Form SC14D9C DUNKIN' BRANDS GROUP, Filed by: DUNKIN' BRANDS GROUP, INC.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

SOLICITATION/RECOMMENDATION STATEMENT

UNDER SECTION 14(d)(4) OF THE

SECURITIES EXCHANGE ACT OF 1934

DUNKIN’ BRANDS GROUP, INC.

(Name of Subject Company)

DUNKIN’ BRANDS GROUP, INC.

(Name of Person(s) Filing Statement)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

265504100

(CUSIP Number of Class of Securities)

W. David Mann

Senior Vice President, Chief Legal Officer

130 Royall Street

Canton, Massachusetts 02021

(781) 737-5149

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications

on Behalf of the Person(s) Filing Statement)

With a copy to:

Jane D. Goldstein

Craig E. Marcus

Sarah H. Young

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, Massachusetts 02199

(617) 951-7000

| ☒ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

This Schedule 14D-9 consists of the following document related to the proposed acquisition of Dunkin’ Brands Group, Inc. (the “Company”), pursuant to the terms of an Agreement and Plan of Merger, dated as of October 30, 2020, among the Company, Inspire Brands, Inc. (“Inspire”) and Vale Merger Sub, Inc.

| 1. | Inspire Newsletter shared by Dunkin’ Brands, dated November 13, 2020, a copy of which is attached hereto as Exhibit 99.1 and incorporated herein by reference. |

The item above was first used or made available on November 13, 2020.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

The tender offer for the outstanding shares of Company common stock described in this communication has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of the Company common stock, nor is it a substitute for any tender offer materials that Inspire, Vale Merger Sub, Inc. or the Company will file with the U.S. Securities and Exchange Commission (the “SEC”). A solicitation and offer to buy shares of the Company common stock will be made only pursuant to an offer to purchase and related materials that Inspire intends to file with the SEC. At the time the tender offer is commenced, Inspire will cause Vale Merger Sub, Inc. to file a tender offer statement on Schedule TO with the SEC, and the Company will file a solicitation/recommendation statement on Schedule 14D-9 with the SEC with respect to the tender offer. COMPANY STOCKHOLDERS AND OTHER INVESTORS ARE URGED TO READ THE TENDER OFFER STATEMENT (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND OTHER TENDER OFFER DOCUMENTS) AND THE RELATED SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 THAT WILL BE FILED BY THE COMPANY WITH THE SEC, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES THERETO THAT SHOULD BE READ CAREFULLY. Both the tender offer statement and the solicitation/recommendation statement will be made available at no charge on the SEC’s website: www.sec.gov. In addition, a copy of the offer to purchase, letter of transmittal and certain other tender offer documents (once they become available) will be mailed to the Company’s stockholders free of charge and additional copies may be obtained free of charge, by contacting Dunkin’ Brands Investor Relations either by telephone at 781-737-3200 or by e-mail at [email protected] or on the Company’s website at www.dunkinbrands.com. In addition to the offer to purchase, the related letter of transmittal and certain other documents, as well as the solicitation/recommendation statement, the Company files annual, quarterly and current reports, proxy statements and other information with the SEC. The Company’s filings with the SEC are available to the public from commercial document-retrieval services and at the website maintained by the SEC at www.sec.gov. Investors and security holders may also obtain free copies of the documents filed with the SEC by the Company at www.dunkinbrands.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This filing, as well as the exhibits attached hereto, contain forward-looking statements and projections within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Generally, these statements may be identified by the use of words such as “expect,” “intend,” “anticipate,” “believe,” “estimate,” “potential,” “should” or similar words and include, among other things, statements about the potential benefits of the proposed transaction, the prospective performance and outlook of the surviving company’s business, performance and opportunities, the ability of the parties to complete the proposed transaction and the expected timing of completion of the proposed transaction. Forward-looking statements are based on management’s current expectations and beliefs, as well as a number of assumptions, estimates and projections concerning future events and do not constitute guarantees of future performance. These statements are subject to risks, uncertainties, changes in circumstances, assumptions and other important factors, many of which are outside management’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. In particular, some of the factors that could cause actual future results to differ materially from those expressed in any forward-looking statements include, among others: (i) uncertainties as to the timing and expected financing of the tender offer; (ii) the risk that the proposed transaction may not be completed, or if it is completed, that it will close in a timely manner; (iii) the possibility that competing offers or acquisition proposals for the Company will be made; (iv) uncertainty surrounding how many of the Company’s stockholders will tender their shares in the tender offer; (v) the possibility that any or all of the various conditions to the consummation of the tender offer may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable governmental entities; (vi) the possibility of business disruptions due to transaction-related uncertainty and the response of business partners to the announcement, including franchisees and licensees; (vii) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; (viii) the risk that stockholder litigation in connection with the proposed transaction may result in significant costs of defense, indemnification and liability; (ix) Inspire’s ability to realize the synergies contemplated by the proposed transaction and integrate the business of the company; (x) Inspire’s level of leverage and debt, including covenants that restrict the operation of its business; (xi) Inspire’s ability to service outstanding debt or obtain additional financing; and (xii) other factors as set forth from time to time in the Company filings with the SEC, including its Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, as well as the tender offer statement, solicitation/recommendation statement and other tender offer documents that will be filed by Inspire and the Company, as applicable. The actual financial impact of the transaction may differ from the expected financial impact described in this filing or the exhibits attached hereto. Therefore, you should not place undue reliance on such forward-looking statements. All forward-looking statements are based on information available to management on the date of this communication, and we assume no obligation to, and expressly disclaim any obligation to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

| Exhibit |

Description | |

| 99.1 | Inspire Newsletter shared by Dunkin’ Brands, dated November 13, 2020. | |

Exhibit 99.1

INSPIRE AND DUNKIN’ BRANDS TEAMS – As we’re only weeks away from the anticipated close of the acquisition and officially welcoming Dunkin’ and Baskin-Robbins to the Inspire family, we’re sharing the inaugural edition of our new weekly newsletter to keep team members informed on the latest updates. You’ll receive this newsletter every Friday. Several cross-functional teams at both companies are working diligently together to ensure a smooth transition. Below is an overview of the integration teams and their roles to help you become more familiar with this process. • STEERING COMMITTEE: Leads the integration progress and makes key decisions. • INTEGRATION MANAGEMENT OFFICE (IMO): Coordinates overall process across stakeholders and reports any challenges or obstacles to the Steering Committee. • IMO WORKSTREAMS: Provides support across all teams to ensure readiness for day one of Dunkin’ and Baskin-Robbins joining the Inspire family. • FUNCTIONAL INTEGRATION TEAMS: Manages integration planning and execution at operational level across all departments. 1. What happens between now and the anticipated close of the acquisition? • Until the transaction is complete, the companies remain separate and independent from each other. It’s important to stay focused on day-to-day operations before and after close. • Teams at both companies have already made significant progress on the integration to help support a smooth transition. 2. How will Inspire, Dunkin’, and Baskin-Robbins work together after the expected close of the acquisition? • Our shared focus will be on building momentum and continuing to energize and nourish the Dunkin’ and Baskin-Robbins brands. Once the transaction closes, Dunkin’ and Baskin-Robbins will operate as distinct brands within Inspire. HAVE A QUESTION? Both Inspire and Dunkin’ Brands teams can ask anonymously. No. 1 KEY DATES NOVEMBER 18 Inspire All-Team Meeting DECEMBER 1 Dunkin’ Brands All-Employee Town Hall BY END OF DECEMBER Anticipated close of acquisition FAQS

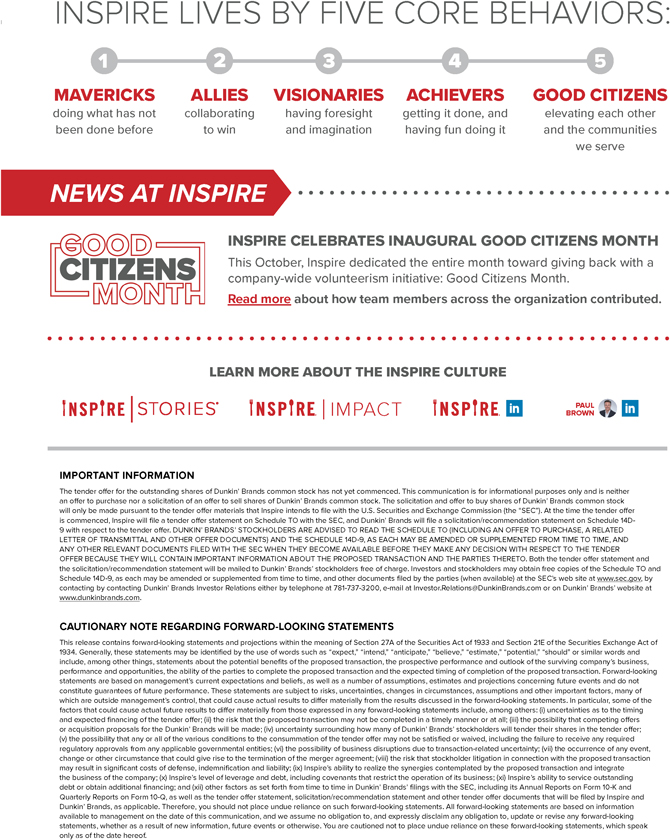

INSPIRE CELEBRATES INAUGURAL GOOD CITIZENS MONTH This October, Inspire dedicated the entire month toward giving back with a company-wide volunteerism initiative: Good Citizens Month. Read more about how team members across the organization contributed. INSPIRE LIVES BY FIVE CORE BEHAVIORS: LEARN MORE ABOUT THE INSPIRE CULTURE IMPORTANT INFORMATION The tender offer for the outstanding shares of Dunkin’ Brands common stock has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Dunkin’ Brands common stock. The solicitation and offer to buy shares of Dunkin’ Brands common stock will only be made pursuant to the tender offer materials that Inspire intends to file with the U.S. Securities and Exchange Commission (the “SEC”). At the time the tender offer is commenced, Inspire will file a tender offer statement on Schedule TO with the SEC, and Dunkin’ Brands will file a solicitation/recommendation statement on Schedule 14D- 9 with respect to the tender offer. DUNKIN’ BRANDS’ STOCKHOLDERS ARE ADVISED TO READ THE SCHEDULE TO (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND OTHER OFFER DOCUMENTS) AND THE SCHEDULE 14D-9, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES THERETO. Both the tender offer statement and the solicitation/recommendation statement will be mailed to Dunkin’ Brands’ stockholders free of charge. Investors and stockholders may obtain free copies of the Schedule TO and Schedule 14D-9, as each may be amended or supplemented from time to time, and other documents filed by the parties (when available) at the SEC’s web site at www.sec.gov, by contacting by contacting Dunkin’ Brands Investor Relations either by telephone at 781-737-3200, e-mail at [email protected] or on Dunkin’ Brands’ website at www.dunkinbrands.com. CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS This release contains forward-looking statements and projections within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Generally, these statements may be identified by the use of words such as “expect,” “intend,” “anticipate,” “believe,” “estimate,” “potential,” “should” or similar words and include, among other things, statements about the potential benefits of the proposed transaction, the prospective performance and outlook of the surviving company’s business, performance and opportunities, the ability of the parties to complete the proposed transaction and the expected timing of completion of the proposed transaction. Forward-looking statements are based on management’s current expectations and beliefs, as well as a number of assumptions, estimates and projections concerning future events and do not constitute guarantees of future performance. These statements are subject to risks, uncertainties, changes in circumstances, assumptions and other important factors, many of which are outside management’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. In particular, some of the factors that could cause actual future results to differ materially from those expressed in any forward-looking statements include, among others: (i) uncertainties as to the timing and expected financing of the tender offer; (ii) the risk that the proposed transaction may not be completed in a timely manner or at all; (iii) the possibility that competing offers or acquisition proposals for the Dunkin’ Brands will be made; (iv) uncertainty surrounding how many of Dunkin’ Brands’ stockholders will tender their shares in the tender offer; (v) the possibility that any or all of the various conditions to the consummation of the tender offer may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable governmental entities; (vi) the possibility of business disruptions due to transaction-related uncertainty; (vii) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; (viii) the risk that stockholder litigation in connection with the proposed transaction may result in significant costs of defense, indemnification and liability; (ix) Inspire’s ability to realize the synergies contemplated by the proposed transaction and integrate the business of the company; (x) Inspire’s level of leverage and debt, including covenants that restrict the operation of its business; (xi) Inspire’s ability to service outstanding debt or obtain additional financing; and (xii) other factors as set forth from time to time in Dunkin’ Brands’ filings with the SEC, including its Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, as well as the tender offer statement, solicitation/recommendation statement and other tender offer documents that will be filed by Inspire and Dunkin’ Brands, as applicable. Therefore, you should not place undue reliance on such forward-looking statements. All forward-looking statements are based on information available to management on the date of this communication, and we assume no obligation to, and expressly disclaim any obligation to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. 5 GOOD CITIZENS elevating each other and the communities we serve MAVERICKS doing what has not been done before ALLIES collaborating to win VISIONARIES having foresight and imagination ACHIEVERS getting it done, and having fun doing it NEWS AT INSPIRE