Form 20-F BP PLC For: Dec 31

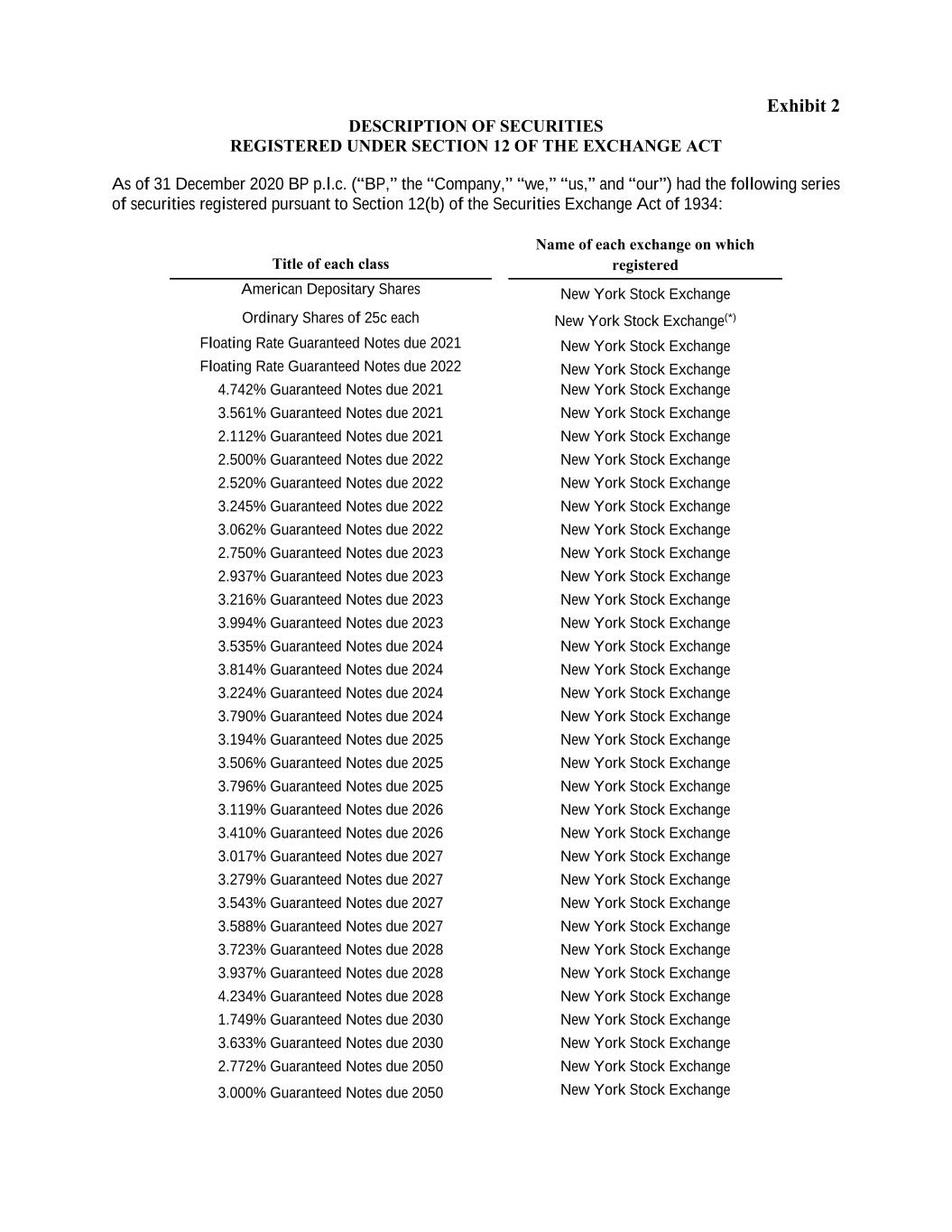

Exhibit 2 DESCRIPTION OF SECURITIES REGISTERED UNDER SECTION 12 OF THE EXCHANGE ACT As of 31 December 2020 BP p.l.c. (“BP,” the “Company,” “we,” “us,” and “our”) had the following series of securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934: Title of each class Name of each exchange on which registered American Depositary Shares New York Stock Exchange Ordinary Shares of 25c each New York Stock Exchange(*) Floating Rate Guaranteed Notes due 2021 New York Stock Exchange Floating Rate Guaranteed Notes due 2022 New York Stock Exchange 4.742% Guaranteed Notes due 2021 New York Stock Exchange 3.561% Guaranteed Notes due 2021 New York Stock Exchange 2.112% Guaranteed Notes due 2021 New York Stock Exchange 2.500% Guaranteed Notes due 2022 New York Stock Exchange 2.520% Guaranteed Notes due 2022 New York Stock Exchange 3.245% Guaranteed Notes due 2022 New York Stock Exchange 3.062% Guaranteed Notes due 2022 New York Stock Exchange 2.750% Guaranteed Notes due 2023 New York Stock Exchange 2.937% Guaranteed Notes due 2023 New York Stock Exchange 3.216% Guaranteed Notes due 2023 New York Stock Exchange 3.994% Guaranteed Notes due 2023 New York Stock Exchange 3.535% Guaranteed Notes due 2024 New York Stock Exchange 3.814% Guaranteed Notes due 2024 New York Stock Exchange 3.224% Guaranteed Notes due 2024 New York Stock Exchange 3.790% Guaranteed Notes due 2024 New York Stock Exchange 3.194% Guaranteed Notes due 2025 New York Stock Exchange 3.506% Guaranteed Notes due 2025 New York Stock Exchange 3.796% Guaranteed Notes due 2025 New York Stock Exchange 3.119% Guaranteed Notes due 2026 New York Stock Exchange 3.410% Guaranteed Notes due 2026 New York Stock Exchange 3.017% Guaranteed Notes due 2027 New York Stock Exchange 3.279% Guaranteed Notes due 2027 New York Stock Exchange 3.543% Guaranteed Notes due 2027 New York Stock Exchange 3.588% Guaranteed Notes due 2027 New York Stock Exchange 3.723% Guaranteed Notes due 2028 New York Stock Exchange 3.937% Guaranteed Notes due 2028 New York Stock Exchange 4.234% Guaranteed Notes due 2028 New York Stock Exchange 1.749% Guaranteed Notes due 2030 New York Stock Exchange 3.633% Guaranteed Notes due 2030 New York Stock Exchange 2.772% Guaranteed Notes due 2050 New York Stock Exchange 3.000% Guaranteed Notes due 2050 New York Stock Exchange

2 3.067% Guaranteed Notes due 2050 New York Stock Exchange 2.939% Guaranteed Notes due 2051 New York Stock Exchange 4.375% Perpetual Subordinated Non-Call 5.25 Fixed Rate Reset Notes New York Stock Exchange 4.875% Perpetual Subordinated Non-Call 10 Fixed Rate Reset Notes New York Stock Exchange (*) Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission. Capitalized terms used but not defined herein have the meanings given to them in BP’s Annual Report and Form 20-F 2020. I. ORDINARY SHARES The following description of our ordinary shares of US$0.25 each is a summary and does not purport to be complete. It is subject to and qualified in its entirety by BP’s Articles of Association and by the Companies Act 2006 (the “Act”) and any other applicable English law concerning companies, as amended from time to time. A copy of BP’s Articles of Association is filed as Exhibit 1 to BP’s Annual Report and Form 20-F 2020. A. General The number of ordinary shares outstanding at 31 December 2020, excluding treasury shares, and including certain shares that will be issuable in the future under employee share-based payment plans was 20,264,027,711. The primary market for the company’s ordinary shares (trading symbol ‘BP.’) is the London Stock Exchange (LSE). The company’s ordinary shares are a constituent element of the Financial Times Stock Exchange 100 Index. In the US, the company’s securities are listed and traded on the New York Stock Exchange (NYSE) in the form of ADSs (trading symbol ‘BP’), for which JPMorgan Chase Bank, N.A. is the depositary (the Depositary) and transfer agent. The Depositary’s principal office is 383 Madison Avenue, Floor 11, New York, NY, 10179, US. Each ADS represents six ordinary shares. ADSs are evidenced by American depositary receipts (ADRs), which may be issued in either certificated or book entry form. The company's ordinary shares are also traded in the form of a global depositary certificate representing the company's ordinary shares on the Frankfurt, Hamburg and Dusseldorf Stock Exchanges. All of the existing issued BP ordinary shares are fully paid. BP ordinary shares are represented in certificated registered form and also in uncertificated form under “CREST”. CREST is an electronic settlement system in the U.K. which enables BP ordinary shares to be evidenced and transferred electronically without use of a physical certificate. B. Dividend rights If recommended by the directors of BP, shareholders of BP may, by resolution, declare dividends but no such dividend may be declared in excess of the amount recommended by the directors. The directors may also pay interim dividends without obtaining shareholder approval. No dividend may be paid other than out of profits available for distribution, as determined under IFRS and the Act. Dividends on ordinary shares are payable only after payment of dividends on BP preference shares. Any dividend unclaimed after a period of 10 years from the date of declaration of such dividend shall be forfeited and reverts to BP. If the company

3 exercises its right to forfeit shares and sells shares belonging to an untraced shareholder then any entitlement to claim dividends or other monies unclaimed in respect of those shares will be for a period of twelve months after the sale. The company may take such steps as the directors decide are appropriate in the circumstances to trace the member entitled and the sale may be made at such time and on such terms as the directors may decide. The directors have the power to declare and pay dividends in any currency provided that a sterling equivalent is announced. It is not the company’s intention to change its current policy of paying dividends in US dollars. At the company’s AGM held on 15 April 2010, shareholders approved the introduction of a Scrip Dividend Programme (the “Scrip Programme”) and to include provisions in the Articles of Association to enable the company to operate the Scrip Programme. The Scrip Programme was renewed at the company’s AGM held on 21 May 2018 for a further three years. The Scrip Programme enables ordinary shareholders and BP ADS holders to elect to receive new fully paid ordinary shares (or BP ADSs in the case of BP ADS holders) instead of cash. The operation of the Scrip Programme is always subject to the directors’ decision to make the scrip offer available in respect of any particular dividend. Should the directors decide not to offer the scrip in respect of any particular dividend, cash will automatically be paid instead. The directors may determine in relation to any scrip dividend plan or programme how the costs of the programme will be met, the minimum number of ordinary shares required in order to be able to participate in the programme and any arrangements to deal with legal and practical difficulties in any particular territory. Apart from shareholders’ rights to share in BP’s profits by dividend (if any is declared or announced), BP’s Articles of Association provide that the directors may set aside: • A special reserve fund out of the balance of profits each year to make up any deficit of cumulative dividend on the BP preference shares. • A general reserve out of the balance of profits each year, which shall be applicable for any purpose to which the profits of the company may properly be applied. This may include capitalization of such sum, pursuant to an ordinary shareholders’ resolution, and distribution to shareholders as if it were distributed by way of a dividend on the ordinary shares or in paying up in full unissued ordinary shares for allotment and distribution as bonus shares. Any such sums so deposited may be distributed in accordance with the manner of distribution of dividends as described above. Holders of shares are not subject to calls on capital by the company, provided that the amounts required to be paid on issue have been paid off. All shares are fully paid. C. Voting rights BP’s Articles of Association provide that voting on resolutions at a shareholders’ meeting will be decided on a poll other than resolutions of a procedural nature, which may be decided on a show of hands. If voting is on a poll, every shareholder who is present in person or by proxy has one vote for every ordinary share held and two votes for every £5 in nominal amount of BP preference shares held. If voting is on a show of hands, each shareholder who is present at the meeting in person or whose duly appointed proxy is present in person will have one vote, regardless of the number of shares held, unless a poll is requested. Shareholders do not have cumulative voting rights. For the purposes of determining which persons are entitled to attend or vote at a shareholders’ meeting and how many votes such persons may cast, the company may specify in the notice of the meeting a time, not

4 more than 48 hours before the time of the meeting, by which a person who holds shares in registered form must be entered on the company’s register of members in order to have the right to attend or vote at the meeting or to appoint a proxy to do so. Holders on record of ordinary shares may appoint a proxy, including a beneficial owner of those shares, to attend, speak and vote on their behalf at any shareholders’ meeting, provided that a duly completed proxy form is received not less than 48 hours (or such shorter time as the directors may determine) before the time of the meeting or adjourned meeting or, where the poll is to be taken after the date of the meeting, not less than 24 hours (or such shorter time as the directors may determine) before the time of the poll. Proxies may be delivered electronically. Corporations who are members of the company may appoint one or more persons to act as their representative or representatives at any shareholders’ meeting provided that the company may require a corporate representative to produce a certified copy of the resolution appointing them before they are permitted to exercise their powers. Matters are transacted at shareholders’ meetings by the proposing and passing of resolutions, of which there are two types: ordinary or special. An ordinary resolution requires the affirmative vote of a majority of the votes of those persons voting at a meeting at which there is a quorum. A special resolution requires the affirmative vote of not less than three quarters of the persons voting at a meeting at which there is a quorum. Any AGM requires 21 clear days’ notice. The notice period for any other general meeting is 14 clear days subject to the company obtaining annual shareholder approval, failing which, a 21 clear day notice period will apply. D. Liquidation rights; redemption provisions In the event of a liquidation of BP, after payment of all liabilities and applicable deductions under UK laws and subject to the payment of secured creditors, the holders of BP preference shares would be entitled to the sum of (1) the capital paid up on such shares plus, (2) accrued and unpaid dividends and (3) a premium equal to the higher of (a) 10% of the capital paid up on the BP preference shares and (b) the excess of the average market price over par value of such shares on the London Stock Exchange during the previous six months. The remaining assets (if any) would be divided pro rata among the holders of ordinary shares. Without prejudice to any special rights previously conferred on the holders of any class of shares, BP may issue any share with such preferred, deferred or other special rights, or subject to such restrictions as the shareholders by resolution determine (or, in the absence of any such resolutions, by determination of the directors), and may issue shares that are to be or may be redeemed. Subject to authorisation by shareholder resolution, BP may purchase its own shares in accordance with the Act. E. Pre-emption rights and new issues of shares Under Section 549 of the Act, the directors are, with certain exceptions, unable to allot equity securities without the authority of the shareholders in a general meeting. The term “equity securities” as defined in the Act includes BP ordinary shares or securities convertible into BP ordinary shares. In addition, Section 561 of the Act imposes further restrictions on the issue of equity securities (as defined in the Act, which would include BP ordinary shares or securities convertible into BP ordinary shares) which are, or are to be, paid up wholly in cash and not first offered to existing shareholders in proportion to their existing

5 shareholdings. Holders of BP ADSs would, acting through the Depositary, be entitled to participate in any such preemptive offer. BP’s Articles of Association authorize the directors to issue equity securities subject to the provisions of the Act and any resolution passed by shareholders in general meeting (such authority is sought on an annual basis). In accordance with institutional investor guidelines, the company deems it appropriate to grant authority to the directors to allot shares and other securities and to disapply pre-emption rights by way of shareholders resolutions at each AGM in place of authority granted by virtue of the company’s Articles of Association. At the AGM on 27 May 2020, authorization was given to the directors to allot shares in the company and to grant rights to subscribe for, or to convert any security into, shares in the company up to an aggregate nominal amount as if section 561(1) of the Act (providing for pre-emption rights for the shareholders of a company in respect of allotments by such company of its equity securities) did not apply. The resolutions dis-applying pre-emption rights comply with institutional shareholder guidance and in particular the Statement of Principles on Disapplying Pre-Emption Rights most recently published by the Pre-Emption Group. These authorities were given for the period until the next AGM in 2021 or 27 August 2021, whichever is the earlier. These authorities are renewed annually at the AGM. F. Variation of rights The rights attached to any class of shares may be varied with the consent in writing of holders of 75% of the shares of that class or on the adoption of a special resolution passed at a separate meeting of the holders of the shares of that class. At every such separate meeting, all of the provisions of the Articles of Association relating to proceedings at a general meeting apply, except that the quorum with respect to a meeting to change the rights attached to the preference shares is 10% or more of the shares of that class, and the quorum to change the rights attached to the ordinary shares is one third or more of the shares of that class. G. Shareholders’ meetings and notices Shareholders must provide BP with a postal or electronic address in the UK to be entitled to receive notice of shareholders’ meetings. Holders of BP ADSs are entitled to receive notices under the terms of the deposit agreement relating to BP ADSs. The substance and timing of notices are described above under the heading Voting rights. Under the Act, the AGM of shareholders must be held once every year, within each six month period beginning with the day following the company’s accounting reference date. All general meetings shall be held at a time and place determined by the directors. If any shareholders’ meeting is adjourned for lack of quorum, notice of the time and place of the adjourned meeting may be given in any lawful manner, including electronically. Powers exist for action to be taken either before or at the meeting by authorized officers to ensure its orderly conduct and safety of those attending. The directors have power to convene a general meeting which is a hybrid meeting, that is to provide facilities for shareholders to attend a meeting which is being held at a physical place by electronic means as well (but not to convene a purely electronic meeting). The provisions of the Articles of Association in relation to satellite meetings permit facilities being provided by electronic means to allow those persons at each place to participate in the meeting. H. Limitations on voting and shareholding

6 There are no limitations, either under the laws of the UK or under the company’s Articles of Association, restricting the right of non-resident or foreign owners to hold or vote BP ordinary or preference shares in the company other than limitations that would generally apply to all of the shareholders and limitations applicable to certain countries and persons subject to EU economic sanctions or those sanctions adopted by the UK government which implement resolutions of the Security Council of the United Nations. I. Transfer of Shares Except as described in this paragraph, the Articles of Association do not restrict the transferability of BP ordinary shares. BP ordinary shares may be transferred by an instrument in any usual form or in any other form acceptable to the directors. The directors may refuse to register a transfer: • if it is of shares which are not fully paid; or • if it is in favor of more than four persons jointly BP may not refuse to register transfers of BP ordinary shares if it would prevent dealings in the shares on the London Stock Exchange from taking place on an open and proper basis. J. Disclosure of interests in shares The Act permits a public company to give notice to any person whom the company believes to be or, at any time during the three years prior to the issue of the notice, to have been interested in its voting shares requiring them to disclose certain information with respect to those interests. Failure to supply the information required may lead to disenfranchisement of the relevant shares and a prohibition on their transfer and receipt of dividends and other payments in respect of those shares and any new shares in the company issued in respect of those shares. In this context the term ‘interest’ is widely defined and will generally include an interest of any kind whatsoever in voting shares, including any interest of a holder of BP ADSs. There are no provisions in the BP’s Articles of Association whereby persons acquiring, holding or disposing of a certain percentage of BP’s shares are required to make disclosure of their ownership percentage, although there are such requirements under Part 6 of the Financial Services and Markets Act 2000 and Rule 5 of the Disclosure Guidance and Transparency Rules made by the Financial Conduct Authority (successor to the UK Financial Services Authority). These requirements impose a statutory obligation on a person to notify BP and the Financial Conduct Authority of the percentage of the voting rights in BP such person directly or indirectly holds or controls, or has rights over, through his direct or indirect holding of certain financial instruments, if the percentage of those voting rights: • reaches, exceeds or falls below 3% and/or any subsequent whole percentage figure as a result of an acquisition or disposal of shares or financial instruments; or • reaches, exceeds or falls below any such threshold as a result of any change in the breakdown or number of voting rights attached to shares in BP. The Disclosure Guidance and Transparency Rules set out in detail the circumstances in which an obligation of disclosure will arise, as well as certain exemptions from those obligations for specified persons. Under section 793 of the Act, BP may, by notice in writing, require a person that BP knows or has reasonable cause to believe is or was during the three years preceding the date of notice interested in BP’s shares to indicate whether or not that is the case and, if that person does or did hold an interest in BP’s shares, to provide certain information as set out in that Act.

7 Article 19 of the EU Market Abuse Regulation (2014/596) further requires persons discharging managerial responsibilities within BP (and their persons closely associated) to notify BP of transactions conducted on their own account in BP shares or derivatives or certain financial instruments relating to BP shares. The City Code on Takeovers and Mergers also imposes strict disclosure requirements with regard to dealings in the securities of an offeror or offeree company on all parties to a takeover and also on their respective associates during the course of an offer period. K. Company records and service of notice In relation to notices not covered by the Act, the reference to notice by advertisement in a national newspaper also includes advertisements via other means such as a public announcement.

8 II. AMERICAN DEPOSITARY SHARES A. General The ordinary shares of BP may be issued in the form of American Depositary Shares (ADSs). Each ADS represents six ordinary shares. ADSs are listed on the NYSE. ADSs are evidenced by American depositary receipts (ADRs), which may be issued in either certificated or book entry form. JPMorgan Chase Bank, N.A. is the depositary (the “Depositary”) and transfer agent. Each ADS represents an ownership interest in six ordinary shares deposited with the custodian, as agent of the depositary, under the Second Amended and Restated Deposit Agreement, dated 6 December 2013, as amended (the Deposit Agreement). The Depositary’s principal office is presently located at 383 Madison Avenue, Floor 11, New York, NY, 10179, US. You may hold ADSs either directly or indirectly through your broker or other financial institution. If you hold ADSs directly, by having an ADS registered in your name on the books of the depositary, you are an ADR holder. If you hold the ADSs through your broker or financial institution nominee, you must rely on the procedures of such broker or financial institution to assert the rights of an ADR holder described in this section. You should consult with your broker or financial institution to find out what those procedures are. The following is a summary of the material terms of the Deposit Agreement. Because it is a summary, it does not contain all the information that may be important to you. For more complete information, you should read the entire form of Deposit Agreement and the form of ADR, which contain the terms of the ADSs. Please refer to Exhibit 99.(A) filed on a post-effective amendment to Form F-6 (File No. 333- 144817) with the SEC on 12 June 2013, Exhibit 99.(a)(2) filed on a post-effective amendment to Form F- 6 (File No. 333-144817) with the SEC on 9 February 2017 and Exhibit 99.(a)(3) filed on a post-effective amendment to Form F-6 (File No. 333-144817) with the SEC on 27 March 2020. Copies of the Deposit Agreement are also available for inspection at the offices of the Depositary. B. Voting Procedure Record holders of BP ADSs are also entitled to attend, speak and vote at any shareholders’ meeting of BP by the appointment by the Depositary of them as proxies in respect of the ordinary shares represented by their ADSs. Each such proxy may also appoint a proxy. Alternatively, holders of BP ADSs are entitled to vote by supplying their voting instructions to the Depositary, who will vote the ordinary shares represented by their ADSs in accordance with their instructions. If ADSs are held indirectly through a brokerage account or otherwise in street name, the holder must rely on the procedures established by his or her broker or financial institution to assert the rights of ADS holders described in this section. In the event a situation arises where the aggregate number of votes to be cast by or on behalf of the Depositary at a BP shareholder meeting exceeds the total number of ordinary shares registered in the name of the Depositary or its custodian as of the record date for ordinary shares, the BP Articles of Association provide an adjustment mechanism intended to ensure that the Depositary may only vote those shares which are registered in its name at the record date for ordinary shares. The adjustment may be made on a pro rata basis or may be made with respect to specific votes. In any circumstance where the Depositary is unable to make an adjustment, the chairman may make any adjustment of the votes to be cast by or on behalf of the Depositary on a pro rata basis or in such other manner as may have been prescribed by regulations or procedures established by the directors.

9 Except in respect of an adjustment of votes as described in the preceding paragraph, if any question arises as to whether an ADS holder, as proxy for the Depositary, or the proxy of an ADS holder, has been validly appointed to vote (or exercise any other right), according to BP’s Articles of Association the question shall be determined: • by the chairman of the meeting or in accordance with procedures established by the board of directors, if such question arises at or in relation to a general shareholders meeting; or • by the board of directors at their discretion, if such question arises in any other circumstances. The Depositary or BP will notify direct ADS holders of the upcoming meeting and arrange to distribute certain materials to such holders. The materials will: • contain such information as is contained in the meeting’s notice or in the solicitation materials; and • explain how ADS holders may instruct the Depositary to vote the ordinary shares or other deposited securities (if any) underlying ADSs if the ADS holder appoints the Depositary as proxy, or how an ADS holder may appoint a proxy other than the Depositary. ADS holders may also vote directly as an ordinary shareholder by withdrawing from the Depositary at least six of the BP ordinary shares underlying one of their ADSs. C. Share Dividends and Other Distributions The Depositary will pay to ADS holders the cash dividends or other distributions it or the custodian receives on ordinary shares or any other deposited securities, after deducting any applicable fees and expenses. The Depositary may also, pursuant to BP’s Articles of Association, request BP to pay to the ADS holder directly the cash dividends or other distributions, if the ADSs are held directly. ADS holders will receive those distributions in proportion to the number or of ordinary shares represented by their ADSs. ADS holders will generally receive cash dividends payable on ordinary shares or any other deposited securities in U.S. dollars. To the extent that BP pays any cash dividend other than in U.S. dollars, the Depositary will convert such dividend into U.S. dollars and distribute the amount received in U.S. dollars except where the Depositary determines that in its judgment any foreign currency received by it cannot be converted on a reasonable basis into U.S. dollars transferable in the U.S. or if any governmental approval for payment in U.S. dollars is required and cannot be obtained with a reasonable cost or within a reasonable time period. In that circumstance the Deposit Agreement allows the Depositary to distribute, subject to applicable laws and regulations, foreign currency only to those ADS holders who are entitled to receive payment in foreign currency. It will hold the foreign currency it cannot convert for the account of ADS holders who have not been paid. It will not invest the foreign currency and it will not be liable for any interest. Before making a distribution the Depositary deducts any withholding taxes. The Depositary will distribute only whole U.S. dollars and cents. Fractional cents will be withheld without liability and dealt with by the Depositary in accordance with its then current practices. If the exchange rates fluctuate during a time when the Depositary cannot convert the foreign currency, holders may lose some or all of the value of the distribution depending on the extent of such currency fluctuation. The Depositary may distribute new ADSs representing any shares BP distributes as a dividend or free distribution, if BP requests it to make this distribution. The Depositary may issue fractional ADSs only in connection with such share distributions. Fractional ADSs may only be issued through the direct registration

10 system maintained by the Depositary. If the Depositary does not distribute additional ADSs, each ADS will also represent the proportion of the new shares allocable to such ADS. If BP offers holders of its securities any rights to subscribe for additional shares or any other rights, BP may make these rights available to holders of ADSs by means of warrants or otherwise, if lawful and feasible. If it is not lawful and not feasible and it is practical to sell the rights, the Depositary may in its discretion sell the rights and distribute the proceeds to ADS holders in the same way as it does with cash. The Depositary may allow rights that are not distributed or sold to lapse. In that case, holders of ADSs will receive no value for them. The Deposit Agreement provides that in respect of any other distributions the Depositary will make distributions to ADS holders by any means the Depositary thinks is equitable and practical, including the sale of what BP distributed and distribute the net proceeds, in the same way as it does with cash, or it may adopt such other methods it deems equitable and practical. The Depositary is not responsible if it decides that it is unlawful or impractical to make a distribution available to any ADS holders. BP has no obligation to register ADSs, shares, rights or other securities under the Securities Act of 1933. It also has no obligation to take any other action to permit the distribution of ADSs, shares, rights or anything else to ADS holders. This means that ADS holders may not receive the distributions BP makes on its shares or any value for them if it is unlawful or impractical for them to be made available to ADS holders. D. Deposit, Withdrawal and Cancellation ADS holders who hold or acquire ordinary shares may deposit them with the Depositary or custodian for the Depositary and hold ADSs instead. Where ordinary shares are deposited with the custodian they will be held by the custodian for the account and to the order of the Depositary. To the extent that an ADS holder is requested to do so by the custodian for the Depositary, an ADS holder must deliver to it the following: • certificates or other instruments of title for the ordinary shares to be deposited, properly endorsed and in a form satisfactory to the custodian; • a written order directing the Depositary to issue to an ADS holder, or upon the written order of an ADS holder, ADRs evidencing the number of ADSs which will represent the number of ordinary shares deposited; • any required payments; • an instrument which provides for the prompt transfer to the custodian of any dividend, right to subscribe for additional ordinary shares or right to receive other property--or, in lieu of such a transfer instrument, an agreement of indemnity; and • any other required documents. The custodian will then as soon as practicable present the ordinary shares for registration of the transfer into the name of the custodian, or its nominee, and notify the Depositary that the registration occurred. The deposit of the ordinary shares will be done at the ADS holder’s cost and expense. Once the Depositary receives notice of the deposit, it shall issue to an ADS holder American Depositary receipts evidencing the number of ADSs to which that holder is entitled. ADSs will be issued in book-entry form, unless an ADS holder specifically requests them in certificated form.

11 ADS holders may deposit ordinary shares directly with the Depositary for the purpose of having them forwarded to the custodian, but a charge will apply and delivery will be at the holder’s risk. Where an ADS holder wishes to hold ordinary shares instead of ADSs, the holder must submit a written order to the Depositary to withdraw ordinary shares from deposit and surrender the ADSs at the Depositary’s office. Upon payment of its fees and expenses and of any taxes or charges, the Depositary will deliver the underlying shares at the office of the custodian. At the holder’s request, risk and expense, the Depositary may also deliver the deposited securities at office or any other place specified by the holder. Fractional shares are not deliverable on the cancellation of ADSs and, to the extent the cancellation of ADSs would give rise to the delivery of a fractional share, the Depositary will promptly advise the holder and will either deliver a new ADR in book entry form evidencing such fractional ADS or arrange to sell the fractional share and deliver the net proceeds from such sale net of the costs and expenses of such sale to the holder entitled thereto. E. Amendment and Termination BP may agree with the Depositary to amend the Deposit Agreement and the ADRs without the consent of ADR holders, and for any reason. If the amendment adds or increases fees or charges, except for taxes and governmental charges, or prejudices an important right of ADR holders, it will only become effective 30 days after the Depositary notifies ADR holders of the amendment. At the time an amendment becomes effective, ADR holders are considered to agree to the amendment and to be bound by the Deposit Agreement as amended. However, no amendment will impair the right of an ADS holder to receive the deposited securities in exchange for ADRs, except in order to comply with mandatory provisions of applicable law. The Depositary will terminate the Deposit Agreement if BP asks it to do so, in which case it must notify ADR holders at least 30 days before termination. The Depositary may also terminate the Deposit Agreement after notifying ADR holders. If the Depositary informs BP that it would like to resign and BP does not appoint a new depositary within 60 days, the Depositary is subject to certain obligations with respect to distributions and deposited securities which are set forth in the Deposit Agreement. F. Reports and Other Communications The Depositary will make available for inspection by holders at its office and at any other designated transfer offices any reports and other communications received from BP which are made generally available to the holders of ordinary shares by BP and will arrange for the transmittal or, when requested by BP, otherwise make available to holders copies of such reports and communications, as provided in the Deposit Agreement. The Depositary will also make available at its offices a register for the transfer of ADRs, which at all reasonable times will be open for the inspection of holders. G. Reclassifications, Recapitalizations and Mergers If BP: • changes the par value of, splits, cancels, consolidates or otherwise reclassifies any of the BP ordinary shares; or • recapitalizes, reorganizes, merges, consolidates, sells its assets, or takes any similar action, then: (1) The cash, ordinary shares or other securities received by the Depositary automatically will become new deposited securities under the Deposit Agreement, and each ADR will

12 represent its equal share of the new deposited securities unless additional ADRs are delivered as in the case of a stock dividend; and (2) The Depositary will, if BP asks it to, issue new ADSs or ask the ADR holder to surrender outstanding ADRs in exchange for new ADRs identifying the new deposited securities. H. Limitations on Obligations and Liability to ADR Holders The Deposit Agreement expressly limits the obligations of BP and the Depositary. It also limits their liability. Pursuant to the Deposit Agreement, BP and the Depositary: • are obliged only to take the actions specifically set forth in the Deposit Agreement without negligence or bad faith; • are not liable if either of them is prevented or delayed by law, any provision of the BP Articles of Association or circumstances beyond their control from performing their obligations under the Deposit Agreement; • are not liable if either of them exercises, or fails to exercise, any discretion permitted under the agreement; • have no obligation to become involved in a lawsuit or proceeding related to the ADRs or the Deposit Agreement on an ADR holder’s behalf or on behalf of any other party unless they are indemnified to their satisfaction; • may rely upon any advice of or information from any legal counsel, accountants, any person depositing ordinary shares, any ADR holder or any other person whom they believe in good faith is competent to give them that advice or information; • may rely and shall be protected in acting upon any written notice or other document believed by them to be genuine; and • shall not be responsible for any failure to carry out any instructions to vote any of the ordinary shares. In the Deposit Agreement, BP and the Depositary agree to indemnify each other under specified circumstances.

13 III. DEBT SECURITIES Each series of notes listed on the New York Stock Exchange and set forth on the cover page to BP’s Annual Report and Form 20-F 2020 has been issued by BP Capital Markets plc. (“BP Capital UK”) or BP Capital Markets America Inc. (“BP Capital America” and, together with BP Capital UK, the “BP Debt Issuers”) and guaranteed by BP. Each of these series of notes and related guarantees was issued pursuant to an effective registration statement and a related prospectus and prospectus supplement (if applicable) setting forth the terms of the relevant series of notes and related guarantees (collectively, the “Notes”). The following description of our Notes is a summary and does not purport to be complete and is qualified in its entirety by the full terms of the Notes. The following table sets forth the aggregate principal amount outstanding, issuer, file numbers of the registration statements and dates of issuance for each relevant series of Notes. Certain of the Notes issued by BP Capital UK (the “Old Exchange Notes”) were exchanged for new Notes issued by BP Capital America on 14 December 2018 (the “New Exchange Notes”) pursuant to an registration statement filed on Form F-4 (Registration Nos. 333-228369 and 333-228369-01). The New Exchange Notes have substantially identical terms to the Old Exchange Notes for which they were exchanged. Series Aggregate Principal Amount Outstanding Date(s) of Issuance Issuer(s) Registration Statement File No. Floating Rate Guaranteed Notes due 2021 $250,000,000 16 September 2016 BP Capital U.K. 333-208478 and 333-208478-01 Floating Rate Guaranteed Notes due 2022 — — — — Old Exchange Notes $117,849,000 19 September 2017 BP Capital U.K. 333-208478 and 333-208478-01 New Exchange Notes $182,151,000 12 December 2018 BP Capital America 333-228369 and 333-228369-01 4.742% Guaranteed Notes due 2021 — — — — Old Exchange Notes $272,684,000 11 March 2011 BP Capital U.K. 333-157906 and 333-157906-01 New Exchange Notes $1,127,316,000 12 December 2018 BP Capital America 333-228369 and 333-228369-01 3.561% Guaranteed Notes due 2021 $1,000,000,000 1 November 2011 BP Capital U.K. 333-157906 and 333-157906-01 2.112% Guaranteed Notes due 2021 — — — — Old Exchange Notes $146,557,000 16 September 2016 BP Capital U.K. 333-208478 and 333-208478-01 New Exchange Notes $603,443,000 12 December 2018 BP Capital America 333-228369 and 333-228369-01 2.500% Guaranteed Notes due 2022 $1,000,000,000 6 November 2012 BP Capital U.K. 333-179953 and 333-179953-01 2.520% Guaranteed Notes due 2022 — — — — Old Exchange Notes $135,041,000 19 September 2017 BP Capital U.K. 333-208478 and 333-208478-01 New Exchange Notes $564,959,000 12 December 2018 BP Capital America 333-228369 and 333-228369-01

14 Series Aggregate Principal Amount Outstanding Date(s) of Issuance Issuer(s) Registration Statement File No. 3.245% Guaranteed Notes due 2022 — — — — Old Exchange Notes $349,823,000 7 May 2012 BP Capital U.K. 333-179953 and 333-179953-01 New Exchange Notes $1,400,177,000 12 December 2018 BP Capital America 333-228369 and 333-228369-01 3.062% Guaranteed Notes due 2022 $1,000,000,000 17 March 2015 BP Capital U.K. 333-201894 and 333-201894-01 2.750% Guaranteed Notes due 2023 — — — — Old Exchange Notes $398,152,000 10 May 2013 BP Capital U.K. 333-179953 and 333-179953-01 New Exchange Notes $1,101,848,000 12 December 2018 BP Capital America 333-228369 and 333-228369-01 2.937% Guaranteed Notes due 2023 $750,000,000 6 April 2020 BP Capital America 333-226485 and 333-226485-02 3.216% Guaranteed Notes due 2023 Old Exchange Notes $206,060,000 28 November 2016 BP Capital U.K. 333-208478 and 333-208478-01 New Exchange Notes $993,940,000 12 December 2018 BP Capital America 333-228369 and 333-228369-01 3.994% Guaranteed Notes due 2023 $750,000,000 26 September 2013 BP Capital U.K. 333-179953 and 333-179953-01 3.535% Guaranteed Notes due 2024 $750,000,000 4 November 2014 BP Capital U.K. 333-179953 and 333-179953-01 3.814% Guaranteed Notes due 2024 $1,250,000,000 10 February 2014 BP Capital U.K. 333-179953 and 333-179953-01 3.224% Guaranteed Notes due 2024 — — — — Old Exchange Notes $903,287,000 14 February 2017 BP Capital U.K. 333-208478 and 333-208478-01 New Exchange Notes $96,713,000 12 December 2018 BP Capital America 333-228369 and 333-228369-01 3.790% Guaranteed Notes due 2024 $1,000,000,000 6 November 2018 BP Capital America 333-226485 and 333-226485-02 3.194% Guaranteed Notes due 2025 $750,000,000 6 April 2020 BP Capital America 333-226485 and 333-226485-02 3.506% Guaranteed Notes due 2025 $1,000,000,000 17 March 2015 BP Capital U.K. 333-201894 and 333-201894-01 3.796% Guaranteed Notes due 2025 $1,000,000,000 21 September 2018 BP Capital America 333-226485 and 333-226485-02 3.119% Guaranteed Notes due 2026 — — — — Old Exchange Notes $251,423,000 4 May 2016 BP Capital U.K. 333-208478 and 333-208478-01 New Exchange Notes $998,577,000 12 December 2018 BP Capital America 333-228369 and 333-228369-01 3.410% Guaranteed Notes due 2026 $1,000,000,000 11 February 2019 BP Capital America 333-226485 and 333-226485-02

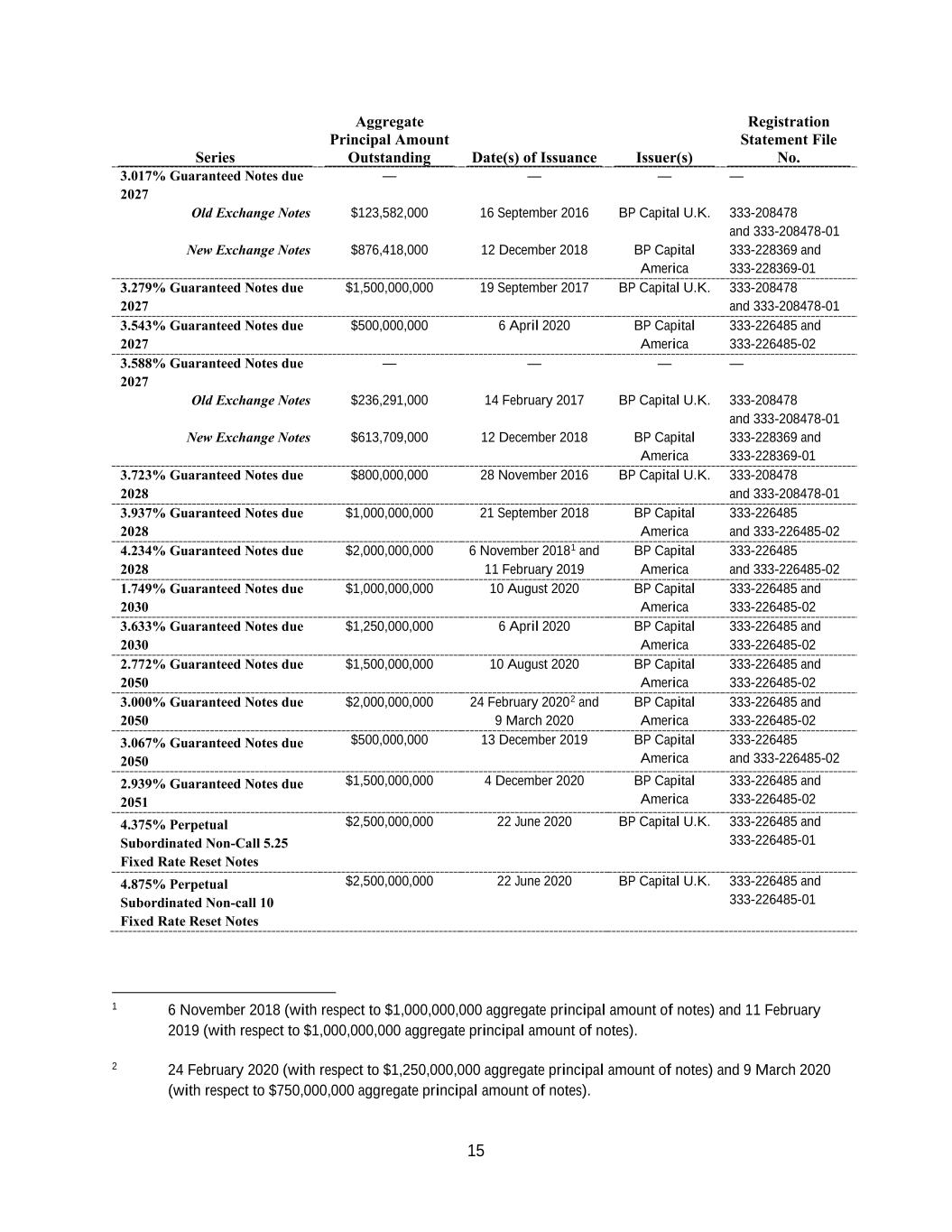

15 Series Aggregate Principal Amount Outstanding Date(s) of Issuance Issuer(s) Registration Statement File No. 3.017% Guaranteed Notes due 2027 — — — — Old Exchange Notes $123,582,000 16 September 2016 BP Capital U.K. 333-208478 and 333-208478-01 New Exchange Notes $876,418,000 12 December 2018 BP Capital America 333-228369 and 333-228369-01 3.279% Guaranteed Notes due 2027 $1,500,000,000 19 September 2017 BP Capital U.K. 333-208478 and 333-208478-01 3.543% Guaranteed Notes due 2027 $500,000,000 6 April 2020 BP Capital America 333-226485 and 333-226485-02 3.588% Guaranteed Notes due 2027 — — — — Old Exchange Notes $236,291,000 14 February 2017 BP Capital U.K. 333-208478 and 333-208478-01 New Exchange Notes $613,709,000 12 December 2018 BP Capital America 333-228369 and 333-228369-01 3.723% Guaranteed Notes due 2028 $800,000,000 28 November 2016 BP Capital U.K. 333-208478 and 333-208478-01 3.937% Guaranteed Notes due 2028 $1,000,000,000 21 September 2018 BP Capital America 333-226485 and 333-226485-02 4.234% Guaranteed Notes due 2028 $2,000,000,000 6 November 20181 and 11 February 2019 BP Capital America 333-226485 and 333-226485-02 1.749% Guaranteed Notes due 2030 $1,000,000,000 10 August 2020 BP Capital America 333-226485 and 333-226485-02 3.633% Guaranteed Notes due 2030 $1,250,000,000 6 April 2020 BP Capital America 333-226485 and 333-226485-02 2.772% Guaranteed Notes due 2050 $1,500,000,000 10 August 2020 BP Capital America 333-226485 and 333-226485-02 3.000% Guaranteed Notes due 2050 $2,000,000,000 24 February 20202 and 9 March 2020 BP Capital America 333-226485 and 333-226485-02 3.067% Guaranteed Notes due 2050 $500,000,000 13 December 2019 BP Capital America 333-226485 and 333-226485-02 2.939% Guaranteed Notes due 2051 $1,500,000,000 4 December 2020 BP Capital America 333-226485 and 333-226485-02 4.375% Perpetual Subordinated Non-Call 5.25 Fixed Rate Reset Notes $2,500,000,000 22 June 2020 BP Capital U.K. 333-226485 and 333-226485-01 4.875% Perpetual Subordinated Non-call 10 Fixed Rate Reset Notes $2,500,000,000 22 June 2020 BP Capital U.K. 333-226485 and 333-226485-01 1 6 November 2018 (with respect to $1,000,000,000 aggregate principal amount of notes) and 11 February 2019 (with respect to $1,000,000,000 aggregate principal amount of notes). 2 24 February 2020 (with respect to $1,250,000,000 aggregate principal amount of notes) and 9 March 2020 (with respect to $750,000,000 aggregate principal amount of notes).

16 A. Descriptions of Notes Description of Floating Rate Guaranteed Notes due 2021 The following terms are applicable to the Floating Rate Guaranteed Notes due 2021. • Issuer: BP Capital U.K. • Title: Floating Rate Guaranteed Notes due 2021 • Total principal amount outstanding: $250,000,000 • Issuance date: 16 September 2016 • Maturity date: 16 September 2021 • Interest rate: The interest rate for the first interest period will be the 3-month U.S. dollar London Interbank Offered Rate ("U.S. dollar LIBOR"), as determined on 14 September 2016, plus the spread (as described below). Thereafter, the interest rate for any interest period will be U.S. dollar LIBOR, as determined on the applicable interest determination date, plus the spread. The interest rate will be reset quarterly on each interest reset date. • Date interest starts accruing: 16 September 2016 • Interest payment dates: Each 16 March, 16 June, 16 September and 16 December of each year, subject to the Day Count Convention. • First interest payment date: 16 December 2016 • Spread: 0.870% • Interest reset dates: The interest reset date for each interest period other than the first interest period will be the first day of such interest period, subject to the day count convention. • Interest periods: The period beginning on, and including an interest payment date and ending on, but not including, the following interest payment date? provided that the first interest period will begin on 16 September 2016, and will end on, but not include, the first interest payment date. • Interest determination date: The interest determination date relating to a particular interest reset date will be the second London business day preceding such interest reset date. • London business day: Any week day on which banking or trust institutions in London are not authorized generally or obligated by law, regulation or executive order to close. • Calculation Agent: The Bank of New York Mellon Trust Company, N.A. • Calculation of U.S. dollar LIBOR: The calculation agent will determine U.S. dollar LIBOR in accordance with the following provisions: With respect to any interest determination date, U.S. dollar LIBOR will be the rate for deposits in U.S. dollars having a maturity of three months commencing on the interest reset date that appears on the designated LIBOR page as of 11:00 a.m., London time, on that interest determination date. If no rate appears, U.S. dollar LIBOR, in respect

17 of that interest determination date, will be determined as follows: the calculation agent will request the principal London offices of each of four major reference banks in the London interbank market, as selected and identified by the issuer, to provide the calculation agent with its offered quotation for deposits in U.S. dollars for the period of three months, commencing on the interest reset date, to prime banks in the London interbank market at approximately 11:00 a.m., London time, on that interest determination date and in a principal amount that is representative for a single transaction in U.S. dollars in that market at that time. If at least two quotations are provided, then U.S. dollar LIBOR on that interest determination date will be the arithmetic mean of those quotations. If fewer than two quotations are provided, then U.S. dollar LIBOR on the interest determination date will be the arithmetic mean of the rates quoted at approximately 11:00 a.m., New York City time, on the interest determination date by three major banks in The City of New York selected and identified by the issuer for loans in U.S. dollars to leading European banks, having a three-month maturity and in a principal amount that is representative for a single transaction in U.S. dollars in that market at that time? provided, however, that if the banks selected and identified by the issuer are not providing quotations in the manner described by this sentence, U.S. dollar LIBOR determined as of that interest determination date will be U.S. dollar LIBOR in effect on that interest determination date. The designated LIBOR page is the Reuters screen "LIBOR01", or any successor service for the purpose of displaying the London interbank rates of major banks for U.S. dollars. The Reuters screen "LIBOR01" is the display designated as the Reuters screen "LIBOR01", or such other page as may replace the Reuters screen "LIBOR01" on that service or such other service or services as may be nominated for the purpose of displaying London interbank offered rates for U.S. dollar deposits by ICE Benchmark Administration Limited ("IBA") or its successor or such other entity assuming the responsibility of IBA or its successor in calculating the London Interbank Offered Rate in the event IBA or its successor no longer does so. All calculations made by the calculation agent for the purposes of calculating the interest rates on the 2021 floating rate notes shall be conclusive and binding on the holders of the 2021 floating rate notes, BP, the issuer and the trustee, absent manifest error. Description of Floating Rate Guaranteed Notes due 2022 The following terms are applicable to the Floating Rate Guaranteed Notes due 2022. • Issuers: BP Capital U.K. (Old Exchange Notes) and BP Capital America (New Exchange Notes) • Title: Floating Rate Guaranteed Notes due 2022 • Total principal amount outstanding: $117,849,000 (Old Exchange Notes) and $182,151,000 (New Exchange Notes) • Issuance dates: 19 September 2017 (Old Exchange Notes) and 12 December 2018 (New Exchange Notes) • Maturity date: 19 September 2022 • Interest rate: The interest rate for the first interest period will be the 3-month U.S. dollar London Interbank Offered Rate ("U.S. dollar LIBOR"), as determined on 15 September 2017, plus the spread (as described below). Thereafter, the interest rate for any interest period will be U.S. dollar LIBOR, as determined on the applicable interest determination date, plus the spread. The interest rate will be reset quarterly on each interest reset date. • Date interest starts accruing: 19 September 2017

18 • Interest payment dates: 19 March, 19 June, 19 September and 19 December of each year, subject to the Day Count Convention. • First interest payment date: 19 December 2017 • Spread: 0.650% • Interest reset dates: The interest reset date for each interest period other than the first interest period will be the first day of such interest period, subject to the day count convention. • Interest periods: The period beginning on, and including an interest payment date and ending on, but not including, the following interest payment date? provided that the first interest period will begin on 19 September 2017, and will end on, but not include, the first interest payment date. • Interest determination date: The interest determination date relating to a particular interest reset date will be the second London business day preceding such interest reset date. • London business day: Any week day on which banking or trust institutions in London are not authorized generally or obligated by law, regulation or executive order to close, on which dealings in deposits in U.S. dollars are transacted in the London interbank market. • Calculation Agent: The Bank of New York Mellon Trust Company, N.A. • Calculation of U.S. dollar LIBOR: The calculation agent will determine U.S. dollar LIBOR in accordance with the following provisions: With respect to any interest determination date, U.S. dollar LIBOR will be the rate for deposits in U.S. dollars having a maturity of three months commencing on the interest reset date that appears on the designated LIBOR page as of 11:00 a.m., London time, on that interest determination date. If no rate appears, U.S. dollar LIBOR, in respect of that interest determination date, will be determined as follows: the calculation agent will request the principal London offices of each of four major reference banks in the London interbank market, as selected and identified by the issuer, to provide the calculation agent with its offered quotation for deposits in U.S. dollars for the period of three months, commencing on the interest reset date, to prime banks in the London interbank market at approximately 11:00 a.m., London time, on that interest determination date and in a principal amount that is representative for a single transaction in U.S. dollars in that market at that time. If at least two quotations are provided, then U.S. dollar LIBOR on that interest determination date will be the arithmetic mean of those quotations. If fewer than two quotations are provided, then U.S. dollar LIBOR on the interest determination date will be the arithmetic mean of the rates quoted at approximately 11:00 a.m., New York City time, on the interest determination date by three major banks in The City of New York selected and identified by the issuer for loans in U.S. dollars to leading European banks, having a three-month maturity and in a principal amount that is representative for a single transaction in U.S. dollars in that market at that time? provided, however, that if the banks selected and identified by the issuer are not providing quotations in the manner described by this sentence, U.S. dollar LIBOR determined as of that interest determination date will be U.S. dollar LIBOR in effect on that interest determination date (i.e., the same as the rate determined for the immediately preceding interest reset date). The designated LIBOR page is Bloomberg L.P.'s page "BBAM", or any successor service for the purpose of displaying the London interbank rates of major banks for U.S. dollars. Bloomberg L.P.'s page "BBAM" is the display designated as "BBAM", or such other page as may replace Bloomberg L.P.'s page "BBAM" on that service or such other service or services as may be nominated for the purpose of displaying London interbank offered rates for U.S. dollar deposits by ICE Benchmark Administration Limited ("IBA") or its successor or such other entity assuming

19 the responsibility of IBA or its successor in calculating the London Interbank Offered Rate in the event IBA or its successor no longer does so. All calculations made by the calculation agent for the purposes of calculating the interest rates on the 2022 floating rate notes shall be conclusive and binding on the holders of the 2022 floating rate notes, BP, the issuer and the trustee, absent manifest error. Description of 4.742% Guaranteed Notes due 2021 The following terms are applicable to the 4.742% Guaranteed Notes due 2021. • Issuer: BP Capital U.K. (Old Exchange Notes) and BP Capital America (New Exchange Notes) • Title: 4.742% Guaranteed Notes due 2021. • Total principal amount outstanding: $272,684,000 (Old Exchange Notes) and $1,127,316,000 (New Exchange Notes) • Issuance date: 11 March 2011 (Old Exchange Notes) and 12 December 2018 (New Exchange Notes) • Maturity date: 11 March 2021. • Interest rate: 4.742% per annum. • Date interest starts accruing: 11 March 2011. • Interest payment dates: Each 11 March and 11 September. • First interest due date: 11 September 2011. • Optional make-whole redemption: The issuer has the right to redeem the 2021 notes, in whole or in part, at any time and from time to time at a redemption price equal to the greater of (i) 100% of the principal amount of the 2021 notes to be redeemed and (ii) the sum of the present values of the remaining scheduled payments of principal and interest on the 2021 notes to be redeemed (not including any portion of payments of interest accrued and unpaid to the redemption date) discounted to the redemption date on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the treasury rate plus 20 basis points, plus in each case accrued and unpaid interest to the date of redemption. For purposes of determining the optional make-whole redemption price, the following definitions are applicable. "Treasury rate" means, with respect to any redemption date, the rate per annum equal to the semi-annual equivalent yield to maturity or interpolated (on a day count basis) of the comparable treasury issue, assuming a price for the comparable treasury issue (expressed as a percentage of its principal amount) equal to the comparable treasury price for such redemption date. "Comparable treasury issue" means the U.S. Treasury security or securities selected by the quotation agent as having an actual or interpolated maturity comparable to the remaining term of the 2021 notes to be redeemed that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new issues of corporate debt securities of comparable maturity to the remaining term of such notes. "Comparable treasury price" means, with respect to any redemption date, the average of the reference treasury dealer quotations for such redemption date. "Quotation agent" means one of the reference treasury dealers appointed by the issuer "Reference treasury dealer" means BNP Paribas Securities Corp. and Citigroup Global Markets Inc. or their affiliates which are primary U.S.

20 government securities dealers, and their respective successors, and two other primary U.S. government securities dealers selected by the issuer, provided, however, that if any of the foregoing shall cease to be a primary U.S. government securities dealer in the United States (a "primary treasury dealer"), the issuer shall substitute therefor another primary treasury dealer. "Reference treasury dealer quotations" means with respect to each reference treasury dealer and any redemption date, the average, as determined by the quotation agent, of the bid and asked prices for the comparable treasury issue (expressed in each case as a percentage of its principal amount) quoted in writing to the quotation agent by such reference treasury dealer at 5:00 p.m. New York time on the third business day preceding such redemption date. Description of 3.561% Guaranteed Notes due 2021 The following terms are applicable to the 3.561% Guaranteed Notes due 2021. • Issuer: BP Capital U.K. • Title: 3.561% Guaranteed Notes due 2021. • Total principal amount outstanding: $1,000,000,000. • Issuance date: 1 November 2011. • Maturity date: 1 November 2021. • Interest rate: 3.561% per annum. • Date interest starts accruing: 1 November 2011. • Interest payment dates: Each 1 May and 1 November, subject to the day count convention. • First interest due date: 1 May 2012. • Optional make-whole redemption:3 The issuer has the right to redeem the 2021 notes, in whole or in part, at any time and from time to time at a redemption price equal to the greater of (i) 100% of the principal amount of the 2021 notes to be redeemed and (ii) the sum of the present values of the remaining scheduled payments of principal and interest on the 2021 notes to be redeemed (not including any portion of payments of interest accrued and unpaid to the redemption date) discounted to the redemption date on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the treasury rate plus 20 basis points, plus in each case accrued and unpaid interest to the date of redemption. For purposes of determining the optional make-whole redemption price, the following definitions are applicable. "Treasury rate" means, with respect to any redemption date, the rate per annum equal to the semi-annual equivalent yield to maturity or interpolated (on a day count basis) of the comparable treasury issue, assuming a price for the comparable treasury issue (expressed as a percentage of its principal amount) equal to the comparable treasury price for such redemption date. "Comparable treasury issue" means the U.S. Treasury security or securities selected by the quotation agent as having an actual or interpolated 3 As of 31 December 2020, the issuer had activated the make-whole redemption right of the 3.561% Guaranteed Notes due 2021.

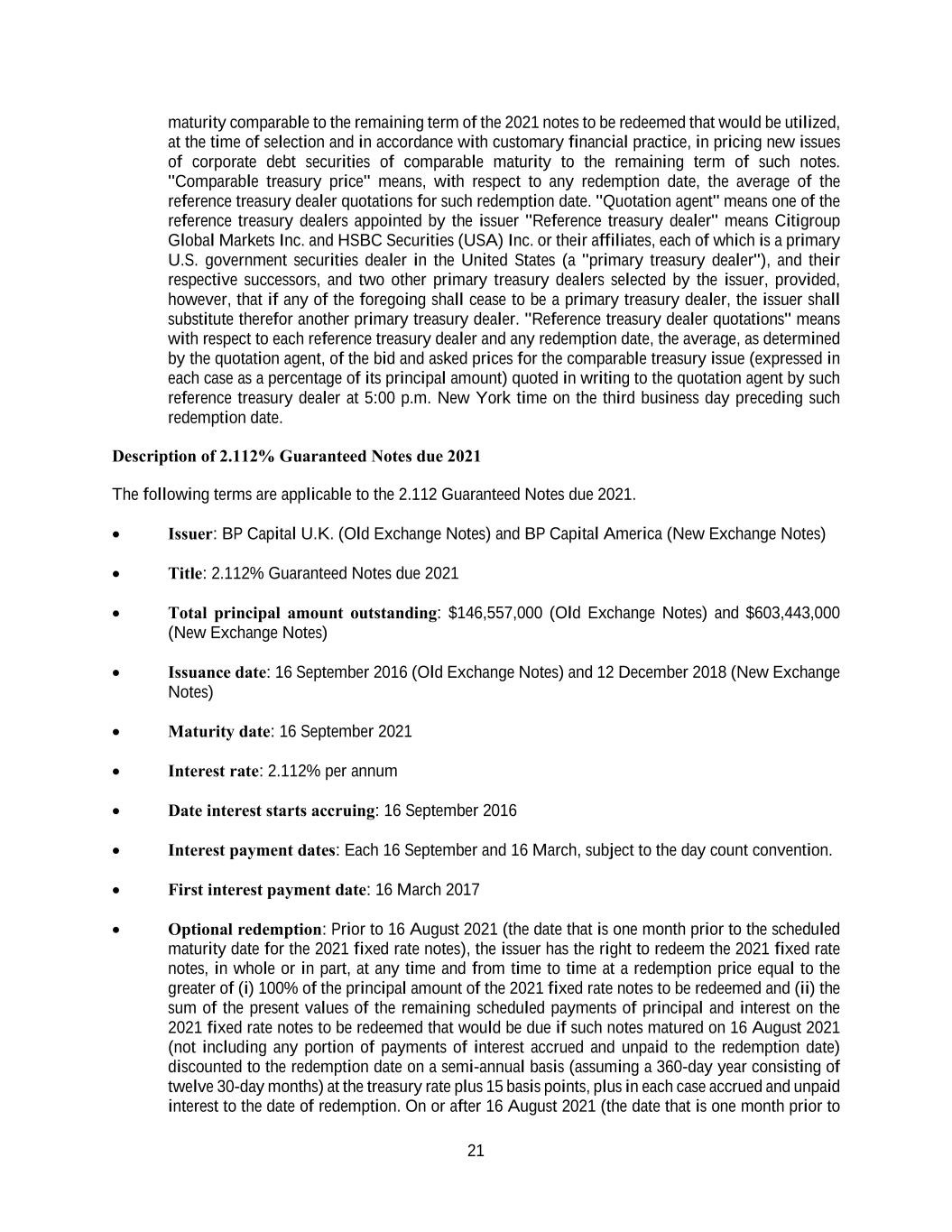

21 maturity comparable to the remaining term of the 2021 notes to be redeemed that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new issues of corporate debt securities of comparable maturity to the remaining term of such notes. "Comparable treasury price" means, with respect to any redemption date, the average of the reference treasury dealer quotations for such redemption date. "Quotation agent" means one of the reference treasury dealers appointed by the issuer "Reference treasury dealer" means Citigroup Global Markets Inc. and HSBC Securities (USA) Inc. or their affiliates, each of which is a primary U.S. government securities dealer in the United States (a "primary treasury dealer"), and their respective successors, and two other primary treasury dealers selected by the issuer, provided, however, that if any of the foregoing shall cease to be a primary treasury dealer, the issuer shall substitute therefor another primary treasury dealer. "Reference treasury dealer quotations" means with respect to each reference treasury dealer and any redemption date, the average, as determined by the quotation agent, of the bid and asked prices for the comparable treasury issue (expressed in each case as a percentage of its principal amount) quoted in writing to the quotation agent by such reference treasury dealer at 5:00 p.m. New York time on the third business day preceding such redemption date. Description of 2.112% Guaranteed Notes due 2021 The following terms are applicable to the 2.112 Guaranteed Notes due 2021. • Issuer: BP Capital U.K. (Old Exchange Notes) and BP Capital America (New Exchange Notes) • Title: 2.112% Guaranteed Notes due 2021 • Total principal amount outstanding: $146,557,000 (Old Exchange Notes) and $603,443,000 (New Exchange Notes) • Issuance date: 16 September 2016 (Old Exchange Notes) and 12 December 2018 (New Exchange Notes) • Maturity date: 16 September 2021 • Interest rate: 2.112% per annum • Date interest starts accruing: 16 September 2016 • Interest payment dates: Each 16 September and 16 March, subject to the day count convention. • First interest payment date: 16 March 2017 • Optional redemption: Prior to 16 August 2021 (the date that is one month prior to the scheduled maturity date for the 2021 fixed rate notes), the issuer has the right to redeem the 2021 fixed rate notes, in whole or in part, at any time and from time to time at a redemption price equal to the greater of (i) 100% of the principal amount of the 2021 fixed rate notes to be redeemed and (ii) the sum of the present values of the remaining scheduled payments of principal and interest on the 2021 fixed rate notes to be redeemed that would be due if such notes matured on 16 August 2021 (not including any portion of payments of interest accrued and unpaid to the redemption date) discounted to the redemption date on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the treasury rate plus 15 basis points, plus in each case accrued and unpaid interest to the date of redemption. On or after 16 August 2021 (the date that is one month prior to

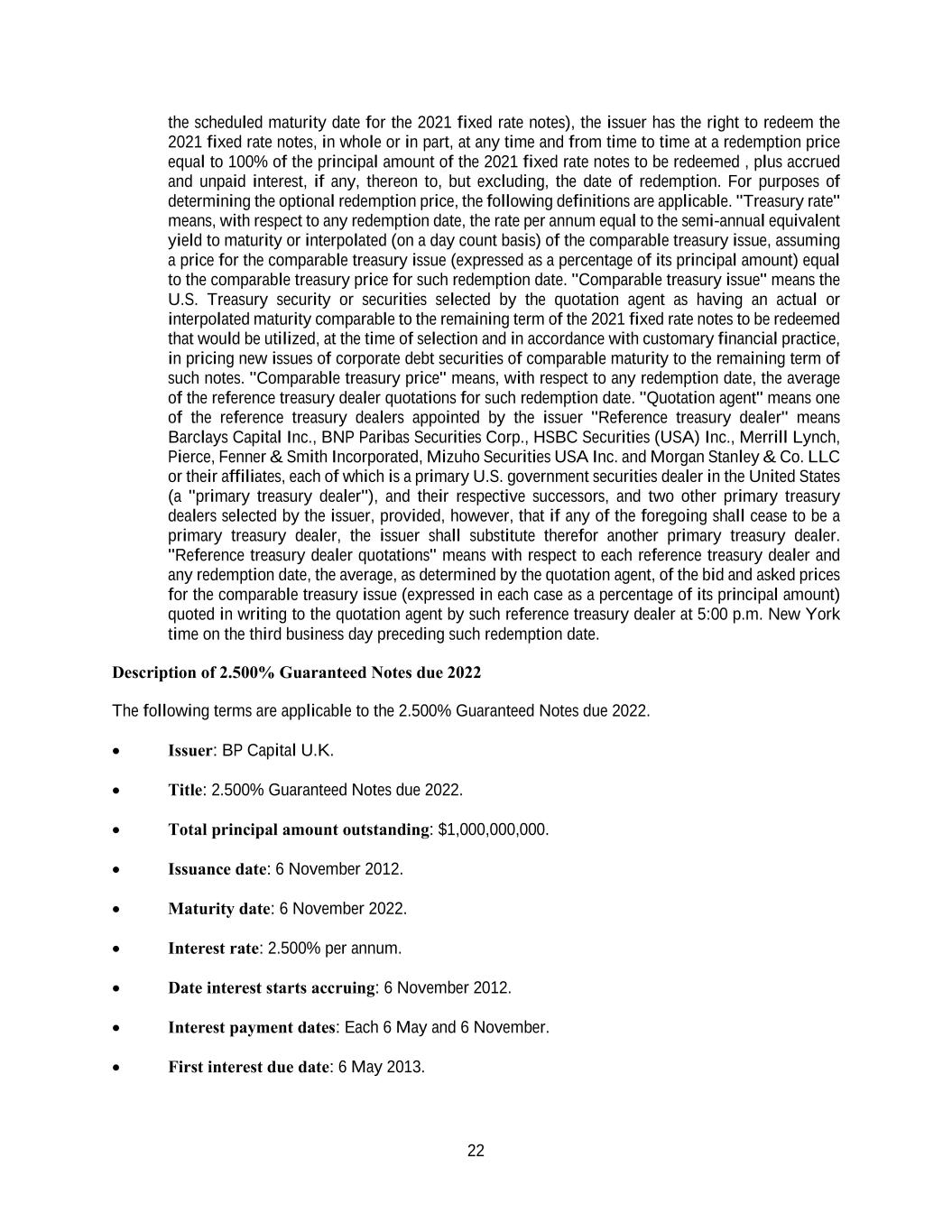

22 the scheduled maturity date for the 2021 fixed rate notes), the issuer has the right to redeem the 2021 fixed rate notes, in whole or in part, at any time and from time to time at a redemption price equal to 100% of the principal amount of the 2021 fixed rate notes to be redeemed , plus accrued and unpaid interest, if any, thereon to, but excluding, the date of redemption. For purposes of determining the optional redemption price, the following definitions are applicable. "Treasury rate" means, with respect to any redemption date, the rate per annum equal to the semi-annual equivalent yield to maturity or interpolated (on a day count basis) of the comparable treasury issue, assuming a price for the comparable treasury issue (expressed as a percentage of its principal amount) equal to the comparable treasury price for such redemption date. "Comparable treasury issue" means the U.S. Treasury security or securities selected by the quotation agent as having an actual or interpolated maturity comparable to the remaining term of the 2021 fixed rate notes to be redeemed that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new issues of corporate debt securities of comparable maturity to the remaining term of such notes. "Comparable treasury price" means, with respect to any redemption date, the average of the reference treasury dealer quotations for such redemption date. "Quotation agent" means one of the reference treasury dealers appointed by the issuer "Reference treasury dealer" means Barclays Capital Inc., BNP Paribas Securities Corp., HSBC Securities (USA) Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated, Mizuho Securities USA Inc. and Morgan Stanley & Co. LLC or their affiliates, each of which is a primary U.S. government securities dealer in the United States (a "primary treasury dealer"), and their respective successors, and two other primary treasury dealers selected by the issuer, provided, however, that if any of the foregoing shall cease to be a primary treasury dealer, the issuer shall substitute therefor another primary treasury dealer. "Reference treasury dealer quotations" means with respect to each reference treasury dealer and any redemption date, the average, as determined by the quotation agent, of the bid and asked prices for the comparable treasury issue (expressed in each case as a percentage of its principal amount) quoted in writing to the quotation agent by such reference treasury dealer at 5:00 p.m. New York time on the third business day preceding such redemption date. Description of 2.500% Guaranteed Notes due 2022 The following terms are applicable to the 2.500% Guaranteed Notes due 2022. • Issuer: BP Capital U.K. • Title: 2.500% Guaranteed Notes due 2022. • Total principal amount outstanding: $1,000,000,000. • Issuance date: 6 November 2012. • Maturity date: 6 November 2022. • Interest rate: 2.500% per annum. • Date interest starts accruing: 6 November 2012. • Interest payment dates: Each 6 May and 6 November. • First interest due date: 6 May 2013.

23 • Optional make-whole redemption: The issuer has the right to redeem the 2022 notes, in whole or in part, at any time and from time to time at a redemption price equal to the greater of (i) 100% of the principal amount of the 2022 notes to be redeemed and (ii) the sum of the present values of the remaining scheduled payments of principal and interest on the 2022 notes to be redeemed (not including any portion of payments of interest accrued and unpaid to the redemption date) discounted to the redemption date on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the treasury rate plus 15 basis points, plus in each case accrued and unpaid interest to the date of redemption. For purposes of determining the optional make-whole redemption price, the following definitions are applicable. “Treasury rate” means, with respect to any redemption date, the rate per annum equal to the semi-annual equivalent yield to maturity or interpolated (on a day count basis) of the comparable treasury issue, assuming a price for the comparable treasury issue (expressed as a percentage of its principal amount) equal to the comparable treasury price for such redemption date. “Comparable treasury issue” means the U.S. Treasury security or securities selected by the quotation agent as having an actual or interpolated maturity comparable to the remaining term of the 2022 notes to be redeemed that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new issues of corporate debt securities of comparable maturity to the remaining term of such notes. “Comparable treasury price” means, with respect to any redemption date, the average of the reference treasury dealer quotations for such redemption date. “Quotation agent” means one of the reference treasury dealers appointed by the issuer “Reference treasury dealer” means Citigroup Global Markets Inc., HSBC Securities (USA) Inc. and UBS Securities LLC or their affiliates, each of which is a primary U.S. government securities dealer in the United States (a “primary treasury dealer”), and their respective successors, and two other primary treasury dealers selected by the issuer, provided, however, that if any of the foregoing shall cease to be a primary treasury dealer, the issuer shall substitute therefor another primary treasury dealer. “Reference treasury dealer quotations” means with respect to each reference treasury dealer and any redemption date, the average, as determined by the quotation agent, of the bid and asked prices for the comparable treasury issue (expressed in each case as a percentage of its principal amount) quoted in writing to the quotation agent by such reference treasury dealer at 5:00 p.m. New York time on the third business day preceding such redemption date. Description of 2.520% Guaranteed Notes due 2022 The following terms are applicable to the 2.520% Guaranteed Notes due 2022. • Issuer: BP Capital U.K. (Old Exchange Notes) and BP Capital America (New Exchange Notes) • Title: 2.520% Guaranteed Notes due 2022 • Total principal amount outstanding: $135,041,000 (Old Exchange Notes) and $564,959,000 (New Exchange Notes) • Issuance date: 19 September 2017 (Old Exchange Notes) and December 12, 2018 (New Exchange Notes) • Maturity date: 19 September 2022 • Interest rate: 2.520% per annum • Date interest starts accruing: 19 September 2017

24 • Interest payment dates: Each 19 March and 19 September, subject to the day count convention. • First interest payment date: 19 March 2018 • Optional redemption: Prior to 19 August 2022 (the date that is one month prior to the scheduled maturity date for the 2022 fixed rate notes), the issuer has the right to redeem the 2022 fixed rate notes, in whole or in part, at any time and from time to time at a redemption price equal to the greater of (i) 100% of the principal amount of the 2022 fixed rate notes to be redeemed and (ii) the sum of the present values of the remaining scheduled payments of principal and interest on the 2022 fixed rate notes to be redeemed that would be due if such notes matured on 19 August 2022 (not including any portion of payments of interest accrued and unpaid to the redemption date) discounted to the redemption date on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the treasury rate plus 12.5 basis points, plus in each case accrued and unpaid interest to the date of redemption. On or after 19 August 2022 (the date that is one month prior to the scheduled maturity date for the 2022 fixed rate notes), the issuer has the right to redeem the 2022 fixed rate notes, in whole or in part, at any time and from time to time at a redemption price equal to 100% of the principal amount of the 2022 fixed rate notes to be redeemed, plus accrued and unpaid interest, if any, thereon to, but excluding, the date of redemption. For purposes of determining the optional redemption price, the following definitions are applicable. “Treasury rate” means, with respect to any redemption date, the rate per annum equal to the semi-annual equivalent yield to maturity or interpolated (on a day count basis) of the comparable treasury issue, assuming a price for the comparable treasury issue (expressed as a percentage of its principal amount) equal to the comparable treasury price for such redemption date. “Comparable treasury issue” means the U.S. Treasury security or securities selected by the quotation agent as having an actual or interpolated maturity comparable to the remaining term of the 2022 fixed rate notes to be redeemed that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new issues of corporate debt securities of comparable maturity to the remaining term of such notes. “Comparable treasury price” means, with respect to any redemption date, the average of the reference treasury dealer quotations for such redemption date. “Quotation agent” means one of the reference treasury dealers appointed by the issuer “Reference treasury dealer” means Credit Suisse Securities (USA) LLC, Goldman Sachs & Co. LLC, HSBC Securities (USA) Inc., J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC and UBS Securities LLC or their affiliates, each of which is a primary U.S. government securities dealer in the United States (a “primary treasury dealer”), and their respective successors, and two other primary treasury dealers selected by the issuer, provided, however, that if any of the foregoing shall cease to be a primary treasury dealer, the issuer shall substitute therefor another primary treasury dealer. “Reference treasury dealer quotations” means with respect to each reference treasury dealer and any redemption date, the average, as determined by the quotation agent, of the bid and asked prices for the comparable treasury issue (expressed in each case as a percentage of its principal amount) quoted in writing to the quotation agent by such reference treasury dealer at 5:00 p.m. New York time on the third business day preceding such redemption date. Description of 3.245% Guaranteed Notes due 2022 The following terms are applicable to the 3.245% Guaranteed Notes due 2022. • Issuer: BP Capital U.K. (Old Exchange Notes) and BP Capital America (New Exchange Notes) • Title: 3.245% Guaranteed Notes due 2022.

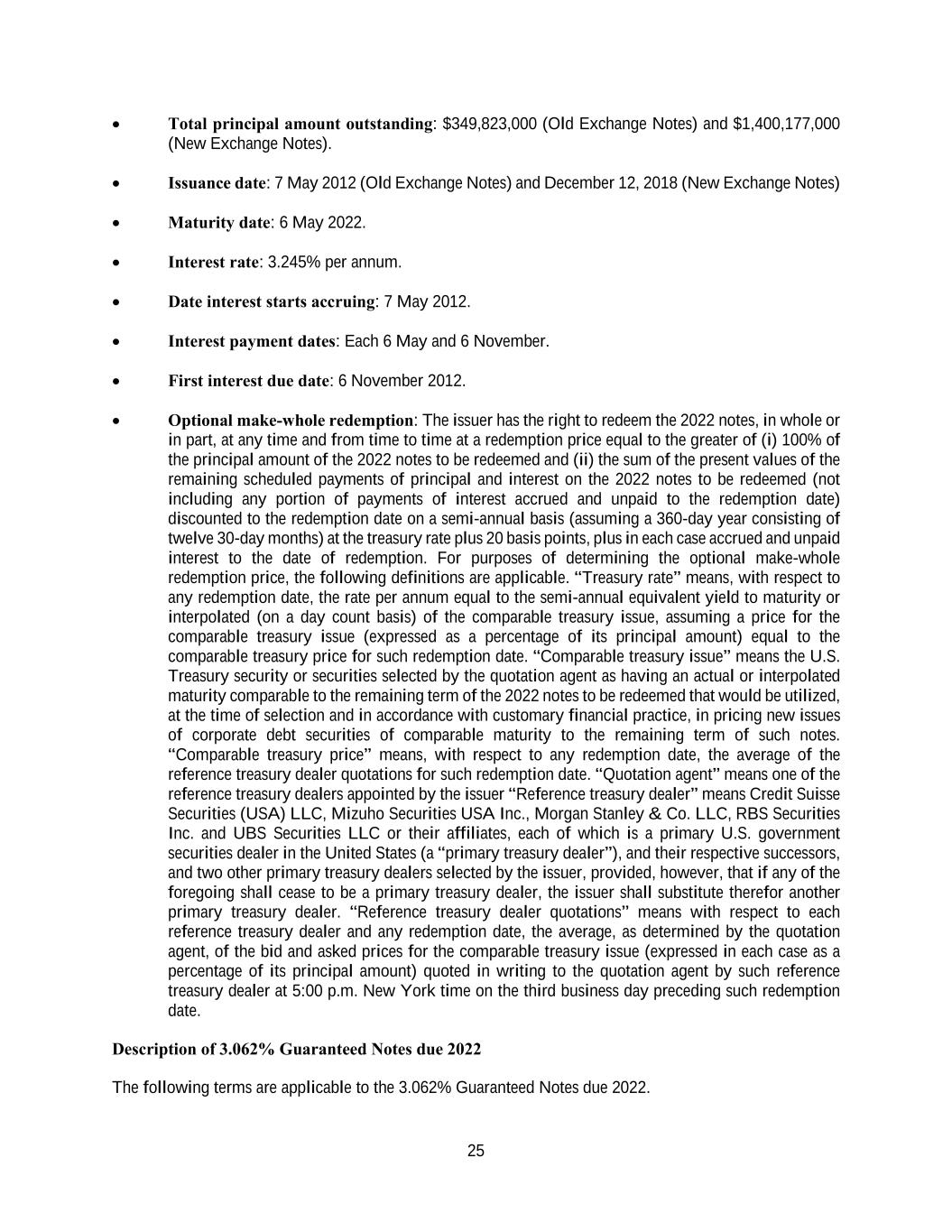

25 • Total principal amount outstanding: $349,823,000 (Old Exchange Notes) and $1,400,177,000 (New Exchange Notes). • Issuance date: 7 May 2012 (Old Exchange Notes) and December 12, 2018 (New Exchange Notes) • Maturity date: 6 May 2022. • Interest rate: 3.245% per annum. • Date interest starts accruing: 7 May 2012. • Interest payment dates: Each 6 May and 6 November. • First interest due date: 6 November 2012. • Optional make-whole redemption: The issuer has the right to redeem the 2022 notes, in whole or in part, at any time and from time to time at a redemption price equal to the greater of (i) 100% of the principal amount of the 2022 notes to be redeemed and (ii) the sum of the present values of the remaining scheduled payments of principal and interest on the 2022 notes to be redeemed (not including any portion of payments of interest accrued and unpaid to the redemption date) discounted to the redemption date on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the treasury rate plus 20 basis points, plus in each case accrued and unpaid interest to the date of redemption. For purposes of determining the optional make-whole redemption price, the following definitions are applicable. “Treasury rate” means, with respect to any redemption date, the rate per annum equal to the semi-annual equivalent yield to maturity or interpolated (on a day count basis) of the comparable treasury issue, assuming a price for the comparable treasury issue (expressed as a percentage of its principal amount) equal to the comparable treasury price for such redemption date. “Comparable treasury issue” means the U.S. Treasury security or securities selected by the quotation agent as having an actual or interpolated maturity comparable to the remaining term of the 2022 notes to be redeemed that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new issues of corporate debt securities of comparable maturity to the remaining term of such notes. “Comparable treasury price” means, with respect to any redemption date, the average of the reference treasury dealer quotations for such redemption date. “Quotation agent” means one of the reference treasury dealers appointed by the issuer “Reference treasury dealer” means Credit Suisse Securities (USA) LLC, Mizuho Securities USA Inc., Morgan Stanley & Co. LLC, RBS Securities Inc. and UBS Securities LLC or their affiliates, each of which is a primary U.S. government securities dealer in the United States (a “primary treasury dealer”), and their respective successors, and two other primary treasury dealers selected by the issuer, provided, however, that if any of the foregoing shall cease to be a primary treasury dealer, the issuer shall substitute therefor another primary treasury dealer. “Reference treasury dealer quotations” means with respect to each reference treasury dealer and any redemption date, the average, as determined by the quotation agent, of the bid and asked prices for the comparable treasury issue (expressed in each case as a percentage of its principal amount) quoted in writing to the quotation agent by such reference treasury dealer at 5:00 p.m. New York time on the third business day preceding such redemption date. Description of 3.062% Guaranteed Notes due 2022 The following terms are applicable to the 3.062% Guaranteed Notes due 2022.