Form DEFR14A VALIC Co I

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☒ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

VALIC COMPANY I

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||||

| (1) | Title of each class of securities to which transaction applies: | |||||

|

|

||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||

|

|

||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||

|

|

||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||

|

|

||||||

| (5) | Total fee paid: | |||||

|

|

||||||

| ☐ | Fee paid previously with preliminary materials. | |||||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||

| (1) | Amount Previously Paid: | |||||

|

|

||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||

|

|

||||||

| (3) | Filing Party: | |||||

|

|

||||||

| (4) | Date Filed: | |||||

|

|

||||||

EXPLANATORY NOTE

VALIC Company I is filing the attached definitive additional materials to amend and restate in their entirety the definitive additional materials previously filed with the Securities and Exchange Commission on August 17, 2022, relating to the “VALIC Company I (VC I) Funds Proxy Mediant Contact Center Scripting.”

|

VALIC Company I (VC I) Funds Proxy Mediant Contact Center Scripting

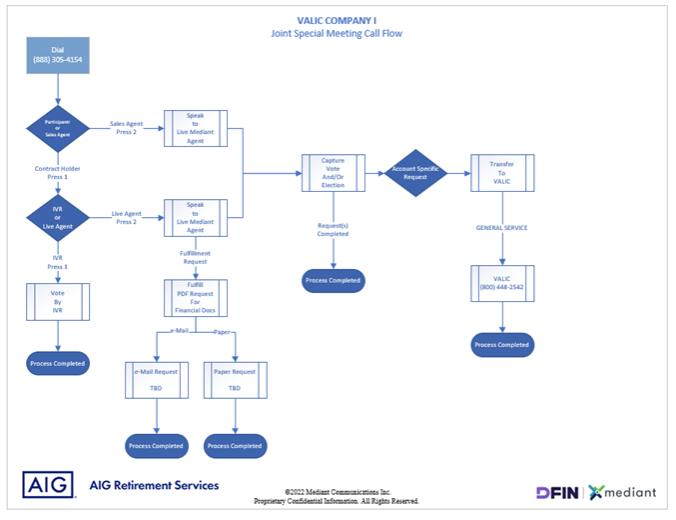

Meeting Date: 10/14/2022 Toll-Free # (888) 305-4154 |

|

INBOUND

GREETING:

Thank you for calling the VALIC Funds Proxy information line. My name is {Provide Name}, may I have your name please?

Thank you, Mr./Ms. {Participant Name}. Are you calling regarding the upcoming Joint Special Meeting of Shareholders?

IF YES:

The Board of Directors requests your approval on the Proposals.

Your Board of Directors respectfully requests your approval on the proposals. Would you like to vote as requested by your Board of Directors?

IF YES:

Thank you. For the record, would you please state your full name and mailing address?

Again, my name is {Provide Name}, a representative on behalf of VALIC Funds.

Today’s date is {DATE} and the time is {TIME} Eastern Time.

Mr./Ms. {Participant Name}, I have recorded your vote(s) in accordance with the Board’s request.

If you wish to make any changes you may contact us by calling (888) 305-4154.

Thank you very much for your participation and have a great day/evening.

IF NO TO VOTING WITH THE BOARD’S RECOMMENDATIONS:

How would you like to cast your vote(s) on the proposals? You may vote FOR, AGAINST, or ABSTAIN on the non-Director Proposals and FOR or WITHHOLD for the individual DIRECTORS.

1

|

VALIC Company I (VC I) Funds Proxy Mediant Contact Center Scripting

Meeting Date: 10/14/2022 Toll-Free # (888) 305-4154 |

|

Proposal 1: To Elect (10) Directors to the Board of the Company:

(01) Thomas J. Brown

(03) Cheryl Creuzot

(05) Darlene T. DeRemer

(07) Eileen A. Kamerick

(09) Peter A. Harbeck

(02) Dr. Judith L. Craven

(04) Yvonne M. Curl

(06) Dr. Timothy J. Ebner

(08) Dr. John E. Maupin, Jr.

(10) Eric S. Levy

(To be voted on by all shareholders of the Funds of the Company, voting together)

Proposal 2: To approve a new investment advisory agreement between VALIC and the Company, on behalf of each of its Funds, and to approve any future investment advisory agreements between VALIC and the Company, each to take effect upon a Change of Control Event resulting from the Separation Plan (With respect to each Fund, to be voted on by shareholders of the Fund voting separately).

Proposal 3: To approve a new investment sub-advisory agreement between VALIC and SunAmerica with respect to each of the Dynamic Allocation Fund, Growth Fund, International Equities Index Fund, Internationally Socially Responsible Fund, Mid Cap Index Fund, Nasdaq-100® Index Fund, Small Cap Index Fund, Stock Index Fund and U.S. Socially Responsible Fund (the “SunAmerica-Advised Funds”), and to approve any future investment sub-advisory agreements between VALIC and SunAmerica with respect to the SunAmerica Advised Funds, each to take effect upon a Change of Control Event resulting from the Separation Plan (With respect to each SunAmerica-Advised Fund, to be voted on by shareholders of the SunAmerica-Advised Fund, voting separately)

Proposal 4: To approve a “manager-of-managers” arrangement that would permit VALIC to enter into and materially amend sub-advisory agreements with unaffiliated and affiliated sub-advisers on behalf of the Funds without obtaining shareholder approval (With respect to each Fund, to be voted on by shareholders of the Fund, voting separately)

Proposal 5: To approve the adoption, revision or elimination, as applicable, of the fundamental investment restrictions, as follows: (With respect to each Fund, to be voted on by shareholders of the Fund, voting separately)

| a. | To revise the fundamental investment restriction regarding borrowing money; |

| b. | To revise the fundamental investment restriction regarding underwriting; |

| c. | To revise the fundamental investment restriction regarding lending; |

| d. | To revise the fundamental investment restriction regarding the issuance of senior securities; |

| e. | To revise the fundamental investment restriction regarding investing in real estate; |

| f. | To revise the fundamental investment restriction regarding investing in commodities; |

2

|

VALIC Company I (VC I) Funds Proxy Mediant Contact Center Scripting

Meeting Date: 10/14/2022 Toll-Free # (888) 305-4154 |

|

| g. | To revise or adopt, as applicable, a fundamental investment restriction regarding concentration; and |

| h. | To eliminate the fundamental investment restriction regarding diversification (all Funds, except for Growth Fund, International Government Bond Fund, the Nasdaq-100® Index Fund and Science & Technology Fund) |

Proposal 6: Approval of a change to the Blue-Chip Growth Fund’s sub-classification under the 1940 Act from “diversified” to “non-diversified” — (To be voted on by shareholders of the Blue Chip Growth Fund only)

IF NO TO VOTING AT ALL:

Are there any questions regarding the proposals being voted on that I can help answer so that you may participate in the vote today?

If a non-proxy related question, respond:

Mr./Ms. {Provide Name}. I apologize as the proxy administrator I do not have access to that information. If you have account specific information, you may call AIG Retirement Services at (800) 448-2542

3

|

VALIC Company I (VC I) Funds Proxy Mediant Contact Center Scripting

Meeting Date: 10/14/2022 Toll-Free # (888) 305-4154 |

|

INBOUND – PRE-EVENT CLOSED MESSAGE

“Thank you for calling the VALIC Funds Proxy Information line. This line will open after 8am Eastern Time on Monday the 22nd. Please call back then. Thank you. “

INBOUND - CLOSED MESSAGE

“Thank you for calling the Mediant Proxy Information Line on behalf of VALIC Funds. Our offices are now closed. Please call us back during our normal business hours which are, 5:00 a.m. and 5:00 p.m. Pacific Time or 8:00 a.m. and 8:00 p.m. Eastern Time, Monday through Friday. Thank you.”

INBOUND - CALL IN QUEUE MESSAGE

“Thank you for calling the Mediant Proxy Information Line on behalf of VALIC Funds. Our representatives are currently assisting other policy owners.

Your call is important to us. Please continue to hold and your call will be answered in the order in which it was received.”

INBOUND – END OF CAMPAIGN MESSAGE

“Thank you for calling the Mediant Proxy Information Line on behalf of VALIC Funds. The Joint Special Meeting of Shareholders has been held and as a result, this toll-free number is no longer in service.

If you have questions about your VALIC policy, please contact VALIC directly at (800) 448-2542. Thank you.”

4

|

VALIC Company I (VC I) Funds Proxy Mediant Contact Center Scripting Meeting Date: 10/14/2022 Toll-Free # (888) 305-4154 |

|

5

|

VALIC Company I (VC I) Funds Proxy Mediant Contact Center Scripting

Meeting Date: 10/14/2022 Toll-Free # (888) 305-4154 |

|

| Prompt Name | Prompt Language | |

| Main Prompt | “Thank you for calling the VALIC Funds proxy information line.” | |

| Main Menu | “If you are a policy holder with VALIC, please press 1... If you are a Sales Agent with VALIC, please press 2.”

| |

| Sub Menu (Policy Holder Only) | “If you have your control number from the material you received and would like to vote your proxy, please press 1. To speak with a proxy specialist, please press 2.” | |

| Transfer Message | “Please hold while your call is transferred.” | |

| Line is Recorded | “This call may be recorded for quality assurance.” | |

| Closed Message | “Our offices are now closed. Please call back during the hours of 5:00 a.m. and 5:00 p.m. Pacific Time or 8:00 a.m. and 8:00 p.m. Eastern Time, Monday through Friday to speak with a representative.”

| |

6