Form DFAN14A PROGENICS PHARMACEUTICAL Filed by: Altiva Management Inc.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

PROGENICS PHARMACEUTICALS, INC. |

(Name of Registrant as Specified in Its Charter) |

VELAN CAPITAL, L.P. ALTIVA MANAGEMENT INC. BALAJI VENKATARAMAN VIRINDER NOHRIA LTE PARTNERS, LLC LTE MANAGEMENT, LLC MELKONIAN CAPITAL MANAGEMENT, LLC RYAN MELKONIAN TERENCE COOKE DEEPAK SARPANGAL |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Velan Capital, L.P., together with the other participants named herein (collectively, the “Participating Stockholders”), has filed a definitive proxy statement and accompanying GREEN proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes against the election of certain directors of Progenics Pharmaceuticals, Inc., a Delaware corporation (the “Company”), at the Company’s 2019 Annual Meeting of Stockholders (the “Annual Meeting”).

Item 1: On June 28, 2019, the Participating Stockholders issued the following press release:

VELAN CLARIFIES INTERACTIONS WITH PROGENICS PHARMACEUTICALS’ BOARD OF DIRECTORS

Highlights How the Board Continues to Distort the Truth and Mislead Stockholders in an Attempt to Preserve the Troubling Status Quo and Avoid Accountability at All Costs

Calls out the Board for Falsely and Recklessly Alleging that Velan’s Settlement Proposals Have Sought Control of the Board

Urges Stockholders to Demand Accountability by Voting AGAINST the Re-election of Peter Crowley and Michael Kishbauch on the GREEN Proxy Card TODAY

Alpharetta, GA - June 28, 2019 /PRNewswire/ -- Velan Capital, L.P. (together with the other participants in its solicitation, “Velan” or “we”), one of the largest stockholders of Progenics Pharmaceuticals, Inc. (“Progenics” or the “Company”)(NASDAQ: PGNX), comprised of successful specialty pharmaceutical operators and financial services experts, today responded to more misleading statements by the Progenics Board of Directors (the “Board”) regarding recent settlement discussions. The Board’s attempts to distort the truth and avoid accountability at all costs continue to prove that its only defense is distraction and misdirection. Velan again sets the record straight below.

The Company issued a press release at approximately 9pm ET on June 27, 2019, a mere hour following Velan’s response to its latest settlement offer, attempting to mislead stockholders regarding Velan’s good faith efforts to reach a compromise that is in the best interests of all Progenics stockholders. Contrary to what the Company claims, Velan’s outreach has been nothing short of reflecting the necessary degree of change and accountability that it believes is required to put the Company on the right path forward and reverse the years of value destruction and squandered opportunities under the incumbent Board.

We are fighting for real change so that the Company will succeed. In contrast, the Board is attempting to duck its responsibilities by creating a whirlwind of delusional statements.

Velan’s Significantly Enhanced Offer and Continued Outreach in Search of Constructive Resolution that Reflects Degree of Change Required at Progenics

Velan initiated outreach to the Board in each of the last two settlement attempts – on June 6, 2019, we approached CEO Baker at the Jefferies Healthcare Conference, and on June 25, 2019, we contacted the Company to see if we could reach a constructive resolution. In addition to this outreach, Velan has made SUBSTANTIAL movement in its proposed Board composition.

Despite Velan’s strong belief that its nominees were the right individuals to help put the Company on the right path, Velan agreed to recommend two new directors for appointment to the Board that were completely independent of Velan and not part of its prior slate of nominees, per the Board’s request. In return, Velan simply asked for two non-voting Board observer seats, which the Board continuously and vehemently refused, in our view, to avoid having individuals in the boardroom that were willing to stand up to the troubling status quo. Our request would have only added value to the boardroom by voicing opinions for the good of the Company.

There is NOTHING in Velan’s proposal that even remotely exemplifies control or the desire for control. Indeed, Progenics refuses to grant Velan shareholder representation — not even a SINGLE director seat — yet it fraudulently claims we seek “Board Control”. Further exacerbating the Board’s deception is the convenient exclusion of the FACT that Board observers are NON-VOTING and have nothing to do with control.

We seek stockholder representation and accountability EVEN IN A NON-VOTING MANNER. This is a critical component of our campaign and our fight for rights for all stockholders.

We see benefits from our involvement for two reasons: (i) our commercial and development expertise in the pharmaceutical and financial services industries, and (ii) stockholder representation and alignment. We seriously question, and urge all stockholders to likewise question, what is going on behind the scenes in the boardroom, where the Board won’t allow Velan to participate even in a NON-VOTING manner?

| Velan’s Initial Settlement Offer | Velan’s Latest Settlement Offer | |

| Addition of Board Director(s) | Add 3 Directors from Velan |

Accepted Company’s Offer to Add 2 Directors with No ESG Concerns and No Ties to Velan

Requested Two Non-Voting Board Observer Seats |

| Removal of Board Director(s) | Remove 3 Directors | Accepted Company’s Offer to Remove One Director (Not Named) by 2020 Annual Meeting Proxy Materials |

Board’s Lack of Movement

In contrast, the Board has shown an inability to engage in a meaningful manner. Other than reducing its initial unreasonably long standstill requirement for Velan, the Board’s ONLY material movement in its negotiations with respect to Board composition is the removal of one director (not named) within a year. Not specifying this director or the timeline of his or her resignation illustrates the Board’s continued reluctancy to instill accountability in the boardroom.

| Board’s Initial Settlement Offer | Board’s Latest Settlement Offer | |

| Addition of Board Director(s) | Add 2 Directors | Add 2 Directors |

| Removal of Board Director(s) | None | Remove One Director (Not Named) by 2020 Annual Meeting Proxy Materials |

***

Velan has shown a willingness to negotiate by initiating the outreach to the Board in its settlement discussions on numerous occasions and by materially improving its settlement offers. In contrast, the Board has decided to engage in a game of deception with stockholders by mischaracterizing its interactions.

While a settlement is much preferred, in Velan’s view, the removal of Messrs. Crowley and Kishbauch will implement much needed accountability and allow two new directors to more properly evaluate management and have a better chance of putting the Company on the right track. As long as such individuals bring appropriate alignment and expertise, we believe that stockholders and patients would be experiencing an upgrade.

The Company’s slogan is “Find, Fight, and Follow” – we urge stockholders to “Find” the status quo unacceptable, “Fight” years of value destruction and squandered opportunities, and “Follow” our call to action by voting AGAINST the re-election of Messrs. Crowley and Kishbauch on the GREEN proxy card.

It is time for accountability at Progenics – Velan urges all stockholders to vote for change on the GREEN proxy card today!

Investor contacts:

Deepak Sarpangal

(415) 677-7050

www.savePGNX.com

Okapi Partners LLC

Pat McHugh / Jason Alexander

+1 (888) 785-6673

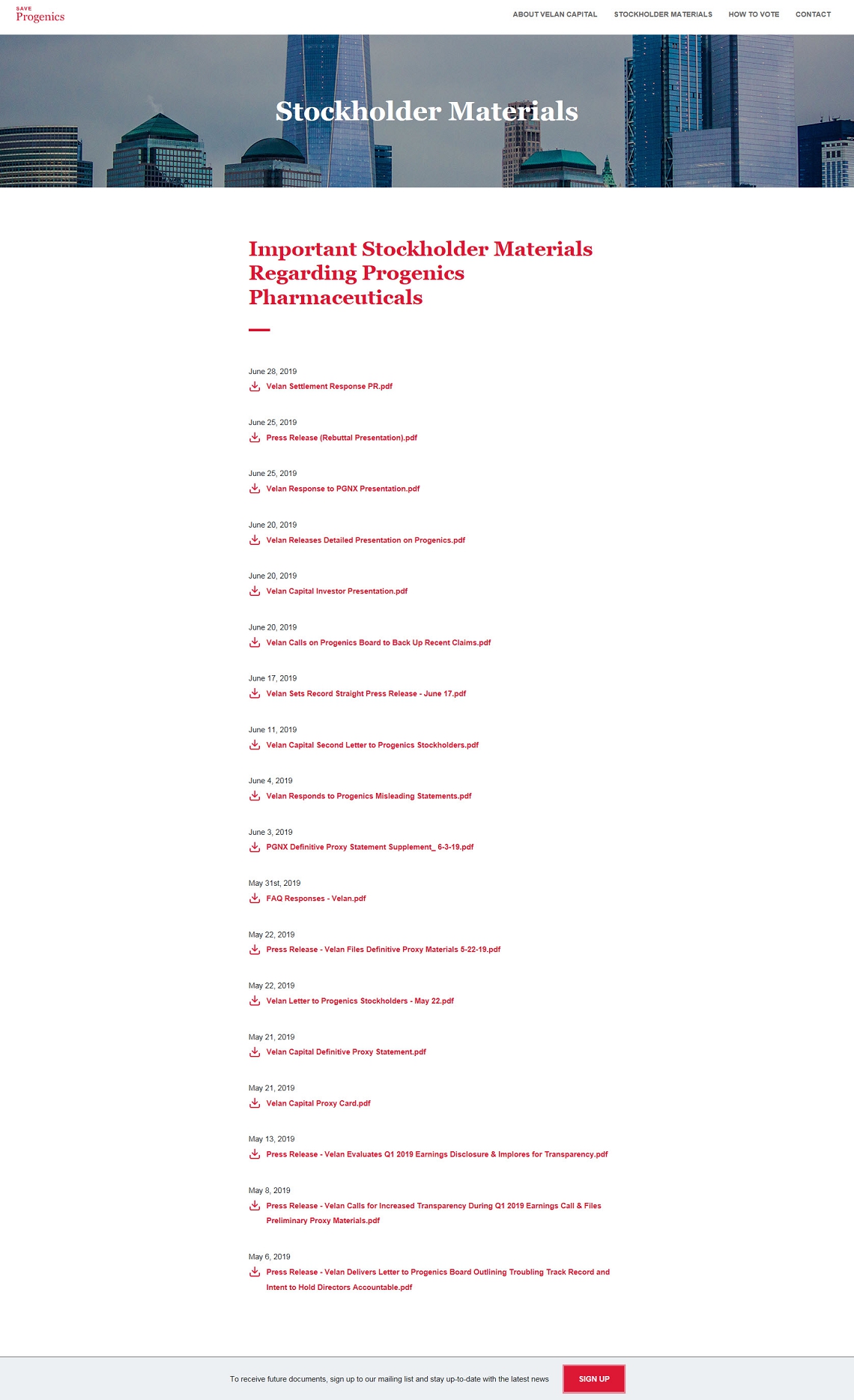

Item 2: On June 28, 2019, the following materials were posted by the Participating Stockholders to www.savePGNX.com:

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- University of Washington School of Medicine AIMS Center and Concert Health to Scale Telepsychiatry Collaborative Care for Complex Psychiatric Disorders

- Correction: Solutions30, through its subsidiary Unit-T, is selected to support Fluvius in their ´Energy Grid upgrade program´ in Flanders with a 5-year contract, extendable for another 3 years

- PharmaEssentia Appoints Robert Geller, M.D. as Head of Medical and Shawn Gibbs, J.D. as Head of Legal

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share