Form SC TO-I PROTHENA CORP PUBLIC Filed by: PROTHENA CORP PUBLIC LTD CO

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

Tender Offer Statement Under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

PROTHENA CORPORATION PUBLIC LIMITED COMPANY

(Name of Subject Company (Issuer))

PROTHENA CORPORATION PUBLIC LIMITED COMPANY

(Name of Filing Person (Offeror))

Options To Purchase Ordinary Shares, Par Value $0.01 Per Share

(Title of Class of Securities)

G72800108

(CUSIP Number of Class of Securities)

Michael J. Malecek

Chief Legal Officer and Company Secretary

Prothena Corporation plc

c/o Prothena Biosciences Inc

331 Oyster Point Boulevard

South San Francisco, California 94080

(650) 837-8550

(Name, Address and Telephone Number of Person Authorized To Receive Notices and Communications on Behalf of the Filing Person)

Copy to:

Alan C. Mendelson, Esq.

Kathleen M. Wells, Esq.

John C. Williams, Esq.

Latham & Watkins LLP

140 Scott Drive

Menlo Park, California 94025

(650) 328-4600

Calculation of Filing Fee

| Transaction Valuation* | Amount of Filing Fee** | |

| $10,977,819

|

$1,197.68

| |

| * | Calculated solely for purposes of determining the filing fee. The calculation of the Transaction Valuation assumes that all outstanding options to purchase ordinary shares of Prothena Corporation plc that may be eligible for exchange in the offer will be exchanged pursuant to the offer. These options cover an aggregate of 2,458,410 ordinary shares of Prothena Corporation plc and have an aggregate value of $10,977,819 as of November 6, 2020, calculated using the Black-Scholes option pricing model. |

| ** | The amount of the filing fee, calculated in accordance with Rule 0-11(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), equals $109.10 per $1,000,000 of the aggregate amount of the Transaction Valuation. The Transaction Valuation set forth above was calculated for the sole purpose of determining the filing fee and should not be used for any other purpose. |

| ☐ | Check box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| Amount Previously Paid: Not applicable. | Filing party: Not applicable. | |

| Form or Registration No.: Not applicable. | Date Filed: Not applicable. | |

| ☐ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| ☐ | third-party tender offer subject to Rule 14d-1. |

| ☒ | issuer tender offer subject to Rule 13e-4. |

| ☐ | going-private transaction subject to Rule 13e-3. |

| ☐ | amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| ☐ | Rule 13e-4(i) (Cross-Border Issuer Tender Offer). |

| ☐ | Rule 14d-1(d) (Cross-Border Third-Party Tender Offer). |

Item 1. Summary Term Sheet.

The information set forth under “Summary Term Sheet and Questions and Answers” in the Offer to Exchange Certain Outstanding Options to Purchase Ordinary Shares for a Number of Replacement Options, dated November 9, 2020 (the “Offer to Exchange”), attached hereto as Exhibit (a)(1)(i), is incorporated herein by reference.

Item 2. Subject Company Information.

(a) Name and Address. The issuer is Prothena Corporation plc, an Irish public limited company (“Prothena” or the “Company”). The Company’s principal executive offices are located at 77 Sir John Rogerson’s Quay, Block C, Grand Canal Docklands, Dublin 2, D02 T804, Ireland, and the telephone number of its principal executive offices is 011-353-1-236-2500. The information set forth in the Offer to Exchange under “This Offer – Section 9 (Information Concerning Prothena)” is incorporated herein by reference.

(b) Securities. This Tender Offer Statement on Schedule TO relates to an offer by the Company to exchange options to purchase the Company’s ordinary shares, par value $0.01 per share, that were granted prior to April 23, 2018, with an exercise price equal to or greater than $17.63 held by employees, including the named executive officers, of the Company or its subsidiaries and non-employee directors of the Company, for replacement options to purchase ordinary shares of the Company to be granted under the Prothena Corporation plc 2018 Long Term Incentive Plan, as amended, upon the terms and subject to the conditions set forth in the Offer to Exchange, and the related Terms of Election (the “Terms of Election” and, together with the Offer to Exchange, as they may be amended from time to time, the “Option Exchange”), attached hereto as Exhibit (a)(1)(i) and Exhibit (a)(1)(iii), respectively. Each option holder that elects to exchange options pursuant to the Option Exchange must submit their election via the option exchange website and agree to the Terms of Election and will be granted replacement options to purchase a lesser number of Company ordinary shares. As of November 6, 2020, there were outstanding eligible options to purchase an aggregate of approximately 2,458,410 ordinary shares of the Company.

The information set forth in the Offer to Exchange under “Summary Term Sheet and Questions and Answers,” “This Offer – Section 1 (Eligibility; Number of Options; Offer Expiration Date),” “This Offer – Section 5 (Acceptance of Options for Exchange; Grant of Replacement Options),” and “This Offer – Section 8 (Source and Amount of Consideration; Terms of Replacement Options)” is incorporated herein by reference.

(c) Trading Market and Price. The information set forth in the Offer to Exchange under “This Offer – Section 7 (Price Range of Ordinary Shares Underlying the Options)” is incorporated herein by reference.

Item 3. Identity and Background of Filing Person.

(a) Name and Address. The Company is both the subject company and the filing person. The information set forth under Item 2(a) above and in the Offer to Exchange under “This Offer – Section 10 (Interests of Directors, Officers and Affiliates; Transactions and Arrangements Concerning our Securities)” is incorporated herein by reference.

Item 4. Terms of the Transaction.

(a) Material Terms. The information set forth in the Offer to Exchange under “Summary Term Sheet and Questions and Answers” and the sections under “This Offer” titled “Section 1 (Eligibility; Number of Options; Offer Expiration Date),” “Section 3 (Procedures for Electing to Exchange Options),” “Section 4 (Withdrawal Rights),” “Section 5 (Acceptance of Options for Exchange; Grant of Replacement Options),” “Section 6 (Conditions of this Offer),” “Section 7 (Price Range of Ordinary Shares Underlying the Options),” “Section 8 (Source and Amount of Consideration; Terms of Replacement Options),” “Section 9 (Information Concerning Prothena),” “Section 11 (Status of Options Acquired by Us in this Offer; Accounting Consequences of this Offer),” “Section 12 (Agreements; Legal Matters; Regulatory Approvals),” “Section 13 (Material U.S. Federal Income Tax Consequences),” and “Section 14 (Extension of Offer; Termination; Amendment)” is incorporated herein by reference.

(b) Purchases. The information set forth in the Offer to Exchange under “This Offer – Section 10 (Interests of Directors, Officers and Affiliates; Transactions and Arrangements Concerning our Securities)” is incorporated herein by reference.

Item 5. Past Contacts, Transactions, Negotiations and Agreements.

(e) Agreements Involving the Subject Company’s Securities. The information set forth in the Offer to Exchange under “This Offer – Section 10 (Interests of Directors, Officers and Affiliates; Transactions and Arrangements our Securities)” is incorporated herein by reference. The documents incorporated herein by reference as Exhibit (d)(1) through Exhibit (d)(12) also contain information regarding agreements relating to securities of the Company.

Item 6. Purposes of the Transaction and Plans or Proposals.

(a) Purposes. The information set forth in the Offer to Exchange under “Summary Term Sheet and Questions and Answers” and “This Offer – Section 2 (Purpose of this Offer)” is incorporated herein by reference.

(b) Use of Securities Acquired. The information set forth in the Offer to Exchange under “This Offer – Section 5 (Acceptance of Options for Exchange; Grant of Replacement Options),” and “This Offer – Section 11 (Status of Options Acquired by Us in this Offer; Accounting Consequences of this Offer)” is incorporated herein by reference.

(c) Plans. The information set forth in the Offer to Exchange under “Summary Term Sheet” and “This Offer – Section 2 (Purpose of this Offer)” is incorporated herein by reference.

Item 7. Source and Amount of Funds or Other Consideration.

(a) Source of Funds. The information set forth in the Offer to Exchange under “This Offer – Section 8 (Source and Amount of Consideration; Terms of Replacement Options)” and “This Offer – Section 15 (Fees and Expenses)” is incorporated herein by reference.

(b) Conditions. The information set forth in the Offer to Exchange under “This Offer – Section 6 (Conditions of this Offer)” is incorporated herein by reference. There are no alternative financing arrangements or financing plans for this Offer.

(d) Borrowed Funds. Not applicable.

Item 8. Interest in Securities of the Subject Company.

(a) Securities Ownership. The information set forth in the Offer to Exchange under “This Offer –Section 10 (Interests of Directors, Officers and Affiliates; Transactions and Arrangements Concerning our Securities)” is incorporated herein by reference.

(b) Securities Transactions. The information set forth in the Offer to Exchange under “This Offer – Section 10 (Interests of Directors, Officers and Affiliates; Transactions and Arrangements Concerning our Securities)” is incorporated herein by reference.

Item 9. Persons/Assets, Retained, Employed, Compensated or Used.

(a) Solicitations or Recommendations. Not applicable.

Item 10. Financial Statements.

(a) Financial Information. The information set forth in the Offer to Exchange under “This Offer – Section 9 (Information Concerning Prothena)” and “This Offer – Section 16 (Additional Information)” is incorporated herein by reference. Our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed with the Securities and Exchange Commission (the “SEC”) on March 3, 2020, including the financial information set forth in Item 8 – Financial Statements and Supplementary Data of our Annual Report on Form 10-K, and our Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2020, June 30, 2020, and September 30, 2020, filed with the SEC on May 6, 2020, August 6, 2020, and November 4, 2020, respectively, including the financial information set forth in Item 1 – Condensed Consolidated Financial Statements (unaudited) therein are incorporated herein by reference. Our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q are available electronically on the SEC’s website at http://www.sec.gov.

(b) Pro Forma Financial Information. Not applicable.

Item 11. Additional Information.

(a) Agreements, Regulatory Requirements and Legal Proceedings. The information set forth in the Offer to Exchange under “Risk Factors,” “This Offer – Section 10 (Interests of Directors, Officers and Affiliates; Transactions and Arrangements Concerning our Securities),” and “This Offer – Section 12 (Agreements; Legal Matters; Regulatory Approvals)” is incorporated herein by reference.

(b) Other Material Information. Not applicable.

Item 12. Exhibits.

The Exhibit Index attached to this Schedule TO is incorporated herein by reference.

Item 13. Information Required by Schedule 13E-3.

Not applicable.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Dated: November 9, 2020 | PROTHENA CORPORATION PLC | |||||

| By: | /s/ Michael J. Malecek | |||||

| Name: Michael J. Malecek | ||||||

| Title: Chief Legal Officer and Company Secretary | ||||||

EXHIBIT INDEX

Exhibit (a)(1)(i)

PROTHENA CORPORATION PLC

OFFER TO EXCHANGE CERTAIN OUTSTANDING OPTIONS

TO PURCHASE ORDINARY SHARES

FOR A NUMBER OF REPLACEMENT OPTIONS

THIS OFFER AND WITHDRAWAL RIGHTS EXPIRE

AT 9:00 P.M. PACIFIC TIME ON DECEMBER 8, 2020

UNLESS THIS OFFER IS EXTENDED

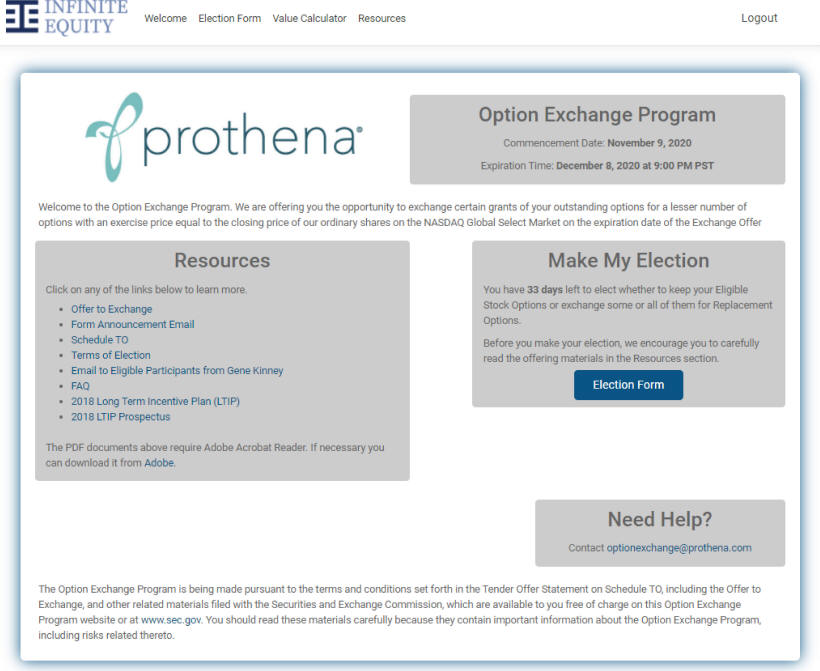

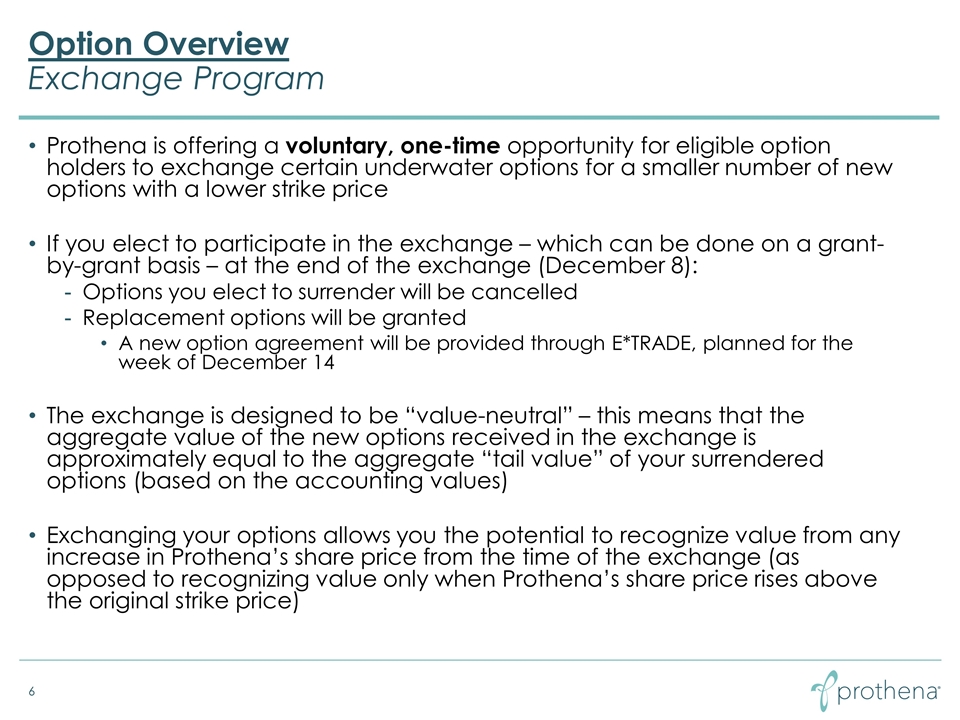

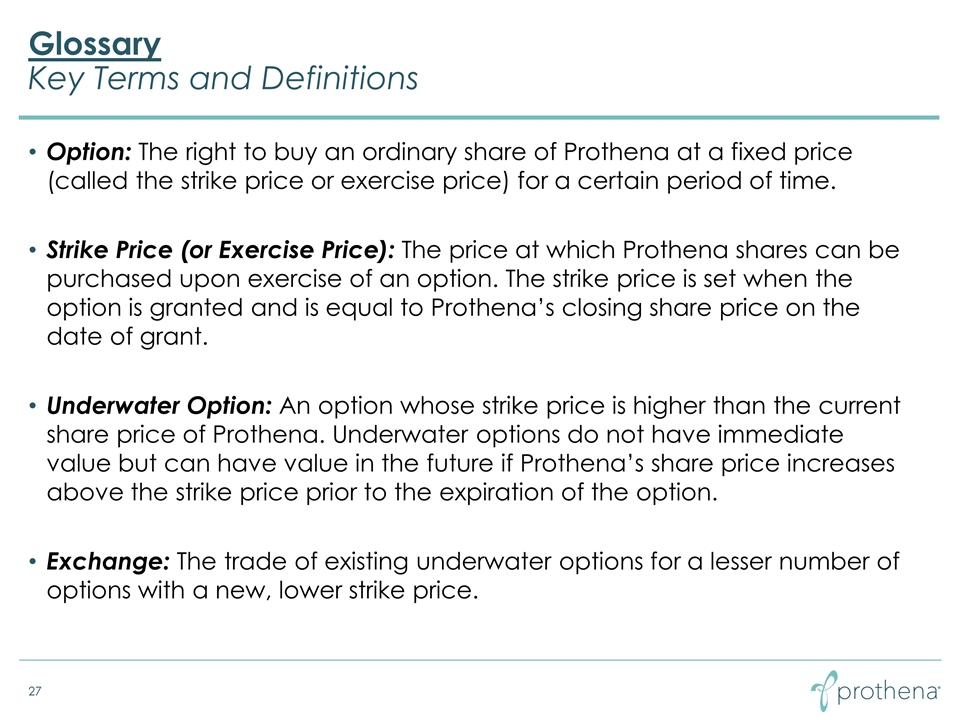

Prothena Corporation plc which is sometimes referred to herein as the “Company,” “Prothena,” “our,” “us,” or “we,” is offering eligible employees and non-employee directors the opportunity to exchange certain outstanding options to purchase our ordinary shares for new options covering a lesser number of our ordinary shares (“replacement options”), calculated in accordance with specified exchange ratios. We expect to grant the replacement options on the date on which we cancel the options accepted for exchange, which will be the completion date of this offer. We are making this offer (“Offer”) upon the terms, and subject to the conditions, set forth in this Offer to Exchange Certain Outstanding Options to Purchase Ordinary Shares for a Number of Replacement Options (this “Offer to Exchange”) and in the related Terms of Election (the “Terms of Election” and, together with this Offer to Exchange, as they may be amended from time to time, the “Option Exchange”).

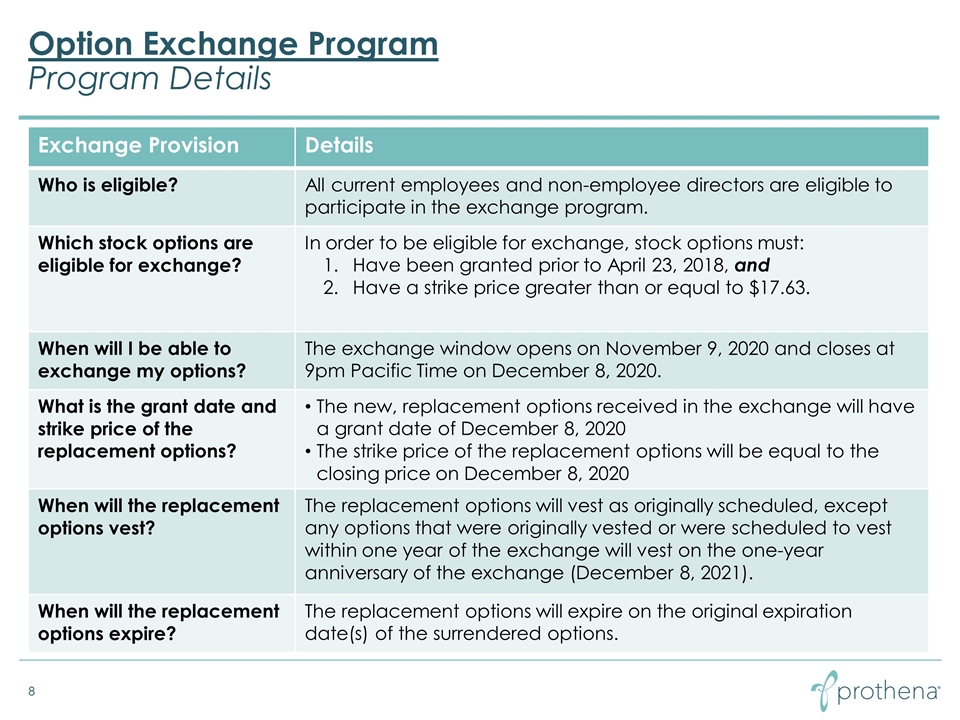

Eligibility. Only eligible options may be exchanged in the Option Exchange. For these purposes, “eligible options” are those options that:

| • | were granted prior to April 23, 2018; and |

| • | have an exercise price equal to or greater than $17.63. |

Options granted on or after April 23, 2018, or having an exercise price less than $17.63 are not eligible to be exchanged in the Option Exchange. Additionally, options that expire pursuant to their terms prior to the completion of the Option Exchange are forfeited and not eligible to be exchanged for replacement options.

You are eligible to participate in the Option Exchange only if you:

| • | are an employee or of the Company or any of our subsidiaries or a non-employee director of the Company on the date this Offer commences and remain an employee or non-employee director, as applicable, through the completion of the Option Exchange; and |

| • | hold at least one eligible option as of the commencement of the Offer. |

The outstanding options that you hold under our existing equity incentive plans give you the right to purchase our ordinary shares once those options vest by paying the applicable exercise price (and satisfying any applicable tax withholding obligations). Thus, when we use the term “option” in this Offer to Exchange, we refer to the actual options you hold to purchase our ordinary shares and not the ordinary shares underlying those options.

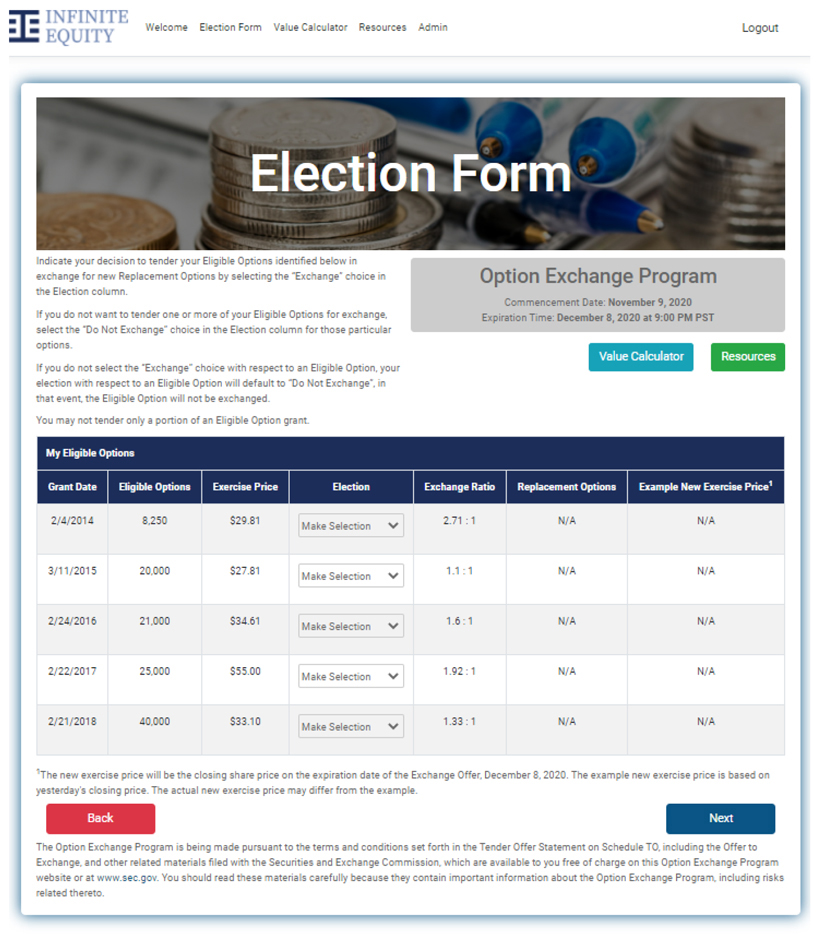

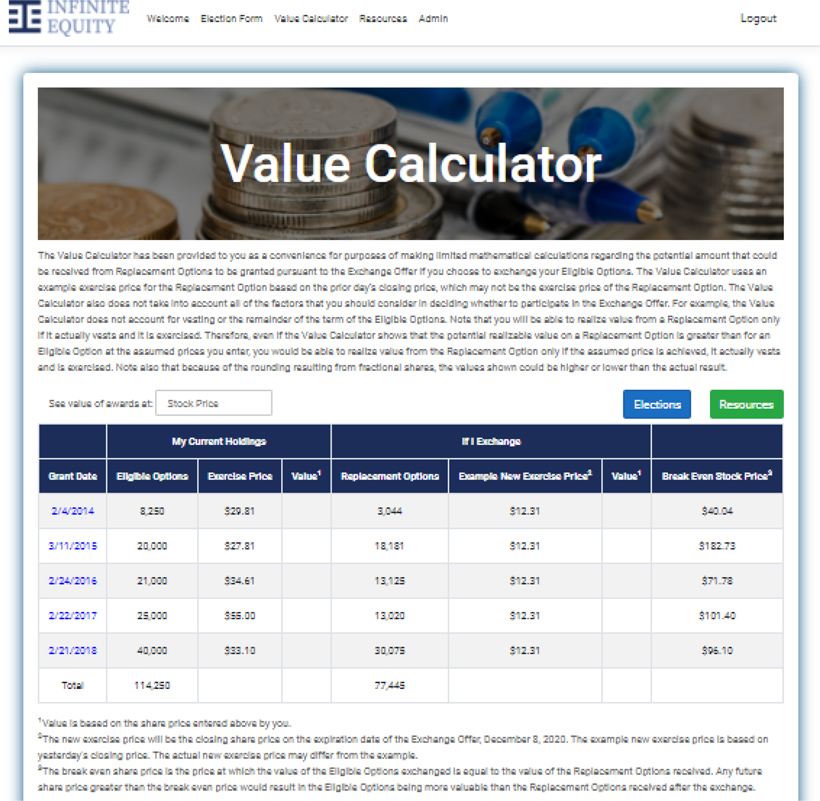

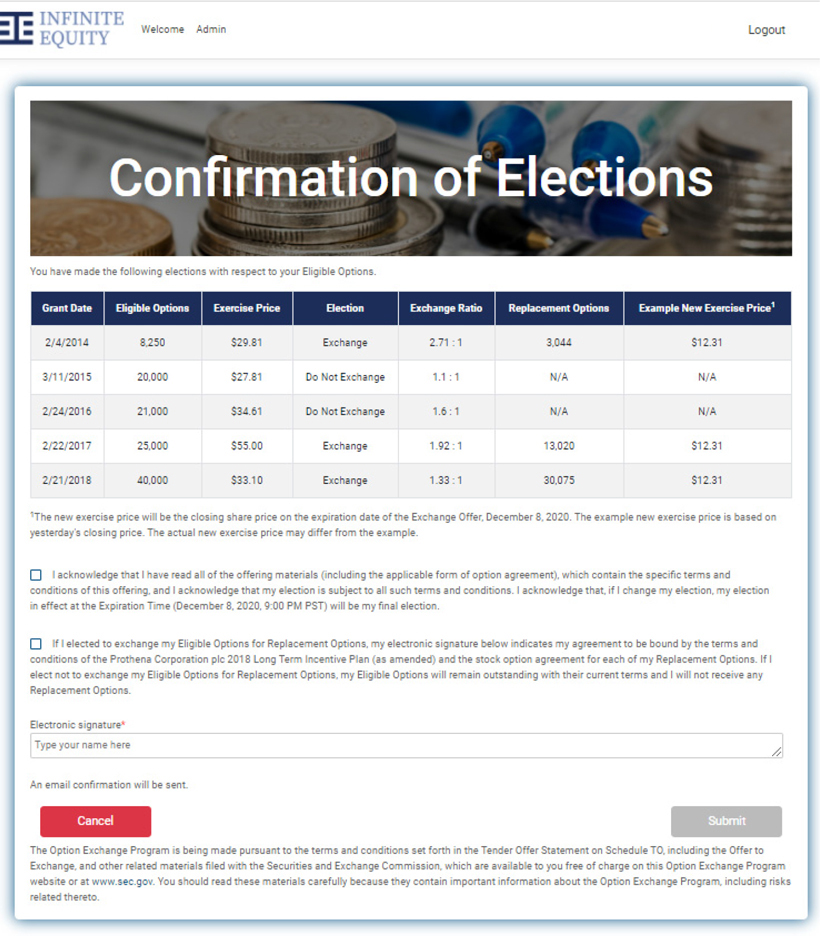

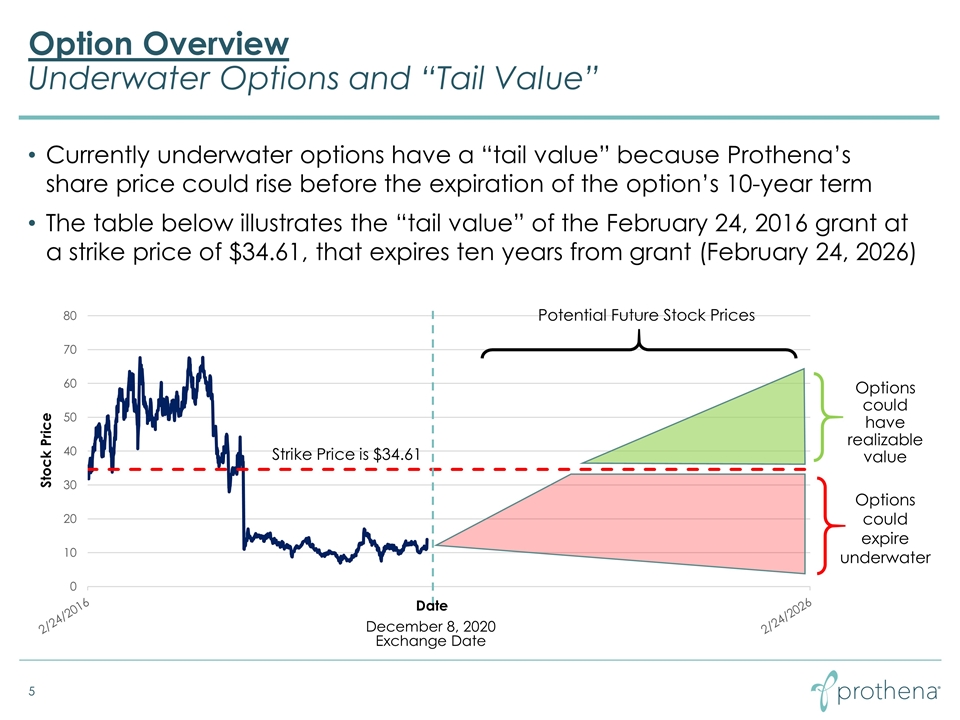

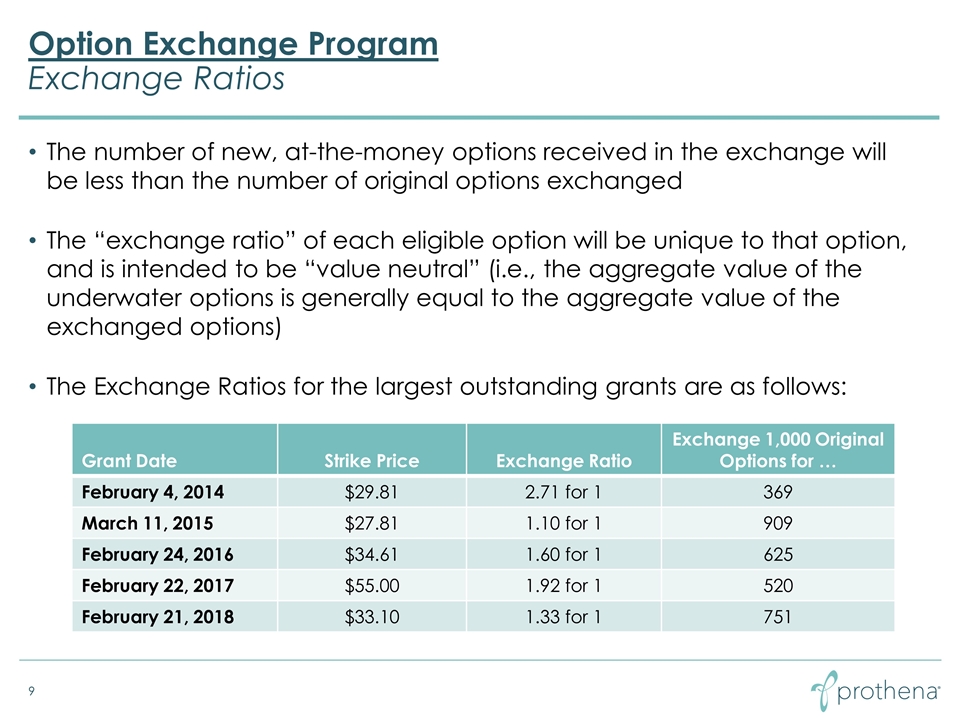

Exchange Ratios. The exchange ratios in the Option Exchange represent the number of ordinary shares underlying an eligible option that an employee must surrender in order to receive one share underlying a replacement option, and vary based on the exercise price and remaining term of the eligible option. The exchange ratios for the Option Exchange were determined using the Black-Scholes model and are based on, among other things, the per share closing trading price of our ordinary shares on November 6, 2020, of $12.31, the exercise prices of the eligible options, and the remaining terms of the eligible options, and the replacement options. The exchange ratios were calculated to result in an aggregate fair value, for accounting purposes, of the replacement options approximately equal to the aggregate current fair value of the eligible options they replace, but measured as of November 6, 2020, in order to balance the compensatory goals of the Option Exchange and the interests of our shareholders, including reducing our total number of ordinary shares underlying outstanding options, avoiding further dilution to our shareholders and minimizing the accounting expense of the grants of replacement options. The number of our ordinary shares subject to each replacement option, calculated according to the

1

exchange ratios, will be rounded down to the nearest whole share on a grant-by-grant basis. Replacement options to purchase fractional shares will not be granted and you will not receive any cash for fractional shares. The table below sets forth the exchange ratios to be used for each of the Company’s annual option grants from 2014 through 2018. The exchange ratio to be used for each other eligible option an eligible participant may hold is available to such participant on the option exchange website at www.myoptionexchange.com.

| Grant Date |

Exercise Price ($/share) | Ratio of Shares Subject to Eligible Options Surrendered to Shares Subject to Replacement Option to be Granted | ||

| February 4, 2014 |

29.81 | 2.71:1 | ||

| March 11, 2015 |

27.81 | 1.10:1 | ||

| February 24, 2016 |

34.61 | 1.60:1 | ||

| February 22, 2017 |

55.00 | 1.92:1 | ||

| February 21, 2018 |

33.10 | 1.33:1 |

If you are eligible to participate in the Option Exchange, you can exchange your eligible options on a grant-by-grant basis, i.e., based on the original grant date and exercise price of the eligible option (referred to herein as a “separate option grant”). No partial exchanges of separate option grants will be permitted; however, you can choose to exchange one or more of your eligible separate option grants without having to exchange all of your eligible separate option grants. If you have previously exercised a portion of an eligible separate option grant, only the portion of the eligible separate option grant which has not yet been exercised will be eligible to be exchanged.

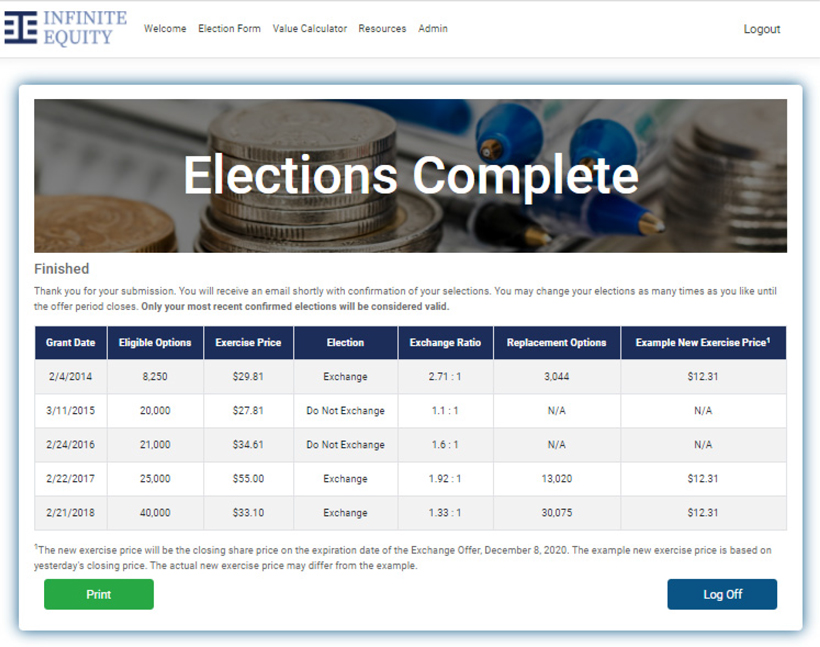

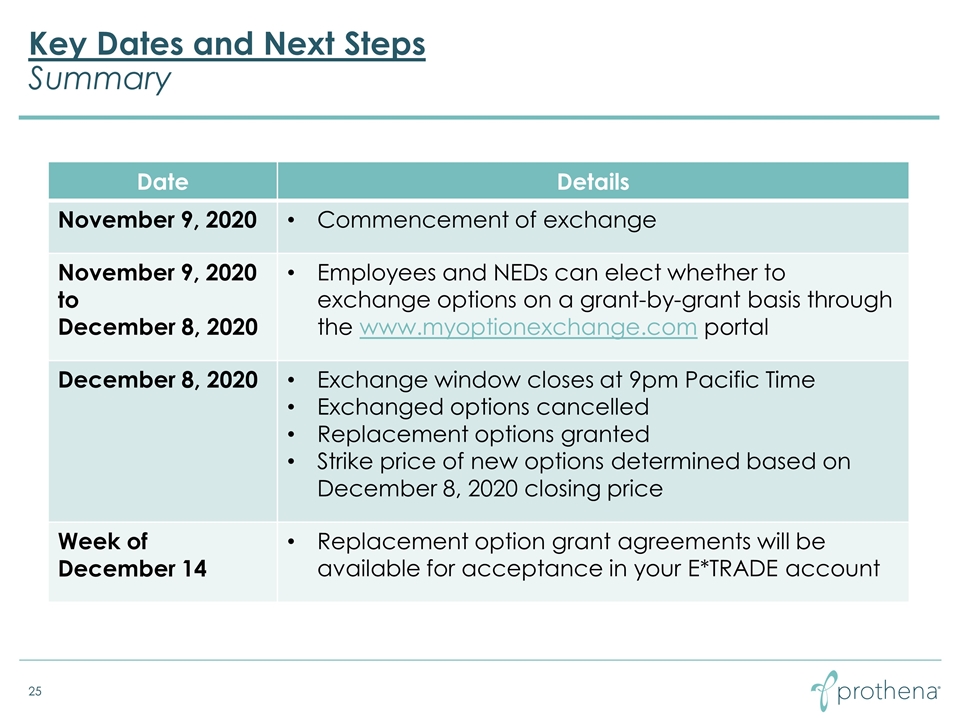

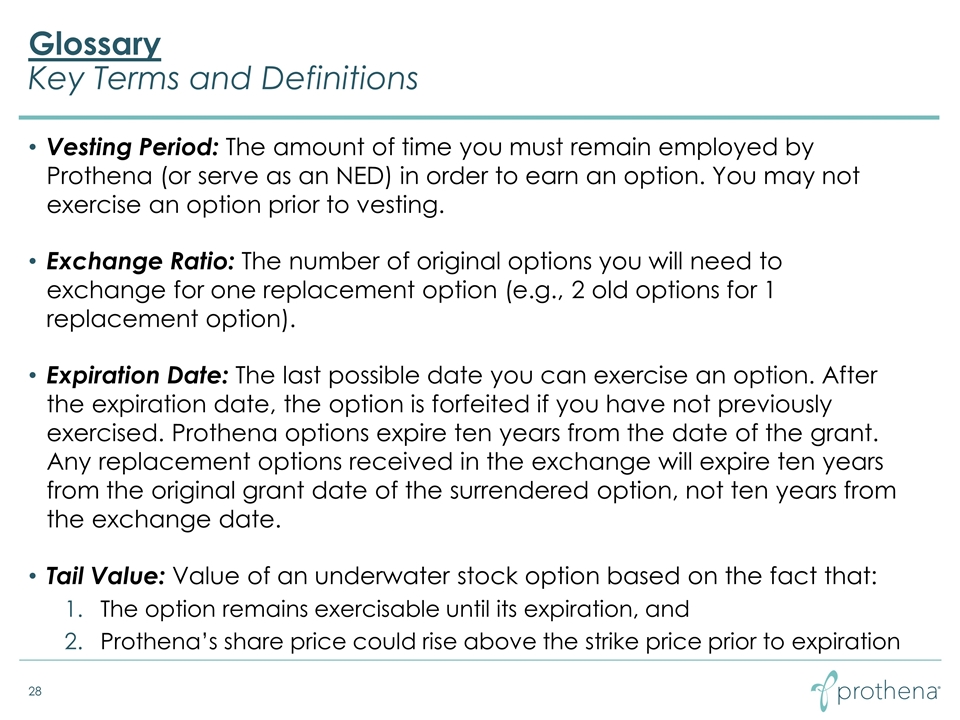

All eligible options that we accept pursuant to the Option Exchange will be cancelled on the expiration date of this Offer (the “Offer expiration date”), currently scheduled for 9:00 P.M. Pacific Time on December 8, 2020, and eligible options elected for exchange will no longer be exercisable after that time. We expect to grant the replacement options on the Offer expiration date, with the date of grant for the replacement options referred to in this Offer as the “replacement option grant date.” The replacement options will have a per share exercise price equal to the per share closing trading price of our ordinary shares on the Nasdaq Global Select Market (the “Nasdaq”), on the replacement option grant date.

Terms of Replacement Options. We will grant the replacement options under the Prothena Corporation plc 2018 Long Term Incentive Plan, as amended and/or restated from time to time (the “2018 LTIP”), on the replacement option grant date, which will be the date on which we cancel the eligible options accepted for exchange. In order to be granted a replacement option, you must remain continuously employed by the Company or one of our subsidiaries or in continuous service as a non-employee director of the Company through the replacement option grant date.

The replacement options:

| • | will have a per share exercise price equal to the per share closing trading price of our ordinary shares on Nasdaq on the replacement option grant date. If the per share closing trading price of our ordinary shares exceeds $17.63 on the replacement option grant date, the replacement options that you receive in exchange for your existing options may have a higher exercise price than some or all of your surrendered eligible options; |

| • | be subject to a new initial one-year vesting period from the replacement option grant date, regardless of whether and to the extent that any of the surrendered eligible options are vested. Upon the first anniversary of the replacement option grant date, the portion of the replacement option corresponding to the portion of the surrendered eligible option that would have been vested as of such date shall vest, and any remaining unvested portion of the replacement option will vest on the same monthly schedule that previously applied to the surrendered eligible option (i.e., in substantially equal installments on the remaining original vesting dates), subject to accelerated vesting upon certain terminations if provided for under the agreement governing the surrendered eligible option; |

2

| • | will have a term equal to the remaining term of the surrendered option; |

| • | will be treated under the U.S. Internal Revenue Code as a non-statutory stock option, regardless of the tax status of the eligible options surrendered for exchange; and |

| • | will have the terms and be subject to the conditions as provided for in the 2018 LTIP and option award agreement. |

Although our Board of Directors has approved this Offer, neither we nor our Board of Directors make any recommendation as to whether you should elect to exchange or refrain from electing to exchange all or any of your eligible options. You must make your own decision regarding whether to elect to exchange all or any of your eligible options.

This Offer is not conditioned upon a minimum aggregate number of eligible options being surrendered for exchange. This Offer is subject to certain conditions which we describe in Section 6 of this Offer to Exchange and the terms described in this Offer.

If the market price of our ordinary shares exceeds $17.63 on the replacement option grant date, the replacement options that you receive in exchange for your existing options may have a higher exercise price than some or all of your surrendered eligible options.

Our ordinary shares are listed on Nasdaq under the symbol “PRTA.” On November 6, 2020, the closing price of our ordinary shares on The Nasdaq Global Select Market was $12.31 per share. We recommend that you obtain current market quotations for our ordinary shares before deciding whether to elect to exchange your eligible options.

As of November 6, 2020, eligible options outstanding under our existing equity incentive plans were exercisable for approximately 2,458,410 ordinary shares, or approximately 6.2% of our total ordinary shares outstanding as of November 6, 2020, which was 39,921,413 shares.

IMPORTANT

If you wish to participate in this Offer, you must log on to the option exchange website at www.myoptionexchange.com and elect to participate on or before 9:00 P.M. Pacific Time, on December 8, 2020 (or such later time and date as may apply if the Offer to Exchange is extended). Election submissions that are received after this deadline will not be accepted. In order to participate in this Offer and submit your election, you will be required to acknowledge your agreement to all of the terms and conditions of the Offer to Exchange as set forth in the Offer documents.

Elections submitted by any other means, including email, facsimile, hand delivery, interoffice, United States mail (or other post) and Federal Express (or similar delivery service), are not permitted and will not be accepted by us.

You should direct questions about this Offer and requests for additional copies of this Offer to Exchange and the other Offer documents by emailing [email protected].

We are not making this Offer to, nor will we accept any election to exchange options from or on behalf of, option holders in any jurisdiction in which this Offer or the acceptance of any election to exchange options would not be in compliance with the laws of that jurisdiction. However, we may, at our discretion, take any actions necessary or desirable for us to make this Offer to option holders in any such jurisdiction.

THIS OPTION EXCHANGE OFFER DOCUMENT HAS NOT BEEN APPROVED OR DISAPPROVED BY THE U.S. SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) OR ANY STATE OR FOREIGN SECURITIES COMMISSION NOR HAS THE SEC OR ANY STATE OR FOREIGN SECURITIES COMMISSION PASSED UPON THE FAIRNESS OR MERITS OF THIS EXCHANGE OFFER OR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

3

PROTHENA HAS NOT AUTHORIZED ANY PERSON TO MAKE ANY RECOMMENDATION ON OUR BEHALF AS TO WHETHER YOU SHOULD ELECT TO EXCHANGE OR REFRAIN FROM ELECTING TO EXCHANGE YOUR OPTIONS PURSUANT TO THIS OFFER. YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS DOCUMENT OR OTHER INFORMATION TO WHICH WE HAVE REFERRED YOU. PROTHENA HAS NOT AUTHORIZED ANYONE TO GIVE YOU ANY INFORMATION OR TO MAKE ANY REPRESENTATION IN CONNECTION WITH THIS OFFER OTHER THAN THE INFORMATION AND REPRESENTATIONS CONTAINED IN THIS DOCUMENT OR IN THE RELATED TERMS OF ELECTION. IF ANYONE MAKES ANY RECOMMENDATION OR REPRESENTATION TO YOU OR GIVES YOU ANY INFORMATION, YOU MUST NOT RELY UPON THAT RECOMMENDATION, REPRESENTATION OR INFORMATION AS HAVING BEEN AUTHORIZED BY PROTHENA.

NOTHING IN THIS DOCUMENT SHALL BE CONSTRUED TO GIVE ANY PERSON THE RIGHT TO REMAIN IN THE EMPLOYMENT OR SERVICE OF PROTHENA OR TO AFFECT OUR RIGHT TO TERMINATE THE EMPLOYMENT OR SERVICE OF ANY PERSON AT ANY TIME WITH OR WITHOUT CAUSE TO THE EXTENT PERMITTED UNDER LAW. NOTHING IN THIS DOCUMENT SHOULD BE CONSIDERED A CONTRACT OR GUARANTEE OF WAGES OR COMPENSATION.

PROTHENA RESERVES THE RIGHT TO AMEND OR TERMINATE THE 2018 LTIP AT ANY TIME, AND THE GRANT OF AN OPTION UNDER THE 2018 LTIP OR THIS OFFER DOES NOT IN ANY WAY OBLIGATE PROTHENA TO GRANT ADDITIONAL OPTIONS OR OFFER FURTHER OPPORTUNITIES TO PARTICIPATE IN ANY OPTION EXCHANGE IN ANY FUTURE YEAR. THE GRANT OF AN OPTION AND ANY FUTURE OPTIONS GRANTED UNDER THE 2018 LTIP OR IN RELATION TO THIS OFFER IS WHOLLY DISCRETIONARY IN NATURE AND IS NOT TO BE CONSIDERED PART OF ANY NORMAL OR EXPECTED COMPENSATION THAT IS OR WOULD BE SUBJECT TO SEVERANCE, RESIGNATION, REDUNDANCY, TERMINATION OR SIMILAR PAY, OTHER THAN TO THE EXTENT REQUIRED BY LOCAL LAW.

4

OPTION EXCHANGE

TABLE OF CONTENTS

| Summary Term Sheet and Questions and Answers | 6 | |||||

| Risk Factors | 16 | |||||

| This Offer | 18 | |||||

| 1. | Eligibility; Number of Options; Offer Expiration Date | 18 | ||||

| 2. | Purpose of this Offer | 19 | ||||

| 3. | Procedures for Electing to Exchange Options | 21 | ||||

| 4. | Withdrawal Rights | 22 | ||||

| 5. | Acceptance of Options for Exchange; Grant of Replacement Options | 23 | ||||

| 6. | Conditions of this Offer | 23 | ||||

| 7. | Price Range of Ordinary Shares Underlying the Options | 25 | ||||

| 8. | Source and Amount of Consideration; Terms of Replacement Options | 26 | ||||

| 9. | Information Concerning Prothena | 31 | ||||

| 10. | Interests of Directors, Officers and Affiliates; Transactions and Arrangements Concerning our Securities | 32 | ||||

| 11. | Status of Options Acquired by Us in this Offer; Accounting Consequences of this Offer | 33 | ||||

| 12. | Agreements; Legal Matters; Regulatory Approvals | 33 | ||||

| 13. | Material U.S. Federal Income Tax Consequences | 33 | ||||

| 14. | Extension of Offer; Termination; Amendment | 34 | ||||

| 15. | Fees and Expenses | 35 | ||||

| 16. | Additional Information | 35 | ||||

| 17. | Miscellaneous | 36 | ||||

| Schedule A | A Guide to Tax & Legal Issues for Non-U.S. Employees | 37 | ||||

| Schedule B | Information Concerning the Directors and Executive Officers of Prothena Corporation plc | 39 |

5

SUMMARY TERM SHEET AND QUESTIONS AND ANSWERS

The following are answers to some of the questions that you may have about this Offer. We urge you to read carefully the following questions and answers, as well as the remainder of this Offer to Exchange. Where applicable, we have included section references to the remainder of this Offer to Exchange where you can find a more complete description of the topics in this question and answer summary. We suggest that you consult with your personal financial and tax advisors before deciding whether to participate in this Offer. Please review this summary term sheet and questions and answers, and the remainder of this Offer to Exchange and the Terms of Election to ensure that you are making an informed decision regarding your participation in this Offer.

For your ease of use, the questions have been separated into three sections:

| 1. | Exchange Design. |

| 2. | Administrative/Timing. |

| 3. | Other Important Questions. |

Exchange Design

| 1. | What is the Option Exchange? |

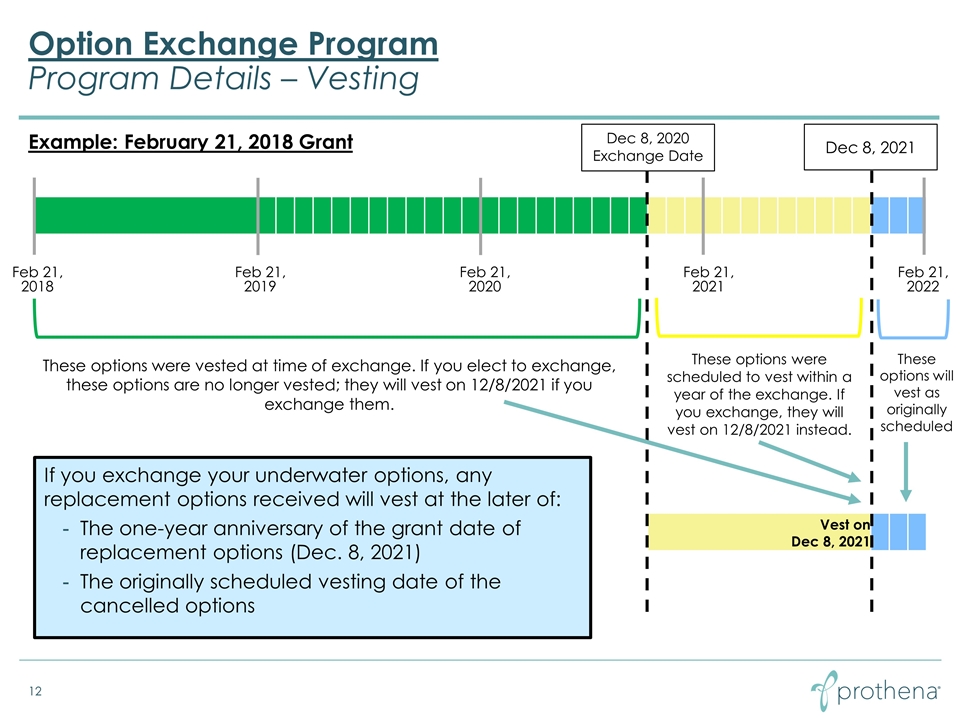

The Option Exchange is being offered by Prothena to allow eligible employees of Prothena or its subsidiaries and non-employee directors of Prothena to exchange their outstanding options that were granted prior to April 23, 2018, and have exercise prices equal to or greater $17.63 for new options covering a lesser amount of shares, which we refer to as replacement options. The number of shares subject to replacement options that will be granted in exchange for existing eligible options will be determined by the exchange ratios described below under question 3. The replacement options will be granted on the date on which we cancel the eligible options accepted for exchange, which we expect will be the expiration date of this Offer. The replacement options will have an exercise price equal to the closing price of our ordinary shares on the date the replacement options are granted. The replacement options will be subject to the terms and conditions as provided for in the 2018 LTIP. Each replacement option will have a term equal to the remaining term of the surrendered option and will be completely unvested as of such date, regardless of whether the surrendered option was wholly or partially vested. Replacement options will be subject to a new initial one-year vesting period from the replacement option grant date, regardless of whether and to the extent that any of the surrendered eligible options are vested. Upon the first anniversary of the replacement option grant date, the portion of the replacement option corresponding to the portion of the surrendered eligible option that would have been vested as of such date shall vest, and any remaining unvested portion of the replacement option will vest on the same monthly schedule that previously applied to the surrendered eligible option (i.e., in substantially equal installments on the remaining original vesting dates), subject to accelerated vesting upon certain terminations if provided for under the agreement governing the surrendered eligible option.

| 2. | Why are we making this Offer? |

An objective of our equity incentive programs has been, and continues to be, to align the interests of equity incentive plan participants with those of our shareholders, and we believe that the Option Exchange is an important component in our efforts to achieve that goal. We are implementing the Option Exchange using exchange ratios designed to result in potential grants of replacement stock options with a fair value that will be approximately equal to the fair value of the eligible options that are surrendered in the Option Exchange.

A significant majority of our employees’ and non-employee directors’ options have exercise prices that exceed, in some cases significantly, the trading prices of our ordinary shares over the past two plus years. We believe these underwater options are no longer effective as incentives to motivate and retain our employees. In the face of a competitive market for exceptional employees, the need for adequate and appropriate incentives and retention tools remains strong. The Offer will also allow our non-employee directors to be fairly compensated for their service on our Board of Directors.

6

As of November 6, 2020, we had an aggregate of 10,324,384 shares subject to outstanding options under our equity plans or available for issuance under the 2018 LTIP, which we collectively refer to as our “overhang,” constituting approximately 25.9% of our outstanding ordinary shares as of November 6, 2020, which was 39,921,413 shares. As of November 6, 2020, eligible options outstanding under our existing equity incentive plans were exercisable for approximately 2,458,410 ordinary shares, or approximately 6.2% of our total ordinary shares outstanding as of November 6, 2020.

Eligible options remain outstanding and contribute to overhang until such time as they expire or are otherwise cancelled. Although eligible options are not likely to be exercised as long as our share price is lower than the applicable exercise price, they will remain an expense on our financial statements with the potential to dilute shareholders’ interests for up to the full term of the options, while delivering relatively little retentive or incentive value, unless they are surrendered or cancelled. If all of these eligible stock options are exchanged and replaced by replacement options, the number of outstanding options under our equity incentive plans would be reduced by approximately 888,468 shares, or approximately 2.2% of our total ordinary shares outstanding as of November 6, 2020. We believe that the replacement options will be more likely to be exercised, which would reduce our overhang. Further, surrendered eligible options will be cancelled and returned to the pool of shares reserved for future grant under the 2018 LTIP.

The Option Exchange is voluntary and will allow eligible employees and non-employee directors to choose whether to keep their existing options at existing exercise prices and vesting schedules or to exchange those options for replacement options with new exercise prices and vesting schedules. We intend the Option Exchange to enable eligible employees and non-employee directors to recognize value from their options, but this cannot be guaranteed considering the unpredictability of the stock market. (See Section 2 of the Offer to Exchange entitled “Purpose of this Offer” below for additional information.)

Subject to the limitations set forth in Sections 6 and 14 of the Offer to Exchange entitled “Conditions of this Offer” and “Extension of Offer; Termination; Amendment,” respectively, we reserve the right before the Offer expiration date, to terminate or amend this Offer and to postpone our acceptance and cancellation of any options elected for exchange, if at any time on or after the date of commencement of the Offer and prior to the Offer expiration date certain events have occurred, including any increase or decrease of greater than 33% of the market price of our ordinary shares that occurs during the tender offer as measured from $12.31, which was the closing price of our ordinary shares on the Nasdaq Global Select Market on November 6, 2020.

| 3. | How does the Option Exchange work? |

We are offering eligible employees and non-employee directors the opportunity to exchange eligible options that were granted prior to April 23, 2018, and have an exercise price equal to or greater than $17.63 for a predetermined number of replacement options, rounded down to the nearest whole share, based on the exchange ratios described in the table below. The outstanding options that you hold give you the right to purchase our ordinary shares once you exercise those options by paying the applicable exercise price of those options (and satisfying any applicable tax withholding obligations). Thus, when we use the term “options” in this Option Exchange, we refer to the actual options you hold to purchase our ordinary shares and not the ordinary shares underlying those options.

Replacement options will be granted at a per share exercise price equal to the per share closing trading price of our ordinary shares on the Nasdaq on the replacement option grant date, which we expect to be the Offer expiration date. Participating in the Option Exchange requires an eligible employee to make a voluntary election to tender eligible options on or before 9:00 P.M. Pacific Time on December 8, 2020, unless this Offer is extended, after which time such election will be irrevocable.

The exchange ratios in the Option Exchange represent the number of ordinary shares underlying an eligible option that an employee must surrender in order to receive one ordinary share underlying a replacement option, and vary based on the exercise price of the eligible options. The exchange ratios for the Option Exchange were determined using the Black-Scholes model and are based on, among other things, the per share closing trading price of our ordinary shares on November 6, 2020 of $12.31, the exercise prices of the options eligible for exchange and the remaining terms of the eligible options. The exchange ratios were calculated to result in an aggregate fair value, for accounting purposes, of the replacement options approximately equal to the aggregate current fair value of the eligible options they replace, measured as of November 6, 2020, in order to balance the compensatory goals of the Option Exchange and the interests of our shareholders, including reducing our total number of ordinary shares underlying outstanding options, avoiding further dilution to our shareholders and minimizing the accounting expense of the grants of replacement options. The number of ordinary shares underlying each replacement option will be calculated according to the exchange ratios and will be rounded down to the nearest whole share on a grant-by-grant basis (based on the grant date of the eligible option). Replacement options to purchase fractional shares will not be granted and cash will not be paid for any fractional shares. The table below sets forth the exchange ratios to be used for each of the Company’s annual option grants from 2014 through 2018. The exchange ratio to be used for each other eligible option an eligible participant may hold is available to such participant on the option exchange website at www.myoptionexchange.com.

7

| Grant Date |

Exercise Price ($/share) | Ratio of Shares Subject to Eligible Options Surrendered to Shares Subject to Replacement Option to be Granted | ||

| February 4, 2014 |

29.81 | 2.71:1 | ||

| March 11, 2015 |

27.81 | 1.10:1 | ||

| February 24, 2016 |

34.61 | 1.60:1 | ||

| February 22, 2017 |

55.00 | 1.92:1 | ||

| February 21, 2018 |

33.10 | 1.33:1 |

The per share exercise price of the replacement options will be the per share closing trading price of our ordinary shares on the Nasdaq on the replacement option grant date.

Unless prevented by law or applicable regulations, eligible options accepted for exchange will be cancelled, and replacement options will be granted under our 2018 LTIP.

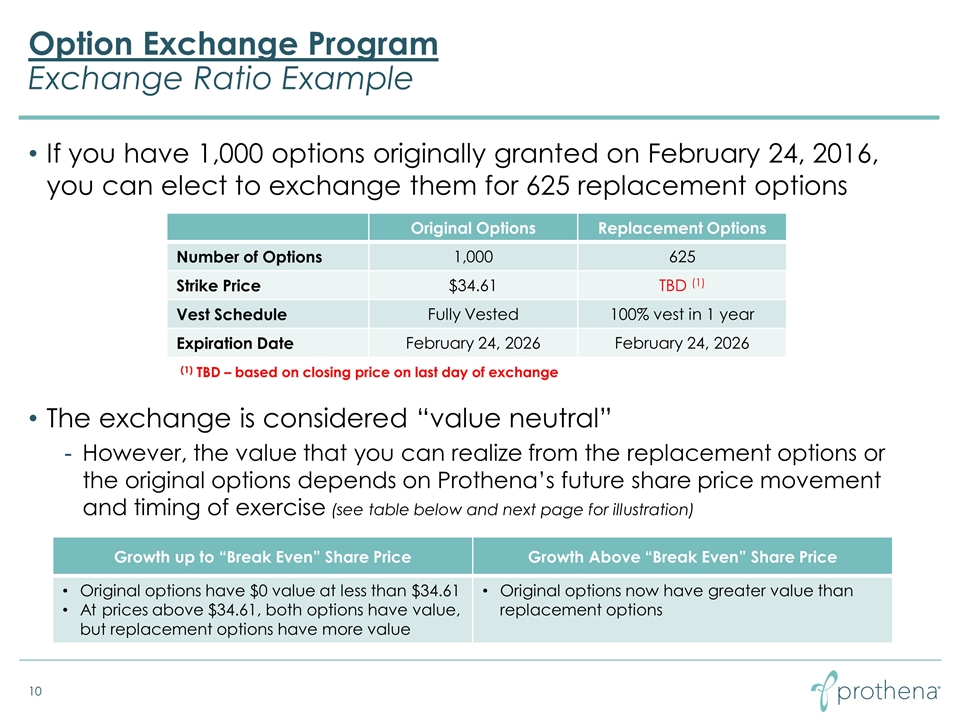

Examples

To illustrate how the exchange ratios work, assume that:

| (a) | You are an active employee. |

| (b) | You have four existing option grants each covering 1,000 ordinary shares with corresponding per share exercise prices of: $6.41 (hypothetical grant date of January 29, 2013), $27.81 (hypothetical grant date of March 11, 2015), $33.10 (hypothetical grant date of February 21, 2018) and $13.53 (hypothetical grant date of February 27, 2019). Each option vests as to 25% of the shares subject to the option on the first anniversary of the vesting commencement date, and as to the remainder in equal monthly installments thereafter, subject to continued employment. |

| (c) | The replacement option grant date is December 8, 2020. |

If you elect to participate in the Offer:

| (a) | You will only be able to elect to exchange your two existing option grants with per share exercise prices of $27.81 and $33.10 for replacement options. Your election to exchange can cover zero shares or all 1,000 shares of each separate grant (i.e., with the same exercise price and grant date). You cannot elect to exchange less than the full amount of a separate grant. For example, you cannot elect to exchange 500 shares of the option grant with the exercise price of $27.81. Instead, you can elect to exchange either all options with that exercise price, or none. If you have previously exercised a portion of an eligible separate option grant, only the portion of the eligible option grant which has not yet been exercised will be eligible to be exchanged. |

| (b) | You will not be able to exchange your existing option grant with a per-share exercise price of $6.41 for a replacement option because the exercise price is below $17.63. You will not be able to exchange your existing option grant with a per-share exercise price of $13.53 for a replacement option because the exercise price is below $17.63 and because it was granted on or after April 23, 2018. |

Under these facts, the table below shows the number of ordinary shares subject to each replacement option you would receive were you to participate in the Offer and elect to exchange the existing eligible options with per-share exercise prices of $27.81 and $33.10.

| Grant Date of Existing |

Exercise Price of Existing Eligible Option |

Cancelled Shares Subject to Existing Eligible Option |

Exchange Ratio |

Shares Subject to Replacement Option | ||||

| March 11, 2015 |

$27.81 |

1,000 | 1.10 for 1 | 909 | ||||

| February 21, 2018 |

$33.10 |

1,000 | 1.33 for 1 | 751 |

8

Replacement options will be subject to a new initial one-year vesting period from December 8, 2020 (the replacement option grant date in this example), regardless of whether any of the surrendered eligible options are vested as of December 8, 2020. On December 8, 2021 (the first anniversary of the replacement option grant date in this example), the portion of the replacement option corresponding to the portion of the surrendered eligible option that would have been vested as of December 8, 2021, shall vest, and any remaining unvested portion of the replacement option will vest on the same monthly schedule that previously applied to the surrendered eligible option (i.e., in substantially equal installments on the remaining original vesting dates), subject to accelerated vesting upon certain terminations if provided for under the agreement governing the surrendered eligible option. This means that each replacement option will be completely unvested on December 8, 2020 (the replacement option grant date in this example), regardless of whether the surrendered option was wholly or partially vested on such date. No portion of the new grant will become vested until December 8, 2021 (the first anniversary of the replacement option grant in this example).

In accordance with the above, the replacement option granted in respect of the surrendered option granted on March 11, 2015, will vest in full on the first anniversary of the replacement grant date December 8, 2021, subject to your continued employment through such date. The replacement option granted in respect of the surrendered option granted on February 21, 2018, will vest as to 703 shares on the first anniversary of the replacement grant date December 8, 2021, and will vest in substantially equal monthly installments thereafter such that the option will be fully vested on February 21, 2022, subject to your continued employment on each applicable vesting date.

| 4. | Which options are eligible for this Offer? |

Options eligible for exchange are those held by employees and non-employee directors that were granted prior to April 23, 2018, having an exercise price equal to or greater than $17.63.

Additionally, options that expire pursuant to their terms prior to the completion of the Option Exchange will be forfeited as of the Offer expiration date and will not eligible to be exchanged for replacement options.

| 5. | Who is eligible to participate in this Offer? |

You are eligible to participate in this Offer only if (i) you are an employee of Prothena or any of our subsidiaries as of the Offer commencement date and remain an employee through the Offer expiration date or you are a non-employee director of Prothena as of the Offer commencement date and remain a non-employee director through the Offer expiration date and (ii) you hold at least one eligible option on the Offer commencement date.

| 6. | What if I leave Prothena before the Offer expiration date? |

If you are no longer employed with Prothena or any of our subsidiaries, whether voluntarily, involuntarily, or for any other reason, or you cease serving as a non-employee director of Prothena before the Offer expiration date, you will not be able to participate in this Offer.

ACCORDINGLY, IF YOU ARE NOT AN ELIGIBLE EMPLOYEE OF PROTHENA OR ANY OF OUR SUBSIDIARIES OR AN ELIGIBLE NON-EMPLOYEE DIRECTOR OF PROTHENA AS DESCRIBED ABOVE ON THE OFFER EXPIRATION DATE, EVEN IF YOU HAD ELECTED TO PARTICIPATE IN THIS OFFER AND HAD TENDERED SOME OR ALL OF YOUR OPTIONS FOR EXCHANGE, YOUR TENDER WILL AUTOMATICALLY BE DEEMED WITHDRAWN AND YOU WILL NOT PARTICIPATE IN THIS OFFER, AND YOU WILL RETAIN YOUR OUTSTANDING OPTION(S) IN ACCORDANCE WITH THEIR CURRENT TERMS AND CONDITIONS. IN THE CASE OF A TERMINATION OF YOUR SERVICE, YOU MAY BE ENTITLED TO EXERCISE YOUR OUTSTANDING OPTION(S) DURING A LIMITED PERIOD OF TIME FOLLOWING THE TERMINATION OF SERVICE IN ACCORDANCE WITH THEIR TERMS TO THE EXTENT THAT THEY ARE VESTED AS OF SUCH TERMINATION OF SERVICE. (See Section 1 of the Offer to Exchange entitled “Eligibility; Number of Options; Offer Expiration Date” and Section 5 of the Offer to Exchange entitled “Acceptance of Options for Exchange; Grant of Replacement Options” below for additional information.)

9

| 7. | Why aren’t the exchange ratios set at one-for-one? |

The exchange ratios were calculated to result in an aggregate fair value, for accounting purposes, of the replacement options approximately equal to the aggregate current fair value of the eligible options they replace, measured as of November 6, 2020, in order to balance the compensatory goals of the option exchange and the interests of our shareholders, including reducing our total number of outstanding options, avoiding further dilution to our shareholders, and minimizing the accounting expense of the grants of replacement options. If we were to exchange the options on a one-for-one basis, but reduce the exercise price to the lower current fair market value of our ordinary shares, the fair value of the replacement options and the associated accounting expense would be greater than the current fair value of the eligible options. Accordingly, the higher-value replacement options will cover fewer shares than the lower-value eligible options they replace to achieve the same relative value.

| 8. | If I participate, what will happen to my exchanged options? |

Eligible options that you elect to exchange will be cancelled on the expiration date of this Offer, which is currently scheduled for 9:00 P.M. Pacific Time on December 8, 2020, unless this Offer is extended.

| 9. | If I elect to exchange some of my eligible options, do I have to elect to exchange all of my eligible options? |

No. You may elect to exchange your eligible options on a grant-by-grant basis (determined based on options having the same grant date and exercise price). If you elect to exchange any portion of a separate eligible option grant in the Offer, you must elect to exchange the entire separate eligible option grant. No partial exchanges of separate option grants will be permitted.

| 10. | What happens to eligible options that I choose not to exchange or that you do not accept for exchange? |

Eligible options that you choose not to exchange or that we do not accept for exchange will remain outstanding and will retain their existing terms, exercise prices and vesting schedules.

| 11. | Will I receive non-qualified stock options or incentive stock options if I participate in this Offer? |

Replacement options will be non-qualified stock options for U.S. federal income tax purposes, just as the surrendered eligible options were non-qualified stock options.

| 12. | What are the conditions to this Offer? |

This Offer is subject to the conditions described in Section 6. This Offer is not conditioned upon a minimum aggregate number of options being elected for exchange. (See Section 6 of the Offer to Exchange entitled “Conditions of this Offer” below for additional information.)

Administrative/Timing

| 13. | How do I participate in this Offer? |

If you choose to participate in the Option Exchange, you must take the following action on or before 9:00 P.M., Pacific Time, on the Offer expiration date:

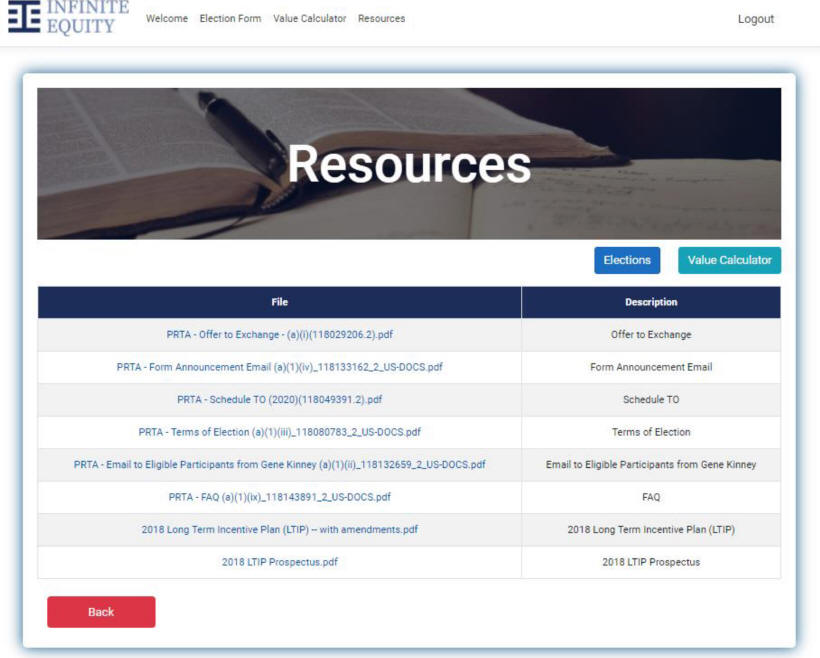

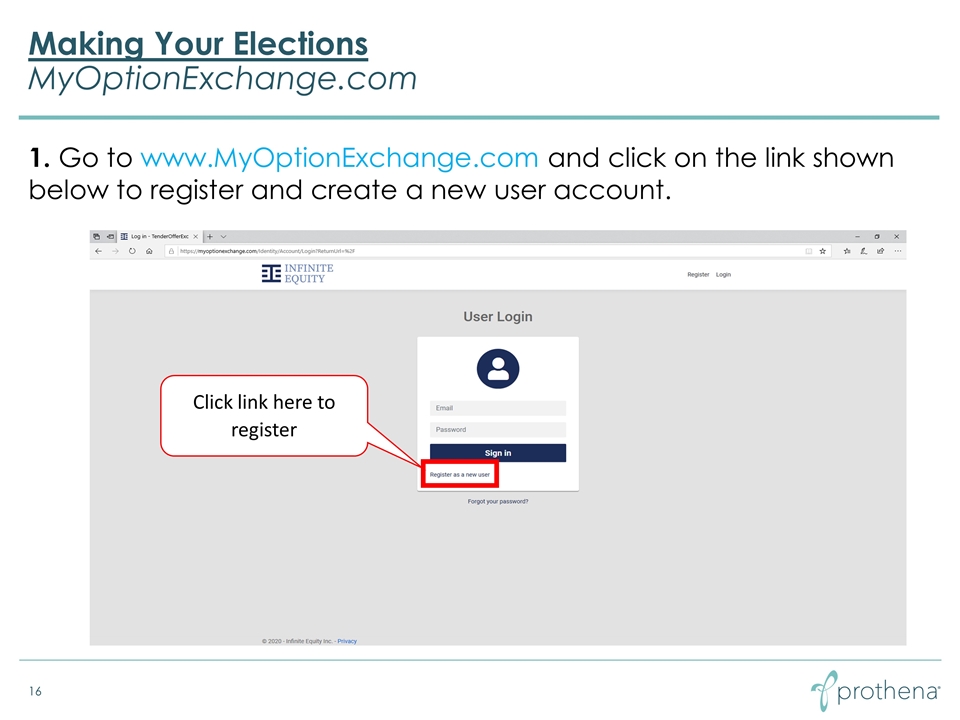

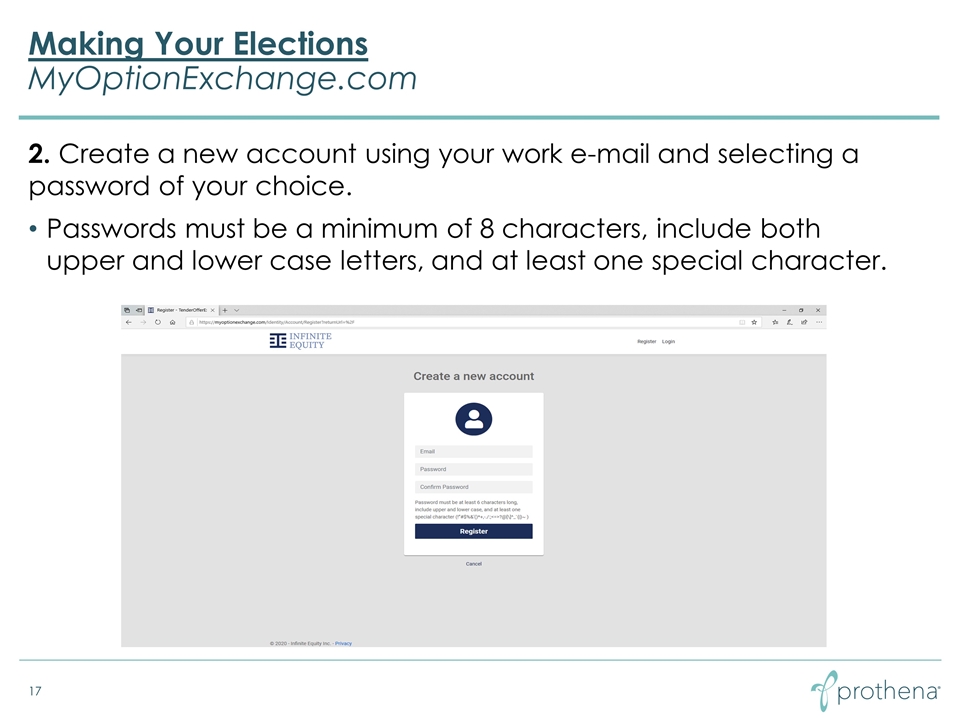

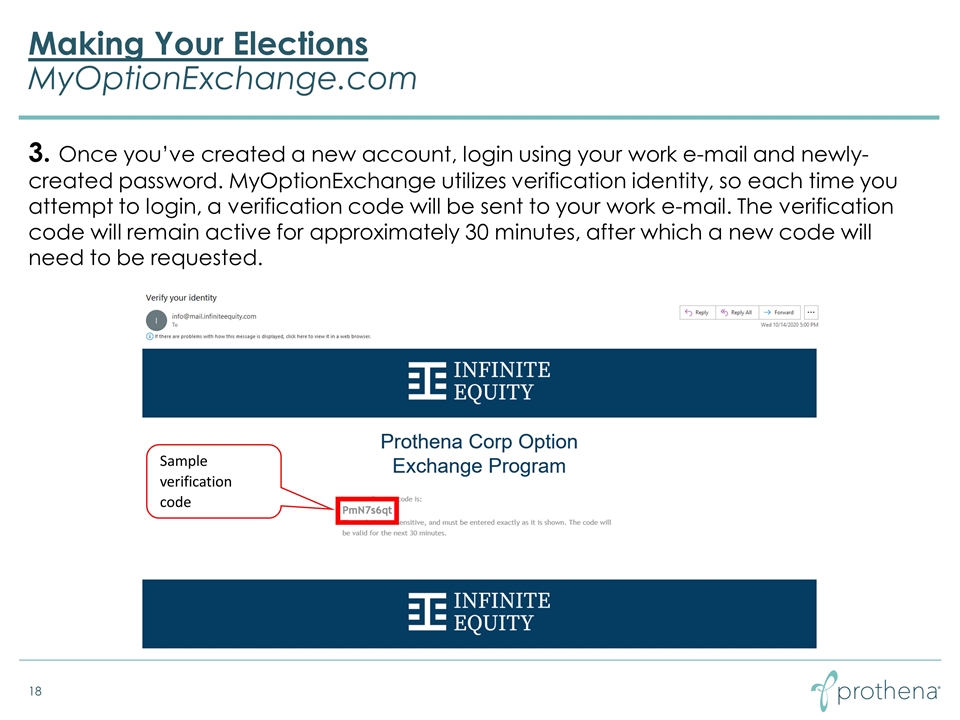

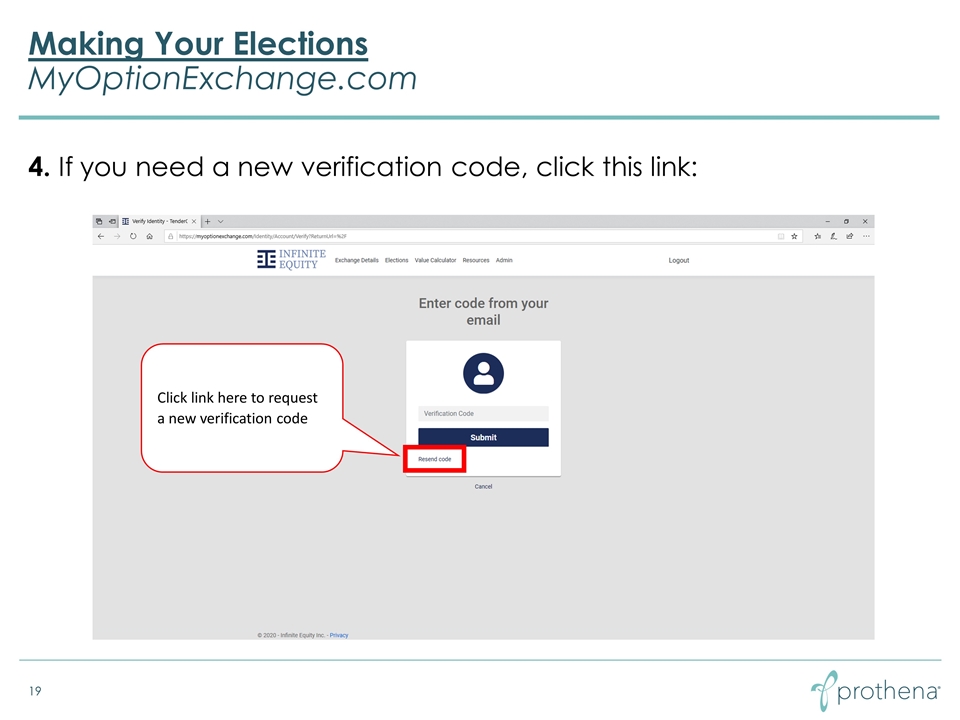

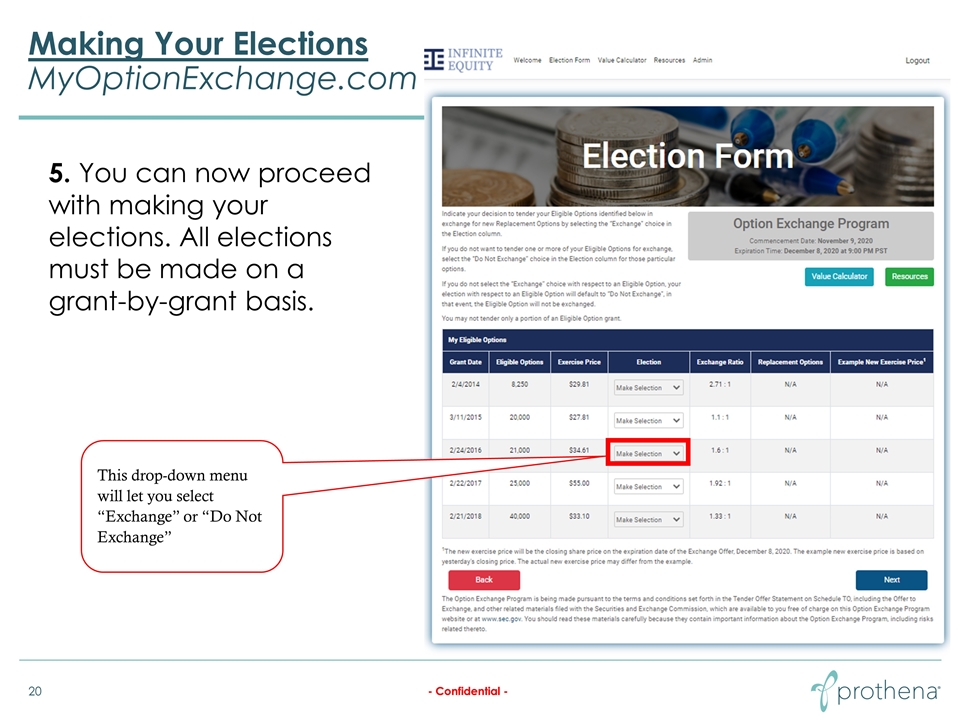

| 1. | Use your user log-in ID and password (which you will set up using instructions that will be emailed to you) to access the option exchange website at www.myoptionexchange.com; and |

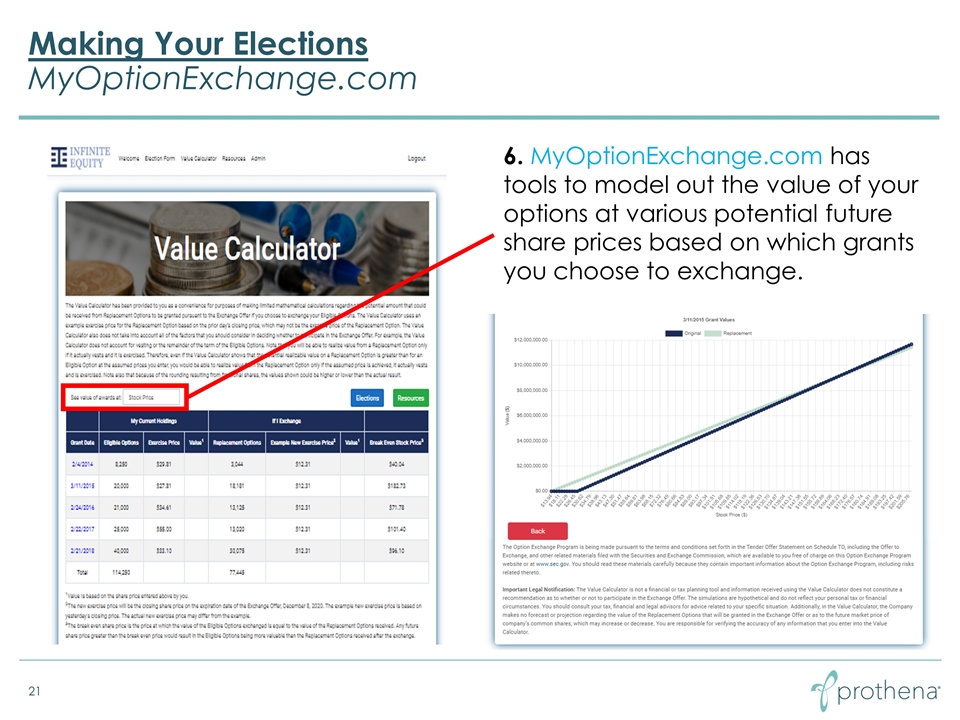

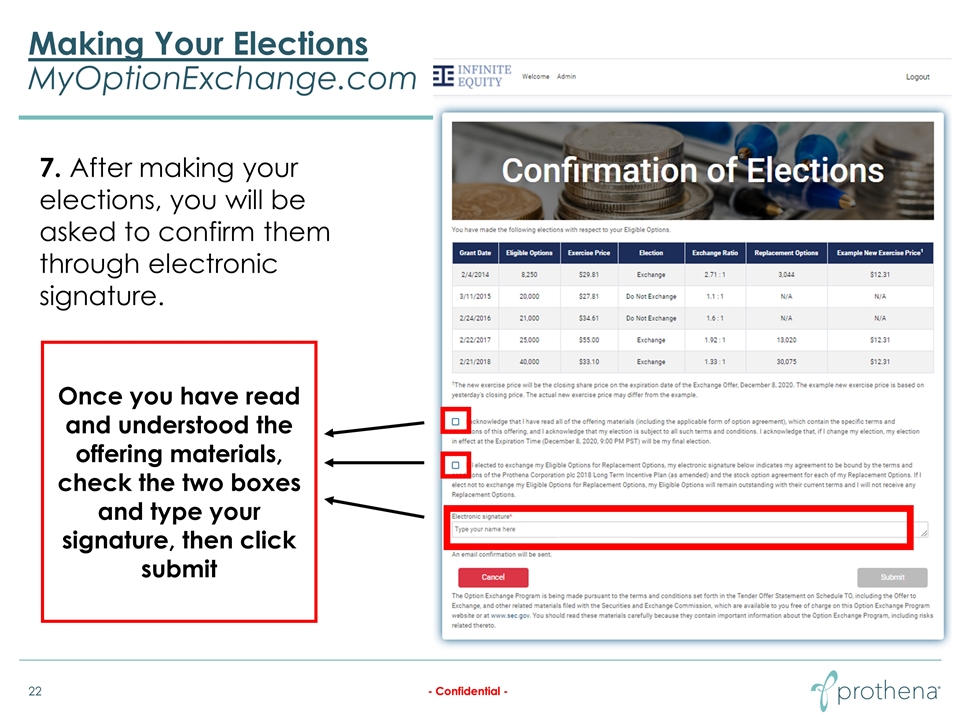

| 2. | Properly complete and submit your election via the option exchange website by (a) navigating to the Election Form page, (b) indicating which eligible options you wish to exchange by selecting “Exchange” or “Do Not Exchange” in the Election column and “Next” at the bottom of the page, and (c) after reading all of the offering materials, checking the appropriate boxes, typing your electronic signature, and selecting “Submit.” By selecting the “Submit” button you are acknowledging and agreeing to the Terms of Election. |

10

Prothena must receive your properly completed submission on or before 9:00 P.M. Pacific Time on the Offer expiration date, which is to occur on December 8, 2020, unless extended by us.

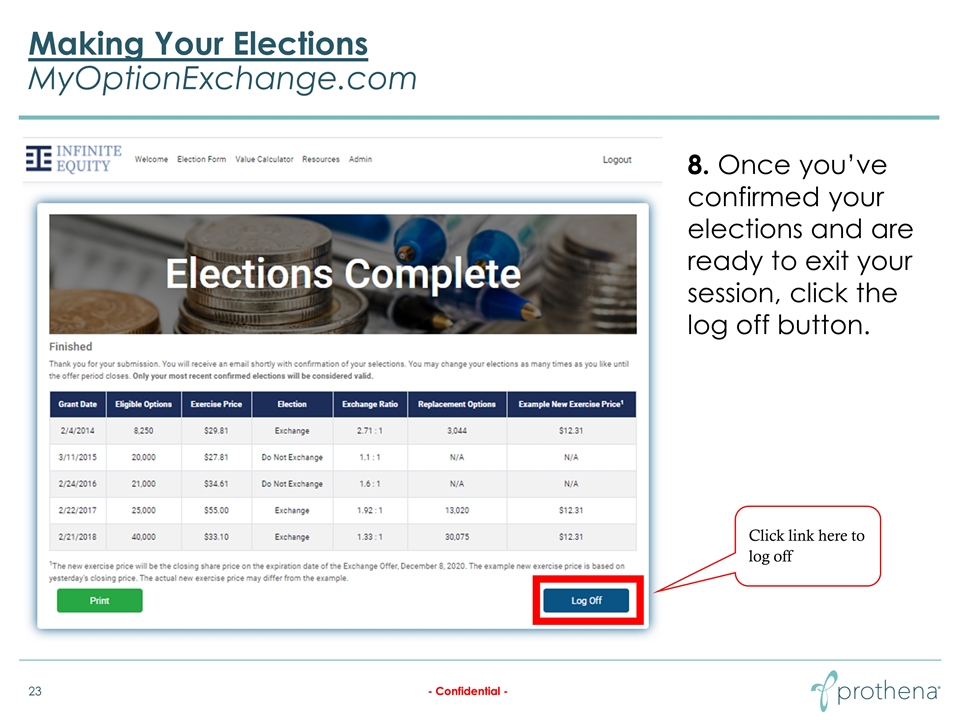

You can change your election any time during the Offering period; however, the last election that you make, if any, on or prior to 9:00 P.M. Pacific Time on the Offer expiration date will be final and irrevocable.

If you elect to exchange an eligible option grant, you must elect to exchange that entire eligible option grant. If you hold more than one eligible option grant, however, you may choose to exchange separate eligible option grants, on a grant-by-grant basis, without having to exchange all of your eligible option grants. No partial exchanges of separate option grants will be permitted. If you are eligible to participate in the Option Exchange, the option exchange website will list all of your eligible separate option grants.

Confirmation statements for submissions through the option exchange website will be emailed directly to you, and you may also obtain a confirmation from the option exchange website after submitting your election or withdrawal. You should print and save a copy of the confirmation for your records.

Elections submitted by any other means, including email, facsimile, hand delivery, interoffice, United States mail (or other post) and Federal Express (or similar delivery service), are not permitted, and will not be accepted.

| 14. | How do I find out the details about my existing options? |

Information on your eligible options will be provided to you with this Offer on the option exchange website located at www.myoptionexchange.com.

| 15. | What will happen if I do not submit my election by the deadline? |

If you do not submit your election by the deadline, then you will not participate in this Offer, and all options currently held by you will remain intact at their original exercise price and subject to their original terms and conditions. (See “Risk Factors” below for additional information).

IF YOU FAIL TO PROPERLY SUBMIT YOUR ELECTION BY THE DEADLINE, YOU WILL NOT BE PERMITTED TO PARTICIPATE IN THIS OFFER.

| 16. | During what period of time can I withdraw or change my previous elections? |

You can withdraw or change your previously submitted election to exchange or not exchange eligible options at any time on or before 9:00 P.M. Pacific Time on the Offer expiration date, which is scheduled to occur on December 8, 2020, unless extended by us. If this Offer is extended beyond December 8, 2020, you can withdraw or change your election at any time until the extended expiration of this Offer. To change your previously submitted election, you must submit a new election in the same manner described in Question 13 before the election deadline. To withdraw your previously submitted election, submit a new election before the election deadline, and select “No” in the election column for the particular option(s) you wish to withdraw. It is your responsibility to confirm that we have received your correct election before the deadline. In all cases, the last election submitted and received prior to the deadline will be final and irrevocable. (See Section 4 of the Offer to Exchange entitled “Withdrawal Rights” below for additional information.)

11

AFTER THE DEADLINE TO WITHDRAW OR CHANGE YOUR ELECTION HAS OCCURRED, YOU WILL NOT BE PERMITTED TO WITHDRAW OR CHANGE YOUR ELECTION.

| 17. | Can I exchange the remaining portion of an eligible option grant that I have already partially exercised? |

Yes, any unexercised portion of a separate eligible option grant can be exchanged. If you have previously exercised a portion of an eligible option grant, only the portion of that option grant that has not yet been exercised will be eligible to be exchanged. Any portion of a separate option grant that has been exercised is not eligible to participate in the Option Exchange. The replacement option will only replace the portion of eligible option grant that is cancelled upon the expiration of this Offer.

| 18. | Can I select which of my eligible options to exchange? |

Yes. You can exchange your eligible options on a grant-by-grant basis, determined based on the grant date and exercise price of the original option. However, no partial exchanges of separate eligible option grants will be permitted.

| 19. | Can I exchange both vested and unvested eligible options? |

Yes. You can exchange eligible options, whether or not they are vested (and you must exchange all of the unexercised portion of a separate option grant if you choose to exchange such separate option grant). Each replacement option, however, will be completely unvested on the replacement option grant date, regardless of whether the surrendered eligible option was wholly or partially vested.

| 20. | What will be my new option exercise price? |

The per share exercise price of the replacement options will be the per share closing trading price of our ordinary shares on the Nasdaq on the replacement option grant date, which is expected to occur on the Offer expiration date. IF THE MARKET PRICE OF OUR ORDINARY SHARES INCREASES BEFORE THE REPLACEMENT OPTION GRANT DATE, THE REPLACEMENT OPTIONS THAT YOU RECEIVE IN EXCHANGE FOR YOUR EXISTING OPTIONS MAY HAVE A HIGHER EXERCISE PRICE THAN SOME OR ALL OF YOUR EXISTING OPTIONS. (See Section 1 of the Offer to Exchange entitled “Eligibility; Number of Options; Offer Expiration Date,” Section 2 of the Offer to Exchange entitled “Purpose of this Offer” and “Risk Factors” below for additional information.)

| 21. | When will the replacement options be granted? |

We will grant the replacement options on the date we cancel options elected for exchange, which we expect to occur on the Offer expiration date, currently scheduled for December 8, 2020. If this Offer is extended beyond December 8, 2020, then the replacement options will be granted on the expiration date of the extended Offer. (See Section 8 of the Offer to Exchange entitled “Source and Amount of Consideration; Terms of Replacement Options” below for more information.)

| 22. | When will the replacement options vest? |

Replacement options will be subject to a new initial one-year vesting period from the replacement option grant date, regardless of whether and to the extent that any of the surrendered eligible options are vested. Upon the first anniversary of the replacement option grant date, the portion of the replacement option corresponding to the portion of the surrendered eligible option that would have been vested as of such date shall vest, and any remaining unvested portion of the replacement option will vest on the same monthly schedule that previously applied to the surrendered eligible option (i.e., in substantially equal installments on the remaining original vesting dates), subject to accelerated vesting upon certain terminations if provided for under the agreement governing the surrendered eligible option. This means that all replacement options will be completely unvested on the replacement option grant date, regardless of whether the surrendered option was wholly or partially vested as of the Offer expiration date.

Like all of our outstanding options, the vesting of the replacement options is dependent upon continued employment with Prothena or any of our subsidiaries (if you are an employee) or continued service with Prothena (if you are a non-employee director) through the applicable vesting date. Replacement options are subject to the terms and conditions as provided for in the 2018 LTIP and may be forfeited if not vested at the time of a termination of service. (See Section 8 of the Offer to Exchange entitled “Source and Amount of Consideration; Terms of Replacement Options” below for additional information.)

12

| 23. | What will be the terms and conditions of my replacement options? |

Replacement options will have terms and conditions set forth in the 2018 LTIP and will be subject to an applicable form of option award agreement (based on your location of residency and whether you are an employee or non-employee director). In addition, the number of shares subject to the replacement options and the replacement options’ exercise prices, vesting dates will be different from such terms that are applicable to eligible options, but the replacement options will otherwise have terms and conditions generally similar to the surrendered eligible options, including any provisions providing for accelerated vesting or extended exercisability upon certain terminations.

You are encouraged to consult the 2018 LTIP and the forms of option award agreements for complete information about the terms of the replacement options, which are available through the option exchange website. Each replacement option will have a term equal to the remaining term of the surrendered option, subject to earlier expiration of the option following termination of your employment or service, as applicable, with Prothena or any of our subsidiaries. (See Section 8 of the Offer to Exchange entitled “Source and Amount of Consideration; Terms of Replacement Options” below for additional information.)

| 24. | What if my employment or service with Prothena is terminated after the replacement options are granted? |

If your employment with Prothena or one of our subsidiaries (if you are an employee) or service with Prothena (if you are a non-employee director) is terminated for any reason after the replacement option has been granted, you will forfeit any ordinary shares underlying your replacement options that are unvested at the date of your termination, subject to any provisions providing for accelerated vesting. You may exercise your replacement options that are vested as of the date of your termination must be exercised within the time set forth in your option award agreement (generally, within 90 days following the date of your termination of employment or service, as applicable). (See Section 8 of the Offer to Exchange entitled “Source and Amount of Consideration; Terms of Replacement Options” below for additional information.)

| 25. | What happens if Prothena is subject to a change in control AFTER the replacement options are granted? |

Although we are not currently contemplating a merger or similar transaction that could result in a change in control of our Company, we are reserving the right to take any actions that we deem necessary or appropriate to complete a transaction that our Board of Directors believes is in the best interest of our Company and our shareholders. It is possible that, after or prior to the grant of replacement options, we might effect or enter into an agreement, such as a merger or other similar transaction, in which the current share ownership of our Company will change such that a new group of shareholders has the number of votes necessary to control shareholder voting decisions. We refer to this type of transaction as a change in control transaction.

To obtain detailed change in control provisions governing your current options, you can refer to our equity incentive plans, as applicable, and the prospectus for each such equity incentive plan, all of which are available through the option exchange website. Your option award agreement(s) and certain other agreements between you and Prothena may also contain provisions that affect the treatment of your options in the event of a change in control.

| 26. | What happens if Prothena is subject to a change in control BEFORE the replacement options are granted? |

Although we are not currently contemplating a merger or similar transaction that could result in a change in control of our Company, we reserve the right to take any actions that we deem necessary or appropriate to complete a transaction that our Board of Directors believes is in the best interest of our Company and our shareholders. This could include terminating this Offer and/or your right to receive replacement options under this Offer.

Any change in control transaction, or announcement of such transaction, could have a substantial effect on our share price, including potentially substantial appreciation in the price of our ordinary shares. Depending on the structure of such a transaction, price appreciation in the ordinary shares associated with the replacement options could be drastically altered. For example, if our ordinary shares were to be acquired in a cash merger, the fair market value of our shares, and hence the price at which we grant the replacement options, would likely be a price at or near the cash price being paid for the ordinary shares in the transaction. As a result of such a transaction, it is possible that the exercise price of the replacement options may be more than you might otherwise

13

anticipate. In addition, in the event of an acquisition of our Company for stock, tendering option holders might receive options to purchase shares of a different issuer. (See Section 2 of the Offer to Exchange entitled “Purpose of this Offer” below for additional information.)

| 27. | Are there other circumstances where I would not be granted replacement options? |

Yes. Even if we accept your tendered options, we will not grant replacement options to you if we are prohibited by applicable law or regulations from doing so, or until all necessary government approvals have been obtained. We will use reasonable efforts to avoid a prohibition, but if prohibited by applicable law or regulation on the expiration date of this Offer, you will not be granted replacement options, if at all, until all necessary government approvals have been obtained. In addition, we will not grant replacement options to you if you are not an eligible employee or non-employee director on the replacement option grant date. (See Section 12 of the Offer to Exchange entitled “Agreements; Legal Matters; Regulatory Approvals” below for additional information.)

| 28. | After the Offer expiration date, what happens if my options end up underwater again? |

The price of our ordinary shares may not appreciate over the long term, and your replacement options may become underwater after the Offer expiration date. WE CAN PROVIDE NO ASSURANCE AS TO THE PRICE OF OUR ORDINARY SHARES AT ANY TIME IN THE FUTURE. (See Section 2 of the Offer to Exchange entitled “Purpose of this Offer” below for additional information.)

Other Important Questions

| 29. | What are the U.S. Federal tax consequences of my participation in this Offer? |

If you accept this Offer and reside and work in the United States, under current U.S. law, you generally will not recognize income for federal income tax purposes either at the time your exchanged options are cancelled or when the replacement options are granted. Each replacement option will be granted as a non-qualified stock option and generally will be subject to tax under U.S. tax law upon exercise and disposition of the underlying shares in the same manner applicable to non-qualified stock options generally. If you are subject to the tax laws of a country other than the United States, even if you are a resident of the United States, you should be aware that there may be other tax consequences that may apply to you. Tax consequences may vary depending on each individual’s circumstances. Included as part of this Option Exchange are disclosures regarding the expected material federal tax consequences of this Offer in the United States and in countries other than the United States in which employees of Prothena and its subsidiaries are eligible to participate in this Offer. You should review these disclosures carefully before deciding whether or not to participate in this Offer. (See Schedule A of the Offer to Exchange entitled “A Guide to Tax & Legal Issues for Non-U.S. Employees” below for additional information.)

| 30. | How should I decide whether or not to participate? |

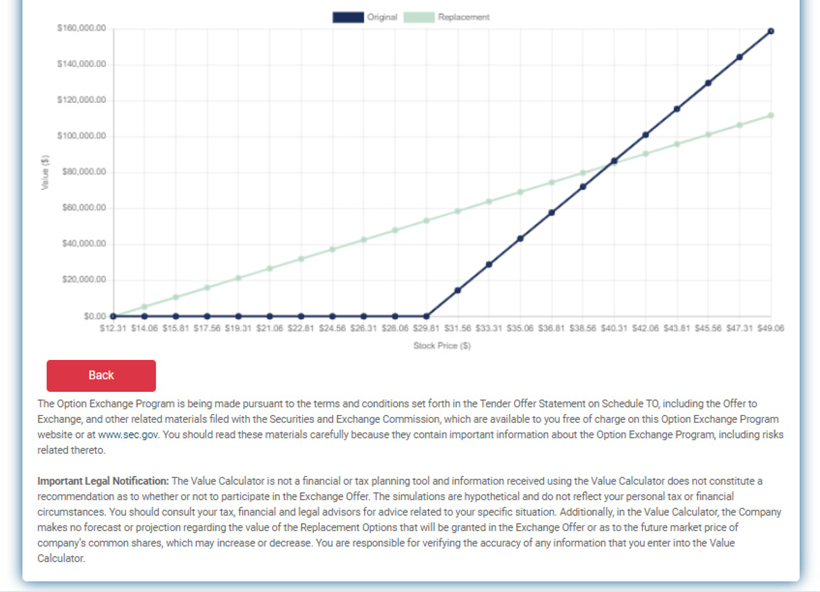

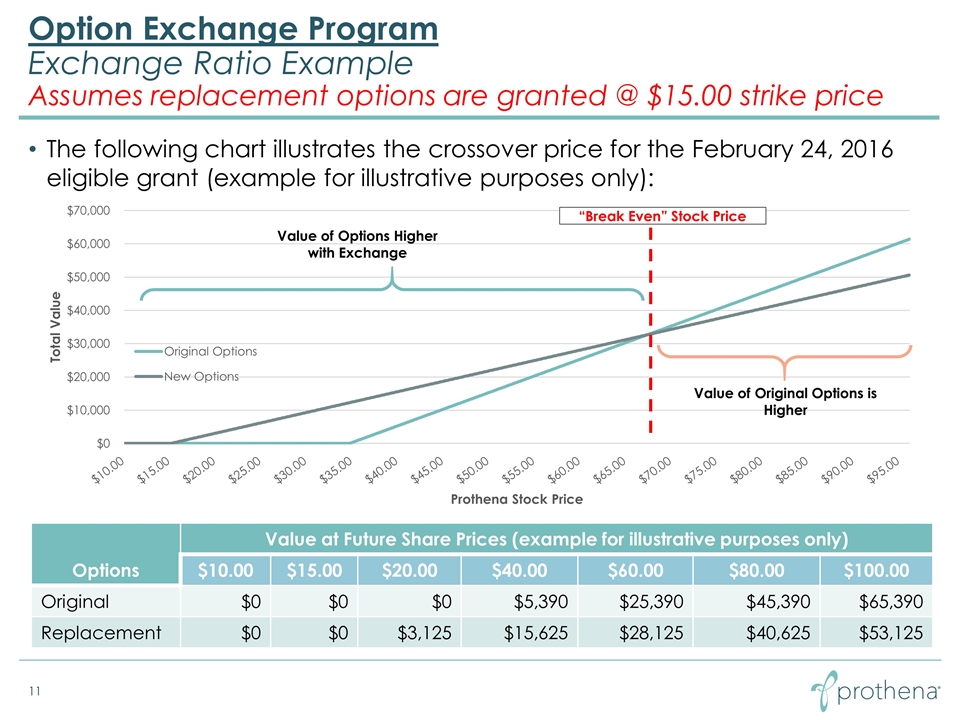

The decision to participate must be each individual’s personal decision and will depend largely on each individual’s assumptions about the future of our business, our share price, the overall economic environment, and the performance of publicly traded stocks generally. The likely lower exercise price of replacement options may allow you to recognize value from your option sooner. There is an inflection point, however, at higher Prothena share prices where the value of the eligible option you surrendered would have been greater than the value of the replacement option. The reason for this is because your replacement option will cover fewer shares than the eligible option you surrendered. The inflection point for each option grant varies depending on the exercise price and the exchange ratio of such eligible option grant. In addition, you should consider the vesting schedule of the replacement options, which will be subject to a new one-year cliff, regardless of whether the surrendered option was wholly or partially vested.

We understand that this will be a challenging decision for all eligible individuals. THE OPTION EXCHANGE CARRIES CONSIDERABLE RISK, AND THERE ARE NO GUARANTEES OF OUR FUTURE SHARE PERFORMANCE OR THE PRICE OF OUR ORDINARY SHARES ON THE OFFER EXPIRATION DATE. (See Section 17 of the Offer to Exchange entitled “Miscellaneous” below for additional information.)

14

| 31. | What do the executive officers and the members of our Board of Directors think of this Offer? Who can I contact to help me decide whether or not I should exchange my eligible options? |

Although our Board of Directors has approved this Offer, neither our executive officers nor the members of our Board of Directors make any recommendation as to whether you should elect to exchange or refrain from exchanging your eligible options. Please contact your personal financial and tax advisors to assist you in determining if you should exchange your eligible options.

| 32. | What are some of the potential risks if I choose to exchange my outstanding eligible options? |

We cannot predict how our ordinary shares or the stock market will perform before the date that the replacement options will be granted, and the price of Prothena ordinary shares may increase significantly. This could result in the new grants having a higher exercise price than those you exchanged and could make the replacement options less valuable than those you exchanged. In addition, because the replacement option you will receive will be exercisable for fewer shares than the eligible option you surrendered, there is an inflection point at higher Prothena share prices where the value of the eligible option you surrendered would have been greater than the value of your replacement option.

If you elect to participate in this Offer, the vesting of each replacement option granted to you will be subject to a new one-year cliff. Upon the first anniversary of the replacement option grant date, the portion of the replacement option corresponding to the portion of the surrendered eligible option that would have been vested as of such date shall vest, and any remaining unvested portion of the replacement option will vest on the same monthly schedule that previously applied to the surrendered eligible option (i.e., in substantially equal installments on the remaining original vesting dates). This means that you will be required to continue employment or service, as applicable, with Prothena or our subsidiaries for one year after the date on which your replacement option is granted in order to be vested in whole or in part in the replacement option. If your employment or service, as applicable, terminates for any reason prior to vesting of your replacement option, you will forfeit the then-unvested portion of your replacement option. (See “Risk Factors” below for additional information.)

| 33. | To whom should I ask questions regarding this Offer? |

If you have questions regarding the Exchange Offer or have requests for assistance (including requests for additional copies of this Offer to Exchange document or other documents relating to the Exchange Offer), please email [email protected].

PROTHENA MAKES NO RECOMMENDATION AS TO WHETHER YOU SHOULD PARTICIPATE IN THE OFFER. YOU MUST MAKE YOUR OWN DECISION WHETHER AND TO WHAT EXTENT TO PARTICIPATE. WE ENCOURAGE YOU TO SPEAK WITH YOUR FINANCIAL, LEGAL AND/OR TAX ADVISORS, AS NECESSARY, BEFORE DECIDING WHETHER TO PARTICIPATE IN THE OFFER.

15

RISK FACTORS

Participation in this Offer involves a number of potential risks and uncertainties, including those described below. This list and the risk factors set forth under the heading entitled “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2020, and our Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC, highlight the material risks related to Prothena which may impact your decision of participating in this Offer. You should carefully consider these risks and we encourage you to speak with your financial, legal and/or tax advisors before deciding whether to participate in this Offer. In addition, we strongly urge you to read the sections in this Option Exchange discussing the tax consequences of participating in this Offer, as well as the rest of this Option Exchange for a more in-depth discussion of the risks that may apply to you.

In addition, this Option Exchange and our SEC reports referred to above include “forward-looking statements” that involve risks and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially from those expressed or implied by such forward-looking statements. The statements contained in this Option Exchange and our SEC reports referred to above that are not purely historical are forward-looking statements. Forward-looking statements are often identified by the use of words such as, but not limited to, “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “will,” “plan,” “project,” “seek,” “should,” “target,” “will,” “would,” and similar expressions or variations intended to identify forward-looking statements. These statements are based on the beliefs and assumptions of our management based on information currently available to management. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those identified below and those discussed in the section titled “Risk Factors” included in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2020 and our Annual Report on Form 10-K for the year ended December 31, 2019. Furthermore, such forward-looking statements speak only as of the date of this report. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

The safe harbor provided in the Private Securities Litigation Reform Act of 1995, by its terms, does not apply to statements made in connection with this Offer.

Risks Related to This Offer

If the price of our ordinary shares increases after the date of grant of the replacement options, your surrendered eligible options might have been worth more than the replacement options that you will receive in exchange for them.

Because you will receive replacement options covering fewer shares than the eligible options surrendered, your replacement options will have less potential for increases in value due to significantly higher Prothena share prices.

Any replacement options you receive in this Offer will have less favorable vesting terms than those of the related eligible options you are surrendering. This means that if your employment or service, as applicable, with us terminates during the new vesting period, or if the replacement option otherwise terminates prior to your being fully vested in it, you might have been better off if you had continued holding the eligible option rather than exchanging it for a replacement option.

If you elect to participate in this Offer, the vesting of each replacement option granted to you will be subject to a new one-year cliff, regardless of whether and to the extent that any of the surrendered eligible options are vested. Upon the first anniversary of the replacement option grant date, the portion of the replacement option corresponding to the portion of the surrendered eligible option that would have been vested as of such date shall vest, and any remaining unvested portion of the replacement option will vest on the same monthly schedule that previously applied to the surrendered eligible option (i.e., in substantially equal installments on the remaining original vesting dates), subject to accelerated vesting upon certain terminations if provided for under the agreement governing the surrendered eligible option. This means that you will be required to continue employment or service, as applicable, with Prothena or our subsidiaries for one year after the date on which your replacement option is granted in order to be vested in whole or in part in the replacement option. If your employment or service, as applicable, terminates for any reason prior to vesting of your replacement option, you will forfeit the then-unvested portion of your replacement option.

16

You should carefully consider the relative benefit to you if the vesting of your eligible options has already accrued, compared to the benefit of a lower-priced option with a longer vesting period. If our share price increases in the future to a value above the exercise price of an eligible option that you surrender in this Offer prior to the cliff vesting date, you could conclude that it would have been preferable to have retained the eligible option with its higher exercise price and greater amount of accrued vesting rather than have surrendered it for a replacement option with a lower exercise price and re-started vesting.

Nothing in this Offer should be construed to confer upon you the right to remain an employee of Prothena or our subsidiaries or a non-employee director of Prothena. The terms of your employment or service with us remain unchanged. We cannot guarantee or provide you with any assurance that you will not be subject to involuntary termination or that you will otherwise remain in our employ or service until the grant date for the replacement options or thereafter.

If you are subject to foreign tax laws, even if you are a resident of the United States, there may be tax and social insurance consequences relating to this Offer.

If you are subject to the tax laws of another country, even if you are a resident of the United States, you should be aware that there may be other tax and social insurance consequences that may apply to you. You should read Schedule A attached to this Option Exchange. Schedule A discusses the tax consequences relating to this Offer for your country of residence. You should also be certain to consult your own tax advisors to discuss these consequences.

Tax-related risks for tax residents of multiple countries.

If you are subject to the tax laws in more than one jurisdiction, you should be aware that there may be tax and social insurance consequences of more than one country that may apply to you. You should be certain to consult your own tax advisor to discuss these tax consequences.

Risks Related to Our Business and Ordinary Shares

You should carefully review the risk factors contained in our Quarterly Reports on Form 10-Q for the quarters ended March 31, June 30, and September 30, 2020, and our Annual Report on Form 10-K for the year ended December 31, 2019, and also the other information provided in this Option Exchange and the other materials that we have filed with the SEC, before making a decision on whether or not to tender your eligible options. You may access these filings electronically at the SEC’s website at http://www.sec.gov. In addition, we will provide without charge to you, upon your request, a copy of any or all of the documents to which we have referred you. See “This Offer - Additional Information” for more information regarding reports we file with the SEC and how to obtain copies of or otherwise review these reports. These reports can also be accessed free of charge at https://ir.prothena.com.

17

THIS OFFER

| 1. | Eligibility; Number of Options; Offer Expiration Date. |