Form 497K VALIC Co I

Summary Prospectus

October 1, 2022

VALIC Company I

Growth Fund

(Ticker: VCULX)

The Fund’s

Statutory Prospectus and Statement of Additional Information, each dated October 1, 2022, as amended and supplemented from time to time, and the most recent shareholder

reports are incorporated into and made part of this Summary Prospectus by reference. The Fund is offered

only to registered and unregistered separate accounts of The Variable Annuity Life Insurance Company and its affiliates and to qualifying retirement plans and IRAs and is not

intended for use by other investors.

Before you invest, you may want to review the Fund’s Statutory Prospectus, which contains more

information about the Fund and its risks. You can find the Statutory Prospectus and the above-incorporated information online at

http://valic.onlineprospectus.net/VALIC/FundDocuments/index.html. You can also get this information at no cost by calling 800-448-2542 or by sending an e-mail request to [email protected].

The Securities and Exchange Commission has not approved or disapproved these securities, nor has it

determined that this Summary Prospectus is accurate or complete. It is a criminal offense to state otherwise.

Investment Objective

The Fund seeks long-term capital growth.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund.

The table and the example below do not reflect the separate account fees charged in the variable annuity or variable life insurance policy

(“Variable Contracts”) in which the Fund is offered. If separate account fees were

shown, the Fund’s annual operating expenses would be higher. Please see your Variable Contract prospectus

for more details on the separate account fees.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Management Fees |

0.68% |

| Other Expenses |

0.09% |

| Total Annual Fund Operating Expenses |

0.77% |

| Fee Waivers and/or Expense Reimbursements1

|

0.16% |

| Total Annual Fund Operating Expenses

After Fee Waivers and/or Expense

Reimbursements1 |

0.61% |

1

The Fund’s investment adviser, The Variable Annuity Life Insurance Company (“VALIC”), has contractually agreed to waive its advisory fee until September 30, 2023, so that the advisory fee payable by the

Fund to VALIC equals 0.57% on the first $500 million of the Fund’s average daily net assets, 0.51% on the

next $500 million of the Fund’s average daily net assets, 0.48% on the next $500 million of the

Fund’s average daily net assets, and 0.45% on average daily net assets over $1.5 billion. This agreement may be modified or discontinued prior to such time only with the approval of the Board of

Directors of VALIC Company I (“VC I”), including a majority of the directors who are not

“interested persons” of VC I as defined in the Investment Company Act of 1940, as amended.

Expense Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem or hold all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses include fee waivers for one year. The Example does not reflect charges imposed by the Variable Contract. If the Variable Contract fees were reflected, the expenses would be higher. See the Variable Contract prospectus for information on such charges. Although your actual costs may be higher or lower, based on these assumptions and the net expenses shown in the fee table, your costs would be:

| 1 Year |

3 Years |

5 Years |

10 Years |

| $62 |

$230 |

$412 |

$939 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns

over” its portfolio). These costs, which are not reflected in annual fund operating expenses or in the

Example, affect the Fund’s performance.

During the most recent fiscal year, the Fund’s portfolio turnover rate was 60% of the average value of its

portfolio.

VALIC Company I

- 1 -

Growth Fund

Principal

Investment Strategies of the Fund

The Fund attempts to achieve its investment objective by investing primarily in common stock of companies that are selected based on such factors as strong earnings, strong sales and revenue growth and capital appreciation potential. The Fund will emphasize common stock of companies with mid- to large-stock market capitalizations; however, the Fund also may invest in the common stock of small companies. The Fund generally invests at least 65% of its total assets in equity securities. Equity securities consist of common stock and American Depositary Receipts (“ADRs”). The Fund may invest without limitation

in the securities of foreign companies in the form of ADRs. In addition to ADRs, the Fund may also invest up to

20% of its total assets in securities of foreign companies, including companies located in emerging

markets.

VALIC is the Fund’s investment adviser. The Fund is managed by two subadvisers. The Fund’s assets

are not necessarily divided equally among the subadvisers. Approximately 25% of the Fund’s assets will be

allocated to one subadviser (the “Passive Manager”) that will passively manage a portion of the

assets allocated to it by seeking to track the S&P 500® Growth Index (the “Underlying Index”), and the remainder of the Fund’s assets will be allocated to the other subadviser (the “Active Manager”). The Fund’s target allocations

among the subadvisers are subject to change at the discretion of VALIC, and actual allocations could vary

substantially from the target allocations due to market valuation changes.

The Passive

Manager primarily seeks to track its sleeve’s Underlying Index by investing in all or substantially all of

the stocks included in the Underlying Index, a strategy known as “replication.” The Passive Manager

may, however, utilize an “optimization” strategy in circumstances in which replication is difficult

or impossible. The goal of optimization is to select stocks which ensure that characteristics such as industry

weightings, average market capitalizations and fundamental characteristics (e.g., price-to-book,

price-to-earnings, debt-to-asset ratios and dividend yields) closely approximate those of the Underlying

Index.

The Active Manager selects not less than 25 to not more than 45 companies through a process of both top-down macro-economic analysis of economic and business conditions, and bottom-up analysis of the business fundamentals of individual companies. Stocks are selected from a universe of companies that the Active Manager believes have above average growth potential. The Active Manager will make investment decisions based

on judgments regarding several valuation parameters relative to anticipated rates of growth in earnings and potential rates of return on equity.

In order to

generate additional income, the Fund may lend portfolio securities to broker-dealers and other financial

institutions provided that the value of the loaned securities does not exceed 30% of the Fund’s total

assets. These loans earn income for the Fund and are collateralized by cash and securities issued or guaranteed

by the U.S. Government or its agencies or instrumentalities.

The Fund is a non-diversified fund, which means that it may invest in a smaller number of issuers than a diversified fund.

Principal Risks of Investing in the Fund

As with any mutual fund, there can be no assurance that the Fund’s investment objective will be met or

that the net return on an investment in the Fund will exceed what could have been obtained through other

investment or savings vehicles. Shares of the Fund are not bank deposits and are not guaranteed or insured by any bank, government entity or the Federal Deposit Insurance Corporation. If the value of the assets of the Fund goes down, you could lose money.

The following is a summary of

the principal risks of investing in the Fund.

Index Risk. In

attempting to track the performance of the index, the Fund may be more susceptible to adverse developments

concerning a particular security, company or industry because the Fund generally will not use any defensive

strategies to mitigate its risk exposure.

Failure to Match Index

Performance Risk. The ability of the Fund to match the performance of the Underlying Index may be affected by, among other things, changes in securities markets, the manner in which performance of the Underlying Index is calculated, changes in the composition of the Underlying Index, the amount and timing of cash flows into and out of the Fund, commissions, portfolio expenses, and any differences in the pricing of securities by the Fund and the Underlying Index. When the Fund employs an “optimization”

strategy, the Fund is subject to an increased risk of tracking error, in that the securities selected in the

aggregate for the Fund may perform differently than the Index.

Management Risk. The investment style or strategy used by the subadviser may fail to produce the intended result. The subadviser’s assessment of a particular security or

VALIC Company I

- 2 -

Growth Fund

company may

prove incorrect, resulting in losses or underperformance.

Dividend-paying Stocks Risk. There is no guarantee that the issuers of the stocks held by the Fund will declare dividends in the future or that, if dividends are declared,

they will remain at their current levels or increase over time. Dividend-paying stocks may not participate in a

broad market advance to the same degree as other stocks, and a sharp rise in interest rates or economic downturn could cause a company to unexpectedly reduce or eliminate its dividend.

Equity Securities Risk. The Fund’s investments in equity securities are subject to the risk that stock prices will fall and may underperform other asset classes. Individual stock prices fluctuate from day-to-day and may decline significantly. The prices of individual stocks may be negatively affected by poor company results or other factors affecting individual prices, as well as industry and/or economic trends and developments affecting industries

or the securities market as a whole.

Currency Risk. Because the Fund’s foreign investments are generally held in foreign currencies, the Fund could experience gains or losses based solely on changes in the exchange rate between foreign currencies and the U.S. dollar. Such gains or losses may be substantial.

Foreign Investment Risk. Investment in foreign securities involves risks due to several factors, such as illiquidity, the lack of public information, changes in the exchange rates between foreign currencies and the U.S. dollar, unfavorable political, social and legal developments, or economic and financial instability. Foreign companies are not subject to the U.S. accounting and financial reporting standards and may have riskier settlement procedures. U.S. investments that are denominated in foreign currencies or that are traded in foreign markets, or securities of U.S. companies that have significant foreign operations may be subject to foreign investment risk.

Depositary Receipts Risk. Depositary receipts are generally subject to the same risks as the foreign securities that they evidence or into which they may be converted. Depositary receipts may or may not be jointly sponsored by the underlying issuer. The issuers of unsponsored depositary receipts are not obligated to disclose information that is considered material in the United States. Therefore, there may be less information available regarding the issuers and there may not be a correlation between such information and the market value of the depositary receipts. Certain depositary

receipts

are not listed on an exchange and therefore may be considered to be illiquid securities.

Emerging Markets Risk. Investments in emerging markets are subject to all of the risks of investments in foreign securities, generally to a greater extent than in developed markets, and additional risks as well. Generally, the economic, social, legal, and political structures in emerging market countries are less diverse, mature and stable than those in developed countries. As a result, investments in emerging market securities tend to be more volatile than investments in developed countries. Unlike most developed countries, emerging market countries may impose restrictions on foreign investment. These countries may also impose confiscatory taxes on investment proceeds or otherwise restrict the ability of foreign investors to withdraw their money at will.

Focused Fund Risk. The Fund, because it may invest in a limited number of companies, may have more volatility in its net asset value and is considered to have more risk than a portfolio that invests in a greater number of companies because changes in the value of a single security may have a more significant effect, either negative or positive, on the Fund’s net asset value. To the

extent the Fund invests its assets in fewer securities, the Fund is subject to greater risk of loss if any of

those securities decline in price.

Growth Style Risk. Generally, “growth” stocks are stocks of companies that a subadviser believes have anticipated earnings ranging from steady to accelerated growth. Many investors buy growth stocks because of anticipated superior earnings growth, but earnings disappointments often result in sharp price declines. Growth companies usually invest a high portion of earnings in their own businesses so their stocks may lack the dividends that can cushion share prices in a down market. In addition, the value of growth stocks may be more sensitive to changes in current or expected earnings than the value of other stocks, because growth stocks trade at higher prices relative to current earnings.

Large- and Mid-Cap Company Risk. Investing in large- and mid-cap companies carries the risk that due to current market conditions these companies may be out of favor with investors. Large-cap companies may be unable to respond quickly to new competitive challenges or attain the high growth rate of successful smaller companies. Stocks of mid-cap companies may be more volatile than those of larger companies due to, among other reasons, narrower product lines, more limited financial resources and fewer experienced managers.

VALIC Company I

- 3 -

Growth Fund

Small-Cap Company Risk. Investing in small-cap companies carries the risk that due to current market conditions these companies may be out of favor with investors. Small companies often are in the early stages of development with limited product lines, markets, or financial resources and managements lacking depth and experience, which may cause their stock prices to be more volatile than those of larger companies. Small company stocks may be less liquid yet subject to abrupt or erratic price movements. It may take a substantial period of time before the Fund realizes a gain on an investment in a small-cap company, if it realizes any gain at all.

Market Risk. The

Fund’s share price can fall because of weakness in the broad market, a particular industry, or specific

holdings or due to adverse political or economic developments here or abroad, changes in investor psychology,

or heavy institutional selling and other conditions or events (including, for example, military confrontations,

war, terrorism, disease/virus, outbreaks and epidemics). The prices of individual securities may fluctuate,

sometimes dramatically, from day to day. The prices of stocks and other equity securities tend to be more

volatile than those of fixed-income securities.

The coronavirus pandemic and the related

governmental and public responses have had and may continue to have an impact on the Fund’s investments

and net asset value and have led and may continue to lead to increased market volatility and the potential for

illiquidity in certain classes of securities and sectors of the market. Preventative or protective actions that

governments may take in respect of pandemic or epidemic diseases may result in periods of business disruption,

business closures, inability to obtain raw materials, supplies and component parts, and reduced or disrupted

operations for the issuers in which the Fund invests. Government intervention in markets may impact interest

rates, market volatility and security pricing. The occurrence, reoccurrence and pendency of such diseases could

adversely affect the economies (including through changes in business activity and increased unemployment) and financial markets either in specific countries or worldwide.

Non-Diversification Risk. Because the Fund may invest in a smaller number of issuers, its value may be affected to a greater extent by the performance of any one of those issuers or by any single economic, political, market or regulatory event affecting any one of those issues than a fund that invests in a larger number of issuers.

Price Volatility

Risk. The Fund’s investment strategy may subject the Fund’s portfolio to increased volatility.

Volatility may cause the value of the Fund’s portfolio to fluctuate significantly in the short

term.

Securities Lending Risk. Engaging in securities lending could increase the market and credit risk for Fund investments. The Fund may lose money if it does not recover borrowed securities, the value of the collateral falls, or the value of investments made with cash collateral declines. The Fund’s loans will be collateralized by

securities issued or guaranteed by the U.S. Government or its agencies and instrumentalities, which subjects

the Fund to the credit risk of the U.S. Government or the issuing federal agency or instrumentality. If the

value of either the cash collateral or the Fund’s investments of the cash collateral falls below the

amount owed to a borrower, the Fund also may incur losses that exceed the amount it earned on lending the

security. Securities lending also involves the risks of delay in receiving additional collateral or possible

loss of rights in the collateral if the borrower fails. Another risk of securities lending is the risk that the

loaned portfolio securities may not be available to the Fund on a timely basis and the Fund may therefore lose

the opportunity to sell the securities at a desirable price.

Sector Risk.

Companies with similar characteristics may be grouped together in broad categories called sectors. Sector risk

is the risk that securities of companies within specific sectors of the economy can perform differently than

the overall market. This may be due to changes in such things as the regulatory or competitive environment or

to changes in investor perceptions regarding a sector. Because the Fund may allocate relatively more assets to

certain sectors than others, the Fund’s performance may be more susceptible to any developments which

affect those sectors emphasized by the Fund.

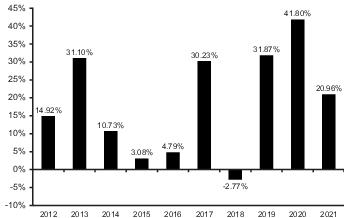

Performance Information

The following Risk/Return Bar Chart and Table illustrate the risks of investing in the Fund by showing

changes in the Fund’s performance from calendar year to calendar year and comparing the Fund’s

average annual returns to those of the Russell 1000® Growth Index and S&P® 500 Growth Index.Fees and expenses incurred at the

contract level are not reflected in the bar chart or table. If these amounts were reflected, returns would be

less than those shown. Of course, past performance of the Fund is not necessarily an indication of how the Fund will perform in the future.

American Century Investment Management, Inc. served as subadviser of the Fund from its inception until September 30, 2019. BlackRock Investment Management, LLC (“BlackRock”) and SunAmerica Asset

VALIC Company

I

- 4 -

Growth Fund

Management, LLC

(“SunAmerica”) assumed subadvisory duties of the Fund on September 30, 2019.

During the period shown in the bar chart:

| Highest Quarterly

Return: |

June 30, 2020 |

28.99% |

| Lowest Quarterly

Return: |

December 31, 2018 |

-16.34% |

| Year to Date Most

Recent Quarter: |

June 30, 2022 |

-32.19% |

Average Annual Total Returns (For the periods ended December 31, 2021)

| |

1

Year |

5

Years |

10 Years |

| Fund |

20.96% |

23.42% |

17.84%

|

| Russell 1000® Growth Index (reflects

no deduction for fees, expenses or

taxes) |

27.60% |

25.32% |

19.79%

|

| S&P 500® Growth Index (reflects no

deduction for fees, expenses or

taxes) |

32.01% |

24.11% |

19.23%

|

Investment Adviser

The Fund’s investment adviser is VALIC.

The

Fund is subadvised by BlackRock and SunAmerica.

Portfolio Managers

| Name and Title |

Portfolio

Manager of the Fund

Since |

| SunAmerica |

|

| Timothy Campion

Senior Vice President and Lead

Portfolio Manager |

2019 |

| Elizabeth Mauro

Portfolio Manager and Co-Portfolio

Manager |

2019 |

| BlackRock |

|

| Lawrence Kemp, CFA

Managing Director and Portfolio

Manager |

2019 |

| Philip H. Ruvinsky, CFA Managing Director and Portfolio Manager |

2020 |

| Caroline Bottinelli

Director and Portfolio Manager |

2022 |

Purchases and Sales of Fund Shares

Shares of the Funds may only be purchased or redeemed through Variable Contracts offered by the separate

accounts of VALIC or other participating life insurance companies and through qualifying retirement plans

(“Plans”) and IRAs. Shares of each Fund may be purchased and redeemed each day the New York Stock

Exchange is open, at the Fund’s net asset value determined after receipt of a request in good

order.

The Funds do not have any initial or subsequent investment minimums. However, your insurance company may impose investment or account value minimums. The prospectus (or other offering document) for your Variable Contract contains additional information about purchases and redemptions of the Funds’ shares.

VALIC Company I

- 5 -

Growth Fund

Tax

Information

A Fund will not be subject to U.S. federal income tax so long as it qualifies as a regulated investment

company and distributes its income and gains each year to its shareholders. However, contractholders may be

subject to federal income tax (and a federal Medicare tax of 3.8% that applies to net income, including taxable

annuity payments, if applicable) upon withdrawal from a Variable Contract. Contractholders should consult the

prospectus (or other offering document) for the Variable Contract for additional information regarding

taxation.

Payments to Broker-Dealers and

Other Financial Intermediaries

Other Financial Intermediaries

The Funds are not sold directly to the general public but instead are offered to registered and unregistered

separate accounts of VALIC and its affiliates and to Plans and IRAs. The Funds and their related companies

may make payments to the sponsoring insurance company or its affiliates for recordkeeping and distribution.

These payments may create a conflict of interest as they may be a factor that the insurance company considers

in including the Funds as underlying investment options in a variable contract. Visit your sponsoring insurance

company’s website for more information.

VALIC Company

I

- 6 -

[THIS PAGE INTENTIONALLY LEFT BLANK]

- 7 -

- 8 -