Form DEF 14A Nielsen Holdings plc For: May 21

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Nielsen Holdings plc

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required. | |||

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

|

(1) |

Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

|

☐ |

Fee paid previously with preliminary materials. | |||

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

|

(1) |

Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

Table of Contents

Table of Contents

(incorporated and registered in England and Wales with registered no. 09422989)

Registered Office:

Nielsen House

John Smith Drive

Oxford

Oxfordshire

OX4 2WB

United Kingdom

April 9, 2019

Dear Fellow Shareholders,

On behalf of the Board of Directors (the “Board”), I cordially invite you to attend the Annual General Meeting of Shareholders of Nielsen Holdings plc (the “Company” or “Nielsen”) to be held at 9:00 a.m. (Eastern Time) on Tuesday, May 21, 2019 (the “Annual Meeting”). The Annual Meeting will be held online at nielsen.onlineshareholdermeeting.com or, to attend in person, please come to 50 Danbury Road, Wilton, CT 06897.

I am excited to have joined Nielsen at such a pivotal time in the Company’s history. The strength of Nielsen’s franchise and its central importance as a provider of independent measurement to the media and consumer packaged goods industries is clear. Independent third party measurement is an essential element to a fully functioning marketplace and Nielsen has been an objective arbiter for our clients for more than 95 years. We are well-positioned to build on our strengths. As we look to the future, our measurement and analytics will be increasingly valuable to advertisers, advertising agencies, and publishers as they seek to understand and monetize their audiences, and as fast-moving consumer goods manufacturers and retailers seek to understand how they connect with end consumers before, during, and after the purchase.

We combine big data sets with finely tuned and precise opt-in panels to produce the highest quality measurement data and analytics for our clients. This is a significant competitive advantage in this age of privacy, where we hear calls for truth and transparency all over the landscape. As the end markets in media and fast moving consumer goods are changing, our clients’ needs are also changing and so is their use of data and technology. Nielsen is also evolving, but we have the opportunity to accelerate our transformation to serve dynamic industry needs.

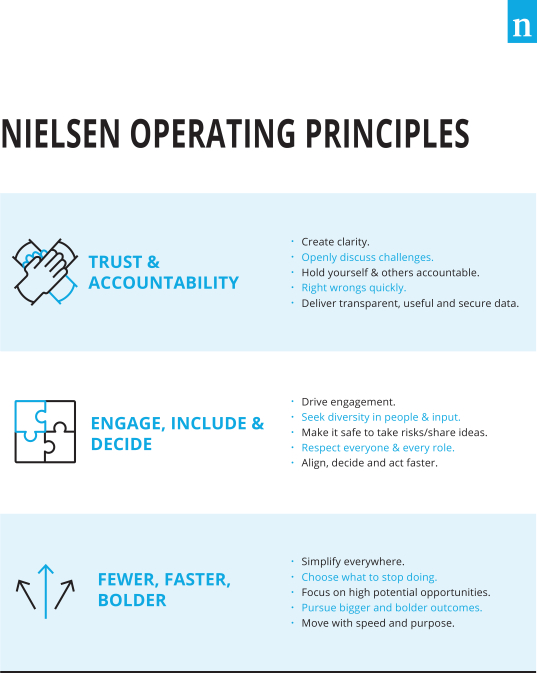

This is our vision for 2019 – transforming Nielsen into a truly product-driven, technology-based organization, able to make faster, bolder decisions. In doing so, we expect to increase our value to clients and their decisions, which will drive our performance and shareholder value.

Specifically, we are focused on expanding our digital platform and becoming even more embedded with our clients, aligning on a single cloud-based architecture for each business and retiring legacy systems. We will also leverage artificial intelligence and machine learning to get the most out of our data – our biggest asset – and use it to improve measurement and predictive models to drive better decisions.

Since joining Nielsen, I’ve had a chance to meet with our talent across the Company. From senior leadership to product and commercial leads, we have a great team in place focused on instilling greater operating discipline and accountability. With world class data science and data integration capabilities, we are focusing our best talent on the most important projects to drive speed and scale. On a parallel path, I’ve recently taken on the role of Chief Diversity Officer to strengthen diversity and inclusion across the organization. Inclusion is integral to our strategy and my goal is to be a change agent within our teams.

As our Board continues to work on the strategic review, evaluating potential opportunities to determine the best path forward, we are focused on maximizing value for the Company and all of our shareholders. I am honored to lead this Company into the future.

|

|

2019 PROXY STATEMENT LTR

|

Table of Contents

In accordance with the UK Companies Act 2006, the formal notice of the Annual Meeting is set out on the pages following the “Summary of Proxy Statement Information.”

Our proxy materials are first being distributed or made available to shareholders on or about April 9, 2019.

Thank you for your continued support.

Sincerely,

David Kenny

Chief Executive Officer, Chief Diversity Officer

|

|

2019 PROXY STATEMENT LTR2

|

Table of Contents

LETTER FROM OUR EXECUTIVE CHAIRMAN TO OUR SHAREHOLDERS

Dear Shareholders,

On behalf of the Nielsen Board, thank you for your investment in Nielsen. It has been an important and consequential year for Nielsen, with the announcement of a review of strategic alternatives for the Company and its businesses and the appointment of a new senior management team. We believe that our new leadership team has already had a positive impact on the Company and we look forward to sharing with you the results of the strategic review when it is completed. Please be assured that all our decisions are made in the best interests of the Company and its shareholders.

Strategic Review

In September 2018, we announced an expanded strategic review to include a review of the entire Company and its businesses. This includes an assessment of a range of potential strategic alternatives, including continuing to operate as a public, independent company, a separation of our Buy business, which we now refer to as Nielsen Global Connect, from the Watch business, which we now refer to as Nielsen Global Media, or a sale of the entire Company. The Board, with the assistance of our advisors and management team, has been deeply involved in this comprehensive strategic review. We have been meeting frequently to oversee this review and are moving forward with urgency. We will share the results of our review with you as soon as possible.

Leadership Transition

In July 2018, we announced that Mitch Barns, our Chief Executive Officer, would retire by the end of 2018. At that time, we also announced that I would assume the role of Executive Chairman. The Board conducted a comprehensive search for a new Chief Executive Officer, which resulted in the appointment of David Kenny in December 2018. In addition, the Board appointed Dave Anderson as our new Chief Financial Officer in September 2018, later also naming him as Chief Operating Officer. This followed the departure of our former Chief Financial Officer. We are delighted to have both David and Dave on board. Together they’ve brought great energy, vision and focus to the Company. In January 2019, the Board appointed George Callard as the Company’s new Chief Legal Officer. These new senior executives, together with the leaders of our Global Media and Global Connect businesses, are working expeditiously to execute on our strategy and 2019 plan, regardless of the outcome of the strategic review.

Company Strategy

The Board and the Company’s new senior management team are working closely together to establish a solid operational foundation to drive greater revenue growth, profitability and increased shareholder value. The Board fully supports the leadership team’s focus for 2019 on transforming the Company into a product-driven, technology organization, making faster, bolder decisions. We will remain actively involved in overseeing the Company’s long-term path to value creation.

Shareholder Engagement and Outreach

The Board and management believe that remaining connected and accountable to our shareholders is central to Nielsen’s success. Constructive dialogue and regular communication with you promotes transparency and accountability and informs our strategic initiatives and policy development. In 2018, I continued to speak with investors on behalf of the Board. Together with the management team, we engaged with investors that represent nearly 65% of our shareholder base on a range of topics, including our strategic review; our strategy and financial performance; our senior management succession; executive compensation; and a variety of corporate governance matters. We are always happy to hear from our investors, as you are key to Nielsen’s long-term success.

In closing, I want to thank you again for your support and assure you that your Board and the Company’s new senior management team are working to represent your interests and make the right decisions for Nielsen and all of our shareholders.

James A. Attwood, Jr.

Executive Chairman

|

|

2019 PROXY STATEMENT LTR3

|

Table of Contents

This summary highlights certain information contained elsewhere in this proxy statement. You should read the complete proxy statement and annexes before voting.

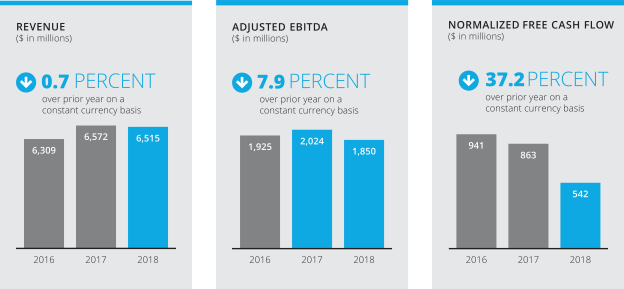

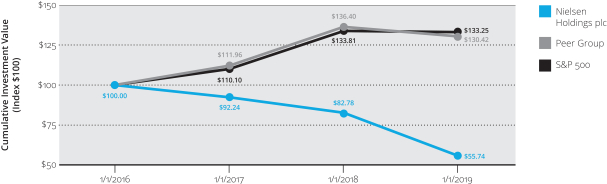

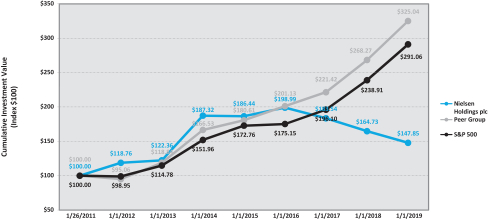

2018 PERFORMANCE HIGHLIGHTS

We are dedicated to driving shareholder value by posting solid operating performance. The Company’s long-term business performance and progress against strategic initiatives form the context in which pay decisions are made. 2018 was a challenging year for Nielsen. We were disappointed in our 2018 financial results, which fell short of the objectives set at the beginning of the year. We set revised objectives for the second half of the year and delivered on our key operational metrics for the second half of the year, positioning ourselves for 2019.

During 2018:

| • | We announced a broad review of strategic alternatives for the Company and its businesses. |

| • | We initiated work to reorganize into two new segments, Nielsen Global Media and Nielsen Global Connect, which better reflect our platforms and vision for 2019, setting the stage for improved performance in the future. |

| • | In our Global Media segment, through our Total Audience Measurement framework, we have built a solid foundation using standard, comparable, de-duplicated, cross-platform measurement; we continued to work towards becoming the currency for digital viewing; and we continued to invest in new products, partnerships and acquisitions. |

| • | In our Global Connect segment, we are executing on Total Consumer Measurement; we continue to grow the number of clients using at least one component of Nielsen Connect; our retailer initiatives had good traction; clients continued to prioritize investments in Emerging Markets given strong tailwinds such as population growth, a rising middle class, and urbanization; and our U.S. Connect business continues to drive progress by building stronger, differentiated offerings. |

Further information about our 2018 performance can be found on pages 33-35.

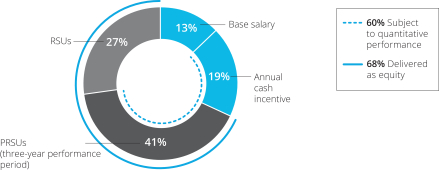

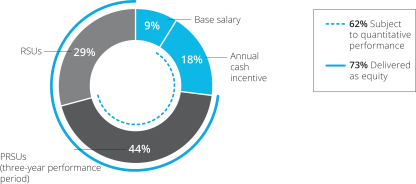

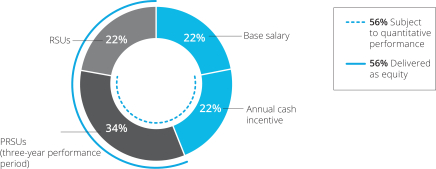

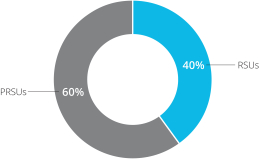

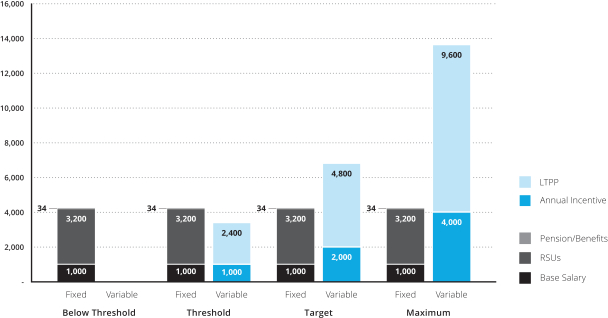

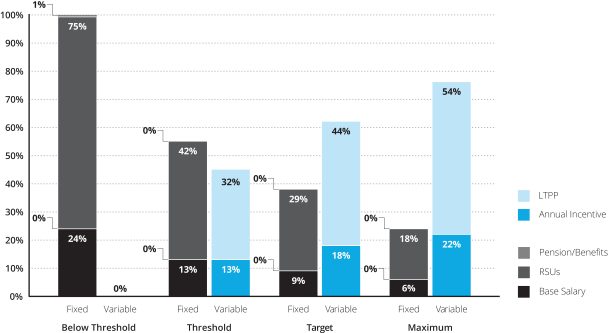

COMPENSATION HIGHLIGHTS

| • | Our executive compensation program is designed to incent and reward our leadership team for delivering sustained financial performance and long-term shareholder value. |

| • | A significant portion of named executive officer (“NEO”) compensation is at risk, dependent on the achievement of challenging annual and long-term performance goals and/or the performance of our share price. |

| • | Nielsen’s executive compensation philosophy includes a stated emphasis on variable, at-risk compensation. Nielsen’s performance in 2018 was reflected in the following pay outcomes: |

| ➤ | Payouts to NEOs under Nielsen’s Annual Incentive Plan for 2018 were zero. |

| ➤ | Payouts to NEOs and other participants in Nielsen’s performance restricted share unit (“PRSU”) award program for the 2016 – 2018 cycle that matured on December 31, 2018 were zero. |

|

|

2019 PROXY STATEMENT SUMM1

|

Table of Contents

| SUMMARY OF PROXY STATEMENT INFORMATION |

| ➤ | The interim performance evaluation for Nielsen’s 2017 – 2019 PRSU cycle is tracking to pay out at zero. PRSUs represent the single largest component by value of NEO compensation. |

| ➤ | Without his severance pay, Mr. Barns’ reported total compensation in the Summary Compensation Table would have decreased nearly 50% from his 2017 reported total compensation. |

| • | Looking to 2019, we have adjusted the performance metrics in both our long-term and short-term incentive plans to more closely align with driving incremental value for our shareholders. |

Further information about our compensation can be found on pages 30-71.

STRATEGIC REVIEW AND MANAGEMENT TRANSITION

In the second half of 2018, the Board initiated a comprehensive strategic review of the entire Company and its businesses. This review process, which is being conducted with the assistance of financial and legal advisors, includes an assessment of a broad range of potential strategic alternatives including continuing to operate as a public, independent company, a separation of the Company’s Connect or Media segment, or a sale of the Company.

Also in the second half of 2018, the Board conducted a search for a new Chief Executive Officer and Chief Financial Officer, spearheaded by Mr. Attwood, who assumed the title of Executive Chairman on an interim basis to lead the Board’s executive search processes as well as its strategic review of the Company and its businesses. The search processes culminated in the appointment of David Kenny as Chief Executive Officer in December 2018 and Dave Anderson as Chief Financial Officer in September 2018. The Board also appointed George Callard as the Company’s new Chief Legal Officer in January 2019.

|

|

2019 PROXY STATEMENT SUMM2

|

Table of Contents

| SUMMARY OF PROXY STATEMENT INFORMATION |

BOARD HIGHLIGHTS

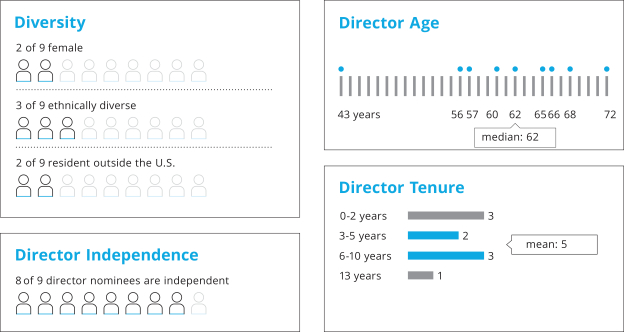

Following the election and re-election of the Board nominees at our Annual Meeting, the Board will have the following characteristics:

BOARD EXPERTISE AND SKILLS

Our directors are keenly focused on building a board that supports Nielsen’s strategic goals and evolving business priorities. In that regard, in addition to the areas of experience set forth below, the qualities that are of paramount importance for our director nominees include: a proven record of success and business judgment, innovative and strategic thinking, a commitment to corporate responsibility, appreciation of multiple cultures and perspectives, and adequate time to devote to their responsibilities.

| CEO/Executive Experience | Business and Operating Experience | Media and Marketing Experience

|

Innovation, Technology and Digital Experience | Global and Emerging Markets Experience | ||||||||||||||||||||||||||||||||||||

| Consumer Goods and Retail Experience |

Audit and Financial Literacy

|

Research, Analytics, Artificial Intelligence and Data Science Experience |

Financial, M&A and Private Equity Investment Experience | Public Company Board and Governance Experience | ||||||||||||||||||||||||||||||||||||

|

|

2019 PROXY STATEMENT SUMM3

|

Table of Contents

| SUMMARY OF PROXY STATEMENT INFORMATION |

GOVERNANCE HIGHLIGHTS

|

Director Independence

• 8 out of 9 of our director nominees are independent

• All Board committees are fully independent

|

Board Accountability

• All directors are elected annually

• Shareholders representing at least 5% of our share capital have the right to call special meetings, remove and appoint directors

• Simple majority vote standard for uncontested director elections

| |||

| Board Leadership

• Independent Executive Chairman

|

Board Refreshment

• Ongoing Board succession planning

• Average tenure of director nominees is 5 years

• 5 new independent directors elected since 2013

| |||

| Board Oversight

• Ongoing focus on strategic matters, including through standalone strategy sessions

• Active leadership of the Company’s strategic review

• Directly engaged in management and operations to facilitate effective CEO and CFO transition in 2018

• Robust oversight of risk management

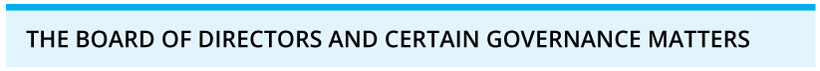

• Active engagement in talent management, leadership development and CEO succession planning

• Regular executive sessions without management present

|

Director Engagement

• Board held 17 meetings in 2018 with all directors attending at least 88% of Board meetings

• Committees held 19 meetings in 2018 with all directors attending at least 86% of applicable meetings

• Governance guidelines restrict the number of other board memberships

• In connection with the nomination process, directors’ other responsibilities/obligations considered

| |||

| Share Ownership

• Five times their annual cash fees (with a transition period for new directors)

• Directors may not hedge their common stock

• No director has shares of common stock subject to a pledge

• All equity currently granted as director compensation must be held for the director’s entire tenure on the Board

|

Director Access

• Board and Independent Executive Chairman actively engage with shareholders and solicit different shareholder viewpoints

• Directors may contact any employee directly and receive access to any aspect of the business or activities undertaken or proposed by management

• Board and its committees may engage independent advisors in their sole discretion

• Shareholders may contact any of the committee chairpersons and the independent directors as a group

| |||

|

|

2019 PROXY STATEMENT SUMM4

|

Table of Contents

| SUMMARY OF PROXY STATEMENT INFORMATION |

NOMINEES FOR BOARD OF DIRECTORS

|

James A. Attwood, Jr.

|

Guerrino De Luca |

Karen M. Hoguet | ||||||||||||

|

Age: 60

Director since: 2006 |

|

Age: 66

Director since: 2017 |

|

Age: 62

Director since: 2010 | |||||||||

|

Executive Chairman Committees: Nomination and Corporate Governance

|

Committees: Compensation |

Committees: Audit (Chairperson) | ||||||||||||

|

David Kenny

|

Harish Manwani |

Robert C. Pozen | ||||||||||||

|

Age: 57

Director since: 2018 |

|

Age: 65

Director since: 2015 |

|

Age: 72

Director since: 2010 | |||||||||

|

Committees: None |

Committees: Compensation (Chairperson) |

Committees: Compensation; Nomination and Corporate Governance (Chairperson)

| ||||||||||||

|

David Rawlinson

|

Javier G. Teruel |

Lauren Zalaznick | ||||||||||||

|

Age: 43

Director since: 2017 |

|

Age: 68

Director since: 2010 |

|

Age: 56

Director since: 2016 | |||||||||

|

Audit |

Committees: Audit |

Committees: Compensation; Nomination and Corporate Governance

| ||||||||||||

|

|

2019 PROXY STATEMENT SUMM5

|

Table of Contents

NIELSEN HOLDINGS PLC

NOTICE OF THE 2019 ANNUAL MEETING

WHEN: May 21, 2019 at 9:00 a.m. (Eastern Time)

WHERE: Online via live webcast at nielsen.onlineshareholdermeeting.com or in person at 50 Danbury Road, Wilton, CT 06897. Check-in both online and in person will begin at 8:30 a.m. (Eastern Time), and you should allow ample time for check-in procedures. Whether you attend the meeting online or in person, you will be able to ask questions and vote during the meeting.

RECORD DATE: March 22, 2019

ITEMS OF BUSINESS:

At the Annual Meeting, you will be asked to consider and vote on the resolutions set forth under Proposals 1 to 7 in the “Proposals to be Voted Upon” section below as well as such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. Explanations of the proposed resolutions together with the relevant information for each resolution are given on pages 1 to 78 and Annexes A, B, C and D of this proxy statement.

The Company’s UK annual report and accounts for the year ended December 31, 2018, which consist of the UK statutory accounts, the UK statutory directors’ report, the UK statutory directors’ compensation report, the UK statutory strategic report and the UK statutory auditor’s report (the “UK Annual Report and Accounts”), has been made available to shareholders together with the other proxy materials. There will be an opportunity at the Annual Meeting for shareholders to ask questions or make comments on the UK Annual Report and Accounts and the other proxy materials.

For additional information about our Annual Meeting, shareholders’ rights, proxy voting and access to proxy materials, see the “General Information and Frequently Asked Questions About the Annual Meeting” section on pages 87 to 92 of this proxy statement.

Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. You may vote your shares by proxy on the Internet, by telephone or by completing, signing and promptly returning the proxy card (if you received one) prior to the meeting or by attending the Annual Meeting and voting online or in person.

PROPOSALS TO BE VOTED UPON1

The Board considers that all the proposals to be put to the Annual Meeting are in the best interest of the Company and its shareholders as a whole.

| Proposal

|

Board Recommendation

| |||||

| Proposal No. 1

|

Election of Directors2

|

|

for each nominee | |||

| Proposal No. 2

|

Ratification of Independent Registered Public Accounting Firm

|

|

||||

| Proposal No. 3

|

Reappointment of UK Statutory Auditor

|

|

||||

| Proposal No. 4

|

Authorization of the Audit Committee to Determine UK Statutory Auditor Compensation

|

|

||||

| Proposal No. 5

|

Non-Binding, Advisory Vote on Executive Compensation

|

|

||||

| Proposal No. 6

|

Non-Binding, Advisory Vote on Directors’ Compensation Report

|

|

||||

| Proposal No. 7

|

Approval of the Nielsen 2019 Stock Incentive Plan

|

|

||||

| 1 | All resolutions above will be proposed as ordinary resolutions. |

| 2 | A separate resolution will be proposed for each director. |

|

|

2019 PROXY STATEMENT NOT1

|

Table of Contents

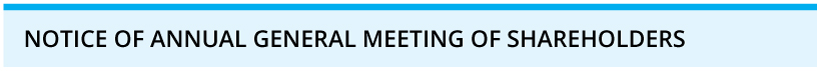

| NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS |

Notes:

| 1. | In accordance with the Company’s articles of association, all resolutions will be taken on a poll. Voting on a poll means that each share represented in person or by proxy will be counted in the vote. All resolutions will be proposed as ordinary resolutions, which under applicable law means that each resolution must be passed by a simple majority of the total voting rights of shareholders who vote on such resolution, whether in person or by proxy. Explanatory notes regarding each of the proposals (and related resolutions) are set out in the relevant sections of the accompanying proxy materials relating to such proposals. |

| 2. | The results of the polls taken on the resolutions at the Annual Meeting and any other information required by the UK Companies Act 2006 will be made available on the Company’s website as soon as reasonably practicable following the Annual Meeting and for a period of two years thereafter. |

| 3. | To be entitled to attend and vote at the Annual Meeting and any adjournment or postponement thereof, shareholders must be registered in the register of members of the Company at the close of business in New York on March 22, 2019 (the “Record Date”). Changes to the Register of Members after the relevant deadline shall be disregarded in determining the rights of any person to attend and vote at the meeting. If you hold shares through a broker, bank or other nominee, you can attend the Annual Meeting and vote by following the instructions you receive from your bank, broker or other nominee. |

| 4. | Shareholders are entitled to appoint a proxy to exercise all or any of their rights to attend and to speak and vote on their behalf at the Annual Meeting. A shareholder may appoint more than one proxy in relation to the Annual Meeting provided that each proxy is appointed to exercise the rights attached to a different share or shares held by that shareholder. A corporate shareholder may appoint one or more corporate representatives to attend and to speak and vote on its behalf at the Annual Meeting. A proxy need not be a shareholder of the Company. |

| 5. | If you are a shareholder of record or hold shares through a broker, bank or other nominee and are voting by proxy through the Internet or by telephone, your vote must be received by 11:59 p.m. (Eastern Time) on May 20, 2019 to be counted. If you are a shareholder of record or hold shares through a broker, bank or other nominee and are voting by mail, your vote must be received by 9:00 a.m. (Eastern Time) on May 17, 2019 to be counted. A shareholder who has returned a proxy instruction is not prevented from attending the Annual Meeting either online or in person and voting if he/she wishes to do so, but please note that only your vote last cast will count. If you hold shares through Nielsen’s 401(k) plan, the plan trustee, Fidelity Management Trust Company, will vote according to the instructions received from you provided that your instructions are received by 11:59 p.m. (Eastern Time) on May 16, 2019. Your instructions cannot be changed or revoked after that time, and the shares you hold through the 401(k) plan cannot be voted online at the Annual Meeting. |

| 6. | Unless you hold shares through Nielsen’s 401(k) plan, you may revoke a previously delivered proxy at any time prior to the Annual Meeting. You may vote online if you attend the Annual Meeting online, or in person if you attend the physical meeting, thereby cancelling any previous proxy. |

| 7. | Shareholders meeting the threshold requirements set out in the UK Companies Act 2006 have the right to require the Company to publish on the Company’s website a statement setting out any matter relating to: (i) the audit of the Company’s accounts (including the auditor’s report and the conduct of the audit) that are to be presented before the Annual Meeting; or (ii) any circumstance connected with the auditor of the Company ceasing to hold office since the previous annual general meeting at which annual accounts and reports were presented in accordance with the UK Companies Act 2006. The Company may not require the shareholders requesting any such website publication to pay its expenses in complying with the UK Companies Act 2006. When the Company is required to place a statement on a website under the UK Companies Act 2006, it must forward the statement to the Company’s auditor not later than the time when it makes the statement available on its website. The business which may be dealt with at the Annual Meeting includes any statement that the Company has been required under the UK Companies Act 2006 to publish on a website. |

| 8. | Pursuant to the Securities and Exchange Commission (“SEC”) rules, the Company’s proxy statement (including this Notice of Annual General Meeting of Shareholders), the Company’s US annual report for the year ended December 31, 2018 (including the Annual Report on Form 10-K for the year ended December 31, 2018), the Company’s UK Annual Report and Accounts and related information prepared in connection with the Annual Meeting are available at: www.proxyvote.com and www.nielsen.com/investors. You will need the 16-digit control number included on your Notice or proxy card in order to access the proxy materials on www.proxyvote.com. These proxy materials will be available free of charge. |

| 9. | You may not use any electronic address provided in this Notice of Annual General Meeting of Shareholders or any related documentation to communicate with the Company for any purposes other than as expressly stated. |

|

|

2019 PROXY STATEMENT NOT2

|

Table of Contents

| NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS |

PROXY VOTING METHODS

Shareholders holding shares of Nielsen on the Record Date may vote their shares by proxy through the Internet, by telephone or by mail or by attending the Annual Meeting online or in person. For shares held through a bank, broker or other nominee, shareholders may vote by submitting voting instructions to the bank, broker or other nominee. To reduce our administrative and postage costs, we ask that shareholders vote through the Internet or by telephone, both of which are available 24 hours a day, seven days a week. Shareholders may revoke their proxies at the times and in the manners described in the “Notes” section of this Notice of Annual General Meeting of Shareholders and the “General Information and Frequently Asked Questions About the Annual Meeting” section on pages 87-92 of this proxy statement.

If you are a shareholder of record or hold shares through a broker, bank or other nominee and are voting by proxy through the Internet or by telephone, your vote must be received by 11:59 p.m. (Eastern Time) on May 20, 2019 to be counted. If you are a shareholder of record or hold shares through a broker, bank or other nominee and are voting by mail, your vote must be received by 9:00 a.m. (Eastern Time) on May 17, 2019 to be counted.

If you hold shares through Nielsen’s 401(k) plan, the plan trustee, Fidelity Management Trust Company, will vote according to the instructions received from you provided that your instructions are received by 11:59 p.m. (Eastern Time) on May 16, 2019. Your instructions cannot be changed or revoked after that time, and the shares you hold through the 401(k) plan cannot be voted at the Annual Meeting.

TO VOTE BY PROXY:

|

|

|

| ||||||||||||||||||||||

| • Go to the website

www.proxyvote.com 24 hours a day, seven days a week (before the meeting) or nielsen.onlineshareholdermeeting

• You will need the 16-digit control number included on your Notice or proxy card in order to vote online.

|

• From a touch-tone phone,

dial

• You will need the 16-digit control number included on your Notice or proxy card in order to vote by telephone. |

• Mark your selections on your proxy card (if you received one).

• Date and sign your name exactly as it appears on your proxy card.

• Mail the proxy card in the postage-paid envelope that is provided to you. | ||||||||||||||||||||||

YOUR VOTE IS IMPORTANT. THANK YOU FOR VOTING.

April 9, 2019

By Order of the Board of Directors,

Emily Epstein

Company Secretary

Registered Office: Nielsen House, John Smith Drive, Oxford, OX4 2WB, United Kingdom

Registered in England and Wales No. 09422989

|

|

2019 PROXY STATEMENT NOT3

|

Table of Contents

Table of Contents

Acting upon the recommendation of its Nomination and Corporate Governance Committee, our Board has nominated the persons identified herein for election or re-election as directors. Directors will hold office until the end of the next annual general meeting of shareholders and the election and qualification of their successors or until their earlier resignation, removal, disqualification or death.

It is intended that the proxies delivered pursuant to this solicitation will be voted in favor of the election or re-election of these nominees, except in cases of proxies bearing contrary instructions. In the event that these nominees should become unavailable for election or re-election due to any presently unforeseen reason, the persons named in the proxy will have the right to use their discretion to vote for a substitute.

ONGOING BOARD SUCCESSION PLANNING

Our Nomination and Corporate Governance Committee seeks to ensure that our Board as a whole possesses the objectivity and the mix of skills and experiences to provide effective oversight and guidance to management to execute on the Company’s long-term strategy. The Nomination and Corporate Governance Committee assesses potential candidates based on their history of achievement, the breadth of their experiences, whether they bring specific skills or expertise in areas that the Nomination and Corporate Governance Committee has identified, and whether they possess personal attributes that will contribute to the effective functioning of the Board.

Ongoing Board refreshment provides fresh perspectives while leveraging the institutional knowledge and historical perspective of our longer-tenured directors. The Nomination and Corporate Governance Committee also considers succession planning for roles such as Board and committee chairpersons for purposes of continuity and to maintain relevant expertise and depth of experience.

|

|

2019 PROXY STATEMENT 1

|

Table of Contents

| ELECTION OF DIRECTORS |

Our Nomination and Corporate Governance Committee uses the following process to identify and add new directors to the Board:

Our Nomination and Corporate Governance Committee is authorized to use an independent search firm to help identify, evaluate and conduct due diligence on potential director candidates. Using an independent search firm helps the Nomination and Corporate Governance Committee ensure that it is conducting a broad search and helps it to consider a diverse slate of candidates with the qualifications and expertise that are needed to provide effective oversight of management and assist in long-term value creation.

Diversity Policy

The charter of our Nomination and Corporate Governance Committee requires the Nomination and Corporate Governance Committee to consider all factors it deems appropriate, which may include age, gender, nationality and ethnic and racial background in nominating directors and to review and make recommendations, as the Nomination and Corporate Governance Committee deems appropriate, regarding the composition and size of the Board to ensure the Board has the requisite expertise and its membership consists of persons with sufficiently diverse and independent backgrounds. Over time, the Nomination and Corporate Governance Committee and the Board as a

|

|

2019 PROXY STATEMENT 2

|

Table of Contents

| ELECTION OF DIRECTORS |

whole will assess the effectiveness of this policy and determine, how, if at all, our implementation of the policy, or the policy itself, should be changed.

Nomination Process

In considering whether to recommend nomination or re-nomination of each of our directors for election at the Annual Meeting, our Nomination and Corporate Governance Committee reviews the experience, qualifications, attributes and skills of our current directors to determine the extent to which those qualities continue to enable our Board to satisfy its oversight responsibilities effectively in light of our evolving business. In determining to nominate the directors named herein for election at the Annual Meeting, the Nomination and Corporate Governance Committee has focused on our current directors’ valuable contributions in recent years, the criteria set forth in “Board Expertise and Skills” in the “Summary of Proxy Statement Information” and the information discussed in the biographies set forth below under “Nominees for Election to the Board of Directors.” In addition, the Nomination and Corporate Governance Committee considered each director’s additional responsibilities and affiliations and the extent to which they could continue to contribute to the success of our Board.

In accordance with our articles of association, shareholders may request that director nominees submitted by such shareholders be included in the agenda of our Annual Meeting through the process described under “Shareholder Proposals for the 2020 Annual General Meeting of Shareholders.” The Nomination and Corporate Governance Committee considers shareholder recommendations for director candidates and evaluates such candidates with the same standards as it does for other Board candidates. The Nomination and Corporate Governance Committee will advise the Board whether to recommend shareholders to vote for or against such shareholder nominated candidates.

|

|

2019 PROXY STATEMENT 3

|

Table of Contents

| ELECTION OF DIRECTORS |

NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS

The following information describes the names, ages as of March 31, 2019, and biographical information of each nominee. Beneficial ownership of equity securities of the nominees is shown under “Ownership of Securities.”

|

James A. Attwood, Jr.

|

Director since 2006

|

Age 60

| ||||

|

Nielsen Committees: Nomination and Corporate Governance |

Other public company directorships: |

|||||

| • Current: Syniverse Holdings, Inc. CoreSite Realty Corporation |

• Past 5 years: Getty Images, Inc. |

|||||

|

Key Experience and Qualifications

• Financial expertise (mathematics and statistics)

• Media/telecommunications/technology expertise and deep management experience at The Carlyle Group

• Public company board experience

• Private equity investment expertise in the media industry

Mr. Attwood has served on Nielsen’s Board since 2006 and has served as Chairman of the Board since January 1, 2016. He served as Lead Independent Director of the Board from January 1, 2015 through December 31, 2015. Beginning on July 26, 2018, Mr. Attwood assumed the title of Executive Chairman on an interim basis to lead the Board’s search process to identify a new Chief Executive Officer as well as to oversee the Board’s strategic review. As Executive Chairman, Mr. Attwood remains an independent member of Nielsen’s Board. He is not a Nielsen employee and has no day-to-day responsibilities for the Company’s business. Mr. Attwood is a Managing Director of The Carlyle Group and the former Head of the Global Telecommunications, Media, and Technology Group. Prior to joining The Carlyle Group in 2000, Mr. Attwood was with Verizon Communications, Inc. and GTE Corporation. Prior to GTE Corporation, he was with Goldman, Sachs & Co. | ||||||

|

Guerrino De Luca

|

Director since 2017

|

Age 66

| ||||

|

Committees: Compensation |

Other public company directorships: |

|||||

| • Current: Logitech International S.A. |

• Past 5 years: None |

|||||

|

Key Experience and Qualifications

• Chief Executive Officer experience and public company board experience at Logitech International S.A.

• Consumer insights, technology, innovation, strategy and marketing experience

• Global markets and general management experience

Mr. De Luca has served as the Chairman of the Board of Logitech International S.A. since January 2008. Mr. De Luca joined Logitech International S.A. in 1998 and served as its President and Chief Executive Officer from February 1998 to December 2007 and as acting President and Chief Executive Officer from July 2011 to December 2012. Prior to joining Logitech International S.A., Mr. De Luca served as Executive Vice President of Worldwide Marketing for Apple Computer, Inc. | ||||||

|

|

2019 PROXY STATEMENT 4

|

Table of Contents

| ELECTION OF DIRECTORS |

|

Karen M. Hoguet

|

Director since 2010

|

Age 62

| ||||

|

Committees: Audit (Chairperson)

|

Other public company directorships: |

|||||

| • Current: None |

• Past 5 years: The Chubb Corporation |

|||||

|

Key Experience and Qualifications

• Audit and risk oversight experience

• Senior management and public company experience at Macy’s, Inc.

• Retail and commercial experience

Ms. Hoguet served as the Chief Financial Officer of Macy’s, Inc. from October 1997 until July of 2018 when she became a strategic advisor to the Chief Executive Officer until her retirement on February 1, 2019. Ms. Hoguet serves on the Board of Directors of Hebrew Union College and UCHealth. | ||||||

|

David Kenny

|

Director since 2018

|

Age 57

| ||||

|

Committees: None |

Other public company directorships: |

|||||

| • Current: Best Buy Co., Inc. |

• Past 5 years: None |

|||||

|

Key Experience and Qualifications

• Data science and Artificial Intelligence

• Retail, marketing and media expertise

• Innovation, technology and digital experience

• Chief Executive Officer and public company board experience

Mr. Kenny has been the Chief Executive Officer of Nielsen since December 3, 2018. Prior to that time, Mr. Kenny served as Senior Vice President of Cognitive Solutions at IBM, joining IBM in January 2016, after its acquisition of The Weather Company’s Product and Technology Business. Previously, from January 2012 until 2016, Mr. Kenny served as Chairman and Chief Executive Officer of The Weather Company. Prior to The Weather Company, Mr. Kenny was President of Akamai, the cloud service provider, and the co-founder, Chairman and Chief Executive Officer of the digital marketing agency Digitas, which was a Nasdaq listed company before its sale to Publicis Groupe in 2007. Mr. Kenny began his career as a consultant at Bain & Company, where he rose to the Partner level. Mr. Kenny serves on the Board of Directors of Teach for America. | ||||||

|

|

2019 PROXY STATEMENT 5

|

Table of Contents

| ELECTION OF DIRECTORS |

|

Harish Manwani

|

Director since 2015

|

Age 65

| ||||

|

Committees: Compensation

|

Other public company directorships: |

|||||

| • Current: Qualcomm Incorporated Whirlpool Corporation Gilead Sciences, Inc. |

• Past 5 years: Pearson plc Hindustan Unilever Limited |

|||||

|

Key Experience and Qualifications

• Global and emerging markets operating experience at Unilever, plc

• Consumer packaged goods experience

• Executive management and board experience at public companies

• Wide ranging international and general experience in managing a global business

Mr. Manwani has been a Senior Operating Partner/Global Executive Advisor for the Blackstone Group since February 2015. He retired from Unilever plc, a leading global consumer products company, at the end of 2014, where he served as the global Chief Operating Officer since September 2011. Mr. Manwani joined Hindustan Unilever Limited (a majority-owned subsidiary of Unilever) in 1976. Through his career, he held positions of increasing responsibility at Unilever which gave him wide ranging international and general management experience. Mr. Manwani is also a member of the Board of Tata Sons Private Limited and the Chairman of the Executive Board of the Indian School of Business. | ||||||

|

Robert C. Pozen

|

Director since 2010

|

Age 72

| ||||

|

Committees: Compensation; Nomination and Corporate Governance (Chairperson)

|

Other public company directorships: |

|||||

| • Current: None |

• Past 5 years: Medtronic Public Limited Company |

|||||

|

Key Experience and Qualifications

• Governance and public policy expertise

• Financial and financial reporting expertise

• Public company board experience

From July 1, 2010 through December 31, 2011, Mr. Pozen was Chairman Emeritus of MFS Investment Management. Prior to that, he was Chairman of MFS Investment Management since February 2004. He previously was Secretary of Economic Affairs for the Commonwealth of Massachusetts in 2003. Mr. Pozen was also the John Olin Visiting Professor, Harvard Law School from 2002 to 2004 and the Chairman of the SEC Advisory Committee on Improvements to Financial Reporting from 2007 to 2008. From 1987 through 2001, Mr. Pozen worked for Fidelity Investments in various jobs, serving as President of Fidelity Management and Research Co. from 1997 through 2001. He is currently a director of AMC, a subsidiary of the International Finance Corporation, a senior lecturer at MIT Sloan School of Management, a non-resident fellow of the Brookings Institution, a member of the Advisory Board of Perella Weinberg Partners and Chairman of the Leadership Council of the Tax Policy Committee. | ||||||

|

|

2019 PROXY STATEMENT 6

|

Table of Contents

| ELECTION OF DIRECTORS |

|

David Rawlinson

|

Director since 2017

|

Age 43

| ||||

|

Committees: Audit |

Other public company directorships: |

|||||

| • Current: MonotaRO Co., Ltd. |

• Past 5 years: None |

|||||

|

Key Experience and Qualifications

• Digital, innovation and technology experience

• E-commerce commercial, brand and marketing experience

• Global operating experience

Mr. Rawlinson is the SVP & President of the Online Business of W.W. Grainger, Inc., where he also previously served as the Vice President for Operations for the Online Business. From July 2012 until August 2015, he was Grainger’s Vice President, Deputy General Counsel and Corporate Secretary. From November 2009 until July 2012, Mr. Rawlinson was Vice President, General Counsel and Director of Corporate Responsibility of a division of ITT Exelis, formerly ITT Corporation. Prior to ITT Exelis, Mr. Rawlinson served as a White House Fellow and in appointed positions for the George W. Bush and Obama Administrations. In the Bush Administration, he was a leader of the outgoing transition. In the Obama Administration, he served as Senior Advisor for Economic Policy at the White House National Economic Council. | ||||||

|

Javier G. Teruel

|

Director since 2010

|

Age 68

| ||||

|

Committees: Audit |

Other public company directorships: |

|||||

| • Current: Starbucks Corporation J.C. Penney Company, Inc. |

• Past 5 years: None |

|||||

|

Key Experience and Qualifications

• Consumer packaged goods experience

• Global operating experience, including as Vice Chairman of Colgate-Palmolive Company

• Public company board experience

Mr. Teruel is a Partner of Spectron Desarrollo, SC, an investment management and consulting firm; Chairman of Alta Growth Capital, a private equity firm; and a majority owner of Mexican investment firm, Desarrollo Empresarial Sebara SA de CV. Previously, Mr. Teruel served as Vice Chairman of Colgate-Palmolive Company, from July 2004 to April 2007. Prior to being appointed Vice Chairman, he served in positions of increasing importance at Colgate since 1971, including as Executive Vice President responsible for Asia, Central Europe, Africa and Hill’s Pet Nutrition, as Vice President of Body Care in Global Business Development in New York, as President and General Manager of Colgate-Mexico, as President of Colgate-Europe, and as Chief Growth Officer responsible for the company’s growth functions. | ||||||

|

|

2019 PROXY STATEMENT 7

|

Table of Contents

| ELECTION OF DIRECTORS |

|

Lauren Zalaznick

|

Director since 2016

|

Age 56

| ||||

|

Committees: Compensation; Nomination and |

Other public company directorships: |

|||||

| • Current: GoPro, Inc. RTL Group |

• Past 5 years: None |

|||||

|

Key Experience and Qualifications

• Media expertise, including at NBCUniversal Media, LLC

• Digital, innovation and technology experience

• Commercial, management and marketing expertise

• Deep consumer insights expertise

Ms. Zalaznick is currently a senior strategic advisor to leading media and digital companies. From 2004 through December 2013, Ms. Zalaznick held various roles of increasing responsibility within NBCUniversal Media, LLC. In 2010 she became Chairman, Entertainment & Digital Networks and Integrated Media. In that capacity she had responsibility for the cable entertainment networks Bravo Media, Oxygen Media, and The Style Network; the Telemundo Spanish language broadcast network; and she ran the company’s digital portfolio. She was promoted to Executive Vice President at Comcast NBCUniversal until departing the company at the end of 2013. Ms. Zalaznick is currently a member of the Board of Directors of Critical Content. She is a senior advisor to The Boston Consulting Group, TMT practice, and to leading content and tech start-ups, including Refinery29, Atlas Obscura, Fatherly.com and Gimlet Media. | ||||||

The nominees for election to the Board of Directors named above are hereby proposed for appointment and reappointment by the shareholders.

|

The Board of Directors recommends that shareholders vote “FOR” the election of each of the nominees named above. |

|

|

2019 PROXY STATEMENT 8

|

Table of Contents

Pursuant to our articles of association and in accordance with the UK Companies Act 2006, our directors are responsible for the management of the Company’s business, for which purpose they may exercise all the powers of the Company.

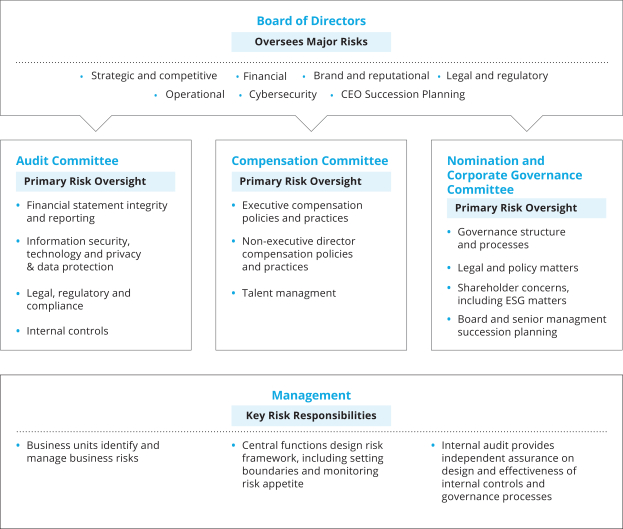

Our Board conducts its business through meetings of the Board and three standing committees: Audit, Compensation and Nomination and Corporate Governance. In accordance with the New York Stock Exchange (“NYSE”) rules and the rules promulgated under each of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), a majority of our Board consists of independent directors, and our Audit, Compensation and Nomination and Corporate Governance Committees are fully independent.

Each director owes a duty to the Company to properly perform the duties assigned to him or her and to act in the best interest of the Company. Under English law, this requires each director to act in a way he or she considers, in good faith, would be most likely to promote the success of the Company for the benefit of its shareholders as a whole, and in doing so have regard (among other matters) for the likely consequences of any decision in the long-term, the interests of the Company’s employees, the Company’s business relationships with suppliers, customers and others, the impact of the Company’s operations on the community and the environment and the need to act fairly amongst shareholders. The Company’s directors are expected to be appointed for one year and may be re-elected at the next Annual Meeting.

DIRECTOR INDEPENDENCE AND INDEPENDENCE DETERMINATIONS

Under the NYSE rules and our Corporate Governance Guidelines, a director is not independent unless the Board affirmatively determines that he or she does not have a direct or indirect material relationship with the Company or any of its subsidiaries. Heightened independence standards apply to members of the Audit and Compensation Committees.

The NYSE independence definition includes a series of objective tests, such as that the director is not an employee of the Company and has not engaged in various types of business dealings with the Company. The Board is also responsible for determining affirmatively, as to each independent director, that no relationships exist which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the Board will broadly consider all relevant facts and circumstances, including information provided by the directors and the Company with regard to each director’s business and personal activities as they may relate to the Company and the Company’s management. As the concern is independence from management and pursuant to the view articulated by the NYSE, ownership of a significant amount of stock, by itself, is not a bar to an independence finding.

The Board undertook its annual review of director independence and affirmatively determined that, except for Mr. Kenny, each of our directors is independent under Section 303A.02 of the NYSE listing rules and under our Corporate Governance Guidelines for purposes of board service. In addition, the Board affirmatively determined that the Audit Committee, the Compensation Committee, and the Nomination and Corporate Governance Committee members are fully independent under the SEC and NYSE independence standards specifically applicable to such committees.

In making the director independence determinations, the Board considered the following:

| • | Mr. Teruel indirectly holds approximately 6% of the capital stock of a private entity in which Nielsen invested $3.25 million, which at the time of investment represented approximately 15.6% of such entity’s capital stock. Nielsen has a board seat on, and a commercial arrangement with, this entity. |

|

|

2019 PROXY STATEMENT 9

|

Table of Contents

| THE BOARD OF DIRECTORS AND CERTAIN GOVERNANCE MATTERS |

Under our Corporate Governance Guidelines, the Board must select its chairperson from its members in any way it considers in the best interest of the Company. Beginning on July 26, 2018, Mr. Attwood assumed the title of Executive Chairman on an interim basis to lead the Board’s search process to identify a new Chief Executive Officer as well as to oversee the Board’s strategic review. As Executive Chairman, Mr. Attwood remains an independent member of Nielsen’s Board. He is not a Nielsen employee and has no day-to-day responsibilities for the Company’s business. From January 1, 2016 to July 26, 2018, Mr. Attwood served as the Board’s non-executive, independent Chairperson. In light of Mr. Attwood’s independence from the Company, the Company does not currently have a Lead Independent Director. As noted further below, each Board committee also has a non-executive, independent chairperson. Our Board believes our leadership structure best encourages the free and open dialogue of competing views and provides for strong checks and balances.

Our Board has established the following committees: an Audit Committee, a Compensation Committee and a Nomination and Corporate Governance Committee. The current composition and responsibilities of each committee are described below. Members serve on these committees until they no longer serve on the Board or until otherwise determined by our Board.

| Name of Independent Director

|

Audit Committee

|

Compensation Committee

|

Nomination and Corporate

| |||

| James A. Attwood, Jr.

|

•

| |||||

| Guerrino De Luca

|

•

|

|||||

| Karen M. Hoguet

|

Chairperson

|

|||||

| Harish Manwani

|

Chairperson

|

|||||

| Robert C. Pozen

|

•

|

Chairperson

| ||||

| David Rawlinson

|

•

|

|||||

| Javier G. Teruel

|

•

|

|||||

| Lauren Zalaznick

|

•

|

•

| ||||

Pursuant to our Corporate Governance Guidelines, all directors are expected to make every effort to attend all meetings of the Board and meetings of the committees of which they are members. All directors are also welcome to attend meetings and review materials of those committees of which they are not members. During 2018, the Board held 17 meetings and 19 committee meetings. Each director attended 88% or more in the aggregate of 2018 Board meetings and 86% or more of the total number of 2018 meetings of those committees on which each such director served and that were held during the period that such director served. All non-executive directors are encouraged (but not required) to attend the Annual Meeting and each extraordinary general meeting of shareholders. Six of our current directors who served at the time of our 2018 Annual Meeting, attended this meeting.

During the second half of 2018 and into 2019, the Board, with the assistance of our advisors and management team, has been deeply involved in a broadened comprehensive strategic review of the entire Company and its businesses, which we announced in September 2018. The Board, as well as a subset of independent directors, has been meeting regularly to receive updates and to provide input into the process.

|

|

2019 PROXY STATEMENT 10

|

Table of Contents

| THE BOARD OF DIRECTORS AND CERTAIN GOVERNANCE MATTERS |

COMMITTEE MEMBERSHIP AND RESPONSIBILITIES

|

Members: • Karen M. Hoguet (Chairperson) • David Rawlinson • Javier G. Teruel

Independence: All members are independent.

Audit Committee Financial Expert: All members qualify as “audit committee financial experts” and meet NYSE financial literacy and expertise requirements.

Meetings in Fiscal Year 2018: 7 |

|

Audit Committee

Key Responsibilities:

• External auditor. Appointing our external auditors, subject to shareholder vote as may be required under English law, overseeing the external auditors’ qualifications, independence and performance, discussing relevant matters with the external auditors and providing preapproval of audit and permitted non-audit services to be provided by the external auditors and related fees;

• Financial reporting. Supervising and monitoring our financial reporting and reviewing with management and the external auditor Nielsen’s annual and quarterly financial statements;

• Internal audit function. Overseeing our internal audit process and our internal audit function;

• Internal controls, risk management and compliance programs. Overseeing our system of internal controls, our enterprise risk management program (including cyber security) and our compliance with relevant legislation and regulations; and

• Information security, technology and privacy & data protection. Evaluating updates received at least quarterly from the Company’s Chief Information Officer regarding the Company’s information, technology and data protection security systems, its preparedness in preventing, detecting and responding to breaches, and any incidents and related response efforts, to then report to the Board. | ||||

|

|

2019 PROXY STATEMENT 11

|

Table of Contents

| THE BOARD OF DIRECTORS AND CERTAIN GOVERNANCE MATTERS |

|

Members: • Harish Manwani (Chairperson) • Guerrino De Luca • Robert C. Pozen • Lauren Zalaznick

Independence: All members are independent.

Meetings in Fiscal Year 2018: 7 |

Compensation Committee

Key Responsibilities:

• Executive compensation. Setting, reviewing and evaluating compensation, and related performance and objectives, of our senior management team;

• Incentive and equity-based compensation plans. Reviewing and approving, or making recommendations to our Board with respect to, our incentive and equity-based compensation plans and equity-based awards;

• Compensation-related disclosure. Overseeing compliance with our compensation-related disclosure obligations under applicable laws;

• Director compensation. Assisting our Board in determining the individual compensation for our directors within the framework permitted by the general compensation policy approved by our shareholders (the “Directors’ Compensation Policy”); and

• Talent development/employee engagement. Overseeing leadership development and employee experience, including recruitment, development, advancement and retention.

Compensation Committee Interlocks and Insider Participation: None of the current members of the Compensation Committee is a former or current officer or employee of the Company or any of its subsidiaries. No Compensation Committee member has any relationship required to be disclosed under this caption under the rules of the SEC. | |||||

|

Members • Robert C. Pozen (Chairperson) • James A. Attwood, Jr. • Lauren Zalaznick

Independence: All members are independent.

Meetings in Fiscal Year 2018: 5 |

Nomination and Corporate Governance Committee

Key Responsibilities:

• Director nomination. Determining selection criteria and appointment procedures for our Board and committee members and making recommendations regarding nominations and committee appointments to the full Board;

• Board composition. Periodically assessing the scope and composition of our Board and its committees;

• Succession planning. Developing and overseeing succession planning and talent management for CEO, other senior leadership positions and directors;

• Corporate governance. Advising the Board on corporate governance matters and overseeing the Company’s corporate responsibility and sustainability strategy; and

• Board and Committee evaluations. Developing and overseeing the evaluation process for our Board and its committees. | |||||

|

|

2019 PROXY STATEMENT 12

|

Table of Contents

| THE BOARD OF DIRECTORS AND CERTAIN GOVERNANCE MATTERS |

BOARD AND COMMITTEE EVALUATIONS

Our Board recognizes that a thorough, constructive evaluation process enhances our Board’s effectiveness and is an essential element of good corporate governance. Accordingly, our Nomination and Corporate Governance Committee develops and oversees the evaluation process to ensure that the full Board and each committee conducts an assessment of its performance and functioning and solicits feedback for enhancement and improvement.

This year, our Nomination and Corporate Governance Committee engaged an independent third party, experienced in corporate governance matters, to interview each director to obtain his or her assessment of the effectiveness of the Board and its committees. The interview process is expected to begin in April 2019. The Nomination and Corporate Governance Committee Chairperson will instruct the third party on the particular criteria to be covered in the assessment, such as conduct of the meetings and committees, leadership and process. Each director will be asked to identify any opportunities the Board can focus on to enhance its effectiveness. In addition, the third party will seek input from each director as to the performance of the other Board members. The third party organizes the director feedback and is expected to review it with the Nomination and Corporate Governance Committee and the Board in July. The Nomination and Corporate Governance Committee Chairperson is expected to lead a discussion to determine which areas the Board would like to focus on during the coming year to enhance its effectiveness. Finally, the Nomination and Corporate Governance Committee Chairperson will engage the Board in a follow-up discussion to gauge the Board’s satisfaction with the progress made in addressing any focus areas that were identified by the Board in its evaluation.

OUR BOARD’S COMMITMENT TO SHAREHOLDER ENGAGEMENT

Why We Engage

Our Board and management team recognize the benefits of regular engagement with our shareholders in order to remain attuned to their different perspectives on the matters affecting Nielsen.

Robust dialogue and engagement efforts allow our Board and management the opportunity to:

| • | consider the viewpoints of our shareholders and the issues that are important to them in connection with their oversight of management and the Company; |

| • | discuss developments in our business and provide transparency and insight about our strategy and performance; and |

| • | assess issues, existing or emerging, that may affect our business, corporate responsibility and governance practices. |

|

|

2019 PROXY STATEMENT 13

|

Table of Contents

| THE BOARD OF DIRECTORS AND CERTAIN GOVERNANCE MATTERS |

How We Engage

|

Outcomes from Investor Feedback

Some tangible examples of the results of our shareholder outreach activities include:

• In response to shareholder demand, we provided shareholders with greater, ongoing access to the Board. Our Executive Chairman regularly engaged with top shareholders particularly in the second half of 2018, via in-person meetings or conference calls.

• With the goal of greater transparency and improved communications, we benchmarked best practices and requested feedback from our key stakeholders in the investment community. As a result of our review, we will begin to incorporate organic constant currency revenue growth and Adjusted EPS into our reporting framework in 2019. These metrics will help to provide more clarity into the normalized revenue and earnings power of the organization.

• We provide regular shareholder feedback to the Board on various topics, including the strategic review and capital allocation. |

|

|

2019 PROXY STATEMENT 14

|

Table of Contents

| THE BOARD OF DIRECTORS AND CERTAIN GOVERNANCE MATTERS |

Any interested party who would like to communicate with, or otherwise make his or her concerns known directly to, the Executive Chairman of the Board or the Chairperson of any of the Audit Committee, Nomination and Corporate Governance Committee and Compensation Committee or to other directors, including the non-management or independent directors, individually or as a group, may do so by addressing such communications or concerns to the Company Secretary at [email protected] or 40 Danbury Road, Wilton, Connecticut 06897. Such communications may be done confidentially or anonymously. The Company Secretary will forward communications received to the appropriate party as necessary and appropriate. Additional contact information is available on our website, www.nielsen.com/investors, under Contact Us.

GLOBAL RESPONSIBILITY AND SUSTAINABILITY

Nielsen is committed to strengthening the communities and markets in which we live and operate our business, recognizing how important this is to a sustainable future. This commitment is supported and expressed at all levels of our organization. The Nomination and Corporate Governance Committee oversees the Company’s strategy and initiatives to evaluate and measure our performance with respect to the advancement of environmental, social, and governance (“ESG”) issues. Highlights of our new and continuing efforts in 2018 include:

Responsibility & Sustainability Strategy and Reporting:

| • | We remain focused on connecting our business with relevant ESG issues through responsible policies and practices, evaluating and measuring performance on these issues, and external reporting and transparency. Regularly reporting our progress to stakeholders supports proactive and useful engagement opportunities to drive continuous improvement and positive change for our company, our people and our world. |

| • | In 2018, we published our second Nielsen Global Responsibility Report, which captures our performance and progress on our long-term, ESG-focused initiatives. The report covers 2016 and 2017, and contains our forward-looking strategy and goals as a company; it also clearly outlines how Nielsen’s ESG issues connect to our most critical business issues, including diversity and inclusion, data privacy, security and integrity. Our Global Responsibility Report allows us to openly share our ESG approach and performance with our stakeholders—our employees, investors, clients, suppliers, and others—and to show our commitment to continuing our progress over the long-term. |

| • | In 2018, Nielsen was included in both the FTSE4Good index and the Dow Jones Sustainability (DJSI) North America index for the second year in a row; we were also included in the DJSI World Index for the first time. We were also honored to be recognized as the industry leader for media companies on JUST Capital’s 2018 “JUST 100” for the second year, advancing more than 50 spots to #40 on the list from the prior year. Finally, Bloomberg included Nielsen as part of its 2019 Gender-Equality Index (GEI); the GEI recognizes the 230 global corporate leaders in advancing women through measurement and transparency. |

| • | In recognition of the business imperative to more strategically engage our clients on meeting their own sustainability goals, we published new, thought leadership and complementary content about consumer preferences regarding the sustainability attributes of the products they purchase. We continue to empower our clients’ sustainability journeys through leveraging Nielsen data and assets. |

Nielsen Green:

| • | We remain focused on creating more sustainable outcomes by leveraging operational efficiencies and harnessing the power of our employees’ contributions. We continue to actively manage our impact on the environment in part through Green Teams, our employee engagement program. In 2018, 20,000 employees participated in Earth Week activities over five days in 55 locations around the world. Our associates also volunteered over 2,000 hours across more than 80 projects in celebration of our first annual World Cleanup Day. |

|

|

2019 PROXY STATEMENT 15

|

Table of Contents

| THE BOARD OF DIRECTORS AND CERTAIN GOVERNANCE MATTERS |

| • | We remain committed to fully calculating and managing our carbon emissions. To that end, in 2018, we have expanded our data collection and reporting to include all Nielsen sites globally. In addition, we onboarded a new data management platform that allows for more accurate and efficient representation of our global footprint and other ongoing measurements. We have also expanded our GHG emissions reporting to include Scope 3 (business travel), and we continue to explore the relevance and applicability of all 15 Scope 3 categories. |

| • | In recognition of both the reality of climate change and the opportunities for increased efficiency and effectiveness that it presents, we completed our first global climate risk assessment in early 2018 to identify Nielsen’s climate-related physical and transitional risks. By investigating physical risks, we aimed to uncover how business assets integral to our operations, such as our facilities, may be affected by extreme weather events (e.g., “super storms,” hurricanes, etc.) and changing climate patterns (e.g., increasing drought, heat waves, sea-level rise, etc.). By looking at transitional risks, we aimed to identify the potential financial implications associated with regulatory pressures related to climate change (e.g., carbon taxes, emission caps, investing in new technology, etc.) as well as potential reputational risks. |

Supply Chain Sustainability:

| • | We recognize that our institutional spend with suppliers around the world comes with risks and impacts that are of concern to our company and our stakeholders—risks relating to climate change, energy use, human rights, conflict minerals and data privacy and security, among others. Like the immense purchasing power of individual consumers, as a global company, our institutional spend of over $2 billion can be a demand signal in the marketplace. Our Supply Chain Sustainability program had a productive third year in our goal to establish a best-practice program with these responsibilities and opportunities in mind. |

| • | At the end of 2018, we identified or added more than 400 impact sourcing jobs in our supply chain, representing a 20% increase compared to 2017. We continue to move toward our goal of 500 impact sourcing jobs in our supply chain by 2020. |

| • | Meaningful supplier engagement is the primary means by which we collaborate with suppliers to meet our program’s sustainability goals. We do this through measurement and disclosure, continuous improvement and capacity building. In 2018 we added a contractual provision to our Supplier Code of Conduct requiring sustainability assessments from suppliers meeting spend, criticality and/or risk exposure criteria. In 2018, we engaged close to 200 of our key suppliers across North America, Europe, Latin America, Asia and the Middle East and exceeded our goal of assessing 100 of our key suppliers with a third party supplier assessment covering ESG issues. In 2017, we engaged over 150 of our key suppliers on ESG issues, covering 40% of our spend, up from 60 suppliers and a third of our spend in 2016. We observed an average ESG score increase of 17% in our lowest scoring supplier sustainability assessments, exceeding our goal of an average 10% score increase. We also began measuring product/service level impacts in 2017. We defined over 40 baseline key performance indicators on our most material purchasing categories in 2017, and in 2018, published the baselines and will publish our primary targets to improve them. |

| • | In 2017 and 2018, we raised awareness of our program internally within Nielsen with presentations to over 100 corporate buyers outside of our centralized Global Procurement team. Externally, our program leaders spoke to combined audiences of 3,500 about our supply chain sustainability program, and its alignment with the United Nations Sustainable Development Goals, including a presentation at the United Nations. |

| • | As part of our commitment to create industry-wide impact, we actively participated as a corporate member with the Responsible Business Alliance, the Responsible Minerals Initiative, the Global Impact Sourcing Coalition (as a Founding Member), and the Sustainable Purchasing Leadership Council. |

Nielsen Cares:

| • | Nielsen Cares mobilizes our data, expertise and associates to positively impact the communities in which we live and work around the world. Nielsen Cares programs, in operation since 2010, aim to commit Nielsen resources and time to social causes where we can make a difference, focused on the priority areas of Education, Hunger & Nutrition, Technology, and Diversity & Inclusion. Our employees share skills, time, data, and insights through our volunteering and our in-kind giving programs. |

|

|

2019 PROXY STATEMENT 16

|

Table of Contents

| THE BOARD OF DIRECTORS AND CERTAIN GOVERNANCE MATTERS |

| • | In 2018, more than 25,000 employees participated on Nielsen Global Impact Day through 1,450 volunteer events in 91 countries. |

| • | To carry out our Nielsen Cares programs around the world, we maintain and support a global council of approximately 20 Nielsen Cares leaders, representing all geographic markets and multiple functional areas across the company. In coordination with this leadership council, we also have local Nielsen Cares leaders on-site at nearly 150 locations around the world. These leaders work to identify local engagement opportunities with organizations and develop projects for associates to connect with their communities and with each other. |

| • | All Nielsen associates have 24 hours of dedicated volunteer time to use annually to volunteer in their communities around the world. Since 2016, our employees have logged more than 260,000 volunteer hours, tracking towards our goal to volunteer at least 300,000 hours by 2020. In 2018, 92% of our employees said that volunteering has a positive influence on their employee experience. |

| • | In 2018, Nielsen forged a year-long collaboration agreement with All Hands and Hearts—Smart Response, a volunteer-driven disaster relief organization. In November, 20 Nielsen associates traveled to Yabucoa, Puerto Rico, for a week of repairing homes, roofing and sanitizing in the continued clean-up from Hurricane Maria. |

|

|

2019 PROXY STATEMENT 17

|

Table of Contents

| THE BOARD OF DIRECTORS AND CERTAIN GOVERNANCE MATTERS |

Data for Good:

| • | Data is the foundation of our work and we believe it can be leveraged to advance social good. We’ve committed to enhancing the use of data to increase impact in reducing discrimination, easing global hunger, promoting STEM education and building stronger leadership in the social sector. |

| • | Since 2012, Nielsen has pledged to donate at least $10 million each year of our data, products and services through pro bono work and skills-based volunteering with nonprofits in our priority cause areas. Nielsen donated a record $21.2 million of data, products and services in 2018, again surpassing our $10 million annual commitment of data, products and services. This is part of a larger goal to contribute a cumulative $50 million in-kind from 2016 to the end of 2020. |