Form 8-K Regional Management Corp For: Nov 12

Investor Presentation November 12, 2020 Exhibit 99.1

Legal Disclosures This document contains summarized information concerning Regional Management Corp. (the “Company”) and the Company’s business, operations, financial performance, and trends. No representation is made that the information in this document is complete. For additional financial, statistical, and business information, please see the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the U.S. Securities and Exchange Commission (the “SEC”), as well as the Company’s other reports filed with the SEC from time to time. Such reports are or will be available on the Company’s website (www.regionalmanagement.com) and on the SEC’s website (www.sec.gov). The information and opinions contained in this document are provided as of the date of this presentation and are subject to change without notice. This document has not been approved by any regulatory or supervisory authority. This presentation, the related remarks, and the responses to various questions may contain various “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact but instead represent the Company’s expectations or beliefs concerning future events. Forward-looking statements include, without limitation, statements concerning future plans, objectives, goals, projections, strategies, events, or performance, and underlying assumptions and other statements related thereto. Words such as “may,” “will,” “should,” “likely,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “outlook,” and similar expressions may be used to identify these forward-looking statements. Such forward-looking statements speak only as of the date on which they were made and are about matters that are inherently subject to risks and uncertainties, many of which are outside of the control of the Company. As a result, actual performance and results may differ materially from those contemplated by these forward-looking statements. Therefore, investors should not place undue reliance on such statements. Factors that could cause actual results or performance to differ from the expectations expressed or implied in forward-looking statements include, but are not limited to, the following: changes in general economic conditions, including levels of unemployment and bankruptcies; the impact of the recent outbreak of a novel coronavirus (COVID-19), including on the Company’s access to liquidity and the credit risk of the Company’s finance receivable portfolio; risks associated with the Company’s ability to timely and effectively implement, transition to, and maintain the necessary information technology systems, infrastructure, processes, and controls to support its operations and initiatives; risks associated with the Company’s loan origination and servicing software system, including the risk of prolonged system outages; risks related to opening new branches, including the ability or inability to open new branches as planned; risks inherent in making loans, including credit risk, repayment risk, and value of collateral, which risks may increase in light of adverse or recessionary economic conditions; risks associated with the implementation of new underwriting models and processes, including as to the effectiveness of new custom scorecards; risks relating to the Company’s asset-backed securitization transactions; changes in interest rates; the risk that the Company’s existing sources of liquidity become insufficient to satisfy its needs or that its access to these sources becomes unexpectedly restricted; changes in federal, state, or local laws, regulations, or regulatory policies and practices, and risks associated with the manner in which laws and regulations are interpreted, implemented, and enforced; changes in accounting standards, rules, and interpretations, and the failure of related assumptions and estimates, including those associated with the implementation of current expected credit loss (CECL) accounting; the impact of changes in tax laws, guidance, and interpretations; the timing and amount of revenues that may be recognized by the Company; changes in current revenue and expense trends (including trends affecting delinquencies and credit losses); changes in the Company’s markets and general changes in the economy (particularly in the markets served by the Company); changes in the competitive environment in which the Company operates or a decrease in the demand for its products; the timing and amount of future cash dividend payments; risks related to acquisitions; changes in operating and administrative expenses; and the departure, transition, or replacement of key personnel. The foregoing factors and others are discussed in greater detail in the Company’s filings with the SEC. The COVID-19 pandemic may also magnify many of these risks and uncertainties. The Company cannot guarantee future events, results, actions, levels of activity, performance, or achievements. The Company will not update or revise forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events or the non-occurrence of anticipated events, whether as a result of new information, future developments, or otherwise, except as required by law. This presentation also contains certain non-GAAP measures. Please refer to the Appendix accompanying this presentation for a reconciliation of non-GAAP measures to the most comparable GAAP measures.

Investment Highlights Clear Path Forward for Sustainable Long-Term Growth Successful Differentiated Growth Strategy Advanced Credit Tools Deep Management Experience Abundant Market Opportunity Modern Infrastructure

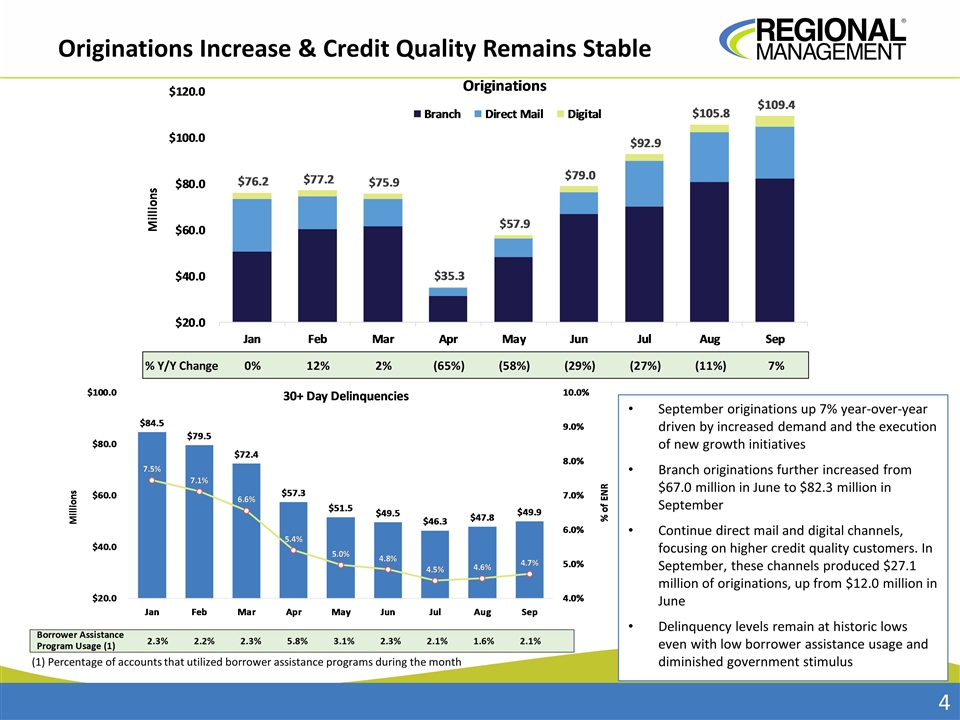

Originations Increase & Credit Quality Remains Stable September originations up 7% year-over-year driven by increased demand and the execution of new growth initiatives Branch originations further increased from $67.0 million in June to $82.3 million in September Continue direct mail and digital channels, focusing on higher credit quality customers. In September, these channels produced $27.1 million of originations, up from $12.0 million in June Delinquency levels remain at historic lows even with low borrower assistance usage and diminished government stimulus (1) Percentage of accounts that utilized borrower assistance programs during the month

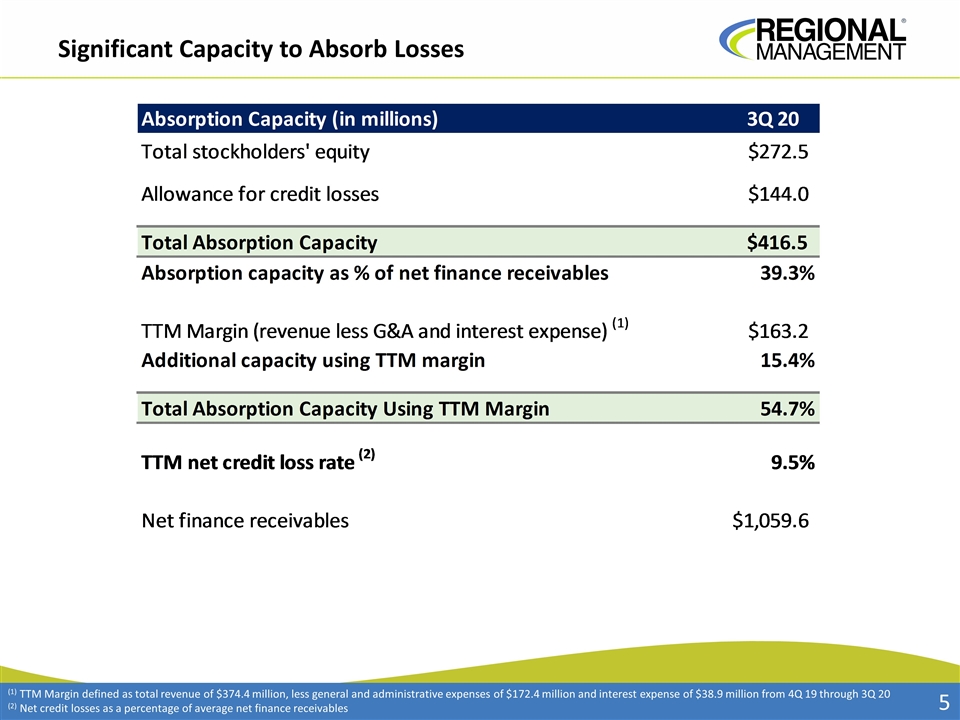

(1) TTM Margin defined as total revenue of $374.4 million, less general and administrative expenses of $172.4 million and interest expense of $38.9 million from 4Q 19 through 3Q 20 (2) Net credit losses as a percentage of average net finance receivables Significant Capacity to Absorb Losses

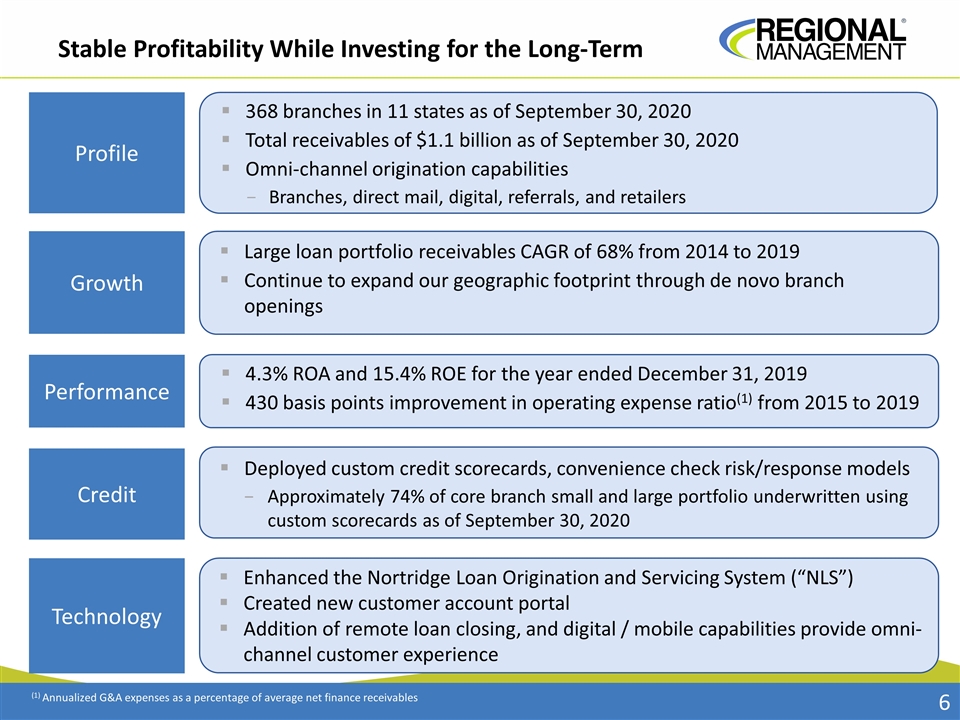

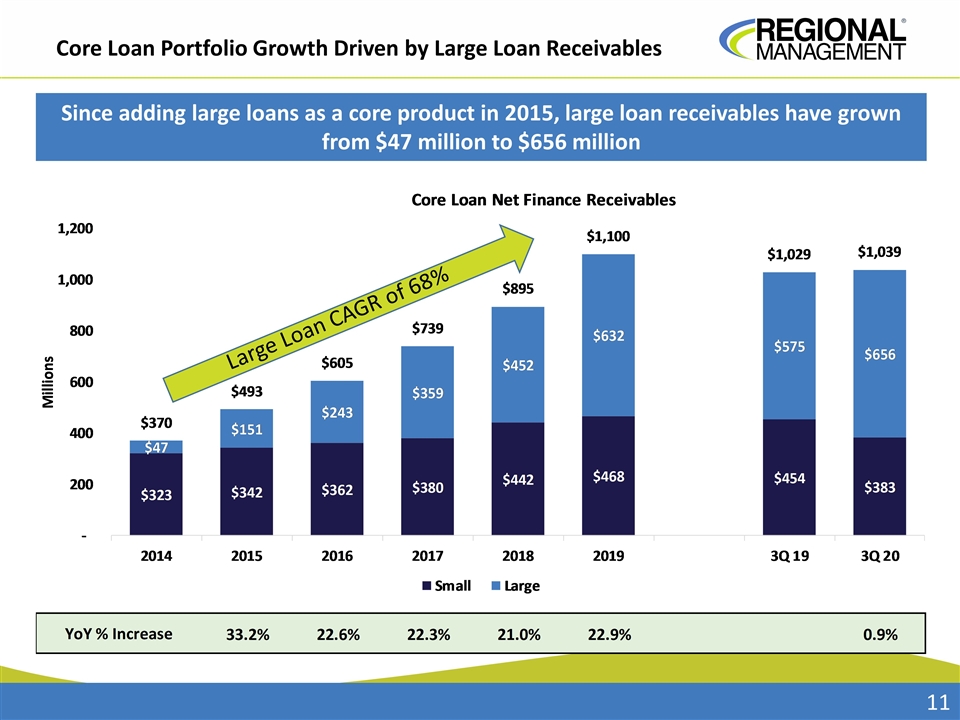

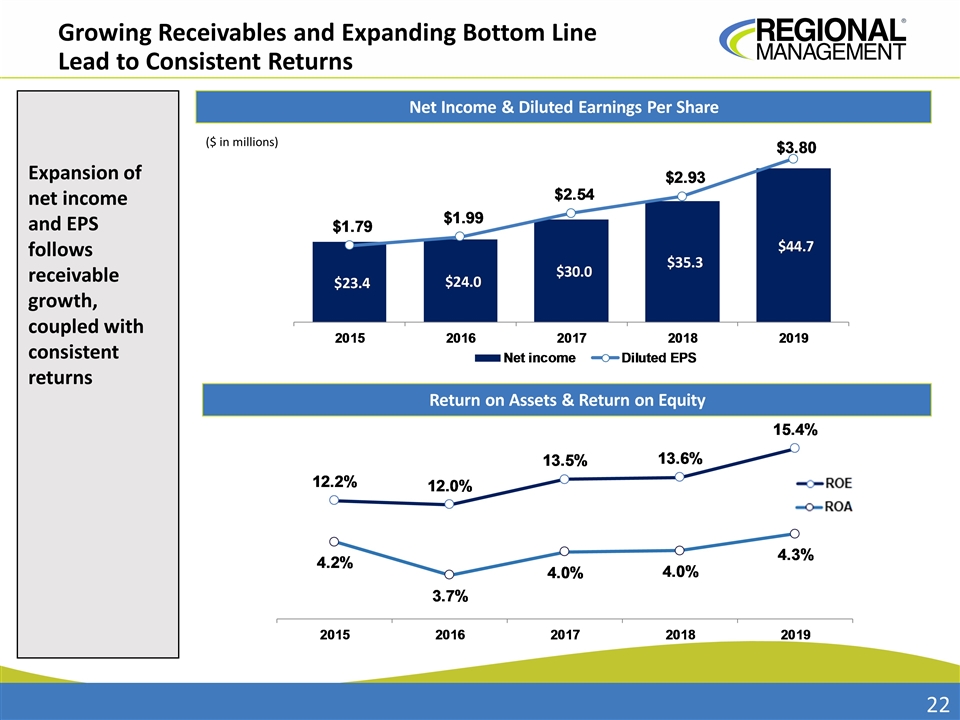

Stable Profitability While Investing for the Long-Term Deployed custom credit scorecards, convenience check risk/response models Approximately 74% of core branch small and large portfolio underwritten using custom scorecards as of September 30, 2020 Large loan portfolio receivables CAGR of 68% from 2014 to 2019 Continue to expand our geographic footprint through de novo branch openings 4.3% ROA and 15.4% ROE for the year ended December 31, 2019 430 basis points improvement in operating expense ratio(1) from 2015 to 2019 Growth Performance Credit Technology 368 branches in 11 states as of September 30, 2020 Total receivables of $1.1 billion as of September 30, 2020 Omni-channel origination capabilities Branches, direct mail, digital, referrals, and retailers Profile Enhanced the Nortridge Loan Origination and Servicing System (“NLS”) Created new customer account portal Addition of remote loan closing, and digital / mobile capabilities provide omni-channel customer experience (1) Annualized G&A expenses as a percentage of average net finance receivables

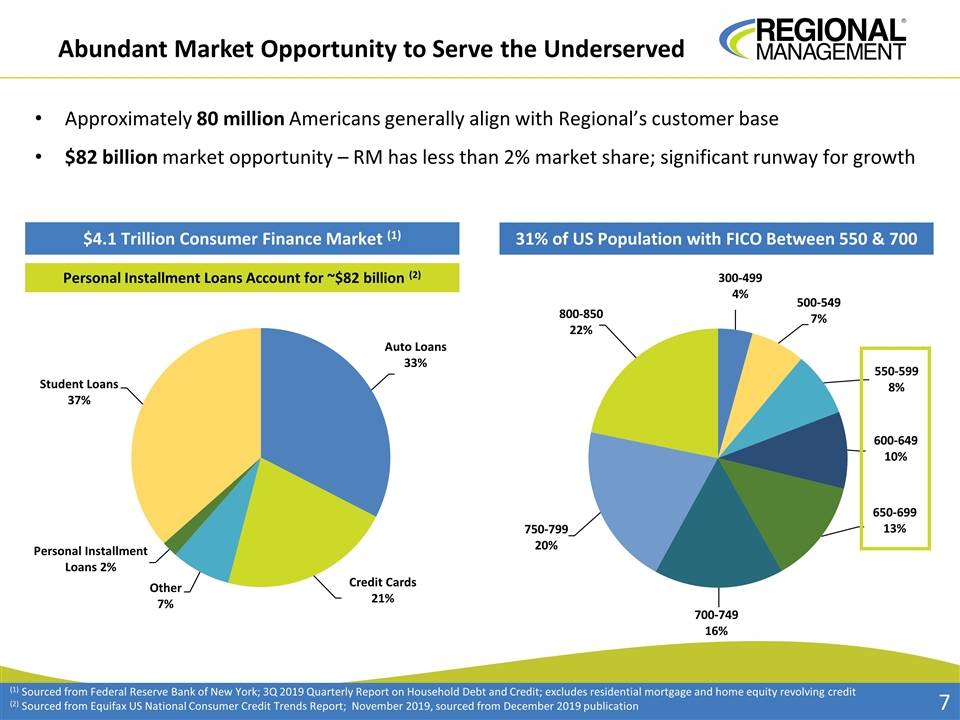

Abundant Market Opportunity to Serve the Underserved Approximately 80 million Americans generally align with Regional’s customer base $82 billion market opportunity – RM has less than 2% market share; significant runway for growth $4.1 Trillion Consumer Finance Market (1) 31% of US Population with FICO Between 550 & 700 Personal Installment Loans Account for ~$82 billion (2) (1) Sourced from Federal Reserve Bank of New York; 3Q 2019 Quarterly Report on Household Debt and Credit; excludes residential mortgage and home equity revolving credit (2) Sourced from Equifax US National Consumer Credit Trends Report; November 2019, sourced from December 2019 publication

Supporting Growth to Generate Shareholder Value Hybrid approach for portfolio growth – increasing receivables per branch and de novo expansion Differentiated go-to-market strategy offering small and large loans Well-established, cost-efficient omni-channel sales with integrated marketing Modernized infrastructure streamlines customer experience and improves service and productivity while enabling digital capabilities Enhanced credit capabilities (custom scorecards and late-stage centralized collections) further stabilize credit Utilize scale to improve operating expense ratio High customer satisfaction and loyalty Diversified funding sources

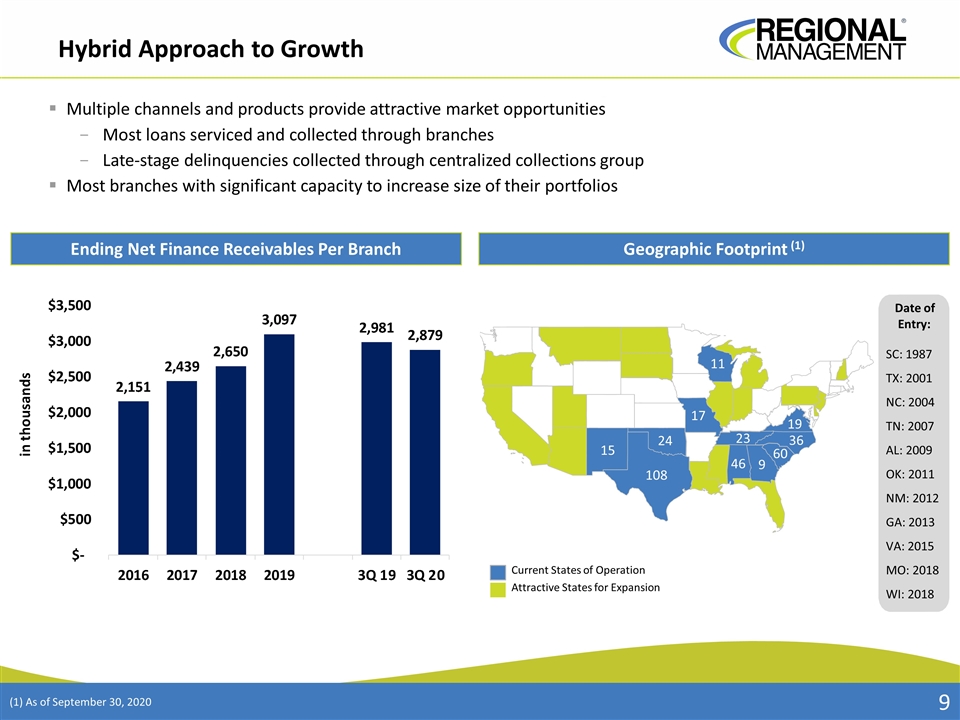

Hybrid Approach to Growth Multiple channels and products provide attractive market opportunities Most loans serviced and collected through branches Late-stage delinquencies collected through centralized collections group Most branches with significant capacity to increase size of their portfolios Ending Net Finance Receivables Per Branch Geographic Footprint (1) Date of Entry: SC: 1987 TX: 2001 NC: 2004 TN: 2007 AL: 2009 OK: 2011 NM: 2012 GA: 2013 VA: 2015 MO: 2018 WI: 2018 Current States of Operation Attractive States for Expansion (1) As of September 30, 2020 15 108 24 17 11 19 23 36 60 9 46

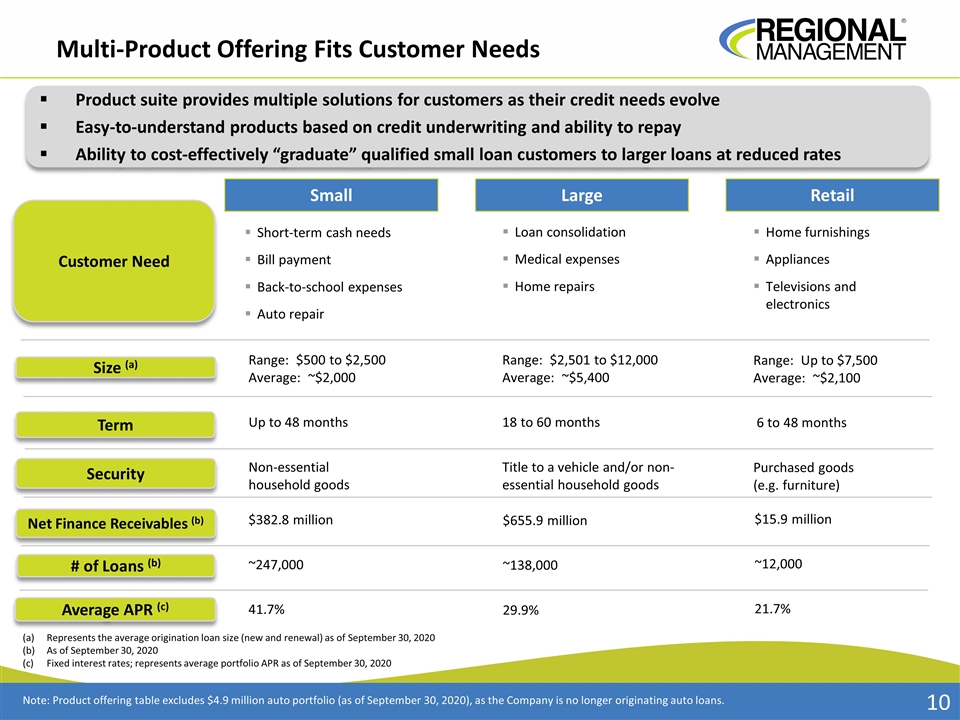

Multi-Product Offering Fits Customer Needs Size (a) Term Security Net Finance Receivables (b) # of Loans (b) Average APR (c) Range: $500 to $2,500 Average: ~$2,000 Up to 48 months Non-essential household goods $382.8 million ~247,000 41.7% Range: $2,501 to $12,000 Average: ~$5,400 18 to 60 months Title to a vehicle and/or non-essential household goods $655.9 million ~138,000 29.9% Range: Up to $7,500 Average: ~$2,100 6 to 48 months Purchased goods (e.g. furniture) $15.9 million ~12,000 21.7% Customer Need Short-term cash needs Bill payment Back-to-school expenses Auto repair Home furnishings Appliances Televisions and electronics Loan consolidation Medical expenses Home repairs Product suite provides multiple solutions for customers as their credit needs evolve Easy-to-understand products based on credit underwriting and ability to repay Ability to cost-effectively “graduate” qualified small loan customers to larger loans at reduced rates Small Large Retail Represents the average origination loan size (new and renewal) as of September 30, 2020 As of September 30, 2020 Fixed interest rates; represents average portfolio APR as of September 30, 2020 Note: Product offering table excludes $4.9 million auto portfolio (as of September 30, 2020), as the Company is no longer originating auto loans.

Core Loan Portfolio Growth Driven by Large Loan Receivables Since adding large loans as a core product in 2015, large loan receivables have grown from $47 million to $656 million Large Loan CAGR of 68%

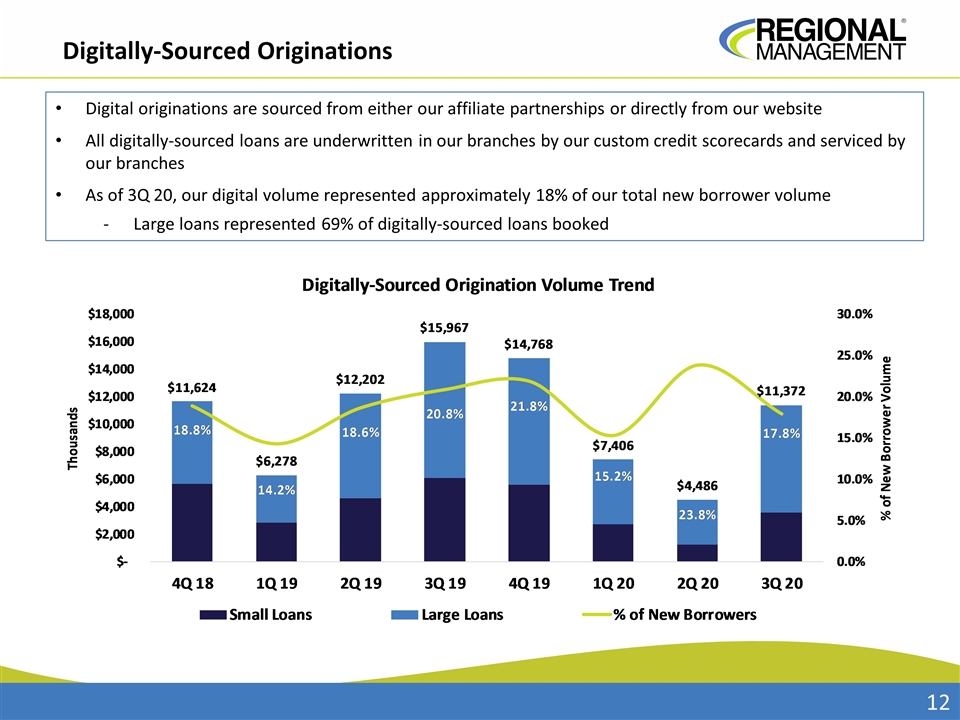

Digitally-Sourced Originations Digital originations are sourced from either our affiliate partnerships or directly from our website All digitally-sourced loans are underwritten in our branches by our custom credit scorecards and serviced by our branches As of 3Q 20, our digital volume represented approximately 18% of our total new borrower volume Large loans represented 69% of digitally-sourced loans booked

$23.3MM Omni-Channel Originations Provide Market Opportunities Branches are the foundation of Regional’s multi-channel strategy. Mail campaigns attract approximately 100,000 new customers per year to Regional. Regional continues to expand digital channel / online lending capabilities to acquire customers. Regional Branch Network Supports All Origination Channels Personal Relationships with Customers Convenience Check Loans Furniture and Appliance Retailers (Relationships with approx. 600 retailers) $133.6MM $202.3MM Large Branch Originated Loans (368 branches as of September 30, 2020) $343.0MM $7.3MM Branch Originated (1) Non-Branch Originated (1) Digital Lead Generation / Partnership Affiliates Retailers Web Mail (1) YTD Origination Volume as of September 30, 2020 Small Branch Originated Loans (368 branches as of September 30, 2020)

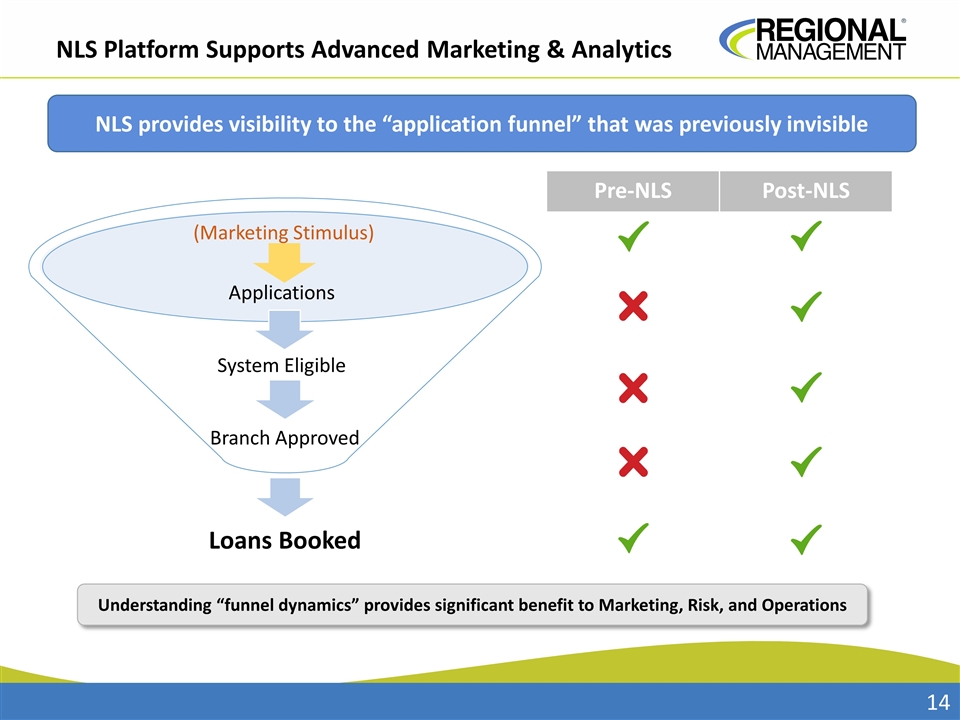

NLS provides visibility to the “application funnel” that was previously invisible Applications System Eligible Branch Approved (Marketing Stimulus) Pre-NLS Post-NLS NLS Platform Supports Advanced Marketing & Analytics Understanding “funnel dynamics” provides significant benefit to Marketing, Risk, and Operations Loans Booked

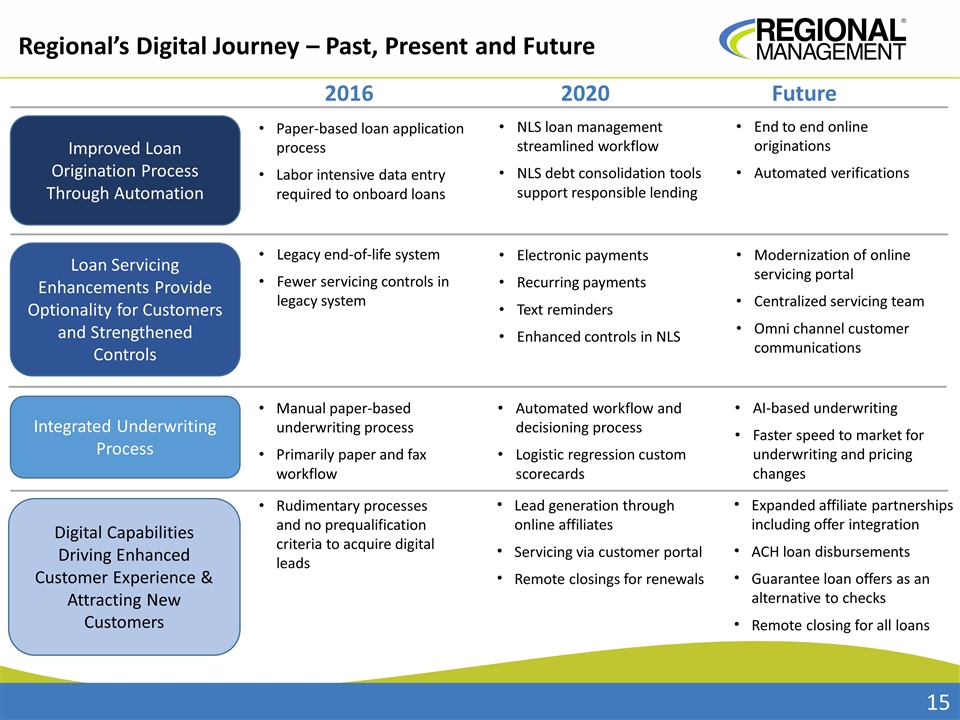

Regional’s Digital Journey – Past, Present and Future Rudimentary processes and no prequalification criteria to acquire digital leads Lead generation through online affiliates Servicing via customer portal Remote closings for renewals Paper-based loan application process Labor intensive data entry required to onboard loans NLS loan management streamlined workflow NLS debt consolidation tools support responsible lending Manual paper-based underwriting process Primarily paper and fax workflow Automated workflow and decisioning process Logistic regression custom scorecards Improved Loan Origination Process Through Automation Loan Servicing Enhancements Provide Optionality for Customers and Strengthened Controls Legacy end-of-life system Fewer servicing controls in legacy system Electronic payments Recurring payments Text reminders Enhanced controls in NLS Integrated Underwriting Process Digital Capabilities Driving Enhanced Customer Experience & Attracting New Customers 2016 2020Future Expanded affiliate partnerships including offer integration ACH loan disbursements Guarantee loan offers as an alternative to checks Remote closing for all loans End to end online originations Automated verifications AI-based underwriting Faster speed to market for underwriting and pricing changes Modernization of online servicing portal Centralized servicing team Omni channel customer communications

Developing Capabilities to Provide Customers the Choice of Where and How to Interact With Us In Branch Phone Browser Originate Service Renew existing future Omni-Channel Capabilities Mobile

Top-Shelf Customer Experience Net promoter score of 58, representing our customers’ strong loyalty and willingness to recommend our products to others (1) 90%+ favorable ratings for key attributes (1): Loan process was quick, easy and understandable People are professional, responsive, respectful, knowledgeable, helpful, friendly 90% of customers would apply to Regional Finance first the next time they need a loan Continued investment in digital channels, remote servicing options, and laser focus on delivering a positive customer experience has allowed us to maintain strong metrics during a very difficult operating environment (1) Sourced from Fall 2020 Customer Satisfaction Survey (1)

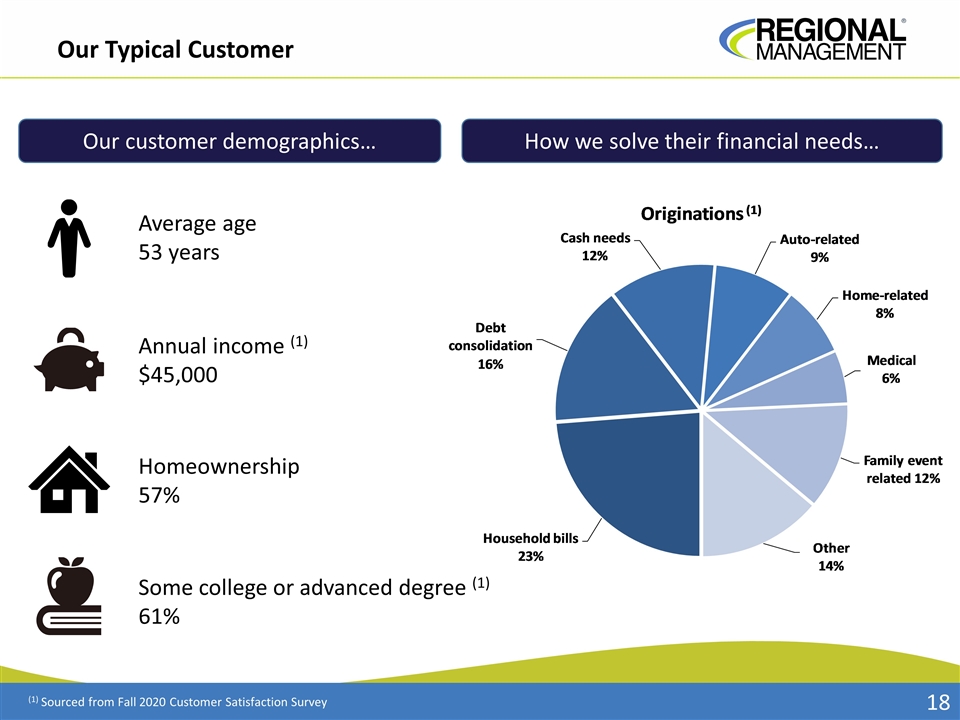

Our Typical Customer Annual income (1) $45,000 Some college or advanced degree (1) 61% Our customer demographics… How we solve their financial needs… Average age 53 years Homeownership 57% (1) Sourced from Fall 2020 Customer Satisfaction Survey

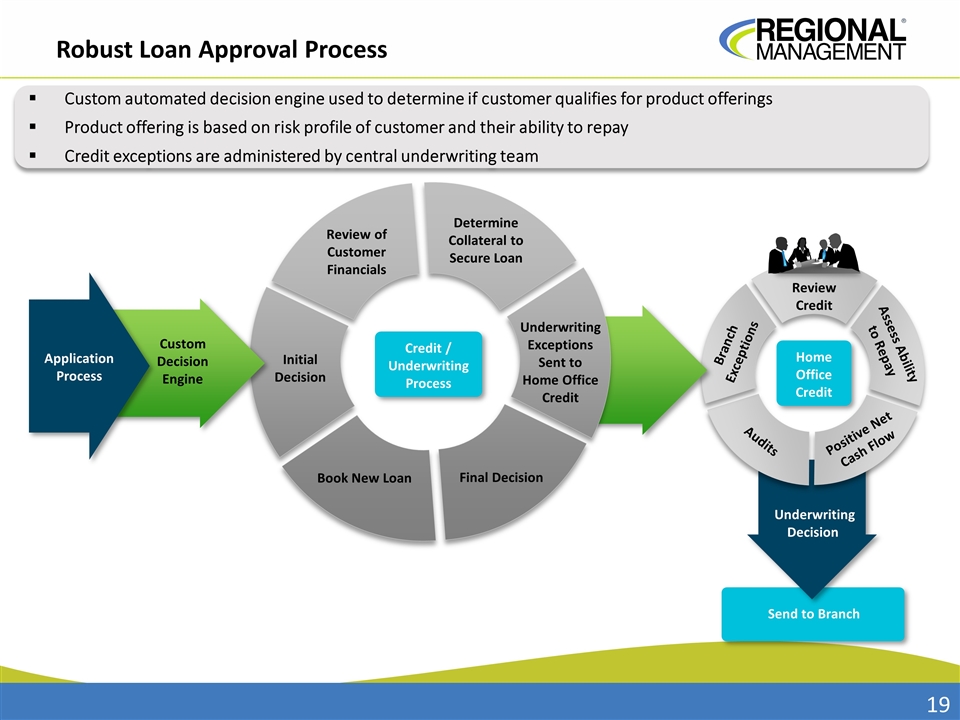

Send to Branch Underwriting Decision Branch Exceptions Review Credit Assess Ability to Repay Positive Net Cash Flow Audits Initial Decision Review of Customer Financials Underwriting Exceptions Sent to Home Office Credit Custom Decision Engine Final Decision Book New Loan Credit / Underwriting Process Application Process Custom automated decision engine used to determine if customer qualifies for product offerings Product offering is based on risk profile of customer and their ability to repay Credit exceptions are administered by central underwriting team Home Office Credit Robust Loan Approval Process Determine Collateral to Secure Loan

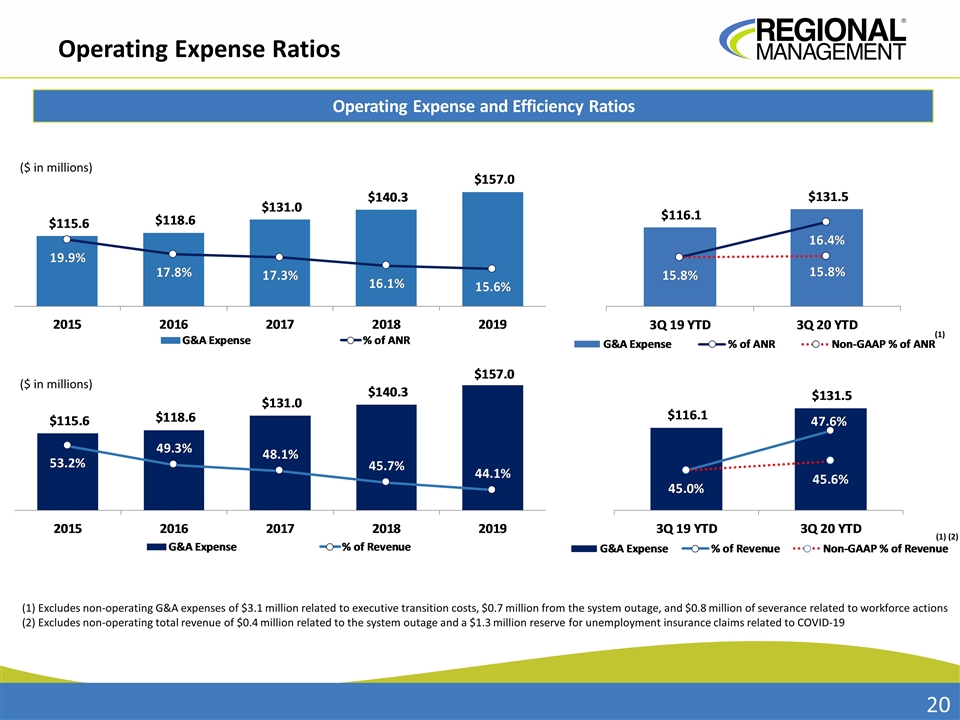

Operating Expense and Efficiency Ratios Operating Expense Ratios ($ in millions) ($ in millions) (1) Excludes non-operating G&A expenses of $3.1 million related to executive transition costs, $0.7 million from the system outage, and $0.8 million of severance related to workforce actions (2) Excludes non-operating total revenue of $0.4 million related to the system outage and a $1.3 million reserve for unemployment insurance claims related to COVID-19 (1) (1) (2)

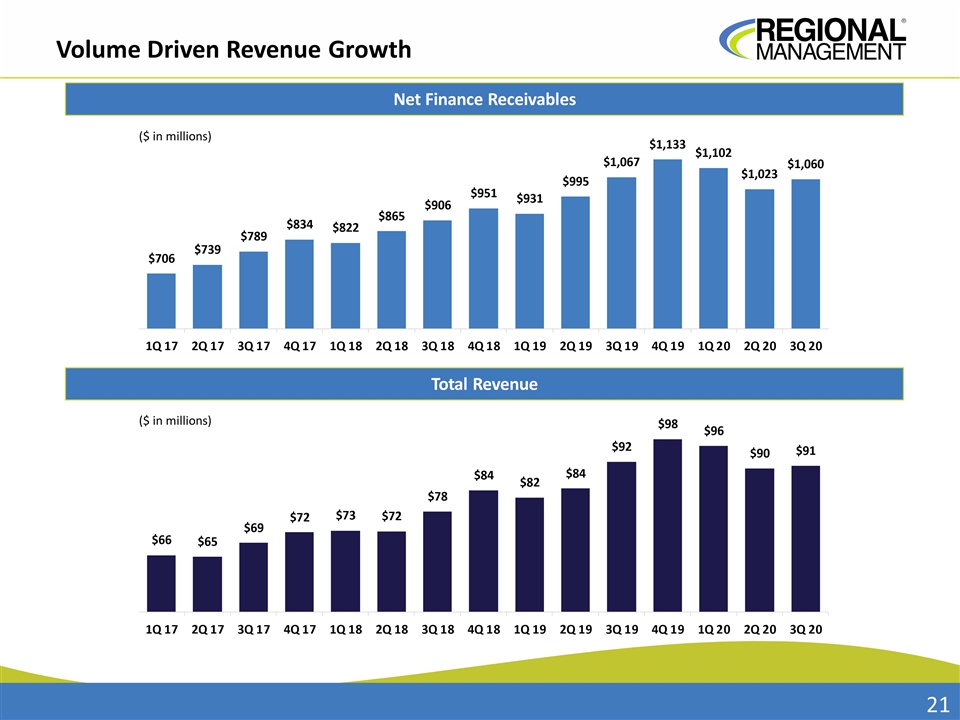

Volume Driven Revenue Growth ($ in millions) ($ in millions) Net Finance Receivables Total Revenue

Growing Receivables and Expanding Bottom Line Lead to Consistent Returns ($ in millions) Net Income & Diluted Earnings Per Share Return on Assets & Return on Equity Expansion of net income and EPS follows receivable growth, coupled with consistent returns

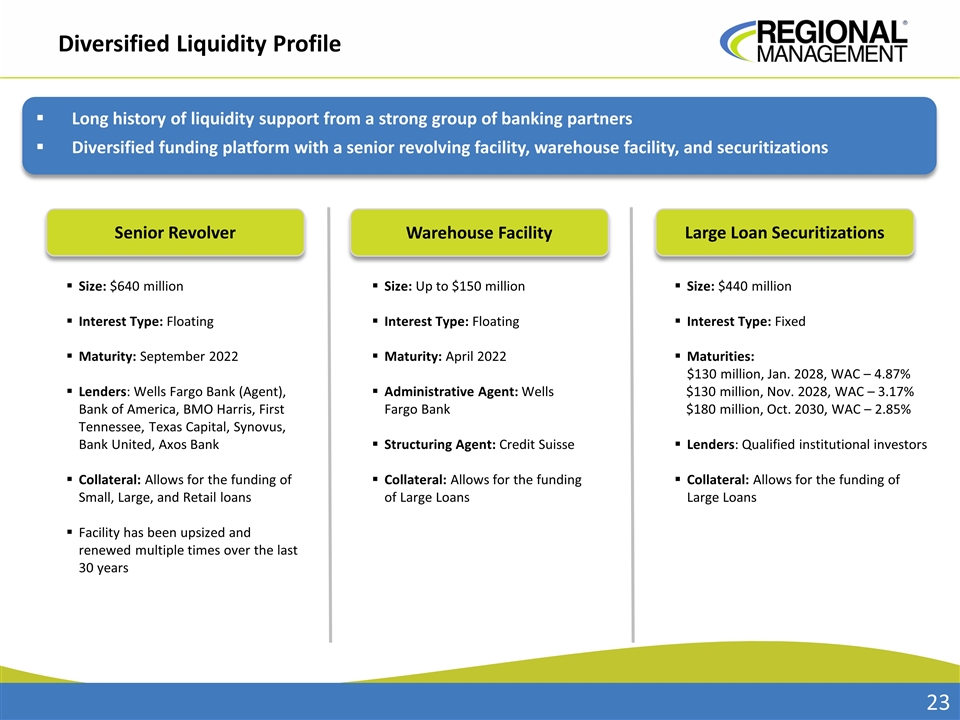

Senior Revolver Size: $640 million Interest Type: Floating Maturity: September 2022 Lenders: Wells Fargo Bank (Agent), Bank of America, BMO Harris, First Tennessee, Texas Capital, Synovus, Bank United, Axos Bank Collateral: Allows for the funding of Small, Large, and Retail loans Facility has been upsized and renewed multiple times over the last 30 years Large Loan Securitizations Warehouse Facility Size: Up to $150 million Interest Type: Floating Maturity: April 2022 Administrative Agent: Wells Fargo Bank Structuring Agent: Credit Suisse Collateral: Allows for the funding of Large Loans Size: $440 million Interest Type: Fixed Maturities: $130 million, Jan. 2028, WAC – 4.87% $130 million, Nov. 2028, WAC – 3.17% $180 million, Oct. 2030, WAC – 2.85% Lenders: Qualified institutional investors Collateral: Allows for the funding of Large Loans Long history of liquidity support from a strong group of banking partners Diversified funding platform with a senior revolving facility, warehouse facility, and securitizations Diversified Liquidity Profile

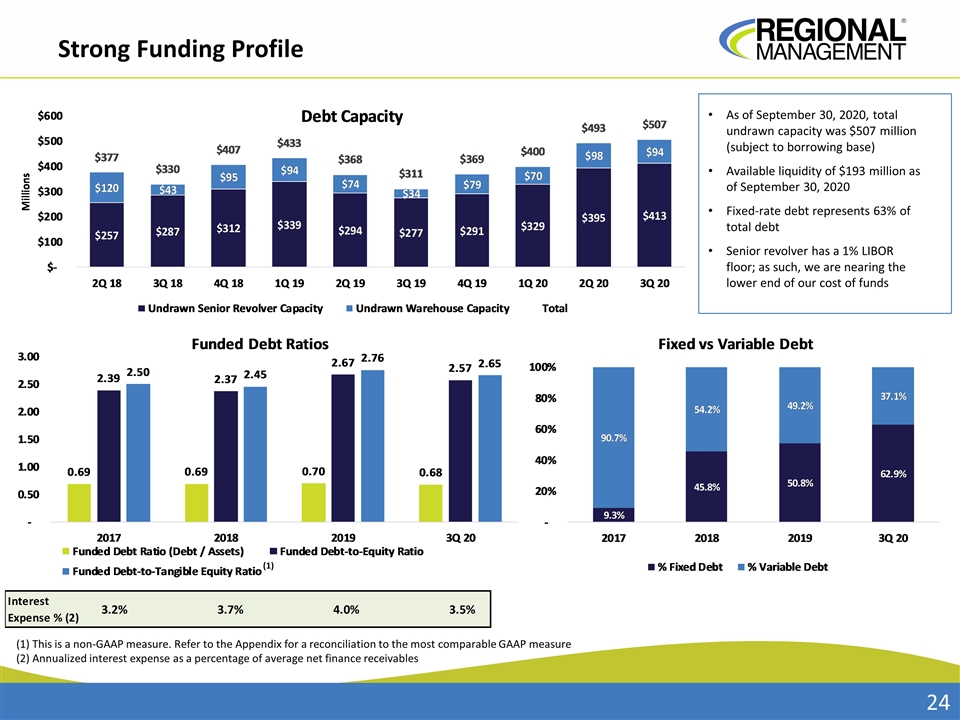

Strong Funding Profile (1) This is a non-GAAP measure. Refer to the Appendix for a reconciliation to the most comparable GAAP measure (2) Annualized interest expense as a percentage of average net finance receivables (1) As of September 30, 2020, total undrawn capacity was $507 million (subject to borrowing base) Available liquidity of $193 million as of September 30, 2020 Fixed-rate debt represents 63% of total debt Senior revolver has a 1% LIBOR floor; as such, we are nearing the lower end of our cost of funds

Announcement of Capital Return Plan Shareholder value creation… Our Board of Directors authorized a new $30 million share repurchase program and initiated a quarterly dividend of $0.20 per common share beginning in 4Q 2020. The Board and Management have confidence in our business model’s ability to generate excess capital to return to our shareholders on a regular basis. The recurring dividend and repurchase programs allow us to return significant value to our shareholders, while retaining ample capital to continue our investment in omni-channel and digital initiatives that will expand our market share and generate sustainable long-term profitable growth.

Investment Highlights Clear Path Forward for Sustainable Long-Term Growth Successful Differentiated Growth Strategy Advanced Credit Tools Deep Management Experience Abundant Market Opportunity Modern Infrastructure

Appendix

Deep and Tested Management Experience Rob Beck President and CEO John Schachtel COO Manish Parmar Chief Credit Risk Officer Mike Dymski Interim CFO and CAO Jim Ryan Chief Marketing Officer 25+ years of financial services experience Regional Management’s Chief Accounting Officer since 2016 Prior to joining Regional, was Director of Finance, South USA with TD Bank 30+ years of consumer financial services experience Prior to joining Regional, was COO at OneMain Financial Extensive operations experience at CitiFinancial (now OneMain) Nearly 20 years of credit and financial experience Prior to joining Regional, was Chief Credit and Analytics Officer at Conn’s, Inc. Held several senior roles at Discover Financial Services, including Head of Consumer Credit Risk Management 30+ years of finance and accounting experience Also spent 29 years at Citi, including service as COO of the US Retail Bank Prior to joining Regional, was EVP and COO for the Leukemia and Lymphoma Society 20+ years of consumer financial services experience Prior to joining Regional, was Chief Marketing Officer at OneMain Financial for 10 years Also held additional senior roles at CitiFinancial, including SVP of Operations and VP of Credit Risk

Strong Corporate Governance and Board of Directors Jonathan Brown Partner with Basswood Capital Management, LLC Formerly at Sandelman Partners Formerly at Goldman Sachs Maria Contreras-Sweet Former Administrator of U.S. Small Business Administration Founder of ProAmerica Bank Former Secretary of CA’s Business, Transportation and Housing Agency

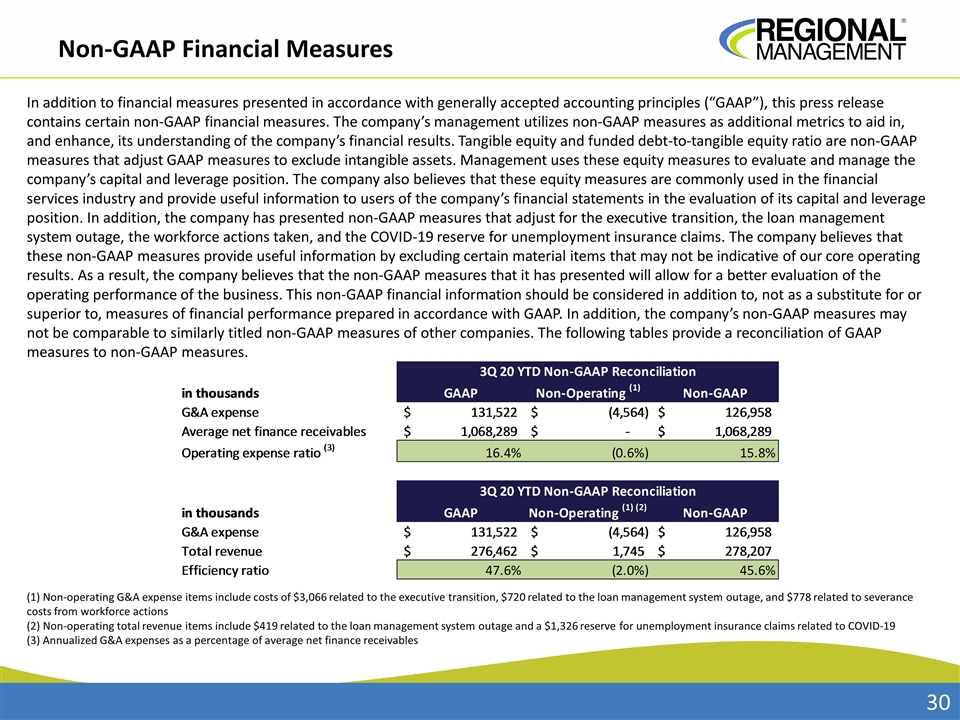

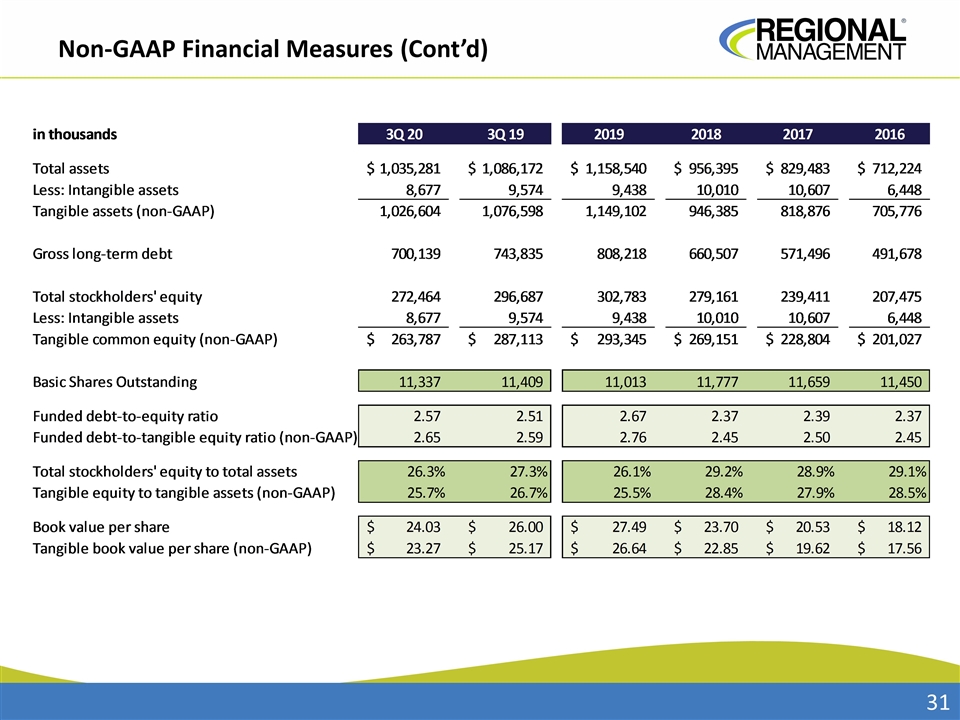

Non-GAAP Financial Measures In addition to financial measures presented in accordance with generally accepted accounting principles (“GAAP”), this press release contains certain non-GAAP financial measures. The company’s management utilizes non-GAAP measures as additional metrics to aid in, and enhance, its understanding of the company’s financial results. Tangible equity and funded debt-to-tangible equity ratio are non-GAAP measures that adjust GAAP measures to exclude intangible assets. Management uses these equity measures to evaluate and manage the company’s capital and leverage position. The company also believes that these equity measures are commonly used in the financial services industry and provide useful information to users of the company’s financial statements in the evaluation of its capital and leverage position. In addition, the company has presented non-GAAP measures that adjust for the executive transition, the loan management system outage, the workforce actions taken, and the COVID-19 reserve for unemployment insurance claims. The company believes that these non-GAAP measures provide useful information by excluding certain material items that may not be indicative of our core operating results. As a result, the company believes that the non-GAAP measures that it has presented will allow for a better evaluation of the operating performance of the business. This non-GAAP financial information should be considered in addition to, not as a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. In addition, the company’s non-GAAP measures may not be comparable to similarly titled non-GAAP measures of other companies. The following tables provide a reconciliation of GAAP measures to non-GAAP measures. (1) Non-operating G&A expense items include costs of $3,066 related to the executive transition, $720 related to the loan management system outage, and $778 related to severance costs from workforce actions (2) Non-operating total revenue items include $419 related to the loan management system outage and a $1,326 reserve for unemployment insurance claims related to COVID-19 (3) Annualized G&A expenses as a percentage of average net finance receivables

Non-GAAP Financial Measures (Cont’d)