Form 8-K PUBLIC SERVICE ENTERPRIS For: Oct 30

EXHIBIT 99

|

Investor Relations |

Public Service Enterprise Group 80 Park Plaza, T4 Newark, NJ 07102 |

|

| CONTACT: | ||||

| Media Relations | Investor Relations | |||

| [email protected] | ||||

| 908-531-4253 |

973-430-6565 |

PSEG ANNOUNCES 2020 THIRD QUARTER RESULTS

$1.14 PER SHARE OF NET INCOME

NON-GAAP OPERATING EARNINGS OF $0.96 PER SHARE

Narrows Non-GAAP Operating Earnings Guidance to $3.35 - $3.50 Per Share

Landmark $1 Billion Clean Energy Future - Energy Efficiency Program Approved

(October 30, 2020 – Newark, NJ) Public Service Enterprise Group (NYSE: PEG) reported Net Income for the third quarter of 2020 of $575 million, or $1.14 per share, compared to Net Income of $403 million, or $0.79 per share, in the third quarter of 2019. Non-GAAP Operating Earnings for the third quarter of 2020 were $488 million, or $0.96 per share, compared to non-GAAP Operating Earnings for the third quarter of 2019 of $495 million, or $0.98 per share. Non-GAAP results for the third quarter exclude items shown in Attachments 8 and 9.

Ralph Izzo, chairman, president and chief executive officer commented, “We delivered a solid quarter at both PSE&G and PSEG Power and remain on track to deliver full year results within our updated range which removes five cents per share from the lower end. Last month, the New Jersey Board of Public Utilities (NJBPU) approved the settlement of our Clean Energy Future – Energy Efficiency (CEF-EE) filing. PSE&G was authorized to invest $1 billion over three years in programs that will allow us to work toward universal access to energy efficiency for all New Jersey customers. This will lower customer bills and shrink their carbon footprint. PSE&G’s CEF-EE investment program will also establish significant job training programs and create over 3,200 clean energy jobs, as it also helps New Jersey avoid 8 million metric tons of carbon emissions through 2050.”

Izzo continued, “In early August, Tropical Storm Isaias wreaked havoc with powerful winds and heavy rains in a fast moving storm that left approximately 575,000 of our New Jersey and 420,000 Long Island customers without power. This was the most damaging storm experienced in the region since Superstorm Sandy. PSE&G and PSEG LI worked around the clock alongside nearly 3,000 mutual aid personnel in New Jersey and over 5,000 in Long Island to restore 90% and 80% of affected customers in NJ and LI within 72 hours, respectively. Our commitment to safely providing reliable service to all our customers remains PSEG’s core focus.

1

Our service area experienced significantly warmer weather during the first half of the summer that helped to moderate the load loss seen earlier in the year from the ongoing economic impacts of the COVID-19 pandemic. New Jersey has aggressively managed its positivity rates since the spring with some recent resurgence and continues a phased reopening of businesses, schools, and activities, which will determine the pace of economic recovery.

PSEG is also continuing efforts to optimize strategic alternatives for PSEG Power’s non-nuclear generating fleet to accelerate the transformation of PSEG into a primarily regulated electric and gas utility focused on reliability and resiliency infrastructure, clean energy investments, methane reduction, and zero-carbon generation. We expect to begin marketing the non-nuclear assets later this year,” said Izzo.

The following table provides a reconciliation of PSEG’s Net Income to non-GAAP Operating Earnings for the third quarter. See Attachments 8 and 9 for a complete list of items excluded from Net Income in the determination of non-GAAP Operating Earnings.

PSEG CONSOLIDATED RESULTS (unaudited)

Third Quarter Comparative Results

2020 and 2019

| Income ($ millions) |

Diluted Earnings Per Share |

|||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Net Income |

$ | 575 | $ | 403 | $ | 1.14 | $ | 0.79 | ||||||||

| Reconciling Items |

(87 | ) | 92 | (0.18 | ) | 0.19 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Non-GAAP Operating Earnings |

$ | 488 | $ | 495 | $ | 0.96 | $ | 0.98 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Avg. Shares | 507M | 507M |

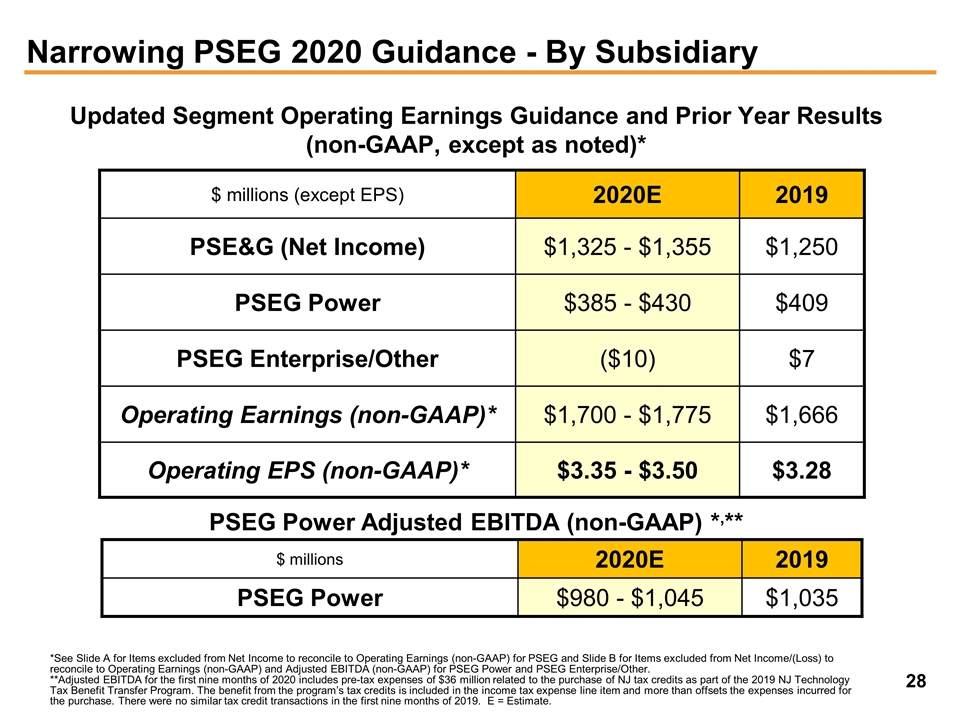

Ralph Izzo added, “We are updating and narrowing PSEG’s full-year 2020, non-GAAP Operating Earnings guidance to $3.35 to $3.50 per share, raising the low end of our guidance to reflect strong cost control at PSEG Power and overall results through the first three quarters of the year. We are aggressively managing our cost structure in both businesses. PSE&G is on schedule with its 2020 capital investment program, and PSEG Power continues to advocate for the preservation of New Jersey nuclear generation with the filing of an application to extend the Zero Emission Certificate program into 2025 as we also work to optimize Power’s fleet in pursuit of a mostly regulated and contracted business profile. We remain on-track to execute on PSEG’s 2020-2024, $13 billion to $15.7 billion capital plan, which we updated following the Clean Energy Future – EE decision. We continue to expect to fund these investments without the need to issue new equity as we prioritize greater visibility in our regulated earnings and opportunities for dividend growth.”

2

The following table outlines PSEG’s updated expectations for non-GAAP Operating Earnings in 2020 by subsidiary:

2020 Non-GAAP Operating Earnings Guidance

($ millions, except EPS)

| Updated 2020E | Original 2020E | |||

| PSE&G |

$1,325 - $1,355 | $1,310 - $1,370 | ||

| PSEG Power |

$385 - $430 | $345 - $435 | ||

| PSEG Enterprise/Other |

($10) | ($5) | ||

| Non-GAAP Operating Earnings |

$1,700 - $1,775 | $1,675 - $1,775 | ||

| Non-GAAP Operating EPS |

$3.35 - $3.50 | $3.30 - $3.50 |

E = Estimate

Results and Outlook by Operating Subsidiary

Public Service Electric & Gas

Third Quarter 2020 and 2019 Comparative Results

($ millions, except EPS)

| PSE&G |

3Q 2020 | 3Q 2019 | Q/Q Change | |||||||||

| Net Income |

$ | 313 | $ | 344 | $ | (31 | ) | |||||

| Earnings Per Share |

$ | 0.61 | $ | 0.68 | $ | (0.07 | ) | |||||

The utility’s third quarter results reflected several items that largely reflect tax adjustments that are timing in nature. For the year to date, PSE&G results remain on track to achieve our full-year guidance, driven by revenue growth from ongoing capital investment programs, lower pension expense and cost control.

Investment in transmission added $0.04 per share to third quarter Net Income. Electric margin was $0.01 per share favorable compared to the year-earlier quarter, driven by higher residential volumes. Summer 2020 weather was $0.01 per share ahead of weather experienced in third quarter 2019. Operating and Maintenance (O&M) expense was $0.03 unfavorable versus third quarter 2019 primarily reflecting more gas work, and internal labor costs from Tropical Storm Isaias, partly offset by the reversal of certain COVID-19 related costs recognized in prior quarters.

In July 2020, the NJBPU authorized PSE&G to defer certain expenses incurred because of the COVID-19 pandemic. In August, PSE&G filed for the first deferral covering the period from early March through June 30, 2020. To reflect the order, PSE&G deferred certain COVID-19 related O&M and gas bad debt expense previously recorded, and established a corresponding regulatory asset of approximately $0.05 per share for future recovery.

3

Largely offsetting this timing item, PSE&G reversed a $0.04 accrual under the weather normalization clause (WNC), for collection of lower gas margins resulting from warmer than normal weather earlier in the year, due to recovery limitations under that clause’s earnings test.

Distribution related depreciation lowered Net Income by $0.01 per share. Non-operating pension expense was $0.01 per share favorable compared with last year’s third quarter. Flow through taxes and other items lowered Net Income by $0.07 per share compared to third quarter 2019, driven largely by the timing of taxes and taxes related to bad debt expense. The majority of these tax items are expected to reverse over the coming quarters through 2021 and beyond.

Summer weather during Q3 2020, as measured by the Temperature-Humidity Index, was nearly 18% warmer than normal and 7% warmer than in the third quarter of 2019. Weather normalized electric sales for the quarter declined by approximately 1% versus last year, with residential loads up 7% but were more than offset by lower commercial and industrial sales that were approximately 6% lower. For the year to date period, weather normalized electric sales were down 3% and gas sales were flat, as the net impact of higher residential volume only partially offsets lower commercial and industrial sales. Residential electric and gas sales and usage were up 5% and 4%, respectively, on a weather normalized basis year-to-date.

On September 23, the NJBPU approved a settlement of PSE&G’s CEF-EE filing, outlining a $1 billion commitment toward energy efficiency investments over the next three years that will extend universal access to energy efficiency savings through ten residential, commercial and industrial programs. CEF-EE investments will receive recovery of and on capital through a clause mechanism at the current authorized return on equity of 9.6%. These EE programs will help New Jersey achieve the NJBPU’s preliminary energy savings targets of 2.15% for electricity and 1.1% for gas within five years. In addition, the NJBPU approved a Conservation Incentive Program (CIP), allowing for the recovery of sales variations in revenues, such as those that could be caused by energy efficiency, weather, and other variables. The CIP will begin in June 2021 for electric revenues and in October 2021 for gas revenues, at which time the weather normalization clause addressing gas weather variations will be phased-out.

In October, PSE&G filed its annual transmission formula rate update with the Federal Energy Regulatory Commission to reflect, among other updates, net plant additions. PJM cost reallocations will more than offset the higher revenue requirements and result in a net reduction in costs to PSE&G customers when implemented in January 2021.

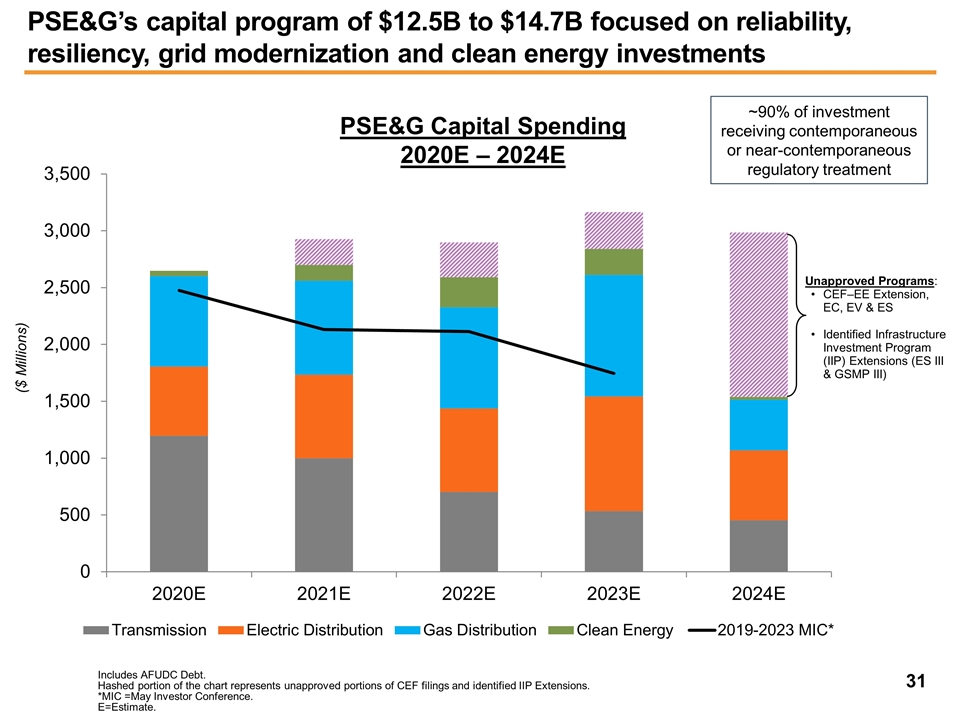

PSE&G’s capital plan remains on schedule with approximately $700 million deployed in the third quarter and $1.9 billion through September 30 as part of its 2020 capital investment program of approximately $2.7 billion in infrastructure upgrades to its transmission and distribution facilities to maintain reliability, increase resiliency and

4

replace aging energy infrastructure.

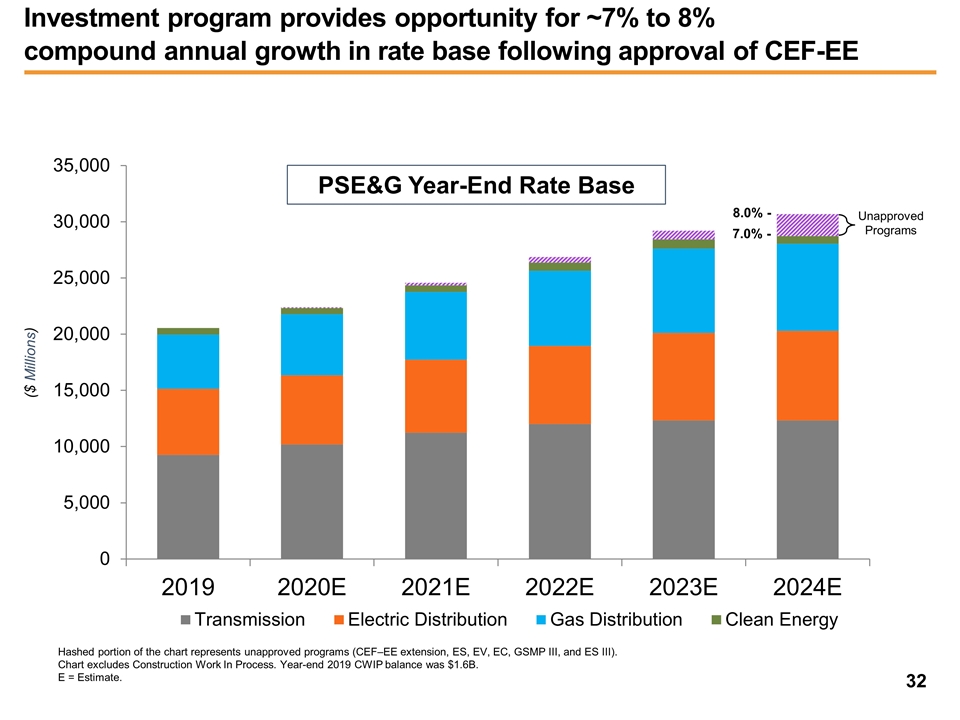

Following the NJBPU’s approval of the CEF-EE settlement, PSE&G updated its 2020-2024 Compound Annual Growth in Rate Base projection to 7% to 8%, from the prior 6.5% to 8%, and narrowed PSE&G’s capital investment program over the same 5-year period to $12.5 billion to $14.7 billion.

PSE&G in partnership with Governor Murphy and the NJBPU, extended to March 2021 the temporary suspension of non-safety related electric and gas residential service shut-offs that began in March 2020.

PSE&G’s forecast of Net Income for 2020 has been updated to $1,325 million - $1,355 million (from $1,310 million - $1,370 million).

PSEG Power

Third Quarter 2020 and 2019 Comparative Results

($ millions, except EPS)

| PSEG Power |

3Q 2020 | 3Q 2019 | Q/Q Change | |||||||||

| Net Income |

$ | 254 | $ | 53 | $ | 201 | ||||||

| Earnings Per Share (EPS) |

$ | 0.51 | $ | 0.10 | $ | 0.41 | ||||||

| Non-GAAP Operating Earnings |

$ | 167 | $ | 145 | $ | 22 | ||||||

| Non-GAAP EPS |

$ | 0.33 | $ | 0.29 | $ | 0.04 | ||||||

| Non-GAAP Adjusted EBITDA |

$ | 349 | $ | 322 | $ | 27 | ||||||

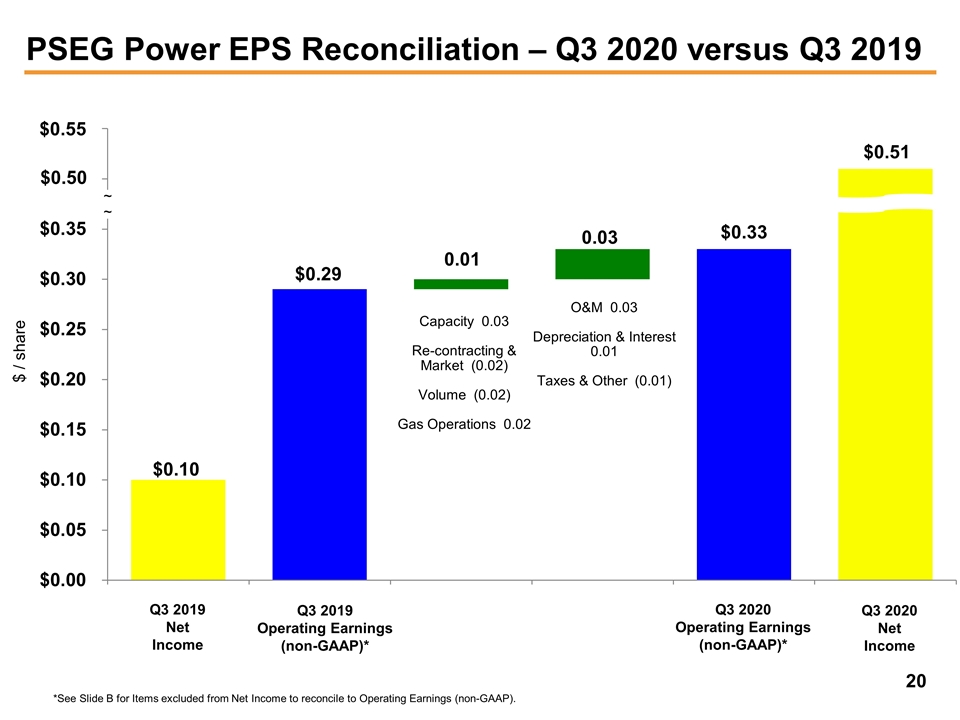

PSEG Power’s third quarter non-GAAP Operating Earnings were positively affected by several items that improved results by $0.04 per share compared to the year-ago quarter. The scheduled rise in PJM capacity revenue on June 1 increased non-GAAP Operating Earnings comparisons by $0.03 per share compared with Q3 2019. Reduced generation volumes lowered results by $0.02 per share versus Q3 2019. Re-contracting and market impacts reduced results by $0.02 per share versus the year-ago quarter. Gas operations were $0.02 per share higher. Lower O&M expense was $0.03 per share favorable compared with last year’s third quarter, reflecting lower fossil maintenance costs including the absence of a major Linden outage in Q3 2019. Lower interest and lower depreciation expense combined to add $0.01 per share versus the year-ago quarter. New Jersey implemented an increase in a corporate surtax to 2.5% during the quarter, lowering comparisons by $0.01 per share to third quarter 2019.

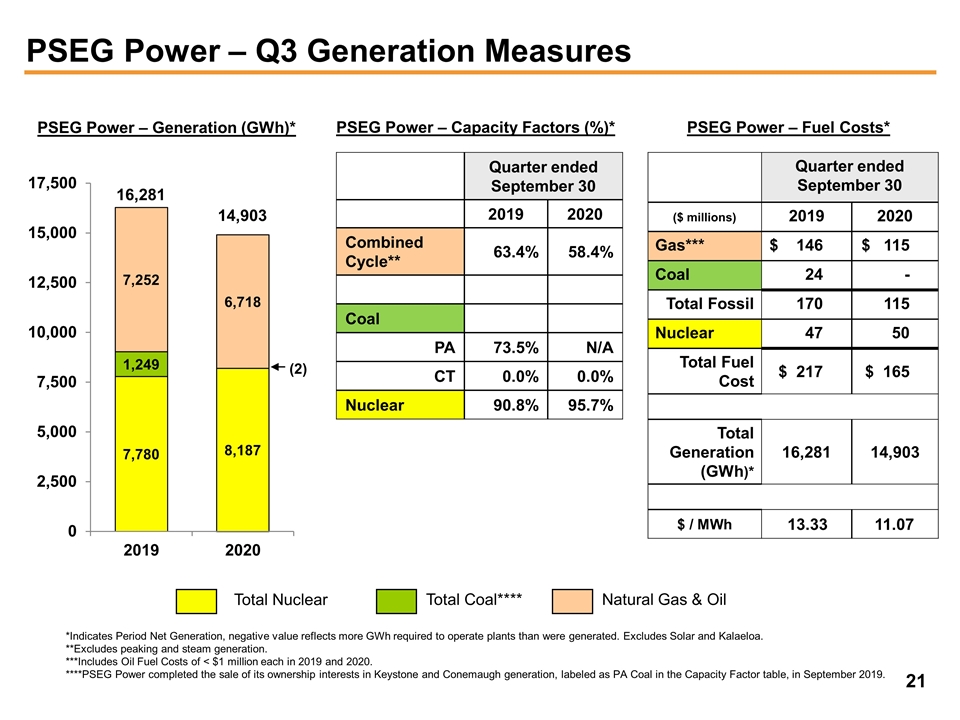

Total generation output declined by 9% to 14.9 TWh for the third quarter of 2020, reflecting the sale of the Keystone and Conemaugh units last fall. PSEG Power’s CCGT fleet produced 6.7 TWh of output, down 7%, reflecting lower market demand driven by ongoing COVID-19 related restrictions on economic activity in the state. The nuclear fleet operated at an average capacity factor of 95.7% for the quarter, producing 8.2

5

TWh, up 5% over Q3 2019, and representing 55% of total generation.

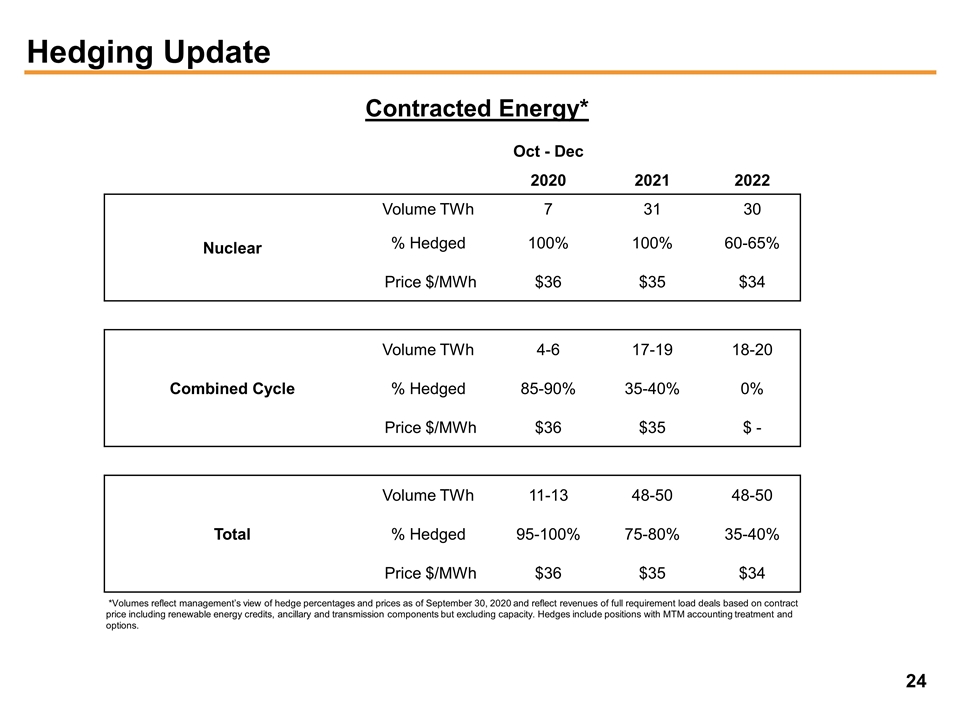

PSEG Power continues to forecast total output for 2020 of 50 - 52 TWh. For the remainder of 2020, Power has hedged approximately 95% - 100% of production at an average price of $36 per MWh. For 2021, Power has hedged 75% - 80% of forecast production of 48 - 50 TWh at an average price of $35 per MWh. Power is also forecasting output for 2022 of 48 - 50 TWh. Approximately 35% – 40% of Power’s output in 2022 is hedged at an average price of $34 per MWh.

We are updating both the forecast of PSEG Power’s non-GAAP Operating Earnings for 2020 to a range of $385 million - $430 million (from $345 million - $435 million), and our estimate of non-GAAP Adjusted EBITDA to a range of $980 million to $1,045 million (from $950 million - $1,050 million).

PSEG Enterprise/Other

PSEG Enterprise/Other reported Net Income of $8 million ($0.02 per share) for the third quarter of 2020 compared to Net Income of $6 million ($0.01 per share) for the third quarter of 2019. Net Income for the quarter reflects ongoing contributions from PSEG Long Island and lower taxes that were partially offset by a loss on the sale of the Powerton and Joliet investments at Energy Holdings.

The forecast for PSEG Enterprise/Other for 2020 has been updated to a Net Loss of $10 million (from a Net Loss of $5 million).

Public Service Enterprise Group Inc. (PSEG) (NYSE: PEG) is a publicly traded diversified energy company with approximately 13,000 employees. Headquartered in Newark, N.J., PSEG’s principal operating subsidiaries are: Public Service Electric and Gas Co. (PSE&G), PSEG Power and PSEG Long Island. PSEG is a Fortune 500 company included in the S&P 500 Index and has been named to the Dow Jones Sustainability Index for North America for 12 consecutive years (https://corporate.pseg.com).

From time to time, PSEG, PSE&G and PSEG Power release important information via postings on their corporate Investor Relations website at https://investor.pseg.com. Investors and other interested parties are encouraged to visit the Investor Relations website to review new postings. You can also use the “Email Alerts” link at https://investor.pseg.com to sign up for automatic email alerts regarding new postings.

Non-GAAP Financial Measures

Management uses non-GAAP Operating Earnings in its internal analysis, and in communications with investors and analysts, as a consistent measure for comparing PSEG’s financial performance to previous financial results. Non-GAAP Operating Earnings exclude the impact of returns (losses) associated with the Nuclear Decommissioning Trust (NDT), Mark-to-Market (MTM) accounting and material one-time items.

Management believes the presentation of non-GAAP Adjusted EBITDA for PSEG Power is useful to investors and other users of our financial statements in evaluating operating performance because it provides them with an additional tool to compare business

6

performance across companies and across periods. Management also believes that non-GAAP Adjusted EBITDA is widely used by investors to measure operating performance without regard to items such as income tax expense, interest expense and depreciation and amortization, which can vary substantially from company to company depending upon, among other things, the book value of assets, capital structure and whether assets were constructed or acquired. Non-GAAP Adjusted EBITDA also allows investors and other users to assess the underlying financial performance of our fleet before management’s decision to deploy capital. Non-GAAP Adjusted EBITDA excludes the same items as our non-GAAP Operating Earnings measure as well as income tax expense, interest expense and depreciation and amortization.

See Attachments 8 and 9 for a complete list of items excluded from Net Income in the determination of non-GAAP Operating Earnings and non-GAAP Adjusted EBITDA. The presentation of non-GAAP Operating Earnings and non-GAAP Adjusted EBITDA is intended to complement, and should not be considered an alternative to the presentation of Net Income, which is an indicator of financial performance determined in accordance with GAAP. In addition, non-GAAP Operating Earnings and non-GAAP Adjusted EBITDA as presented in this release may not be comparable to similarly titled measures used by other companies.

Due to the forward looking nature of non-GAAP Operating Earnings and non-GAAP Adjusted EBITDA guidance, PSEG is unable to reconcile these non-GAAP financial measures to the most directly comparable GAAP financial measure. Management is unable to project certain reconciling items, in particular MTM and NDT gains (losses), for future periods due to market volatility.

Forward-Looking Statements

Certain of the matters discussed in this release about our and our subsidiaries’ future performance, including, without limitation, future revenues, earnings, strategies, prospects, consequences and all other statements that are not purely historical constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from those anticipated. Such statements are based on management’s beliefs as well as assumptions made by and information currently available to management. When used herein, the words “anticipate,” “intend,” “estimate,” “believe,” “expect,” “plan,” “should,” “hypothetical,” “potential,” “forecast,” “project,” variations of such words and similar expressions are intended to identify forward-looking statements. Factors that may cause actual results to differ are often presented with the forward-looking statements themselves. Other factors that could cause actual results to differ materially from those contemplated in any forward-looking statements made by us herein are discussed in filings we make with the United States Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K and subsequent reports on Form 10-Q and Form 8-K. These factors include, but are not limited to:

| • | fluctuations in wholesale power and natural gas markets, including the potential impacts on the economic viability of our generation units; |

| • | our ability to obtain adequate fuel supply; |

| • | market risks impacting the operation of our generating stations; |

| • | increases in competition in wholesale energy and capacity markets; |

| • | changes in technology related to energy generation, distribution and consumption and customer usage patterns; |

| • | economic downturns; |

| • | third-party credit risk relating to our sale of generation output and purchase of fuel; |

| • | adverse performance of our nuclear decommissioning and defined benefit plan trust fund investments and changes in funding requirements; |

| • | the impact of changes in state and federal legislation and regulations on our business, including PSE&G’s ability to recover costs and earn returns on authorized investments; |

| • | PSE&G’s proposed investment programs may not be fully approved by regulators and its capital investment may be lower than planned; |

| • | the impact on our New Jersey nuclear plants if such plants are not awarded Zero Emission Certificates (ZEC) in future periods, there is an adverse change in the amount of future ZEC payments, the ZEC program is overturned or modified through legal proceedings or if adverse changes are made to the capacity market construct; |

| • | adverse changes in energy industry laws, policies and regulations, including market structures and transmission planning; |

| • | the impact of state and federal actions aimed at combating climate change on our natural gas assets; |

| • | risks associated with our ownership and operation of nuclear facilities, including regulatory risks, such as compliance with the Atomic Energy Act and trade control, environmental and other regulations, as well as financial, environmental and health and safety risks; |

| • | changes in federal and state environmental regulations and enforcement; |

| • | delays in receipt of, or an inability to receive, necessary licenses and permits; |

| • | the impact of any future rate proceedings; |

| • | adverse outcomes of any legal, regulatory or other proceeding, settlement, investigation or claim applicable to us and/or the energy industry; |

| • | changes in tax laws and regulations; |

| • | the impact of our holding company structure on our ability to meet our corporate funding needs, service debt and pay dividends; |

| • | lack of growth or slower growth in the number of customers or changes in customer demand; |

| • | any inability of PSEG Power to meet its commitments under forward sale obligations; |

| • | reliance on transmission facilities that we do not own or control and the impact on our ability to maintain adequate transmission capacity; |

7

| • | any inability to successfully develop, obtain regulatory approval for, or construct generation, transmission and distribution projects; |

| • | any equipment failures, accidents, severe weather events or other incidents, including pandemics such as the ongoing coronavirus pandemic, that may impact our ability to provide safe and reliable service to our customers; |

| • | our inability to exercise control over the operations of generation facilities in which we do not maintain a controlling interest; |

| • | any inability to recover the carrying amount of our long-lived assets and leveraged leases; |

| • | any inability to maintain sufficient liquidity; |

| • | any inability to realize anticipated tax benefits or retain tax credits; |

| • | challenges associated with recruitment and/or retention of key executives and a qualified workforce; |

| • | the impact of our covenants in our debt instruments on our operations; |

| • | the impact of the ongoing coronavirus pandemic; |

| • | the impact of acts of war, terrorism, cybersecurity attacks or intrusions; and |

| • | failure to sell or otherwise dispose of all or a portion of PSEG Power’s non-nuclear generating fleet on terms that are favorable to us, or at all, or any delay of such transaction or transactions due to market conditions, the failure to satisfy conditions to closing or otherwise. |

All of the forward-looking statements made in this release are qualified by these cautionary statements and we cannot assure you that the results or developments anticipated by management will be realized or even if realized, will have the expected consequences to, or effects on, us or our business, prospects, financial condition, results of operations or cash flows. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this release apply only as of the date of this release. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even in light of new information or future events, unless otherwise required by applicable securities laws.

The forward-looking statements contained in this release are intended to qualify for the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

8

Attachment 1

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Consolidating Statements of Operations

(Unaudited, $ millions, except per share data)

| Three Months Ended September 30, 2020 | ||||||||||||||||

| PSEG | PSEG Enterprise/ Other (a) |

PSE&G | PSEG Power |

|||||||||||||

| OPERATING REVENUES |

$ | 2,370 | $ | (36 | ) | $ | 1,660 | $ | 746 | |||||||

| OPERATING EXPENSES |

||||||||||||||||

| Energy Costs |

775 | (178 | ) | 663 | 290 | |||||||||||

| Operation and Maintenance |

767 | 145 | 409 | 213 | ||||||||||||

| Depreciation and Amortization |

317 | 8 | 218 | 91 | ||||||||||||

| Gain on Asset Dispositions |

(122 | ) | — | — | (122 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Operating Expenses |

1,737 | (25 | ) | 1,290 | 472 | |||||||||||

| OPERATING INCOME |

633 | (11 | ) | 370 | 274 | |||||||||||

| Income from Equity Method Investments |

4 | — | — | 4 | ||||||||||||

| Net Gains (Losses) on Trust Investments |

107 | 3 | 1 | 103 | ||||||||||||

| Other Income (Deductions) |

39 | — | 28 | 11 | ||||||||||||

| Net Non-Operating Pension and OPEB Credits (Costs) |

62 | 3 | 51 | 8 | ||||||||||||

| Interest Expense |

(149 | ) | (24 | ) | (97 | ) | (28 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| INCOME (LOSS) BEFORE INCOME TAXES |

696 | (29 | ) | 353 | 372 | |||||||||||

| Income Tax Benefit (Expense) |

(121 | ) | 37 | (40 | ) | (118 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME |

$ | 575 | $ | 8 | $ | 313 | $ | 254 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reconciling Items Excluded from Net Income(b) |

(87 | ) | — | — | (87 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS (non-GAAP) |

$ | 488 | $ | 8 | $ | 313 | $ | 167 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings Per Share |

||||||||||||||||

| NET INCOME |

$ | 1.14 | $ | 0.02 | $ | 0.61 | $ | 0.51 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reconciling Items Excluded from Net Income(b) |

(0.18 | ) | — | — | (0.18 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS (non-GAAP) |

$ | 0.96 | $ | 0.02 | $ | 0.61 | $ | 0.33 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Three Months Ended September 30, 2019 | ||||||||||||||||

| PSEG | PSEG Enterprise/ Other (a) |

PSE&G | PSEG Power |

|||||||||||||

| OPERATING REVENUES |

$ | 2,302 | $ | (73 | ) | $ | 1,604 | $ | 771 | |||||||

| OPERATING EXPENSES |

||||||||||||||||

| Energy Costs |

753 | (224 | ) | 618 | 359 | |||||||||||

| Operation and Maintenance |

745 | 124 | 388 | 233 | ||||||||||||

| Depreciation and Amortization |

307 | 8 | 206 | 93 | ||||||||||||

| Loss on Asset Dispositions |

7 | — | — | 7 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Operating Expenses |

1,812 | (92 | ) | 1,212 | 692 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING INCOME |

490 | 19 | 392 | 79 | ||||||||||||

| Income from Equity Method Investments |

3 | — | — | 3 | ||||||||||||

| Net Gains (Losses) on Trust Investments |

(3 | ) | 1 | — | (4 | ) | ||||||||||

| Other Income (Deductions) |

35 | (2 | ) | 22 | 15 | |||||||||||

| Net Non-Operating Pension and OPEB Credits (Costs) |

55 | 1 | 46 | 8 | ||||||||||||

| Interest Expense |

(147 | ) | (21 | ) | (92 | ) | (34 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| INCOME (LOSS) BEFORE INCOME TAXES |

433 | (2 | ) | 368 | 67 | |||||||||||

| Income Tax Benefit (Expense) |

(30 | ) | 8 | (24 | ) | (14 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME |

$ | 403 | $ | 6 | $ | 344 | $ | 53 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reconciling Items Excluded from Net Income(b) |

92 | — | — | 92 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS (non-GAAP) |

$ | 495 | $ | 6 | $ | 344 | $ | 145 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings Per Share |

||||||||||||||||

| NET INCOME |

$ | 0.79 | $ | 0.01 | $ | 0.68 | $ | 0.10 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reconciling Items Excluded from Net Income(b) |

0.19 | — | — | 0.19 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS (non-GAAP) |

$ | 0.98 | $ | 0.01 | $ | 0.68 | $ | 0.29 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Includes activities at Energy Holdings, PSEG Long Island and the Parent as well as intercompany eliminations. |

| (b) | See Attachments 8 and 9 for details of items excluded from Net Income/(Loss) to compute Operating Earnings (non-GAAP). |

Attachment 2

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Consolidating Statements of Operations

(Unaudited, $ millions, except per share data)

| Nine Months Ended September 30, 2020 | ||||||||||||||||

| PSEG | PSEG Enterprise/ Other (a) |

PSE&G | PSEG Power |

|||||||||||||

| OPERATING REVENUES |

$ | 7,201 | $ | (447 | ) | $ | 4,999 | $ | 2,649 | |||||||

| OPERATING EXPENSES |

||||||||||||||||

| Energy Costs |

2,276 | (894 | ) | 1,881 | 1,289 | |||||||||||

| Operation and Maintenance |

2,254 | 400 | 1,175 | 679 | ||||||||||||

| Depreciation and Amortization |

956 | 23 | 657 | 276 | ||||||||||||

| Gain on Asset Dispositions |

(122 | ) | — | — | (122 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Operating Expenses |

5,364 | (471 | ) | 3,713 | 2,122 | |||||||||||

| OPERATING INCOME |

1,837 | 24 | 1,286 | 527 | ||||||||||||

| Income from Equity Method Investments |

10 | — | — | 10 | ||||||||||||

| Net Gains (Losses) on Trust Investments |

87 | 6 | 2 | 79 | ||||||||||||

| Other Income (Deductions) |

81 | — | 81 | — | ||||||||||||

| Non-Operating Pension and OPEB Credits (Costs) |

186 | 7 | 154 | 25 | ||||||||||||

| Interest Expense |

(453 | ) | (70 | ) | (291 | ) | (92 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| INCOME (LOSS) BEFORE INCOME TAXES |

1,748 | (33 | ) | 1,232 | 549 | |||||||||||

| Income Tax Benefit (Expense) |

(274 | ) | 34 | (196 | ) | (112 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME |

$ | 1,474 | $ | 1 | $ | 1,036 | $ | 437 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reconciling Items Excluded from Net Income (b) |

(62 | ) | — | — | (62 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS (non-GAAP) |

$ | 1,412 | $ | 1 | $ | 1,036 | $ | 375 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings Per Share |

||||||||||||||||

| NET INCOME |

$ | 2.91 | $ | — | $ | 2.04 | $ | 0.87 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reconciling Items Excluded from Net Income (b) |

(0.13 | ) | — | — | (0.13 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS (non-GAAP) |

$ | 2.78 | $ | — | $ | 2.04 | $ | 0.74 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Nine Months Ended September 30, 2019 | ||||||||||||||||

| PSEG | PSEG Enterprise/ Other (a) |

PSE&G | PSEG Power |

|||||||||||||

| OPERATING REVENUES |

$ | 7,598 | $ | (690 | ) | $ | 5,018 | $ | 3,270 | |||||||

| OPERATING EXPENSES |

||||||||||||||||

| Energy Costs |

2,581 | (1,069 | ) | 2,094 | 1,556 | |||||||||||

| Operation and Maintenance |

2,251 | 350 | 1,165 | 736 | ||||||||||||

| Depreciation and Amortization |

928 | 26 | 620 | 282 | ||||||||||||

| Loss on Asset Dispositions |

402 | — | — | 402 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Operating Expenses |

6,162 | (693 | ) | 3,879 | 2,976 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING INCOME |

1,436 | 3 | 1,139 | 294 | ||||||||||||

| Income from Equity Method Investments |

10 | — | — | 10 | ||||||||||||

| Net Gains (Losses) on Trust Investments |

164 | 3 | 1 | 160 | ||||||||||||

| Other Income (Deductions) |

101 | (2 | ) | 60 | 43 | |||||||||||

| Non-Operating Pension and OPEB Credits (Costs) |

121 | 2 | 105 | 14 | ||||||||||||

| Interest Expense |

(417 | ) | (64 | ) | (268 | ) | (85 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| INCOME (LOSS) BEFORE INCOME TAXES |

1,415 | (58 | ) | 1,037 | 436 | |||||||||||

| Income Tax Benefit (Expense) |

(159 | ) | 31 | (63 | ) | (127 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME (LOSS) |

$ | 1,256 | $ | (27 | ) | $ | 974 | $ | 309 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reconciling Items Excluded from Net Income (Loss) (b) |

80 | 32 | — | 48 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS (non-GAAP) |

$ | 1,336 | $ | 5 | $ | 974 | $ | 357 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings Per Share |

||||||||||||||||

| NET INCOME (LOSS) |

$ | 2.47 | $ | (0.06 | ) | $ | 1.92 | $ | 0.61 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reconciling Items Excluded from Net Income (Loss) (b) |

0.17 | 0.07 | — | 0.10 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS (non-GAAP) |

$ | 2.64 | $ | 0.01 | $ | 1.92 | $ | 0.71 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Includes activities at Energy Holdings, PSEG Long Island and the Parent as well as intercompany eliminations. |

| (b) | See Attachments 8 and 9 for details of items excluded from Net Income/(Loss) to compute Operating Earnings (non-GAAP). |

Attachment 3

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Capitalization Schedule

(Unaudited, $ millions)

| September 30, | December 31, | |||||||

| 2020 | 2019 | |||||||

| DEBT |

||||||||

| Commercial Paper and Loans |

$ | 300 | $ | 1,115 | ||||

| Long-Term Debt* |

16,885 | 15,108 | ||||||

|

|

|

|

|

|||||

| Total Debt |

17,185 | 16,223 | ||||||

| STOCKHOLDERS’ EQUITY |

||||||||

| Common Stock |

5,016 | 5,003 | ||||||

| Treasury Stock |

(863 | ) | (831 | ) | ||||

| Retained Earnings |

12,135 | 11,406 | ||||||

| Accumulated Other Comprehensive Loss |

(452 | ) | (489 | ) | ||||

|

|

|

|

|

|||||

| Total Stockholders’ Equity |

15,836 | 15,089 | ||||||

|

|

|

|

|

|||||

| Total Capitalization |

$ | 33,021 | $ | 31,312 | ||||

|

|

|

|

|

|||||

| * | Includes current portion of Long-Term Debt |

Attachment 4

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, $ millions)

| Nine Months Ended September 30, | ||||||||

| 2020 | 2019 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES |

||||||||

| Net Income |

$ | 1,474 | $ | 1,256 | ||||

| Adjustments to Reconcile Net Income to Net Cash Flows From Operating Activities |

1,043 | 1,453 | ||||||

|

|

|

|

|

|||||

| NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES |

2,517 | 2,709 | ||||||

|

|

|

|

|

|||||

| NET CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES |

(1,855 | ) | (2,359 | ) | ||||

|

|

|

|

|

|||||

| NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES |

161 | (393 | ) | |||||

|

|

|

|

|

|||||

| Net Change in Cash, Cash Equivalents and Restricted Cash |

823 | (43 | ) | |||||

| Cash, Cash Equivalents and Restricted Cash at Beginning of Period |

176 | 199 | ||||||

|

|

|

|

|

|||||

| Cash, Cash Equivalents and Restricted Cash at End of Period |

$ | 999 | $ | 156 | ||||

|

|

|

|

|

|||||

Attachment 5

PUBLIC SERVICE ELECTRIC & GAS COMPANY

Retail Sales

(Unaudited)

September 30, 2020

Electric Sales

| Three Months | Change vs. | Nine Months | Change vs. | |||||||||

| Sales (millions kWh) |

Ended | 2019 | Ended | 2019 | ||||||||

| Residential |

5,014 | 9% | 11,127 | 5% | ||||||||

| Commercial & Industrial |

7,088 | (5%) | 19,124 | (7%) | ||||||||

| Other |

74 | 0% | 248 | 1% | ||||||||

|

|

|

|

|

|||||||||

| Total | 12,176 | 0% | 30,499 | (3%) | ||||||||

|

|

|

|

|

|||||||||

Gas Sold and Transported

| Three Months | Change vs. | Nine Months | Change vs. | |||||||||||||

| Sales (millions therms) |

Ended | 2019 | Ended | 2019 | ||||||||||||

| Firm Sales |

||||||||||||||||

| Residential Sales |

95 | 4% | 970 | (6%) | ||||||||||||

| Commercial & Industrial |

90 | (16%) | 674 | (12%) | ||||||||||||

|

|

|

|

|

|||||||||||||

| Total Firm Sales |

185 | (7%) | 1,644 | (9%) | ||||||||||||

|

|

|

|

|

|||||||||||||

| Non-Firm Sales* |

||||||||||||||||

| Commercial & Industrial |

319 | (23%) | 689 | (30%) | ||||||||||||

|

|

|

|

|

|||||||||||||

| Total Non-Firm Sales |

319 | 689 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Total Sales |

504 | (17%) | 2,333 | (16%) | ||||||||||||

|

|

|

|

|

|||||||||||||

| * | Contract Service Gas rate included in non-firm sales |

Weather Data

| Three Months | Change vs. | Nine Months | Change vs. | |||||||||

| Ended | 2019 | Ended | 2019 | |||||||||

| THI Hours - Actual |

14,366 | 7% | 18,420 | 7% | ||||||||

| THI Hours - Normal |

12,207 | 16,372 | ||||||||||

| Degree Days - Actual |

2,746 | (8%) | ||||||||||

| Degree Days - Normal |

3,072 | |||||||||||

Attachment 6

PSEG POWER LLC

Generation Measures(1)

(Unaudited)

| GWhr Breakdown | GWhr Breakdown | |||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Nuclear - NJ |

5,487 | 5,028 | 15,491 | 14,595 | ||||||||||||

| Nuclear - PA |

2,700 | 2,752 | 8,512 | 8,545 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Nuclear |

8,187 | 7,780 | 24,003 | 23,140 | ||||||||||||

| Fossil - Natural Gas - NJ |

3,008 | 3,651 | 6,678 | 8,526 | ||||||||||||

| Fossil - Natural Gas - NY |

1,478 | 1,357 | 3,636 | 3,305 | ||||||||||||

| Fossil - Natural Gas - MD |

1,276 | 1,266 | 3,732 | 3,488 | ||||||||||||

| Fossil - Natural Gas - CT |

956 | 978 | 2,786 | 1,185 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Natural Gas(2) |

6,718 | 7,252 | 16,832 | 16,504 | ||||||||||||

| Fossil - Coal |

(2 | ) | 1,249 | (16 | ) | 3,867 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 14,903 | 16,281 | 40,819 | 43,511 | |||||||||||||

| % Generation by Fuel Type | % Generation by Fuel Type | |||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Nuclear - NJ |

37 | % | 31 | % | 38 | % | 33 | % | ||||||||

| Nuclear - PA |

18 | % | 17 | % | 21 | % | 20 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Nuclear |

55 | % | 48 | % | 59 | % | 53 | % | ||||||||

| Fossil - Natural Gas - NJ |

20 | % | 22 | % | 16 | % | 19 | % | ||||||||

| Fossil - Natural Gas - NY |

10 | % | 8 | % | 9 | % | 8 | % | ||||||||

| Fossil - Natural Gas - MD |

9 | % | 8 | % | 9 | % | 8 | % | ||||||||

| Fossil - Natural Gas - CT |

6 | % | 6 | % | 7 | % | 3 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Natural Gas(2) |

45 | % | 44 | % | 41 | % | 38 | % | ||||||||

| Fossil - Coal | 0 | % | 8 | % | 0 | % | 9 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 100 | % | 100 | % | 100 | % | 100 | % | |||||||||

| (1) | Indicates Period Net Generation, negative value reflects more GWh required to operate plants than were generated. Excludes Solar and Kalaeloa. |

| (2) | Includes several units that are dual fuel for oil. |

Attachment 7

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Statistical Measures

(Unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Weighted Average Common Shares Outstanding (millions) |

||||||||||||||||

| Basic |

504 | 504 | 504 | 504 | ||||||||||||

| Diluted |

507 | 507 | 507 | 507 | ||||||||||||

| Stock Price at End of Period |

$ | 54.91 | $ | 62.08 | ||||||||||||

| Dividends Paid per Share of Common Stock |

$ | 0.49 | $ | 0.47 | $ | 1.47 | $ | 1.41 | ||||||||

| Dividend Yield |

3.6 | % | 3.0 | % | ||||||||||||

| Book Value per Common Share |

$ | 31.43 | $ | 29.62 | ||||||||||||

| Market Price as a Percent of Book Value |

175 | % | 210 | % | ||||||||||||

Attachment 8

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Consolidated Operating Earnings (non-GAAP) Reconciliation

| Reconciling Items | Three Months Ended | Nine Months Ended | ||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| ($ millions, Unaudited) | ||||||||||||||||

| Net Income |

$ | 575 | $ | 403 | $ | 1,474 | $ | 1,256 | ||||||||

| (Gain) Loss on Nuclear Decommissioning Trust (NDT) Fund Related Activity, pre-tax (PSEG Power) |

(100 | ) | 4 | (73 | ) | (164 | ) | |||||||||

| (Gain) Loss on Mark-to-Market (MTM), pre-tax (a) (PSEG Power) |

82 | 121 | 82 | (195 | ) | |||||||||||

| Plant Retirements and Dispositions, pre-tax (PSEG Power) |

(122 | ) | 7 | (122 | ) | 402 | ||||||||||

| Oil Lower of Cost or Market (LOCOM) adjustment, pre-tax (PSEG Power) |

— | — | 11 | — | ||||||||||||

| Lease Related Activity, pre-tax (PSEG Enterprise/Other) |

— | — | — | 58 | ||||||||||||

| Income Taxes related to Operating Earnings (non-GAAP) reconciling items(b) |

53 | (40 | ) | 40 | (21 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating Earnings (non-GAAP) |

$ | 488 | $ | 495 | $ | 1,412 | $ | 1,336 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| PSEG Fully Diluted Average Shares Outstanding (in millions) |

507 | 507 | 507 | 507 | ||||||||||||

| ($ Per Share Impact - Diluted, Unaudited) | ||||||||||||||||

| Net Income |

$ | 1.14 | $ | 0.79 | $ | 2.91 | $ | 2.47 | ||||||||

| (Gain) Loss on NDT Fund Related Activity, pre-tax (PSEG Power) |

(0.20 | ) | 0.01 | (0.15 | ) | (0.32 | ) | |||||||||

| (Gain) Loss on MTM, pre-tax (a) (PSEG Power) |

0.16 | 0.24 | 0.16 | (0.38 | ) | |||||||||||

| Plant Retirements and Dispositions, pre-tax (PSEG Power) |

(0.24 | ) | 0.01 | (0.24 | ) | 0.79 | ||||||||||

| Oil LOCOM adjustment, pre-tax (PSEG Power) |

— | — | 0.02 | — | ||||||||||||

| Lease Related Activity, pre-tax (PSEG Enterprise/Other) |

— | — | — | 0.11 | ||||||||||||

| Income Taxes related to Operating Earnings (non-GAAP) reconciling items(b) |

0.10 | (0.07 | ) | 0.08 | (0.03 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating Earnings (non-GAAP) |

$ | 0.96 | $ | 0.98 | $ | 2.78 | $ | 2.64 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Includes the financial impact from positions with forward delivery months. |

| (b) | Income tax effect calculated at the statutory rate except for lease related activity which is calculated at a combined leveraged lease effective tax rate, and NDT related activity which is calculated at the statutory rate plus a 20% tax on income (loss) from qualified NDT funds. |

Attachment 9

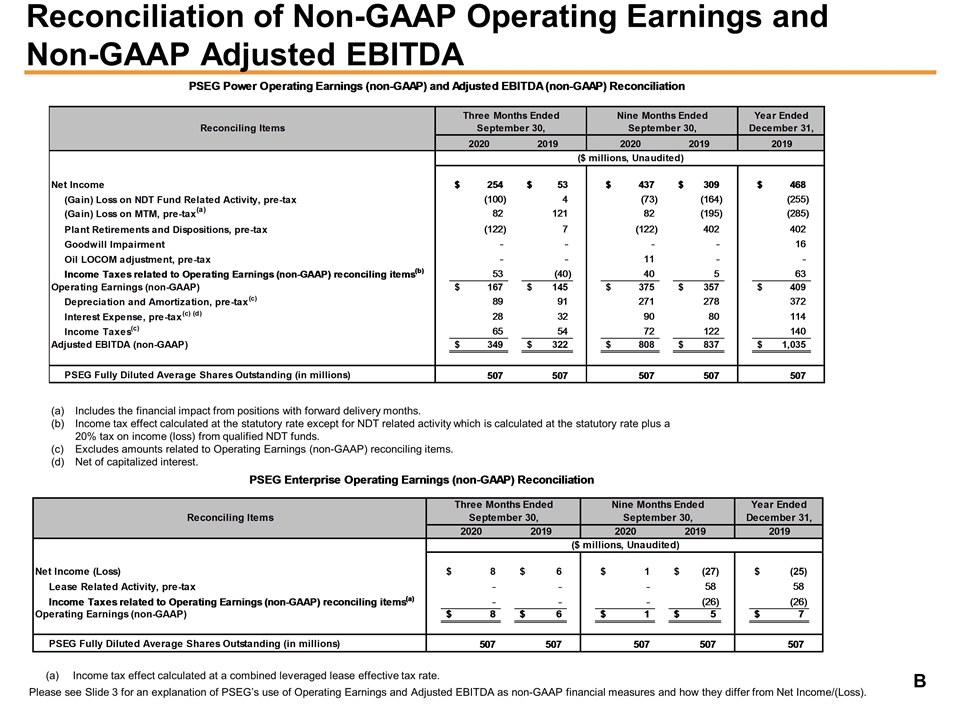

PSEG Power Operating Earnings (non-GAAP) and Adjusted EBITDA (non-GAAP) Reconciliation

| Reconciling Items | Three Months Ended | Nine Months Ended | ||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| ($ millions, Unaudited) | ||||||||||||||||

| Net Income |

$ | 254 | $ | 53 | $ | 437 | $ | 309 | ||||||||

| (Gain) Loss on NDT Fund Related Activity, pre-tax |

(100 | ) | 4 | (73 | ) | (164 | ) | |||||||||

| (Gain) Loss on MTM, pre-tax (a) |

82 | 121 | 82 | (195 | ) | |||||||||||

| Plant Retirements and Dispositions, pre-tax |

(122 | ) | 7 | (122 | ) | 402 | ||||||||||

| Oil LOCOM adjustment, pre-tax |

— | — | 11 | — | ||||||||||||

| Income Taxes related to Operating Earnings (non-GAAP) reconciling items(b) |

53 | (40 | ) | 40 | 5 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating Earnings (non-GAAP) |

$ | 167 | $ | 145 | $ | 375 | $ | 357 | ||||||||

| Depreciation and Amortization, pre-tax (c) |

89 | 91 | 271 | 278 | ||||||||||||

| Interest Expense, pre-tax (c) (d) |

28 | 32 | 90 | 80 | ||||||||||||

| Income Taxes (c) |

65 | 54 | 72 | 122 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA (non-GAAP) |

$ | 349 | $ | 322 | $ | 808 | $ | 837 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| PSEG Fully Diluted Average Shares Outstanding (in millions) |

507 | 507 | 507 | 507 | ||||||||||||

| (a) | Includes the financial impact from positions with forward delivery months. |

| (b) | Income tax effect calculated at the statutory rate except for NDT related activity which is calculated at the statutory rate plus a 20% tax on income (loss) from qualified NDT funds. |

| (c) | Excludes amounts related to Operating Earnings (non-GAAP) reconciling items. |

| (d) | Net of capitalized interest. |

PSEG Enterprise/Other

Operating Earnings (non-GAAP) Reconciliation

| Reconciling Items | Three Months Ended | Nine Months Ended | ||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| ($ millions, Unaudited) | ||||||||||||||||

| Net Income (Loss) |

$ | 8 | $ | 6 | $ | 1 | $ | (27 | ) | |||||||

| Lease Related Activity, pre-tax |

— | — | — | 58 | ||||||||||||

| Income Taxes related to Lease related activity(a) |

— | — | — | (26 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating Earnings (non-GAAP) |

$ | 8 | $ | 6 | $ | 1 | $ | 5 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| PSEG Fully Diluted Average Shares Outstanding (in millions) |

507 | 507 | 507 | 507 | ||||||||||||

| (a) | Income tax effect calculated at a combined leveraged lease effective tax rate. |

Public Service Enterprise Group PSEG Earnings Conference Call 3rd Quarter 2020 October 30, 2020 EXHIBIT 99.1

Certain of the matters discussed in this presentation about our and our subsidiaries’ future performance, including, without limitation, future revenues, earnings, strategies, prospects, consequences and all other statements that are not purely historical constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from those anticipated. Such statements are based on management’s beliefs as well as assumptions made by and information currently available to management. When used herein, the words “anticipate,” “intend,” “estimate,” “believe,” “expect,” “plan,” “should,” “hypothetical,” “potential,” “forecast,” “project,” variations of such words and similar expressions are intended to identify forward-looking statements. Factors that may cause actual results to differ are often presented with the forward-looking statements themselves. Other factors that could cause actual results to differ materially from those contemplated in any forward-looking statements made by us herein are discussed in filings we make with the United States Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K and subsequent reports on Form 10-Q and Form 8-K. These factors include, but are not limited to: fluctuations in wholesale power and natural gas markets, including the potential impacts on the economic viability of our generation units; our ability to obtain adequate fuel supply; market risks impacting the operation of our generating stations; increases in competition in wholesale energy and capacity markets; changes in technology related to energy generation, distribution and consumption and customer usage patterns; economic downturns; third-party credit risk relating to our sale of generation output and purchase of fuel; adverse performance of our nuclear decommissioning and defined benefit plan trust fund investments and changes in funding requirements; the impact of changes in state and federal legislation and regulations on our business, including PSE&G’s ability to recover costs and earn returns on authorized investments; PSE&G’s proposed investment programs may not be fully approved by regulators and its capital investment may be lower than planned; the impact on our New Jersey nuclear plants if such plants are not awarded Zero Emission Certificates (ZEC) in future periods, there is an adverse change in the amount of future ZEC payments, the ZEC program is overturned or modified through legal proceedings or if adverse changes are made to the capacity market construct; adverse changes in energy industry laws, policies and regulations, including market structures and transmission planning; the impact of state and federal actions aimed at combating climate change on our natural gas assets; risks associated with our ownership and operation of nuclear facilities, including regulatory risks, such as compliance with the Atomic Energy Act and trade control, environmental and other regulations, as well as financial, environmental and health and safety risks; changes in federal and state environmental regulations and enforcement; delays in receipt of, or an inability to receive, necessary licenses and permits; the impact of any future rate proceedings; adverse outcomes of any legal, regulatory or other proceeding, settlement, investigation or claim applicable to us and/or the energy industry; changes in tax laws and regulations; the impact of our holding company structure on our ability to meet our corporate funding needs, service debt and pay dividends; lack of growth or slower growth in the number of customers or changes in customer demand; any inability of PSEG Power to meet its commitments under forward sale obligations; reliance on transmission facilities that we do not own or control and the impact on our ability to maintain adequate transmission capacity; any inability to successfully develop, obtain regulatory approval for, or construct generation, transmission and distribution projects; any equipment failures, accidents, severe weather events or other incidents, including pandemics such as the ongoing coronavirus pandemic, that may impact our ability to provide safe and reliable service to our customers; our inability to exercise control over the operations of generation facilities in which we do not maintain a controlling interest; any inability to recover the carrying amount of our long-lived assets and leveraged leases; any inability to maintain sufficient liquidity; any inability to realize anticipated tax benefits or retain tax credits; challenges associated with recruitment and/or retention of key executives and a qualified workforce; the impact of our covenants in our debt instruments on our operations; the impact of the ongoing coronavirus pandemic; the impact of acts of war, terrorism, cybersecurity attacks or intrusions; and failure to sell or otherwise dispose of all or a portion of PSEG Power’s non-nuclear generating fleet on terms that are favorable to us, or at all, or any delay of such transaction or transactions due to market conditions, the failure to satisfy conditions to closing or otherwise. All of the forward-looking statements made in this presentation are qualified by these cautionary statements and we cannot assure you that the results or developments anticipated by management will be realized or even if realized, will have the expected consequences to, or effects on, us or our business, prospects, financial condition, results of operations or cash flows. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this presentation apply only as of the date of this presentation. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even in light of new information or future events, unless otherwise required by applicable securities laws. The forward-looking statements contained in this presentation are intended to qualify for the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-Looking Statements

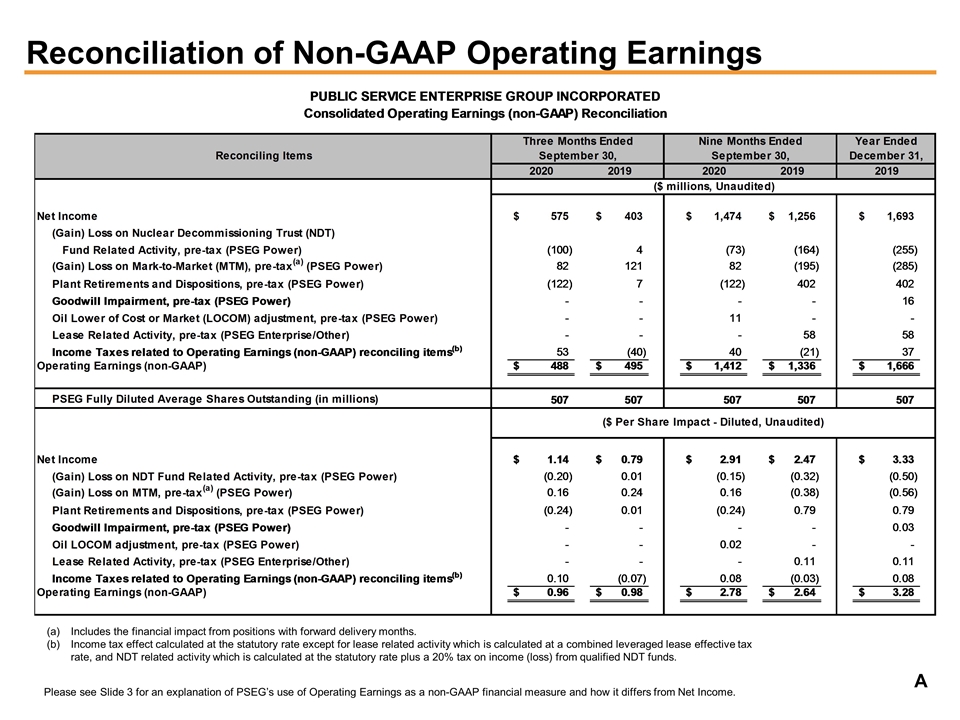

PSEG presents Operating Earnings and Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) in addition to its Net Income reported in accordance with accounting principles generally accepted in the United States (GAAP). Operating Earnings and Adjusted EBITDA are non-GAAP financial measures that differ from Net Income. Non-GAAP Operating Earnings exclude the impact of returns (losses) associated with the Nuclear Decommissioning Trust (NDT), Mark-to-Market (MTM) accounting and material one-time items. Non-GAAP Adjusted EBITDA excludes the same items as our non-GAAP Operating Earnings measure as well as income tax expense, interest expense and depreciation and amortization. The last two slides in this presentation (Slides A and B) include a list of items excluded from Net Income/(Loss) to reconcile to non-GAAP Operating Earnings and non-GAAP Adjusted EBITDA with a reference to those slides included on each of the slides where the non-GAAP information appears. Management uses non-GAAP Operating Earnings in its internal analysis, and in communications with investors and analysts, as a consistent measure for comparing PSEG’s financial performance to previous financial results. Management believes non-GAAP Adjusted EBITDA is useful to investors and other users of our financial statements in evaluating operating performance because it provides them with an additional tool to compare business performance across companies and across periods. Management also believes that non-GAAP Adjusted EBITDA is widely used by investors to measure operating performance without regard to items such as income tax expense, interest expense and depreciation and amortization, which can vary substantially from company to company depending upon, among other things, the book value of assets, capital structure and whether assets were constructed or acquired. Non-GAAP Adjusted EBITDA also allows investors and other users to assess the underlying financial performance of our fleet before management’s decision to deploy capital. The presentation of non-GAAP Operating Earnings and non-GAAP Adjusted EBITDA is intended to complement, and should not be considered an alternative to, the presentation of Net Income/(Loss), which is an indicator of financial performance determined in accordance with GAAP. In addition, non-GAAP Operating Earnings and non-GAAP Adjusted EBITDA as presented in this release may not be comparable to similarly titled measures used by other companies. Due to the forward looking nature of non-GAAP Operating Earnings and non-GAAP Adjusted EBITDA guidance, PSEG is unable to reconcile these non-GAAP financial measures to the most directly comparable GAAP financial measure. Management is unable to project certain reconciling items, in particular MTM and NDT gains (losses), for future periods due to market volatility. GAAP Disclaimer From time to time, PSEG, PSE&G and PSEG Power release important information via postings on their corporate Investor Relations website at https://investor.pseg.com. Investors and other interested parties are encouraged to visit the Investor Relations website to review new postings. You can also use the “Email Alerts” link at https://investor.pseg.com to sign-up for automatic email alerts regarding new postings.

PSEG Q3 2020 Review Ralph Izzo Chairman, President and Chief Executive Officer

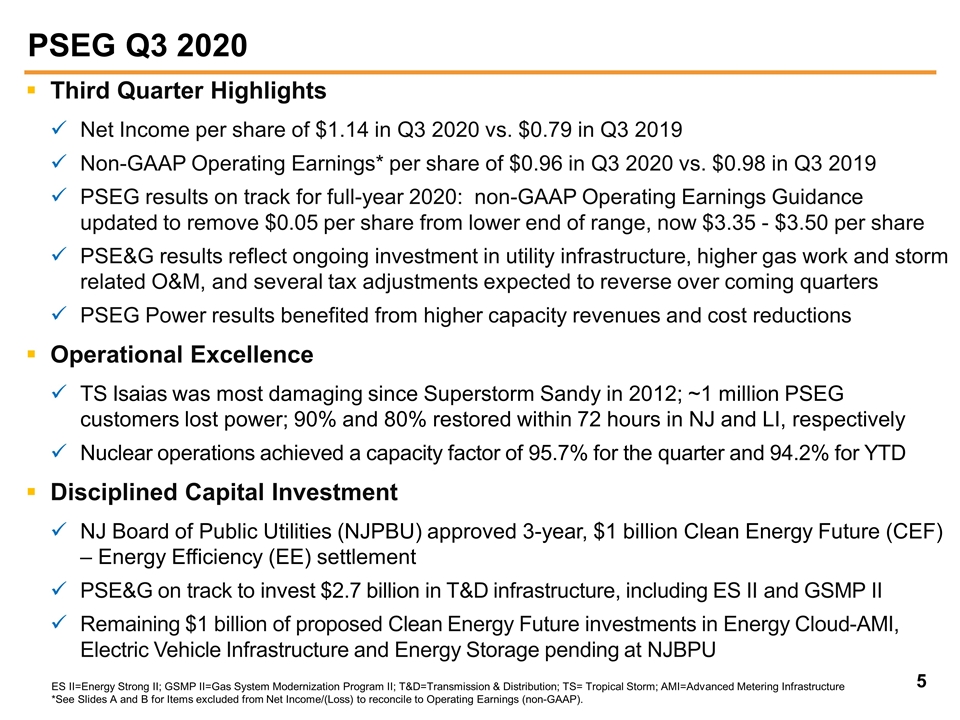

PSEG Q3 2020 Third Quarter Highlights Net Income per share of $1.14 in Q3 2020 vs. $0.79 in Q3 2019 Non-GAAP Operating Earnings* per share of $0.96 in Q3 2020 vs. $0.98 in Q3 2019 PSEG results on track for full-year 2020: non-GAAP Operating Earnings Guidance updated to remove $0.05 per share from lower end of range, now $3.35 - $3.50 per share PSE&G results reflect ongoing investment in utility infrastructure, higher gas work and storm related O&M, and several tax adjustments expected to reverse over coming quarters PSEG Power results benefited from higher capacity revenues and cost reductions Operational Excellence TS Isaias was most damaging since Superstorm Sandy in 2012; ~1 million PSEG customers lost power; 90% and 80% restored within 72 hours in NJ and LI, respectively Nuclear operations achieved a capacity factor of 95.7% for the quarter and 94.2% for YTD Disciplined Capital Investment NJ Board of Public Utilities (NJPBU) approved 3-year, $1 billion Clean Energy Future (CEF) – Energy Efficiency (EE) settlement PSE&G on track to invest $2.7 billion in T&D infrastructure, including ES II and GSMP II Remaining $1 billion of proposed Clean Energy Future investments in Energy Cloud-AMI, Electric Vehicle Infrastructure and Energy Storage pending at NJBPU ES II=Energy Strong II; GSMP II=Gas System Modernization Program II; T&D=Transmission & Distribution; TS= Tropical Storm; AMI=Advanced Metering Infrastructure *See Slides A and B for Items excluded from Net Income/(Loss) to reconcile to Operating Earnings (non-GAAP).

Raising the low end of guidance to reflect strong cost control at PSEG Power and overall results through the first three quarters Non-GAAP Operating Earnings* Contribution by Subsidiary 2019 Actual and 2020E Guidance *See Slides A and B for Items excluded from Net Income/(Loss) to reconcile to Operating Earnings (non-GAAP). **Based on the mid-point of 2020 non-GAAP Operating Earnings guidance of $3.35 - $3.50 per share. E = Estimate. $3.35 - $3.50E PSEG Updating 2020 Full-Year Guidance and Adjusting Subsidiary Contribution Ranges

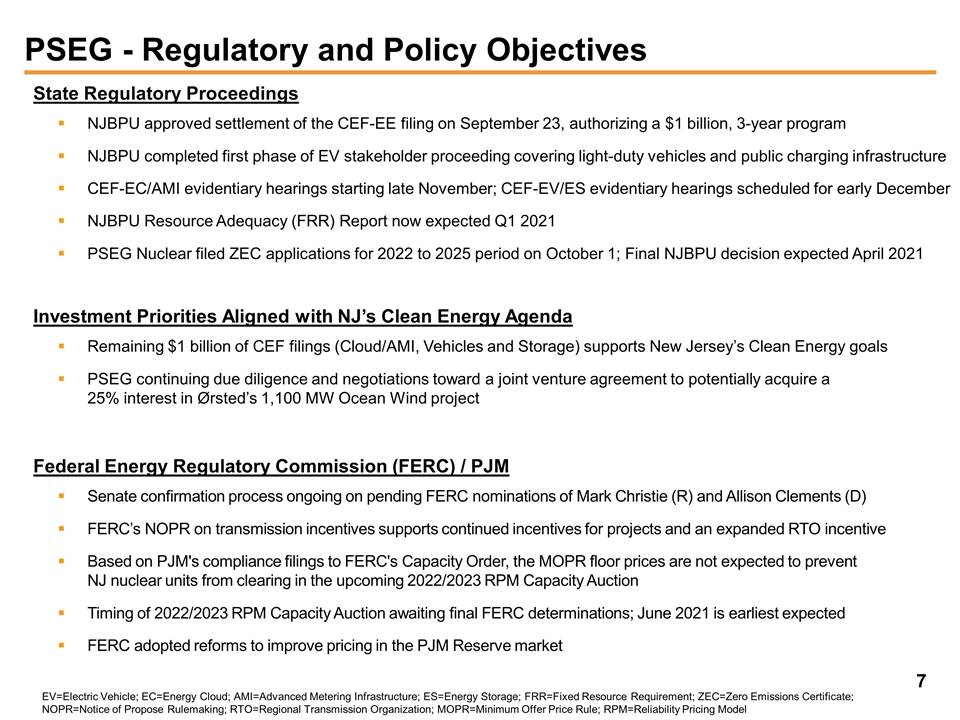

PSEG - Regulatory and Policy Objectives State Regulatory Proceedings NJBPU approved settlement of the CEF-EE filing on September 23, authorizing a $1 billion, 3-year program NJBPU completed first phase of EV stakeholder proceeding covering light-duty vehicles and public charging infrastructure CEF-EC/AMI evidentiary hearings starting late November; CEF-EV/ES evidentiary hearings scheduled for early December NJBPU Resource Adequacy (FRR) Report now expected Q1 2021 PSEG Nuclear filed ZEC applications for 2022 to 2025 period on October 1; Final NJBPU decision expected April 2021 Investment Priorities Aligned with NJ’s Clean Energy Agenda Remaining $1 billion of CEF filings (Cloud/AMI, Vehicles and Storage) supports New Jersey’s Clean Energy goals PSEG continuing due diligence and negotiations toward a joint venture agreement to potentially acquire a 25% interest in Ørsted’s 1,100 MW Ocean Wind project Federal Energy Regulatory Commission (FERC) / PJM Senate confirmation process ongoing on pending FERC nominations of Mark Christie (R) and Allison Clements (D) FERC’s NOPR on transmission incentives supports continued incentives for projects and an expanded RTO incentive Based on PJM's compliance filings to FERC's Capacity Order, the MOPR floor prices are not expected to prevent NJ nuclear units from clearing in the upcoming 2022/2023 RPM Capacity Auction Timing of 2022/2023 RPM Capacity Auction awaiting final FERC determinations; June 2021 is earliest expected FERC adopted reforms to improve pricing in the PJM Reserve market EV=Electric Vehicle; EC=Energy Cloud; AMI=Advanced Metering Infrastructure; ES=Energy Storage; FRR=Fixed Resource Requirement; ZEC=Zero Emissions Certificate; NOPR=Notice of Propose Rulemaking; RTO=Regional Transmission Organization; MOPR=Minimum Offer Price Rule; RPM=Reliability Pricing Model

PSEG Q3 2020 Operating Company Review Dan Cregg EVP and Chief Financial Officer

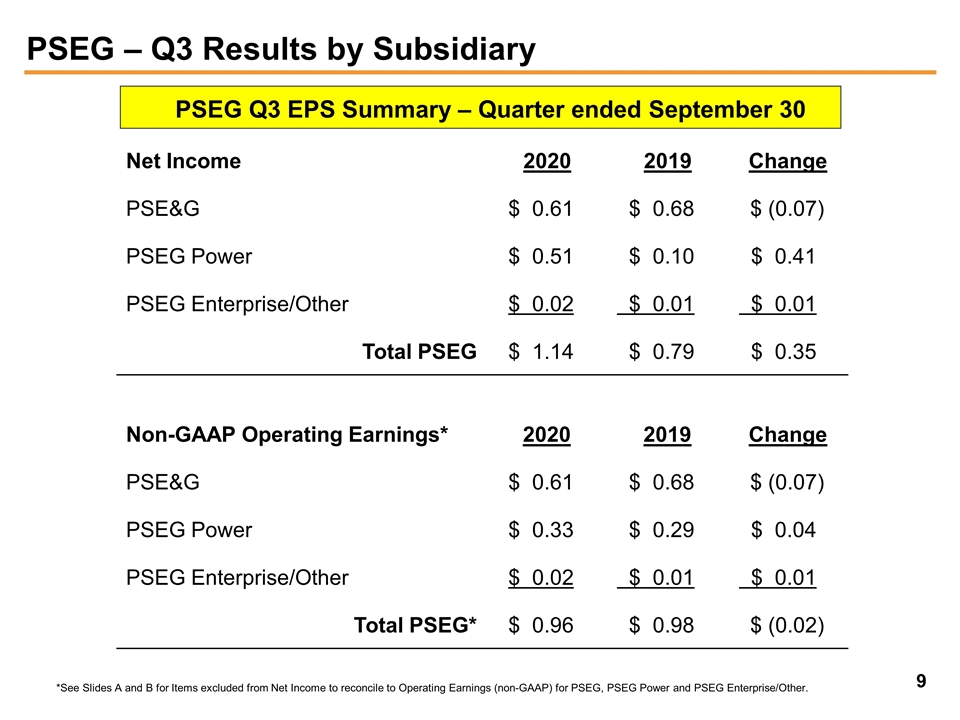

PSEG – Q3 Results by Subsidiary Net Income 2020 2019 Change PSE&G $ 0.61 $ 0.68 $ (0.07) PSEG Power $ 0.51 $ 0.10 $ 0.41 PSEG Enterprise/Other $ 0.02 $ 0.01 $ 0.01 Total PSEG $ 1.14 $ 0.79 $ 0.35 Non-GAAP Operating Earnings* 2020 2019 Change PSE&G $ 0.61 $ 0.68 $ (0.07) PSEG Power $ 0.33 $ 0.29 $ 0.04 PSEG Enterprise/Other $ 0.02 $ 0.01 $ 0.01 Total PSEG* $ 0.96 $ 0.98 $ (0.02) *See Slides A and B for Items excluded from Net Income to reconcile to Operating Earnings (non-GAAP) for PSEG, PSEG Power and PSEG Enterprise/Other. PSEG Q3 EPS Summary – Quarter ended September 30

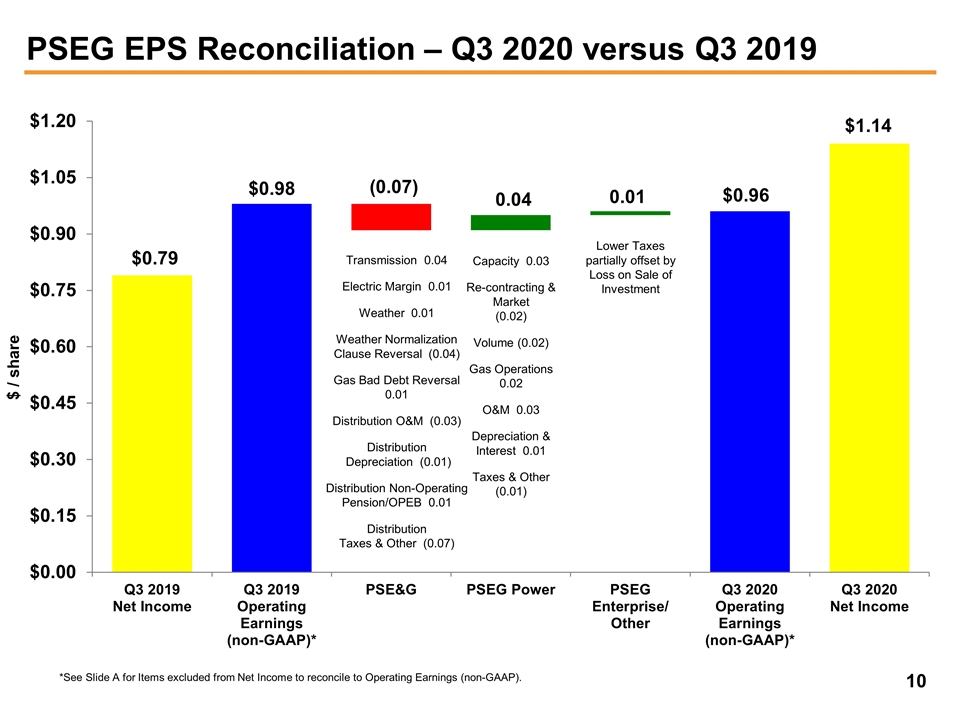

$ / share PSEG EPS Reconciliation – Q3 2020 versus Q3 2019 Capacity 0.03 Re-contracting & Market (0.02) Volume (0.02) Gas Operations 0.02 O&M 0.03 Depreciation & Interest 0.01 Taxes & Other (0.01) Transmission 0.04 Electric Margin 0.01 Weather 0.01 Weather Normalization Clause Reversal (0.04) Gas Bad Debt Reversal 0.01 Distribution O&M (0.03) Distribution Depreciation (0.01) Distribution Non-Operating Pension/OPEB 0.01 Distribution Taxes & Other (0.07) Lower Taxes partially offset by Loss on Sale of Investment *See Slide A for Items excluded from Net Income to reconcile to Operating Earnings (non-GAAP).

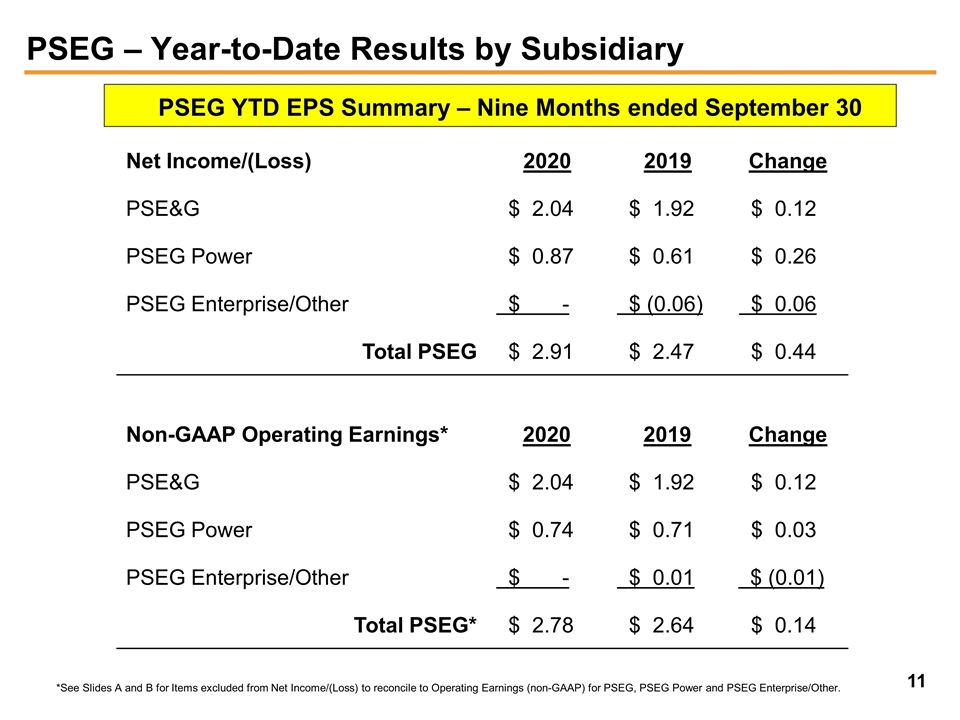

PSEG – Year-to-Date Results by Subsidiary Net Income/(Loss) 2020 2019 Change PSE&G $ 2.04 $ 1.92 $ 0.12 PSEG Power $ 0.87 $ 0.61 $ 0.26 PSEG Enterprise/Other $ - $ (0.06) $ 0.06 Total PSEG $ 2.91 $ 2.47 $ 0.44 Non-GAAP Operating Earnings* 2020 2019 Change PSE&G $ 2.04 $ 1.92 $ 0.12 PSEG Power $ 0.74 $ 0.71 $ 0.03 PSEG Enterprise/Other $ - $ 0.01 $ (0.01) Total PSEG* $ 2.78 $ 2.64 $ 0.14 *See Slides A and B for Items excluded from Net Income/(Loss) to reconcile to Operating Earnings (non-GAAP) for PSEG, PSEG Power and PSEG Enterprise/Other. PSEG YTD EPS Summary – Nine Months ended September 30

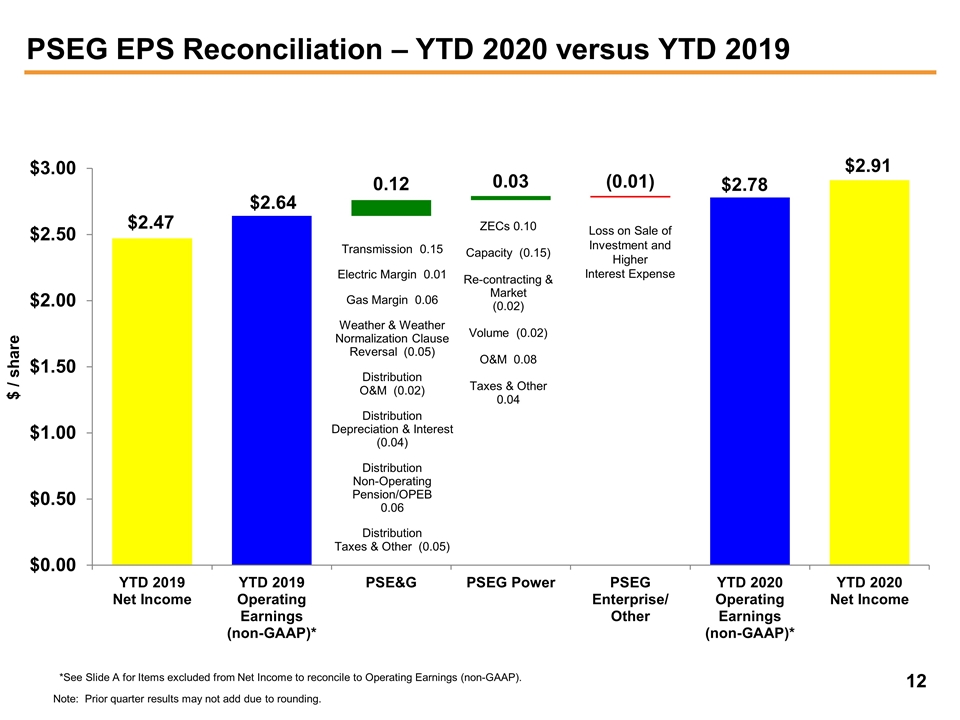

$ / share PSEG EPS Reconciliation – YTD 2020 versus YTD 2019 ZECs 0.10 Capacity (0.15) Re-contracting & Market (0.02) Volume (0.02) O&M 0.08 Taxes & Other 0.04 Transmission 0.15 Electric Margin 0.01 Gas Margin 0.06 Weather & Weather Normalization Clause Reversal (0.05) Distribution O&M (0.02) Distribution Depreciation & Interest (0.04) Distribution Non-Operating Pension/OPEB 0.06 Distribution Taxes & Other (0.05) Loss on Sale of Investment and Higher Interest Expense *See Slide A for Items excluded from Net Income to reconcile to Operating Earnings (non-GAAP). Note: Prior quarter results may not add due to rounding.

PSE&G Q3 2020 Review

$ / share PSE&G EPS Reconciliation – Q3 2020versus Q3 2019 Transmission 0.04 Electric Margin 0.01 Weather 0.01 Weather Normalization Clause Reversal (0.04) Gas Bad Debt Reversal 0.01 Distribution O&M (0.03) Distribution Depreciation (0.01) Distribution Non-Operating Pension/OPEB 0.01 Distribution Taxes & Other (0.07)

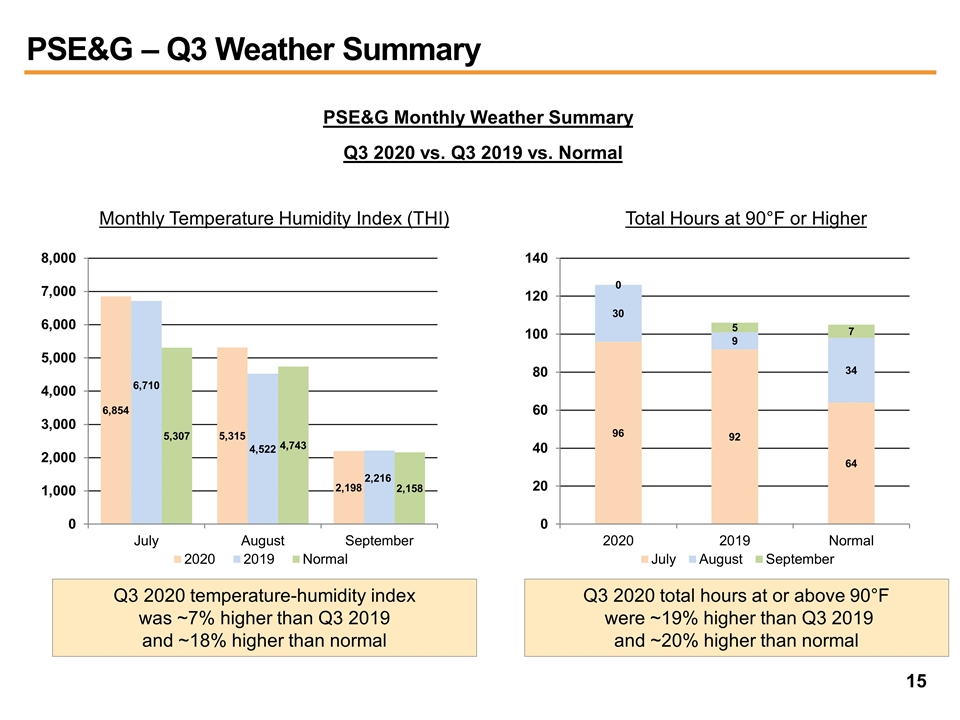

PSE&G – Q3 Weather Summary Q3 2020 vs. Q3 2019 vs. Normal PSE&G Monthly Weather Summary Monthly Temperature Humidity Index (THI) Q3 2020 temperature-humidity index was ~7% higher than Q3 2019 and ~18% higher than normal Total Hours at 90°F or Higher Q3 2020 total hours at or above 90°F were ~19% higher than Q3 2019 and ~20% higher than normal

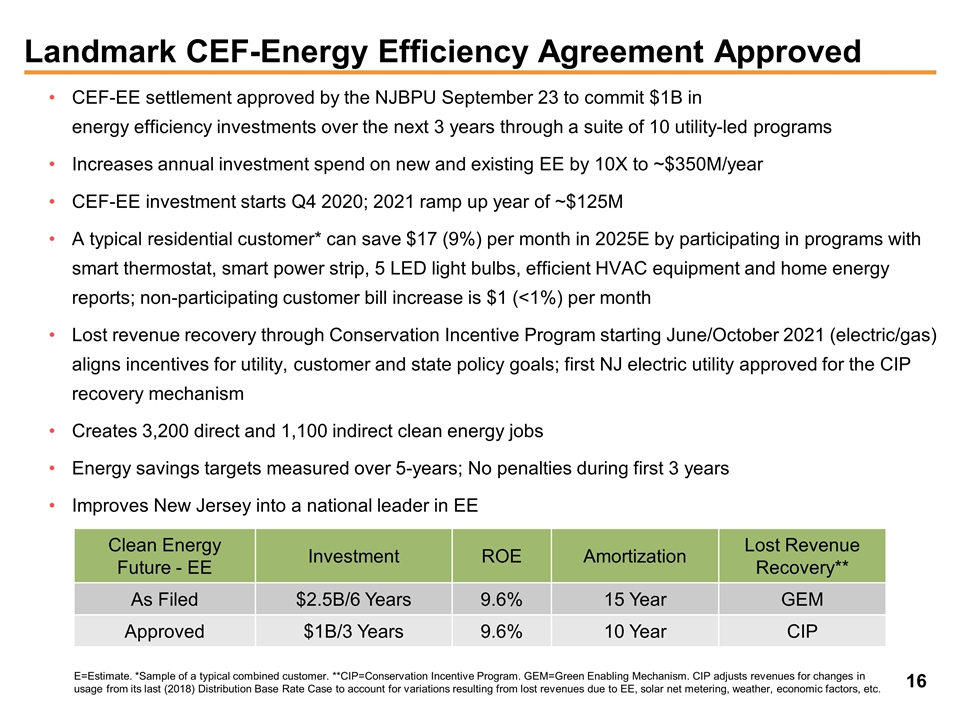

Landmark CEF-Energy Efficiency Agreement Approved CEF-EE settlement approved by the NJBPU September 23 to commit $1B in energy efficiency investments over the next 3 years through a suite of 10 utility-led programs Increases annual investment spend on new and existing EE by 10X to ~$350M/year CEF-EE investment starts Q4 2020; 2021 ramp up year of ~$125M A typical residential customer* can save $17 (9%) per month in 2025E by participating in programs with smart thermostat, smart power strip, 5 LED light bulbs, efficient HVAC equipment and home energy reports; non-participating customer bill increase is $1 (<1%) per month Lost revenue recovery through Conservation Incentive Program starting June/October 2021 (electric/gas) aligns incentives for utility, customer and state policy goals; first NJ electric utility approved for the CIP recovery mechanism Creates 3,200 direct and 1,100 indirect clean energy jobs Energy savings targets measured over 5-years; No penalties during first 3 years Improves New Jersey into a national leader in EE Clean Energy Future - EE Investment ROE Amortization Lost Revenue Recovery** As Filed $2.5B/6 Years 9.6% 15 Year GEM Approved $1B/3 Years 9.6% 10 Year CIP E=Estimate. *Sample of a typical combined customer. **CIP=Conservation Incentive Program. GEM=Green Enabling Mechanism. CIP adjusts revenues for changes in usage from its last (2018) Distribution Base Rate Case to account for variations resulting from lost revenues due to EE, solar net metering, weather, economic factors, etc.

PSE&G to invest $1B of capital in Energy Efficiency, one of the largest efforts in the U.S. PSE&G Investment: $1 Billion, 3-Year Program delivering universal access to lower customer bills through a comprehensive suite of EE programs PSE&G Energy Efficiency Offerings Residential Programs $300M Commercial & Industrial Programs $700M Efficient Products Prescriptive Existing Homes Custom Behavioral Small Non-Res Efficiency Multi-Family Energy Management Income Eligible Engineered Solutions Other Benefits Conservation Incentive Program addresses lost revenues 3,200 direct clean energy jobs 8 million metric tons of CO2 avoided* 2.2 NJ cost test score** *Through 2050. ** Source: PSEG. NJ Cost Test Score represents the relative value of societal benefits including, among other things, environmental, economic and non-energy benefits, to program costs.

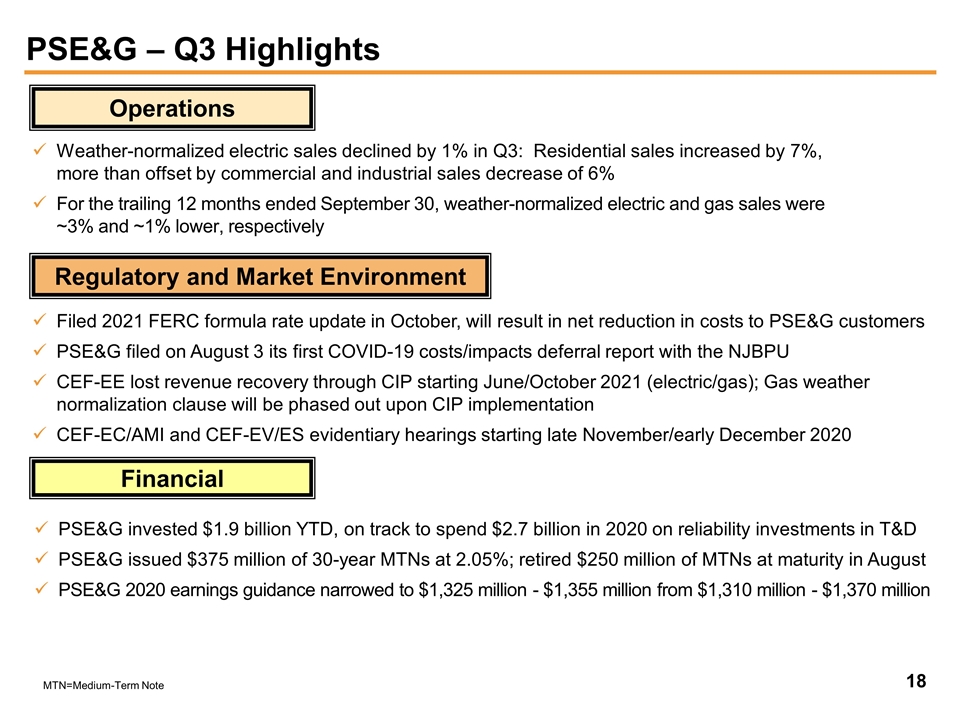

PSE&G – Q3 Highlights Weather-normalized electric sales declined by 1% in Q3: Residential sales increased by 7%, more than offset by commercial and industrial sales decrease of 6% For the trailing 12 months ended September 30, weather-normalized electric and gas sales were ~3% and ~1% lower, respectively Filed 2021 FERC formula rate update in October, will result in net reduction in costs to PSE&G customers PSE&G filed on August 3 its first COVID-19 costs/impacts deferral report with the NJBPU CEF-EE lost revenue recovery through CIP starting June/October 2021 (electric/gas); Gas weather normalization clause will be phased out upon CIP implementation CEF-EC/AMI and CEF-EV/ES evidentiary hearings starting late November/early December 2020 Operations Regulatory and Market Environment PSE&G invested $1.9 billion YTD, on track to spend $2.7 billion in 2020 on reliability investments in T&D PSE&G issued $375 million of 30-year MTNs at 2.05%; retired $250 million of MTNs at maturity in August PSE&G 2020 earnings guidance narrowed to $1,325 million - $1,355 million from $1,310 million - $1,370 million Financial MTN=Medium-Term Note

PSEG Power Q3 2020 Review

PSEG Power EPS Reconciliation – Q3 2020 versus Q3 2019 Q3 2019 Net Income Q3 2019 Operating Earnings (non-GAAP)* Q3 2020 Net Income Q3 2020 Operating Earnings (non-GAAP)* Capacity 0.03 Re-contracting & Market (0.02) Volume (0.02) Gas Operations 0.02 O&M 0.03 Depreciation & Interest 0.01 Taxes & Other (0.01) *See Slide B for Items excluded from Net Income to reconcile to Operating Earnings (non-GAAP). $ / share ~ ~ $0.55 $0.50

PSEG Power – Q3 Generation Measures Total Nuclear Total Coal**** Natural Gas & Oil *Indicates Period Net Generation, negative value reflects more GWh required to operate plants than were generated. Excludes Solar and Kalaeloa. **Excludes peaking and steam generation. ***Includes Oil Fuel Costs of < $1 million each in 2019 and 2020. ****PSEG Power completed the sale of its ownership interests in Keystone and Conemaugh generation, labeled as PA Coal in the Capacity Factor table, in September 2019. PSEG Power – Generation (GWh)* 16,281 14,903 PSEG Power – Capacity Factors (%)* Quarter ended September 30 ($ millions) 2019 2020 Gas*** $ 146 $ 115 Coal 24 - Total Fossil 170 115 Nuclear 47 50 Total Fuel Cost $ 217 $ 165 Total Generation (GWh)* 16,281 14,903 $ / MWh 13.33 11.07 PSEG Power – Fuel Costs* Quarter ended September 30 2019 2020 Combined Cycle** 63.4% 58.4% Coal PA 73.5% N/A CT 0.0% 0.0% Nuclear 90.8% 95.7% (2)

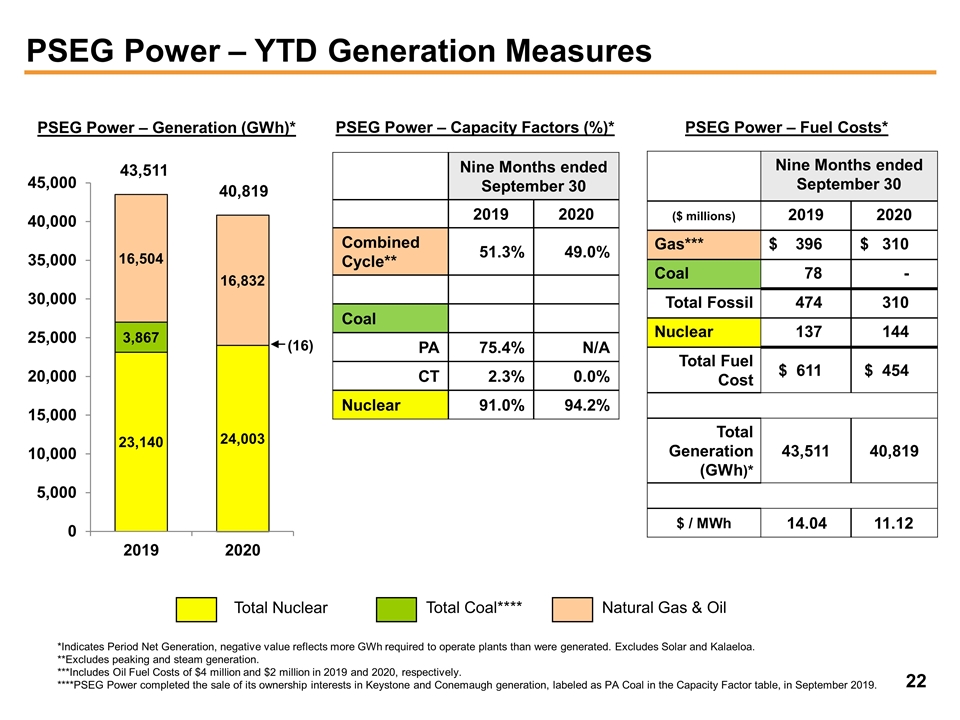

PSEG Power – YTD Generation Measures Total Nuclear Total Coal**** Natural Gas & Oil PSEG Power – Generation (GWh)* 43,511 40,819 PSEG Power – Capacity Factors (%)* PSEG Power – Fuel Costs* *Indicates Period Net Generation, negative value reflects more GWh required to operate plants than were generated. Excludes Solar and Kalaeloa. **Excludes peaking and steam generation. ***Includes Oil Fuel Costs of $4 million and $2 million in 2019 and 2020, respectively. ****PSEG Power completed the sale of its ownership interests in Keystone and Conemaugh generation, labeled as PA Coal in the Capacity Factor table, in September 2019. (16) Nine Months ended September 30 ($ millions) 2019 2020 Gas*** $ 396 $ 310 Coal 78 - Total Fossil 474 310 Nuclear 137 144 Total Fuel Cost $ 611 $ 454 Total Generation (GWh)* 43,511 40,819 $ / MWh 14.04 11.12 Nine Months ended September 30 2019 2020 Combined Cycle** 51.3% 49.0% Coal PA 75.4% N/A CT 2.3% 0.0% Nuclear 91.0% 94.2%

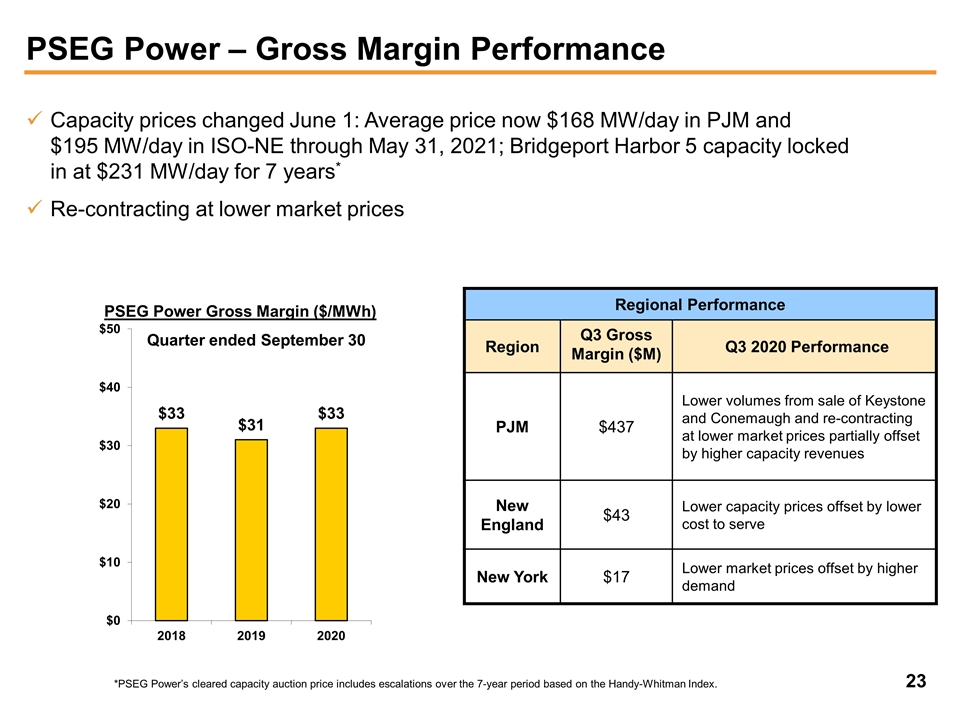

PSEG Power – Gross Margin Performance Capacity prices changed June 1: Average price now $168 MW/day in PJM and $195 MW/day in ISO-NE through May 31, 2021; Bridgeport Harbor 5 capacity locked in at $231 MW/day for 7 years* Re-contracting at lower market prices Regional Performance Region Q3 Gross Margin ($M) Q3 2020 Performance PJM $437 Lower volumes from sale of Keystone and Conemaugh and re-contracting at lower market prices partially offset by higher capacity revenues New England $43 Lower capacity prices offset by lower cost to serve New York $17 Lower market prices offset by higher demand PSEG Power Gross Margin ($/MWh) Quarter ended September 30 *PSEG Power’s cleared capacity auction price includes escalations over the 7-year period based on the Handy-Whitman Index.

Hedging Update Contracted Energy* *Volumes reflect management’s view of hedge percentages and prices as of September 30, 2020 and reflect revenues of full requirement load deals based on contract price including renewable energy credits, ancillary and transmission components but excluding capacity. Hedges include positions with MTM accounting treatment and options. Oct - Dec 2020 2021 2022 Nuclear Volume TWh 7 31 30 % Hedged 100% 100% 60-65% Price $/MWh $36 $35 $34 Combined Cycle Volume TWh 4-6 17-19 18-20 % Hedged 85-90% 35-40% 0% Price $/MWh $36 $35 $ - Total Volume TWh 11-13 48-50 48-50 % Hedged 95-100% 75-80% 35-40% Price $/MWh $36 $35 $34

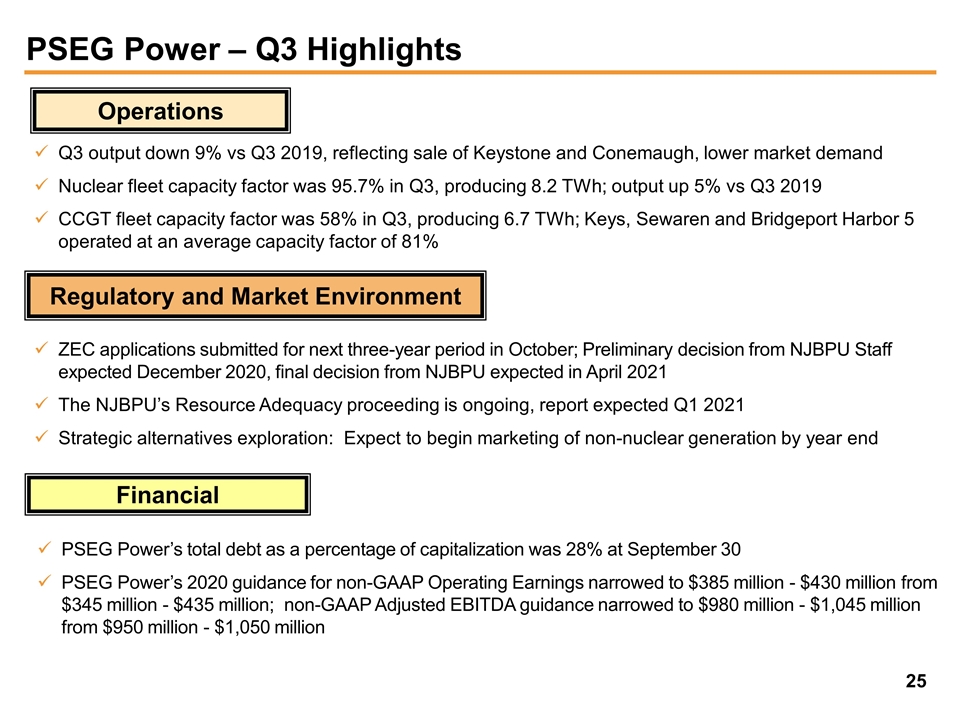

PSEG Power – Q3 Highlights Q3 output down 9% vs Q3 2019, reflecting sale of Keystone and Conemaugh, lower market demand Nuclear fleet capacity factor was 95.7% in Q3, producing 8.2 TWh; output up 5% vs Q3 2019 CCGT fleet capacity factor was 58% in Q3, producing 6.7 TWh; Keys, Sewaren and Bridgeport Harbor 5 operated at an average capacity factor of 81% Operations Regulatory and Market Environment Financial ZEC applications submitted for next three-year period in October; Preliminary decision from NJBPU Staff expected December 2020, final decision from NJBPU expected in April 2021 The NJBPU’s Resource Adequacy proceeding is ongoing, report expected Q1 2021 Strategic alternatives exploration: Expect to begin marketing of non-nuclear generation by year end PSEG Power’s total debt as a percentage of capitalization was 28% at September 30 PSEG Power’s 2020 guidance for non-GAAP Operating Earnings narrowed to $385 million - $430 million from $345 million - $435 million; non-GAAP Adjusted EBITDA guidance narrowed to $980 million - $1,045 million from $950 million - $1,050 million

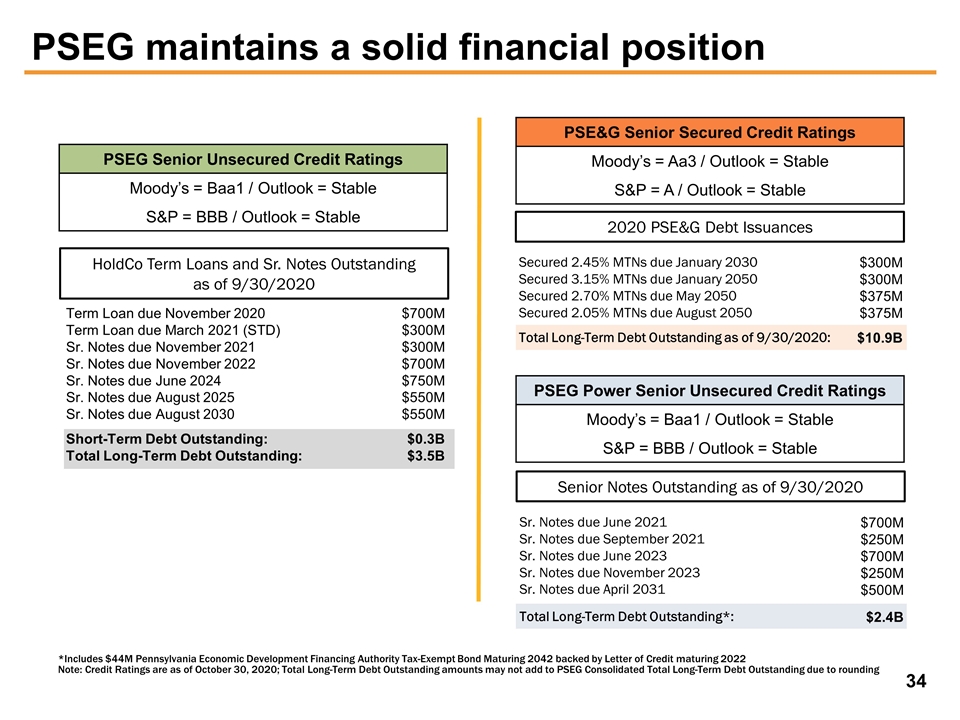

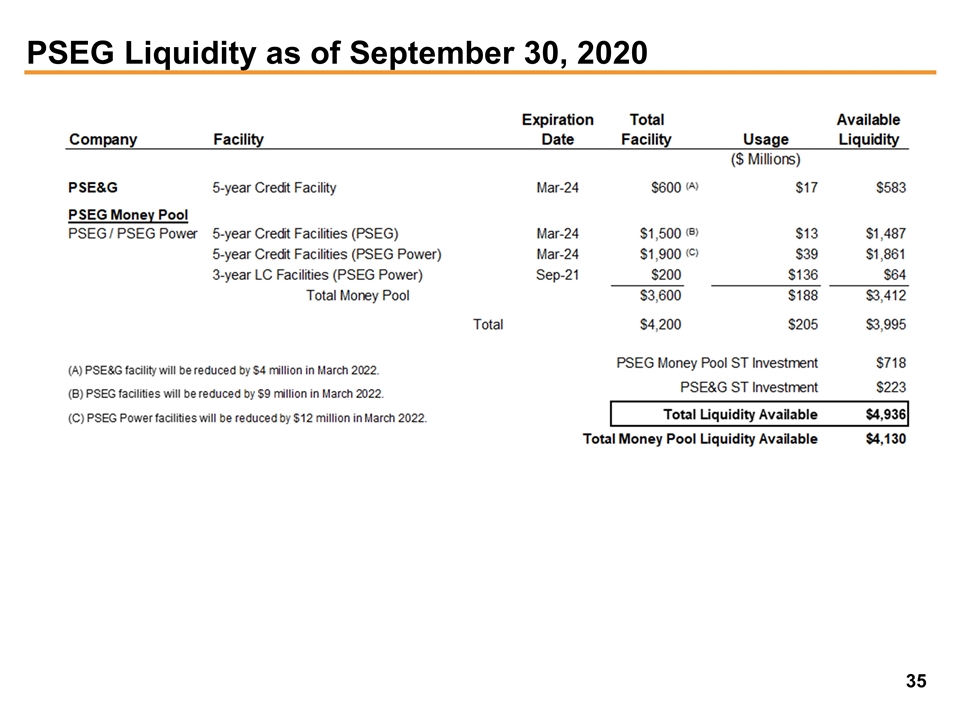

PSEG

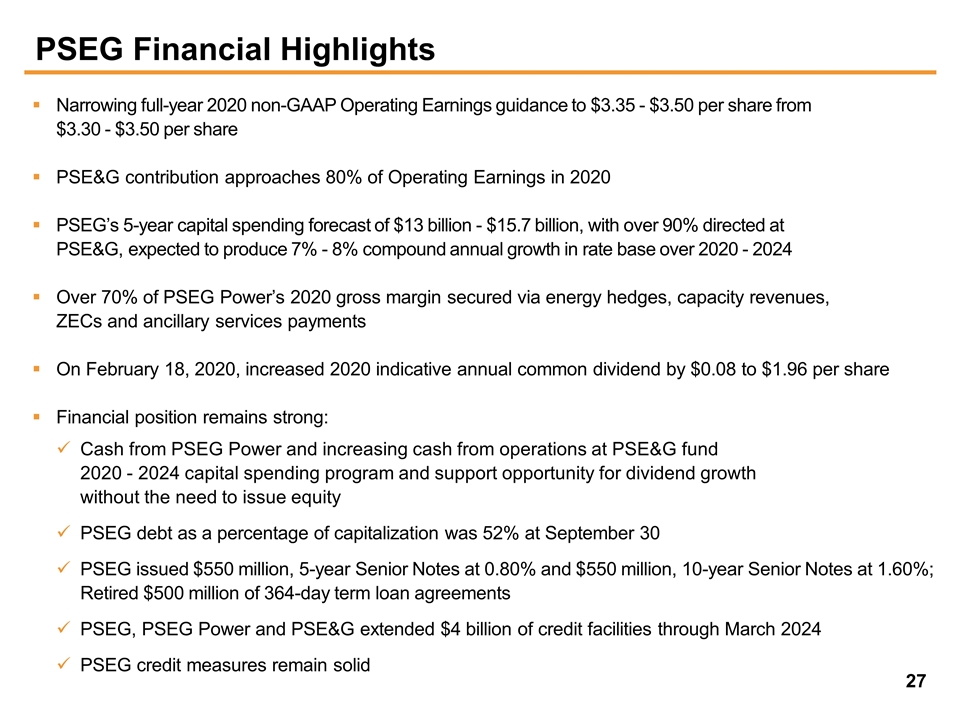

PSEG Financial Highlights Narrowing full-year 2020 non-GAAP Operating Earnings guidance to $3.35 - $3.50 per share from $3.30 - $3.50 per share PSE&G contribution approaches 80% of Operating Earnings in 2020 PSEG’s 5-year capital spending forecast of $13 billion - $15.7 billion, with over 90% directed at PSE&G, expected to produce 7% - 8% compound annual growth in rate base over 2020 - 2024 Over 70% of PSEG Power’s 2020 gross margin secured via energy hedges, capacity revenues, ZECs and ancillary services payments On February 18, 2020, increased 2020 indicative annual common dividend by $0.08 to $1.96 per share Financial position remains strong: Cash from PSEG Power and increasing cash from operations at PSE&G fund 2020 - 2024 capital spending program and support opportunity for dividend growth without the need to issue equity PSEG debt as a percentage of capitalization was 52% at September 30 PSEG issued $550 million, 5-year Senior Notes at 0.80% and $550 million, 10-year Senior Notes at 1.60%; Retired $500 million of 364-day term loan agreements PSEG, PSEG Power and PSE&G extended $4 billion of credit facilities through March 2024 PSEG credit measures remain solid