Form 8-K VERIZON COMMUNICATIONS For: Nov 12

Exhibit 99.1 Sellside Analyst Day November 11, 2020

Safe Harbor Statement NOTE: In this presentation we have made forward-looking statements. These disruption of our key suppliers’ or vendors' provisioning of products or services, statements are based on our estimates and assumptions and are subject to risks including as a result of the COVID-19 outbreak; material adverse changes in and uncertainties. Forward-looking statements include the information labor matters and any resulting financial or operational impact; the effects of concerning our possible or assumed future results of operations. Forward-looking competition in the markets in which we operate; failure to take advantage of statements also include those preceded or followed by the words “anticipates,” developments in technology and address changes in consumer demand; “believes,” “estimates,” “expects,” “hopes” or similar expressions. For those performance issues or delays in the deployment of our 5G network resulting in statements, we claim the protection of the safe harbor for forward-looking significant costs or a reduction in the anticipated benefits of the enhancement statements contained in the Private Securities Litigation Reform Act of 1995. We to our networks; the inability to implement our business strategy; adverse undertake no obligation to revise or publicly release the results of any revision to conditions in the U.S. and international economies; changes in the regulatory these forward-looking statements, except as required by law. Given these risks environment in which we operate, including any increase in restrictions on our and uncertainties, readers are cautioned not to place undue reliance on such ability to operate our business; our high level of indebtedness; an adverse forward-looking statements. The following important factors, along with those change in the ratings afforded our debt securities by nationally accredited discussed in our filings with the Securities and Exchange Commission (the ratings organizations or adverse conditions in the credit markets affecting the “SEC”), could affect future results and could cause those results to differ cost, including interest rates, and/or availability of further financing; significant materially from those expressed in the forward-looking statements: cyber attacks increases in benefit plan costs or lower investment returns on plan assets; impacting our networks or systems and any resulting financial or reputational changes in tax laws or treaties, or in their interpretation; and changes in impact; natural disasters, terrorist attacks or acts of war or significant litigation accounting assumptions that regulatory agencies, including the SEC, may and any resulting financial or reputational impact; the impact of the global require or that result from changes in the accounting rules or their application, outbreak of COVID-19 on our operations, our employees and the ways in which which could result in an impact on earnings. our customers use our networks and other products and services; As required by SEC rules, we have provided a reconciliation of the non-GAAP financial measures included in this presentation to the most directly comparable GAAP measures in materials on our website at www.verizon.com/about/investors © 2020 Verizon 2

Presented Feb. 2019 Investor Day Strategy Fundamentals Driving 2.0 Transformation CUSTOMERS INNOVATION DRIVING FIRST NEW GROWTH • Best Network Experiences • 5G & Edge Compute • Customer-Centric Models • New Market Opportunities Network-as-a-Service PURPOSE-DRIVEN 000/ Platform FINANCIAL CULTURE DISCIPLINE • Responsible Business $ • Balanced Capital Allocation • Preferred Place for Talent • Best-in-Class Cost Models Target GDP+ Revenue Growth Driving Strong Earnings and Cash Flow © 2020 Verizon 4

Presented Feb. 2019 Investor Day 5G Creating Value Across Existing and New Businesses NEW Fixed Wireless Access (FWA) (Consumer & VZ Solutions 3rd Party Developer Ecosystem EXTEND Business) Business Models Manufacturing Mobile Edge Compute (MEC) 5G Mobility DEFEND © 2020 Verizon 5

2020: Strong Execution Against Strategic Priorities and … LTE Award LTE Home Internet RootMetrics & Expansion JD Power Mix & Match 3.0 Verizon Mix & Match Visa Card for Business # 1 COVID-19 2nd $1B 2020 Response Green Commitments Bond 1Q 2Q 3Q 4Q Boston & SF Launch Strong 3Q * Financials 2019 ESG Fastest 5G Nationwide and UW – Report Award UW on all Stadiums & Arenas Best Overall Mobile iPhone 12 models Network, 1H’20 * TracFone acquisition expected to close in 2021, subject to regulatory approval YTD 5G 55 UW 12 Home 43 Stadiums & 5 Edge Nationwide Mobility Deployment Mobility Markets Markets 7 Airports Markets (200M+ POPs, 1.8K Cities) © 2020 Verizon 6

Presented Feb. 2020 Investor Day …Fulfilling 2020 Commitments while Driving COVID-19 Initiatives Continued 2.0 Transformation Strengthen & Network & Customer innovation: IE Network, VZ Credit Card, Mix & Match √ Grow Core Business VBG Investments to capture new markets; deliver on 4-year $10B cash savings On Track 5G Deployment Dynamic spectrum sharing (DSS) nationwide roll-out √ Leverage Assets to Drive 5x+ YoY increase in 5G small cells On Track New Growth 60+ 5G Ultra Wideband (UW) Mobility cities On Track 10+ 5G UW Home cities on 5G NR and nextGen CPE √ Drive Operational 10+ 5G commercial MEC centers On Track & Financial Revenue Growth and Financial Discipline Discipline On Track Absent Accelerate revenue & adjusted EPS* growth with consistent levels of capex intensity COVID Impact Cultivate Balanced capital allocation approaching leverage target √ Purpose-Driven Responsible Business Commitments Culture Climate, digital divide and purpose-driven brand √ © 2020 Verizon * Non-GAAP measure 7

Strategy Execution Resulting in Financial Strength Total Wireless Service Revenue Y/Y Growth* Adjusted EPS*** W/O 606 2019 2020 guidance: 4.3% 4Q guidance: $1.26 0-2% Y/Y growth** Reported 2.5% 2.8% 2.7% A 2020 $1.25 2.5% >=2.0%** $1.23 1.9% 1.9% 3.1% 0.0% $1.25 B 0.9% 0.8% 0.1% 0.3% $1.20 $1.18 $1.13 -1.7% -2.4% $0.23 COVID Pressure in 2020 COVID Pressure 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q 2Q 3Q 4Q Cash Flow ($B) C 32.5 A Wireless serviceservice revenue revenue growth growth driven driven by by Unlimited Unlimited CFFO 26.7 Mix && Match andand expanded expanded customer customer base base 14.2 Steady underlying earnings growth in the face of CapEx 12.3 B Steady underlying earnings growth in the face of COVID headwinds FCF*** 14.4 18.3 Resilient businessbusiness drivingdriving strong strong cash cash flow flow while while C Sep'19 YTD Sep'20 YTD investing forfor growth growth Financial Strength Creating Momentum for Growth in 2021 * Prior year amounts revised to conform to current period presentation. ** Provided guidance range at 3Q earnings. *** Non-GAAP measure © 2020 Verizon 8

The Verizon Growth Agenda Network-as-a-Service at Scale Strategic foundation to maximize growth in the fully networked economy. World-class partnerships to accelerate scale. © 2020 Verizon 9

Executing Growth Across 5 Vectors 5G Network Next-gen B2B Customer New Adoption Monetization Applications Differentiation Markets © 2020 Verizon 10

Executing Growth Across 5 Vectors © 2020 Verizon 11

Executing Growth Across 5 Vectors © 2020 Verizon 12

Executing Growth Across 5 Vectors © 2020 Verizon 13

Executing Growth Across 5 Vectors © 2020 Verizon 14

Executing Growth Across 5 Vectors © 2020 Verizon 15

Network-as-a-Service at Scale 5G Network Next-gen B2B Customer New Adoption Monetization Applications Differentiation Markets 5G UW MVNO partnerships MEC leadership Deepen and broaden TracFone* 5G Nationwide Increase 5G traffic, site Monetize remote work, customer relationships Visible and Yahoo! Mobile profitability distance learning, telehealth New Consumer Mix & Match 5G Home Expand LTE Home Internet plans (with Disney+) Public sector interoperability Strategic partnerships: New Business Unlimited • Apple, NFL, NBA, NHL plans (with security) * LTE Home Internet Note: *TracFone acquisition expected to close in 2021 subject to regulatory approval. © 2020 Verizon 16

Accelerating Momentum Heading into Next Year Macro and Industry Considerations Verizon Leadership and Execution • Economic uncertainty likely to persist • Build on momentum in core businesses • Mobility & Broadband to remain key economic drivers • Scale in 5G deployment & monetization • Strong demand continues for network reliability • Capitalize on new opportunities • 5G adoption to increase • Maintain customer-centricity & brand strength • 5G ecosystems to be differentiator • Strong balance sheet & cash flow generation Strength in Network, Brand & Financials Provides Platform for 2021 Execution © 2020 Verizon 17

Delivering on our network initiatives in 2020 1 Continue to provide highest-quality, most reliable service 2 Launched 5G Nationwide DSS in October 3 On track with 5G mmWave expansion 4 Maintaining network leadership in 4G LTE and 5G 5 Obtained significant CBRS spectrum to augment network capacity Superior performance, today and tomorrow © 2020 Verizon 19

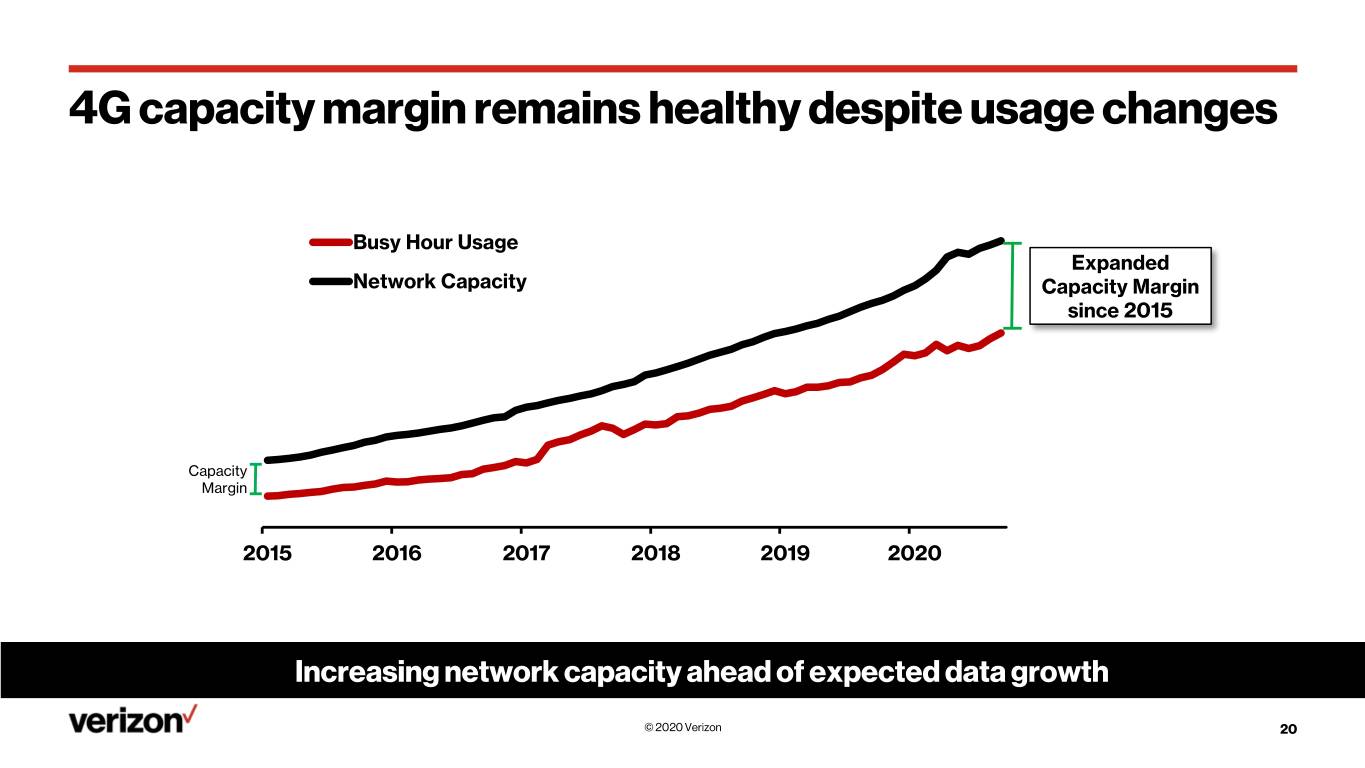

4G capacity margin remains healthy despite usage changes Busy Hour Usage Expanded Network Capacity Capacity Margin since 2015 Capacity Margin 2015 2016 2017 2018 2019 2020 Increasing network capacity ahead of expected data growth © 2020 Verizon 20

Accelerated pace of 4G capacity expansion given demand 4G – Carrier Adds CBRS Adds Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Actual Target Actual Target 4G Carrier Adds and CBRS Adds have already exceeded year-end goal © 2020 Verizon 21

Dynamic Spectrum Sharing (DSS) working well Ookla® Median Download Speed of 5G Capable Devices Pre 5G Nationwide Post 5G Nationwide Throughput [Mbps] Aug 2020 Sep 2020 Oct 2020 Nov 2020 Based on Verizon's analysis of Ookla® Speedtest Intelligence® U.S. daily data of median download speeds from August 7, 2020 through November 4, 2020. Ookla trademarks used under license and reprinted with permission. Great performance and throughput with launch of DSS © 2020 Verizon 22

Extending our lead in network performance rankings Root Metrics – Overall Win Rate Verizon Competitor A Competitor B Verizon maintains network leadership by a wide margin © 2020 Verizon 23

5G Ultra Wideband (UW) build tracking ahead of plan 5G UW Sites Activated YTD Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2019 2020 Strong momentum in putting sites on air at scale © 2020 Verizon 24

5G UW enables unmatched performance • 5G UW available in 55 cities now, vs. 31 at year-end 2019 • On track for 60 5G UW cities by year-end • Build areas represent a high percentage of peak hour usage • Real-world speeds of 4 Gbps, faster than wired broadband, and up to 5 Gbps in the lab • October 2020 mmWave usage is 4x that seen in January 2020 • Significant improvement in capital efficiency ($/MHz) vs. 4G LTE Rapidly scaling the breadth and power of 5G UW © 2020 Verizon 25

Driving efficient use of assets Illustrative Distribution of Cell Sites based on Utilization Count of Cell Sites Cell of Count Low Peak High Peak Utilization Utilization © 2020 Verizon 26

Driving efficient use of assets Illustrative Distribution of Cell Sites based on Utilization • In highest utilization areas (most dense 5G UW and highest traveled locations), deploy Mobility + mmWave spectrum Home Count of Cell Sites Cell of Count Low Peak High Peak Utilization Utilization © 2020 Verizon 27

Driving efficient use of assets Illustrative Distribution of Cell Sites based on Utilization • In highest utilization areas (most dense and highest traveled locations), deploy 4G LTE + 5G UW FWA Mobility + mmWave spectrum Home • In areas with excess capacity, monetize it with 4G FWA product (LTE Home Internet) Count of Cell Sites Cell of Count Low Peak High Peak Utilization Utilization © 2020 Verizon 28

Driving efficient use of assets Illustrative Distribution of Cell Sites based on Utilization • In highest utilization areas (most dense and highest traveled locations), deploy 4G LTE + Carrier 5G UW FWA Adds/ Mobility + mmWave spectrum CBRS Home • In areas with excess capacity, monetize it with 4G FWA product (LTE Home Internet) • Carrier Adds/CBRS deployment create additional capacity in the network to shift the utilization curve to the left Count of Cell Sites Cell of Count Low Peak High Peak Utilization Utilization Shifting the curve improves performance + increases opportunity for network as a service © 2020 Verizon 29

5G UW Technology Roadmap • New 5G Home CPE & Self-Setup • 5G In-Building • 5G Core and 5G Stand Alone • 10CC for >5Gbps • Network Slicing • MEC & Private Networks • Virtualization and Webscale • Security Verizon is paving the way to deploy the full functionality of 5G © 2020 Verizon 30

Network-based strategy driving results and path to growth 5G DSS 4G LTE 5G UW Nationwide Best-in-class and most reliable network, today and tomorrow © 2020 Verizon 31

Verizon’s platform strategy Consumers Customer Enhancements Go to * market Enabling Modular, API-driven, AI-ready technology stack and data layer tech layer Core Customer Networks Distribution Billing Platforms (incl. MEC) Service Note: *TracFone acquisition expected to close in 2021 subject to regulatory approval. © 2020 Verizon 33

Executing and accelerating our strategy The 5G America’s been waiting for Digital, Seamless Omni-Channel Signature experiences growing premium accounts Journeys, and Contactless Retail LTE Home Expanding our home internet presence Internet Launch More value to customers driving loyalty * Controlling our own destiny in the Value market MSO Partnerships Network-as-a-Service platform strategy Note: *TracFone acquisition expected to close in 2021 subject to regulatory approval. © 2020 Verizon 34

Consumer Growth Platform P&L Drivers New Accounts Value Proposition Unlimited Mix Premium Mix Verizon Up Lower Churn Omni-channel Base Management and Step Ups Experience Additional Lines Personalization Credit Card Product Attach Rate Mobile & Devices & Products Home New Revenue Increase Penetration Equipment Gaming Protection Quality | Choice | Experience © 2020 Verizon 35

Mobile: Accelerating growth Postpaid Account Mix Key Growth Drivers New Accounts 45% 39% Metered 58% 60% 88% of new accounts chose of new unlimited accounts an unlimited plan (3Q’20) chose a premium plan (3Q’20) Entry 44% Unlimited Base Accounts 44% 36% Premium 17% 11% Unlimited 4% YE'18 YE'19 3Q'20 4G Premium Step up/down Ratio Net Step Monthly Recurring Charges © 2020 Verizon 36

Changing the Home Experience More choice w/ Mix & Customer Experience & More at Home Match on Fios Rewards • Pay only for what you need • Superior network performance • VZ Protect Home • Mix shift to Premium • Mobile + Home Rewards • Stream TV Platform • Growing Fios margin • Easy self setup • Premium content partnerships • Advanced home security © 2020 Verizon 37

Mobile: Accelerating growth Expanding Expanding and Innovating Coverage device line up 5G Cities with 5G Home 12 Home 48 States with LTE Home • 5G Home average usage of 20+ • High power 5G Home CPE GB per day LTE Fios Home • Integrated home Wi-Fi router • Expanding broadband to millions more homes • CBRS/LTE compatibility Expanding broadband reach while targeting existing mobile base © 2020 Verizon 38

Summary • Investments and transformations have laid the foundation • Vectors of growth will help deliver on our GDP+ plan • Strength in core business with continued headroom for growth • New revenue streams (5G, FWA, product, Value) • Evolving the broadband experience and differentiating against our mobile competitors Driving growth through disciplined execution on our strategy © 2020 Verizon 39

© 2020 Verizon