Form FWP GS Finance Corp. Filed by: GS Finance Corp.

Free Writing Prospectus pursuant to Rule 433 dated December 9, 2020

Registration Statement No. 333-239610

|

|

Leveraged Basket-Linked Notes due |

|

OVERVIEW

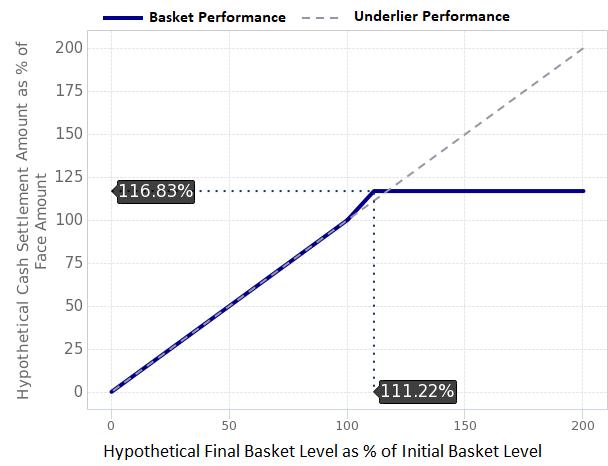

The notes do not bear interest. The amount that you will be paid on your notes on the stated maturity date is based on the performance of an unequally-weighted basket comprised of the common stock or ordinary shares (basket stocks) of 23 companies as measured from the trade date to and including the determination date.

The initial basket level is 100 and the final basket level will equal the sum of the products, as calculated for each basket stock, of: (i) its final stock price on the determination date divided by its initial stock price multiplied by (ii) its initial weighted value.

If the final basket level on the determination date is greater than the initial basket level, the return on your notes will be positive and will equal 150% times the basket return, subject to the maximum settlement amount (expected to be between $1,168.3 and $1,197.4 for each $1,000 face amount of your notes).

If the final basket level is less than the initial basket level, the return on your notes will be negative and will equal the basket return.

You should read the accompanying preliminary prospectus supplement dated December 9, 2020, which we refer to herein as the accompanying preliminary prospectus supplement, to better understand the terms and risks of your investment, including the credit risk of GS Finance Corp. and The Goldman Sachs Group, Inc.

|

Key Terms |

|

|

CUSIP/ISIN: |

40057EUC9 / US40057EUC91 |

|

Company (Issuer): |

GS Finance Corp. |

|

Guarantor: |

The Goldman Sachs Group, Inc. |

|

Basket: |

an unequally weighted basket comprised of the common stock or ordinary shares of 23 companies |

|

Basket Stocks |

the 23 common stocks or ordinary shares listed under “About the Basket” below. |

|

Basket stock issuer: |

with respect to a basket stock, the issuer of such basket stock as then in effect |

|

Trade date: |

|

|

Settlement date: |

expected to be the fifth scheduled business day following the trade date |

|

Determination date: |

a specified date that is expected to be between 13 and 15 months following the trade date |

|

Stated maturity date: |

a specified date that is expected to be the second scheduled business day after the determination date |

|

Hypothetical Payment amount AT Maturity* |

||

|

|

||

|

|

Hypothetical Final |

Hypothetical Payment Amount at Maturity |

|

175.000% |

116.830% |

|

|

150.000% |

116.830% |

|

|

125.000% |

116.830% |

|

|

111.220% |

116.830% |

|

|

104.000% |

106.000% |

|

|

102.000% |

103.000% |

|

|

100.000% |

100.000% |

|

|

90.000% |

90.000% |

|

|

75.000% |

75.000% |

|

|

50.000% |

50.000% |

|

|

25.000% |

25.000% |

|

|

0.000% |

0.000% |

|

|

|

|

|

*assumes a cap level of 111.22% of the initial basket level

This document does not provide all of the information that an investor should consider prior to making an investment decision. You should not invest in the notes without reading the accompanying preliminary prospectus supplement and related documents for a more detailed description of the basket, the terms of the notes and certain risks.

|

|

● if the basket return is positive (the final basket level is greater than the initial basket level), the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) 150% times (c) the basket return, subject to the maximum settlement amount; or ● if the basket return is zero or negative (the final basket level is equal to or less than the initial basket level), the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the basket return. |

|

Initial basket level: |

100 |

|

Initial weighted value: |

for each of the basket stocks, the product of the initial weight of such basket stock in the basket times the initial basket level. |

|

Final basket level: |

the closing level of the basket on the determination date |

|

Closing level of the basket: |

on any trading day, the sum of, for each of the basket stocks: the product of (i) the quotient of (a) the closing price of such basket stock on such trading day divided by (b) the initial stock price of such basket stock times (ii) the initial weighted value of such basket stock |

|

Initial stock price: |

for each of the basket stocks, set on the trade date and may be higher or lower than the actual closing price of the basket stock on that date, as determined by the calculation agent in its sole discretion |

|

Final stock price: |

for each of the basket stocks, the closing price of such basket stock on the determination date |

|

Basket return: |

the quotient of (i) the final basket level minus the initial basket level divided by (ii) the initial basket level, expressed as a percentage |

|

Cap Level: |

expected to be between 111.22% and 113.16% |

|

Maximum settlement amount: |

expected to be between $1,168.3 and $1,197.4 |

|

Estimated value range: |

$940 to $970 (which is less than the original issue price; see accompanying preliminary prospectus supplement) |

|

About the Basket |

|

The following table lists the basket stocks and related information, including their corresponding Bloomberg tickers, primary listings, initial weights in the basket, initial weighted values and initial stock prices. The initial stock prices will not be determined until the trade date. Each of the basket stock issuers faces its own business risks and other competitive factors. All of those factors may affect the basket return, and, consequently, the amount payable on your notes, if any, on the stated maturity date. Our offering of the notes does not constitute our recommendation or the recommendation of our affiliates to invest in the basket, any basket stock or the notes. You should make your own investigation of the basket stocks and the basket stock issuers and whether to obtain exposure to the basket through an investment in the notes. |

|

Current Bloomberg Ticker |

Type of Security |

Current Primary Listing |

Initial Weight in the Basket |

Initial Weighted Value |

Initial Stock Price (USD) |

|

|

Align Technology, Inc. |

ALGN |

Common Stock |

The Nasdaq Stock Market LLC |

3.75% |

3.75 |

|

|

Amgen Inc. |

AMGN |

Common Stock |

Nasdaq Global Select Market |

5.00% |

5.00 |

|

|

Bristol-Myers Squibb Company |

BMY |

Common Stock |

New York Stock Exchange |

5.00% |

5.00 |

|

|

Cerner Corporation |

CERN |

Common Stock |

The Nasdaq Stock Market LLC |

4.28% |

4.28 |

|

|

CVS Health Corporation |

CVS |

Common Stock |

New York Stock Exchange |

4.29% |

4.29 |

|

|

DexCom, Inc. |

DXCM |

Common Stock |

The Nasdaq Stock Market LLC |

3.75% |

3.75 |

|

|

Eli Lilly and Company |

LLY |

Common Stock |

New York Stock Exchange |

5.00% |

5.00 |

|

|

Exact Sciences Corporation |

EXAS |

Common Stock |

The Nasdaq Stock Market LLC |

3.75% |

3.75 |

|

|

HCA Healthcare, Inc. |

HCA |

Common Stock |

New York Stock Exchange |

4.29% |

4.29 |

|

|

Humana Inc. |

HUM |

Common Stock |

New York Stock Exchange |

4.29% |

4.29 |

|

|

Illumina, Inc. |

ILMN |

Common Stock |

The Nasdaq Global Select Market |

3.75% |

3.75 |

|

|

Intuitive Surgical, Inc. |

ISRG |

Common Stock |

The Nasdaq Global Select Market |

3.75% |

3.75 |

|

|

IQVIA Holdings Inc |

IQV |

Common Stock |

New York Stock Exchange |

4.28% |

4.28 |

|

|

Johnson & Johnson |

JNJ |

Common Stock |

New York Stock Exchange |

5.00% |

5.00 |

|

|

Medtronic Public Limited Company |

MDT |

Ordinary Shares |

New York Stock Exchange |

3.75% |

3.75 |

|

|

Merck & Co., Inc. |

MRK |

Common Stock |

New York Stock Exchange |

5.00% |

5.00 |

|

|

PPD, Inc. |

PPD |

Common Stock |

The Nasdaq Stock Market LLC |

4.28% |

4.28 |

|

|

Regeneron Pharmaceuticals, Inc. |

REGN |

Common Stock |

The Nasdaq Global Select Market |

5.00% |

5.00 |

|

|

Stryker Corporation |

SYK |

Common Stock |

New York Stock Exchange |

3.75% |

3.75 |

|

|

Thermo Fisher Scientific Inc. |

TMO |

Common Stock |

New York Stock Exchange |

3.75% |

3.75 |

|

|

UnitedHealth Group Incorporated |

UNH |

Common Stock |

New York Stock Exchange |

4.29% |

4.29 |

|

|

Vertex Pharmaceuticals Incorporated |

VRTX |

Common Stock |

The Nasdaq Global Select Market |

5.00% |

5.00 |

|

|

Zoetis Inc. |

ZTS |

Common Stock |

New York Stock Exchange |

5.00% |

5.00 |

|

This document does not provide all of the information that an investor should consider prior to making an investment decision. You should not invest in the notes without reading the accompanying preliminary prospectus supplement and related documents for a more detailed description of the basket, the terms of the notes and certain risks.

GS Finance Corp. and The Goldman Sachs Group, Inc. have filed a registration statement (including a prospectus, as supplemented by the prospectus supplement and preliminary prospectus supplement listed below) with the Securities and Exchange Commission (SEC) for the offering to which this communication relates. Before you invest, you should read the prospectus, prospectus supplement and preliminary prospectus supplement, and any other documents relating to this offering that GS Finance Corp. and The Goldman Sachs Group, Inc. have filed with the SEC for more complete information about us and this offering. You may get these documents without cost by visiting EDGAR on the SEC web site at sec.gov. Alternatively, we will arrange to send you the prospectus, prospectus supplement and preliminary prospectus supplement if you so request by calling (212) 357-4612.

The notes are part of the Medium-Term Notes, Series F program of GS Finance Corp. and are fully and unconditionally guaranteed by The Goldman Sachs Group, Inc. This document should be read in conjunction with the following:

RISK FACTORS

An investment in the notes is subject to risks. Many of the risks are described in the accompanying preliminary prospectus supplement, accompanying prospectus supplement and accompanying prospectus. Below we have provided a list of certain risk factors discussed in such documents. In addition to the below, you should read in full “Additional Risk Factors Specific to Your Notes” in the accompanying preliminary prospectus supplement as well as the risks and considerations described in the accompanying prospectus supplement and accompanying prospectus.

The following risk factors are discussed in greater detail in the accompanying preliminary prospectus supplement:

This document does not provide all of the information that an investor should consider prior to making an investment decision. You should not invest in the notes without reading the accompanying preliminary prospectus supplement and related documents for a more detailed description of the basket, the terms of the notes and certain risks.

The following risk factors are discussed in greater detail in the accompanying prospectus supplement:

|

▪ The Return on Indexed Notes May Be Below the Return on Similar Securities ▪ The Issuer of a Security or Currency That Serves as an Index Could Take Actions That May Adversely Affect an Indexed Note ▪ An Indexed Note May Be Linked to a Volatile Index, Which May Adversely Affect Your Investment |

|

▪ An Index to Which a Note Is Linked Could Be Changed or Become Unavailable ▪ We May Engage in Hedging Activities that Could Adversely Affect an Indexed Note ▪ Information About an Index or Indices May Not Be Indicative of Future Performance ▪ We May Have Conflicts of Interest Regarding an Indexed Note |

The following risk factors are discussed in greater detail in the accompanying prospectus:

Risks Relating to Regulatory Resolution Strategies and Long-Term Debt Requirements

|

▪ The application of regulatory resolution strategies could increase the risk of loss for holders of our debt securities in the event of the resolution of Group Inc. ▪ The application of Group Inc.’s proposed resolution strategy could result in greater losses for Group Inc.’s security holders |

|

|

This document does not provide all of the information that an investor should consider prior to making an investment decision. You should not invest in the notes without reading the accompanying preliminary prospectus supplement and related documents for a more detailed description of the basket, the terms of the notes and certain risks.