Form DEF 14A Container Store Group, For: Aug 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐ | |

Check the appropriate box: | |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

THE CONTAINER STORE GROUP, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box): | |

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| |

| |

| |

The Container Store Group, Inc. | |

| |

NOTICE & PROXY STATEMENT | |

| |

Annual Meeting of Shareholders | |

August 31, 2022 | |

10:30 a.m. (Central Time) | |

| |

THE CONTAINER STORE GROUP, INC.

500 FREEPORT PARKWAY, COPPELL, TEXAS 75019

July 12, 2022

To Our Shareholders:

You are cordially invited to attend the 2022 Annual Meeting of Shareholders of The Container Store Group, Inc. at 10:30 a.m. Central Time, on Wednesday, August 31, 2022, via live webcast.

The 2022 Annual Meeting of Shareholders will be a virtual meeting. We believe the virtual meeting technology provides expanded shareholder access while providing shareholders the same rights and opportunities to participate as they would have at an in-person meeting. During the virtual meeting, you may ask questions and will be able to vote your shares electronically. To participate in the Annual Meeting, you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials or on your proxy card. We encourage you to allow ample time for online check-in, which will begin at 10:15 a.m. Central Time. Please note that there is no in-person annual meeting for you to attend.

The Notice of Meeting and Proxy Statement on the following pages describe the matters to be presented at the Annual Meeting.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to promptly vote and submit your proxy by phone, via the Internet, or, if you received paper copies of these materials, by signing, dating, and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed in the United States. If you have previously received our Notice of Internet Availability of Proxy Materials, then instructions regarding how you can vote are contained in that notice. If you have received a proxy card, then instructions regarding how you can vote are contained on the proxy card. You may also vote your shares online during the Annual Meeting even if you have previously submitted your proxy. Instructions on how to vote while participating in the meeting live via the Internet are provided in the accompanying proxy statement and posted at www.virtualshareholdermeeting.com/TCS2022.

Thank you for your support.

Sincerely,

Satish Malhotra

Chief Executive Officer and President

|

Notice of Annual Meeting of Shareholders

To Be Held Wednesday, August 31, 2022

THE CONTAINER STORE GROUP, INC.

500 FREEPORT PARKWAY, COPPELL, TEXAS 75019

The 2022 Annual Meeting of Shareholders (the “Annual Meeting”) of The Container Store Group, Inc., a Delaware corporation (the “Company”), will be held on Wednesday, August 31, 2022, at 10:30 a.m. Central Time, via live webcast, for the following purposes:

| ● | To elect Lisa Klinger, Satish Malhotra and Wendi Sturgis as Class III Directors to serve until the 2025 Annual Meeting of Shareholders and until their respective successors shall have been duly elected and qualified; |

| ● | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending April 1, 2023; and |

| ● | To approve, on an advisory (non-binding) basis, the compensation of our named executive officers. |

We will also transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting.

Holders of record of our common stock at the close of business on July 7, 2022 are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment of the Annual Meeting. A complete list of these shareholders will be available for examination of any shareholder (i) for a period of ten days prior to the Annual Meeting for a purpose germane to the meeting by sending an email to Michael Lambeth, Vice President, Treasurer and Secretary, at [email protected], stating the purpose of the request and providing proof of ownership of Company stock and (ii) during the Annual Meeting, via the Internet at www.virtualshareholdermeeting.com/TCS2022. The Annual Meeting may be continued or adjourned from time to time without notice other than by announcement at the Annual Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the materials that follow. If you received a copy of the proxy card by mail, you may alternatively sign, date and mail the proxy card in the accompanying return envelope. Submitting your proxy now will not prevent you from voting your shares during the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

By Order of the Board of Directors,

Michael Lambeth, Secretary

Coppell, Texas

July 12, 2022

|

TABLE OF CONTENTS

| Page |

1 | |

1 | |

2 | |

2 | |

2 | |

Questions and Answers about the 2022 Annual Meeting of Shareholders | 4 |

9 | |

9 | |

PROPOSAL 2 Ratification of Appointment of Independent Registered Public Accounting Firm | 14 |

15 | |

16 | |

Independent Registered Public Accounting Firm Fees and Other Matters | 17 |

18 | |

19 | |

19 | |

19 | |

19 | |

20 | |

20 | |

21 | |

21 | |

22 | |

22 | |

22 | |

23 | |

25 | |

28 | |

Security Ownership of Certain Beneficial Owners and Management | 40 |

40 | |

42 | |

42 | |

43 | |

43 | |

44 | |

45 | |

46 | |

47 | |

48 |

i

|

THE CONTAINER STORE GROUP, INC.

500 FREEPORT PARKWAY, COPPELL, TEXAS 75019

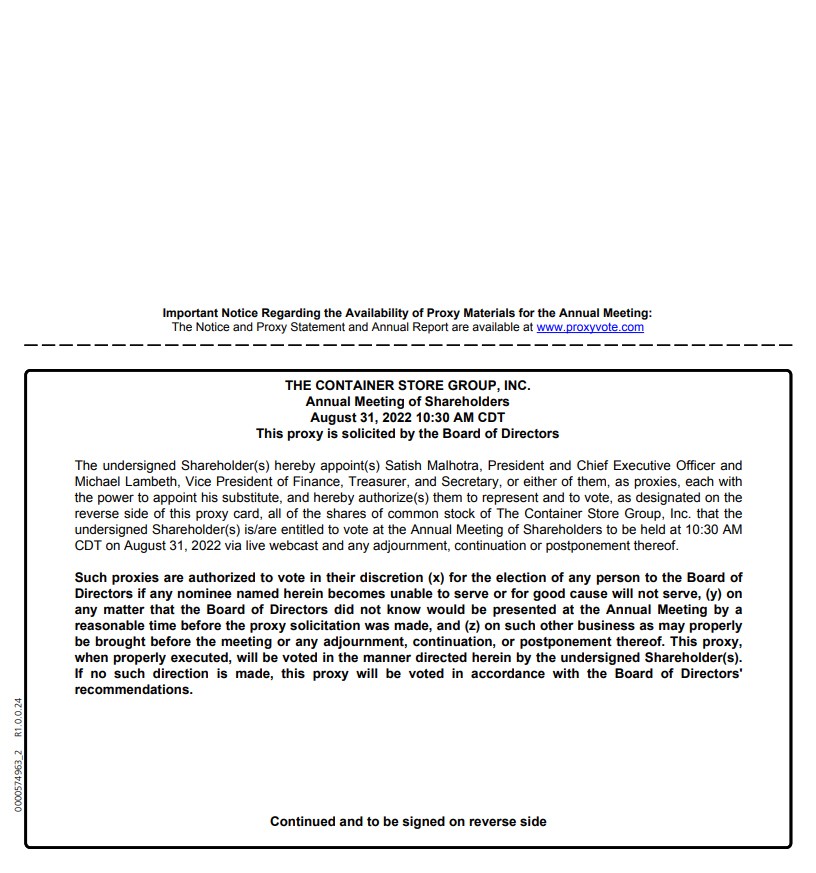

This proxy statement is furnished in connection with the solicitation by the Board of Directors of The Container Store Group, Inc. (the “Board of Directors” or “Board”) of proxies to be voted at our Annual Meeting of Shareholders to be held on Wednesday, August 31, 2022 (the “Annual Meeting”), at 10:30 a.m. Central Time, via live webcast, and at any continuation, postponement, or adjournment of the Annual Meeting.

Holders of record of shares of our common stock, $0.01 par value (“Common Stock”), at the close of business on July 7, 2022 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement, or adjournment of the Annual Meeting. As of the Record Date, there were approximately 51,533,476 shares of Common Stock issued and outstanding and entitled to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote on any matter presented to shareholders at the Annual Meeting.

This proxy statement and the Company’s Annual Report to Shareholders for the fiscal year ended April 2, 2022 (the “2021 Annual Report”) will be released on or about July 12, 2022 to our shareholders on the Record Date.

In this proxy statement, “we,” “us,” “our,” the “Company” and “The Container Store” refer to The Container Store Group, Inc. and “The Container Store, Inc.” refers to The Container Store, Inc., a Texas corporation and our wholly-owned subsidiary.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON WEDNESDAY, AUGUST 31, 2022

This proxy statement and our 2021 Annual Report to Shareholders are available at http://www.proxyvote.com/.

The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/TCS2022.

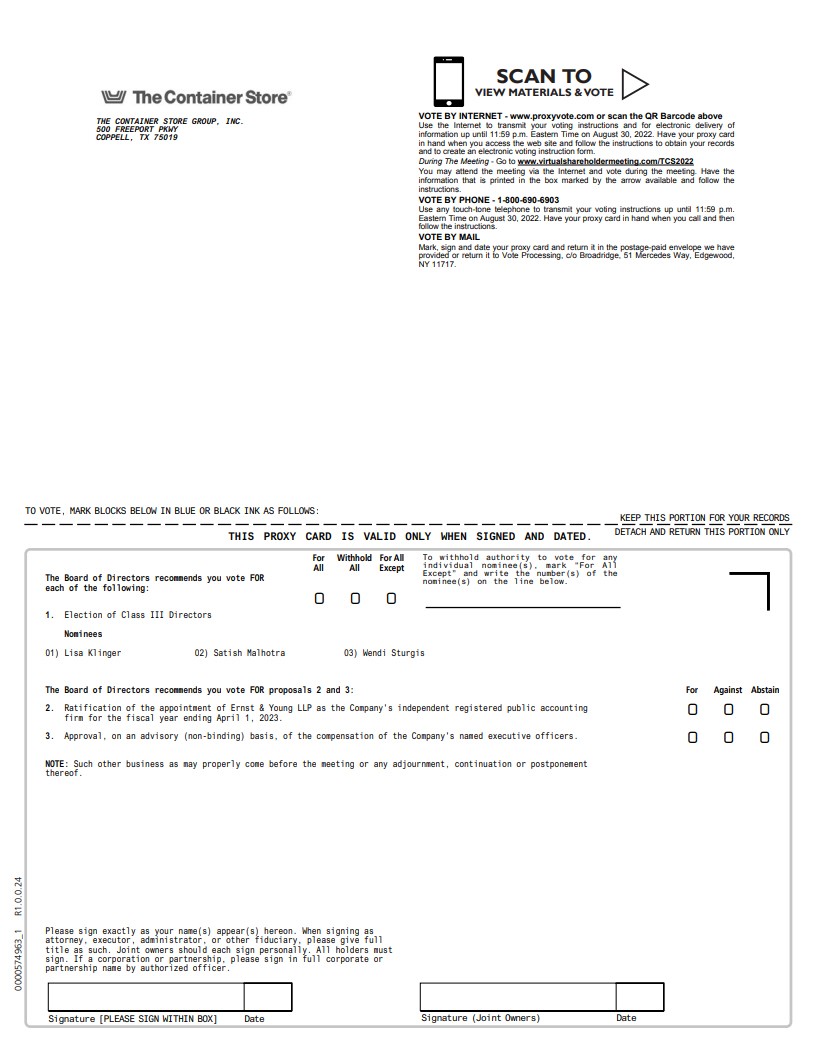

At the Annual Meeting, our shareholders will be asked:

| ● | To elect Lisa Klinger, Satish Malhotra and Wendi Sturgis as Class III Directors to serve until the 2025 Annual Meeting of Shareholders and until their respective successors shall have been duly elected and qualified; |

| ● | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending April 1, 2023; and |

| ● | To approve, on an advisory (non-binding) basis, the compensation of our named executive officers. |

We will also transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting. We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the shareholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

The Board of Directors, or Board, recommends that you vote your shares as indicated below. If you return a properly completed proxy card, or vote your shares by telephone or Internet, your shares of Common Stock will be voted on your behalf as you direct. If not otherwise specified, the shares of Common Stock represented by the proxies will be voted, and the Board of Directors recommends that you vote:

| ● | FOR the election of Lisa Klinger, Satish Malhotra and Wendi Sturgis as Class III Directors; |

| ● | FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending April 1, 2023; and |

| ● | FOR the approval, on an advisory (non-binding) basis, of the compensation of our named executive officers. |

Information About This Proxy Statement

Why you received this proxy statement. You are viewing or have received these proxy materials because The Container Store’s Board of Directors is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (“SEC”) and that is designed to assist you in voting your shares.

Notice of Internet Availability of Proxy Materials. As permitted by SEC rules, The Container Store is making this proxy statement and its 2021 Annual Report available to its shareholders electronically via the Internet. On or about July 12, 2022, we mailed to our shareholders a Notice of Internet Availability of Proxy Materials (the “Internet Notice”) containing instructions on how to access this proxy statement and our 2021 Annual Report and vote online. If you received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them. Instead, the Internet Notice instructs you on how to access and review all of the important information contained in the proxy statement and 2021 Annual Report. The Internet Notice also instructs you on how you may submit your proxy over the Internet. If you received an Internet Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the Internet Notice.

2

Printed Copies of Our Proxy Materials. If you received printed copies of our proxy materials, then instructions regarding how you can vote are contained on the proxy card included in the materials.

Householding. The SEC’s rules permit us to deliver a single set of proxy materials to one address shared by two or more of our shareholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one set of proxy materials to multiple shareholders who share an address, unless we received contrary instructions from the impacted shareholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the proxy materials, as requested, to any shareholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the proxy materials, contact Broadridge Financial Solutions, Inc. (“Broadridge”) at (866) 540-7095 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

If you are currently a shareholder sharing an address with another shareholder and wish to receive only one set of proxy materials for your household, please contact Broadridge at the above phone number or address.

3

|

QUESTIONS AND ANSWERS ABOUT THE 2022 ANNUAL MEETING OF SHAREHOLDERS

WHO IS ENTITLED TO VOTE AT THE ANNUAL MEETING?

The Record Date for the Annual Meeting is July 7, 2022. You are entitled to vote at the Annual Meeting only if you were a shareholder of record at the close of business on that date, or if you hold a valid proxy for the Annual Meeting. Each outstanding share of Common Stock is entitled to one vote for all matters before the Annual Meeting. At the close of business on the Record Date, there were 51,533,476 shares of Common Stock issued and outstanding and entitled to vote at the Annual Meeting.

WHAT IS THE DIFFERENCE BETWEEN BEING A “RECORD HOLDER” AND HOLDING SHARES IN “STREET NAME”?

A record holder holds shares in his or her name. Shares held in “street name” means shares that are held in the name of a bank or broker on a person’s behalf.

AM I ENTITLED TO VOTE IF MY SHARES ARE HELD IN “STREET NAME”?

Yes. If your shares are held by a bank or a brokerage firm, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials are being provided to you by your bank or brokerage firm, along with a voting instruction card if you received printed copies of our proxy materials. As the beneficial owner, you have the right to direct your bank or brokerage firm how to vote your shares, and the bank or brokerage firm is required to vote your shares in accordance with your instructions.

HOW MANY SHARES MUST BE PRESENT TO HOLD THE ANNUAL MEETING?

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, via live webcast or by proxy, of the holders of a majority in voting power of the Common Stock issued and outstanding and entitled to vote on the Record Date will constitute a quorum.

WHO CAN ATTEND THE ANNUAL MEETING?

You may attend the Annual Meeting only if you are a The Container Store shareholder who is entitled to vote at the Annual Meeting, or if you hold a valid proxy for the Annual Meeting. The Annual Meeting will be held entirely online to allow greater participation. You will be able to attend the Annual Meeting online and submit your questions by visiting www.virtualshareholdermeeting.com/TCS2022. You will also be able to vote your shares electronically at the Annual Meeting.

To participate in the Annual Meeting, you will need the 16-digit control number included in your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials. The meeting webcast will begin promptly at 10:30 a.m. Central Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 10:15 a.m. Central Time, and you should allow ample time for the check-in procedures. If your shares are held in street name and you did not receive a 16-digit control number, you may gain access to and vote at the Annual Meeting by logging in to your bank or brokerage firm’s website and selecting the shareholder communications mailbox to access the meeting. The control number will automatically populate. Instructions should also be provided on the voting instruction card provided by your bank or brokerage firm. If you lose your 16-digit control number, you may join the Annual Meeting as a

4

“Guest,” but you will not be able to vote, ask questions, or access the list of stockholders as of the Record Date.

WHAT IF DURING THE CHECK-IN TIME OR DURING THE ANNUAL MEETING I HAVE TECHNICAL DIFFICULTIES OR TROUBLE ACCESSING THE VIRTUAL MEETING?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting log in page.

WILL THERE BE A QUESTION AND ANSWER SESSION DURING THE ANNUAL MEETING?

As part of the Annual Meeting, we will hold a live Q&A session, during which we intend to answer appropriate questions submitted by stockholders during or prior to the meeting that are pertinent to the Company and the meeting matters, as time permits after the completion of the Annual Meeting. Only stockholders that have accessed the Annual Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above in “Who can attend the Annual Meeting?” will be permitted to submit questions during the Annual Meeting. Each stockholder is limited to no more than two questions. Questions should be succinct and only cover a single topic. We will not address questions that are, among other things:

| ● | irrelevant to the business of the Company or to the business of the Annual Meeting; |

| ● | related to material non-public information of the Company, including the status or results of our business since our last Quarterly Report on Form 10-Q; |

| ● | related to any pending, threatened or ongoing litigation; |

| ● | related to personal grievances; |

| ● | derogatory references to individuals or that are otherwise in bad taste; |

| ● | substantially repetitious of questions already made by another stockholder; |

| ● | in excess of the two-question limit; |

| ● | in furtherance of the stockholder’s personal or business interests; or |

| ● | out of order or not otherwise suitable for the conduct of the Annual Meeting as determined by the Chair or Secretary in their reasonable judgment. |

Additional information regarding the Q&A session will be available in the “Rules of Conduct” available on the Annual Meeting webpage for stockholders that have accessed the Annual Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above in “Who can attend the Annual Meeting?”.

WHAT IF A QUORUM IS NOT PRESENT AT THE ANNUAL MEETING?

If a quorum is not present at the scheduled time of the Annual Meeting, the chairperson of the Annual Meeting may adjourn the Annual Meeting.

5

WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE INTERNET NOTICE OR MORE THAN ONE SET OF PROXY MATERIALS?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each Internet Notice or set of proxy materials, please submit your proxy by phone, via the Internet, or, if you received printed copies of the proxy materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope.

HOW DO I VOTE?

Shareholders of Record

We recommend that shareholders vote by proxy even if they plan to attend participate in the online Annual Meeting and vote electronically. If you are a shareholder of record, there are three ways to vote by proxy:

| ● | by Internet—You can vote over the Internet at www.proxyvote.com by following the instructions on the Internet Notice or proxy card; |

| ● | by Telephone—You can vote by telephone by calling 1-800-690-6903 and following the instructions on the proxy card; or |

| ● | by Mail—You can vote by mail by signing, dating and mailing the proxy card, which you may have received by mail. |

Internet and telephone voting facilities for shareholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern Time, on August 30, 2022. Shareholders of record may vote during the Annual Meeting by visiting www.virtualshareholdermeeting.com/TCS2022 and entering the 16-digit control number included in your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials. The meeting webcast will begin promptly at 10:30 a.m. Central Time on August 31, 2022.

Beneficial Owners

If your shares are held in street name through a bank or broker, you will receive instructions on how to vote from the bank or broker. You must follow their instructions in order for your shares to be voted. Internet and telephone voting also may be offered to shareholders owning shares through certain banks and brokers. If your shares are held in street name and you would like to vote at the Annual Meeting, you may visit www.virtualshareholdermeeting.com/TCS2022 and enter the 16-digit control number included in the voting instruction card provided to you by your bank or brokerage firm. If you hold your shares in street name and you did not receive a 16-digit control number, you may need to log in to your bank or brokerage firm’s website and select the shareholder communications mailbox to access the meeting and vote. Instructions should also be provided on the voting instruction card provided by your bank or brokerage firm.

CAN I CHANGE MY VOTE AFTER I SUBMIT MY PROXY?

Yes.

If you are a registered shareholder, you may revoke your proxy or change your vote:

| ● | by submitting a duly executed proxy bearing a later date; |

| ● | by granting a subsequent proxy through the Internet or telephone; |

6

| ● | by giving written notice of revocation to the Secretary of The Container Store at [email protected] prior to the Annual Meeting; or |

| ● | by attending and voting during the Annual Meeting live webcast. |

Your most recent proxy card or Internet or telephone proxy is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Secretary before your proxy is voted or you vote at the Annual Meeting.

If your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote at the Annual Meeting by following the procedures described above.

WHO WILL COUNT THE VOTES?

A representative of Broadridge Financial Solutions, Inc., our inspector of election, will tabulate and certify the votes.

WHAT IF I DO NOT SPECIFY HOW MY SHARES ARE TO BE VOTED?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board of Directors. The Board of Directors’ recommendations are indicated on page 2 of this proxy statement, as well as with the description of each proposal in this proxy statement.

WILL ANY OTHER BUSINESS BE CONDUCTED AT THE ANNUAL MEETING?

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the shareholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

7

HOW MANY VOTES ARE REQUIRED FOR THE APPROVAL OF THE PROPOSALS TO BE VOTED UPON AND HOW WILL ABSTENTIONS AND BROKER NON-VOTES BE TREATED?

PROPOSAL |

| Votes required |

| Effect of Votes Withheld / |

PROPOSAL 1: ELECTION OF DIRECTORS | | The plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative “FOR” votes will be elected as Class III Directors. | | Votes withheld and broker non-votes will have no effect. |

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | The affirmative vote of the holders of a majority in voting power of the shares of Common Stock of the Company which are present via live webcast or by proxy and entitled to vote on the proposal. | | Abstentions will have the same effect as votes against the proposal. We do not expect any broker non-votes on this proposal. |

PROPOSAL 3: APPROVAL, ON AN ADVISORY (NON-BINDING) BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | | The affirmative vote of the holders of a majority in voting power of the shares of Common Stock of the Company which are present via live webcast or by proxy and entitled to vote on the proposal. | | Abstentions will have the same effect as votes against the proposal. Broker non-votes will have no effect on the proposal. |

WHAT IS AN ABSTENTION AND HOW WILL VOTES WITHHELD AND ABSTENTIONS BE TREATED?

A “vote withheld,” in the case of the proposal regarding the election of directors, or an “abstention,” in the case of each other proposal before the Annual Meeting, represents a shareholder’s affirmative choice to decline to vote on a proposal. Votes withheld and abstentions are counted as present and entitled to vote for purposes of determining a quorum. Votes withheld have no effect on the election of directors. Abstentions have the same effect as votes against on each other proposal before the Annual Meeting.

WHAT ARE BROKER NON-VOTES AND DO THEY COUNT FOR DETERMINING A QUORUM?

Generally, broker non-votes occur when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on routine matters, such as the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm, without instructions from the beneficial owner of those shares. On the other hand, each other proposal to be voted on at the Annual Meeting is a non-routine matter and, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on such matters. Broker non-votes count for purposes of determining whether a quorum is present.

WHERE CAN I FIND THE VOTING RESULTS OF THE ANNUAL MEETING?

We plan to announce preliminary voting results at the Annual Meeting and we will report the final results in a Current Report on Form 8-K, which we intend to file with the SEC shortly after the Annual Meeting.

8

|

PROPOSAL 1 Election of Directors

At the Annual Meeting, three Class III Directors are to be elected to hold office until the Annual Meeting of Shareholders to be held in 2025 and until each such director’s respective successor is duly elected and qualified or until each such director’s earlier death, resignation or removal.

We currently have nine Directors on our Board, including three Class III Directors. Our current Class III Directors are Lisa Klinger, Satish Malhotra and Wendi Sturgis. The Board has nominated the current Class III directors for re-election at the Annual Meeting.

Our Board of Directors is currently divided into three classes with staggered, three-year terms. At each annual meeting of shareholders, the successor to each director whose term then expires will be elected to serve from the time of election and qualification until the third annual meeting of shareholders following election or such director’s death, resignation or removal, whichever is earliest to occur. The current class structure is as follows: Class I, whose term expires at the 2023 Annual Meeting of Shareholders; Class II, whose term expires at the 2024 Annual Meeting of Shareholders; and Class III, whose term currently expires at the Annual Meeting and whose subsequent term will expire at the 2025 Annual Meeting of Shareholders. The current Class I Directors are Robert E. Jordan, Jonathan D. Sokoloff and Caryl Stern; the current Class II Directors are J. Kristofer Galashan, Anthony Laday and Nicole Otto; and the current Class III Directors are Lisa Klinger, Satish Malhotra and Wendi Sturgis.

As indicated in our Amended and Restated Certificate of Incorporation, our Board of Directors consists of such number of directors as determined from time to time by resolution adopted by a majority of the total number of authorized directors. Any additional directorships resulting from an increase in the number of directors may be filled only by the affirmative vote of a majority of the remaining directors then in office, even though less than a quorum of the Board of Directors.

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote the shares of Common Stock represented by the proxy for the election as Class III Directors the persons whose names and biographies appear below. All of the persons whose names and biographies appear below are currently serving as our directors. In the event any of the nominees should become unable to serve or for good cause will not serve as a director, it is intended that votes will be cast for a substitute nominee designated by the Board of Directors or the Board may elect to reduce its size. The Board of Directors has no reason to believe that the nominees named below will be unable to serve if elected. Each of the nominees has consented to being named in this proxy statement and to serve if elected.

VOTE REQUIRED

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative “FOR” votes will be elected as Class III Directors. Votes withheld and broker non-votes will have no effect on the outcome of the vote on this proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

| The Board of Directors unanimously recommends a vote FOR the election of the below Class III Director nominees. |

9

CLASS III DIRECTOR NOMINEES (SUBSEQUENT TERMS TO EXPIRE AT THE 2025 ANNUAL MEETING)

The nominees for election to the Board of Directors as Class III Directors are as follows:

|

| |

| Served as a |

| |

Name | | Age | | Director Since | | Positions with The Container Store |

Lisa Klinger |

| 55 |

| 2022 |

| Director |

Satish Malhotra | | 47 | | 2021 | | Chief Executive Officer, President and Director |

Wendi Sturgis | | 55 | | 2019 | | Director |

The principal occupations and business experience, for at least the past five years, of each Class III Director nominee are as follows:

| LISA KLINGER | Age 55 |

Lisa Klinger has served on our Board of Directors since March 2022. Ms. Klinger served as the Chief Administrative and Financial Officer for Ideal Image Development Corp., an L Catterton portfolio company and the largest U.S. retail provider of nonsurgical cosmetic procedures from January 2018 to February 2019. Before Ideal Image, from June 2016 to December 2017, she served as Chief Administrative and Financial Officer for Peloton Interactive, Inc. Ms. Klinger's previously served as Chief Financial Officer at Vince Holding Corp. from December 2012 to December 2015 and The Fresh Market, Inc from March 2009 to December 2012. Ms. Klinger's career in retail began in 2000 at Limited Brands and continued at Michael’s Stores where she had various senior finance leadership roles including Treasurer, Investor Relations, and Acting Chief Financial Officer. Ms. Klinger has served on the Board of Directors and as Audit Committee Chair of both Emerald Holdings, Inc., a leading U.S. business-to-business platform producer of trade shows, events, conferences, marketing, and B2B software solutions, since 2018, and Tremor International Ltd., a global leader in Video and Connected TV advertising offering an end-to-end technology platform to advertisers, since 2021. Ms. Klinger also served on the Board of Directors and Audit Committee of Party City Holdco, Inc., a vertically integrated party goods supplier and retailer from 2015 to 2021. Ms. Klinger was selected to our Board of Directors due to her financial expertise and significant experience serving on public company Boards of Directors and Audit Committees.

| SATISH MALHOTRA | Age 47 |

Satish Malhotra has served on our Board of Directors and as our Chief Executive Officer and President since February 2021. Mr. Malhotra previously served in a variety of key leadership roles with increasing responsibility at Sephora from November 1999 to January 2021, ultimately progressing to Chief Operating Officer from 2016 to 2019 and to Chief Retail and Operating Officer from 2019 until his departure. In his latest role, Mr. Malhotra was responsible for supporting Sephora’s growth by expanding the in-store client experience and services, increasing points of distribution and building scalable infrastructures. Mr. Malhotra received his Bachelor of Science in Business Administration from the Haas School of Business at the University of California, Berkeley. Mr. Malhotra also holds an inactive Certified Public Accountant’s license from the State of California. Mr. Malhotra was selected to our Board due to his extensive leadership experience in the retail industry and his operational expertise, including in the areas of in-store experience, store development, technology, supply chain and finance.

10

| WENDI STURGIS | Age 55 |

Wendi Sturgis has served on our Board of Directors since August 2019. Ms. Sturgis currently serves as Chief Executive Officer of cleverbridge, Inc. a global billing solution provider for digital goods and services. Previously, Ms. Sturgis served as President of Lyte, Inc., an event ticketing technology platform company, from April 2021 to November 2021. Ms. Sturgis served as Chief Revenue Officer at Lyte, Inc. from January 2021 to March 2021. Previously, Ms. Sturgis served as President and Chief Executive Officer of Yext, Europe at Yext, Inc., a New York based technology company operating in the area of on-line brand management, a position that she held from April 2019 to January 2021. Ms. Sturgis joined Yext in 2011, and held a variety of executive roles, including Executive Vice President of Sales and Services from August 2011 to December 2016 and Chief Client Officer from December 2016 to August 2019. Ms. Sturgis previously ran the North America Account Management team at Yahoo! Inc., where she was responsible for an 800-person organization and $1.4 billion in revenue. She has also previously held executive positions at Price Waterhouse, Oracle, Scient, Gartner and Right Media, served as a director and as a member of the Innovation and Technology committee of Student Transportation of America, where she gained experience in cybersecurity leading the company’s annual cybersecurity risk review, and served as a director of TPG Pace Tech Opportunities. Ms. Sturgis also serves on the Board of Directors of Sabre Corporation where she is also a member of the Governance and Nominating Committee and Technology Committee and on the Board of Directors of several private companies. Ms. Sturgis was selected to our Board of Directors because of her leadership experience in the technology, digital transformation and marketing fields.

CONTINUING MEMBERS OF THE BOARD OF DIRECTORS:

CLASS I DIRECTORS (TERMS TO EXPIRE AT THE 2023 ANNUAL MEETING)

The current members of the Board of Directors who are Class I Directors are as follows:

|

| |

| Served as a |

| |

Name | | Age | | Director Since | | Positions with The Container Store |

Robert E. Jordan |

| 61 |

| 2013 | | Director |

Jonathan D. Sokoloff |

| 64 |

| 2007 | | Director |

Caryl Stern | | 64 | | 2014 | | Director |

The principal occupations and business experience, for at least the past five years, of each Class I Director nominee are as follows:

| ROBERT E. JORDAN | Age 61 |

Robert E. Jordan was appointed as a director to the Board of Directors in October 2013. Mr. Jordan is the Chief Executive Officer of Southwest Airlines, a commercial airline company. Mr. Jordan serves on the Board of Directors of Southwest Airlines, where he is a member of its Executive Committee, and serves as a board member of several private companies. Mr. Jordan joined Southwest Airlines in 1988 and has served in a number of roles including Executive Vice President of Corporate Services, Executive Vice President & Chief Commercial Officer and President of AirTran Airways, Executive Vice President Strategy & Planning, Executive Vice President Strategy & Technology, Senior Vice President Enterprise Spend Management, Vice President Technology, Vice President Purchasing, Controller, Director Revenue Accounting, and Manager Sales Accounting. Mr. Jordan has led a number of significant initiatives including the acquisition of AirTran Airways, the development of the new e-commerce platform and the all new loyalty program. Mr. Jordan was selected to our Board because he brings financial experience and possesses particular knowledge and experience in strategic planning and leadership of complex organizations.

11

| JONATHAN D. SOKOLOFF | Age 64 |

Jonathan D. Sokoloff has served on our Board of Directors since August 2007. Mr. Sokoloff is currently a Managing Partner with LGP, a private equity firm, which he joined in 1990. Before joining LGP, he was a Managing Director in Investment Banking at Drexel Burnham Lambert. Mr. Sokoloff also serves on the board of Shake Shack Inc., where he is also a member of the Compensation Committee, Jo Ann Stores, Inc., Advantage Solutions, Inc. and on the boards of several private companies and non-profit organizations. Mr. Sokoloff previously served on the Board of Directors of Whole Foods Market, Inc., Top Shop/Top Man Limited, BJ’s Wholesale Club, Inc., Signet Jewelers Limited, and J. Crew Group, Inc. He co-chairs the Endowment Committee for Private Equity at his alma mater, Williams College. Mr. Sokoloff was selected to our Board of Directors because he possesses particular knowledge and experience in accounting, finance and capital structure, strategic planning and leadership of complex organizations, retail businesses and board practices of other major corporations.

| CARYL STERN | Age 64 |

Caryl Stern was appointed to the Board of Directors in October 2014. Ms. Stern was appointed Executive Director of the Walton Family Foundation in December 2019. Prior to that, she served as President and Chief Executive Officer of the U.S. Fund for UNICEF, a child welfare organization, from June 2007 to December 2019. Ms. Stern has three decades of non-profit and education experience including serving as the Chief Operating Officer and Senior Associate National Director of the Anti-Defamation League; the founding Director of ADL’s A WORLD OF DIFFERENCE Institute; and the Dean of Students at Polytechnic University. She has served on numerous non-profit boards and currently, she serves on the Board of several private entities. Ms. Stern is the author of I BELIEVE IN ZERO: Learning from the World’s Children. Ms. Stern was selected to our Board because of her global business perspective and her organizational leadership, operational and financial expertise.

CLASS II DIRECTORS (TERMS TO EXPIRE AT THE 2024 ANNUAL MEETING)

The current members of the Board of Directors who are Class II Directors are as follows:

|

| |

| Served as a |

| |

Name | | Age | | Director Since | | Positions with The Container Store |

J. Kristofer Galashan |

| 44 |

| 2007 | | Director |

Anthony Laday | | 55 | | 2021 | | Director |

Nicole Otto |

| 51 |

| 2021 | | Director |

The principal occupations and business experience, for at least the past five years, of each Class II Director are as follows:

| J. KRISTOFER GALASHAN | Age 44 |

J. Kristofer Galashan has served on our Board of Directors since August 2007. Mr. Galashan is currently a Partner with LGP, a private equity firm, which he joined in 2002. Prior to joining LGP he had been in the Investment Banking Division of Credit Suisse First Boston (“CSFB”) in Los Angeles which he joined in 2000 following CSFB’s acquisition of Donaldson, Lufkin & Jenrette (“DLJ”). Mr. Galashan had been with DLJ since 1999. Mr. Galashan serves on the board of Union Square Hospitality Group Acquisition Corp., Mister Car Wash, Inc., Life Time Group Holdings, Inc. and several private companies. Mr. Galashan previously served on the Board of Directors of BJ’s Wholesale Club, Inc. Mr. Galashan was selected to our Board of Directors because he possesses particular knowledge and experience in accounting, finance and capital structure, strategic planning and leadership of complex organizations, retail businesses and board practices of other major corporations.

12

| ANTHONY LADAY | Age 55 |

Anthony Laday has served on our Board of Directors since September 2021. Since 2014, Mr. Laday has served as the Chief Financial Officer of Fogo de Chão, where he leads the Accounting, Finance, IT and Supply Chain functions. In 2015, Mr. Laday was instrumental in the successful completion of Fogo de Chão’ s initial public offering on Nasdaq. He also helped navigate a go-private transaction in April 2018 when Rhône Capital acquired Fogo de Chão in an all-cash transaction valued at $650 million. Mr. Laday has held finance roles of increasing responsibility for a number of prominent brands prior to Fogo de Chão including Brinker International, FedEx Office, and American Airlines. Mr. Laday was selected to our Board of Directors because of his experience serving as a public company executive and his strong background in finance and accounting.

| NICOLE OTTO | Age 51 |

Nicole Otto has served on our Board of Directors since September 2021. Ms. Otto serves as the Global Brand President of The North Face since June 2022. Ms. Otto previously served as the VP/GM of Nike Direct North America from January 2018 to June 2021. In this role, she oversaw Nike’s integrated physical and digital ecosystem that delivers seamless shopping journeys, online-to-offline services and experiences, and deep connections with Nike consumers. This ecosystem includes Nike digital commerce, Nike activity apps, Nike owned and partner stores and the Nike value marketplace throughout the United States and Canada. Through these touchpoints, Ms. Otto and her team built personal, one-to-one relationships with Nike members at scale. Ms. Otto joined Nike in 2005 and throughout her career at Nike, Ms. Otto played a central role in building and leading high-performing teams and defining pinnacle mono-brand retail experiences. Ms. Otto held several leadership roles at Nike within the digital business, both overseas and on Nike’s global team. These roles included serving as VP/GM of Digital Commerce in Europe from July 2016 to December 2017, VP/GM of Nike.com Global Store from January 2015 to July 2016, VP of Global Digital Commerce Operations from April 2013 to April 2015 and VP of Consumer Digital Tech from December 2010 to April 2013. Ms. Otto was selected to our Board due to her executive-level experience in the retail industry, particularly in the area of digital commerce.

We believe that all of our current Board members possess the professional and personal qualifications necessary for Board service and have highlighted particularly noteworthy attributes for each Board member and nominee in the individual biographies included in this proxy statement.

13

|

PROPOSAL 2 Ratification of Appointment of Independent Registered Public Accounting Firm

Our Audit Committee has appointed Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending April 1, 2023. Our Board has directed that this appointment be submitted to our shareholders for ratification. Although ratification of our appointment of Ernst & Young LLP is not required, we value the opinions of our shareholders and believe that shareholder ratification of our appointment is a good corporate governance practice.

Ernst & Young LLP also served as our independent registered public accounting firm for the fiscal year ended April 2, 2022. Neither the accounting firm nor any of its members has any direct or indirect financial interest in or any connection with us in any capacity other than as our auditors, providing audit and non-audit related services. A representative of Ernst & Young LLP is expected to attend the Annual Meeting via live webcast and be available to respond to appropriate questions from shareholders.

In the event that the appointment of Ernst & Young LLP is not ratified by the shareholders, the Audit Committee will consider this fact when it appoints the independent auditors for the fiscal year ending March 30, 2024. Even if the appointment of Ernst & Young LLP is ratified, the Audit Committee retains the discretion to appoint a different independent auditor at any time if it determines that such a change is in the interests of The Container Store.

VOTE REQUIRED

This proposal requires the approval of the affirmative vote of the holders of a majority in voting power of the shares of Common Stock of the Company which are present via live webcast or by proxy and entitled to vote thereon. Abstentions will have the same effect as a vote against this proposal. Because brokers have discretionary authority to vote on the ratification of the appointment of Ernst & Young LLP, we do not expect any broker non-votes in connection with this proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

| The Board of Directors unanimously recommends a vote FOR the Ratification of the Appointment of Ernst & Young LLP as our Independent Registered Public Accounting Firm. |

14

|

PROPOSAL 3 Approval, on an Advisory (Non-Binding) Basis, of the Compensation of our Named Executive Officers

In accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) and Rule 14a-21 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company requests that our shareholders cast a non-binding, advisory vote to approve the compensation of the Company’s named executive officers identified in the section titled “Executive and Director Compensation” set forth below in this proxy statement. This proposal, commonly known as a “say-on-pay” proposal, gives our shareholders the opportunity to express their views on our named executive officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement.

Accordingly, we ask our shareholders to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that the Company’s shareholders hereby approve, on an advisory (non-binding) basis, the compensation of the Company’s named executive officers, as disclosed in this proxy statement pursuant to the compensation disclosure rules of the SEC, including the section titled “Executive and Director Compensation,” the Summary Compensation Table and the other related tables and disclosures.”

We believe that our compensation programs and policies for the fiscal year ended April 2, 2022 were an effective incentive for the achievement of the Company’s goals, aligned with shareholders’ interest and worthy of continued shareholder support. Additional details concerning how we structure our compensation programs to meet the objectives of our compensation program are provided in the section titled “Executive and Director Compensation” set forth below in this proxy statement. In particular, we discuss how we design performance-based compensation programs and set compensation targets and other objectives to maintain a close correlation between executive pay and Company performance.

This vote is merely advisory and will not be binding upon the Company, the Board or the Culture and Compensation Committee, nor will it create or imply any change in the duties of the Company, the Board or the Culture and Compensation Committee. The Culture and Compensation Committee will, however, take into account the outcome of the vote when considering future executive compensation decisions. The Board values constructive dialogue on executive compensation and other significant governance topics with the Company’s shareholders and encourages all shareholders to vote their shares on this important matter. In accordance with the advisory vote regarding the frequency of “say-on-pay” votes held at the 2019 Annual Meeting of Shareholders, the Company has determined to continue to hold the “say-on-pay” advisory vote every year until the next such “say-on-pay” frequency advisory vote. The next “say-on-pay” advisory vote will occur at the 2023 Annual Meeting of Shareholders.

VOTE REQUIRED

This proposal requires the approval of the affirmative vote of the holders of a majority in voting power of the shares of Common Stock of the Company which are present via live webcast or by proxy and entitled to vote thereon. Abstentions will have the same effect as a vote against this proposal. Broker non-votes will have no effect on the proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

| The Board of Directors unanimously recommends a vote FOR the approval, on an advisory (non-binding) basis, of the compensation of our named executive officers. |

15

|

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee has reviewed The Container Store’s audited financial statements for the fiscal year ended April 2, 2022 and has discussed these financial statements with management and The Container Store’s independent registered public accounting firm. The Audit Committee has also received from, and discussed with, The Container Store’s independent registered public accounting firm various communications that such independent registered public accounting firm is required to provide to the Audit Committee, including the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC.

The Container Store’s independent registered public accounting firm also provided the Audit Committee with a formal written statement required by PCAOB Rule 3526 (Communications with Audit Committees Concerning Independence) describing all relationships between the independent registered public accounting firm and The Container Store, including the disclosures required by the applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence. In addition, the Audit Committee discussed with the independent registered public accounting firm its independence from The Container Store. Based on its discussions with management and the independent registered public accounting firm, and its review of the representations and information provided by management and the independent registered public accounting firm, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in The Container Store’s Annual Report on Form 10-K for the fiscal year ended April 2, 2022.

Anthony Laday (Chair)

Caryl Stern

Wendi Sturgis

Lisa Klinger

16

|

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES AND OTHER MATTERS

The following table summarizes the fees of Ernst & Young LLP, our independent registered public accounting firm, billed to us for each of the last two fiscal years for audit services and billed to us in each of the last two fiscal years for other services:

Fee Category |

| Fiscal 2021 |

| Fiscal 2020 |

| ||

Audit Fees | | $ | 1,777,015 | | $ | 1,457,125 | |

Audit-Related Fees | | $ | 456,000 | | $ | — | |

Tax Fees | | $ | 225,953 | | $ | 336,299 | |

All Other Fees | | $ | 2,710 | | $ | 2,719 | |

Total Fees | | $ | 2,461,678 | | $ | 1,796,143 | |

AUDIT FEES

Audit fees consist of fees for the audit of our consolidated financial statements, the review of the unaudited interim financial statements included in our quarterly reports on Form 10-Q and other professional services provided in connection with statutory and regulatory filings or engagements.

AUDIT-RELATED FEES

Audit-related fees consist of fees for assurance and related services that are reasonably related to the performance of the audit and the review of our financial statements and which are not reported under “Audit Fees.”

TAX FEES

Tax fees comprise fees for a variety of permissible services relating to international tax compliance, tax planning, and tax advice.

ALL OTHER FEES

All other fees were paid for an online technical research tool.

AUDIT COMMITTEE PRE-APPROVAL POLICY AND PROCEDURES

Our Audit Committee’s charter provides that the Audit Committee, or the chair of the committee, must pre-approve any audit or non-audit service provided to us by our independent registered public accounting firm, unless the engagement is entered into pursuant to appropriate pre-approval policies established by the Audit Committee or if the service falls within available exceptions under SEC rules. Without limiting the foregoing, the Audit Committee may delegate authority to one or more independent members of the committee to grant pre-approvals of audit and permitted non-audit services. Any such pre-approvals must be presented to the full Audit Committee at its next scheduled meeting.

17

|

The following table identifies our current executive officers:

Name |

| Age |

| Position |

Satish Malhotra 1 | | 47 | | Chief Executive Officer and President |

Jeffrey A. Miller 2 | | 50 | | Chief Financial Officer |

Melissa Collins 3 | | 55 | | Chief Marketing Officer |

John Gehre 4 | | 52 | | Chief Merchandising Officer |

Dhritiman Saha 5 | | 50 | | Chief Information Officer |

| 1 | See biography on page 10 of this proxy statement. |

| 2 | Jeffrey A. Miller has been with The Container Store since August 2013 and has served as our Chief Financial Officer since August 2020. Mr. Miller is responsible for the business areas of Finance, Accounting, Real Estate, Information Security, Procurement, Internal Audit and ESG. Previously, Mr. Miller served as Vice President and Chief Accounting Officer of The Container Store since August 2013. Prior to joining The Container Store, Mr. Miller was at FedEx Office for over 10 years and served in a variety of roles with increasing responsibility, progressing to Vice President and Controller from 2008 until his departure. Mr. Miller began his career as an auditor with Arthur Andersen and Ernst & Young. |

| 3 | Melissa Collins has been with The Container Store for 25 years and has served as our Chief Marketing Officer since July 2016. Ms. Collins serves as the Company’s primary marketing strategist, and oversees such key functional areas as brand positioning, advertising, public relations, digital marketing, visual merchandising, e-commerce, social media and “Organized Insider”, our customer engagement and loyalty program. Previously, from August 2008 to July 2016, Ms. Collins served as Vice President of Creative and Online. Prior to that, she served in a variety of roles with increasing responsibility, beginning as Art Director and progressing to Senior Director of Creative and Online Services. |

| 4 | John Gehre has served as our Chief Merchandising Officer since August 2019 and, prior to that, as Executive Vice President of Merchandising and Planning since May 2018, with responsibility for product assortment, inventory allocation, global sourcing initiatives and private label strategy. Prior to joining The Container Store, Mr. Gehre served as the Vice President of General Merchandise, Global Sourcing, and Front End from February 2007 to January 2018 at H-E-B, an American supermarket chain. Mr. Gehre previously gained experience in merchandise planning, product development, omni-channel marketing, and supply chain with BJ’s Wholesale, Linens ‘n Things, Saks Fifth Avenue and Federated. |

| 5 | Dhritiman Saha joined The Container Store as our Executive Vice President and Chief Information Officer in May 2021, bringing more than 27 years of expertise in P&L, leading and managing multi-billion dollar ecommerce transformation & growth, digital marketing, subscription business, omnichannel customer experience, technology and global operations. Prior to joining The Container Store, Mr. Saha served as the Chief Digital Officer at GameStop from February 2021 to April 2021 and led e-commerce business, digital marketing & customer experience, online assortment expansion, digital and omnichannel technology & product management. Prior to GameStop, Mr. Saha served as Global Chief Customer and Digital Officer at Bodybuilding.com from December 2018 to February 2020 and as Senior Vice President of Digital for JCPenny from April 2014 to December 2018. Throughout Mr. Saha’s extensive career, he has also served in a variety of leadership roles driving technology and omnichannel business transformation at other chain retailers such as Target and Kohls. Mr. Saha received his MBA from Johns Hopkins University and completed his bachelors degree in Electronics and Telecommunications Engineering in Jalandhar, India. |

18

|

Our Board of Directors has adopted Corporate Governance Guidelines, a Code of Business Conduct and Ethics and charters for our Nominating and Corporate Governance Committee, Audit Committee and Culture and Compensation Committee to assist the Board in the exercise of its responsibilities and to serve as a framework for the effective governance of The Container Store. You can access our current committee charters, our Corporate Governance Guidelines and our Code of Business Conduct and Ethics in the “Corporate Governance” section of the “Investor Relations” page of our website located at www.containerstore.com, or by writing to our Secretary at our offices at 500 Freeport Parkway, Coppell, Texas 75019.

Our Board of Directors currently consists of nine members: J. Kristofer Galashan, Robert E. Jordan, Lisa Klinger, Anthony Laday, Satish Malhotra, Nicole Otto, Jonathan D. Sokoloff, Caryl Stern and Wendi Sturgis. As indicated in our Amended and Restated Certificate of Incorporation, our Board of Directors consists of such number of directors as determined from time to time by resolution adopted by a majority of the total number of authorized directors. Any additional directorships resulting from an increase in the number of directors or any vacancies in the Board resulting from death, resignation, retirement, disqualification, removal from office or other cause, may be filled only by the affirmative vote of a majority of the remaining directors then in office, even though less than a quorum of the Board of Directors.

Our Board of Directors is currently divided into three classes with staggered, three-year terms. At each annual meeting of shareholders, the successor to each director whose term then expires will be elected to serve from the time of election and qualification until the third annual meeting following election or such director’s death, resignation or removal, whichever is earliest to occur. Our Board of Directors has nominated Lisa Klinger, Satish Malhotra and Wendi Sturgis for re-election at the Annual Meeting.

Our Board of Directors has affirmatively determined that each of J. Kristofer Galashan, Robert E. Jordan, Lisa Klinger, Anthony Laday, Nicole Otto, Jonathan D. Sokoloff, Caryl Stern and Wendi Sturgis is an “independent director,” as defined under NYSE rules. Our Board of Directors also affirmatively determined that each of Timothy J. Flynn and Rajendra (Raj) Sisodia, who served on the Board of Directors during fiscal 2021, was an “independent director,” as defined under NYSE rules. In evaluating and determining the independence of the directors, the Board considered that The Container Store may have certain relationships with its directors. Specifically, the Board considered that Messrs. Flynn, Galashan and Sokoloff are affiliated with LGP, which owns approximately 30.5% of our outstanding Common Stock as of July 7, 2022. The Board determined that this relationship does not impair their independence from us and our management. The Board also considered that Messrs. Flynn and Sokoloff serve on the board of directors of Advantage Solutions, Inc. (“Advantage”), a company that provides online advertising services to the Company, and that LGP owns approximately 23.7% of Advantage’s common stock. Since the beginning of fiscal 2021, the Company paid approximately $155,000 in fees to Advantage. The Board has determined that the Company’s relationship with Advantage does not impair the independence of Messrs. Flynn and Sokoloff from us and our management.

19

The Nominating and Corporate Governance Committee is responsible for identifying and reviewing the qualifications of potential director candidates and recommending to the Board those candidates to be nominated for election to the Board, subject to any obligations and procedures governing the nomination of directors to the Board of Directors that may be included in any stockholders agreement to which we are a party.

To facilitate the search process for director candidates, the Nominating and Corporate Governance Committee may solicit our current directors and executives for the names of potentially qualified candidates or may ask directors and executives to pursue their own business contacts for the names of potentially qualified candidates. The Nominating and Corporate Governance Committee may also consult with outside advisors or retain search firms to assist in the search for qualified candidates or consider director candidates recommended by our shareholders. In fiscal 2021, the Nominating and Corporate Governance Committee engaged a search firm to assist in the identification and evaluation of director candidates. As part of its evaluation, the Nominating and Corporate Governance Committee considered the gender and racial and ethnic diversity of director candidates proposed by the search firm. Lisa Klinger, a Class III director nominee, was recommended by the search firm.

Once potential candidates are identified, the Nominating and Corporate Governance Committee reviews the backgrounds of those candidates, evaluates candidates’ independence from us and potential conflicts of interest and determines if candidates meet the qualifications desired by the committee of candidates for election as director.

In accordance with our Corporate Governance Guidelines, in evaluating the suitability of individual candidates, the Nominating and Corporate Governance Committee will consider (i) minimum individual qualifications, including strength of character, mature judgment, industry knowledge or experience and an ability to work collegially with the other members of the Board and (ii) all other factors it considers appropriate, which may include age, gender and ethnic and racial background, existing commitments to other businesses, potential conflicts of interest with other pursuits, legal considerations such as antitrust issues, corporate governance background, relevant business or government acumen, financial and accounting background, executive compensation background and the size, composition and combined expertise of the existing Board. In particular, experience, qualifications or skills in the following areas are particularly relevant: retail merchandising; marketing and advertising; consumer goods; sales and distribution; accounting, finance, and capital structure; strategic planning and leadership of complex organizations; legal/regulatory and government affairs; people management; communications and interpersonal skills and board practices of other major corporations. Our Corporate Governance Guidelines provide that the Board should monitor the mix of specific experience, qualifications and skills of its directors in order to assure that the Board, as a whole, has the necessary tools to perform its oversight function effectively in light of the Company’s business and structure.

Shareholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential Director candidates by submitting the names of the recommended individuals, together with appropriate biographical information and background materials, to the Nominating and Corporate Governance Committee, c/o Secretary, The Container Store Group, Inc., 500 Freeport Parkway, Coppell, Texas 75019. In the event there is a vacancy, and assuming that appropriate biographical and background material has been provided on a timely basis, the Committee will evaluate shareholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

Communications from Interested Parties

Anyone who would like to communicate with, or otherwise make his or her concerns known directly to the chairperson of any of the Audit, Nominating and Corporate Governance, and Culture and Compensation Committees, or to the non-management or independent directors as a group, may do so by addressing such

20

communications or concerns to the Secretary of the Company, 500 Freeport Parkway, Coppell, Texas 75019, who will forward such communications to the appropriate party. Such communications may be done confidentially or anonymously.

Board Leadership Structure and Role in Risk Oversight

Our Corporate Governance Guidelines provide that the roles of Chairperson of the Board and Chief Executive Officer may be separated or combined, and our Board of Directors exercises its discretion in combining or separating these positions as it deems appropriate in light of prevailing circumstances. Currently, Robert E. Jordan serves as our Chairman of the Board and Satish Malhotra serves as our Chief Executive Officer.

The Board has carefully considered its leadership structure and determined that separating positions of Chief Executive Officer and Chairperson of the Board serves the best interests of the Company and its shareholders. Specifically, the separation of the Chief Executive Officer and Chairperson positions provides Mr. Malhotra with the ability to focus on the Company’s strategy, business, and operating and financial performance. The Board believes that Mr. Jordan is best situated to serve as Chairperson at this time due to his deep knowledge of our Company and his prior experience serving as lead independent director of the Board. We believe that we, like many U.S. companies, are well-served by a flexible leadership structure. Our Board of Directors will continue to consider whether the positions of Chairperson of the Board and Chief Executive Officer should be separated or combined at any given time as part of our succession planning process.

Our Corporate Governance Guidelines provide that whenever our Chairperson of the Board is also our Chief Executive Officer or is a director that does not otherwise qualify as an independent director, the independent directors will elect a lead director whose responsibilities include presiding over all meetings of the Board at which the Chairperson is not present, including any executive sessions of the independent directors or the non-management directors; assisting in scheduling Board meetings and approving meeting schedules; communicating and collaborating with the Chief Executive Officer on various matters; and acting as the liaison between the independent or non-management directors and the Chairperson of the Board, as appropriate. The full list of responsibilities of our lead director may be found in Annex A to our Corporate Governance Guidelines. Because the Board has determined to separate the Chairperson and Chief Executive Officers positions, currently the Company does not have a lead director.

Our Board of Directors is responsible for overseeing our risk management process. Our Board of Directors focuses on our general risk management strategy, the most significant risks facing us, including cybersecurity and risks relating to the ongoing COVID-19 pandemic, and oversees the implementation of risk mitigation strategies by management. Our Board of Directors is also apprised of particular risk management matters in connection with its general oversight and approval of corporate matters and significant transactions. Our Audit Committee oversees financial and cybersecurity risk and our Nominating and Corporate Governance Committee oversees risk relating to our environmental, social and governance strategy. The Board does not believe that its role in the oversight of our risks affects the Board’s leadership structure.

We have adopted a Code of Business Conduct and Ethics that applies to all of our directors, officers and employees. A copy of the code is available on our website located at www.containerstore.com in the “Corporate Governance” section of the “Investor Relations” page. We expect that any amendments to the code, or any waivers of its requirements, that are required to be disclosed by SEC or NYSE rules will be disclosed on our website.

21

Our Board of Directors has adopted an Insider Trading Compliance Policy, which applies to all of our directors, officers and employees. The policy prohibits our directors, officers and employees and any entities they control from engaging in all hedging or monetization transactions, such as zero-cost collars and forward sale contracts, involving our equity securities.

Attendance by Members of the Board of Directors at Meetings

There were 5 meetings of the Board of Directors during the fiscal year ended April 2, 2022. During the fiscal year ended April 2, 2022, each Director attended at least 75% of the aggregate of (i) all meetings of the Board of Directors and (ii) all meetings of the committees on which the Director served during the period in which he or she served as a Director.

Our Corporate Governance Guidelines provide that all directors are expected to make best efforts to attend the Annual Meeting. Seven out of nine directors who were members of our Board at the time of the 2021 Annual Meeting of Shareholders attended the meeting.

The non-management members of the Board meet in regularly scheduled executive sessions. Robert E. Jordan, as the Chairperson, presides over the regularly scheduled executive sessions at which he is present.

22

|

Environmental, Social and Governance Approach

Governance of Corporate Responsibility

The Board’s role includes overseeing the Company’s corporate strategy and enterprise risk management, including sustainability efforts. Our Board and its committees play a critical role in the oversight of our corporate culture and hold management accountable for its maintenance of high ethical standards, governance practices and compliance programs to protect our business, employees, and reputation. The Nominating and Corporate Governance Committee of the Board of Directors oversees our ESG efforts (with the Compensation and Culture Committee having primary responsibility for matters relating to human capital management and management development). Our Chief Financial Officer, a member of the executive committee, leads the ESG function. The Senior Director of ESG manages corporate sustainability activities and strategy, and reports to the Chief Financial Officer.

Environmental Stewardship

At The Container Store, we recognize the importance of our impact on people, the planet and the communities where we operate. It is imperative to the success of our business that we continue to learn, improve, and advance our vision in those key areas by implementing a strong and thoughtful ESG strategy.

Our top priorities are to develop policies and programs that focus on the environment, social responsibility and our employees, respect for human rights and ethics. Our contribution to a sustainable society is to reduce environmental impact and improve our sustainable business practices to meet stakeholder demand and address growing environmental concerns and risks. In fiscal 2021, we conducted our first assessment to identify and prioritize the ESG topics most important to our business and our stakeholders. Additionally, we onboarded tools to help us measure baseline Scope 1 and Scope 2 Green House Gas emissions and energy intensity data according to the Green House Gas Protocol. We continue to offset power usage in our stores, distribution centers, and support center with 100% renewable energy.

Our Elfa-manufactured products, which contributed approximately 30% of our fiscal year 2021 retail sales, are largely made from recycled materials and Elfa has a robust sustainability program in place.

Employee and Stakeholder Engagement

We continue our progress towards a fair, healthy, and safe workplace, while creating work environment policies that promote diversity, equality, and inclusion. We believe that when we create a workplace where our colleagues are engaged, committed and empowered for the long-term, we are better positioned to create value for our company, as well as for our shareholders. We are proud of our focus on promoting human rights across our operations – from our supply chain to our products – and are committed to build our business on a foundation of ethics.

Our customers consider us their happy place; and we recognize the importance of taking care of the employees who are responsible for creating this environment in our stores. That’s why we are committed to providing a robust and ongoing training and development program. Through training, we equip our team to meet the needs of our customers, whether they work in our Stores, Distribution Centers or the Support Center. Training also helps our employees become knowledgeable and trusted experts armed with intuition and trained for success.

23

Our commitment to equity and inclusion extends beyond our employees. We know supporting the local communities where we have stores and distribution centers makes the communities stronger. Therefore, we are proud to offer opportunities within our supply chain to small and diverse-owned businesses and through our philanthropy efforts focus on causes that are important to our employees and customers and align with our commitment to making a lasting social and economic impact in those communities.

You can read more learn more about our diversity, equity, and inclusion efforts at www.containerstore.com/inclusion. The information contained on our website is not incorporated by reference into this proxy statement.

24

|

Our Board has established three standing committees—Audit, Culture and Compensation and Nominating and Corporate Governance—each of which operates under a written charter that has been approved by our Board.

The current members of each of the Board committees are set forth in the following chart.

|

| |

| |

| Nominating and Corporate |

Name | | Audit | | Culture and Compensation | | Governance |

Robert E. Jordan* |

| |

| X |

| X |

Satish Malhotra |

| |

| |

| |

J. Kristofer Galashan* |

| |

| |

| Chair |

Anthony Laday* | | Chair | | | | X |

Nicole Otto* |

| |

| X |

| |

Jonathan D. Sokoloff* |

| |

| |

| |

Caryl Stern* |

| X |

| Chair |

| |

Wendi Sturgis* |

| X |

| |

| X |

Lisa Klinger* | | X | | | | |

* | Independent director |

AUDIT COMMITTEE

Our Audit Committee’s responsibilities include, but are not limited to:

| ● | appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm; |

| ● | discussing with our independent registered public accounting firm their independence from management; |

| ● | reviewing with our independent registered public accounting firm the scope and results of their audit; |

| ● | approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm; |

| ● | overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC; |

| ● | discussing the Company’s policies with respect to risk management, including regarding financial and cybersecurity risks; |

| ● | reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls and compliance with legal and regulatory requirements; and |

| ● | establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters. |