Form PRE 14A CANTEL MEDICAL CORP For: Jul 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x | |

Filed by a Party other than the Registrant o | |

Check the appropriate box: | |

x | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material under §240.14a-12 |

Cantel Medical Corp. | ||

(Name of Registrant as Specified In Its Charter) | ||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

Payment of Filing Fee (Check the appropriate box): | ||

x | No fee required. | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) | Title of each class of securities to which transaction applies: | |

(2) | Aggregate number of securities to which transaction applies: | |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

(4) | Proposed maximum aggregate value of transaction: | |

(5) | Total fee paid: | |

o | Fee paid previously with preliminary materials. | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) | Amount Previously Paid: | |

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: | |

Cantel Medical Corp.

150 Clove Road

Little Falls, NJ 07424

150 Clove Road

Little Falls, NJ 07424

NOTICE OF 2017 ANNUAL MEETING OF STOCKHOLDERS

To Be Held On January 3, 2018

The Annual Meeting of Stockholders of Cantel Medical Corp. will be held on Wednesday, January 3, 2018 at 9:30 a.m., Eastern Standard Time, at Loews Regency New York Hotel, 540 Park Avenue, New York, New York. We are holding the Annual Meeting to:

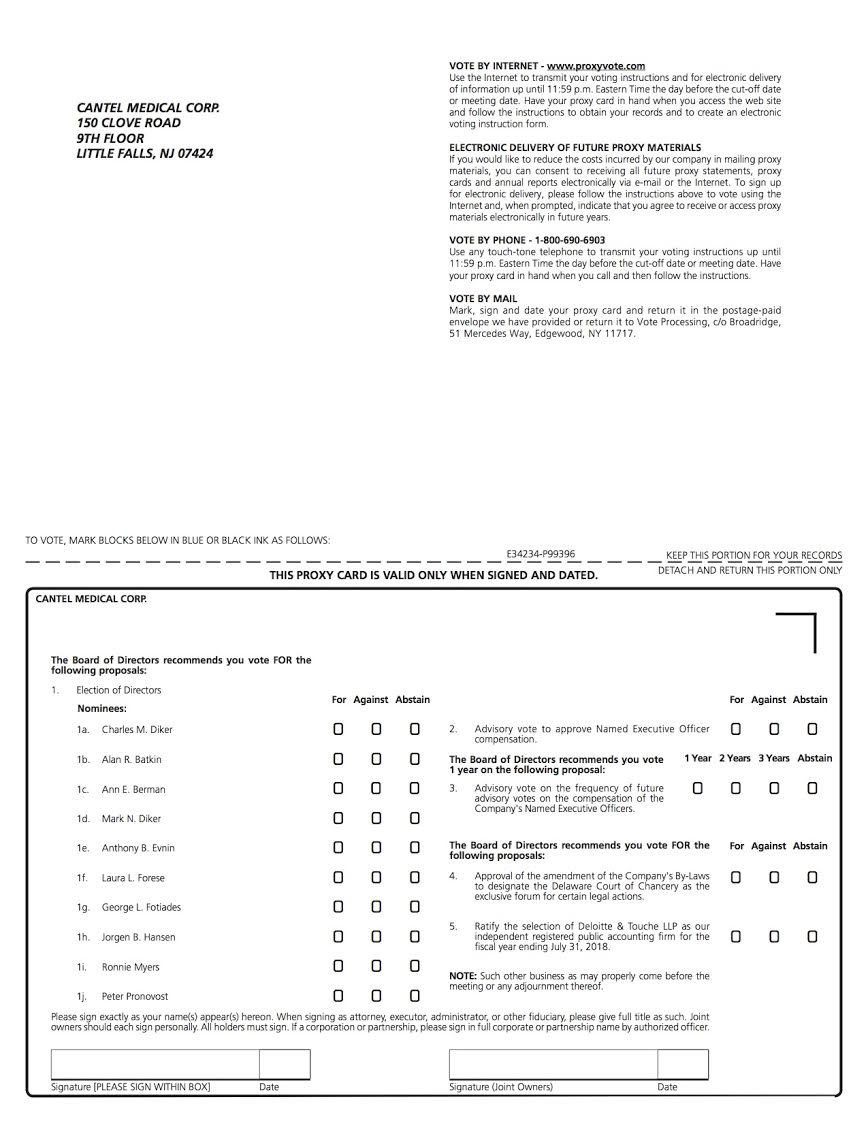

1. | Elect as directors the ten (10) nominees named in the attached Proxy Statement (Proposal 1); |

2. | Conduct an advisory vote on the compensation of the Company’s Named Executive Officers (Proposal 2); |

3. | Conduct an advisory vote on the frequency of future advisory votes on the compensation of the Company’s Named Executive Officers (Proposal 3); |

4. | Consider and approve an amendment to the Company’s By-Laws to designate the Delaware Court of Chancery as the exclusive forum for certain legal actions (Proposal 4); |

5. | Ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending July 31, 2018 (Proposal 5); and |

6. | Transact such other business as may properly be brought before the meeting. |

The record date for the Annual Meeting is November 13, 2017. Only our stockholders of record at the close of business on that date may vote at the meeting, or any adjournment of the meeting. A copy of our Annual Report to Stockholders for the fiscal year ended July 31, 2017 is being mailed with this Proxy Statement.

You are invited to attend the Annual Meeting. Your vote is very important. Whether or not you plan to attend the meeting, we hope that you will read the proxy statement and vote your proxy by telephone, via the Internet or by requesting a printed copy of the proxy materials and completing, signing, and returning the proxy card enclosed therein in order that your vote can be recorded.

By the order of the Board of Directors

Eric W. Nodiff

Corporate Secretary

Little Falls, New Jersey

November 28, 2017

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

to Be Held on January 3, 2018.

to Be Held on January 3, 2018.

This Proxy Statement and the Company's Annual Report are all available free of charge at www.proxyvote.com.

1

Cantel Medical Corp.

150 Clove Road

Little Falls, NJ 07424

150 Clove Road

Little Falls, NJ 07424

________________________

PROXY STATEMENT

_______________________________________________________________________________________________________________________

Cantel Medical Corp. (we, Cantel or the Company) are providing these proxy materials in connection with the solicitation by our Board of Directors (the Board) of proxies to be voted at our 2017 Annual Meeting of Stockholders to be held on Wednesday, January 3, 2018 beginning at 9:30 a.m. Eastern Standard Time at Loews Regency New York Hotel, 540 Park Avenue, New York, New York and at any adjournments thereof. This Proxy Statement is being sent to stockholders on or about November 28, 2017. You should review this information together with our 2017 Annual Report to Stockholders, which accompanies this Proxy Statement.

Information about the Annual Meeting

Q: Why did you send me this Proxy Statement?

A: We sent you this Proxy Statement and the enclosed proxy card because the Board is soliciting your proxy to vote at our 2017 Annual Meeting of Stockholders (the meeting) to be held on Wednesday, January 3, 2018, or any adjournments of the meeting. This Proxy Statement summarizes information that is intended to assist you in making an informed vote on the proposals described in this Proxy Statement.

Q: Who can vote at the meeting?

A: Only stockholders of record as of the close of business on November 13, 2017 are entitled to vote at the meeting. On that date, there were 41,936,902 shares of our common stock (each, a share) outstanding and entitled to vote.

Q: How many shares must be present to conduct the meeting?

A: We must have a “quorum” present in person or by proxy to hold the meeting. A quorum is a majority of the outstanding shares entitled to vote. Abstentions and broker non-votes (defined below) will be counted for the purpose of determining the existence of a quorum.

Q: What matters are to be voted upon at the meeting?

A: Five proposals are scheduled for a vote:

• | Election as directors of the ten nominees named in this Proxy Statement, to serve until the first Annual Meeting of Stockholders following the fiscal year ending July 31, 2018 (fiscal year 2018); |

• | Approval, on an advisory basis, of the compensation of the Company’s Named Executive Officers; |

• | Approval, on an advisory basis, of the frequency of future advisory votes on the compensation of the Company’s Named Executive Officers; |

• | Approval of an amendment to the Company’s By-Laws to designate the Delaware Court of Chancery as the exclusive forum for certain legal actions; and |

• | Ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2018. |

As of the date of this Proxy Statement, these five proposals are the only matters that our Board intends to present at the meeting. Our Board does not know of any other business to be presented at the meeting. If other business is properly brought before the meeting, the persons named on the enclosed proxy card will vote on these other matters in their discretion.

2

Q: How does the Board recommend that I vote?

A: The Board recommends that you vote:

• | FOR the election of each of the nominees for director named in this Proxy Statement; |

• | FOR the proposal to approve (on an advisory basis) the compensation of the Company’s Named Executive Officers; |

• | FOR (on an advisory basis) future advisory votes on the compensation of the Company’s Named Executive Officers to be held every 1 year; |

• | FOR the proposal to approve an amendment to the Company’s By-Laws to designate the Delaware Court of Chancery as the exclusive forum for certain legal actions; and |

• | FOR the proposal to ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2018. |

Q: How do I vote before the meeting?

A: You may vote your shares by mail by filling in, signing and returning the enclosed proxy card. For your convenience, you may also vote your shares by telephone and Internet by following the instructions on the enclosed proxy card. If you vote by telephone or via the Internet, you do not need to return your proxy card.

With respect to the election of directors, you may vote “FOR” or “AGAINST” or abstain from voting with respect to each nominee. For the advisory vote on the frequency of future advisory votes on the compensation of the Company’s Named Executive Officers, you may vote for every “3 Years”, “2 Years”, “1 Year” or abstain from voting. For the approval of all other matters, you may vote “FOR” or “AGAINST” or abstain from voting.

Q: May I vote at the meeting?

A: Yes, you may vote your shares at the meeting if you attend in person. Even if you plan to attend the meeting in person, we recommend that you also submit your proxy or voting instructions as described above so that your vote will be counted if you later decide not to attend the meeting in person. For information on how to obtain directions to the meeting, please contact us at (973) 890-7220.

Q: How do I vote if my broker holds my shares in “street name”?

A: If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker. For directions on how to vote shares held beneficially in street name, please refer to the voting instruction card provided by your broker.

Q: What should I do if I receive more than one set of proxy materials?

A: You may receive more than one set of these proxy materials, including multiple copies of this Proxy Statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please complete, sign, date and return each proxy card and voting instruction card that you receive to ensure that all your shares are voted.

Q: How many votes do I have?

A: Each share that you own as of the close of business on November 13, 2017 entitles you to one vote on each matter voted upon at the meeting. As of the close of business on November 13, 2017, there were 41,936,902 shares outstanding.

Q: May I change my vote?

3

A: Yes, you may change your vote or revoke your proxy at any time before the vote at the meeting. You may change your vote prior to the meeting by executing a valid proxy bearing a later date and delivering it to us prior to the meeting at Cantel Medical Corp., 150 Clove Road, Little Falls, New Jersey 07424, Attn: Secretary. You may withdraw your vote at the meeting and vote in person by giving written notice to our Secretary. You may also revoke your vote without voting by sending written notice of revocation to our Secretary at the above address.

Q: How are my shares voted if I submit a proxy but do not specify how I want to vote?

A: If you submit a properly executed proxy card, the persons named in the proxy card (or, if applicable, their substitutes) will vote your shares as you instruct. If you sign your proxy card and return it without indicating how you would like to vote your shares, your shares will be voted as the Board recommends, which is:

• | FOR the election of each of the nominees for director named in this Proxy Statement; |

• | FOR the proposal to approve (on an advisory basis) the compensation of the Company’s Named Executive Officers; |

• | FOR the proposal to approve (on an advisory basis) future advisory votes on the compensation of the Company’s Named Executive Officers to be held every 1 year; |

• | FOR the proposal to approve an amendment to the Company’s By-Laws to designate the Delaware Court of Chancery as the exclusive forum for certain legal actions; and |

• | FOR the proposal to ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2018. |

Q: What is a broker non-vote?

A: If you are a beneficial owner whose shares are held of record by a broker, you must instruct the broker how to vote your shares. If you do not provide voting instructions, your shares will not be voted on any proposal on which the broker does not have discretionary authority to vote. This is called a “broker non-vote.” In these cases, the broker can register your shares as being present at the meeting for purposes of determining the presence of a quorum but will not be able to vote on those matters for which specific authorization is required under the rules of the New York Stock Exchange (NYSE). If you are a beneficial owner whose shares are held of record by a broker, your broker has discretionary voting authority under NYSE rules to vote your shares on the proposal to ratify the selection of Deloitte & Touche LLP even if the broker does not receive voting instructions from you. However, your broker does not have discretionary authority to vote on the election of directors, the advisory votes on executive compensation and frequency of future advisory votes on executive compensation or the approval of an amendment to the Company’s By-Laws without instructions from you, in which case a broker non-vote will occur and your shares will not be voted on these matters.

Your vote is important and we strongly encourage you to vote your shares by following the instructions provided on the voting instruction card. Please return your proxy card to your broker, bank or other nominee and contact the person responsible for your account to ensure that a proxy card is voted on your behalf.

Q: What vote is required to elect directors?

A: Under our By-laws and our Corporate Governance Guidelines, nominees for director must be elected by a majority of the votes cast in uncontested elections, such as the election of directors at the meeting. This means that the number of votes cast “for” a director nominee must exceed the number of votes cast “against” that nominee. Abstentions and broker non-votes are not counted as votes “for” or “against” a director nominee and therefore have no impact on the outcome of director elections. Any nominee who does not receive a majority of votes cast “for” his or her election would be required to tender his or her resignation promptly following the failure to receive the required vote. Our Board’s Nominating and Governance Committee (Nominating Committee) would then be required to make a recommendation to the Board as to whether the Board should accept the resignation, and the Board would be required to decide whether to accept the resignation and to publicly disclose its decision. In a contested election, the required vote would be a plurality of votes cast.

4

Q: What happens in an uncontested election if an incumbent director does not receive enough votes to be elected?

A: Pursuant to our Corporate Governance Guidelines, each director who fails to receive the required number of votes cast for his or her re-election is required to tender his or her resignation to the Board. Such resignation is subject to acceptance by the Board. In order to ensure that the Company always has a fully functioning Board, if an incumbent director fails to receive the required number of votes cast, he or she continues as a director. The Nominating Committee will act on an expedited basis to determine whether to accept or reject the director’s resignation and will submit such recommendation to the Board for prompt consideration. The Nominating Committee and the Board may consider any factors they deem relevant in deciding whether to accept a director’s resignation. The Board will make its decision public as soon as practicable following the meeting.

Q: What vote is required to approve, on an advisory basis, the compensation of the Company’s Named Executive Officers?

A: This matter is being submitted to enable stockholders to approve, on an advisory basis, the compensation of the Company’s Named Executive Officers. Since it is an advisory vote, the provisions of our By-laws regarding the vote required to “approve” a proposal are not applicable to this matter. In order to be approved on an advisory basis, this proposal must receive the “FOR” vote of a majority of the votes cast by stockholders present in person or by proxy and entitled to vote on the matter. Abstentions will not be counted as votes cast and, therefore, have no effect on the proposal. Broker non-votes will have no effect on this proposal as brokers are not entitled to vote on such proposals in the absence of voting instructions from the beneficial owner.

Q: What vote is required to approve, on an advisory basis, the frequency of future advisory votes on the compensation of the Company’s Named Executive Officers?

A: This matter is being submitted to enable stockholders to express a preference as to whether future advisory votes on executive compensation should be held every year, every two years or every three years. Since it is an advisory vote, the provisions of our By-Laws regarding the vote required to “approve” a proposal are not applicable to this matter. Abstentions and broker non-votes will not be counted as expressing any preference. If none of the frequency alternatives (one year, two years or three years) receives a majority vote, we will consider the frequency that receives the highest number of votes by stockholders to be the frequency that has been selected by stockholders. However, because this vote is advisory and not binding on us or our Board in any way, our Board may decide that it is in our and our stockholders’ best interests to hold an advisory vote on executive compensation more or less frequently than the alternative selected by our stockholders.

Q: What vote is required to approve an amendment to the Company’s By-Laws to designate the Delaware Court of Chancery as the exclusive forum for certain legal actions?

A: For approval of this proposal, the proposal must receive the “FOR” vote of a majority of all the issued and outstanding shares of common stock of the Company entitled to vote. Abstentions and broker non-votes will have the same effect as a vote against the proposal since the vote required to approve the amendment is based upon a proportion of all issued and outstanding shares, not simply a proportion of the votes cast.

Q: What vote is required to ratify the selection of Deloitte & Touche LLP as Cantel’s independent registered public accounting firm for fiscal year 2018?

A: For approval of this proposal, the proposal must receive the "FOR" vote of a majority of the votes cast by stockholders present in person or by proxy and entitled to vote on the matter. Because this proposal is considered a discretionary item for which a broker will have discretionary voting power if you do not give instructions with respect to this proposal, there will be no broker non-votes with respect to this proposal. Abstentions will not be counted as votes cast and, therefore, have no effect on the proposal.

Q: Who will count the votes?

A: Votes will be counted by an independent inspector of election appointed by the Company.

5

Q: Who pays for the solicitation of proxies?

A: We will pay for the entire cost of soliciting proxies. We will also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners. In addition, our directors and employees may solicit proxies in person, by telephone, via the Internet, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies.

Q: How can I find out the results of the voting at the meeting?

A: We will announce preliminary results at the meeting. We will report final results in a filing with the U.S. Securities and Exchange Commission (SEC) on a Current Report on Form 8-K within four business days after the meeting.

Q: What is “householding” and how does it work?

A: The SEC’s “householding” rules permit us to deliver only one set of proxy materials to stockholders who share an address unless otherwise requested. This procedure reduces printing and mailing costs. If you share an address with another stockholder and have received only one set of proxy materials, you may request a separate copy of these materials at no cost to you by writing to Cantel Medical Corp., 150 Clove Road, Little Falls, New Jersey 07424, Attn: Secretary, or by calling us at (973) 890-7220. Alternatively, if you are currently receiving multiple copies of the proxy materials at the same address and wish to receive a single copy in the future, you may contact us by calling or writing to us at the telephone number or address given above.

If you are a beneficial owner (i.e., your shares are held in the name of a bank, broker or other holder of record), the bank, broker or other holder of record may deliver only one copy of the notices of stockholder meetings and related proxy statements to stockholders who have the same address unless the bank, broker or other holder of record has received contrary instructions from one or more of the stockholders. If you wish to receive a separate copy of the notices of stockholder meetings and proxy statements, now or in the future, you may contact us at the address or telephone number above and we will promptly deliver a separate copy. Beneficial owners sharing an address, who are currently receiving multiple copies of the notice of stockholders meetings and proxy statements and wish to receive a single copy in the future, should contact their bank, broker or other holder of record to request that only a single copy be delivered to all stockholders at the shared address in the future.

6

SECURITY OWNERSHIP OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT

Director and Officer Owners

The table below shows the number of shares of our common stock beneficially owned as of the close of business on November 13, 2017 by each of our current directors and nominees for director, and each Named Executive Officer listed in the 2017 Summary Compensation Table below, as well as the number of shares beneficially owned by all of our directors and current executive officers as a group. The table and footnotes also include information about stock options held by directors and executive officers under the Company’s 2006 Equity Incentive Plan (2006 Plan) and 2016 Equity Incentive Plan (2016 Equity Plan).

Beneficial Owners | Number of Shares(1) | Options Currently Exercisable or Exercisable Within 60 Days | Total Beneficial Ownership(2) | Percent of Class |

Alan R. Batkin | 71,225 | — | 71,225 | * |

Ann E. Berman | 5,424 | — | 5,424 | * |

Peter G. Clifford | 16,226 | — | 16,226 | * |

Lawrence Conway | 2,663 | — | 2,663 | * |

Charles M. Diker(3) | 4,270,086 | 65,000 | 4,335,086 | 10.3% |

Mark N. Diker(4) | 476,801 | — | 476,801 | 1.1% |

Anthony B. Evnin | 6,272 | — | 6,272 | * |

Laura L. Forese | 4,210 | — | 4,210 | * |

George L. Fotiades | 100,066 | — | 100,066 | * |

Jorgen B. Hansen | 40,161 | — | 40,161 | * |

Ronnie Myers | 2,258 | — | 2,258 | * |

Eric W. Nodiff(5) | 39,796 | — | 39,796 | * |

Peter Provonost | 19,610 | — | 19,610 | * |

Seth M. Yellin | 21,976 | — | 21,976 | * |

All Directors, Nominees for Director, and Executive Officers as a group (15 persons)(6) | 5,033,380 | 65,000 | 5,098,380 | 12.2% |

_____________________________________

* | Represents beneficial ownership of less than one percent (1%). |

(1) | Includes unvested restricted stock awards (RSAs) for which the named person has voting rights. Excludes unvested restricted stock units (RSUs) for which the named person does not having voting or disposition rights. |

(2) | Unless otherwise noted, we believe that all persons named in the table have sole voting and investment power with respect to all shares of common stock beneficially owned by them. A person is deemed to be the beneficial owner of securities that can be acquired by such person within 60 days from November 13, 2017 upon the exercise of options. Each beneficial owner’s percentage ownership is determined by assuming that options that are held by such person (but not those held by any other person) and that are exercisable within 60 days from November 13, 2017 have been exercised. |

(3) | Includes an aggregate of 1,183,130 shares for which Mr. Diker may be deemed to be the beneficial owner comprised of (i) 453,538 shares owned by Mr. Diker’s wife, (ii) 108,271 shares owned by trusts for the benefit of Mr. Diker’s children, (iii) 85,454 shares held in accounts for Mr. Diker’s grandchildren over which he exercises investment discretion (including 47,204 shares disclosed in the chart above as beneficially owned by Mark N. Diker), (iv) 29,430 shares held by the DicoGroup, Inc., a corporation of which Mr. Diker serves as Chairman of the Board, (v) 216,621 shares owned by a non-profit corporation of which Mr. Diker and his wife are the principal officers and directors, and (vi) 289,816 shares held in certain other trading accounts over which Mr. Diker exercises investment discretion. |

(4) | Includes an aggregate of 47,204 shares owned by a trust for the benefit of his children for which Mr. Diker may be deemed to be the beneficial owner. |

(5) | Includes an aggregate of 2,906 shares owned by his wife for which Mr. Nodiff may be deemed to be the beneficial owner. |

(6) | Includes those shares set forth in footnotes (3), (4) and (5) above (but without double counting the 47,204 shares beneficially owned by both Charles M. Diker and Mark N. Diker disclosed in footnotes (3) and (4) above). |

7

Beneficial Owners

Based on filings made under Sections 13(d) and 13(g) of the Securities Exchange Act of 1934, as amended (Exchange Act), as of November 13, 2017, the only persons known by us to be the beneficial owner of more than 5% of our common stock was as follows:

Name | Address | Number of Shares | Percent of Class |

BlackRock, Inc. | 55 East 52nd Street New York, NY 10055 | 4,610,150(1) | 11.0% |

Brown Capital Management, LLC | 1201 N. Calvert Street Baltimore, MD 21202 | 4,263,602(2) | 10.2% |

Charles M. Diker | 150 Clove Road Little Falls, NJ 07424 | 4,335,086(3) | 10.3% |

The Vanguard Group | 100 Vanguard Blvd. Malvern, PA 19355 | 2,934,629(4) | 7.0% |

________________________

(1) | This information is based solely on a Schedule 13G/A filed by BlackRock, Inc. with the SEC on January 12, 2017. |

(2) | This information is based solely on a Schedule 13G/A filed by Brown Capital Management, LLC with the SEC on February 9, 2017. |

(3) | See Footnotes 2 and 3 under table of Director and Officer Owners above. |

(4) | This information is based solely on a Schedule 13G/A filed by The Vanguard Group with the SEC on February 10, 2017. |

Section 16(a) Beneficial Ownership Reporting Compliance

Federal securities laws require our executive officers and directors and persons owning more than 10% of our common stock to file certain reports on ownership and changes in ownership with the SEC. Based on a review of our records and other information, we believe that during the fiscal year ended July 31, 2017 (fiscal year 2017), our executive officers and directors and all persons holding more than 10% of our common stock timely filed all such Section 16(a) reports except as described herein. On June 9, 2017, Brian Capone was appointed Chief Accounting Officer of the Company and the Form 3 that was required to be filed by June 19, 2017, ten days following the appointment, was filed on June 20, 2017. On September 30, 2016, Ann E. Berman sold 1,453 shares of common stock in an open market transaction and was required to file a Form 4 to report such disposition by October 4, 2016, two business days following the sale. The Form 4 was filed on October 5, 2016.

8

PROPOSAL 1

ELECTION OF DIRECTORS

Our entire Board is elected each year at the Annual Meeting of Stockholders. The Board is currently comprised of ten members. All of the nominees listed below are incumbent directors. The nomination of each nominee to serve for a one-year term was recommended by our Nominating Committee and approved by the Board. The ten nominees include seven independent directors as defined in the NYSE rules and regulations.

A majority of the votes cast is required for the election of directors in an uncontested election (which is the case for the election of directors at the meeting). A majority of the votes cast means that the number of votes cast “for” a director nominee must exceed the number of votes cast “against” that nominee. Our Corporate Governance Guidelines contain detailed procedures to be followed in the event that one or more directors do not receive a majority of the votes cast. Each nominee elected as a director will continue in office until his or her successor has been elected or appointed and qualified, or until his or her earlier death, resignation or retirement. Each person nominated has agreed to serve if elected.

The persons named as proxies intend to vote the proxies “FOR” the election of each of the nominees unless you indicate on the proxy card that your vote should be against or abstain from voting with respect to any of the nominees. If for some reason any director nominee is unable to serve, the persons named as proxies may vote for a substitute nominee recommended by the Board, and unless you indicate otherwise on the proxy card, the proxies will be voted in favor of the remaining nominees.

The following persons have been nominated as directors:

Name and Principal Occupation or Position Alan R. Batkin Chairman and Chief Executive Officer (CEO) of Converse Associates, Inc., a strategic advisory firm, since January 2013. From February 2007 until December 2012, Mr. Batkin served as Vice Chairman of Eton Park Capital Management, L.P., an investment firm. For more than five years prior thereto, Mr. Batkin served as Vice Chairman of Kissinger Associates, Inc., a geopolitical consulting firm that advises multi-national companies. He is also a director of Hasbro, Inc. (NASDAQ), a toy and game company, Omnicom Group, Inc. (NYSE), a global marketing and corporate communications company, and Pattern Energy Group, Inc. (NASDAQ), an independent power company. We believe that Mr. Batkin’s specific banking, consulting and directorial experience described above qualifies him for service on the Board. | Age 73 | Has Been a Director Since 2004 |

9

Name and Principal Occupation or Position Ann E. Berman From October 1994 through June 2009, Ms. Berman served in various financial capacities at Harvard University, most recently (commencing April 2006) as senior advisor to the president of Harvard University and prior thereto as Vice President of Finance and Chief Financial Officer (CFO). Ms. Berman is a certified public accountant (CPA), and is also a director of Loews Corporation (NYSE), a holding company whose subsidiaries include a commercial property-casualty insurer; an offshore drilling company; a natural gas transportation and storage company; and a luxury lodging company; and Eaton Vance Corporation, an investment manager. We believe that Ms. Berman’s accounting and financial management expertise and service as an audit committee member and chair of other public companies qualify her for service on the Board. | Age 65 | Has Been a Director Since 2011 |

Charles M. Diker Chairman of the Board since 1986 and a member of the Office of the Chairman since April 2008. Mr. Diker was responsible for the Company’s transitioning into infection prevention. He has also served as Chairman and co-founder of Diker Management LLC, a registered investment advisor, for over ten years. He is also a director of Loews Corporation (NYSE), a holding company whose subsidiaries include a commercial property-casualty insurer; an offshore drilling company; a natural gas transportation and storage company; and a luxury lodging company. We believe that Mr. Diker’s thirty-two years of service as Chairman and a director of Cantel, knowledge of the Company’s business and his strong strategic vision for the Company qualify him to serve on the Board. | 82 | 1985 |

Mark N. Diker CEO and co-founder of Diker Management LLC, a registered investment adviser, for more than the past five years. We believe that Mr. Diker’s experience in investment-related matters and ability to assist in the analysis of acquisition targets qualify him to serve on the Board. | 51 | 2007 |

Anthony B. Evnin Partner, Venrock, a venture capital firm, since 1975. Mr. Evnin currently serves on the Board of Directors of Juno Therapeutics, Inc. (NASDAQ), AVEO Pharmaceuticals, Inc. (NASDAQ), and Infinity Pharmaceuticals, Inc. (NASDAQ) as well as on the Board of two private companies. He was formerly a Director of over 35 companies, both public and private, in the life sciences area. He is a Member of the Boards of Overseers and Managers of Memorial Sloan-Kettering Cancer Center, a Trustee of The Jackson Laboratory, a Director of the New York Genome Center, a Member of the Board of Directors of the Albert and Mary Lasker Foundation, a Trustee Emeritus of Princeton University, and a Trustee Emeritus of The Rockefeller University. We believe that Mr. Evnin’s long time experience in the healthcare and life sciences area qualifies him to serve on the Board. | 76 | 2017 |

10

Name and Principal Occupation or Position Laura L. Forese Executive Vice President and Chief Operating Officer (COO) of NewYork-Presbyterian, a comprehensive academic health care delivery system in collaboration with two renowned medical schools, Weill Cornell Medicine and Columbia University College of Physicians & Surgeons. NewYork-Presbyterian includes academic medical centers, regional hospitals, employed and affiliated physician practices and ambulatory and post-acute facilities. Dr. Forese is responsible for all enterprise operations as well as strategy and execution of acquisitions and partnerships. She is also chairwoman of the board of directors of NIH Clinical Center, the nation’s premier hospital devoted to clinical research. Dr. Forese was President of NYP Healthcare System (now subsumed into NewYork-Presbyterian) from 2013 to 2015 and Group SVP and COO NYP/Weill Cornell from 2011 to 2015. Dr. Forese is board certified in orthopedic surgery. We believe that Dr. Forese’s experience as a hospital executive, faculty member and practicing physician in one of the largest health care enterprises in the United States qualifies her to serve on the Board. | Age 56 | Has Been a Director Since 2015 |

George L. Fotiades Partner, Healthcare investments at Diamond Castle Holdings, LLC, a private equity firm, since April 2007 and Operating Partner at Five Arrows Capital Partners (Rothschild Merchant Banking), since April 2017. For more than five years prior thereto, Mr. Fotiades served as President and COO of Cardinal Health, Inc., a leading provider of healthcare products and services. Mr. Fotiades is also a director of Prologis, Inc. (NYSE), a leading owner, operator and developer of industrial real estate, and AptarGroup Inc. (NYSE), a leader in the global dispensing systems industry. He has served as Vice Chairman of the Board of Cantel and a non-executive member of the Office of the Chairman since April 2008. We believe that Mr. Fotiades’ extensive experience in executive management of global operations, strategic planning, and sales and marketing, particularly in the healthcare industry, qualifies him to serve on the Board. | 64 | 2008 |

Jorgen B. Hansen CEO and member of the Office of the Chairman of the Company since August 2016. Mr. Hansen has also served as President of the Company since November 2014. Prior thereto, from November 2012 to July 2016, he served as COO of the Company, and from November 2012 to November 2014, he served as Executive Vice President of the Company. He also served as President and CEO of Medivators Inc., a subsidiary of the Company from November 2012 to July 2015. Prior to joining the Company, Mr. Hansen had global leadership positions with increasing responsibility within the healthcare and medical devices industry for over fifteen years. Most recently, he was Senior Vice President, Global Marketing, Business Development, Science and Innovation for ConvaTec Corp. We believe that Mr. Hansen’s detailed knowledge of the Company’s business and operations, his current service as President and CEO of the Company, his past service as COO of the Company and CEO of Medivators Inc., and his experience in international healthcare-related markets qualify him to serve on the Board. | 50 | 2016 |

11

Name and Principal Occupation or Position Ronnie Myers Dean of the Touro College of Dental Medicine at New York Medical College since July 2017, previously having served as Senior Associate Dean for Academic and Administrative Affairs since June 2016. From January 2011 to June 2012 and then again from August 2013 to May 2016, Dr. Myers served as Vice Dean for Administration of Columbia University College of Dental Medicine. He served as Interim Dean of Columbia University College of Dental Medicine from July 2012 to July 2013. Dr. Myers maintained a private practice in general dentistry for 36 years and currently delivers lectures on the topic of infection prevention in the field of dentistry. We believe that Dr. Myers’ experience in dentistry and infection prevention, coupled with his practical experience, qualify him to serve on the Board. | Age 65 | Has Been a Director Since 2016 |

Peter J. Pronovost Professor of anesthesiology and critical care medicine, surgery, nursing, health policy and management, engineering, and business at the Johns Hopkins University School of Medicine. He is a practicing critical care physician who is dedicated to finding ways to make hospitals and healthcare safer for patients. In June 2011, he was named director of the new Armstrong Institute for Patient Safety and Quality at Johns Hopkins, as well as Johns Hopkins Medicine’s senior vice president for patient safety and quality. Dr. Pronovost is also a member of the Institute of Medicine-National Academy of Science. In 2008 he was named one of Time magazine’s 100 most influential people in the world for his work in improving healthcare safety. He is a lecturer and author in the fields of patient safety and healthcare management. Additionally, Dr. Pronovost is a researcher centered on improving the quality of care. Previously, from January 2010 to June 2015, Dr. Pronovost served as a director of the Company. We believe that Dr. Pronovost’s position as a world renowned leader of patient safety and quality qualifies him to serve on the Board. | 52 | 2017 |

The Board recommends that you vote “FOR” the election of each of the ten nominees.

CORPORATE GOVERNANCE

We seek to follow best practices in corporate governance in a manner that is in the best interests of our business and our stockholders. We are in compliance with the corporate governance requirements imposed by the Sarbanes-Oxley Act, the SEC and the NYSE and will continue to review our policies and practices to meet ongoing developments in this area.

Code of Business Conduct and Ethics; Executive Compensation Clawback Policy

All of our directors and employees, including our CEO, CFO, all other senior financial officers and all other executive officers, are required to comply with our Code of Business Conduct and Ethics. You can access our Code of Business Conduct and Ethics by clicking on the “Corporate Governance” link in the “Investor Relations” section of our website at www.cantelmedical.com. The Code of Business Conduct and Ethics is also available without charge in print to any requesting stockholder. We post amendments to, and waivers of, our Code of Business Conduct and Ethics, as applicable, on our website.

We have an Executive Compensation Clawback Policy under which a designated officer of the Company, if found to have engaged in misconduct causing a restatement of financial statements, could have a portion of his or her compensation recovered by the Company to the extent of the benefit received by such officer based on the financial statements that were restated. You can access our Executive Compensation Clawback Policy by clicking on the “Corporate Governance” link in the “Investor Relations” section of our website at www.cantelmedical.com.

Corporate Governance Guidelines

Our Corporate Governance Guidelines reflect the principles by which we operate. From time to time, the Nominating Committee and the Board review and revise our Corporate Governance Guidelines in response to regulatory requirements and evolving best practices. You can access our Corporate Governance Guidelines by clicking on the “Corporate Governance” link

12

in the “Investor Relations” section of our website at www.cantelmedical.com. The Corporate Governance Guidelines are also available without charge in print to any requesting stockholder.

Certain Relationships and Related Person Transactions

Our Corporate Governance Guidelines address, among other things, the consideration and approval of any related person transactions. Under these Governance Guidelines, any related person transaction that would require disclosure by us under Item 404(a) of Regulation S-K of the rules and regulations of the SEC, including those with respect to a director, a nominee for director or an executive officer, must be reviewed and approved or ratified by the Nominating Committee, excluding any director(s) interested in such transaction. Any such related person transactions will only be approved or ratified if the Nominating Committee determines that such transaction will not impair the involved person(s)’ service to, and exercise of judgment on behalf of, the Company, or otherwise create a conflict of interest that would be detrimental to the Company.

Mark N. Diker, our Chairman’s son, has served as a director of Cantel since October 18, 2007. Because of such family relationship, he is not treated as an independent director. During fiscal year 2017, Mr. Mark Diker’s total compensation was approximately [$45,000] and he was awarded 875 RSAs under the 2016 Equity Plan in connection with his directorship at Cantel.

Other than compensation paid to our executive officers and directors and disclosed in this Proxy Statement or otherwise approved by our Compensation Committee or Board, we did not engage in any related person transactions in fiscal year 2017.

BOARD MATTERS; COMMITTEES

Board Meetings and Attendance of Directors

The Board held five meetings, four regular meetings and one special meeting, during fiscal year 2017. During fiscal year 2017, each of the directors attended 75% or more of the combined total meetings of the Board and the respective committees on which he or she served. Directors are required to make every reasonable effort to attend the Annual Meeting of Stockholders. Eight of nine individuals then serving as members of the Board attended our last Annual Meeting of Stockholders.

Director Independence

In determining independence pursuant to NYSE standards, each year the Board affirmatively determines whether directors have a direct or indirect material relationship with the Company that may interfere with their ability to exercise their independence from the Company. When assessing the materiality of a director’s relationship with the Company, the Board considers all relevant facts and circumstances, not merely from the director’s standpoint, but from that of the persons or organizations with which the director has an affiliation. Material relationships can include commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships. The Board has affirmatively determined that the following seven directors have no material relationship with us and are independent within the meaning of Rule 10A-3 of the Exchange Act and within the NYSE definition of "independence": Alan R. Batkin, Ann E. Berman, Anthony B. Evnin, Laura L. Forese, George L. Fotiades, Ronnie Myers and Peter J. Pronovost. Our Board has also concluded that none of these directors possessed the objective relationships set forth in the NYSE listing standards that prevent independence. None of our independent directors has any relationship with the Company other than his or her service as a director and on committees of the Board. Independent directors receive no compensation from us for service on the Board or the Committees other than directors’ fees and equity grants under our 2016 Equity Plan.

Executive Sessions; Presiding Director

As required by the NYSE listing standards, our non-management directors meet in executive sessions at which only non-management directors are present on a periodic basis, generally following meetings of the full board of directors. Meetings of non-management directors are generally followed by meetings of the independent directors. Mr. Batkin serves as the presiding independent director (Presiding Director) and is the chairperson for all non-management and independent director meetings. He has been selected by our non-management directors to serve in such position each year since December 2004. In addition, Mr. Fotiades, in his capacity as Vice Chairman of the Board, performs certain responsibilities sometimes attributable to a presiding or lead director, particularly with respect to helping build and maintain a productive relationship between the Chairman and the CEO as well as the Board and the CEO.

Communications with Directors; Hotline

13

You may contact the entire Board, any Committee, the Presiding Director or any other non-management directors as a group or any individual director by visiting www.cantelmedical.alertline.com, or by calling our toll-free Hotline at 1-800-826-6762 (for calls originated within the United States or Canada). For calls originated outside the United States and Canada, the toll-free Hotline number is 1-800-714-4152; please visit our website identified below or the AT&T website http://www.business.att.com/bt/access.jsp for international access codes required for calls originated outside the United States and Canada. An outside vendor collects all reports or complaints and delivers them to our General Counsel and Chief Compliance Officer, who, in appropriate cases, forwards them to the Audit Committee and/or the appropriate director or group of directors or member of management. You are also welcome to communicate directly with the Board at the meeting. Additional information regarding the Hotline can be found by clicking on the “Corporate Governance” link in the “Investor Relations” section of our website at www.cantelmedical.com.

Committees

The Board has three standing committees: the Audit Committee, the Compensation Committee, and the Nominating Committee. All members of the Audit Committee, the Compensation Committee, and the Nominating Committee are independent directors within the definition in the NYSE listing standards and Rule 10A-3 of the Exchange Act. Each of the Committees has the authority to retain independent advisors and consultants, with all fees and expenses to be paid by us. The Board-approved charters of each of the Committees can be found by clicking on the “Corporate Governance” link in the “Investor Relations” section of our website at www.cantelmedical.com or (free of charge) by sending a written request to Cantel Medical Corp., 150 Clove Road, Little Falls, NJ 07424, Attn: Secretary.

Audit Committee. The Audit Committee is composed of Ms. Berman (Chair) and Messrs. Batkin and Fotiades. All of the Audit Committee members are financially literate, and at least one member has accounting and financial management expertise. The Board has determined that Ms. Berman qualifies as an “audit committee financial expert” for purposes of the federal securities laws. Ms. Berman developed such qualifications through her skills as a CPA and her service as a Vice President of Finance and CFO of Harvard University.

The Audit Committee performs the following functions: (1) assisting the Board in fulfilling its oversight responsibilities with respect to (a) the integrity of our financial statements, (b) our compliance with legal and regulatory requirements, (c) the independent registered public accounting firm’s qualifications and independence, and (d) the performance of our internal audit function and independent registered public accounting firm and (2) preparing a report in accordance with the rules of the SEC to be included in our annual proxy statement.

The Audit Committee held eight meetings during fiscal year 2017, of which four were meetings held prior to the filing of our Quarterly Reports on Form 10-Q or Annual Report on Form 10-K for the primary purpose of reviewing such reports and the quarterly financial closing process.

Compensation Committee. The Compensation Committee is composed of Mr. Batkin (Chair) and Drs. Myers and Forese. If Dr. Pronovost is elected at the meeting he will be appointed to the Compensation Committee in place of Dr. Myers. The Compensation Committee performs the following functions: (1) discharging the Board's responsibilities relating to compensation of our executive officers; (2) producing an annual report on executive compensation for inclusion in our proxy statement in accordance with applicable rules and regulations; and (3) administering our equity incentive plans in accordance with the terms of such plans. The Compensation Committee held four meetings during fiscal year 2017. In discharging its responsibilities, the Compensation Committee, among other things, evaluates the CEO’s performance and determines and approves the CEO’s compensation level based on such evaluation. The Compensation Committee also determines and approves the compensation of other executive officers. The CEO makes recommendations to the Compensation Committee regarding the amount and form of his compensation and the compensation of our other executive officers.

As described further in “Compensation Discussion and Analysis” below, the Compensation Committee retained Frederic W. Cook & Co. (FW Cook), an independent compensation consultant to provide advice with respect to executive compensation for fiscal years 2017 and 2018. FW Cook’s primary responsibility was to review our existing annual and long-term incentive plan designs and provide advice to the Compensation Committee on refinements and modifications to the plans in preparation for fiscal year 2017.

Compensation Committee Interlocks and Insider Participation. None of the directors who served on the Compensation Committee during fiscal year 2017 is or has been an officer or employee of the Company or had any relationship that is required to be disclosed as a transaction with a related person. During fiscal year 2017, none of our executive officers served as a member of the board of directors or compensation committee of any entity that has one or more executive officers who serve on our Board or our Compensation Committee.

14

Nominating Committee. The Nominating Committee is composed of Mr. Fotiades (Chairman), and Drs. Forese and Myers. The Nominating Committee performs the following functions: (1) identifying individuals qualified to become Board members, consistent with criteria approved by the Board and recommending that the Board select the director nominees for the next Annual Meeting of Stockholders; (2) developing and recommending to the Board the Corporate Governance Guidelines; (3) overseeing evaluation of the Board and management and (4) reviewing and assessing the compensation paid to members of the Board and its committees. The Nominating Committee held three meetings during fiscal year 2017.

Board Leadership Structure

The CEO and Chairman roles at Cantel are separated between Jorgen B. Hansen (who assumed the CEO role on August 1, 2016) and Charles M. Diker, respectively, in recognition of their differing responsibilities. The CEO is responsible for leading the organization’s day-to-day performance, executing the Company’s strategies and ensuring the success of our acquisition program. The Chairman is responsible for advising the CEO, collaborating on acquisitions, and presiding over meetings of the Board. In addition, the Chairman and the CEO have principal responsibility for setting the strategic direction of the Company. Although we do not have a formal policy regarding whether the offices of Chairman and CEO should be separate, our Board believes that the existing leadership structure, with the separation of the Chairman of the Board and CEO roles, enhances the accountability of the CEO to the Board and strengthens the Board’s independence from management. In addition, the Board believes that having a separate Chairman creates an environment that is more conducive to the objective evaluation and oversight of management’s performance, increasing management accountability, and improving the ability of the Board to monitor whether management’s actions are in the best interests of the Company and our stockholders.

Board Role in Risk Oversight

The Board, through its Audit Committee, is responsible for oversight of the Company’s management of enterprise risks. Cantel’s senior management is responsible for the Company’s risk management process and the day-to-day supervision and mitigation of enterprise risks. Management of the Company advises the Audit Committee and Board on areas of material Company risk, including strategic, operational, financial, legal and regulatory risks. We do not believe our Board’s oversight of risk influences our leadership structure, though we believe our leadership structure helps mitigate risk by separating oversight of our day-to-day business from the oversight of our Board.

Selection of Nominees for Election to the Board

The Nominating Committee has established a process for identifying and evaluating nominees for director. Although the Nominating Committee will consider nominees recommended by stockholders, the Nominating Committee believes that the process it utilizes to identify and evaluate nominees for director is designed to produce nominees that possess the educational, professional, business and personal attributes that are best suited to further our purposes. Any interested person may recommend a nominee by submitting the nomination, together with appropriate biographical information, to the Nominating Committee, c/o Cantel Medical Corp., 150 Clove Road, Little Falls, NJ 07424, Attn: Secretary. All recommended candidates will be considered using the criteria set forth in our Corporate Governance Guidelines.

The Nominating Committee will consider, among other things, the following factors to evaluate recommended nominees: the Board's current composition, including expertise, diversity, balance of management and non-management directors, independence and other qualifications required or recommended by applicable laws, rules and regulations (including NYSE requirements) and company policies or procedures. Although the Board considers diversity as a factor to be considered in identifying and evaluating nominees, it does not have any formal policy with respect to diversity. The Nominating Committee will also consider the general qualifications of potential nominees, including, but not limited to personal integrity; concern for Cantel’s success and welfare; experience at strategy/policy setting level; high-level leadership experience in business or administrative activity; breadth of knowledge about issues affecting Cantel; an ability to work effectively with others; sufficient time to devote to the Company; and freedom from conflicts of interests.

15

EXECUTIVE OFFICERS OF CANTEL

Name | Age | Position |

Charles M. Diker | 82 | Chairman of the Board and member of Office of the Chairman |

Jorgen B. Hansen | 50 | President, CEO and member of Office of the Chairman |

Peter G. Clifford | 47 | Executive Vice President, General Counsel, Secretary and member of Office of the Chairman |

Eric W. Nodiff | 60 | Executive Vice President, CFO and member of Office of the Chairman |

Seth M. Yellin | 43 | Executive Vice President, Strategy and Corporate Development and member of Office of the Chairman |

Dottie Donnelly-Brienza | 56 | Senior Vice President and Chief Human Resources Officer |

Lawrence Conway | 54 | Senior Vice President - Business Systems and Procurement |

Set forth below is certain biographical information concerning our current executive officers who are not also directors:

Mr. Clifford has served as Executive Vice President and CFO of the Company since March 2015. Prior to joining the Company, Mr. Clifford served in various financial positions with increasing responsibility for over twenty years. For more than five years prior to joining the Company, he was Group Vice President of Operations Finance and Information Technology for IDEX Corporation.

Mr. Nodiff has served as Executive Vice President and General Counsel since November 2014. Prior thereto, from January 2005 through November 2014, he served as Senior Vice President and General Counsel. He has also served as Secretary since January 2009.

Mr. Yellin has served as Executive Vice President, Strategy and Corporate Development of the Company since September 2016. Prior thereto, from March 2013 to September 2016, he served as Senior Vice President – Corporate Development, and from April 2012 through March 2013, he served as Vice President – Corporate Development. From January 2011 through January 2012, Mr. Yellin was an analyst in the Medical Devices & Life Science Tools segment of Citadel Asset Management.

Ms. Donnelly-Brienza has served as Senior Vice President and Chief Human Resources Officer of the Company since January 2017. Prior to joining the Company, she served as the Head of Organizational Performance at Bristol-Myers Squibb from October 2014 until January 2017. From April 2012 to October 2014, Ms. Donnelly-Brienza served in various positions at Merck including Head of Global Talent Management and Chief Diversity Officer. Earlier in her career, Ms. Donnelly-Brienza had almost 20 years at Johnson and Johnson in a variety of executive roles including Worldwide Vice President Human Resources at Ethicon, Inc.

Mr. Conway was appointed Senior Vice President - Business Systems and Procurement of the Company in November 2017, having served as Vice President - Business Systems and Procurement since September 2013 and as an independent consultant of the Company since May 2013. For more than 10 years prior to joining, Mr. Conway served in various management positions at Convatec, most recently as Vice President and General Manager Ostomy Care.

16

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

This Compensation Discussion and Analysis (CD&A) describes our executive compensation philosophy and program, the compensation decisions made under this program and the specific factors we considered in making those decisions. This CD&A focuses on the compensation of our “Named Executive Officers” (NEOs) for fiscal year 2017, who were:

• | Charles M. Diker - Chairman of the Board |

• | Jorgen B. Hansen - President and CEO |

• | Peter G. Clifford - Executive Vice President and CFO |

• | Eric W. Nodiff - Executive Vice President, General Counsel and Secretary |

• | Seth M. Yellin - Executive Vice President, Strategy and Corporate Development |

All of the NEOs served as members of the Office of the Chairman through July 31, 2017.

Ø | Fiscal Year 2017 Performance Highlights |

Fiscal year 2017 was a very successful year for the Company as we significantly improved every key financial performance metric. We delivered record top and bottom line performance and improved cash flows, while investing strategically in the business and closing three acquisitions. Performance highlights included the following:

• | Net sales increased by 15.9% to a record $770.2 million from $664.8 million. |

• | Net income under generally accepted accounting principles (GAAP) increased by 19.1% to $71.4 million from $60.0 million. |

• | Diluted EPS increased by 18.9% to $1.71 from $1.44. |

• | Non-GAAP diluted EPS increased by 18.7% to $2.08 from $1.75. |

Ø | How Pay Was Tied to the Company’s Performance in Fiscal Year 2017 |

Historically, our annual cash incentive awards have been the only form of executive compensation directly tied to performance. As discussed below, payments of cash incentive awards are tied to our non-GAAP EPS. Commencing with fiscal year 2017, we granted performance-based equity grants (in addition to strictly time-based equity grants). Our fiscal year 2017 results and compensation decisions illustrate that our pay-for-performance philosophy works as intended, with incentive-based cash bonuses and equity awards being driven by performance. In alignment with our pay-for-performance philosophy, the incentive payout for each of our NEOs was above target for both annual cash bonuses and sales-based performance equity awards due to the Company’s strong non-GAAP EPS and net sales for fiscal year 2017 compared to the targets established at the beginning of the fiscal year.

Ø | Compensation Philosophy and Objectives |

The approach to our compensation is designed to accomplish the following objectives:

● | Pay-for-Performance. To reward performance that drives the achievement of the Company’s short- and long-term goals and, ultimately, stockholder value. Our pay-for-performance orientation increased in fiscal year 2017. |

● | Align Management and Stockholder Interests. To align the interests of our executive officers with our stockholders by using long-term, equity-based incentives, maintaining stock ownership and retention guidelines that encourage a culture of ownership, and rewarding executive officers for sustained and superior Company performance as measured by operating results and relative total stockholder return (TSR). |

● | Attract, Retain, and Motivate Talented Executives. To compete and provide incentives for talented, high-performing executives. |

● | Address Risk-Management Considerations. To motivate our executives to pursue objectives that create long-term stockholder value and discourage behavior that could lead to unnecessary or excessive risk-taking inconsistent with our strategic and financial objectives, by providing a certain amount of fixed pay and balancing our executives’ at-risk pay |

17

between short-term (one-year) and long-term (three-year) performance horizons, using a variety of financial and other performance metrics.

● | Support Financial Efficiency. To help ensure that payouts under our cash-based and equity-based incentive awards are appropriately supported by performance and to allow the Compensation Committee to design these awards in a way that is intended to be treated as performance-based compensation that is tax deductible by the Company under Section 162(m) (Section 162(m)) of the Internal Revenue Code of 1986, as amended (the Code), as appropriate. |

What the Company’s Compensation Program is Designed to Reward

The Company’s business plan emphasizes growth through the expansion of existing operations (i.e., organic growth), the addition of new businesses and products through acquisitions, and product development. This strategy is advanced by identifying and acquiring businesses; effectively integrating acquired operations, personnel, products and technologies into the organization; retaining and motivating key personnel throughout the Company; attracting and retaining customers; and encouraging new product development. In addition, the Company relies on its executives to sustain and efficiently manage current businesses while adapting and growing its business segments in response to the ever-changing competitive landscape, and, in general, to maximize stockholder value. The compensation program is designed to reward the NEOs for successfully managing these tasks, increasing earnings of the Company, and creating stockholder value.

The abilities and performance of the Company’s executives are critical to the Company’s long-term success, and the objectives of the compensation program are designed to complement each other by balancing the Company’s interest in achieving both its short-term and long-term goals. Base salary and incentive-based cash bonuses are paid to reward performance and the achievement of short-term objectives and equity awards are used to align the executives’ interests with the long-term success of the Company and to attract and retain executives.

Responsibilities in Setting Executive Compensation

The Compensation Committee has responsibility for determining executive compensation. The Compensation Committee is made up entirely of independent directors as defined by our Governance Guidelines and NYSE listing standards. It regularly reviews the design and implementation of our executive compensation program and reports on its discussions and actions to the Board. In particular, the Compensation Committee (i) oversees our executive compensation program, (ii) approves the performance goals for our NEOs, evaluates results against those targets each year, and determines and approves the compensation of our CEO and our other NEOs, as well as any other executive officers of the Company and division and regional presidents, and (iii) makes recommendations to the Board with respect to the structure of overall incentive and equity-based plans. The Compensation Committee makes its determinations regarding executive compensation after consulting with the Chairman and the CEO and, if retained, the Compensation Committee’s independent compensation consultant (as further described below). Its decisions are based on a variety of factors, including the Company’s performance, individual executives’ performance, and input and recommendations from the Chairman and the CEO. Individual performance is evaluated primarily based on the consolidated performance of the Company, and, in the case of division and regional presidents, on the business or operations for which the executive is responsible, the individual’s skill set relative to industry peers, overall experience and time in the position, the critical nature of the individual’s role, difficulty of replacement, expected future contributions, readiness for promotion to a higher level, role relative to that of other executive officers, and, in the case of externally recruited NEOs, compensation earned with a prior employer. NEOs do not have a role in the determination of their own compensation, but the Chairman of the Board and the CEO do discuss their compensation with the Compensation Committee. Following the Compensation Committee’s determination of the Chairman’s annual equity award and other compensation, the Board is requested to consider and ratify such compensation. The Compensation Committee currently consists of Mr. Batkin (Chairman) and Drs. Forese and Myers.

Role of Compensation Data and Independent Consulting Firm

The Compensation Committee retained FW Cook as an independent compensation consultant to provide advice with respect to executive compensation for fiscal year 2017. With respect to the compensation of our CEO and other senior executives in fiscal year 2017, in order to obtain a general understanding of current trends in compensation practices and ranges of amounts being awarded by other public companies to their executive officers, FW Cook provided the Compensation Committee with a list of peer group companies to the Company that are public companies engaged in our industry, in related industries, or that possess size or other characteristics which are similar to ours, as well as compensation data of the peer group companies. While the consulting firm provided the peer group and such data, it did not otherwise provide advice to the Compensation Committee regarding compensation decisions. Prior to FW Cook providing the recommended peer group list and compensation data, the

18

Company had announced a succession plan under which the then-current CEO would be retiring and a new CEO (Mr. Hansen) would be appointed upon the commencement of fiscal year 2017, and the compensation of the new CEO had already been negotiated and finalized. As such, the Compensation Committee did not utilize any specific survey data or benchmarking with respect to fiscal year 2017 compensation of the CEO or any of the other NEOs, though it has in the past and may do so in the future. Instead, the Compensation Committee relied on its own analyses and processes described herein in setting fiscal year 2017 compensation for the NEOs.

The companies in the peer group consisted of: Analogic Corporation, CONMED Corporation, Globus Medical, Inc., Integer Holdings Corporation (f/k/a Greatbatch, Inc.), Haemonetics Corporation, HeartWare International, Inc., ICU Medical, Inc., Integra LifeSciences Corporation, Masimo Corporation, Merit Medical Systems Inc., Natus Medical Inc., NuVasive, Inc., NxStage Medical, Inc. and Wright Medical Group, Inc.

The Compensation Committee used the peer group data principally to obtain a general understanding of median base salary, bonus and severance levels paid to chief executive officers in the healthcare industry and to determine where compensation levels of the Company’s CEO and other executives fell relative to median compensation levels of comparable industry executives. The data showed that the combined base salaries and short-term cash incentives were mixed relative to the medians in the comparative group. However, the Compensation Committee did not utilize the data for benchmarking to specific market percentiles or modify any salaries, incentives or benefits of the CEO based on the data in the survey.

FW Cook’s primary responsibility with respect to fiscal year 2017 was to review our existing annual and long-term incentive plan designs and provide advice to the Compensation Committee on refinements and modifications to the plans in preparation for fiscal year 2017, as well as advise the Compensation Committee generally on market trends in incentive plan design, risk and reward structure of executive compensation plans. For fiscal year 2018, FW Cook also assisted in the evaluation and implementation of changes to the Company’s long term incentive plans and programs thereunder, including a change in fiscal year 2018 from granting RSAs to RSUs.

The Compensation Committee has assessed the independence of FW Cook pursuant to the NYSE listing standards and SEC rules and is not aware of any conflict of interest that would prevent FW Cook from providing independent advice to the Committee concerning executive compensation matters.

Elements of the Compensation Program; Why the Compensation Committee Chose Each Element and How Each Relates to the Company’s Objectives

The two principal elements comprising executive compensation are cash and equity awards. The cash element is divided into base salary and annual cash incentives. The equity element historically consisted of RSAs (subject to a risk of forfeiture) and, to a limited extent, stock options, under the Company’s 2006 Plan or 2016 Equity Plan. These elements complemented each other and gave the Compensation Committee flexibility to create compensation packages that provided short and long-term incentives in line with the Company’s approach to compensation. Such approach was designed to provide the executive sufficient cash to be competitive with other employment opportunities, while at the same time providing the executive with an incentive to build stockholder value by aligning the executive’s interests with those of our stockholders.

Prior to the fiscal year ended July 31, 2016 (fiscal year 2016), cash awards and equity awards were granted each October following the end of the fiscal year based on targets established at the beginning of the fiscal year (as described below). However, the Compensation Committee decided that commencing with fiscal year 2017, equity awards would be granted at the beginning of the fiscal year and would include (for the first time) performance-based equity grants, as described below, in addition to strictly time-based equity grants. Therefore, the equity grants made to executives at the beginning of fiscal year 2017 (in October 2016) were attributable to fiscal year 2017. The equity grants were in the form of time-based and performance-based RSAs, described below. Commencing in fiscal year 2018, equity grants were in the form of time-based and performance-based RSUs.

Cash

Base salary is the primary fixed element of the Company’s compensation program and is used to attract and retain, as well as motivate and reward, executive officers. In determining the base salary of NEOs, the Compensation Committee considers the experience, skills, knowledge and responsibilities required of the executive officer in his role, specifically, the functional role of the position, the level of the individual's responsibility, the ability to replace the individual, and if applicable, the base salary of the individual at his prior employment.

19

Short-term incentive compensation is an opportunity for executives to receive cash bonuses based on the Company’s (or its divisions’) annual financial performance. The short-term incentive compensation is intended to reward performance for the most recently completed fiscal year when financial objectives are achieved and motivate and retain qualified individuals who have the opportunity to influence future results, advance business objectives, and enhance stockholder value. Likewise, this element of compensation is designed to provide a reduced award or no award when financial objectives are not achieved. Target amounts for the annual bonus opportunity are historically established within 75 days after the commencement of the fiscal year and are based on achievement of a financial metric, which in fiscal year 2017 was non-GAAP EPS. The exact annual metric and targets are determined and approved by the Compensation Committee each year. For fiscal year 2017, to ensure deductibility of executive compensation in excess of one million dollars under Section 162(m), the Compensation Committee approved a compensation program with established award targets and performance targets.

The Compensation Committee awarded Mr. C. Diker a discretionary cash bonus of $150,000 for fiscal year 2017 as a result of the Company achieving annual financial performance targets imposed on executives for fiscal year 2016. This award was ratified by unanimous vote of the independent members of the Board.

For fiscal year 2017, the Compensation Committee established a target level, as a percentage of base salary, for each member of senior management (exclusive of Mr. C. Diker) for purposes of determining cash bonuses. Mr. C. Diker is excluded because the Compensation Committee determines his annual bonus on a discretionary basis. Achievement of the target levels was based on attainment of the Company’s fiscal year 2017 targeted diluted non-GAAP EPS and, in the case of division and regional Presidents, budgeted operating income for the applicable division, subject to achieving a minimum gross margin requirement. Additional factors included in the process of determining senior management target levels, as well as discretionary additional bonuses, were business performance, scope of responsibilities and accountability, competitive and other industry compensation data, special circumstances and expertise, individual performance, comparison with compensation of our other senior managers and recommendations of the CEO.

Equity

The primary purpose of equity grants is to contribute to the motivation of key employees in accomplishing the Company’s long-term strategic, operational and financial objectives as well as stockholder value goals. Equity awards (which may consist of RSAs, RSUs, stock options, stock appreciation rights or performance awards) are granted to NEOs under our 2016 Equity Plan in order to give them an ownership interest in the Company, thereby aligning their interests with those of the stockholders and providing a long-term incentive. RSAs consist of awards of the Company’s common stock subject to specified vesting restrictions or conditions including, among other things, continued employment with the Company. Stock options and stock appreciation rights (rights to receive a payment equal to the increase in fair market value of the Company’s common stock since the grant date thereof) are equity awards whose value depends on an increase in the Company’s common stock price. For more than the past five years, the Compensation Committee has awarded only RSAs and RSUs and no stock options to management, other than Mr. C. Diker who, prior to fiscal year 2016, received stock options. Grants of RSAs and RSUs have intrinsic value regardless of price appreciation, and may create a stronger alignment of interests between management and other stockholders. In addition, the Compensation Committee believes that due to their intrinsic value, RSAs and RSUs may have a stronger retentive effect on management than stock options.

During fiscal year 2017 (in October 2016), RSAs were granted to senior management under the Company’s 2016 Equity Plan. Half of the awards were time-based and half were performance-based RSAs, except that all of the equity awards to Mr. C. Diker were time-based RSAs. The awards to Mr. C. Diker were approved by the Compensation Committee and ratified by the Board. During fiscal year 2018 (in October 2017), the Compensation Committee decided that the composition of equity awards to Mr. C. Diker should be the same as senior management. As such, like senior management, Mr. C. Diker was granted half time-based awards and half performance-based RSUs.