Form DEFA14A Walt Disney Co

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material under §240.14a-12 |

The Walt Disney Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

THE CURRENT DISNEY BOARD IS THE RIGHT BOARD FOR SHAREHOLDERS January 17, 2023

Disclaimer Forward-Looking Statements This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding mandates, the future, business and strategic plans, financial performance and other statements that are not historical in nature. These statements are made on the basis of the Company’s views and assumptions regarding future events and business performance and plans as of the time the statements are made. The Company does not undertake any obligation to update these statements unless required by applicable laws or regulations, and you should not place undue reliance on forward-looking statements. Actual results may differ materially from those expressed or implied. Such differences may result from actions taken by the Company, including restructuring or strategic initiatives or other business decisions, as well as from developments beyond the Company’s control, including: further deterioration in domestic and global economic conditions; deterioration in or pressures from competitive conditions; consumer preferences and acceptance of our content, offerings, pricing model and price increases and the market for advertising sales on our DTC services and linear networks; health concerns and their impact on our businesses; international, regulatory, political or military developments; technological developments; labor markets and activities; adverse weather conditions or natural disasters; legal or regulatory changes; each such risk includes the current and future impacts of, and is amplified by, COVID-19 and related mitigation efforts. Such developments may further affect entertainment, travel and leisure businesses generally and may, among other things, affect (or further affect, as applicable): our operations, business plans or profitability; and demand for our products and services. Additional factors are set forth in the Company’s Annual Report on Form 10-K for the year ended October 1, 2022 under the captions “Risk Factors,” “Management’s Discussion and Analysis,” and “Business,” and subsequent filings with the Securities and Exchange Commission, including, among others, quarterly reports on Form 10-Q. Additional Information and Where to Find it Disney has filed with the SEC a preliminary proxy statement on Schedule 14A, containing a form of WHITE proxy card, with respect to its solicitation of proxies for Disney’s 2023 Annual Meeting of Shareholders. The proxy statement is in preliminary form and Disney intends to file and mail a definitive proxy statement to stockholders of Disney. This communication is not a substitute for any proxy statement or other document that Disney has filed or may file with the SEC in connection with any solicitation by Disney. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY DISNEY AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Investors and security holders may obtain copies of these documents and other documents filed with the SEC by Disney free of charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by Disney are also available free of charge by accessing Disney’s website at www.thewaltdisneycompany.com. Participants in the Solicitation This communication is neither a solicitation of a proxy or consent nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, Disney, its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies with respect to a solicitation by Disney. Information about Disney’s executive officers and directors is available in Disney’s preliminary proxy statement for its 2023 Annual Meeting, which was filed with the SEC on January 17, 2023, and will be included in Disney’s definitive proxy statement, once available. To the extent holdings of Disney securities reported in the proxy statement for the 2023 Annual Meeting have changed, such changes have been or will be reflected on Statements of Change in Ownership on Forms 3, 4 or 5 filed with the SEC. These documents are or will be available free of charge at the SEC’s website at www.sec.gov. Non-GAAP Financial Measures This presentation presents EBITDA, net debt and net leverage, all of which are important financial measures for the Company, but are not financial measures prepared in accordance with GAAP. These measures should be reviewed in conjunction with the most comparable GAAP financial measures and are not presented as alternative measures of total debt, segment operating income or cash provided by continuing operations as determined in accordance with GAAP. EBITDA and net leverage as we have calculated them may not be comparable to similarly titled measures reported by other companies. The Company defines EBITDA as segment operating income minus corporate and unallocated shared expenses plus depreciation and amortization plus equity-based compensation minus minority interest. EBITDA is used in the calculation of net leverage defined below. The Company defines net debt as total borrowings less net debt issuance discounts, costs and purchase accounting adjustments less cash and cash equivalents. Net debt is used in the calculation of net leverage defined below. The Company uses net leverage (net debt divided by EBITDA) to regularly assess its capital structure and make decisions related to capital allocation. Net leverage is commonly used by investors and other market participants to evaluate and compare leverage between companies.

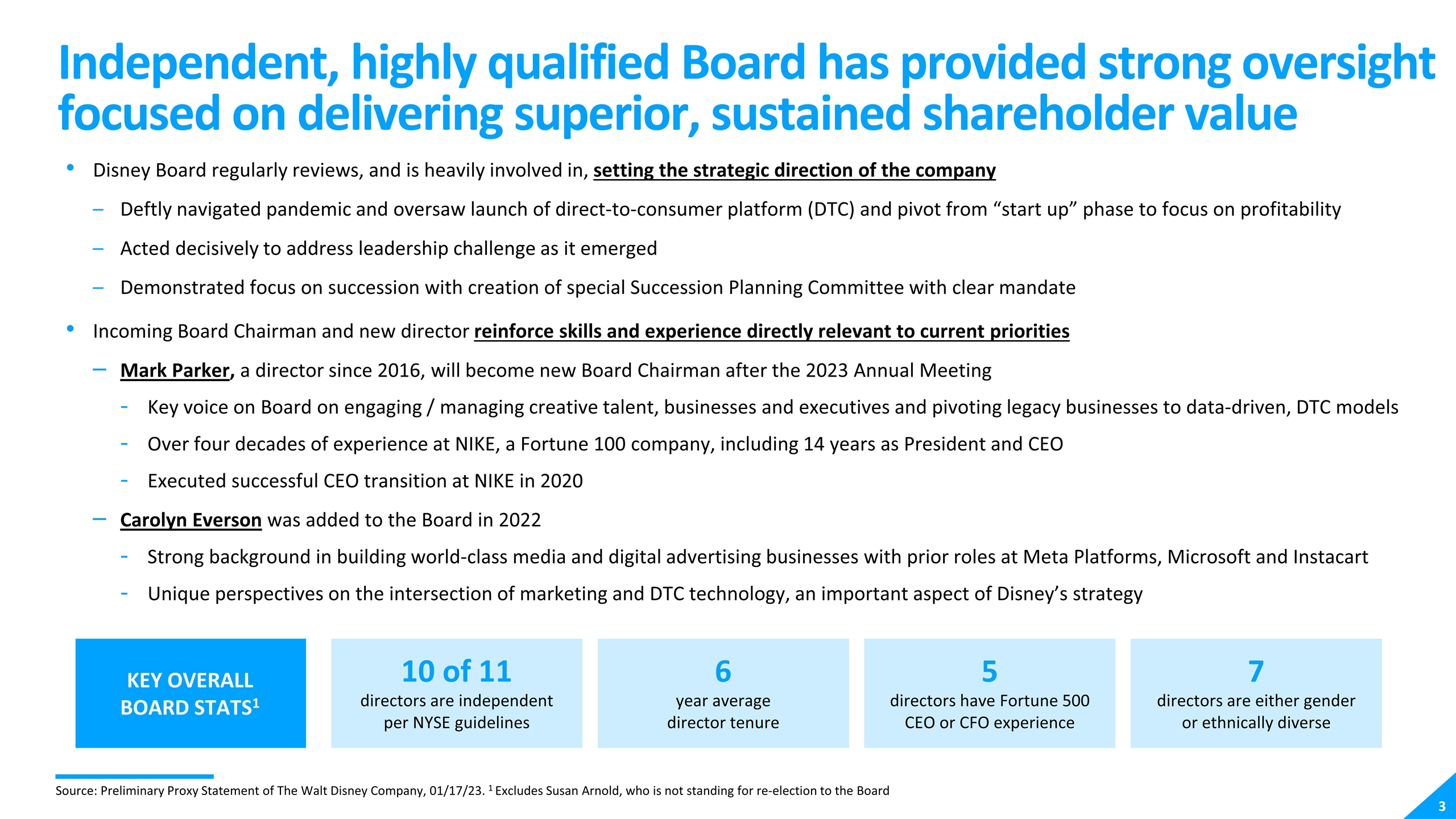

Independent, highly qualified Board has provided strong oversight focused on delivering superior, sustained shareholder value Disney Board regularly reviews, and is heavily involved in, setting the strategic direction of the company Deftly navigated pandemic and oversaw launch of direct-to-consumer platform (DTC) and pivot from “start up” phase to focus on profitability Acted decisively to address leadership challenge as it emerged Demonstrated focus on succession with creation of special Succession Planning Committee with clear mandate Incoming Board Chairman and new director reinforce skills and experience directly relevant to current priorities Mark Parker, a director since 2016, will become new Board Chairman after the 2023 Annual Meeting Key voice on Board on engaging / managing creative talent, businesses and executives and pivoting legacy businesses to data-driven, DTC models Over four decades of experience at NIKE, a Fortune 100 company, including 14 years as President and CEO Executed successful CEO transition at NIKE in 2020 Carolyn Everson was added to the Board in 2022 Strong background in building world-class media and digital advertising businesses with prior roles at Meta Platforms, Microsoft and Instacart Unique perspectives on the intersection of marketing and DTC technology, an important aspect of Disney’s strategy Key overall Board stats1 10 of 11 directors are independent per NYSE guidelines 5 directors have Fortune 500 CEO or CFO experience 7 directors are either gender or ethnically diverse 6 year average director tenure Source: Preliminary Proxy Statement of The Walt Disney Company, 01/17/23. 1 Excludes Susan Arnold, who is not standing for re-election to the Board

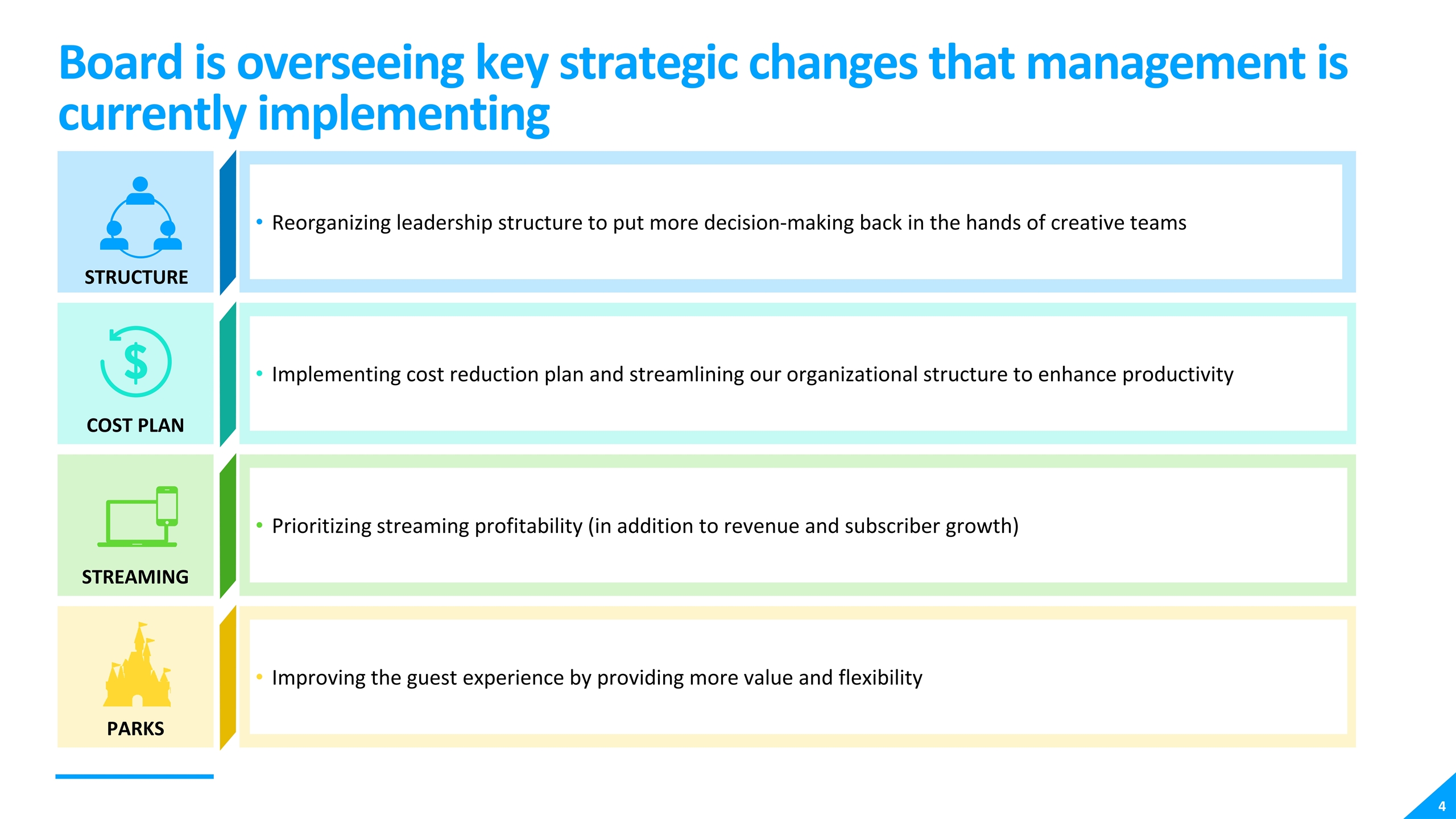

Board is overseeing key strategic changes that management is currently implementing Reorganizing leadership structure to put more decision-making back in the hands of creative teams STREAMING Prioritizing streaming profitability (in addition to revenue and subscriber growth) COST PLAN Implementing cost reduction plan and streamlining our organizational structure to enhance productivity PARKS Improving the guest experience by providing more value and flexibility STRUCTURE

Nelson Peltz does not understand Disney’s businesses and lacks the skills and experience to assist the Board in delivering shareholder value in a rapidly shifting media ecosystem

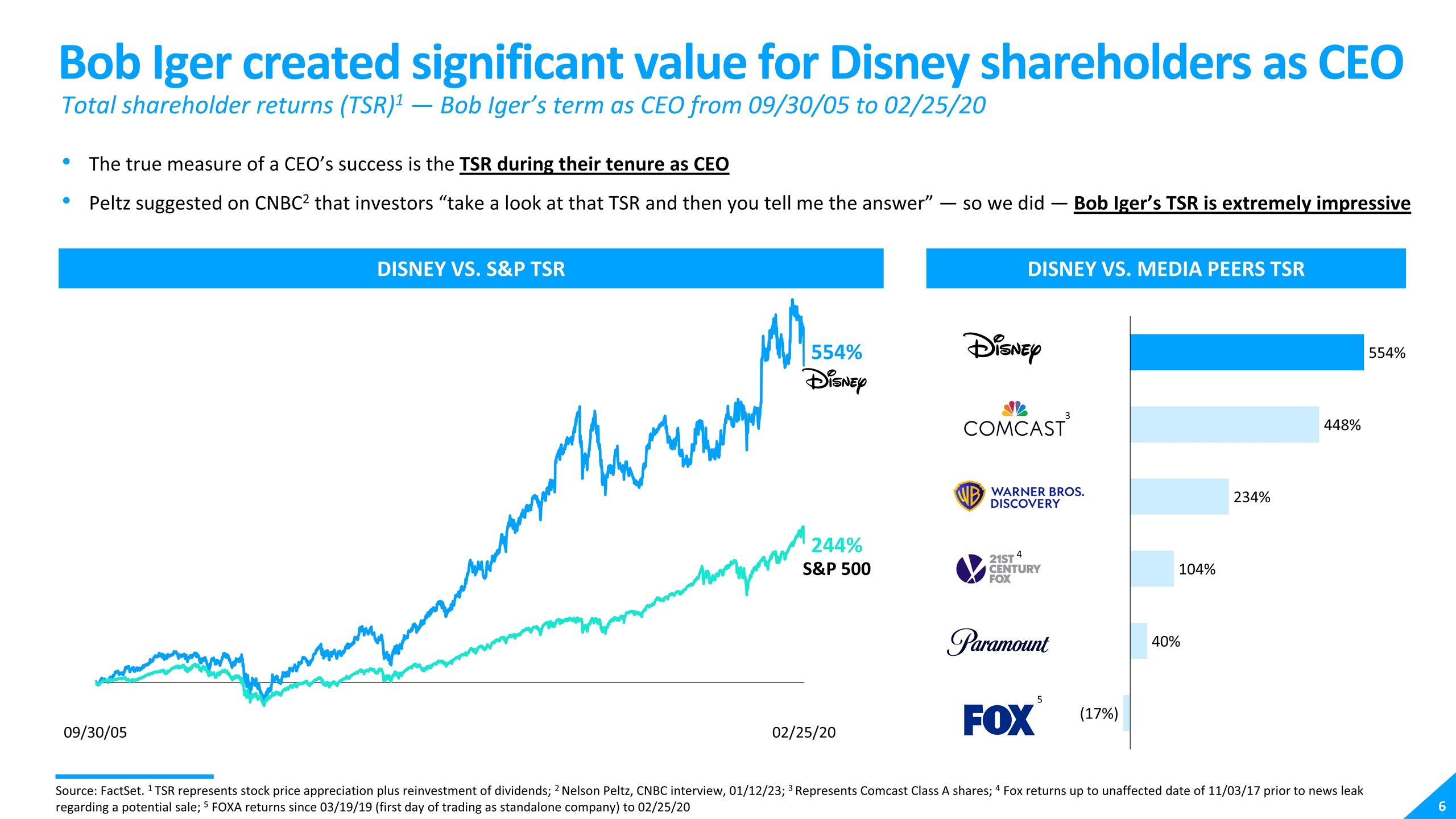

Bob Iger created significant value for Disney shareholders as CEO Source: FactSet. 1 TSR represents stock price appreciation plus reinvestment of dividends; 2 Nelson Peltz, CNBC interview, 01/12/23; 3 Represents Comcast Class A shares; 4 Fox returns up to unaffected date of 11/03/17 prior to news leak regarding a potential sale; 5 FOXA returns since 03/19/19 (first day of trading as standalone company) to 02/25/20 S&P 500 244% 554% 4 Total shareholder returns (TSR)1 — Bob Iger’s term as CEO from 09/30/05 to 02/25/20 disney vs. S&P TSR Disney vs. media peers TSR 5 The true measure of a CEO’s success is the TSR during their tenure as CEO Peltz suggested on CNBC2 that investors “take a look at that TSR and then you tell me the answer” — so we did — Bob Iger’s TSR is extremely impressive 3

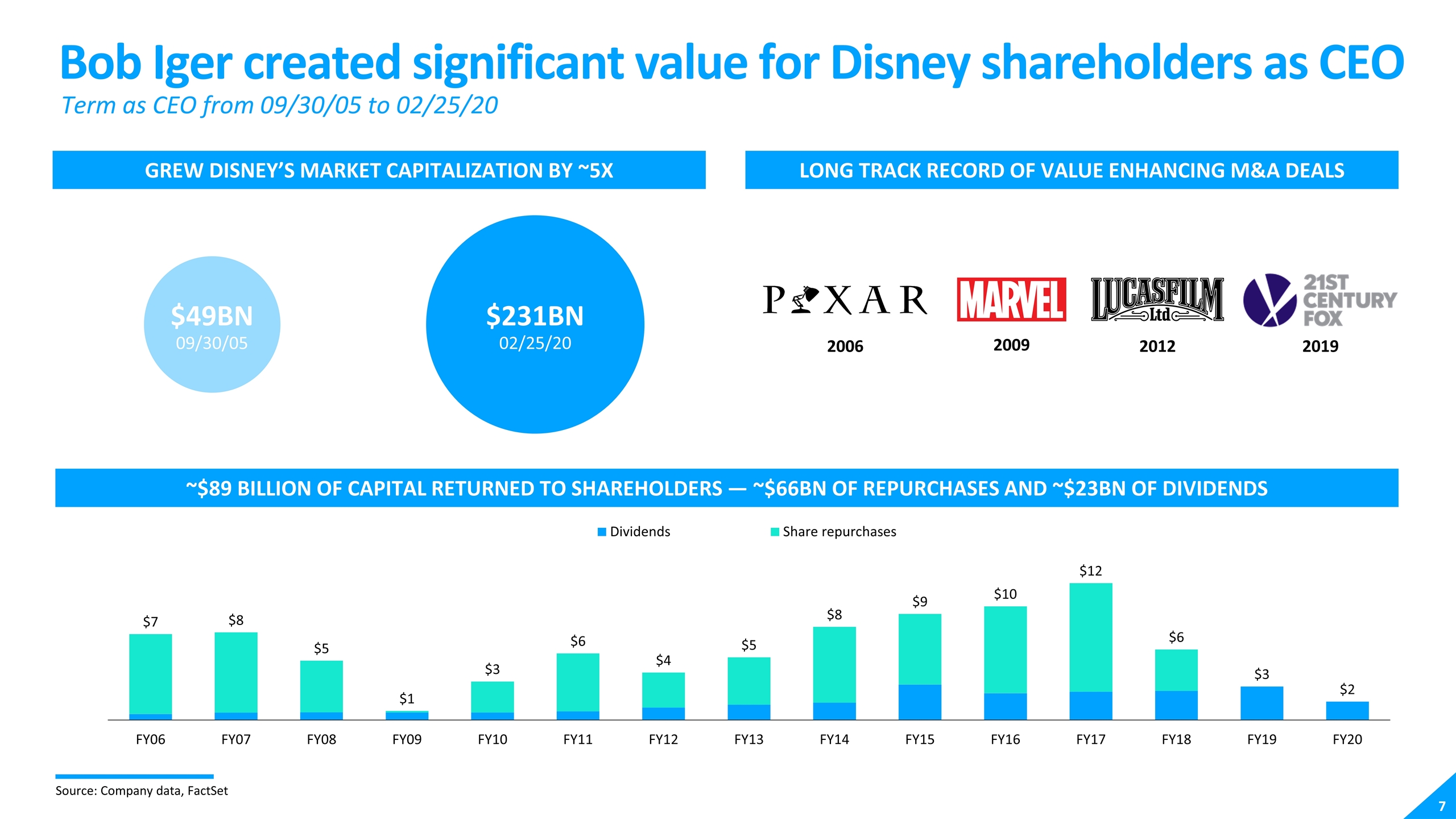

Bob Iger created significant value for Disney shareholders as CEO Grew Disney’s market capitalization by ~5x Long Track record of value enhancing M&A deals ~$89 billion of capital returned to shareholders — ~$66BN of repurchases and ~$23bn of dividends $49BN 09/30/05 $231BN 02/25/20 2012 2006 2009 2019 Term as CEO from 09/30/05 to 02/25/20 Source: Company data, FactSet

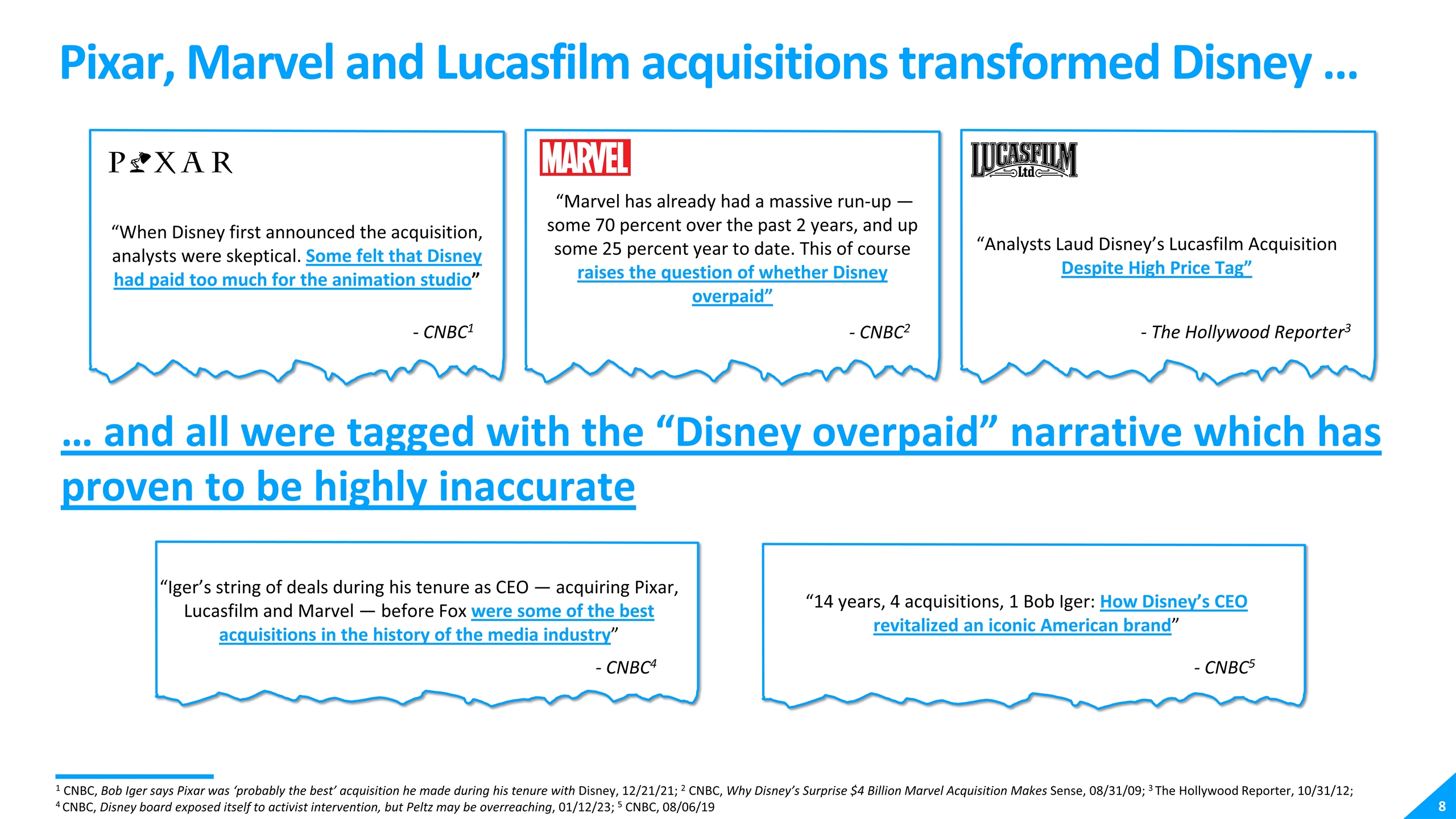

Pixar, Marvel and Lucasfilm acquisitions transformed Disney … 1 CNBC, Bob Iger says Pixar was ‘probably the best’ acquisition he made during his tenure with Disney, 12/21/21; 2 CNBC, Why Disney’s Surprise $4 Billion Marvel Acquisition Makes Sense, 08/31/09; 3 The Hollywood Reporter, 10/31/12; 4 CNBC, Disney board exposed itself to activist intervention, but Peltz may be overreaching, 01/12/23; 5 CNBC, 08/06/19 “When Disney first announced the acquisition, analysts were skeptical. Some felt that Disney had paid too much for the animation studio” - CNBC1 “Marvel has already had a massive run-up —some 70 percent over the past 2 years, and up some 25 percent year to date. This of course raises the question of whether Disney overpaid” - CNBC2 “Analysts Laud Disney’s Lucasfilm Acquisition Despite High Price Tag” - The Hollywood Reporter3 … and all were tagged with the “Disney overpaid” narrative which has proven to be highly inaccurate Sans Kevin Feige being able to wrestle control of the theatrical department from Ike Perlmutter in 2015, we’d probably still see an MCU mostly dominated by white guys named Chris. “Iger’s string of deals during his tenure as CEO — acquiring Pixar, Lucasfilm and Marvel — before Fox were some of the best acquisitions in the history of the media industry” - CNBC4 “14 years, 4 acquisitions, 1 Bob Iger: How Disney’s CEO revitalized an iconic American brand” - CNBC5

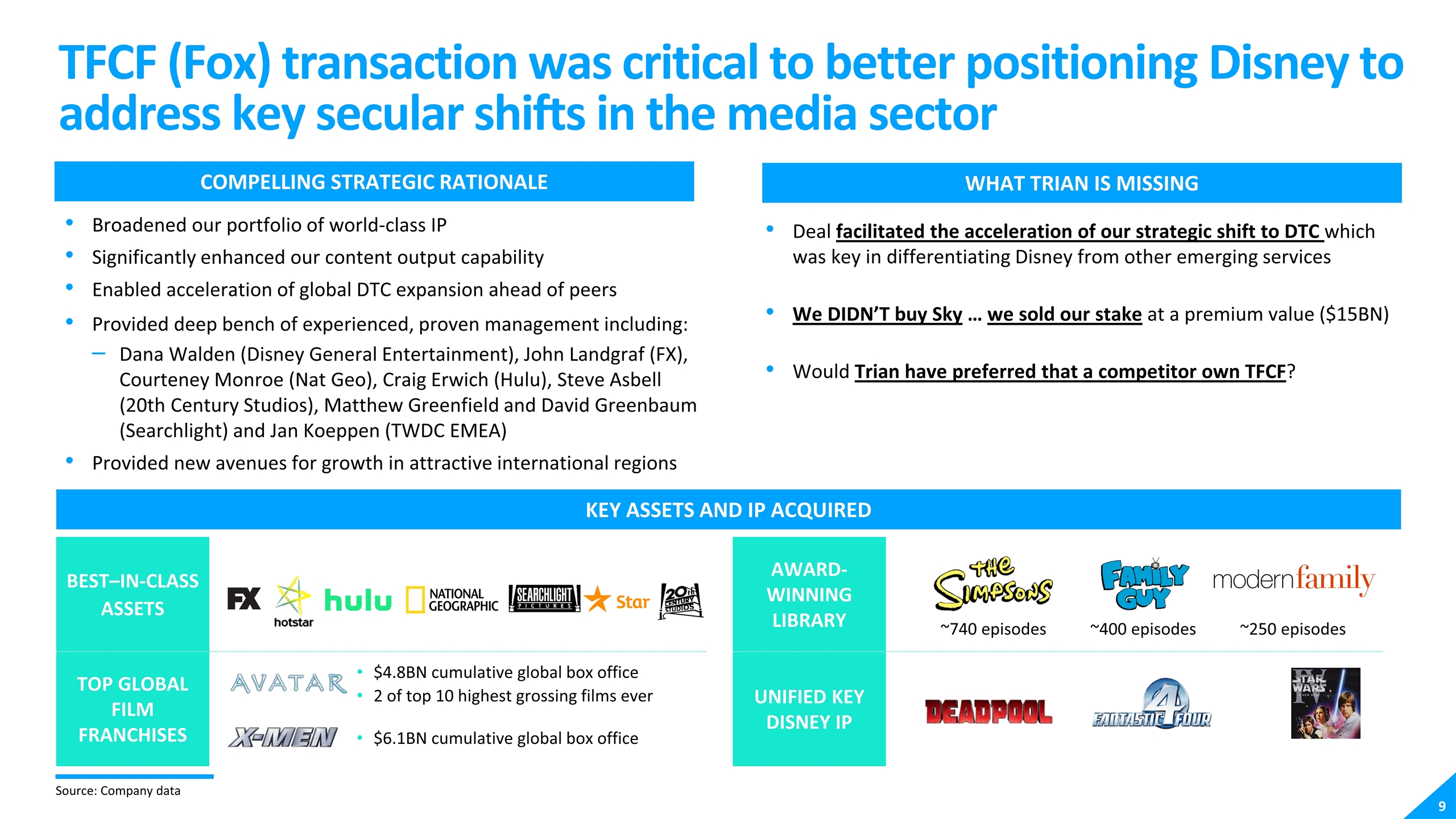

TFCF (Fox) transaction was critical to better positioning Disney to address key secular shifts in the media sector Source: Company data Broadened our portfolio of world-class IP Significantly enhanced our content output capability Enabled acceleration of global DTC expansion ahead of peers Provided deep bench of experienced, proven management including: Dana Walden (Disney General Entertainment), John Landgraf (FX), Courteney Monroe (Nat Geo), Craig Erwich (Hulu), Steve Asbell (20th Century Studios), Matthew Greenfield and David Greenbaum (Searchlight) and Jan Koeppen (TWDC EMEA) Provided new avenues for growth in attractive international regions Compelling Strategic rationale Key assets and IP acquired What TRIAN is missing Deal facilitated the acceleration of our strategic shift to DTC which was key in differentiating Disney from other emerging services We DIDN’T buy Sky … we sold our stake at a premium value ($15BN) Would Trian have preferred that a competitor own TFCF? BEST–IN-CLASS ASSETS TOP GLOBAL FILM FRANCHISES $4.8BN cumulative global box office 2 of top 10 highest grossing films ever $6.1BN cumulative global box office Award-Winning Library Unified key Disney ip ~740 episodes ~400 episodes ~250 episodes

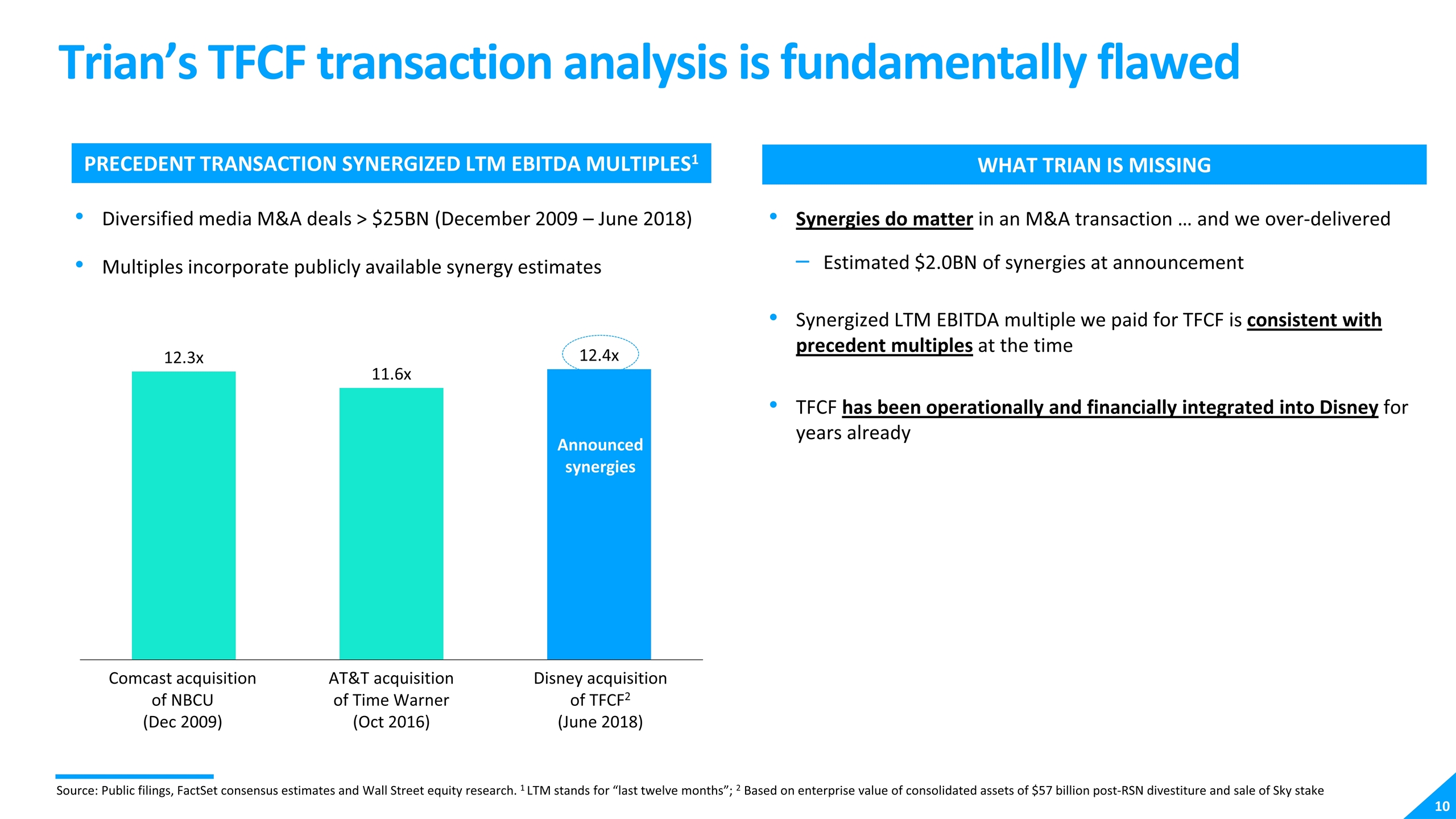

Trian’s TFCF transaction analysis is fundamentally flawed What TRIAN is missing Synergies do matter in an M&A transaction … and we over-delivered Estimated $2.0BN of synergies at announcement Synergized LTM EBITDA multiple we paid for TFCF is consistent with precedent multiples at the time TFCF has been operationally and financially integrated into Disney for years already Precedent Transaction Synergized LTM EBITDA multiples1 Comcast acquisition of NBCU (Dec 2009) Diversified media M&A deals > $25BN (December 2009 – June 2018) Multiples incorporate publicly available synergy estimates AT&T acquisition of Time Warner (Oct 2016) Disney acquisition of TFCF2 (June 2018) Source: Public filings, FactSet consensus estimates and Wall Street equity research. 1 LTM stands for “last twelve months”; 2 Based on enterprise value of consolidated assets of $57 billion post-RSN divestiture and sale of Sky stake Announced synergies

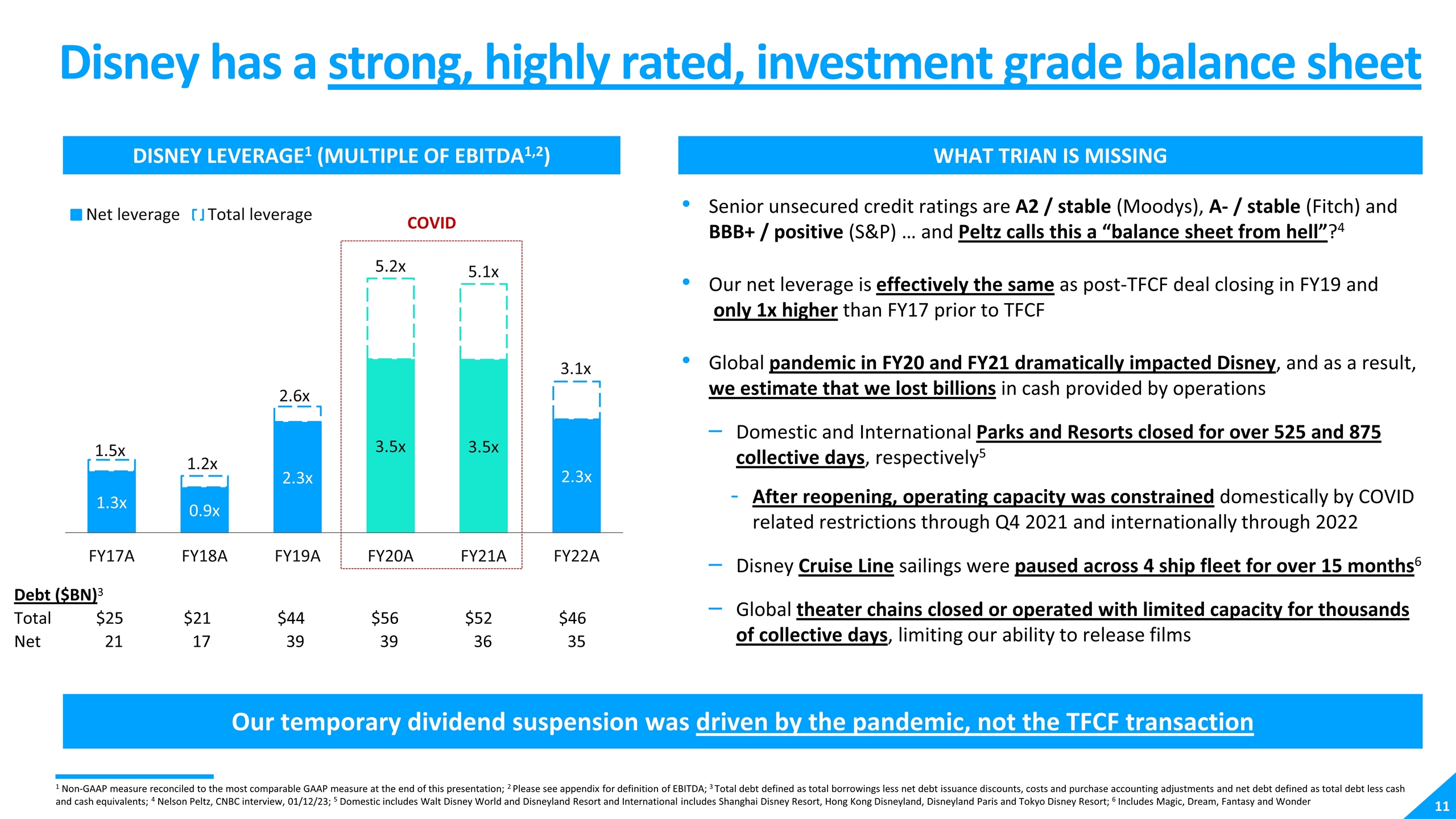

Disney has a strong, highly rated, investment grade balance sheet Disney leverage1 (multiple of ebitda1,2) WHAT trian is missing Senior unsecured credit ratings are A2 / stable (Moodys), A- / stable (Fitch) and BBB+ / positive (S&P) … and Peltz calls this a “balance sheet from hell”?4 Our net leverage is effectively the same as post-TFCF deal closing in FY19 and only 1x higher than FY17 prior to TFCF Global pandemic in FY20 and FY21 dramatically impacted Disney, and as a result, we estimate that we lost billions in cash provided by operations Domestic and International Parks and Resorts closed for over 525 and 875 collective days, respectively5 After reopening, operating capacity was constrained domestically by COVID related restrictions through Q4 2021 and internationally through 2022 Disney Cruise Line sailings were paused across 4 ship fleet for over 15 months6 Global theater chains closed or operated with limited capacity for thousands of collective days, limiting our ability to release films Our temporary dividend suspension was driven by the pandemic, not the TFCF transaction 1 Non-GAAP measure reconciled to the most comparable GAAP measure at the end of this presentation; 2 Please see appendix for definition of EBITDA; 3 Total debt defined as total borrowings less net debt issuance discounts, costs and purchase accounting adjustments and net debt defined as total debt less cash and cash equivalents; 4 Nelson Peltz, CNBC interview, 01/12/23; 5 Domestic includes Walt Disney World and Disneyland Resort and International includes Shanghai Disney Resort, Hong Kong Disneyland, Disneyland Paris and Tokyo Disney Resort; 6 Includes Magic, Dream, Fantasy and Wonder Debt ($BN)3 Total $25 $21 $44 $56 $52 $46 Net 21 17 39 39 36 35 COVID

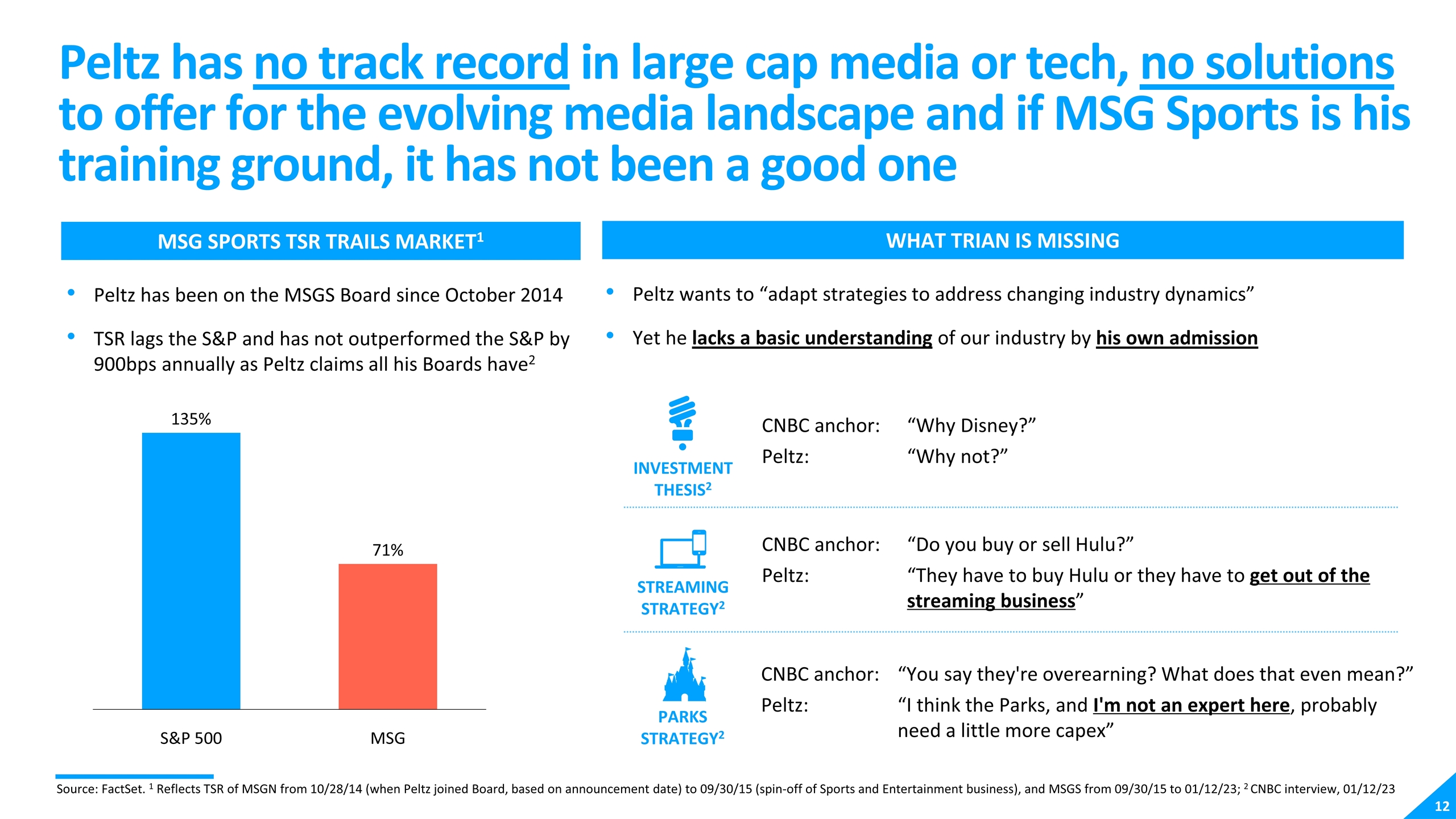

Peltz has no track record in large cap media or tech, no solutions to offer for the evolving media landscape and if MSG Sports is his training ground, it has not been a good one MSG SPORTS TSR trails market1 Peltz has been on the MSGS Board since October 2014 TSR lags the S&P and has not outperformed the S&P by 900bps annually as Peltz claims all his Boards have2 What trian is missing Peltz wants to “adapt strategies to address changing industry dynamics” Yet he lacks a basic understanding of our industry by his own admission Source: FactSet. 1 Reflects TSR of MSGN from 10/28/14 (when Peltz joined Board, based on announcement date) to 09/30/15 (spin-off of Sports and Entertainment business), and MSGS from 09/30/15 to 01/12/23; 2 CNBC interview, 01/12/23 Streaming Strategy2 CNBC anchor: “Do you buy or sell Hulu?” Peltz: “They have to buy Hulu or they have to get out of the streaming business” Parks strategy2 CNBC anchor: “You say they're overearning? What does that even mean?” Peltz: “I think the Parks, and I'm not an expert here, probably need a little more capex” Investment Thesis2 CNBC anchor: “Why Disney?” Peltz: “Why not?”

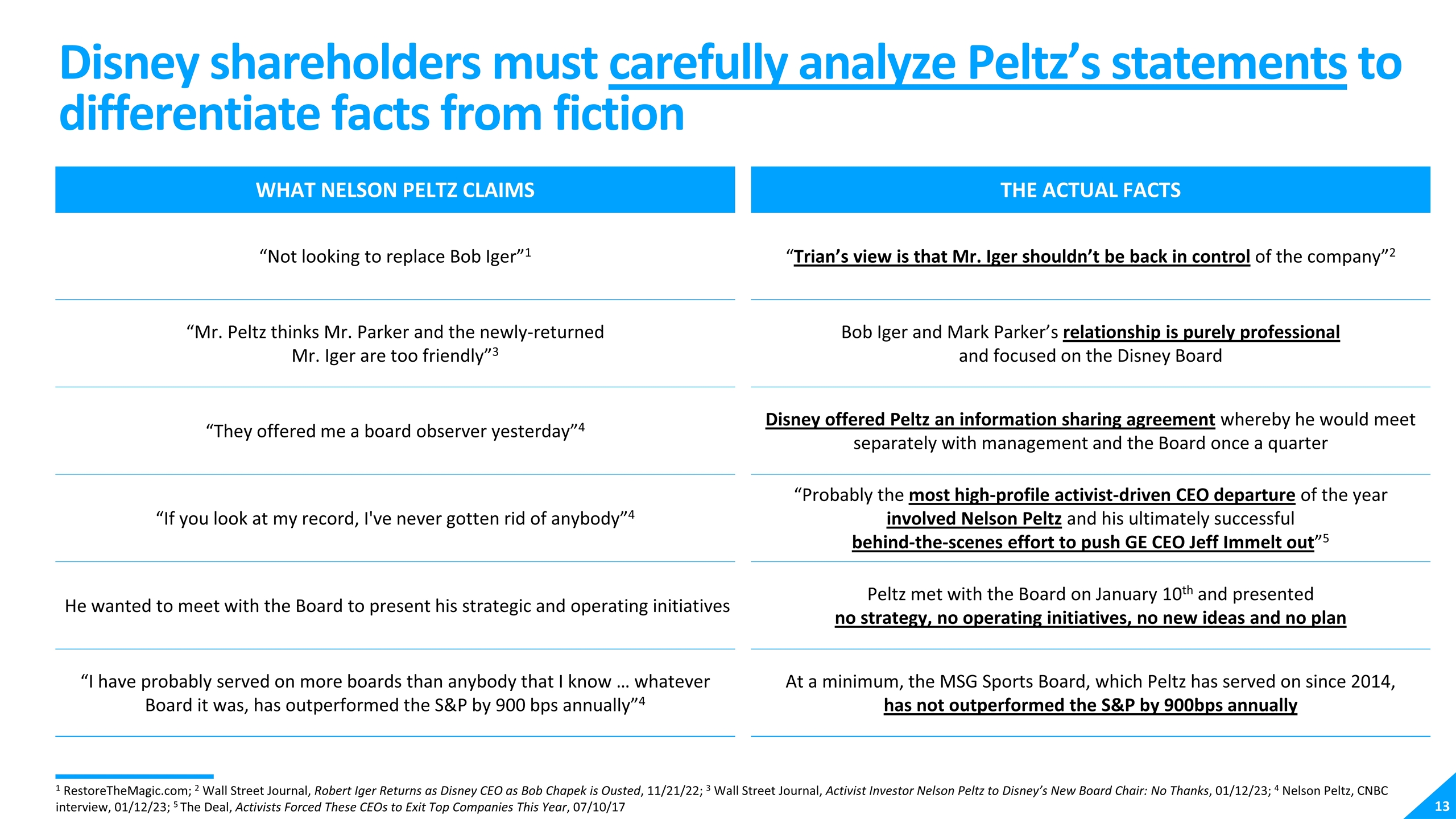

Disney shareholders must carefully analyze Peltz’s statements to differentiate facts from fiction WHAT NELSON PELTZ CLAIMS THE ACTUAL FACTS “Not looking to replace Bob Iger”1 “Trian’s view is that Mr. Iger shouldn’t be back in control of the company”2 “Mr. Peltz thinks Mr. Parker and the newly-returned Mr. Iger are too friendly”3 Bob Iger and Mark Parker’s relationship is purely professional and focused on the Disney Board “They offered me a board observer yesterday”4 Disney offered Peltz an information sharing agreement whereby he would meet separately with management and the Board once a quarter “If you look at my record, I've never gotten rid of anybody”4 “Probably the most high-profile activist-driven CEO departure of the year involved Nelson Peltz and his ultimately successful behind-the-scenes effort to push GE CEO Jeff Immelt out”5 He wanted to meet with the Board to present his strategic and operating initiatives Peltz met with the Board on January 10th and presented no strategy, no operating initiatives, no new ideas and no plan “I have probably served on more boards than anybody that I know … whatever Board it was, has outperformed the S&P by 900 bps annually”4 At a minimum, the MSG Sports Board, which Peltz has served on since 2014, has not outperformed the S&P by 900bps annually 1 RestoreTheMagic.com; 2 Wall Street Journal, Robert Iger Returns as Disney CEO as Bob Chapek is Ousted, 11/21/22; 3 Wall Street Journal, Activist Investor Nelson Peltz to Disney’s New Board Chair: No Thanks, 01/12/23; 4 Nelson Peltz, CNBC interview, 01/12/23; 5 The Deal, Activists Forced These CEOs to Exit Top Companies This Year, 07/10/17

Appendix

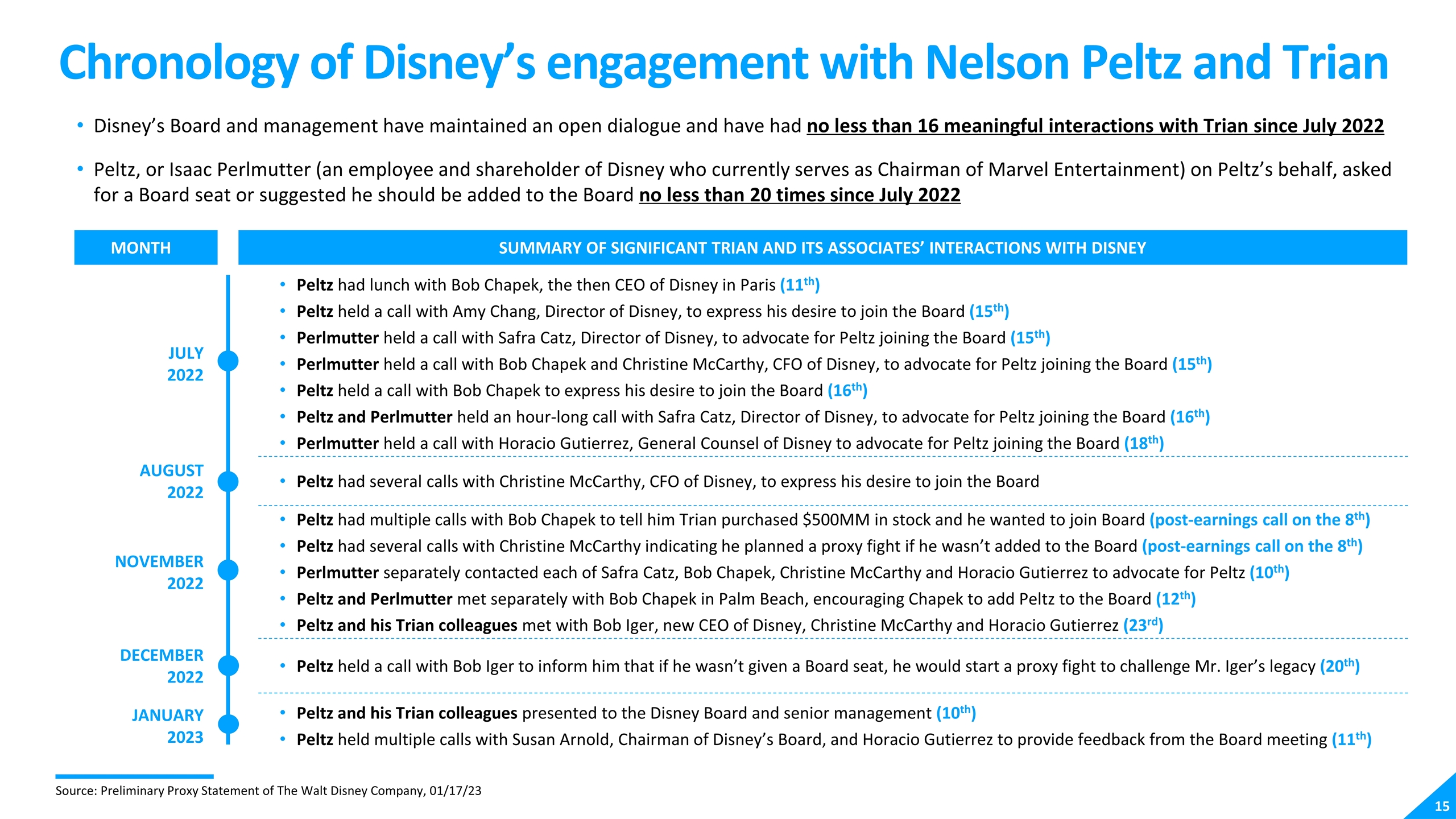

Chronology of Disney’s engagement with Nelson Peltz and Trian Source: Preliminary Proxy Statement of The Walt Disney Company, 01/17/23 Disney’s Board and management have maintained an open dialogue and have had no less than 16 meaningful interactions with Trian since July 2022 Peltz, or Isaac Perlmutter (an employee and shareholder of Disney who currently serves as Chairman of Marvel Entertainment) on Peltz’s behalf, asked for a Board seat or suggested he should be added to the Board no less than 20 times since July 2022 July 2022 Peltz had lunch with Bob Chapek, the then CEO of Disney in Paris (11th) Peltz held a call with Amy Chang, Director of Disney, to express his desire to join the Board (15th) Perlmutter held a call with Safra Catz, Director of Disney, to advocate for Peltz joining the Board (15th) Perlmutter held a call with Bob Chapek and Christine McCarthy, CFO of Disney, to advocate for Peltz joining the Board (15th) Peltz held a call with Bob Chapek to express his desire to join the Board (16th) Peltz and Perlmutter held an hour-long call with Safra Catz, Director of Disney, to advocate for Peltz joining the Board (16th) Perlmutter held a call with Horacio Gutierrez, General Counsel of Disney to advocate for Peltz joining the Board (18th) August 2022 Peltz had several calls with Christine McCarthy, CFO of Disney, to express his desire to join the Board November 2022 Peltz had multiple calls with Bob Chapek to tell him Trian purchased $500MM in stock and he wanted to join Board (post-earnings call on the 8th) Peltz had several calls with Christine McCarthy indicating he planned a proxy fight if he wasn’t added to the Board (post-earnings call on the 8th) Perlmutter separately contacted each of Safra Catz, Bob Chapek, Christine McCarthy and Horacio Gutierrez to advocate for Peltz (10th) Peltz and Perlmutter met separately with Bob Chapek in Palm Beach, encouraging Chapek to add Peltz to the Board (12th) Peltz and his Trian colleagues met with Bob Iger, new CEO of Disney, Christine McCarthy and Horacio Gutierrez (23rd) December 2022 Peltz held a call with Bob Iger to inform him that if he wasn’t given a Board seat, he would start a proxy fight to challenge Mr. Iger’s legacy (20th) January 2023 Peltz and his Trian colleagues presented to the Disney Board and senior management (10th) Peltz held multiple calls with Susan Arnold, Chairman of Disney’s Board, and Horacio Gutierrez to provide feedback from the Board meeting (11th) Month Summary of significant TRIAN and its associates’ interactions with disney

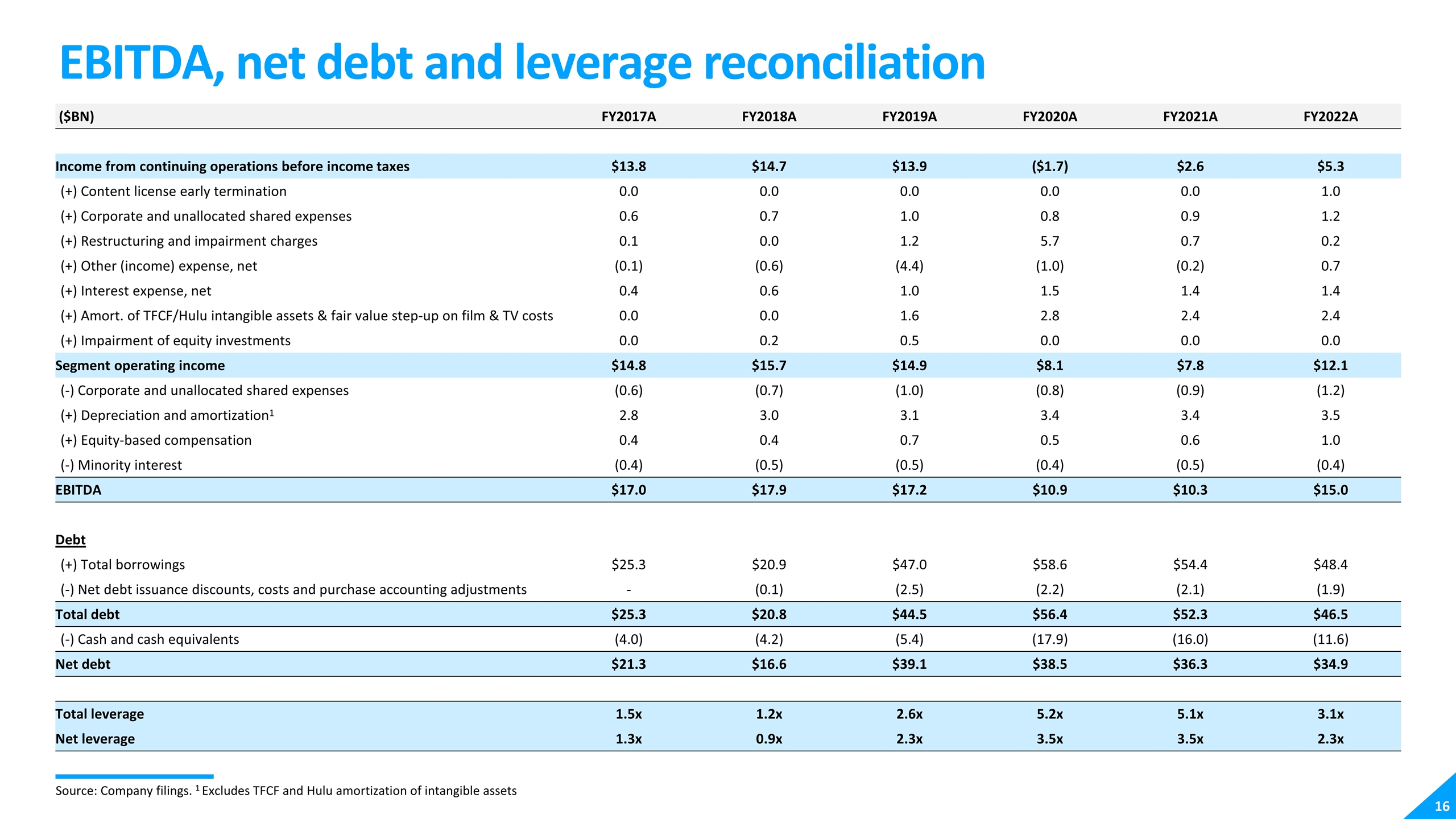

EBITDA, net debt and leverage reconciliation Source: Company filings. 1 Excludes TFCF and Hulu amortization of intangible assets ($BN) FY2017A FY2018A FY2019A FY2020A FY2021A FY2022A Income from continuing operations before income taxes $13.8 $14.7 $13.9 ($1.7) $2.6 $5.3 (+) Content license early termination 0.0 0.0 0.0 0.0 0.0 1.0 (+) Corporate and unallocated shared expenses 0.6 0.7 1.0 0.8 0.9 1.2 (+) Restructuring and impairment charges 0.1 0.0 1.2 5.7 0.7 0.2 (+) Other (income) expense, net (0.1) (0.6) (4.4) (1.0) (0.2) 0.7 (+) Interest expense, net 0.4 0.6 1.0 1.5 1.4 1.4 (+) Amort. of TFCF/Hulu intangible assets & fair value step-up on film & TV costs 0.0 0.0 1.6 2.8 2.4 2.4 (+) Impairment of equity investments 0.0 0.2 0.5 0.0 0.0 0.0 Segment operating income $14.8 $15.7 $14.9 $8.1 $7.8 $12.1 (-) Corporate and unallocated shared expenses (0.6) (0.7) (1.0) (0.8) (0.9) (1.2) (+) Depreciation and amortization1 2.8 3.0 3.1 3.4 3.4 3.5 (+) Equity-based compensation 0.4 0.4 0.7 0.5 0.6 1.0 (-) Minority interest (0.4) (0.5) (0.5) (0.4) (0.5) (0.4) EBITDA $17.0 $17.9 $17.2 $10.9 $10.3 $15.0 Debt (+) Total borrowings $25.3 $20.9 $47.0 $58.6 $54.4 $48.4 (-) Net debt issuance discounts, costs and purchase accounting adjustments - (0.1) (2.5) (2.2) (2.1) (1.9) Total debt $25.3 $20.8 $44.5 $56.4 $52.3 $46.5 (-) Cash and cash equivalents (4.0) (4.2) (5.4) (17.9) (16.0) (11.6) Net debt $21.3 $16.6 $39.1 $38.5 $36.3 $34.9 Total leverage 1.5x 1.2x 2.6x 5.2x 5.1x 3.1x Net leverage 1.3x 0.9x 2.3x 3.5x 3.5x 2.3x