Form 424B2 MORGAN STANLEY

| PROSPECTUS SUPPLEMENT | Filed Pursuant to Rule 424(b)(2) |

| For Currency-Linked Performance Leveraged Upside Securities | Registration Statement Nos. 333-250103 |

| (To Prospectus dated November 16, 2020) | 333-250103-01 |

GLOBAL MEDIUM-TERM NOTES, SERIES I

Senior Notes

Morgan Stanley Finance LLC

GLOBAL MEDIUM-TERM NOTES, SERIES A

Senior Notes

Fully and Unconditionally Guaranteed by Morgan Stanley

Currency-Linked Performance Leveraged Upside SecuritiesSM (“PLUSSM”)

We, Morgan Stanley and Morgan Stanley Finance LLC (“MSFL”), a wholly owned finance subsidiary of Morgan Stanley, may offer from time to time performance leveraged upside securities, which we refer to as PLUS, that may be linked to a single currency or a basket of currencies. The specific terms of any such PLUS that we offer, including the name of the underlying currency or currencies, will be included in a pricing supplement. If the terms described in the applicable pricing supplement are inconsistent with those described in this prospectus supplement for PLUS or the accompanying prospectus, the terms described in the applicable pricing supplement will prevail. The PLUS will have the following general terms:

| • | The PLUS do not guarantee the return of principal at maturity. |

| • | At maturity, the PLUS will pay an amount in cash that may be greater than, equal to or less than the principal amount of each PLUS based on the performance of the underlying currency or basket of currencies over the life of the PLUS. |

| • | A positive return on the PLUS may be based on either the positive performance (strengthening relative to another currency) or the negative performance |

(weakening relative to another currency) of the underlying currency or basket of currencies. The positive return on the PLUS is leveraged and generally limited by a maximum payment amount per PLUS.

| • | The PLUS will be unsubordinated unsecured obligations of ours. All payments under the PLUS are subject to our credit risk. |

| • | The PLUS will be held in global form by The Depository Trust Company, unless the applicable pricing supplement provides otherwise. |

The applicable pricing supplement will describe the specific terms of the PLUS, including any changes to the terms specified in this prospectus supplement. See “Description of the PLUS––General Terms of the PLUS––Terms Specified in Pricing Supplements” on page S-39.

MSFL’s payment obligations on PLUS issued by it will be fully and unconditionally guaranteed by Morgan Stanley.

Investing in the PLUS involves risks not associated with an investment in ordinary debt securities. See “Risk Factors” beginning on page S-31.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Morgan Stanley & Co. LLC, a wholly owned subsidiary of Morgan Stanley and an affiliate of MSFL, has agreed to use reasonable efforts to solicit offers to purchase these securities as our agent. The agent may also purchase these securities as principal at prices to be agreed upon at the time of sale. The agent may resell any securities it purchases as principal at prevailing market prices, or at other prices, as the agent determines.

Morgan Stanley & Co. LLC may use this prospectus supplement, the applicable pricing supplement and the accompanying prospectus in connection with offers and sales of the securities in market-making transactions.

These securities are not deposits or savings accounts and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency or instrumentality, nor are they obligations of, or guaranteed by, a bank.

MORGAN STANLEY

November 16, 2020

For a description of certain restrictions on offers, sales and deliveries of the PLUS and on the distribution of this prospectus supplement and the accompanying prospectus relating to the PLUS, see the section of this prospectus supplement called “Plan of Distribution (Conflicts of Interest).”

No action has been or will be taken by us, the agent or any dealer that would permit a public offering of the PLUS or possession or distribution of this prospectus supplement or the accompanying prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Neither this prospectus supplement nor the accompanying prospectus may be used for the purpose of an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

With respect to sales of the PLUS in Canada, the PLUS may be sold only to purchasers purchasing, or deemed to be purchasing, as principal that are both accredited investors, as defined in National Instrument 45-106 Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and permitted clients, as defined in National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations. Any resale of the PLUS must be made in accordance with an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities laws.

Securities legislation in certain provinces or territories of Canada may provide a purchaser with remedies for rescission or damages if this document (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser within the time limit prescribed by the securities legislation of the purchaser’s province or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser’s province or territory for particulars of these rights or consult with a legal advisor.

Unless otherwise noted in the applicable pricing supplement, pursuant to section 3A.3 (or, in the case of PLUS issued or guaranteed by the government of a non-Canadian jurisdiction, section 3A.4) of National Instrument 33-105 Underwriting Conflicts (“NI 33-105”), the dealers, underwriters or agents, if any, involved in the sale of the PLUS are not required to comply with the disclosure requirements of NI 33-105 regarding underwriter conflicts of interest in connection with this offering.

IMPORTANT – EEA AND UNITED KINGDOM RETAIL INVESTORS – The PLUS are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (the “EEA”) or in the United Kingdom. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU, as amended (“MiFID II”); (ii) a customer within the meaning of Directive (EU) 2016/97 (the “Insurance Distribution Directive”), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in the European Union’s Regulation (EU) 2017/1129 (the “Prospectus Regulation”). Consequently no key information document required by Regulation (EU) No 1286/2014, as amended (the “PRIIPs Regulation”) for offering or selling the PLUS or otherwise making them available to retail investors in the EEA or in the United Kingdom has been prepared and therefore offering or selling the PLUS or otherwise making them available to any retail investor in the EEA or in the United Kingdom may be unlawful under the PRIIPs Regulation.

Neither this prospectus supplement nor the accompanying prospectus is a prospectus for the purposes of the Prospectus Regulation. This prospectus supplement and the accompanying prospectus have been prepared on the basis that all offers of the PLUS made to persons in the EEA or in the United Kingdom will be made pursuant to an exemption under the Prospectus Regulation from the requirement to produce a prospectus in connection with offers of the PLUS.

The agent has represented and agreed, and each further agent, dealer and underwriter appointed under this program will be required to represent and agree, that it has not offered, sold or otherwise made available and will not offer, sell or otherwise make available any PLUS to any retail investor in the EEA or in the United Kingdom. For the purposes of this provision:

(a) the expression “retail investor” means a person who is one (or more) of the following:

(i) a retail client as defined in point (11) of Article 4(1) of MiFID II; or

S-2

(ii) a customer within the meaning of the Insurance Distribution Directive, where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or

(iii) not a qualified investor as defined in the Prospectus Regulation; and

(b) the expression an “offer” includes the communication in any form and by any means of sufficient information on the terms of the offer and the PLUS to be offered so as to enable an investor to decide to purchase or subscribe for the PLUS.

With respect to PLUS to be offered or sold in the United Kingdom, the agent has represented and agreed, and each underwriter, dealer, other agent and remarketing firm participating in the distribution of the PLUS will be required to represent and agree, that (1) it has only communicated or caused to be communicated and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the Financial Services and Markets Act 2000, as amended (the “FSMA”)) received by it in connection with the issue or sale of any PLUS in circumstances in which Section 21(1) of the FSMA does not apply to us, and (2) it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to any PLUS in, from or otherwise involving the United Kingdom.

The communication of this prospectus supplement, the accompanying prospectus and any other documents or materials relating to the issue of PLUS is not being made, and such documents and/or materials have not been approved, by an authorised person for the purposes of Section 21 of the FSMA. Accordingly, such documents and/or materials are not being distributed to, and must not be passed on to, the general public in the United Kingdom. The communication of such documents and/or materials as a financial promotion is only being made to those persons in the United Kingdom falling within the definition of investment professionals as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Financial Promotion Order”) or within Article 49(2)(A) to (D) of the Financial Promotion Order, or to any other persons to whom it may otherwise lawfully be made under the Financial Promotion Order (all such persons together being referred to as “relevant persons”). In the United Kingdom the PLUS are only available to, and any investment or investment activity to which this prospectus supplement or the accompanying prospectus relates will be engaged in only with, relevant persons. Any person in the United Kingdom that is not a relevant person should not act or rely on this prospectus supplement or the accompanying prospectus or any of its or their contents.

Where PLUS have a maturity of less than one year from their date of issue and either (a) the issue proceeds are received by us in the United Kingdom or (b) the activity of issuing the PLUS is carried on from an establishment maintained by us in the United Kingdom, each such PLUS must: (i)(A) have a minimum redemption value of £100,000 (or its equivalent in other currencies) (B) no part of any such PLUS may be transferred unless the redemption value of that part is not less than £100,000 (or its equivalent in other currencies) and (C) be issued only to persons whose ordinary activities involve them in acquiring, holding, managing or disposing of investments (as principal or agent) for the purposes of their businesses or who it is reasonable to expect will acquire, hold, manage or dispose of investments (as principal or agent) for the purposes of their businesses; or (ii) be issued in other circumstances which do not constitute a contravention of Section 19 of the FSMA by us.

With respect to such PLUS that have a maturity of less than one year, the agent has represented and agreed, and each underwriter, dealer, other agent and remarketing firm participating in the distribution of the PLUS will be required to represent and agree, that (1) it is a person whose ordinary activities involve it in acquiring, holding, managing or disposing of investments (as principal or agent) for the purposes of its business, and (2) it has not offered or sold and will not offer or sell any such PLUS other than to persons:

(i) whose ordinary activities involve them in acquiring, holding, managing or disposing of investments (as principal or agent) for the purposes of their businesses; or

(ii) who it is reasonable to expect will acquire, hold, manage or dispose of investments (as principal or agent) for the purposes of their businesses,

where the issue of the PLUS would otherwise constitute a contravention of Section 19 of the FSMA by us.

S-3

The PLUS have not been and will not be registered under the Financial Instruments and Exchange Act of Japan (Law No.25 of 1948, as amended, the “FIEA”). The agent has agreed, and each further agent, dealer and underwriter appointed with respect to any PLUS will be required to agree, that the PLUS may not be offered or sold, directly or indirectly, in Japan or to or for the account or benefit of any resident of Japan (as defined under Item 5, Paragraph 1, Article 6 of the Foreign Exchange and Foreign Trade Act (Law No. 228 of 1949, as amended)) or to others for re-offering or resale, directly or indirectly, in Japan or to or for the account or benefit of any resident of Japan, except pursuant to an exemption from the registration requirements of and otherwise in compliance with the FIEA and any other applicable laws, regulations and ministerial guidelines of Japan.

The agent has represented and agreed, and each further agent, dealer and underwriter appointed with respect to any PLUS will be required to represent and agree, that it will not offer or sell, directly or indirectly, any PLUS in the Republic of France and will not distribute or cause to be distributed in the Republic of France this prospectus supplement or the accompanying prospectus or any other offering material relating to the PLUS, except to qualified investors (investisseurs qualifiés) as defined in and in accordance with Articles L.411-2 and D.411-1 of the French Code Monétaire et Financier.

The contents of this prospectus supplement and the accompanying prospectus have not been reviewed or approved by any regulatory authority in Hong Kong. This prospectus supplement or the accompanying prospectus does not constitute an offer or invitation to the public in Hong Kong to acquire PLUS. No PLUS have been offered or sold or will be offered or sold, in Hong Kong, by means of any document, other than to “professional investors” as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong (“SFO”) and any rules made under that Ordinance; or in other circumstances which do not result in the document being a “prospectus” as defined in the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32) of Hong Kong (“CO”) or which do not constitute an offer to the public within the meaning of the CO. No document, invitation or advertisement relating to the PLUS has been issued or will be issued or has been or will be in the possession of any person for the purpose of issue (in each case whether in Hong Kong or elsewhere), which is directed at, or the contents of which are likely to be accessed or read by, the public of Hong Kong (except if permitted under the securities laws of Hong Kong) other than with respect to PLUS which are or are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” as defined in the SFO and any rules made under that Ordinance. The offer of the PLUS is personal to the person to whom this prospectus supplement or the accompanying prospectus has been delivered by or on behalf of us, and a subscription for PLUS will only be accepted from such person. No person to whom a copy of this prospectus supplement or the accompanying prospectus is issued may copy, issue or distribute this prospectus supplement or the accompanying prospectus to any other person. You are advised to exercise caution in relation to the offer. If you are in any doubt about the contents of this prospectus supplement or the accompanying prospectus, you should obtain independent professional advice.

Neither this prospectus supplement nor the accompanying prospectus has been registered as a prospectus under the Securities and Futures Act, Chapter 289 of Singapore, as amended (the “SFA”) by the Monetary Authority of Singapore and the PLUS will be offered pursuant to exemptions under the SFA. Accordingly, none of this prospectus supplement, the accompanying prospectus and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of any PLUS may be circulated or distributed, nor may any PLUS be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the SFA (an “Institutional Investor”)) pursuant to Section 274 of the SFA, (ii) to an accredited investor (as defined in Section 4A of the SFA (an “Accredited Investor”)) or other relevant person (as defined in Section 275(2) of the SFA (a “Relevant Person”)) and pursuant to Section 275(1) of the SFA, or to any person pursuant to an offer referred to in Section 275(1A) of the SFA, and in accordance with the conditions specified in Section 275 of the SFA and (where applicable) Regulation 3 of the Securities and Futures (Classes of Investors) Regulations 2018, or (iii) otherwise pursuant to, and in accordance with, the conditions of any other applicable exemption or provision of the SFA. Where PLUS are subscribed for or acquired pursuant to an offer made in reliance on Section 275 of the SFA by a Relevant Person which is:

(i) a corporation (which is not an Accredited Investor), the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an Accredited Investor; or

S-4

(ii) a trust (where the trustee is not an Accredited Investor), the sole purpose of which is to hold investments and each beneficiary of the trust is an individual who is an Accredited Investor,

securities or securities-based derivatives contracts (each as defined in Section 2(1) of the SFA) of that corporation and the beneficiaries’ rights and interests (howsoever described) in that trust shall not be transferred for six months after that corporation or that trust has subscribed for or acquired the PLUS except:

(A) to an Institutional Investor, or an Accredited Investor or other Relevant Person, or which arises from an offer referred to in Section 275(1A) of the SFA (in the case of that corporation) or Section 276(4)(i)(B) of the SFA (in the case of that trust);

(B) where no consideration is or will be given for the transfer;

(C) where the transfer is by operation of law;

(D) as specified in Section 276(7) of the SFA; or

(E) as specified in Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018 of Singapore.

The agent has represented and agreed, and each further agent, dealer and underwriter appointed under this program will be required to represent and agree, that, subject to the paragraph immediately below:

(i) the PLUS may not be publicly offered, directly or indirectly, in Switzerland within the meaning of the Swiss Financial Services Act (the “FinSA”) and will not be admitted to trading on a trading venue (exchange or multilateral trading facility) in Switzerland;

(ii) none of this prospectus supplement, the accompanying prospectus or any other offering or marketing material relating to any PLUS (x) constitutes a prospectus compliant with the requirements of articles 652a and 1156 of the Swiss Code of Obligations (as such articles were in effect immediately prior to the entry into effect of the FinSA) in accordance with article 109 of the Swiss Financial Services Ordinance (“FinSO”) or pursuant to articles 35 and 45 of the FinSA for a public offering of the PLUS in Switzerland and no such prospectus has been or will be prepared for or in connection with the offering of the PLUS in Switzerland or (y) has been or will be filed with or approved by a Swiss review body (Prüfstelle) pursuant to article 52 of the FinSA; and

(iii) none of this prospectus supplement, the accompanying prospectus or other offering or marketing material relating to any PLUS may be publicly distributed or otherwise made publicly available in Switzerland.

Notwithstanding the paragraph immediately above, in respect of any issuance of PLUS, the issuer of PLUS, the agent and the relevant dealer(s) and underwriter(s) may agree that (x) such PLUS may be publicly offered in Switzerland within the meaning of the FinSA and/or (y) an application will be made by (or on behalf of) the issuer to admit such PLUS to trading on a trading venue (exchange or multilateral trading facility) in Switzerland, provided that:

(i) the issuer is able to rely, and is relying, on an exemption from the requirement to prepare and publish a prospectus under the FinSA in connection with such public offer and/or application for admission to trading;

(ii) in the case of any such public offer, the relevant agent, dealer(s) and underwriter(s) have agreed to comply with any restrictions applicable to the offer and sale of such PLUS that must be complied with in order for the issuer to rely on such exemption; and

(iii) the applicable pricing supplement will specify that such PLUS may be publicly offered in Switzerland within the meaning of the FinSA and/or the trading venue in Switzerland to which an application will be made by (or on behalf of) the issuer to admit such PLUS to trading thereon.

The agent has represented and agreed, and each further agent, dealer and underwriter appointed under this program will be required to represent and agree, that,

S-5

(i) no key information document (Basisinformationsblatt) pursuant to article 58 (1) of the FinSA (or any equivalent document under the FinSA) has been or will be prepared in relation to any PLUS; and

(ii) therefore, any PLUS with a derivative character within the meaning of article 86 (2) of the FinSO may not be offered or recommended to private clients within the meaning of the FinSA in Switzerland.

The agent has represented and agreed, and each further agent, dealer and underwriter appointed with respect to any PLUS will be required to represent and agree, that it will not offer or sell, directly or indirectly, any PLUS in the Republic of Chile and will not distribute or cause to be distributed in the Republic of Chile this prospectus supplement, the accompanying prospectus or any other offering material relating to the PLUS, except to “qualified investors” and subject to Norma de Carácter General No. 336 (“NCG 336”) of June 27, 2012 issued by the Financial Market Commission of Chile (“CMF”).

The CMF nor any other regulatory authority in the Republic of Chile has reviewed or approved the contents of this prospectus supplement or the accompanying prospectus. This prospectus supplement or the accompanying prospectus does not constitute an offer or invitation to the public in Chile to acquire PLUS.

According to NCG 336, on or before making any offer of the PLUS in Chile, the person making the offer shall include in all offering materials the following cautionary language in English and in Spanish:

“IMPORTANT INFORMATION FOR INVESTORS RESIDENT IN CHILE: (1) The offering of the PLUS will commence in Chile on [dd/mm/yyyy]; (2) the offering will be subject to Norma de Carácter General N° 336 of the CMF; (3) the offered PLUS are not and will not be registered in the Securities Registry (Registro de Valores) or in the Foreign Securities Registry (Registro de Valores Extranjeros) of the CMF and will therefore not be subject to the supervision of the CMF; (4) the offered PLUS are not registered in Chile and the issuer thereof is not required to disclose information to the public in Chile about its PLUS; and (5) the offered PLUS cannot and will not be publicly offered in Chile unless and until the offered PLUS are registered in the corresponding securities registry of the CMF.

INFORMACIÓN IMPORTANTE PARA INVERSIONISTAS RESIDENTES EN CHILE: (1) La oferta de los valores comenzará en Chile el día [dd/mm/aaaa]; (2) la oferta se acogerá a la Norma de Carácter General N° 336 de la CMF; (3) los valores no están ni estarán inscritos en el Registro de Valores o en el Registro de Valores Extranjeros que lleva la CMF, por lo que tales valores no están sujetos a la fiscalización de ésta; (4) Por tratarse de valores no inscritos, no existe obligación por parte del emisor de entregar en Chile información pública respecto de estos valores, y (5) Los valores no podrán ser objeto de oferta pública en Chile mientras no sean inscritos en el Registro de Valores correspondiente.”

Pursuant to NCG 336, the PLUS may be privately offered to certain “qualified investors” as such are defined in NCG 336 and further described in Rules No. 216 of June 12, 2008 and 410 of July 27, 2016 of the CMF. The person making the offer in Chile should consult with local counsel about these definitions.

The PLUS have not been, and will not be, issued, placed, distributed, offered or negotiated in the Brazilian capital markets. The issuance of the PLUS has not been nor will the PLUS be registered with the Brazilian Securities Commission (Comissão de Valores Mobiliários), or the CVM. Any public offering or distribution, as defined under Brazilian laws and regulations, of the PLUS in Brazil is not permitted without such registration or an express exemption or registration with the CVM pursuant to Brazilian laws and regulations. Documents relating to the offering of the PLUS, as well as information contained therein, may not be supplied to the public in Brazil (as the offering of the PLUS is not a public offering of securities in Brazil), nor be used in connection with any offer for subscription or sale of the PLUS to the public in Brazil. This prospectus supplement or the accompanying prospectus is not addressed to Brazilian residents and it should not be forwarded or distributed to, nor read or consulted by, acted on or relied upon by Brazilian residents. Any investment to which this prospectus supplement or the accompanying prospectus relates is available only to non-Brazilian residents and will only be made by non- Brazilian residents. If you are a Brazilian resident and received this prospectus supplement or the accompanying prospectus, please destroy it along with any copies.

The PLUS have not been and will not be registered with the National Securities Registry (Registro Nacional de Valores) maintained by the Mexican National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores; the “CNBV”) and, therefore, may not be offered or sold publicly in Mexico,

S-6

except that the PLUS may be sold to Mexican institutional and accredited investors solely pursuant to the private placement exemption set forth in the Mexican Securities Market Law (Ley del Mercado de Valores). Each of this prospectus supplement and the accompanying prospectus is solely our responsibility and has not been reviewed or authorized by the CNBV. The acquisition of the PLUS by an investor who is a resident of Mexico will be made under its own responsibility.

S-7

TABLE OF CONTENTS

Page

Prospectus Supplement

| Summary | S-9 |

| Estimated Value and Secondary Market Prices of the PLUS | S-18 |

| How Do Currency Exchange Rates Work? | S-19 |

| Hypothetical Payments on the PLUS | S-21 |

| Risk Factors | S-31 |

| Description of PLUS | S-38 |

| Payment at Maturity | S-45 |

| Use of Proceeds and Hedging | S-50 |

| PLUS Offered on a Global Basis | S-50 |

| Benefit Plan Investor Considerations | S-51 |

| United States Federal Taxation | S-53 |

| Plan of Distribution (Conflicts of Interest) | S-61 |

| Annex I Certain Additional Currency Exchange Rate Risks | I-1 |

| Argentina | I-1 |

| Brazil | I-1 |

| Chile | I-2 |

| The People’s Republic of China | I-2 |

| Hong Kong | I-3 |

| Hungary | I-3 |

| India | I-4 |

| Indonesia | I-4 |

| The Republic of Korea | I-5 |

| Malaysia | I-5 |

| Mexico | I-5 |

| Philippines | I-6 |

| Poland | I-6 |

| Romania | I-7 |

| Russia | I-7 |

| Singapore | I-7 |

| South Africa | I-8 |

| Taiwan | I-8 |

| Thailand | I-8 |

| Turkey | I-8 |

| United Arab Emirates | I-9 |

| Vietnam | I-9 |

Page

| Prospectus | |

| Summary | 1 |

| Risk Factors | 7 |

| Where You Can Find More Information | 12 |

| Morgan Stanley | 14 |

| Morgan Stanley Finance LLC | 14 |

| Use of Proceeds | 15 |

| Description of Debt Securities | 15 |

| Description of Units | 49 |

| Description of Warrants | 57 |

| Description of Purchase Contracts | 61 |

| Description of Capital Stock | 63 |

| Forms of Securities | 75 |

| Securities Offered on a Global Basis | |

| Through the Depositary | 78 |

| United States Federal Taxation | 81 |

| Plan of Distribution (Conflicts of Interest) | 87 |

| Legal Matters | 89 |

| Experts | 90 |

| Benefit Plan Investor Considerations | 90 |

You should rely only on the information contained or incorporated by reference in this prospectus supplement, the prospectus and any applicable pricing supplement. We have not authorized anyone else to provide you with different or additional information. We are offering to sell these securities and seeking offers to buy these securities only in jurisdictions where offers and sales are permitted. As used in this prospectus supplement, “we,” “us” and “our” refer to Morgan Stanley or MSFL, or Morgan Stanley and MSFL collectively, as the context requires.

S-8

Summary

The following summary describes the performance leveraged upside securities linked to a single currency or a basket of currencies that we, Morgan Stanley and MSFL, may offer from time to time, in general terms only. You should read the summary together with the more detailed information contained in this prospectus supplement, in the accompanying prospectus and in the applicable pricing supplement. We may also prepare free writing prospectuses that describe the preliminary terms proposed for particular issuances of PLUS. Any free writing prospectus should also be read in connection with this prospectus supplement and the accompanying prospectus. For purposes of this prospectus supplement, any references to an applicable pricing supplement may also refer to a free writing prospectus, unless the context otherwise requires.

We will sell the PLUS primarily in the United States, but may also sell them outside the United States or both in and outside the United States simultaneously. In the case of Morgan Stanley, the PLUS it offers under this prospectus supplement are among the notes referred to as its Series I medium-term notes. The offering of Morgan Stanley’s Series I medium-term notes is referred to as its Series I program. In the case of MSFL, the PLUS it offers under this prospectus supplement are among the notes referred to as its Series A medium-term notes. The offering of MSFL’s Series A medium-term notes is referred to as its Series A program. See “Plan of Distribution (Conflicts of Interest)” in this prospectus supplement.

“Performance Leveraged Upside Securities” and “PLUS” are our service marks.

| Risk factor summary |

You should carefully consider whether the PLUS are suited to your particular circumstances before you decide to purchase them. See “Risk Factors” for a full discussion of the material risks relating to the PLUS, which include, but are not limited to, the following:

· PLUS do not pay interest or guarantee return of principal;

· Your appreciation potential is limited;

· The market price of the PLUS will be influenced by many unpredictable factors;

· The PLUS are subject to our credit risk, and any actual or anticipated changes to our credit ratings or credit spreads may adversely affect the market value of the PLUS;

· As a finance subsidiary, MSFL has no independent operations and will have no independent assets;

· PLUS issued by MSFL will not have the benefit of any cross-default or cross-acceleration with other indebtedness of MSFL or Morgan Stanley; a Morgan Stanley covenant default or bankruptcy, insolvency or reorganization event does not constitute an event of default with respect to MSFL PLUS;

· In the case of PLUS with multiple valuation dates, the PLUS may pay less than the principal amount at maturity even where the underlying currency or basket of currencies has strengthened (or weakened, in the case of PLUS that are bearish on a foreign currency or a basket of foreign currencies) as of the final valuation date;

· The estimated value of the PLUS will be less than the original issue price and will adversely affect secondary market prices;

· The estimated value of the PLUS, as set forth in the applicable pricing |

S-9

|

supplement, will be determined by reference to our pricing and valuation models, which may differ from those of other dealers, and will not represent a maximum or minimum secondary market price;

· Secondary trading may be limited;

· Investing in the PLUS is not equivalent to investing directly in the underlying currency or basket currencies;

· The calculation agent, which is a subsidiary of Morgan Stanley and an affiliate of MSFL, will make determinations with respect to the PLUS;

· Hedging and trading activity by our affiliates could potentially adversely affect the value of the PLUS;

· The U.S. federal income tax consequences of an investment in the PLUS are uncertain;

· The PLUS are subject to currency exchange risk;

· Specific currency exchange rates are volatile and are affected by factors specific to the relevant sovereign government;

· Intervention in the currency markets by the countries issuing underlying currencies could materially and adversely affect the value of the PLUS;

· Even though currencies trade around-the-clock, the PLUS will not;

· Changes in the value of one or more of the basket currencies may offset each other;

· The basket currencies may not be equally weighted; and

· Suspension or disruptions of market trading in the underlying currencies may adversely affect the value of the PLUS.

In addition, please see “Annex I–– Certain Additional Currency Exchange Rate Risks” for risks related to specific currencies and “Risk Factors” in Part I, Item 1A of Morgan Stanley’s most recent annual report on Form 10-K and its current and periodic reports filed pursuant to the Securities and Exchange Act of 1934 for risks related to Morgan Stanley and its business. | |

| General terms of the PLUS | Unlike ordinary debt securities, the PLUS do not guarantee the return of principal at maturity. The PLUS generally do not pay interest, but may do so if so specified in the applicable pricing supplement. At maturity, the PLUS will pay an amount in cash based on the performance of a single currency or a basket of currencies over the life of the PLUS as more fully explained below. The payments due, including any property deliverable, under any PLUS issued by MSFL, will be fully and unconditionally guaranteed by Morgan Stanley |

| Payment at maturity | At maturity, you will receive for each PLUS that you hold an amount in cash that may be greater than, equal to or less than the stated principal amount based on the performance of a single currency or a basket of currencies, which we refer to as the currency performance and the basket performance, respectively, over the life of the PLUS. The performance of the specified underlying currency, whether it is the sole |

S-10

| underlying currency or one of a basket of currencies, is always measured relative to another currency. In the examples provided in this prospectus supplement, we describe PLUS that are based on the performance of a foreign currency relative to the U.S. dollar, but we may also issue PLUS that are based on the performance of a foreign currency relative to another foreign currency. | |

|

For PLUS that are bullish on a foreign currency (or a basket of foreign currencies) and accordingly bearish on the U.S. dollar––where any positive return is based on how much the foreign currency (or the basket of foreign currencies) has strengthened relative to the U.S. dollar:

· a positive currency performance (or basket performance) will indicate that the foreign currency (or the basket of foreign currencies) has strengthened relative to the U.S. dollar; and

· a negative currency performance (or basket performance) will indicate that the foreign currency (or the basket of foreign currencies) has weakened relative to the U.S. dollar.

Conversely, for PLUS that are bearish on a foreign currency (or a basket of foreign currencies) and accordingly bullish on the U.S. dollar––where any positive return is based on how much the foreign currency (or the basket of foreign currencies) has weakened relative to the U.S. dollar:

· a positive currency performance (or basket performance) will indicate that the foreign currency (or the basket of foreign currencies) has weakened relative to the U.S. dollar; and

· a negative currency performance (or basket performance) will indicate that the foreign currency (or the basket of foreign currencies) has strengthened relative to the U.S. dollar. |

| PLUS Linked to a Single Currency |

|

· If the currency performance is positive, you will receive for each PLUS that you hold a payment at maturity equal to: | |

| stated principal amount per PLUS + leveraged upside payment, | |

| subject to a maximum payment at maturity, if any, specified in the applicable pricing supplement, | |

|

· If the currency performance is zero or negative, you will receive for each PLUS that you hold a payment at maturity that is less than the stated principal amount of each PLUS by an amount proportionate to the decline in the currency performance as of the valuation date, as measured by the particular “currency performance” formula for that PLUS, and that will be equal to: | |

| stated principal amount × (1 + currency performance) | |

| Because in this scenario, the currency performance will be zero or negative, this payment will be less than or equal to the stated principal amount. | |

| where, |

S-11

| stated principal amount | = | the stated principal amount per PLUS, as specified in the applicable pricing supplement |

| leveraged upside payment | = | stated principal amount | × | leverage factor | × | currency performance |

currency performance |

|

| The particular currency performance formula that we will specify in the applicable pricing supplement will depend on (i) how the relevant exchange rate is expressed (that is, (a) as the number of units of a foreign currency per one U.S. dollar or (b) as the number of U.S. dollars per one unit of a foreign currency) and (ii) whether a positive return on the particular PLUS is linked to the positive performance (i.e., bullish on the foreign currency) or the negative performance (i.e., bearish on the foreign currency) of the underlying currency or basket of currencies. Whether the PLUS are bullish or bearish on a foreign currency or a basket of foreign currencies, the formula for calculating currency performance will be set so that a positive currency performance or basket performance, as applicable, will result in a positive return on an investment in the PLUS. See “How Do Currency Exchange Rates Work?” starting on page S-19 and “Hypothetical Payments on the PLUS” starting on page S-21. |

| and where, |

| initial exchange rate | = | the exchange rate on the pricing date specified in the applicable pricing supplement | |

| final exchange rate | = | the exchange rate on the valuation date specified in the applicable pricing supplement. For PLUS with multiple valuation dates, calculation of the currency performance or the basket performance, as applicable, will be based on the arithmetic average of the exchange rates on the valuation dates, as calculated by the calculation agent on the final valuation date, which we refer to as the “final average exchange rate,” in lieu of the final exchange rate. |

S-12

| PLUS Linked to a Basket of Currencies | |

|

· If the basket performance is positive, you will receive for each PLUS that you hold a payment at maturity equal to: | |

| stated principal amount per PLUS + leveraged upside payment, | |

| subject to a maximum payment at maturity, if any, specified in the applicable pricing supplement, | |

|

· If the basket performance is zero or negative, you will receive for each PLUS that you hold a payment at maturity that is less than the stated principal amount of each PLUS by an amount proportionate to the decline in the basket performance and that will be equal to: | |

| stated principal amount × (1 + basket performance) | |

| Because in this scenario, the basket performance will be zero or negative, this payment will be less than or equal to the stated principal amount. | |

| where, | |

| leveraged upside payment | = | stated principal amount | × | leverage factor | × | basket performance |

| basket performance | = | the sum of the currency performance values for each currency in the basket (which we refer to as a basket currency) as specified in the applicable pricing supplement |

| currency performance value | = |

for each basket currency, the product of (i) currency performance and (ii) weighting. |

| weighting | = | the weighting for each basket currency specified in the applicable pricing supplement |

| and where, | |

| “currency performance,” “initial exchange rate” and “final exchange rate,” as applied to each basket currency, are as defined above under the heading “—PLUS Linked to a Single Currency.” | |

| * * * * * | |

| The valuation date on which the payment at maturity is to be calculated will be specified in the applicable pricing supplement. The applicable pricing supplement may specify that the PLUS will have multiple valuation dates as described under “PLUS with Multiple Valuation Dates” below. | |

| The applicable pricing supplement may indicate that a particular issuance of PLUS will not be subject to a maximum payment at maturity. In such cases, the leveraged |

S-13

| upside payment will not be capped. | |

| In each applicable pricing supplement, we will provide a graph which will illustrate the payment at maturity on the particular issuance of PLUS over a range of hypothetical currency performances or basket performances, as applicable. You should also review the graphs in the section of this prospectus supplement titled “Hypothetical Payments on the PLUS at Maturity,” which provide illustrations of the payment at maturity on the PLUS. |

| Other features of the PLUS | Certain PLUS may have features that differ from the PLUS features described above. For example, an issuance of PLUS could combine one or more of the features listed below. |

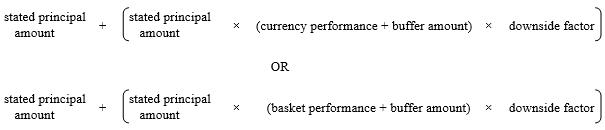

| Buffered PLUS | |

| For issuances of PLUS with a buffer amount, which we refer to as “Buffered PLUS,” the payment at maturity will be determined as follows. | |

|

· if the currency performance or the basket performance, as applicable, is positive, | |

| stated principal amount + leveraged upside payment, | |

| subject to a maximum payment at maturity, if any, specified in the applicable pricing supplement; | |

|

· if the currency performance or the basket performance, as applicable, is zero or negative but has not declined by more than the buffer amount, | |

| stated principal amount, or | |

|

· if the currency performance or the basket performance, as applicable, has declined by more than the buffer amount, the payment at maturity will be based on the following alternative formulas, depending on whether there is a minimum payment at maturity or not: | |

|

º if there is a minimum payment at maturity, the payment at maturity will be, depending on whether the Buffered PLUS are linked to a single currency or a basket of currencies: |

|

Ø This payment will be less than the stated principal amount; however, the payment at maturity for each Buffered PLUS will not be less than the minimum payment at maturity, which will be the stated principal amount times the buffer amount. | |

| where, |

| minimum payment at maturity | = | stated principal amount × buffer amount |

S-14

º if there is no minimum payment at maturity, the payment at maturity will be, depending on whether the Buffered PLUS are linked to a single currency or a basket of currencies: |

|

Ø Because in this scenario the sum of the currency performance or the basket performance, as applicable, and the buffer amount will be negative, the payment at maturity will be less than the stated principal amount, and, due to the downside factor, the payment at maturity may be zero. | |

| where, |

| buffer amount | = | the percentage specified in the applicable pricing supplement by which the currency performance or the basket performance, as applicable, may be below zero before you will lose any part of the stated principal amount per Buffered PLUS. | |

| downside factor | = | the factor specified as such in the applicable pricing supplement |

| See “Description of the PLUS—General Terms of the PLUS—Some Definitions” for the definition of terms related to Buffered PLUS. | |

| PLUS with Multiple Valuation Dates | |

| For issuances of PLUS that have multiple valuation dates, which will be specified in the applicable pricing supplement, the applicable provisions described above under “—Payment at maturity” or “—Other features of the PLUS—Buffered PLUS” will apply, except that, in lieu of the final exchange rate for each applicable underlying currency, we will use the final average exchange rate for such underlying currency for purposes of calculating the currency performance. | |

| See “Description of the PLUS—General Terms of the PLUS—Some Definitions” for the definition of terms related to PLUS with multiple valuation dates. |

| Your return on the PLUS will be limited by the maximum payment at maturity | Unless the applicable pricing supplement for a PLUS does not specify a maximum payment at maturity, your return on the PLUS will be limited by the maximum payment at maturity. Although the leverage factor provides increased exposure to any positive performance or negative performance, as the case may be, of the underlying currency or basket of currencies, the payment at maturity will never exceed the maximum payment at maturity, which will be a fixed percentage of the stated principal amount per PLUS. Further, you will be fully exposed to the downside if the value of the underlying currency or basket of currencies moves in |

S-15

| the wrong direction under the terms of any particular issuance of PLUS. As a result, you may receive less, and possibly significantly less, than the stated principal amount per PLUS. | |

| Issue price of the PLUS includes commissions and projected profit | The issue price of the PLUS, which will be specified in the applicable pricing supplement, includes the agent’s commissions paid with respect to the PLUS and the cost of hedging our obligations under the PLUS. The cost of hedging includes the projected profit that our affiliates may realize in consideration for assuming the risks inherent in managing the hedging transactions. The fact that the issue price of the PLUS includes these commissions and hedging costs is expected to adversely affect the secondary market prices of the PLUS. See “Risk Factors—The rate we are willing to pay for securities of this type, maturity and issuance size is likely to be lower than the rate implied by our secondary market credit spreads and advantageous to us. Both the lower rate and the inclusion of costs associated with issuing, selling, structuring and hedging the PLUS in the original issue price reduce the economic terms of the PLUS, cause the estimated value of the PLUS to be less than the original issue price and will adversely affect secondary market prices” and “Use of Proceeds and Hedging” below. |

| Interest | The PLUS may bear interest, if any, at either a fixed rate or a floating rate, as specified in the applicable pricing supplement and may pay such interest, if any, on the dates specified in the applicable pricing supplement. |

| Other terms of the PLUS |

• You will not have the right to present the PLUS to us for repayment prior to maturity unless we specify otherwise in the applicable pricing supplement. |

|

• We may from time to time, without your consent, create and issue additional PLUS with the same terms as PLUS previously issued so that they may be combined with the earlier issuance. | |

|

• The PLUS will not be listed on any securities exchange, unless we specify otherwise in the applicable pricing supplement. | |

| MSCS will be the calculation agent | We have appointed our affiliate Morgan Stanley Capital Services LLC or its successors, which we refer to as MSCS, to act as calculation agent for us with respect to the PLUS. The calculation agent will determine the initial exchange rate and final exchange rate for each underlying currency, the currency performance or basket performance, as applicable, and will calculate the payment to you at maturity, if any. Moreover, certain determinations made by MSCS, in its capacity as calculation agent, may require it to exercise discretion and make subjective judgments, such as with respect to the calculation of any exchange rate in the event of a discontinuance of reporting of any underlying currency’s exchange rate. These potentially subjective determinations may affect the payout to you at maturity, if any. All determinations made by the calculation agent will be at the sole discretion of the calculation agent and will, in the absence of manifest error, be conclusive for all purposes and binding on you, the Trustee and us. We may appoint another of our affiliates, including Morgan Stanley & Co. LLC, which we refer to as MS & Co., or Morgan Stanley Capital Group Inc., to act as calculation agent for us with respect to the PLUS, which we will specify in the applicable pricing supplement. |

| MS & Co. will be the agent; conflicts of interest | The agent for the offering of the PLUS is expected to be MS & Co., a wholly owned subsidiary of Morgan Stanley and an affliliate of MSFL, which will conduct this offering in compliance with the requirements of FINRA Rule 5121 of the Financial Industry Regulatory Authority, Inc., which is commonly referred to as FINRA, |

S-16

| regarding a FINRA member firm’s distribution of the securities of an affiliate and related conflicts of interest. In accordance with FINRA Rule 5121, MS & Co. or any of our other affiliates may not make sales in this offering to any discretionary account without the prior written approval of the customer. See “Plan of Distribution (Conflicts of Interest)” in this prospectus supplement. | |

| Forms of securities | The PLUS will be issued in fully registered form and will be represented by a global security registered in the name of a nominee of The Depository Trust Company, as depositary, unless we indicate in the applicable pricing supplement that they will be represented by certificates issued in definitive form. We will not issue book-entry securities as certificated securities except under the circumstances described in “Forms of Securities—The Depositary” in the accompanying prospectus, under which heading you may also find information on The Depository Trust Company’s book-entry system. |

| Where you can find more information on the PLUS | Because this is a summary, it does not contain all of the information that may be important to you. You should read the “Description of the PLUS” section in this prospectus supplement and the “Description of Debt Securities” section in the accompanying prospectus for a detailed description of the terms of the PLUS. You should also read about some of the risks involved in an investment in the PLUS in the section of this prospectus supplement called “Risk Factors.” The tax and accounting treatment of investments in currency-linked securities such as the PLUS may differ from that of investments in ordinary debt securities. See the section of this prospectus supplement called “Description of the PLUS—United States Federal Taxation.” You should consult with your investment, legal, tax, accounting and other advisers with regard to any proposed or actual investment in the PLUS. |

S-17

ESTIMATED VALUE AND SECONDARY MARKET PRICES OF THE PLUS

Our Estimated Value of the PLUS

Unless otherwise specified in the applicable pricing supplement, the original issue price for each offering of notes will include costs associated with issuing, selling, structuring and hedging the PLUS, which will be borne by you, and, consequently, the estimated value of the PLUS on the pricing date will be less than the original issue price. Our estimate of the value of the PLUS as determined on the pricing date will be set forth on the cover of the applicable pricing supplement.

Determining the Estimated Value of the PLUS

Unless otherwise specified in the applicable pricing supplement, in valuing the PLUS on the pricing date, we will take into account that the PLUS comprise both a debt component and a performance-based component linked to the underlying currency or basket of currencies. The estimated value of the PLUS will be determined using our own pricing and valuation models, market inputs and assumptions relating to the underlying currency or basket of currencies, instruments based on the underlying currency or basket of currencies (or the component securities), volatility and other factors including current and expected interest rates, as well as an interest rate related to our secondary market credit spread, which is the implied interest rate at which our conventional fixed rate debt trades in the secondary market.

Determining the Economic Terms of the PLUS

Unless otherwise specified in the applicable pricing supplement, in determining the economic terms for each offering of notes, such as the participation rate or any other economic terms, we will use an internal funding rate, which is likely to be lower than our secondary market credit spreads and therefore advantageous to us. If the issuing, selling, structuring and hedging costs borne by you were lower or if the internal funding rate were higher, one or more of the economic terms for such offering of notes would be more favorable to you.

The Relationship Between the Estimated Value on the Pricing Date and the Secondary Market Price of the PLUS

The price at which MS & Co. purchases the PLUS in the secondary market, absent changes in market conditions, including those related to the underlying currency or basket of currencies, may vary from, and be lower than, the estimated value on the pricing date, because the secondary market price takes into account our secondary market credit spread as well as the bid-offer spread that MS & Co. would charge in a secondary market transaction of this type and other factors. However, unless otherwise specified in the applicable pricing supplement, because the costs associated with issuing, selling, structuring and hedging the PLUS will not be fully deducted upon issuance, for a predetermined period of time following the original issue date (to be specified in the applicable pricing supplement), to the extent that MS & Co. may buy or sell the PLUS in the secondary market, absent changes in market conditions, including those related to the underlying currency or basket of currencies, and to our secondary market credit spreads, it would do so based on values higher than the estimated value. We expect that those higher values will also be reflected in your brokerage account statements.

MS & Co. may, but is not obligated to, make a market in the PLUS, and, if it once chooses to make a market, may cease doing so at any time.

For additional information on the estimated value and the secondary market prices of the PLUS, see “Risk Factors—The rate we are willing to pay for securities of this type, maturity and issuance size is likely to be lower than the rate implied by our secondary market credit spreads and advantageous to us. Both the lower rate and the inclusion of costs associated with issuing, selling, structuring and hedging the PLUS in the original issue price reduce the economic terms of the PLUS, cause the estimated value of the PLUS to be less than the original issue price and will adversely affect secondary market prices” and “—The estimated value of the PLUS, as set forth in the applicable pricing supplement, will be determined by reference to our pricing and valuation models, which may differ from those of other dealers, and will not represent a maximum or minimum secondary market price” below.

S-18

How Do Currency Exchange Rates Work?

| · | Exchange rates reflect the amount of one currency that can be exchanged for a unit of another currency. |

| · | Exchange rates for certain currencies (such as the Australian dollar, the British pound, the Eurozone euro and the New Zealand dollar) are expressed as the number of U.S. dollars per unit of the relevant foreign currency. As a result, an increase in the exchange rate means that the relevant foreign currency has appreciated / strengthened relative to the U.S. dollar. This means that one (1) unit of the relevant foreign currency can purchase more U.S. dollars on the valuation date than it did on the pricing date. |

In calculating the payout on the PLUS, the currency performance or basket performance, as applicable, is the percentage currency gain or loss (in U.S. dollar terms) as measured from the perspective of a U.S. dollar investor, unless otherwise specified in the applicable pricing supplement. In the example below, an investor holding U.S. dollars could purchase one Eurozone euro with $1.50 on the pricing date and if that euro was converted back into U.S. dollars on the valuation date, the investor would receive $1.65 (110% of the original $1.50). Accordingly, from the point of view of a U.S. dollar investor, the Eurozone euro has strengthened relative to the U.S. dollar by 10%:

| Pricing Date (# USD / 1 EUR) | Valuation Date (#USD / 1 EUR) |

| 1.50 | 1.65 |

Conversely, a decrease in the exchange rate means that the relevant foreign currency has depreciated / weakened relative to the U.S. dollar. This means that one (1) unit of the relevant foreign currency can purchase fewer U.S. dollars on the valuation date than it did on the pricing date.

In the example below, an investor holding U.S. dollars could purchase one Eurozone euro with $1.50 on the pricing date and if that euro was converted back into U.S. dollars on the valuation date, the investor would receive $1.35 (90% of the original $1.50). Accordingly, from the point of view of a U.S. dollar investor, the Eurozone euro has weakened relative to the U.S. dollar by 10%:

| Pricing Date (# USD / 1 EUR) | Valuation Date (#USD / 1 EUR) |

| 1.50 | 1.35 |

| · | Exchange rates can also be expressed as the number of units of the relevant foreign currency per one U.S. dollar, as in the case of the Canadian dollar, the Chinese renminbi, the Japanese yen, the Mexican peso and the Swiss franc, to name a few. As a result, a decrease in the exchange rate means that the relevant foreign currency has appreciated / strengthened relative to the U.S. dollar. This means that it takes fewer of the relevant foreign currency to purchase one (1) U.S. dollar on the valuation date than it did on the pricing date. |

In the example below, an investor holding U.S. dollars could purchase one hundred Japanese yen with $1.00 on the pricing date and if those Japanese yen were converted back into U.S. dollars on the valuation date, the investor would receive $1.10 (i.e., 110% of the original $1.00) as 90.9090 yen would be exchanged for $1.00 and the remaining 9.0909 yen would be exchanged for an additional $0.10 at an exchange rate of 90.9090 yen per dollar on the valuation date. Accordingly, from the point of view of a U.S. dollar investor, the Japanese yen has strengthened relative to the U.S. dollar by 10%:

| Pricing Date (# JPY / 1 USD) | Valuation Date (# JPY / 1 USD) |

| 100 | 90.9090 |

Conversely, an increase in the exchange rate means that the relevant foreign currency has depreciated / weakened relative to the U.S. dollar. This means that it takes more of the relevant foreign currency to purchase one (1) U.S. dollar on the valuation date than it did on the pricing date.

S-19

In the example below, an investor holding U.S. dollars could purchase one hundred Japanese yen with $1.00 on the pricing date and if those Japanese yen were converted back into U.S. dollars on the valuation date, the investor would receive $0.90 (i.e., 90% of the original $1.00) as the 100 yen held by the investor would be exchanged for only $0.90 at an exchange rate of 111.1111 yen per dollar on the valuation date. Accordingly, from the point of view of a U.S. dollar investor, the Japanese yen has weakened relative to the U.S. dollar by 10%:

| Pricing Date (# JPY / 1 USD) | Valuation Date (# JPY / 1 USD) |

| 100 | 111.1111 |

Actual exchange rates on the pricing date and the valuation date will vary from those used in the examples above.

The PLUS can be designed to provide a bullish exposure to a foreign currency (or a basket of foreign currencies) from the point of view of a U.S. dollar investor, as in these examples, or a bearish exposure to a foreign currency (or a basket of foreign currencies). Whether the PLUS are bullish or bearish on the foreign currency is a fundamental difference and the payment at maturity is calculated differently for the two types of PLUS. See “Hypothetical Payments on the PLUS” for examples of both types of currency exposure.

S-20

Hypothetical Payments on the PLUS

Example 1: PLUS without a buffer

The following graph illustrates the payment at maturity for a range of hypothetical currency performances on the two hypothetical issuances of PLUS described below that are based on the performance of the Japanese yen relative to the U.S. dollar. The PLUS Zone illustrates the leveraging effect of the leverage factor, taking into account the maximum payment at maturity. The graph is based on the following hypothetical terms for the two hypothetical issuances of PLUS described below:

| • | initial exchange rate: | 100 Japanese yen / 1 U.S. dollar |

| • | stated principal amount: | $1,000 |

| • | leverage factor: | 200% |

| • | maximum payment at maturity: | $1,400 (140% of the stated principal amount) |

The exchange rate between the Japanese yen and the U.S. dollar is typically expressed as the number of Japanese yen per one U.S. dollar. Consequently, strengthening of the Japanese yen relative to the U.S. dollar is indicated by a decrease in the quoted exchange rate, while weakening of the Japanese yen relative to the U.S. dollar is indicated by an increase in the quoted exchange rate. See “How Do Currency Exchange Rates Work?” on page S-19.

Whether the PLUS are bullish or bearish on the foreign currency is a fundamental difference and the payment at maturity is calculated differently for the two types of PLUS, as set forth in the following examples.

S-21

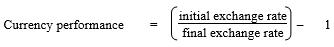

(i) PLUS that are bullish on the Japanese yen and accordingly bearish on the U.S. dollar

These PLUS pay a positive return if the Japanese yen strengthens relative to the U.S. dollar, and investors are fully exposed to the currency performance downside if the Japanese yen instead weakens relative to the U.S. dollar. Under the terms of these PLUS, a positive currency performance will indicate that the Japanese yen has strengthened relative to the U.S. dollar, while a negative currency performance will indicate that the Japanese yen has weakened relative to the U.S. dollar. The currency performance, which will measure how much the Japanese yen has strengthened or weakened relative to the U.S. dollar, will be calculated using the following formula:

Based on the above formula, a currency performance of 10% will indicate that the Japanese yen has strengthened relative to the U.S. dollar by 10%, while a currency performance of –10% will indicate that the Japanese yen has weakened relative to the U.S. dollar by 10%.

Where the currency performance is positive, the payment at maturity on the PLUS reflected in the graph above is greater than the $1,000 stated principal amount per PLUS, but in all cases is subject to the maximum payment at maturity. Where the currency performance is zero or negative, the payment at maturity is less than or equal to the $1,000 stated principal amount per PLUS. For example, with an initial exchange rate of 100 yen per dollar, a final exchange rate of 200 yen per dollar would result in a currency performance of –50% ((100/200) – 1) and a payment at maturity of $1,000 × [1 + (–50%)], or only $500.

In this hypothetical issuance of PLUS, you will realize the maximum payment at maturity with a currency performance of 20% (i.e., with a final exchange rate of 83.3333 yen per dollar ((100/83.3333) – 1)). Although the leverage factor provides 200% exposure to any strengthening in the Japanese yen relative to the U.S. dollar, because the payment at maturity will be limited to 140% of the stated principal amount, any strengthening of the Japanese yen relative to the U.S. dollar by more than 20% (i.e., any decrease in the final exchange rate below 83.3333 yen per dollar) will not further increase the return on the PLUS.

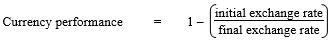

(ii) PLUS that are bearish on the Japanese yen and accordingly bullish on the U.S. dollar

These PLUS pay a positive return if the Japanese yen weakens relative to the U.S. dollar, and investors are fully exposed to the currency performance downside if the Japanese yen instead strengthens relative to the U.S. dollar. These PLUS are designed to provide investors with a short exposure to the Japanese yen and a long exposure to the U.S. dollar. Accordingly, these PLUS replicate a currency shorting strategy of a dollar investor borrowing the Japanese yen and selling it for U.S. dollars on the pricing date and repaying that borrowing by purchasing the Japanese yen on the valuation date, subject to the maximum payment at maturity and the leverage factor. Under the terms of these PLUS, a positive currency performance will indicate that the Japanese yen has weakened relative to the U.S. dollar, while a negative currency performance will indicate that the Japanese yen has strengthened relative to the U.S. dollar. The currency performance, which will measure how much the Japanese yen has weakened or strengthened relative to the U.S. dollar, will be calculated using the following formula:

Based on the above formula, a currency performance of 10% will indicate that the Japanese yen has weakened relative to the U.S. dollar by 10%, while a currency performance of –10% will indicate that the Japanese yen has strengthened relative to the U.S. dollar by 10%.

Where the currency performance is positive, the payment at maturity on the PLUS reflected in the graph above is greater than the $1,000 stated principal amount per PLUS, but in all cases is subject to the maximum payment at maturity. For example, with an initial exchange rate of 100 yen per dollar, a final exchange rate of 110 yen per dollar will result in a positive currency performance of 9.0909% (1 – (100/110)). However, where the currency performance is zero or negative, the payment at maturity is less than or equal to the $1,000 stated principal amount

S-22

per PLUS. For example, with an initial exchange rate of 100 yen per dollar, a final exchange rate of 50 yen per dollar will result in a currency performance of –100% (1 – (100/50)) and a payment at maturity of $1,000 × [1 + (–100%)], or $0. As these PLUS replicate a currency shorting strategy as described above, if the Japanese yen doubles in value relative to the U.S. dollar (as represented by the change in the exchange rate from 100 to 50), you will lose your entire investment.

In this hypothetical issuance of PLUS, you will realize the maximum payment at maturity with a currency performance of 20% (i.e., with a final exchange rate of 125 yen per dollar (1 – (100/125))). Although the leverage factor provides 200% exposure to any weakening in the Japanese yen relative to the U.S. dollar, because the payment at maturity will be limited to 140% of the stated principal amount, any weakening of the Japanese yen relative to the U.S. dollar by more than 20% (i.e., any increase in the final exchange rate above 125 yen per dollar) will not further increase the return on the PLUS.

PLUS with multiple valuation dates:

Presented below are hypothetical examples showing how the currency performance would be calculated for PLUS with multiple valuation dates. These examples assume an initial exchange rate of 100 yen per dollar. A decrease in the exchange rate means the Japanese yen has strengthened relative to the U.S. dollar and an increase in the exchange rate means the Japanese yen has weakened relative to the U.S. dollar. See “How Do Currency Exchange Rates Work?”.

For PLUS with multiple valuation dates, currency performance and, thus, the payment at maturity are based on the final average exchange rate, which equals the arithmetic average of the exchange rates on the valuation dates (four dates in our examples below) specified in the applicable pricing supplement. The examples of the calculations that follow are intended to illustrate the effect of general trends in the exchange rate on the amount payable to you at maturity and are provided for illustrative purposes only.

| Example 1 | Example 2 | Example 3 | |

| Exchange Rate | Exchange Rate | Exchange Rate | |

| 1st Valuation Date | 97 | 96 | 96 |

| 2nd Valuation Date | 95 | 105 | 94 |

| 3rd Valuation Date | 94 | 106 | 98 |

| Final Valuation Date | 90 | 97 | 100 |

| Final Average Exchange Rate: | 94 | 101 | 97 |

| Currency Performance: | 6.3830% | –0.9901% | 3.0928% |

| • | In Example 1, the Japanese yen strengthens relative to the U.S. dollar on each valuation date and, due to the averaging of the exchange rates over the valuation dates, the final average exchange rate of 94 yen per dollar is higher than the exchange rate of 90 yen per dollar on the final valuation date, resulting in a currency performance of 6.3830% which is less than 11.1111%, which would have been the currency performance if it were to have been based solely on the exchange rate on the final valuation date. |

| • | In Example 2, the Japanese yen strengthens relative to the U.S. dollar initially on the first valuation date, weakens on the second and third valuation dates, and strengthens again on the final valuation date. Due to the averaging of the exchange rates over the valuation dates, the final average exchange rate of 101 yen per dollar is higher than the exchange rate on the final valuation date and also higher than the initial exchange rate, resulting in a currency performance of –0.9901% despite the strengthening of the Japanese yen on the final valuation date. |

| • | In Example 3, the Japanese yen initially strengthens relative to the U.S. dollar but the exchange rate on the final valuation date is the same as the initial exchange rate, resulting in the currency performance of 3.0928% which is higher than 0%, which would have been the currency performance if it were to have been based solely on the exchange rate on the final valuation date. |

S-23

Example 2: Buffered

PLUS with a minimum payment at maturity

(minimum payment at maturity = stated principal amount × buffer amount)

The following graph illustrates the payment at maturity for a range of hypothetical currency performances on the two hypothetical issuances of Buffered PLUS described below that are based on the performance of the Japanese yen relative to the U.S. dollar and that provide a minimum payment at maturity of 15% of the stated principal amount. The PLUS Zone illustrates the leveraging effect of the leverage factor, taking into account the maximum payment at maturity, while the Buffer Zone illustrates the buffer effect with respect to a certain degree of negative currency performance. The graph is based on the following hypothetical terms for the two hypothetical issuances of Buffered PLUS described below:

| • | initial exchange rate: | 100 Japanese yen / 1 U.S. dollar |

| • | stated principal amount: | $1,000 |

| • | leverage factor: | 200% |

| • | maximum payment at maturity: | $1,300 (130% of the stated principal amount) |

| • | buffer amount: | 15% |

| • | minimum payment at maturity: | $150 |

Whether the Buffered PLUS are bullish or bearish on the foreign currency is a fundamental difference and the payment at maturity is calculated differently for the two types of Buffered PLUS, as set forth in the following examples.

S-24

(i) Buffered PLUS that are bullish on the Japanese yen and accordingly bearish on the U.S. dollar

These Buffered PLUS pay a positive return if the Japanese yen strengthens relative to the U.S. dollar, resulting in a positive currency performance. Under the terms of these Buffered PLUS, a positive currency performance will indicate that the Japanese yen has strengthened relative to the U.S. dollar, while a negative currency performance will indicate that the Japanese yen has weakened relative to the U.S. dollar. The currency performance, which will measure how much the Japanese yen has strengthened or weakened relative to the U.S. dollar, will be calculated using the following formula:

Based on the above formula, a currency performance of 10% will indicate that the Japanese yen has strengthened relative to the U.S. dollar by 10%, while a currency performance of –10% will indicate that the Japanese yen has weakened relative to the U.S. dollar by 10%.

Where the currency performance is positive, the payment at maturity on the Buffered PLUS reflected in the graph above is greater than the $1,000 stated principal amount per Buffered PLUS, but in all cases is subject to the maximum payment at maturity.

Where the currency performance is zero or negative but is greater than or equal to –15%, the payment at maturity on the Buffered PLUS is the $1,000 stated principal amount. Therefore, the Buffered PLUS offer limited protection against a negative currency performance down to –15% (i.e., against an increase in the final exchange rate of up to 117.6471 yen per dollar ((100/117.6471) – 1)).

Where the currency performance is less than –15%, the payment at maturity on the Buffered PLUS is less than the $1,000 stated principal amount per Buffered PLUS, but in all cases is subject to the minimum payment at maturity. For example, a final exchange rate of 200 yen per dollar will result in a currency performance of –50% ((100/200) – 1) and a payment at maturity of $1,000 × [1 + (–50%)] + $150, or $650.

In this hypothetical issuance of Buffered PLUS, you will realize the maximum payment at maturity with a currency performance of 15% (i.e., with a final exchange rate of 86.9565 yen per dollar ((100/86.9565) – 1)). Although the leverage factor provides 200% exposure to any strengthening in the Japanese yen relative to the U.S. dollar, because the payment at maturity will be limited to 130% of the stated principal amount, any strengthening of the Japanese yen relative to the U.S. dollar by more than 15% (i.e., any decrease in the final exchange rate below 86.9565 yen per dollar) will not further increase the return on the Buffered PLUS.

(ii) Buffered PLUS that are bearish on the Japanese yen and accordingly bullish on the U.S. dollar

These Buffered PLUS pay a positive return if the Japanese yen weakens relative to the U.S. dollar, resulting in a positive currency performance. These Buffered PLUS are designed to provide investors with a short exposure to the Japanese yen and a long exposure to the U.S. dollar. Accordingly, these Buffered PLUS replicate a currency shorting strategy of a dollar investor borrowing the Japanese yen and selling it for U.S. dollars on the pricing date and repaying that borrowing by purchasing the Japanese yen on the valuation date, subject to the buffer amount, the maximum payment at maturity and the leverage factor. Under the terms of these Buffered PLUS, a positive currency performance will indicate that the Japanese yen has weakened relative to the U.S. dollar while a negative currency performance will indicate that the Japanese yen has strengthened relative to the U.S. dollar. The currency performance, which will measure how much the Japanese yen has weakened or strengthened relative to the U.S. dollar, will be calculated using the following formula:

S-25

Based on the above formula, a currency performance of 10% will indicate that the Japanese yen has weakened relative to the U.S. dollar by 10%, while a currency performance of –10% will indicate that the Japanese yen has strengthened relative to the U.S. dollar by 10%.