Form PRE 14A CISCO SYSTEMS, INC. For: Dec 10

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ☒ |

||

| Filed by a Party other than the Registrant ☐ |

||

| Check the appropriate box: |

||

| ☒ Preliminary Proxy Statement |

||

| ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| ☐ Definitive Proxy Statement |

||

| ☐ Definitive Additional Materials |

||

| ☐ Soliciting Material Pursuant to § 240.14a-12 |

||

CISCO SYSTEMS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required. | |||

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| |||

| (1) |

Title of each class of securities to which transaction applies:

| |||

| (2) |

Aggregate number of securities to which transaction applies:

| |||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11(set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) |

Proposed maximum aggregate value of transaction:

| |||

| (5) |

Total fee paid:

| |||

| ☐ |

Fee paid previously with preliminary materials. | |||

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) |

Amount previously paid:

| |||

| (2) |

Form, Schedule or Registration Statement No.:

| |||

| (3) |

Filing Party:

| |||

| (4) |

Date Filed:

| |||

Table of Contents

Notice of

2020 Annual Meeting of Shareholders and Proxy Statement

| Date and Time: | December 10, 2020 at 8:00 a.m. Pacific Time |

| Virtual: | Attend the annual meeting online, |

| including submitting questions and voting, |

| at www.virtualshareholdermeeting.com/CSCO2020 |

Table of Contents

October 19, 2020

Dear Cisco Shareholder:

You are cordially invited to participate in the Annual Meeting of Shareholders of Cisco Systems, Inc., which will be held online on Thursday, December 10, 2020 at 8:00 a.m. Pacific Time. Details of the business to be conducted at the annual meeting are given in the Notice of Annual Meeting of Shareholders and the Proxy Statement. You will find a Proxy Summary starting on the first page of the Proxy Statement.

We are using the Internet as our primary means of furnishing proxy materials to shareholders. Consequently, most shareholders will not receive paper copies of our proxy materials. We will instead send these shareholders a notice with instructions for accessing the proxy materials and voting via the Internet. The notice also provides information on how shareholders may obtain paper copies of our proxy materials if they so choose.

We encourage shareholders to consent to online delivery of shareholder materials via the Cisco website at investor.cisco.com. Navigate to “Resources & FAQs” via the menu at the top left-hand corner, and then to “Personal Investing”. Consent to online delivery of shareholder materials is available under the heading “Electronic Enrollment”. Thank you for your support of our efforts to preserve resources by reducing mail.

Due to the public health impact of the COVID-19 pandemic and to support the health and well-being of our employees and shareholders, we are pleased to provide shareholders with the opportunity to participate in the annual meeting online via the Internet to facilitate shareholder attendance and provide a consistent experience to all shareholders regardless of location. We will provide a live webcast of the annual meeting at www.virtualshareholdermeeting.com/CSCO2020, where you will also be able to submit questions and vote online.

Charles H. Robbins

Chairman and Chief Executive Officer

San Jose, California

Your Vote is Important

Whether or not you participate in the Annual Meeting, it is important that your shares be part of the voting process. See the section entitled “Information about the Meeting — Voting via the Internet, by Telephone or by Mail” on page 82 of the Proxy Statement for detailed information regarding voting instructions.

Table of Contents

Notice of Annual Meeting of Shareholders

| Date | December 10, 2020 | |

| Time | 8:00 a.m. Pacific Time | |

| Virtual | Attend the annual meeting online, including voting and submitting questions, at www.virtualshareholdermeeting.com/CSCO2020 | |

| Record date | October 12, 2020 | |

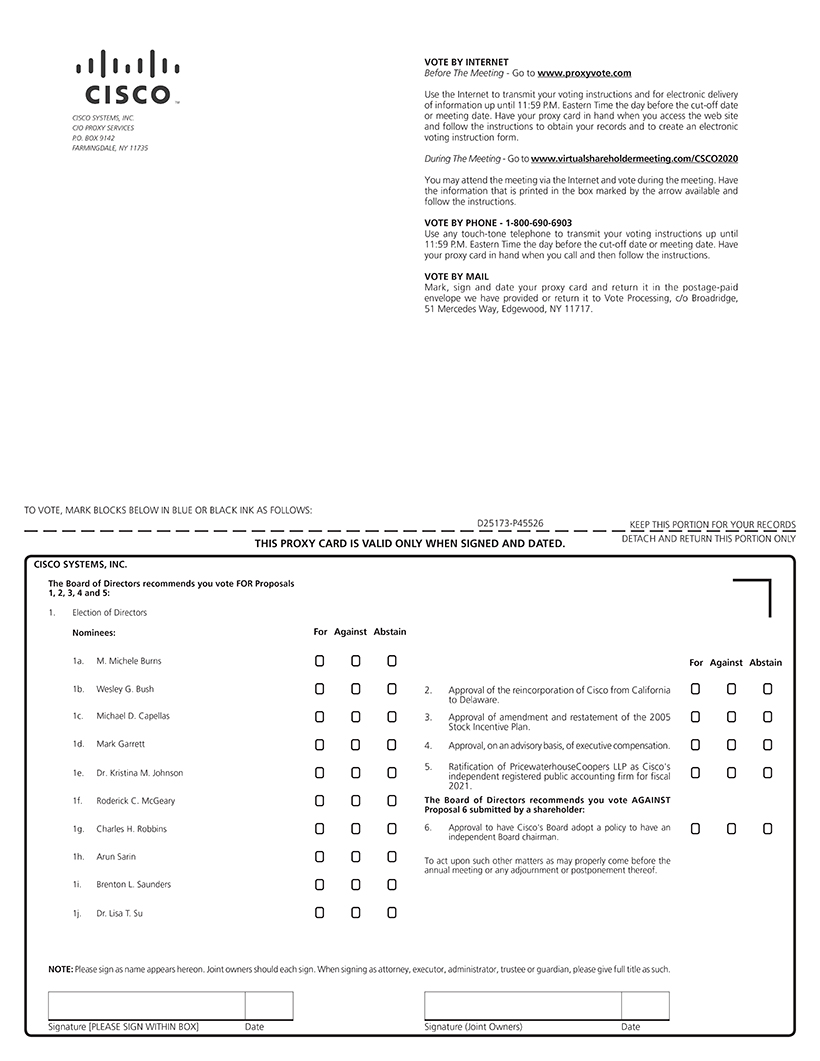

| Items of business | • To elect to Cisco’s Board of Directors the following ten nominees presented by the Board of Directors: M. Michele Burns, Wesley G. Bush, Michael D. Capellas, Mark Garrett, Dr. Kristina M. Johnson, Roderick C. McGeary, Charles H. Robbins, Arun Sarin, Brenton L. Saunders and Dr. Lisa T. Su

• To vote upon a proposal to approve the reincorporation of Cisco from California to Delaware by means of a merger with and into a wholly-owned Delaware subsidiary

• To approve the amendment and restatement of the Cisco Systems, Inc. 2005 Stock Incentive Plan (“2005 Stock Incentive Plan”)

• To vote on a non-binding advisory resolution to approve executive compensation

• To ratify the appointment of PricewaterhouseCoopers LLP as Cisco’s independent registered public accounting firm for the fiscal year ending July 31, 2021

• To vote upon a proposal submitted by a shareholder, if properly presented at the annual meeting

• To act upon such other matters as may properly come before the annual meeting or any adjournments or postponements thereof | |

| Proxy voting | Whether or not you plan to participate in the annual meeting, please vote as soon as possible. Please refer to the section entitled “Information about the Meeting — Voting via the Internet, by Telephone or by Mail” on page 82 of the Proxy Statement for a description of how to vote in advance of the meeting. | |

By Order of the Board of Directors

Evan Sloves

Secretary

San Jose, California

October 19, 2020

Table of Contents

Proxy Statement for

2020 Annual Meeting of Shareholders

|

|

1 | |||||

|

|

|

3 | ||||

| 3 | ||||||

| 4 | ||||||

| 4 | ||||||

| 5 | ||||||

| 5 | ||||||

| 6 | ||||||

| 6 | ||||||

| Shareholder Communications with the Board of Directors

|

|

6

|

| |||

|

|

|

7 | ||||

| 7 | ||||||

| 11 | ||||||

| 11 | ||||||

| 12 | ||||||

| 12 | ||||||

|

|

|

16

|

| |||

|

|

Proposal No. 2 — Approval of the Reincorporation of Cisco from California to Delaware |

20 | ||||

| 20 | ||||||

| 21 | ||||||

| 22 | ||||||

| 24 | ||||||

| 24 | ||||||

| 24 | ||||||

| Interest of Cisco’s Directors and Executive Officers in the Reincorporation |

29 | |||||

| U.S. Federal Income Tax Consequences

|

|

29

|

|

Table of Contents

|

|

Proposal No. 3 — Approval of the Amendment and Restatement of the 2005 Stock Incentive Plan |

31 | ||||

| Proposal No. 4 — Advisory Vote to Approve Executive Compensation |

40 | |||||

| 42 | ||||||

| 42 | ||||||

| 42 | ||||||

| 45 | ||||||

| 45 | ||||||

| 45 | ||||||

| 56 | ||||||

| 57 | ||||||

| 58 | ||||||

| 61 | ||||||

| 61 | ||||||

| 62 | ||||||

| 62 | ||||||

| 65 | ||||||

| 67 | ||||||

| 69 | ||||||

| 69 | ||||||

| 70 | ||||||

| 71 | ||||||

| 72 | ||||||

|

|

|

73

|

| |||

|

Proposal No. 5 — Ratification of Independent Registered Public Accounting Firm |

75 | |||||

| 77 | ||||||

| 77 | ||||||

| Certain Relationships and Transactions with Related Persons

|

|

78

|

| |||

|

|

79 | |||||

|

|

|

81 | ||||

| 81 | ||||||

| 82 | ||||||

| 82 | ||||||

| 83 | ||||||

| 83 | ||||||

| 83 | ||||||

| 84 | ||||||

| Shareholder Proposals and Nominations for 2021 Annual Meeting of Shareholders |

84 | |||||

| 86 | ||||||

| A-1 | ||||||

| B-1 | ||||||

| C-1 | ||||||

| Appendix D: Amended 2005 Stock Incentive Plan

|

|

D-1

|

|

Table of Contents

These proxy materials are provided in connection with the solicitation of proxies by the Board of Directors of Cisco Systems, Inc., a California corporation, for the Annual Meeting of Shareholders to be held on December 10, 2020, and at any adjournments or postponements of the annual meeting. These proxy materials were first sent on or about October 21, 2020 to shareholders entitled to vote at the annual meeting.

This summary highlights selected information about the items to be voted on at the annual meeting and information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider in deciding how to vote, and you should read the entire Proxy Statement carefully before voting. For more complete information about these topics, please review our Annual Report on Form 10-K and the entire Proxy Statement. The information contained on cisco.com or any other website referred to herein is provided for reference only and is not incorporated by reference into this Proxy Statement.

Participating in the Annual Meeting

| Date and Time |

Participating online via the Internet | |

| Thursday, December 10, 2020 8:00 a.m. Pacific Time |

Attend the annual meeting online at www.virtualshareholdermeeting.com/CSCO2020 | |

| Online check-in starts at 7:45 a.m. Pacific Time |

Shareholders may vote and submit questions while attending the meeting online via the Internet. For a description of how to participate online via the Internet, see the section entitled “Information about the Meeting — Participating in the Meeting” | |

Annual Meeting Proposals

| Proposal |

Recommendation of the Board |

Page | ||||

| FOR each of the nominees | 7 | |||||

| 2 — Approval of the Reincorporation of Cisco from California to Delaware |

FOR | 20 | ||||

| 3 — Approval of the Amendment and Restatement of the 2005 Stock Incentive Plan |

FOR | 31 | ||||

| FOR | 40 | |||||

| 5 — Ratification of Independent Registered Public Accounting Firm |

FOR | 75 | ||||

| AGAINST | 79 | |||||

Corporate Governance Highlights

Cisco’s Board of Directors is composed of skilled and diverse directors and has established robust corporate governance practices and policies. The Board believes strongly in the value of an independent board of directors. Cisco has established a Lead Independent Director role with broad authority and responsibility, which is currently filled by Mr. Capellas. See the “Corporate Governance” section for more information on the following:

| • | Our corporate governance policies and practices and where you can find key information regarding our corporate governance initiatives |

| • | Our balanced Board leadership structure and qualifications, including a Lead Independent Director, with currently 90% of the members being independent |

| • | Our shareholder engagement during fiscal 2020, during which we engaged with shareholders representing approximately 27% of our outstanding shares, including 65% of our top 30 shareholders on a variety of topics, including our business and long-term strategy, corporate governance and risk management practices, board leadership and refreshment, diversity, corporate social responsibility initiatives (including environmental, social, and governance matters), our executive compensation program, and other matters of shareholder interest |

1

Table of Contents

Business Overview

As our customers add billions of new connections to their enterprises, and as more applications move to a multicloud environment, the network becomes even more critical. Our customers are navigating change at an unprecedented pace and our mission is to inspire new possibilities for them by helping transform their infrastructure, expand applications and analytics, address their security needs, and empower their teams. We believe that our customers are looking for intent-based networks that provide meaningful business value through automation, security, and analytics across private, hybrid, and multicloud environments. Our vision is to deliver highly secure, software-defined, automated and intelligent platforms for our customers.

We are expanding our research and development (R&D) investments in certain product areas including cloud security, cloud collaboration, and application insights and analytics. We are investing to optimize our product offerings for application to education, healthcare and other specific industries. We are also making investments to enable us to increase automation and support the customer as the workplace changes. In addition, we continue to remain focused on investments around Software-Defined Wide Area Networking, multicloud environments, 5G and WiFi-6, 400G speeds, optical networking, next generation silicon and artificial intelligence (AI). We are also accelerating our efforts to enable the delivery of network functionality as a service.

Executive Compensation Highlights

Our pay practices align with our pay-for-performance philosophy and underscore our commitment to sound compensation and governance practices.

| Our executive compensation program rewards performance |

Compensation philosophy designed to attract and retain, motivate performance, and reward achievement | |

| Performance measures aligned with shareholder interests | ||

| Majority of annual total direct compensation is performance-based | ||

| No dividends paid on unvested awards | ||

| We apply leading executive compensation practices |

Independent compensation committee | |

| Independent compensation consultant | ||

| Comprehensive annual compensation program risk assessment | ||

| Caps on incentive compensation | ||

| None of our executive officers have employment, severance or change in control agreements | ||

| Stock ownership guidelines | ||

| Recoupment policy | ||

| No single-trigger vesting of equity award grants | ||

| No stock option repricing or cash-out of underwater equity awards | ||

| “No perks” policy with limited exceptions | ||

| No supplemental executive retirement plan or executive defined benefit pension plan | ||

| No golden parachute tax gross-ups | ||

| Broad anti-pledging and anti-hedging policies | ||

2

Table of Contents

Corporate Governance Policies and Practices

Cisco is committed to shareholder-friendly corporate governance and the Board of Directors has adopted clear corporate policies that promote excellence in corporate governance. We have adopted policies and practices that are consistent with our commitment to transparency and best-in-class practices, as well as to ensure compliance with the rules and regulations of the Securities and Exchange Commission, the listing requirements of Nasdaq, and applicable corporate governance requirements. Key corporate governance policies and practices include:

| • | The Board of Directors has held annual elections of directors since Cisco’s initial public offering |

| • | The Board of Directors has adopted majority voting for uncontested elections of directors |

| • | A majority of the Board of Directors is independent of Cisco and its management |

| • | The Board of Directors has a robust Lead Independent Director role |

| • | The independent members of the Board of Directors meet regularly without the presence of management |

| • | Shareholders may recommend a director nominee to Cisco’s Nomination and Governance Committee |

| • | Shareholders that meet eligibility requirements may submit director candidates for election in Cisco’s proxy statement through its proxy access bylaw provision |

| • | Shareholders have the right to take action by written consent |

| • | Shareholders have the right to call a special meeting |

| • | No poison pill |

| • | All members of the key committees of the Board of Directors — the Audit Committee, the Compensation Committee, and the Nomination and Governance Committee — are independent |

| • | The charters of the committees of the Board of Directors clearly establish the committees’ respective roles and responsibilities |

| • | Cisco has a clear Code of Business Conduct (“COBC”) that is monitored by Cisco’s ethics office and is annually affirmed by its employees |

| • | Cisco’s ethics office has a hotline available to all employees, and Cisco’s Audit Committee has procedures in place for the anonymous submission of employee complaints on accounting, internal accounting controls, or auditing matters |

| • | Cisco has adopted a code of ethics that applies to its principal executive officer and all members of its finance department, including the principal financial officer and principal accounting officer |

| • | Cisco’s internal audit function maintains critical oversight over the key areas of its business and financial processes and controls, and reports directly to Cisco’s Audit Committee |

| • | Cisco has adopted a compensation recoupment policy that applies to its executive officers |

| • | Cisco has stock ownership guidelines for its non-employee directors and executive officers |

Key information regarding Cisco’s corporate governance initiatives can be found on its website, including Cisco’s corporate governance policies, Cisco’s COBC and the charter for each committee of the Board of Directors. The corporate governance page can be found in the Governance section of Cisco’s Investor Relations website at investor.cisco.com.

Cisco’s Board of Directors believes strongly in the value of an independent board of directors. Independent board members have consistently comprised over 75% of the members of Cisco’s Board of Directors. All members of the key board committees — the Audit Committee, the Compensation Committee, and the Nomination and Governance Committee — are independent. Cisco has established a Lead Independent Director role with broad authority and responsibility, as described further below. The independent members of the Board of Directors also meet regularly without management; the Lead Independent Director chairs those meetings. Mr. Capellas currently serves as Lead Independent Director, and Mr. Robbins currently serves as Cisco’s Board chair and CEO.

3

Table of Contents

The Board of Directors believes that it should maintain flexibility to select Cisco’s board leadership structure from time to time. Our policies do not preclude the CEO from also serving as Board chair. Mr. Robbins, our CEO, also serves as Board chair. The Board of Directors believes that this leadership structure with a strong Lead Independent Director provides balance and currently is in the best interest of Cisco and its shareholders. The role given to the Lead Independent Director helps ensure a strong independent and active Board, while Mr. Robbins’ demonstrated leadership during his tenure at Cisco, and his ability to speak as Board chair and CEO provides strong unified leadership for Cisco. In connection with Mr. Capellas’ appointment as Lead Independent Director, the Board of Directors considered Mr. Capellas’ demonstrated leadership during his tenure as a member of the Board of Directors, and also his leadership during his tenure as chair of both the Finance and Acquisition Committees, and believes that Mr. Capellas’ ability to act as a strong Lead Independent Director provides balance in Cisco’s leadership structure and will be in the best interest of Cisco and its shareholders.

The Lead Independent Director is elected by and from the independent directors. Each term of service in the Lead Independent Director position is one year, and the Lead Independent Director has the following responsibilities:

| • | authority to call meetings of the independent directors |

| • | presiding at all meetings of the Board of Directors at which the Chairman is not present, including executive sessions of the independent directors (during which Cisco’s strategy is reviewed and other topics are discussed) |

| • | serving as principal liaison between the independent directors and the Chairman and CEO |

| • | communicating from time to time with the Chairman and CEO and disseminating information to the rest of the Board of Directors as appropriate |

| • | providing leadership to the Board of Directors if circumstances arise in which the role of the Board chair may be, or may be perceived to be, in conflict |

| • | reviewing and approving agendas, meeting schedules to assure that there is sufficient time for discussion of all agenda items, and information provided to the Board (including the quality, quantity, and timeliness of such information) |

| • | being available, as appropriate, for consultation and direct communication with major shareholders |

| • | presiding over the annual performance evaluation of the Board of Directors, including the performance evaluation of each Board committee and individual Board members |

| • | facilitating the Board of Directors’ performance evaluation of the CEO in conjunction with the Compensation Committee |

Board Performance Evaluation Process

The Board of Directors recognizes that a robust and constructive performance evaluation process is an essential component of Board effectiveness. As such, the Board of Directors conducts an annual Board performance evaluation that is intended to determine whether the Board, each of its committees, and individual Board members are functioning effectively, and to provide them with an opportunity to reflect upon and improve processes and effectiveness. The Nomination and Governance Committee oversees this process, which is led by the Lead Independent Director. The Lead Independent Director, along with outside counsel, conducts one-on-one discussions with each board member and certain members of management to obtain their assessment of the effectiveness and performance of the Board, its committees, and individual Board members. A summary of the results is presented to the Nomination and Governance Committee identifying any themes or issues that have emerged. The results are then reported to the full Board of Directors which considers the results and ways in which Board processes and effectiveness may be enhanced.

Cisco regularly evaluates the need for board refreshment. The Nomination and Governance Committee, and the Board of Directors, are focused on identifying individuals whose skills and experiences will enable them to make meaningful contributions to the shaping of Cisco’s business strategy. During fiscal 2020, the Board of Directors appointed Dr. Lisa T. Su to the Board upon the recommendation of the Nomination and Governance Committee. For more information on the skills and experience of Dr. Su, see “Board of Directors — Proposal No. 1 — Election of Directors”.

4

Table of Contents

As part of its consideration of director succession, the Nomination and Governance Committee from time to time reviews the appropriate skills and characteristics required of board members such as diversity of business experience, viewpoints and personal background, and diversity of skills in technology, finance, marketing, international business, financial reporting and other areas that are expected to contribute to an effective Board of Directors. Additionally, due to the global and complex nature of our business, the Board believes it is important that the Board include individuals with diversity of race, ethnicity, gender, sexual orientation, age, education, cultural background, and professional experiences, and those factors are considered in evaluating board candidates in order to provide practical insights and diverse perspectives.

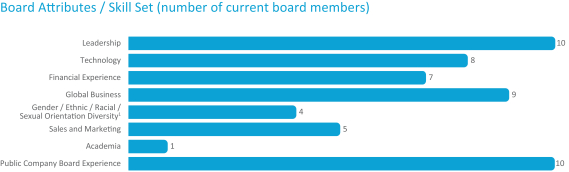

The Nomination and Governance Committee and the Board will regularly evaluate the key qualifications, skills and attributes required in order to effectively refresh the Board with engaged and dynamic leaders with a proven business track record who will bring fresh perspectives to the Board while maintaining the productive working dynamics and collegiality of the Board. The graph below summarizes key qualifications, skills and attributes that we believe are most relevant to the decision to nominate candidates to serve on the Board of Directors and the prevalence of those characteristics on Cisco’s current Board.

| 1 | Categories covered under California law AB 979. |

See the “Board of Directors — Proposal No. 1 — Election of Directors — Board Meetings and Committees — Nomination and Governance Committee” section in this Proxy Statement for more information on the process and procedures related to the Board nomination process.

At Cisco, we recognize the importance of regular and transparent communication with our shareholders. Each year, we continually engage with a significant portion of shareholders that include our top institutional investors. In fiscal 2020, our Chairman and CEO, Secretary, and Investor Relations team held meetings and conference calls with investors representing approximately 27% of our outstanding shares, including 65% of our top 30 shareholders. We engaged with these shareholders on a variety of topics, including our business and long-term strategy, corporate governance and risk management practices, board leadership and refreshment, diversity, corporate social responsibility initiatives (including environmental, social, and governance matters), our executive compensation program, and other matters of shareholder interest.

Corporate Social Responsibility

Cisco’s Corporate Social Responsibility (CSR) efforts are organized into several areas that guide our work to power an inclusive future for all: trust and responsibility, leading a conscious culture, energy and greenhouse gas (GHG) emissions, circular economy, supply chain excellence, and technology for good. For fiscal 2020, we have adjusted our CSR pillars to describe our commitments, goals, and impacts more specifically and to focus on the environmental, social and governance (ESG) topics that are significant to Cisco. During fiscal 2020, we also engaged with shareholders on our CSR and sustainability initiatives.

Cisco Corporate Affairs leads our social investment programs and champions our commitment to CSR performance and transparency. This team engages with internal and external stakeholders and leads CSR assessment and reporting activities, which are aligned with standards set by the Global Reporting Initiative (GRI). Cisco supports the United Nations’ Sustainable Development Goals and aligns its ESG work with them.

5

Table of Contents

The team works cross-functionally to assess and monitor CSR priorities, drive process for CSR management, and provide reporting guidance and coordination across business functions. CSR priorities are owned by business functions and are integrated into ongoing business strategy and planning. Business functions set CSR goals, implement plans, and measure performance. Where a cross-functional approach is needed, teams are established to implement our commitments. The Nomination and Governance Committee of the Board reviews Cisco’s policies and programs concerning corporate social responsibility, including ESG matters.

Cisco has signed the CEO Action for Diversity and Inclusion Pledge. We are delivering on our vision of accelerating full-spectrum diversity — including gender, age, race, ethnicity, orientation, ability, nationality, religion, veteran status, background, culture, experience, strengths and perspectives. It starts at the top in that 40% of our Executive Leadership Team (ELT) are women and 53% are diverse in terms of gender and ethnicity.

For more information about our programs concerning Cisco’s CSR, including ESG matters, see our CSR website at csr.cisco.com. Our 2020 CSR Impact Report and Environmental Technical Review are expected to be published in December 2020.

Information about Cisco’s public policy engagement approach, including its policy priorities, the limitations it imposes on itself relating to public policy-related activities, and the manner in which it discloses its public policy efforts, is disclosed on Cisco’s public website on a webpage entitled “Government Affairs”: https://www.cisco.com/c/en/us/about/government-affairs.html. In part as a result of proactive engagement with its shareholders, Cisco regularly reviews and updates this webpage. For example, in fiscal 2019 Cisco expanded disclosure to now include its annual payments to trade associations and political action committee contributions.

Following a robust review of shareholder feedback, corporate governance best practices and trends, and Cisco’s particular facts and circumstances, in July 2016, the Board of Directors adopted amendments to Cisco’s bylaws to allow a shareholder, or a group of up to 20 shareholders, owning continuously for at least three years a number of Cisco shares that constitutes at least 3% of Cisco’s outstanding shares, to nominate and include in Cisco’s proxy materials director nominees constituting up to the greater of two individuals or 20% of the Board of Directors. The amended bylaws specifically allow funds under common management to be treated as a single shareholder, and permit share lending with a five day recall. They do not contain any post-meeting holding requirements, do not have any limits on resubmission of failed nominees, and do not contain restrictions on third-party compensation.

Shareholder Communications with the Board of Directors

Shareholders may communicate with Cisco’s Board of Directors through Cisco’s Secretary by sending an email to [email protected], or by writing to the following address: Board of Directors, c/o Secretary, Cisco Systems, Inc., 170 West Tasman Drive, San Jose, California 95134. Shareholders also may communicate with Cisco’s Compensation Committee through Cisco’s Secretary by sending an email to [email protected], or by writing to the following address: Compensation and Management Development Committee, c/o Secretary, Cisco Systems, Inc., 170 West Tasman Drive, San Jose, California 95134. Cisco’s Secretary will forward all correspondence to the Board of Directors or the Compensation Committee, except for spam, junk mail, mass mailings, product or service complaints or inquiries, job inquiries, surveys, business solicitations or advertisements, or patently offensive or otherwise inappropriate material. Cisco’s Secretary may forward certain correspondence, such as product-related inquiries, elsewhere within Cisco for review and possible response.

6

Table of Contents

Proposal No. 1 — Election of Directors

The names of persons who are nominees for director and their current positions and offices with Cisco are set forth in the table below. The proxy holders intend to vote all proxies received by them for the nominees listed below unless otherwise instructed. Each of the current directors has been nominated for election by the Board of Directors upon recommendation by the Nomination and Governance Committee and has decided to stand for election. The authorized number of directors is ten.

The Board of Directors appointed Dr. Lisa T. Su to the Board in January 2020 upon the recommendation of the Nomination and Governance Committee. Dr. Su was brought to the attention of the Nomination and Governance Committee as a potential candidate by a third-party search firm.

| Director Nominees |

Positions and Offices Held with Cisco |

Age | Director Since |

Other Public Company Boards | ||||

| M. Michele Burns |

Director | 62 | 2003 | 3 | ||||

| Wesley G. Bush |

Director | 59 | 2019 | 2 | ||||

| Michael D. Capellas |

Director | 66 | 2006 | 2 | ||||

| Mark Garrett |

Director | 62 | 2018 | 3 | ||||

| Dr. Kristina M. Johnson |

Director | 63 | 2012 | — | ||||

| Roderick C. McGeary |

Director | 70 | 2003 | 2 | ||||

| Charles H. Robbins |

Chairman and CEO | 54 | 2015 | 1 | ||||

| Arun Sarin |

Director | 65 | 2009 | 3 | ||||

| Brenton L. Saunders |

Director | 50 | 2017 | 2 | ||||

| Dr. Lisa T. Su |

Director | 50 | 2020 | 1 |

Business Experience and Qualifications of Nominees

Ms. Burns, 62, has been a member of the Board of Directors since November 2003. She has served on the Advisory Board of the Center on Longevity at Stanford University since October 2019 and previously served as the Center Fellow and Strategic Advisor from August 2012 to October 2019. She served as the Chief Executive Officer of the Retirement Policy Center sponsored by Marsh & McLennan Companies, Inc. from October 2011 to February 2014. From September 2006 to October 2011, Ms. Burns served as Chairman and Chief Executive Officer of Mercer LLC, a global leader for human resources and related financial advice and services. She assumed that role after joining Marsh & McLennan Companies, Inc. in March 2006 as Chief Financial Officer. From May 2004 to January 2006, Ms. Burns served as Chief Financial Officer and Chief Restructuring Officer of Mirant Corporation, where she successfully helped Mirant restructure and emerge from bankruptcy. In 1999, Ms. Burns joined Delta Air Lines, Inc. assuming the role of Chief Financial Officer in 2000 and holding that position through April 2004. She began her career in 1981 at Arthur Andersen LLP and became a partner in 1991. Ms. Burns also currently serves on the boards of directors of Anheuser-Busch InBev SA/NV, Etsy, Inc. and The Goldman Sachs Group, Inc. She previously served as a director of Alexion Pharmaceuticals, Inc., ending in 2018.

Ms. Burns provides to the Board of Directors expertise in corporate finance, accounting and strategy, including experience gained as the chief financial officer of three public companies. Through her experience gained as chief executive officer of Mercer, she brings expertise in global and operational management, including a background in organizational leadership and human resources. Ms. Burns also has experience serving as a public company outside director.

Mr. Bush, 59, has been a member of the Board of Directors since May 2019. He served as Chief Executive Officer of Northrop Grumman Corporation (“Northrop Grumman”) from January 2010 through December 2018 and served on its board from September 2009 to July 2019 and in the role of chairman from July 2011 to July 2019. Prior to January 2010, he served in various leadership roles, including as Northrop Grumman’s President and Chief Operating Officer, Corporate Vice President and Chief Financial Officer, and President of its Space Technology sector. Mr. Bush also served in various leadership roles at TRW Inc. prior to its acquisition by Northrop Grumman in 2002. Mr. Bush is a member of the National Academy of Engineering. Mr. Bush also currently serves on the board of directors of Dow Inc. and General Motors Corporation. He previously served as a director of Norfolk Southern Corporation and Northrop Grumman Corporation, each ending in 2019.

7

Table of Contents

Mr. Bush brings to the Board of Directors his extensive international business experience, including over 35 years in the aerospace and defense industry. In addition, he brings extensive financial, strategic and operational experience. Mr. Bush also has experience serving as a public company outside director.

Mr. Capellas, 66, has been a member of the Board of Directors since January 2006. He has served as founder and Chief Executive Officer of Capellas Strategic Partners since November 2012. He served as Chairman of the Board of VCE Company, LLC from January 2011 until November 2012 and as Chief Executive Officer of VCE from May 2010 to September 2011. Mr. Capellas was the Chairman and Chief Executive Officer of First Data Corporation from September 2007 to March 2010. From November 2002 to January 2006, he served as Chief Executive Officer of MCI, Inc. (“MCI”), previously WorldCom. From November 2002 to March 2004, he was also Chairman of the Board of WorldCom, and he continued to serve as a member of the board of directors of MCI until January 2006. Mr. Capellas left MCI as planned in early January 2006 upon its acquisition by Verizon Communications Inc. Previously, Mr. Capellas was President of Hewlett-Packard Company from May 2002 to November 2002. Before the merger of Hewlett-Packard and Compaq Computer Corporation in May 2002, Mr. Capellas was President and Chief Executive Officer of Compaq, a position he had held since July 1999, and Chairman of the Board of Compaq, a position he had held since September 2000. Mr. Capellas held earlier positions as Chief Information Officer and Chief Operating Officer of Compaq. Mr. Capellas also currently serves as the chairman of the board of directors of Flex Ltd. and on the board of directors of Vesper Healthcare Acquisition Corp. He previously served as lead independent director of MuleSoft, Inc., ending in 2018.

Mr. Capellas brings to the Board of Directors experience in executive roles and a background of leading global organizations in the technology industry. Through this experience, he has developed expertise in several valued areas including strategic product development, business development, sales, marketing, and finance.

Mr. Garrett, 62, has been a member of the Board of Directors since April 2018. Mr. Garrett served as Executive Vice President and Chief Financial Officer of Adobe Systems Incorporated from February 2007 to April 2018. From January 2004 to February 2007, Mr. Garrett served as Senior Vice President and Chief Financial Officer of the Software Group of EMC Corporation. From August 2002 to January 2004 and from 1997 to 1999, Mr. Garrett served as Executive Vice President and Chief Financial Officer of Documentum, Inc., including throughout its acquisition by EMC in December 2003. Mr. Garrett also currently serves on the boards of directors of GoDaddy Inc., Pure Storage, Inc. and Snowflake Inc. He previously served as a director of Informatica Corporation, ending in 2015 and Model N, Inc., ending in 2016.

Mr. Garrett brings to the Board of Directors extensive history of leadership in finance and accounting in the technology industry, including experience in product and business model transition and transformation to the cloud. Mr. Garrett also has experience serving as a public company outside director.

Dr. Johnson, 63, has been a member of the Board of Directors since August 2012. Dr. Johnson has served as the President of The Ohio State University since September 1, 2020. Previously Dr. Johnson served as the chancellor of the State University of New York from September 2017 to August 2020. From January 2014 to September 2017, Dr. Johnson served as the Chief Executive Officer of Cube Hydro Partners, LLC, a clean energy company, and a joint venture between Enduring Hydro, a company she founded in January 2011 and I Squared Capital, a private equity firm. From May 2009 to October 2010, Dr. Johnson served as Under Secretary of Energy at the U.S. Department of Energy. Prior to this, Dr. Johnson was Provost and Senior Vice President for Academic Affairs at The Johns Hopkins University from 2007 to 2009 and Dean of the Pratt School of Engineering at Duke University from 1999 to 2007. Previously, she served as a professor in the Electrical and Computer Engineering Department, University of Colorado and as director of the National Science Foundation Engineering Research Center for Optoelectronics Computing Systems at the University of Colorado, Boulder. She holds 119 U.S. and international patents and has received the John Fritz Medal, widely considered the highest award given in the engineering profession. Dr. Johnson was inducted into the National Inventors Hall of Fame in 2015 and she is also a member of the National Academy of Engineering. She previously served as a director of Boston Scientific Corporation, ending in 2017 and The AES Corporation, ending in 2019.

Dr. Johnson brings to the Board of Directors an engineering background as well as expertise in science, technology, business, education and government. In addition, she has leadership and management experience, both in an academic context as chancellor, provost and dean of nationally recognized academic institutions and in a corporate context as a board member of public technology companies.

8

Table of Contents

Mr. McGeary, 70, has been a member of the Board of Directors since July 2003. He served as Chairman of Tegile Systems, Inc. from June 2010 to June 2012. From November 2004 to December 2009, he served as Chairman of the Board of BearingPoint, Inc. and also was interim Chief Executive Officer of BearingPoint from November 2004 to March 2005. Mr. McGeary served as Chief Executive Officer of Brience, Inc. from July 2000 to July 2002. From April 2000 to June 2000, he served as a Managing Director of KPMG Consulting LLC, a wholly owned subsidiary of BearingPoint, Inc. (formerly KPMG Consulting, Inc.). From August 1999 to April 2000, he served as Co-President and Co-Chief Executive Officer of BearingPoint, Inc. From January 1997 to August 1999, he was employed by KPMG LLP as its Co-Vice Chairman of Consulting. Prior to 1997, he served in several capacities with KPMG LLP, including audit partner for technology clients. Mr. McGeary is a Certified Public Accountant and holds a B.S. degree in Accounting from Lehigh University. Mr. McGeary also currently serves on the boards of directors of PACCAR Inc. and Raymond James Financial, Inc.

Mr. McGeary brings to the Board of Directors a combination of executive experience in management and technology consulting. He also has expertise in leading talented teams as well as skills in finance, accounting and auditing with technology industry experience.

Mr. Robbins, 54, has served as Chief Executive Officer since July 2015, as a member of the Board of Directors since May 2015 and as Chairman of the Board since December 2017. He joined Cisco in December 1997, from which time until March 2002 he held a number of managerial positions within Cisco’s sales organization. Mr. Robbins was promoted to Vice President in March 2002, assuming leadership of Cisco’s U.S. channel sales organization. Additionally, in July 2005 he assumed leadership of Cisco’s Canada channel sales organization. In December 2007, Mr. Robbins was promoted to Senior Vice President, U.S. Commercial, and in August 2009 he was appointed Senior Vice President, U.S. Enterprise, Commercial and Canada. In July 2011, Mr. Robbins was named Senior Vice President, Americas. In October 2012, Mr. Robbins was promoted to Senior Vice President, Worldwide Field Operations, in which position he served until assuming the role of CEO. Mr. Robbins also currently serves on the board of directors of BlackRock, Inc.

Mr. Robbins brings to the Board of Directors extensive industry, company and operational experience acquired from having served as Cisco’s CEO since 2015, and prior to that from having led Cisco’s global sales and partner teams. He has a thorough knowledge of Cisco’s segments, technology areas, geographies and competition. He has a proven track record of driving results and played a key role in leading and executing many of Cisco’s investments and strategy shifts to meet its growth initiatives.

Mr. Sarin, 65, has been a member of the Board of Directors since September 2009 and previously served on the Board of Directors from September 1998 to July 2003. In April 2003, he became CEO designate of Vodafone Group Plc and served as its Chief Executive Officer from July 2003 to July 2008. He also served as a member of the board of directors of that company from 1999 to 2008. From July 2001 to January 2003, he was Chief Executive Officer of Accel-KKR Telecom. He was the Chief Executive Officer of InfoSpace, Inc., and a member of its board of directors from April 2000 to January 2001. He was the Chief Executive Officer of the USA/Asia Pacific Region for Vodafone AirTouch Plc from July 1999 to April 2000. From February 1997 to July 1999, he was the President of AirTouch Communications, Inc. Prior to that, from April 1994 to February 1997, he served as President and Chief Executive Officer of AirTouch International. Mr. Sarin joined AirTouch Communications, Inc. in 1994 as Senior Vice President Corporate Strategy and Development upon its demerger from Pacific Telesis Group, which he joined in 1984. Mr. Sarin also currently serves on the boards of directors of Accenture plc, Cerence Inc. and The Charles Schwab Corporation. Mr. Sarin served as a Senior Advisor at Kohlberg Kravis Roberts & Co. from October 2009 to October 2014. He previously served as a director of Safeway, Inc., ending in 2015 and Blackhawk Network Holdings, Inc., ending in 2018. In 2010, Mr. Sarin was named an Honorary Knight of the British Empire for services to the communications industry.

Mr. Sarin provides to the Board of Directors a telecommunications industry and technology background, as well as leadership skills, including his global chief executive experience at Vodafone Group Plc. He also provides an international perspective as well as expertise in general management, finance, marketing and operations. In addition, Mr. Sarin has experience as a director, including service as an outside board member of companies in the information technology, banking, financial services, and retail industries.

Mr. Saunders, 50, has been a member of the Board of Directors since March 2017. Mr. Saunders has served as President, Chief Executive Officer and Chairman of the Board of Directors of Vesper Healthcare Acquisition Corp. since July 2020. Previously he served as CEO and President of Allergan plc (“Allergan”) from July 2014

9

Table of Contents

to May 2020 when Allergan was acquired by AbbVie, Inc. He was a board member of Allergan from July 2014 to May 2020 and served as its Chairman from October 2016 to May 2020. He previously served as Chief Executive Officer and President of Forest Laboratories, Inc. from October 2013 until July 2014 and had served as a board member of Forest Laboratories, Inc. beginning in 2011. In addition, Mr. Saunders served as Chief Executive Officer of Bausch + Lomb Incorporated, a leading global eye health company, from March 2010 until August 2013. From 2003 to 2010 Mr. Saunders also held a number of leadership positions at Schering-Plough, including the position of President of Global Consumer Health Care and was named head of integration for Schering-Plough’s merger with Merck & Co. and for its acquisition of Organon BioSciences. Before joining Schering-Plough, Mr. Saunders was a Partner and Head of Compliance Business Advisory Group at PricewaterhouseCoopers LLP from 2000 to 2003. Prior to that, he was Chief Risk Officer at Coventry Health Care, Inc. and Senior Vice President, Compliance, Legal and Regulatory at Home Care Corporation of America. Mr. Saunders began his career as Chief Compliance Officer for the Thomas Jefferson University Health System. Mr. Saunders also currently serves on the board of directors of BridgeBio Pharma, Inc.

Mr. Saunders brings to the Board of Directors his extensive leadership experience, including his role as chief executive officer of two global healthcare companies, as well as his financial, strategic and operational experience. He is a natural innovator and leader with a deep understanding of business transformation.

Dr. Su, 50, has been a member of the Board of Directors since January 2020. Dr. Su joined Advanced Micro Devices, Inc. (“AMD”) in 2012 and has held the position of President and Chief Executive Officer since October 2014. She also serves on AMD’s Board of Directors. Previously, Dr. Su served as Senior Vice President and General Manager, Networking and Multimedia at Freescale Semiconductor, Inc., and was responsible for global strategy, marketing and engineering for the company’s embedded communications and applications processor business. Dr. Su joined Freescale in 2007 as Chief Technology Officer, where she led the company’s technology roadmap and research and development efforts. Dr. Su spent the previous 13 years at IBM in various engineering and business leadership positions, including Vice President of the Semiconductor Research and Development Center responsible for the strategic direction of IBM’s silicon technologies, joint development alliances and semiconductor R&D operations. Prior to IBM, she was a member of the technical staff at Texas Instruments Incorporated from 1994 to 1995. Dr. Su has a Bachelor of Science, Master of Science and Doctorate degrees in Electrical Engineering from the Massachusetts Institute of Technology (MIT). Dr. Su previously served as a director of Analog Devices, Inc., ending in 2020.

Dr. Su brings to the Board of Directors her extensive business leadership experience, including her role as president and chief executive officer of a global semiconductor company, as well as her technology and semiconductor expertise. Dr. Su also provides expertise in global strategy, marketing and engineering, and has experience serving as a public company outside director.

The table below summarizes key qualifications, skills and attributes most relevant to the decision to nominate the candidates to serve on the Board of Directors. A mark indicates a specific area of focus or experience on which the Board relies most. The lack of a mark does not mean the director nominee does not possess that qualification or skill. Each director nominee biography above in this section describes each nominee’s qualifications and relevant experience in more detail.

| Director Nominees |

Leadership | Technology | Financial Experience |

Global Business |

Gender/ Ethnic/ Racial/Sexual Orientation Diversity1 |

Sales and Marketing |

Academia | Public Company Board Experience | ||||||||

| M. Michele Burns

|

|

|

|

|

| |||||||||||

| Wesley G. Bush

|

|

|

|

|

| |||||||||||

| Michael D. Capellas

|

|

|

|

|

|

| ||||||||||

| Mark Garrett

|

|

|

|

|

| |||||||||||

| Dr. Kristina M. Johnson

|

|

|

|

|

| |||||||||||

| Roderick C. McGeary

|

|

|

|

|

| |||||||||||

| Charles H. Robbins

|

|

|

|

|

| |||||||||||

| Arun Sarin

|

|

|

|

|

|

|

| |||||||||

| Brenton L. Saunders

|

|

|

|

|

| |||||||||||

| Dr. Lisa T. Su

|

|

|

|

|

|

|

| 1 | Categories covered under California law AB 979. |

10

Table of Contents

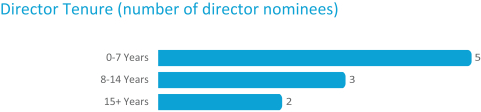

Cisco policy also provides that the Board will take into consideration the age of any current or prospective Board member whose age would be 72 or older when elected, re-elected or appointed to the Board and, before nominating or appointing such Board member, the Board will make an affirmative determination that it is in the best interests of Cisco and its shareholders for that individual to serve on the Board. The average tenure of the director nominees is approximately 7.8 years.

Upon recommendation of the Nomination and Governance Committee, the Board of Directors has affirmatively determined that each member of the Board of Directors other than Mr. Robbins is independent under the criteria established by Nasdaq for director independence. All members of each of Cisco’s Audit, Compensation and Management Development, and Nomination and Governance committees are independent directors. In addition, upon recommendation of the Nomination and Governance Committee, the Board of Directors has determined that the members of the Audit Committee and the members of the Compensation Committee meet the additional independence criteria required for membership on those committees under applicable Nasdaq listing standards.

The Nasdaq criteria include a subjective test and various objective standards, such as that the director is not an employee of Cisco. Mr. Robbins is not deemed independent because he is a Cisco employee. The subjective test under Nasdaq criteria for director independence requires that each independent director not have a relationship that, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The subjective evaluation of director independence by the Board of Directors was made in the context of the objective standards referenced above. In making its independence determinations, the Board of Directors generally considers commercial, financial services, charitable, and other transactions and other relationships between Cisco and each director or nominee and his or her family members and affiliated entities. For example, the Nomination and Governance Committee reviewed, for each independent director and nominee, the amount of all transactions between Cisco and other organizations where such directors serve as executive officers or directors, none of which exceeded 1% of the recipient’s annual revenues during the relevant periods, except as described below.

For each of the independent directors, the Board of Directors determined based on the recommendation of the Nomination and Governance Committee that none of the transactions or other relationships exceeded Nasdaq objective standards and none would otherwise interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making this determination, the Board of Directors considered certain relationships that did not exceed Nasdaq objective standards but were identified by the Nomination and Governance Committee for further consideration under the subjective test. The Board of Directors determined that none of these relationships would interfere with the exercise of independent judgment by the director in carrying out is responsibilities as a director.

The following is a description of the two relationships in which a director serves as an outside board member of other companies and in which payments by Cisco exceeded 1% of the recipient’s annual revenues:

| • | Mr. Capellas is a member of the board of directors of Flex Ltd. Cisco has ordinary course commercial relationships with Flex Ltd., including design, manufacturing and after-market services. |

| • | Mr. Garrett is a member of the board of directors of Snowflake Inc. Cisco has purchased cloud data warehouse platform services from Snowflake Inc. |

The Role of the Board of Directors in Strategy

One of the Board’s key responsibilities is overseeing management’s formulation and execution of Cisco’s strategy. Throughout the year, our CEO, the executive leadership team, and other leaders from across the company provide detailed business and strategy updates to the Board. During these reviews, the Board engages

11

Table of Contents

with the executive leadership team and other business leaders regarding various topics, including business strategy and initiatives, capital allocation, portfolio updates, the competitive landscape, talent and culture including inclusion and diversity, ESG concerns including human rights implications of Cisco product development and sales, and regulatory developments. Additionally, on an annual basis, the Board reviews and approves Cisco’s financial plan. The Lead Independent Director also chairs regularly scheduled executive sessions of the independent directors, without Cisco management present, during which Cisco’s strategy is reviewed and other topics are discussed.

The Role of the Board of Directors in Risk Oversight

We believe that risk is inherent in innovation and the pursuit of long-term growth opportunities. Cisco’s management is responsible for day-to-day risk management activities. The Board of Directors, acting directly and through its committees, is responsible for the oversight of Cisco’s risk management. With the oversight of the Board of Directors, Cisco has implemented practices, processes and programs designed to help manage the risks to which we are exposed in our business and to align risk-taking appropriately with our efforts to increase shareholder value.

Cisco’s management has implemented an enterprise risk management (“ERM”) program, managed by Cisco’s internal audit function, that is designed to work across the business to identify, assess, govern and manage risks and Cisco’s response to those risks. Cisco’s internal audit function performs an annual risk assessment which is utilized by the ERM program. The structure of the ERM program includes both an ERM operating committee that focuses on risk management-related topics, as well as, an ERM executive committee consisting of members of executive management. The ERM operating committee conducts global risk reviews and provides regular updates to the ERM executive committee.

The Audit Committee, which oversees our financial and risk management policies, including data protection (comprising both privacy and security), receives regular reports on ERM from the chair of the ERM operating committee and regular reports on cybersecurity from Cisco’s Chief Security and Trust Officer. As part of its responsibilities and duties, the Audit Committee reviews Cisco’s policies and programs for addressing data protection, including both privacy and security, including with respect to (a) Cisco’s products and services, (b) Cisco’s servers, data centers and cloud based solutions on which Cisco’s data, and data of its customers, suppliers and business partners are stored and/or processed, and (c) the cloud-based services provided by or enabled by Cisco. The Committee provides updates to the Board of Directors, at least annually, on such review.

As part of the overall risk oversight framework, other committees of the Board of Directors also oversee certain categories of risk associated with their respective areas of responsibility. For example, the Finance Committee oversees matters related to risk management policies and programs addressing currency, interest rate, equity, and insurance risk, as well as Cisco’s customer and channel partner financing activities, investment policy and certain risk management activities of Cisco’s treasury function. The Compensation Committee oversees compensation-related risk management, as discussed in the “Board of Directors — Proposal No. 1 — Election of Directors — Board Meetings and Committees — Compensation and Management Development Committee” and “Compensation Committee Matters — Compensation Discussion and Analysis” (“CD&A”) sections in this Proxy Statement.

Each committee reports regularly to the full Board of Directors on its activities. In addition, the Board of Directors participates in regular discussions with Cisco’s executive management on many core subjects, including strategy, operations, information systems, finance, legal and public policy matters, in which risk oversight is an inherent element. The Board of Directors believes that the leadership structure described above in the “Corporate Governance — Board Leadership Structure” section facilitates the Board’s oversight of risk management because it allows the Board, with leadership from the Lead Independent Director and working through its committees, including the independent Audit Committee, to participate actively in the oversight of management’s actions.

During fiscal 2020, the Board of Directors held 10 meetings. During this period, all of the incumbent directors attended at least 75% of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings held by all committees of the Board of Directors on which each such director served, during the period for which each such director served. Cisco’s directors are strongly encouraged to attend the annual meeting of shareholders. Seven of Cisco’s directors who were then serving on the Board of Directors attended last year’s annual meeting.

12

Table of Contents

Cisco has five standing committees: the Audit Committee, the Compensation Committee, the Nomination and Governance Committee, the Acquisition Committee, and the Finance Committee. Each of these committees has a written charter approved by the Board of Directors. A copy of each charter can be found on the “Committees” page, which is located in the Governance section of Cisco’s Investor Relations website at investor.cisco.com.

The members of the committees and their independence status, as of the date of this Proxy Statement, and the number of committee meetings during fiscal 2020 are identified in the following table.

| Directors |

Independent (1) | Audit Committee |

Compensation Committee |

Nomination and Governance Committee |

Acquisition Committee |

Finance Committee | ||||||

| M. Michele Burns

|

|

|

Chair

| |||||||||

| Wesley G. Bush

|

|

|

| |||||||||

| Michael D. Capellas

|

|

Chair

|

Chair

|

|||||||||

| Mark Garrett

|

|

Chair

|

|

|||||||||

|

Dr. Kristina M. Johnson

|

|

|

| |||||||||

| Roderick C. McGeary

|

|

|

Chair

|

|

||||||||

| Charles H. Robbins

|

||||||||||||

| Arun Sarin

|

|

|

|

|||||||||

| Brenton L. Saunders

|

|

|

|

|||||||||

| Dr. Lisa T. Su

|

|

|

||||||||||

| Number of Committee Meetings

|

15

|

7

|

6

|

11

|

10

| |||||||

| (1) | Mr. Capellas currently serves as Lead Independent Director. |

Audit Committee

The Audit Committee is directly responsible for the appointment, retention and oversight of the independent accountants. The Audit Committee is also responsible for reviewing the financial information which will be provided to shareholders and others, including the quarterly and year-end financial results, reviewing the system of internal controls which management and the Board of Directors have established, reviewing Cisco’s financial and risk management policies, including data protection (comprising both privacy and security), appointing, retaining and overseeing the performance of the independent registered public accounting firm, overseeing Cisco’s accounting and financial reporting processes and the audits of Cisco’s financial statements, pre-approving audit and permissible non-audit services provided by the independent registered public accounting firm, overseeing and reviewing related party transactions, and establishing procedures for the receipt, retention, and treatment of complaints received by Cisco regarding accounting, internal accounting controls, or auditing matters, and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

The Audit Committee reviews the responsibilities and activities of each of the Governance, Risk and Controls Department, and the Compliance Office. The Audit Committee also meets separately in periodic executive sessions with each of management, the head of Cisco’s internal audit function, and the independent registered public accounting firm. The Board of Directors has determined that each of Ms. Burns, Mr. Garrett and Mr. McGeary is an “audit committee financial expert” as defined in Item 407(d) of Regulation S-K. Each member of this committee is an independent director and meets each of the other requirements for audit committee members under applicable Nasdaq listing standards.

Compensation and Management Development Committee

The Compensation Committee’s responsibility is to review the performance and development of Cisco’s management in achieving corporate goals and objectives and to assure that Cisco’s executive officers are compensated effectively in a manner consistent with Cisco’s strategy, competitive practice, sound corporate governance principles and shareholder interests. Toward that end, this committee reviews and approves Cisco’s

13

Table of Contents

compensation to executive officers. The Compensation Committee also reviews matters related to succession planning, including review and approval of CEO succession planning. Each member of this committee is an independent director under applicable Nasdaq listing standards, including the additional independence requirements specific to compensation committee membership, an “outside director” as defined in Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), and a “non-employee director” as defined in Rule 16b-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The Compensation Committee’s responsibilities and duties include an annual review and approval of Cisco’s compensation strategy to help ensure that it promotes shareholder interests and supports Cisco’s strategic and tactical objectives, and that it provides appropriate rewards and incentives for management and employees, including review of compensation-related risk management. For fiscal 2020, the Compensation Committee performed these oversight responsibilities and duties by, among other things, conducting an evaluation of the design of our executive compensation program, in light of our risk management policies and programs. For additional information regarding the Compensation Committee’s risk management review, see the “Executive Compensation Governance Components” section of the CD&A.

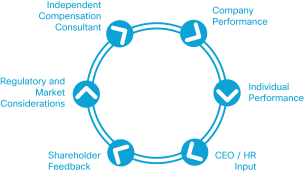

The Compensation Committee has the exclusive authority and responsibility to determine all aspects of executive compensation packages for executive officers. The Compensation Committee has retained Frederic W. Cook & Co., Inc. (“FWC”) as its independent compensation consultant to help the Compensation Committee establish and implement its compensation philosophy, to evaluate compensation proposals recommended by management, and to provide advice and recommendations on competitive market practices and specific compensation decisions for executive officers. The Compensation Committee retains and does not delegate any of its exclusive power to determine all matters of executive compensation and benefits, although the CEO and the People and Communities Department present compensation and benefit proposals to the Compensation Committee. FWC works directly with the Compensation Committee (and not on behalf of management) to assist the Compensation Committee in satisfying its responsibilities and will undertake no projects for management except at the request of the Compensation Committee chair and in the capacity of the Compensation Committee’s agent. FWC performs no other consulting or other services for Cisco management and, to date, has not undertaken any projects for management. For additional description of the Compensation Committee’s processes and procedures for consideration and determination of executive officer compensation, see the CD&A.

Nomination and Governance Committee

The Nomination and Governance Committee is responsible for overseeing, reviewing and making periodic recommendations concerning Cisco’s corporate governance policies, for reviewing Cisco’s policies and programs concerning CSR (including ESG matters), for reviewing and assessing director independence, for making recommendations regarding the size, structure and composition of the Board and its committees, for overseeing the annual Board evaluation process, for recommending to the full Board of Directors candidates for election to the Board of Directors, and for reviewing and recommending compensation for non-employee members of the Board. Each member of this committee is an independent director under applicable Nasdaq listing standards.

In connection with reviewing and recommending compensation for non-employee directors, the Nomination and Governance Committee has retained FWC as its independent compensation consultant. The Nomination and Governance Committee makes recommendations to the Board of Directors regarding compensation for non-employee directors using a process similar to the one used by the Compensation Committee for determining compensation for Cisco’s executive officers. Generally, the Nomination and Governance Committee annually reviews the market practice for non-employee director compensation for companies in Cisco’s Peer Group (as defined in the CD&A) in consultation with FWC and assesses whether Cisco’s non-employee director compensation program continues to be competitive with the market for qualified directors, incorporates best practices and aligns the interests of our non-employee directors with the long-term interests of our shareholders.

As part of its consideration of director succession, the Nomination and Governance Committee from time to time reviews, including when considering potential candidates, the appropriate skills and characteristics required of board members, including factors that it seeks in board members such as diversity of business experience, viewpoints and personal background, and diversity of skills in technology, finance, marketing, international business, financial reporting and other areas that are expected to contribute to an effective Board of Directors. In evaluating potential candidates for the Board of Directors, the Nomination and Governance Committee considers

14

Table of Contents

these factors in the light of the specific needs of the Board of Directors at that time. Additionally, due to the global and complex nature of our business, the Board believes it is important to consider diversity of race, ethnicity, gender, sexual orientation, age, education, cultural background, and professional experiences in evaluating board candidates in order to provide practical insights and diverse perspectives. The brief biographical description of each nominee and the matrix set forth in the “Board of Directors — Proposal No. 1 — Election of Directors — Business Experience and Qualifications of Nominees” section includes the primary individual experience, qualifications, attributes and skills of each of our directors that led to the conclusion that each director should serve as a member of the Board of Directors at this time.

Shareholders may recommend a director nominee to Cisco’s Nomination and Governance Committee. In recommending candidates for election to the Board of Directors, the Nomination and Governance Committee considers nominees recommended by directors, officers, employees, shareholders and others, using the same criteria to evaluate all candidates. The Nomination and Governance Committee reviews each candidate’s qualifications, including whether a candidate possesses any of the specific qualities and skills desirable in certain members of the Board of Directors. Evaluations of candidates generally involve a review of background materials, internal discussions and interviews with selected candidates as appropriate. Upon selection of a qualified candidate, the Nomination and Governance Committee would recommend the candidate for consideration by the full Board of Directors. The Nomination and Governance Committee may engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

To recommend a prospective nominee for the Nomination and Governance Committee’s consideration, submit the candidate’s name and qualifications to Cisco’s Secretary in writing to the following address: Cisco Systems, Inc., Attention: Secretary, 170 West Tasman Drive, San Jose, California 95134, with a copy to Cisco Systems, Inc., Attention: General Counsel at the same address. When submitting candidates for nomination to be elected at Cisco’s annual meeting of shareholders, shareholders must also follow the notice procedures and provide the information required by Cisco’s bylaws. In particular, for the Nomination and Governance Committee to consider a candidate recommended by a shareholder for nomination at the 2021 Annual Meeting of Shareholders, the recommendation must be delivered or mailed to and received by Cisco’s Secretary between July 23, 2021 and August 22, 2021 (or, if the 2021 annual meeting is called for a date that is not within 30 calendar days of the anniversary of the date of the 2020 Annual Meeting, within 10 calendar days after Cisco’s public announcement of the date of the 2021 annual meeting). The recommendation must include the same information as is specified in Cisco’s bylaws for shareholder nominees to be considered at an annual meeting, including the following:

| • | The shareholder’s name and address and the beneficial owner, if any, on whose behalf the nomination is proposed; |

| • | The shareholder’s reason for making the nomination at the annual meeting, and the signed consent of the nominee to serve if elected; |

| • | The number of shares owned by, and any material interest of, the record owner and the beneficial owner, if any, on whose behalf the record owner is proposing the nominee; |

| • | A description of any arrangements or understandings between the shareholder, the nominee and any other person regarding the nomination; and |

| • | Information regarding the nominee that would be required to be included in Cisco’s proxy statement by the SEC rules, including the nominee’s age, business experience for the past five years and any directorships held by the nominee, including directorships held during the past five years. |

Pursuant to the proxy access provisions of Cisco’s bylaws, an eligible shareholder or group of shareholders may nominate one or more director candidates to be included in Cisco’s proxy materials. The nomination notice and other materials required by these provisions must be delivered or mailed to and received by Cisco’s Secretary in writing between May 24, 2021 and June 23, 2021 (or, if the 2021 annual meeting is called for a date that is not within 30 calendar days of the anniversary of the date of the 2020 Annual Meeting, by the later of the close of business on the date that is 180 days prior to the date of the 2021 annual meeting or within 10 calendar days after Cisco’s public announcement of the date of the 2021 annual meeting) at the following address: Cisco Systems, Inc., Attention: Secretary, 170 West Tasman Drive, San Jose, California 95134, with a copy to Cisco Systems, Inc., Attention: General Counsel at the same address. When submitting nominees for inclusion in Cisco’s proxy materials pursuant to the proxy access provisions of Cisco’s bylaws, shareholders must follow the

15

Table of Contents

notice procedures and provide the information required by Cisco’s bylaws. Notwithstanding the foregoing, if “Delaware Reincorporation — Proposal No. 2 — Approval of the Reincorporation of Cisco from California to Delaware” is approved by the shareholders at the 2020 annual meeting, Cisco’s shareholders will become stockholders under Delaware law and Cisco’s 2021 annual meeting shall be an Annual Meeting of Stockholders. The requirements for notice shall otherwise remain unchanged following the Reincorporation.

For more detailed information on how to recommend a prospective nominee for the Nomination and Governance Committee’s consideration or to submit a nominee for inclusion in Cisco’s proxy materials pursuant to the proxy access provisions of Cisco’s bylaws, see the “Information About the Meeting — Shareholder Proposals and Nominations for 2021 Annual Meeting of Shareholders” section.

Acquisition Committee

The Acquisition Committee reviews acquisition strategies and opportunities with management. The Acquisition Committee also approves certain acquisitions and investment transactions, and makes recommendations to the Board of Directors.

Finance Committee

The Finance Committee reviews and approves Cisco’s global investment policy; oversees Cisco’s stock repurchase programs; and reviews minority investments, fixed income assets, insurance risk management policies and programs, tax programs, currency, interest rate and equity risk management policies and programs, and capital structure and capital allocation strategy. This committee is also authorized to approve the issuance of debt securities, certain real estate acquisitions and leases, and charitable contributions made on behalf of Cisco.

This section provides information regarding the compensation policies for non-employee directors and amounts paid and equity awards granted to these directors in fiscal 2020. Non-employee directors typically do not receive forms of remuneration or benefits other than those described below, but are reimbursed for their expenses in attending meetings. Cisco’s non-employee director compensation policy is designed to provide the appropriate amount and form of compensation to our non-employee directors.

Director Compensation Highlights

| • | Meeting fees for committee service to differentiate individual pay based on workload. |

| • | Emphasis on equity in the overall compensation mix. |

| • | Full-value equity grants under a fixed-value annual grant policy with immediate vesting. |

| • | A robust stock ownership guideline set at five times the annual cash retainer to support shareholder alignment. |

| • | Flexible deferral provisions to facilitate stock ownership. |