Form 8-K CIGNA CORP For: Aug 08

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 8, 2018

Cigna Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation)

|

1-08323

(Commission File Number)

|

06-1059331

(IRS Employer

Identification No.)

|

900 Cottage Grove Road

Bloomfield, Connecticut 06002

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code:

(860) 226-6000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[X] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communication pursuant to Rule 13e-49(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On August 8, 2018, Cigna Corporation ("Cigna") made available a presentation titled "Cigna Reiterates Support for Proposed Merger with Express Scripts," which includes, among other things, disclosures about rebates. A copy of Cigna's presentation is attached as Exhibit 99.1 to this report and is incorporated herein by reference.

FORWARD LOOKING STATEMENTS

Information included or incorporated by reference in this communication, and information which may be contained in other filings with the Securities and Exchange Commission (the "SEC") and press releases or other public statements, contains or may contain forward-looking statements. These forward-looking statements include, among other things, statements of plans, objectives, expectations (financial or otherwise) or intentions, including statements concerning the potential future performance of Cigna, Express Scripts, or the combined company, the potential for new laws or regulations, or any impact of any such new laws or regulations, including on the business of Cigna, Express Scripts or the combined company, the ability to achieve the anticipated benefits of the proposed merger, on the expected timeline or at all, the timeline for deleveraging the combined company, and the ability to consummate the proposed merger, on the anticipated timeline or at all, and other statements regarding the parties' future beliefs, expectations, plans, intentions, financial condition or performance. You may identify forward-looking statements by the use of words such as "believe," "expect," "plan," "intend," "anticipate," "estimate," "predict," "potential," "may," "should," "will" or other words or expressions of similar meaning, although not all forward-looking statements contain such terms.

Forward-looking statements, including as they relate to Express Scripts or Cigna, the management of either such company, the transaction or any expected benefits of the transaction, involve risks and uncertainties. Actual results may differ significantly from those projected or suggested in any forward-looking statements. Express Scripts and Cigna do not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect events or circumstances occurring after the date hereof or to reflect the occurrence of unanticipated events. Any number of factors could cause actual results to differ materially from those contemplated by any forward-looking statements, including, but not limited to, the risks associated with the following:

|

●

|

the inability of Express Scripts and Cigna to obtain stockholder or regulatory approvals required for the merger or the requirement to accept conditions that could reduce the anticipated benefits of the merger as a condition to obtaining regulatory approvals;

|

|

●

|

the possibility that the anticipated benefits from the merger cannot be realized in full, or at all or may take longer to realize than expected;

|

|

●

|

a longer time than anticipated to consummate the proposed merger;

|

|

●

|

problems regarding the successful integration of the businesses of Express Scripts and Cigna;

|

|

●

|

unexpected costs regarding the proposed merger;

|

|

●

|

diversion of management's attention from ongoing business operations and opportunities;

|

|

●

|

potential litigation associated with the proposed merger;

|

|

●

|

the ability to retain key personnel;

|

|

●

|

the availability of financing;

|

|

●

|

effects on the businesses as a result of uncertainty surrounding the proposed merger;

|

|

●

|

the ability of the combined company to achieve financial, strategic and operational plans and initiatives;

|

|

●

|

the ability of the combined company to predict and manage medical costs and price effectively and develop and maintain good relationships with physicians, hospitals and other health care providers;

|

|

●

|

the impact of modifications to the combined company's operations and processes;

|

|

●

|

the ability of the combined company to identify potential strategic acquisitions or transactions and realize the expected benefits of such transactions;

|

|

●

|

the substantial level of government regulation over the combined company's business and the potential effects of new laws or regulations or changes in existing laws or regulations;

|

|

●

|

the outcome of litigation relating to the businesses of Express Scripts and Cigna, regulatory audits, investigations, actions and/or guaranty fund assessments;

|

|

●

|

uncertainties surrounding participation in government-sponsored programs such as Medicare;

|

|

●

|

the effectiveness and security of the combined company's information technology and other business systems;

|

|

●

|

unfavorable industry, economic or political conditions, including foreign currency movements;

|

|

●

|

acts of war, terrorism, natural disasters or pandemics; and

|

|

●

|

the industry may be subject to future risks that are described in SEC reports filed by Express Scripts and Cigna.

|

You should carefully consider these and other relevant factors, including those risk factors in this communication and other risks and uncertainties that affect the businesses of Express Scripts and Cigna described in their respective filings with the SEC, when reviewing any forward-looking statement. These factors are noted for investors as permitted under the Private Securities Litigation Reform Act of 1995. Investors should understand it is impossible to predict or identify all such factors or risks. As such, you should not consider either foregoing lists, or the risks identified in SEC filings, to be a complete discussion of all potential risks or uncertainties, and should not place undue reliance on forward-looking statements.

IMPORTANT INFORMATION ABOUT THE TRANSACTION AND WHERE TO FIND IT

This communication does not constitute an offer to sell or solicitation of an offer to buy any securities. In connection with the proposed transaction, the newly formed company which will become the holding company following the transaction ("Holdco") filed with the SEC a registration statement on Form S-4. The registration statement on Form S-4 includes a joint proxy statement of Cigna and Express Scripts that also constitutes a prospectus of Holdco. The registration statement was declared effective by the SEC on July 16, 2018, and Cigna and Express Scripts commenced mailing the definitive joint proxy statement/prospectus to the respective stockholders of Cigna and Express Scripts on or about July 17, 2018. Cigna and Express Scripts also plan to file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the registration statement or the joint proxy statement/prospectus or any other document which Cigna, Express Scripts or Holdco may file with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the registration statement on Form S-4 and the definitive joint proxy statement/prospectus and other relevant documents filed by Holdco, Cigna and Express Scripts with the SEC at the SEC's website at www.sec.gov. Copies of documents filed with the SEC by Cigna will be available free of charge on Cigna's website at www.Cigna.com or by contacting Cigna's Investor Relations Department at (215) 761-4198. Copies of documents filed with the SEC by Express Scripts will be available free of charge on Express Scripts' website at www.express-scripts.com or by contacting Express Scripts' Investor Relations Department at (314) 810-3115.

PARTICIPANTS IN THE SOLICITATION

Cigna (and, in some instances, Holdco) and Express Scripts and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction under the rules of the SEC. Investors may obtain information regarding the names, affiliations and interests of directors and executive officers of Cigna (and, in some instances, Holdco) in Cigna's Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on February 28, 2018, and its definitive proxy statement for its 2018 Annual Meeting, which was filed with the SEC on March 16, 2018. Investors may obtain information regarding the names, affiliations and interests of Express Scripts' directors and executive officers in Express Scripts' Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on February 27, 2018, and its proxy statement for its 2018 Annual Meeting, which was filed with the SEC on March 29, 2018. You may obtain free copies of these documents at the SEC's website at www.sec.gov, at Cigna's website at www.Cigna.com or by contacting Cigna's Investor Relations Department at (215) 761-4198. Copies of documents filed with the SEC by Express Scripts will be available free of charge on Express Scripts' website at www.express-scripts.com or by contacting Express Scripts' Investor Relations Department at (314) 810-3115. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the joint proxy statement/prospectus and other relevant materials filed or to be filed with the SEC regarding the proposed transaction. Investors should read the joint proxy statement/prospectus carefully and in its entirety before making any voting or investment decisions.

NO OFFER OR SOLICITATION

This communication is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe for, buy or sell or an invitation to subscribe for, buy or sell any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

|

|

(d)

|

Exhibits.

|

|

|

|

|

Exhibit No.

|

Description

|

|

99.1

|

Cigna Corporation presentation titled "Cigna Reiterates Support for Proposed Merger with Express Scripts"

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Cigna Corporation

|

|

|

Date: August 8, 2018

|

By: /s/ Eric P. Palmer

|

|

Eric P. Palmer

|

|

|

Executive Vice President and

|

|

|

Chief Financial Officer

|

|

|

(Principal Financial Officer)

|

|

CIGNA REITERATES SUPPORT FOR PROPOSED MERGER WITH EXPRESS SCRIPTS August 2018

FORWARD LOOKING STATEMENTSInformation included or incorporated by reference in this communication, and information which may be contained in other filings with the Securities and Exchange Commission (the “SEC”) and press releases or other public statements, contains or may contain forward-looking statements. These forward-looking statements include, among other things, statements of plans, objectives, expectations (financial or otherwise) or intentions, including statements concerning the potential future performance of Cigna, Express Scripts, or the combined company, the potential for new laws or regulations, or any impact of any such new laws or regulations, including on the business of Cigna, Express Scripts or the combined company, the ability to achieve the anticipated benefits of the proposed merger, on the expected timeline or at all, the timeline for deleveraging the combined company, and the ability to consummate the proposed merger, on the anticipated timeline or at all, and other statements regarding the parties’ future beliefs, expectations, plans, intentions, financial condition or performance. You may identify forward-looking statements by the use of words such as “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “may,” “should,” “will” or other words or expressions of similar meaning, although not all forward-looking statements contain such terms.Forward-looking statements, including as they relate to Express Scripts or Cigna, the management of either such company, the transaction or any expected benefits of the transaction, involve risks and uncertainties. Actual results may differ significantly from those projected or suggested in any forward-looking statements. Express Scripts and Cigna do not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect events or circumstances occurring after the date hereof or to reflect the occurrence of unanticipated events. Any number of factors could cause actual results to differ materially from those contemplated by any forward-looking statements, including, but not limited to, the risks associated with the following:the inability of Express Scripts and Cigna to obtain stockholder or regulatory approvals required for the merger or the requirement to accept conditions that could reduce the anticipated benefits of the merger as a condition to obtaining regulatory approvals; the possibility that the anticipated benefits from the merger cannot be realized in full, or at all or may take longer to realize than expected;a longer time than anticipated to consummate the proposed merger; problems regarding the successful integration of the businesses of Express Scripts and Cigna;unexpected costs regarding the proposed merger; diversion of management’s attention from ongoing business operations and opportunities; potential litigation associated with the proposed merger; the ability to retain key personnel; the availability of financing; effects on the businesses as a result of uncertainty surrounding the proposed merger; the ability of the combined company to achieve financial, strategic and operational plans and initiatives; the ability of the combined company to predict and manage medical costs and price effectively and develop and maintain good relationships with physicians, hospitals and other health care providers;the impact of modifications to the combined company’s operations and processes; the ability of the combined company to identify potential strategic acquisitions or transactions and realize the expected benefits of such transactions;the substantial level of government regulation over the combined company’s business and the potential effects of new laws or regulations or changes in existing laws or regulations;the outcome of litigation relating to the businesses of Express Scripts and Cigna, regulatory audits, investigations, actions and/or guaranty fund assessments;uncertainties surrounding participation in government-sponsored programs such as Medicare; the effectiveness and security of the combined company’s information technology and other business systems; unfavorable industry, economic or political conditions, including foreign currency movements; acts of war, terrorism, natural disasters or pandemics; andthe industry may be subject to future risks that are described in SEC reports filed by Express Scripts and Cigna.You should carefully consider these and other relevant factors, including those risk factors in this communication and other risks and uncertainties that affect the businesses of Express Scripts and Cigna described in their respective filings with the SEC, when reviewing any forward-looking statement. These factors are noted for investors as permitted under the Private Securities Litigation Reform Act of 1995. Investors should understand it is impossible to predict or identify all such factors or risks. As such, you should not consider either foregoing lists, or the risks identified in SEC filings, to be a complete discussion of all potential risks or uncertainties, and should not place undue reliance on forward-looking statements. Important Information for Investors and Shareholders 2

IMPORTANT INFORMATION ABOUT THE TRANSACTION AND WHERE TO FIND ITThis communication does not constitute an offer to sell or solicitation of an offer to buy any securities. In connection with the proposed transaction, the newly formed company which will become the holding company following the transaction (“Holdco”) filed with the SEC a registration statement on Form S-4. The registration statement on Form S-4 includes a joint proxy statement of Cigna and Express Scripts that also constitutes a prospectus of Holdco. The registration statement was declared effective by the SEC on July 16, 2018, and Cigna and Express Scripts commenced mailing the definitive joint proxy statement/prospectus to the respective stockholders of Cigna and Express Scripts on or about July 17, 2018. Cigna and Express Scripts also plan to file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the registration statement or the joint proxy statement/prospectus or any other document which Cigna, Express Scripts or Holdco may file with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the registration statement on Form S-4 and the definitive joint proxy statement/prospectus and other relevant documents filed by Holdco, Cigna and Express Scripts with the SEC at the SEC’s website at www.sec.gov. Copies of documents filed with the SEC by Cigna will be available free of charge on Cigna’s website at www.Cigna.com or by contacting Cigna’s Investor Relations Department at (215) 761-4198. Copies of documents filed with the SEC by Express Scripts will be available free of charge on Express Scripts’ website at www.express-scripts.com or by contacting Express Scripts’ Investor Relations Department at (314) 810-3115.PARTICIPANTS IN THE SOLICITATIONCigna (and, in some instances, Holdco) and Express Scripts and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction under the rules of the SEC. Investors may obtain information regarding the names, affiliations and interests of directors and executive officers of Cigna (and, in some instances, Holdco) in Cigna’s Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on February 28, 2018, and its definitive proxy statement for its 2018 Annual Meeting, which was filed with the SEC on March 16, 2018. Investors may obtain information regarding the names, affiliations and interests of Express Scripts’ directors and executive officers in Express Scripts’ Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on February 27, 2018, and its proxy statement for its 2018 Annual Meeting, which was filed with the SEC on March 29, 2018. You may obtain free copies of these documents at the SEC’s website at www.sec.gov, at Cigna’s website at www.Cigna.com or by contacting Cigna’s Investor Relations Department at (215) 761-4198. Copies of documents filed with the SEC by Express Scripts will be available free of charge on Express Scripts’ website at www.express-scripts.com or by contacting Express Scripts’ Investor Relations Department at (314) 810-3115. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the joint proxy statement/prospectus and other relevant materials filed or to be filed with the SEC regarding the proposed transaction. Investors should read the joint proxy statement/prospectus carefully and in its entirety before making any voting or investment decisions. NO OFFER OR SOLICITATIONThis communication is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe for, buy or sell or an invitation to subscribe for, buy or sell any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. Important Information for Investors and Shareholders 3

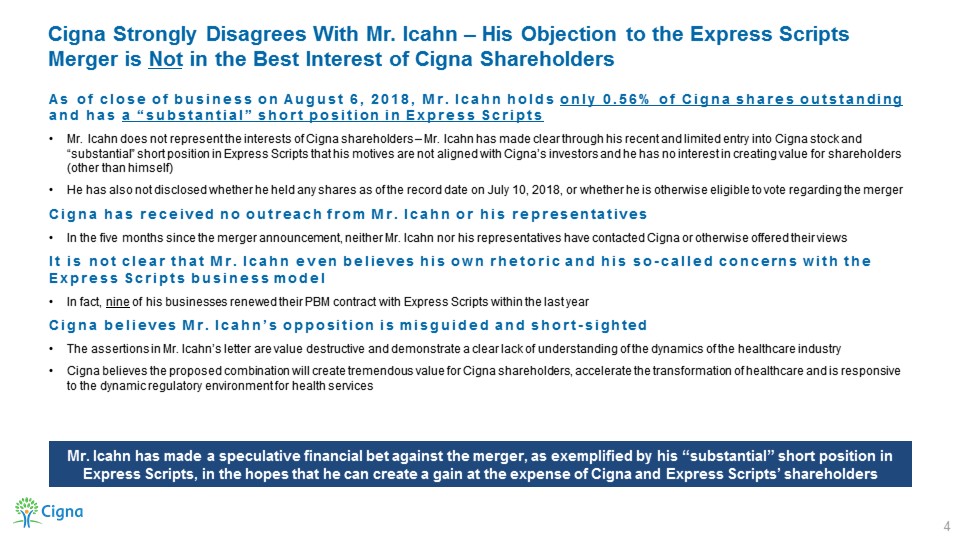

Cigna Strongly Disagrees With Mr. Icahn – His Objection to the Express Scripts Merger is Not in the Best Interest of Cigna Shareholders 4 As of close of business on August 6, 2018, Mr. Icahn holds only 0.56% of Cigna shares outstanding and has a “substantial” short position in Express ScriptsMr. Icahn does not represent the interests of Cigna shareholders – Mr. Icahn has made clear through his recent and limited entry into Cigna stock and “substantial” short position in Express Scripts that his motives are not aligned with Cigna’s investors and he has no interest in creating value for shareholders (other than himself)He has also not disclosed whether he held any shares as of the record date on July 10, 2018, or whether he is otherwise eligible to vote regarding the mergerCigna has received no outreach from Mr. Icahn or his representativesIn the five months since the merger announcement, neither Mr. Icahn nor his representatives have contacted Cigna or otherwise offered their viewsIt is not clear that Mr. Icahn even believes his own rhetoric and his so-called concerns with the Express Scripts business modelIn fact, nine of his businesses renewed their PBM contract with Express Scripts within the last yearCigna believes Mr. Icahn’s opposition is misguided and short-sightedThe assertions in Mr. Icahn’s letter are value destructive and demonstrate a clear lack of understanding of the dynamics of the healthcare industryCigna believes the proposed combination will create tremendous value for Cigna shareholders, accelerate the transformation of healthcare and is responsive to the dynamic regulatory environment for health services Mr. Icahn has made a speculative financial bet against the merger, as exemplified by his “substantial” short position in Express Scripts, in the hopes that he can create a gain at the expense of Cigna and Express Scripts’ shareholders

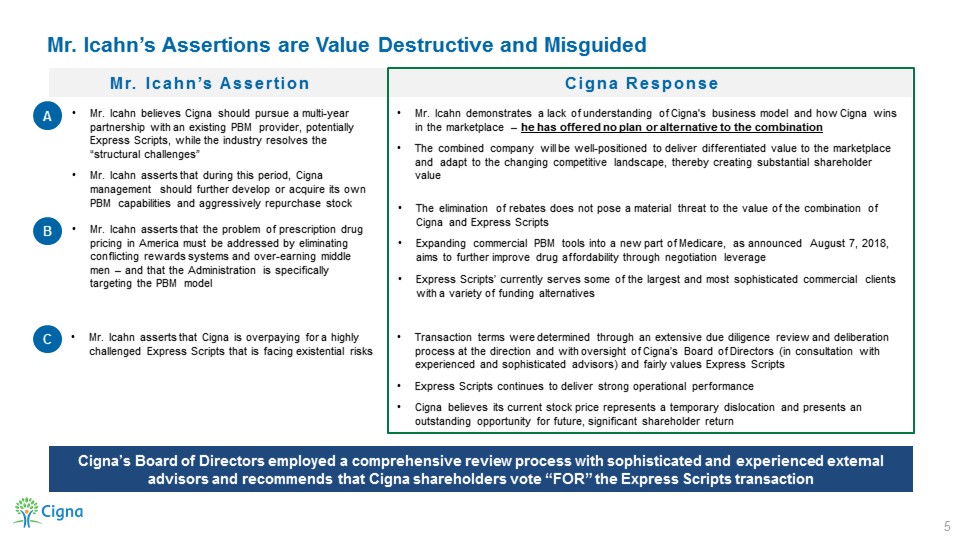

Mr. Icahn’s Assertions are Value Destructive and Misguided 5 A Mr. Icahn asserts that Cigna is overpaying for a highly challenged Express Scripts that is facing existential risks B C Mr. Icahn asserts that the problem of prescription drug pricing in America must be addressed by eliminating conflicting rewards systems and over-earning middle men – and that the Administration is specifically targeting the PBM model Mr. Icahn believes Cigna should pursue a multi-year partnership with an existing PBM provider, potentially Express Scripts, while the industry resolves the “structural challenges” Mr. Icahn asserts that during this period, Cigna management should further develop or acquire its own PBM capabilities and aggressively repurchase stock Cigna’s Board of Directors employed a comprehensive review process with sophisticated and experienced external advisors and recommends that Cigna shareholders vote “FOR” the Express Scripts transaction Transaction terms were determined through an extensive due diligence review and deliberation process at the direction and with oversight of Cigna’s Board of Directors (in consultation with experienced and sophisticated advisors) and fairly values Express Scripts Express Scripts continues to deliver strong operational performanceCigna believes its current stock price represents a temporary dislocation and presents an outstanding opportunity for future, significant shareholder return Mr. Icahn demonstrates a lack of understanding of Cigna's business model and how Cigna wins in the marketplace – he has offered no plan or alternative to the combinationThe combined company will be well-positioned to deliver differentiated value to the marketplace and adapt to the changing competitive landscape, thereby creating substantial shareholder value Mr. Icahn’s Assertion Cigna Response The elimination of rebates does not pose a material threat to the value of the combination of Cigna and Express ScriptsExpanding commercial PBM tools into a new part of Medicare, as announced August 7, 2018, aims to further improve drug affordability through negotiation leverageExpress Scripts’ currently serves some of the largest and most sophisticated commercial clients with a variety of funding alternatives

Mr. Icahn demonstrates a lack of understanding of Cigna's business model and how Cigna wins in the marketplaceThe integrated medical, pharmacy and behavioral services model has been the cornerstone of Cigna’s long-term strategyCigna will not be able to inoculate itself from changes in the dynamic marketplace by sitting on the sidelines and hoping that others figure it out – nor would Cigna want to take that approachIn fact, with respect to pharmacy, costs have rapidly risen from approximately 10% of the total healthcare equation to almost 25%, and as such present a critical and sustained opportunity for innovation and value creation for clients and customers 6 Expanding Cigna’s Capabilities and Distribution Reach by Acquiring Express Scripts is Strategically and Financially Attractive A Mr. Icahn’s letter provides no alternative plan of action, favoring a quick financial engineering scheme for the benefit of a single, transitional investor “Cigna's core health insurance business should be improved due to the integrated benefit offering and the opportunity to target new customers. In fact, the companies overlap in only ~30% of markets, suggesting there could be a significant opportunity to grab market share for each business.”– Michael Wiederhorn, Oppenheimer (6/12/18) All agree the marketplace is dynamic with significant reformatting being pursued to improve affordability, customer access and strategic use of data and insightsThe notion that Cigna can negotiate a multi-year agreement with a third party that will allow us to deliver attractive PBM affordability to clients and customers, while the rest of the industry reformats itself, is naïve at bestCigna has first-hand knowledge as a PBM operator that these arrangements are complex. It would be exceedingly difficult to draft and operationalize a static contract that benefits Cigna in all scenarios in a changing environment and that will allow us to continue delivering differentiated affordability to customers and clients over the long-term “ESRX is a strategic platform acquisition for CI to drive industry leading total cost trend across medical and pharmacy, particularly with the increasing importance of Specialty Pharmacy. ESRX offers CI a combined platform at scale that can compete with the new Big 4: UNH with Optum Rx, ANTM with Ingenio Rx, and AET with CVS.” – Ana Gupte, Leerink (3/26/18) Note: Permission to use quotes was not sought or obtained; Source: Wall Street Analyst Research Reports

7 Expanding Cigna’s Capabilities and Distribution Reach by Acquiring Express Scripts is Strategically and Financially Attractive A The combined company will be well-positioned to adapt to changing competitive landscape “David Cordani CI CEO has built more management credibility in our view with the strong Beat and Raise 2Q, and stated confidence on the 2Q conference call that he would achieve shareholder approval.” – Ana Gupte, Leerink (8/7/18) Cigna continues to embrace changes and innovate in order to find opportunities for growth in this dynamic landscapeDuring a period of unprecedented changes in the healthcare environment, Cigna has delivered for its shareholders:Double-digit top-line and bottom-line growth over an 8-year period1Outperformed the two key ISS benchmarks – the S&P 500 and Healthcare Index – over every relevant period of time – 1, 3, 5 years384% cumulative total shareholder returns from December 31, 2009 through June 30, 2018Leading U.S. total medical cost trend results – less than 3% in 2017, representing the lowest in the industryThe combined company will have the broad capabilities, financial flexibility, reach and expansion opportunities to compete from a position of strength by delivering differentiated value through affordable, high quality solutions at a predictable costCigna has set a strategic goal for the combined company to achieve CPI-level medical cost trend by 2021 1. YE 2009- YE 2017; 2. Excluding transitioning clients; Note: Permission to use quotes was not sought or obtained; Source: Wall Street Analyst Research Reports The combination delivers immediate and long-term value to Cigna shareholdersExpected mid-teens accretion in the first full year after closing2 and projected to generate greater than $600 million in retained synergies annuallyAs a result, Cigna has raised its 2021 EPS target to $20 - $21 vs. prior guidance of $18Expected to generate greater than $6 billion in free cash flow in 2021, allowing for rapid deleveraging and exceptional strategic and financial flexibility in a highly dynamic marketplace

7 Expanding Cigna’s Capabilities and Distribution Reach by Acquiring Express Scripts is Strategically and Financially Attractive A The combined company will be well-positioned to adapt to changing competitive landscape “David Cordani CI CEO has built more management credibility in our view with the strong Beat and Raise 2Q, and stated confidence on the 2Q conference call that he would achieve shareholder approval.” – Ana Gupte, Leerink (8/7/18) Cigna continues to embrace changes and innovate in order to find opportunities for growth in this dynamic landscapeDuring a period of unprecedented changes in the healthcare environment, Cigna has delivered for its shareholders:Double-digit top-line and bottom-line growth over an 8-year period1Outperformed the two key ISS benchmarks – the S&P 500 and Healthcare Index – over every relevant period of time – 1, 3, 5 years and since Cigna’s CEO, David Cordani, began his tenure384% cumulative total shareholder returns from December 31, 2009 through June 30, 2018Leading U.S. total medical cost trend results – less than 3% in 2017, representing the lowest in the industryThe combined company will have the broad capabilities, financial flexibility, reach and expansion opportunities to compete from a position of strength by delivering differentiated value through affordable, high quality solutions at a predictable costCigna has set a strategic goal for the combined company to achieve CPI-level medical cost trend by 2021 1. YE 2009- YE 2017; 2. Excluding transitioning clients; Note: Permission to use quotes was not sought or obtained; Source: Wall Street Analyst Research Reports The combination delivers immediate and long-term value to Cigna shareholdersExpected mid-teens accretion in the first full year after closing2 and projected to generate greater than $600 million in retained synergies annuallyAs a result, Cigna has raised its 2021 EPS target to $20 - $21 vs. prior guidance of $18Expected to generate greater than $6 billion in free cash flow in 2021, allowing for rapid deleveraging and exceptional strategic and financial flexibility in a highly dynamic marketplace

8 B PBMs Provide Economic Value Beyond Rebates, and Current Rebate Concerns are Known and Manageable Potential changes to rebate regulation are not newPotential changes to Anti-Kickback statute safe harbor rules pertain to government programs and have been suggested in various forms Additionally, changes to safe harbor rules have been publicly suggested in the past, including in months leading up to the Cigna/Express Scripts deal announcement – and thus were taken into account in the diligence processThe elimination of rebates in Medicare would have an immaterial impact on Express Scripts’ earningsThe Administration’s Blueprint in its current form applies to federally funded healthcare programs like the Medicare Part D program, where 100% rebates are essentially a pass-thoughElimination of these rebates without equal reductions in list prices would result in significant cost increases Medicare plans, their patients and the federal governmentExpress Scripts’ currently serves some of the largest and most sophisticated commercial clients, and has a range of tools it utilizes to manage drug spend, of which rebates are only one componentToday, Express Scripts passes 95% of all pharmaceutical purchase discounts, price reductions and rebates back to their core PBM commercial and health plan clients and their customers Nearly half of Express Scripts’ clients have opted for a full, direct pass through arrangement for all rebates, demonstrating that a variety of customized funding arrangements exist today with clients choosing the services and funding arrangements that best fit their needsRebates are applicable to less than 10% of Express Scripts’ claims; Express Scripts retains approximately $400 million of rebates1Express Scripts continues to protect its clients from runaway price inflation and abusive pricing practices by helping its customers receive medications at the lowest net cost – utilizing a variety of tools including rebates, discounts, and generic therapies Elimination of rebates does not pose a material threat to the value of Cigna and Express Scripts combination “Competitive risk from Amazon. Our thesis on the topic is unchanged as we think it underestimates the complexity of the business and view it as a very heavy lift outside of the purchase of a scaled asset with in-place capabilities … we see a significant difference between distributing drugs and managing a pharmacy benefit, think pharmacy scale is what is relevant (Prime users apples and oranges) and view ESRX's customers as sophisticated buyers, including AMZN, which recognizes the value of a PBM and is an ESRX customer.”– David S. MacDonald, SunTrust (8/8/18) Note: Permission to use quotes was not sought or obtained; Source: Wall Street Analyst Research Reports.1. Includes core PBM commercial and health plan clients but excludes value–based reimbursements and Express Scripts PDP.

“Curbing rebates is seemingly at odds with the administration’s push on Tuesday to expand them through price negotiation.”– Anna Edney (8/7/18) PBMs Provide Economic Value Beyond Rebates, and Current Rebate Concerns are Known and Manageable 9 On August 7, 2018, CMS announced a new policy to expand the use of private sector tools (e.g. step therapy, rebates, discounts, adherence programs) into Medicare Part B to improve value and affordability Beginning in 2019, the new policy provides Medicare Advantage (MA) the opportunity to leverage broader commercial PBM solutions to deliver better affordability and qualityWith the ability to require patients to try certain more cost-effective drugs first (“step therapy”), private plans will strengthen their negotiation leverage and can then use that leverage to negotiate lower costs with drug manufacturers Health and Human Services Secretary Alex Azar emphasized that MA plans have access to a broad range of PBM solutions – e.g., formularies, step therapies, discounts (including rebates) – that will bring drug list prices down “For the first time ever, we’re going to unleash these plans, which are so good at negotiating, to try to get discounts on Part B drugs” “This is a very important change in terms of drug pricing as well as just in managing and modernizing how Medicare functions”“You really can only manage what you have choices for. So you [MA plans] need multiple therapies that can deliver clinically appropriate solutions to be able to manage and demand rebates and discounts from pharma”What form cost-cutting measures take (e.g. discounts or rebates) “is a separate question than empowering the insurers or PBMs to go after pharma” B Note: Permission to use quotes was not sought or obtained; Source: “Trump Administration Gives Medicare New Tools to Negotiate Lower Drug Prices for Patients” (HHS release dated 8/7/18); CMS empowers patients with more choices and takes action to lower drug prices (CMS release data 8/7/18); “Trump Forces Pharma to Face More Medicare Drug-Price Negotiation” (Bloomberg article dated 8/7/18); Wall Street Analyst Research Reports The expansion of commercial PBM tools into a new part of Medicare, as a means of modernizing the program and enabling more holistic management, creates a strong growth platform for the combined company in public programs “CMS's unexpected release of new rules allowing Medicare Advantage plans to utilize step therapy as a way to bring down drug costs is, in our view, a positive for Medicare Advantage providers as it validates the value and cost savings that PBMs bring to the healthcare system. Additionally, the new rules underscore the strategic synergies that the pending PBM-health plan mergers (CVS-AET, ESRX-CI) should realize if the deals are completed.”– Brian Tanquilut, Jefferies (8/7/18)

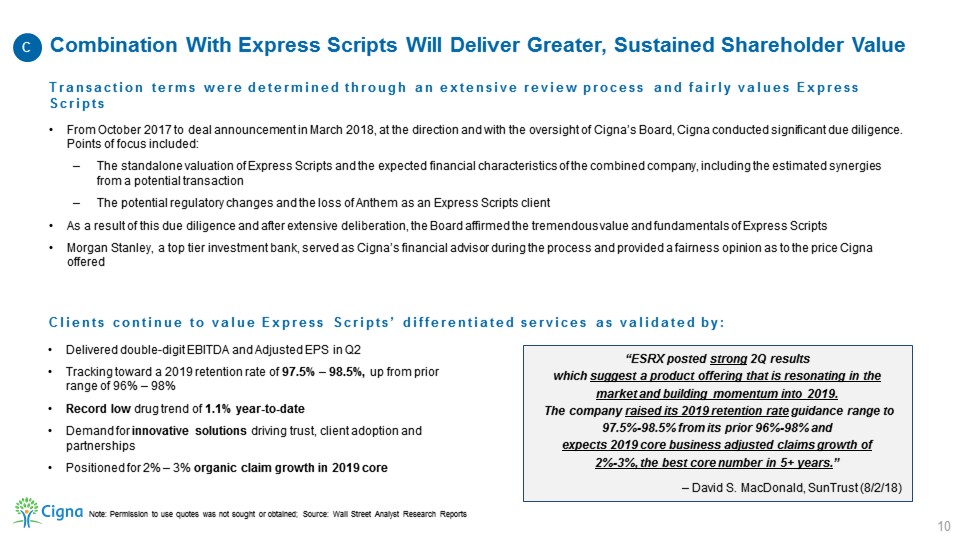

Combination With Express Scripts Will Deliver Greater, Sustained Shareholder Value 10 From October 2017 to deal announcement in March 2018, at the direction and with the oversight of Cigna’s Board, Cigna conducted significant due diligence. Points of focus included:The standalone valuation of Express Scripts and the expected financial characteristics of the combined company, including the estimated synergies from a potential transactionThe potential regulatory changes and the loss of Anthem as an Express Scripts client As a result of this due diligence and after extensive deliberation, the Board affirmed the tremendous value and fundamentals of Express ScriptsMorgan Stanley, a top tier investment bank, served as Cigna’s financial advisor during the process and provided a fairness opinion as to the price Cigna offered Clients continue to value Express Scripts’ differentiated services as validated by: C Transaction terms were determined through an extensive review process and fairly values Express Scripts “ESRX posted strong 2Q results which suggest a product offering that is resonating in the market and building momentum into 2019. The company raised its 2019 retention rate guidance range to 97.5%-98.5% from its prior 96%-98% and expects 2019 core business adjusted claims growth of 2%-3%, the best core number in 5+ years.” – David S. MacDonald, SunTrust (8/2/18) Delivered double-digit EBITDA and Adjusted EPS in Q2Tracking toward a 2019 retention rate of 97.5% – 98.5%, up from prior range of 96% – 98%Record low drug trend of 1.1% year-to-dateDemand for innovative solutions driving trust, client adoption and partnershipsPositioned for 2% – 3% organic claim growth in 2019 core Note: Permission to use quotes was not sought or obtained; Source: Wall Street Analyst Research Reports

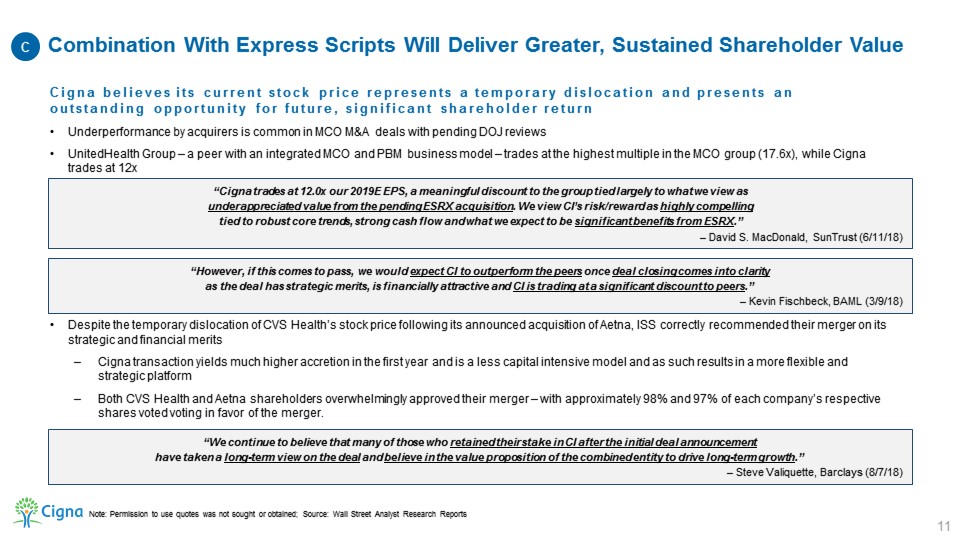

Cigna believes its current stock price represents a temporary dislocation and presents an outstanding opportunity for future, significant shareholder returnUnderperformance by acquirers is common in MCO M&A deals with pending DOJ reviews UnitedHealth Group – a peer with an integrated MCO and PBM business model – trades at the highest multiple in the MCO group (17.6x), while Cigna trades at 12xDespite the temporary dislocation of CVS Health’s stock price following its announced acquisition of Aetna, ISS correctly recommended their merger on its strategic and financial meritsCigna transaction yields much higher accretion in the first year and is a less capital intensive model and as such results in a more flexible and strategic platform Both CVS Health and Aetna shareholders overwhelmingly approved their merger – with approximately 98% and 97% of each company’s respective shares voted voting in favor of the merger. 11 Combination With Express Scripts Will Deliver Greater, Sustained Shareholder Value C “Cigna trades at 12.0x our 2019E EPS, a meaningful discount to the group tied largely to what we view as underappreciated value from the pending ESRX acquisition. We view CI’s risk/reward as highly compelling tied to robust core trends, strong cash flow and what we expect to be significant benefits from ESRX.” – David S. MacDonald, SunTrust (6/11/18) “We continue to believe that many of those who retained their stake in CI after the initial deal announcement have taken a long-term view on the deal and believe in the value proposition of the combined entity to drive long-term growth.” – Steve Valiquette, Barclays (8/7/18) “However, if this comes to pass, we would expect CI to outperform the peers once deal closing comes into clarity as the deal has strategic merits, is financially attractive and CI is trading at a significant discount to peers.” – Kevin Fischbeck, BAML (3/9/18) Note: Permission to use quotes was not sought or obtained; Source: Wall Street Analyst Research Reports

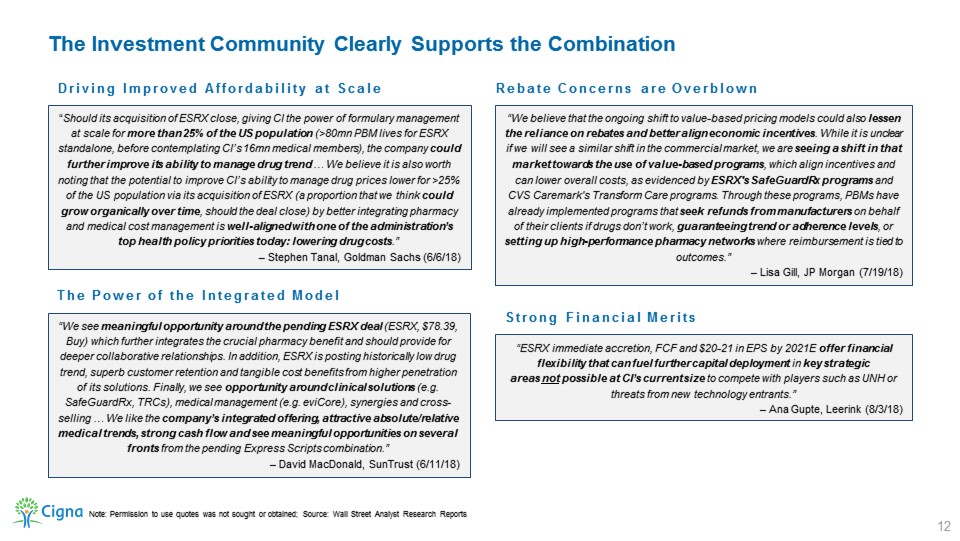

The Investment Community Clearly Supports the Combination 12 Note: Permission to use quotes was not sought or obtained; Source: Wall Street Analyst Research Reports “We believe that the ongoing shift to value-based pricing models could also lessen the reliance on rebates and better align economic incentives. While it is unclear if we will see a similar shift in the commercial market, we are seeing a shift in that market towards the use of value-based programs, which align incentives and can lower overall costs, as evidenced by ESRX's SafeGuardRx programs and CVS Caremark's Transform Care programs. Through these programs, PBMs have already implemented programs that seek refunds from manufacturers on behalf of their clients if drugs don’t work, guaranteeing trend or adherence levels, or setting up high-performance pharmacy networks where reimbursement is tied to outcomes.” – Lisa Gill, JP Morgan (7/19/18) “Should its acquisition of ESRX close, giving CI the power of formulary management at scale for more than 25% of the US population (>80mn PBM lives for ESRX standalone, before contemplating CI’s 16mn medical members), the company could further improve its ability to manage drug trend … We believe it is also worth noting that the potential to improve CI’s ability to manage drug prices lower for >25% of the US population via its acquisition of ESRX (a proportion that we think could grow organically over time, should the deal close) by better integrating pharmacy and medical cost management is well-aligned with one of the administration’s top health policy priorities today: lowering drug costs.” – Stephen Tanal, Goldman Sachs (6/6/18) “ESRX immediate accretion, FCF and $20-21 in EPS by 2021E offer financial flexibility that can fuel further capital deployment in key strategic areas not possible at CI’s current size to compete with players such as UNH or threats from new technology entrants.” – Ana Gupte, Leerink (8/3/18) Driving Improved Affordability at Scale Strong Financial Merits Rebate Concerns are Overblown “We see meaningful opportunity around the pending ESRX deal (ESRX, $78.39, Buy) which further integrates the crucial pharmacy benefit and should provide for deeper collaborative relationships. In addition, ESRX is posting historically low drug trend, superb customer retention and tangible cost benefits from higher penetration of its solutions. Finally, we see opportunity around clinical solutions (e.g. SafeGuardRx, TRCs), medical management (e.g. eviCore), synergies and cross-selling … We like the company’s integrated offering, attractive absolute/relative medical trends, strong cash flow and see meaningful opportunities on several fronts from the pending Express Scripts combination.” – David MacDonald, SunTrust (6/11/18) The Power of the Integrated Model

Combined Company Will Grow Shareholder Value and Transform Healthcare in an Increasingly Demanding Healthcare Environment 13 A B C Cigna's Board and management team believe that its proposed merger with Express Scripts is in the best interest of shareholders and recommend that Cigna shareholders vote “FOR” the Express Scripts transaction Expanding Cigna’s capabilities and distribution reach by acquiring Express Scripts is strategically and financially attractive Broadens capabilities and distribution for 100+ million combined customers and deepens data and insights to improve affordability, predictability and health outcomes Integrated pharmacy services provide significant economic value for clients and customers beyond rebates, and current rebate concerns are (and were) known and manageable Combination with Express Scripts will deliver greater, sustained shareholder valueDrives strong EPS accretion – mid-teens in year 1Delivers immediate and longer-term improvement in affordabilityDelivers tremendous free cash flowResults in exceptional strategic and financial flexibility

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Cigna Corp. (CI) Declares $1.40 Quarterly Dividend; 1.6% Yield

- NorthEast Community Bancorp, Inc. Reports Results for the Three Months Ended March 31, 2024

- NEOS Investments Announces April ETF Suite Distributions

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share