Form FWP TORONTO DOMINION BANK Filed by: TORONTO DOMINION BANK

|

|

Filed Pursuant to Rule 433

Registration Statement No. 333-231751 Dated April 7, 2021

|

|

Market Linked Securities -Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the S&P 500® Index, the Russel 2000® Index and the Nasdaq-100®

Index due October 27, 2022

Term Sheet to Preliminary Pricing Supplement dated April 7, 2021

|

|

Issuer

|

The Toronto-Dominion Bank (“TD”)

|

|

Issue

|

Senior Debt Securities, Series E

|

|

Term

|

Approximately 18 months, subject to an automatic call

|

|

Reference Asset:

|

S&P 500® Index (Bloomberg Ticker: SPX, “SPX”), the Russell 2000® Index (Bloomberg Ticker: RTY, “RTY”) and the Nasdaq-100® Index (Bloomberg Ticker: NDX, “NDX”)

|

|

Pricing Date

|

Expected to be April 29, 2021 *

|

|

Issue Date

|

Expected to be May 4, 2021 *

|

|

Principal Amount

|

$1,000 per Security

|

|

Issue Price

|

$1,000 per Security except that certain investors that purchase for certain fee based advisory accounts may purchase for not less than $984.75 per Security.

|

|

Contingent

Coupon Payment

|

See “How Contingent Coupons Are Calculated” on page 2. Contingent Coupons on the Securities are not guaranteed.

|

|

Contingent

Coupon Rate:

|

Between 7.65% and 8.65% per annum (to be determined on the Pricing Date)

|

|

Automatic Call

Feature

|

See “How To Determine if the Securities Will Be Automatically Called” on page 2.

|

|

Valuation Dates

|

Quarterly, on the 24th day of each January, April, July and October, commencing on July 24, 2021 and ending on October 24, 2022 (which is also the “Final Valuatoin Date”)

|

|

Contingent

Coupon Payment

Dates

|

Three Business Days after the applicable Valuation Date, provided that the Contingent Coupon Payment Date with respect to the Final Valuation Date will be the Maturity Date.

|

|

Payment at

Maturity

|

See “How the Payment at Maturity is Calculated” on page 3

|

|

Maturity Date

|

Expected to be October 27, 2022

|

|

Initial Level

|

For each Reference Asset, its Closing Level on the Pricing Date

|

|

Final Level

|

For each Reference Asset, its Closing Level on the Final Valuation Date

|

|

Coupon

Threshold Level

|

With respect to SPX, [●], with respect to RTY, [●] and with respect to NDX, [●], in each case equal to 70.00% of its Initial Level (to be determined on the Pricing Date)

|

|

Downside

Threshold Level

|

With respect to SPX, [●], with respect to RTY, [●] and with respect to NDX, [●], in each case equal to 70.00% of its Initial Level (to be determined on the Pricing Date)

|

|

Percentage

Change

|

With respect to any Reference Asset on any Valuation Date, the Percentage Change will be calculated as follows:

Closing Level on such Valuation Date – Initial Level

Initial Level

|

|

Lowest

Performing

Reference Asset

|

For any Valuation Date, the Reference Asset with the lowest Percentage Change as of such Valuation Date

|

|

Calculation Agent

|

TD

|

|

Minimum

Investment

|

$1,000 and minimum denominations of $1,000 in excess thereof

|

|

Agents

|

TD Securities (USA) LLC and Wells Fargo Securities, LLC

|

|

Underwriting

Discount and

Commission

|

Up to 1.525% to Agents, of which dealers, including Wells Fargo Advisors, LLC (“WFA”), may receive a selling concession of 1.00% and WFA will receive a distribution expense fee of

0.075%.

We may pay a fee of up to $1.00 per security for certain Securities sold in this offering to selected securities dealers in consideration for marketing and other services in connection

with the distribution of the Securities to other securities dealers.

|

|

CUSIP / ISIN

|

89114TEU2 / US89114TEU25

|

*We expect that delivery of the Securities will be made against payment therefor on or about the 3rd business day following the Pricing Date (this settlement

cycle being referred to as “T+3”). Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in 2 business days (“T+2”), unless the parties to any such trade

expressly agree otherwise. Accordingly, purchasers who wish to trade the Securities on the Pricing Date will be required, by virtue of the fact that each Security initially will settle in 3 business days (T+3), to specify alternative

settlement arrangements to prevent a failed settlement.

Investment Description

| • |

Linked to the lowest performing of the S&P 500® Index, the Russell 2000® Index and the Nasdaq-100® Index.

|

| • |

Unlike ordinary debt securities, the Securities do not provide for fixed payments of interest, do not repay a fixed amount of principal at maturity and are subject to potential automatic call prior to

maturity upon the terms described below. Whether the Securities pay a Contingent Coupon, whether the Securities are automatically called prior to maturity and, if they are not automatically called, whether you are repaid the

Principal Amount of your Securities at maturity will depend in each case on the Closing Level of the Lowest Performing Reference Asset on the relevant Valuatoin Date. The Lowest Performing Reference Asset on any Valuation Date is the

Reference Asset that has the lowest Percentage Change on that Valuation Date

|

| • |

Contingent Coupon Payments. The Securities will pay a Contingent Coupon Payment on each Contingent Coupon Payment Date until the earlier of the Maturity Date or

automatic call if, and only if, the Closing Level of the Lowest Performing Reference Asset on the related Valuation Date is greater than or equal to its Coupon Threshold Level. However, if on

any Valuation Date, the Closing Level of the Lowest Performing Reference Asset is less than its Coupon Threshold Level, you will not receive any Contingent Coupon Payment on the related Contingent Coupon Payment Date. If the Closing

Level of the Lowest Performing Reference Asset (which may vary over the term of the Securities) is less than its Coupon Threshold Level on each Valuation Date, you will not receive any Contingent Coupon Payments throughout the entire

term of the Securities and will not receive a positive return on the Securities. Accordingly, Contingent Coupon Payments are not guaranteed and you should not view Contingent Coupon Payments as ordinary periodic interest payments

|

| • |

Automatic Call. If the Closing Level of the Lowest Performing Reference Asset on any Valuation Date from October 25, 2021 to July 24, 2022, inclusive is greater than

or equal to its Initial Level, we will automatically call the Securities for the Principal Amount plus the Contingent Coupon Payment applicable to that Valuation Date

|

| • |

Potential Loss of Principal. If the Securities are not automatically called prior to the Maturity Date, the amount that you will be paid on your Securities at

maturity will be based on the performance of the Lowest Performing Reference Asset from its Initial Level to its Closing Level on the Final Valuation Date (its “Final Level”). If the Securities are not automatically called, you will

receive the Principal Amount per Security at maturity if, and only if, the Final Level of the Lowest Performing Reference Asset is greater than or equal to its Downside Threshold Level.

However, if the Final Level of the Lowest Performing Reference Asset is less than its Downside Threshold Level, you will have full downside exposure to the decrease in the level of the Lowest Performing Reference Asset from its

Initial Level to its Final Level, and will lose more than 30.00%, and possibly all, of the Principal Amount at maturity. Specifically, you will lose 1% of the Principal Amount for each 1% decrease in

the Lowest Performing Reference Asset from its Initial Level to its Final Level and you may lose all of the Principal Amount.

|

| • |

Investors may lose up to 100.00% of the Principal Amount.

|

| • |

Your return on the Securities will depend solely on the performance of the Reference Asset that is the Lowest Performing Reference Asset on each Valuation Date. You

will not benefit in any way form the performance of any better performing Reference Asset. Therefore, you will be adversely affected if any Reference Asset performs poorly, and such poor

performance will not be offset or mitigated by positive or less negative performance by any other Reference Asset.

|

| • |

Any payments on the Securities are subject to TD’s credit risk

|

| • |

You will have no right to the stocks comprising the Reference Asset (the “Reference Asset Constituents”)

|

| • |

No guaranteed periodic interest payments or dividends

|

| • |

No exchange listing; designed to be held to maturity

|

|

Our estimated value of the Securities at the time the terms of your Securities are set on the Pricing Date is expected to

be between $935.00 and $965.00 per Security. The estimated value is expected to be less than the public offering price of the Securities. See “Additional Information Regarding Our Estimated Value of the Securities” in the

accompanying preliminary pricing supplement.

|

|

|

This introductory term sheet does not provide all of the information that an investor should consider prior to making an investment decision.

The Securities have complex features and investing in the Securities involves a number of risks. See “Additional Risk Factors” beginning on page P-9 of the accompanying preliminary pricing supplement, “Additional Risk Factors Specific to

the Notes” beginning on page PS-6 of the product prospectus supplement MLN-EI-1 dated November 6, 2020 (the “product prospectus supplement”) and “Risk Factors” on page 1 of the prospectus dated June 18, 2019 (the “prospectus”). The Securities are

not a bank deposit and not insured or guaranteed by the Canada Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation or any other governmental agency or instrumentality of Canada or the United States.

|

TD SECURITIES (USA) LLC

|

WELLS FARGO SECURITIES, LLC

|

How Contingent Coupon Payments Are Calculated

On each Contingent Coupon Payment Date the Securities will pay a Contingent Coupon Payment at a per annum rate equal to the

Contingent Coupon Rate if, and only if, the Closing Level of the Lowest Performing Reference Asset on the related Valuation Date is greater than or equal to its Coupon Threshold Level.

Each “Contingent Coupon Payment”, if any, per Security will be equal to:

$1,000 × Contingent Coupon Rate

4

4

If on any Valuation Date, the Closing Level of the Lowest Performing Reference Asset is less than its Coupon Threshold Level, you will not

receive any Contingent Coupon Payment on the related Contingent Coupon Payment Date. If the Closing Level of the Lowest Performing Reference Asset is less than its Coupon Threshold Level on each Valuation Date, you will not receive any Contingent

Coupon Payments over the term of the Securities and will not receive a positive return on the Securities.

Any Contingent Coupon Payments will be rounded to the nearest cent, with one-half cent rounded upward.

How To Determine if the Securities Will Be Automatically Called

If the Closing Level of the Lowest Performing Reference Asset on any Valuation Date from October 25, 2021 to July 24, 2022,

inclusive is greater than or equal to its Initial Level, the Securities will be automatically called, and on the related Call Payment Date, you will receive a cash payment per Security equal to the Principal Amount plus the final Contingent Coupon

Payment.

If the Securities are automatically called, they will cease to be outstanding on the related Call Payment Date and you will have no further rights under the

Securities after such Call Payment Date. You will not receive any notice from us if the Securities are automatically called.

How the Payment at Maturity is Calculated

If the Securities are not automatically called prior to maturity, the Payment at Maturity per Security, if any, (in addition to the final Contingent Coupon

Payment, if one is payable with respect to the Final Valuation Date) will be based on the performance of the Lowest Performing Reference Asset, calculated as follows:

| • |

If the Final Level of the Lowest Performing Reference Asset is greater than or equal to its Downside Threshold Level:

|

Principal Amount of $1,000.

| • |

If the Final Level of the Lowest Performing Reference Asset is less than its Downside Threshold Level:

|

Principal Amount + (Principal Amount × Percentage Change of the Lowest Performing Reference Asset on the Final Valuation Date)

If the Securities are not automatically called prior to maturity and the Final Level of the Lowest Performing Reference Asset is less than its

Downside Threshold Level, investors will have full downside exposure to the decrease in the level of the Lowest Performing Reference Asset from its Initial Level and will lose more than 30.00%, and possibly all, of the Principal Amount.

Specifically, investors will lose 1% of the Principal Amount for each 1% decrease in the level of the Lowest Performing Reference Asset from its Initial Level to its Final Level and may lose all of the Principal Amount.

Any positive return on the Securities will be limited to the sum of your Contingent Coupon Payments, if any. You will not participate in any appreciation of

any Reference Asset, but you will have full downside exposure to the Lowest Performing Reference Asset on the Final Valuation Date if the Final Level of that Reference Asset is less than its Downside Threshold Level.

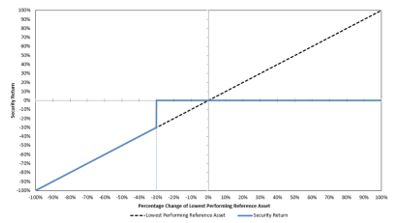

Hypothetical Payout Profile

The profile to the right illustrates the potential Payment at Maturity on the Securities (excluding the final Contingent Coupon Payment, if any)

for a range of hypothetical performances of the Lowest Performing Reference Asset on the Final Valuation Date from its Initial Level to its Final Level, assuming the Securities have not been automatically called prior to the Maturity Date. This

graph has been prepared for purposes of illustration only. Your actual return will depend on the actual Final Level of the Lowest Performing Reference Asset and whether you hold your Securities to maturity. The performance of the better

performing Reference Assets is not relevant to your return on the Securities.

This hypothetical payout profile has been prepared only for illustration purposes. Neither TD nor either Agent is predicting or guaranteeing any

gain or particular return on the Securities.

*The profile to the right represents a hypothetical payout profile for the Securities. The 45 degree dotted line represents the hypothetical

percentage change of the Reference Asset.

|

|

Hypothetical Returns

If the Securities are automatically called: If the Securities are automatically called prior to the Maturity Date, you will receive a

cash payment on the related Call Payment Date equal to the Principal Amount plus the Contingent Coupon Payment otherwise due. In the event the Securities are automatically called, your total return on the Securities will equal any Contingent Coupon

Payments received prior to the Call Payment Date and the Contingent Coupon Payment received on the Call Payment Date.

If the Securities are not automatically called: If the Securities are not automatically called prior to the Maturity Date, the following

table illustrates, for a range of hypothetical Percentage Changes of the Lowest Performing Reference Asset on the Final Valuation Date, the hypothetical Payment at Maturity per security (excluding the final Contingent Coupon Payment, if any). The

Percentage Change of the Lowest Performing Reference Asset on the Final Valuation Date is equal to the percentage change from its Initial Level to its Final Level (i.e., Final Level minus Initial Level, divided by Initial Level).

|

Hypothetical Percentage Change of Lowest Performing

Reference Asset on Final Valuation Date

|

Hypothetical Payment at Maturity per security

|

|

75.00%

|

$1,000.00

|

|

60.00%

|

$1,000.00

|

|

50.00%

|

$1,000.00

|

|

40.00%

|

$1,000.00

|

|

30.00%

|

$1,000.00

|

|

20.00%

|

$1,000.00

|

|

10.00%

|

$1,000.00

|

|

0.00%

|

$1,000.00

|

|

-10.00%

|

$1,000.00

|

|

-20.00%

|

$1,000.00

|

|

-30.00%

|

$1,000.00

|

| -30.01% |

$699.90 |

|

-40.00%

|

$600.00

|

|

-50.00%

|

$500.00

|

|

-60.00%

|

$400.00

|

|

-75.00%

|

$250.00

|

|

-100.00%

|

$0.00

|

The above figures do not take into account Contingent Coupon Payments, if any, received during the term of the Securities. As evidenced above, in no event will you have a positive

rate of return based solely on the Payment at Maturity; any positive return will be based solely on the Contingent Coupon Payments, if any, received during the term of the Securities.

The above figures are for purposes of illustration only and may have been rounded for ease of analysis. If the Securities are not automatically called prior to the Maturity Date,

the actual amount you will receive at maturity will depend on the actual Final Level of the Lowest Performing Reference Asset. The performance of the better performing Reference Assets is not relevant to your return on the Securities.

Historical Performance of the Reference Assets

S&P 500® Index (SPX)

Russell 2000® Index (RTY)

Nasdaq-100® Index (NDX)

* The graphs above set forth the historical daily

performance of each Reference Asset from January 1, 2016 through April 5, 2021. The graph is based upon actual daily historical closing levels of each Reference Asset.

We obtained the information regarding the historical performance of the Reference Assets used in calculating the graphs above from Bloomberg®

Professional service (“Bloomberg”). We have not conducted any independent review or due diligence of publicly available information obtained from Bloomberg. The historical performance of the Reference Assets should not be taken as an indication of

their future performance, and no assurance can be given as to the Closing Level of any Reference Asset on any day. Additionally, the hypothetical examples above reflect the performance of each Reference Asset, and do not reflect or incorporate any

terms of the Security. We cannot give you assurance that the performance of the Reference Assets will result in any positive return on your initial investment and cannot give any assurance as to which Reference Asset will be the Lowest Performing

Reference Asset as of any Valuation Date.

We have filed a registration statement (including a prospectus), a product prospectus supplement and a pricing supplement with the SEC for the offering to which this free writing

prospectus relates. Before you invest, you should read the prospectus in that registration statement and other documents that we have filed with the SEC for more complete information about us and this offering. You may get those documents for free

by visiting EDGAR on the SEC website www.sec.gov. Alternatively, we, TD Securities (USA) LLC or Wells Fargo Securities will arrange to send you the prospectus if you request it by calling toll-free at 1-855-303-3234.

Selected Risk Considerations

The risks set forth below are discussed in detail in the “Additional Risk Factors” section in the accompanying preliminary pricing supplement, the “Additional

Risk Factors Specific to the Notes” section in the product prospectus supplement and the “Risk Factors” section in the prospectus. Please review those risk disclosures carefully.

| • |

Principal at Risk. The Securities do not guarantee the return of the Principal Amount. If the Securities are not automatically called and the Final Level of the Lowest Performing

Reference Asset is less than its Downside Threshold Level, you will lose 1% of the Principal Amount of the Securities for each 1% that the Final Level of the Lowest Performing Reference Asset is less than its Downside Threshold Level and

may lose all of the Principal Amount. For example, if the Lowest Performing Reference Asset declines by 30.1% from its Initial Level to its Final Level, you will not receive any benefit of the contingent downside feature and you will lose

30.1% of the Principal Amount per Security.

|

| • |

The Contingent Downside Feature Applies Only at Maturity.

|

| • |

You Will Not Receive Any Contingent Coupon Payment on Any Contingent Coupon Payment Date If the Closing Level of the Lowest Performing Reference Asset on the Corresponding Valuation Date Is Less Than its Coupon

Threshold Level.

|

| • |

Your Potential Positive Return on the Securities Will Be Limited to the Contingent Coupon Payments Paid on the Securities, If Any, Regardless of Any Increase in the Level of any Reference Asset And May Be Less

Than the Return on a Hypothetical Direct Investment in the Reference Assets.

|

| • |

The Securities May Be Automatically Called Prior to the Maturity Date And Are Subject to Reinvestment Risk.

|

| • |

Investors Are Exposed to the Market Risk of Each Reference Asset on Each Valuation Date (Including the Final Valuation Date).

|

| • |

Because the Securities are Linked to the Lowest Performing Reference Asset, You Are Exposed to a Greater Risk of no Contingent Coupon Payments and Losing a Significant Portion or All of Your Initial Investment

at Maturity than if the Securities Were Linked to a Single Reference Asset or Fewer Reference Assets.

|

| • |

The Amount Payable on the Securities is Not Linked to the Level of the Lowest Performing Reference Asset at Any Time Other Than on the Valuation Dates (Including the Final Valuation Date).

|

| • |

The Contingent Coupon Rate Will Reflect, In Part, the Volatility of each Reference Asset and May Not Be Sufficient to Compensate You for the Risk of Loss at Maturity.

|

| • |

There Are Market Risks Associated with each Reference Asset.

|

| • |

The Securities are Subject to Risks Associated with Small-Capitalization Stocks.

|

| • |

The Securities are Subject to Risks Associated with Non-U.S. Companies.

|

| • |

The Reference Assets Reflect Price Return, Not Total Return, and You Will Not Have Any Rights to the Reference Asset Constituents.

|

| • |

We Have No Affiliation with Any Index Sponsor and Will Not Be Responsible for Any Actions Taken by Any Index Sponsor.

|

| • |

Past Performance of the Reference Assets Performance is Not Indicative of Future Performance of the Reference Assets.

|

| • |

The Estimated Value of Your Securities Is Expected to Be Less Than the Public Offering Price of Your Securities.

|

| • |

The Estimated Value of Your Securities Is Based on Our Internal Funding Rate.

|

| • |

The Estimated Value of the Securities Is Based on Our Internal Pricing Models, Which May Prove to Be Inaccurate and May Be Different from the Pricing Models of Other Financial Institutions.

|

| • |

The Estimated Value of Your Securities Is Not a Prediction of the Prices at Which You May Sell Your Securities in the Secondary Market, if Any, and Such Secondary Market Prices, if Any, Will Likely Be Less Than

the Public Offering Price of Your Securities and May Be Less Than the Estimated Value of Your Securities.

|

| • |

The Temporary Price at Which We May Initially Buy the Securities in the Secondary Market May Not Be Indicative of Future Prices of Your Securities.

|

| • |

The Agent Discount, Offering Expenses and Certain Hedging Costs Are Likely to Adversely Affect Secondary Market Prices.

|

| • |

There May Not Be an Active Trading Market for the Securities — Sales in the Secondary Market May Result in Significant Losses.

|

| • |

If the Level of any Reference Assets Change, the Market Value of Your Securities May Not Change in the Same Manner.

|

| • |

There Are Potential Conflicts of Interest Between You and the Calculation Agent.

|

| • |

Each Valuation Date (including the Final Valuation Date) and the Related Payment Date (including the Maturity Date) is Subject to Market Disruption Events and Postponements.

|

| • |

Trading and Business Activities by TD or its Affiliates May Adversely Affect the Market Value of, and Any Amount Payable on, the Securities.

|

| • |

Investors Are Subject to TD’s Credit Risk, and TD’s Credit Ratings and Credit Spreads May Adversely Affect the Market Value of the Securities.

|

| • |

Significant Aspects of the Tax Treatment of the Securities Are Uncertain.

|

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo

& Company.