Form 6-K Cardiol Therapeutics For: May 24

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2022

Commission File Number: 001-40712

Cardiol

Therapeutics Inc.

(Translation of registrant's name into English)

602-2265

Upper Middle Road East, Oakville, Ontario, Canada L6H 0G5

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

¨ Form 20-F x Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

SUBMITTED HEREWITH

Exhibits

| 99.1 | Notice of Annual General Meeting of Shareholders | |

| 99.2 | Management Information Circular | |

| 99.3 | Form of Proxy | |

| 99.4 | Notice of Availability of Proxy Materials |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| CARDIOL THERAPEUTICS INC. | |||

| (Registrant) | |||

| Date: May 24, 2022 | By: | /s/ Chris Waddick | |

| Name: | Chris Waddick | ||

| Title: | Chief Financial Officer | ||

Exhibit 99.1

CARDIOL THERAPEUTICS INC.

602-2265 Upper Middle Road East,

Oakville, ON, Canada, L6H 0G5

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that an annual general meeting (the “Meeting”) of the holders (the “Shareholders”) of all of the issued and outstanding Class A common shares (“Common Shares”) in the capital of Cardiol Therapeutics Inc. (the “Corporation” or “Cardiol”) will be held on June 28, 2022, at 4:30 p.m. (EDT) for the following purposes:

| 1. | to receive the audited financial statements of the Corporation for the fiscal year ended December 31, 2021, and the report of the auditors thereon; |

| 2. | to elect directors of the Corporation; |

| 3. | to appoint BDO Canada LLP as auditors of the Corporation for the current fiscal year ending December 31, 2022, and to authorize the directors of the Corporation to fix the auditors’ remuneration; and |

| 4. | to transact such further and other business as may properly come before the Meeting or any adjournment or adjournments thereof. |

Shareholders must return their proxies or voting instruction forms to intermediaries not later than 48 hours (excluding Saturdays, Sundays, and statutory holidays in the City of Toronto, Ontario) prior to the time set for the Meeting or any adjournments or postponements thereof.

Cardiol is conducting an online only shareholders’ meeting. Registered Shareholders (as defined in this Circular) and duly appointed proxyholders can attend the meeting online at https://web.lumiagm.com/452344863 where they can participate, vote, or submit questions during the meeting’s live webcast.

Website Where Meeting Materials are Posted

The Circular, financial statements of the Corporation for the year ended December 31, 2021 ("Financial Statements"), and management's discussion and analysis of the Corporation's results of operations and financial condition for 2021 ("MD&A") may be viewed online via the System for Electronic Document Analysis and Retrieval ("SEDAR") at www.sedar.com or on the Corporation's website at www.cardiolrx.com.

Obtaining Paper Copies of Materials

Shareholders may also obtain paper copies of the Circular, Financial Statements, and MD&A free of charge by contacting Computershare Investor Services Inc. ("Computershare") toll-free at 1-866-962-0498 or upon request to the Corporation's Corporate Secretary at 602-2265 Upper Middle Road East, Oakville, ON, Canada, L6H 0G5, telephone (289) 910-0850.

A request for paper copies which are required in advance of the Meeting should be sent so that they are received by the Corporation or Computershare, as applicable, by June 14, 2022 in order to allow sufficient time for Shareholders to receive the paper copies and to return their proxies or voting instruction forms to intermediaries not later than 48 hours (excluding Saturdays, Sundays, and statutory holidays in the City of Toronto, Ontario) prior to the time set for the Meeting or any adjournments or postponements thereof (the "Proxy Deadline").

Notice-and-Access

The Corporation is utilizing the notice-and-access mechanism (the "Notice-and-Access Provisions") under National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer and National Instrument 51-102 – Continuous Disclosure Obligations, for distribution of Meeting materials to registered and beneficial Shareholders. The Notice-and-Access Provisions allow reporting issuers to post electronic versions of proxy-related materials (such as proxy circulars and annual financial statements) on-line, via SEDAR, and on one other website, rather than mailing paper copies of such materials to Shareholders. The Corporation anticipates that using notice-and-access for delivery to all Shareholders will directly benefit the Corporation through a substantial reduction in both postage and material costs, and also promote environmental responsibility by decreasing the large volume of paper documents generated by printing proxy-related materials.

The Corporation will not use procedures known as "stratification" in relation to the use of Notice-and-Access Provisions. Stratification occurs when a reporting issuer using the Notice-and-Access Provisions provides a paper copy of the Circular to some Shareholders with this notice package. In relation to the Meeting, all Shareholders will receive the required documentation under the Notice-and-Access Provisions, which will not include a paper copy of the Circular.

Shareholders with questions about notice-and-access can call the Corporation's transfer agent, Computershare, toll-free at 1-866-962-0492.

Voting

The Board of Directors of the Corporation has fixed the close of business on May 13, 2022 as the record date (the "Record Date") for the purpose of determining Shareholders entitled to receive notice of, and vote at, the Meeting. The failure of any Shareholder to receive notice of the Meeting does not deprive such Shareholder of the right to vote at the Meeting. Only Shareholders of record at the close of business on May 13, 2022 are entitled to vote at the Meeting.

All Shareholders are invited to attend the Meeting and may attend or may be represented by proxy. A "beneficial" or "non-registered" Shareholder will not be recognized directly at the Meeting for the purposes of voting common shares registered in the name of his/her/its broker; however, a beneficial Shareholder may attend the Meeting as proxyholder for a registered Shareholder and vote the common shares in that capacity. Only Shareholders as of the Record Date are entitled to receive notice of and vote at the Meeting. Shareholders who are unable to attend the Meeting, or any adjournments or postponements thereof, are requested to complete, date, and sign the form of proxy (registered holders) or voting instruction form (beneficial holders).

SHAREHOLDERS ARE REMINDED TO REVIEW THE CIRCULAR BEFORE VOTING.

DATED at Oakville, Ontario, on this 13th day of May, 2022.

| BY ORDER OF THE BOARD OF DIRECTORS | |

| (signed) “David Elsley” | |

| Director, President and Chief Executive Office |

“B” -1

Exhibit 99.2

CARDIOL THERAPEUTICS INC.

602-2265 Upper Middle Road East,

Oakville, ON, Canada, L6H 0G5

Telephone: (289) 910-0850

MANAGEMENT INFORMATION CIRCULAR

FOR THE ANNUAL GENERAL MEETING OF SHAREHOLDERS

(Containing Information as at May 13, 2022, unless otherwise stated)

Cardiol Therapeutics Inc. (the "Corporation") is utilizing the notice-and-access mechanism (the "Notice-and-Access Provisions") under National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer ("NI 54-101") and National Instrument 51-102 – Continuous Disclosure Obligations ("NI 51-102") for distribution of this Circular (as defined below) to both registered and non-registered (or beneficial) shareholders of the Corporation (collectively, the "Shareholders"). Further information on notice-and-access is contained below under the heading Notice-and-Access and Shareholders are encouraged to read this information for an explanation of their rights.

SOLICITATION OF PROXIES

This management information circular (the "Circular") is furnished in connection with the solicitation of proxies by the management of the Corporation for use at the annual general meeting (the "Meeting") of Shareholders of Class A common shares without par value in the capital of the Corporation (the "Shares"), to be held on Tuesday, the 28th day of June, 2022, at the time and place and for the purposes set forth in the accompanying notice of meeting (the "Notice") and at any adjournment or postponement thereof. It is expected that the solicitation of proxies on behalf of management will be primarily by mail; however, proxies may be solicited personally or by telephone by the regular officers, employees, or agents of the Corporation. The cost of soliciting proxies on behalf of management will be borne by the Corporation. The Corporation may also reimburse brokers and other persons holding Shares in their names or in the name of nominees, for their costs incurred in sending proxy materials to beneficial owners and obtaining their proxies or voting instructions.

NOTICE-AND-ACCESS

As noted above, the Corporation is utilizing the Notice-and-Access Provisions under NI 54-101 and NI 51-102 for distribution of this Circular to all registered Shareholders and Non-Registered Holders (as defined under "Appointment of Proxies – Non-Registered Holders")

The Notice-and-Access Provisions are a set of rules that allow reporting issuers to post electronic versions of proxy-related materials (such as proxy circulars and annual financial statements) on-line, via the System for Electronic Document Analysis and Retrieval ("SEDAR"), and one other website, rather than mailing paper copies of such materials to Shareholders. Electronic copies of the Circular, audited financial statements of the Corporation for the year ended December 31, 2021 (the "Financial Statements") and management's discussion and analysis of the Corporation's results of operations and financial condition for 2021 (the "MD&A") may be found on the Corporation's SEDAR profile at www.sedar.com and also on the Corporation's website at www.cardiolrx.com. The Corporation will not use procedures known as "stratification" in relation to the use of Notice-and-Access Provisions. Stratification occurs when a reporting issuer using the Notice-and-Access Provisions provides a paper copy of this Circular to some Shareholders with the notice package. In relation to the Meeting, all Shareholders will receive the required documentation under the Notice-and-Access Provisions, which will not include a paper copy of this Circular.

Shareholders are reminded to review this Circular before voting.

Although this Circular, the Financial Statements and the MD&A will be posted electronically on-line as noted above, Shareholders will receive paper copies of a "notice package" via prepaid mail containing the Notice with information prescribed by NI 54-101 and NI 51-102, a form of proxy or voting instruction form, and supplemental mail list return card for Shareholders to request they be included in the Corporation's supplementary mailing list for receipt of the Corporation's interim financial statements for the 2022 fiscal year.

The Corporation anticipates that Notice-and-Access will directly benefit the Corporation through a substantial reduction in both postage and material costs, and also promote environmental responsibility by decreasing the large volume of paper documents generated by printing proxy-related materials.

Shareholders with questions about Notice-and-Access can call the Corporation's transfer agent and registrar, Computershare Investor Services Inc. ("Computershare") toll-free at 1-866-962-0492. Shareholders may also obtain paper copies of this Circular, the Financial Statements and the MD&A free of charge by contacting Computershare at the same toll-free number or upon request to the Corporation's Corporate Secretary at 602-2265 Upper Middle Road East, Oakville, ON, Canada L6H 0G5, telephone (289) 910-0850.

A request for paper copies which are required in advance of the Meeting should be sent so that they are received by the Corporation or Computershare, as applicable, by June 14, 2022 in order to allow sufficient time for Shareholders to receive their paper copies and to return a) their form of proxy to the Corporation or Computershare, or b) their voting instruction form to their Intermediaries (as defined below) by its due date.

APPOINTMENT OF PROXIES

The persons named in the accompanying form of proxy (the "Proxy") are representatives of management of the Corporation and are directors and/or officers of the Corporation (the “Management Representatives”). A SHAREHOLDER HAS THE RIGHT TO APPOINT A PERSON (WHO NEED NOT BE A SHAREHOLDER) TO ATTEND AND ACT FOR HIM/HER/IT ON HIS/HER/ITS BEHALF AT THE MEETING OTHER THAN THE MANAGEMENT REPRESENTATIVES NAMED IN THE ENCLOSED PROXY. TO EXERCISE THIS RIGHT, A SHAREHOLDER MAY STRIKE OUT THE NAMES OF THE MANAGEMENT REPRESENTATIVES NAMED IN THE PROXY AND INSERT THE NAME OF HIS/HER/ITS NOMINEE IN THE BLANK SPACE PROVIDED, OR COMPLETE ANOTHER PROXY. A PROXY WILL NOT BE VALID UNLESS IT IS DEPOSITED WITH COMPUTERSHARE, AT 100 UNIVERSITY AVENUE, 8TH FLOOR, TORONTO, ONTARIO, M5J 2Y1, OR VIA THE INTERNET AT WWW.INVESTORVOTE.COM, NOT LESS THAN 48 HOURS (EXCLUDING SATURDAYS, SUNDAYS, AND HOLIDAYS) BEFORE THE TIME OF THE MEETING OR ANY ADJOURNMENT OR POSTPONEMENT THEREOF. ALTERNATIVELY, PROXIES MAY BE FAXED TO 1-866-249-7775 (TOLL-FREE) BY SUCH TIME, IN WHICH EVENT ALL PAGES OF A PROXY SHOULD BE RETURNED.

The Proxy must be signed by the Shareholder or by his/her attorney in writing, or, if the Shareholder is a corporation, it must either be under its common seal or signed by a duly authorized officer.

- 2 -

Shareholders who wish to appoint a third-party proxyholder to represent them at the online meeting must submit their proxy or voting instruction form (if applicable) prior to registering your proxyholder. Registering your proxyholder is an additional step once you have submitted your proxy or voting instruction form. Failure to register the proxyholder will result in the proxyholder not receiving a Username to participate in the meeting. To register a proxyholder, Shareholders MUST visit https://www.computershare.com/cardiol not less than 48 hours (excluding Saturdays, Sundays, and holidays) before the time of the meeting and provide Computershare with their proxyholder’s contact information, so that Computershare may provide the proxyholder with a Username via email. If a Shareholder who has submitted a proxy attends the meeting via the webcast and has accepted the terms and conditions when entering the meeting online, any votes cast by such shareholder on a ballot will be counted and the submitted proxy will be disregarded.

NON-REGISTERED HOLDERS

Only those Shareholders whose names appear on the securities register of the Corporation (the "Registered Shareholders"), or the persons they appoint as their proxies, are permitted to attend and vote at the Meeting. However, in many cases, Shares beneficially owned by a holder (a "Non-Registered Holder") are registered either:

| (a) | in the name of an intermediary (an "Intermediary") that the Non-Registered Holder deals with in respect of the Shares, such as, among others, banks, trust companies, securities dealers or brokers, and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans; or |

| (b) | in the name of a clearing agency (such as CDS Clearing and Depository Services Inc.) of which the Intermediary is a participant. |

In accordance with the requirements of NI 54-101, the Corporation has distributed copies of this Circular, the Notice, the Financial Statements and the MD&A (together, the "Meeting Materials") to the clearing agencies and Intermediaries for onward distribution to Non-Registered Holders. The Corporation has agreed to pay to distribute the Meeting Materials to “objecting beneficial owners” (as defined in NI 54-101).

Intermediaries are required to forward Meeting Materials to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive them. Intermediaries will often use service companies to forward the Meeting Materials to Non-Registered Holders. Generally, Non-Registered Holders who have not waived the right to receive Meeting Materials will either:

| A. | be given a voting instruction form which must be completed and signed by the Non-Registered Holder in accordance with the directions on the voting instruction form (which may in some cases permit the completion of the voting instruction form by telephone); or |

| B. | be given a Proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature) which is restricted as to the number of Shares beneficially owned by the Non-Registered Holder, but which is otherwise uncompleted. This Proxy need not be signed by the Non-Registered Holder. In this case, the Non-Registered Holder who wishes to submit a Proxy should otherwise properly complete the form of Proxy and deposit it with Computershare, as described above. |

The purpose of these procedures is to permit Non-Registered Holders to direct the voting of the Shares they beneficially own. Should a Non-Registered Holder who receives either a Proxy or a voting instruction form wish to attend and vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Holder), the Non-Registered Holder should strike out the names of the persons named in the Proxy and insert the Non-Registered Holder's (or such other person's) name in the blank space provided or, in the case of a voting instruction form, follow the corresponding instructions on the form. In either case, Non-Registered Holders should carefully follow the instructions of their Intermediaries and their service companies.

- 3 -

REVOCATION

A Registered Shareholder who has given a Proxy may revoke the Proxy by:

| (a) | completing and signing a Proxy bearing a later date and depositing it with Computershare as described above; |

| (b) | depositing an instrument in writing executed by the Shareholder or by the Shareholder's attorney authorized in writing: (i) at the registered office of the Corporation at any time up to and including the last business day preceding the day of the Meeting, or any adjournment or postponement of the Meeting, at which the Proxy is to be used, or (ii) with the chairman of the Meeting prior to the commencement of the Meeting on the day of the Meeting or any adjournment or postponement of the Meeting; or |

| (c) | in any other manner permitted by law. |

A Non-Registered Holder may revoke a voting instruction form or a waiver of the right to receive Meeting Materials and to vote given to an Intermediary at any time by written notice to the Intermediary, except that an Intermediary may not be required to act on a revocation of a voting instruction form or of a waiver of the right to receive Meeting Materials and to vote that is not received by the Intermediary at least seven days prior to the Meeting.

VOTING OF PROXIES

The Management Representatives designated in the enclosed Proxy will vote or withhold from voting the Shares in respect of which they are appointed by Proxy on any ballot that may be called for in accordance with the instructions of the Shareholder as indicated on the Proxy and, if the Shareholder specifies a choice with respect to any matter to be acted upon, the Shares will be voted accordingly. In the absence of such instructions, such Shares will be voted by the Management Representatives: (i) FOR the election of each of the individual nominees named in this Circular as directors of the Corporation; and (ii) FOR the appointment of BDO Canada LLP, Chartered Professional Accountants, Montreal, Quebec, as auditors of the Corporation and the authorization of the directors of the Corporation to fix the auditors’ remuneration.

The enclosed Proxy confers discretionary authority upon the Management Representatives designated in the Proxy with respect to amendments to or variations of matters identified in the notice of Meeting and with respect to other matters which may properly come before the Meeting. At the date of this Circular, management of the Corporation are not aware of any such amendments, variations, or other matters.

Voting by proxy may also occur over the Internet. The enclosed Proxy or voting instruction form you may receive from your broker or other intermediary contains details on how to vote over the Internet.

PARTICIPATING AT THE MEETING

The meeting will be hosted online by way of a live webcast. Shareholders will not be able to attend the meeting in person. A summary of the information shareholders will need to attend the online meeting is provided below. The meeting will begin on June 28, 2022, at 4:30 p.m. (EDT).

- 4 -

Registered Shareholders who have a 15-digit control number, along with duly appointed proxyholders who were assigned a Username by Computershare, will be able to vote and submit questions during the Meeting. To do so, please go to https://web.lumiagm.com/452344863 prior to the start of the Meeting to login. Click on “I have a login” and enter your 15-digit control number or Username along with the password “cardiol2022”. Non-Registered Holders who have not appointed themselves to vote at the Meeting, may login as a guest, by clicking on “I am a Guest” and complete the online form.

United States Beneficial holders: To attend and vote at the virtual Meeting, you must first obtain a valid legal proxy from your broker, bank, or other agent and then register in advance to attend the Annual General Meeting. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a legal proxy form. After first obtaining a valid legal proxy from your broker, bank, or other agent, to then register to attend the Annual General Meeting, you must submit a copy of your legal proxy to Computershare. Requests for registration should be directed to Computershare (100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1 OR Email at [email protected]).

Requests for registration must be labeled as “Legal Proxy” and be received no later than not less than 48 hours (excluding Saturdays, Sundays, and holidays) before the time of the Meeting. You will receive a confirmation of your registration by email after we receive your registration materials. You may attend the Annual General Meeting and vote your shares at https://web.lumiagm.com/452344863 during the Meeting. Please note that you are required to register your appointment at www.computershare.com/cardiol.

Non-Registered Holders who do not have a 15-digit control number or Username will only be able to attend as a guest which allows them listen to the Meeting; however, they will not be able to vote or submit questions. Please see the information under the heading “Non-Registered Holders” for an explanation of why certain shareholders may not receive a form of proxy.

If you are using a 15-digit control number to login to the online meeting and you accept the terms and conditions, you will be revoking any and all previously submitted proxies. However, in such a case, you will be provided the opportunity to vote by ballot on the matters put forth at the meeting. If you DO NOT wish to revoke all previously submitted proxies, do not accept the terms and conditions, in which case you can only enter the meeting as a guest.

If you are eligible to vote at the Meeting, it is important that you are connected to the internet at all times during the Meeting in order to vote when balloting commences. It is your responsibility to ensure connectivity for the duration of the Meeting.

VOTING AT THE MEETING

Registered Shareholders or Non-Registered Holders who have appointed themselves or a third-party proxyholder to represent them at the Meeting, will appear on a list of shareholders prepared by Computershare, the transfer agent and registrar for the Meeting. To have their Shares voted at the meeting, each Registered Shareholder or proxyholder will be required to enter their control number or Username provided by Computershare at https://web.lumiagm.com/452344863 prior to the start of the meeting. In order to vote, Non-Registered Holders who appoint themselves as a proxyholder MUST register with Computershare at https://www.computershare.com/cardiol after submitting their voting instruction form in order to receive a Username.

ADVANCE NOTICE REQUIREMENT

Pursuant to the Corporation's By-law No. 1, as amended (“By-law No. 1”), a Shareholder wishing to nominate an individual to be a director, other than pursuant to a requisition of a meeting made pursuant to the Business Corporations Act (Ontario) (the “OBCA”) or a shareholder proposal made pursuant to the provisions of the OBCA, is required to comply with the advance notice requirement as set out in By-law No. 1 (the “Advance Notice Requirement”). Among other things, the Advance Notice Requirement fixes a deadline by which Shareholders must provide notice to the Corporation of nominations for election to the Board of Directors of the Corporation (the “Board” or the “Board of Directors”). The notice must include all information that would be required to be disclosed, under applicable corporate and securities laws, in a dissident proxy circular in connection with the solicitations of proxies for the election of directors relating to the Shareholder making the nominations (as if that Shareholder were a dissident soliciting proxies) and each person that the Shareholder proposes to nominate for election as a director. In addition, the notice must provide information as to the shareholdings of the Shareholder making the nominations, confirmation that the proposed nominees meet the qualifications of directors and residency requirements imposed by corporate law, and confirmation as to whether each proposed nominee is independent for the purposes of National Instrument 52-110 – Audit Committees ("NI-52-110"). The deadline by which the notice must be delivered to the Corporation is set out in the table below.

- 5 -

| Meeting Type | Nomination Deadline |

| Annual meeting of Shareholders | Either (a) no more than ten days after the date of the first public filing or announcement of the date of the meeting, if the meeting is called for a date that is fewer than 50 days after the date of that public filing or announcement or (b) no fewer than 30 days and no more than 65 days prior to the date of the meeting. |

| Special meeting of Shareholders (which is not also an annual meeting) | No more than 15 days after the date of the first public filing or announcement of the date of the meeting. |

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

The authorized share capital of the Corporation consists of an unlimited number of Shares. The record date for the determination of Shareholders entitled to receive notice of the Meeting has been fixed at May 13, 2022 (the "Record Date"). As at the Record Date, the Corporation had 61,927,999 Shares issued and outstanding.

Each Share entitles the holder thereof to one vote on all matters to be acted upon at the Meeting. All such holders of record of Shares on the Record Date, all Shareholders are entitled either to attend and vote the Shares held by such Shareholder, or, provided a completed and executed proxy shall have been delivered to the Corporation's transfer agent and registrar, Computershare, within the time specified in the Notice of Meeting, to attend and to vote by proxy the Shares held by such Shareholder.

To the knowledge of the directors and executive officers of the Corporation, as of the date hereof, no person or company beneficially owns, controls or directs, directly or indirectly, voting securities of the Corporation carrying 10% or more of the voting rights attached to the outstanding Shares.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

Except as otherwise disclosed herein, none of:

| (a) | the directors or executive officers of the Corporation at any time since the beginning of the last financial year of the Corporation; |

| (b) | the proposed nominees for election as a director of the Corporation; or |

| (c) | any associate or affiliate of the foregoing persons, |

has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matters to be acted upon at the Meeting other than the election of directors.

- 6 -

PARTICULARS OF MATTERS TO BE ACTED UPON

ELECTION OF DIRECTORS

The Corporation’s articles (the “Articles”) provide that the Board of Directors is to consist of a minimum of one and a maximum of ten directors as determined from time to time by the Directors. The Articles also provide that the Board of Directors has the power to appoint additional directors: in accordance with the Articles and the OBCA, the Board of Directors may appoint one or more additional directors who shall hold office until the close of the next annual meeting of Shareholders, provided that the total number of directors so appointed does not exceed one-third of the number of directors elected at the previous annual meeting of Shareholders.

The Board currently consists of six directors: Dr. Guillermo Torre-Amione, Peter Pekos, David Elsley, Colin Stott, Michael Willner, and Jennifer Chao. At the Meeting, Management will put forward Dr. Guillermo Torre-Amione, Peter Pekos, David Elsley, Colin Stott, Michael Willner, Jennifer Chao, Chris Waddick and Teri Loxam as nominees for election as a Director for the ensuing year (the "Nominees"). Chris Waddick and Teri Loxam have not previously served as Directors.

The Board recommends that Shareholders vote in favour of the eight proposed Nominees. Shareholders have the option to (i) vote for all of the Nominees; (ii) vote for some of the Nominees and withhold for others; or (iii) withhold for all of the Nominees. Unless the Shareholder has specifically instructed in the enclosed form of proxy that the Shares represented by such Proxy are to be withheld or voted otherwise, the Management Representatives named in the accompanying Proxy will vote FOR the election of each of the Nominees.

Each Director is elected annually and holds office until the next annual meeting of Shareholders or, if his or her office is earlier vacated, until his or her successor is duly elected or appointed in accordance with the Articles.

Information Concerning the Nominees

The following table sets out the names of the Nominees nominated by Management for election as a Director, the province or state and country in which he or she is ordinarily resident, the positions and offices which each presently holds with the Corporation, the period of time for which he or she has been a Director of the Corporation, their respective principal occupations or employment and the number of Shares which each beneficially owns, directly or indirectly, or over which control or direction is exercised as of the date of this Circular. The information as to Shares beneficially owned, directly or indirectly or over which control or direction is exercised, not being with the knowledge of the Corporation, has been furnished by the respective Nominees individually.

- 7 -

The Nominees for the election to the Board, and information concerning them as furnished by the individual Nominees, are as follows:

| Name, Province and Country of Ordinary Residence and Positions Held with the Corporation |

Present Principal Occupation and/or Past Principal Occupation Within the Previous Five Years |

Director Since(6) |

No. of Shares Beneficially Owned, Directly or Indirectly(7) |

|

David Elsley Ontario, Canada President & CEO Director |

President and Chief Executive Officer of Cardiol since January 19, 2017. Self employed, investigating drug formulations that are the foundation of Cardiol’s business (from 2013 to 2017) | January 19, 2017 | 1,754,500 |

|

Peter Pekos(2)(5) Ontario, Canada Director |

Chief Executive Officer of Dalton Pharma Services (“Dalton”), a cGMP manufacturer of pharmaceuticals. | December 15, 2017 | 467,290 |

|

Dr. Guillermo Torre-Amione(1)(2)(5) Monterrey, Mexico Director |

Chairman of Cardiol since July 7, 2021. President of TecSalud del Tecnológico de Monterrey, Mexico, part of the Instituto Tecnológico y de Estudios Superiorers de Monterrey, Mexico. Previously, Chief of Heart Failure Division and Medical Director of Cardiac Transplantation, Houston Methodist DeBakey Heart & Vascular Center. | August 20, 2018 | 89,164 |

|

Colin Stott(1)(5) Southport, United Kingdom Director |

Chief Operating Officer of Alterola Biotech Inc. Previously Chief Operating Officer of Alinova Biosciences Ltd. (July 2019 to December 2020). Previously Scientific Affairs Director, International (from 2017 to 2019). | December 3, 2019 | 82,500 |

|

Michael Willner(1)(3)(5) Florida, USA Director |

Founder of Willner Capital, Inc., an investment company specializing in public and private equities, as well as debt instruments | September 7, 2021 | 685,105 |

|

Jennifer Chao(2)(4)(5) New York, USA Director |

Founder of CoreStrategies Management, LLC. | March 15, 2022 | nil |

|

Chris Waddick Ontario, Canada CFO & Proposed Director |

Chief Financial Officer and Corporate Secretary of Cardiol since August 16, 2018. Executive Vice President and CFO of Active Energy Inc., a private energy company, since January 2013 and President of NRJ Consulting Inc., a consulting company, since November 2009. | N/A | 110,000 |

|

Teri Loxam(5) Pennsylvania, USA Proposed Director |

Chief Operating Officer and Chief Financial Officer of Kira Pharmaceuticals since November 2021. Director of Vaxcyte since September 2021. Advisor to the Corporation since May 2021. Chief Financial Officer of SQZ Biotechnologies from September 2019 to November 2021. Senior Vice President (Investor Relations and Global Communications) of Merck from November 2015 to August 2019. | N/A | nil |

Notes:

| (1) | Member of the Audit Committee. | |

| (2) | Member of the Corporate Governance and Compensation Committee (“CG&C Committee”). | |

| (3) | Chair of the Audit Committee. |

- 8 -

| (4) | Chair of the CG&C Committee. | |

| (5) | Independent. | |

| (6) | Each current director's term expires at the Meeting. | |

| (7) | The information as to beneficial ownership of Shares was provided by the respective directors and executive officers individually, as it is not within the knowledge of the Corporation. |

Biographies of Proposed Nominees For Director

David Elsley, MBA – President, Chief Executive Officer, and Director

Mr. David Elsley is a business leader with a proven track record of developing, financing, and managing all aspects of corporate development in biotechnology and high-growth organizations. In 1990, Mr. Elsley founded Vasogen Inc., a biotechnology company focused on the research and commercial development of novel therapeutics for the treatment of heart failure and other inflammatory conditions. Mr. Elsley assembled a team of management, directors, and scientific advisors comprising industry professionals and thought leaders from North America and Europe. He managed and directed Vasogen’s growth from start-up to an organization employing over 250 people with operations and R&D programs in Canada, the United States, and Europe. Mr. Elsley established the research and development infrastructure, partnerships, manufacturing capability, and corporate quality systems necessary to advance two anti-inflammatory therapies from concept to completion of international multi center pivotal phase III clinical trials involving 2,500 patients. Vasogen went public on the TSX and the Nasdaq, raising over $200 million to support corporate development and reached a market capitalization of over US$1 billion. Mr. Elsley holds a Master of Business Administration from the Ivey School of Business, University of Western Ontario.

Guillermo Torre-Amione, MD, PhD – Chairman and Director

Board certified in Cardiovascular Disease and Advanced Heart Failure/Transplant Cardiology, Dr. Guillermo Torre Amione is former chief of the Heart Failure Division and former medical director of Cardiac Transplantation at the Houston Methodist DeBakey Heart & Vascular Center. He is a senior member at The Methodist Hospital Research Institute, full professor of medicine at the Weill Cornell Medical College of Cornell University, New York, and, more recently, became President of TecSalud, an academic medical center and medical school of the Instituto Tecnológico y de Estudios Superiores de Monterrey (ITESM) in Mexico. Dr. Torre-Amione spearheads the Gene and Judy Campbell Laboratory for Cardiac Transplant Research, where his primary areas of research include heart failure, cardiac transplantation, and the role of the immune response in modulating the progression of heart failure. He initiated a series of clinical studies that led to an FDA-approved phase II clinical trial of neurostimulation in heart failure, a novel approach to the treatment of patients with advanced heart failure. Dr. Torre-Amione received his medical degree from the ITESM and a doctorate degree in immunology from the University of Chicago. He has published more than 170 manuscripts in peer-reviewed journals. He currently divides his time between his clinical and academic activities at The Methodist Hospital and ITESM. Prior to being appointed to Cardiol’s Board of Directors, Dr. Torre-Amione was a member of the Corporation’s Scientific Advisory Board.

Peter Pekos, BSc, MSc – Director

Mr. Peter Pekos, is a veteran of the pharmaceutical services industry. In 1986, he was a founder of Dalton Pharma Services (Dalton). Over a period of 36 years, he directed Dalton’s growth based on strong client relationships. Dalton provides pharma and biotech clients with an array of integrated services in a world-class 42,000 square foot facility, with more than 140 employees, in the heart of one of North America’s largest biomedical clusters. This includes premium contract chemistry research, a full range of analytical support, medicinal chemistry, formulation, cGMP manufacture of solid dosage forms, and cGMP aseptic fill-in vials and syringes. Mr. Pekos is currently CEO of Dalton, guiding the evolution of the company to best serve the changing needs of its clients throughout the major global economies, including the world’s largest pharmaceutical companies. In 1983, he obtained a Chemistry/Biochemistry Double Specialist Degree with a Minor in Biology from the University of Toronto. In 1986, he completed a Master’s Degree in synthetic chemistry at York University, and with his Professor, Doug Butler, founded Dalton with a very modest amount of capital. The company used incubator facilities at York University, and initially manufactured and sold specialty chemical compounds. Mr. Pekos also founded Ashbury Biologicals. Inc., a phyto-pharmaceutical company, Jupiter Consumer Products, a company that targeted the development of adult-focused confections, and several other technology-based companies focused on advanced materials and pharmaceutical development tools. Mr. Pekos was founding Chairman of ventureLAB, a Regional Innovation Center located at IBM’s York Region campus. VentureLAB guides government program delivery to support the innovation ecosystem for biotechnology and related industries in southern Ontario.

- 9 -

Colin G. Stott, BSc (Hons) - Director

Mr. Colin Stott is a veteran of the pharmaceutical and biotech industries, having almost 30 years’ experience in pre-clinical and clinical development, with specific expertise in the development of cannabinoid-based medicines, and 19 years’ experience in the field. Currently Chief Operating Officer of Alterola Biotech Inc., Mr. Stott is the former Scientific Affairs Director, International and R&D Operations Director for GW Pharmaceuticals plc (“GW Pharma”), a world leader in the development of cannabinoid therapeutics. As R&D Operations Director at GW Pharma for over 16 years, he was a key player in the development of their discovery and development pipeline, and was closely involved in the Marketing Authorization Application submission and approval of Sativex® and the New Drug Application submission of Epidiolex®, which was approved by the U.S. Food and Drug Administration as an orphan drug for the treatment of rare forms of paediatric epilepsy in June 2018, and the European Medicines Agency in September 2019 (as Epidyolex®). More recently, as Scientific Affairs Director, International, he was part of the Medical Affairs team responsible for the preparation of the international launch of Epidiolex®. Mr. Stott holds a BSc (Hons) in Medicinal & Pharmaceutical Chemistry and a Diploma in Industrial Studies from Loughborough University of Technology, U.K., as well as a Post Graduate Diploma in Clinical Research from the Welsh School of Pharmacy, Cardiff University, U.K. He has published over 20 research papers and is a named inventor on 17 international patent applications.

Michael J. Willner, Esq. – Director

Mr. Michael J. Willner has practiced as both an Attorney and a Certified Public Accountant. He graduated from Emory University Law School as a member of the Emory Law Review. Subsequently, he practiced real estate and corporate law with New York City-based Milbank, Tweed, Hadley & McCloy, one of the nation’s most prominent international law firms. Prior to his legal career, Mr. Willner was employed by the former Arthur Andersen & Company, a national accounting firm, where he practiced in Arthur Andersen’s tax department. Mr. Willner has been a very active and successful opportunistic investor for over forty years and is the founder of Willner Capital, Inc., an investment company specializing in public and private equities, as well as debt instruments. Willner Capital primarily uses fundamental analysis as an evaluation method and event-driven strategies. Over the past ten years, Willner Capital has made significant investments in both the biotechnology and pharmaceutical cannabinoid industries, focusing primarily on clinical-stage companies that seek to address significant unmet medical needs. Mr. Willner has been quoted in the New York Times business section and has served as a moderator and participant on numerous panel discussions and advisory boards regarding his investments in the pharmaceutical side of the cannabinoid industry.

- 10 -

Jennifer Chao –- Director

Ms. Jennifer Chao has over 25 years of experience in the biotech and life sciences industries focused primarily on finance and corporate strategy. She is Managing Partner of CoreStrategies Management, LLC, a company she founded in 2008 to provide transformational corporate and financial strategies to biotech/life science companies for maximizing core valuation. She currently serves on the Board of Directors of Endo Pharmaceuticals and is a member of the Audit Committee and Compliance Committee. Prior to joining Endo, Ms. Chao served as Chairman of the Board of BioSpecifics Technologies Corp. (BioSpecifics) from October 2019 until its acquisition by Endo for approximately US $660 million in December 2020. She also served as Chair of BioSpecifics’ Compensation Committee and as a member of the Audit Committee, Strategy Committee, Intellectual Property Committee, and Nominating and Corporate Governance Committee from 2015 to 2020. Additionally, from 2004 to 2008, Ms. Chao was Managing Director and Senior Lead Biotechnology Securities Analyst at Deutsche Bank, responsible for U.S. large- and small- to mid-cap biotechnology companies with global client coverage; and was known for differentiated fundamentals securities analysis and high visibility coverage of game changing technologies, paradigm shifting treatment algorithms, industry trends and portfolio risk/reward management. Prior to that, Ms. Chao served as Managing Director and Senior Lead Biotechnology Analyst at RBC Capital Markets and VP, Senior Biotechnology Analyst at Leerink Swann & Co. Ms. Chao was a research fellow at Massachusetts General Hospital/Harvard Medical School, as a recipient of the BioMedical Research Career Award, and received her B.A. in Politics and Greek Classics from New York University.

Chris Waddick, MBA, CPA, CA – Chief Financial Officer, Corporate Secretary and Proposed Nominee for Director

Mr. Chris Waddick has over thirty years of experience in financial and executive roles in the biotechnology and energy industries, with substantial knowledge of public company management and corporate governance, and in designing, building, and managing financial processes, procedures, and infrastructure. Mr. Waddick has served as Chief Financial Officer and Corporate Secretary of Cardiol since August 16, 2018. He serves as Executive Vice President and Chief Financial Officer for a private Ontario energy company where he was retained by the shareholders to refinance the company and establish a new strategic direction, as well as the appropriate financial infrastructure. Mr. Waddick spent more than twelve years at Vasogen Inc., a biotechnology company focused on the research and commercial development of novel therapeutics for the treatment of heart failure and other inflammatory conditions. While serving as Chief Financial Officer and Chief Operating Officer, the company grew from start up to an organization employing over 250 employees that established the necessary systems and infrastructure to advance an anti-inflammatory therapy through to the completion of an international multi-center pivotal trial involving 2,500 patients. Vasogen went public on the TSX and the NASDAQ, raising over $200 million to support corporate development and reached a market capitalization of over US$ 1 billion. Prior to Vasogen, he held progressively senior financial positions at Magna International Inc. and Union Gas Limited. Mr. Waddick is a CPA and earned a business degree from Wilfrid Laurier University and a Master of Business Administration from York University.

Teri Loxam, MBA –- Proposed Nominee for Director

Ms. Teri Loxam has over 25 years of experience in biotech, life sciences and entertainment industries with diverse roles spanning strategy, investor relations, finance and communications. Ms. Loxam joined Kira Pharmaceuticals in November 2021 as Chief Operating Officer and Chief Financial Officer. In this role, she oversees finance, operations and strategic functions for the company. Prior to joining Kira, Ms. Loxam served as SQZ Biotech’s Chief Financial Officer where she led the company’s financial operations, investor relations and communications/public relations functions. While at SQZ, she was instrumental in helping the company raise over $200M in private and public funding, including taking the company public through an IPO on the NYSE in October 2020. Before joining SQZ Biotech, Ms. Loxam served as Sr. Vice President of Investor Relations and Global Communications at Merck. In this role, she led its investor relations and investment community interactions as well as its internal and external communications efforts globally, including corporate and financial media relations, product communications, public affairs and employee communications. Prior to Merck, Ms. Loxam was Vice President, Investor Relations for IMAX Corporation, where she reshaped the entertainment company’s investor strategy, helping to convert its investor base and helping the company go public in China with an IPO on the Hong Kong Exchange. Ms. Loxam also spent over a decade at Bristol-Myers Squibb in a variety of roles of increasing responsibility across Strategy, Treasury and Investor Relations. She started her career as a marine biologist and worked at Sea World of San Diego for several years before making a transition into business. Ms. Loxam is a member of the board of directors of Vaxcyte. She holds an MBA from the University of California, Irvine and a Bachelor of Science degree in Biology from the University of Victoria, B.C. Canada.

| - 11 - |

Corporate Cease-Trade Orders

To the knowledge of management of the Corporation, none of the Directors or executive officers has, within the ten years prior to the date of this Circular, been a director, chief executive officer, or chief financial officer of any company (including Cardiol) that, while such person was acting in that capacity (or after such person ceased to act in that capacity but resulting from an event that occurred while that person was acting in such capacity) was the subject of a cease-trade order, an order similar to a cease-trade order, or an order that denied the company access to any exemption under securities legislation, in each case for a period of more than 30 consecutive days.

Corporate Bankruptcies

To the knowledge of management of the Corporation, none of the Directors or executive officers has, within the ten years prior to the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager, or trustee appointed to hold its assets, been a director or executive officer of any company, that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager, or trustee appointed to hold its assets.

Penalties or Sanctions

To the knowledge of management of the Corporation, no Director or executive officer of the Corporation or Shareholder holding sufficient securities of the Corporation to affect materially the control of the Corporation has:

| · | been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or |

| · | been subject to any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable investor making an investment decision. |

Majority Voting Policy

The Corporation has adopted a Majority Voting Policy (the “Majority Voting Policy”) for director elections that applies at this Meeting and at any meeting of the Corporation’s Shareholders where an uncontested election of directors is held. Pursuant to this policy, if the number of proxy votes withheld for a particular director nominee is greater than the votes for such director, the director nominee will be required to submit his or her resignation as a director to the Chair of the Board promptly following the applicable shareholders’ meeting. Following receipt of the resignation, the CG&C Committee will consider whether or not to accept the offer of resignation and make a recommendation to the Board. Within 90 days following the applicable shareholders’ meeting, the Board shall publicly disclose their decision whether or not to accept the applicable director’s resignation, including the reasons for rejecting the resignation, if applicable. A director who tenders his or her resignation pursuant to this policy will not be permitted to participate in any meeting of the Board or the CG&C Committee at which the resignation is considered. A copy of the Majority Voting Policy is available on the Corporation’s website at www.cardiolrx.com.

| - 12 - |

APPOINTMENT AND REMUNERATION OF AUDITORS

At the Meeting, the Board proposes to appoint BDO Canada LLP ("BDO"), Chartered Professional Accountants, of 1000 de la Gauchetière, Bureau 200, Montreal, Quebec H3B 4W5, as auditors of the Corporation and to authorize remuneration to be fixed by the Board. BDO will hold office until the next annual general meeting of the Shareholders or until its successor is appointed. BDO were first appointed as the auditors of the Corporation on January 12, 2018.

The Board recommends that Shareholders vote in favour of the appointment of BDO as auditors of the Corporation. In the absence of contrary instructions, the Management Representatives named in the accompanying Proxy intend to vote any Shares represented by such Proxies FOR the re-appointment of BDO as auditors of the Corporation for the ensuing year and to authorize the Board to fix their remuneration.

OTHER MATTERS

Management of the Corporation is not aware of any amendment, variation, or other matter to come before the Meeting other than the matters referred to in the Notice. However, if any other matter properly comes before the Meeting, the form of proxy furnished by the Corporation will be voted on such matters in accordance with the best judgment of the persons voting the proxy.

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This compensation discussion and analysis describes and explains the Corporation's policies and practices with respect to the compensation of the Corporation's named executive officers, being its Chief Executive Officer (or person who acted in a similar capacity), Chief Financial Officer, Chief Operating Officer (or person who acted in a similar capacity), Chief Medical Officer (or person who acted in a similar capacity) and Executive Chairman (collectively the "NEOs") for the financial years ended December 31, 2021, December 31, 2020, and December 31, 2019.

Executive Compensation

In accordance with the provisions of applicable securities legislation, the Corporation's five NEOs during the financial year ended December 31, 2021 were: Dr. Eldon R. Smith, Chairman (former) and Chief Medical Officer (former), Mr. David Elsley, the President and Chief Executive Officer, Mr. Chris Waddick, the Chief Financial Officer and Corporate Secretary, Mr. Bernard Lim, the Chief Operating Officer, and Dr. Andrew Hamer, the Chief Medical Officer.

The CG&C Committee determines the compensation of the Corporation's NEOs and the Directors of the Corporation with a view to ensuring that the remuneration appropriately reflects the responsibilities and risks involved in being an effective executive officer and/or director of the Corporation. The CG&C Committee periodically reviews the Corporation's compensation philosophy and objectives taking into consideration various factors discussed below.

| - 13 - |

A summary of the compensation received by the NEOs for the financial years ended December 31, 2021, December 31, 2020, and December 31, 2019 is provided under the heading "Summary Compensation Table" below. A summary of the compensation received by the non-NEO directors of the Corporation for the financial year ended December 31, 2021, is provided under the heading "Compensation of Directors" below.

Nature and Responsibilities of the Corporate Governance and Compensation Committee

The CG&C Committee is responsible for making recommendations to the Board with respect to, among other things: executive and director compensation, including reviewing and determining director compensation, overseeing the Corporation's base compensation structure and equity-based compensation program, recommending compensation of the Corporation's officers and employees and evaluating the performance of officers generally and in light of annual goals and objectives and any changes with a view to providing competitive compensation programs which attract, motivate, and retain high-caliber individuals.

The CG&C Committee also assumes responsibility for reviewing and monitoring the long-range compensation strategy for the Corporation's senior management. The CG&C Committee reviews the compensation of senior management on an annual basis taking into account compensation paid by other issuers of similar size and activity. A copy of the CG&C Committee Mandate can be found on the Corporation's website at www.cardiolrx.com.

Recommendations of the CG&C Committee are referred to the Board for approval, modification, or amendment.

Composition of the Corporate Governance and Compensation Committee

The CG&C Committee members are Jennifer Chao (Chair), Dr. Guillermo Torre-Amione, and Peter Pekos, each of whom is a Director and independent (within the meaning of section 1.4 of NI 52-110).

The majority of the members of the CG&C Committee have direct experience which is relevant to their responsibilities in executive compensation as they have been previously, and are currently, involved with compensation matters at other companies, both public and private, of which they are directors.

Skills and experience that enable the CG&C Committee to make decisions on the suitability of the Corporation’s compensation policies and practice include:

| Jennifer Chao: | Ms. Chao is the founder of CoreStrategies Management, LLC. Ms. Chao currently sits on the board of Eno International plc, serving as a member of both the audit and compliance committees. She was previously Chairman of BioSpecifics Technologies, Corp., and while there served as the chair of the compensation committee and executive search committees. |

| Dr. Guillermo Torre-Amione: | Dr. Torre-Amione currently serves as Chairman of Cardiol’s Board. He is the President of TecSalud del Tecnológico de Monterrey, Mexico, part of the Instituto Tecnológico y de Estudios Superiorers de Monterrey, Mexico. He was previously, Chief of Heart Failure Division and Medical Director of Cardiac Transplantation, Houston Methodist DeBakey Heart & Vascular Center. |

| Peter Pekos: | Mr. Pekos is a veteran of the pharmaceutical services industry. In 1986, he was a founder of Dalton Pharma Services (Dalton). Mr. Pekos is currently on the board of and was founding Chairman of ventureLAB, a Regional Innovation Center located at IBM’s York Region campus. |

| - 14 - |

To ensure the effectiveness of the CG&C Committee’s oversight in determining executive compensation, the members of the CG&C Committee are independent. See "Particulars Of Matters To Be Acted Upon Election of Directors – Biographies of Directors" for additional education and experience of the Corporation's CG&C Committee members standing for re-election to the Board.

Philosophy and Objectives of the Compensation Program

The Corporation’s compensation practices are designed to retain, motivate, and reward our executive officers for their performance and contribution to our long-term success. The Board seeks to compensate executive officers by combining short-term and long-term cash and equity incentives. It also seeks to reward the achievement of corporate and individual performance objectives and to align executive officers’ incentives with the Corporation’s performance. The Corporation seeks to tie individual goals to the area of the senior executive officer’s primary responsibility. These goals may include the achievement of specific financial or business development goals. Corporation performance goals are based on the Corporation’s financial performance during the applicable financial year.

In order to achieve our growth objectives, attracting and retaining the right team members is critical. A key part of this is a well thought-out compensation plan that attracts high performers and compensates them for continued achievements. Many of the Corporation’s team members will participate in the Omnibus Equity Incentive Plan (the “Omnibus Equity Incentive Plan”) (or its predecessor, the “Equity Compensation Plan”), driving retention and ownership. Communicating clear and concrete criteria and processes for merit-based increases and bonuses will also motivate the entire team to achieve individual and corporate goals.

Elements of Compensation

The Corporation’s executive compensation program consists primarily of three elements: base salary, annual bonuses, and long-term equity incentives.

Base Salary

Base salaries for executive officers are established based on the scope of their responsibilities and their prior relevant experience, taking into account compensation paid by other companies in the industry for similar positions and the overall market demand for such executives at the time of hire. The Corporation does not actively benchmark its compensation to other companies, but has reviewed the public disclosure available for other comparable clinical stage biopharmaceutical companies to assist in determining the competitiveness of base salary, bonuses, benefits, and Options paid to the executive officers of the Corporation. An executive officer’s base salary is determined by reviewing the executive officer’s other compensation to ensure that the executive officer’s total compensation is in line with the Corporation’s overall compensation philosophy.

Base salaries are reviewed annually and increased for merit reasons, based on the executive’s success in meeting or exceeding individual objectives and/or for market competitiveness. Additionally, base salaries can be adjusted as warranted throughout the year to reflect promotions or other changes in the scope or breadth of an executive’s role or responsibilities, as well as for market competitiveness.

Bonus Plans

The Corporation’s compensation program includes eligibility for annual incentive cash bonuses. The range of potential bonuses is based on a percentage of base salary and is reviewed annually. NEO bonuses include corporate and financial performance targets, as well as personal performance objectives that are determined by the Board upon recommendations by the CG&C Committee, which may include the implementation of new strategic initiatives, the development of innovations, team building, the ability to manage the costs of the business, and other factors. The mix between corporate and financial performance targets and personal performance objectives and the resulting bonus entitlements vary for each NEO.

| - 15 - |

Equity Compensation

In 2021, the Board of Directors adopted and the Shareholders approved the Omnibus Equity Incentive Plan (to replace the Equity Compensation Plan), which allows for the grant and issue, from time to time, of Options, Performance Share Units, Restricted Share Units, Deferred Share Units, and/or other share-based awards (collectively, the “Awards”) pursuant to the terms and conditions of the Omnibus Equity Incentive Plan. The Awards may be issued or granted to a “Non-Executive Employee”, an “Independent Director” or a “Consultant”, as such terms are defined under the Omnibus Equity Incentive Plan or the Equity Compensation Plan. The purpose of the Omnibus Equity Incentive Plan is to enable the Corporation to issue different types of securities to Directors, Employees and Consultants primarily as a means to conserve cash for its operations.

The Board of Directors is responsible for administering the Omnibus Equity Incentive Plan. The CG&C Committee is responsible for making recommendations to the Board of Directors in respect of matters relating to the Omnibus Equity Incentive Plan, subject to the CG&C Committee’s ability to delegate certain functions to a director or officer.

Determination of Compensation

The CG&C Committee is, among other things, responsible for determining all forms of compensation and for evaluating the Chief Executive Officer's performance and for reviewing and approving the recommendations of the Chief Executive Officer to the Board for the other NEOs.

The appropriate quantum and form of compensation for the NEOs has been based on their qualifications, level of experience, and the compensation being paid to comparable executives in the Corporation's peer groups. In making compensation recommendations to the Board in respect of these elements, the CG&C Committee considers both the cumulative compensation being granted to executives, as well as internal comparisons among the Corporation's executives. The CG&C Committee reviews and approves recommendations of the Chief Executive Officer to the Board for the performance of each NEO at the year end.

Base Salaries

Base salaries or equivalent consulting fees for the NEOs are generally fixed by the Board following recommendations from the CG&C Committee. Increases or decreases on a year-over-year basis are dependent on the CG&C Committee's assessment of the performance of the Corporation overall, the Corporation's projects, and the individual's overall performance and skills. In determining such amounts, the CG&C Committee generally balances the compensation objectives set out herein including the experience, skill, and scope of responsibility of the executive with the goal of keeping cash compensation for its executive officers within the range of cash compensation paid by companies of similar size and industry.

Options, Restricted Share Units, Performance Share Units, Deferred Share Units or Other Share-Based Awards

Long-term equity incentive compensation in the form of Awards comprises a significant portion of overall compensation for the NEOs and the Board. The CG&C Committee believes that this is appropriate because it creates a strong correlation between variations in the Corporation's Share price and the compensation of its executives, thereby aligning the interests of the Corporation's executives and Shareholders.

| - 16 - |

The Omnibus Equity Incentive Plan provides that Awards will be issued pursuant to stock option or share-based award agreements to directors, officers, employees, or consultants of the Corporation or a subsidiary of the Corporation. The grant of Awards to executive officers is determined by the Board as recommended by the CG&C Committee. Awards assist the Corporation in attracting, motivating, and retaining top talent. The Corporation has used initial larger one-time grants to recruit new executives and directors and ensure that the NEOs have a significant stake in the performance of the Corporation. The CG&C Committee reviews the Awards schedule periodically during each financial year and the contributions made to the Corporation by executive officers to determine whether additional Awards grants should be made. Previous grants of Awards are taken into account when considering new grants. Although some Options granted to the current date have a term of seven years, grants within the past three years have a term of five years. The term of the options encourages the long-term retention of the Corporation's officers, employees, and consultants.

Discussions by the CG&C Committee and subsequently by the Board are not dependent on or determined by formal analyses, criteria, benchmarking, or objectives and are not linked in any quantitative way to the Corporation's Share price quoted on the Toronto Stock Exchange (“TSX”) or the Nasdaq Capital Market (“Nasdaq”). Rather, the Corporation relies on the knowledge and experience of the directors who sit on the CG&C Committee, together with background information on other similar companies in determining appropriate amounts for each element of the compensation package for the Chief Executive Officer and for reviewing and approving the recommendations of the Chief Executive Officer to the Board for the other NEOs.

Assessment of Risks Associated with the Corporation's Compensation Policies and Practices

The Board, based on recommendations from the CG&C Committee, assesses the Corporation's compensation plans and programs for its executive officers to ensure alignment with the Corporation's business plan and to evaluate the potential risks associated with those plans and programs. The CG&C Committee will ensure that the compensation policies and practices do not create any risks that are reasonably likely to have a material adverse effect on the Corporation.

The CG&C Committee considers the risks associated with executive compensation and corporate incentive plans when designing and reviewing such plans, and programs are generally implemented by or at the direction of the CG&C Committee.

Share-Based and Option-Based Awards

For information on the Corporation's option-based awards, refer to the heading "Compensation Discussion and Analysis – Determination of Compensation – Share-Based and Option-Based Awards" in this Circular.

Compensation Governance

For information on the Corporation's compensation governance, refer to the heading "Compensation Discussion and Analysis – Executive Compensation" in this Circular.

| - 17 - |

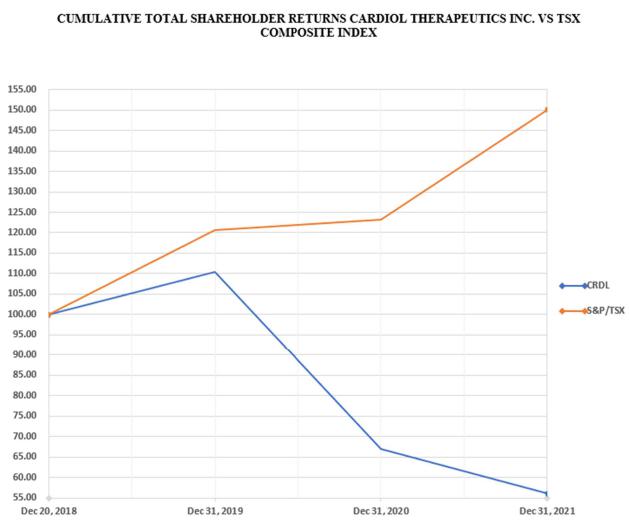

PERFORMANCE GRAPH

The following graph compares the year-end investment value of the total cumulative shareholder return for $100 invested in Shares of the Corporation against the cumulative total return of the S&P/TSX Composite Index since the date of public trading on the TSX until the fiscal year ended December 31, 2021.

| Fiscal Year | CRDL | S&P/TSX | ||||||

| December 20, 2018(1) | 100.00 | 100.00 | ||||||

| December 31, 2019 | 110.36 | 120.66 | ||||||

| December 31, 2020 | 66.99 | 123.28 | ||||||

| December 31, 2021 | 56.14 | 150.07 | ||||||

Note:

(1) The Corporation commenced trading on the TSX on December 20, 2018.

| - 18 - |

Summary Compensation Table

The following table sets out certain information respecting the compensation paid for the financial years ended December 31, 2021, 2020, and 2019 to NEOs of the Corporation:

| Share | Option | Non-equity

incentive compensation ($) (f) |

|||||||||||||||||||||||||

| based | based | Annual | Long-term | Pension | All other | Total | |||||||||||||||||||||

| Name and | Salary | Awards | Awards | incentive | incentive | value | compensation | compensation | |||||||||||||||||||

| principal position | Year | ($) | ($) | ($)(1) | plans | plans | ($) | ($) | ($) | ||||||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (f1) | (f2) | (g) | (h) | (i) | ||||||||||||||||||

| Dr. Eldon R. Smith former Chairman and former Chief Medical Officer(3) |

2021 | Nil | Nil | Nil | Nil | Nil | Nil | 215,247 | (2) | 215,247 | |||||||||||||||||

| 2020 | Nil | Nil | Nil | Nil | Nil | Nil | 312,947 | (2) | 312,947 | ||||||||||||||||||

| 2019 | Nil | Nil | Nil | Nil | Nil | Nil | 108,000 | (2) | 108,000 | ||||||||||||||||||

| Mr. David Elsley President and Chief Executive Officer |

2021 | 454,545 | Nil | 636,030 | 169,212 | Nil | Nil | Nil | 1,259,787 | ||||||||||||||||||

| 2020 | 450,000 | Nil | Nil | 67,430 | Nil | Nil | Nil | 517,430 | |||||||||||||||||||

| 2019 | 450,000 | Nil | Nil | Nil | Nil | Nil | Nil | 450,000 | |||||||||||||||||||

| Mr. Chris Waddick Chief Financial Officer and Corporate Secretary |

2021 | 184,773 | Nil | 309,920 | 54,900 | Nil | Nil | Nil | 549,593 | ||||||||||||||||||

| 2020 | 182,500 | Nil | Nil | 21,877 | Nil | Nil | Nil | 204,377 | |||||||||||||||||||

| 2019 | 202,100 | Nil | 593,221 | Nil | Nil | Nil | Nil | 795,321 | |||||||||||||||||||

Bernard Lim Chief Operating Officer(6) |

2021 | 248,788 | Nil | 371,904 | 59,563 | Nil | Nil | Nil | 680,255 | ||||||||||||||||||

| 2020 | 18,261 | Nil | 240,981 | Nil | Nil | Nil | Nil | 259,242 | |||||||||||||||||||

Dr. Andrew Hamer(3) Chief Medical Officer |

2021 | Nil | 279,709 | 1,348,357 | Nil | Nil | Nil | 360,038 | (4) | 1,988,104 | |||||||||||||||||

| Dr. Anthony E. Bolton former Chief Scientific Officer(5) |

2021 | Nil | Nil | Nil | Nil | Nil | Nil | Nil | Nil | ||||||||||||||||||

| 2020 | Nil | Nil | Nil | Nil | Nil | Nil | Nil | Nil | |||||||||||||||||||

| 2019 | Nil | Nil | Nil | Nil | Nil | Nil | 48,495 | (4) | 48,495 | ||||||||||||||||||

Notes:

| (1) | These amounts are the fair value of the Options based on the Black-Scholes option pricing model. The model used has been based on IFRS guidelines and has been tied to the option periods. The undernoted weighted average assumptions were utilized for 2021: expected dividend yield of 0%; risk-free rate of 1.21%; expected life of 5 years; and an expected volatility of 101%. The undernoted weighted average assumptions were utilized for 2020: expected dividend yield of 0%; risk-free rate of 0.46%; expected life of 5 years; and an expected volatility of 108%. The undernoted weighted average assumptions were utilized for 2019: expected dividend yield of 0%; risk-free rate of 1.76%; expected life of 7 years; and an expected volatility of 162%. |

| (2) | These amounts, plus applicable GST, were paid to Eldon R. Smith & Associates Ltd. for services provided to the Corporation. |

| (3) | Dr. Eldon Smith resigned as the Chief Medical Officer of the Corporation effective March 29, 2021. Dr. Andrew Hamer was appointed Chief Medical Officer of the Corporation on the same day. Dr. Eldon Smith resigned as Chairman of the Board on July 7, 2021. Dr. Guillermo Torre-Amione was appointed Chairman in Dr. Eldon Smith’s stead on the same day. |

| (4) | These amounts were paid to Dr. Bolton & Dr. Hamer pursuant to their management consulting agreements with the Corporation. |

| (5) | Dr. Anthony Bolton resigned as the Chief Scientific Officer of the Corporation effective March 20, 2019. |

| (6) | Bernard Lim was appointed Chief Operating Officer of the Corporation on December 3, 2020. |

| - 19 - |

Incentive Based Awards

The Corporation has an Omnibus Equity Incentive Plan in place, which was established to provide incentive to qualified parties to increase their equity interest in the Corporation and thereby encourage their continuing association with the Corporation. The grant of Awards to executive officers is determined by the Board of Directors upon recommendation by the CG&C Committee. The CG&C Committee proposes Awards grants based on such criteria as performance, previous grants, and hiring incentives. All grants require approval of the Board. The Omnibus Equity Incentive Plan is administered by the Board and provides that Options or Share-Based Awards may be issued to directors, officers, employees, or consultants of the Corporation or a subsidiary of the Corporation. Due to the adoption of the Omnibus Equity Incentive Plan, no further Awards have been or will be granted under the Equity Compensation Plan.

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth particulars of all outstanding share-based and option-based awards granted to the NEOs and which were outstanding as at December 31, 2021:

| Option–based Awards | Share-based Awards | ||||||||||||||

| Name | Number

of securities underlying unexercised options (#) |

Option exercise price ($) |

Option

expiration date |

Value

of unexercised in-the-money- options (1) ($) |

Number

of shares or units of shares that have not vested (#) |

Market

or payout value of share- based awards that have not vested ($) (2) |

Market

or payout value of vested share-based awards not paid out or distributed |

||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | ($) | ||||||||

| Mr. David Elsley | 325,000 | 3.59 | December 8, 2026 | Nil | N/A | N/A | N/A | ||||||||

| Mr. Chris Waddick | 200,000 150,000 150,000 |

5.00 4.30 2.65 |

August 16, 2025 January 2, 2026 December 8, 2026 |

Nil Nil Nil |

N/A | N/A | N/A | ||||||||

| Mr. Bernard Lim | 20,000 120,000 80,000 180,000 |

3.54 2.59 5.77 2.65 |

February 23, 2025 December 2, 2025 April 1, 2026 December 8, 2026 |

Nil Nil Nil Nil |

N/A | N/A | N/A | ||||||||

| Dr. Andrew Hamer | 400,000 | 4.51 | March 29, 2026 | Nil | 75,000 | 174,750 | N/A | ||||||||

Note:

| (1) | Based on the difference between the exercise price of the Option and the closing market price of the Corporation’s Shares on the TSX on December 31, 2021 of $2.33. |

| (2) | Based on the closing market price of the Corporation’s Shares on the TSX on December 31, 2021 of $2.33. |

| - 20 - |

Incentive Plan Awards – Value Vested or Earned During the Year

The following table sets forth particulars of the value of all incentive plan awards vested in or earned by the NEOs during the year ended December 31, 2021:

| Name | Option-based awards – Value vested during the year ($)(1) | Share-based awards – Value vested during the year ($) | Non-equity incentive plan compensation – Value earned during the year ($) | |||||||||

| Dr. Eldon R. Smith | Nil | Nil | Nil | |||||||||

| Mr. David Elsley | Nil | Nil | Nil | |||||||||

| Mr. Chris Waddick | Nil | Nil | Nil | |||||||||

| Mr. Bernard Lim | Nil | Nil | Nil | |||||||||

| Dr. Andrew Hamer | Nil | 134,250 | Nil | |||||||||

Note:

| (1) | The exercise price of the Options granted during the year was equal to or in excess of the market price of the Corporation’s Shares on the date the Options were granted and accordingly the value vested or earned is nil. |

Pension Plan Benefits

The Corporation does not have any pension or retirement plan in place.

Termination and Change of Control Benefits

The Corporation has entered into a written agreement with each NEO that sets out the terms of his relationship as a consultant or employee, including the NEO’s entitlement in the event of the cessation of employment.