have filed with the SEC for more complete information about us and this offering. You may get these documents without cost by visiting EDGAR on the SEC web site at sec.gov. Alternatively, we will arrange to send you the prospectus, prospectus supplement and preliminary prospectus supplement if you so request by calling (212) 357-4612.

The notes are part of the Medium-Term Notes, Series F program of GS Finance Corp. and are fully and unconditionally guaranteed by The Goldman Sachs Group, Inc. This document should be read in conjunction with the following:

RISK FACTORS

An investment in the notes is subject to risks. Many of the risks are described in the accompanying preliminary prospectus supplement, accompanying prospectus supplement and accompanying prospectus. Below we have provided a list of certain risk factors discussed in such documents. In addition to the below, you should read in full “Additional Risk Factors Specific to Your Notes” in the accompanying preliminary prospectus supplement as well as the risks and considerations described in the accompanying prospectus supplement and accompanying prospectus.

The following risk factors are discussed in greater detail in the accompanying preliminary prospectus supplement:

|

▪ |

The Notes Are Subject to the Credit Risk of the Issuer and the Guarantor |

|

▪ |

The Amount Payable on Your Notes Is Not Linked to the Level of the Basket at Any Time Other Than the Determination Date |

|

▪ |

You May Lose Your Entire Investment in the Notes |

|

▪ |

Your Notes Do Not Bear Interest |

|

▪ |

The Potential for the Value of Your Notes to Increase Will Be Limited |

|

▪ |

We May Sell an Additional Aggregate Face Amount of the Notes at a Different Issue Price |

|

▪ |

If You Purchase Your Notes at a Premium to Face Amount, the Return on Your Investment Will Be Lower Than the Return on Notes Purchased at Face Amount and the Impact of Certain Key Terms of the Notes Will Be Negatively Affected |

|

▪ |

As of the Date of this Prospectus Supplement, There is No History for the Closing Levels of the Basket |

|

▪ |

Past Basket Stock Performance is No Guide to Future Performance |

|

▪ |

Hypothetical Past Basket Performance is No Guide to Future Performance |

|

▪ |

There Is Limited Hypothetical Historical Information About the Basket |

|

▪ |

The Return on Your Notes Will Not Reflect Any Dividends Paid on the Basket Stocks |

|

▪ |

The Market Value of Your Notes May Be Influenced By Many Unpredictable Factors |

|

▪ |

In Some Circumstances, the Payment You Receive On the Notes May Be Based On the Securities of Another Company and Not the Issuer of a Basket Stock |

|

▪ |

The Lower Performance of One or More Basket Stocks May Offset an Increase in the Other Basket Stocks |

|

▪ |

Your Notes are Linked to the Basket Stocks and Therefore the Price Movements of Those Stocks |

|

▪ |

If the Level of the Basket Changes, the Market Value of Your Notes May Not Change in the Same Manner |

|

▪ |

There is No Affiliation Between the Basket Stock Issuers and Us and We Are Not Responsible for Any Disclosure By Any of the Basket Stock Issuers |

|

▪ |

Goldman Sachs’ Trading and Investment Activities for its Own Account or for its Clients, Could Negatively Impact Investors in the Notes |

|

▪ |

Goldman Sachs’ Market-Making Activities Could Negatively Impact Investors in the Notes |

This document does not provide all of the information that an investor should consider prior to making an investment decision. You should not invest in the notes without reading the accompanying preliminary prospectus supplement and related documents for a more detailed description of the underlier, the terms of the notes and certain risks.

|

▪ |

The Offering of the Notes May Reduce an Existing Exposure of Goldman Sachs or Facilitate a Transaction or Position That Serves the Objectives of Goldman Sachs or Other Parties |

|

▪ |

Other Investors in the Notes May Not Have the Same Interests as You |

|

▪ |

As Calculation Agent, GS&Co. Will Have the Authority to Make Determinations that Could Affect the Value of Your Notes, When Your Notes Mature, and the Amount You Receive at Maturity |

|

▪ |

Your Notes May Not Have an Active Trading Market |

|

▪ |

|

▪ |

You Have No Shareholder Rights or Rights to Receive Any Basket Stock |

|

▪ |

The Calculation Agent Can Postpone the Determination Date If a Market Disruption Event or Non-Trading Day With Respect to Any Basket Stock Occurs |

|

▪ |

Certain Considerations for Insurance Companies and Employee Benefit Plans |

|

▪ |

The Tax Consequences of an Investment in Your Notes Are Uncertain |

|

▪ |

Foreign Account Tax Compliance Act (FATCA) Withholding May Apply to Payments on Your Notes, Including as a Result of the Failure of the Bank or Broker Through Which You Hold the Notes to Provide Information to Tax Authorities |

The following risk factors are discussed in greater detail in the accompanying prospectus supplement:

|

▪ |

The Return on Indexed Notes May Be Below the Return on Similar Securities |

|

▪ |

The Issuer of a Security or Currency That Serves as an Index Could Take Actions That May Adversely Affect an Indexed Note |

|

▪ |

An Indexed Note May Be Linked to a Volatile Index, Which May Adversely Affect Your Investment |

|

▪ |

An Index to Which a Note Is Linked Could Be Changed or Become Unavailable |

|

▪ |

We May Engage in Hedging Activities that Could Adversely Affect an Indexed Note |

|

▪ |

Information About an Index or Indices May Not Be Indicative of Future Performance |

|

▪ |

We May Have Conflicts of Interest Regarding an Indexed Note |

The following risk factors are discussed in greater detail in the accompanying prospectus:

Risks Relating to Regulatory Resolution Strategies and Long-Term Debt Requirements

This document does not provide all of the information that an investor should consider prior to making an investment decision. You should not invest in the notes without reading the accompanying preliminary prospectus supplement and related documents for a more detailed description of the underlier, the terms of the notes and certain risks.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Seven New Hotels, Including Hotel Maya Long Beach, Sign with UNITE HERE Local 11, Raising the Total to 41 Agreements

- Jaxon Announces Resignation of CFO

- GOODRX ALERT: Bragar Eagel & Squire, P.C. Announces that a Class Action Lawsuit Has Been Filed Against GoodRx Holdings, Inc. and Encourages Investors to Contact the Firm

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share