Form FWP GS Finance Corp. Filed by: GS Finance Corp.

Free Writing Prospectus pursuant to Rule 433 dated December 9, 2020

Registration Statement No. 333-239610

|

|

Buffered Basket-Linked Notes due |

OVERVIEW

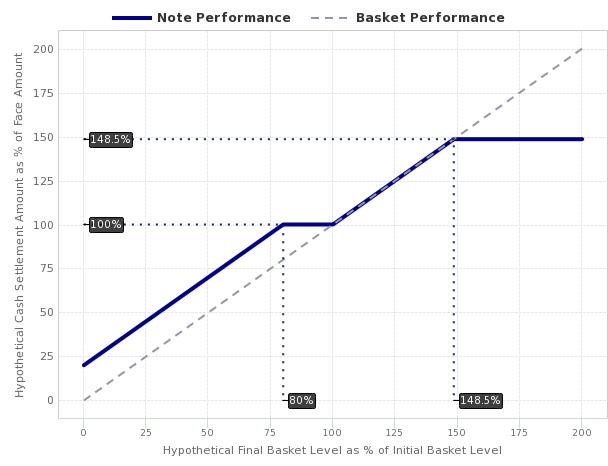

The notes do not bear interest. The amount that you will be paid on your notes on the stated maturity date is based on the performance of a weighted basket comprised of the S&P 500® Index (1/3 or approximately 33.33% weighting), the MSCI EAFE Index (1/3 or approximately 33.33% weighting) and the MSCI Emerging Markets Index (1/3 or approximately 33.33% weighting) as measured from the trade date to and including the determination date.

The initial basket level is 100 and the final basket level will equal the sum of the products, as calculated for each basket underlier, of: (i) its final underlier level divided by its initial underlier level multiplied by (ii) its applicable initial weighted value.

If the final basket level on the determination date is greater than the initial basket level, the return on your notes will be positive and will equal the basket return, subject to the maximum settlement amount (expected to be between $1,485 and $1,530 for each $1,000 face amount of your notes). If the final basket level declines by up to 20% from the initial basket level, you will receive the face amount of your notes.

If the final basket level declines by more than 20% from the initial basket level, the return on your notes will be negative and will equal the basket return plus 20%.

You could lose a significant portion of the face amount of your notes.

Declines in one basket index may offset increases in the other basket indices.

You should read the accompanying preliminary pricing supplement dated December 9, 2020, which we refer to herein as the accompanying preliminary pricing supplement, to better understand the terms and risks of your investment, including the credit risk of GS Finance Corp. and The Goldman Sachs Group, Inc.

|

Key Terms |

|

|

CUSIP/ISIN: |

40057EU70 / US40057EU705 |

|

Company (Issuer): |

GS Finance Corp. |

|

Guarantor: |

The Goldman Sachs Group, Inc. |

|

Basket underliers: |

the S&P 500® Index (current Bloomberg symbol: “SPX Index”), the MSCI EAFE Index (current Bloomberg symbol: “MXEA Index”) and the MSCI Emerging Markets Index (current Bloomberg symbol: “MXEF Index”), |

|

Trade date: |

expected to be December 16, 2020 |

|

Settlement date: |

expected to be December 21, 2020 |

|

Determination date: |

expected to be December 16, 2026 |

|

Stated maturity date: |

expected to be December 21, 2026 |

|

Hypothetical Payment amount AT Maturity* |

||

|

|

||

|

|

Hypothetical Final |

Hypothetical Payment Amount at Maturity |

|

175.000% |

148.500% |

|

|

150.000% |

148.500% |

|

|

148.500% |

148.500% |

|

|

115.000% |

115.000% |

|

|

110.000% |

110.000% |

|

|

100.000% |

100.000% |

|

|

95.000% |

100.000% |

|

|

90.000% |

100.000% |

|

|

80.000% |

100.000% |

|

|

75.000% |

95.000% |

|

|

50.000% |

70.000% |

|

|

25.000% |

45.000% |

|

|

0.000% |

20.000% |

|

|

*assumes a cap level of 148.5% of the initial basket level |

This document does not provide all of the information that an investor should consider prior to making an investment decision. You should not invest in the notes without reading the accompanying preliminary pricing supplement and related documents for a more detailed description of the underlier, the terms of the notes and certain risks.

2

GS Finance Corp. and The Goldman Sachs Group, Inc. have filed a registration statement (including a prospectus, as supplemented by the prospectus supplement, underlier supplement no. 14, general terms supplement no. 8,671 and preliminary pricing supplement listed below) with the Securities and Exchange Commission (SEC) for the offering to which this communication relates. Before you invest, you should read the prospectus, prospectus supplement, underlier supplement no. 14, general terms supplement no. 8,671 and preliminary pricing supplement, and any other documents relating to this offering that GS Finance Corp. and The Goldman Sachs Group, Inc. have filed with the SEC for more complete information about us and this offering. You may get these documents without cost by visiting EDGAR on the SEC web site at sec.gov. Alternatively, we will arrange to send you the prospectus, prospectus supplement, underlier supplement no. 14, general terms supplement no. 8,671 and preliminary pricing supplement if you so request by calling (212) 357-4612.

The notes are part of the Medium-Term Notes, Series F program of GS Finance Corp. and are fully and unconditionally guaranteed by The Goldman Sachs Group, Inc. This document should be read in conjunction with the following:

RISK FACTORS

An investment in the notes is subject to risks. Many of the risks are described in the accompanying preliminary pricing supplement, accompanying general terms supplement no. 8,671, accompanying underlier supplement no. 14, accompanying prospectus supplement and accompanying prospectus. Below we have provided a list of certain risk factors discussed in such documents. In addition to the below, you should read in full “Additional Risk Factors Specific to Your Notes” in the accompanying preliminary pricing supplement, “Additional Risk Factors Specific to the Notes” in the accompanying general terms supplement no. 8,671 and, “Additional Risk Factors Specific to the Notes” in the accompanying underlier supplement no. 14, as well as the risks and considerations described in the accompanying prospectus supplement and accompanying prospectus.

The following risk factors are discussed in greater detail in the accompanying preliminary pricing supplement:

|

▪ |

The Notes Are Subject to the Credit Risk of the Issuer and the Guarantor |

|

▪ |

The Amount Payable on Your Notes Is Not Linked to the Level of Each Basket Underlier at Any Time Other Than the Determination Date |

|

▪ |

You May Lose a Substantial Portion of Your Investment in the Notes |

|

▪ |

The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors |

|

▪ |

Your Notes Do Not Bear Interest |

|

▪ |

The Potential for the Value of Your Notes to Increase Will Be Limited |

|

▪ |

The Lower Performance of One Basket Underlier May Offset an Increase in the Other Basket Underliers |

|

▪ |

You Have No Shareholder Rights or Rights to Receive Any Basket Underlier Stock |

|

▪ |

We May Sell an Additional Aggregate Face Amount of the Notes at a Different Issue Price |

|

▪ |

If You Purchase Your Notes at a Premium to Face Amount, the Return on Your Investment Will Be Lower Than the Return on Notes Purchased at Face Amount and the Impact of Certain Key Terms of the Notes Will Be Negatively Affected |

|

▪ |

An Investment in the Offered Notes Is Subject to Risks Associated with Foreign Securities |

|

▪ |

Your Investment in the Notes Will Be Subject to Foreign Currency Exchange Rate Risk |

|

▪ |

Regulators Are Investigating Potential Manipulation of Published Currency Exchange Rates |

|

▪ |

Foreign Account Tax Compliance Act (FATCA) Withholding May Apply to Payments on Your Notes, Including as a Result of the Failure of the Bank or Broker Through Which You Hold the Notes to Provide Information to Tax Authorities |

The following risk factors are discussed in greater detail in the accompanying general terms supplement no. 8,671:

3

|

▪ |

Goldman Sachs’ Trading and Investment Activities for its Own Account or for its Clients Could Negatively Impact Investors in the Notes |

|

▪ |

Goldman Sachs’ Market-Making Activities Could Negatively Impact Investors in the Notes |

|

▪ |

You Should Expect That Goldman Sachs Personnel Will Take Research Positions, or Otherwise Make Recommendations, Provide Investment Advice or Market Color or Encourage Trading Strategies That Might Negatively Impact Investors in the Notes |

|

▪ |

Goldman Sachs Regularly Provides Services to, or Otherwise Has Business Relationships with, a Broad Client Base, Which May Include the Sponsors of the Underlier or Underliers or Constituent Indices, As Applicable, or the Issuers of the Underlier Stocks or Other Entities That Are Involved in the Transaction |

|

▪ |

The Offering of the Notes May Reduce an Existing Exposure of Goldman Sachs or Facilitate a Transaction or Position That Serves the Objectives of Goldman Sachs or Other Parties |

|

▪ |

|

▪ |

Your Notes May Not Have an Active Trading Market |

|

▪ |

The Calculation Agent Will Have the Authority to Make Determinations That Could Affect the Market Value of Your Notes, When Your Notes Mature and the Amount, If Any, Payable on Your Notes |

|

▪ |

The Policies of an Underlier Sponsor, if Applicable, and Changes that Affect an Underlier to Which Your Notes are Linked, or the Constituent Indices or Underlier Stocks Comprising Such Underlier, Could Affect the Amount Payable on Your Notes and Their Market Value |

|

▪ |

The Calculation Agent Can Postpone the Determination Date, Averaging Date, Call Observation Date or Coupon Observation Date If a Market Disruption Event or Non-Trading Day Occurs or Is Continuing |

|

▪ |

Except to the Extent That We or Our Affiliates May Currently or in the Future Own Securities of, or Engage in Business With, the Applicable Underlier Sponsor or the Underlier Stock Issuers, There Is No Affiliation Between the Underlier Stock Issuers or Any Underlier Sponsor and Us |

|

▪ |

Certain Considerations for Insurance Companies and Employee Benefit Plans |

The following risk factor is discussed in greater detail in the accompanying underlier supplement no. 14:

|

▪ |

Except to the Extent The Goldman Sachs Group, Inc. Is One of the Companies Whose Common Stock Comprises an Underlier, and Except to the Extent That We or Our Affiliates May Currently or in the Future Own Securities of, or Engage in Business With, the Applicable Underlier Sponsor or the Underlier Stock Issuers, There Is No Affiliation Between the Underlier Stock Issuers or Any Underlier Sponsor and Us |

The following risk factors are discussed in greater detail in the accompanying prospectus supplement:

|

▪ |

The Return on Indexed Notes May Be Below the Return on Similar Securities |

|

▪ |

The Issuer of a Security or Currency That Serves as an Index Could Take Actions That May Adversely Affect an Indexed Note |

|

▪ |

An Indexed Note May Be Linked to a Volatile Index, Which May Adversely Affect Your Investment |

|

▪ |

An Index to Which a Note Is Linked Could Be Changed or Become Unavailable |

|

▪ |

We May Engage in Hedging Activities that Could Adversely Affect an Indexed Note |

|

▪ |

Information About an Index or Indices May Not Be Indicative of Future Performance |

|

▪ |

We May Have Conflicts of Interest Regarding an Indexed Note |

The following risk factors are discussed in greater detail in the accompanying prospectus:

Risks Relating to Regulatory Resolution Strategies and Long-Term Debt Requirements

|

▪ |

The application of regulatory resolution strategies could increase the risk of loss for holders of our debt securities in the event of the resolution of Group Inc. |

This document does not provide all of the information that an investor should consider prior to making an investment decision. You should not invest in the notes without reading the accompanying preliminary pricing supplement and related documents for a more detailed description of the underlier, the terms of the notes and certain risks.

5