Form 424B2 GOLDMAN SACHS GROUP INC

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-239610

|

|

|

|

|

GS Finance Corp. $2,227,000 Leveraged Buffered Index-Linked Notes guaranteed by The Goldman Sachs Group, Inc. |

This document relates to four separate offerings. Each note is linked to the performance of one index (either the MSCI KLD 400 Social Index, the S&P 500® Index, the Russell 2000® Index, or the NASDAQ-100 Technology Sector Index). Each note has its own terms (set forth in the table below), which were set on the trade date (October 30, 2020).

The notes do not bear interest. The amount that you will be paid on your notes on the stated maturity date (May 5, 2022) is based on the performance of the applicable index as measured from the trade date to and including the determination date (May 2, 2022).

If the final level of the applicable index on the determination date is greater than its initial level, the return on your notes will be positive and will equal the applicable participation rate times the index return of the applicable index (the percentage increase or decrease in the final level of the applicable index from its initial level), subject to the applicable maximum settlement amount.

If the final level of the applicable index is equal to or less than its initial level but greater than or equal to its applicable buffer level, you will receive the face amount of your notes.

If the final level of the applicable index is less than its applicable buffer level, the return on your notes will be negative and will equal the index return of the applicable index plus the applicable buffer amount. You could lose a significant portion of the face amount of your notes.

At maturity, for each $1,000 face amount of your notes, you will receive an amount in cash equal to:

|

● |

if the final level of the applicable index is greater than its initial level, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the applicable participation rate times (c) the index return of the applicable index, subject to the applicable maximum settlement amount; |

|

● |

if the final level of the applicable index is equal to or less than its initial level, but greater than or equal to its applicable buffer level, $1,000; or |

|

● |

if the final level of the applicable index is less than its applicable buffer level, the sum of (i) $1,000 plus (ii) the product of (a) the sum of the index return of the applicable index plus the applicable buffer amount times (b) $1,000. You will receive less than the face amount of your notes. |

|

Face Amount |

Index |

Initial Level |

Participation Rate |

Buffer Level (% of Initial Level) |

Buffer Amount |

Maximum Settlement Amount (Per $1,000 Face Amount) |

Estimated Value (Per $1,000 Face Amount) |

|

$32,000 |

MSCI KLD 400 Social Index |

1,246.98 |

150% |

90% |

10% |

$1,130 |

$966 |

|

$1,148,000 |

S&P 500® Index |

3,269.96 |

150% |

90% |

10% |

$1,130 |

$967 |

|

$446,000 |

Russell 2000® Index |

1,538.479 |

150% |

90% |

10% |

$1,140 |

$961 |

|

$601,000 |

NASDAQ-100 Technology Sector Index |

6,320.768 |

150% |

90% |

10% |

$1,180 |

$965 |

You should read the disclosure herein to better understand the terms and risks of your investment, including the credit risk of GS Finance Corp. and The Goldman Sachs Group, Inc. See page PS-26.

The approximate estimated value of your notes at the time the terms of your notes are set on the trade date is equal to the dollar amount set forth above. For a discussion of the estimated value and the price at which Goldman Sachs & Co. LLC would initially buy or sell your notes, if it makes a market in the notes, see the following page.

|

Notes Linked To |

CUSIP |

Original Issue Date |

Original Issue Price (% of Face Amount) |

Underwriting Discount (% of Face Amount) |

Net Proceeds to the Issuer (% of Face Amount) |

|

MSCI KLD 400 Social Index |

40057CZD6 |

November 4, 2020 |

100% |

Up to 1%* |

At least 99% |

|

S&P 500® Index |

40057CZE4 |

November 4, 2020 |

100% |

Up to 1%* |

At least 99% |

|

Russell 2000® Index |

40057CZF1 |

November 4, 2020 |

100% |

Up to 1%* |

At least 99% |

|

NASDAQ-100 Technology Sector Index |

40057CZG9 |

November 4, 2020 |

100% |

Up to 1%* |

At least 99% |

*See “Supplemental Plan of Distribution; Conflicts of Interest” on page PS-62 for additional information regarding the fees comprising the underwriting discount specific to each offering of notes.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. The notes are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed by, a bank.

Goldman Sachs & Co. LLC

Pricing Supplement Nos. 374, 375, 376 and 377 dated October 30, 2020.

The issue price, underwriting discount and net proceeds listed above relate to the notes we sell initially. We may decide to sell additional notes after the date of this pricing supplement, at issue prices and with underwriting discounts and net proceeds that differ from the amounts set forth above. The return (whether positive or negative) on your investment in notes will depend in part on the issue price you pay for such notes.

GS Finance Corp. may use this prospectus in the initial sale of the notes. In addition, Goldman Sachs & Co. LLC or any other affiliate of GS Finance Corp. may use this prospectus in a market-making transaction in a note after its initial sale. Unless GS Finance Corp. or its agent informs the purchaser otherwise in the confirmation of sale, this prospectus is being used in a market-making transaction.

Four Separate Offerings of Notes

This pricing supplement relates to four separate offerings of notes. Each note is linked to one, and only one, index. You may participate in any of the four offerings or, at your election, in two or more of the offerings. This pricing supplement does not, however, allow you to purchase a note linked to a basket of some or all of the indices.

|

The approximate estimated value of your notes at the time the terms of your notes are set on the trade date (as determined by reference to pricing models used by Goldman Sachs & Co. LLC (GS&Co.) and taking into account our credit spreads) is equal to the dollar amount specified in the table above (in each case, per $1,000 face amount), which is less than the original issue price. The value of your notes at any time will reflect many factors and cannot be predicted; however, the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would initially buy or sell notes (if it makes a market, which it is not obligated to do) and the value that GS&Co. will initially use for account statements and otherwise is equal to approximately the estimated value of your notes at the time of pricing, plus an additional amount (initially equal to $34 per $1,000 face amount with respect to the notes linked to the MSCI KLD 400 Social Index, $33 per $1,000 face amount with respect to the notes linked to the S&P 500® Index, $39 per $1,000 face amount with respect to the notes linked to the Russell 2000® Index and $35 per $1,000 face amount with respect to the notes linked to the NASDAQ-100 Technology Sector Index). Prior to April 30, 2021, the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would buy or sell your notes (if it makes a market, which it is not obligated to do) will equal approximately the sum of (a) the then-current estimated value of your notes (as determined by reference to GS&Co.’s pricing models) plus (b) any remaining additional amount (the additional amount will decline to zero on a straight-line basis from the time of pricing through April 29, 2021). On and after April 30, 2021, the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would buy or sell your notes (if it makes a market) will equal approximately the then-current estimated value of your notes determined by reference to such pricing models. |

PS-2

|

About Your Prospectus The notes are part of the Medium-Term Notes, Series F program of GS Finance Corp. and are fully and unconditionally guaranteed by The Goldman Sachs Group, Inc. This prospectus includes this pricing supplement and the accompanying documents listed below. This pricing supplement constitutes a supplement to the documents listed below, does not set forth all of the terms of your notes and therefore should be read in conjunction with such documents: ●General terms supplement no. 8,671 dated July 1, 2020 ●Underlier supplement no. 13 dated October 23, 2020 ●Prospectus supplement dated July 1, 2020 ●Prospectus dated July 1, 2020 The information in this pricing supplement supersedes any conflicting information in the documents listed above. In addition, some of the terms or features described in the listed documents may not apply to your notes. This pricing supplement relates to four separate offerings of notes, each of which is a separate tranche of our debt securities under the Medium-Term Notes, Series F program. We refer to the notes we are offering by this pricing supplement as the “offered notes” or the “notes”. Each of the offered notes has the terms described below. Please note that in this pricing supplement, references to “GS Finance Corp.”, “we”, “our” and “us” mean only GS Finance Corp. and do not include its subsidiaries or affiliates, references to “The Goldman Sachs Group, Inc.”, our parent company, mean only The Goldman Sachs Group, Inc. and do not include its subsidiaries or affiliates and references to “Goldman Sachs” mean The Goldman Sachs Group, Inc. together with its consolidated subsidiaries and affiliates, including us. The notes will be issued under the senior debt indenture, dated as of October 10, 2008, as supplemented by the First Supplemental Indenture, dated as of February 20, 2015, each among us, as issuer, The Goldman Sachs Group, Inc., as guarantor, and The Bank of New York Mellon, as trustee. This indenture, as so supplemented and as further supplemented thereafter, is referred to as the “GSFC 2008 indenture” in the accompanying prospectus supplement. The notes will be issued in book-entry form and represented by a master global note. |

PS-3

TERMS AND CONDITIONS FOR THE NOTES LINKED TO THE MSCI KLD 400 INDEX

(Terms From Pricing Supplement No. 374 Incorporated Into Master Note No. 2)

|

These terms and conditions relate to pricing supplement no. 374 dated October 30, 2020 of GS Finance Corp. and The Goldman Sachs Group, Inc. with respect to the issuance by GS Finance Corp. of its Leveraged Buffered Index-Linked Notes and the guarantee thereof by The Goldman Sachs Group, Inc. The provisions below are hereby incorporated into master note no. 2, dated July 1, 2020. References herein to “this note” shall be deemed to refer to “this security” in such master note no. 2, dated July 1, 2020. Certain defined terms may not be capitalized in these terms and conditions even if they are capitalized in master note no. 2, dated July 1, 2020. Defined terms that are not defined in these terms and conditions shall have the meanings indicated in such master note no. 2, dated July 1, 2020, unless the context otherwise requires. |

CUSIP / ISIN: 40057CZD6 / US40057CZD63

Company (Issuer): GS Finance Corp.

Guarantor: The Goldman Sachs Group, Inc.

Underlier: the MSCI KLD 400 Social Index (current Bloomberg symbol: “KLD400 Index”), or any successor underlier, as it may be modified, replaced or adjusted from time to time as provided herein

Face amount: $32,000 in the aggregate on the original issue date; the aggregate face amount may be increased if the company, at its sole option, decides to sell an additional amount on a date subsequent to the trade date.

Authorized denominations: $1,000 or any integral multiple of $1,000 in excess thereof

Principal amount: On the stated maturity date, the company will pay, for each $1,000 of the outstanding face amount, an amount, if any, in cash equal to the cash settlement amount.

Cash settlement amount:

|

● |

if the final underlier level is greater than the initial underlier level, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the upside participation rate times (c) the underlier return, subject to the maximum settlement amount; |

|

● |

if the final underlier level is equal to or less than the initial underlier level but greater than or equal to the buffer level, $1,000; or |

|

● |

if the final underlier level is less than the buffer level, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the buffer rate times (c) the sum of the underlier return plus the buffer amount |

Initial underlier level: 1,246.98

Final underlier level: the closing level of the underlier on the determination date, subject to adjustment as provided in “— Consequences of a market disruption event or non-trading day” and “— Discontinuance or modification of the underlier” below

Cap level: approximately 108.667% of the initial underlier level

Maximum settlement amount: $1,130

Upside participation rate: 150%

Underlier return: the quotient of (i) the final underlier level minus the initial underlier level divided by (ii) the initial underlier level, expressed as a percentage

Buffer level: 90% of the initial underlier level

Buffer rate: 100%

Buffer amount: 10%

Trade date: October 30, 2020

Original issue date: November 4, 2020

Determination date: May 2, 2022, unless the calculation agent determines that a market disruption event occurs or is continuing on such day or such day is not a trading day. In that event, the determination date will be the first following trading day on which the calculation agent determines that a market disruption event does not occur and is not continuing. However, the determination date will not be postponed to a date later than the originally

PS-4

scheduled stated maturity date or, if the originally scheduled stated maturity date is not a business day, later than the first business day after the originally scheduled stated maturity date. If a market disruption event occurs or is continuing on the day that is the last possible determination date or such last possible day is not a trading day, that day will nevertheless be the determination date.

Stated maturity date: May 5, 2022, unless that day is not a business day, in which case the stated maturity date will be postponed to the next following business day. The stated maturity date will also be postponed if the determination date is postponed as described under “— Determination date” above. In such a case, the stated maturity date will be postponed by the same number of business day(s) from but excluding the originally scheduled determination date to and including the actual determination date.

Closing level: for any given trading day, the closing level of the underlier or any successor underlier reported by Bloomberg Financial Services, or any successor reporting service the company may select, on such trading day for the underlier. As of the trade date, whereas the underlier sponsor publishes the official closing level of the underlier to six decimal places, Bloomberg Financial Services reports the closing level of the underlier to fewer decimal places.

Trading day: a day on which the respective principal securities markets for all of the underlier stocks are open for trading, the underlier sponsor is open for business and the underlier is calculated and published by the underlier sponsor

Successor underlier: any substitute underlier approved by the calculation agent as a successor underlier as provided under “— Discontinuance or modification of the underlier” below

Underlier sponsor: at any time, the person or entity, including any successor sponsor, that determines and publishes the underlier as then in effect. The notes are not sponsored, endorsed, sold or promoted by the underlier sponsor or any of its affiliates and the underlier sponsor and its affiliates make no representation regarding the advisability of investing in the notes.

Underlier stocks: at any time, the stocks that comprise the underlier as then in effect, after giving effect to any additions, deletions or substitutions

Market disruption event: With respect to any given trading day, any of the following will be a market disruption event with respect to the underlier:

|

● |

a suspension, absence or material limitation of trading in underlier stocks constituting 20% or more, by weight, of the underlier on their respective primary markets, in each case for more than two consecutive hours of trading or during the one-half hour before the close of trading in that market, as determined by the calculation agent in its sole discretion, |

|

● |

a suspension, absence or material limitation of trading in option or futures contracts relating to the underlier or to underlier stocks constituting 20% or more, by weight, of the underlier in the respective primary markets for those contracts, in each case for more than two consecutive hours of trading or during the one-half hour before the close of trading in that market, as determined by the calculation agent in its sole discretion, or |

|

● |

underlier stocks constituting 20% or more, by weight, of the underlier, or option or futures contracts, if available, relating to the underlier or to underlier stocks constituting 20% or more, by weight, of the underlier do not trade on what were the respective primary markets for those underlier stocks or contracts, as determined by the calculation agent in its sole discretion, |

and, in the case of any of these events, the calculation agent determines in its sole discretion that such event could materially interfere with the ability of the company or any of its affiliates or a similarly situated person to unwind all or a material portion of a hedge that could be effected with respect to this note.

The following events will not be market disruption events:

|

● |

a limitation on the hours or numbers of days of trading, but only if the limitation results from an announced change in the regular business hours of the relevant market, and |

|

● |

a decision to permanently discontinue trading in option or futures contracts relating to the underlier or to any underlier stock. |

For this purpose, an “absence of trading” in the primary securities market on which an underlier stock is traded, or on which option or futures contracts relating to the underlier or an underlier stock are traded, will not include any time when that market is itself closed for trading under ordinary circumstances. In contrast, a suspension or limitation of trading in an underlier stock or in option or futures contracts, if available, relating to the underlier or an underlier stock in the primary market for that stock or those contracts, by reason of:

|

● |

a price change exceeding limits set by that market, |

PS-5

|

● |

a disparity in bid and ask quotes relating to that underlier stock or those contracts, |

will constitute a suspension or material limitation of trading in that stock or those contracts in that market.

Consequences of a market disruption event or a non-trading day: If a market disruption event occurs or is continuing on a day that would otherwise be the determination date or such day is not a trading day, then the determination date will be postponed as described under “— Determination date” above.

If the calculation agent determines that the closing level of the underlier that must be used to determine the cash settlement amount is not available on the last possible determination date because of a market disruption event, a non-trading day or for any other reason (other than as described under “— Discontinuance or modification of the underlier” below), the calculation agent will nevertheless determine the closing level of the underlier based on its assessment, made in its sole discretion, of the level of the underlier on that day.

Discontinuance or modification of the underlier: If the underlier sponsor discontinues publication of the underlier and the underlier sponsor or any other person or entity publishes a substitute underlier that the calculation agent determines is comparable to the underlier and approves as a successor underlier, or if the calculation agent designates a substitute underlier, then the calculation agent will determine the amount payable on the stated maturity date by reference to such successor underlier.

If the calculation agent determines that the publication of the underlier is discontinued and there is no successor underlier, the calculation agent will determine the amount payable on the stated maturity date by a computation methodology that the calculation agent determines will as closely as reasonably possible replicate the underlier.

If the calculation agent determines that (i) the underlier, the underlier stocks or the method of calculating the underlier is changed at any time in any respect — including any addition, deletion or substitution and any reweighting or rebalancing of the underlier or the underlier stocks and whether the change is made by the underlier sponsor under its existing policies or following a modification of those policies, is due to the publication of a successor underlier, is due to events affecting one or more of the underlier stocks or their issuers or is due to any other reason — and is not otherwise reflected in the level of the underlier by the underlier sponsor pursuant to the then-current underlier methodology of the underlier or (ii) there has been a split or reverse split of the underlier, then the calculation agent will be permitted (but not required) to make such adjustments in the underlier or the method of its calculation as it believes are appropriate to ensure that the final underlier level, used to determine the amount payable on the stated maturity date, is equitable.

All determinations and adjustments to be made by the calculation agent with respect to the underlier may be made by the calculation agent in its sole discretion. The calculation agent is not obligated to make any such adjustments.

Calculation agent: Goldman Sachs & Co. LLC (“GS&Co.”)

Tax characterization: The holder, on behalf of itself and any other person having a beneficial interest in this note, hereby agrees with the company (in the absence of a change in law, an administrative determination or a judicial ruling to the contrary) to characterize this note for all U.S. federal income tax purposes as a pre-paid derivative contract in respect of the underlier.

Overdue principal rate: the effective Federal Funds rate

PS-6

TERMS AND CONDITIONS FOR THE NOTES LINKED TO THE S&P 500® INDEX

(Terms From Pricing Supplement No. 375 Incorporated Into Master Note No. 2)

|

These terms and conditions relate to pricing supplement no. 375 dated October 30, 2020 of GS Finance Corp. and The Goldman Sachs Group, Inc. with respect to the issuance by GS Finance Corp. of its Leveraged Buffered Index-Linked Notes and the guarantee thereof by The Goldman Sachs Group, Inc. The provisions below are hereby incorporated into master note no. 2, dated July 1, 2020. References herein to “this note” shall be deemed to refer to “this security” in such master note no. 2, dated July 1, 2020. Certain defined terms may not be capitalized in these terms and conditions even if they are capitalized in master note no. 2, dated July 1, 2020. Defined terms that are not defined in these terms and conditions shall have the meanings indicated in such master note no. 2, dated July 1, 2020, unless the context otherwise requires. |

CUSIP / ISIN: 40057CZE4 / US40057CZE47

Company (Issuer): GS Finance Corp.

Guarantor: The Goldman Sachs Group, Inc.

Underlier: the S&P 500® Index (current Bloomberg symbol: “SPX Index”), or any successor underlier, as it may be modified, replaced or adjusted from time to time as provided herein

Face amount: $1,148,000 in the aggregate on the original issue date; the aggregate face amount may be increased if the company, at its sole option, decides to sell an additional amount on a date subsequent to the trade date.

Authorized denominations: $1,000 or any integral multiple of $1,000 in excess thereof

Principal amount: On the stated maturity date, the company will pay, for each $1,000 of the outstanding face amount, an amount, if any, in cash equal to the cash settlement amount.

Cash settlement amount:

|

● |

if the final underlier level is greater than the initial underlier level, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the upside participation rate times (c) the underlier return, subject to the maximum settlement amount; |

|

● |

if the final underlier level is equal to or less than the initial underlier level but greater than or equal to the buffer level, $1,000; or |

|

● |

if the final underlier level is less than the buffer level, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the buffer rate times (c) the sum of the underlier return plus the buffer amount |

Initial underlier level: 3,269.96

Final underlier level: the closing level of the underlier on the determination date, subject to adjustment as provided in “— Consequences of a market disruption event or non-trading day” and “— Discontinuance or modification of the underlier” below

Cap level: approximately 108.667% of the initial underlier level

Maximum settlement amount: $1,130

Upside participation rate: 150%

Underlier return: the quotient of (i) the final underlier level minus the initial underlier level divided by (ii) the initial underlier level, expressed as a percentage

Buffer level: 90% of the initial underlier level

Buffer rate: 100%

Buffer amount: 10%

Trade date: October 30, 2020

Original issue date: November 4, 2020

Determination date: May 2, 2022, unless the calculation agent determines that a market disruption event occurs or is continuing on such day or such day is not a trading day. In that event, the determination date will be the first following trading day on which the calculation agent determines that a market disruption event does not occur and

PS-7

is not continuing. However, the determination date will not be postponed to a date later than the originally scheduled stated maturity date or, if the originally scheduled stated maturity date is not a business day, later than the first business day after the originally scheduled stated maturity date. If a market disruption event occurs or is continuing on the day that is the last possible determination date or such last possible day is not a trading day, that day will nevertheless be the determination date.

Stated maturity date: May 5, 2022, unless that day is not a business day, in which case the stated maturity date will be postponed to the next following business day. The stated maturity date will also be postponed if the determination date is postponed as described under “— Determination date” above. In such a case, the stated maturity date will be postponed by the same number of business day(s) from but excluding the originally scheduled determination date to and including the actual determination date.

Closing level: for any given trading day, the official closing level of the underlier or any successor underlier published by the underlier sponsor on such trading day

Trading day: a day on which the respective principal securities markets for all of the underlier stocks are open for trading, the underlier sponsor is open for business and the underlier is calculated and published by the underlier sponsor

Successor underlier: any substitute underlier approved by the calculation agent as a successor underlier as provided under “— Discontinuance or modification of the underlier” below

Underlier sponsor: at any time, the person or entity, including any successor sponsor, that determines and publishes the underlier as then in effect. The notes are not sponsored, endorsed, sold or promoted by the underlier sponsor or any of its affiliates and the underlier sponsor and its affiliates make no representation regarding the advisability of investing in the notes.

Underlier stocks: at any time, the stocks that comprise the underlier as then in effect, after giving effect to any additions, deletions or substitutions

Market disruption event: With respect to any given trading day, any of the following will be a market disruption event with respect to the underlier:

|

● |

a suspension, absence or material limitation of trading in underlier stocks constituting 20% or more, by weight, of the underlier on their respective primary markets, in each case for more than two consecutive hours of trading or during the one-half hour before the close of trading in that market, as determined by the calculation agent in its sole discretion, |

|

● |

a suspension, absence or material limitation of trading in option or futures contracts relating to the underlier or to underlier stocks constituting 20% or more, by weight, of the underlier in the respective primary markets for those contracts, in each case for more than two consecutive hours of trading or during the one-half hour before the close of trading in that market, as determined by the calculation agent in its sole discretion, or |

|

● |

underlier stocks constituting 20% or more, by weight, of the underlier, or option or futures contracts, if available, relating to the underlier or to underlier stocks constituting 20% or more, by weight, of the underlier do not trade on what were the respective primary markets for those underlier stocks or contracts, as determined by the calculation agent in its sole discretion, |

and, in the case of any of these events, the calculation agent determines in its sole discretion that such event could materially interfere with the ability of the company or any of its affiliates or a similarly situated person to unwind all or a material portion of a hedge that could be effected with respect to this note.

The following events will not be market disruption events:

|

● |

a limitation on the hours or numbers of days of trading, but only if the limitation results from an announced change in the regular business hours of the relevant market, and |

|

● |

a decision to permanently discontinue trading in option or futures contracts relating to the underlier or to any underlier stock. |

For this purpose, an “absence of trading” in the primary securities market on which an underlier stock is traded, or on which option or futures contracts relating to the underlier or an underlier stock are traded, will not include any time when that market is itself closed for trading under ordinary circumstances. In contrast, a suspension or limitation of trading in an underlier stock or in option or futures contracts, if available, relating to the underlier or an underlier stock in the primary market for that stock or those contracts, by reason of:

|

● |

a price change exceeding limits set by that market, |

|

● |

an imbalance of orders relating to that underlier stock or those contracts, or |

|

● |

a disparity in bid and ask quotes relating to that underlier stock or those contracts, |

PS-8

will constitute a suspension or material limitation of trading in that stock or those contracts in that market.

Consequences of a market disruption event or a non-trading day: If a market disruption event occurs or is continuing on a day that would otherwise be the determination date or such day is not a trading day, then the determination date will be postponed as described under “— Determination date” above.

If the calculation agent determines that the closing level of the underlier that must be used to determine the cash settlement amount is not available on the last possible determination date because of a market disruption event, a non-trading day or for any other reason (other than as described under “— Discontinuance or modification of the underlier” below), the calculation agent will nevertheless determine the closing level of the underlier based on its assessment, made in its sole discretion, of the level of the underlier on that day.

Discontinuance or modification of the underlier: If the underlier sponsor discontinues publication of the underlier and the underlier sponsor or any other person or entity publishes a substitute underlier that the calculation agent determines is comparable to the underlier and approves as a successor underlier, or if the calculation agent designates a substitute underlier, then the calculation agent will determine the amount payable on the stated maturity date by reference to such successor underlier.

If the calculation agent determines that the publication of the underlier is discontinued and there is no successor underlier, the calculation agent will determine the amount payable on the stated maturity date by a computation methodology that the calculation agent determines will as closely as reasonably possible replicate the underlier.

If the calculation agent determines that (i) the underlier, the underlier stocks or the method of calculating the underlier is changed at any time in any respect — including any addition, deletion or substitution and any reweighting or rebalancing of the underlier or the underlier stocks and whether the change is made by the underlier sponsor under its existing policies or following a modification of those policies, is due to the publication of a successor underlier, is due to events affecting one or more of the underlier stocks or their issuers or is due to any other reason — and is not otherwise reflected in the level of the underlier by the underlier sponsor pursuant to the then-current underlier methodology of the underlier or (ii) there has been a split or reverse split of the underlier, then the calculation agent will be permitted (but not required) to make such adjustments in the underlier or the method of its calculation as it believes are appropriate to ensure that the final underlier level, used to determine the amount payable on the stated maturity date, is equitable.

All determinations and adjustments to be made by the calculation agent with respect to the underlier may be made by the calculation agent in its sole discretion. The calculation agent is not obligated to make any such adjustments.

Calculation agent: Goldman Sachs & Co. LLC (“GS&Co.”)

Tax characterization: The holder, on behalf of itself and any other person having a beneficial interest in this note, hereby agrees with the company (in the absence of a change in law, an administrative determination or a judicial ruling to the contrary) to characterize this note for all U.S. federal income tax purposes as a pre-paid derivative contract in respect of the underlier.

Overdue principal rate: the effective Federal Funds rate

PS-9

TERMS AND CONDITIONS FOR THE NOTES LINKED TO THE RUSSELL 2000® INDEX

(Terms From Pricing Supplement No. 376 Incorporated Into Master Note No. 2)

|

These terms and conditions relate to pricing supplement no. 376 dated October 30, 2020 of GS Finance Corp. and The Goldman Sachs Group, Inc. with respect to the issuance by GS Finance Corp. of its Leveraged Buffered Index-Linked Notes and the guarantee thereof by The Goldman Sachs Group, Inc. The provisions below are hereby incorporated into master note no. 2, dated July 1, 2020. References herein to “this note” shall be deemed to refer to “this security” in such master note no. 2, dated July 1, 2020. Certain defined terms may not be capitalized in these terms and conditions even if they are capitalized in master note no. 2, dated July 1, 2020. Defined terms that are not defined in these terms and conditions shall have the meanings indicated in such master note no. 2, dated July 1, 2020, unless the context otherwise requires. |

CUSIP / ISIN: 40057CZF1 / US40057CZF12

Company (Issuer): GS Finance Corp.

Guarantor: The Goldman Sachs Group, Inc.

Underlier: the Russell 2000® Index (current Bloomberg symbol: “RTY Index”), or any successor underlier, as it may be modified, replaced or adjusted from time to time as provided herein

Face amount: $446,000 in the aggregate on the original issue date; the aggregate face amount may be increased if the company, at its sole option, decides to sell an additional amount on a date subsequent to the trade date.

Authorized denominations: $1,000 or any integral multiple of $1,000 in excess thereof

Principal amount: On the stated maturity date, the company will pay, for each $1,000 of the outstanding face amount, an amount, if any, in cash equal to the cash settlement amount.

Cash settlement amount:

|

● |

if the final underlier level is greater than the initial underlier level, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the upside participation rate times (c) the underlier return, subject to the maximum settlement amount; |

|

● |

if the final underlier level is equal to or less than the initial underlier level but greater than or equal to the buffer level, $1,000; or |

|

● |

if the final underlier level is less than the buffer level, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the buffer rate times (c) the sum of the underlier return plus the buffer amount |

Initial underlier level: 1,538.479

Final underlier level: the closing level of the underlier on the determination date, subject to adjustment as provided in “— Consequences of a market disruption event or non-trading day” and “— Discontinuance or modification of the underlier” below

Cap level: approximately 109.333% of the initial underlier level

Maximum settlement amount: $1,140

Upside participation rate: 150%

Underlier return: the quotient of (i) the final underlier level minus the initial underlier level divided by (ii) the initial underlier level, expressed as a percentage

Buffer level: 90% of the initial underlier level

Buffer rate: 100%

Buffer amount: 10%

Trade date: October 30, 2020

Original issue date: November 4, 2020

Determination date: May 2, 2022, unless the calculation agent determines that a market disruption event occurs or is continuing on such day or such day is not a trading day. In that event, the determination date will be the first following trading day on which the calculation agent determines that a market disruption event does not occur and is not continuing. However, the determination date will not be postponed to a date later than the originally

PS-10

scheduled stated maturity date or, if the originally scheduled stated maturity date is not a business day, later than the first business day after the originally scheduled stated maturity date. If a market disruption event occurs or is continuing on the day that is the last possible determination date or such last possible day is not a trading day, that day will nevertheless be the determination date.

Stated maturity date: May 5, 2022, unless that day is not a business day, in which case the stated maturity date will be postponed to the next following business day. The stated maturity date will also be postponed if the determination date is postponed as described under “— Determination date” above. In such a case, the stated maturity date will be postponed by the same number of business day(s) from but excluding the originally scheduled determination date to and including the actual determination date.

Closing level: for any given trading day, the closing level of the underlier or any successor underlier reported by Bloomberg Financial Services, or any successor reporting service the company may select, on such trading day for such underlier. As of the trade date, whereas the underlier sponsor publishes the official closing level of the underlier to six decimal places, Bloomberg Financial Services reports the closing level to fewer decimal places.

Trading day: a day on which the respective principal securities markets for all of the underlier stocks are open for trading, the underlier sponsor is open for business and the underlier is calculated and published by the underlier sponsor

Successor underlier: any substitute underlier approved by the calculation agent as a successor underlier as provided under “— Discontinuance or modification of the underlier” below

Underlier sponsor: at any time, the person or entity, including any successor sponsor, that determines and publishes the underlier as then in effect. The notes are not sponsored, endorsed, sold or promoted by the underlier sponsor or any of its affiliates and the underlier sponsor and its affiliates make no representation regarding the advisability of investing in the notes.

Underlier stocks: at any time, the stocks that comprise the underlier as then in effect, after giving effect to any additions, deletions or substitutions

Market disruption event: With respect to any given trading day, any of the following will be a market disruption event with respect to the underlier:

|

● |

a suspension, absence or material limitation of trading in underlier stocks constituting 20% or more, by weight, of the underlier on their respective primary markets, in each case for more than two consecutive hours of trading or during the one-half hour before the close of trading in that market, as determined by the calculation agent in its sole discretion, |

|

● |

a suspension, absence or material limitation of trading in option or futures contracts relating to the underlier or to underlier stocks constituting 20% or more, by weight, of the underlier in the respective primary markets for those contracts, in each case for more than two consecutive hours of trading or during the one-half hour before the close of trading in that market, as determined by the calculation agent in its sole discretion, or |

|

● |

underlier stocks constituting 20% or more, by weight, of the underlier, or option or futures contracts, if available, relating to the underlier or to underlier stocks constituting 20% or more, by weight, of the underlier do not trade on what were the respective primary markets for those underlier stocks or contracts, as determined by the calculation agent in its sole discretion, |

and, in the case of any of these events, the calculation agent determines in its sole discretion that such event could materially interfere with the ability of the company or any of its affiliates or a similarly situated person to unwind all or a material portion of a hedge that could be effected with respect to this note.

The following events will not be market disruption events:

|

● |

a limitation on the hours or numbers of days of trading, but only if the limitation results from an announced change in the regular business hours of the relevant market, and |

|

● |

a decision to permanently discontinue trading in option or futures contracts relating to the underlier or to any underlier stock. |

For this purpose, an “absence of trading” in the primary securities market on which an underlier stock is traded, or on which option or futures contracts relating to the underlier or an underlier stock are traded, will not include any time when that market is itself closed for trading under ordinary circumstances. In contrast, a suspension or limitation of trading in an underlier stock or in option or futures contracts, if available, relating to the underlier or an underlier stock in the primary market for that stock or those contracts, by reason of:

|

● |

a price change exceeding limits set by that market, |

PS-11

|

● |

a disparity in bid and ask quotes relating to that underlier stock or those contracts, |

will constitute a suspension or material limitation of trading in that stock or those contracts in that market.

Consequences of a market disruption event or a non-trading day: If a market disruption event occurs or is continuing on a day that would otherwise be the determination date or such day is not a trading day, then the determination date will be postponed as described under “— Determination date” above.

If the calculation agent determines that the closing level of the underlier that must be used to determine the cash settlement amount is not available on the last possible determination date because of a market disruption event, a non-trading day or for any other reason (other than as described under “— Discontinuance or modification of the underlier” below), the calculation agent will nevertheless determine the closing level of the underlier based on its assessment, made in its sole discretion, of the level of the underlier on that day.

Discontinuance or modification of the underlier: If the underlier sponsor discontinues publication of the underlier and the underlier sponsor or any other person or entity publishes a substitute underlier that the calculation agent determines is comparable to the underlier and approves as a successor underlier, or if the calculation agent designates a substitute underlier, then the calculation agent will determine the amount payable on the stated maturity date by reference to such successor underlier.

If the calculation agent determines that the publication of the underlier is discontinued and there is no successor underlier, the calculation agent will determine the amount payable on the stated maturity date by a computation methodology that the calculation agent determines will as closely as reasonably possible replicate the underlier.

If the calculation agent determines that (i) the underlier, the underlier stocks or the method of calculating the underlier is changed at any time in any respect — including any addition, deletion or substitution and any reweighting or rebalancing of the underlier or the underlier stocks and whether the change is made by the underlier sponsor under its existing policies or following a modification of those policies, is due to the publication of a successor underlier, is due to events affecting one or more of the underlier stocks or their issuers or is due to any other reason — and is not otherwise reflected in the level of the underlier by the underlier sponsor pursuant to the then-current underlier methodology of the underlier or (ii) there has been a split or reverse split of the underlier, then the calculation agent will be permitted (but not required) to make such adjustments in the underlier or the method of its calculation as it believes are appropriate to ensure that the final underlier level, used to determine the amount payable on the stated maturity date, is equitable.

All determinations and adjustments to be made by the calculation agent with respect to the underlier may be made by the calculation agent in its sole discretion. The calculation agent is not obligated to make any such adjustments.

Calculation agent: Goldman Sachs & Co. LLC (“GS&Co.”)

Tax characterization: The holder, on behalf of itself and any other person having a beneficial interest in this note, hereby agrees with the company (in the absence of a change in law, an administrative determination or a judicial ruling to the contrary) to characterize this note for all U.S. federal income tax purposes as a pre-paid derivative contract in respect of the underlier.

Overdue principal rate: the effective Federal Funds rate

PS-12

TERMS AND CONDITIONS FOR THE NOTES LINKED TO THE NASDAQ-100 TECHNOLOGY SECTOR INDEX

(Terms From Pricing Supplement No. 377 Incorporated Into Master Note No. 2)

|

These terms and conditions relate to pricing supplement no. 377 dated October 30, 2020 of GS Finance Corp. and The Goldman Sachs Group, Inc. with respect to the issuance by GS Finance Corp. of its Leveraged Buffered Index-Linked Notes and the guarantee thereof by The Goldman Sachs Group, Inc. The provisions below are hereby incorporated into master note no. 2, dated July 1, 2020. References herein to “this note” shall be deemed to refer to “this security” in such master note no. 2, dated July 1, 2020. Certain defined terms may not be capitalized in these terms and conditions even if they are capitalized in master note no. 2, dated July 1, 2020. Defined terms that are not defined in these terms and conditions shall have the meanings indicated in such master note no. 2, dated July 1, 2020, unless the context otherwise requires. |

CUSIP / ISIN: 40057CZG9 / US40057CZG94

Company (Issuer): GS Finance Corp.

Guarantor: The Goldman Sachs Group, Inc.

Underlier: the NASDAQ-100 Technology Sector Index (current Bloomberg symbol: “NDXT Index”), or any successor underlier, as it may be modified, replaced or adjusted from time to time as provided herein

Face amount: $601,000 in the aggregate on the original issue date; the aggregate face amount may be increased if the company, at its sole option, decides to sell an additional amount on a date subsequent to the trade date.

Authorized denominations: $1,000 or any integral multiple of $1,000 in excess thereof

Principal amount: On the stated maturity date, the company will pay, for each $1,000 of the outstanding face amount, an amount, if any, in cash equal to the cash settlement amount.

Cash settlement amount:

|

● |

if the final underlier level is greater than or equal to the cap level, the maximum settlement amount; |

|

● |

if the final underlier level is greater than the initial underlier level but less than the cap level, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the upside participation rate times (c) the underlier return; |

|

● |

if the final underlier level is equal to or less than the initial underlier level but greater than or equal to the buffer level, $1,000; or |

|

● |

if the final underlier level is less than the buffer level, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the buffer rate times (c) the sum of the underlier return plus the buffer amount |

Initial underlier level: 6,320.768

Final underlier level: the closing level of the underlier on the determination date, subject to adjustment as provided in “— Consequences of a market disruption event or non-trading day” and “— Discontinuance or modification of the underlier” below

Cap level: 112% of the initial underlier level

Maximum settlement amount: $1,180

Upside participation rate: 150%

Underlier return: the quotient of (i) the final underlier level minus the initial underlier level divided by (ii) the initial underlier level, expressed as a percentage

Buffer level: 90% of the initial underlier level

Buffer rate: 100%

Buffer amount: 10%

Trade date: October 30, 2020

Original issue date: November 4, 2020

Determination date: May 2, 2022, unless the calculation agent determines that a market disruption event occurs or is continuing on such day or such day is not a trading day. In that event, the determination date will be the first following trading day on which the calculation agent determines that a market disruption event does not occur and is not continuing. However, the determination date will not be postponed to a date later than the originally

PS-13

scheduled stated maturity date or, if the originally scheduled stated maturity date is not a business day, later than the first business day after the originally scheduled stated maturity date. If a market disruption event occurs or is continuing on the day that is the last possible determination date or such last possible day is not a trading day, that day will nevertheless be the determination date.

Stated maturity date: May 5, 2022, unless that day is not a business day, in which case the stated maturity date will be postponed to the next following business day. The stated maturity date will also be postponed if the determination date is postponed as described under “— Determination date” above. In such a case, the stated maturity date will be postponed by the same number of business day(s) from but excluding the originally scheduled determination date to and including the actual determination date.

Closing level: for any given trading day, the official closing level of the underlier or any successor underlier published by the underlier sponsor on such trading day

Trading day: a day on which the respective principal securities markets for all of the underlier stocks are open for trading, the underlier sponsor is open for business and the underlier is calculated and published by the underlier sponsor

Successor underlier: any substitute underlier approved by the calculation agent as a successor underlier as provided under “— Discontinuance or modification of the underlier” below

Underlier sponsor: at any time, the person or entity, including any successor sponsor, that determines and publishes the underlier as then in effect. The notes are not sponsored, endorsed, sold or promoted by the underlier sponsor or any of its affiliates and the underlier sponsor and its affiliates make no representation regarding the advisability of investing in the notes.

Underlier stocks: at any time, the stocks that comprise the underlier as then in effect, after giving effect to any additions, deletions or substitutions

Market disruption event: With respect to any given trading day, any of the following will be a market disruption event with respect to the underlier:

|

● |

a suspension, absence or material limitation of trading in underlier stocks constituting 20% or more, by weight, of the underlier on their respective primary markets, in each case for more than two consecutive hours of trading or during the one-half hour before the close of trading in that market, as determined by the calculation agent in its sole discretion, |

|

● |

a suspension, absence or material limitation of trading in option or futures contracts relating to the underlier or to underlier stocks constituting 20% or more, by weight, of the underlier in the respective primary markets for those contracts, in each case for more than two consecutive hours of trading or during the one-half hour before the close of trading in that market, as determined by the calculation agent in its sole discretion, or |

|

● |

underlier stocks constituting 20% or more, by weight, of the underlier, or option or futures contracts, if available, relating to the underlier or to underlier stocks constituting 20% or more, by weight, of the underlier do not trade on what were the respective primary markets for those underlier stocks or contracts, as determined by the calculation agent in its sole discretion, |

and, in the case of any of these events, the calculation agent determines in its sole discretion that such event could materially interfere with the ability of the company or any of its affiliates or a similarly situated person to unwind all or a material portion of a hedge that could be effected with respect to this note.

The following events will not be market disruption events:

|

● |

a limitation on the hours or numbers of days of trading, but only if the limitation results from an announced change in the regular business hours of the relevant market, and |

|

● |

a decision to permanently discontinue trading in option or futures contracts relating to the underlier or to any underlier stock. |

For this purpose, an “absence of trading” in the primary securities market on which an underlier stock is traded, or on which option or futures contracts relating to the underlier or an underlier stock are traded, will not include any time when that market is itself closed for trading under ordinary circumstances. In contrast, a suspension or limitation of trading in an underlier stock or in option or futures contracts, if available, relating to the underlier or an underlier stock in the primary market for that stock or those contracts, by reason of:

|

● |

a price change exceeding limits set by that market, |

|

● |

an imbalance of orders relating to that underlier stock or those contracts, or |

|

● |

a disparity in bid and ask quotes relating to that underlier stock or those contracts, |

PS-14

will constitute a suspension or material limitation of trading in that stock or those contracts in that market.

Consequences of a market disruption event or a non-trading day: If a market disruption event occurs or is continuing on a day that would otherwise be the determination date or such day is not a trading day, then the determination date will be postponed as described under “— Determination date” above.

If the calculation agent determines that the closing level of the underlier that must be used to determine the cash settlement amount is not available on the last possible determination date because of a market disruption event, a non-trading day or for any other reason (other than as described under “— Discontinuance or modification of the underlier” below), the calculation agent will nevertheless determine the closing level of the underlier based on its assessment, made in its sole discretion, of the level of the underlier on that day.

Discontinuance or modification of the underlier: If the underlier sponsor discontinues publication of the underlier and the underlier sponsor or any other person or entity publishes a substitute underlier that the calculation agent determines is comparable to the underlier and approves as a successor underlier, or if the calculation agent designates a substitute underlier, then the calculation agent will determine the amount payable on the stated maturity date by reference to such successor underlier.

If the calculation agent determines that the publication of the underlier is discontinued and there is no successor underlier, the calculation agent will determine the amount payable on the stated maturity date by a computation methodology that the calculation agent determines will as closely as reasonably possible replicate the underlier.

If the calculation agent determines that (i) the underlier, the underlier stocks or the method of calculating the underlier is changed at any time in any respect — including any addition, deletion or substitution and any reweighting or rebalancing of the underlier or the underlier stocks and whether the change is made by the underlier sponsor under its existing policies or following a modification of those policies, is due to the publication of a successor underlier, is due to events affecting one or more of the underlier stocks or their issuers or is due to any other reason — and is not otherwise reflected in the level of the underlier by the underlier sponsor pursuant to the then-current underlier methodology of the underlier or (ii) there has been a split or reverse split of the underlier, then the calculation agent will be permitted (but not required) to make such adjustments in the underlier or the method of its calculation as it believes are appropriate to ensure that the final underlier level, used to determine the amount payable on the stated maturity date, is equitable.

All determinations and adjustments to be made by the calculation agent with respect to the underlier may be made by the calculation agent in its sole discretion. The calculation agent is not obligated to make any such adjustments.

Calculation agent: Goldman Sachs & Co. LLC (“GS&Co.”)

Tax characterization: The holder, on behalf of itself and any other person having a beneficial interest in this note, hereby agrees with the company (in the absence of a change in law, an administrative determination or a judicial ruling to the contrary) to characterize this note for all U.S. federal income tax purposes as a pre-paid derivative contract in respect of the underlier.

Overdue principal rate: the effective Federal Funds rate

PS-15

The only events of default for the notes are (i) payment defaults that continue for a 30 day-grace period and (ii) certain insolvency events. No other breach or default under our senior debt indenture or the notes will result in an event of default for the notes or permit the trustee or holders to accelerate the maturity of the notes - that is, they will not be entitled to declare the face or principal amount of any notes to be immediately due and payable. See “Risks Relating to Regulatory Resolution Strategies and Long-Term Debt Requirements” and “Description of Debt Securities We May Offer — Default, Remedies and Waiver of Default — Securities Issued Under the 2008 GSFC Indenture” in the accompanying prospectus for further details.

PS-16

This pricing supplement relates to four separate offerings of notes, each of which is a separate tranche of our debt securities under the Medium-Term Notes, Series F program. Each note is linked to one, and only one, underlier. The following examples are divided into subsections. Each subsection applies only to the particular specified note identified in the subsection. Please carefully review the subsection(s) relating to the particular tranche(s) of notes that you are purchasing. Each tranche of notes has its own underlier, determination date, stated maturity date, upside participation rate, buffer level, buffer amount, cap level and maximum settlement amount.

The following examples are provided for purposes of illustration only. They should not be taken as an indication or prediction of future investment results and merely are intended to illustrate the impact that the various hypothetical underlier levels for the applicable underlier on the determination date could have on the cash settlement amount at maturity assuming all other variables remain constant.

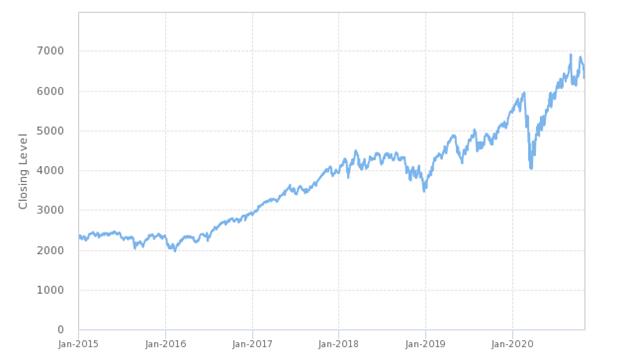

The examples below are based on a range of final underlier levels that are entirely hypothetical; the underlier level of the applicable underlier on any day throughout the life of the notes, including the final underlier level of such underlier on the determination date, cannot be predicted. In each case, the underlier has been highly volatile in the past — meaning that such underlier level of the underlier has changed considerably in relatively short periods — and its performance cannot be predicted for any future period.

In each case, the information in the following examples assumes that (i) neither a market disruption event nor a non-trading day occurs on the originally scheduled determination date, (ii) there is no change in or affecting any of the underlier stocks or method by which the underlier sponsor calculates the underlier, (iii) the notes are purchased on the original issue date at the face amount and held to the stated maturity date. If you sell your notes in a secondary market prior to the stated maturity date, your return will depend upon the market value of your notes at the time of sale, which may be affected by a number of factors that are not reflected in the examples below, such as interest rates, the volatility of the underlier, the creditworthiness of GS Finance Corp., as issuer, and the creditworthiness of The Goldman Sachs Group, Inc., as guarantor. In addition, the estimated value of your notes at the time the terms of your notes are set on the trade date (as determined by reference to pricing models used by GS&Co.) is less than the original issue price of your notes. For more information on the estimated value of your notes, see “Additional Risk Factors Specific to Your Notes — The Estimated Value of Your Notes At the Time the Terms of Your Notes Are Set On the Trade Date (as Determined By Reference to Pricing Models Used By GS&Co.) Is Less Than the Original Issue Price Of Your Notes” on page PS-26 of this pricing supplement.

For these reasons, in each case the actual performance of the underlier over the life of your notes, as well as the amount payable at maturity, may bear little relation to the hypothetical examples shown below or to the historical underlier levels shown elsewhere in this pricing supplement. Before investing in any offered notes, you should consult publicly available information to determine the levels of the applicable underlier between the date of this pricing supplement and the date of your purchase of the offered notes.

Also, the hypothetical examples shown below do not take into account the effects of applicable taxes. Because of the U.S. tax treatment applicable to your notes, tax liabilities could affect the after-tax rate of return on your notes to a comparatively greater extent than the after-tax return on the underlier stocks.

The cash settlement amounts shown below are entirely hypothetical; they are based on market prices for the applicable underlier stocks that may not be achieved on the applicable determination date and on assumptions that may prove to be erroneous. The actual market value of your notes on the stated maturity date or at any other time, including any time you may wish to sell your notes, may bear little relation to the hypothetical cash settlement amounts shown below, and these amounts should not be viewed as an indication of the financial return on an investment in any offered notes. The hypothetical cash settlement amounts on notes held to the stated maturity date in the examples below assume you purchased your notes at their face amount and have not been adjusted to reflect the actual issue price you pay for your notes. The return on your investment (whether positive or negative) in your notes will be affected by the amount you pay for your notes. If you purchase your notes for a price other than the face amount, the return on your investment will differ from, and may be significantly lower than, the hypothetical returns suggested by the below examples. Please read “Additional Risk Factors Specific to Your Notes — The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors” on page PS-28.

Payments on the notes are economically equivalent to the amounts that would be paid on a combination of other instruments. For example, payments on the notes are economically equivalent to a combination of an interest-bearing bond bought by the holder and one or more options entered into between the holder and us (with one or more implicit option premiums paid over time). The discussion in this paragraph does not modify or affect the terms of the notes or the U.S. federal income tax treatment of the notes, as described elsewhere in this pricing supplement.

PS-17

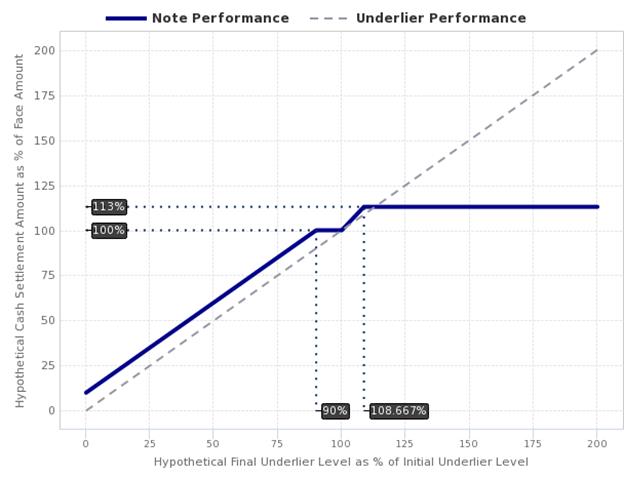

Notes Linked to the MSCI KLD 400 Social Index (KLD400)

The following examples reflect an upside participation rate of 150%, a cap level of approximately 108.667% of the initial underlier level, a maximum settlement amount of $1,130, a buffer level of 90% of the initial underlier level, a buffer rate of 100% and a buffer amount of 10%. You should carefully review these examples. In reviewing these examples, you should also review the assumptions on page PS-17.

The levels in the left column of the table below represent hypothetical final underlier levels of the KLD400 underlier and are expressed as percentages of its initial underlier level. The amounts in the right column represent the hypothetical cash settlement amounts, based on the corresponding hypothetical final underlier level of the KLD400 underlier, and are expressed as percentages of the face amount of a note (rounded to the nearest one-thousandth of a percent). Thus, a hypothetical cash settlement amount of 100.000% means that the value of the cash payment that we would deliver for each $1,000 of the outstanding face amount of the offered notes on the stated maturity date would equal 100.000% of the face amount of a note, based on the corresponding hypothetical final underlier level of the KLD400 underlier and the assumptions noted above.

|

|

Hypothetical Final Underlier Level of the KLD400 Underlier (as Percentage of Initial Underlier Level) |

Hypothetical Cash Settlement Amount (as Percentage of Face Amount) |

|

|

200.000% |

113.000% |

|

|

185.000% |

113.000% |

|

|

160.000% |

113.000% |

|

|

135.000% |

113.000% |

|

|

108.667% |

113.000% |

|

|

106.000% |

109.000% |

|

|

104.000% |

106.000% |

|

|

102.000% |

103.000% |

|

|

100.000% |

100.000% |

|

|

97.000% |

100.000% |

|

|

95.000% |

100.000% |

|

|

92.000% |

100.000% |

|

|

90.000% |

100.000% |

|

|

75.000% |

85.000% |

|

|

50.000% |

60.000% |

|

|

25.000% |

35.000% |

|

|

0.000% |

10.000% |

If, for example, the final underlier level of the KLD400 underlier were determined to be 25.000% of its initial underlier level, the cash settlement amount that we would deliver on your notes at maturity would be 35.000% of the face amount of your notes, as shown in the table above. As a result, if you purchased your notes on the original issue date at the face amount and held them to the stated maturity date, you would lose 65.000% of your investment (if you purchased your notes at a premium to face amount you would lose a correspondingly higher percentage of your investment). In addition, if the final underlier level of the KLD400 underlier were determined to be 200.000% of its initial underlier level, the cash settlement amount that we would deliver on your notes at maturity would be capped at the maximum settlement amount, or 113.000% of each $1,000 face amount of your notes, as shown in the table above. As a result, if you held your notes to the stated maturity date, you would not benefit from any increase in the final underlier level of the KLD400 underlier over approximately 108.667% of its initial underlier level.

The following chart shows a graphical illustration of the hypothetical cash settlement amounts that we would pay on your notes on the stated maturity date, if the final underlier level of the KLD400 underlier were any of the hypothetical levels shown on the horizontal axis. The hypothetical cash settlement amounts in the chart are expressed as percentages of the face amount of your notes and the hypothetical final underlier levels of the KLD400 underlier are expressed as percentages of its initial underlier level. The chart shows that any hypothetical final underlier level of the KLD400 underlier of less than 90.000% (the section left of the 90.000% marker on the horizontal axis) would result in a hypothetical cash settlement amount of less than 100.000% of the face amount of your notes (the section below the 100.000% marker on the vertical axis) and, accordingly, in a loss of principal to the holder of the notes. The chart also shows that any hypothetical final underlier level of the KLD400 underlier of greater than or equal to approximately 108.667% (the section right of the 108.667% marker on the horizontal axis) would result in a capped return on your investment.

PS-18

PS-19

Notes Linked to the S&P 500® Index (SPX)

The following examples reflect an upside participation rate of 150%, a cap level of approximately 108.667% of the initial underlier level, a maximum settlement amount of $1,130, a buffer level of 90% of the initial underlier level, a buffer rate of 100% and a buffer amount of 10%. You should carefully review these examples. In reviewing these examples, you should also review the assumptions on page PS-17.

The levels in the left column of the table below represent hypothetical final underlier levels of the SPX underlier and are expressed as percentages of its initial underlier level. The amounts in the right column represent the hypothetical cash settlement amounts, based on the corresponding hypothetical final underlier level of the SPX underlier, and are expressed as percentages of the face amount of a note (rounded to the nearest one-thousandth of a percent). Thus, a hypothetical cash settlement amount of 100.000% means that the value of the cash payment that we would deliver for each $1,000 of the outstanding face amount of the offered notes on the stated maturity date would equal 100.000% of the face amount of a note, based on the corresponding hypothetical final underlier level of the SPX underlier and the assumptions noted above.

|

|

Hypothetical Final Underlier Level of the SPX Underlier (as Percentage of Initial Underlier Level) |

Hypothetical Cash Settlement Amount (as Percentage of Face Amount) |

|

|

200.000% |

113.000% |

|

|

185.000% |

113.000% |

|

|

160.000% |

113.000% |

|

|

135.000% |

113.000% |

|

|

108.667% |

113.000% |

|

|

106.000% |

109.000% |

|

|

104.000% |

106.000% |

|

|

102.000% |

103.000% |

|

|

100.000% |

100.000% |

|

|

97.000% |

100.000% |

|

|

95.000% |

100.000% |

|

|

92.000% |

100.000% |

|

|

90.000% |

100.000% |

|

|

75.000% |

85.000% |

|

|

50.000% |

60.000% |

|

|

25.000% |

35.000% |

|

|

0.000% |

10.000% |

If, for example, the final underlier level of the SPX underlier were determined to be 25.000% of its initial underlier level, the cash settlement amount that we would deliver on your notes at maturity would be 35.000% of the face amount of your notes, as shown in the table above. As a result, if you purchased your notes on the original issue date at the face amount and held them to the stated maturity date, you would lose 65.000% of your investment (if you purchased your notes at a premium to face amount you would lose a correspondingly higher percentage of your investment). In addition, if the final underlier level of the SPX underlier were determined to be 200.000% of its initial underlier level, the cash settlement amount that we would deliver on your notes at maturity would be capped at the maximum settlement amount, or 113.000% of each $1,000 face amount of your notes, as shown in the table above. As a result, if you held your notes to the stated maturity date, you would not benefit from any increase in the final underlier level of the SPX underlier over approximately 108.667% of its initial underlier level.

The following chart shows a graphical illustration of the hypothetical cash settlement amounts that we would pay on your notes on the stated maturity date, if the final underlier level of the SPX underlier were any of the hypothetical levels shown on the horizontal axis. The hypothetical cash settlement amounts in the chart are expressed as percentages of the face amount of your notes and the hypothetical final underlier levels of the SPX underlier are expressed as percentages of its initial underlier level. The chart shows that any hypothetical final underlier level of the SPX underlier of less than 90.000% (the section left of the 90.000% marker on the horizontal axis) would result in a hypothetical cash settlement amount of less than 100.000% of the face amount of your notes (the section below the 100.000% marker on the vertical axis) and, accordingly, in a loss of principal to the holder of the notes. The chart also shows that any hypothetical final underlier level of the SPX underlier of greater than or equal to approximately 108.667% (the section right of the 108.667% marker on the horizontal axis) would result in a capped return on your investment.

PS-20

PS-21

Notes Linked to the Russell 2000® Index (RTY)

The following examples reflect an upside participation rate of 150%, a cap level of approximately 109.333% of the initial underlier level, a maximum settlement amount of $1,140, a buffer level of 90% of the initial underlier level, a buffer rate of 100% and a buffer amount of 10%. You should carefully review these examples. In reviewing these examples, you should also review the assumptions on page PS-17.

The levels in the left column of the table below represent hypothetical final underlier levels of the RTY underlier and are expressed as percentages of its initial underlier level. The amounts in the right column represent the hypothetical cash settlement amounts, based on the corresponding hypothetical final underlier level of the RTY underlier, and are expressed as percentages of the face amount of a note (rounded to the nearest one-thousandth of a percent). Thus, a hypothetical cash settlement amount of 100.000% means that the value of the cash payment that we would deliver for each $1,000 of the outstanding face amount of the offered notes on the stated maturity date would equal 100.000% of the face amount of a note, based on the corresponding hypothetical final underlier level of the RTY underlier and the assumptions noted above.

|

|

Hypothetical Final Underlier Level of the RTY Underlier (as Percentage of Initial Underlier Level) |

Hypothetical Cash Settlement Amount (as Percentage of Face Amount) |

|

|

200.000% |

114.000% |

|

|

195.000% |

114.000% |

|

|

170.000% |

114.000% |

|

|

145.000% |

114.000% |

|

|

109.333% |

114.000% |

|

|

105.000% |

107.500% |

|

|

102.000% |