Form PREC14A PROGENICS PHARMACEUTICAL Filed by: Altiva Management Inc.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN CONSENT STATEMENT

SCHEDULE 14A INFORMATION

Consent Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☒ | Preliminary Consent Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Consent Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

| PROGENICS PHARMACEUTICALS, INC. |

(Name of Registrant as Specified in Its Charter) |

VELAN

CAPITAL, L.P. |

(Name of Persons(s) Filing Consent Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

VELAN CAPITAL, L.P.

September 18, 2019

Wholesale Board and Leadership Change is Necessary at Progenics Pharmaceuticals to Address Significant Value Destruction and Stockholder Concerns

It is Time for the Current Board to be Held Accountable for Years of Poor Performance, Abysmal Corporate Governance, Commercial Missteps, Poor Decision-Making and Lack of Transparency

With Your Support, We Believe a Reconstituted and Improved Board Can Save PGNX and Unlock Unrealized Value

Velan Will Issue a Comprehensive Strategic and Operational Plan to Help Progenics Reach its Full Potential in the Coming Weeks

Dear Fellow Progenics Stockholders:

Velan Capital, L.P., Altiva Management Inc., Balaji Venkataraman, Virinder Nohria, LTE Partners, LLC, LTE Management, LLC, Melkonian Capital Management, LLC, Ryan Melkonian, Terence Cooke and Deepak Sarpangal (collectively, the “Participating Stockholders”, “we”, “our” or “us”), and the other participants named herein, beneficially own in the aggregate 10,161,733 shares of common stock, par value $0.0013 per share (the “Common Stock”), of Progenics Pharmaceuticals, Inc., a Delaware corporation (“Progenics”, “PGNX” or the “Company”), representing approximately 11.8% of the outstanding shares of Common Stock, making us one of the Company’s largest stockholders. For the reasons set forth in the attached Consent Statement, we believe significant changes to the leadership and composition of the Board of Directors of the Company (the “Board”) are necessary in order to address the destruction of significant stockholder value at Progenics and to ensure that the Company is being run in a manner consistent with your best interests. We are therefore seeking to reconstitute the Board by removing long-tenured Progenics directors, Mark Baker, David A. Scheinberg and Nicole S. Williams, and electing our five highly-qualified nominees, Gérard Ber, Eric J. Ende, Ann MacDougall, Heinz Mäusli and David W. Mims (the “Nominees”).

We continue to believe there is significant value to be realized at Progenics but as you may know from our 2019 campaign for change at Progenics, we have deep concerns regarding the direction of the Company under the oversight of the current Board. Importantly, we are not alone in our serious concerns. Stockholders spoke loud and clear at the Company’s 2019 Annual Meeting of Stockholders (the “2019 Annual Meeting”) regarding dissatisfaction with the status quo, by supporting our call for change through an overwhelming vote against the re-election of Peter J. Crowley, then Chairman of the Board, and Michael D. Kishbauch, then Chairman of the Nominating and Corporate Governance Committee. Stockholders also expressed dissatisfaction with the performance of CEO Mark Baker; approximately 36% of the votes cast were against his re-election at the 2019 Annual Meeting despite the fact that we did not solicit votes against Mr. Baker in our 2019 Annual Meeting campaign.

During the 2019 Annual Meeting campaign, we believed that a solution to the Company’s current issues could be achieved by changing less than a majority of the Board. Unfortunately, the Company does not seem to have heeded the clear message from the recent vote. In fact, our concerns with the direction of Progenics have only intensified following the 2019 Annual Meeting, leaving us with no choice but to pursue this Consent Solicitation. Furthermore, the Company’s continued failed execution paired with a continued lack of transparency, lead us to believe a change in a majority of the Board is required. Specifically, we believe the Board’s actions after the 2019 Annual Meeting, including its lack of cooperation and engagement with us until just recently (and only after our public pressure and repeated outreach), issuance of stock to departing directors, oversight of continual underperformance, and inability to set and disclose metrics to properly judge management’s performance, all point to a glaring and unmistakable conclusion – this Board does not have a pulse on the business, its management team or the overwhelming level of stockholder discontent, and instead prefers to maintain an unsustainable status quo. Indeed, rather than immediately accept the resignations of Messrs. Crowley and Kishbauch from the Board as a result of their failure to receive the requisite vote, the Board chose to wait until October 17, 2019 for their resignations to become effective - more than three months after stockholders voted against their re-election at the 2019 Annual Meeting.

These actions make it clear to us that a change in a majority of the Board would be necessary to ensure that the best interests of all stockholders are being represented in the boardroom. Although our proposed solution, if successful, would result in a change in a majority of the Board, it is important to point out the following:

| i) | Our proposal keeps half of the incumbent non-executive directors1 for continuity, including directors that chair the Nominating and Corporate Governance Committee and Compensation Committee, and together serve as sole members of the Nominating and Corporate Governance Committee; |

| ii) | Following the Consent Solicitation, if successful, our Nominees intend to consider any candidates that have been identified or appointed by the Nominating and Corporate Governance Committee to fill the resignations of Messrs. Crowley and Kishbauch as potential additions to the Board; |

| iii) | Our Nominees are truly independent and not affiliated with (or paid by) the Participating Stockholders; and |

| iv) | Although several of our Nominees are highly qualified and are able to support and guide the Company during a CEO transition, including by serving as interim CEO, we believe that following the reconstitution of the Board, it would be most appropriate for the new Board to conduct a full CEO search process in which it would consider both internal and external candidates. |

Current Progenics CEO Mark Baker and the Board have presided (and continue to preside) over an extended period of dismal stock price performance, commercial missteps, questionable clinical decision-making, a lack of relevant management experience, limited public transparency, inefficient capital allocation and expense management, lack of stockholder alignment and preference for unnecessary and costly dilution, and poor corporate governance, which we believe has resulted (and will continue to result) in significant value destruction for Progenics stockholders. In fact, since Mark Baker joined the Company in 2005, became a member of the Board in 2009, and became CEO in 2011, Progenics stock has declined 77%, 12%, and 21%, respectively, through September 6, 2019. One of the most important governance responsibilities of the Board is to ensure that the right executive leadership is in place. Unfortunately, the Board, and in particular, longest tenured-directors David A. Scheinberg (director since 1996) and Nicole S. Williams (director since 2007), do not appear to have fulfilled this basic responsibility given their failure to hold Mr. Baker accountable for his prolonged underperformance. We believe that an objective, properly functioning Board would come to the right determination that CEO Mark Baker has failed essentially all stakeholders and that new leadership is required -- consistent with what we understand to be the views of most stockholders.

1 Excluding Messrs. Crowley and Kishbauch, whose tendered resignations become effective October 17, 2019.

Progenics stockholders deserve an independent board that will truly look out for stockholders’ best interests and ensure management accountability. We therefore feel compelled, on behalf of all stockholders, to again take action in order to provide for a better future for all Progenics stakeholders before it is too late.

Accordingly, we urge you to join us in seeking to remove three current directors of Progenics, Mark Baker, David Scheinberg and Nicole Williams, who are the three longest-tenured directors, and electing our five highly-qualified Nominees, Gérard Ber, Eric J. Ende, Ann MacDougall, Heinz Mäusli and David W. Mims, who we believe have the experience and skill sets necessary to help drive value for Progenics stockholders. We are seeking the election of our five Nominees to fill (i) the potential three vacancies to occur as a result of our efforts to remove Messrs. Baker and Scheinberg and Ms. Williams from the Board and (ii) the two upcoming vacancies to occur as a result of the resignations of Messrs. Crowley and Kishbauch, effective October 17, 2019.

The Board is currently comprised of seven directors. We are not seeking removal of current directors Bradley L. Campbell and Karen Jean Ferrante.

Through an exhaustive search process, we have identified these fully-independent and highly-qualified Nominees with particular experience in skillsets that we believe are lacking from the existing Board: pharmaceutical and radiopharmaceutical commercialization and supply chain expertise, investor relations and appropriate stockholder communication, sophisticated financial analysis and judgment, and appropriate governance and compensation oversight. We believe this reconstituted Board can unlock the value currently trapped at Progenics under the status quo.

Further, this slate of independent director Nominees is committed to executing on a comprehensive strategic plan for Progenics that will seek to put operations on par with well-performing competitors and create substantial value for stockholders. We are working diligently on this comprehensive plan with our Nominees that we plan to release in the coming weeks, which will include an outline of the operational actions our Nominees would pursue, if elected. A key element of our plan will therefore be for the reconstituted Board to immediately commence a search process to identify a top-tier CEO to lead Progenics going forward. We have already been in touch with several reputable executive search firms who would be prepared to assist if needed – though ultimately this determination would be made by the new Board.

We fully appreciate that asking for a majority of the Board, including removal of CEO Mark Baker as a director, is no trivial matter. However, in our view, there is an urgent need for wholesale Board and leadership changes at Progenics before the Company’s failures become irreparable.

We hope it is clear to you that the extraordinary action of launching this Consent Solicitation was not our preference, but is necessary at this critical stage to ensure that the collective best interests of all stockholders are properly represented.

If you endorsed our campaign for change at the 2019 Annual Meeting, we thank you for facilitating that important first step towards achieving the kind of wholesale change that we believe is necessary to save Progenics. Note that in this solicitation, the proposals set forth in the attached Consent Statement, including the election of directors, requires the vote of a majority of all shares of Common Stock outstanding, not just a majority of the votes cast. This means that your written consent in support of our proposals is even more important in this solicitation.

We urge you to carefully consider the information contained in the attached Consent Statement and then support our efforts by signing, dating and returning the enclosed GREEN consent card today. The attached Consent Statement and the enclosed GREEN consent card are first being furnished to the stockholders on or about [_________], 2019. We urge you not to sign any revocation of consent card that may be sent to you by Progenics. If you have done so, you may revoke that revocation of consent by delivering a later dated GREEN consent card to the Participating Stockholders, in care of Okapi Partners LLC, which is assisting us, at their address listed on the following page, or to the principal executive offices of Progenics.

| Thank you for your support, |

| /s/ Balaji Venkataraman |

| Balaji Venkataraman |

| Velan Capital, L.P. |

|

If you have any questions regarding your GREEN consent card or need assistance in executing your proxy, please contact:

Okapi Partners LLC 1212 Avenue of the Americas, 24th Floor New York, New York 10036 Stockholders may call toll-free: (888) 785-6673 Banks and brokers call: (212) 297-0720 E-mail: [email protected] |

PRELIMINARY

COPY SUBJECT TO COMPLETION

DATED SEPTEMBER 18, 2019

Progenics

pharmaceuticals, inc.

_________________________

CONSENT STATEMENT

OF

velan capital, l.p.

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED GREEN CONSENT CARD TODAY

This Consent Statement and the accompanying GREEN consent card are being furnished to you as a stockholder of Progenics Pharmaceuticals, Inc., a Delaware corporation (“Progenics” or the “Company”), by Velan Capital, L.P. (“Velan”), Altiva Management Inc. (“Altiva”), Balaji Venkataraman, Virinder Nohria, LTE Partners, LLC (“LTE”), LTE Management, LLC (“LTE Management”), Melkonian Capital Management, LLC (“MCM”), Ryan Melkonian, Terence Cooke, and Deepak Sarpangal (collectively, the “Participating Stockholders”, “we”, “our” or “us”) and the other participants named herein, in connection with our solicitation of written consents to reconstitute a majority of the Board of Directors of the Company (the “Board”). As significant stockholders of the Company, with aggregate ownership of 10,161,733 shares of the Company’s common stock, par value $0.0013 per share (the “Common Stock”), constituting approximately 11.8% of the outstanding shares, we believe that the Board must be significantly and immediately reconstituted to ensure that the best interests of the stockholders, the true owners of Progenics, are appropriately represented in the boardroom.

A solicitation of written consents is a process that allows a company’s stockholders to act by submitting written consents to any proposed stockholder actions in lieu of voting in person or by proxy at an annual or special meeting of stockholders. We are soliciting written consents from the holders of shares of the Common Stock to take the following actions (each, as more fully described in this Consent Statement, a “Proposal” and together, the “Proposals”), in the following order, without a stockholders’ meeting, as authorized by Delaware law:

Proposal 1 – Repeal any provision of the By-Laws of the Company (the “Bylaws”) in effect at the time this proposal becomes effective, including any amendments thereto, which were not included in the Bylaws that were in effect as of April 1, 2019 and were filed with the Securities and Exchange Commission on April 1, 2019 (the “Bylaw Restoration Proposal”);

Proposal 2 – Remove without cause three members of the Board: Mark R. Baker, David A. Scheinberg and Nicole S. Williams and, in addition, any person (other than those elected by this Consent Solicitation) nominated, elected or appointed to the Board to fill any vacancy on the Board or any newly-created directorships on or after September 18, 2019 and prior to the time that any of the actions proposed to be taken by this Consent Solicitation become effective, including any director appointed or designated by the Board to fill any vacancy to be caused by the resignations of Peter Crowley and Michael Kishbauch, effective October 17, 2019 (such vacancies, the “October Vacancies”) (the “Removal Proposal”);

Proposal 3 – Amend Article IV, Section 4.04 of the Bylaws, as set forth on Schedule III to this Consent Statement, to provide that when one or more directors shall resign from the Board, effective at a future date, either stockholders or a majority of the directors then in office, including those who have so resigned, shall have the power to fill such vacancy or vacancies (the “Future Vacancy Proposal”);

Proposal 4 – Amend Article IV, Section 4.01 of the Bylaws, as set forth on Schedule IV to this Consent Statement, to fix the size of the Board at seven members (the “Board Size Proposal”); and

Proposal 5 – Elect Velan’s five nominees: Gérard Ber, Eric J. Ende, Ann MacDougall, Heinz Mäusli and David W. Mims (each a “Nominee” and collectively, the “Nominees”), to serve as directors of the Company until the Company’s 2020 annual meeting of stockholders and until their successors are duly elected and qualified (or, if any such Nominee is unable or unwilling to serve as a director of the Company, any other person designated as a nominee by the remaining Nominee or Nominees) (the “Election Proposal”).

This Consent Statement and the enclosed GREEN consent card are first being sent or given to the stockholders of Progenics on or about [_________], 2019.

We are soliciting your consent in favor of the adoption of the Removal Proposal, the Future Vacancy Proposal, the Board Size Proposal and the Election Proposal because we believe Progenics stockholders will be best served by directors who are committed to safeguarding and promoting the best interests of all Progenics stockholders. In addition, we are also soliciting your consent in favor of the adoption of the Bylaw Restoration Proposal to ensure that the incumbent Board does not limit the effect of your consent to the removal of the incumbent members of the Board and the election of the Nominees through changes to the Bylaws not filed with the SEC on or before April 1, 2019, the last date amendments to the Bylaws were filed with the SEC.

The effectiveness of each of the Proposals requires the affirmative consent of the holders of record of a majority of the shares of outstanding voting securities as of the close of business on the Record Date (as defined below). Each Proposal will be effective without further action when we deliver to Progenics such requisite number of consents. Proposal 1 (Bylaw Restoration Proposal), Proposal 2 (Removal Proposal), Proposal 3 (Future Vacancy Proposal) and Proposal 4 (Board Size Proposal) are not subject to, or conditioned upon, the effectiveness of the other Proposals. Proposal 5 (Election Proposal), is conditioned, in part, upon the Removal Proposal. If none of the members of (or appointees to) the Board are removed pursuant to the Removal Proposal, including the directors appointed by the Board to fill the October Vacancies (assuming the Board fills such vacancies), and there are no vacancies to fill, none of the Nominees can be elected pursuant to the Election Proposal. If the Board does not fill the October Vacancies, however, there will be two vacancies on the Board that can be filled by stockholders through the election of our Nominees in Proposal 5.

On September 18, 2019, the Participating Stockholders delivered to the Secretary of Progenics written notice of the Proposals and a request for the Board to fix a record date in accordance with the Bylaws for determining stockholders entitled to give their written consent to the Proposals. On ________ __, 2019, Progenics announced that the Board has established the close of business on ________ __, 2019 as the record date for purposes of determining stockholders entitled to give their written consent to the Proposals (the “Record Date”). According to the Company, as of the Record Date, there were ________ shares of Common Stock outstanding, each of which is entitled to one consent on each Proposal.

In addition, none of the Proposals will be effective unless the delivery of the written consents complies with Section 228(c) of the Delaware General Corporation Law (“DGCL”). For the Proposals to be effective, properly completed and unrevoked written consents must be delivered to Progenics within 60 days of the earliest dated written consent delivered to Progenics. The Participating Stockholders delivered a written consent to Progenics on September 18, 2019. Consequently, by November 17, 2019, the Participating Stockholders will need to deliver properly completed and unrevoked written consents to the Proposals from the holders of record of a majority of the outstanding voting securities as of the close of business on the Record Date. We intend to set November [ ], 2019 as the goal for submission of written consents.

WE URGE YOU TO ACT TODAY TO ENSURE THAT YOUR CONSENT WILL COUNT.

The Participating Stockholders reserve the right to submit to Progenics consents at any time within 60 days of the earliest dated written consent delivered to Progenics. See “Consent Procedures” for additional information regarding such procedures.

As of September 18, 2019, the Group (as defined below) collectively owned an aggregate of 10,161,733 shares of Common Stock, representing approximately 11.8% of the outstanding shares of Common Stock of the Company. The Group intends to express consent in favor of the Proposals with respect to all of such shares of Common Stock.

As of the Record Date, there were [________] shares of Common Stock outstanding, as reported in the Company’s [_________], filed with the SEC on _______ __, 2019. The mailing address of the principal executive offices of Progenics is One World Trade Center, 47th Floor, New York, NY 10007.

The failure to sign and return a consent will have the same effect as voting against the Proposals. Please note that in addition to signing the enclosed GREEN consent card, you must also date it to ensure its validity.

THIS CONSENT SOLICITATION IS BEING MADE BY THE PARTICIPATING STOCKHOLDERS AND NOT BY OR ON BEHALF OF THE COMPANY. THE PARTICIPATING STOCKHOLDERS URGE YOU TO SIGN, DATE AND RETURN THE GREEN CONSENT CARD IN FAVOR OF THE PROPOSALS DESCRIBED HEREIN

Important Notice Regarding the Availability of Consent Materials for this Consent Solicitation

This Consent Statement is available at www.SavePGNX.com

IMPORTANT

PLEASE READ THIS CAREFULLY

If your shares of Common Stock are registered in your own name, please submit your consent to us today by signing, dating and returning the enclosed GREEN consent card in the postage-paid envelope provided.

If you hold your shares in “street” name with a bank, broker firm, dealer, trust company or other nominee, only they can exercise your right to consent with respect to your shares of Common Stock and only upon receipt of your specific instructions. Accordingly, it is critical that you promptly give instructions to consent to the Proposals to your bank, broker firm, dealer, trust company or other nominee. Please follow the instructions to consent provided on the enclosed GREEN consent card. If your bank, broker firm, dealer, trust company or other nominee provides for consent instructions to be delivered to them by telephone or Internet, instructions will be included on the enclosed GREEN consent card. The Participating Stockholders urge you to confirm in writing your instructions to the person responsible for your account and provide a copy of those instructions to the Participating Stockholders, c/o Okapi Partners LLC (“Okapi”) so that we will be aware of all instructions given and can attempt to ensure that such instructions are followed.

Execution and delivery of a consent by a record holder of shares of Common Stock will be presumed to be a consent with respect to all shares held by such record holder unless the consent specifies otherwise.

Only holders of record of voting securities of the Company as of the close of business on the Record Date will be entitled to consent to the Proposals. If you are a stockholder of record as of the close of business on the Record Date, you will retain your right to consent even if you sell your shares of Common Stock after the Record Date.

IF YOU TAKE NO ACTION, YOU WILL IN EFFECT BE REJECTING THE PROPOSALS. ABSTENTIONS, FAILURES TO CONSENT AND BROKER NON-VOTES WILL HAVE THE SAME EFFECT AS WITHHOLDING CONSENT.

|

If you have any questions regarding your GREEN consent card or need assistance in executing your proxy, please contact:

Okapi Partners LLC 1212 Avenue of the Americas, 24th Floor New York, New York 10036 Stockholders may call toll-free: (888) 785-6673 Banks and brokers call: (212) 297-0720 E-mail: [email protected] |

Background to the Solicitation

Below is a chronological list of interactions and events leading up to this proxy solicitation:

| · | After having followed the Company and its predecessors for years, Velan initiated its current investment in July 2018 and initially interacted with representatives of the Company during a telephonic conversation on November 29, 2018. |

| · | Over the ensuing months, Velan pursued further due diligence related to the Company, which included consultations with several third parties, including key opinion leaders (“KOLs”) and other industry participants. |

| · | On January 7, 2019, Velan met with Patrick Fabbio, Chief Financial Officer of the Company, at the annual J.P. Morgan Healthcare Conference. After this meeting, Velan contacted the Company’s management on multiple occasions to schedule further interactions but did not receive any response or acknowledgment from the management team. |

| · | On February 18, 2019, Velan sent a letter to the Board expressing disappointment with the Company’s lack of responsiveness to the attempted outreach of an interested stockholder, highlighting certain important issues that Velan had sought to cover with senior management. |

| · | On February 22, 2019, Peter Crowley, then Chairman of the Board, responded to Velan’s letter noting the Board had yet to review or consider Velan’s observations. |

| · | On March 7, 2019, Velan sent another letter to the Board noting Velan’s disappointment in the continued lack of response and engagement from the Company. As a result, Velan requested the documentation required in order to nominate directors for election to the Board. In this letter, Velan made clear its preference to work constructively with the Board. |

| · | On March 8, 2019, Mr. Crowley responded to Velan’s letter of March 7, 2019, proposing a meeting between himself, Velan and Mark Baker, Chief Executive Officer and a director of the Company. |

| · | On March 13, 2019, Mr. Venkataraman had a telephone conversation with the Mr. Crowley. During the call, Mr. Venkataraman discussed his views on the Company (including its management team) and noted Velan’s willingness to work with the Company. Mr. Venkataraman felt that Mr. Crowley acknowledged that execution was meaningfully lacking, though Mr. Crowley later disputed this account. |

| · | On March 15, 2019, given the limited engagement and openness believed to be shown by the Company, Velan nominated six candidates for election to the Board at the Company’s 2019 Annual Meeting of Stockholders (the “2019 Annual Meeting”), including Messrs. Venkataraman, Nohria, Sarpangal, Melkonian, Cooke and Matthew Heck, in order to facilitate stockholder involvement and value creation. |

| · | On March 25, 2019, Messrs. Venkataraman and Sarpangal met with Messrs. Crowley and Baker in New York City to discuss the issues and concerns highlighted by Velan. During this meeting, Velan disclosed that it owned approximately 4% of the Company’s outstanding shares, which included a significant amount of stock purchased immediately following the Company’s fourth quarter 2018 earnings call, and that while already one of the Company’s large stockholders, there was a good chance that Velan might become one of the largest, if not the largest stockholder. Mr. Crowley stated they would consider the topics raised by Messrs. Venkataraman and Sarpangal at an April 1, 2019 meeting of the Board. |

| · | On March 27, 2019, Velan sent a letter to Messrs. Crowley and Baker noting Velan’s disappointment with the tone of the in-person meeting on March 25, 2019, and expressing hope that Velan’s concerns and issues would be seriously considered by the Board. In order to facilitate any such review, Velan also shared a presentation highlighting various concerns, along with the benefits that Velan believed its nominees would provide. |

| · | On March 27, 2019, the Participating Stockholders crossed the 5% ownership threshold, thereby triggering their obligation under the Securities Exchange Act of 1934 (the “Exchange Act”) to file a Schedule 13D within 10 calendar days. |

| · | On April 4, 2019, Mr. Crowley sent a letter to Velan confirming receipt of Velan’s March 27, 2019 letter. Mr. Crowley did not indicate whether or not Velan’s concerns were discussed at the April 1, 2019 meeting of the Board or provide any further feedback on the concerns Velan had raised. |

| · | Prior to the Participating Stockholders’ filing of their Schedule 13D on April 5, 2019, Mr. Sarpangal called Mr. Crowley multiple times to follow up on the March 25, 2019 meeting but the calls were neither accepted nor returned. The final call on April 4, 2019 was meant to inform the Company of the upcoming Schedule 13D filing. |

| · | On April 5, 2019, the Participating Stockholders filed a Schedule 13D with the SEC reporting their collective beneficial ownership, as of the close of business on April 4, 2019, of 6,233,796 shares of the Common Stock, representing 7.4% of the Company’s outstanding shares. |

| · | Between April 7, 2019 and April 15, 2019, Mr. Fabbio and Velan engaged in email communications regarding scheduling interviews with the Company’s Nominating and Corporate Governance Committee for Velan’s nominees. |

| · | On April 11, 2019, Mr. Sarpangal emailed Mr. Fabbio to schedule a brief phone call to discuss clarification questions related to the Company’s financial profile. After not receiving a response for several days, Mr. Sarpangal emailed Mr. Fabbio again on April 14, 2019, after which Mr. Fabbio and Melissa Downs, the Company’s Associate Director, Investor Relations, arranged a half hour phone call on April 15, 2019. |

| · | On April 15, 2019, Mr. Fabbio provided a letter confirming the meeting dates for Velan’s nominees and requesting clarification of Velan’s share ownership at the time Velan’s nomination materials were submitted. |

| · | On April 16, 2019, Velan’s outside counsel sent a letter to Mr. Fabbio responding to Mr. Fabbio’s letter of April 15, 2019 and confirming Velan’s ownership of its shares in the Company at the time its nomination materials were submitted and offering to provide any further confirmation the Company may request. |

| · | On April 18, 2019, Dr. Nohria held a telephonic meeting with Michael Kishbauch, then Chairman of the Nominating and Corporate Governance Committee, and Nicole Williams, a director of the Company, to discuss Dr. Nohria’s qualifications for serving on the Board. |

| · | On April 19, 2019, Mr. Melkonian held an in-person meeting in New York City with Mr. Kishbauch which included telephonic participation by Ms. Williams to discuss Mr. Melkonian’s qualifications for serving on the Board. |

| · | Between April 15-22, 2019, Velan and its outside counsel contacted the Company on multiple occasions seeking clarification of the correct record date. This outreach was ignored by the Company. |

| · | On April 22, 2019, the Company delivered a letter to Velan, which it filed with the SEC, invalidating Velan’s nomination of director candidates on technical grounds2, thereby deeming Velan’s nominees ineligible for election as directors at the 2019 Annual Meeting. |

| · | On April 24, 2019, Messrs. Venkataraman, Heck, Sarpangal and Cooke held separate in-person meetings in New York City with Mr. Kishbauch and Ms. Williams to discuss their respective qualifications for serving on the Board. During Mr. Venkataraman’s meeting, he again conveyed Velan’s willingness to constructively engage with Progenics and requested a response from the Company by April 25, 2019. |

| · | On April 25, 2019, the Company delivered a letter to Velan noting that the Board was considering Velan’s request for a response. |

| · | Following delivery of the Company’s April 25th letter, outside counsel for each of Velan and the Company engaged in various discussions regarding the Company’s responses to Velan’s requests and Velan’s desire for a swift response. Notwithstanding Velan’s desire for a more immediate response, it requested that the Company respond to its requests no later than May 3, 2019. |

| · | On April 30, 2019, Velan delivered a letter to the Company, within its rights as a stockholder of the Company under Delaware law, demanding production of certain of the Company’s books and records, pursuant to Section 220 of the Delaware General Corporation Law. |

| · | On May 1, 2019, the Participating Stockholders filed Amendment No. 1 to the Schedule 13D with the SEC reporting their collective beneficial ownership, as of the close of business on April 30, 2019, of 7,679,578 shares of the Common Stock, representing 9.1% of the Company’s outstanding shares. |

| · | On May 3, 2019, the Company responded to Velan’s request, however, Velan did not believe the response reflected the level of change that it believes is necessary to drive stockholder value at the Company. |

| · | On May 6, 2019, Velan delivered a letter to the Board and issued a press release expressing its concerns with the Company’s persistent underperformance and poor corporate governance practices in light of the Company’s invalidation of its nomination of director candidates. Velan also stated in the letter that despite its sincere efforts to work constructively with the Company, it has been left with no choice but to hold the Board accountable at the 2019 Annual Meeting. |

2 On the date Velan submitted its nomination, it beneficially owned shares of Progenics in “street” name. While Velan is currently a stockholder of record of Progenics, it was not a stockholder of record on the date it submitted its nomination pursuant to the Company’s Bylaws.

| · | On May 7, 2019, the Participating Stockholders filed a preliminary proxy statement in connection with the 2019 Annual Meeting. |

| · | On May 8, 2019, Velan issued a press release calling on the Company’s management team and Board to increase the level of disclosure and transparency when Progenics reports first quarter results on May 9, 2019 and posed a series of questions to be answered by the Company on the earnings call. Velan also announced that it filed a preliminary proxy statement seeking stockholder support against the election of Messrs. Crowley and Kishbauch at the 2019 Annual Meeting. |

| · | On May 13, 2019, Velan issued a press release calling on the Company’s management team and Board to increase the level of disclosure and transparency to stockholders given Velan’s belief that the Company failed to adequately respond to its series of questions and call for increased transparency on the Company’s first quarter 2019 earnings call held on May 9, 2019. |

| · | On May 17, 2019, Velan filed amendment no. 1 to its preliminary proxy statement in connection with the 2019 Annual Meeting. |

| · | On May 21, 2019, Velan filed its definitive proxy statement in connection with the 2019 Annual Meeting. |

| · | On May 22, 2019, Velan issued a press release with its first letter to stockholders and noting the launch of its campaign website – www.SavePGNX.com. |

| · | On May 30, 2019, the Company filed its definitive proxy statement in connection with the 2019 Annual Meeting. |

| · | On May 31, 2019, Velan issued an FAQ to stockholders regarding the 2019 Annual Meeting. |

| · | On June 3, 2019, Velan issued a supplement to its definitive proxy statement. |

| · | On June 3, 2019, the Company issued a press release containing the Board’s first letter to stockholders. |

| · | On June 4, 2019, Velan issued a press release responding to statements made by the Board in its letter to stockholders. |

| · | On June 6, 2019, Ryan Melkonian approached Mr. Baker expressing Velan’s disappointment that a settlement had not been reached. |

| · | On June 11, 2019, Velan issued a press release with its second letter to stockholders highlighting the Board’s continual preference for dilution as evidenced by its decision to pay a June 2019 milestone in equity instead of cash. |

| · | On June 12, 2019, counsel for Velan delivered a revised proposal to Progenics’ counsel requesting (i) the appointment of two of its principals to the Board, (ii) the removal of one Board member to be replaced by a mutually acceptable independent candidate, (iii) the appointment of a new Chairman and (iv) that the standstill expire prior to the nomination deadline for the 2020 Annual Meeting of Stockholders (the “2020 Annual Meeting”). |

| · | On June 13, 2019, the Company issued a press release containing the Board’s second letter to stockholders. |

| · | On June 14, 2019, counsel for each of Progenics and Velan engaged in a discussion regarding Velan’s revised proposal and a potential response. |

| · | On June 17, 2019, Velan issued a press release in response to the Board’s second letter to stockholders. |

| · | On June 19, 2019, the Company issued a press release containing the Board’s third letter to stockholders. |

| · | On June 20, 2019, Velan issued a press release requesting the Board to support various claims made by Progenics in its third letter to stockholders. Later that day, Velan issued another press release announcing the release of its Investor Presentation detailing its case for change at Progenics in connection with the 2019 Annual Meeting. |

| · | On June 21, 2019, the Company released its Investor Presentation in connection with the 2019 Annual Meeting. |

| · | On June 24, 2019, the Company issued a press release and second presentation in response to Velan’s Investor Presentation. |

| · | On June 25, 2019, Velan issued a press release and second presentation in response to the Company’s Investor Presentation. Later that day, counsel for Velan again reached out to Progenics’ counsel to see if the Board thought there could be an acceptable resolution for both parties. |

| · | On June 26, 2019, Progenics’ counsel delivered the Board’s counterproposal to Velan’s counsel, which included the retirement of one unidentified director by the 2020 Annual Meeting but offered the same terms for the appointment of new directors (two new directors with no ties to the Participating Stockholders) and the standstill (through the 2020 Annual Meeting). Thereafter, counsel for each of Velan and Progenics exchanged additional counterproposals on behalf of their respective clients. |

| · | On June 27, 2019, counsel for each of Velan and Progenics resumed discussions, pursuant to which Velan and the Board ultimately agreed in principle to (i) the appointment of two independent nominees (with no ties to the Participating Stockholders), expanding the Board to nine directors, (ii) the retirement of an unidentified director by the 2020 Annual Meeting, (iii) a standstill that would expire before the nomination deadline for the 2020 Annual Meeting, and (iv) certain committee appointments. The Board however, rejected Velan’s request for at least one non-voting observer seat. Later that evening, the Company issued a press release regarding these settlement discussions. |

| · | On June 28, 2019, Velan issued a press release responding to the Company’s press release to clarify the settlement negotiations that were taking place between both parties. Later that day, Velan issued an additional press release noting that Institutional Shareholder Services Inc., a leading proxy advisory firm (“ISS”), supported its call for change at Progenics by recommending that stockholders vote against the re-election of Messrs. Crowley and Kishbauch at the 2019 Annual Meeting. The Company also issued a press release in response to ISS’ report and provided a brochure to stockholders. |

| · | On July 1, 2019, Velan issued a press release reiterating ISS’ support for change and noting its disagreement with the conclusion reached by Glass Lewis & Co., LLC (“Glass Lewis”) but citing excerpts from Glass Lewis’ report that highlighted the multiple shortcomings of the Board. The Company also issued a press release in response to Glass Lewis’ report. |

| · | On July 8, 2019, Velan issued a press release urging stockholders to vote against the re-election of Messrs. Crowley and Kishbauch and published a flyer summarizing Velan’s stance. That same day, the Company issued a press release regarding the 2019 Annual Meeting. |

| · | On July 11, 2019, the 2019 Annual Meeting was held, pursuant to which approximately 65% of the votes cast (excluding abstentions) were against the re-election of Messrs. Crowley and Kishbauch. During the 2019 Annual Meeting, Velan indicated its preference and willingness to reach a settlement and noted its intention to stay in New York City the following day to meet with the Board. Following the 2019 Annual Meeting, counsel for each of Velan and Progenics engaged in a series of discussions to set up a meeting between Velan and the Board. |

| · | On July 12, 2019, the Company issued a press release noting the preliminary results of the 2019 Annual Meeting, which indicated that Messrs. Crowley and Kishbauch were not re-elected by stockholders at the meeting. |

| · | On July 15, 2019, Mr. Baker and Mr. Bradley Campbell had a telephonic discussion with representatives of Velan. During this discussion, Velan expressed its disappointment that no other directors were on the call and reiterated its prior offer (made before the stockholder vote at the 2019 Annual Meeting) with the additional requests that the Board accept the resignations of Messrs. Crowley and Kishbauch and adopt director stock ownership requirements. |

| · | On July 22, 2019, Velan issued a press release announcing the certified voting results for the 2019 Annual Meeting, which confirmed stockholders’ support of its campaign for change at Progenics with approximately two-thirds of the votes cast against the re-election of Messrs. Crowley and Kishbauch. Velan also commented on the Board’s lack of engagement with Velan following the 2019 Annual Meeting. |

| · | On July 26, 2019, counsel for Velan reached out to counsel for Progenics in an effort to reach a constructive resolution with the Company following the certified vote and provided a revised proposal to the Board, which removed Velan’s prior request for non-voting observer seats and requested a third director be mutually appointed between the parties. All other terms remained consistent with Velan’s prior offers. |

| · | On August 3, 2019, counsel for Progenics informed counsel for Velan that the Board should be getting back to Velan on its revised proposal the following week. The Board officially responded to Velan’s revised offer in September. |

| · | On August 8, 2019, the Company issued a press release announcing certain governance changes and that the Board had accepted the contingent resignations of Messrs. Crowley and Kishbauch, with an effective date of October 17, 2019. |

| · | On August 12, 2019, Velan issued a press release noting concerning factors regarding the Company’s Q2 2019 performance and continual lack of transparency, and noted Velan’s intention to take further action on behalf of all stockholders if an appropriate settlement was not reached. |

| · | On August 15, 2019, counsel for Velan sent a letter to the Secretary of Progenics requesting the documentation set forth in the Bylaws to be completed by director nominees for election to the Board. |

| · | On August 19, 2019, the Company provided Velan’s counsel with the requested materials for director nominees. |

| · | On August 26, 2019, Velan sent a private letter to the Board noting its displeasure with the Board’s lack of engagement and noting Velan’s intentions to pursue a consent solicitation if the Board continues to refuse to meaningfully engage with Velan. Later that day, the Participating Stockholders filed Amendment No. 2 to the Schedule 13D with the SEC reporting their collective beneficial ownership, as of the close of business on August 26, 2019, of 9,453,672 shares of the Common Stock, representing 10.9% of the Company’s outstanding shares. |

| · | On August 27, 2019, the Board publicly responded to Velan’s private letter to the Board. |

| · | On September 6, 2019, counsel for Progenics engaged in a discussion with counsel for Velan regarding the Board’s counterproposal to Velan’s July 26, 2019 proposal, which was thereafter formalized in an email to Velan’s counsel on September 7, 2019. In its counter, the Board proposed: (i) expiration of the standstill through the 2020 Annual Meeting; (ii) the addition of three new directors for a Board size of eight directors – one designated by Velan (but no one affiliated with Velan), one identified by the Company to be selected by Velan and one selected by the newly reconstituted Board of seven directors, which could include candidates proposed by Velan for consideration; (iii) new Board Chair must be agreed upon by six members of the reconstituted Board; and (iv) relevant committee appointments for new directors. The proposed board composition by Progenics was, in Velan’s view, worse than its prior offer for Velan to appoint two directors. |

| · | On September 8, 2019, counsel for Velan delivered Velan’s response to Progenics’ latest offer. In return for Velan agreeing to a longer standstill, which Progenics made clear was a sticking point in its latest offer, Velan added one request to its prior offer – the resignation of CEO Mark Baker by December 31, 2019. The remaining terms of Velan’s proposal remain unchanged, including the appointment of three new directors – two independent directors to be appointed by Velan and a mutual third candidate to be agreed upon between Velan and Progenics, expanding the Board to eight directors. Velan reiterated its displeasure with the Board’s delay and lack of engagement following the 2019 Annual Meeting and therefore requested a prompt response from the Board. |

| · | On September 11, 2019, Progenics’ counsel delivered the Board’s response to Velan’s counsel, which included the following: (i) expiration of the standstill through the 2020 Annual Meeting; (ii) the addition of three new directors for a Board size of eight directors – two designated by Velan (but no one affiliated with Velan) and one candidate to be agreed upon between the newly reconstituted Board of seven directors and Velan, to be chosen from the pool of candidates identified by Korn Ferry, the Company’s search firm; (iii) new Board Chair must be agreed upon by six members of the reconstituted Board; (iv) relevant committee appointments for new directors, including a Velan designee to serve on the Compensation Committee; and (v) expense reimbursement for Velan. |

| · | On September 16, 2019, the Participating Stockholders delivered a letter to the Board expressing their disappointment that the Company’s latest counterproposal again failed to address a key stockholder concern, namely, holding CEO Mark Baker accountable for the Company’s poor performance and inability to provide products to cancer patients. Velan also reiterated its offer to accept Progenics’ ask of a longer standstill on the condition that CEO Mark Baker would retire or resign. |

| · | On September 18, 2019, the Participating Stockholders filed this preliminary Consent Statement soliciting stockholders’ consent in favor of the Proposals. |

| · | Also on September 18, 2019, Velan delivered to the Secretary of Progenics written notice of the Proposals and an executed written consent in support of the Proposals, along with a request for the Company to establish a record date to determine the Progenics stockholders entitled to consent to the corporate actions set forth in the Proposals in writing in lieu of a meeting of stockholders of the Company (the “Written Notice”). |

QUESTIONS AND ANSWERS ABOUT THIS CONSENT SOLICITATION

The following are some of the questions you, as a stockholder, may have and answers to those questions. The following is not meant to be a substitute for the information contained in the remainder of this Consent Statement, and the information contained below is qualified by the more detailed descriptions and explanations contained elsewhere in this Consent Statement. We urge you to carefully read this entire Consent Statement prior to making any decision on whether to grant any consent hereunder.

WHO IS MAKING THE SOLICITATION?

The Participating Stockholders are making this solicitation. See “Additional Participant Information” for additional information regarding the participants in this consent solicitation.

WHAT ARE THE PROPOSALS FOR WHICH CONSENTS ARE BEING SOLICITED?

We are asking you to consent to five corporate actions: (1) the Bylaw Restoration Proposal, (2) the Removal Proposal, (3) the Future Vacancy Proposal, (4) the Board Size Proposal and (5) the Election Proposal. Each of these Proposals are more fully described below.

The Participating Stockholders are asking you to consent to the Proposals in order to reconstitute the Board through the removal of three of Progenics’ current directors and any appointees to the Board prior to the effectiveness of the Proposals, including any appointees to fill the October Vacancies, and the election of our five Nominees.

WHY ARE WE SOLICITING YOUR CONSENT?

We believe significant changes to the leadership and composition of the Board are necessary in order to address the destruction of significant stockholder value at Progenics and to ensure that the Company is being run in a manner consistent with your best interests. Unfortunately, we have lost faith in the ability of the long-standing members of the Board to objectively and effectively evaluate the performance of CEO Mark Baker, who has presided over an extended period of significant stock price and operating underperformance. The Board’s actions leading up to, and following, the stockholder vote at the 2019 Annual Meeting, as described in more detail in the “Background to this Solicitation” and “Reasons for this Solicitation of Written Consents” sections of this Consent Statement, have solidified our belief that substantial change is desperately needed to put this Company on the right path forward.

This Consent Solicitation is the best option we have available at this time for immediately installing a new, independent majority on the Board that, in our opinion, will ensure our collective best interests are being looked after. Our highly-qualified Nominees are fully committed to improving the Company’s performance and increasing value for the benefit of all stockholders. We believe that reconstituting a majority of the Board with our independent Nominees will give stockholders the best chance of turning around the Company’s serial underperformance. In our view, Progenics stockholders can no longer afford to trust that the current Board will look after their best interests.

WHO ARE THE NOMINEES?

We are asking you to elect each of Gérard Ber, Eric J. Ende, Ann MacDougall, Heinz Mäusli and David W. Mims as a director of Progenics. Collectively, they have significant operating, financial, corporate governance and transaction experience across a variety of sectors and directly relevant experience to a specialty pharmaceutical company such as Progenics. The business experience of our highly qualified Nominees is set forth in this Consent Statement under the section entitled “The Nominees,” which we urge you to read.

WHO IS ELIGIBLE TO GRANT WRITTEN CONSENTS IN FAVOR OF THE PROPOSALS?

Stockholders of record of voting securities at the close of business on the Record Date have the right to consent to the Proposals. The Participating Stockholders made a request on September 18, 2019 that the Board fix a record date for this consent solicitation. According to the Company, as of the Record Date, there were [________] shares of Common Stock outstanding, each of which is entitled to one consent on each Proposal.

WHEN IS THE DEADLINE FOR SUBMITTING CONSENTS?

We urge you to submit your consent as soon as possible. In order for our Proposals to be adopted, the Company must receive written unrevoked consents signed by a sufficient number of stockholders to adopt the Proposals within 60 calendar days of the date of the earliest dated consent delivered to the Company. The Participating Stockholders delivered its written consent to the Company on September 18, 2019. Consequently, the Participating Stockholders will need to deliver properly completed and unrevoked written consents to the Proposals from the holders of record of a majority of the outstanding voting securities as of the close of business on the Record Date no later than November 17, 2019. Nevertheless, we intend to set November [__], 2019 as the goal for submission of written consents. Effectively, this means that you have until November [__], 2019 to consent to the Proposals.

HOW MANY CONSENTS MUST BE RECEIVED IN ORDER TO ADOPT THE PROPOSALS?

The Proposals will be adopted and become effective when properly completed, unrevoked consents are signed by the holders of a majority of the outstanding voting securities as of the close of business on the Record Date, provided that such consents are delivered to the Company within 60 calendar days of the date of the earliest dated consent delivered to the Company. According to the Company, as of the Record Date, there were [________] shares of Common Stock outstanding, each of which is entitled to one consent on each Proposal. This means that the consent of the holders of at least [__________] shares of outstanding voting securities would be necessary to effect these Proposals. As of the Record Date, the Group collectively owned in the aggregate 10,161,733 shares of Common Stock, representing approximately 11.8% of the outstanding shares of Common Stock of the Company.

WHAT SHOULD YOU DO TO SUPPORT OUR PROPOSALS?

If your shares of Common Stock are registered in your own name, please submit your consent to us by signing, dating and returning the enclosed GREEN consent card in the postage-paid envelope provided.

If you hold your shares in “street” name with a bank, broker firm, dealer, trust company or other nominee, only they can exercise your right to consent with respect to your shares of Common Stock and only upon receipt of your specific instructions. Accordingly, it is critical that you promptly give instructions to consent to the Proposals to your bank, broker firm, dealer, trust company or other nominee. Please follow the instructions to consent provided on the enclosed GREEN consent card. If your bank, broker firm, dealer, trust company or other nominee provides for consent instructions to be delivered to them by telephone or Internet, instructions will be included on the enclosed GREEN consent card. We urge you to confirm in writing your instructions to the person responsible for your account and provide a copy of those instructions to the Participating Stockholders, c/o Okapi so that we will be aware of all instructions given and can attempt to ensure that such instructions are followed.

WHOM SHOULD YOU CALL IF YOU HAVE QUESTIONS ABOUT THE SOLICITATION?

Please call our solicitor Okapi toll-free at: (888) 785-6673 (Stockholders). Banks and Brokers call collect at: (212) 297-0720.

|

If you have any questions regarding your GREEN consent card or need assistance in executing your proxy, please contact:

Okapi Partners LLC 1212 Avenue of the Americas, 24th Floor New York, New York 10036 Stockholders may call toll-free: (888) 785-6673 Banks and brokers call: (212) 297-0720 E-mail: [email protected] |

REASONS FOR OUR SOLICITATION

WE BELIEVE THE TIME FOR SUBSTANTIAL CHANGE IS NOW

As one of the largest stockholders of Progenics, we have conducted extensive due diligence on the Company. In doing so, we have carefully analyzed the Company’s operating and financial performance as well as the competitive landscape in the pharmaceutical industry in which it operates. We have also engaged in extensive discussions with numerous stakeholders relevant to Progenics to get a deeper understanding of the Company and their views on the direction of Progenics under the current leadership regime, including discussions with current and former employees, executives with significant experience in developing and commercializing radiopharmaceutical products, physicians, thought leaders, and importantly, the majority of Progenics stockholders through our campaign for change at the 2019 Annual Meeting, all of which has solidified our belief that substantial change at Progenics is urgently required.

We believe there is significant value to be realized at Progenics. However, we have lost faith in the current Board’s ability to oversee the Company in a manner consistent with the best interests of all stockholders. Specifically, we are deeply concerned with the Board’s and management’s persistent track record of presiding over dismal stock price performance, commercial missteps, questionable clinical decision-making, limited public transparency, inefficient capital allocation and expense management, a lack of relevant management experience, lack of stockholder alignment and preference for unnecessary and costly dilution, and poor corporate governance, which we believe has resulted in significant value destruction for Progenics stockholders.

By way of brief background, as experienced investors and specialty pharmaceutical operators, we have attempted to work constructively with the Board to address our concerns as well as the opportunities that we believe are available to drive value for the benefit of all Progenics stockholders. Given the seeming lack of urgency in addressing our concerns and to preserve our rights as stockholders, we nominated a slate of director candidates for election to the Board at the 2019 Annual Meeting. Unfortunately, the Board chose to invalidate our nomination on technical grounds3, solidifying our belief that the Board had no interest in providing stockholders with the option to choose the best path forward for the Company and that substantial change was required.

We therefore felt compelled to take initial action to hold certain members of the Board responsible for this entrenchment-minded tactic as well as the overall lack of accountability at Progenics given the Company’s persistent underperformance and destruction of stockholder value. Despite our sincere efforts to reach a constructive resolution with the Company, we were left with no choice but to run a solicitation at the 2019 Annual Meeting against the re-election of Peter Crowley, as then Chairman of the Board, and Michael Kishbauch, as then Chairman of the Nominating and Corporate Governance Committee. This campaign was supported by a significant majority of stockholder votes, resulting in the resignations of Messrs. Crowley and Kishbauch – sending a strong message to the Board that the status quo is simply not acceptable. Stockholders also expressed dissatisfaction with the performance of CEO Mark Baker; approximately 36% of the votes cast were against his re-election at the 2019 Annual Meeting, despite the fact that we did not solicit votes against the re-election of Mr. Baker in our 2019 Annual Meeting campaign.

3 On the date Velan submitted its nomination, it beneficially owned shares of Progenics in “street” name. While Velan is currently a stockholder of record of Progenics, it was not a stockholder of record on the date it submitted its nomination pursuant to the Company’s Bylaws.

Unfortunately, this stockholder mandate does not appear to have improved the behavior of this Board. Indeed, our concerns with the direction of Progenics have only intensified following the 2019 Annual Meeting, leaving us with no choice but to pursue this Consent Solicitation. Specifically, we believe the Board’s actions (or lack thereof) after the 2019 Annual Meeting, including its lack of cooperation and engagement with us (despite widespread stockholder support for our campaign for change), issuance of stock to departing directors, oversight of continual underperformance, and inability to set and disclose metrics to properly judge management’s performance, all point to a glaring and unmistakable conclusion – this Board does not have a pulse on the business, its management team or the overwhelming level of stockholder discontent, and prefers to maintain an unsustainable status quo.

Even with the upcoming resignations of two directors, which the Board chose to stall until October 2019 despite the clear stockholder mandate three months earlier, we simply cannot trust that this Board will do the right thing or that it will act with a sense of urgency given its troubling track record. Further, we believe the Board is stale and lacks radiopharmaceutical commercialization and supply chain expertise, among others skill sets, and importantly, has left CEO Mark Baker at the helm despite his persistent and prolonged failures as CEO. Indeed, the Board’s recent engagement with us, which occurred only after our public pressure and continued outreach following the Board’s refusal to engage with us following the 2019 Annual Meeting, has only solidified our belief that a reconstituted Board is urgently required as the current Board continues to refuse to acknowledge the real issues facing the Company – the need for new leadership and a new direction for Progenics.

It has therefore become increasingly clearer to us that accountability in the boardroom and wholesale change at Progenics is desperately needed. In order to continue the fight for value creation on behalf of all stockholders, we have therefore pursued this Consent Solicitation to reconstitute the Board.

Accordingly, we are seeking your support to remove three current directors – Mark Baker, David Scheinberg and Nicole Williams, who are the three longest-tenured directors responsible for Progenics’ persistent underperformance – and elect our five highly-qualified independent Nominees, Gérard Ber, Eric J. Ende, Ann MacDougall, Heinz Mäusli and David W. Mims, who we believe have the experience, skill sets and objectivity necessary to help drive value for the benefit of all Progenics stockholders. These new, fully-independent and highly-qualified Nominees bring particular experience in skillsets that we believe are lacking from the existing Board, including: radiopharmaceutical commercialization and supply chain expertise, investor relations and stockholder communication, sophisticated financial analysis and judgment, and appropriate governance and compensation oversight.

We believe that a significant refreshment of the Board through this Consent Solicitation will be a positive catalyst and continue the strong message that stockholders remain dissatisfied with the status quo and that meaningful leadership change is required.

We are Concerned with the Company’s Dismal Stock Price Performance Under the Current Leadership Team and Board

We believe the Board has failed to hold management accountable for the Company’s dismal stock price performance. Since the height of the financial crisis in 2009, the Board, including Messrs. Baker and Scheinberg and Ms. Williams, has managed to oversee the decline of Progenics’ share value during what has frequently been referred to as the longest bull market in our lifetimes. This speaks to underperformance for not just years, but across decades.

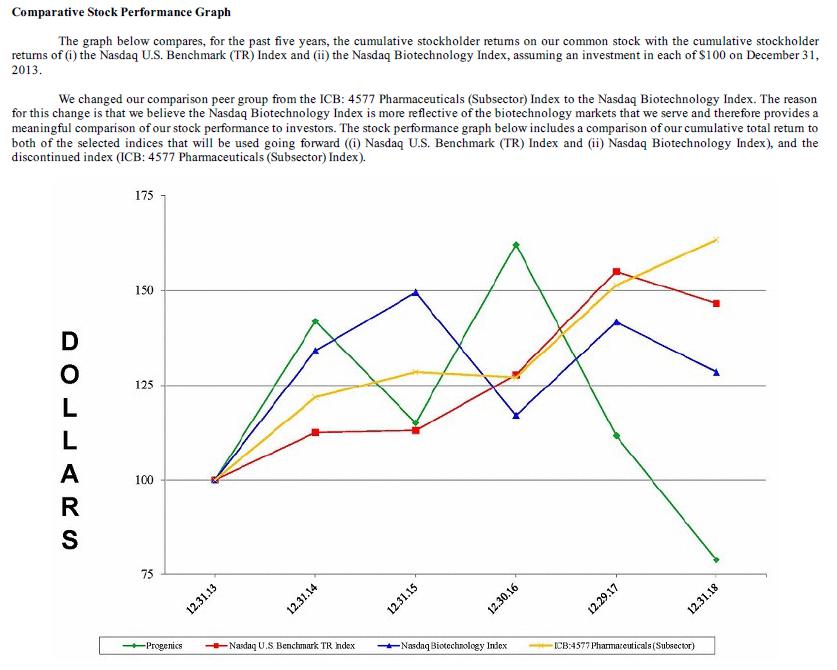

As it relates to more recent history and particularly during the past three years, the Company has substantially underperformed its peers and relevant indices, as displayed in the following chart excerpted from the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018 (the “2018 10-K”).

Poor stock price performance is simply a manifestation of two key issues: persistently weak operating performance and lack of investor confidence in the governance and management of the company under the current regime. Importantly, we believe these dynamics can be fixed, but doing so requires substantial change at Progenics, including through the appointment of new and experienced directors that are willing to hold CEO Mark Baker accountable for his shortcomings.

Similarly troubling but not particularly surprising given this Board’s track record, the Company previously tried to defend its stock price performance by choosing eight different sets of “relevant peers” (such “peers” included companies whose clinical programs have failed and are now essentially trading near their cash balances) in June 2019. We believe this behavior clearly exemplifies the Board’s reflex-like approach to ignore, and its attempt to justify, potential problems rather than seek to acknowledge and remedy issues plaguing the Company.

Indeed, ISS likewise noted concerns with the Board’s failure to acknowledge the real issues facing the Company in its report for the 2019 Annual Meeting, stating: “The board's justifications for suboptimal performance have been uncompelling, and its apparent lack of acknowledgement that any issues exist seems to imply that it plans to make no substantive changes.”

We are Concerned with the Lack of Execution Surrounding AZEDRA’s Commercial Launch

We believe the Company’s management team and Board have been unable to successfully execute on AZEDRA’s launch. AZEDRA was approved by the FDA in July 2018 at which point the Company stated it would take a “matter of weeks” to complete the onboarding processes, and as of June 2019, only two patients had received therapy with AZEDRA (as disclosed on the Company’s Q2 2019 earnings call on August 9, 2019). Under the direction of CEO Mark Baker and the current Board, it took the Company ten months to dose a single patient. This is even more concerning given that AZEDRA has no FDA Orange Book patents – each day delayed was (and each day numerous patients continue to be neglected is) another day lost of its FDA orphan drug exclusivity. Numerous patients afflicted by pheochromocytoma or paraganglioma continue to take an unapproved, compounded product while the Company’s management has been unable to successfully get AZEDRA in the hands of physicians and patients who need it.

It should also be noted that in June 2019 during the middle of our 2019 Annual Meeting proxy campaign, the Company stated that “Progenics has mastered [AZEDRA’s] complex commercialization process” yet in August 2019, the Company admitted this launch was “challenging” and management was “learning a lot” – two statements that are more reflective of AZEDRA’s performance to-date. Our research consistently suggests that the scarce progress on AZEDRA is not a demand problem, rather a supply (execution) issue.

We Question the Company’s Clinical Program Decision-Making and Prioritization

Progenics acquired Molecular Insight Pharmaceuticals, Inc. (“MIP”) and the rights to AZEDRA and development pipeline projects “1404” and “1095” over six years ago, in January 2013. The early clinical results of 1095 covering subjects treated between 2011 and 2013 were published in July 2014 (Zechmann et al.) and March 2017 (Afshar-Oromieh et al.) and as of today, this remains the most recent subject data referenced by the Company in its corporate presentation. Endocyte Inc., in contrast, acquired the rights to a similar asset in October 2017, created substantial value in the platform within a year, and sold the business to Novartis Pharmaceuticals Corporation for approximately $2.1 billion. Instead of focusing on 1095, we believe Progenics spent unnecessary time and resources on other less-valuable projects.

Instead of harnessing its potential first-mover advantage, Progenics is now behind a well-capitalized and well-entrenched competitor, which we believe is a result of poor judgment and a lack of focus at the Company as well as a lack of effective oversight by the Board. The current lack of urgency by Progenics is further exemplified by the Company’s statement in its 2018 10-K disclosure that 1095’s current patent coverage expires from 2027 through 2031, with the 2027 composition of matter patent being the “most significant” – this provides limited protection in the event of a potential 2026 commercial launch (Progenics’ disclosed commercial milestone date in the 2018 10-K). We fear that continued mismanagement and distractions may further delay 1095 and continue to erode stockholder value.

We are Concerned with the Limited Transparency and Openness with Stockholders

In our view, one of the most important obligations of a public company is to be open and transparent with its stockholders. We believe that Progenics could drastically improve in this regard.

| · | Commercialization. We remain disappointed with the Company’s lack of clarity around AZEDRA’s launch. Management has not provided any sales guidance and has even admitted that the treatment request metric it has given stockholders multiple instances in 2019 is “not great” to measure their progress. Management also refused to directly answer analyst questions during its Q2 2019 earnings call regarding the evolution of these treatment requests. Given the amount of time that has passed, we believe Progenics should have been (and should continue to be) more transparent with its stockholders regarding the continued inability in providing product to patients and in providing sales expectations and forecasts. |

| · | Regulatory Interactions. Progenics has noted its FDA interactions in its conference calls but has failed to disclose key items discussed with, and the resulting feedback from, the FDA. Given the potential value inherent in its pipeline and AZEDRA basket trial, we believe Progenics should disclose to stockholders the nature of its discussions with the FDA and any potentially material feedback received. |

| · | Clinical Progress. Progenics to-date has not provided an update on patient recruitment for 1095’s clinical trial. We believe this is because Progenics’ manufacturer currently has an import ban and cannot ship product into the United States, and, as a result, is currently only recruiting patients in Canada. We believe the Company should be forthright with stockholders regarding 1095’s expected clinical progress. A delay to the 1095 clinical trial because of these issues and a reluctance to implement a backup plan would destroy significant stockholder value. |

| · | Manufacturing. Progenics acquired a facility in Somerset, NJ in February 2019, more than six months after receiving FDA approval. The Company admitted to Velan that it had to make “tweaks” to its AZEDRA manufacturing process after acquiring the facility in February 2019, thereby implying that finished product was not available prior to this acquisition. When asked directly, the Company refused to provide a straightforward answer. Compare this to the Company’s 2017 10-K which stated Progenics is “in the final stages of establishing manufacturing capacity that we believe will be sufficient to deliver commercial supplies of AZEDRA.” Furthermore, the Company may encounter supply chain constraints in its current facility once the AZEDRA basket trial is launched and currently cannot manufacture 1095 in the United States which to-date has limited its clinical trial to Canadian sites. Given the value of AZEDRA and 1095, we believe Progenics should be forthright with stockholders and disclose the rationale and benefits (and timing thereof) regarding its manufacturing arrangements. |

| · | Financial Profile. The Company has failed to provide meaningful answers to important questions related to the Company’s revenue and expense base. For example, what is the expected ramp of AZEDRA sales? How much does the Company plan to spend to “dramatically expand the indications for AZEDRA”? Is a quarterly cash burn of ~$25 million this year indicative of future expenses? How and when will the Company evaluate a potential financing and what non-dilutive alternatives are available? |

We are Concerned with Progenics’ Inefficient Capital Allocation and Expense Management

Progenics’ headquarters is comprised of a 26,000 square foot lease at One World Trade Center in New York City, one of the highest expense cities in the world. We believe that prudent expense management, including evaluating lower cost alternatives and solid execution, is more important than high-end office space, which we believe would ultimately translate into favorable returns to stockholders.

The Company reported SG&A and development expenses, excluding one-time write-offs, in excess of $60 million in 2018. The accumulated deficit has surpassed an astonishing $600 million. Even during 2019, the Company continues to burn cash of ~$25 million per quarter which is not sustainable given its cash balance and the current ramp of AZEDRA’s commercial launch. In another egregious demonstration, the Company spent nearly $6 million through Q2 2019 in legal and advisory fees attempting to defend the troubling status quo and resist a large stockholder’s push for beneficial changes in governance, which were ultimately supported by stockholders at the 2019 Annual Meeting. We suspect the Company spent even more in Q3 2019, the quarter in which the 2019 Annual Meeting was held, and may continue to spend stockholders’ capital once again fighting concerned stockholders instead of embracing long-overdue change.

We Believe There is a Lack of Relevant Management Experience at Progenics and Ineffective Oversight of Management

The Progenics management team continues to prove incapable of handling the successful commercialization of AZEDRA. Outside of Bryce Tenbarge, the Company’s Senior Vice President, Commercial, no other members of the management team have meaningful commercial launch experience or have held a commercial senior leadership role in the pharmaceutical industry prior to joining Progenics. Mr. Tenbarge’s immediate experience prior to Progenics was at a development-stage company, Celldex Therapeutics, which has yet to receive FDA approval for a single product. To compound this issue, prior to joining Progenics, Mr. Baker had zero operational experience within the pharmaceutical industry, yet he was appointed as CEO to lead a successful commercial pharmaceutical company. We believe Mr. Baker’s track record of value destruction at Progenics clearly demonstrates that he lacks the qualifications necessary to lead the Company.

The Progenics management team also appears complacent with operating its business without a backup plan (or at least one that is communicated to stockholders). This is evidenced by (i) the opacity behind AZEDRA’s manufacturing situation, (ii) the reliance upon a Canadian manufacturer with a current FDA import ban to be the sole supplier for 1095’s clinical trials in the United States, and (iii) the lack of pipeline progress for 1095 prior to the time 1404’s Phase 3 trial failed.

Given the persistent underperformance at Progenics, we question how the Board has seemingly failed to recognize the need to hire senior executives with relevant experience necessary to run a specialty pharmaceutical company and improve execution to a satisfactory level. In fact, Mr. Baker has received more than $[20] million in pay since his appointment as CEO while stockholders have suffered a decline in the Common Stock by 21% (through September 6, 2019) during his tenure.

The most important governance responsibilities of the Board are to provide effective oversight of the Company and ensure that the right executive leadership is in place. Unfortunately, the Board, particularly longest-tenured directors Mr. Scheinberg and Ms. Williams, appear complacent with Mr. Baker’s underperformance, failing this basic duty to Progenics stockholders. A refreshed Board is desperately needed to instill accountability and put this Company on the right path forward.

Indeed, we believe ISS summed it up best in its 2019 report:

“Most importantly, the board has failed to hold the management accountable for multiple strategic and operational missteps, which have resulted in value destruction for the shareholders despite the company's possession of several promising assets…in a best case scenario, the board waited too long to add executives with the required expertise” (emphasis added).

We Believe the Board is Stale and Not Aligned with Stockholders, Creating a Preference for Unnecessary and Costly Stockholder Dilution