Form FWP ROYAL BANK OF CANADA Filed by: ROYAL BANK OF CANADA

Filed Pursuant to Rule 433

Registration Statement No. 333-227001

January 31, 2021 RBC Global Tactical Equity Total Return Index Performance Factsheet Index Objectives: The RBC Global Tactical Equity Total Return Index

is designed to meet or exceed risk‐adjusted returns relative to the benchmark by optimizing asset allocation (equities versus cash) and geographic exposure. This dynamic asset allocation is implemented by observing bullish or bearish trends in

each of four broad‐based equity indices, on a monthly basis, to determine the exposure to each of these markets versus cash. Index Ticker Symbols: Bloomberg: RBCEGTUT Index Thomson Reuters: .RBCEGTUT Index Launch Date: February 18, 2019 Index

Base Date: December 19, 2007 Asset Class: Equity Fixed Income (Cash) Target Allocations: Large Cap US (50%) International Developed (25%) Emerging Market (15%) Small Cap US (10%) Rebalanced annually Last Rebalancing Date: Benchmark: MSCI ACWI Net

Total Return USD Index Bloomberg: M1WD Index Thomson Reuters: .MIWD00000NUS Liquidity: The Index tracks equity futures and cash. Each tracked futures contract averages significantly in excess of $1bn in daily trading volume. Availability:

Investors cannot invest directly in the Index. The Index can be used as an underlying for various investment vehicles to provide exposure to investors. Index Description The Index is comprised of four Sub‐Indices, each of which provides exposure

to a different equity market, weighted as follows: 50% Large‐Cap U.S. stocks, 10% Small‐Cap U.S. stocks, 25% International Developed Market stocks, and 15% Emerging Market stocks. In order to obtain exposure to these markets, the Index is

allocated on a fixed‐weight basis, rebalancing once a year, to the four Sub‐Indices. Each Sub‐Index obtains exposure to one of the relevant markets by tracking the performance of the relevant futures contract. On the specified monthly

determination date, the allocation of each Sub‐index is determined based on the observation of a pre‐defined Tactical Trigger: the relevant daily moving average (DMA). If a specific ETF that tracks the relevant market (indicated on page 3) is at

or above its relevant DMA (a bullish trend), the Sub‐Index will allocate to equity via the relevant futures contract plus the Federal Funds rate (to replicate the total return) or only to the Federal Funds rate if the ETF is below its relevant

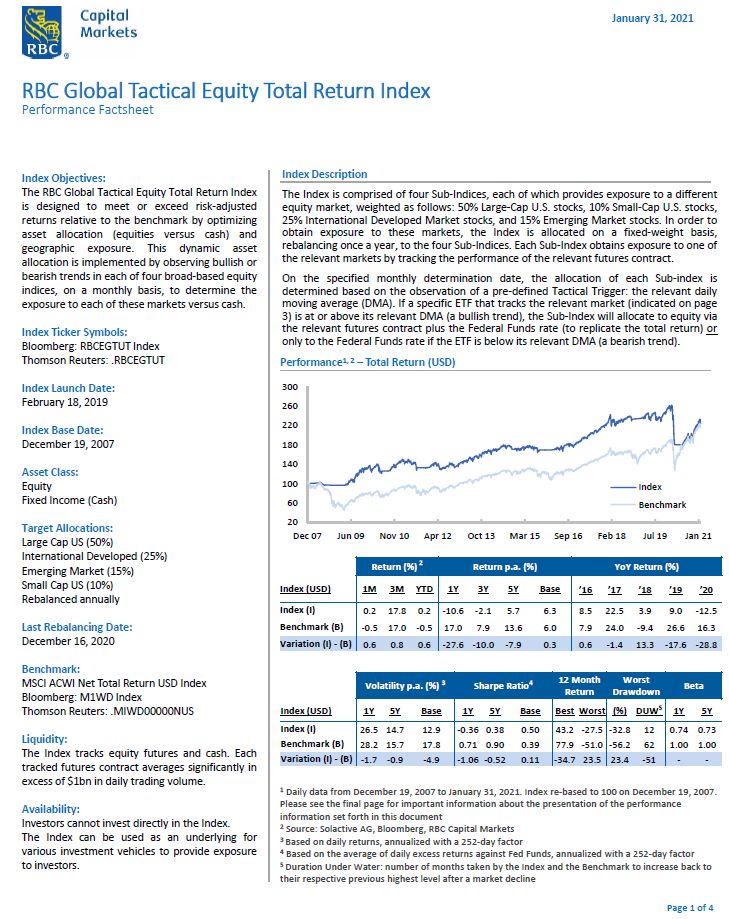

DMA (a bearish trend). 20 60 100 140 180 220 260 300 Dec 07 Jun 09 Nov 10 Apr 12 Oct 13 Mar 15 Sep 16 Feb 18 Jul 19 Jan 21 Index Benchmark Return (%) 2 Return p.a. (%) YoY Return (%) Index (USD) 1M 3M YTD 1Y 3Y 5Y Base ’16 ’17 ’18 ’19 ’20 Index

(I) 0.2 17.8 0.2 ‐10.6 ‐2.1 5.7 6.3 8.5 22.5 3.9 9.0 ‐12.5 Benchmark (B) ‐0.5 17.0 ‐0.5 17.0 7.9 13.6 6.0 7.9 24.0 ‐9.4 26.6 16.3 Variation (I) ‐ (B) 0.6 0.8 0.6 ‐27.6 ‐10.0 ‐7.9 0.3 0.6 ‐1.4 13.3 ‐17.6 ‐28.8 Volatility p.a. (%) 3 Sharpe Ratio4

12 Month Return Worst Drawdown Beta Index (USD) 1Y 5Y Base 1Y 5Y Base Best Worst (%) DUW5 1Y 5Y Index (I) 26.5 14.7 12.9 ‐0.36 0.38 0.50 43.2 ‐27.5 ‐32.8 12 0.74 0.73 Benchmark (B) 28.2 15.7 17.8 0.71 0.90 0.39 77.9 ‐51.0 ‐56.2 62 1.00 1.00

Variation (I) ‐ (B) ‐1.7 ‐0.9 ‐4.9 ‐1.06 ‐0.52 0.11 ‐34.7 23.5 23.4 ‐51 ‐ ‐1 Daily data from December 19, 2007 to January 31, 2021. Index re‐based to 100 on December 19, 2007. Please see the final page for important information about the

presentation of the performance information set forth in this document Source: Solactive AG, Bloomberg, RBC Capital Markets 3 Based on daily returns, annualized with a 252‐day factor 4 Based on the average of daily excess returns against Fed

Funds, annualized with a 252‐day factor 5 Duration Under Water: number of months taken by the Index and the Benchmark to increase back to their respective previous highest level after a market decline Page 1 of 4

January 31, 2021 Allocation History1 (over last 12 months)Allocation Date Large Cap US International Developed Emerging Market Small Cap US Cash Benchmark

Performance *January 13, 2021 50% 25% 15% 10% 0% TBD**December 16, 2020 50% 25% 15% 10% 0% 3.9%November 18, 2020 50% 25% 15% 10% 0% 4.5%October 14, 2020 50% 25% 15% 10% 0% 4.1%September 16, 2020 50% 25% 15% 10% 0% 2.2%August 19, 2020 50% 25% 15%

10% 0% 0.6%July 15, 2020 50% 25% 15% 10% 0% 4.2%June 17, 2020 50% 25% 15% 10% 0% 4.3%May 13, 2020 0% 0% 0% 0% 100% 11.0%April 15, 2020 0% 0% 0% 0% 100% 2.2%March 18, 2020 0% 0% 0% 0% 100% 16.3%February 19, 2020 50% 25% 15% 10% 0% ‐30.4%1

Determination Date was two business days prior to Allocation Date. Target Allocations shown; Current allocations may vary* Benchmark performance between current and next Allocation Date;Current Allocation (as of January 31, 2021)Emerging

Market15.5%InternationalDeveloped24.6%Small Cap US10.4%Large Cap US49.5%Equity Exposure Fed Funds ExposureCharacteristics SnapshotSub‐Index (Indicator) Closing Level Tactical TriggerLarge Cap US (SPY) 378.69 15.8% ABOVE 200 DMAInt’l Developed

(EFA) 74.74 10.5% ABOVE 100 DMAEmerging Market (EEM) 53.97 14.2% ABOVE 100 DMASmall Cap US (IWM) 207.54 22.1% ABOVE 100 DMAAs of Month End (January 31, 2021)Sub‐Index (Indicator) Closing Level Distance from DMALarge Cap US (SPY) 370.07 10.7%Int’l

Developed (EFA) 72.39 5.1%Emerging Market (EEM) 53.31 9.7%Small Cap US (IWM) 205.56 16.0%Date Last NextDetermination January 11, 2021 February 12, 2021Allocation January 13, 2021 February 17, 2021Rebalancing December 16, 2020 December 15,

2021Monthly Returns (%, as of January 31, 2021)Index Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year2021 0.2% 0.2%2020 ‐2.0% ‐7.6% ‐21.9% 0.0% 0.0% ‐0.5% 4.9% 5.9% ‐3.0% ‐1.9% 12.0% 5.0% ‐12.5%2019 0.2% 0.5% 0.5% 3.5% ‐6.2% 5.4% 0.3% ‐3.8%

0.4% 2.5% 2.4% 3.4% 9.0%2018 5.6% ‐4.2% ‐1.9% 0.6% 1.3% 0.0% 2.4% 2.1% 0.1% ‐2.3% 0.2% 0.2% 3.9%2017 2.1% 2.7% 1.3% 1.3% 2.1% 0.8% 2.7% 0.1% 2.1% 2.2% 1.9% 1.4% 22.5%2016 0.0% 0.0% 1.4% 0.3% 1.0% ‐0.4% 3.4% 0.1% 0.9% ‐1.9% 2.0% 1.4% 8.5%2015

‐1.7% 3.7% ‐1.2% 0.9% 0.4% ‐2.1% 1.5% ‐3.5% 0.7% 0.0% 0.0% 0.0% ‐1.2%Benchmark Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year2021 ‐0.5% ‐0.5%2020 ‐1.1% ‐8.1% ‐13.5% 10.7% 4.3% 3.2% 5.3% 6.1% ‐3.2% ‐2.4% 12.3% 4.6% 16.3%2019 7.9% 2.7% 1.3%

3.4% ‐5.9% 6.5% 0.3% ‐2.4% 2.1% 2.7% 2.4% 3.5% 26.6%2018 5.6% ‐4.2% ‐2.2% 1.0% 0.1% ‐0.5% 3.0% 0.8% 0.4% ‐7.5% 1.5% ‐7.0% ‐9.4%2017 2.7% 2.8% 1.2% 1.6% 2.2% 0.5% 2.8% 0.4% 1.9% 2.1% 1.9% 1.6% 24.0%2016 ‐6.0% ‐0.7% 7.4% 1.5% 0.1% ‐0.6% 4.3% 0.3%

0.6% ‐1.7% 0.8% 2.2% 7.9%2015 ‐1.6% 5.6% ‐1.6% 2.9% ‐0.1% ‐2.4% 0.9% ‐6.9% ‐3.6% 7.9% ‐0.8% ‐1.8% ‐2.4%Page 2 of 4

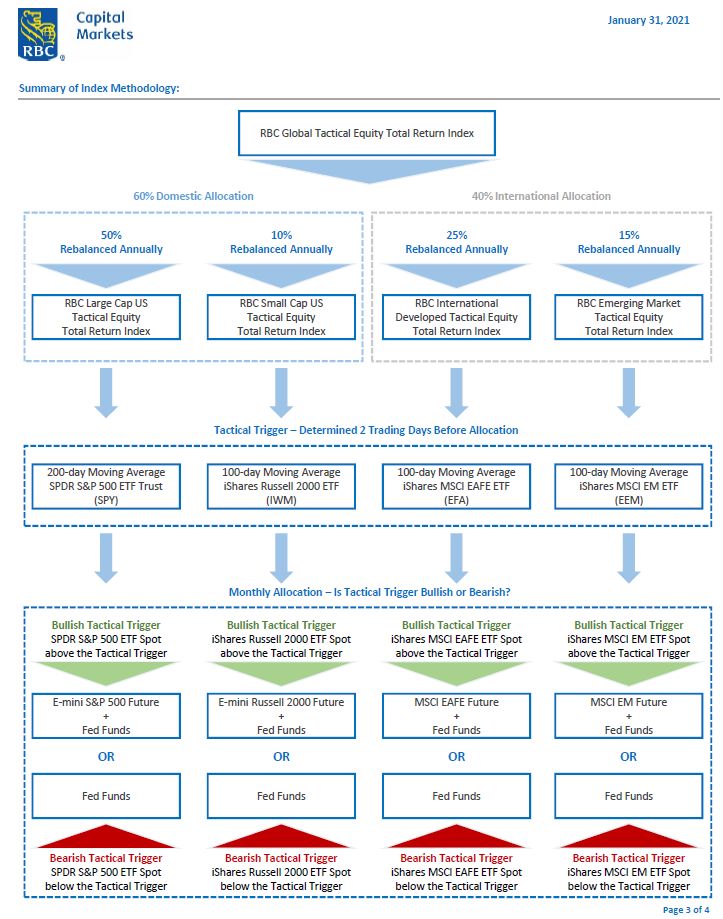

January 31, 2021Summary of Index Methodology:RBC Global Tactical Equity Total Return Index60% Domestic Allocation50%Rebalanced AnnuallyRBC Large Cap

USTactical EquityTotal Return Index10%Rebalanced AnnuallyRBC Small Cap USTactical EquityTotal Return Index40% International Allocation25%Rebalanced AnnuallyRBC InternationalDeveloped Tactical EquityTotal Return Index15%Rebalanced AnnuallyRBC

Emerging MarketTactical EquityTotal Return IndexTactical Trigger – Determined 2 Trading Days Before Allocation200‐day Moving AverageSPDR S&P 500 ETF Trust(SPY)100‐day Moving AverageiShares Russell 2000 ETF(IWM)100‐day Moving AverageiShares

MSCI EAFE ETF(EFA)100‐day Moving AverageiShares MSCI EM ETF(EEM)Monthly Allocation – Is Tactical Trigger Bullish or Bearish?Bullish Tactical TriggerSPDR S&P 500 ETF Spotabove the Tactical TriggerE‐mini S&P 500 Future+Fed FundsORFed

FundsBearish Tactical TriggerSPDR S&P 500 ETF Spotbelow the Tactical TriggerBullish Tactical TriggeriShares Russell 2000 ETF Spotabove the Tactical TriggerE‐mini Russell 2000 Future+Fed FundsORFed FundsBearish Tactical TriggeriShares Russell

2000 ETF Spotbelow the Tactical TriggerBullish Tactical TriggeriShares MSCI EAFE ETF Spotabove the Tactical TriggerMSCI EAFE Future+Fed FundsORFed FundsBearish Tactical TriggeriShares MSCI EAFE ETF Spotbelow the Tactical TriggerBullish Tactical

TriggeriShares MSCI EM ETF Spotabove the Tactical TriggerMSCI EM Future+Fed FundsORBearish Tactical TriggeriShares MSCI EM ETF Spotbelow the Tactical Trigger Page 3 of 4

January 31, 2021This

communication has been generated by employees of RBC Capital Markets’ Global Equity Linked Products, and is not a research report or a product of RBCCapital Markets’ Research Department.This document is for informational purposes only and is

not intended to set forth a final expression of the terms and conditions of any offering, and may beamended, superseded or replaced in its entirety by subsequent summaries. When making an investment decision, any prospective investor should

rely solely on therelevant transaction documentation, which will contain the final terms and conditions of the transaction. The information contained herein has been compiled fromsources believed to be reliable by RBC Capital Markets or any of

its businesses. Neither RBC Capital Markets nor any of its businesses or representatives hasundertaken any independent review or due diligence of such sources. This document shall not constitute a commitment or recommendation to enter into

anytransaction by any RBC entity.All information, terms and pricing set forth herein is indicative and subject to change without notice. Any opinions expressed herein reflect our judgment at the dateand time hereof and are subject to change

without notice. The information contained in this document has been internally developed or taken from trade andstatistical services and other sources which we deem reliable. Transactions of the type described herein may involve a high degree

of risk and the value of suchinvestments may be highly volatile. Such risks may include, without limitation, risk of adverse or unanticipated market developments, risk of issuer default and risk ofilliquidity. In certain transactions,

counterparties may lose their entire investment or incur an unlimited loss.This brief statement does not purport to identify or suggest all the risks (directly or indirectly) and other significant aspects in connection with transactions of

thetype described herein, and investors should ensure that they fully understand the terms of the transaction, including the relevant risk factors and any legal, tax,regulatory or accounting considerations applicable to them, prior to

transacting. No representation is made concerning the legal, tax, regulatory or accountingimplications in any applicable jurisdiction, and we are not advising you in respect of such matters.Accordingly you must independently determine, with

your own advisors, the appropriateness for you of the transaction before transacting. RBC is acting solely in thecapacity of an arm’s length contractual counterparty and not in the capacity of your financial adviser or fiduciary.RBC Capital

Markets is the global brand name for the capital markets business of Royal Bank of Canada and its affiliates, including RBC Capital Markets, LLC (memberFINRA, NYSE and SIPC); RBC Dominion Securities Inc. (member IIROC and CIPF); Royal Bank of

Canada ‐ Sydney Branch (ABN 86 076 940 880); RBC Capital Markets(Hong Kong) Limited (regulated by the Securities and Futures Commission of Hong Kong and the Hong Kong Monetary Authority) and RBC Europe Limited (authorizedby the Prudential

Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority.)Royal Bank of Canada has filed a registration statement (including a prospectus) with the SEC for the offerings to which this document

relates. Before you invest, youshould read those documents and the other documents relating to these offerings that Royal Bank of Canada has filed with the SEC for more complete informationabout us and these offerings. You may obtain these

documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, Royal Bank ofCanada, any agent or any dealer participating in this offering will arrange to send you the prospectus and any related supplements if you so

request by calling tollfreeat 1‐877‐688‐2301.® Registered trademark of Royal Bank of Canada. Used under license. All rights reserved.Important

Information About the Historical Performance of the IndexThe Index was launched on February 18, 2019. Accordingly, all of the information about the performance

of the Index prior to that date is based on hypotheticalback‐tested information.The hypothetical performance of the Index is based on criteria that have been applied retroactively with the benefit of hindsight; these criteria cannot account for

allfinancial risk that may affect the actual performance of the Index in the future. The future performance of the Index may vary significantly from the hypotheticalperformance data in this document. For example, not all of the futures

contracts and ETFs upon which the Index is based existed during all the periods shown;accordingly, we have used other related financial assets for those periods, when needed. In addition, please note that the back‐tested performance of the

Index setforth in this document does not reflect the deduction of any fees and charges that would be applicable to a financial instrument that references the Index.For the full Index methodology, please visit the following link: www.solactive.comPage 4 of 4