Form 8-K INTERNATIONAL BUSINESS For: Mar 31

Exhibit 99.1

| IBM Provides Historical Software Segment Data to Reflect Announced Divestiture March 31, 2022 In January 2022, IBM took another step in the execution of a more focused platform-based hybrid cloud and AI strategy with the announcement of the divestiture of our healthcare data and analytics assets. A copy of the announcement press release including the strategic rationale is available here. The healthcare data and analytics assets to be divested have been reported in Hybrid Platform & Solutions within IBM’s Software segment. During the first quarter of 2022, we realigned our management structure to have these assets managed outside the Software segment in advance of the divestiture. As a result, starting in the first quarter, the financial results of these assets will be reflected in Other – divested businesses (Other). The movement of historical financials to Other is consistent with the treatment of select other divested software and services content, and results in a Software segment more closely aligned to its go-forward business. There is no change to IBM Consolidated results, and only the Software segment and Other are affected. We are providing recast historical financials today to allow investors and analysts to update their Software segment models ahead of the first quarter earnings report in April. 1 |

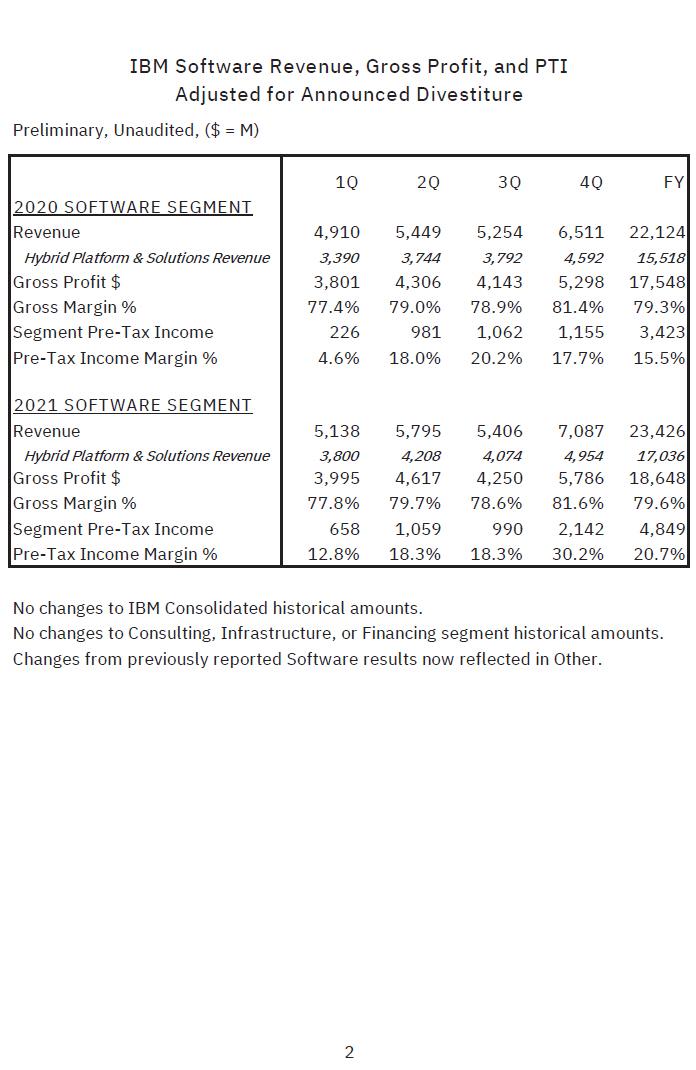

| IBM Software Revenue, Gross Profit, and PTI Adjusted for Announced Divestiture Preliminary, Unaudited, ($ = M) No changes to IBM Consolidated historical amounts. No changes to Consulting, Infrastructure, or Financing segment historical amounts. Changes from previously reported Software results now reflected in Other. 2 2020 S OFT WA RE S E G ME NT Revenue Hybrid Platform & Solutions Revenue Gross Profit $ Gross Margin % Segment Pre-Tax Income Pre-Tax Income Margin % 2021 S OFT WA RE S E G ME NT Revenue Hybrid Platform & Solutions Revenue Gross Profit $ Gross Margin % Segment Pre-Tax Income Pre-Tax Income Margin % 1Q 2Q 3Q 4Q FY 4,910 5,449 5,254 6,511 22,124 3,390 3,744 3,792 4,592 15,518 3,801 4,306 4,143 5,298 17,548 77.4% 79.0% 78.9% 81.4% 79.3% 226 981 1,062 1,155 3,423 4.6% 18.0% 20.2% 17.7% 15.5% 5,138 5,795 5,406 7,087 23,426 3,800 4,208 4,074 4,954 17,036 3,995 4,617 4,250 5,786 18,648 77.8% 79.7% 78.6% 81.6% 79.6% 658 1,059 990 2,142 4,849 12.8% 18.3% 18.3% 30.2% 20.7% |