Form 8-K Zoom Telephonics, Inc. For: Apr 15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) April 15, 2021

|

ZOOM TELEPHONICS, INC.

|

|

(Exact Name Of Registrant As Specified In Its Charter)

|

|

Delaware

|

|

(State or Other Jurisdiction of Incorporation)

|

|

001-37649

|

04-2621506

|

|

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

848 Elm Street, Manchester, NH

|

03101

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

(617) 423-1072

|

|

(Registrant’s Telephone Number, Including Area Code)

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 7.01

|

Regulation FD Disclosure.

|

Executive officers of Zoom Telephonics, Inc., a Delaware corporation also known as Minim (the “Company”), will make presentations to

investors at a virtual investor conference on April 15, 2021. The foregoing description of information contained in the presentation is qualified by reference to such presentation materials attached as Exhibit 99.1. The Company is not undertaking to

update this presentation or the information contained therein.

The information contained in and accompanying this Item 7.01 of this Current Report on Form 8-K (including Exhibit 99.1 hereto) is being furnished pursuant to Item 7.01 of Form 8-K and

shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, nor shall such information be deemed incorporated by reference in any filing

under the Securities Act of 1933, as amended.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

(d)

|

Exhibits.

|

|

Exhibit Number

|

Title

|

|

|

Investor Presentation of Zoom Telephonics, Inc.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: April 15, 2021

|

ZOOM TELEPHONICS, INC.

|

||

|

By:

|

/s/ Sean Doherty

|

||

|

Name:

|

Sean Doherty

|

||

|

Title:

|

Chief Financial Officer

|

||

Exhibit 99.1

MinimInvestor Presentation・April 2021

Forward Looking Statements:This presentation contains forward-looking information relating to plans, expectations, and intentions from

Zoom Telephonics, Inc. doing business as “Minim”. Actual results may be materially different from expectations as a result of known and unknown risks, including: the potential increase in tariffs on the Company's imports; potential difficulties

and supply interruptions from moving the manufacturing of most of the Company’s products to Vietnam; potential changes in NAFTA; the potential need for additional funding which Minim may be unable to obtain; declining demand for certain of

Minim’s products; delays, unanticipated costs, interruptions or other uncertainties associated with Minim’s production and shipping, including chip shortages; Minim’s reliance on several key outsourcing partners; uncertainty of key customers’

plans and orders; risks relating to product certifications; Minim’s dependence on key employees; uncertainty of new product development, including certification and overall project delays, budget overruns, and the risk that newly introduced

products may contain undetected errors or defects or otherwise not perform as anticipated; costs and senior management distractions due to patent related matters; and other risks set forth in Minim’s filings with the Securities and Exchange

Commission. Minim cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. Minim expressly disclaims any obligation or undertaking to release publicly any updates or revisions

to any such statements to reflect any change in Minim’s expectations or any change in events, conditions or circumstance on which any such statement is based. OTCMKTS: MINM 2

3 We are on a mission to make every connected home safe and easy to use for life and work. We do this by delivering software-driven

internet connectivity products with a global exclusive license to the Motorola brand.

$356 billion market (9% CAGR to 2027) with tremendous room for growth as 50% of homes lack connectivityStrong tech tailwinds - 5G,

satellite services & high-speed connectivity standardsStrong smart home tailwinds – global growth in smart home tech, streaming services, gaming Strong pandemic tailwinds – Accelerated remote working, telemedicine, & education The

home internet market is massive. In 2020, the world broke 1 billion internet subscribers. 4

Investment highlights 1B connected homes and growing $356 billion market (9% CAGR) All need reliable and secure

WiFiMinim makes every smart home safe and easy to use for life and workGlobally recognized Motorola brand license for home connectivity & security hardware productsWe deliver AI-driven cloud SaaS that secures and manages all your home

devices: parental controls, ad block, data tracking, and more Merger of Zoom Telephonics & Minim (Dec 2020)Recurring revenue model via SaaS distribution through 130+ ISPs & businesses & Amazon, Best Buy, Target, Walmart, Staples

& moreExpanded revenue through higher ASP bundled software / hardware.Expanded profit margins through SaaS delivery and continued operational efficiencies. #1 fastest-growing cable product brand in the U.S. in 2020Noteworthy 2020 net

revenue of $48.0 million, +28% over 2019#1 brand in Amazon last month in cable products in the US (from #3)Global ISP customers: Africa, Europe, Canada, AsiaNew leadership former Dyn mgmt. with a successful exit to Oracle

Minim at a glance Key assets Key stats Proven model & teamMinim-Zoom merger resulted 2.5x growth in market cap1Former leaders of

Dyn (ACQ: Oracle for $600M) Seasoned Board with deep industry experienceWide GTM channelsD2C: Amazon, Target, Best Buy, Microcenter, Walmart… B2B: 130+ ISPs, partnerships with Irdeto & TelarusMotorola brand licenseExclusive license for home

networking & connected security#1 cable connectivity brand selling in Amazon US in Q1 2021Quality hardware portfolioHighly rated modems, routers, MoCA devicesAffordable WiFi 6 product family coming this yearQuality manufacturing in Vietnam

(tariff avoidance)Advanced software platformHigh-margin SaaS revenue model Award-winning Minim app, competitive with Plume & EeroProprietary 26-point fingerprinting technologyBundled license targets explosive subscriber growth Market cap

of $111M2MC/TTM Revenue of 2.3x. Comparables: Netgear (1.0x), Sierra Wireless (1.0x), Calix (4.7x), and Ubiquity (11.0x)2Gross profit margins are 28% (FY20), consistent with comparable companies – and growing. 6 1 9/25/2020 market

capitalization of $46.1M; 4/1/2021 market capitalization of $115M2 Trailing 30-day average (4/12/21)

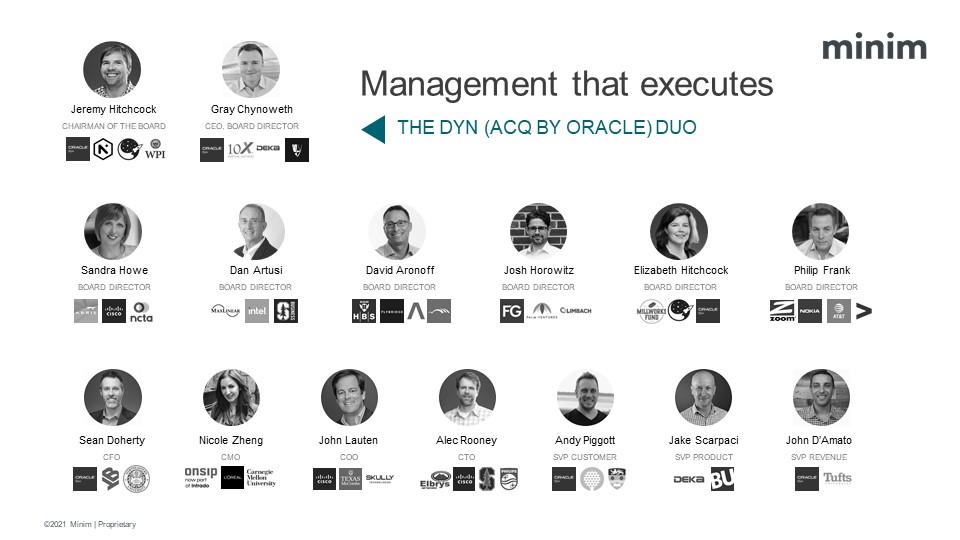

Management that executes Sean DohertyCFO Nicole ZhengCMO John LautenCOO Alec RooneyCTO John D’AmatoSVP REVENUE Andy PiggottSVP

CUSTOMER Jake ScarpaciSVP PRODUCT David AronoffBOARD DIRECTOR Josh HorowitzBOARD DIRECTOR Elizabeth HitchcockBOARD DIRECTOR Dan ArtusiBOARD DIRECTOR Sandra HoweBOARD DIRECTOR Jeremy HitchcockCHAIRMAN OF THE BOARD Philip FrankBOARD

DIRECTOR THE DYN (ACQ BY ORACLE) DUO Gray ChynowethCEO, BOARD DIRECTOR

Our product strategy 8 Apps you can loveCustomer-led design. So simple it’s automated Brand transformationWe rep the Minim brand,

Motorola brand, and more Fast, forward technologyAI-driven software-enabled products and the latest standards Platform thinkingValue creation for retailers, partners, customers Goals

9 Products: Minim for homes 63% WiFi enabled products in 2020 gross sales; 36% cable modem only in 2020 gross sales Room to grow:

Majority of sales in retail & e-commerce with room to grow via ISP & SMB & WiFi categoriesProduct launches exceeding expectations: Motorola MG8702 & Motorola MB8611 just launched in 10 channels~20 product lines with widening

software distribution: TP-Link, MikroTik, Zoom® ZM.1

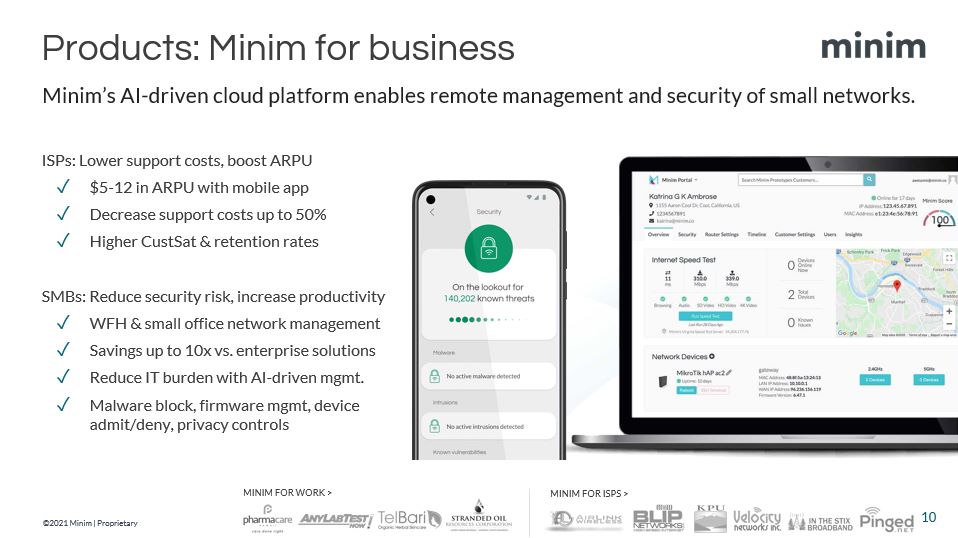

10 Products: Minim for business Minim’s AI-driven cloud platform enables remote management and security of small networks. MINIM FOR

ISPS > MINIM FOR WORK > ISPs: Lower support costs, boost ARPU$5-12 in ARPU with mobile appDecrease support costs up to 50%Higher CustSat & retention ratesSMBs: Reduce security risk, increase productivityWFH & small office

network managementSavings up to 10x vs. enterprise solutionsReduce IT burden with AI-driven mgmt.Malware block, firmware mgmt, device admit/deny, privacy controls

The future & how we plan to win Consumer driven ISP driven Android approachopen standard, easy to integrate iOS approachclosed

systemand/or complex SW integration Open to partner. Some competitors are tightly aligned with Tier 1 ISPs, competing with other ISPs. One is owned by a large e-comm platform that competes with retailers. Minim is an ecosystem player. Able

to compete. By vertically integrating the ISP, edge, smart home, browser, and ad-based & commerce business models, some competitors are stronger privacy and antitrust regulatory targets. Open to change. Many competitors are fundamentally

hardware-focused enterprises where SaaS business models and software investments face great friction. Able to integrate. Major player with ‘open source’ strategy has 10x requirements on hardware memory and displaces OEM software

(commoditization). Others are walled gardens, not open platforms. Minim offers an additive, light-weight, open-source integration. Customer-led R&D. Minim has direct relationships with businesses, ISPs, and consumers for agile and modern

product development leveraging our AI platform. Landscape The Minim advantage 11 PARTNERSHIPS & ECOSYSTEM >

Targeted growth in shareholder value 12 Sustainable growthIncreased capital access and investment in the business Operational

excellenceOptimized supply chain and risk management Profit margin expansionSoftware revenue & higher ASP products InnovationInvesting in innovative R&D in hardware & software Goals

13 Revenue growth & margin expansion Revenue growth driversExisting sales channel expansion: Amazon revenue grew 22% Q4/Q3 2020

& we continue to target growth here. Increasing & shifting marketing budget with retailers to online.New B2C sales channels: Added retailers Staples, B&H, Newegg, Barnes & Noble. Working on International.New B2B customers:

Adding ISPs & SMBs globally through channel partners and inside sales.Introducing higher ASP products Motorola MG8702 is +69% price point from prior gen DOCSIS 3.0 product (no software). Margin expansion drivers:Cost management: Shifting

production away from China to avoid tariff expenses. Limiting use of air freight. Introducing higher margin, higher ASP products with software bundled in; Company targets 10-20% lift to ASPs for the software alone.

14 Sustainable growth & innovation Our commitment to strategic capitalizationCredit line expansion: In March 2021, Company

increased credit line from $5M to $13M. New LOC with Silicon Valley Bank to fund increased production and sales & marketing.Exposure & expertise: Now advised by Hayden IR and working on NASDAQ uplist filing.Our investments in innovation

and scaleHardware innovation: Led first to market with CableLabs Low Latency Device stamp; exciting new product design underwaySoftware innovation: Industry-leading mobile app functionality. Brought firmware talent in-house for agility and

quality. From 17% software engineering 74% post-merger. S&M transformation: Built talented omnichannel sales & marketing teams for efficient budget ROI and stellar sales growth. MINM (ZMTP pre 12/4/20) is now valued at 2.4X TTM

revenue 240% multiple Y/Y

We have lots of room to grow Software Driven Model Legacy Hardware Model 2020Q2 pre merger 2021 Target Future Target MC / TTM

Revenue 1x 2.5x 8x 8x 4x 11x 1.0x 1.8x 0.4x SDM average: 8.7x LHM average: 1.4x 15 Plume: Estimation; calculated revenue at 22M subs & $0.75/mo. per sub Minim: Assumes a discount to the 8.7x average for SDM

16 Targeting operational excellence Cost management & supply chain resiliency: Tariff avoidance by shifting production facility

from China to Vietnam. Building supplier channel diversity to both drive cost efficiencies and to hedge against widespread chip shortagesDigital transformation: Improved processes and wider use of software platforms to improve efficiency;

Zendesk has reduced our customer service wait times by 6x.Data-driven leadership: New investment in market intelligence, customer support data, customer review data, and performance KPI tracking for effective decision making from the top down.

Culture curation: New DEI and culture focus, fostering inclusivity, transparency, connection, empowerment, collaboration, and accountability— Aligning employee motivations & rewards to delivering great outcomes to customers, shareholders,

and the company.

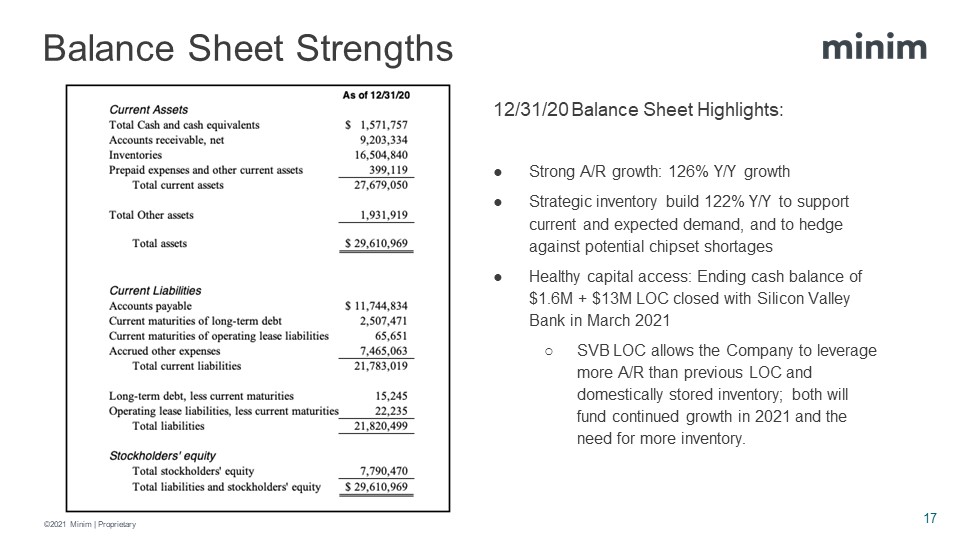

17 Balance Sheet Strengths 12/31/20 Balance Sheet Highlights:Strong A/R growth: 126% Y/Y growthStrategic inventory build 122% Y/Y to

support current and expected demand, and to hedge against potential chipset shortages Healthy capital access: Ending cash balance of $1.6M + $13M LOC closed with Silicon Valley Bank in March 2021SVB LOC allows the Company to leverage more A/R

than previous LOC and domestically stored inventory; both will fund continued growth in 2021 and the need for more inventory.

Questions welcome Zoom Telephonics, dba Minim® (OTCQB: MINM), is the creator of innovative internet access products that dependably

connect people to the information they need and the people they love. Headquartered in Manchester, NH, the company delivers smart software-driven communications products under the globally recognized Motorola® brand. Minim end users benefit

from a personalized and secure WiFi experience, leading to happy and safe homes where things just work.

Appendix 19

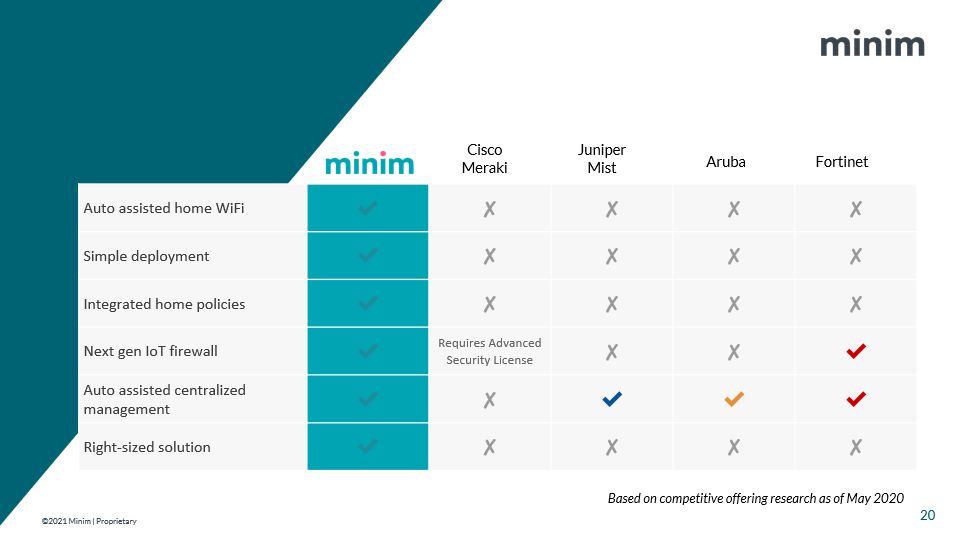

Cisco Meraki Juniper Mist Aruba Fortinet Based on competitive offering research as of May 2020 Auto assisted home

WiFi ✔ ✘ ✘ ✘ ✘ Simple deployment ✔ ✘ ✘ ✘ ✘ Integrated home policies ✔ ✘ ✘ ✘ ✘ Next gen IoT firewall ✔ Requires Advanced Security License ✘ ✘ ✔ Auto assisted centralized management ✔ ✘ ✔ ✔ ✔ Right-sized

solution ✔ ✘ ✘ ✘ ✘ 20