Form 8-K MORGAN STANLEY For: Jan 20

Exhibit 99.1

Morgan Stanley Fourth Quarter and Full Year 2020 Earnings Results

Morgan Stanley Reports Fourth Quarter Net Revenues of $13.6 Billion, EPS of $1.81 and ROTCE of 17.7%; Record Full Year

Net Revenues of $48.2 Billion, EPS of $6.46 and ROTCE of 15.2%

NEW YORK, January 20, 2021 – Morgan Stanley (NYSE: MS) today reported net revenues of $13.6 billion for the fourth quarter ended December 31, 2020 compared with $10.9 billion a year ago. Net income applicable to Morgan Stanley was $3.4 billion, or

$1.81 per diluted share,1 compared with $2.2 billion, or $1.30 per diluted share,1 for the same period a year ago. The comparisons of current year results to prior periods

were impacted by the acquisition of E*TRADE Financial Corporation (“E*TRADE”), completed on October 2, 2020, reported in the Wealth Management segment.

Full year net revenues were a record $48.2 billion compared with $41.4 billion a year ago. Net income applicable to Morgan Stanley for the current year was $11.0

billion, or $6.46 per diluted share,1 compared with $9.0 billion, or $5.19 per diluted share,1 a year ago.

James P. Gorman, Chairman and

Chief Executive Officer, said, “The Firm produced a very strong quarter and record full-year results, with excellent performance across all three

businesses and geographies. I am extremely proud of how our employees came together to support each other and our communities and deliver for our clients in an incredibly challenging year. Our unique business model continues to serve us well as we

further execute on our long-term strategy with the acquisitions of E*TRADE and Eaton Vance. We enter 2021 with significant momentum, and I am very confident in our competitive position and our opportunities for continued growth.”

|

Financial Summary2,3

|

||||||||||||||||

|

Firm ($MM, except per share data)

|

4Q 2020

|

4Q 2019

|

FY 2020

|

FY 2019

|

||||||||||||

|

Net revenues

|

$

|

13,640

|

$

|

10,857

|

$

|

48,198

|

$

|

41,419

|

||||||||

|

Compensation expense

|

$

|

5,450

|

$

|

5,228

|

$

|

20,854

|

$

|

18,837

|

||||||||

|

Non-compensation expenses

|

$

|

3,760

|

$

|

2,896

|

$

|

12,926

|

$

|

11,281

|

||||||||

|

Pre-tax income8

|

$

|

4,430

|

$

|

2,733

|

$

|

14,418

|

$

|

11,301

|

||||||||

|

Net income app. to MS

|

$

|

3,385

|

$

|

2,239

|

$

|

10,996

|

$

|

9,042

|

||||||||

|

Expense efficiency ratio6

|

68

|

%

|

75

|

%

|

70

|

%

|

73

|

%

|

||||||||

|

Earnings per diluted share

|

$

|

1.81

|

$

|

1.30

|

$

|

6.46

|

$

|

5.19

|

||||||||

|

Book value per share

|

$

|

51.13

|

$

|

45.82

|

$

|

51.13

|

$

|

45.82

|

||||||||

|

Tangible book value per share

|

$

|

41.95

|

$

|

40.01

|

$

|

41.95

|

$

|

40.01

|

||||||||

|

Return on equity

|

14.7

|

%

|

11.3

|

%

|

13.1

|

%

|

11.7

|

%

|

||||||||

|

Return on tangible equity4

|

17.7

|

%

|

13.0

|

%

|

15.2

|

%

|

13.4

|

%

|

||||||||

|

Institutional Securities

|

||||||||||||||||

|

Net revenues

|

$

|

7,004

|

$

|

5,054

|

$

|

25,948

|

$

|

20,386

|

||||||||

|

Investment Banking

|

$

|

2,302

|

$

|

1,576

|

$

|

7,204

|

$

|

5,734

|

||||||||

|

Sales & Trading

|

$

|

4,220

|

$

|

3,194

|

$

|

18,792

|

$

|

13,695

|

||||||||

|

Wealth Management

|

||||||||||||||||

|

Net revenues

|

$

|

5,681

|

$

|

4,582

|

$

|

19,055

|

$

|

17,737

|

||||||||

|

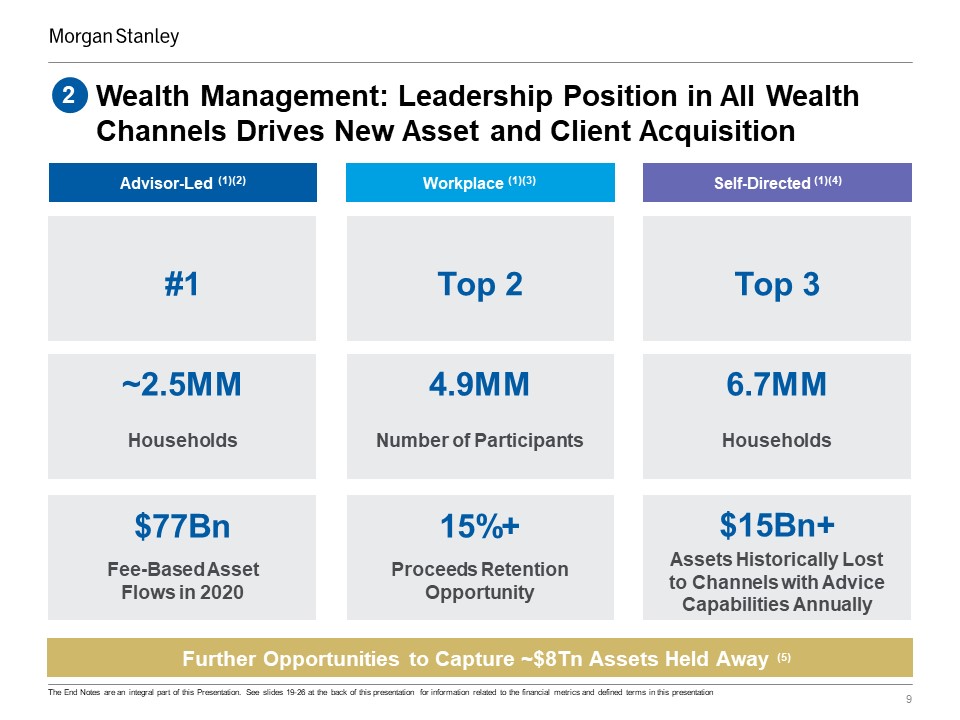

Fee-based client assets ($Bn)9

|

$

|

1,472

|

$

|

1,267

|

$

|

1,472

|

$

|

1,267

|

||||||||

|

Fee-based asset flows ($Bn)10

|

$

|

24.1

|

$

|

24.9

|

$

|

77.4

|

$

|

64.9

|

||||||||

|

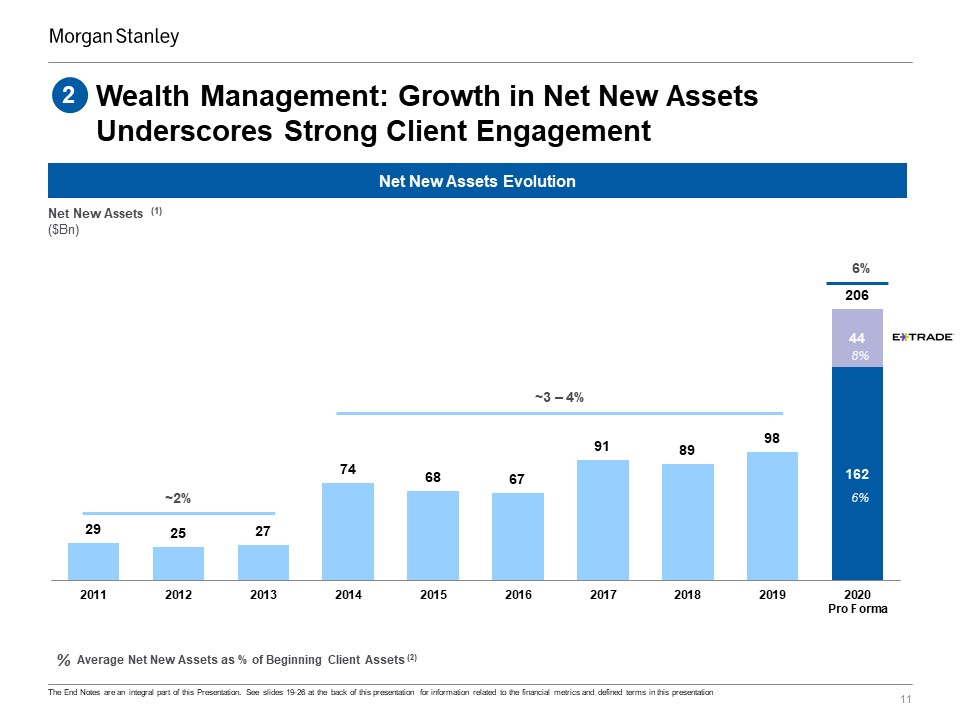

Net new assets ($Bn)11

|

$

|

66.1

|

$

|

27.1

|

$

|

175.4

|

$

|

97.8

|

||||||||

|

Loans ($Bn)

|

$

|

98.1

|

$

|

80.1

|

$

|

98.1

|

$

|

80.1

|

||||||||

|

Investment Management

|

||||||||||||||||

|

Net revenues

|

$

|

1,100

|

$

|

1,356

|

$

|

3,734

|

$

|

3,763

|

||||||||

|

AUM ($Bn)12

|

$

|

781

|

$

|

552

|

$

|

781

|

$

|

552

|

||||||||

|

Long-term net flows ($Bn)13

|

$

|

8.5

|

$

|

6.7

|

$

|

41.0

|

$

|

15.4

|

||||||||

|

|

|

|

Highlights

|

|

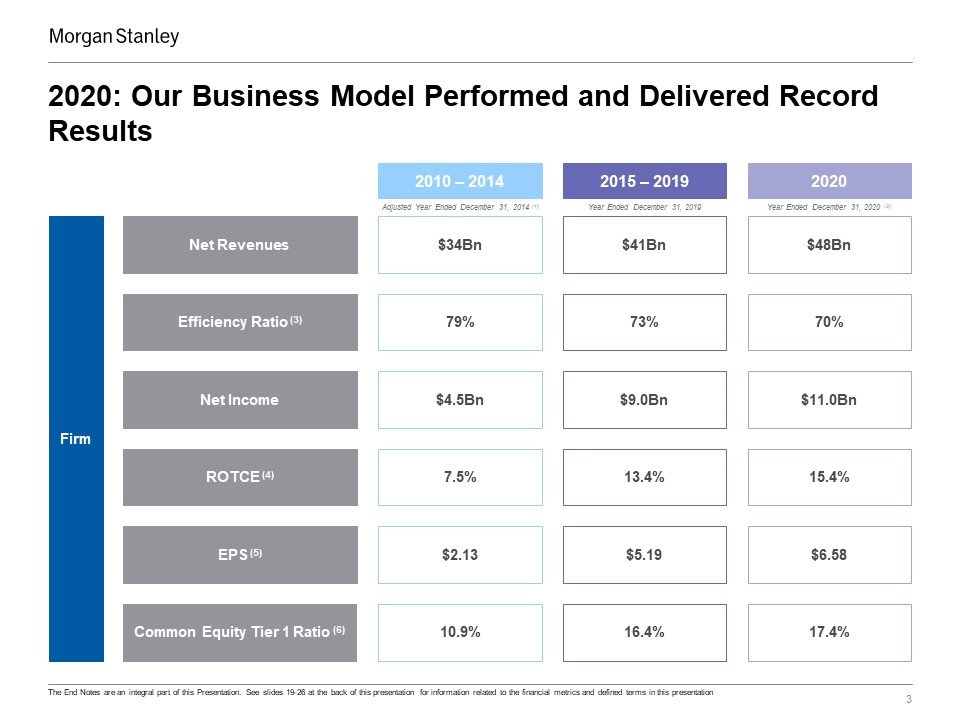

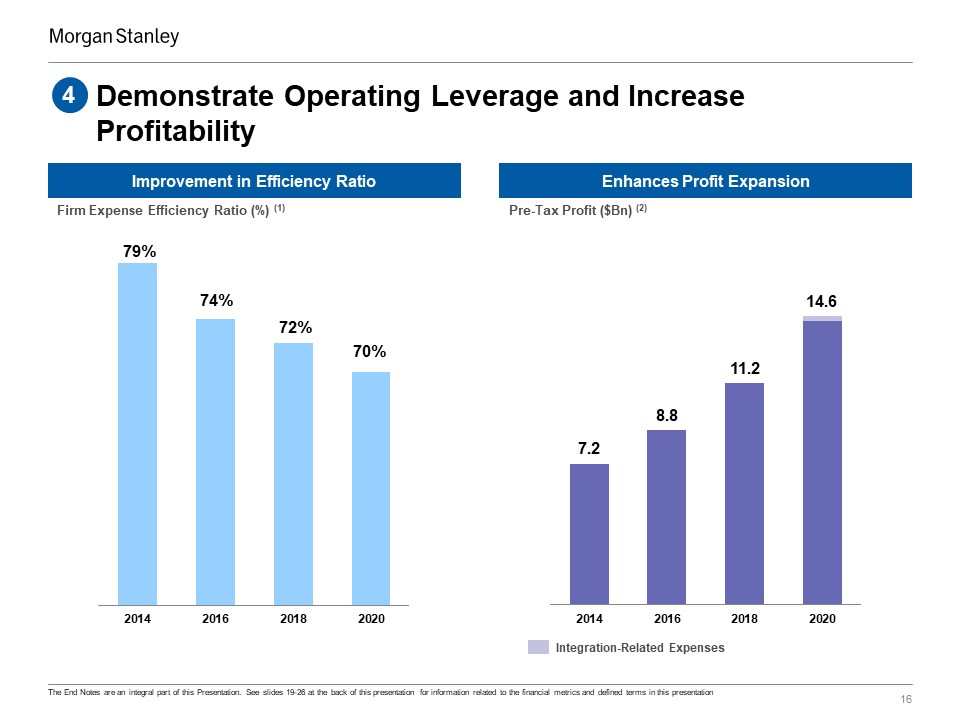

| • | The Firm’s full year results reflect both record net revenues of $48 billion up 16% year over year and net income of $11 billion up 22%. |

|

|

|

| • |

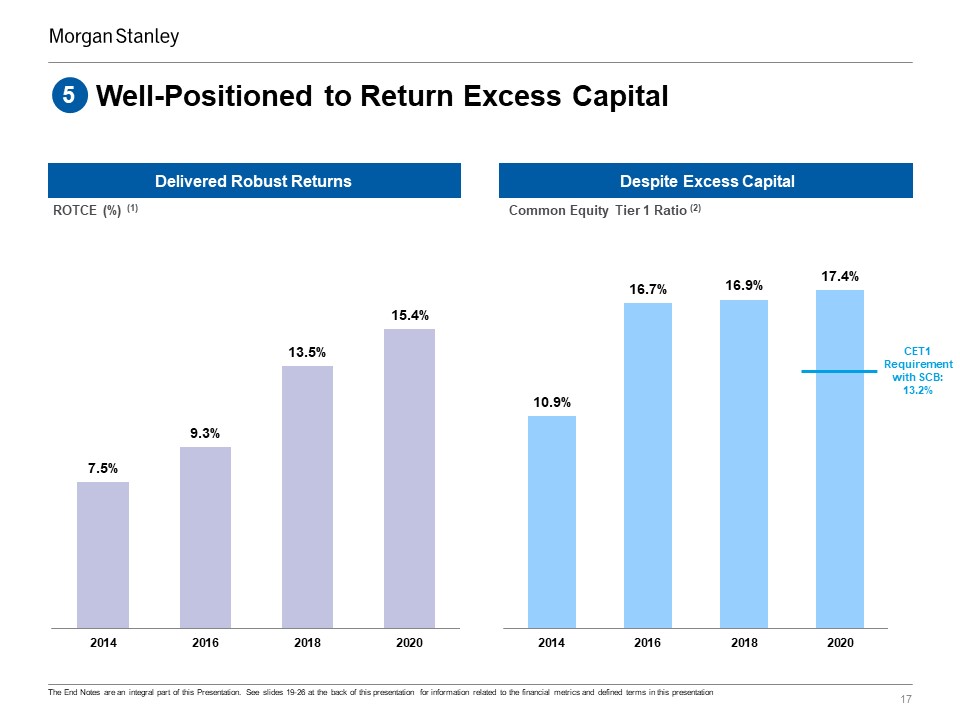

The Firm delivered full year ROTCE of 15.2% or 15.4% excluding the impact of integration-related expenses.4,5

|

|

|

|

| • |

The full year Firm expense efficiency ratio was 70% excluding the impact of integration-related expenses.5,6

|

|

|

|

| • |

Common Equity Tier 1 capital standardized ratio of 17.4%.

|

|

|

|

| • |

Institutional Securities delivered record full year net revenues of $25.9 billion. Fourth quarter net revenues were up 39% driven by continued strong client engagement in a constructive market environment.

|

|

|

|

| • |

Wealth Management delivered a full year pre-tax margin of 23.0% (24.2% excluding $231 million of integration-related expenses).7 Fourth quarter results reflect growth in client assets, increases in bank deposits and

lending as well as strong transactional activity.

|

| • |

Strong Investment Management results reflect record asset management fees in both the quarter and full year driven by record AUM of $781 billion and record long-term net flows of $41 billion.

|

|

Media Relations: Wesley McDade 212-761-2430

|

Investor Relations: Sharon Yeshaya 212-761-1632

|

Fourth Quarter Results

Institutional Securities

Institutional Securities reported net revenues for the current quarter of $7.0 billion compared

with $5.1 billion a year ago. Pre-tax income was $3.2 billion compared with $1.1 billion a year ago.8

|

|

|

|

Investment Banking revenues up 46% from a year ago:

|

|

|

|

|

| • | Advisory revenues increased from a year ago driven by higher M&A completed transactions. |

|

|

|

| • |

Equity underwriting revenues increased from a year ago driven by higher revenues on IPOs, blocks and follow-on offerings.

|

|

|

|

| • |

Fixed income underwriting revenues decreased from a year ago as lower volumes contributed to a decline in bond revenues, partially offset by higher event driven activity.

|

|

|

|

|

Sales and Trading net revenues up 32% from a year ago:

|

|

|

|

|

| • |

Equity sales and trading net revenues increased from a year ago reflecting strong performance across products and geographies driven by increased client activity, with particular

strength in derivatives.

|

| • |

Fixed Income sales and trading net revenues increased from a year ago reflecting strong performance across businesses, benefitting from strong client engagement and market

volatility, with notable strength in foreign exchange and credit products.

|

| • |

Other sales and trading net revenues increased from a year ago reflecting gains on investments associated with certain employee deferred compensation plans.

|

|

Investments and Other:

|

|

| • |

Other revenues increased from a year ago primarily driven by a reduction in the provision for credit losses on loans held for investment, mark-to-market gains on loans held for

sale related to corporate lending activity and gains on the sale of a commodities related intangible asset.

|

|

Total Expenses:

|

|

| • |

Compensation expense decreased from a year ago driven by lower discretionary compensation, partially offset by increases in the fair value of deferred compensation plan referenced

investments.

|

| • |

Non-compensation expenses increased from a year ago driven by higher volume related expenses, higher litigation expense, and an increase in the provision for credit losses on

unfunded lending commitments.

|

|

($ millions)

|

4Q 2020

|

4Q 2019

|

||||||

|

Net Revenues

|

$

|

7,004

|

$

|

5,054

|

||||

|

Investment Banking

|

$

|

2,302

|

$

|

1,576

|

||||

|

Advisory

|

$

|

827

|

$

|

654

|

||||

|

Equity underwriting

|

$

|

1,000

|

$

|

422

|

||||

|

Fixed income underwriting

|

$

|

475

|

$

|

500

|

||||

|

Sales and Trading

|

$

|

4,220

|

$

|

3,194

|

||||

|

Equity

|

$

|

2,498

|

$

|

1,920

|

||||

|

Fixed Income

|

$

|

1,664

|

$

|

1,273

|

||||

|

Other

|

$

|

58

|

$

|

1

|

||||

|

Investments and Other

|

$

|

482

|

$

|

284

|

||||

|

Investments

|

$

|

68

|

$

|

68

|

||||

|

Other

|

$

|

414

|

$

|

216

|

||||

|

Total Expenses

|

$

|

3,844

|

$

|

3,929

|

||||

|

Compensation

|

$

|

1,575

|

$

|

2,057

|

||||

|

Non-compensation

|

$

|

2,269

|

$

|

1,872

|

||||

2

Wealth Management

Wealth Management reported net revenues for the current quarter of $5.7 billion compared with $4.6 billion a year ago. Pre-tax income of $1.1

billion8 in the current quarter resulted in a

pre-tax margin of 18.8%7 or 22.9% excluding

the impact of integration-related expenses.5

The comparisons of current year results to prior periods were impacted by the acquisition of E*TRADE.

|

($ millions)

|

4Q 2020

|

4Q 2019

|

||||||

|

Net Revenues

|

$

|

5,681

|

$

|

4,582

|

||||

|

Net revenues up 24% from a year ago:

|

|

|

|

|

| • |

Asset management revenues increased from a year ago reflecting higher asset levels driven by market appreciation and strong fee-based flows.

|

|

|

|

| • |

Transactional revenues14 increased 37% excluding the impact of mark-to-market gains on investments associated with

certain employee deferred compensation plans. Results reflect strong client activity in both the advisor-led and self-directed channels.

|

|

|

|

| • |

Net interest income (NII) increased from a year ago driven by incremental NII as a result of the E*TRADE acquisition as well as higher deposits and bank lending,

partially offset by the impact of lower average rates.

|

|

|

|

|

Total Expenses:

|

|

|

|

|

| • |

Compensation expense increased from a year ago driven by incremental compensation as a result of the E*TRADE acquisition and integration-related expenses,5 increases in

the fair value of deferred compensation plan referenced investments, and higher compensable revenues.

|

|

|

|

| • |

Non-compensation expense increased from a year ago primarily driven by incremental operating and other expenses as a result of the E*TRADE acquisition and

integration-related expenses.5

|

|

Asset management

|

$

|

2,975

|

$

|

2,655

|

||||

|

Transactional14

|

$

|

1,340

|

$

|

829

|

||||

|

Net interest

|

$

|

1,207

|

$

|

1,033

|

||||

|

Other

|

$

|

159

|

$

|

65

|

||||

|

Total Expenses

|

$

|

4,611

|

$

|

3,419

|

||||

|

Compensation

|

$

|

3,345

|

$

|

2,590

|

||||

|

Non-compensation

|

$

|

1,266

|

$

|

829

|

Investment Management

Investment Management reported net revenues of $1.1 billion compared with $1.4 billion a year ago. Pre-tax income was $196 million compared

with $447 million a year ago.8

Net revenues down 19% from a year ago:

|

|

|

|

•

|

Asset management revenues increased from a year ago driven by record AUM, reflecting strong investment performance and positive net flows.

|

|

|

|

| • |

Investments revenues decreased from a year ago due to significant gains reflected in the prior year quarter related to an investment’s initial public offering within

an Asia private equity fund.

|

|

|

|

|

Total Expenses:

|

|

|

|

|

| • |

Compensation expense decreased from a year ago principally due to lower carried interest in the quarter.

|

|

|

|

| • |

Non-compensation expenses increased from a year ago driven by higher brokerage and clearing expense.

|

|

($ millions)

|

4Q 2020

|

4Q 2019

|

||||||

|

Net Revenues

|

$

|

1,100

|

$

|

1,356

|

||||

|

Asset management

|

$

|

869

|

$

|

736

|

||||

|

Investments

|

$

|

256

|

$

|

670

|

||||

|

Other

|

$

|

(25

|

)

|

$

|

(50

|

)

|

||

|

Total Expenses

|

$

|

904

|

$

|

909

|

||||

|

Compensation

|

$

|

530

|

$

|

581

|

||||

|

Non-compensation

|

$

|

374

|

$

|

328

|

||||

3

Full Year Results

Institutional Securities

Institutional Securities reported net revenues of $25.9 billion compared with

$20.4 billion a year ago. Pre-tax income was $9.2 billion compared with $5.5 billion in the prior year.8

|

Investment Banking revenues up 26% from a year ago:

|

|

|

|

|

| • |

Advisory revenues decreased from a year ago due to fewer large completed M&A transactions.

|

|

|

|

| • |

Equity underwriting revenues increased 81% from a year ago driven by growth in blocks, IPOs and follow-on offerings as clients continued to access capital

markets.

|

|

|

|

| • |

Fixed income underwriting revenues increased from a year ago on higher investment and non-investment grade bond issuances driven by elevated volumes as clients

accessed capital markets, partially offset by lower investment grade loan issuances.

|

|

|

|

|

Sales and Trading net revenues up 37% from a year ago:

|

|

|

|

|

| • |

Equity sales and trading net revenues increased 22% from a year ago reflecting strong performance across products and geographies driven by increased client

activity.

|

|

|

|

| • |

Fixed Income sales and trading net revenues increased 59% from a year ago reflecting strong performance across businesses benefitting from strong client engagement

and market volatility, with notable strength in foreign exchange and credit products.

|

| • |

Other sales and trading net revenues increased from a year ago primarily driven by gains on economic hedges associated with corporate lending activity, partially

offset by lower rates on liquidity investments.

|

|

Investments and Other:

|

|

| • |

Revenues decreased from a year ago reflecting lower mark-to-market gains on investments.

|

| • |

Other revenues decreased from a year ago due to mark-to-market losses on corporate loans held for sale and an increase in the provision for credit losses on loans

held for investment.

|

|

Total Expenses:

|

|

| • |

Compensation expense increased from a year ago driven by higher discretionary compensation expense as a result of higher revenues.

|

| • |

Non-compensation expenses increased from a year ago driven by higher volume related expenses and an increase in the provision for credit losses on unfunded

lending commitments.

|

|

($ millions)

|

FY 2020

|

FY 2019

|

||||||

|

Net Revenues

|

$

|

25,948

|

$

|

20,386

|

||||

|

Investment Banking

|

$

|

7,204

|

$

|

5,734

|

||||

|

Advisory

|

$

|

2,008

|

$

|

2,116

|

||||

|

Equity underwriting

|

$

|

3,092

|

$

|

1,708

|

||||

|

Fixed income underwriting

|

$

|

2,104

|

$

|

1,910

|

||||

|

Sales and Trading

|

$

|

18,792

|

$

|

13,695

|

||||

|

Equity

|

$

|

9,801

|

$

|

8,056

|

||||

|

Fixed Income

|

$

|

8,824

|

$

|

5,546

|

||||

|

Other

|

$

|

167

|

$

|

93

|

||||

|

Investments and Other

|

$

|

(48

|

)

|

$

|

957

|

|||

|

Investments

|

$

|

166

|

$

|

325

|

||||

|

Other

|

$

|

(214

|

)

|

$

|

632

|

|||

|

Total Expenses

|

$

|

16,797

|

$

|

14,896

|

||||

|

Compensation

|

$

|

8,342

|

$

|

7,433

|

||||

|

Non-compensation

|

$

|

8,455

|

$

|

7,463

|

||||

4

Wealth Management

Wealth Management reported net revenues of $19.1 billion compared with $17.7 billion a year ago. Pre-tax income of $4.4 billion resulted in a pre-tax margin of 23.0%7,8 or 24.2% excluding the impact of integration-related expenses.5

Net revenues up 7% from a year ago:

|

•

|

Asset management revenues increased from a year ago on higher asset levels driven by market appreciation and record fee-based flows.

|

|

•

|

Transactional revenues14 increased from a year ago primarily driven by an increase in

commissions on higher client activity, gains on investments associated with certain employee deferred compensation plans, and incremental revenues in the fourth quarter as a result of the E*TRADE acquisition.

|

|

•

|

Net interest income decreased from a year ago primarily driven by the impact of lower interest rates, partially offset by increases due to higher deposits and bank lending as well as incremental NII as a

result of the E*TRADE acquisition.

|

Total Expenses:

|

•

|

Compensation expense increased from a year ago primarily driven by higher compensable revenues, incremental compensation as a result of the E*TRADE acquisition and integration-related expenses,5 as well as increases in the fair value of deferred compensation plan referenced

investments.

|

|

($ millions)

|

FY 2020

|

FY 2019

|

||||||

|

Net Revenues

|

$

|

19,055

|

$

|

17,737

|

||||

|

Asset management

|

$

|

10,955

|

$

|

10,199

|

||||

|

Transactional14

|

$

|

3,694

|

$

|

2,969

|

||||

|

Net interest

|

$

|

4,022

|

$

|

4,222

|

||||

|

Other

|

$

|

384

|

$

|

347

|

||||

|

Total Expenses

|

$

|

14,668

|

$

|

12,905

|

||||

|

Compensation

|

$

|

10,970

|

$

|

9,774

|

||||

|

Non-compensation

|

$

|

3,698

|

$

|

3,131

|

||||

|

|

||||||||

|

•

|

Non-compensation expenses increased from a year ago primarily driven by incremental operating and other expenses as a result of the E*TRADE acquisition, integration-related expenses,5 and a regulatory charge, partially offset by lower marketing and business development expenses.

|

Investment Management

Investment Management net revenues were essentially unchanged from a year ago. Pre-tax income was $870 million compared with $985 million in the prior year.8

Net revenues:

|

•

|

Asset management revenues increased from a year ago driven by record AUM, reflecting strong investment performance and positive net flows.

|

|

•

|

Investments revenues decreased from a year ago driven by lower accrued carried interest.

|

Total Expenses:

|

•

|

Compensation expense decreased from a year ago principally due to a decrease in carried interest.

|

|

•

|

Non-compensation expenses increased from a year ago driven by higher brokerage and clearing costs.

|

|

($ millions)

|

FY 2020

|

FY 2019

|

||||||

|

Net Revenues

|

$

|

3,734

|

$

|

3,763

|

||||

|

Asset management

|

$

|

3,013

|

$

|

2,629

|

||||

|

Investments

|

$

|

808

|

$

|

1,213

|

||||

|

Other

|

$

|

(87

|

)

|

$

|

(79

|

)

|

||

|

Total Expenses

|

$

|

2,864

|

$

|

2,778

|

||||

|

Compensation

|

$

|

1,542

|

$

|

1,630

|

||||

|

Non-compensation

|

$

|

1,322

|

$

|

1,148

|

||||

5

Other Matters

|

•

|

The Firm’s Board of Directors authorized the repurchase of outstanding common stock of up to $10 billion in 2021.

|

|

•

|

The Board of Directors declared a $0.35 quarterly dividend per share, payable on February 12, 2021 to common shareholders of record on January 29, 2021.

|

|

•

|

The Firm’s provision for credit losses on loans and lending commitments was $5 million for the fourth quarter of 2020, compared with $57 million for the fourth quarter of 2019 and $111 million for the

third quarter of 2020. The allowance for credit losses on loans and lending commitments was $1.2 billion as of December 31, 2020, a decrease of approximately $29 million from September 30, 2020 and an

increase of approximately $641 million from December 31, 2019.

|

| 4Q 2020 |

4Q 2019

|

FY 2020

|

FY 2019

|

|||||||||||||

|

Common Stock Repurchases

|

||||||||||||||||

|

Repurchases ($MM)

|

NA

|

$

|

1,500

|

$

|

1,347

|

$

|

5,360

|

|||||||||

|

Number of Shares (MM)

|

NA

|

31

|

29

|

121

|

||||||||||||

|

Average Price

|

NA

|

$

|

48.49

|

$

|

46.01

|

$

|

44.23

|

|||||||||

|

Period End Shares (MM)

|

1,810

|

1,594

|

1,810

|

1,594

|

||||||||||||

|

Tax Rate

|

23.0

|

%

|

15.7

|

%

|

22.5

|

%

|

18.3

|

%

|

||||||||

|

Capital15

|

||||||||||||||||

|

Standardized Approach

|

||||||||||||||||

|

CET1 capital16

|

17.4

|

%

|

16.4

|

%

|

||||||||||||

|

Tier 1 capital16

|

19.4

|

%

|

18.6

|

%

|

||||||||||||

|

Advanced Approach

|

||||||||||||||||

|

CET1 capital16

|

17.7

|

%

|

16.9

|

%

|

||||||||||||

|

Tier 1 capital16

|

19.8

|

%

|

19.2

|

%

|

||||||||||||

|

Leverage-based capital

|

||||||||||||||||

|

Tier 1 leverage17

|

8.4

|

%

|

8.3

|

%

|

||||||||||||

|

SLR18

|

7.4

|

%

|

6.4

|

%

|

||||||||||||

6

Morgan Stanley is a leading global financial services firm providing a wide range of investment banking, securities, wealth management and investment management services. With offices in

more than 41 countries, the Firm’s employees serve clients worldwide including corporations, governments, institutions and individuals. For further information about Morgan Stanley, please visit www.morganstanley.com.

A financial summary follows. Financial, statistical and business-related information, as well as information regarding business and segment trends, is included in the Financial Supplement. Both the earnings release

and the Financial Supplement are available online in the Investor Relations section at www.morganstanley.com.

NOTICE:

The information provided herein and in the financial supplement may include certain non-GAAP financial measures. The definition of such measures or reconciliation of such metrics to the comparable U.S. GAAP figures

are included in this earnings release and the Financial Supplement, both of which are available on www.morganstanley.com.

This earnings release contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,”

“anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words. Forward-looking statements by their nature address matters that are,

to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. All such forward-looking statements are subject to risks, uncertainties and

assumptions that could cause actual results to differ materially from those expressed in such forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to, (i) the

completion of the proposed transaction on anticipated terms and timing, including obtaining required regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues,

expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined company’s

operations and other conditions to the completion of the acquisition, including the possibility that any of the anticipated benefits of the proposed transaction will not be realized or will not be realized within the

expected time period, (ii) the ability of Morgan Stanley and Eaton Vance to integrate the business successfully and to achieve anticipated synergies, risks and costs, (iii) potential litigation relating to the proposed

transaction that could be instituted against Morgan Stanley, Eaton Vance or their respective directors, (iv) the risk that disruptions from the proposed transaction will harm Morgan Stanley’s and Eaton Vance’s business,

including current plans and operations, (v) the ability of Morgan Stanley or Eaton Vance to retain and hire key personnel, (vi) potential adverse reactions or changes to business relationships resulting from the

announcement or completion of the acquisition, (vii) continued availability of capital and financing and rating agency actions, (viii) legislative, regulatory and economic developments, (ix) potential business

uncertainty, including changes to existing business relationships, during the pendency of the acquisition that could affect Morgan Stanley’s and/or Eaton Vance’s financial performance, (x) certain restrictions during the

pendency of the acquisition that may impact Morgan Stanley’s or Eaton Vance’s ability to pursue certain business opportunities or strategic transactions, (xi) unpredictability and severity of catastrophic events,

including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as Morgan Stanley’s or Eaton Vance’s management’s response to any of the aforementioned factors, (xii) dilution caused by Morgan

Stanley’s issuance of additional shares of its common stock in connection with the proposed transaction, (xiii) the possibility that the transaction may be more expensive to complete than anticipated, including as a

result of unexpected factors or events, (xiv) those risks described in Item 1A of Morgan Stanley’s most recently filed Annual Report on Form 10-K and subsequent reports on Forms 10-Q and 8-K, (xv) those risks described

in Item 1A of Eaton Vance’s most recently filed Annual Report on Form 10-K and any subsequent reports on Forms 10-Q and 8-K and (xvi) those risks that are described in the registration statement on Form S-4 available

from the sources indicated above. These risks, as well as other risks associated with the proposed acquisition, are more fully discussed in the registration statement on Form S-4, as amended, filed with the SEC in

connection with the proposed acquisition. While the list of factors presented here is, and the list of factors presented in the registration statement on Form S-4 will be, considered representative, no such list should

be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material

differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties

and similar risks, any of which could have a material adverse effect on Morgan Stanley’s or Eaton Vance’s consolidated financial condition, results of operations, credit rating or liquidity. Neither Morgan Stanley nor

Eaton Vance assumes any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except

as otherwise required by securities and other applicable laws.

7

1 Includes preferred dividends related to the calculation of earnings per share for the fourth quarter of 2020 and 2019 of approximately

$119 million and $154 million, respectively. Includes preferred dividends related to the calculation of earnings per share for the years ended 2020 and 2019 of approximately $496 million and $530 million, respectively.

2 The Firm prepares its Consolidated Financial Statements using accounting principles generally accepted in the United States (U.S.

GAAP). From time to time, Morgan Stanley may disclose certain “non-GAAP financial measures” in the course of its earnings releases, earnings conference calls, financial presentations and otherwise. The Securities and

Exchange Commission defines a “non-GAAP financial measure” as a numerical measure of historical or future financial performance, financial position, or cash flows that is subject to adjustments that effectively exclude, or

include amounts from the most directly comparable measure calculated and presented in accordance with U.S. GAAP. Non-GAAP financial measures disclosed by Morgan Stanley are provided as additional information to analysts,

investors and other stakeholders in order to provide them with greater transparency about, or an alternative method for assessing our financial condition, operating results, or capital adequacy. These measures are not in

accordance with, or a substitute for U.S. GAAP, and may be different from or inconsistent with non-GAAP financial measures used by other companies. Whenever we refer to a non-GAAP financial measure, we will also generally

define it or present the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP, along with a reconciliation of the differences between the non-GAAP financial measure we reference

and such comparable U.S. GAAP financial measure.

3 Our earnings releases, earnings conference calls, financial presentations and other communications may also include certain metrics

which we believe to be useful to us, investors, analysts and other stakeholders by providing further transparency about, or an additional means of assessing, our financial condition and operating results.

4 Return on average tangible common equity and return on average tangible common equity excluding integration-related expenses are

non-GAAP financial measures that the Firm considers useful for analysts, investors and other stakeholders to allow comparability of period-to-period operating performance and capital adequacy. The calculation of return on

average tangible common equity represents full year net income or annualized net income applicable for the quarter applicable to Morgan Stanley less preferred dividends as a percentage of average tangible common equity.

Tangible common equity, also a non-GAAP financial measure, represents common equity less goodwill and intangible assets net of allowable mortgage servicing rights deduction.

5 The Firm’s fourth quarter results include $231 million of integration-related expenses on a pre-tax basis ($189 million after-tax) as a

result of the E*TRADE acquisition. Total non-interest expenses include $151 million in compensation expense and $80 million in non-compensation expense.

6 The Firm expense efficiency ratio of 70.1% represents total non-interest expenses as a percentage of net revenues. The Firm expense

efficiency ratio excluding integration-related expenses of 69.6% represents total non-interest expenses adjusted for integration-related expenses as a percentage of net revenues. The Firm expense efficiency ratio excluding

integration-related expenses is a non-GAAP financial measure that the Firm considers useful for analysts, investors and other stakeholders to allow comparability of period-to-period operating performance.

7 Pre-tax margin represents income before taxes divided by net revenues. Wealth Management pre-tax margin excluding the

integration-related expenses represents income before taxes less those expenses divided by net revenues. Wealth Management pre-tax margin excluding integration-related expenses is a non-GAAP financial measure that the

Firm considers useful for analysts, investors and other stakeholders to allow comparability of period-to-period operating performance.

8 Pre-tax income represents income before taxes.

9 Wealth Management fee-based client assets represent the amount of assets in client accounts where the basis of payment for services is a

fee calculated on those assets.

10 Wealth Management fee-based asset flows include net new fee-based assets, net account transfers, dividends, interest, and client fees

and exclude institutional cash management related activity.

8

11 Wealth Management net new assets represents client inflows (including dividend and interest) less client outflows (excluding activity

from business combinations/divestitures and impact of fees and commissions).

12 AUM is defined as assets under management or supervision.

13 Long-term net flows include the Equity, Fixed Income and Alternative/Other asset classes and exclude the Liquidity asset class.

14 Transactional revenues include investment banking, trading, and commissions and fee revenues. Transactional revenues excluding the

impact of mark-to-market gains on investments associated with employee deferred cash-based compensation plans is a non-GAAP financial measure that the Firm considers useful for analysts, investors and other stakeholders to

allow comparability of period-to-period operating performance.

15 Capital ratios are estimates as of the press release date, January 20, 2021.

16 CET1 capital is defined as Common Equity Tier 1 capital. The Firm’s risk-based capital ratios are computed under each of the (i)

standardized approaches for calculating credit risk and market risk risk‐weighted assets (RWAs) (the “Standardized Approach”) and (ii) applicable advanced approaches for calculating credit risk, market risk and operational

risk RWAs (the “Advanced Approach”). For information on the calculation of regulatory capital and ratios, and associated regulatory requirements, please refer to "Management’s Discussion and Analysis of Financial

Condition and Results of Operations – Liquidity and Capital Resources – Regulatory Requirements" in the Firm’s Form 10-Q for the period ended September 30, 2020 and in the Firm's 2019 Form 10‐K.

17 The Tier 1 leverage ratio is a leverage-based capital requirement that measures the Firm’s leverage. Tier 1 leverage ratio utilizes

Tier 1 capital as the numerator and average adjusted assets as the denominator.

18 SLR is defined as supplementary leverage ratio. The Firm’s SLR utilizes a Tier 1 capital numerator of approximately $88.1 billion and

$73.4 billion, and supplementary leverage exposure denominator of approximately $1.19 trillion and $1.16 trillion, for the fourth quarter of 2020 and 2019, respectively. Based on a Federal Reserve interim final rule in

effect until March 31, 2021, our SLR and supplementary leverage exposure as of December 31, 2020 reflect the exclusion of U.S. Treasury securities and deposits at Federal Reserve Banks. The exclusion of these assets had

the effect of increasing our SLR by 0.8% as of December 31, 2020.

9

|

Consolidated Income Statement Information

|

||||||||||||||||||||||||||||||||

|

(unaudited, dollars in millions)

|

||||||||||||||||||||||||||||||||

|

Quarter Ended

|

Percentage Change From:

|

Twelve Months Ended

|

Percentage

|

|||||||||||||||||||||||||||||

|

Dec 31, 2020

|

Sep 30, 2020

|

Dec 31, 2019

|

Sep 30, 2020

|

Dec 31, 2019

|

Dec 31, 2020

|

Dec 31, 2019

|

Change

|

|||||||||||||||||||||||||

|

Revenues:

|

||||||||||||||||||||||||||||||||

|

Investment banking

|

$

|

2,435

|

$

|

1,826

|

$

|

1,696

|

33

|

%

|

44

|

%

|

$

|

7,674

|

$

|

6,163

|

25

|

%

|

||||||||||||||||

|

Trading

|

3,161

|

3,092

|

2,314

|

2

|

%

|

37

|

%

|

13,992

|

11,095

|

26

|

%

|

|||||||||||||||||||||

|

Investments

|

327

|

346

|

739

|

(5

|

%)

|

(56

|

%)

|

986

|

1,540

|

(36

|

%)

|

|||||||||||||||||||||

|

Commissions and fees

|

1,352

|

1,037

|

984

|

30

|

%

|

37

|

%

|

4,851

|

3,919

|

24

|

%

|

|||||||||||||||||||||

|

Asset management

|

3,926

|

3,664

|

3,451

|

7

|

%

|

14

|

%

|

14,272

|

13,083

|

9

|

%

|

|||||||||||||||||||||

|

Other

|

568

|

206

|

240

|

176

|

%

|

137

|

%

|

110

|

925

|

(88

|

%)

|

|||||||||||||||||||||

|

Total non-interest revenues

|

11,769

|

10,171

|

9,424

|

16

|

%

|

25

|

%

|

41,885

|

36,725

|

14

|

%

|

|||||||||||||||||||||

|

Interest income

|

2,245

|

2,056

|

3,952

|

9

|

%

|

(43

|

%)

|

10,162

|

17,098

|

(41

|

%)

|

|||||||||||||||||||||

|

Interest expense

|

374

|

570

|

2,519

|

(34

|

%)

|

(85

|

%)

|

3,849

|

12,404

|

(69

|

%)

|

|||||||||||||||||||||

|

Net interest

|

1,871

|

1,486

|

1,433

|

26

|

%

|

31

|

%

|

6,313

|

4,694

|

34

|

%

|

|||||||||||||||||||||

|

Net revenues

|

13,640

|

11,657

|

10,857

|

17

|

%

|

26

|

%

|

48,198

|

41,419

|

16

|

%

|

|||||||||||||||||||||

|

Non-interest expenses:

|

||||||||||||||||||||||||||||||||

|

Compensation and benefits

|

5,450

|

5,086

|

5,228

|

7

|

%

|

4

|

%

|

20,854

|

18,837

|

11

|

%

|

|||||||||||||||||||||

|

Non-compensation expenses:

|

||||||||||||||||||||||||||||||||

|

Brokerage, clearing and exchange fees

|

776

|

697

|

633

|

11

|

%

|

23

|

%

|

2,929

|

2,493

|

17

|

%

|

|||||||||||||||||||||

|

Information processing and communications

|

697

|

616

|

567

|

13

|

%

|

23

|

%

|

2,465

|

2,194

|

12

|

%

|

|||||||||||||||||||||

|

Professional services

|

679

|

542

|

555

|

25

|

%

|

22

|

%

|

2,205

|

2,137

|

3

|

%

|

|||||||||||||||||||||

|

Occupancy and equipment

|

456

|

373

|

375

|

22

|

%

|

22

|

%

|

1,559

|

1,428

|

9

|

%

|

|||||||||||||||||||||

|

Marketing and business development

|

161

|

78

|

200

|

106

|

%

|

(20

|

%)

|

434

|

660

|

(34

|

%)

|

|||||||||||||||||||||

|

Other

|

991

|

778

|

566

|

27

|

%

|

75

|

%

|

3,334

|

2,369

|

41

|

%

|

|||||||||||||||||||||

|

Total non-compensation expenses

|

3,760

|

3,084

|

2,896

|

22

|

%

|

30

|

%

|

12,926

|

11,281

|

15

|

%

|

|||||||||||||||||||||

|

Total non-interest expenses

|

9,210

|

8,170

|

8,124

|

13

|

%

|

13

|

%

|

33,780

|

30,118

|

12

|

%

|

|||||||||||||||||||||

|

Income before provision for income taxes

|

4,430

|

3,487

|

2,733

|

27

|

%

|

62

|

%

|

14,418

|

11,301

|

28

|

%

|

|||||||||||||||||||||

|

Provision for income taxes

|

1,018

|

736

|

428

|

38

|

%

|

138

|

%

|

3,239

|

2,064

|

57

|

%

|

|||||||||||||||||||||

|

Net income

|

$

|

3,412

|

$

|

2,751

|

$

|

2,305

|

24

|

%

|

48

|

%

|

$

|

11,179

|

$

|

9,237

|

21

|

%

|

||||||||||||||||

|

Net income applicable to nonredeemable noncontrolling interests

|

27

|

34

|

66

|

(21

|

%)

|

(59

|

%)

|

183

|

195

|

(6

|

%)

|

|||||||||||||||||||||

|

Net income applicable to Morgan Stanley

|

3,385

|

2,717

|

2,239

|

25

|

%

|

51

|

%

|

10,996

|

9,042

|

22

|

%

|

|||||||||||||||||||||

|

Preferred stock dividend

|

119

|

120

|

154

|

(1

|

%)

|

(23

|

%)

|

496

|

530

|

(6

|

%)

|

|||||||||||||||||||||

|

Earnings applicable to Morgan Stanley common shareholders

|

$

|

3,266

|

$

|

2,597

|

$

|

2,085

|

26

|

%

|

57

|

%

|

$

|

10,500

|

$

|

8,512

|

23

|

%

|

||||||||||||||||

|

The End Notes are an integral part of this presentation. Refer to the Financial Supplement on pages 12 - 17 for Definition of U.S. GAAP to Non-GAAP Measures, Definitions of Performance Metrics and Terms,

Supplemental Quantitative Details and Calculations, and Legal Notice for additional information.

|

10

|

Consolidated Financial Metrics, Ratios and Statistical Data

|

||||||||||||||||||||||||||||||||

|

(unaudited)

|

||||||||||||||||||||||||||||||||

|

Quarter Ended

|

Percentage Change From:

|

Twelve Months Ended

|

Percentage

|

|||||||||||||||||||||||||||||

|

Dec 31, 2020

|

Sep 30, 2020

|

Dec 31, 2019

|

Sep 30, 2020

|

Dec 31, 2019

|

Dec 31, 2020

|

Dec 31, 2019

|

Change

|

|||||||||||||||||||||||||

|

Financial Metrics:

|

||||||||||||||||||||||||||||||||

|

Earnings per basic share

|

$

|

1.84

|

$

|

1.68

|

$

|

1.33

|

10

|

%

|

38

|

%

|

$

|

6.55

|

$

|

5.26

|

25

|

%

|

||||||||||||||||

|

Earnings per diluted share

|

$

|

1.81

|

$

|

1.66

|

$

|

1.30

|

9

|

%

|

39

|

%

|

$

|

6.46

|

$

|

5.19

|

24

|

%

|

||||||||||||||||

|

Return on average common equity

|

14.7

|

%

|

13.2

|

%

|

11.3

|

%

|

13.1

|

%

|

11.7

|

%

|

||||||||||||||||||||||

|

Return on average tangible common equity

|

17.7

|

%

|

15.0

|

%

|

13.0

|

%

|

15.2

|

%

|

13.4

|

%

|

||||||||||||||||||||||

|

Book value per common share

|

$

|

51.13

|

$

|

50.67

|

$

|

45.82

|

$

|

51.13

|

$

|

45.82

|

||||||||||||||||||||||

|

Tangible book value per common share

|

$

|

41.95

|

$

|

44.81

|

$

|

40.01

|

$

|

41.95

|

$

|

40.01

|

||||||||||||||||||||||

|

Excluding integration-related expenses

|

||||||||||||||||||||||||||||||||

|

Adjusted earnings per diluted share

|

$

|

1.92

|

$

|

1.66

|

$

|

1.30

|

16

|

%

|

48

|

%

|

$

|

6.58

|

$

|

5.19

|

27

|

%

|

||||||||||||||||

|

Adjusted return on average common equity

|

15.6

|

%

|

13.2

|

%

|

11.3

|

%

|

13.3

|

%

|

11.7

|

%

|

||||||||||||||||||||||

|

Adjusted return on average tangible common equity

|

18.7

|

%

|

15.0

|

%

|

13.0

|

%

|

15.4

|

%

|

13.4

|

%

|

||||||||||||||||||||||

|

Financial Ratios:

|

||||||||||||||||||||||||||||||||

|

Pre-tax profit margin

|

32

|

%

|

30

|

%

|

25

|

%

|

30

|

%

|

27

|

%

|

||||||||||||||||||||||

|

Compensation and benefits as a % of net revenues

|

40

|

%

|

44

|

%

|

48

|

%

|

43

|

%

|

45

|

%

|

||||||||||||||||||||||

|

Non-compensation expenses as a % of net revenues

|

28

|

%

|

26

|

%

|

27

|

%

|

27

|

%

|

27

|

%

|

||||||||||||||||||||||

|

Firm expense efficiency ratio

|

68

|

%

|

70

|

%

|

75

|

%

|

70

|

%

|

73

|

%

|

||||||||||||||||||||||

|

Firm expense efficiency ratio excluding integration-related expenses

|

66

|

%

|

70

|

%

|

75

|

%

|

70

|

%

|

73

|

%

|

||||||||||||||||||||||

|

Effective tax rate

|

23.0

|

%

|

21.1

|

%

|

15.7

|

%

|

22.5

|

%

|

18.3

|

%

|

||||||||||||||||||||||

|

Statistical Data:

|

||||||||||||||||||||||||||||||||

|

Period end common shares outstanding (millions)

|

1,810

|

1,576

|

1,594

|

15

|

%

|

14

|

%

|

|||||||||||||||||||||||||

|

Average common shares outstanding (millions)

|

||||||||||||||||||||||||||||||||

|

Basic

|

1,774

|

1,542

|

1,573

|

15

|

%

|

13

|

%

|

1,603

|

1,617

|

(1

|

%)

|

|||||||||||||||||||||

|

Diluted

|

1,802

|

1,566

|

1,602

|

15

|

%

|

12

|

%

|

1,624

|

1,640

|

(1

|

%)

|

|||||||||||||||||||||

|

Worldwide employees

|

68,097

|

63,051

|

60,431

|

8

|

%

|

13

|

%

|

|||||||||||||||||||||||||

|

Notes:

|

|

| - | The Firm’s fourth quarter results include $231 million of integration-related expenses on a pre-tax basis ($189 million after-tax) as a result of the E*TRADE acquisition.

Total non-interest expenses include $151 million in compensation expense and $80 million in non-compensation expense. |

| - | The End Notes are an integral part of this presentation. Refer to the Financial Supplement on pages 12 - 17 for Definition of U.S. GAAP to Non-GAAP Measures, Definitions of

Performance Metrics and Terms, Supplemental Quantitative Details and Calculations, and Legal Notice for additional information. |

11

Exhibit 99.2

|

Fourth Quarter 2020 Earnings Results

|

|

|

Quarterly Financial Supplement

|

Page

|

|

Consolidated Financial Summary

|

1

|

|

Consolidated Financial Metrics, Ratios and Statistical Data

|

2

|

|

Consolidated and U.S. Bank Supplemental Financial Information

|

3

|

|

Consolidated Average Common Equity and Regulatory Capital Information

|

4

|

|

Institutional Securities Income Statement Information, Financial Metrics and Ratios

|

5

|

|

Wealth Management Income Statement Information, Financial Metrics and Ratios

|

6

|

|

Wealth Management Financial Information and Statistical Data

|

7

|

|

Investment Management Income Statement Information, Financial Metrics and Ratios

|

8

|

|

Investment Management Financial Information and Statistical Data

|

9

|

|

Consolidated Loans and Lending Commitments

|

10

|

|

Consolidated Loans and Lending Commitments Allowance for Credit Losses

|

11

|

|

Definition of U.S. GAAP to Non-GAAP Measures

|

12

|

|

Definitions of Performance Metrics and Terms

|

13 - 14

|

|

Supplemental Quantitative Details and Calculations

|

15 - 16

|

|

Legal Notice

|

17

|

|

The Firm's fourth quarter earnings results reflect the completed acquisition of E*TRADE Financial Corporation (E*TRADE), which closed on October 2, 2020. The comparisons of current and prior periods

are impacted by the financial results of E*TRADE reported in the Wealth Management Segment.

|

|

Consolidated Financial Summary

|

||||||||||||||||||||||||||||||||

|

(unaudited, dollars in millions)

|

||||||||||||||||||||||||||||||||

|

Quarter Ended

|

Percentage Change From:

|

Twelve Months Ended

|

Percentage

|

|||||||||||||||||||||||||||||

|

Dec 31, 2020

|

Sep 30, 2020

|

Dec 31, 2019

|

Sep 30, 2020

|

Dec 31, 2019

|

Dec 31, 2020

|

Dec 31, 2019

|

Change

|

|||||||||||||||||||||||||

|

Net revenues

|

||||||||||||||||||||||||||||||||

|

Institutional Securities

|

$

|

7,004

|

$

|

6,062

|

$

|

5,054

|

16

|

%

|

39

|

%

|

$

|

25,948

|

$

|

20,386

|

27

|

%

|

||||||||||||||||

|

Wealth Management

|

5,681

|

4,657

|

4,582

|

22

|

%

|

24

|

%

|

19,055

|

17,737

|

7

|

%

|

|||||||||||||||||||||

|

Investment Management

|

1,100

|

1,056

|

1,356

|

4

|

%

|

(19

|

%)

|

3,734

|

3,763

|

(1

|

%)

|

|||||||||||||||||||||

|

Intersegment Eliminations

|

(145

|

)

|

(118

|

)

|

(135

|

)

|

(23

|

%)

|

(7

|

%)

|

(539

|

)

|

(467

|

)

|

(15

|

%)

|

||||||||||||||||

|

Net revenues

|

$

|

13,640

|

$

|

11,657

|

$

|

10,857

|

17

|

%

|

26

|

%

|

$

|

48,198

|

$

|

41,419

|

16

|

%

|

||||||||||||||||

|

Non-interest expenses

|

||||||||||||||||||||||||||||||||

|

Institutional Securities

|

$

|

3,844

|

$

|

4,014

|

$

|

3,929

|

(4

|

%)

|

(2

|

%)

|

$

|

16,797

|

$

|

14,896

|

13

|

%

|

||||||||||||||||

|

Wealth Management

|

4,611

|

3,537

|

3,419

|

30

|

%

|

35

|

%

|

14,668

|

12,905

|

14

|

%

|

|||||||||||||||||||||

|

Investment Management

|

904

|

741

|

909

|

22

|

%

|

(1

|

%)

|

2,864

|

2,778

|

3

|

%

|

|||||||||||||||||||||

|

Intersegment Eliminations

|

(149

|

)

|

(122

|

)

|

(133

|

)

|

(22

|

%)

|

(12

|

%)

|

(549

|

)

|

(461

|

)

|

(19

|

%)

|

||||||||||||||||

|

Non-interest expenses (1)

|

$

|

9,210

|

$

|

8,170

|

$

|

8,124

|

13

|

%

|

13

|

%

|

$

|

33,780

|

$

|

30,118

|

12

|

%

|

||||||||||||||||

|

Income before taxes

|

||||||||||||||||||||||||||||||||

|

Institutional Securities

|

$

|

3,160

|

$

|

2,048

|

$

|

1,125

|

54

|

%

|

181

|

%

|

$

|

9,151

|

$

|

5,490

|

67

|

%

|

||||||||||||||||

|

Wealth Management

|

1,070

|

1,120

|

1,163

|

(4

|

%)

|

(8

|

%)

|

4,387

|

4,832

|

(9

|

%)

|

|||||||||||||||||||||

|

Investment Management

|

196

|

315

|

447

|

(38

|

%)

|

(56

|

%)

|

870

|

985

|

(12

|

%)

|

|||||||||||||||||||||

|

Intersegment Eliminations

|

4

|

4

|

(2

|

)

|

--

|

*

|

10

|

(6

|

)

|

*

|

||||||||||||||||||||||

|

Income before taxes

|

$

|

4,430

|

$

|

3,487

|

$

|

2,733

|

27

|

%

|

62

|

%

|

$

|

14,418

|

$

|

11,301

|

28

|

%

|

||||||||||||||||

|

Net Income applicable to Morgan Stanley

|

||||||||||||||||||||||||||||||||

|

Institutional Securities

|

$

|

2,422

|

$

|

1,647

|

$

|

1,034

|

47

|

%

|

134

|

%

|

$

|

7,012

|

$

|

4,599

|

52

|

%

|

||||||||||||||||

|

Wealth Management

|

802

|

842

|

889

|

(5

|

%)

|

(10

|

%)

|

3,361

|

3,728

|

(10

|

%)

|

|||||||||||||||||||||

|

Investment Management

|

158

|

225

|

317

|

(30

|

%)

|

(50

|

%)

|

615

|

719

|

(14

|

%)

|

|||||||||||||||||||||

|

Intersegment Eliminations

|

3

|

3

|

(1

|

)

|

--

|

*

|

8

|

(4

|

)

|

*

|

||||||||||||||||||||||

|

Net Income applicable to Morgan Stanley

|

$

|

3,385

|

$

|

2,717

|

$

|

2,239

|

25

|

%

|

51

|

%

|

$

|

10,996

|

$

|

9,042

|

22

|

%

|

||||||||||||||||

|

Earnings applicable to Morgan Stanley common shareholders

|

$

|

3,266

|

$

|

2,597

|

$

|

2,085

|

26

|

%

|

57

|

%

|

$

|

10,500

|

$

|

8,512

|

23

|

%

|

||||||||||||||||

|

The End Notes are an integral part of this presentation. See pages 12 - 17 for Definition of U.S. GAAP to Non-GAAP Measures, Definitions of Performance Metrics and Terms, Supplemental Quantitative

Details and Calculations, and Legal Notice.

|

1

|

Consolidated Financial Metrics, Ratios and Statistical Data

|

||||||||||||||||||||||||||||||||

|

(unaudited)

|

||||||||||||||||||||||||||||||||

|

Quarter Ended

|

Percentage Change From:

|

Twelve Months Ended

|

Percentage

|

|||||||||||||||||||||||||||||

|

Dec 31, 2020

|

Sep 30, 2020

|

Dec 31, 2019

|

Sep 30, 2020

|

Dec 31, 2019

|

Dec 31, 2020

|

Dec 31, 2019

|

Change

|

|||||||||||||||||||||||||

|

Financial Metrics:

|

||||||||||||||||||||||||||||||||

|

Earnings per basic share

|

$

|

1.84

|

$

|

1.68

|

$

|

1.33

|

10

|

%

|

38

|

%

|

$

|

6.55

|

$

|

5.26

|

25

|

%

|

||||||||||||||||

|

Earnings per diluted share

|

$

|

1.81

|

$

|

1.66

|

$

|

1.30

|

9

|

%

|

39

|

%

|

$

|

6.46

|

$

|

5.19

|

24

|

%

|

||||||||||||||||

|

Return on average common equity

|

14.7

|

%

|

13.2

|

%

|

11.3

|

%

|

13.1

|

%

|

11.7

|

%

|

||||||||||||||||||||||

|

Return on average tangible common equity

|

17.7

|

%

|

15.0

|

%

|

13.0

|

%

|

15.2

|

%

|

13.4

|

%

|

||||||||||||||||||||||

|

Book value per common share

|

$

|

51.13

|

$

|

50.67

|

$

|

45.82

|

$

|

51.13

|

$

|

45.82

|

||||||||||||||||||||||

|

Tangible book value per common share

|

$

|

41.95

|

$

|

44.81

|

$

|

40.01

|

$

|

41.95

|

$

|

40.01

|

||||||||||||||||||||||

|

Excluding integration-related expenses (1)

|

||||||||||||||||||||||||||||||||

|

Adjusted earnings per diluted share

|

$

|

1.92

|

$

|

1.66

|

$

|

1.30

|

16

|

%

|

48

|

%

|

$

|

6.58

|

$

|

5.19

|

27

|

%

|

||||||||||||||||

|

Adjusted return on average common equity

|

15.6

|

%

|

13.2

|

%

|

11.3

|

%

|

13.3

|

%

|

11.7

|

%

|

||||||||||||||||||||||

|

Adjusted return on average tangible common equity

|

18.7

|

%

|

15.0

|

%

|

13.0

|

%

|

15.4

|

%

|

13.4

|

%

|

||||||||||||||||||||||

|

Financial Ratios:

|

||||||||||||||||||||||||||||||||

|

Pre-tax profit margin

|

32

|

%

|

30

|

%

|

25

|

%

|

30

|

%

|

27

|

%

|

||||||||||||||||||||||

|

Compensation and benefits as a % of net revenues

|

40

|

%

|

44

|

%

|

48

|

%

|

43

|

%

|

45

|

%

|

||||||||||||||||||||||

|

Non-compensation expenses as a % of net revenues

|

28

|

%

|

26

|

%

|

27

|

%

|

27

|

%

|

27

|

%

|

||||||||||||||||||||||

|

Firm expense efficiency ratio

|

68

|

%

|

70

|

%

|

75

|

%

|

70

|

%

|

73

|

%

|

||||||||||||||||||||||

|

Firm expense efficiency ratio excluding integration-related expenses (1)

|

66

|

%

|

70

|

%

|

75

|

%

|

70

|

%

|

73

|

%

|

||||||||||||||||||||||

|

Effective tax rate

|

23.0

|

%

|

21.1

|

%

|

15.7

|

%

|

22.5

|

%

|

18.3

|

%

|

||||||||||||||||||||||

|

Statistical Data:

|

||||||||||||||||||||||||||||||||

|

Period end common shares outstanding (millions)

|

1,810

|

1,576

|

1,594

|

15

|

%

|

14

|

%

|

|||||||||||||||||||||||||

|

Average common shares outstanding (millions)

|

||||||||||||||||||||||||||||||||

|

Basic

|

1,774

|

1,542

|

1,573

|

15

|

%

|

13

|

%

|

1,603

|

1,617

|

(1

|

%)

|

|||||||||||||||||||||

|

Diluted

|

1,802

|

1,566

|

1,602

|

15

|

%

|

12

|

%

|

1,624

|

1,640

|

(1

|

%)

|

|||||||||||||||||||||

|

Worldwide employees

|

68,097

|

63,051

|

60,431

|

8

|

%

|

13

|

%

|

|||||||||||||||||||||||||

|

Notes:

|

|

| - | The Firm’s fourth quarter results include $231 million of integration-related expenses on a pre-tax basis ($189 million after-tax) as a result of the E*TRADE acquisition. Total non-interest expenses include $151 million in compensation expense and $80 million in non-compensation expense. |

| - | The End Notes are an integral part of this presentation. See pages 12 - 17 for Definition of U.S. GAAP to Non-GAAP Measures, Definitions of Performance Metrics and Terms, Supplemental Quantitative Details and Calculations, and Legal Notice. |

2

|

Consolidated and U.S. Bank Supplemental Financial Information

|

||||||||||||||||||||||||||||||||

|

(unaudited, dollars in millions)

|

||||||||||||||||||||||||||||||||

|

Quarter Ended

|

Percentage Change From:

|

Twelve Months Ended

|

Percentage

|

|||||||||||||||||||||||||||||

|

Dec 31, 2020

|

Sep 30, 2020

|

Dec 31, 2019

|

Sep 30, 2020

|

Dec 31, 2019

|

Dec 31, 2020

|

Dec 31, 2019