Form 6-K GOLDCORP INC For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of October 2017

Commission File Number: 001-12970

Goldcorp Inc.

(Translation of registrant's name into English)

Suite 3400 - 666 Burrard St.

Vancouver, British Columbia V6C 2X8 Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F o Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

INCORPORATION BY REFERENCE

Exhibit 99.1 (Management's Discussion and Analysis of Financial Condition and Results of Operations for the three and nine months ended September 30, 2017) and Exhibit 99.2 (Condensed Interim Consolidated Financial Statements of the Company for the three and nine months ended September 30, 2017) to this Report on Form 6-K shall be incorporated by reference into Registration Statement Nos. 333-126039, 333-126040, 333-151243, 333-151251, 333-174376, 333-181116, 333-188805, 333-195816 and 333-213153 on Form S-8, No. 333-207371 on Form F-3 and No. 333-211892 on Form F-10 of the Company, as filed with the Securities and Exchange Commission, to the extent not superseded by documents or reports subsequently filed or furnished by us under the Securities Act of 1933 or the Securities Act of 1934, in each case as amended.

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

GOLDCORP INC. | ||

Date: October 25, 2017 | /s/ Anna M. Tudela | |

Name: Anna M. Tudela Title: Vice-President, Diversity, Regulatory Affairs and Corporate Secretary | ||

EXHIBIT INDEX

Exhibit | Description of Furnished Exhibit | |

99.1 | Management’s Discussion and Analysis of Financial Condition and Results of Operations for the three and nine months ended September 30, 2017 | |

99.2 | Condensed Interim Consolidated Financial Statements of the Company for the three and nine months ended September 30, 2017 | |

99.3 | Form 52-109F2 Certification of Interim Filings - CEO | |

99.4 | Form 52-109F2 Certification of Interim Filings - CFO | |

Exhibit 99.1

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2017

This Management’s Discussion and Analysis (“MD&A”) should be read in conjunction with the condensed interim consolidated financial statements of Goldcorp Inc. (“Goldcorp” or “the Company”) for the three and nine months ended September 30, 2017 and related notes thereto which have been prepared in accordance with International Accounting Standard 34 – Interim Financial Reporting of International Financial Reporting Standards (“GAAP” or “IFRS”) as issued by the International Accounting Standards Board (“IASB”). All figures are in United States (“US”) dollars unless otherwise noted. References to C$ are to Canadian dollars. This MD&A has been prepared as of October 25, 2017.

TABLE OF CONTENTS

Page Number | ||

Cautionary Statements | ||

Quarter Highlights | ||

Business Overview and Strategy | ||

Corporate Developments | ||

Market Overview | ||

Quarterly Results | ||

Liquidity and Capital Resources | ||

Guidance | ||

Operational and Projects Review | ||

2017 Reserves and Resources Update | ||

Non-GAAP Performance Measures | ||

Risks and Uncertainties | ||

Accounting Matters | ||

Controls and Procedures | ||

Mineral Reserves and Resources | ||

GOLDCORP | 1

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This MD&A contains “forward-looking statements” within the meaning of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended, the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United States Securities and Exchange Commission, all as may be amended from time to time, and "forward-looking information" under the provisions of applicable Canadian securities legislation, concerning the business, operations and financial performance and condition of Goldcorp. Forward-looking statements include, but are not limited to, statements with respect to the future price of gold, silver, copper, lead and zinc, the estimation of Mineral Reserves (as defined below) and Mineral Resources (as defined below), the realization of Mineral Reserve estimates, the timing and amount of estimated future production, costs of production, targeted cost reductions, capital expenditures, free cash flow, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, hedging practices, currency exchange rate fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, timing and possible outcome of pending litigation, title disputes or claims and limitations on insurance coverage. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” , “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes”, or variations or comparable language of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, "should", “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof.

Forward-looking statements are necessarily based upon a number of factors and assumptions that, if untrue, could cause the actual results, performances or achievements of Goldcorp to be materially different from future results, performances or achievements expressed or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which Goldcorp will operate in the future, including the price of gold, anticipated costs and ability to achieve goals. Certain important factors that could cause actual results, performances or achievements to differ materially from those in the forward-looking statements include, among others, gold price volatility, discrepancies between actual and estimated production, Mineral Reserves and Mineral Resources and metallurgical recoveries, mining operational and development risks, litigation risks, regulatory restrictions (including environmental regulatory restrictions and liability), changes in national and local government legislation, taxation, controls or regulations and/or change in the administration of laws, policies and practices, expropriation or nationalization of property and political or economic developments in Canada, the United States and other jurisdictions in which the Company does or may carry on business in the future, delays, suspension and technical challenges associated with capital projects, higher prices for fuel, steel, power, labour and other consumables, currency fluctuations, the speculative nature of gold exploration, the global economic climate, dilution, share price volatility, competition, loss of key employees, additional funding requirements and defective title to mineral claims or property. Although Goldcorp believes its expectations are based upon reasonable assumptions and has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended.

Forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause the actual results, level of activity, performance or achievements of Goldcorp to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to the integration of acquisitions; risks related to international operations, including economic and political instability in foreign jurisdictions in which Goldcorp operates; risks related to current global financial conditions; risks related to joint venture operations; actual results of current exploration activities; actual results of current reclamation activities; environmental risks; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of gold, silver, copper, lead and zinc; possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; mine development and operating risks; accidents, labour disputes and other risks of the mining industry; risks associated with restructuring and cost-efficiency initiatives; delays in obtaining governmental approvals or financing or in the completion of development or construction activities; risks related to indebtedness and the service of such indebtedness, as well as those factors discussed in the section entitled "Description of the Business – Risk Factors” in Goldcorp’s most recent annual information form available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. Although Goldcorp has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Forward-looking statements are made as of the date hereof and, accordingly, are subject to change after such date. Except as otherwise indicated by Goldcorp, these statements do not reflect the potential impact of any non-recurring or other special items or of any disposition, monetization, merger, acquisition, other business combination or other transaction that may be announced or that may occur after the date hereof. Forward-looking statements are provided for the purpose of providing information about management’s current expectations and plans and allowing investors and others to get a better understanding of Goldcorp's operating environment. Goldcorp does not intend or undertake to publicly update any forward-looking statements that are included in this document, whether as a result of new information, future events or otherwise, except in accordance with applicable securities laws.

CAUTIONARY STATEMENT REGARDING CERTAIN MEASURES OF PERFORMANCE

This MD&A presents certain measures, including "total cash costs: by-product", "total cash costs: co-product", ‘‘all-in sustaining costs", ‘‘adjusted operating cash flow’’, "EBITDA", "adjusted EBITDA" and "adjusted net debt", that are not recognized measures under IFRS. This data may not be comparable to data presented by other gold producers. For a reconciliation of these measures to the most directly comparable financial information presented in the consolidated financial statements prepared in accordance with IFRS, see Non-GAAP Financial Performance Measures in this MD&A. The Company believes that these generally accepted industry measures are realistic indicators of operating performance and are useful in performing year over year comparisons. However, these non-GAAP measures should be considered together with other data prepared in accordance with IFRS, and these measures, taken by themselves, are not necessarily indicative of operating costs or cash flow measures prepared in accordance with IFRS. This MD&A also contains

GOLDCORP | 2

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

information as to estimated future all-in sustaining costs. The estimates of future all-in sustaining costs are not based on total production cash costs calculated in accordance with IFRS, which forms the basis of the Company’s cash costs: by-product. The estimates of future all-in sustaining costs are anticipated to be adjusted to include sustaining capital expenditures, corporate administrative expense, exploration and evaluation costs and reclamation cost accretion and amortization, and exclude the effects of expansionary capital, tax payments, dividends and financing costs. Projected IFRS total production cash costs for the full year would require inclusion of the projected impact of future included and excluded items, including items that are not currently determinable, but may be significant, such as sustaining capital expenditures, reclamation cost accretion and amortization and tax payments. Due to the uncertainty of the likelihood, amount and timing of any such items, the Company does not have information available to provide a quantitative reconciliation of projected all-in sustaining costs to a total production cash costs projection.

CAUTIONARY NOTE REGARDING RESERVES AND RESOURCES

Scientific and technical information contained in this MD&A relating to Mineral Reserves and Mineral Resources was reviewed and approved by Dan Redmond, P.Geo., Director, Reserves & Mine Planning for Goldcorp, and a “qualified person” as defined by Canadian Securities Administrators' National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Scientific and technical information in this MD&A relating to exploration results was reviewed and approved by Sally Goodman, PhD, P.Geo., Director, Generative Geology for Goldcorp, and a "qualified person" as defined by NI 43-101. All Mineral Reserves and Mineral Resources have been estimated in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") and NI 43-101, or the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves equivalent. All Mineral Resources are reported exclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Information on data verification performed on the mineral properties mentioned in this MD&A that are considered to be material mineral properties to the Company are contained in Goldcorp’s most recent annual information form and the current technical report for each of those properties, all available on SEDAR at www.sedar.com.

Cautionary Note to United States investors concerning estimates of measured, indicated and inferred resources: The Mineral Resource and Mineral Reserve estimates contained in this MD&A have been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws and use terms that are not recognized by the United States Securities and Exchange Commission (“SEC”). Canadian reporting requirements for disclosure of mineral properties are governed by NI 43-101. The definitions used in NI 43-101 are incorporated by reference from the CIM Definition Standards adopted by CIM Council on May 10, 2014 (the “CIM Definition Standards”). U.S. reporting requirements are governed by the SEC Industry Guide 7 (“Industry Guide 7”) under the United States Securities Act of 1933, as amended. These reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, but embody difference approaches and definitions. For example, the terms “Mineral Reserve”, “Proven Mineral Reserve” and “Probable Mineral Reserve” are Canadian mining terms as defined in in NI 43-101, and these definitions differ from the definitions in Industry Guide 7. Under Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. Further, under Industry Guide 7, mineralization may not be classified as "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made.

While the terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are defined in and required to be disclosed by NI 43-101, these terms are not defined terms under Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. United States readers are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. In addition, “Inferred Mineral Resources” have a great amount of uncertainty as to their existence and their economic and legal feasibility. A significant amount of exploration must be completed in order to determine whether an Inferred Mineral Resource may be upgraded to a higher category. Under Canadian regulations, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. United States readers are cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations if such disclosure includes the grade or quality and the quantity for each category of Mineral Resource and Mineral Reserve; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this MD&A containing descriptions of the Goldcorp’s mineral deposits may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

GOLDCORP | 3

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

FINANCIAL AND OPERATIONAL HIGHLIGHTS FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2017

Net earnings were $111 million, or $0.13 per share, compared to net earnings of $59 million, or $0.07 per share, for the third quarter of 2016. Operating cash flows for the third quarter of 2017 were $315 million compared to $267 million for the same period in the prior year. Adjusted operating cash flows were $308 million (1) for the third quarter of 2017 compared to $401 million for the same period in the prior year.

Gold production of 633,000 ounces at all-in sustaining costs ("AISC") of $827 per ounce, compared to 715,000 ounces at AISC of $812 per ounce for the third quarter of 2016 (1). 2017 guidance reconfirmed for gold production of 2.5 million ounces (+/- 5%) and AISC of $825(2) per ounce (+/- 5%), previously improved from $850 per ounce, reflecting the progress the Company has made on its efficiency program.

Program to implement $250 million of sustainable annual efficiencies by the middle of 2018 is on track with $200 million expected to be achieved in 2017 across the Company's portfolio. More than 100% of the $250 million of efficiencies have been identified, with the program likely to be extended and the efficiency target increased, after the Company achieves its current target.

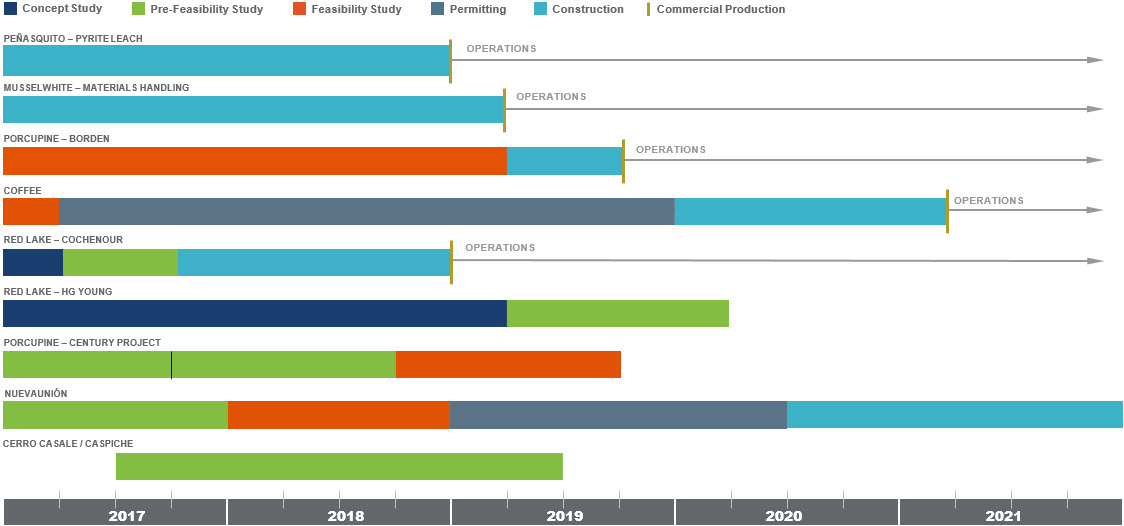

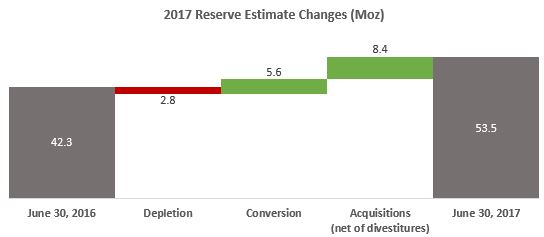

Solid reserve growth and project execution enhances confidence in the Company's 20/20/20 growth plan. An increase in proven and probable gold reserves to 53.5 million ounces, strong project delivery of expansions at Peñasquito, Musselwhite and Porcupine (Borden) underpin our plan for a 20% increase in gold production, a 20% increase in gold reserves and a 20% reduction in AISC by 2021, while delivering increasing cash flows over the next five years.

(1) | The Company has included non-GAAP performance measures on an attributable (or Goldcorp's share) basis throughout this document. Adjusted operating cash flows and AISC per ounce and adjusted operating cash flows are non-GAAP financial performance measures with no standardized definition under IFRS. For further information and detailed reconciliations, please see pages 33-40 of this MD&A. |

(2) | Refer to footnote (4) on page 17 of this MD&A regarding the Company's projection of AISC. |

GOLDCORP | 4

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

BUSINESS OVERVIEW

Goldcorp is a leading gold producer focused on responsible mining practices, with production from a portfolio of long-life, high quality assets throughout the Americas that it believes position the Company to deliver long-term value.

The Company’s principal producing mining properties are comprised of the Éléonore, Musselwhite, Porcupine and Red Lake mines in Canada; the Peñasquito mine in Mexico; the Cerro Negro mine in Argentina; and the Pueblo Viejo mine (40.0% interest) in the Dominican Republic.

The Company’s current sources of operating cash flows are primarily from the sale of gold, silver, lead, zinc and copper. Goldcorp's principal product is refined gold bullion sold primarily in the London spot market. As a result, Goldcorp is not dependent on a particular purchaser with regard to the sale of the gold bullion. In addition to gold, the Company also produces silver, copper, lead and zinc primarily from concentrate produced at the Peñasquito mine, which is sold to third party smelters and refineries.

Goldcorp has an investment-grade credit rating, supported by a strong balance sheet, and remains 100% unhedged to gold sales, providing full exposure to gold prices.

STRATEGY

Goldcorp's vision is to create sustainable value for all of its stakeholders by growing net asset value ("NAV") per share to generate long-term shareholder value. With a portfolio of large, long-life assets that provide economies of scale, coupled with low AISC and underpinned by a strong balance sheet, Goldcorp continues to optimize its portfolio of assets and reinvest in a strong pipeline of organic opportunities to drive increasing margins and returns on investment.

The Company has outlined its 20/20/20 growth plan that is expected to deliver a 20% increase in gold production, a 20% increase in gold reserves and a 20% reduction in AISC by 2021. In pursuit of this, Goldcorp is committed to being responsible stewards of the environment and building collaborative partnerships with communities, governments and all other stakeholders for mutual success.

With a strong balance sheet, Goldcorp believes it is well-positioned to weather gold price volatility. The Company's capital allocation strategy focuses on investing in its pipeline of organic growth opportunities, further debt reduction and returning capital to its shareholders by paying a sustainable dividend. Furthermore, Goldcorp leverages its exploration spending in the most efficient way possible through small toehold investments in junior mining companies.

CORPORATE DEVELOPMENTS

Acquisition of the Caspiche Project

During the second quarter of 2017, the Company acquired 83% of the issued and outstanding shares of Exeter Resource Corporation ("Exeter") and its Caspiche project (the "Caspiche Transaction"), located in the Maricunga Gold Belt, for share consideration of approximately $131 million. On August 2, 2017, the Company completed the acquisition of the remaining 17% interest in Exeter through the issuance of 1,890,144 common shares with a fair value of $25 million. After completing the acquisition of the 100% interest in Exeter, Goldcorp contributed the Caspiche project into the joint operation with Barrick Gold Corporation ("Barrick"), which resulted in Barrick and Goldcorp each holding an indirect 50% interest in the combined Cerro Casale and Caspiche projects. The transactions are consistent with the Company's strategy of populating its pipeline with high-quality, long-dated optionality to drive increasing NAV per share.

Sale of the San Nicolas Project

On October 18, 2017, the Company sold its 21% interest in the San Nicolas copper-zinc project, a stand-alone project in Mexico, to Teck Resources Limited for cash consideration of $50 million. The carrying value of San Nicolas was nominal at September 30, 2017; the resulting gain will be recognized in the fourth quarter of 2017.

PROGRESS TOWARDS DELIVERING $250 MILLION OF SUSTAINABLE ANNUAL EFFICIENCIES

During the third quarter of 2017, the Company continued to execute its productivity and cost optimization program, with all operations participating in the delivery phase of the program. At Cerro Negro and Goldcorp’s corporate offices, voluntary and involuntary staff reductions and other cost savings initiatives have been implemented which contribute to $115 million per year in cost reductions. In the third quarter of 2017, Peñasquito and Eleonore continued the process of rationalizing maintenance and supply contracts. Both Porcupine and Red Lake continue to achieve productivity goals related to underground mine development and site-wide cost reductions. Given the Company's progress to date, the program is likely to be extended and the efficiency target increased, after the Company attains its current target, which it expects to achieve by the middle of 2018.

GOLDCORP | 5

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

BOARD APPOINTMENT

Mr. Matthew Coon Come was appointed to the Company's Board of Directors in July 2017. Mr. Coon Come is a national and international leader and advocate of indigenous rights, having previously served as both the Grand Chief of the Grand Council of the Crees and the Chairperson of the Cree Regional Authority for over 20 years. He also served as National Chief of the Assembly of First Nations from 2000 to 2003. Mr. Coon Come studied political science, economics, native studies and courses in law at both Trent and McGill Universities. In addition, he was granted the degree of Doctor of Laws Honoris Causta from Trent University in 1998 and the Honorary Doctor of Laws from the University of Toronto in 2000 in recognition of his leadership and the significance of his work.

MARKET OVERVIEW

Gold

The market price of gold is the primary driver of Goldcorp's profitability. The price of gold can fluctuate widely and is affected by a number of macroeconomic factors, including the sale or purchase of gold by central banks and financial institutions, interest rates, exchange rates, inflation or deflation, global and regional supply and demand and the political and economic conditions of major gold-producing and gold-consuming countries throughout the world.

Source: London Bullion Market Association (LBMA) Gold PM Fix

In contrast to second quarter of 2017, the price of gold showed greater resolve throughout most of the third quarter of 2017, underpinned by geo-political risks in Europe and Asia as well as steady physical and Central Bank demand. Gold began the quarter at $1,240 per ounce and traded to a 12-month high of $1,357.50 in early September 2017, before profit-taking and a refocus on market expectations for further interest rate increases by the Federal Reserve saw prices slip to $1,280 for a net gain of $40 per ounce during a period typically characterized by quiet summer holiday trading conditions. During the third quarter of 2017, the Company realized an average gold price of $1,287 per ounce, a 3% decrease compared to $1,333 per ounce in the third quarter of 2016. For the nine months ended September 30, 2017, the Company realized an average gold price of $1,259 per ounce, a 1% decrease compared to $1,267 per ounce in the nine months ended September 30, 2016.

Currency Markets (1)

The results of Goldcorp's mining operations are affected by the US dollar exchange rates. The Company has exposure to the Canadian dollar at Éléonore, Musselwhite, Porcupine and Red Lake, exposure to the Mexican peso at Peñasquito, exposure to the Argentine peso at Cerro Negro and exposure to the Dominican Republic peso relating to its investment in Pueblo Viejo. The Company's exposure to the Mexican peso and Guatemalan quetzal decreased in the second quarter of 2017 after the closing of the sale of the Los Filos mine in April and the closure of the Marlin mine at the end of May.

Fluctuations in the US dollar can cause volatility of costs reported in US dollars. In addition, monetary assets and liabilities that are denominated in non-US dollar currencies, such as cash and cash equivalents and value-added taxes, are subject to currency risk. Goldcorp is further exposed to currency risk through non-monetary assets and liabilities of entities whose taxable profit or tax loss are denominated in non-US dollar currencies. Changes in exchange rates give rise to temporary differences resulting in deferred tax assets and liabilities with the resulting deferred tax charged or credited to income tax expense.

Goldcorp's financial risk management policy allows the hedging of foreign exchange exposure to reduce the risk associated with currency fluctuations. The Company enters into Mexican peso currency hedge contracts to purchase Mexican pesos at pre-determined US dollar amounts. These contracts are entered into to normalize operating expenses and capital expenditures at Peñasquito expressed in US dollar terms.

GOLDCORP | 6

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

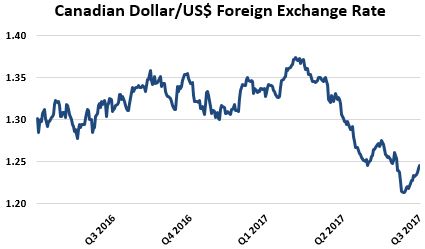

Currency markets continued to fluctuate in the third quarter of 2017. The Canadian dollar exhibited increased volatility during the third quarter of 2017, strengthening to a 2-year high against the US dollar in mid-September, as a result of two interest rate hikes from the Bank of Canada, and then falling back to $1.25 at the end of the quarter. The Mexican peso remained relatively stable during the quarter.

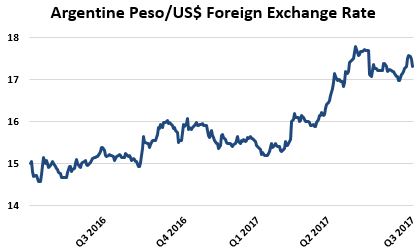

The Argentine peso continued its weakening trend, despite significant rallies throughout the quarter. This trend is due largely to concerns of inflation continuing to exceed the central bank target, and political uncertainty surrounding the legislative elections in October 2017.

(1) | Foreign Exchange Rate Sources: |

(a) | Canadian Dollar/US$: Bank of Canada Noon rate (July 1, 2016 - April 28, 2017), Bank of Canada Daily Average (April 29, 2017 - September 30, 2017) |

(b) | Mexican Peso/US$: Central Bank of Mexico Current Day Fixing |

(c) | Argentine Peso/US$: Central Bank of Argentina Current Day Fixing |

GOLDCORP | 7

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

OVERVIEW OF QUARTERLY FINANCIAL AND OPERATING RESULTS

September 30 | June 30 | March 31 | December 31 | |||||||||||||||||||||

2017 | 2016 | 2017 | 2016 | 2017 | 2016 | 2016 | 2015 | |||||||||||||||||

Financial Results | ||||||||||||||||||||||||

Revenues | $ | 866 | $ | 915 | $ | 822 | $ | 753 | $ | 882 | $ | 944 | $ | 898 | $ | 1,072 | ||||||||

Net earnings (loss) | $ | 111 | $ | 59 | $ | 135 | $ | (78 | ) | $ | 170 | $ | 80 | $ | 101 | $ | (4,271 | ) | ||||||

Net earnings (loss) per share | ||||||||||||||||||||||||

– Basic and diluted | $ | 0.13 | $ | 0.07 | $ | 0.16 | $ | (0.09 | ) | $ | 0.20 | $ | 0.10 | $ | 0.12 | $ | (5.14 | ) | ||||||

Operating cash flow | $ | 315 | $ | 267 | $ | 158 | $ | 234 | $ | 227 | $ | 59 | $ | 239 | $ | 401 | ||||||||

Adjusted operating cash flow (1) | $ | 308 | $ | 401 | $ | 320 | $ | 204 | $ | 315 | $ | 330 | $ | 306 | $ | 339 | ||||||||

Adjusted EBITDA (1), (2) | $ | 396 | $ | 477 | $ | 417 | $ | 266 | $ | 421 | $ | 396 | $ | 519 | $ | (4,595 | ) | |||||||

Expenditures on mining interests (cash basis) | $ | 291 | $ | 168 | $ | 233 | $ | 177 | $ | 186 | $ | 182 | $ | 217 | $ | 251 | ||||||||

– Sustaining | $ | 143 | $ | 112 | $ | 133 | $ | 140 | $ | 113 | $ | 140 | $ | 145 | $ | 188 | ||||||||

– Expansionary | $ | 148 | $ | 56 | $ | 100 | $ | 37 | $ | 73 | $ | 42 | $ | 72 | $ | 63 | ||||||||

Dividends paid | $ | 15 | $ | 14 | $ | 16 | $ | 16 | $ | 15 | $ | 51 | $ | 16 | $ | 49 | ||||||||

Operating Results (1) | ||||||||||||||||||||||||

Gold produced (thousands of ounces) | 633 | 715 | 635 | 613 | 655 | 784 | 761 | 909 | ||||||||||||||||

Gold sold (thousands of ounces) | 606 | 686 | 649 | 616 | 646 | 799 | 768 | 918 | ||||||||||||||||

Silver produced (thousands of ounces) | 7,000 | 7,700 | 7,400 | 5,300 | 7,100 | 7,700 | 7,400 | 10,200 | ||||||||||||||||

Copper produced (thousands of pounds) | 6,300 | 16,900 | 7,900 | 14,400 | 9,700 | 17,200 | 20,400 | 21,400 | ||||||||||||||||

Lead produced (thousands of pounds) | 38,300 | 33,700 | 26,100 | 17,100 | 32,400 | 29,000 | 29,600 | 40,500 | ||||||||||||||||

Zinc produced (thousands of pounds) | 98,400 | 75,200 | 84,100 | 38,300 | 80,700 | 71,100 | 78,300 | 89,300 | ||||||||||||||||

Average realized gold price (per ounce) | $ | 1,287 | $ | 1,333 | $ | 1,256 | $ | 1,277 | $ | 1,236 | $ | 1,203 | $ | 1,181 | $ | 1,098 | ||||||||

Cash costs: by-product (per ounce) (3) | $ | 483 | $ | 554 | $ | 510 | $ | 728 | $ | 540 | $ | 557 | $ | 481 | $ | 687 | ||||||||

Cash costs: co-product (per ounce) (4) | $ | 663 | $ | 657 | $ | 644 | $ | 716 | $ | 701 | $ | 604 | $ | 619 | $ | 739 | ||||||||

All-in sustaining costs (per ounce) | $ | 827 | $ | 812 | $ | 800 | $ | 1,067 | $ | 800 | $ | 836 | $ | 747 | $ | 977 | ||||||||

(1) | The Company has presented the non-GAAP performance measures on an attributable (or Goldcorp's share) basis in the table above. Adjusted operating cash flows, Adjusted EBITDA and AISC are non-GAAP financial performance measures with no standardized definition under IFRS. For further information and detailed reconciliations, please see pages 33-40 of this report. |

(2) | Adjusted EBITDA for the three months ended December 31, 2016 includes an impairment reversal of $49 million and for the three months ended December 31, 2015 includes an impairment charge of $4.9 billion. Please refer to the respective quarterly reports for other non-cash or other items that management believes are not reflective of the performance of the underlying operations. |

(3) | Total cash costs: by-product, per ounce, is calculated net of Goldcorp’s share of by-product sales revenues (by-product silver sales revenues for Cerro Negro, Marlin and Pueblo Viejo; by-product lead, zinc and copper sales revenues and 75% of silver sales revenues for Peñasquito at market silver prices, and 25% of silver sales revenues for Peñasquito at $4.13 per silver ounce (2016 – $4.09 per silver ounce) sold to Wheaton Precious Metals Corp. ("Wheaton") and by-product copper sales revenues for Alumbrera). |

(4) | Total cash costs: co-product, per ounce, is calculated by allocating Goldcorp’s share of production costs to each co-product (Alumbrera (copper); Marlin (silver); Pueblo Viejo (silver and copper); Peñasquito (silver, lead and zinc)) based on the ratio of actual sales volumes multiplied by budget metal prices (see page 33). |

GOLDCORP | 8

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

REVIEW OF THIRD QUARTER FINANCIAL RESULTS

Three months ended September 30, 2017 compared to the three months ended September 30, 2016

Net earnings for the three months ended September 30, 2017 were $111 million, or $0.13 per share, compared to net earnings of $59 million, or $0.07 per share, for the three months ended September 30, 2016. The increase in net earnings in the third quarter of 2017 compared to the same period in 2016 was primarily due to higher earnings from Peñasquito from higher gold and zinc production from metal recoveries and increases in zinc market prices, the impact of the Company's initiative to realize $250 million of sustainable annual efficiencies and an increase in the Company's income tax recovery compared to the same period in the prior year. These increases were partially offset by lower earnings from Red Lake as the mine focused on increased mine development and initiatives to enhance mining methods and rationalize the cost structure as it transitions to a lower grade mining environment, and a decrease in earnings from Pueblo Viejo due to lower ore grades attributable to the mining sequence.

Net earnings and earnings per share for the third quarter of 2017 were affected by a negative impact from the buildup of unsold gold at the end of the quarter and, for both the third quarter of 2017 and 2016, among other things, the following non-cash or other items that management believes are not reflective of the performance of the underlying operations (items are denoted as (increases)/decreases to net earnings and net earnings per share):

Three months ended September 30, 2017 | Three months ended September 30, 2016 | |||||||||||||||||

(in millions, except per share) | Pre-tax | After-tax | Per share ($/share) | Pre-tax | After-tax | Per share ($/share) | ||||||||||||

(Positive)/negative deferred tax effects of foreign exchange on tax assets and liabilities and losses (1) | $ | — | $ | (40 | ) | $ | (0.04 | ) | $ | — | $ | 22 | $ | 0.03 | ||||

Unrealized foreign exchange loss on Argentine peso denominated construction value-added tax receivable | $ | 2 | $ | 2 | $ | — | $ | 2 | $ | 2 | $ | — | ||||||

Restructuring costs | $ | 1 | $ | 1 | $ | — | $ | 6 | $ | 4 | $ | 0.01 | ||||||

(1) | Positive deferred tax effects of foreign exchange on tax assets and liabilities and losses of $40 million in the three months ended September 30, 2017 (three months ended September 30, 2016 – negative deferred tax effects of $22 million) was primarily comprised of a foreign exchange gain on the translation of current and deferred income tax assets and liabilities, arising primarily from acquisitions and dispositions, of $19 million (three months ended September 30, 2016 – foreign exchange loss of $30 million) and Argentine tax deductible foreign exchange losses on US dollar denominated debt in local currency of $21 million (three months ended September 30, 2016 – $8 million). |

Revenues

Three months ended September 30 | 2017 (1) | 2016 (1) | Change % | ||||||

Gold | |||||||||

Revenue (millions) | $ | 628 | $ | 716 | (12 | )% | |||

Ounces sold (thousands) | 490 | 537 | (9 | )% | |||||

Average realized price ($/ounce) | $ | 1,287 | $ | 1,336 | (4 | )% | |||

Silver | |||||||||

Revenue (millions) | $ | 90 | $ | 119 | (24 | )% | |||

Ounces sold (thousands) | 6,780 | 7,355 | (8 | )% | |||||

Average realized price ($/ounce) | $ | 14.01 | $ | 16.93 | (17 | )% | |||

Other metals | |||||||||

Revenue (millions) | $ | 148 | $ | 80 | 85 | % | |||

Total revenue (millions) | $ | 866 | $ | 915 | (5 | )% | |||

(1) | Excludes attributable share of revenues from the Company's associates. |

Revenues decreased by $49 million, or 5%, primarily due to decreases in gold and silver sales volumes of 9% and 8%, respectively, and decreases in the average realized gold and silver realized prices, partially offset by a 33% increase in the average realized zinc price and higher zinc sales volumes. The decrease in the gold sales volumes was primarily due to lower sales at Red Lake, due to lower tonnes and grade from the High Grade Zone, and the impact of the sale of Los Filos in April 2017 and closure of Marlin in the second quarter of 2017, offset partially by higher sales volumes at Peñasquito and Cerro Negro. The decrease in silver sales volumes was due to the closure of Marlin in the second quarter of 2017. The increase in zinc sales volumes was due to higher grade ore processed at Peñasquito.

GOLDCORP | 9

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

Production Costs

Production costs in the third quarter of 2017 decreased by $64 million, or 12%, when compared to the same period in the prior year primarily due to the closure of Marlin in the second quarter of 2017 ($49 million) and the divestiture of Los Filos in April 2017 ($32 million) and the impact of the Company's initiative to realize $250 million of sustainable annual efficiencies. These decreases were partially offset by higher costs at Cerro Negro due to the elimination of an export tax credit at the end of 2016 and the impact of inflation in Argentina out-pacing the devaluation of the Argentine peso.

Depreciation and Depletion

Three months ended September 30 | 2017 (1) | 2016 (1) | Change % | |||||

Depreciation and depletion (millions) | $ | 250 | $ | 267 | (6 | )% | ||

Sales ounces (thousands) | 490 | 537 | (9 | )% | ||||

Depreciation and Depletion per ounce | $ | 510 | $ | 497 | 3 | % | ||

(1) | Excludes attributable share of depreciation and depletion from the Company's associates. |

Depreciation and depletion decreased by $17 million, or 6%, mainly due to a decrease in sales volumes. The lower sales volumes were primarily due to lower sales at Red Lake and the impact of the sale of Los Filos in April 2017 and closure of Marlin in the second quarter of 2017, offset partially by higher sales volumes at Peñasquito and Cerro Negro.

Share of Net Earnings Related to Associates and Joint Venture

Three months ended September 30 | 2017 | 2016 | Change % | |||||

Pueblo Viejo | $ | 26 | $ | 47 | (45 | )% | ||

Alumbrera | — | — | — | % | ||||

NuevaUnión | 1 | — | — | % | ||||

Share of net earnings related to associates and joint venture | $ | 27 | $ | 47 | (43 | )% | ||

The Company’s share of earnings related to associates and joint venture decreased by $20 million in the third quarter of 2017 compared to the same period in the prior year primarily due to a decrease in net earnings from Pueblo Viejo due to lower grades attributable to the mining sequence. Higher grade ore is expected in the fourth quarter of 2017. With respect to Alumbrera, the Company has discontinued recognizing its share of earnings or losses of Alumbrera since impairing the investment to nil in 2015, and did not recognize its share of earnings of Alumbrera for the three months ended September 30, 2017 as future earnings will be recognized only after the Company's provision to fund its share of Alumbrera's reclamation costs is fully reversed. At September 30, 2017, the balance of the Company's provision to fund its share of Alumbrera's reclamation costs was $42 million.

Corporate Administration

Corporate administration expenses decreased by $2 million in the third quarter of 2017 compared to the third quarter of 2016, primarily due to lower employee compensation expense as a result of the impact of cost savings initiatives undertaken in 2016 and the first quarter of 2017 to restructure and decentralize the Company's operating model.

Restructuring Costs

Restructuring costs were $1 million in the three months ended September 30, 2017 compared to $6 million in the third quarter of 2016. Restructuring costs in 2017 have been lower than 2016 as the majority of the workforce reductions from the decentralization initiative at several mine site and corporate offices were executed in 2016.

Other Income/Expense

Other expense of $1 million for the three months ended September 30, 2017 was comprised primarily of foreign exchange losses arising from value added tax receivables denominated in Argentine pesos, net of foreign exchange gains on Canadian dollar cash balances, partially offset by gains on dispositions of securities and interest income on loans held with Pueblo Viejo. Other income of $5 million for the three months ended September 30, 2016 related primarily to interest income on loans held with Pueblo Viejo and short-term money market investments and gains on dispositions of investments in securities, offset partially by foreign exchange losses arising primarily on value added tax receivables denominated in Mexican and Argentine pesos.

GOLDCORP | 10

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

Income Tax Recovery

Income tax recovery for the three months ended September 30, 2017 of $19 million represented a negative 21% rate (three months ended September 30, 2016 – income tax expense of $30 million representing a 34% rate) and was impacted by:

• | $19 million foreign exchange gains on the translation of deferred income tax assets and liabilities arising primarily from acquisitions, compared to $30 million foreign exchange losses for the three months ended September 30, 2016; and |

• | A higher effective tax rate in the third quarter of 2017 compared to the third quarter of 2016, after adjusting for the above noted item and non-deductible share-based compensation expense. The increase in the effective tax rate in the third quarter of 2017 was primarily due to lower after-tax income from associates that is not subject to further income tax, compared to the three months ended September 30, 2016, which was partially offset by higher tax deductible Argentine Peso foreign exchange losses on US dollar denominated debt, compared to the three months ended September 30, 2016. |

AISC

AISC were $827 per ounce (1) for the three months ended September 30, 2017, compared to $812 per ounce for the three months ended September 30, 2016. The increase in AISC was primarily due to lower gold sales ($109 per ounce) and higher sustaining capital ($50 per ounce), mainly offset by lower production costs ($122 per ounce) and the impact of by-product production and market prices ($20 per ounce). The increase in sustaining capital was primarily due to costs associated with the tailings dam raise at Peñasquito and higher sustaining capital expenditures at Éléonore as a result of a planned increase in development rates and expenditures on the tailings cell and expansion of the waste pad.

(1) | AISC per ounce is a non-GAAP financial performance measure with no standardized definition under IFRS. For further information and detailed reconciliations, please see pages 33-40 of this report. |

GOLDCORP | 11

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

REVIEW OF THIRD QUARTER FINANCIAL RESULTS

Nine months ended September 30, 2017 compared to the nine months ended September 30, 2016

Net earnings for the nine months ended September 30, 2017 were $416 million, or $0.48 per share, compared to net earnings of $61 million, or $0.07 per share, for the nine months ended September 30, 2016. The increase in net earnings for the nine months ended September 30, 2017 compared to the same period in 2016 was primarily due to higher earnings from Peñasquito from increases in zinc market prices and higher gold and zinc production from higher metal recoveries and higher ore grades, the impact of the Company's initiative to realize $250 million of sustainable annual efficiencies, and an increase in the Company's income tax recovery compared to the same period in the prior year. These increases were partially offset by lower earnings from Red Lake as the mine focused on increased mine development and initiatives to enhance mining methods and rationalize the cost structure as it transitions to a lower grade mining environment, and lower earnings at Porcupine due to increases in mine development expenses and depreciation and depletion expense related to the Hoyle Deep winze. The sale of Los Filos and closure of Marlin, on a combined basis, did not have a significant impact on results for the nine month period September 30, 2017 compared to the same period in the prior year.

Net earnings and earnings per share for the nine months ended September 30, 2017 were affected by a negative impact from the buildup of unsold gold at the end of the September 2017 and, for both the nine months ended September 30, 2017 and 2016, among other things, the following non-cash or other items that management believes are not reflective of the performance of the underlying operations (items are denoted as (increases)/decreases to net earnings and net earnings per share):

Nine months ended September 30, 2017 | Nine months ended September 30, 2016 | |||||||||||||||||

(in millions, except per share) | Pre-tax | After-tax | Per share ($/share) | Pre-tax | After-tax | Per share ($/share) | ||||||||||||

Reduction in the Company's obligation to fund its share of Alumbrera's reclamation costs (1) | $ | (26 | ) | $ | (26 | ) | $ | (0.03 | ) | $ | — | $ | — | $ | — | |||

(Positive)/negative deferred tax effects of foreign exchange on tax assets and liabilities and losses (2) | $ | — | $ | (146 | ) | $ | (0.17 | ) | $ | — | $ | 42 | $ | 0.05 | ||||

Restructuring costs | $ | 4 | $ | 3 | $ | — | $ | 45 | $ | 32 | $ | 0.04 | ||||||

Unrealized foreign exchange loss on Argentine peso denominated construction value-added tax receivable | $ | 5 | $ | 5 | $ | — | $ | 22 | $ | 22 | $ | 0.03 | ||||||

(1) | $7 million of the $33 million reduction in the Company's provision to fund its share of Alumbrera’s reclamation costs relates to Alumbrera's financial performance for the nine months ended September 30, 2017 and is therefore considered reflective of the performance of the Company's underlying operations. |

(2) | Positive deferred tax effects of foreign exchange on tax assets and liabilities and losses of $146 million in the nine months ended September 30, 2017 (nine months ended September 30, 2016 – negative deferred tax effects of $42 million) was primarily comprised of a foreign exchange gain on the translation of current and deferred income tax assets and liabilities, arising primarily from acquisitions and dispositions, of $100 million (nine months ended September 30, 2016 – foreign exchange loss of $121 million) and Argentine tax deductible foreign exchange losses on US dollar denominated debt in local currency of $46 million (nine months ended September 30, 2016 – $79 million). |

Revenues

Nine months ended September 30 | 2017 (1) | 2016 (1) | Change % | ||||||

Gold | |||||||||

Revenue (millions) | $ | 1,916 | $ | 2,148 | (11 | )% | |||

Ounces sold (thousands) | 1,526 | 1,699 | (10 | )% | |||||

Average realized price | $ | 1,259 | $ | 1,266 | (1 | )% | |||

Silver | |||||||||

Revenue (millions) | $ | 282 | $ | 289 | (2 | )% | |||

Ounces sold (thousands) | 20,730 | 19,525 | 6 | % | |||||

Average realized price | $ | 14.27 | $ | 15.45 | (8 | )% | |||

Other metals | |||||||||

Revenue (millions) | $ | 372 | $ | 175 | 113 | % | |||

Total revenue (millions) | $ | 2,570 | $ | 2,612 | (2 | )% | |||

(1) | Excludes attributable share of revenues from the Company's associates. |

GOLDCORP | 12

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

Revenues for the nine months ended September 30, 2017 were generally consistent with the same period in the prior year as the $232 million decrease in gold revenues was mostly offset by an increase of approximately $195 million in zinc and lead revenue. The decrease in gold revenues was primarily due to lower sales volumes at Red Lake, due to lower tonnes and grade from the High Grade Zone, and the impact of the sale of Los Filos in April 2017 and closure of Marlin in the second quarter of 2017, offset partially by higher sales volumes at Peñasquito. The increase in zinc and lead revenue were due to increases in the average realized prices of 39% and 28%, respectively, and increases in sales volumes of 41% and 24%, respectively. The increase in zinc and lead sales volumes was due to higher grade ore, tonnes milled and metal recoveries at Peñasquito.

Production Costs

Production costs for the nine months ended September 30, 2017 decreased by $115 million, or 7%, when compared to the same period in the prior year, primarily due to the divestiture of Los Filos in April 2017, including the impact of lower production prior to its sale ($102 million), and the closure of Marlin in the second quarter of 2017 ($88 million). These decreases were partially offset by higher costs at Peñasquito ($49 million) due to higher fuel prices as a result of the deregulation of the fuel markets and a one-time $12 million charge to the oxide heap leach operation which was recognized in the first quarter of 2017, higher costs at Porcupine ($12 million) due to an increase in expensed mine development costs and higher costs at Cerro Negro ($9 million) due to the elimination of an export tax credit at the end of 2016 and the impact of inflation in Argentina out-pacing the devaluation of the Argentine peso, which more than offset the cost reductions from employee and contractor reductions. Production costs in 2016 were also lower comparatively due to a prolonged period of planned and unplanned maintenance at Peñasquito during the second quarter of 2016.

Depreciation and Depletion

Nine months ended September 30 | 2017 (1) | 2016 (1) | Change % | |||||

Depreciation and depletion (millions) | $ | 735 | $ | 770 | (5 | )% | ||

Sales ounces (thousands) | 1,526 | 1,699 | (10 | )% | ||||

Depreciation and Depletion per ounce | $ | 482 | $ | 453 | 6 | % | ||

(1) | Excludes attributable share of depreciation and depletion from the Company's associates. |

Depreciation and depletion decreased by $35 million, or 5%, mainly due to lower sales volumes, offset partially by the impact of incremental depletion from the Hoyle Deep winze at Porcupine which finished construction in 2016. The lower sales volumes were primarily due to lower sales at Red Lake and the impact of the sale of Los Filos in April 2017 and closure of Marlin in the second quarter of 2017, offset partially by higher sales volumes at Peñasquito.

Share of Net Earnings Related to Associates and Joint Venture

Nine months ended September 30 | 2017 | 2016 | Change % | |||||

Pueblo Viejo | $ | 94 | $ | 109 | (14 | )% | ||

Alumbrera | 33 | — | – | |||||

NuevaUnión | 1 | 2 | (50 | )% | ||||

Share of net earnings related to associates and joint venture | $ | 128 | $ | 111 | 15 | % | ||

The Company’s share of earnings related to associates and joint venture increased by $17 million in the third quarter of 2017 compared to the same period in the prior year primarily due to a $33 million reduction in the Company's provision to fund its share of Alumbrera’s reclamation costs in the first quarter of 2017, which was classified as Share of Net Earnings Related to Associates and Joint Venture, offset partially by a $15 million decrease in net earnings from Pueblo Viejo. The reduction in the provision for Alumbrera reflected the expectation that Alumbrera will be able to fund a greater portion of its reclamation costs than previously estimated due to improved financial results, primarily as a result of higher realized copper prices. At December 31, 2015, the Company recognized an impairment of its investment in Alumbrera, resulting in the carrying amount of its interest being reduced to zero, and recognized a $75 million provision to fund its share of Alumbrera's reclamation costs. Since then, the Company discontinued recognizing its share of losses of Alumbrera and did not recognize its share of earnings of Alumbrera for the nine months ended September 30, 2017 as future earnings will be recognized only after the Company's provision to fund its share of Alumbrera's reclamation costs is fully reversed. The decrease in net earnings from Pueblo Viejo was primarily due to lower grades in the third quarter of 2017, attributable to the mining sequence. Higher grade ore is expected in the fourth quarter of 2017.

GOLDCORP | 13

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

Impairment reversal/expense

The Company recorded a net impairment reversal of $3 million in the nine months ended September 30, 2017. The net impairment reversal was comprised of a reversal of impairment at Cerro Blanco of $19 million, which was based on the expected proceeds from the sale to Bluestone Resources Inc. being greater than the carrying value of the asset, partially offset by an impairment expense at Los Filos of $16 million, based on changes to the carrying value of the Los Filos assets sold to Leagold Mining Corporation ("Leagold").

Corporate Administration

Corporate administration expenses decreased by $37 million in the nine months ended September 30, 2017 compared to the same period in the prior year, primarily due to lower employee compensation expense as a result of the impact of cost savings initiatives undertaken in 2016 and the first quarter of 2017 to restructure and decentralize the Company's operating model.

Restructuring Costs

Restructuring costs were $4 million for the nine months ended September 30, 2017 compared to $45 million for the nine months ended September 30, 2016. Restructuring costs in 2017 have been lower than 2016 as the majority of the workforce reductions from the decentralization initiative at several mine site and corporate offices were executed in 2016.

Other Income/Expense

Other income of $22 million for the nine months ended September 30, 2017 was comprised primarily of interest income on loans held with Pueblo Viejo, gains on dispositions of investments in securities and foreign exchange gains arising primarily on cash balances denominated in Canadian dollars and Mexican pesos and value added tax receivables denominated in Mexican pesos, offset partially by foreign exchange losses on accounts payable denominated in Mexican pesos and value added tax receivables denominated in Argentine pesos. Other expense of $1 million for the nine months ended September 30, 2016 was comprised of a $59 million foreign exchange loss arising primarily on value added tax receivables denominated in Argentine and Mexican pesos which was offset partially by $38 million of interest income on loans held with Pueblo Viejo and short term money market investments and gains of $22 million on dispositions of investments in securities.

Income Tax Expense/Recovery

Income tax recovery for the nine months ended September 30, 2017 of $124 million represented a negative 42% rate (nine months ended September 30, 2016 – income tax recovery of $22 million representing a 27% rate) and was impacted by:

• | $100 million foreign exchange gains on the translation of deferred income tax assets and liabilities arising primarily from acquisitions, compared to $121 million foreign exchange losses for the nine months ended September 30, 2016; and |

• | A lower effective tax rate in the first nine months of 2017 compared to the first nine months of 2016, after adjusting for the above noted item and non-deductible share-based compensation expense. The decrease in the effective tax rate for the first nine months of 2017 was primarily due to higher after-tax income from associates that is not subject to further income tax compared to the nine months ended September 30, 2016, which was partially offset by lower tax deductible Argentine Peso foreign exchange losses on US dollar denominated debt, compared to the nine months ended September 30, 2016. |

AISC

AISC were $808 per ounce(1) for the nine months ended September 30, 2017, compared to $896 per ounce for the nine months ended September 30, 2016. The decrease in AISC was primarily due to the higher by-product production at Peñasquito and by-product prices ($93 per ounce), lower production costs ($61 per ounce), lower Corporate Administration costs ($18 per ounce), and lower sustaining capital ($4 per ounce) partially offset by lower gold sales ($95 per ounce).

(1) | AISC per ounce is a non-GAAP financial performance measure with no standardized definition under IFRS. For further information and detailed reconciliations, please see pages 33-40 of this report. |

GOLDCORP | 14

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

FINANCIAL POSITION AND LIQUIDITY

The following table summarizes Goldcorp's cash flow activity:

Three Months Ended September 30 | Nine Months Ended September 30 | |||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||

Cash flow | ||||||||||||

From continuing operations provided by operating activities | $ | 315 | $ | 267 | $ | 700 | $ | 560 | ||||

From continuing operations used in investing activities | (239 | ) | (111 | ) | (742 | ) | (436 | ) | ||||

From continuing operations (used) provided by financing activities | (1 | ) | (144 | ) | 20 | (110 | ) | |||||

(Decrease) Increase in cash and cash equivalents | 75 | 12 | (22 | ) | 14 | |||||||

Cash and cash equivalents, beginning of period | 80 | 328 | 157 | 326 | ||||||||

Decrease in cash and cash equivalents reclassified as held for sale | — | — | 20 | — | ||||||||

Cash and cash equivalents, end of period | $ | 155 | $ | 340 | $ | 155 | $ | 340 | ||||

Cash flow provided by operating activities for the three and nine months ended September 30, 2017 increased by $48 million and $140 million, respectively, compared to the same periods in the prior year, primarily due to positive changes in non-cash working capital of $89 million and $106 million, respectively. The positive changes in non-cash working capital for both periods were primarily due to timing of payments. Changes in the Company's non-cash working capital can be significantly impacted by the timing of value added tax (“VAT”) refunds received from taxing authorities in the various jurisdictions in which the Company operates, including Mexico and Argentina, as the timing of refunds are dependent upon many factors. In June 2017, the Mexican government’s tax authority indicated that it had experienced an increase in VAT refund requests and as a result had commenced more in-depth assessments of the requests which resulted in the Company not receiving any VAT refunds from the Mexican government in the second quarter and receiving only $6 million in the third quarter of 2017 (second quarter of 2016 - $30 million; third quarter of 2016 - $28 million). Subsequent to September 30, 2017, the Company received VAT refund proceeds of $85 million and $27 million from the Mexican and Argentinian tax authorities, respectively.

The increase in cash flow used in investing activities for the three months ended September 30, 2017 compared to the three months ended September 30, 2016 was primarily due to increases in expenditures on mining interest as noted below, offset partially by the payment by Leagold to the Company of the $29 million promissory note which formed part of the proceeds on the sale of Los Filos.

The increase in cash flow used in investing activities for the nine months ended September 30, 2017 compared to the nine months ended September 30, 2016 was mainly due to $266 million, including transaction costs, paid to acquire Kinross' 25% interest in the Cerro Casale project, increases in expenditures on mining interests as noted below and the purchase of a 4% gold stream on the El Morro deposit, part of the Company's NuevaUnión joint venture, from New Gold Inc. for $65 million. These increases were offset partially by $271 million, net of transaction costs and cash disposed, received on the sale of Los Filos and Cerro Blanco. Further, the Company received a principal repayment from Pueblo Viejo of $43 million, which partially offset purchases of securities and interest paid in the period of $58 million.

Expenditures on mining interests (including deposits on mining interest expenditures) were as follows:

Three Months Ended September 30 | Nine Months Ended September 30 | |||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||

Peñasquito | $ | 151 | $ | 47 | $ | 304 | $ | 167 | ||||

Cerro Negro | 20 | 24 | 58 | 75 | ||||||||

Red Lake | 18 | 21 | 55 | 76 | ||||||||

Éléonore | 25 | 23 | 83 | 62 | ||||||||

Porcupine | 24 | 11 | 74 | 41 | ||||||||

Musselwhite | 11 | 7 | 36 | 19 | ||||||||

Other | 16 | 21 | 56 | 53 | ||||||||

Total | $ | 265 | $ | 154 | $ | 666 | $ | 493 | ||||

The increase in expenditures on mining interests during the three and nine months ended September 30, 2017 compared to the same periods in the prior year was due primarily to increases in expansionary capital of $92 million and $186 million, respectively, related to the construction of the Pyrite Leach Project at Peñasquito, the development ramp at Borden and the Material Handling Project at Musselwhite.

GOLDCORP | 15

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

The decrease of $143 million in cash used in financing activities during the three months ended September 30, 2017 as compared to the three months ended September 30, 2016 was primarily due to a $16 million draw on the credit facility in the three months ended September 30, 2017, compared to a repayment of $125 million in the three months ended September 30, 2016. The increase of $130 million in cash provided by financing activities during the nine months ended September 30, 2017 as compared to the same period in the prior year was primarily due to a $70 million draw on the credit facility in the nine months ended September 30, 2017 compared to a draw of nil in the same period in the prior year, combined with a $35 million decrease in dividends paid in the nine months ended September 30, 2017 compared to the same period in 2016. Effective April 1, 2016, the Company’s Board of Directors reduced the annual dividend to $0.08 per share and amended the dividend payment schedule such that dividends were paid quarterly commencing in June 2016.

On June 22, 2017, the Company completed the extension of its $3.0 billion credit facility term by one year to June 22, 2022. The unsecured, floating-rate facility bears interest at LIBOR plus 150 points when drawn, based on Goldcorp's current bond ratings, and is intended to be used for liquidity and general corporate purposes.

At September 30, 2017, the Company's adjusted net debt was $2.2 billion(1), consistent with the adjusted net debt balance at December 31, 2016. During the third quarter of 2017, the Pueblo Viejo joint venture repaid the remainder of the project finance facility. At September 30, 2017, excluding cash and cash equivalents held at associates of $156 million, the Company had $3.1 billion of available liquidity, comprised of $195 million of cash and cash equivalents and short term investments, and $2.9 billion available on its $3.0 billion credit facility.

The Company may from time to time seek to retire or repurchase its outstanding debt in open market purchases, privately negotiated transactions or otherwise. Such repurchases, if any, will depend upon prevailing market conditions, the Company's liquidity requirements, contractual restrictions and other factors. The amount of debt retired or repurchased may be material.

(1) | The Company has presented the non-GAAP performance measures on an attributable (or Goldcorp's share) basis. Adjusted net debt is non-GAAP financial performance measure with no standardized definition under IFRS. For further information, please see pages 33-40 of this report. |

Outstanding Share Data

As at October 25, 2017, there were 867 million common shares of the Company issued and outstanding and 7 million stock options outstanding, which are exercisable into common shares at exercise prices ranging between C$20.27 per share to C$33.48 per share, and 3 million restricted share units outstanding.

GUIDANCE (1)

2017 Guidance

Consistent with Goldcorp’s focus on profitable ounces and growing NAV per share, 2017 gold production is expected to be 2.5 million ounces (+/- 5%), in line with previous 2017 guidance.

Due to the focus on capital management discipline as part of the Company's $250 million sustainable annual efficiency program, the Company expects sustaining capital expenditures of $600 million for 2017 (+/- 5%), a reduction of $100 million compared to the Company's original guidance. Expansionary capital is also forecasted to be lower at $550 million (+/- 5%), a $50 million decrease compared to the Company's original guidance. In the second quarter of 2017, the Company's AISC guidance was reduced from $850 per ounce to $825 per ounce (+/- 5%). Total cash costs on a by-product basis are still expected to be $500 per ounce (+/- 5%) (2).

Company-wide exploration expenditures in 2017 are still expected to total $100 million, of which approximately 40% is expected to be expensed. Corporate administration expense is expected to be approximately $160 million, which includes share-based compensation of approximately $50 million. Depreciation and depletion expense is expected to be $425 per ounce. The effective tax rate on net income before share-based compensation is expected to be approximately 40%.

Five-Year Forecast

The Company’s five year outlook is focused on growing production by 20% to 3 million ounces, reducing AISC by 20% to $700 per ounce and growing gold reserves by 20% to 60 million ounces. Year-by-year gold production and AISC are forecast as follows:

Year | Gold Production (oz) (3) (+/-5%) | AISC ($/oz) (2), (4) (+/-5%) |

2017 | 2,500,000 | $825 |

2018 | 2,500,000 | $800 |

2019 | 2,700,000 | $750 |

2020 | 3,000,000 | $700 |

2021 | 3,000,000 | $700 |

GOLDCORP | 16

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

(1) | Guidance projections (“Guidance”) are considered “forward-looking statements” and represent management’s good faith estimates or expectations of future production results as of the date hereof. Guidance is based upon certain assumptions, including, but not limited to, metal prices, oil prices, certain exchange rates and other assumptions. Such assumptions may prove to be incorrect and actual results may differ materially from those anticipated. Consequently, Guidance cannot be guaranteed. As such, investors are cautioned not to place undue reliance upon Guidance and forward-looking statements as there can be no assurance that the plans, assumptions or expectations upon which they are placed will occur. See the "Cautionary Statement Regarding Forward-Looking Statements". |

(2) | The Company has presented the non-GAAP performance measures on an attributable (or Goldcorp's share) basis. AISC per ounce and cash costs: by-product are non-GAAP financial performance measures with no standardized definition under IFRS. For further information, please see pages 33-40 of this report. |

(3) | The assumptions below were used to forecast total cash costs and gold equivalent ounces: |

2017 - 2018 | 2019 - 2021 | |

Gold (oz) | $1,250 | $1,250 |

Silver (oz) | $19.00 | $19.00 |

Copper (lb) | $2.25 | $2.25 |

Zinc (lb) | $1.00 | $0.90 |

Lead (lb) | $0.89 | $0.80 |

Foreign exchange (respectively to the US$) | ||

Canadian dollar | $1.30 | $1.30 |

Mexican peso | 19.00 | 16.25 |

(4) | The Company’s projected AISC are not based on GAAP total production cash costs, which forms the basis of the Company’s cash costs: by-product. The projected range of AISC is anticipated to be adjusted to include sustaining capital expenditures, corporate administrative expense, mine-site exploration and evaluation costs and reclamation cost accretion and amortization, and exclude the effects of expansionary capital, non-sustaining expenditures, tax payments, dividends and financing costs. Projected GAAP total production cash costs for the full year would require inclusion of the projected impact of future included and excluded items, including items that are not currently determinable, but may be significant, such as sustaining capital expenditures, reclamation cost accretion and amortization and tax payments. Due to the uncertainty of the likelihood, amount and timing of any such items, the Company does not have information available to provide a quantitative reconciliation of projected AISC to a total production cash costs projection. |

OPERATIONAL REVIEW

The Company’s principal producing mining properties are comprised of the Peñasquito mine in Mexico; the Cerro Negro mine in Argentina; the Pueblo Viejo mine (40.0% interest) in the Dominican Republic and the Red Lake, Éléonore, Porcupine, and Musselwhite mines in Canada.

Operating results of operating segments are reviewed by the Company's chief operating decision maker ("CODM") to make decisions about resources to be allocated to the segments and to assess their performance. The Company considers each individual mine site as an operating segment for financial reporting purposes except as noted below.

Following the Company's acquisition and divestitures and the closure of the Marlin mine during the three months ended June 30, 2017, the Company reassessed its segments for financial reporting purposes. The Company concluded that Marlin and Los Filos were no longer operating segments and are included in Other; they were previously included in the Other mines operating segment. The Company's 37.5% interest in Alumbrera, which was previously reported as Other associate, and the Company's interest in Leagold, are also presented in Other, because their financial results do not meet the quantitative threshold required for segment disclosure purposes. Prior periods have been re-presented to reflect the current presentation.

The Company’s 100% interests in the Cochenour and Borden projects in Canada are included in the Red Lake and Porcupine reportable operating segments, respectively. The Company's 50% interests in the NuevaUnión and the Cerro Casale/Caspiche projects in Chile, and 100% interest in the Coffee project in the Yukon, are included in Other.

The Company’s principal product is gold bullion which is sold primarily in the London spot market. Concentrate produced at Peñasquito and Alumbrera, containing both gold and by-product metals, is sold to third party smelters and traders.

GOLDCORP | 17

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

Segmented Financial and Operating Highlights

Three months ended September 30 | Revenue ($ millions) | Gold produced (000's of ounces) | Gold sold (000's of ounces) | Total cash costs: by-product ($/oz) (1), (4) | AISC ($/oz) (3), (4) | Earnings (loss) from operations ($ millions) | |||||||

Peñasquito | 2017 | 395 | 133 | 133 | (168 | ) | 288 | 118 | |||||

2016 | 289 | 121 | 100 | 423 | 777 | 22 | |||||||

Cerro Negro | 2017 | 166 | 115 | 118 | 510 | 712 | 15 | ||||||

2016 | 147 | 96 | 99 | 450 | 651 | 26 | |||||||

Red Lake | 2017 | 49 | 43 | 38 | 981 | 1,417 | (6 | ) | |||||

2016 | 111 | 84 | 82 | 516 | 775 | 34 | |||||||

Éléonore | 2017 | 95 | 77 | 74 | 802 | 1,067 | — | ||||||

2016 | 87 | 68 | 66 | 876 | 970 | (4 | ) | ||||||

Porcupine | 2017 | 89 | 75 | 70 | 758 | 978 | (4 | ) | |||||

2016 | 85 | 64 | 64 | 758 | 947 | 17 | |||||||

Musselwhite | 2017 | 72 | 58 | 57 | 587 | 674 | 25 | ||||||

2016 | 79 | 59 | 58 | 626 | 753 | 26 | |||||||

Other mines (2) | 2017 | — | — | — | — | — | — | ||||||

2016 | 117 | 73 | 68 | 816 | 983 | 2 | |||||||

Other (3) | 2017 | — | — | — | — | 78 | (24 | ) | |||||

2016 | — | — | — | — | 75 | (6 | ) | ||||||

Total before associates and joint venture | 2017 | 866 | 501 | 490 | 451 | 835 | 124 | ||||||

2016 | 915 | 565 | 537 | 609 | 917 | 117 | |||||||

Pueblo Viejo (4) | 2017 | 128 | 101 | 95 | 452 | 612 | 44 | ||||||

2016 | 175 | 126 | 127 | 376 | 454 | 61 | |||||||

Other mines (2) | 2017 | 42 | 31 | 21 | 1,361 | 1,611 | (20 | ) | |||||

2016 | 61 | 24 | 22 | 237 | 330 | 21 | |||||||

Attributable segment total (4) | 2017 | 1,036 | 633 | 606 | 483 | 827 | 148 | ||||||

2016 | 1,151 | 715 | 686 | 554 | 812 | 199 | |||||||

GOLDCORP | 18

Third Quarter Report – 2017

(in United States dollars, tabular amounts in millions, except where noted)

Nine months ended September 30 | Revenue ($ millions) | Gold produced (000's of ounces) | Gold sold (000's of ounces) | Total cash costs: by-product ($/oz) (1), (4) | AISC ($/oz) (3), (4) | Earnings (loss) from operations ($ millions) | |||||||

Peñasquito | 2017 | 1,086 | 393 | 404 | (18 | ) | 336 | 302 | |||||

2016 | 682 | 282 | 264 | 678 | 1,252 | (1 | ) | ||||||

Cerro Negro | 2017 | 436 | 322 | 313 | 487 | 689 | 44 | ||||||

2016 | 442 | 297 | 312 | 443 | 633 | 75 | |||||||

Red Lake | 2017 | 189 | 150 | 150 | 879 | 1,206 | (9 | ) | |||||

2016 | 301 | 236 | 237 | 574 | 853 | 59 | |||||||

Éléonore | 2017 | 269 | 221 | 214 | 846 | 1,115 | (13 | ) | |||||

2016 | 264 | 209 | 209 | 845 | 951 | (19 | ) | ||||||

Porcupine | 2017 | 241 | 196 | 192 | 791 | 1,012 | (12 | ) | |||||

2016 | 267 | 211 | 212 | 675 | 872 | 64 | |||||||

Musselwhite | 2017 | 210 | 169 | 168 | 652 | 789 | 63 | ||||||

2016 | 234 | 186 | 186 | 548 | 671 | 80 | |||||||

Other mines (2) | 2017 | 139 | 83 | 85 | 738 | 795 | (9 | ) | |||||

2016 | 422 | 281 | 279 | 782 | 922 | 9 | |||||||

Other (3) | 2017 | — | — | — | — | 70 | 9 | ||||||

2016 | — | — | — | — | 81 | (82 | ) | ||||||

Total before associates and joint venture | 2017 | 2,570 | 1,534 | 1,526 | 512 | 851 | 375 | ||||||

2016 | 2,612 | 1,702 | 1,699 | 643 | 980 | 185 | |||||||

Pueblo Viejo (4) | 2017 | 403 | 311 | 304 | 403 | 525 | 137 | ||||||

2016 | 439 | 340 | 335 | 398 | 488 | 148 | |||||||