Form DEF 14A MICRON TECHNOLOGY INC For: Jan 12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ | ||||||||

Filed by a party other than the Registrant ☐ | ||||||||

| Check the appropriate box: | ||||||||

| ☐ | Preliminary Proxy Statement | |||||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||

| ☒ | Definitive Proxy Statement | |||||||

| ☐ | Definitive Additional Materials | |||||||

| ☐ | Soliciting Material under §240.14a-12 | |||||||

| Micron Technology, Inc. | ||||||||

| (Name of Registrant as Specified in Its Charter) | ||||||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||||||

| Payment of Filing Fee (Check all boxes that apply): | ||||||||

| ☒ | No fee required | |||||||

| ☐ | Fee paid previously with preliminary materials. | |||||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||||||

Notice of Fiscal 2022 Annual Meeting of Shareholders

January 12, 2023

To the Shareholders:

NOTICE IS HEREBY GIVEN that the Fiscal 2022 Annual Meeting of Shareholders of Micron Technology, Inc., a Delaware corporation, will be held virtually on January 12, 2023, at 9:00 a.m., Pacific Standard Time, for the purposes listed below. As used herein, “we,” “our,” “us,” “the Company,” and similar terms refer to Micron Technology, Inc., unless the context indicates otherwise.

1. To elect eight directors to serve for the ensuing year and until their successors are elected and qualified;

2. To approve on a non-binding basis the compensation of our Named Executive Officers;

3. To approve our Amended and Restated 2007 Equity Incentive Plan to increase the shares reserved for issuance thereunder by 50 million;

4. To ratify the appointment of PricewaterhouseCoopers LLP as our Independent Registered Public Accounting Firm for the fiscal year ending August 31, 2023; and

5. To transact such other business as may properly come before the meeting or any adjournment thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only shareholders of record at the close of business on November 14, 2022 are entitled to receive notice of and to vote at the meeting and any postponements or adjournments of the meeting. A complete list of shareholders entitled to vote at the meeting will be open to the examination of any shareholder, for any purpose germane to the business to be transacted at the meeting, for the ten-day period immediately preceding the date of the meeting, at our headquarters at 8000 S. Federal Way, Boise, Idaho 83716.

The Securities and Exchange Commission permits proxy materials to be furnished over the Internet rather than in paper form. Accordingly, unless otherwise requested, we are sending our shareholders a notice regarding the availability of this Proxy Statement, our Annual Report on Form 10-K for fiscal 2022, and other proxy materials via the Internet (the “Notice”). This electronic process gives you fast, convenient access to the materials, reduces the impact on the environment, and reduces our printing and mailing costs. If you received a Notice by mail, you will not receive a printed copy of the proxy materials in the mail. The Notice instructs you on how to access and review all of the important information contained in the Proxy Statement and Annual Report. The Notice also instructs you on how you may submit your vote over the Internet. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice.

We are pleased to provide shareholders with the opportunity to participate in the annual meeting online via the Internet in a virtual-only meeting format to facilitate shareholder attendance and provide a consistent experience to all shareholders regardless of location. We will provide a live webcast of the annual meeting at www.virtualshareholdermeeting.com/MU2022, where you will also be able to submit questions and vote online. You will not be able to attend the meeting at a physical location.

To ensure your representation at the meeting, you are urged to vote, whether or not you attend the meeting. You may vote by telephone or electronically via the Internet. Alternatively, if you received a paper copy, you may sign, date, and return the proxy card in the postage-prepaid envelope enclosed for that purpose. Please refer to the instructions included with the proxy card for additional details. Shareholders attending the meeting may vote using the virtual meeting platform even if they have already submitted their proxy, and any previous votes that were submitted by the shareholder, whether by Internet, telephone, or mail, will be superseded by the vote that such shareholder casts at the meeting.

| By Order of the Board of Directors | ||||||||

Boise, Idaho December 2, 2022 | Rob Beard Senior Vice President, General Counsel and Corporate Secretary | |||||||

YOUR VOTE IS IMPORTANT. PLEASE SUBMIT YOUR PROXY PROMPTLY.

TABLE OF CONTENTS

| Proxy Section | Page | Frequently Requested Information | Page | |||||||||||

| Delinquent Section 16(a) Reports | ||||||||||||||

| Proposal 3 - Approval of Amended and Restated 2007 Equity Incentive Plan | ||||||||||||||

Approval of 50 Million Additional Shares of Common Stock for Issuance under the 2007 Plan | ||||||||||||||

| Important Provisions of the 2007 Plan | ||||||||||||||

| Summary of the 2007 Plan as Proposed to be Amended and Restated | ||||||||||||||

| Certain Federal Tax Effects | ||||||||||||||

| New Plan Benefits | ||||||||||||||

PROXY STATEMENT

FISCAL 2022 ANNUAL MEETING OF SHAREHOLDERS

January 12, 2023

9:00 a.m. Pacific Standard Time

____________________________

INFORMATION CONCERNING SOLICITATION AND VOTING

General

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies on behalf of the Board of Directors of Micron Technology, Inc. (the “Board”), for use at the Fiscal 2022 Annual Meeting of Shareholders to be held on January 12, 2023, at 9:00 a.m., Pacific Standard Time, or at any adjournment or postponement thereof (the “Annual Meeting”). The purpose of the Annual Meeting is set forth herein and in the accompanying Notice of Fiscal 2022 Annual Meeting of Shareholders. The Annual Meeting will be held via a live webcast, and there will not be a physical meeting location. You will be able to attend the annual meeting online and to vote your shares electronically on the virtual meeting platform by visiting www.virtualshareholdermeeting.com/MU2022 and entering the 16-digit control number included in our Notice, on your proxy card, or in the instructions that accompanied your proxy materials.

Shareholders will be able to submit questions before the Annual Meeting through www.proxyvote.com or during the Annual Meeting using the virtual meeting platform. Relevant questions submitted before or during the Annual Meeting will be addressed after the Annual Meeting in the Investor Relations section of our website at www.micron.com.

We encourage you to access the Annual Meeting before it begins. Online check-in will start approximately 15 minutes before the Annual Meeting. If you have difficulty accessing the meeting or other technical or logistical issues, please call the technical support number that will be posted on the virtual Annual Meeting login page. We will have technicians available to assist you.

This Proxy Statement and related proxy card are first being distributed on or about December 2, 2022, to all shareholders entitled to vote at the meeting.

Shareholders can vote their shares using one of the following methods:

•Vote through the Internet at www.proxyvote.com, using the instructions included in the notice regarding the Internet availability of proxy materials, the proxy card, or voting instruction card;

•Vote by telephone using the instructions on the proxy card or voting instruction card if you received a paper copy of the proxy materials;

•Complete and return a written proxy or voting instruction card using the proxy card or voting instruction card if you received a paper copy of the proxy materials; or

•Attend the meeting and vote electronically on the virtual meeting platform.

Internet and telephone voting are available 24 hours a day, and if you use one of those methods, you do not need to return a paper proxy or voting instruction card. Unless you are planning to vote at the meeting, your vote must be received by 11:59 p.m., Eastern Standard Time, on January 11, 2023.

1

1Record Date

Shareholders of record at the close of business on November 14, 2022 (the “Record Date”) are entitled to receive notice of and to vote at the meeting.

Revocability of Proxy

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by attending the Annual Meeting and voting online or by delivering to us a written notice of revocation at Micron Technology, Inc., Attn.: Corporate Secretary, 8000 South Federal Way, Boise, Idaho 83716 or corporatesecretary@micron.com or another duly executed proxy bearing a date later than the earlier given proxy but prior to the date of the Annual Meeting.

Solicitation

We will bear the cost of solicitation. In addition, we may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners. Proxies may be solicited by our directors, officers, and employees, without additional compensation, personally or by telephone or Internet. We intend to use the services of D.F. King & Co., a proxy solicitation firm, in connection with the solicitation of proxies. Although the exact cost of the solicitation services is not known at this time, it is anticipated that the fees paid by us for these services will be approximately $12,500.

Outstanding Shares

We have one class of stock outstanding, common stock, $0.10 par value per share (the “Common Stock”). As of the Record Date, 1,090,892,865 shares of Common Stock were issued and outstanding and entitled to vote.

Voting Rights and Required Vote

Under the Delaware General Corporation Law, our Restated Certificate of Incorporation, and our Amended and Restated Bylaws (“Bylaws”), each shareholder will be entitled to one vote for each share of Common Stock held at the Record Date for all matters. The required quorum for the transaction of business at the Annual Meeting is a majority in voting power of shares of our Common Stock issued and outstanding on the Record Date and entitled to vote thereat, present in person or represented by proxy. Shares that are voted “FOR,” “AGAINST,” or “ABSTAIN” are treated as being present at the Annual Meeting for the purposes of establishing a quorum. Broker non-votes will also be considered present and entitled to vote for purposes of determining the presence or absence of a quorum for the transaction of business, but such non-votes will not be included in the tabulation of the voting results with respect to voting results for the election of directors and other non-routine matters.

Shares held in a brokerage account or by another nominee are considered held in “street name” by the shareholder or “beneficial owner.” A broker or nominee holding shares for a beneficial owner may not vote on matters relating to the election of directors or other non-routine matters unless the broker or nominee receives specific voting instructions from the beneficial owner of the shares. As a result, absent specific instructions, brokers or nominees may not vote a beneficial owner’s shares on Proposals 1, 2, and 3 and such shares will be considered “broker non-votes” for such proposals. Brokers or nominees may vote a beneficial owner’s shares on Proposal 4.

Directors will be elected if the number of votes “FOR” a particular director exceeds the number of votes “AGAINST” that same director, with abstentions and broker-non votes not counted as a vote “FOR” or “AGAINST” that director’s election. With respect to all other items of business, the “FOR” vote of the holders of a majority of the voting power of the shares of Common Stock attending online in person or represented by proxy is required in order for such matter to be considered approved by the shareholders. For such non-routine matters, abstentions will have the same effect as voting against such items of business, but broker non-votes will not be counted in the tabulation of results. For routine matters, abstentions and broker non-votes will have the same effect as voting against such items of business.

2 | 2022 Proxy Statement

Voting of Proxies

The shares of Common Stock represented by all properly executed proxies received by 11:59 P.M. Eastern Standard Time, on January 11, 2023 will be voted in accordance with the directions given by the shareholders. If no instructions are given with respect to a properly executed proxy timely received by us, the shares of Common Stock represented thereby will be voted (i) FOR each of the nominees named herein as directors, or their respective substitutes as may be appointed by the Board, (ii) FOR a non-binding resolution to approve the compensation of our Named Executive Officers as described in this Proxy Statement, (iii) FOR the approval of our Amended and Restated 2007 Equity Incentive Plan to increase the shares reserved for issuance thereunder by 50 million, (iv) FOR ratification of the appointment of PricewaterhouseCoopers LLP as our Independent Registered Public Accounting Firm for the fiscal year ending August 31, 2023, and (v) in the discretion of the proxy holders for such other business which may properly come before the Annual Meeting.

3

3| PROPOSAL 1 - ELECTION OF DIRECTORS | ||

•All directors elected annually by a simple majority of votes cast •Independent Board Chair •Seven of eight director nominees are independent | ||

| BOARD RECOMMENDATION | |||||

Our Board is presenting eight nominees for election as directors at the Annual Meeting. Each of the nominees is currently a member of our Board and was elected to our Board at the Fiscal 2021 Annual Meeting of Shareholders. Each director elected at the Annual Meeting will serve until our Fiscal 2023 Annual Meeting of Shareholders and until a successor is duly elected and qualified. Each of the nominees has consented to be named in this Proxy Statement and to serve as a director if elected. If any nominee is unable or unwilling for good cause to stand for election or serve as a director if elected, the persons named as proxies may vote for a substitute nominee designated by our existing Board, or our Board may choose to reduce its size.

| VOTE REQUIRED FOR APPROVAL | |||||

Each director nominee will be elected as a director if such nominee receives the affirmative vote of a majority of the votes cast with respect to his or her election (in other words, the number of shares voted “FOR” a director must exceed the number of votes cast “AGAINST” that director).

If a nominee who is serving as a director is not elected at the Annual Meeting by the requisite majority of votes cast, Delaware law provides that the director would continue to serve on our Board as a holdover director. However, under our Bylaws, any incumbent director who fails to be elected must offer to tender his or her resignation to our Board. The Governance and Sustainability Committee will then make a recommendation to our Board on whether to accept or reject the resignation or whether other action should be taken. Our Board will act on the Governance and Sustainability Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date the election results are certified. Any director who offers to tender his or her resignation will not participate in the Board’s or the Governance and Sustainability Committee’s decision.

4 | 2022 Proxy Statement

| SUMMARY OF SKILLS AND EXPERIENCE OF DIRECTOR NOMINEES | |||||

The following table highlights the specific skills, experience, qualifications and attributes that each of the director nominees brings to the Board. A particular director nominee may possess other skills, experience, qualifications or attributes even though they are not indicated below.

| Skills and Experience | Richard M. Beyer | Lynn A. Dugle | Steven J. Gomo | Linnie M. Haynesworth | Mary Pat McCarthy | Sanjay Mehrotra | Robert E. Switz | MaryAnn Wright | ||||||||||||||||||

| Independence | • | • | • | • | • | • | • | |||||||||||||||||||

| Multinational experience | • | • | • | • | • | • | • | • | ||||||||||||||||||

| Executive leadership (public or private) | • | • | • | • | • | • | • | • | ||||||||||||||||||

| Research and development | • | • | • | • | • | • | ||||||||||||||||||||

| Technology industry | • | • | • | • | • | • | • | • | ||||||||||||||||||

| Corporate strategy | • | • | • | • | • | • | • | • | ||||||||||||||||||

| Corporate development | • | • | • | • | ||||||||||||||||||||||

| Corporate governance | • | • | • | • | • | |||||||||||||||||||||

| Operations | • | • | • | • | • | • | ||||||||||||||||||||

| Marketing | • | |||||||||||||||||||||||||

| Cybersecurity | • | • | ||||||||||||||||||||||||

| Other public board service | • | • | • | • | • | • | • | • | ||||||||||||||||||

| Finance | • | • | • | • | • | • | • | |||||||||||||||||||

| Auditing / accounting | • | • | ||||||||||||||||||||||||

5

5Nominees For Election

| Board of Directors | ||

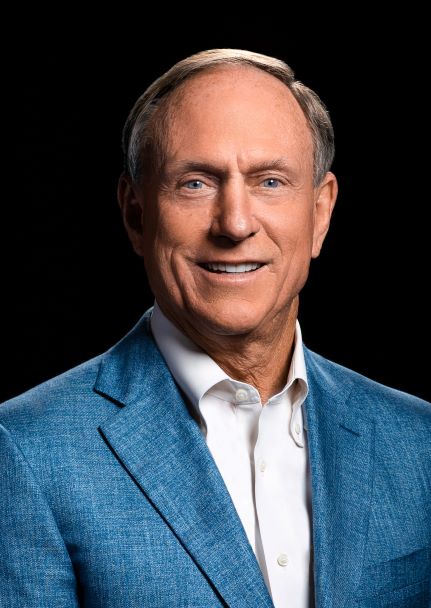

Richard M. Beyer Independent | Professional Experience | |||||||

| - | Chairman and Chief Executive Officer of Freescale Semiconductor, Inc. from 2008 through June 2012; director from 2008 to 2013. | |||||||

| - | Prior to Freescale, Mr. Beyer was President, Chief Executive Officer and a director of Intersil Corporation from 2002 to 2008. | |||||||

| - | Mr. Beyer previously served in executive management roles at FVC.com, VLSI Technology, and National Semiconductor Corporation, and served three years as an officer in the United States Marine Corps. | |||||||

| - | Within the past five years, Mr. Beyer served on the Board of Directors of Dialog Semiconductor and Microsemi Corporation. | |||||||

| Other Current Public Company Directorships | ||||||||

| - | None | |||||||

| Board Skills, Qualifications, and Expertise | ||||||||

| Mr. Beyer’s experience as the Chief Executive Officer and a director at leading technology companies provides our Board expertise in the technology industry and also in corporate strategy, financial management, operations, marketing, and research and development, all of which are critical to achieving our strategic objectives. We believe these experiences, qualifications, attributes, and skills qualify Mr. Beyer to serve as a member of our Board. | ||||||||

Age 74 | Director Since 2013 | Committees Compensation (Chair), Governance and Sustainability, Security | ||||||||

Lynn A. Dugle Independent | Professional Experience | |||||||

| - | Chairman, Chief Executive Officer, and President of Engility Holdings Inc., an NYSE-listed engineering services firm, from 2016 to 2019. | |||||||

| - | Prior to Engility, Ms. Dugle was Vice President, President of Intelligence and Information Systems of Raytheon Company from 2009 to 2015. | |||||||

| - | Within the past five years, Ms. Dugle served on the Board of Directors of State Street Corporation. | |||||||

| Other Current Public Company Directorships | ||||||||

| - | First Light Acquisition Group, Inc. (advisor partner) | |||||||

| - | TE Connectivity Ltd. | |||||||

| - | KBR, Inc. | |||||||

| Board Skills, Qualifications, and Expertise | ||||||||

| Ms. Dugle’s experience as chairman and chief executive officer of a public engineering services firm and senior officer of a leading public technology company provides our Board expertise in information, technology, cybersecurity, corporate strategy, operations, and research and development, all of which are critical to achieving our strategic objectives. We believe these experiences, qualifications, attributes, and skills qualify Ms. Dugle to serve as a member of our Board. | ||||||||

Age 63 | Director Since 2020 | Committees Audit, Security (Chair) | ||||||||

6 | 2022 Proxy Statement

| Board of Directors | ||

Steven J. Gomo Independent | Professional Experience | |||||||

| - | Executive Vice President, Finance and Chief Financial Officer from October 2004 until his retirement in December 2011, and Senior Vice President, Finance and Chief Financial Officer from August 2002 to September 2004 at NetApp, Inc., a storage and data management company. | |||||||

| Other Current Public Company Directorships | ||||||||

| - | Nutanix, Inc. | |||||||

| - | Enphase Energy, Inc. | |||||||

| Board Skills, Qualifications, and Expertise | ||||||||

| Mr. Gomo’s experience as the chief financial officer of a public technology company provides our Board expertise in the technology industry, particularly in the areas of finance, accounting, treasury, investor relations, and securities, which contribute valuable insights and perspectives to our business and operations. We believe these experiences, qualifications, attributes, and skills qualify Mr. Gomo to serve as a member of our Board. | ||||||||

Age 70 | Director Since 2018 | Committees Audit (Chair), Finance | ||||||||

Linnie M. Haynesworth Independent | Professional Experience | |||||||

| - | Sector Vice President, Cyber and Intelligence Mission Solutions Division from January 2016 to 2019, and Sector Vice President and General Manager from December 2013 to 2019 at Northrop Grumman, a defense and space company. | |||||||

| Other Current Public Company Directorships | ||||||||

| - | Truist Financial Corporation | |||||||

| - | Automatic Data Processing, Inc. | |||||||

| Board Skills, Qualifications, and Expertise | ||||||||

| Ms. Haynesworth’s experience as the sector vice president and general manager of a public defense and space company provides our Board expertise in technology integration, cybersecurity (including a Certificate in Cybersecurity Oversight), enterprise strategy, risk management, and large complex system development, delivery, and deployment, and contributes valuable insights and perspectives to our business and operations. Additionally, Ms. Haynesworth became a Member of the Defense Business Board of the United States Department of Defense in November 2021. We believe these experiences, qualifications, attributes, and skills qualify Ms. Haynesworth to serve as a member of our Board. | ||||||||

Age 65 | Director Since 2021 | Committees Governance and Sustainability, Security | ||||||||

7

7| Board of Directors | ||

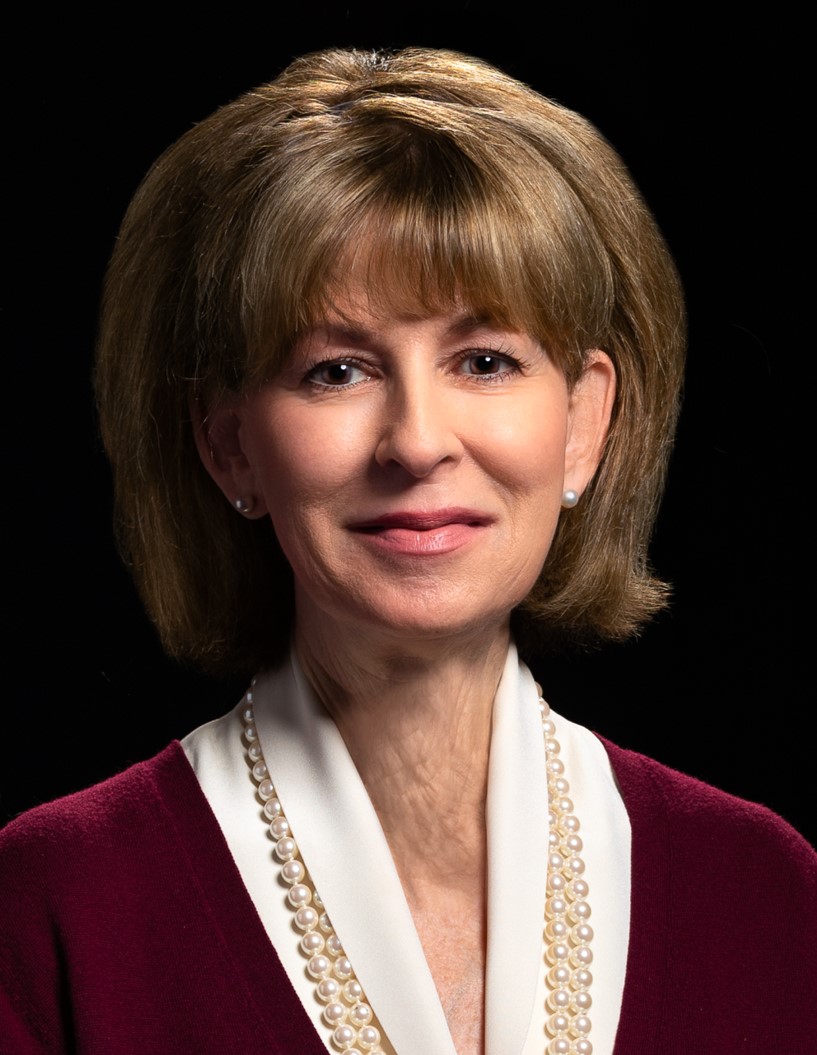

Mary Pat McCarthy Independent | Professional Experience | |||||||

| - | Vice Chair of KPMG LLP, the U.S. member firm of the global audit, tax, and advisory services firm, from July 1998 until her retirement in December 2011. Ms. McCarthy joined KMPG in 1977, became a partner in 1987, and held numerous senior leadership positions with the firm during her tenure. | |||||||

| - | Within the past five years, Ms. McCarthy served on the Board of Directors of Andeavor Corporation and Mutual of Omaha. | |||||||

| Other Current Public Company Directorships | ||||||||

| - | Palo Alto Networks, Inc. | |||||||

| Board Skills, Qualifications, and Expertise | ||||||||

| Ms. McCarthy’s experience advising numerous companies on financial and accounting matters as a Certified Public Accountant (ret.) provides our Board deep technical expertise in financial and accounting matters, and contributes valuable insights and perspectives to our business and operations. We believe these experiences, qualifications, attributes, and skills qualify Ms. McCarthy to serve as a member of our Board. | ||||||||

Age 67 | Director Since 2018 | Committees Audit, Finance (Chair) | ||||||||

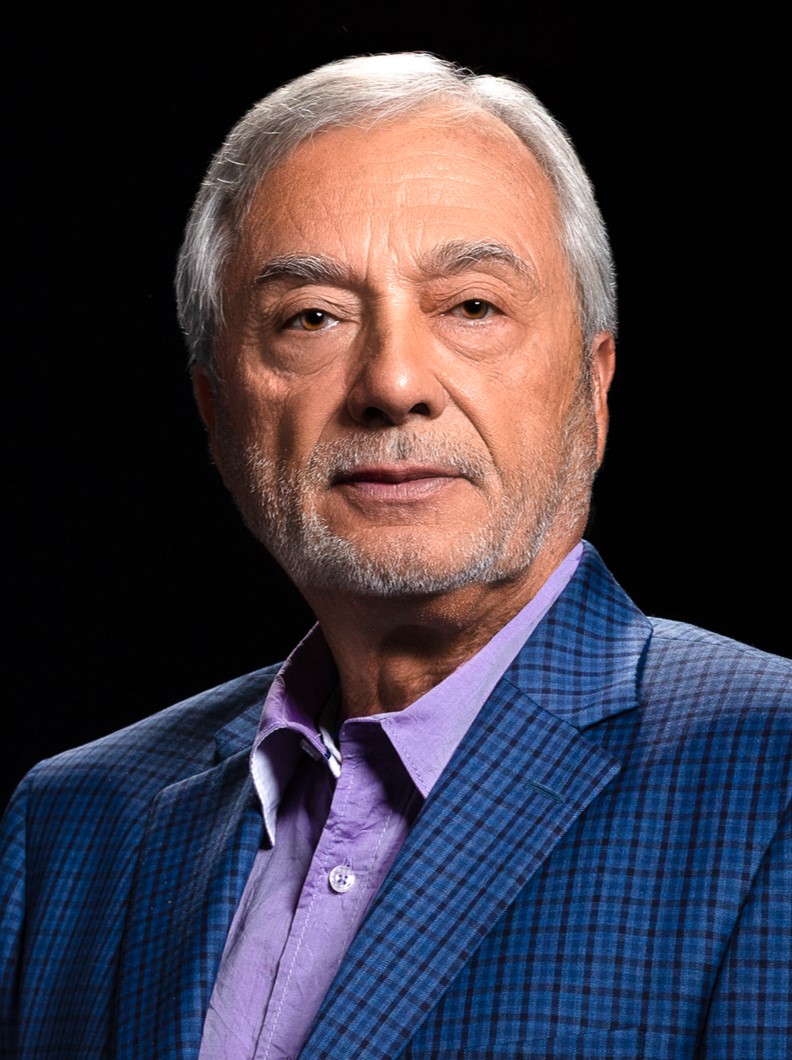

Sanjay Mehrotra Chief Executive Officer | Professional Experience | |||||||

| - | Mr. Mehrotra has served as Micron’s President, Chief Executive Officer, and Director since May 2017. | |||||||

| - | Prior to that, Mr. Mehrotra co-founded and led SanDisk Corporation as a start-up in 1988 until its eventual sale in May 2016, serving as its President and Chief Executive Officer from January 2011 to May 2016 and as a member of its Board of Directors from July 2010 to May 2016. | |||||||

| - | Within the past five years, Mr. Mehrotra served on the Board of Directors of Cavium, Inc. | |||||||

| Other Current Public Company Directorships | ||||||||

| - | CDW Corporation | |||||||

| Board Skills, Qualifications, and Expertise | ||||||||

| Mr. Mehrotra has 42 years of experience in the semiconductor memory industry, and as a co-founder of SanDisk, he offers a unique perspective on the industry and has significant senior leadership and technological expertise. In addition, Mr. Mehrotra’s experience provides our Board expertise in finance, corporate development, corporate governance, and business strategy, all of which are critical to achieving our strategic objectives. We believe these experiences, qualifications, attributes, and skills qualify Mr. Mehrotra to serve as a member of our Board. | ||||||||

Age 64 | Director Since 2017 | Committee Finance | ||||||||

8 | 2022 Proxy Statement

| Board of Directors | ||

Robert E. Switz Independent, Chair of the Board | Professional Experience | |||||||

| - | President and Chief Executive Officer of ADC Telecommunications, Inc., a supplier of network infrastructure products and services, from August 2003 until December 2010 and Chairman from 2008 until December 2010, when Tyco Electronics Ltd. acquired ADC. Mr. Switz joined ADC in 1994 and throughout his career there held numerous leadership positions. | |||||||

| - | Within the past five years, Mr. Switz served on the Board of Directors of Gigamon, Inc. and Mandiant, Inc. | |||||||

| Other Current Public Company Directorships | ||||||||

| - | Marvell Technology Group Ltd. | |||||||

| Board Skills, Qualifications, and Expertise | ||||||||

| Appointed Chair of Micron’s Board of Directors in 2012, Mr. Switz’s experience as Chief Executive Officer and Chairman of a leading technology company and history and leadership on Micron’s Board provide the Board expertise in the technology industry as well as international business operations, finance, corporate development, corporate governance, and management, all of which are critical to achieving our strategic objectives. We believe these experiences, qualifications, attributes, and skills qualify Mr. Switz to serve as a member of our Board. | ||||||||

Age 76 | Director Since 2006 | Committees Compensation, Governance and Sustainability | ||||||||

9

9| Board of Directors | ||

MaryAnn Wright Independent | Professional Experience | |||||||

| - | Group Vice President of Engineering and Product Development of Johnson Controls International (“JCI”) from 2013 to 2017. Ms. Wright also served as Vice President and General Manager for Johnson Controls’ Hybrid Systems business and as CEO of Johnson Controls-Saft from 2007 to 2009. | |||||||

| - | Prior to joining JCI, Ms. Wright served in the Office of the Chair and was EVP Engineering, Sales and Program Management at Collins & Aikman from 2006 to 2007. | |||||||

| - | Prior to that, Ms. Wright held several executive positions at Ford Motor Company, including Chief Engineer, from 2003 to 2005, and Director of Sustainable Mobility Technologies and Hybrid and Fuel Cell Vehicle Programs from 2004 to 2005. | |||||||

| - | Within the past five years, Ms. Wright served on the Board of Directors of Maxim Integrated Products, Inc. and Delphi Technologies. | |||||||

| Other Current Public Company Directorships | ||||||||

| - | Group 1 Automotive, Inc. | |||||||

| - | Brunswick Corporation | |||||||

| - | Solid Power, Inc. | |||||||

| Board Skills, Qualifications, and Expertise | ||||||||

| Ms. Wright’s extensive experience in, and knowledge of, the automotive industry (OEM and Tier 1 supplier), public board experience and her expertise in vehicle, advance powertrain, and energy storage system technologies, provide our Board expertise in the technology industry as well as business operations, finance, corporate development, corporate governance, and management, all of which are critical to achieving our strategic objectives. We believe these experiences, qualifications, attributes, and skills qualify Ms. Wright to serve as a member of our Board. | ||||||||

Age 60 | Director Since 2019 | Committees Compensation, Governance and Sustainability (Chair) | ||||||||

There are no family relationships between any of our directors or executive officers.

The Board recommends voting “FOR” approval of the nominees listed above.

10 | 2022 Proxy Statement

Director Nominations and Board Refreshment and Diversity

Nomination Process

The Governance and Sustainability Committee regularly reviews the appropriate size and composition of the Board, including by anticipating vacancies and required expertise for the effective oversight of the Company. In evaluating the existing Board and any desired characteristics of potential nominees, the Governance and Sustainability Committee considers the knowledge, experience, integrity, and judgment of the candidates, their contribution to the diversity of backgrounds, experience and skills on the Board, and their ability to devote sufficient time and effort to their duties as directors. The Governance and Sustainability Committee considers the following experience particularly relevant: experience in the semiconductor industry or related industries; strong business acumen and judgment; excellent interpersonal skills; business relationships with key individuals in industry, government, and education that may be of significant assistance to us and our operations; familiarity with accounting rules and practices; and “independence” as defined and required by the Listing Rules of the Nasdaq Stock Market LLC (“Nasdaq”) and relevant rules and regulations of the Securities and Exchange Commission (“SEC”). The Governance and Sustainability Committee then recommends the best candidates to the Board.

When the Board decides to add directors to the Board, the Governance and Sustainability Committee works with a third party executive search firm to assist them in identifying and evaluating potential candidates.

Although the Governance and Sustainability Committee has not established specific diversity guidelines, the Board seeks to maintain a balance of perspectives, qualities, and skills on the Board to obtain a diversity of viewpoints to better understand the technical, economic, political, and social environments in which we operate and to enhance Micron’s performance. Accordingly, the Governance and Sustainability Committee takes into account the personal characteristics, experience, and skills of current and prospective directors, including gender, race, and ethnicity, to ensure that our Board comprises a broad range of perspectives, and measures success by the range of viewpoints represented on the Board.

Shareholder Recommendations of Director Candidates

Our Bylaws permit shareholders to nominate directors at an annual meeting of shareholders or at a special meeting at which directors are to be elected. A shareholder may recommend a director candidate to the Governance and Sustainability Committee by delivering a written notice to our Corporate Secretary at our principal executive offices and including the following in the notice: the name and address of the shareholder as they appear on our books or other proof of share ownership; the number of shares of our Common Stock beneficially owned by the shareholder as of the date the shareholder gives written notice; a description of all arrangements or understandings between the shareholder and the director candidate and any other person(s) pursuant to which the recommendation or nomination is to be made by the shareholder; the name, age, business address, and residence address of the director candidate and a description of the director candidate’s business experience for at least the previous five years; the principal occupation or employment of the director candidate; the number of shares of our Common Stock beneficially owned by the director candidate; the consent of the director candidate to serve as a member of our Board if appointed or elected; and any other information required to be disclosed with respect to a director nominee in solicitations for proxies for the election of directors pursuant to our Bylaws and the applicable rules of the SEC.

The Governance and Sustainability Committee may require additional information as it deems reasonably required to determine the eligibility of the director candidate to serve as a member of our Board. Shareholders recommending candidates for consideration by our Board in connection with the next annual meeting of shareholders should submit their written recommendation no later than one hundred twenty (120) calendar days in advance of the date of our Proxy Statement released in connection with the previous year's annual meeting of shareholders. The Governance and Sustainability Committee will evaluate director candidates recommended by shareholders for election to our Board in the same manner and using the same criteria as it uses for any other director candidate. If the Governance and Sustainability Committee determines that a shareholder-recommended

11

11candidate is suitable for membership on our Board, it will include the candidate in the pool of candidates to be considered for nomination upon the occurrence of the next vacancy on our Board or in connection with the next annual meeting of shareholders.

Proxy Access

Our Bylaws permit up to 20 shareholders owning continuously for at least three years shares representing in the aggregate at least 3% of the total voting power of the Company’s outstanding common stock to nominate and include shareholder-nominated director candidates in our proxy materials for annual meetings of shareholders. A shareholder, or group of not more than 20 shareholders (collectively, an “eligible shareholder”), meeting specified eligibility requirements is generally permitted to nominate the greater of (i) two director nominees or (ii) 20% of the number of directors on our Board. Use of the proxy access process to submit shareholder nominees is subject to additional eligibility, procedural, and disclosure requirements set forth in Article II, Section 11 of our Bylaws. A copy of our Bylaws can be found on the Corporate Governance page of our website at www.micron.com and is available in print without charge upon request to corporatesecretary@micron.com.

Other Director Nominations

Shareholders who wish to nominate a person for election as a director in connection with an annual meeting of shareholders (as opposed to making a recommendation to the Governance and Sustainability Committee as described above) and who do not intend for the nomination to be included in our proxy materials pursuant to the proxy access process described above must comply with the advance notice requirement set forth in Article II, Section 11 of our Bylaws.

Board Refreshment and Diversity

The Board believes that periodic Board refreshment can provide new experiences and fresh perspectives to our Board and is most effective if it is sufficiently balanced to maintain continuity among Board members that will allow for the sharing of historical perspectives and experiences relevant to the Company. Our Board seeks to achieve this balance through its director succession planning process, as well as in response to the annual Board and individual director assessment process discussed below. With the appointments of Ms. Haynesworth in 2021, Ms. Dugle in 2020, Ms. Wright in 2019, and Ms. McCarthy and Mr. Gomo in 2018, our Board refreshed its composition while maintaining institutional knowledge with directors of varying lengths of tenure.

12 | 2022 Proxy Statement

The Governance and Sustainability Committee is committed to continuing to identify and recruit highly qualified director candidates with diverse experiences, perspectives, and backgrounds to join our Board. The table below provides certain information regarding the composition of our Board. Each of the categories listed in the table below has the meaning as it is used in Nasdaq Rule 5605(f) and related instructions.

| Board Diversity Matrix (as of September 2, 2021 and September 1, 2022) | ||||||||||||||

| Total Number of Directors | 8 | |||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||

| Part I: Gender Identity | ||||||||||||||

| Directors | 4 | 4 | - | - | ||||||||||

| Part II: Demographic Background | ||||||||||||||

| African American or Black | 1 | - | - | - | ||||||||||

| Alaskan Native or Native American | - | - | - | - | ||||||||||

| Asian | - | 1 | - | - | ||||||||||

| Hispanic or Latinx | - | - | - | - | ||||||||||

| Native Hawaiian or Pacific Islander | - | - | - | - | ||||||||||

| White | 3 | 3 | - | - | ||||||||||

| Two or More Races or Ethnicities | - | - | - | - | ||||||||||

| LGBTQ+ | - | - | - | - | ||||||||||

| Did Not Disclose Demographic Background | - | - | - | - | ||||||||||

In addition, one of our directors is a veteran of the U.S. military.

The Board’s Role and Responsibilities

Shareholder Engagement

We are committed to engaging with our shareholders and soliciting their views and input on important matters.

•Our directors occasionally participate in discussions with our shareholders.

•Members of our management team, together with our investor relations, sustainability and legal teams, maintain an active dialogue with shareholders throughout the year to obtain their input on key matters, and keep our management and Board informed about the issues that matter most to our shareholders.

•The Compensation Committee and Governance and Sustainability Committee routinely review our executive compensation design and governance practices and policies, with an eye towards continual improvement and enhancements. Our investor relations team updates the Board concerning shareholder input on these issues, allowing the Board and its committees to take shareholder input into account when setting pay and governance practices.

In fiscal 2022, our discussions with investors covered a variety of topics, including performance, executive compensation, board composition, governance, environmental sustainability, human capital management, and diversity, equality, and inclusion (“DEI”).

13

13Human Capital and Culture

We believe our people are our most important resource and a critical driver of our competitive advantage. We also believe that our best innovation springs from our team members’ diverse experiences, perspectives, and backgrounds. Our Board considers the creation and maintenance of a diverse and inclusive environment to be a crucial element of the Company’s business strategy, including effectively addressing customer, shareholder, and other stakeholder needs, and believes each Micron hire is an opportunity to enhance the competencies, skills, talent, experience, and perspectives in our Company with diverse perspectives, backgrounds, and viewpoints. The Board has tasked the Company’s management team with taking a proactive approach to DEI, and periodically reviews our programs and processes to ensure continual improvement. In addition to this proactive approach to improving our Company, the Board encouraged the Company to commit resources to the well-being of our communities across the globe. In fiscal 2022, we continued our progress increasing representation of underrepresented groups, maintained pay equity, and continued our work to strengthen our culture of inclusion. We also continued making progress on our six DEI commitments, which focus on internal opportunities and expand our impact outside of Micron into the communities where we work and live. In fiscal 2022, we achieved our goal of investing $500 million with minority-owned and led organizations that provide vital financial services to underserved communities.

Diversity

Our Board believes a diverse workforce is a competitive advantage and that diverse teams drive more innovation, delivering value to our customers and increased returns to shareholders. We believe diverse teams expand creativity and problem-solving, lead to better decision-making, and enhance team member engagement and retention. Encouraged by our Board, we actively pursue a diverse talent pool using advanced technologies and inclusive hiring practices, and we partner with universities around the world to help us grow a workforce that reflects our customers and our communities.

Equality

We believe our vision to enrich life for all includes how we compensate our employees. We analyze our global compensation and benefits to ensure opportunities for all employees because our People value makes it essential we pay everyone fairly. In fiscal 2022, we maintained comprehensive global pay equity for all employees in total compensation across base pay, bonuses, and stock rewards. We have a regular review cadence for pay globally—including base pay and stock awards. If we find gaps during the review, we fix them. We work with a third-party and use dynamic technology to help us analyze and understand our pay variances and adjust when needed. Historically, our pay equity study has focused on gender globally. Our study now focuses on all underrepresented groups: women and people with disabilities globally and veterans, Blacks, and Hispanics in the United States. In addition, in fiscal 2022 we expanded opportunities for pay equity and inclusive benefits by adding race/ethnicity information into our pay equity analysis outside of the United States, including Singapore Malay. We are committed to pay equity for all.

We integrate training on inclusion and allyship, inviting our global employees to learn from various underrepresented groups about their culture, lived experiences, and challenges they may face as a result of their differences. In addition, we provided global inclusive leadership training in fiscal 2022, with an emphasis on supporting team members with disabilities. These trainings help our employees and leaders understand, recognize, and overcome the unconscious biases we all have. We have also added an inclusion advocate in talent review meetings. The inclusion advocate listens carefully for unconscious bias, calls any to the attention of the team, and challenges unfair assumptions to ensure decisions regarding promotions, rotation assignments, access to training and other advancement opportunities are determined fairly.

We also provide grants to minority-owned businesses to help underrepresented businesses have equitable opportunities, which also creates a multiplying effect on the economies of those communities.

14 | 2022 Proxy Statement

Inclusion

We believe that creating an inclusive culture at Micron helps us unleash the human potential of our team members, so everyone feels seen, heard, valued, and respected. These values help us create an environment where team members know they can bring their whole selves to work developing the next solution for data storage, health care technology, self-driving cars, or whatever our applications need to do to drive technology forward. We continue to strengthen our culture of inclusion, with a continued increase in our Inclusion Index score in fiscal 2022 for the third year in a row. And employee resource group (“ERG”) membership continued to grow, increasing by 47% from fiscal 2021, with 39% of our workforce belonging to at least one ERG. In addition, in fiscal 2022 for the first time, we issued stock grants to team members for leadership of our ERGs.

Please see our DEI Annual Report 2021, available at micron.com/DEI, for more information about how we ensure DEI is part of our Company’s global DNA, expanding to a global focus, especially in Asia. Our DEI Annual Report 2021 and the information at or accessible through our website, are not part of or incorporated by reference into this Proxy Statement.

Sustainability

Our commitment to understanding and addressing environmental, social, and governance (“ESG”) issues along our value chain and in our communities is a critical part of our culture and our vision to transform how the world uses information to enrich life for all. Our Board considers ESG issues to be an integral part of its business oversight and our corporate strategy, and has encouraged a proactive approach toward mitigating our impact on the environment, supporting our team members and the communities in which they live, respecting human rights, driving transparency and accountability in our supply chain, and developing innovative products that support a sustainable future. We have developed and are executing on a sustainability strategy in response to these issues that leverages our leading products, responsible sourcing and operations, and engaged team members.

The Board, supported by the Governance and Sustainability Committee and other Board committees as needed, oversees and monitors the development and integration of this strategy, and regularly reviews sustainability performance. Board oversight includes, but is not limited to, material ESG trends and related long and short-term impacts of the Company’s operations, supply chains, and products, as well as the Company’s activities and annual public reporting on these topics directed by the Company’s Sustainability Council, sustainability staff, and various teams implementing the Company’s sustainability efforts.

The Governance and Sustainability Committee reviews and discusses ESG issues at each regularly-scheduled committee meeting. Discussions and reports to the Committee include information about significant ESG issues, such as observations from consultations with team members, customers, investors, and other stakeholders about their interests and expectations for us; our social and environmental impacts and benefits; and the impacts of these issues on our business. Over the past year, the Governance and Sustainability Committee reviewed the implementation of our long-term environmental goals and aspirations. We expect to allocate about $1 billion of capital expenditures to support these goals, though we cannot guarantee that our environmental goals and aspirations set forth below will be realized. These goals and initiatives have been developed based in part on feedback from investors, customers, and current and prospective team members, and are a critical component of our management of evolving physical, regulatory, market, supply chain, and other risks and opportunities related to climate change, water availability, and other ESG issues.

15

15| Our Environmental Goals and Aspirations | ||||||||

| Goals | Aspirations | |||||||

| Emissions: | 75% reduction in greenhouse gas emissions per unit in calendar year 2030 vs. calendar year 2018 42% absolute reduction in scope 1 emissions by calendar year 2030 vs. calendar year 2020 | Net zero scope 1 and 2 emissions by calendar year 2050 | ||||||

| Energy: | 100% renewable energy in U.S. operations in calendar year 2025 100% renewable energy in Malaysia in calendar year 2022 | 100% renewable energy worldwide, where available | ||||||

| Water: | 75% water conservation through reuse, recycling, and restoration in calendar year 2030 | 100% water conservation through reuse, recycling, and restoration | ||||||

| Waste: | 95% reuse, recycle, and recovery and zero hazardous waste to landfill in calendar year 2030* | Zero waste to landfill through waste minimization, reuse, recycling, and recovery | ||||||

* Subject to vendor availability

In fiscal 2022, the Board also reviewed:

•our annual sustainability report content and processes, which in fiscal 2022 included indexes and information aligning with the Sustainability Accounting Standards Board (“SASB”) semiconductor industry standard and Taskforce on Climate-related Financial Disclosures (“TCFD”), supporting investor requests to align with the SASB standard and TCFD recommendations;

•our responsible sourcing and human rights efforts, including our conflict minerals report outlining our response to human rights and other concerns related to mineral sourcing as well as our annual modern slavery and human trafficking statement;

•our human capital initiatives, including our talent acquisition, retention, and development policies and practices; and

•findings from team member, customer, investor and other stakeholder engagement exercises.

We strive to make a positive impact on our team members, the communities in which we operate, and the planet, as well as our customers’ sustainability performance. We plan to continue regular consultation with stakeholders regarding environmental and social issues and report annually on our progress in these efforts. Our 2022 Sustainability Report, available at micron.com/sustainability, includes more details about the ways we are committed to sustainable practices and supporting our global community. Our Sustainability Report, and the information at or accessible through our website, are not part of or incorporated by reference into this Proxy Statement.

Risk Assessment and Mitigation

We operate in a dynamic economic, social, and political landscape, making structured and conscientious risk management more important than ever. Our Board reviews and oversees our Enterprise Risk Management (“ERM”) program, which is a unified approach to risk management that helps us achieve a shared understanding of risks and make informed business decisions. This approach enhances our capability to address future events that create uncertainty and respond in an efficient and effective manner. It also facilitates prompt action to mitigate identified risks and embeds risk management into our culture.

16 | 2022 Proxy Statement

The Board has delegated primary oversight of our ERM process to the Audit Committee, which conducts reviews of our risk assessment and ERM policies as described below, including overseeing the management of risks related to financial reporting and compliance. Other Board committees provide additional insights into our ERM program in the areas of their core competencies, and report to the Board regularly on matters relating to the following specific areas of risk the committees oversee:

•The Compensation Committee oversees management of risks relating to our compensation plans and programs.

•The Finance Committee oversees the Company’s strategies for management of significant financial risks.

•The Governance and Sustainability Committee oversees risks associated with the Board’s governance, director independence, and the Company’s human capital programs and sustainability initiatives.

•The Security Committee oversees risks associated with physical security and cybersecurity.

ERM Process

We designed our ERM program to clearly identify risk management roles and responsibilities, bring together senior management to discuss risk, promote visibility and constructive dialogue, and facilitate risk response and mitigation strategies. The Audit Committee plays a key role in this process, and the full Board conducts periodic reviews.

•As an initial step, our Risk Advisory Services representative meets periodically with business unit and functional area heads to identify significant financial and nonfinancial risk exposures and to develop risk mitigation measures and contingency plans.

•After we collect data from stakeholders throughout the Company, our Risk Advisory Services representative summarizes the results of these meetings and creates a consolidated risk profile.

•Our Risk Advisory Services representative then reviews this risk profile with our senior management, seeking input and agreement on mitigation and response strategies. This process is iterative, and repeats as significant risks are added to, or are removed from, the ERM program.

•Our Risk Advisory Services representative attends quarterly Audit Committee meetings, where the Audit Committee reviews our risk profile and mitigation and response strategies, as well as our progress toward mitigating identified risks. This process repeats for the full Board periodically.

•After incorporating input from the Audit Committee and/or the full Board, Risk Advisory Services designs our internal audit strategies and plans to minimize the impact of relevant risks.

Compensation Risks

The Compensation Committee reviews our compensation programs annually and has concluded that our compensation policies and practices are not reasonably likely to create situations that would have a material adverse effect on us. In making this assessment, the Compensation Committee reviewed our compensation programs to determine if the programs’ provisions and operations create undesired or unintentional risk of a material nature. The Compensation Committee also reviewed the results of our findings with our outside compensation consultant. This risk assessment process included a review of program policies and practices; program analysis to identify risk and risk-control related to the programs; and determinations as to the sufficiency of risk identification, the balance of potential risk to potential reward, and risk-control. Although the Compensation Committee reviewed all compensation programs, the Committee focused on the programs with variability of payout, with the ability of a participant to directly affect payout, and the controls on participant action and payout. In most cases, our compensation policies and practices are centrally designed and administered and are substantially the same across the Company. Certain internal groups have different or supplemental compensation programs tailored to their specific operations and goals, and programs may differ by country due to variations in local laws and customs.

17

17Cybersecurity Risks

The Security Committee regularly reviews and oversees our policies and practices to identify and mitigate cybersecurity risks. Our management team updates the Security Committee at least quarterly on cybersecurity matters. Our cybersecurity policies and practices follow the cybersecurity framework of the National Institute of Standards and Technology (NIST). We engage third parties to perform assessments of our cybersecurity measures at least annually. The results of those assessments are reported to the Security Committee, and we make adjustments to our cybersecurity policies and practices as necessary in light of the assessments. While we have not experienced a material information security (cybersecurity) incident in the past three fiscal years, we maintain an information security (cybersecurity) risk insurance policy as a matter of good practice.

Board Processes and Policies

Code of Business Conduct and Ethics

Acting ethically is a critical part of our culture and our vision to transform how the world uses information to enrich life for all. The Board has adopted a Code of Business Conduct and Ethics that is applicable to all our directors, officers, and team members. The Code of Business Conduct and Ethics sets out our expectations regarding the treatment of our team members, customers, and the communities in which we operate, as well as our commitment to high product quality, ethical and legal sourcing of our materials, and acting with integrity for our investors. A copy of our Code of Business Conduct and Ethics is available at www.micron.com and is also available in print without charge upon request. Any amendments or waivers of the Code of Business Conduct and Ethics will also be posted on our website within four business days of the amendment or waiver as required by applicable rules and regulations of the SEC and the Listing Rules of Nasdaq.

Board Self-Evaluation

The Governance and Sustainability Committee oversees the Board’s ongoing and annual assessments of its effectiveness, including the effectiveness of its committees and directors. All directors complete an evaluation form for the Board and for each committee on which they serve. These forms include ratings for certain key metrics, as well as the opportunity for written comments. The comments provide key insights into the areas directors believe the Board can improve or in which its performance is strong. Evaluation topics include number and length of meetings, topics covered and materials provided, committee structure and activities, Board composition and expertise, succession planning, director participation and interaction with management, and promotion of ethical behavior. Our Board considers the results when making decisions on the structure and responsibilities of our Board and its committees, agendas and meeting schedules for our Board and its committees, and changes in the performance or functioning of our Board.

Director Skills Evaluation

The Governance and Sustainability Committee oversees the Board’s ongoing and annual assessments of the Board’s composition and the skills each director possesses. The Governance and Sustainability Committee has identified and continually refines a list of skills, attributes, and experiences that it believes will result in an effective, dynamic, and diverse Board. The Governance and Sustainability Committee then reviews each director on a matrix in an effort to identify needed skills, experiences, or perspectives. The Governance and Sustainability Committee uses the insights this matrix provides to recommend committee assignments and inform searches for new director candidates or opportunities to refresh Board composition.

Board Structure

Director Independence

The Board has determined that directors Beyer, Dugle, Gomo, Haynesworth, McCarthy, Switz, and Wright qualify as independent directors. In determining the independence of our directors, the Board has adopted independence standards that mirror the criteria specified by applicable laws and regulations of the SEC and the Listing Rules of

18 | 2022 Proxy Statement

Nasdaq. None of these directors have a relationship with us, other than any relationship that is categorically not material under the guidelines referenced above. See “Certain Relationships and Related Transactions.”

Board Leadership Structure

Mr. Switz has served as our independent Chair of the Board since February 2012. We do not have a fixed policy on whether the roles of Chair of the Board and CEO should be separate or combined. The Board’s determination to have an independent, non-employee director as our Chair is based on the Board’s consideration of our and our shareholders’ best interests under the current circumstances. In his role as Chair, Mr. Switz oversees meetings of the independent directors and acts as a liaison between the independent directors and CEO.

Board Meetings and Committees

Our Board held nine formal meetings during fiscal 2022. The Board met in Executive Session (meetings in which only non-employee directors are present) five times during fiscal 2022. In fiscal 2022, the Board had a standing Audit Committee, Compensation Committee, Finance Committee, Governance and Sustainability Committee, and Security Committee. During fiscal 2022, the Audit Committee met fifteen times, the Compensation Committee met five times, the Finance Committee met four times, the Governance and Sustainability Committee met four times, and the Security Committee met five times. In addition to formal committee meetings, the chair of each committee engaged in regular discussions with management regarding various issues relevant to their respective committees. All incumbent directors attended 75% or more of the total number of meetings of the Board during fiscal 2022. All incumbent directors who served on the Audit, Compensation, Finance, Governance and Sustainability, and Security Committees attended 75% or more of the total number of applicable committee meetings during fiscal 2022. We expect director attendance at the Annual Meeting of Shareholders, and all then-incumbent members of our Board were present at the Fiscal 2021 Annual Meeting of Shareholders.

The Audit, Compensation, Finance, Governance and Sustainability, and Security Committees each have written charters that comply with SEC and Nasdaq rules relating to corporate governance matters. Copies of the committee charters as well as our Corporate Governance Guidelines are available at www.micron.com and are also available in print without charge upon request to corporatesecretary@micron.com. The Board has determined that all the members of the Audit, Compensation, Governance and Sustainability, and Security Committees satisfy the independence requirements of applicable SEC laws and the Listing Rules of Nasdaq for such committees.

Audit Committee

Mses. McCarthy and Dugle and Mr. Gomo currently serve, and during fiscal 2022 served, on the Audit Committee. Mr. Gomo has served as the Chair of the Audit Committee since January 2019. The Board has determined that all Audit Committee members qualify as an “audit committee financial expert” for purposes of the rules and regulations of the SEC and that each of these members is sufficiently proficient in reading and understanding our financial statements to serve on the Audit Committee. The purpose of the Audit Committee is to assist the Board in overseeing and monitoring:

•the integrity of our financial statements;

•the adequacy of our internal controls and procedures;

•the performance of our internal audit function;

•the performance of our Independent Registered Public Accounting Firm;

•the qualifications and independence of our Independent Registered Public Accounting Firm; and

•our compliance with legal and regulatory requirements.

The Audit Committee is also responsible for preparing the Audit Committee report that is included in our annual Proxy Statement. See “Audit Committee Matters – Report of the Audit Committee of the Board of Directors.” The

19

19complete duties and responsibilities of the Audit Committee are set forth in its written charter, which is available at www.micron.com and is also available in print without charge upon request to corporatesecretary@micron.com.

Compensation Committee

Ms. Wright and Messrs. Beyer and Switz currently serve, and during fiscal 2022 served, on the Compensation Committee. Mr. Beyer has served as the Chair of the Compensation Committee since April 2021. Previously, Mr. Switz had served as the Chair of the Compensation Committee since January 2019. The Board has determined that all Compensation Committee members qualify as “non-employee directors” as defined under Rule 16b-3, promulgated under Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Compensation Committee is responsible for reviewing and approving the compensation of our executive officers. See “Executive Compensation and Related Information – Compensation Discussion and Analysis” and “– Compensation Committee Report” for information regarding how the Compensation Committee sets executive compensation levels. The Compensation Committee has authority to delegate any of its responsibilities to a subcommittee as it may deem appropriate in its judgment. The complete duties of the Compensation Committee are set forth in its written charter, which is available at www.micron.com and is also available in print without charge upon request to corporatesecretary@micron.com.

Finance Committee

Ms. McCarthy and Messrs. Gomo and Mehrotra currently serve, and during fiscal 2022 served, on the Finance Committee. Mr. Mehrotra joined the Finance Committee when he became our President and CEO in May 2017. Ms. McCarthy has served as the Chair of the Finance Committee since January 2019. The Finance Committee represents and assists the Board in discharging its responsibilities with respect to oversight of our financial policies, financial strategies, capital structure, debt and equity offerings, capital return program, cash management and investments, risk management related to hedge and derivative instruments, and insurance. The complete duties of the Finance Committee are set forth in its written charter, which is available at www.micron.com and is also available in print without charge upon request to corporatesecretary@micron.com.

Governance and Sustainability Committee

Mses. Haynesworth and Wright and Messrs. Beyer and Switz currently serve, and during fiscal 2022 served, on the Governance and Sustainability Committee. Ms. Wright has served as Chair of the Governance and Sustainability Committee since April 2021. The responsibilities of the Governance and Sustainability Committee include assisting the Board in discharging its duties with respect to the following:

•the identification and selection of nominees to our Board;

•director compensation;

•oversight and monitoring of the development and integration of material social and environmental strategies;

•oversight and monitoring of our human capital management efforts, including culture, talent development and retention, and DEI programs and initiatives;

•the development of our Corporate Governance Guidelines; and

•evaluation of the Board and management.

The complete duties and responsibilities of the Governance and Sustainability Committee are set forth in its written charter, which is available at www.micron.com and is also available in print without charge upon request to corporatesecretary@micron.com.

20 | 2022 Proxy Statement

Security Committee

Mses. Dugle and Haynesworth and Mr. Beyer currently serve, and during fiscal 2022 served, on the Security Committee. Ms. Dugle has served as Chair of the Security Committee since June 2021. The responsibilities of the Security Committee include assisting the Board in discharging its duties with respect to oversight of the following:

•physical security of our facilities and employees as well as enterprise cybersecurity and data protection risks associated with our security-related infrastructure and related operations including outside partners;

•cyber crisis preparedness and security breach and incident response plans;

•compliance with applicable information security and data protection laws and industry standards;

•our physical and cybersecurity strategy, crisis or incident management, and security-related information technology planning processes; and

•public disclosure relating to security of our employees, facilities, and information technology systems, including privacy, network security, and data security.

The complete duties and responsibilities of the Security Committee are set forth in its written charter, which is available at www.micron.com and is also available in print without charge upon request to corporatesecretary@micron.com.

Executive Sessions and Communications with the Board of Directors

Mr. Switz has been the independent Chair of our Board since February 2012. As part of his duties as Chair, Mr. Switz chairs Executive Session meetings of our Board. Shareholders and interested parties wishing to communicate with our Board may contact Mr. Switz at chair@micron.com.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Related party transactions are reviewed by our Board in accordance with our related party transaction policy. Related parties include our directors and officers, their family members and affiliates, and certain beneficial owners. In cases where the related party is a director or an affiliate of a director, that director does not participate in the review of the proposed transaction. In reviewing a proposed related party transaction, the Board considers all the relevant facts and circumstances of the transaction, such as (i) the nature and terms of the transaction, (ii) the dollar value of the transaction, (iii) whether the terms of the transaction are at least as favorable as they would have been if a related party was not involved, (iv) the business reasons for the transaction, (v) whether the transaction would result in an improper conflict of interest, and (vi) the effects of the transaction on the ongoing relationship between us and the related party. There were no actual or proposed related party transactions in excess of $120,000 for fiscal 2022 and through November 14, 2022. Subsequent to November 14, 2022, Mr. Mehrotra reimbursed the Company in respect of his usage of Micron aircraft for personal travel in fiscal 2022. See “Executive Compensation and Related Information – Compensation Discussion and Analysis – CEO Compensation – Other Compensation” below.

21

21DIRECTOR COMPENSATION

The Governance and Sustainability Committee oversees the setting of compensation for our non-employee members of the Board. Each year, the Governance and Sustainability Committee works with the compensation consultant to review and evaluate director compensation for the ensuing fiscal year, in light of prevailing market conditions and to attract, retain, and reward qualified non-employee directors. The compensation consultant gathers and reviews market data for non-employee directors from the same Compensation Peer Group used to evaluate officer compensation. For a discussion concerning the companies that comprised our Compensation Peer Group, please see “Executive Compensation and Related Information – Compensation Discussion and Analysis” below. Upon completion of its review and evaluation, the Governance and Sustainability Committee did not recommend any changes to the Board in director compensation for fiscal 2023.

Elements of Director Compensation

Annual Retainer and Committee Chair Remuneration

Non-employee directors were entitled to receive an annual retainer of $125,000 in fiscal 2022. Pursuant to our 2008 Director’s Compensation Plan (the “DCP”), which operates as a sub-plan of the Amended and Restated 2007 Equity Incentive Plan (the “2007 Plan”), non-employee directors may elect to take some or all of their annual retainer in the form of cash, shares of Common Stock, or deferred rights to receive Common Stock upon termination as a director. Employee directors receive no additional or special remuneration for their service as directors. The amounts earned by the non-employee directors in respect of their service during fiscal 2022 are set forth below under “Fiscal 2022 Director Compensation.”

Set forth below are the amounts directors are entitled to receive for their service as committee chair or Chair of the Board for fiscal 2022 and 2023:

| 2023 | 2022 | ||||||||||

| Audit Committee Chair | $ | 35,000 | $ | 35,000 | |||||||

| Compensation Committee Chair | 30,000 | 30,000 | |||||||||

| Finance Committee Chair | 20,000 | 20,000 | |||||||||

| Governance and Sustainability Committee Chair | 20,000 | 20,000 | |||||||||

| Security Committee Chair | 20,000 | 20,000 | |||||||||

| Chair of the Board | 150,000 | 150,000 | |||||||||

Except for the foregoing, directors do not receive any additional or special cash remuneration for their service on any of the committees established by the Board. We reimburse directors for travel and lodging expenses, if any, incurred in connection with attendance at Board meetings.

Equity Award

Non-employee directors receive an equity award each fiscal year. Since fiscal 2007, the equity award has been exclusively in the form of restricted stock. The restricted stock includes the right to receive dividend equivalents, which will accumulate and pay out in cash, if and when the underlying shares are released. The “targeted value” for the annual non-employee director equity award is established each year by the Board following discussions with the compensation consultant and has been set at $250,000 since fiscal 2015. The number of restricted shares awarded to each non-employee director is determined by dividing the applicable targeted value by the Fair Market Value of a share of our Common Stock, as defined under our equity plans. For purposes of our equity plans, “Fair Market Value” is the closing price of our Common Stock on the last market-trading day prior to the date of grant. The restrictions on the shares awarded in fiscal 2022 lapse for 100% of such shares on the first anniversary of the date of grant (the “Vesting Period”). Notwithstanding the foregoing, the restrictions will lapse for 100% of such shares in the event a director reaches the mandatory retirement age, if any, or retires from the Board during the Vesting Period having achieved a minimum of three years of service with the Board prior to the effective date of their retirement, or upon a director’s death or disability.

22 | 2022 Proxy Statement

Fiscal 2022 Director Compensation

The following table details the total compensation earned by our non-employee directors in fiscal 2022.

| Name | Fees Earned or Paid in Cash | Stock Awards(1) | Total | ||||||||

| Richard M. Beyer | $ | 155,000 | $ | 250,000 | $ | 405,000 | |||||

| Lynn A. Dugle | 145,000 | 250,000 | 395,000 | ||||||||

| Steven J. Gomo | 160,000 | 250,000 | 410,000 | ||||||||

| Linnie M. Haynesworth | 125,000 | 250,000 | 375,000 | ||||||||

| Mary Pat McCarthy | 145,000 | 250,000 | 395,000 | ||||||||

| Robert E. Switz | 275,000 | 250,000 | 525,000 | ||||||||

| MaryAnn Wright | 145,000 | 250,000 | 395,000 | ||||||||

(1)On October 13, 2021, each of Messrs. Beyer, Gomo, and Switz, and Mses. Dugle, Haynesworth, McCarthy, and Wright was granted 3,747 shares of restricted stock with a grant date fair value of $250,000 ($66.72 per share). For information on the restrictions associated with these awards, see “Elements of Director Compensation – Equity Award” above.

As of September 1, 2022, each of Messrs. Beyer, Gomo, and Switz, and Mses. Dugle, Haynesworth, McCarthy, and Wright had outstanding a grant of 3,747 shares of restricted stock. For information regarding Mr. Mehrotra’s holding of stock as of September 1, 2022, see “Outstanding Equity Awards at Fiscal 2022 Year-End” below.

As of September 1, 2022, each of Messrs. Beyer, Gomo, and Switz, and Mses. Dugle, Haynesworth, McCarthy, and Wright had outstanding a grant of 3,747 shares of restricted stock. For information regarding Mr. Mehrotra’s holding of stock as of September 1, 2022, see “Outstanding Equity Awards at Fiscal 2022 Year-End” below.

Stock Ownership Guidelines

We have established stock ownership guidelines for our directors. The minimum ownership guideline for directors is to hold shares with a value equal to five times their annual retainer. The minimum ownership guideline for our CEO is to hold shares with a value equal to five times his base salary. Directors are given five years to meet the ownership guidelines. The Governance and Sustainability Committee reviews the Ownership Guidelines annually and monitors each person’s progress toward, and continued compliance with, the guidelines. Stock sales restrictions may be imposed upon directors if the stock ownership guidelines are not met. All our directors are either in compliance with the guidelines or are newer directors who have time remaining to meet the guidelines.

The following table shows non-employee director compliance with the guidelines as of the Record Date:

| Director | Guideline Multiplier | Guideline Amount | Compliance with Guideline | ||||||||

| Richard M. Beyer | 5 | $ | 625,000 | Yes | |||||||

| Lynn A. Dugle | 5 | 625,000 | Yes | ||||||||

| Steven J. Gomo | 5 | 625,000 | Yes | ||||||||

| Linnie M. Haynesworth | 5 | 625,000 | (1) | ||||||||

| Mary Pat McCarthy | 5 | 625,000 | Yes | ||||||||

| Robert E. Switz | 5 | 625,000 | Yes | ||||||||

| MaryAnn Wright | 5 | 625,000 | Yes | ||||||||

(1)Ms. Haynesworth has until February 15, 2026 to meet the guidelines because she first joined the Board in 2021.

Please refer to page 47 for information on the stock ownership guidelines for our Named Executive Officers.

23

23EXECUTIVE COMPENSATION AND RELATED INFORMATION

| PROPOSAL 2 – ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS (“SAY-ON-PAY”) | ||

| PROPOSAL DETAILS | |||||

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 enables our shareholders to vote to approve, on an advisory (non-binding) basis, the compensation of our Named Executive Officers as described in this Proxy Statement in the “Compensation Discussion and Analysis” section and the related compensation tables beginning on page 26. We seek your advisory vote and ask that you indicate your support for the compensation of the Named Executive Officers as disclosed in this Proxy Statement.

This “say-on-pay” proposal gives our shareholders the opportunity to express their views on the compensation of our Named Executive Officers. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our Named Executive Officers as described in this Proxy Statement. At our Fiscal 2017 Annual Meeting of Shareholders, our shareholders voted to have an annual advisory vote on say-on-pay and in accordance with the results of this vote, the Board determined to implement an advisory vote on executive compensation every year until the next required vote on the frequency of shareholder votes on the compensation of executives, which is expected to occur at the Fiscal 2023 Annual Meeting of Shareholders.