Form N-CSR GOLDMAN SACHS MLP & ENER For: Nov 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22979

Goldman Sachs MLP and Energy Renaissance Fund

(Exact name of registrant as specified in charter)

200 West Street,

New York, NY 10282

(Address of principal executive offices) (Zip code)

| Copies to: | ||

| Caroline Kraus, ESQ. |

Stephen H. Bier, ESQ. | |

| Goldman Sachs & Co. LLC |

Allison M. Fumai, ESQ. | |

| 200 West Street |

Dechert LLP | |

| New York, New York 10282 |

1095 Avenue of the Americas | |

| New York, NY 10036-6797 | ||

(Name and address of agents for service)

Registrant’s telephone number, including area code: (212) 902-1000

Date of fiscal year end: November 30

Date of reporting period: November 30, 2020

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| The Annual Report to Shareholders is filed herewith. |

Goldman Sachs Closed End Fund

| Annual Report | November 30, 2020 | |||

| MLP and Energy Renaissance Fund | ||||

Goldman Sachs MLP and Energy Renaissance Fund

| 1 | ||||

| 8 | ||||

| 11 | ||||

| 12 | ||||

| 16 | ||||

| 17 | ||||

| 29 | ||||

| 34 | ||||

| 50 | ||||

| 51 | ||||

| 74 | ||||

| 76 | ||||

| 77 | ||||

| NOT FDIC-INSURED | May Lose Value | No Bank Guarantee | ||

PORTFOLIO RESULTS

Goldman Sachs MLP and Energy Renaissance Fund

Investment Objective and Principal Investment Strategy

The Fund seeks a high level of total return with an emphasis on current distributions to shareholders. The Fund seeks to achieve its investment objective by investing primarily in master limited partnership (“MLP”) and other energy investments. The Fund intends to selectively use leverage to seek to achieve its investment objective. It concentrates its investments in the energy sector, with an emphasis on midstream MLP investments. Under normal market conditions, the Fund will invest at least 80% of its managed assets in MLPs and other energy investments. The Fund’s MLP investments may include, but are not limited to, MLPs structured as limited partnerships (“LPs”) or limited liability companies (“LLCs”); MLPs that are organized as LPs or LLCs, but taxed as “C” corporations; equity securities that represent an indirect interest in an MLP issued by an MLP affiliate, including institutional units and MLP general partner or managing member interests; “C” corporations whose predominant assets are interests in MLPs; MLP equity securities, including MLP common units, MLP subordinated units, MLP convertible subordinated units and MLP preferred units; private investments in public equities issued by MLPs; MLP debt securities; and other U.S. and non-U.S. equity and fixed income securities and derivative instruments that provide exposure to the MLP market, including pooled investment vehicles that primarily hold MLP interests and exchange-traded notes. The Fund’s other energy investments may include equity and fixed income securities of U.S. and non-U.S. companies other than MLPs that (i) are classified by a third party as operating within the oil and gas storage, transportation, refining, marketing, drilling, exploration or production sub-industries or (ii) have at least 50% of their assets, income, sales or profits committed to, or derived from, the exploration, development, production, gathering, transportation (including marine), transmission, terminal operation, processing, storage, refining, distribution, mining or marketing of natural gas, natural gas liquids (including propane), crude oil, refined petroleum products, coal, electricity or other energy sources, energy-related equipment or services.

Portfolio Management Discussion and Analysis

The reorganization of the Goldman Sachs MLP Income Opportunities Fund with and into the Goldman Sachs MLP and Energy Renaissance Fund (the “Fund”) was completed before the opening of trading on the New York Stock Exchange on September 28, 2020. Below, the Goldman Sachs Energy and Infrastructure Team discusses the Fund’s performance and positioning for the 12-month period ended November 30, 2020, including the combined performance and positioning for the period from the completion of the reorganization on September 28, 2020 through November 30, 2020 (the “Reporting Period”).

| Q | How did the Fund perform during the Reporting Period? |

| A | During the Reporting Period, the Fund’s average annual total return based on its net asset value (“NAV”) was -70.48%. The Fund’s average annual total return based on market price was -75.55% for the same period. By way of reference, the Alerian MLP Index1 had an average annual total return of -24.45% during the Reporting Period. By comparison, the Cushing® MLP High Income Index2 had an average annual total return of -20.95% for the Reporting Period. |

| The Fund’s NAV was $4.12 when the Reporting Period began on December 1, 2019. The Fund’s NAV fell alongside COVID-19-related demand destruction and the collapse of talks between the Organization of the Petroleum Exporting Countries (“OPEC”) and Russia, which sparked a producer price war. Because of the decline in the Fund’s share price, the Fund effected a 9-for-1 reverse share split for the Fund’s issued and outstanding common shares effective after the market close on April 13, 2020. The Fund’s common shares began trading on a split-adjusted basis when the market opened on April 14, 2020. In addition, in early March, the use of leverage significantly impaired the Fund’s performance. On March 9th, we decided to |

| 1 | The Alerian MLP Index is the leading gauge of energy infrastructure MLPs. The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return basis (AMZ) and on a total-return basis (AMZX). It is not possible to invest directly in an index. |

| 2 | Source: Cushing® Asset Management. The Cushing® MLP High Income Index tracks the performance of 30 publicly traded energy and shipping MLP securities with an emphasis on current yield. It is not possible to invest directly in an index. |

1

PORTFOLIO RESULTS

| effectively eliminate the Fund’s leverage, as we sought to reduce the Fund’s overall risk profile amid the near-term uncertainty. The costs of terminating the Fund’s fixed-rate borrowings had a materially negative impact on the Fund’s NAV when the leverage was removed. At the end of the Reporting Period, the Fund’s NAV was $9.80, and its market price was $7.69. |

| Q | What was the Fund’s current distribution rate at the end of the Reporting Period? |

| A | During the Reporting Period overall, the Fund declared four quarterly distributions. On February 7, 2020, the Fund declared a quarterly distribution of $0.16 per share, which matches the quarterly distribution declared on November 20, 2019. A second quarterly distribution of $0.155 per share was announced on May 8th, following the 9-for-1 reverse share split mentioned above. That distribution, adjusted for the Fund’s new number of issued and outstanding common shares, represented a distribution cut of 89.2%. We set the Fund’s new distribution at a level we believed would be sustainable over the long term, without the Fund relying on the use of leverage. On August 14, 2020 and again on November 13, 2020, the Fund declared a quarterly distribution of $0.155 per share. As of November 30, 2020, the Fund’s current annualized distribution rate based on its NAV was 6.33%. The Fund’s current annualized distribution rate based on its market price was 8.06% on November 30, 2020. |

| Q | How did energy-related assets overall perform during the Reporting Period? |

| A | Energy-related assets broadly sold off during the Reporting Period. Energy infrastructure master limited partnerships (“MLPs”) generally, as measured by the Alerian MLP Index,3 produced a total return of -24.45%, while higher-yielding energy infrastructure MLPs, as measured by the Cushing® MLP High Income Index,4 generated a total return of -20.95%. The broader midstream5 sector, as measured by the Alerian Midstream Energy Index6 (“ANMA Index”) (which includes both energy MLPs and “C” corporations), generated a total return of -17.82% during the Reporting Period. |

| In December 2019, when the Reporting Period began, the growth outlooks for the U.S. shale industry and the global economy were positive and stable overall. Conditions abruptly changed in early 2020 with the emergence and spread of COVID-19 and the start of a crude oil producer price war, which together created a more challenging and uncertain global environment for the energy markets and energy-related equities. |

| The energy markets experienced unprecedented weakness during the first quarter of 2020, driven by two factors. The first was a demand-side shock, as quarantine efforts and travel restrictions implemented to reduce the spread of COVID-19 led to a sharp drop in demand. The second was a supply-side shock, as OPEC and Russia failed to reach an agreement on production cuts and entered into a crude oil price war, which ultimately added supply to an already oversupplied market. Crude oil prices fell, with the prices of West Texas Intermediate (“WTI”) and Brent crude oil declining approximately 25% and 24%, respectively, on March 9th, the first trading day after the OPEC+ talks collapsed.7 (OPEC+ is composed of OPEC countries and non-OPEC oil producing countries, most notably Russia.) Crude oil prices then continued to trend down fueled by market uncertainty about demand given the global economic impact of COVID-19 as well as by shorter-term concerns around U.S. storage constraints. |

| Energy-related equities sold off during the first quarter of 2020 on investor uncertainty about the ultimate impact on the U.S. shale industry of the simultaneous demand-side and supply-side shocks. We believe the sell-off was exacerbated by selling in the midstream sector, as closed-end funds de-levered to reduce volatility and, in some cases, to maintain compliance with leverage covenants. We estimate more than $3 billion in holdings were sold by closed-end funds during the first 15 trading days of March.8 Midstream equities were also pressured during the first calendar quarter by the |

| 3 | Source: Alerian. The Alerian MLP Index is the leading gauge of energy infrastructure MLPs. The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return basis (AMZ) and on a total-return basis (AMZX). It is not possible to invest directly in an unmanaged index. |

| 4 | Source: Cushing® Asset Management. The Cushing® MLP High Income Index tracks the performance of 30 publicly traded energy and shipping MLP securities with an emphasis on current yield. It is not possible to invest directly in an unmanaged index. |

| 5 | The midstream component of the energy industry is usually defined as those companies providing products or services that help link the supply side (i.e., energy producers) and the demand side (i.e., energy end-users for any type of energy commodity. Such midstream businesses can include, but are not limited those that process, store, market and transport various energy commodities. |

| 6 | Source: Alerian. The Alerian Midstream Energy Index is a broad-based composite of North American energy infrastructure companies. The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return (AMNA), total-return (AMNAX), net total-return (AMNAN), and adjusted net total-return (AMNTR) basis. |

| 7 | Source of crude oil price data: Bloomberg. |

| 8 | Source of sales data: Bloomberg and U.S. Capital Advisors. |

2

PORTFOLIO RESULTS

| magnitude of uncertainty within the equities and energy markets broadly, even though midstream cash flows are predominantly volume based and generally less sensitive to commodity price fluctuations due to contractual agreements, which we believe help manage one-to-one exposure between midstream cash flows and volume declines. Furthermore, in response to severe commodity price weakness during the first calendar quarter, a number of midstream energy companies announced plans to strengthen their balance sheets, with some keeping their distributions flat, some cutting distribution payout levels, and many reducing their expected capital expenditures for 2020. In most cases, these defensive actions were positively received by investors. |

| In April 2020, the energy markets and energy-related equities experienced some relief, as the crude oil price war appeared to reach a resolution. OPEC+ members met, starting on April 9th, and proposed their largest-ever production cut of 9.7 million barrels per day on April 12th.9 Saudi Arabia subsequently deepened its commitment to the production cut, reducing output by an additional 1.0 million barrels per day. Several other countries also announced voluntary production cuts. Despite the April OPEC+ production agreement, significant crude oil oversupply led to logistical issues and storage capacity constraints in the U.S. that same month, resulting in unprecedentedly low WTI crude oil prices and even negative WTI crude oil futures contracts for the first time in history. Midstream equities remained relatively resilient during April, as we believe many investors looked past transient supply-side issues and instead valued equities on longer-dated commodity price expectations. |

| In May 2020, market expectations about the supply-demand gap started to ease, as crude oil demand improved relative to the troughs seen in early April and global supply levels began to react to lower prices in the marketplace. In particular, production cuts from OPEC+ members, as well as market-driven reductions in U.S. production, slowed inventory builds relative to their April levels. Meanwhile, future production activity indicators, such as rig counts and 2020 capital expenditure expectations for exploration and production companies, fell substantially. As a result, the crude oil market started to show signs of tightening in May, enabling prices to rebound off their prior month lows. At the same time, energy-related equities, particularly midstream equities, continued to experience a meaningful recovery from their lows in mid-March. The Alerian MLP Index and the AMNA Index recorded gains of 148% and 107%, respectively, between March 18th and June 8th. They retreated thereafter, dropping 32% and 24%, respectively, from June 9th through the end of October. We believe the drop in midstream equity performance from mid-June through October 2020 was driven largely by weak investor sentiment, not fundamentals. The weakness in sentiment was due to a number of factors, including uncertainty about the then-upcoming U.S. elections, given the seemingly unfavorable oil and gas policy views of Democratic candidates. Midstream equities were also hurt, in our opinion, by environmental, social and governance-related capital allocation headwinds and terminal value10 concerns for oil and gas assets given growing interest in renewable energy. Meanwhile, the fundamental backdrop for energy-related companies improved considerably. First, oil demand picked up steam. We track traffic data across the world, and within the largest cities in Asia and Europe, traffic congestion grew closer to pre-COVID-19 levels. Although the recovery in U.S. traffic congestion was comparatively slower, we also started to see improvement domestically. Second, on the supply side, we witnessed production discipline from OPEC+ countries and U.S. shale producers, which narrowed the supply-demand gap and provided upside support for crude oil prices. Third, many midstream energy companies had significantly reduced their capital expenditures, a welcome and appropriate change, in our view. Finally, even with the dramatic decline in oil demand during the second quarter of 2020, midstream cash flows were rather resilient. If one were to look at a list of the most prominent midstream energy companies, their earnings before interest, taxes, depreciation and amortization (“EBITDA”) were only down an average of approximately 11% year-over-year during the second calendar quarter. During that same quarter, the share prices of these companies fell an average of 44%, demonstrating the disconnect between equity price performance and the sector’s fundamentals, in our view. |

| During November 2020, energy markets and energy-related securities experienced strong rebounds. WTI and Brent crude oil prices rose 27% and 25%, respectively. Energy-related securities rallied, with the Alerian MLP Index and AMNA Index up 24% and 19%, respectively. We believe the strong performance was driven by positive COVID-19 vaccine news, which materially improved the outlook for energy demand, and by resilient earnings of midstream energy companies. Nine of the top 10 U.S. midstream energy companies beat consensus EBITDA expectations for the third calendar quarter |

| 9 | Source of production cut data: OPEC and Bloomberg. |

| 10 | Terminal value is the value of a business or project beyond the forecast period when future cash flows can be estimated. Terminal value assumes a business will grow at a set growth rate forever after the forecast period. |

3

PORTFOLIO RESULTS

| by an average of 7.5%, while also posting healthy distribution coverage ratios11 and strong free cash flow outlooks. Price performance was also bolstered, in our view, by the announcement of share buyback programs, with $2.3 billion authorized in November alone, and continued cost rationalization,12 with consensus expectations for 2021 midstream capital expenditures declining more than 50% relative to the estimates at 2019 year-end, greatly increasing market expectations for free cash flow and capital return to investors. At the same time, the market appeared to view the U.S. election results as relatively benign, given that a Democratic President may be coupled with a potentially Republican Senate, alleviating investors’ worst-case concerns about punitive legislation against the oil and gas sector. Finally, we believe energy-related equities benefited from a growth to value rotation, as promising COVID-19 vaccine news and potential economic reopening led many investors to focus on undervalued businesses. This view is supported, we believe, by the approximately 550 basis point outperformance of the Russell 1000 Value Index13 versus the Russell 1000 Growth Index14 between October 1, 2020 and the end of the Reporting Period. (A basis point is 1/100th of a percentage point.) |

| Q | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | Security selection and severe weakness in the energy markets drove the Fund’s performance during the Reporting Period. |

| In terms of its exposures, the Fund was negatively affected by positions in the gathering and processing and the petroleum pipeline transportation subsectors.15 Both subsectors were hurt by extreme volatility in crude oil prices, which suffered from the global demand destruction associated with efforts to contain COVID-19 and a supply shock stemming from a price war between OPEC and Russia. |

| Additionally, in early to mid-March, weakness in commodity prices and in midstream equity prices caused significant distress for the Fund, which, like other energy-related closed-end funds, has historically employed leverage in an effort to increase total returns. In an up market, leverage can increase total return potential. However, it can extend losses in down markets. During early March, the use of leverage significantly impaired the Fund’s NAV. On March 9th, the first trading day following the collapse of the OPEC+ production curtailment agreement, we decided to effectively eliminate the Fund’s leverage, as we sought to reduce the Fund’s overall risk profile amid the near-term uncertainty. The breakage costs of terminating the Fund’s fixed-rate borrowings had a materially negative impact on the Fund’s NAV when the leverage was removed. As a result, the use of leverage and the subsequent termination of fixed rate borrowings during the Reporting Period detracted from the Fund’s performance. |

| Q | What individual holdings detracted from the Fund’s performance during the Reporting Period? |

| A | Positions in DCP Midstream, LP; Targa Resources Corp. and PBF Logistics LP detracted from the Fund’s returns during the Reporting Period. |

| The Fund’s top detractor was DCP Midstream, LP (DCP), one of the largest natural gas gatherers in North America and a top producer and primary marketer of natural gas liquids. Severe weakness in the energy markets led to a steep decline in DCP’s stock price, which we believe is largely due to the company’s high leverage profile and direct commodity exposure relative to many of its peers. DCP’s management team responded to the sell-off with a 50% distribution cut, a meaningful reduction in 2020 capital expenditures, and an announcement of additional cost savings initiatives in an effort to strengthen the company’s balance sheet. Although DCP’s capital discipline was generally viewed positively, we believe the market remained concerned about the company’s ability to decrease leverage given a reduction in producer activity and weak commodity prices. We sold the Fund’s position in DCP during March 2020 and reallocated the proceeds to companies that we believed had comparatively stronger balance sheets and less commodity price sensitivity. By the end of the Reporting Period, crude oil supply/demand had largely balanced and prices had stabilized, with market |

| 11 | The distribution coverage ratio is an energy company’s distributable cash flow divided by the total amount of distributions it has paid out. It is an indication of an energy company’s ability to maintain its current cash distribution level. |

| 12 | Cost rationalization addresses the sources of costs through the supply chain. |

| 13 | The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® Index companies with lower price-to-book ratios and lower expected growth values. The Russell 1000® Index measures the performance of the large-cap segment of the U.S. equity universe and includes approximately 1000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000® Index represents approximately 92% of the U.S. market. |

| 14 | The Russell 1000® Growth Index is an unmanaged index of common stock prices that measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. |

| 15 | Sector and subsector allocations are defined by GSAM and may differ from sector allocations used by the Alerian MLP Index. |

4

PORTFOLIO RESULTS

| expectations for U.S. total liquids production rising from trough levels. Amid an improving macro environment for the energy market, DCP reported strong second calendar quarter earnings that significantly beat consensus estimates and reaffirmed its management’s original, pre-COVID-19 guidance for the 2020 calendar year. In the week after the positive earnings announcement, average analyst consensus for the company’s 2021 price target increased considerably. Given DCP’s resilient earnings results, its management’s continued commitment to cost controls and the improving macro environment, we re-established the Fund’s position in DCP near the end of October 2020. |

| Another leading detractor from Fund performance was Targa Resources Corp. (TRGP), an independent midstream services provider primarily engaged in gathering, storing, processing and transporting crude oil, natural gas and refined petroleum products. During the Reporting Period, TRGP’s high leverage profile compared to its peers, its concentrated customer base and its commodity price sensitivity drove a sell-off in its stock price, as commodity prices tumbled due to COVID-19-related effects. Over the last two years, TRGP has been implementing a large capital expenditure program, and most market observers expected the company to improve its leverage metrics as projects came online. However, because of the OPEC-Russia price war and falling global demand, the timeline for de-leveraging was extended. Its company management announced plans to reduce its capital expenditure budget and cut its dividend by 89% to shore up the company’s balance sheet. We eliminated the Fund’s position in TRGP during the Reporting Period, as we sought to reduce risk exposure given severe market uncertainty. The proceeds were reallocated to companies with what we considered comparatively stronger balance sheets, less commodity price sensitivity and greater asset diversity. |

| The Fund was also hurt by a position in PBF Logistics LP (PBFX), which owns, leases, operates, develops and acquires crude oil and refined petroleum products, terminals, pipelines and storage facilities. PBFX’s stock price suffered as a result of refined product demand destruction stemming from COVID-19 containment efforts. In addition, PBFX was negatively impacted by investor uncertainty around the company’s affiliate and primary counterparty PBF Energy (PBF), which had exposure to gasoline, diesel and jet fuel amid worsening refining conditions. The PBFX management team took several steps in response to the stock price weakness, including a 42% quarterly distribution cut and reductions in capital expenditures and operating expenses. PBFX also announced it would use its excess cash to decrease leverage and improve its distribution coverage ratio. We trimmed the Fund’s position in PBFX during the Reporting Period to increase exposure to what we believed were higher quality companies with more diverse customer bases and greater trading liquidity. |

| Q | What individual holdings added to the Fund’s performance during the Reporting Period? |

| A | During the Reporting Period, the Fund’s investments in The Williams Companies, Inc., Magellan Midstream Partners, LP and Antero Midstream Corp. contributed positively to performance. |

| The Fund’s top contributor was The Williams Companies, Inc. (WMB), an energy infrastructure company primarily focused on gathering, processing, interstate transportation and storage of natural gas and natural gas liquids. We believe WMB’s favorable asset base, natural gas-focused revenue stream and “C” corporation structure led it to outperform during the severe market stress following the collapse of OPEC+ production cut negotiations. WMB owns one of the most extensive natural gas pipeline systems in the U.S., TransContinental Pipeline (“Transco”), which serves key demand regions along the U.S. eastern seaboard. The market-dictated reductions in U.S. crude oil production and associated gas (a byproduct of oil production) helped to improve natural gas supply-demand dynamics, which was supportive for natural gas prices. The improvement in natural gas prices helped WMB’s gathering and processing segment through the resulting reduction in counterparty credit risk, which had previously weighed on WMB’s equity price performance. In addition, we believe WMB’s better than market expected second quarter earnings results, which were announced in August 2020, and the company’s high quality asset base, which delivered rather steady operating results amid the COVID-19 pandemic, made its stock a somewhat defensive holding amid significant market volatility. The defensive nature of Transco, its resilient earnings and improving natural gas fundamentals helped WMB contribute favorably to the Fund’s performance during the Reporting Period. |

| The Fund’s relative performance was further bolstered during the Reporting Period by its position in Magellan Midstream Partners, LP (MMP), which engages in the transportation, storage and distribution of refined petroleum products and crude oil. MMP performed better than many of its midstream peers due, in our view, to its strong corporate governance, disciplined capital allocation policies, healthy balance sheet and demand-pull business model, which positioned MMP to endure the volatile market conditions. |

5

PORTFOLIO RESULTS

| Another notable contributor during the Reporting Period was Antero Midstream Corp. (AM), a provider of integrated and customized midstream services primarily engaged in gathering and compression, water distribution, fractionation and pipeline safety services. In 2019, persistent natural gas price weakness significantly stressed AM’s parent company, Antero Resources Corp. (AR), whose share price declined approximately 70% during that calendar year. Investor concerns about a potential bankruptcy raised questions about AR and AM’s contracts, putting pressure on AM’s share price. On December 9, 2019, AM announced plans to repurchase $100 million of shares from AR and signed a growth incentive fee program with AR, which encourages greater use of AM’s assets in exchange for volume-based discounts. AM’s equity price rallied on the announcement, as the agreement eased investor concerns around the potential restructuring of AR’s fees with AM. After the stock appreciated, we took advantage of the strength to sell the Fund’s position in AM given ongoing weakness in natural gas prices and based on our belief that AR continued to face bankruptcy risk. |

| Q | Were there any notable purchases or sales during the Reporting Period? |

| A | Among notable purchases during the Reporting Period were WMB and MMP, each mentioned previously. We established both positions in an effort to increase the Fund’s exposure to high quality midstream energy companies during a period of severe market uncertainty driven by COVID-19. In our view, WMB and MMP have premier asset exposure and strong balance sheets relative to their peers. |

| In addition, during the Reporting Period, the Fund established a position in Rice Acquisition Corp. (RICE/U), a special-purpose acquisition company (SPAC), through an initial public offering. A SPAC raises capital through an initial public offering for the purpose of acquiring an existing company and driving shareholder value through strategic management and operational expertise. We decided to allocate capital to RICE/U as we are confident in its management team, members of which previously served as executive officers of Rice Energy Inc. and Rice Midstream Partners LP. In our opinion, they are well equipped to deliver upon their objective of producing attractive and sustainable risk-adjusted returns through the development of the world’s clean energy supply, a theme we believe will become more prominent in the global energy mix over the next several decades. |

| As noted earlier, we eliminated the Fund’s investment in TRGP, as we sought to reduce portfolio risk. We replaced this holding with positions in companies that we felt had comparatively stronger balance sheets and less commodity price sensitivity. |

| In addition, we sold the Fund’s position in Genesis Energy, LP (GEL), a midstream MLP that provides energy infrastructure and logistics services. A significant portion of GEL’s cash flow comes from its soda ash segment, and soda ash demand was negatively impacted by the spread of COVID-19. Additionally, cash flows from soda ash can have greater variability than those from more traditional midstream business segments because of the length and nature of soda ash contracts. Because of uncertainty around the performance of GEL’s soda ash segment, COVID-19-related impacts to its more traditional midstream segments and the company’s relatively high level of leverage, we decided to exit the Fund’s position in its stock. |

| Q | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | During the Reporting Period, the Fund did not use derivatives or similar instruments. |

| Q | How did the Fund use leverage during the Reporting Period? |

| A | At the beginning of the Reporting Period, the Fund obtained leverage through a fixed/floating rate margin loan facility with a major financial institution. During December 2019, we reduced the Fund’s leverage from approximately 38% of its managed assets to approximately 35% by the end of the 2019 calendar year. We continued reducing the Fund’s leverage during the first two months of 2020, as market uncertainties around COVID-19 started to take shape. That said, the Fund held leverage representing approximately 25% of its managed assets heading into the March OPEC+ meeting. After the agreement to curtail production collapsed at the meeting, we decided to terminate the Fund’s leverage, as we sought to reduce the Fund’s overall risk profile amid near-term uncertainty created by COVID-19-related demand destruction and the start of a producer price war between OPEC nations and Russia. The breakage costs of terminating the Fund’s fixed rate borrowings had a materially negative impact on the Fund’s NAV when the leverage was removed on March 9, 2020. As a result, the use of leverage and its subsequent termination detracted from the Fund’s performance during the Reporting Period overall. General market conditions had improved by the end of the Reporting Period, with some clarity around a COVID-19 vaccine and a better line of sight |

6

PORTFOLIO RESULTS

| into 2021 cash flows for the companies held by the Fund. As a result, we may consider adding leverage back into the Fund as we look into 2021. However, we anticipate that any such leverage strategy, if implemented, would likely be conservative relative to the Fund’s historic levels of leverage and would generally be used to seek higher price returns, not to pay higher than market yields. |

| On January 4, 2021, after the end of the Reporting Period, the Fund used its fixed/floating rate margin loan facility with a major financial institution, to introduce a modest level of leverage back into the Fund, representing 2.85% of the Fund’s managed assets. There can be no assurances that the Fund will be able to obtain or maintain a specific level of leverage, that the terms under which the Fund borrows will not change, or that the Fund’s use of leverage will be profitable. The future leverage of the Fund may be higher or lower than the levels discussed above. |

| The Fund is permitted to obtain leverage using any form or combination of financial leverage instruments, including through funds borrowed from banks or other financial institutions (i.e., a credit facility), margin facilities or notes issued by the Fund and the leverage attributable to similar transactions entered into by the Fund, and it reserves the right to obtain leverage to the extent permitted by the Investment Company Act of 1940. |

| Q | What is the Fund’s tactical view and strategy for the months ahead? |

| A | At the end of the Reporting Period, we had a positive outlook for the energy markets and energy-related equities in 2021. Taking a macro perspective, we noted that crude oil demand had improved toward the end of the Reporting Period, not only internationally, but also in the U.S., and we believed the COVID-19 vaccine would only accelerate this trend. Additionally, in our view, U.S. producers were demonstrating unprecedented supply-side discipline, and OPEC+ members were showing solidarity. Assuming global production remained disciplined and demand increased on the back of rapid testing and a vaccine, Goldman Sachs Global Investment Research was forecasting at the end of the Reporting Period that Brent crude oil prices would hit $63 per barrel in 2021. Furthermore, a decline in U.S.-based upstream16 drilling activity seemed to have reduced the need for more pipeline projects, which led many midstream energy companies to shift their focus from new project spending to debt reduction and possible share buyback programs during the Reporting Period. Coupled with lower distribution payouts, this should result in strong free cash flow into 2021, in our view. We thought the shift in capital allocation was long overdue, and more free cash flow-centric business models may well be a key factor for the long-term sustainability of the midstream energy sector. In our opinion, the sector’s free cash flow potential has also created a significant opportunity for share repurchase programs, which we believe could be a meaningful catalyst for a recovery in equity prices, given the depressed valuations at the end of the Reporting Period. |

| Looking ahead to 2021, we believe the midstream energy sector has the potential to generate $35-$45 billion of excess cash after distributions and capital expenditures, which amounts to nearly 15% of the market capitalization of midstream energy companies generating positive free cash flow at the end of the Reporting Period. To put this in context, Wells Fargo said it expects the midstream energy sector to generate nearly $7 billion of excess cash in 2021 alone17. If just 50% of that excess cash is used for share buyback programs, it would reverse almost all of the investment outflows experienced from January 2020 through the end of the Reporting Period. We have seen several billion dollars of share buyback authorizations from midstream companies during 2020 year to date through November 2020, and we anticipate more buyback programs may be announced in coming calendar quarters. In our opinion, these programs should be accretive to shareholder value and may also be a strong technical tailwind for midstream equity prices. |

| At the end of the Reporting Period, we believed the risk-reward profile of midstream equities had grown increasingly positive. In managing the Fund, we intended to remain focused on companies we deemed to be of high quality, with strong dividend and distribution coverage ratios, healthy balance sheets and robust free cash flow outlooks. At the end of the Reporting Period, we believed the Fund was well positioned to benefit from the rebound in midstream equity prices we expect to see in 2021. |

| 16 | The upstream component of the energy industry is usually defined as those operations stages in the oil and gas industry that involve exploration and production. Upstream operations deal primarily with the exploration stages of the oil and gas industry, with upstream firms taking the first steps to first locate, test and drill for oil and gas. Later, once reserves are proven, upstream firms will extract any oil and gas from the reserve. |

| 17 | Source of midstream energy sector data: Wells Fargo. |

7

Goldman Sachs MLP and Energy Renaissance Fund

as of November 30, 2020

| FUND SNAPSHOT |

| |||||

| As of November 30, 2020 | ||||||

| Net Asset Value (NAV)1 | $ | 9.80 | ||||

| Market Price1 | $ | 7.69 | ||||

| Premium (Discount) to NAV2 | -21.53 | % | ||||

| Leverage3 | 0.00 | % | ||||

| Distribution Rate – NAV4 | 6.33 | % | ||||

| Distribution Rate – Market Price4 | 8.06 | % | ||||

| 1 | The Market Price is the price at which the Fund’s common shares are trading on the NYSE. The Market Price of the Fund’s common shares will fluctuate and, at the time of sale, common shares may be worth more or less than the original investment or the Fund’s then current net asset value (“NAV”). The NAV is the market value of one share of the Fund. This amount is derived by dividing the total value of all the securities in the Fund’s portfolio, plus any other assets, less any liabilities, by the number of Fund shares outstanding. The Fund cannot predict whether its common shares will trade at, above or below NAV. Shares of closed-end investment companies frequently trade at a discount from their NAV, which may increase investors’ risk of loss. |

| 2 | The premium/discount to NAV is calculated as the market price divided by the NAV of the Fund minus 1, expressed as a percentage. If this value is positive, the Fund is trading at a premium to its NAV. If the value is negative, the Fund is trading at a discount to its NAV. |

| 3 | The Fund is permitted to obtain leverage using any form or combination of financial leverage instruments, including through funds borrowed from banks or other financial institutions (i.e., a credit facility), margin facilities or notes issued by the Fund and the leverage attributable to similar transactions entered into by the Fund. The Fund’s use of leverage through a credit facility is calculated as a percentage of the Fund’s Managed Assets. Managed Assets are defined as total assets of the Fund (including assets attributable to borrowings for investment purposes) minus the sum of the Fund’s accrued liabilities (other than liabilities representing borrowings for investment purposes). |

| 4 | The Distribution Rate is calculated by annualizing the most recent distribution amount declared divided by the most recent closing Market Price or NAV. The Distribution Rate is subject to change and is not an indication of Fund performance. A portion of the Fund’s distributions will likely be treated for tax purposes as a return of capital. A return of capital is not taxable and results in a reduction in the tax basis of a shareholder’s investment. The final determination regarding the nature of the distributions will be made after the end of the Fund’s fiscal year when the Fund can determine its earnings and profits. The final tax status of the distribution may vary substantially and will be made available to shareholders after the close of each calendar year. The proportion of distributions that are treated as taxable distributions may also vary and/or increase in future years. The ultimate composition of these distributions may vary due to a variety of factors including projected income and expenses, depreciation and depletion, and any tax elections made by the underlying MLP investments. |

| PERFORMANCE REVIEW |

| |||||||||

| December 1, 2019–November 30, 2020 | Fund Total Return (based on NAV)5 |

Fund Total Return (based on Market Price)5 |

||||||||

| Common Shares | -70.48 | % | -75.55 | % | ||||||

| 5 | Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of each period reported. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. The Total Returns based on NAV and Market Price do not reflect brokerage commissions or sales charges in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. The NAV used in the Total Return calculation includes all management fees, interest expense (if any) and operating expenses incurred by the Fund. Operating expenses include custody, accounting and administrative services, professional fees, transfer agency fees, registration, printing and mailing costs and Trustee fees. Total returns for periods less than one full year are not annualized. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment returns and principal value will fluctuate. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com/CEF to obtain the most recent month-end returns. Closed-end funds, unlike open-end funds, are not continuously offered. Once issued in a public offering, shares of closed-end funds are traded in the open market through a stock exchange.

8

FUND BASICS

| TOP TEN HOLDINGS AS OF 11/30/20‡ | ||||||||

| Holding | % of Net Assets | Line of Business | ||||||

| MPLX LP | 11.8 | % | Gathering + Processing | |||||

| Enterprise Products Partners LP | 11.0 | Pipeline Transportation | Natural Gas | ||||||

| Magellan Midstream Partners LP | 10.8 | Pipeline Transportation | Petroleum | ||||||

| Plains All American Pipeline LP | 7.3 | Pipeline Transportation | Petroleum | ||||||

| Energy Transfer LP | 6.1 | Pipeline Transportation | Natural Gas | ||||||

| Phillips 66 Partners LP | 4.1 | Pipeline Transportation | Petroleum | ||||||

| The Williams Cos., Inc. | 3.7 | Gathering + Processing | ||||||

| Pembina Pipeline Corp. | 3.6 | Pipeline Transportation | Petroleum | ||||||

| Sunoco LP | 3.0 | Marketing | Wholesale | ||||||

| Atlantica Sustainable Infrastructure PLC | 2.8 | Power Generation | ||||||

| ‡ | The top 10 holdings may not be representative of the Fund’s future investments. |

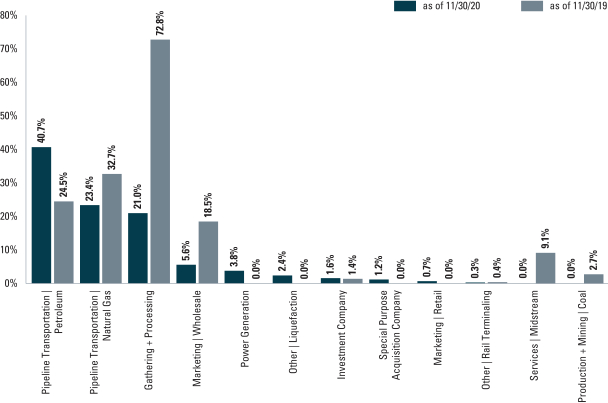

| FUND SECTOR ALLOCATIONS† |

| † | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of total net assets. As a result of borrowings, the percentages may add to an amount in excess of 100%. Sector allocations are defined by GSAM and may differ from sector allocations used by the Alerian MLP Index. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

9

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Performance Summary

November 30, 2020

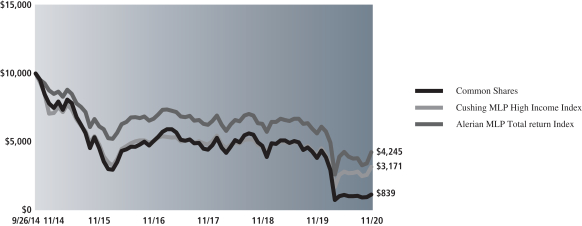

The following graph shows the market price performance of a $10,000 investment in Fund shares for the period from September 26, 2014 (commencement of operations) through November 30, 2020. The performance calculation assumes the purchase of Fund shares at the offering price at the beginning of the period and the sale of Fund shares at the market price at the end of the period. For comparative purposes, the performance of the Fund’s benchmark indexes, the Cushing MLP High Income Index and the Alerian MLP Total Return Index, are shown. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. The performance does not reflect brokerage commissions in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. The returns set forth below represent past performance. Past performance does not guarantee future results. The market price of Fund shares value will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted below. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns.

| MLP and Energy Renaissance Fund’s Lifetime Performance |

Market price performance of a $10,000 investment, with distributions reinvested, from September 26, 2014 through November 30, 2020.

| Average Annual Total Return through November 30, 2020* | One Year | Five Years | Since Inception | |||||||

| Common Shares (Commenced September 26, 2014) |

-75.55% | -27.87% | -32.42% | |||||||

|

| ||||||||||

| * | Total returns are calculated assuming purchase of a share at the market price on the first day and sale of a share at the market price on the last day of each period reported. The total returns assume the reinvestment of dividends and do not reflect brokerage commissions in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. |

10

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

November 30, 2020

| Shares |

Description | Value | ||||||

| Common Stocks – 97.9% | ||||||||

| Gathering + Processing – 21.0% | ||||||||

| 238,302 | Crestwood Equity Partners LP | $ | 3,886,706 | |||||

| 104,090 | DCP Midstream LP | 1,681,054 | ||||||

| 944,036 | MPLX LP | 19,862,517 | ||||||

| 295,644 | The Williams Cos., Inc. | 6,202,611 | ||||||

| 289,349 | Western Midstream Partners LP | 3,732,602 | ||||||

|

|

|

|||||||

| 35,365,490 | ||||||||

|

|

|

|||||||

| Marketing | Retail – 0.7% | ||||||||

| 78,881 | Suburban Propane Partners LP | 1,208,457 | ||||||

|

|

|

|||||||

| Marketing | Wholesale – 5.6% | ||||||||

| 261,770 | CrossAmerica Partners LP | 4,486,738 | ||||||

| 180,447 | Sunoco LP | 5,014,622 | ||||||

|

|

|

|||||||

| 9,501,360 | ||||||||

|

|

|

|||||||

| Other | Liquefaction – 2.4% | ||||||||

| 106,155 | Cheniere Energy Partners LP | 4,044,505 | ||||||

|

|

|

|||||||

| Other | Rail Terminaling – 0.3% | ||||||||

| 150,406 | USD Partners LP | 556,502 | ||||||

|

|

|

|||||||

| Pipeline Transportation | Natural Gas – 23.4% | ||||||||

| 1,668,240 | Energy Transfer LP | 10,309,723 | ||||||

| 953,031 | Enterprise Products Partners LP | 18,488,802 | ||||||

| 332,495 | Equitrans Midstream Corp. | 2,713,159 | ||||||

| 81,040 | TC Energy Corp. | 3,560,087 | ||||||

| 142,737 | TC PipeLines LP | 4,410,573 | ||||||

|

|

|

|||||||

| 39,482,344 | ||||||||

|

|

|

|||||||

| Pipeline Transportation | Petroleum – 40.7% | ||||||||

| 311,318 | BP Midstream Partners LP | 3,530,346 | ||||||

| 116,116 | Delek Logistics Partners LP | 3,515,992 | ||||||

| 122,815 | Enbridge, Inc. | 3,833,056 | ||||||

| 243,626 | Holly Energy Partners LP | 3,298,696 | ||||||

| 443,799 | Magellan Midstream Partners LP | 18,262,329 | ||||||

| 290,330 | NuStar Energy LP | 3,858,486 | ||||||

| 402,865 | PBF Logistics LP | 3,758,730 | ||||||

| 240,640 | Pembina Pipeline Corp. | 6,133,914 | ||||||

| 256,752 | Phillips 66 Partners LP | 6,901,494 | ||||||

| 1,546,223 | Plains All American Pipeline LP | 12,277,011 | ||||||

| 318,542 | Shell Midstream Partners LP | 3,268,241 | ||||||

|

|

|

|||||||

| 68,638,295 | ||||||||

|

|

|

|||||||

| Power Generation – 3.8% | ||||||||

| 136,332 | Atlantica Sustainable Infrastructure PLC | 4,688,458 | ||||||

| 15,140 | Brookfield Renewable Partner LP | 962,601 | ||||||

| 13,283 | NextEra Energy Partners LP | 843,072 | ||||||

|

|

|

|||||||

| 6,494,131 | ||||||||

|

|

|

|||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $163,875,434) | $ | 165,291,084 | ||||||

|

|

|

|||||||

| Units | Description | Value | ||||||

| Special Purpose Acquisition Company*(a) – 1.2% | ||||||||

| 195,116 | Rice Acquisition Corp. | $ | 2,021,402 | |||||

| (Cost 1,951,160) | ||||||||

|

|

|

|||||||

| Shares | Dividend Rate |

Value | ||||||

| Investment Company(b) – 1.6% | ||||||||

| |

Goldman Sachs Financial Square Government Fund

– |

| ||||||

| 2,597,513 | 0.016% | $ | 2,597,513 | |||||

| (Cost $2,597,513) | ||||||||

|

|

|

|||||||

| TOTAL INVESTMENTS – 100.7% | ||||||||

| (Cost $168,424,107) | $ | 169,909,999 | ||||||

|

|

|

|||||||

| |

LIABILITIES IN EXCESS OF OTHER ASSETS – (0.7)% |

(1,116,769 | ) | |||||

|

|

|

|||||||

| NET ASSETS – 100.0% | $ | 168,793,230 | ||||||

|

|

|

|||||||

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. | ||

| * |

Non-income producing security. | |

| (a) |

Units consist of 1 share of common stock and 1/2 warrant. | |

| (b) |

Represents an affiliated issuer. | |

|

| ||

| Investment Abbreviations: | ||

| LP |

—Limited Partnership | |

| PLC |

—Public Limited Company | |

|

| ||

| The accompanying notes are an integral part of these financial statements. | 11 |

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Statement of Assets and Liabilities

November 30, 2020

|

|

||||||

| Assets: |

| |||||

| Investments of unaffiliated issuers, at value (cost $165,826,594) |

$ | 167,312,486 | ||||

| Investments of affiliated issuers, at value (cost $2,597,513) |

2,597,513 | |||||

| Receivables: |

||||||

| Current taxes |

1,109,284 | |||||

| Dividends |

170,886 | |||||

| Prepaid state and local franchise taxes |

7,271 | |||||

| Other assets |

40,946 | |||||

| Total assets | 171,238,386 | |||||

| Liabilities: |

| |||||

| Due to custodian/over-draft |

1,454,497 | |||||

| Payables: |

||||||

| Professional fees |

437,301 | |||||

| Management fees |

132,091 | |||||

| Interest on borrowing |

30,695 | |||||

| Distributions payable |

10,881 | |||||

| Accrued expenses |

379,691 | |||||

| Total liabilities | 2,445,156 | |||||

| Net Assets: |

| |||||

| Paid-in capital |

1,282,954,223 | |||||

| Total distributable earnings (loss) |

(1,114,160,993 | ) | ||||

| NET ASSETS | $ | 168,793,230 | ||||

| Shares Outstanding $0.001 par value (unlimited shares authorized): |

17,219,530 | |||||

| Net asset value per share: |

$9.80 | |||||

| 12 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Statement of Operations

For the Fiscal Year Ended November 30, 2020

|

|

||||||

| Investment income: |

| |||||

| Dividends — unaffiliated issuers (net of foreign withholding taxes of $83,628) |

$ | 24,026,348 | ||||

| Dividends — affiliated issuers |

22,672 | |||||

| Less: Return of Capital on Dividends |

(23,074,008 | ) | ||||

| Interest |

5,105 | |||||

| Total investment income | 980,117 | |||||

| Expenses: |

| |||||

| Interest on borrowings |

39,212,707 | |||||

| Management fees |

2,295,285 | |||||

| Professional fees |

454,672 | |||||

| Franchise tax expense |

448,931 | |||||

| Trustee fees |

160,412 | |||||

| Custody, accounting and administrative services |

67,553 | |||||

| Printing and mailing costs |

49,339 | |||||

| Transfer agency fees |

17,550 | |||||

| Other |

116,051 | |||||

| Total operating expenses, before income taxes | 42,822,500 | |||||

| Less — expense reductions |

(3,280 | ) | ||||

| Net operating expenses, before income taxes | 42,819,220 | |||||

| NET INVESTMENT LOSS, BEFORE INCOME TAXES | (41,839,103 | ) | ||||

| Current and deferred tax benefit | 2,363 | |||||

| NET INVESTMENT LOSS, NET OF TAXES | (41,836,740 | ) | ||||

| Realized and unrealized gain (loss): |

| |||||

| Net realized gain (loss) from: |

||||||

| Investments — unaffiliated issuers |

(302,758,403 | ) | ||||

| Foreign currency transactions |

(192 | ) | ||||

| Current and deferred tax benefit |

17,097 | |||||

| Net change in unrealized gain on: |

||||||

| Investments — unaffiliated issuers |

135,183,820 | |||||

| Foreign currency translation |

960 | |||||

| Deferred tax expense |

(7,634 | ) | ||||

| Net realized and unrealized loss, net of taxes | (167,564,352 | ) | ||||

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | (209,401,092 | ) | |||

| The accompanying notes are an integral part of these financial statements. | 13 |

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Statements of Changes in Net Assets

| For the Fiscal Year Ended November 30, 2020 |

For the Fiscal Year Ended November 30, 2019 |

|||||||||

| From operations: |

| |||||||||

| Net investment loss, net of taxes |

$ | (41,836,740 | ) | $ | (9,211,177 | ) | ||||

| Net realized loss, net of taxes |

(302,741,498 | ) | (34,111,776 | ) | ||||||

| Net change in unrealized gain (loss), net of taxes |

135,177,146 | (39,067,627 | ) | |||||||

| Net decrease in net assets resulting from operations | (209,401,092 | ) | (82,390,580 | ) | ||||||

| Distributions to shareholders: |

| |||||||||

| From distributable earnings |

— | (1,370,834 | ) | |||||||

| From return of capital |

(18,131,005 | ) | (49,493,089 | ) | ||||||

| Total distributions to shareholders | (18,131,005 | ) | (50,863,923 | ) | ||||||

| From share transactions: |

| |||||||||

| Proceeds received in connection with reorganization |

67,864,483 | — | ||||||||

| Increase from reinvestment of distributions |

777,286 | — | ||||||||

| Net increase in net assets resulting from share transactions | 68,641,769 | — | ||||||||

| TOTAL DECREASE | (158,890,328 | ) | (133,254,503 | ) | ||||||

| Net assets: |

| |||||||||

| Beginning of year |

327,683,558 | 460,938,061 | ||||||||

| End of year |

$ | 168,793,230 | $ | 327,683,558 | ||||||

| 14 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Statement of Cash Flows

For the Fiscal Year Ended November 30, 2020

|

|

||||||

| Increase/(Decrease) in cash – Cash flows provided by operating activities: |

| |||||

| Net decrease in net assets from operations |

$ | (209,401,092 | ) | |||

| Adjustments to reconcile net decrease in net assets from operations to net cash provided by/(used in) operating activities: |

||||||

| Payments for purchases of investments |

(135,127,172 | ) | ||||

| Proceeds from sales of investment securities |

370,893,771 | |||||

| Corporate actions purchases and sales, net |

690,642 | |||||

| Sales of short term investments, net |

2,145,574 | |||||

| Return of capital on dividends |

23,074,008 | |||||

| (Increase) Decrease in Assets: |

||||||

| Receivable for investments sold |

2,121,969 | |||||

| Receivable for dividends |

(86,436 | ) | ||||

| Receivable for current taxes |

(898,356 | ) | ||||

| Prepaid state and local franchise taxes |

140,321 | |||||

| Other assets |

(39,606 | ) | ||||

| Increase (Decrease) in Liabilities: |

||||||

| Payable for investments purchased |

(4,257,985 | ) | ||||

| Management fees payable |

(401,103 | ) | ||||

| Interest on borrowings payable |

(1,239,227 | ) | ||||

| Payable for deferred tax, net |

(9,889 | ) | ||||

| Professional fees payable |

110,002 | |||||

| Accrued expenses |

(704,197 | ) | ||||

| Net realized gain (loss) on: |

||||||

| Investments |

302,758,403 | |||||

| Net change in unrealized gain (loss) on: |

||||||

| Investments |

(135,183,820 | ) | ||||

| Net cash provided by operating activities | 214,585,807 | |||||

| Cash flows used in financing activities: |

| |||||

| Repayment of borrowing facility |

(202,500,000 | ) | ||||

| Cash received in connection with tax-free reorganization(a) |

82,854 | |||||

| Cash distributions paid |

(18,181,540 | ) | ||||

| Net cash used in financing activities | (220,598,686 | ) | ||||

| NET DECREASE IN CASH | $ | (6,012,879 | ) | |||

| Cash: |

| |||||

| Beginning of year |

4,558,382 | |||||

| End of year |

$ | (1,454,497 | ) | |||

| Supplemental disclosure: |

| |||||

| Cash paid for interest on borrowings and related fees |

$ | 40,451,934 | ||||

| Cash paid for income taxes |

(898,356 | ) | ||||

| Reinvestment of distributions |

777,286 | |||||

| (a) | After the close of business on September 25, 2020, net assets of $67,864,483 were acquired in connection with the tax-free reorganization, including $82,854 in cash, $235,982 in other assets and $430,244 of assumed liabilities. |

| The accompanying notes are an integral part of these financial statements. | 15 |

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Selected Share Data for a Share Outstanding Throughout Each Year

| Goldman Sachs MLP and Energy Renaissance Fund | ||||||||||||||||||||||

| Year Ended November 30, | ||||||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||||

| Per Share Data* |

| |||||||||||||||||||||

| Net asset value, beginning of year |

$ | 37.08 | $ | 52.20 | $ | 54.45 | $ | 68.04 | $ | 67.05 | ||||||||||||

| Net investment loss(a) |

(4.06 | ) | (1.08 | ) | (1.35 | ) | (1.89 | ) | (1.17 | ) | ||||||||||||

| Net realized and unrealized gain (loss) |

(21.31 | ) | (8.28 | ) | 4.86 | (5.94 | ) | 7.92 | ||||||||||||||

| Total from investment operations |

(25.37 | ) | (9.36 | ) | 3.51 | (7.83 | ) | 6.75 | ||||||||||||||

| Distributions to shareholders from net investment income |

— | (0.18 | ) | (3.87 | ) | (3.15 | ) | — | ||||||||||||||

| Distributions to shareholders from return of capital |

(1.91 | ) | (5.58 | ) | (1.89 | ) | (2.61 | ) | (5.76 | ) | ||||||||||||

| Total distributions |

(1.91 | ) | (5.76 | ) | (5.76 | ) | (5.76 | ) | (5.76 | ) | ||||||||||||

| Net asset value, end of year |

9.80 | 37.08 | 52.20 | 54.45 | 68.04 | |||||||||||||||||

| Market price, end of year |

$ | 7.69 | $ | 35.28 | $ | 47.79 | $ | 51.03 | $ | 63.81 | ||||||||||||

| Total return based on net asset value(b) | (70.47 | )% | (18.85 | )% | 6.31 | % | (12.32 | )% | 12.13 | % | ||||||||||||

| Total return based on market price(b) | (75.64 | )% | (15.66 | )% | 3.86 | % | (12.38 | )% | 4.20 | % | ||||||||||||

| Net assets, end of year (in 000s) |

$ | 168,793 | $ | 327,684 | $ | 460,938 | $ | 479,443 | $ | 597,558 | ||||||||||||

| Ratio of net expenses to average net assets after interest expense and tax benefit/(expenses)(c) |

26.26 | % | 2.78 | % | 3.46 | % | 2.79 | % | 3.29 | % | ||||||||||||

| Ratio of net expenses to average net assets after interest expense and before tax benefit/(expenses) |

26.27 | % | 3.48 | % | 2.88 | % | 3.03 | % | 3.01 | % | ||||||||||||

| Ratio of total expenses to average net assets before interest expense and tax benefit/(expenses) |

2.21 | % | 1.77 | % | 1.65 | % | 1.68 | % | 1.75 | % | ||||||||||||

| Ratio of net investment loss to average net assets(d) |

(25.67 | )% | (2.09 | )% | (2.28 | )% | (2.78 | )% | (2.01 | )% | ||||||||||||

| Portfolio turnover rate(e) |

61 | % | 69 | % | 61 | % | 31 | % | 64 | % | ||||||||||||

| Asset coverage, end of period per $1,000(f) |

$ | — | $ | 2,618 | $ | 2,983 | $ | 2,998 | $ | 3,339 | ||||||||||||

| * | On April 13, 2020, the Fund effected a 9-for-1 reverse share split. All per share data prior to April 13, 2020 has been adjusted to reflect the reverse share split. |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of the period reported. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total return does not reflect brokerage commissions or sales charges in connection with the purchase or sale of Fund shares. |

| (c) | Current and deferred tax expense/benefit for the ratio calculation is derived from the net investment income (loss), and realized and unrealized gains (losses). |

| (d) | Current and deferred tax expense/benefit for the ratio calculation is derived from the net investment income (loss) only. |

| (e) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments. If such transactions were included, the Fund’s portfolio turnover rate may be higher. On September 25, 2020, Goldman Sachs MLP and Energy Renaissance Fund acquired all of the net assets of Goldman Sachs MLP Income Opportunities Fund pursuant to an Agreement and Plan of Reorganization. Portfolio turnover excludes purchases and sales of securities by Goldman Sachs MLP Income Opportunities Fund (acquired fund) prior to the reorganization date. |

| (f) | Calculated by dividing the Fund’s Managed Assets by the amount of borrowings outstanding under the credit facility at period end. As of November 30, 2020 the Fund had no borrowings under the credit facility. |

| 16 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

November 30, 2020

| 1. ORGANIZATION |

The Goldman Sachs MLP and Energy Renaissance Fund (the “Fund”) is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”) and the Securities Act of 1933, as amended (the “1933 Act”). The Fund was organized as a Delaware statutory trust on July 7, 2014. The shares of the Fund are listed on the New York Stock Exchange (“NYSE”) and trade under the symbol “GER”.

Goldman Sachs Asset Management, L.P. (“GSAM”), an affiliate of Goldman Sachs & Co. LLC, serves as investment adviser to the Fund pursuant to a management agreement (the “Agreement”) with the Fund.

On April 13, 2020, the Goldman Sachs MLP and Energy Renaissance Fund had a 9-for-1 reverse share split, effective after the market close on April 13, 2020. The share split had no impact on the overall value of a shareholder’s investment in the Fund.

Pursuant to an Agreement and Plan of Reorganization (the “Reorganization Agreement”) approved by the Fund’s Board of Trustees and shareholders of the Goldman Sachs MLP Income Opportunities Fund (the “Acquired Fund”), all of the assets and liabilities of the Acquired Fund were transferred to the Goldman Sachs MLP and Energy Renaissance Fund (“Survivor Fund”) as of the close of business on September 25, 2020 (the “Reorganization”). Shareholders of the Fund also approved the issuance of additional common shares in connection with the Reorganization. As part of the Reorganization, holders of the Acquired Fund’s shares received shares of the Fund in an amount equal to the aggregate net asset value of their investment in the Acquired Fund. The Reorganization was a tax-free event to shareholders.

| 2. SIGNIFICANT ACCOUNTING POLICIES |

The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and require management to make estimates and assumptions that may affect the reported amounts and disclosures. Actual results may differ from those estimates and assumptions. The Fund is an investment company under GAAP and follows the accounting and reporting guidance applicable to investment companies.

A. Investment Valuation — The Fund’s valuation policy is to value investments at fair value.

B. Investment Income and Investments — Investment income includes interest income, dividend income, net of any foreign withholding taxes and less any amounts reclaimable. Interest income is accrued daily and adjusted for amortization of premiums and accretion of discounts. Dividend income is recognized on ex-dividend date or, for certain foreign securities, as soon as such information is obtained subsequent to the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Investment transactions are reflected on trade date. Realized gains and losses are calculated using identified cost. Investment transactions are recorded on the following business day for daily net asset value (“NAV”) calculations. Distributions from master limited partnerships (“MLPs”) are generally recorded based on the characterization reported on a Fund’s schedule K-1 received from the MLPs. The Fund records its pro-rata share of the income/loss and capital gains/losses, allocated

from the underlying partnerships and adjust the cost basis of the underlying partnerships accordingly.

C. Expenses — Expenses incurred by the Fund, which may not specifically relate to the Fund, may be shared with other registered investment companies having management agreements with GSAM or its affiliates, as appropriate. These expenses are allocated to the Fund on a straight-line and/or pro-rata basis depending upon the nature of the expenses and are accrued daily.

D. Distributions to Shareholders — While the Fund seeks to distribute substantially all of the Fund’s distributable cash flow received as cash distributions from MLPs, interest payments received on debt securities owned by the Fund and other payments on securities owned by the Fund, less Fund expenses, in order to permit the Fund to maintain more stable quarterly distributions, the distributions paid by the Fund may be more or less than the amount of net distributable earnings actually earned by the Fund. These distributions could include a return of a shareholder’s invested capital which would reduce such Fund’s NAV. The Fund estimates that only a portion of the distributions paid to shareholders will be treated as dividend income. The remaining portion of the Fund’s distribution, which may be significant, is expected to be a return of capital. These estimates are based on the Fund’s operating results during the period, and their final federal income tax characterization may differ.

17

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Notes to Financial Statements (continued)

November 30, 2020

| 2. SIGNIFICANT ACCOUNTING POLICIES (continued) |

The characterization of distributions to shareholders for financial reporting purposes is determined in accordance with federal income tax rules, which may differ from GAAP. Certain components of the Fund’s net assets on the Statement of Assets and Liabilities reflect permanent GAAP/Tax differences based on the appropriate tax character.

E. Income Taxes — The Fund does not intend to qualify as a regulated investment company pursuant to Subchapter M of the Internal Revenue Code of 1986, as amended, but will rather be taxed as a corporation. As a result, the Fund is obligated to pay federal, state and local income tax on its taxable income. The Fund invests primarily in MLPs, which generally are treated as partnerships for federal income tax purposes. As a limited partner in the MLPs, the Fund must report its allocable share of the MLPs’ taxable income or loss in computing its own taxable income or loss. In addition, sales of MLP investments will result in allocations to the Fund of taxable ordinary income or loss and capital gain or loss, each in amounts that will not be reported to the Fund until the following year, in magnitudes often not readily estimable before such reporting is made.

The Fund’s tax expense or benefit is included in the Statement of Operations based on the component of income or gains/losses to which such expense or benefit relates. Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Such temporary differences are principally: (i) taxes on unrealized gains/losses, which are attributable to the temporary difference between fair market value and tax basis, (ii) the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting and income tax purposes, and (iii) the net tax benefit of accumulated net operating losses and capital loss carryforwards. The Fund will accrue a deferred income tax liability balance, at the currently effective statutory United States (“U.S.”) federal income tax rate plus an estimated state and local income tax rate, for its future tax liability associated with the capital appreciation of its investments and the distributions received by the Fund on interests of MLPs considered to be return of capital and for any net operating gains. The Fund may also record a deferred tax asset balance, which reflects an estimate of the Fund’s future tax benefit associated with net operating losses, capital loss carryforwards, and/or unrealized losses.

To the extent the Fund has a deferred tax asset, consideration is given to whether or not a valuation allowance, which would offset the value of some or all of the deferred tax asset balance, is required. A valuation allowance is required if based on the evaluation criterion provided by Accounting Standards Codification (“ASC”) 740, Income Taxes (ASC 740) it is more likely than not that some portion, or all, of the deferred tax asset will not be realized. The factors considered in assessing the Fund’s valuation allowance include: the nature, frequency and severity of current and cumulative losses, the duration of the statutory carryforward periods and the associated risks that operating and capital loss carryforwards may expire unutilized. From time to time, as new information becomes available, the Fund will modify its estimates or assumptions regarding the deferred tax liability or asset. Unexpected significant decreases in cash distributions from the Fund’s MLP investments or significant declines in the fair value of its investments may change the Fund’s assessment regarding the recoverability of their deferred tax assets and may result in a valuation allowance. If a valuation allowance is required to reduce any deferred tax asset in the future, it could have a material impact on the Fund’s NAV and results of operations in the period it is recorded. The Fund will rely to some extent on information provided by MLPs, which may not be provided to the Fund on a timely basis, to estimate operating income/loss and gains/losses and current taxes and deferred tax liabilities and/or asset balances for purposes of daily reporting of NAVs and financial statement reporting.

It is the Fund’s policy to classify interest and penalties associated with underpayment of federal and state income taxes, if any, as income tax expense on its Statement of Operations. The Fund anticipates filing income tax returns in the U.S. federal jurisdiction and various states, and such returns are subject to examination by the tax jurisdictions. The Fund has reviewed all major jurisdictions and concluded that there is no significant impact on its net assets and no tax liability resulting from unrecognized tax benefits or expenses relating to uncertain tax positions expected to be taken on its tax returns.

Return of Capital Estimates — Distributions received from the Fund’s investments in MLPs generally are comprised of income and return of capital. The Fund records investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded.

18

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

| 3. INVESTMENTS AND FAIR VALUE MEASUREMENTS |

The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price); the Fund’s policy is to use the market approach. GAAP establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The level in the fair value hierarchy within which the fair value measurement in its entirety falls shall be determined based on the lowest level input that is significant to the fair value measurement in its entirety. The levels used for classifying investments are not necessarily an indication of the risk associated with investing in these investments. The three levels of the fair value hierarchy are described below:

Level 1 — Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2 — Quoted prices in markets that are not active or financial instruments for which significant inputs are observable (including, but not limited to, quoted prices for similar investments, interest rates, foreign exchange rates, volatility and credit spreads), either directly or indirectly;

Level 3 — Prices or valuations that require significant unobservable inputs (including GSAM’s assumptions in determining fair value measurement).