Form DEF 14A Elanco Animal Health For: May 08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

|

|

| SCHEDULE 14A |

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

|

|

|

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ | |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

| Elanco Animal Health Incorporated | ||

| (Name of registrant as specified in its charter) | ||

| (Name of person(s) filing proxy statement, if other than the registrant) | ||

| Payment of Filing Fee (Check the appropriate box): | ||

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) |

Title of each class of securities to which transaction applies: |

|

| (2) |

Aggregate number of securities to which transaction applies: |

|

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

| (4) |

Proposed maximum aggregate value of transaction: |

|

| (5) |

Total fee paid: |

|

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) |

Amount Previously Paid: |

|

| (2) |

Form, Schedule or Registration Statement No.: |

|

| (3) |

Filing Party: |

|

| (4) |

Date Filed: |

|

|

2019 |

Notice of Annual Meeting of Shareholders and Proxy Statement |

|

|

ELANCO ANIMAL HEALTH INCORPORATED

2500 Innovation Way

Greenfield, Indiana 46140

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 8, 2019

The 2019 Annual Meeting of Shareholders of ELANCO ANIMAL HEALTH INCORPORATED, an Indiana corporation (the “Company” or “Elanco”), will be a virtual meeting

of shareholders, conducted via live audio webcast at www.virtualshareholdermeeting.com/ELAN2019 on Wednesday, May 8, 2019, at 8:00 a.m. Eastern Time (the “meeting”), to consider and act upon the following matters:

Items of Business

| 1. | Election of the four directors named in this proxy statement to serve three-year terms. |

| 2. | Ratification of the appointment of Ernst & Young LLP as the Company’s principal independent auditor for 2019. |

| 3. | Non-binding vote on the compensation of named executive officers. |

| 4. | Non-binding vote on the frequency of shareholder votes on the compensation of named executive officers. |

| 5. | Transaction of such other business as may properly come before the meeting. |

Voting

Only shareholders of record at the close of business on March 22, 2019 are entitled to notice of, and to vote at, the meeting. At least five days prior to the meeting, a complete list of shareholders will be available for inspection by any shareholder entitled to vote at the meeting, during ordinary business hours, at the office of the Secretary of the Company at 2500 Innovation Way, Greenfield, Indiana 46140. You are cordially invited to participate in the annual meeting via live audio webcast and vote on the business items described in this proxy statement. Regardless of whether you expect to participate in the meeting online, please either complete, sign and date the enclosed proxy card and mail it promptly in the enclosed envelope, or vote electronically by telephone or the Internet as described in greater detail in the proxy statement. Returning the enclosed proxy card or voting electronically or telephonically will not affect your right to vote online if you participate in the meeting.

By Order of the Board of Directors

![]()

Michael-Bryant Hicks

Executive Vice President, General Counsel and Corporate Secretary

April 3, 2019

Even though you may plan to participate in the meeting online, please vote by telephone or the Internet, or execute the enclosed proxy card and mail it promptly. A return envelope (which requires no postage if mailed in the United States) is enclosed for your convenience. Telephone and Internet voting information is provided on your proxy card. Should you participate in the meeting online, you may revoke your proxy and vote your shares electronically during the meeting.

Table of Contents

|

Page |

|

| Proxy Statement | 1 |

| 2019 Proxy Summary | 2 |

| About the Meeting | 4 |

| Governance | 7 |

| 7 | |

| 8 | |

| 12 | |

| 14 | |

| 14 | |

| 14 | |

| 14 | |

| 15 | |

| 17 | |

| 17 | |

| 17 | |

| 23 | |

| 24 | |

| Executive Compensation | 26 |

| 26 | |

| 40 | |

| Ownership of Company Stock | 50 |

ELANCO ANIMAL HEALTH INCORPORATED

2500 Innovation Way

Greenfield, Indiana 46140

|

|

|

|

2019 ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation of proxies by the board of directors of Elanco Animal Health Incorporated (the “Board”), a Indiana corporation, to be voted at the 2019 Annual Meeting of Shareholders, which we refer to as the “annual meeting” or the “meeting,” and any adjournment or postponement of the meeting. The meeting will be a virtual meeting, conducted via live audio webcast on Wednesday, May 8, 2019, at 8:00 a.m. Eastern Time, for the purposes contained in the accompanying Notice of Annual Meeting of Shareholders and as set forth in this proxy statement. On April 3, 2019, we first mailed this proxy statement and form of proxy, together with our 2018 Annual Report, to our shareholders.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on May 8, 2019: The Annual Report and Notice & Proxy Statement are available at www.proxyvote.com. (All website addresses given in this document are for informational purposes only and are not intended to be an active link or to incorporate any website information into this document).

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

1

|

This summary highlights information contained in this proxy statement. This summary does not contain all of the information that you should consider, and you should carefully read the entire proxy statement before voting.

Annual Meeting of Shareholders

| • | Time and Date: 8:00 a.m., Eastern Time, Wednesday, May 8, 2019 |

| • | Place: Audio webcast at www.virtualshareholdermeeting.com/ELAN2019 |

| • | Record Date: Close of business on March 22, 2019 |

| • | Voting: Shareholders as of the record date are entitled to vote; each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on |

Voting Matters and Board Recommendations

| Matter | Board Recommendation | |

| 1. | Election of the four directors named in this proxy statement | FOR EACH NOMINEE |

| 2. | Ratification of the appointment of Ernst & Young LLP as the Company’s principal independent auditor for 2019 | FOR |

| 3. | Non-binding vote on the compensation of named executive officers | FOR |

| 4. | Non-binding vote on the frequency of shareholder votes on the compensation of named executive officers | EVERY YEAR |

ELECTION OF DIRECTORS: Board Nominees

| Name | Age | Director Since |

Committee Memberships |

Principal Occupation |

| Kapila K. Anand | 65 | 2018 |

Audit (Chair) Finance |

Retired Partner, KPMG |

| John P. Bilbrey | 62 | 2019 |

Finance (Chair) Audit |

Former CEO and President, The Hershey Co. |

| R. David Hoover (Chairman of the Board) | 73 | 2018 |

Audit Nominating and Corporate Governance (Chair) |

Former CEO, Ball Corp. |

| Lawrence Kurzius | 61 | 2018 |

Compensation (Chair) Finance |

Chair and CEO, McCormick & Company |

DIRECTORS CONTINUING IN OFFICE

Terms expiring in 2020

| Name | Age | Director Since |

Committee Memberships |

Principal Occupation |

| Michael J. Harrington | 56 | 2018 | Finance | Senior Vice President and General Counsel, Eli Lilly & Company |

| Deborah T. Kochevar | 62 | 2019 |

Compensation Nominating and Corporate Governance |

Provost and Senior Vice President ad interim, Tufts University |

| Kirk McDonald | 52 | 2019 |

Compensation Nominating and Corporate Governance |

Chief Marketing Officer, Xandr, AT&T |

Terms expiring in 2021

| Name | Age | Director Since |

Committee Memberships |

Principal Occupation |

| Denise Scots-Knight | 59 | 2019 |

Compensation Finance |

CEO and Co-Founder, Mereo BioPharma Group plc |

| Jeffrey N. Simmons | 51 | 2018 | Finance | President and CEO, Elanco Animal Health Incorporated |

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

2

|

PROPOSAL TO RATIFY THE APPOINTMENT OF PRINCIPAL Independent AUDITOR for 2019

Although not required, we are asking shareholders to ratify the selection of Ernst & Young LLP as our principal independent auditor for 2019.

ADVISORY VOTE TO APPROVE COMPENSATION OF Named Executive Officers

Our named executive officers for this proxy statement are:

| ● | Jeffrey N. Simmons, President and Chief Executive Officer |

| ● | Todd S. Young, Executive Vice President and Chief Financial Officer (Chief Financial Officer since November 1, 2018) |

| ● | Sarena S. Lin, Executive Vice President, Elanco USA, Corporate Strategy and Global Marketing |

| ● | David A. Urbanek, Executive Vice President, Manufacturing and Quality |

| ● | David S. Kinard, Executive Vice President, Human Resources |

| ● | Christopher W. Jensen, Former Chief Financial Officer (Chief Financial Officer from April 2018, but began a medical leave of absence in August 2018 and did not return to his position) |

| ● | Lucas E. Montarce, Former Acting Chief Financial Officer (from August 2018 through October 2018) |

We are asking our shareholders to approve on an advisory basis the compensation of our named executive officers. Our Board recommends a FOR vote because we believe our compensation program aligns the interests of our named executive officers with those of our shareholders. We also believe that our compensation program achieves our compensation objective of rewarding management based upon individual and Company performance and the creation of shareholder value over the long term. Although shareholder votes on executive compensation are non-binding, the Board and the Compensation Committee consider the results when reviewing whether any changes should be made to our compensation program and policies.

Executive Compensation

Prior to Elanco’s initial public offering (the “IPO”), Elanco’s business operated as part of a division of Lilly. As a result, the discussion in this proxy statement as it relates to Elanco’s compensation programs prior to the IPO relates to Lilly’s compensation philosophy. In connection with the IPO, Elanco’s Board approved the pay packages for the executive officers of Elanco, including certain of the named executive officers. Elanco’s compensation programs and policies following the IPO through December 31, 2018 largely reflect Elanco’s determination to generally maintain Lilly’s compensation philosophy and other elements of Lilly’s compensation programs and policies, with certain adjustments to pay packages in connection with the IPO. This Elanco compensation programs and policies for 2018 are more fully described below under “Compensation Discussion and Analysis – Elanco Compensation Program.”

SEPARATION and EXCHANGE OFFER

Elanco was founded in 1954 as part of Eli Lilly & Company (“Lilly”). On September 24, 2018, we completed our IPO, pursuant to which we issued and sold 19.8% of our total outstanding shares, with Lilly retaining the remaining shares. On March 11, 2019, Lilly completed an exchange offer pursuant to which it transferred its remaining holdings in us to its shareholders in exchange for shares of Lilly common stock. We refer to this transaction in this proxy statement as the “exchange offer.” Following the exchange offer, Lilly no longer owns any shares in us, and we are an independent publicly trading company.

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

3

|

2. What Am I Voting On?

You are voting on four items:

| ● | election of the four directors named in this proxy statement (see page 8); |

| ● |

ratification of the appointment of Ernst & Young LLP as our principal independent auditor for 2019 (see page 51);

|

| ● | non-binding vote on the compensation of named executive officers (see page 54); and |

| ● | non-binding vote on the frequency of shareholder votes on the compensation of named executive officers (see page 55). |

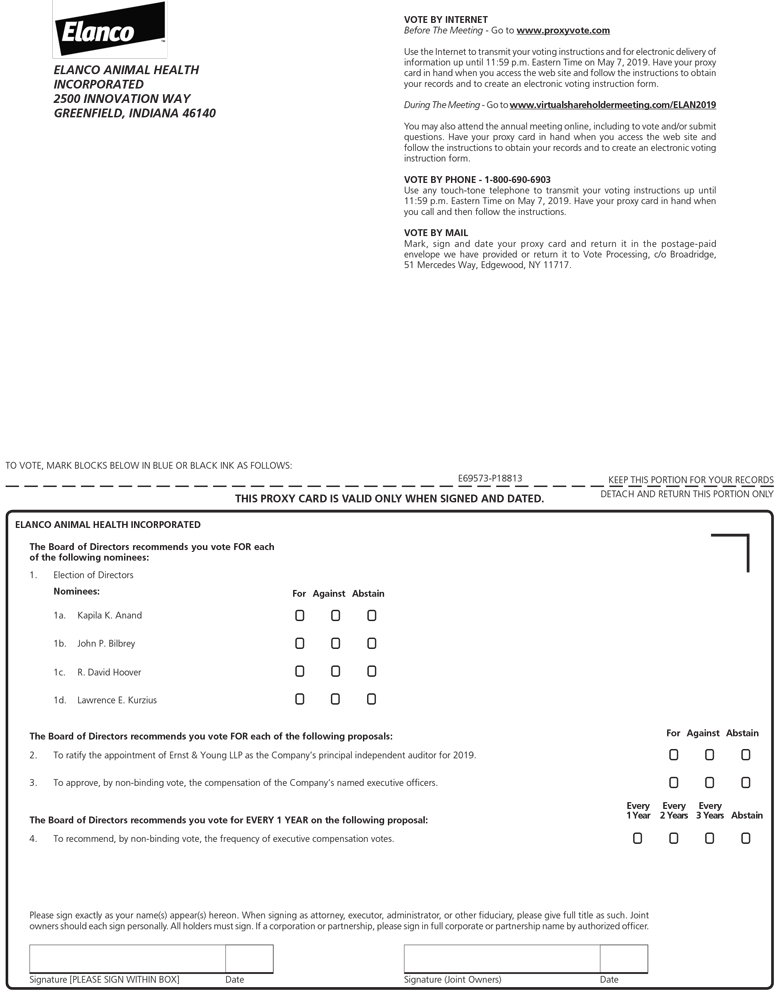

3. How Do I Vote?

If you are a shareholder of record, there are three ways to vote:

|

BY INTERNET www.proxyvote.com* You may also attend the annual meeting online, including to vote and/or submit questions, at www.virtualshareholdermeeting.com/ELAN2019 |

|

|

BY TELEPHONE toll-free 1-800-690-6903* |

|

BY MAIL

completing and returning your proxy card |

Shares of our common stock that are held in a brokerage account in the name of the broker are held in “street name.” If your shares are held in street name, you should follow the voting instructions provided by your broker. You may complete and return a voting instruction card to your broker or vote by telephone or the Internet. Check your voting instructions card for more information.

|

|

*

|

The deadline to vote by telephone or Internet is 11:59 p.m. Eastern Time on May 7, 2019.

|

4. What Are the Voting Recommendations of the Board of Directors?

| Matter | Board Recommendation |

| Election of the four directors named in this proxy statement | FOR EACH NOMINEE |

| Ratification of the appointment of Ernst & Young LLP as our principal independent auditor for 2019 | FOR |

| Non-binding vote on the compensation of named executive officers | FOR |

| Non-binding vote on the frequency of shareholder votes on the compensation of named executive officers | EVERY YEAR |

If you return a properly executed proxy card without instructions, the persons named as proxy holders will vote your shares in accordance with the recommendations of our Board.

5. Will Any Other Matters Be Voted On?

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

4

|

6. Who Is Entitled to Vote at the Meeting?

7. How Many Votes Do I Have?

You will have one vote for each share of our common stock you owned at the close of business on the record date.

8. How Many Votes Can Be Cast By All Shareholders?

9. How Many Votes Must Be Present to Hold the Meeting?

10. What Vote Is Required to Approve Each Proposal?

proposal at the meeting. With respect to Item 4, the option receiving the highest number of votes will be given due consideration by the Board when determining frequency of shareholder votes on the compensation of named executive officers.

Abstentions or broker non-votes with respect to Items 2, 3 and 4, if any, are not counted or deemed present or represented for determining whether shareholders have approved the proposal and will have no effect on the outcome of the vote. Brokers have discretionary authority with respect to the ratification of the appointment of the principal independent auditor. Brokers do not have discretionary authority with respect to the other proposals.

11. Can I Change My Vote or Revoke My Proxy?

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

5

|

12. How Can I Attend the Annual Meeting?

Attending Online. If you plan to attend the annual meeting online, please be aware of what you will need to gain admission, as described below. If you do not comply with the procedures described here for attending the annual meeting online, you will not be able to participate at the annual meeting but may listen to the annual meeting webcast. Shareholders may participate in the annual meeting by visiting www.virtualshareholdermeeting.com/ELAN2019; interested persons who were not shareholders as of the close of business on March 22, 2019 may listen to, but not participate, in the annual meeting via www.virtualshareholdermeeting.com/ELAN2019.

To attend online and participate in the annual meeting, shareholders of record will need to use their control number to log into www.virtualshareholdermeeting.com/ELAN2019; beneficial shareholders who do not have a control number may

We encourage you to access the meeting prior to the start time. Please allow ample time for online check-in, which will begin at 7:45 a.m. Eastern

Time. If you have difficulties during the check-in time or during the annual meeting, we will have technicians ready to assist you with any difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the

virtual meeting during the check-in or course of the annual meeting, please call please call the technical support number that will be posted on the virtual shareholder meeting log-in page.

Asking Questions. Shareholders who wish to submit a question to Elanco for the meeting may do so during the meeting at www.virtualshareholdermeeting.com/ELAN2019.

13. How Will My Shares Be Voted if I Submit a Proxy Without Indicating My Vote?

If you submit a properly executed proxy without indicating your vote, your shares will be voted as follows:

| ● | FOR each director nominee named in this proxy statement; |

| ● | FOR ratification of the appointment of Ernst & Young LLP as our principal independent auditor for 2019; |

| ● | FOR the approval, by non-binding vote, of the compensation of the Company’s named executive officers; and |

| ● | FOR EVERY YEAR with respect to the non-binding vote on the frequency of shareholder votes on the compensation of named executive officers. |

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

6

|

Overview of Our Corporate Governance

Our company is committed to the values of effective corporate governance and high ethical standards. These values are conducive to long-term performance and the Board reevaluates our policies on an ongoing basis to ensure they sufficiently meet the Company’s needs. We believe our key corporate governance and ethics policies enable us to manage our business in accordance with the highest standards of business practice and in the best interests of our shareholders.

The following sections provide information about our governance profile, directors, including their qualifications, the director nomination process, and director compensation.

|

Board Independence |

■ Seven out of nine of our directors are independent ■ Our CEO is the only management director |

|

|

Board Composition |

■ Currently, the Board has fixed the number of directors at nine ■ The Board will regularly assess its performance through Board and committee self-evaluation ■ The Nominating and Corporate Governance Committee leads the full Board in considering board competencies and refreshment in light of company strategy |

|

|

Board Committees |

■ We have four Board committees – Audit, Compensation, Nominating and Corporate Governance and Finance ■ Our Audit, Compensation, and Nominating and Corporate Governance Committees are composed entirely of independent directors |

|

|

Leadership Structure |

■ The Chairman of our Board is an independent director | |

|

Risk Oversight |

■ Our full Board is responsible for risk oversight, and has designated committees to have particular oversight of certain key risks. Our Board oversees management as management fulfills its responsibilities for the assessment and mitigation of risks and for taking appropriate risks | |

|

Open Communication |

■ We encourage open communication and strong working relationships among the Chairman and other directors ■ Our directors have access to management and employees |

|

|

Director Stock Ownership |

■ Directors are expected to hold meaningful equity ownership positions in the company ■ A significant portion of director compensation is made in the form of company equity ■ Directors are prohibited from hedging, or using as collateral, their Elanco stock |

|

|

Accountability to Shareholders |

■ We use plurality voting in director elections ■ We have a classified board with annual election of approximately 1/3 of directors ■ We have not adopted a shareholder rights plan (“poison pill”) ■ Shareholders can contact our Board or management through our website or by regular mail |

|

|

Management Succession Planning |

■ The Board actively monitors our succession planning and management development and receives regular updates on employee engagement, diversity and retention matters ■ At least once per year, the Board reviews senior management succession and development plans |

|

|

Corporate Responsibility |

■ The Board, through the Audit Committee, monitors our programs and initiatives on political contributions and social responsibility | |

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

7

|

Proxy Item No. 1: Election of Directors

Under our articles of incorporation, the Board is divided into three classes with approximately one-third of the directors standing for election each year. Our Board currently consists of nine directors. The directors hold office for staggered terms of three years (and until their successors are elected and qualified, or until their earlier death, resignation or removal). One of the three classes is elected each year to succeed the directors whose terms are expiring.

The directors in the class whose terms expire at the 2019 annual meeting are Kapila Anand, John (J.P.) Bilbrey, David Hoover and Lawrence Kurzius. Each of these directors has been nominated by the Board upon the recommendation of the Nominating and Corporate Governance Committee. The term for directors to be elected this year will expire at the annual meeting of shareholders to be held in 2022. Each of the four director nominees listed below has agreed to serve that term.

The Nominating and Corporate Governance Committee considers a number of factors and principles in determining the slate of director nominees for election to the company’s Board,

as discussed under “Selection of Nominees for the Board of Directors” below. The Nominating and Corporate Governance Committee and the Board have evaluated each of Ms. Anand, Mr. Bilbrey, Mr. Hoover and Mr. Kurzius, based on the factors and principles we use to select nominees. Based on this evaluation, the Nominating and Corporate Governance Committee and the Board have concluded that it is in the best interests of Elanco and our shareholders for each of these nominees to serve as a director of Elanco.

Our Board has appointed Michael-Bryant Hicks and Darlene Quashie Henry as proxies to vote your shares on your behalf. If any nominee is not able to serve, the Board can either designate a substitute nominee to serve in his or her place as a director or reduce the size of the Board. If the Board nominates another individual, the persons named as proxies may vote for such substitute nominee. Proxies cannot be voted for a greater number of persons than the number of nominees named below.

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

8

|

The ages, principal occupations, directorships held and other information about our nominees and directors are shown below as of March 15, 2019.

|

Kapila Kapur

Anand, C.P.A

|

Kapila Kapur Anand has served as a member of the Board since September 2018. Ms. Anand has served as a Senior Advisor to KPMG LLP, an accounting firm, since 2016. Prior to that, Ms. Anand served in various leadership roles as a partner at KPMG LLP, including Industry Segment Leader — Travel, Leisure and Hospitality from 2011 to 2017, Partner in Charge — Public Policy Business Initiatives from 2009 to 2013, KPMG LLP Board member from 2005 to 2010, Advisory Leader — Private Equity, Real Estate and Hospitality from 2002 to 2009 and Audit Partner — Real Estate and Hospitality from 1989 to 2002. Ms. Anand currently serves on the boards of directors of Extended Stay America, Inc. and Omega Healthcare Investors, Inc.

Skills and Experience Ms. Anand’s experience described above, including her extensive financial, managerial and corporate governance experience, provides her with the qualifications and skills to serve as a director on Elanco’s board. |

|

Age: 65 Director since: 2018

|

|

|

Committees: Audit (Chair) Finance |

|

|

| John P. Bilbrey |

John P. Bilbrey, also known as J.P., has served as a member of the Board since March 2019. He served as the CEO and President of The Hershey Company, a multinational consumer food company, from 2011 until his retirement in 2017, and as Chairman of the Board from 2015 until 2018. Previously, Bilbrey served in various roles at The Hershey Company, including as the Chief Operating Officer and EVP from 2010 to 2011, the President of North America from 2007 to 2010, the President of International Commercial group from 2005 to 2007. Prior to joining The Hershey Company, he held leadership positions at Mission Foods, Danone Waters of North America, Inc., Bilbrey Farms and Ranch and Procter & Gamble Company. Mr. Bilbrey currently serves on the board of directors of Colgate-Palmolive Company and has previously served on the boards of directors of The Hershey Company and McCormick & Company, Incorporated. Skills and Experience Mr. Bilbrey’s experience described above, including the unique combination of livestock production, food industry and consumer insights experience, provides him with the qualifications and skills to serve as a director on Elanco’s board. |

|

Age: 62 Director since: 2019 |

|

|

Committees: Finance (Chair) Audit |

|

|

| R. David Hoover |

R. David Hoover has served as the chairman of the Board since May 2018. Mr. Hoover has been retired since 2013. Prior to that, Mr. Hoover served in various roles at Ball Corporation, a company supplying innovative, sustainable packaging solutions and other technologies and services, including Chairman from 2002 to 2013, Chief Executive Officer from 2010 to 2011, President and Chief Executive Officer from 2001 to 2010, Chief Operating Officer from 2000 to 2001 and Chief Financial Officer from 1998 to 2000. Mr. Hoover currently serves on the board of directors of Edgewell Personal Care Company and has previously served on the board of directors of Ball Corporation.

Skills and Experience Mr. Hoover’s experience described above, including his extensive management experience as Chief Executive Officer and Chief Financial Officer at Ball Corporation and corporate governance experience through his service on other public boards, including nine years he previously served as a director for Lilly, provides him with the qualifications and skills to serve as a director on Elanco’s board. |

|

Age: 73 Director since: 2018 |

|

|

Committees: Audit Nominating and Corporate Governance (Chair)

|

|

|

|

Lawrence E.

Kurzius

|

Lawrence E. Kurzius has served as a member of the Board since September 2018. Mr. Kurzius has served in various leadership roles at McCormick & Company, a global food company, including director since 2015 and Chairman of the Board of Directors since 2017, Chief Executive Officer since 2016, President since 2015, Chief Operating Officer from 2015 to 2016, Chief Administrative Officer from 2013 to 2015, President, International Businesses from 2008 to 2013, President, Europe, Middle East and Africa from 2007 to 2008 and President, U.S. Consumer Foods from 2005 to 2006.

Skills and Experience Mr. Kurzius’ experience described above, including his extensive management experience and corporate governance experience, provides him with the qualifications and skills to serve as a director on Elanco’s board. |

|

Age: 61 Director since: 2018 |

|

|

Committees: Compensation (Chair) Finance |

|

|

|

Recommendation of the Board

The Board unanimously recommends a vote FOR the election of each director nominee listed above. |

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

9

|

Directors Continuing in Office

Terms Expiring in 2020

| Michael J. Harrington |

Michael J. Harrington has served as a director on Elanco’s board since September 2018. Mr. Harrington has served as the Senior Vice President and General Counsel for Lilly since January 2013. Prior to 2013, Mr. Harrington served in various legal roles for Lilly, including Vice President and Deputy General Counsel of Global Pharmaceutical Operations from 2010 to 2012 and Vice President and General Counsel, Corporate from 2004 to 2010.

Skills and Experience Mr. Harrington’s experience described above, including his knowledge of Elanco and the animal health industry and his business and management experience, provides him with the qualifications and skills to serve as a director on Elanco’s board. |

|

Age: 56 Director since: 2018 |

|

|

Committees: Finance |

|

|

|

Deborah T. Kochevar |

Deborah T. Kochevar, D.V.M., Ph.D., DACVCP, has served as a member of the Board since March 2019. Dr. Kochevar has served has served as the provost and senior vice president ad interim at Tufts University since 2018. She served as the Dean of the Cummings School of Veterinary Medicine at Tufts University from 2006 through 2018. Previously, Dr. Kochevar was a long-time faculty member and administrator at the College of Veterinary Medicine and Biomedical Sciences, Texas A&M University, where she held the Wiley Chair of Veterinary Medical Education. Dr. Kochevar is a past-president of the Association of American Veterinary Medical Colleges and American College of Veterinary Clinical Pharmacology. Dr. Kochevar is active in the American Veterinary Medical Association, having chaired its Council on Education and the Educational Commission for Foreign Veterinary Graduates. Dr. Kochevar currently serves on the board of directors of Charles River Laboratories International, Inc. |

|

Age: 62 Director since: 2019 |

|

|

Committees: Compensation Nominating and Corporate Governance |

|

|

Skills and Experience Dr. Kochevar’s experience described above, including her deep animal health expertise and One Health approach, will add to Elanco’s focus on delivering best-in-class innovation across the portfolio and provides her with the qualifications and skills to serve as a director on Elanco’s board. |

| Kirk McDonald |

Kirk McDonald has served as a member of the Board since March 2019. Mr. McDonald has served as the Chief Marketing Officer of Xandr, AT&T’s Advertising and Analytics company, since November 2017. Prior to Xandr, McDonald served as the President of PubMatic, a company developing and implementing online advertising software and strategies, since 2011. Before joining PubMatic, he was President of Digital at Time Inc., from 2009 to 2011 and the Chief Advertising Officer of the Fortune|Money Group. He has also served as the SVP of Sales, Marketing and Client Services for DRIVEpm and Atlas, both units of Microsoft’s advertising business, as well as in various roles at CNET, Ziff Davis and Condé Nast. McDonald serves on several professional and not-for-profit boards. He was a former advisor on the LUMA Partners board and is currently the Chairman of a non-profit, Code Interactive, which is focused on inspiring the next generation of technology leaders from underserved communities.

Skills and Experience Mr. McDonald’s experience described above, including his proficiency driving digital transformation, marketing capability and know-how in using cutting-edge technology to connect with today’s customers, provides him with the qualifications and skills to serve as a director on Elanco’s board. |

|

Age: 52 Director since: 2019 |

|

|

Committees: Compensation Nominating and Corporate Governance |

|

|

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

10

|

Terms Expiring in 2021

| Denise Scots-Knight |

Denise Scots-Knight, PhD, has served as a member of the Board since March 2019. Dr. Scots-Knight was the co-founder of, and has served as the Chief Executive Officer and member of the board of Mereo BioPharma Group plc, a specialty biopharmaceutical company, since 2015. From 2010 until 2015, she was the Managing Partner of Phase4 Partners Ltd., a global life science venture capital firm. From 2004 to 2010, Dr. Scots-Knight was head of Nomura Phase4 Ventures, a venture capital affiliate of Nomura International plc, a leading Japanese financial institution. Dr. Scots-Knight has served on the boards of directors of Oncomed Pharmaceuticals, Inc., Idenix Pharmaceuticals, Inc. and Nabriva Therapeutics AG.

Skills and Experience Ms. Scots Knight’s experience described above, including her extensive previous board leadership, history leading an innovation and growth-oriented company, and expertise building innovation models and partnerships, provides her with the qualifications and skills to serve as a director on Elanco’s board. |

|

Age: 59 Director since: 2019 |

|

|

Committees: Compensation Finance |

|

|

| Jeffrey N. Simmons |

Jeffrey N. Simmons has served as Elanco’s President and Chief Executive Officer and as a member of the Board since July 2018. Mr. Simmons served as the President of the Elanco Animal Health division of Lilly and Senior Vice President of Lilly from 2008 until September 2018. Prior to 2008, Mr. Simmons held various leadership roles for Elanco, including District Sales Manager, International Marketing Manager, Country Director for Brazil, Area Director for Western Europe and Executive Director for U.S. and Global Research & Development.

Skills and Experience Mr. Simmons’ experience described above, including his knowledge of Elanco and the animal health industry and his business and management experience, provides him with the qualifications and skills to serve as a director on Elanco’s board. |

|

Age: 51 Director since: 2018 |

|

|

Committees: Finance |

|

|

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

11

|

Committees of the Board of Directors

Our Board is responsible for establishing broad corporate policies and for overseeing the overall management of the Company. In addition to considering various matters which require its approval, our Board provides advice and counsel to, and ultimately monitors the performance of, our senior executives.

|

Audit Committee |

Compensation Committee |

Finance Committee |

Nominating and Corporate |

|||||

| Kapila K. Anand |  |

|

||||||

| John P. Bilbrey |  |

|

||||||

| Michael J. Harrington |  |

|||||||

| R. David Hoover |  |

|

||||||

| Deborah T. Kochevar |  |

|

||||||

| Lawrence E. Kurzius |  |

|

||||||

| Kirk McDonald |  |

|

||||||

| Denise Scots-Knight |  |

|

||||||

| Jeffrey N. Simmons |  |

|||||||

Chairperson

Chairperson  Member

Member

Our Board has four standing committees: the Audit Committee, the Compensation Committee, the Finance Committee and the Nominating and Corporate Governance Committee. Each committee has a written charter. Our Board met three times in 2018. Each director attended at least 75% of the total number of meetings of the Board and the Board committees of which he or she was a member in 2018. While we do not have a formal policy requiring members of the Board to attend the annual meeting of shareholders, we encourage all directors to attend.

The following table lists the members, primary functions, and number of meetings held with respect to each committee.

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

12

|

| Members | Primary Functions | Meetings in 2018 |

|

Audit Committee

Kapila K. Anand (Chair) R. David Hoover John P. Bilbrey

* Each member of the Audit Committee has been determined by the Board, in its judgment, to be financially literate and Ms. Anand was determined by the Board to be an audit committee financial expert, as defined under applicable SEC rules.

|

• Assist the Board in its oversight of (i) the integrity of Elanco’s financial statements and any other financial information which is provided to its shareholders and others; (ii) the independent auditor’s qualifications and independence; (iii) the systems of internal controls and disclosure controls which its management has established; (iv) the performance of internal and independent audit functions; and (v) Elanco’s compliance with legal and regulatory requirements. |

Four

|

|

Compensation Committee

Lawrence E. Kurzius (Chair) Deborah T. Kochevar Kirk McDonald Denise Scots-Knight

|

• Assist the Board in overseeing Elanco’s management compensation policies and practices, including (i) determining and approving the compensation of Elanco’ executive officers; and (ii) overseeing Elanco’s compensation plans, including

by reviewing and approving incentive compensation and equity compensation policies and programs.

|

One

|

|

Finance Committee John P. Bilbrey (Chair) Kapila K. Anand Michael J. Harrington Lawrence E. Kurzius Denise Scots-Knight Jeffrey N. Simmons

|

• Assist the Board in oversight of (i) selected financial policies, plans, and transactions, including mergers, acquisitions, divestitures, and strategic partnerships, and capital, foreign exchange and debt transactions; and (ii)

matters of balance sheet management and financial strategy.

|

None

|

|

Nominating and Corporate Governance Committee R. David Hoover (Chair) Deborah T. Kochevar Kirk McDonald |

• Recommend to the Board the qualifications required for membership on the Board and its committees thereof. • Identify and recommend to the Board candidates for membership on the Board and its committees. • Develop and recommend criteria and policies relating to the services of directors. • Oversee matters of corporate governance. |

One

|

Compensation Committee

Compensation Committee Report

The Compensation Committee evaluates and establishes compensation for executive officers and oversees the company’s stock plans, and other management incentive and benefit programs. Management has the primary responsibility for the company’s financial statements and reporting process, including the disclosure of executive compensation. With this in mind, the Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis (CD&A) below. The Compensation Committee recommended to the Board that the CD&A be included in this proxy statement for filing with the SEC.

|

|

Lawrence E. Kurzius (Chair)

Kapila K. Anand (member until March 11, 2019)

R. David Hoover (member until March 11, 2019)

|

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

13

|

|

GOVERNANCE

|

Compensation Committee Interlocks and Insider Participation

Elanco does not have any interlocking relationships between any members of its Compensation Committee and any of its executive officers that would require disclosure under the applicable rules promulgated under the federal securities laws.

Section 16 Subcommittee

From the completion of the IPO until the completion of the exchange offer, Ms. Anand and Messrs. Kurzius and Hoover, each of whom qualified as a “non-employee director” under Rule 16b-3 of the Exchange Act, served as a subcommittee of the Compensation Committee for the purpose of reviewing and approving equity awards to our directors and executive officers made pursuant to the 2018 Elanco Stock Plan.

Risk Assessment

As part of the company’s overall enterprise risk management program, the Compensation Committee is responsible for evaluating the company’s compensation policies and practices. We believe that such programs and practices are not reasonably likely to have a material adverse effect on the company.

The Board annually determines, taking into consideration the recommendations of the Nominating and Corporate Governance Committee, and discloses the independence of directors. No director is considered independent unless the board has determined, based on all relevant facts and circumstances, that he or she has no material relationship with the company, either directly or as a partner, significant shareholder, or officer of an organization that has a material relationship with the company. The board has adopted the categorical independence standards for directors established in the NYSE listing standards.

On the recommendation of the Nominating and Corporate Governance Committee, the Board determined that each of Ms. Anand, Mr. Bilbrey, Mr. Hoover, Dr. Kochevar, Mr. Kurzius, Mr. McDonald and Dr. Scots-Knight is independent. The Board determined that none of the non-employee directors, other than Mr. Harrington, has had during the last three years (i) any of the relationships identified in the company’s categorical independence standards or (ii) any other material relationship with the company that would compromise his or her independence.

The Board also determined that each of the members of the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee also meet our independence standards.

Leadership Structure of the Board of Directors

The board currently has a strong, independent, non-executive chairman to further strengthen the company’s governance structure. R. David Hoover has served as the Chairman of our Board since May 2018. The board believes this provides an effective leadership model for the company to assure effective independent oversight at this time.

However, no single leadership model is right for all companies and at all times. Depending on the circumstances, other leadership models, such as combining the roles of the CEO and chairman of the board, might be appropriate. Accordingly, the board periodically reviews its leadership structure.

Corporate Governance Guidelines and Committee Charters

Elanco has adopted corporate governance guidelines in accordance with the corporate governance rules of the NYSE, which serve as a flexible framework within which the Board and its committees operate. These guidelines cover a number of areas, including the role of the Board, Board composition, director independence, director selection, qualification and election, director compensation, executive sessions, key board responsibilities, CEO evaluation, succession planning, risk management, board leadership and operations, conflicts of interest, annual board assessments, board committees, director orientation and continuing education, board agenda, materials, information and presentations, director access to management and independent advisers, and board communication with shareholders and others. A copy of Elanco’s corporate governance guidelines as well as the charter for each committee of the Board is available on Elanco’s website at investor.elanco.com under “Governance.”

Code of Ethics

Elanco has adopted a code of conduct and code of ethical conduct for financial management that applies to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of the code is available on Elanco’s website at investor.elanco.com under “Governance.” Any amendments to or waivers from Elanco’s code of ethical

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

14

|

|

GOVERNANCE

|

Selection of Nominees for the Board of Directors

The Board is responsible for selecting candidates for board membership and for establishing the general criteria to be used in identifying potential candidates. The Nominating and Corporate Governance Committee leads the director succession planning process. The Nominating and Corporate Governance Committee makes recommendations to the board for nominations, identifies and screens potential new candidates, including by reviewing recommendations from other board members, management and shareholders, and assesses the ongoing contributions of incumbent directors whose terms are expiring with input from all other board members. The Nominating and Corporate Governance Committee may also retain search firms to assist in identifying and screening candidates.

The committee employs the same process for evaluating all candidates, including those submitted by shareholders. The committee initially evaluates a candidate based on publicly available information and any additional information supplied by the party recommending the candidate. If the candidate appears to satisfy the selection criteria and the committee’s initial evaluation is favorable, the committee, assisted by management or a search firm, gathers additional data on the candidate’s qualifications, availability, probable level of interest, and any potential conflicts of interest. If the committee’s subsequent evaluation continues to be favorable, the candidate is contacted by the Chairman of the Board and one or more of the independent directors, for direct discussions to determine the mutual level of interest in pursuing the candidacy. If these discussions are favorable, the committee makes a final recommendation to the board to nominate the candidate for election by the shareholders (or to select the candidate to fill a vacancy, as applicable).

The committee intends to perform periodic assessments of the overall composition and skills of the board in order to ensure that the board and management are actively engaged in succession planning for directors, and that our board reflects the appropriate viewpoints, diversity, and expertise necessary to support our complex and evolving business. The committee, with input from all board members, also considers the contributions of the individual directors at least every three years when considering whether to nominate the director to a new three-year term. The results of these assessments inform the Board’s recommendations on nominations for directors at the annual meeting each year and help provide us with insight on the types of experiences, skills, and other characteristics we should be seeking for future director candidates. Pursuant to our corporate governance guidelines, the Board selects director candidates who represent a mix of backgrounds and experiences that will enhance the quality of the Board’s deliberations and decisions. We believe that the Board membership should reflect diversity in its broadest sense, including persons diverse in geography, gender, and ethnicity.

Since our initial public offering in 2018, four directors have been elected to our Board: John P. Bilbrey, Deborah T. Kochevar, Kirk McDonald and Denise Scots-Knight. Mr. Bilbrey, Dr. Kochevar and Dr. Scots-Knight were identified as a potential candidate by our executive officers or members of the Board and Mr. McDonald was identified as a potential candidate by a third-party search firm. The third party search firm provided us assistance in evaluating each of these potential candidates.

Elanco Non-Employee Director Compensation Program

Directors who are employed by Elanco or any of its affiliates are not eligible to receive compensation for their service on the Board. In 2018, directors who were employed by Lilly or its affiliates were similarly not eligible to receive compensation for their service on our Board. Currently, all members of the Board, other than those employed by Elanco, receive an annual retention fee of $70,000 in cash and an annual equity award granted under the Elanco Directors’ Deferral Plan in the number of shares of our common stock having a grant date value equal to $180,000. The chairman of Elanco’s board of directors also receives an annual retention fee of $100,000 in cash, the chairman of the Elanco Audit Committee also receives an annual retention fee of $18,000 in cash, and the chairman of the Compensation Committee, Finance Committee and Nominating and Corporate Governance Committee each also receive an annual retention fee of $16,000 in cash. The annual equity awards granted to directors are subject to mandatory deferral under the Elanco Directors’ Deferral Plan and the cash compensation is subject to elective deferral under such plan, as described below.

Elanco’s directors may be reimbursed for reasonable out-of-pocket travel expenses incurred in connection with attendance at board and committee meetings and other board-related activities. The Elanco Compensation Committee will review director compensation from time to time and make recommendations to the Board.

2018 Director Compensation

Elanco directors who were not also employees of Lilly or Elanco received the following compensation for their service in 2018, which represents prorated amounts from the time of the IPO through December 31, 2018 unless otherwise indicated:

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

15

|

|

GOVERNANCE

|

| Name* | Fees Earned or Paid in Cash ($) |

Stock Awards ($)(1) |

All Other Compensation Payments ($) |

Total ($) |

||||

| Kapila Anand | $29,333(4) | $60,004 | $0 | $89,337 | ||||

| R. David Hoover | $62,000(2) | $60,004 | $0 | $122,004 | ||||

| Lawrence Kurzius | $28,667(3) | $60,004 | $0 | $88,671 | ||||

|

*

|

During 2018, in addition to the directors listed and Jeffrey N. Simmons whose compensation is disclosed in the “Summary Compensation Table,” our board also included Michael J. Harrington, Carl L. McMillian, David A. Ricks, Aarti S. Shah and

Joshua L. Smiley, each of whom was also an employee of Lilly and did not receive any compensation from us for their service as our director.

|

| (1) | Each non-employee director received an award of stock valued at $60,004 (1,796 shares), representing a pro-rated award for a partial year of service, which awards are mandatorily deferred and not issued until the second January following the director’s departure from service under the Director Deferral Plan. The column shows the grant date fair value for each director’s stock award computed in accordance with FASB ASC Topic 718 based upon the closing price on the grant date and the assumptions in Note 13: Stock-Based Compensation to the consolidated financial statements in the Annual Report on Form 10-K for the fiscal year ended December 31, 2018 filed by us on February 20, 2019. |

| (2) | Also includes a fee of $10,000 per month from the date of Mr. Hoover’s appointment as Chairman of the Board from May 26, 2018 through the IPO. See “Director Letter Agreement with Chairman” below. |

| (3) | Includes pro-rated fee for service as the chairman of the Compensation Committee. |

| (4) | Includes pro-rated fee for service as the chairman of the Audit Committee. |

Director Letter Agreement with Chairman

In connection with the appointment of R. David Hoover as a director and chairman of Elanco’s board of directors, Elanco entered into a letter agreement with Mr. Hoover, which provided, in part, that Mr. Hoover would assist in the identification and recruitment of potential candidates to serve on the Board. Under the letter agreement, Mr. Hoover was entitled to a payment of $10,000 per month prior to the IPO. Since the IPO, Mr. Hoover has been compensated in the same manner as the other non-employee directors as described under “Elanco Non-Employee Director Compensation Program” above.

Elanco Directors’ Deferral Plan

Prior to the IPO, the Board and Lilly, as Elanco’s sole shareholder, approved the Elanco Directors’ Deferral Plan (the “Directors’ Deferral Plan”), which became effective on September 18, 2018. Under the Elanco Directors’ Deferral Plan, non-employee directors’ equity compensation (but no more than the lesser of 30,000 shares or the number of shares equal in value to $800,000 (as of the applicable valuation date) less the directors’ cash compensation for the applicable plan year) are credited annually in a deferred stock account (as described below). The Elanco Directors’ Deferral Plan also allows non-employee directors to defer receipt of all or part of their cash compensation until after their service on our board of directors has ended. Each director can choose to invest their deferred cash compensation in one or both of the following two accounts:

Deferred Stock Account. This account allows the director, in effect, to invest his or her deferred cash compensation in company stock. Funds in this account are credited as hypothetical shares of company stock based on the closing stock price on pre-set dates. The number of shares credited in respect of deferred cash compensation is calculated by the amount deferred divided by the closing stock price on pre-set dates. In addition, the annual stock compensation awards described above is also credited to this account. Deferred stock accounts are also credited for dividends as if the credited shares were actual shares, with such credited dividends credited in additional shares.

Deferred Compensation Account. Funds in this account earn interest each year at a rate of 120 percent of the applicable federal long-term rate, compounded monthly, as established the preceding December by the U.S. Treasury Department under Section 1274(d) of the Internal Revenue Code of 1986 (the Internal Revenue Code).

Both accounts may generally only be paid in a lump sum in January of the second plan year following the plan year in which the director separates from service or in annual installments over between two and 10 years, beginning at the same time the lump sum payment would be made. Amounts credited to the director’s deferred stock account would generally be paid in shares of company stock and amounts credited to the director’s deferred compensation account would be paid in cash.

Stock Ownership Guidelines

Pursuant to our corporate governance guidelines, directors should hold meaningful equity ownership positions in the company. Accordingly, a significant portion of director compensation is made in the form of company equity. The board will consider from time to time equity ownership requirements for non-employee directors.

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

16

|

|

GOVERNANCE

|

Hedging/Pledging Policy

Elanco’s Compensation Committee adopted a hedging and pledging policy under which our non-employee directors and employees are not permitted to hedge their economic exposures to Elanco stock through short sales or derivative transactions. Non-employee directors and all members of senior management are prohibited from pledging any Elanco stock (i.e., using Elanco stock as collateral for a loan or trading shares on margin).

The Board of Directors’ Role in Enterprise Risk Management

Communicating with the Board of Directors

You may send written communications to one or more members of the Board, addressed to:

Board of Directors

Elanco Animal Health Incorporated

c/o Corporate Secretary

2500 Innovation Way

Greenfield, Indiana 46140

Transactions with Related Persons

Relationship between Elanco and Lilly

On September 24, 2018, immediately prior to the completion of the IPO, Elanco entered into a master separation agreement and a number of other agreements with Lilly to effect the separation of Elanco’s business from Lilly and to provide a framework for Elanco’s ongoing relationship with Lilly after the IPO and the separation, each of which remain in effect following the completion of the exchange offer. The following is a summary of the terms of the master separation agreement and other material agreements between us and Lilly.

Master Separation Agreement

Elanco entered into a master separation agreement with Lilly immediately prior to the completion of the IPO. The master separation agreement governs certain pre-IPO transactions, as well as the ongoing relationship between Lilly and Elanco following the IPO and the separation.

The separation of Elanco’s business; contribution of entities. The master separation agreement generally allocates certain assets and liabilities between Elanco and Lilly according to the business to which such assets or liabilities relate. Prior to the completion of the IPO, Lilly or its affiliates, as applicable, conveyed, contributed, assigned, distributed, delivered or otherwise transferred ownership of substantially all of the assets that are used exclusively in, relate exclusively to, or arise exclusively out of, the operation or conduct of its animal health businesses, to certain direct and indirect subsidiaries of Lilly.

Effective as of the closing of the IPO on September 24, 2018, Lilly contributed to Elanco, pursuant to the master separation agreement, the equity interests of certain entities that held, either directly or indirectly through the equity ownership of additional entities, substantially all of the assets of Lilly’s animal health businesses, which now forms the Elanco business. The master separation agreement also generally provides for the assumption by Elanco or the entities that are now its subsidiaries pursuant to foregoing contribution, as applicable, of all historical and future liabilities to the extent relating to, arising out of or resulting from the ownership or operation of such animal health business. In exchange for the transfer to Elanco of the entities holding substantially all of the assets and liabilities of Lilly’s animal health businesses, Lilly received (i) all of the net proceeds ($1,659.7 million) that Elanco received from the sale of Elanco common stock in the IPO, including the net proceeds received as a result of the exercise of the underwriters’ option to purchase additional shares, (ii) all of the net proceeds (approximately $2,000 million) received in the Senior Notes Offering and (iii) all of the net proceeds ($498.6 million) received from the entry by Elanco into a term loan facility. Following the IPO, Elanco made a payment to Lilly of $359.9 million pursuant to the terms of the master separation agreement, which required that Elanco pay additional amounts

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

17

|

|

GOVERNANCE

|

to Lilly to the extent that Elanco’s total unrestricted cash for working capital and other general corporate purposes exceeded $300 million following the completion of the IPO. A portion of the total consideration to be paid to Lilly was temporarily retained by Elanco as restricted cash in connection with the anticipated transfer to Elanco from Lilly of certain animal health assets in certain jurisdictions.

Except as expressly set forth in any of the transaction documents, or as required by law, the assets that have been or will be conveyed, contributed or assigned, transferred, distributed or delivered to Elanco or its subsidiaries (including entities the equity interests of which have been or will be transferred to Elanco by Lilly) are being so transferred on an “as is,” “where is” basis, without any representations or warranties, and Elanco has agreed to bear the economic and legal risks that any conveyance was insufficient to vest in it good title, free and clear of any security interest, that any necessary consents or approvals were not obtained or that any conveyance was not done in compliance with any requirements of law or judgments.

Delayed transfers and further assurances. To the extent that the transfers of the assets and the assumptions of the liabilities allocated to Elanco under the master separation agreement were not completed on or prior to the IPO, Elanco and Lilly agreed to cooperate with each other and use commercially reasonable efforts to effect such transfers and assumptions as promptly as practicable thereafter or at such other time as Elanco and Lilly have agreed. Under the master separation agreement, until the transfer of such assets and the assumption of such liabilities have occurred, the benefits and burdens relating to any such assets and liabilities generally will inure, after the IPO, to the entity who would have received such asset or liability, had it been transferred prior to completion of the IPO, including, in the case of the jurisdictions in which Lilly and Elanco have agreed to defer the applicable transfers and assumptions, by calculating the net economic benefit and detriment attributable to such assets and liabilities and making payments in connection therewith in the manner agreed upon by Elanco and Lilly. If, despite Lilly and Elanco’s cooperating with one another and using their respective commercially reasonable efforts, the transfers and assumptions of the applicable assets and liabilities in one or more of such jurisdictions has not occurred on or prior to the date previously agreed upon in writing by Elanco and Lilly, then Lilly shall be paid any remaining consideration retained by Elanco as restricted cash, and shall be entitled to retain, sell, transfer or otherwise dispose of any such remaining asset or liability, in its sole discretion.

Elanco and Lilly have agreed to cooperate with each other and use their respective commercially reasonable efforts to take or cause to be taken all actions, and to do, or cause to be done, all things reasonably necessary, proper or advisable under applicable law, regulations and agreements to consummate and make effective the transactions contemplated by the master separation agreement and the other transaction documents.

Distribution. The master separation agreement provides that Elanco would cooperate with Lilly in all respects to make a distribution to its shareholders of all or a portion of its equity interests in Elanco, including in connection with the exchange offer.

Insurance. Following the time that Lilly holds 50% or less of Elanco’s common stock, subject to certain exceptions, Elanco will arrange for its own insurance policies and will no longer seek benefit from any of Lilly’s or its affiliates’ insurance policies that may provide coverage for claims relating to the animal health business prior to the date on which Elanco obtains its own insurance coverage. The master separation agreement contains procedures for the administration of insured claims and allocates the right to claim coverage and control over the prosecution and defense of claims between Elanco and Lilly.

Mutual releases and indemnification. Except for each party’s obligations under the master separation agreement, the other transaction documents and certain other specified liabilities, under the master separation agreement, Elanco and Lilly have released and discharged the other from any and all liabilities existing or arising from acts or events that occurred (or failed to occur) prior to the completion of IPO.

Elanco will indemnify, defend and hold harmless Lilly, each of its affiliates and each of its and their respective directors, officers, managers, members, employees and agents from and against any and all losses relating to, arising out of or resulting from, among others:

| ● | the liabilities of the animal health businesses that are allocated to Elanco; |

| ● | any breach by Elanco or its subsidiaries of the master separation agreement or any other transaction document; |

| ● | any untrue statement or omission of a material fact in Lilly’s governmental or public filings, to the extent caused by information furnished by Elanco or incorporated by reference from Elanco’s public filings; or |

| ● | any untrue statement or omission of a material fact in Elanco’s governmental or public filings, to the extent not caused by information furnished by Lilly. |

Lilly will indemnify, defend and hold harmless Elanco, each of its affiliates and each of its and their respective directors, officers, managers, members, employees and agents from and against any and all losses relating to, arising out of or resulting from, among others:

|

|

● | the liabilities allocated to Lilly under the master separation agreement; |

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

18

|

|

GOVERNANCE

|

| ● | any breach by Lilly or its subsidiaries of the master separation agreement or any other transaction document; |

| ● | any untrue statement or omission of a material fact in Elanco’s governmental or public filings, to the extent caused by information furnished by Lilly or incorporated by reference from Lilly’s public filings; or |

| ● | any untrue statement or omission of a material fact in Lilly’s governmental or public filings, to the extent not caused by information furnished by Elanco. |

Exchange of Information. The master separation agreement provides for the mutual sharing of information between Lilly and Elanco in order to comply with applicable law, reporting, filing, audit or tax requirements or other applicable obligations, or for use in judicial or other proceedings.

Financial Reporting Covenants. Under the master separation agreement, Elanco agreed to comply with certain covenants relating to its financial reporting for so long as Lilly was required to consolidate Elanco’s results of operations and financial position or to account for its investment in Elanco under the equity method of accounting.

Elanco has also agreed that, for so long as Lilly provides Elanco services under the transitional services agreement, Elanco will not change its auditor, nor will Elanco engage its auditor for any non-audit services, in each case, without Lilly’s prior consent, and Elanco will generally implement and maintain Lilly’s business practices and standards in accordance with certain policies and procedures specified by Lilly, subject to appropriate materiality thresholds.

Other covenants and approval rights. The master separation agreement also contained certain other covenants that placed restrictions on Elanco’s actions, or required Lilly’s prior written approval to such actions, until Lilly disposed of its Elanco shares in the exchange offer.

Board representation. The master separation agreement provided that, for so long as Lilly and its affiliates beneficially owned at least 10% of Elanco voting shares, Lilly was entitled to designate for nomination certain representatives on the Board. Following the completion of the exchange offer, Lilly no longer has such rights.

No solicitation of employees. Subject to certain customary exceptions, for a period of 12 months following the date on which Lilly and its affiliates no longer own a majority of Elanco’s outstanding shares of common stock, neither Elanco or its affiliates, nor Lilly or its affiliates, will directly or indirectly solicit or encourage any employee of the other party at the level of senior director and above to leave his or her employment without the prior written consent of the other party.

Dispute resolution. The master separation agreement provides that Elanco and Lilly will use their respective commercially reasonable efforts to resolve disputes expeditiously and on a mutually acceptable negotiated basis by our respective senior level representatives. Any disputes unable to be resolved through such process will be referred to mediation, for non-binding resolution. Subject to compliance with the terms of the master separation agreement, either Elanco or Lilly, following the escalation and mediation procedures in the master separation agreement, may submit a dispute to a court of competent jurisdiction in Indiana.

Term. The master separation agreement will continue unless terminated by the mutual consent of Elanco and Lilly, although certain rights and obligations terminated upon a reduction in Lilly’s ownership of Elanco’s outstanding common stock.

Transitional Services Agreement

Historically, Lilly has provided Elanco significant shared services and resources related to corporate functions such as executive oversight, treasury, legal, finance, human resources, tax, internal audit, financial reporting, information technology and investor relations, which are referred to collectively as the “Lilly Services.” The transitional services agreement became operative as of the completion of IPO and the agreement will continue until the expiration or termination of the last Lilly Service to expire or be terminated, unless the agreement is earlier terminated according to its terms.

Under the transitional services agreement, Elanco is able to use Lilly Services for a fixed term established on a service-by-service basis. Partial reduction in the provision of any Lilly Service or termination of a Lilly Service prior to the expiration of the applicable fixed term requires Lilly’s consent. In addition, either party can terminate the agreement due to a material breach of the other party, upon prior written notice, subject to limited cure periods or if the other party undergoes a change of control.

Elanco will pay Lilly mutually agreed-upon fees for the Lilly Services provided under the transitional services agreement, which will be based on Lilly’s cost (including third-party costs) of providing the Lilly Services through March 31, 2021 and subject to a mark-up of 7% thereafter, with additional inflation-based escalation beginning January 1, 2020.

Tax Matters Agreement

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

19

|

|

GOVERNANCE

|

preparation and filing of tax returns, the control of audits and other tax proceedings and other matters regarding taxes. In general, under the agreement:

| ● | Lilly is responsible for any U.S. federal, state, local or foreign taxes (and any related interest, penalties or audit adjustments and including those taxes attributable to Elanco’s business) reportable on a consolidated, combined or unitary return that includes Lilly or any of its subsidiaries (and Elanco and/or any of its subsidiaries) for any periods or portions thereof ending on or prior to the date of the closing of the IPO. Elanco is responsible for the portion of any such taxes for periods or portions thereof beginning after such date, as would be applicable to Elanco if it filed the relevant tax returns on a standalone basis. |

| ● | Elanco is responsible for any U.S. federal, state, local or foreign taxes (and any related interest, penalties or audit adjustments) that are reportable on returns that include only Elanco and/or any of its subsidiaries, for all tax periods whether before or after the completion of the IPO. |

| ● | Lilly is responsible for certain taxes imposed on Lilly and/or any of its subsidiaries and Elanco and/or any of its subsidiaries arising from, or attributable to, certain transfers of assets or liabilities in the separation. |

Elanco is not generally entitled to receive payment from Lilly in respect of any of Elanco’s tax attributes or tax benefits or any reduction of taxes of Lilly. Neither party’s obligations under the agreement are limited in amount or subject to any cap. The agreement also assigns responsibilities for administrative matters, such as the filing of returns, payment of taxes due, retention of records and conduct of audits, examinations or similar proceedings. In addition, the agreement provides for cooperation and information sharing with respect to tax matters.

Lilly is primarily responsible for preparing and filing any tax return with respect to the Lilly affiliated group for U.S. federal income tax purposes and with respect to any consolidated, combined, unitary or similar group for U.S. state or local or foreign tax purposes that includes Lilly or any of its subsidiaries (including those that also include Elanco and/or any of its subsidiaries), as well as any tax return that includes only Lilly and/or any of its subsidiaries (including such tax returns that reflect taxes attributable to Elanco’s business). Elanco is generally responsible for preparing and filing any tax returns that include only Elanco and/or any of its subsidiaries.

The party responsible for preparing and filing a given tax return generally has exclusive authority to control tax contests related to any such tax return. Elanco generally has exclusive authority to control tax contests with respect to tax returns that include only Elanco and/or any of its subsidiaries.

Preservation of the tax-free status of certain aspects of the separation. Elanco and Lilly intend the separation, the transfer of net cash proceeds from the IPO and certain related financing transactions (which we refer to as the Debt Transactions) to Lilly and the exchange offer to qualify as a tax-free transaction under Section 355, Section 368(a)(1)(D) and related provisions of the Code. In addition, Elanco and Lilly intend for the separation, the transfer of net cash proceeds from the IPO and the Debt Transactions to Lilly, the exchange offer and certain related transactions to qualify for tax-free treatment under U.S. federal, state and local tax law and/or foreign tax law.

In connection with certain opinions obtained by Lilly from its outside tax attorneys and advisors, Elanco has made representations regarding the past and future conduct of its business and certain other matters. Elanco has also agreed to certain covenants that contain restrictions intended to preserve the tax-free status of the separation, the transfer of net cash proceeds from the IPO and the Debt Transactions to Lilly, the exchange offer and certain related transactions. Elanco may take certain actions prohibited by these covenants only if Lilly receives a private letter ruling from the IRS or Elanco obtains and provides to Lilly an opinion from a U.S. tax counsel or accountant of recognized national standing, in either case acceptable to Lilly in its sole and absolute discretion, to the effect that such action would not jeopardize the tax-free status of these transactions. Elanco is barred from taking any action, or failing to take any action, where such action or failure to act adversely affects or could reasonably be expected to adversely affect the tax-free status of these transactions, for all time periods. In addition, during the time period ending two years after the date of the exchange offer these covenants include specific restrictions on Elanco’s:

| ● | issuance or sale of stock or other securities (including securities convertible into Elanco stock but excluding certain compensatory arrangements); |

| ● | sales of assets outside the ordinary course of business; and |

| ● | entering into any other corporate transaction which would cause Elanco to undergo a 40% or greater change in its stock ownership. |

Elanco has generally agreed to indemnify Lilly and its affiliates against any and all tax-related liabilities incurred by them relating to the separation, the transfer of net cash proceeds from the IPO and the Debt Transactions to Lilly, the exchange offer and/or certain related transactions to the extent caused by an acquisition of Elanco stock or assets or by any other action undertaken by Elanco. This indemnification provision applies even if Lilly has permitted Elanco to take an action that would otherwise have been prohibited under the tax-related covenants described above.

|

ELANCO ANIMAL HEALTH INCORPORATED - Proxy Statement

|

20

|

|

GOVERNANCE

|

Employee Matters Agreement

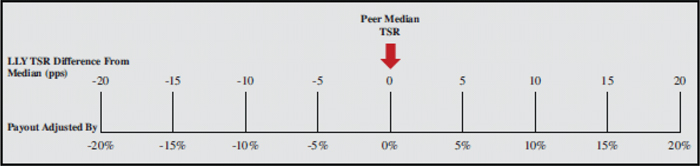

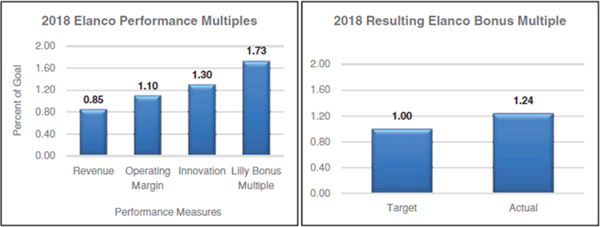

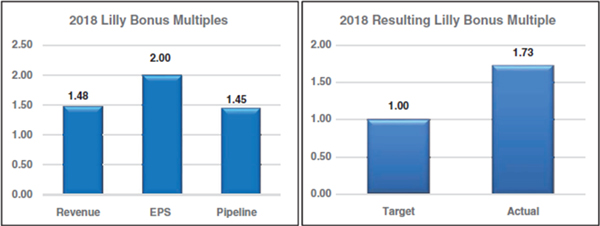

Elanco entered into an employee matters agreement with Lilly immediately prior to the completion of IPO. The employee matters agreement governs Lilly’s, Elanco’s and the parties’ respective subsidiaries’ and affiliates’ rights, responsibilities and obligations after the IPO with respect to employees, compensation, employment, employee benefit plans and related matters. Below is a summary of the terms of the employee matters agreement.