Form 8-K OFFICE PROPERTIES INCOME For: Oct 30

Exhibit 99.1

| FOR IMMEDIATE RELEASE | Contact: | ||||

| Olivia Snyder, Manager, Investor Relations | |||||

| (617) 219-1410 | |||||

Office Properties Income Trust Announces Third Quarter 2020 Results

Third Quarter Net Loss of $3.8 Million, or $0.08 Per Share

Third Quarter Normalized FFO of $62.6 Million, or $1.30 Per Share

Third Quarter CAD of $44.6 Million, or $0.93 Per Share, Increased 15.4% Year Over Year

Third Quarter Same Property Cash Basis NOI Increased 1.7%

Completed 595,000 Square Feet of Leasing in the Third Quarter for a 31.0% Roll-Up in Rents

Newton, MA (October 30, 2020): Office Properties Income Trust (Nasdaq: OPI) today announced its financial results for the quarter and nine months ended September 30, 2020.

David Blackman, President and Chief Executive Officer of OPI, made the following statement:

“OPI delivered strong financial and operating results for the third quarter of 2020. Normalized FFO beat the high end of our guidance and consensus estimates and CAD increased by more than 15% year over year. We entered 595,000 square feet of new and renewal leasing that resulted in a 31% roll up in rents and a weighted average lease term of 10.6 years.

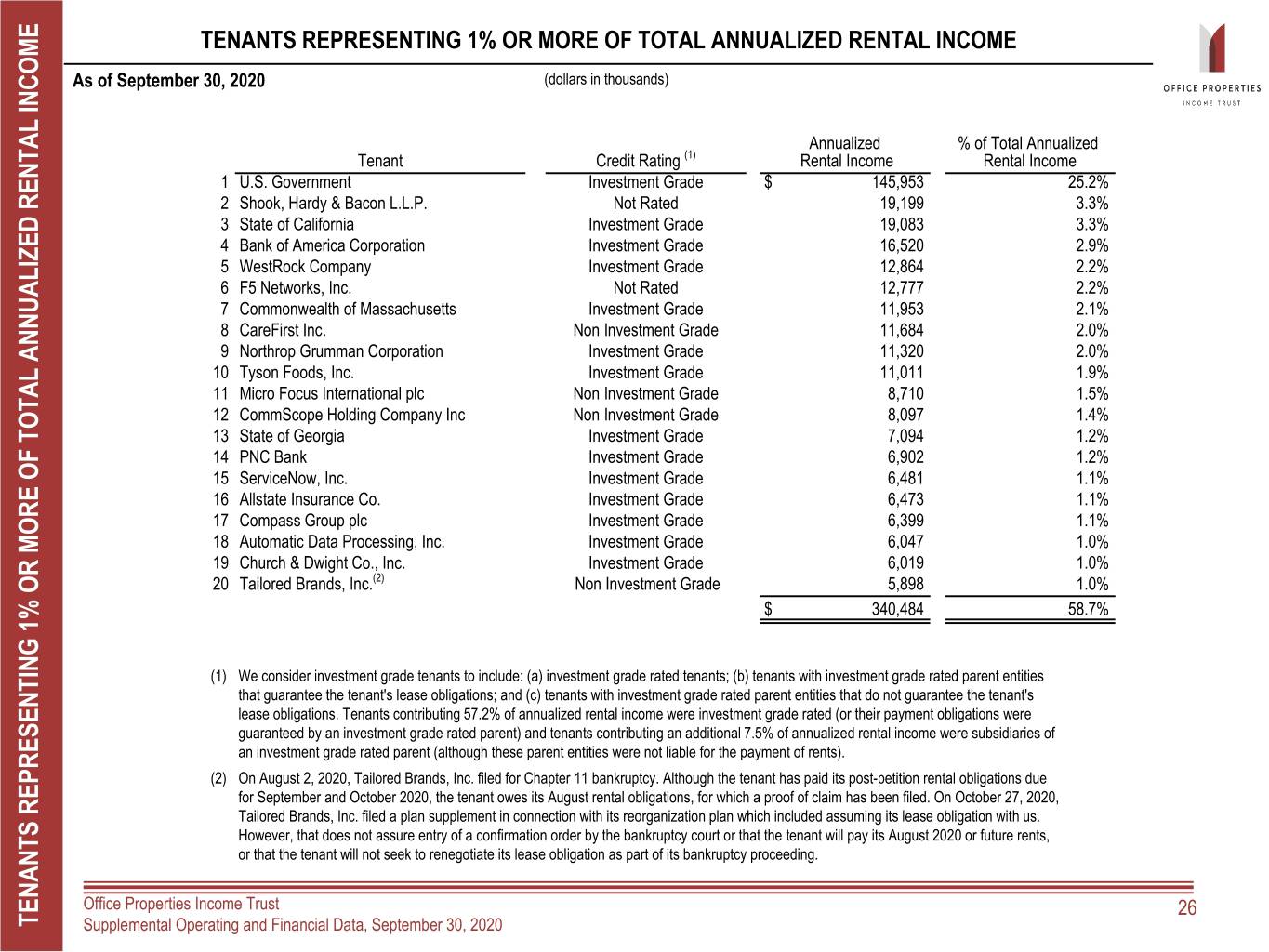

We also continue to benefit from OPI's high percentage of annualized rental income paid by investment grade tenants (64.7% as of September 30, 2020) and our resulting low rent deferrals and high rent collections. The total amount of granted deferrals for the months of April through September represents only 91 basis points of contractual rents over that period and average monthly rent collections were approximately 99% during the third quarter.

OPI also improved its liquidity during the quarter by raising more than $250 million of proceeds from a senior note offering. As a result, we repaid all amounts outstanding on our $750 million credit facility and now have virtually no debt maturities until 2022.

I think OPI has outperformed under extraordinary circumstances this quarter and believe we are well positioned to further execute its strategic business plan."

Results for the Quarter Ended September 30, 2020:

Net loss for the quarter ended September 30, 2020 was $3.8 million, or $0.08 per diluted share, compared to a net loss of $3.9 million, or $0.08 per diluted share, for the quarter ended September 30, 2019. Net loss for the quarter ended September 30, 2020 includes a $3.0 million, or $0.06 per diluted share, loss on impairment of real estate. Net loss for the quarter ended September 30, 2019 includes an $11.5 million, or $0.24 per diluted share, gain on sale of real estate, partially offset by an

A Maryland Real Estate Investment Trust with transferable shares of beneficial interest listed on the Nasdaq.

No shareholder, Trustee or officer is personally liable for any act or obligation of the Trust.

$8.5 million, or $0.18 per diluted share, loss on impairment of real estate. The weighted average number of diluted common shares outstanding was 48.1 million for the quarters ended September 30, 2020 and 2019.

Normalized funds from operations, or Normalized FFO, and cash available for distribution, or CAD, for the quarter ended September 30, 2020 were $62.6 million, or $1.30 per diluted share, and $44.6 million, or $0.93 per diluted share, respectively, compared to Normalized FFO and CAD for the quarter ended September 30, 2019 of $69.7 million, or $1.45 per diluted share, and $38.6 million, or $0.80 per diluted share, respectively.

Reconciliations of net income (loss) determined in accordance with U.S. generally accepted accounting principles, or GAAP, to funds from operations, or FFO, Normalized FFO and CAD for the quarters ended September 30, 2020 and 2019 appear later in this press release.

Results for the Nine Months Ended September 30, 2020:

Net income for the nine months ended September 30, 2020 was $8.3 million, or $0.17 per diluted share, compared to a net loss of $34.7 million, or $0.72 per diluted share, for the nine months ended September 30, 2019. Net income for the nine months ended September 30, 2020 includes a $10.8 million, or $0.22 per diluted share, gain on sale of real estate, partially offset by a $3.8 million, or $0.08 per diluted share, loss on early extinguishment of debt and a $3.0 million, or $0.06 per diluted share, loss on impairment of real estate. Net loss for the nine months ended September 30, 2019 includes a $44.0 million, or $0.92 per diluted share, realized loss on equity securities related to the sale of OPI's investment in The RMR Group Inc., or RMR Inc., on July 1, 2019, and a $14.1 million, or $0.29 per diluted share, loss on impairment of real estate, partially offset by a $33.5 million, or $0.70 per diluted share, gain on sale of real estate and certain net revenue events during the second quarter of 2019 totaling $8.2 million, or $0.17 per diluted share, including a $7.4 million early termination fee related to a single tenant property located in San Jose, CA. The weighted average number of diluted common shares outstanding was 48.1 million for the nine months ended September 30, 2020 and 2019.

Normalized FFO and CAD for the nine months ended September 30, 2020 were $197.4 million, or $4.10 per diluted share, and $137.5 million, or $2.86 per diluted share, respectively, compared to Normalized FFO and CAD for the nine months ended September 30, 2019 of $222.3 million, or $4.63 per diluted share, and $148.9 million, or $3.10 per diluted share, respectively.

Reconciliations of net income (loss) determined in accordance with GAAP to FFO, Normalized FFO and CAD for the nine months ended September 30, 2020 and 2019 appear later in this press release.

Leasing, Occupancy and Same Property Results:

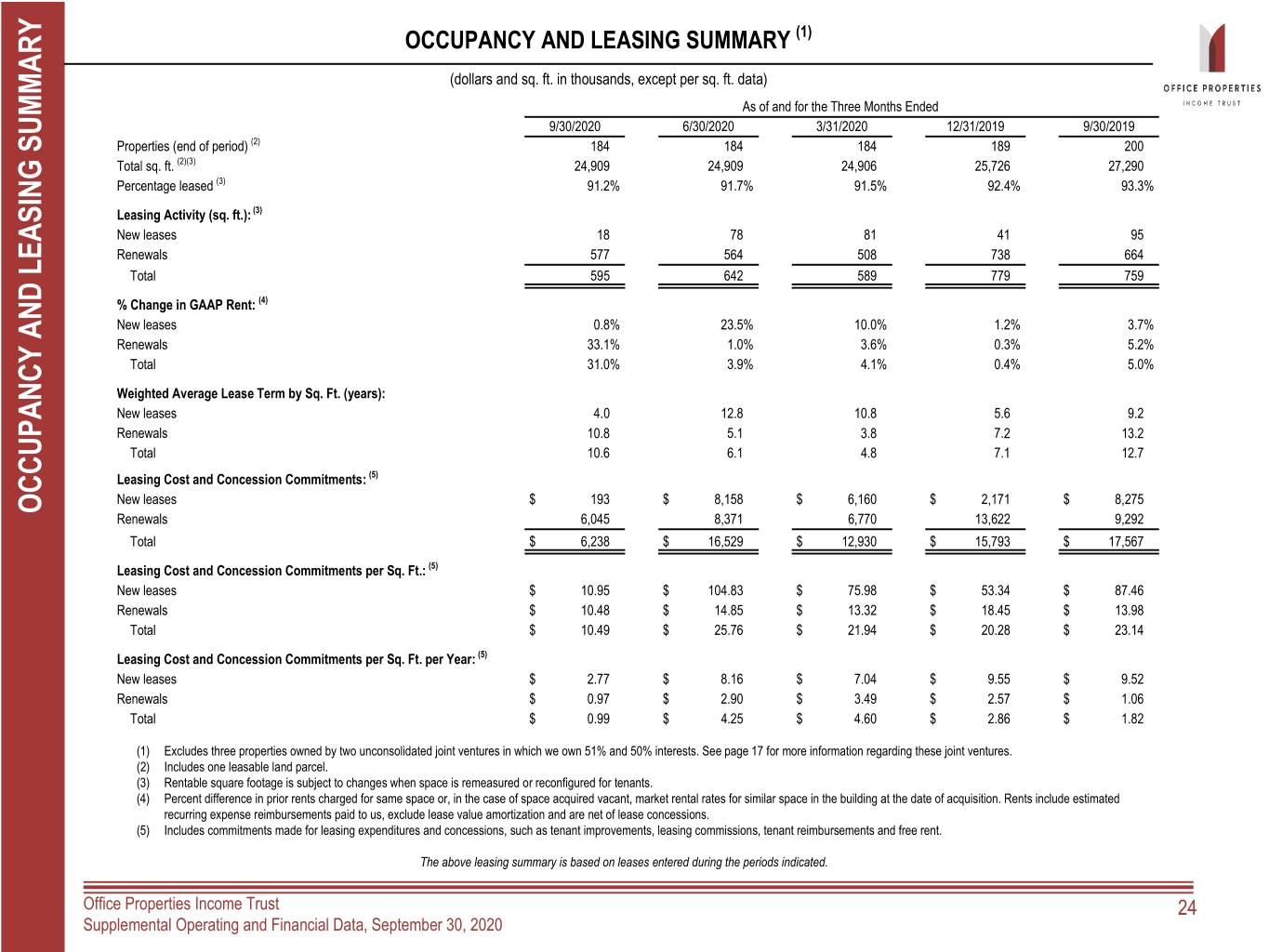

During the quarter ended September 30, 2020, OPI entered new and renewal leases for an aggregate of 595,000 rentable square feet at weighted (by rentable square feet) average rents that were 31.0% above prior rents for the same space. The weighted (by rentable square feet) average lease term for these leases was approximately 10.6 years and leasing concessions and capital commitments were $6.2 million, or only $0.99 per square foot, per lease year.

As of September 30, 2020, 91.2% of OPI’s total rentable square feet was leased, compared to 91.7% as of June 30, 2020 and 93.3% as of September 30, 2019. Occupancy for properties owned continuously since July 1, 2019, or same properties, was 92.3% as of September 30, 2020, compared to 92.8% as of June 30, 2020 and 93.5% as of September 30, 2019. Same property cash basis net operating income, or Cash Basis NOI, increased 1.7% for the quarter ended September 30, 2020 compared to the quarter ended September 30, 2019. The increase in same property Cash Basis NOI is due primarily to decreases in operating expenses, including approximately $1.4 million of expense savings as a result of cost savings initiatives in response to the COVID-19 pandemic.

Reconciliations of net income (loss) determined in accordance with GAAP to net operating income, or NOI, and Cash Basis NOI, and a reconciliation of NOI to same property NOI and same property Cash Basis NOI, for the quarters ended September 30, 2020 and 2019, appear later in this press release.

2

As a result of the COVID-19 pandemic, overall new leasing volume for 2020 has slowed and may continue to slow or remain at a similar level of activity; however, OPI remains focused on proactive dialogue with its existing tenants and overall tenant retention. Also, as a result of the COVID-19 pandemic, OPI has granted temporary rent assistance to date totaling $2.5 million to 19 tenants, pursuant to deferred payment plans. These tenants will pay, in most cases, one month of rent over a 12-month period, certain of which commenced in September 2020. The $2.5 million of granted temporary rent assistance is detailed as follows:

| Granted Rent Deferrals | Percentage of Total Granted Rent Deferrals | Percentage of Quarterly Contractual Rents | ||||||||||||||||||

| Quarter ended June 30, 2020 | $ | 2,055,449 | 80.6% | 1.5% | ||||||||||||||||

| Quarter ended September 30, 2020 | 494,069 | 19.4% | 0.3% | |||||||||||||||||

| Total granted deferrals | $ | 2,549,518 | 100.0% | 0.9% | ||||||||||||||||

Less: Amounts repaid (1) | (1,450,969) | 56.9% | ||||||||||||||||||

| Outstanding granted rent deferral balance | $ | 1,098,549 | 43.1% | |||||||||||||||||

(1)Represents rent deferrals repaid as of October 26, 2020.

For the quarter ended September 30, 2020, OPI collected approximately 99% of contractual rent obligations before and after giving effect to such rent deferrals.

While it is still early to assess the full impact the COVID-19 pandemic will have on OPI's business, OPI believes it will benefit from the approximately 64.7% of annualized rental income paid by investment grade tenants, the majority of which is made up of government tenants, and the diversity of its tenant base, both geographically and by industry, which OPI believes may help mitigate the economic impact caused by the COVID-19 pandemic.

Recent Acquisition Activities:

In August 2020, OPI terminated a previously announced agreement to acquire an office property in Denver, CO for a purchase price of $38.1 million.

In October 2020, OPI entered into an agreement to acquire three properties containing approximately 194,000 square feet adjacent to properties it owns in an office park in Brookhaven, GA for a purchase price of $15.3 million, excluding acquisition related costs.

Recent Disposition Activities:

As previously reported, in July 2020, OPI entered into an agreement to sell a four property business park located in Fairfax, VA containing approximately 171,000 rentable square feet for a sales price of $25.1 million, excluding closing costs. OPI completed this sale in October 2020.

Recent Financing Activities:

In August 2020, OPI repaid at maturity, at par plus accrued interest, a mortgage note secured by one property with an outstanding principal balance of $39.6 million and an annual interest rate of 2.2% using cash on hand and borrowings under its revolving credit facility.

As previously reported, in July 2020, OPI issued an additional $12.0 million of its 6.375% senior unsecured notes due 2050 pursuant to the underwriters' partial exercise of the over allotment option of the $150.0 million 6.375% senior unsecured notes issued in an underwritten public offering in June 2020. OPI used the aggregate net proceeds of this offering to repay amounts outstanding under its revolving credit facility and for general business purposes.

3

In September 2020, OPI issued $250.0 million of its 4.50% senior unsecured notes due 2025 in an underwritten public offering. These notes are a further issuance of OPI's existing $400.0 million of senior unsecured notes due 2025. The public offering price was 101.414% of the principal amount raising net proceeds of $251.3 million, after underwriters’ discounts and estimated offering expenses. OPI used the net proceeds of this offering to repay amounts outstanding under its revolving credit facility and for general business purposes.

Conference Call:

At 10:00 a.m. Eastern Time this morning, President and Chief Executive Officer, David Blackman, Chief Financial Officer and Treasurer, Matthew Brown, and Vice President and Chief Operating Officer, Christopher Bilotto, will host a conference call to discuss OPI’s third quarter 2020 financial results.

The conference call telephone number is (877) 328-1172. Participants calling from outside the United States and Canada should dial (412) 317-5418. No pass code is necessary to access the call from either number. Participants should dial in about 15 minutes prior to the scheduled start of the call. A replay of the conference call will be available through 11:59 p.m. on Friday, November 6, 2020. To access the replay, dial (412) 317-0088. The replay pass code is 10148151.

A live audio webcast of the conference call will also be available in a listen only mode on OPI’s website, at www.opireit.com. Participants wanting to access the webcast should visit OPI’s website about five minutes before the call. The archived webcast will be available for replay on OPI’s website following the call for about one week. The transcription, recording and retransmission in any way of OPI’s third quarter conference call are strictly prohibited without the prior written consent of OPI.

Supplemental Data:

A copy of OPI’s Third Quarter 2020 Supplemental Operating and Financial Data is available for download at OPI’s website, www.opireit.com. OPI’s website is not incorporated as part of this press release.

Non-GAAP Financial Measures:

OPI presents certain “non-GAAP financial measures” within the meaning of applicable rules of the Securities and Exchange Commission, or SEC, including FFO, Normalized FFO, CAD, Property NOI, Property Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI. These measures do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income (loss) as indicators of OPI’s operating performance or as measures of OPI’s liquidity. These measures should be considered in conjunction with net income (loss) as presented in OPI's condensed consolidated statements of income (loss). OPI considers these non-GAAP measures to be appropriate supplemental measures of operating performance for a real estate investment trust, or REIT, along with net income (loss). OPI believes these measures provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation and amortization expense, they may facilitate a comparison of OPI’s operating performance between periods and with other REITs and, in the case of Property NOI, Property Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI reflecting only those income and expense items that are generated and incurred at the property level may help both investors and management to understand the operations of OPI's properties.

Please see the pages attached hereto for a more detailed statement of OPI’s operating results and financial condition and for an explanation of OPI’s calculation of FFO, Normalized FFO, CAD, Property NOI, Property Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI and a reconciliation of those amounts to amounts determined in accordance with GAAP.

OPI is a REIT focused on owning, operating and leasing properties primarily leased to single tenants and those with high credit quality characteristics such as government entities. OPI is managed by the operating subsidiary of The RMR Group Inc. (Nasdaq: RMR), an alternative asset management company that is headquartered in Newton, Massachusetts.

4

Office Properties Income Trust

Condensed Consolidated Statements of Income (Loss)

(amounts in thousands, except per share data)

(unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||||||

| Rental income | $ | 145,806 | $ | 167,411 | $ | 441,294 | $ | 518,220 | ||||||||||||||||||

| Expenses: | ||||||||||||||||||||||||||

| Real estate taxes | 16,113 | 18,824 | 48,701 | 55,363 | ||||||||||||||||||||||

| Utility expenses | 7,564 | 9,518 | 19,777 | 26,369 | ||||||||||||||||||||||

| Other operating expenses | 26,366 | 30,376 | 78,033 | 90,204 | ||||||||||||||||||||||

| Depreciation and amortization | 62,227 | 74,939 | 189,340 | 226,373 | ||||||||||||||||||||||

Loss on impairment of real estate (1) | 2,954 | 8,521 | 2,954 | 14,105 | ||||||||||||||||||||||

Acquisition and transaction related costs (2) | — | — | — | 682 | ||||||||||||||||||||||

| General and administrative | 7,059 | 7,990 | 21,372 | 25,457 | ||||||||||||||||||||||

| Total expenses | 122,283 | 150,168 | 360,177 | 438,553 | ||||||||||||||||||||||

Gain on sale of real estate (3) | — | 11,463 | 10,822 | 33,538 | ||||||||||||||||||||||

| Dividend income | — | — | — | 1,960 | ||||||||||||||||||||||

Loss on equity securities, net (4) | — | — | — | (44,007) | ||||||||||||||||||||||

| Interest and other income | 2 | 358 | 738 | 847 | ||||||||||||||||||||||

Interest expense (including net amortization of debt premiums, discounts and issuance costs of $2,477, $2,560, $7,162 and $8,264, respectively) | (27,097) | (32,367) | (79,461) | (104,848) | ||||||||||||||||||||||

Loss on early extinguishment of debt (5) | — | (284) | (3,839) | (769) | ||||||||||||||||||||||

| Income (loss) before income tax (expense) benefit and equity in net losses of investees | (3,572) | (3,587) | 9,377 | (33,612) | ||||||||||||||||||||||

| Income tax (expense) benefit | 54 | (156) | (220) | (509) | ||||||||||||||||||||||

| Equity in net losses of investees | (279) | (196) | (815) | (573) | ||||||||||||||||||||||

| Net income (loss) | $ | (3,797) | $ | (3,939) | $ | 8,342 | $ | (34,694) | ||||||||||||||||||

| Weighted average common shares outstanding (basic and diluted) | 48,132 | 48,073 | 48,111 | 48,051 | ||||||||||||||||||||||

| Per common share amounts (basic and diluted): | ||||||||||||||||||||||||||

| Net income (loss) | $ | (0.08) | $ | (0.08) | $ | 0.17 | $ | (0.72) | ||||||||||||||||||

See Notes on pages 6 and 7.

5

Office Properties Income Trust

Funds from Operations, Normalized Funds from Operations and Cash Available for Distribution

(amounts in thousands, except per share data)

(unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||||||

Calculation of FFO, Normalized FFO and CAD (6)(7): | ||||||||||||||||||||||||||

| Net income (loss) | $ | (3,797) | $ | (3,939) | $ | 8,342 | $ | (34,694) | ||||||||||||||||||

| Add (less): Depreciation and amortization: | ||||||||||||||||||||||||||

| Consolidated properties | 62,227 | 74,939 | 189,340 | 226,373 | ||||||||||||||||||||||

| Unconsolidated joint venture properties | 1,244 | 1,397 | 3,722 | 4,558 | ||||||||||||||||||||||

Loss on impairment of real estate (1) | 2,954 | 8,521 | 2,954 | 14,105 | ||||||||||||||||||||||

Gain on sale of real estate (3) | — | (11,463) | (10,822) | (33,538) | ||||||||||||||||||||||

Loss on equity securities, net (4) | — | — | — | 44,007 | ||||||||||||||||||||||

| FFO | 62,628 | 69,455 | 193,536 | 220,811 | ||||||||||||||||||||||

Add (less): Acquisition and transaction related costs (2) | — | — | — | 682 | ||||||||||||||||||||||

Loss on early extinguishment of debt (5) | — | 284 | 3,839 | 769 | ||||||||||||||||||||||

| Normalized FFO | 62,628 | 69,739 | 197,375 | 222,262 | ||||||||||||||||||||||

Add (less): Non-cash expenses (8) | 533 | 611 | 1,420 | 1,898 | ||||||||||||||||||||||

| Distributions from unconsolidated joint ventures | 255 | 852 | 408 | 1,973 | ||||||||||||||||||||||

| Depreciation and amortization - unconsolidated joint ventures | (1,244) | (1,397) | (3,722) | (4,558) | ||||||||||||||||||||||

| Equity in net losses of investees | 279 | 196 | 815 | 573 | ||||||||||||||||||||||

| Loss on early extinguishment of debt settled in cash | — | — | (1,138) | — | ||||||||||||||||||||||

| Non-cash straight line rent adjustments included in rental income | (3,912) | (6,904) | (12,963) | (19,365) | ||||||||||||||||||||||

| Lease value amortization included in rental income | 1,312 | 35 | 4,149 | 2,628 | ||||||||||||||||||||||

Net amortization of debt premiums, discounts and issuance costs | 2,477 | 2,560 | 7,162 | 8,264 | ||||||||||||||||||||||

| Recurring capital expenditures | (17,771) | (27,068) | (56,040) | (64,813) | ||||||||||||||||||||||

CAD (7) | $ | 44,557 | $ | 38,624 | $ | 137,466 | $ | 148,862 | ||||||||||||||||||

| Weighted average common shares outstanding (basic and diluted) | 48,132 | 48,073 | 48,111 | 48,051 | ||||||||||||||||||||||

| Per common share amounts (basic and diluted): | ||||||||||||||||||||||||||

| Net income (loss) | $ | (0.08) | $ | (0.08) | $ | 0.17 | $ | (0.72) | ||||||||||||||||||

| FFO | $ | 1.30 | $ | 1.44 | $ | 4.02 | $ | 4.60 | ||||||||||||||||||

| Normalized FFO | $ | 1.30 | $ | 1.45 | $ | 4.10 | $ | 4.63 | ||||||||||||||||||

| CAD | $ | 0.93 | $ | 0.80 | $ | 2.86 | $ | 3.10 | ||||||||||||||||||

| Distributions declared per share | $ | 0.55 | $ | 0.55 | $ | 1.65 | $ | 1.65 | ||||||||||||||||||

(1)Loss on impairment of real estate for the three and nine months ended September 30, 2020 represents an adjustment of $2,954 to reduce the carrying value of four properties to their estimated fair value less costs to sell. Loss on impairment of real estate for the three months ended September 30, 2019 includes an adjustment of $6,342 to reduce the carrying value of eight properties to their estimated fair value less costs to sell and a $2,179 loss on impairment of real estate related to the disposal of one property. Loss on impairment of real estate for the nine months ended September 30, 2019 also includes an adjustment of $5,137 to reduce the carrying value of two properties to their estimated fair value less costs to sell and a $447 loss on impairment of real estate related to the sale of a portfolio of 34 properties during the six months ended June 30, 2019.

(2)Acquisition and transaction related costs for the nine months ended September 30, 2019 consist of post-merger activity costs incurred in connection with OPI's acquisition of Select Income REIT on December 31, 2018 in a merger transaction and other related transactions.

(3)Gain on sale of real estate for the nine months ended September 30, 2020 represents a $10,822 net gain on the sale of six properties. Gain on sale of real estate for the three months ended September 30, 2019 represents an $11,463 gain on the sale of two properties. Gain on sale of real estate for the nine months ended September 30, 2019 also includes a $22,075 gain on the sale of one property during the six months ended June 30, 2019.

6

(4)Loss on equity securities, net represents a realized loss for the nine months ended September 30, 2019 from the sale of OPI's 2.8 million shares of RMR Inc. common stock on July 1, 2019.

(5)Loss on early extinguishment of debt for the nine months ended September 30, 2020 includes prepayment fees related to the repayment of two mortgage notes, write offs of the unamortized portion of certain discounts and issuance costs resulting from the early repayment of debt and a loss related to the settlement of a mortgage note receivable in connection with a property OPI sold in 2016. Loss on early extinguishment of debt for the three and nine months ended September 30, 2019 includes write offs of the unamortized portion of certain discounts and issuance costs resulting from the early repayment of debt.

(6)OPI calculates FFO and Normalized FFO as shown above. FFO is calculated on the basis defined by The National Association of Real Estate Investment Trusts, which is net income (loss), calculated in accordance with GAAP, plus real estate depreciation and amortization of consolidated properties and its proportionate share of the real estate depreciation and amortization of unconsolidated joint venture properties, but excluding impairment charges on real estate assets, any gain or loss on sale of real estate and equity securities, as well as certain other adjustments currently not applicable to OPI. In calculating Normalized FFO, OPI adjusts for the other items shown above and includes business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as an expense in accordance with GAAP due to their quarterly volatility not necessarily being indicative of OPI’s core operating performance and the uncertainty as to whether any such business management incentive fees will be payable when all contingencies for determining such fees are known at the end of the calendar year. FFO and Normalized FFO are among the factors considered by OPI’s Board of Trustees when determining the amount of distributions to OPI’s shareholders. Other factors include, but are not limited to, requirements to maintain OPI's qualification for taxation as a REIT, limitations in OPI’s credit agreement and public debt covenants, the availability to OPI of debt and equity capital, OPI’s expectation of its future capital requirements and operating performance and OPI’s expected needs for and availability of cash to pay its obligations. Other real estate companies and REITs may calculate FFO and Normalized FFO differently than OPI does.

(7)OPI calculates CAD as shown above. OPI defines CAD as Normalized FFO minus recurring real estate related capital expenditures and other non-cash and non-recurring items. CAD is among the factors considered by OPI's Board of Trustees when determining the amount of distributions to its shareholders. Other real estate companies and REITs may calculate CAD differently than OPI does.

(8)Non-cash expenses include equity based compensation, adjustments recorded to capitalize interest expense and amortization of the liability for the amount by which the estimated fair value for accounting purposes exceeded the price OPI paid for its former investment in RMR Inc. common stock in June 2015. This liability is being amortized on a straight line basis through December 31, 2035 as an allocated reduction to business management fee expense and property management fee expense, which are included in general and administrative and other operating expenses, respectively.

7

Office Properties Income Trust

Calculation and Reconciliation of Property NOI, Property Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI (1)

(amounts in thousands)

(unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||||||

| Calculation of Property NOI and Property Cash Basis NOI: | ||||||||||||||||||||||||||

| Rental income | $ | 145,806 | $ | 167,411 | $ | 441,294 | $ | 518,220 | ||||||||||||||||||

| Property operating expenses | (50,043) | (58,718) | (146,511) | (171,936) | ||||||||||||||||||||||

| Property NOI | 95,763 | 108,693 | 294,783 | 346,284 | ||||||||||||||||||||||

| Non-cash straight line rent adjustments included in rental income | (3,912) | (6,904) | (12,963) | (19,365) | ||||||||||||||||||||||

| Lease value amortization included in rental income | 1,312 | 35 | 4,149 | 2,628 | ||||||||||||||||||||||

| Lease termination fees included in rental income | (2) | (22) | (8) | (9,183) | ||||||||||||||||||||||

Non-cash amortization included in property operating expenses (2) | (121) | (121) | (363) | (363) | ||||||||||||||||||||||

| Property Cash Basis NOI | $ | 93,040 | $ | 101,681 | $ | 285,598 | $ | 320,001 | ||||||||||||||||||

| Reconciliation of Net Income (Loss) to Property NOI and Property Cash Basis NOI: | ||||||||||||||||||||||||||

| Net income (loss) | $ | (3,797) | $ | (3,939) | $ | 8,342 | $ | (34,694) | ||||||||||||||||||

| Equity in net losses of investees | 279 | 196 | 815 | 573 | ||||||||||||||||||||||

| Income tax expense (benefit) | (54) | 156 | 220 | 509 | ||||||||||||||||||||||

| Income (loss) before income tax expense (benefit) and equity in net losses of investees | (3,572) | (3,587) | 9,377 | (33,612) | ||||||||||||||||||||||

| Loss on early extinguishment of debt | — | 284 | 3,839 | 769 | ||||||||||||||||||||||

| Interest expense | 27,097 | 32,367 | 79,461 | 104,848 | ||||||||||||||||||||||

| Interest and other income | (2) | (358) | (738) | (847) | ||||||||||||||||||||||

| Loss on equity securities, net | — | — | — | 44,007 | ||||||||||||||||||||||

| Dividend income | — | — | — | (1,960) | ||||||||||||||||||||||

| Gain on sale of real estate | — | (11,463) | (10,822) | (33,538) | ||||||||||||||||||||||

| General and administrative | 7,059 | 7,990 | 21,372 | 25,457 | ||||||||||||||||||||||

| Acquisition and transaction related costs | — | — | — | 682 | ||||||||||||||||||||||

| Loss on impairment of real estate | 2,954 | 8,521 | 2,954 | 14,105 | ||||||||||||||||||||||

| Depreciation and amortization | 62,227 | 74,939 | 189,340 | 226,373 | ||||||||||||||||||||||

| Property NOI | 95,763 | 108,693 | 294,783 | 346,284 | ||||||||||||||||||||||

Non-cash amortization included in property operating expenses (2) | (121) | (121) | (363) | (363) | ||||||||||||||||||||||

| Lease termination fees included in rental income | (2) | (22) | (8) | (9,183) | ||||||||||||||||||||||

| Lease value amortization included in rental income | 1,312 | 35 | 4,149 | 2,628 | ||||||||||||||||||||||

| Non-cash straight line rent adjustments included in rental income | (3,912) | (6,904) | (12,963) | (19,365) | ||||||||||||||||||||||

| Property Cash Basis NOI | $ | 93,040 | $ | 101,681 | $ | 285,598 | $ | 320,001 | ||||||||||||||||||

Reconciliation of Property NOI to Same Property NOI (3) (4): | ||||||||||||||||||||||||||

| Rental income | $ | 145,806 | $ | 167,411 | $ | 441,294 | $ | 518,220 | ||||||||||||||||||

| Property operating expenses | (50,043) | (58,718) | (146,511) | (171,936) | ||||||||||||||||||||||

| Property NOI | 95,763 | 108,693 | 294,783 | 346,284 | ||||||||||||||||||||||

| Less: NOI of properties not included in same property results | (460) | (10,819) | (1,556) | (50,111) | ||||||||||||||||||||||

| Same Property NOI | $ | 95,303 | $ | 97,874 | $ | 293,227 | $ | 296,173 | ||||||||||||||||||

Calculation of Same Property Cash Basis NOI (3) (4): | ||||||||||||||||||||||||||

| Same Property NOI | $ | 95,303 | $ | 97,874 | $ | 293,227 | $ | 296,173 | ||||||||||||||||||

Add: Lease value amortization included in rental income | 1,318 | 66 | 4,170 | 2,892 | ||||||||||||||||||||||

Less: Non-cash straight line rent adjustments included in rental income | (3,950) | (6,813) | (12,235) | (18,345) | ||||||||||||||||||||||

Lease termination fees included in rental income | (2) | (22) | (8) | (1,541) | ||||||||||||||||||||||

Non-cash amortization included in property operating expenses (2) | (114) | (99) | (343) | (288) | ||||||||||||||||||||||

| Same Property Cash Basis NOI | $ | 92,555 | $ | 91,006 | $ | 284,811 | $ | 278,891 | ||||||||||||||||||

See Notes on page 9.

8

(1) The calculations of Property NOI and Property Cash Basis NOI exclude certain components of net income (loss) in order to provide results that are more closely related to OPI’s property level results of operations. OPI calculates Property NOI and Property Cash Basis NOI as shown above. OPI defines Property NOI as income from its rental of real estate less its property operating expenses. Property NOI excludes amortization of capitalized tenant improvement costs and leasing commissions that OPI records as depreciation and amortization expense. OPI defines Property Cash Basis NOI as Property NOI excluding non-cash straight line rent adjustments, lease value amortization, lease termination fees, if any, and non-cash amortization included in other operating expenses. OPI calculates Same Property NOI and Same Property Cash Basis NOI in the same manner that it calculates the corresponding Property Cash Basis NOI amounts, except that it only includes same properties in calculating Same Property NOI and Same Property Cash Basis NOI. OPI uses Property NOI, Property Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI to evaluate individual and company-wide property level performance. Other real estate companies and REITs may calculate Property NOI, Property Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI differently than OPI does.

(2) OPI recorded a liability for the amount by which the estimated fair value for accounting purposes exceeded the price OPI paid for its former investment in RMR Inc. common stock in June 2015. A portion of this liability is being amortized on a straight line basis through December 31, 2035 as a reduction to property management fee expense, which is included in property operating expenses.

(3) For the three months ended September 30, 2020 and 2019, Same Property NOI and Same Property Cash Basis NOI are based on properties OPI owned continuously since July 1, 2019, and exclude properties classified as held for sale and properties undergoing significant redevelopment, if any, and three properties owned by two unconsolidated joint ventures in which OPI owns 51% and 50% interests.

(4) For the nine months ended September 30, 2020 and 2019, Same Property NOI and Same Property Cash Basis NOI are based on properties OPI owned continuously since January 1, 2019, and exclude properties classified as held for sale and properties undergoing significant redevelopment, if any, and three properties owned by two unconsolidated joint ventures in which OPI owns 51% and 50% interests.

9

Office Properties Income Trust

Condensed Consolidated Balance Sheets

(dollars in thousands, except per share data)

(unaudited)

| September 30, | December 31, | |||||||||||||

| 2020 | 2019 | |||||||||||||

| ASSETS | ||||||||||||||

| Real estate properties: | ||||||||||||||

| Land | $ | 840,931 | $ | 840,550 | ||||||||||

| Buildings and improvements | 2,685,988 | 2,652,681 | ||||||||||||

| Total real estate properties, gross | 3,526,919 | 3,493,231 | ||||||||||||

| Accumulated depreciation | (436,346) | (387,656) | ||||||||||||

| Total real estate properties, net | 3,090,573 | 3,105,575 | ||||||||||||

| Assets of properties held for sale | 20,716 | 70,877 | ||||||||||||

| Investments in unconsolidated joint ventures | 38,533 | 39,756 | ||||||||||||

| Acquired real estate leases, net | 604,233 | 732,382 | ||||||||||||

| Cash and cash equivalents | 45,035 | 93,744 | ||||||||||||

| Restricted cash | 12,604 | 6,952 | ||||||||||||

| Rents receivable | 100,363 | 83,556 | ||||||||||||

| Deferred leasing costs, net | 44,485 | 40,107 | ||||||||||||

| Other assets, net | 16,503 | 20,187 | ||||||||||||

| Total assets | $ | 3,973,045 | $ | 4,193,136 | ||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||||||||

| Unsecured revolving credit facility | $ | — | $ | — | ||||||||||

| Senior unsecured notes, net | 2,031,197 | 2,017,379 | ||||||||||||

| Mortgage notes payable, net | 170,244 | 309,946 | ||||||||||||

| Liabilities of properties held for sale | 331 | 14,693 | ||||||||||||

| Accounts payable and other liabilities | 116,047 | 125,048 | ||||||||||||

| Due to related persons | 7,349 | 7,141 | ||||||||||||

| Assumed real estate lease obligations, net | 11,205 | 13,175 | ||||||||||||

| Total liabilities | 2,336,373 | 2,487,382 | ||||||||||||

| Commitments and contingencies | ||||||||||||||

| Shareholders’ equity: | ||||||||||||||

| Common shares of beneficial interest, $.01 par value: 200,000,000 shares authorized, 48,318,366 and 48,201,941 shares issued and outstanding, respectively | 483 | 482 | ||||||||||||

| Additional paid in capital | 2,614,346 | 2,612,425 | ||||||||||||

| Cumulative net income | 185,559 | 177,217 | ||||||||||||

| Cumulative other comprehensive loss | — | (200) | ||||||||||||

| Cumulative common distributions | (1,163,716) | (1,084,170) | ||||||||||||

| Total shareholders’ equity | 1,636,672 | 1,705,754 | ||||||||||||

| Total liabilities and shareholders’ equity | $ | 3,973,045 | $ | 4,193,136 | ||||||||||

10

Warning Concerning Forward-Looking Statements

This press release contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Also, whenever OPI uses words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions, OPI is making forward-looking statements. These forward-looking statements are based upon OPI’s present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by OPI’s forward-looking statements as a result of various factors. Forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond OPI's control. For example:

•Mr. Blackman's statements about OPI's operating results, leasing activity and roll-ups in rents may imply that OPI will continue to have similar and better results and positive leasing activity in future periods. However, OPI's operating results and its ability to realize positive leasing activity depend on various factors, including market conditions, tenants' demand for OPI's properties, the timing of lease expirations and OPI's ability to successfully compete for tenants, among other factors. As a result, OPI may not realize positive leasing activity in future periods,

•Mr. Blackman's statements about the limited amount of rent deferrals that OPI granted to its tenants and statements elsewhere in this press release about the extent of OPI's rent collections in the third quarter despite the COVID-19 pandemic may imply that OPI will continue to have strong rent collections in the future. However, if the COVID-19 pandemic and the current economic conditions continue for an extended period of time or worsen, OPI’s tenants may be significantly adversely impacted, which may result in those tenants seeking relief from their rent obligations, their inability to pay rent, the termination of their leases or OPI's tenants not renewing their leases or renewing their leases for less space. Further, some of OPI’s government leases provide the tenant with certain rights to terminate their lease early. Budgetary and other fiscal pressures may result in some governmental tenants terminating their leases early or not renewing their leases. In addition, the COVID-19 pandemic has caused changes in workplace practices, including increased remote work arrangements. To the extent those practices become permanent or increased, leasing demand for office space may decline. Therefore, the impact OPI experiences in the near term may be worse than it expects and its tenant retention levels may not increase and they could decline,

•Mr. Blackman states that OPI has improved its liquidity during the quarter. In addition, this press release includes additional statements regarding OPI's belief that the characteristics of its tenant base will help mitigate the economic impact from the COVID-19 pandemic and that OPI will continue to benefit from these tenant characteristics. However, if the COVID-19 pandemic and the current economic conditions continue for an extended period or worsen, OPI may not be able to maintain its current leverage or liquidity levels and its portfolio may not prove as stable as currently expected. Further, OPI’s ability to borrow under its revolving credit facility is subject to OPI satisfying certain covenants and conditions. If OPI’s operating results and financial condition are significantly negatively impacted by current economic conditions or otherwise, OPI may fail to satisfy those covenants and conditions,

•Mr. Blackman states that OPI repaid all amounts outstanding under its revolving credit facility. This may imply that OPI will maintain zero borrowings under the credit facility. However, OPI's revolving credit facility allows OPI to borrow, repay and reborrow funds under that facility, subject to satisfying conditions. As a result, OPI may borrow funds under its revolving credit facility in the future and it is highly likely that it will do so in furtherance of its business and operations,

•Mr. Blackman references that he thinks OPI has outperformed under extraordinary circumstances this quarter and his belief that OPI is well positioned to further execute its strategic business plan. This may imply that OPI will outperform in the future and that it will successfully execute its business plan and that doing so will benefit OPI. However, OPI's business is subject to various risks and conditions and OPI may not outperform, and may underperform in the future. Further, OPI may not succeed in executing its business plan, and if it does succeed, it may not realize the benefits it expects, and

•OPI has entered into an agreement to acquire three properties adjacent to properties it owns in an office park in Brookhaven, GA for $15.3 million, excluding acquisition related costs. This acquisition is subject to conditions. Those conditions may not be satisfied and this acquisition may not occur, may be delayed or the terms may change.

11

The information contained in OPI’s filings with the SEC, including under “Risk Factors” in OPI’s periodic reports, or incorporated therein, identifies other important factors that could cause OPI’s actual results to differ materially from those stated in or implied by OPI’s forward-looking statements. OPI’s filings with the SEC are available on the SEC's website at www.sec.gov.

You should not place undue reliance upon forward-looking statements.

Except as required by law, OPI does not intend to update or change any forward-looking statements as a result of new information, future events or otherwise.

(END)

12

Office Properties Income Trust Exhibit 99.2 Primary Tenant: CareFirst, Inc. 840 First Street, NE, Washington, DC One Building, Square Feet: 253,164 Third Quarter 2020 Supplemental Operating and Financial Data All amounts in this report are unaudited.

TABLE OF CONTENTS CORPORATE INFORMATION PAGE Company Profile....................................................................................................................................................................................................................................... 4 Investor Information.................................................................................................................................................................................................................................. 5 Research Coverage.................................................................................................................................................................................................................................. 6 FINANCIALS Key Financial Data.................................................................................................................................................................................................................................... 8 TABLE OF CONTENTS Condensed Consolidated Balance Sheets............................................................................................................................................................................................... 9 Condensed Consolidated Statements of Income (Loss).......................................................................................................................................................................... 10 Debt Summary.......................................................................................................................................................................................................................................... 12 Debt Maturity Schedule............................................................................................................................................................................................................................ 13 Leverage Ratios, Coverage Ratios and Public Debt Covenants.............................................................................................................................................................. 14 Capital Expenditures Summary................................................................................................................................................................................................................ 15 Property Acquisitions and Dispositions Information Since January 1, 2020............................................................................................................................................. 16 Investments in Unconsolidated Joint Ventures......................................................................................................................................................................................... 17 Calculation and Reconciliation of Property NOI and Property Cash Basis NOI....................................................................................................................................... 18 Reconciliation and Calculation of Same Property NOI and Same Property Cash Basis NOI................................................................................................................... 19 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre..................................................................................................................................................................... 20 Calculation of FFO, Normalized FFO and CAD........................................................................................................................................................................................ 21 PORTFOLIO INFORMATION Summary Same Property Results............................................................................................................................................................................................................ 23 Occupancy and Leasing Summary........................................................................................................................................................................................................... 24 Tenant Diversity and Credit Characteristics............................................................................................................................................................................................. 25 Tenants Representing 1% or More of Total Annualized Rental Income................................................................................................................................................... 26 Lease Expiration Schedule....................................................................................................................................................................................................................... 27 NON-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS..................................................................................................................................................................... 28 WARNING CONCERNING FORWARD-LOOKING STATEMENTS......................................................................................................................................................................... 30 Please refer to Non-GAAP Financial Measures and Certain Definitions for terms used throughout this document. Office Properties Income Trust 2 Supplemental Operating and Financial Data, September 30, 2020

CORPORATE INFORMATION Tenant: U.S. Government 1185, 1249 & 1387 S. Vinnell Way, Boise, ID Three Buildings, Square Feet: 180,952 Office Properties Income Trust Supplemental Operating and Financial Data, September 30, 2020

COMPANY PROFILE The Company: Corporate Headquarters: Office Properties Income Trust, or OPI, we, our, or us, is a real estate investment trust, or REIT, focused on owning, Two Newton Place operating and leasing properties primarily leased to single tenants and those with high credit quality characteristics like 255 Washington Street, Suite 300 government entities. The majority of our properties are office buildings. OPI is a component of 122 market indices and it Newton, MA 02458-1634 comprises more than 1% of the following indices as of September 30, 2020: BI North America Office REIT Valuation Peers (617) 219-1440 (BROFFRTV), Invesco KBW Premium Yield Equity REIT ETF INAV Index (KBWYIV) and Bloomberg Reit Office Property Index (BBREOFPY). Stock Exchange Listing: COMPANY PROFILE Nasdaq Trading Symbols: Common Shares: OPI Senior Unsecured Notes due 2046: OPINI Senior Unsecured Notes due 2050: OPINL Management: OPI is managed by The RMR Group LLC, or RMR LLC, the majority owned operating subsidiary of The RMR Group Inc. Issuer Ratings: (Nasdaq: RMR). RMR is an alternative asset management company that was founded in 1986 to manage real estate Moody’s: Baa3 companies and related businesses. RMR primarily provides management services to four publicly traded equity REITs and S&P Global: BBB- three real estate related operating businesses. In addition to managing OPI, RMR manages Diversified Healthcare Trust, a REIT that owns high-quality, private-pay healthcare properties like medical office and life science properties, senior living Key Data (As of and For the communities and wellness centers, Industrial Logistics Properties Trust, a REIT that owns industrial and logistics properties, Quarter Ended September 30, 2020): and Service Properties Trust, a REIT that owns a diverse portfolio of hotels and net lease service and necessity-based retail properties. RMR also provides management services to Five Star Senior Living Inc., a publicly traded operator of senior (dollars and sq. ft. in thousands) living communities, Sonesta International Hotels Corporation, a privately owned operator and franchisor of hotels and cruise Total properties (1) 184 boats, and TravelCenters of America Inc., a publicly traded operator and franchisor of travel centers along the U.S. Interstate Total sq. ft. (1) 24,909 Highway System, standalone truck service facilities and restaurants. RMR also advises RMR Mortgage Trust, which is in the (1) Percent leased 91.2% process of converting from a registered investment company to a publicly traded mortgage REIT, and Tremont Mortgage Trust, a publicly traded mortgage REIT, both of which will focus on originating and investing in floating rate first mortgage Q3 2020 rental income $ 145,806 whole loans, secured by middle market and transitional commercial real estate, through wholly owned Securities and Q3 2020 net loss $ (3,797) Exchange Commission, or SEC, registered investment advisory subsidiaries. As of September 30, 2020, RMR had $32.1 Q3 2020 Normalized FFO $ 62,628 billion of real estate assets under management and the combined RMR managed companies had approximately $12 billion Q3 2020 CAD $ 44,557 of annual revenues, over 2,100 properties and approximately 42,500 employees. We believe that being managed by RMR is a competitive advantage for OPI because of RMR’s depth of management and experience in the real estate industry. We (1) Excludes three properties owned by two also believe RMR provides management services to us at costs that are lower than we would have to pay for similar quality unconsolidated joint ventures. services if we were self managed. Office Properties Income Trust 4 Supplemental Operating and Financial Data, September 30, 2020

INVESTOR INFORMATION Board of Trustees Donna D. Fraiche Barbara D. Gilmore John L. Harrington Independent Trustee Independent Trustee Independent Trustee William A. Lamkin Elena B. Poptodorova Jeffrey P. Somers Independent Trustee Lead Independent Trustee Independent Trustee David M. Blackman Adam D. Portnoy INVESTOR INFORMATION Managing Trustee Chair of the Board & Managing Trustee Executive Officers David M. Blackman Matthew C. Brown Christopher J. Bilotto President and Chief Executive Officer Chief Financial Officer and Treasurer Vice President and Chief Operating Officer Contact Information Investor Relations Inquiries Office Properties Income Trust Financial inquiries should be directed to Matthew C. Brown, Two Newton Place Chief Financial Officer and Treasurer, 255 Washington Street, Suite 300 at (617) 219-1440 Newton, MA 02458-1634 or [email protected] (617) 219-1410 [email protected] Investor and media inquiries should be directed to www.opireit.com Olivia Snyder, Manager, Investor Relations, at (617) 219-1410 or [email protected] Office Properties Income Trust 5 Supplemental Operating and Financial Data, September 30, 2020

RESEARCH COVERAGE Equity Research Coverage B. Riley Securities, Inc. BofA Securities Bryan Maher James Feldman [email protected] [email protected] (646) 885-5423 (646) 855-5808 JMP Securities Mizuho Securities Aaron Hecht Omotayo Okusanya RESEARCH COVERAGE [email protected] [email protected] (415) 835-3963 (646) 949-9672 Morgan Stanley RBC Capital Markets Vikram Malhotra Michael Carroll [email protected] [email protected] (212) 761-7064 (440) 715-2649 Rating Agencies Moody’s Investors Service S&P Global Lori Marks Michael Souers [email protected] [email protected] (212) 553-0376 (212) 438-2508 OPI is followed by the analysts and its credit is rated by the rating agencies listed above. Please note that any opinions, estimates or forecasts regarding OPI’s performance made by these analysts or agencies do not represent opinions, forecasts or predictions of OPI or its management. OPI does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts or agencies. Office Properties Income Trust 6 Supplemental Operating and Financial Data, September 30, 2020

FINANCIALS Tenant: Arris Technology, Inc. 2450 & 2500 Walsh Avenue, Santa Clara, CA Two Buildings, Square Feet: 131,680 Office Properties Income Trust Supplemental Operating and Financial Data, September 30, 2020

KEY FINANCIAL DATA (dollars in thousands, except per share data) As of and for the Three Months Ended 9/30/2020 6/30/2020 3/31/2020 12/31/2019 9/30/2019 Selected Balance Sheet Data: Total gross assets $ 4,409,391 $ 4,400,379 $ 4,431,934 $ 4,580,792 $ 4,735,814 Total assets $ 3,973,045 $ 3,977,663 $ 4,028,705 $ 4,193,136 $ 4,360,249 Total liabilities $ 2,336,373 $ 2,311,233 $ 2,338,331 $ 2,487,382 $ 2,693,636 Total shareholders' equity $ 1,636,672 $ 1,666,430 $ 1,690,374 $ 1,705,754 $ 1,666,613 KEY FINANCIAL DATA Selected Income Statement Data: Rental income $ 145,806 $ 145,603 $ 149,885 $ 160,184 $ 167,411 Net income (loss) $ (3,797) $ 1,299 $ 10,840 $ 65,029 $ (3,939) Property NOI $ 95,763 $ 98,834 $ 100,186 $ 103,158 $ 108,693 Adjusted EBITDAre $ 89,817 $ 92,883 $ 94,213 $ 96,513 $ 102,886 FFO $ 62,628 $ 66,640 $ 64,268 $ 66,443 $ 69,455 Normalized FFO $ 62,628 $ 67,197 $ 67,550 $ 66,443 $ 69,739 CAD $ 44,557 $ 45,543 $ 47,366 $ 39,744 $ 38,624 Rolling four quarter CAD (1) $ 177,210 $ 171,277 $ 182,453 $ 188,606 N/A Per Common Share Data (basic and diluted): Net income (loss) $ (0.08) $ 0.03 $ 0.23 $ 1.35 $ (0.08) FFO $ 1.30 $ 1.39 $ 1.34 $ 1.38 $ 1.44 Normalized FFO $ 1.30 $ 1.40 $ 1.40 $ 1.38 $ 1.45 CAD $ 0.93 $ 0.95 $ 0.98 $ 0.83 $ 0.80 Rolling four quarter CAD (1) $ 3.68 $ 3.56 $ 3.79 $ 3.92 N/A Dividends: Annualized dividends paid per share during the period $ 2.20 $ 2.20 $ 2.20 $ 2.20 $ 2.20 Annualized dividend yield (at end of period) 10.6% 8.5% 8.1% 6.8% 7.2% Normalized FFO payout ratio 42.3% 39.3% 39.3% 39.9% 37.9% CAD payout ratio 59.1% 57.9% 56.1% 66.3% 68.8% Rolling four quarter CAD payout ratio (1) 59.6% 61.8% 58.0% 56.1% N/A (1) Rolling four quarter CAD data prior to December 31, 2019 does not include a full four quarters of operations of the properties acquired as part of our acquisition of Select Income REIT, or SIR, on December 31, 2018 in a merger transaction, or the Merger, and therefore is not comparable. Office Properties Income Trust 8 Supplemental Operating and Financial Data, September 30, 2020

CONDENSED CONSOLIDATED BALANCE SHEETS (dollars in thousands, except per share data) September 30, December 31, 2020 2019 ASSETS Real estate properties: Land $ 840,931 $ 840,550 Buildings and improvements 2,685,988 2,652,681 Total real estate properties, gross 3,526,919 3,493,231 Accumulated depreciation (436,346) (387,656) Total real estate properties, net 3,090,573 3,105,575 Assets of properties held for sale 20,716 70,877 Investments in unconsolidated joint ventures 38,533 39,756 Acquired real estate leases, net 604,233 732,382 Cash and cash equivalents 45,035 93,744 Restricted cash 12,604 6,952 Rents receivable 100,363 83,556 Deferred leasing costs, net 44,485 40,107 Other assets, net 16,503 20,187 Total assets $ 3,973,045 $ 4,193,136 LIABILITIES AND SHAREHOLDERS’ EQUITY Unsecured revolving credit facility $ — $ — Senior unsecured notes, net 2,031,197 2,017,379 Mortgage notes payable, net 170,244 309,946 Liabilities of properties held for sale 331 14,693 Accounts payable and other liabilities 116,047 125,048 Due to related persons 7,349 7,141 Assumed real estate lease obligations, net 11,205 13,175 Total liabilities 2,336,373 2,487,382 CONDENSED CONSOLIDATED BALANCE SHEETS Commitments and contingencies Shareholders’ equity: Common shares of beneficial interest, $.01 par value: 200,000,000 shares authorized, 48,318,366 and 48,201,941 shares issued and outstanding, respectively 483 482 Additional paid in capital 2,614,346 2,612,425 Cumulative net income 185,559 177,217 Cumulative other comprehensive loss — (200) Cumulative common distributions (1,163,716) (1,084,170) Total shareholders’ equity 1,636,672 1,705,754 Total liabilities and shareholders’ equity $ 3,973,045 $ 4,193,136 Office Properties Income Trust 9 Supplemental Operating and Financial Data, September 30, 2020

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS) (amounts in thousands, except per share data) Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 2020 2019 Rental income $ 145,806 $ 167,411 $ 441,294 $ 518,220 Expenses: Real estate taxes 16,113 18,824 48,701 55,363 Utility expenses 7,564 9,518 19,777 26,369 Other operating expenses 26,366 30,376 78,033 90,204 Depreciation and amortization 62,227 74,939 189,340 226,373 Loss on impairment of real estate (1) 2,954 8,521 2,954 14,105 Acquisition and transaction related costs (2) — — — 682 General and administrative 7,059 7,990 21,372 25,457 Total expenses 122,283 150,168 360,177 438,553 Gain on sale of real estate (3) — 11,463 10,822 33,538 Dividend income — — — 1,960 Loss on equity securities, net (4) — — — (44,007) Interest and other income 2 358 738 847 Interest expense (including net amortization of debt premiums, discounts and issuance costs of $2,477, $2,560, $7,162 and $8,264, respectively) (27,097) (32,367) (79,461) (104,848) Loss on early extinguishment of debt (5) — (284) (3,839) (769) Income (loss) before income tax (expense) benefit and equity in net losses of investees (3,572) (3,587) 9,377 (33,612) Income tax (expense) benefit 54 (156) (220) (509) Equity in net losses of investees (279) (196) (815) (573) Net income (loss) $ (3,797) $ (3,939) $ 8,342 $ (34,694) Weighted average common shares outstanding (basic and diluted) 48,132 48,073 48,111 48,051 Per common share amounts (basic and diluted): Net income (loss) $ (0.08) $ (0.08) $ 0.17 $ (0.72) Additional Data: General and administrative expenses / total assets (at end of period) 0.18% 0.18% 0.54% 0.58% Non-cash straight line rent adjustments included in rental income $ 3,912 $ 6,904 $ 12,963 $ 19,365 Lease value amortization included in rental income $ (1,312) $ (35) $ (4,149) $ (2,628) Lease termination fees included in rental income $ 2 $ 22 $ 8 $ 9,183 Non-cash amortization included in other operating expenses (6) $ 121 $ 121 $ 363 $ 363 (6) CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS) Non-cash amortization included in general and administrative expenses $ 151 $ 151 $ 453 $ 452 See accompanying notes on the following page. Office Properties Income Trust 10 Supplemental Operating and Financial Data, September 30, 2020

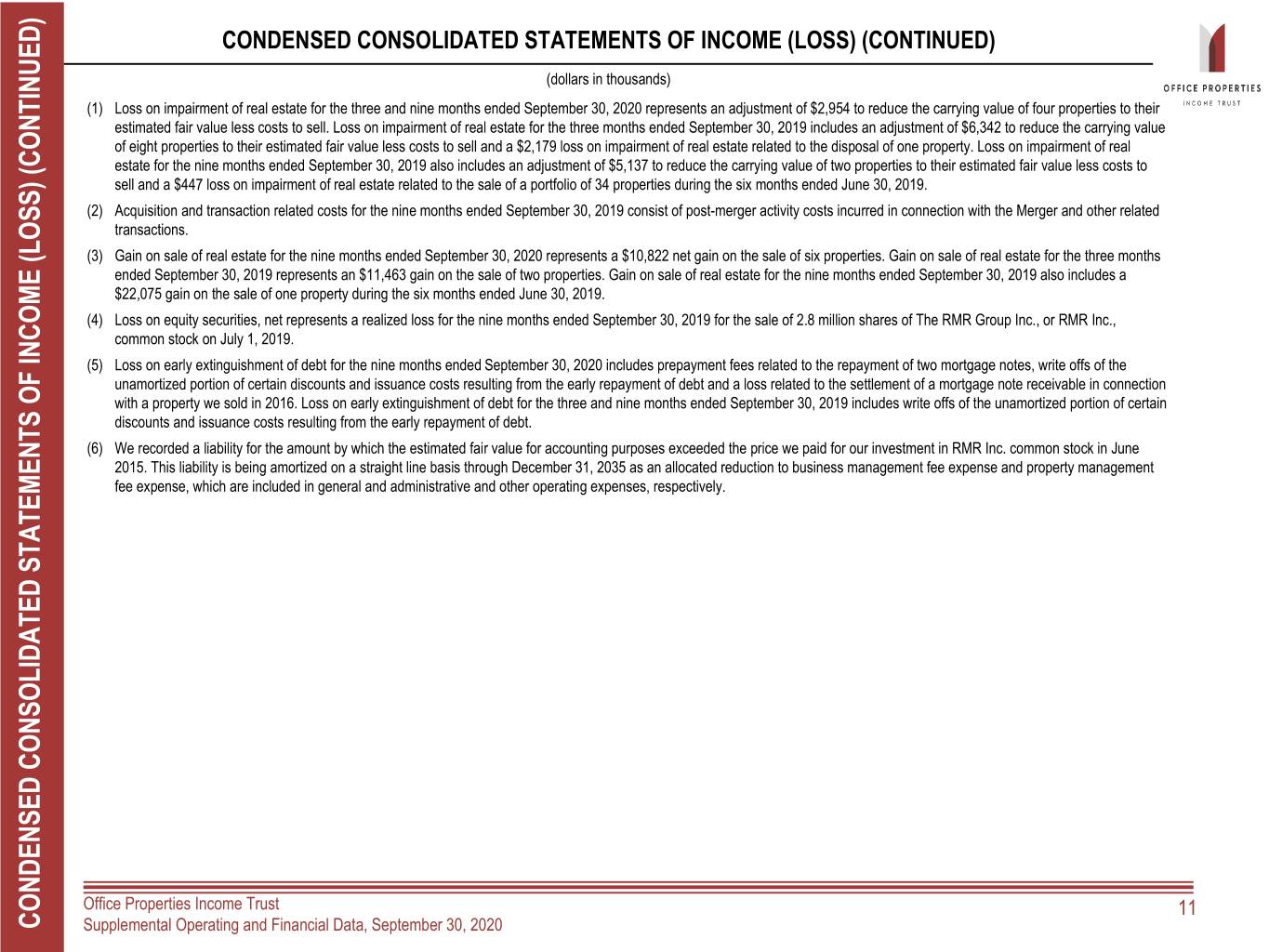

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS) (CONTINUED) (dollars in thousands) (1) Loss on impairment of real estate for the three and nine months ended September 30, 2020 represents an adjustment of $2,954 to reduce the carrying value of four properties to their estimated fair value less costs to sell. Loss on impairment of real estate for the three months ended September 30, 2019 includes an adjustment of $6,342 to reduce the carrying value of eight properties to their estimated fair value less costs to sell and a $2,179 loss on impairment of real estate related to the disposal of one property. Loss on impairment of real estate for the nine months ended September 30, 2019 also includes an adjustment of $5,137 to reduce the carrying value of two properties to their estimated fair value less costs to sell and a $447 loss on impairment of real estate related to the sale of a portfolio of 34 properties during the six months ended June 30, 2019. (2) Acquisition and transaction related costs for the nine months ended September 30, 2019 consist of post-merger activity costs incurred in connection with the Merger and other related transactions. (3) Gain on sale of real estate for the nine months ended September 30, 2020 represents a $10,822 net gain on the sale of six properties. Gain on sale of real estate for the three months ended September 30, 2019 represents an $11,463 gain on the sale of two properties. Gain on sale of real estate for the nine months ended September 30, 2019 also includes a $22,075 gain on the sale of one property during the six months ended June 30, 2019. (4) Loss on equity securities, net represents a realized loss for the nine months ended September 30, 2019 for the sale of 2.8 million shares of The RMR Group Inc., or RMR Inc., common stock on July 1, 2019. (5) Loss on early extinguishment of debt for the nine months ended September 30, 2020 includes prepayment fees related to the repayment of two mortgage notes, write offs of the unamortized portion of certain discounts and issuance costs resulting from the early repayment of debt and a loss related to the settlement of a mortgage note receivable in connection with a property we sold in 2016. Loss on early extinguishment of debt for the three and nine months ended September 30, 2019 includes write offs of the unamortized portion of certain discounts and issuance costs resulting from the early repayment of debt. (6) We recorded a liability for the amount by which the estimated fair value for accounting purposes exceeded the price we paid for our investment in RMR Inc. common stock in June 2015. This liability is being amortized on a straight line basis through December 31, 2035 as an allocated reduction to business management fee expense and property management fee expense, which are included in general and administrative and other operating expenses, respectively. Office Properties Income Trust 11 CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS) (CONTINUED) Supplemental Operating and Financial Data, September 30, 2020

DEBT SUMMARY (1) As of September 30, 2020 (dollars in thousands) Coupon Interest Principal Maturity Years to Rate (2) Rate (3) Balance Date Due at Maturity Maturity Unsecured Floating Rate Debt: $750,000 unsecured revolving credit facility (4) (5) 1.197% 1.197% $ — 1/31/2023 $ — 2.3 DEBT SUMMARY Unsecured Fixed Rate Debt: Senior unsecured notes due 2022 4.150% 4.196% 300,000 2/1/2022 300,000 1.3 Senior unsecured notes due 2022 4.000% 4.000% 300,000 7/15/2022 300,000 1.8 Senior unsecured notes due 2024 4.250% 4.404% 350,000 5/15/2024 350,000 3.6 Senior unsecured notes due 2025 4.500% 4.521% 650,000 2/1/2025 650,000 4.3 Senior unsecured notes due 2046 5.875% 5.875% 310,000 5/1/2046 310,000 25.6 Senior unsecured notes due 2050 6.375% 6.375% 162,000 6/23/2050 162,000 29.7 Subtotal / weighted average 4.687% 4.726% 2,072,000 2,072,000 8.6 Secured Fixed Rate Debt: Mortgage debt - One property in Lakewood, CO 8.150% 6.150% 694 3/1/2021 118 0.4 Mortgage debt - One property in Washington, DC 4.220% 4.190% 25,986 7/1/2022 24,668 1.8 Mortgage debt - Three properties in Seattle, WA 3.550% 4.210% 71,000 5/1/2023 71,000 2.6 Mortgage debt - One property in Chicago, IL 3.700% 4.210% 50,000 6/1/2023 50,000 2.7 Mortgage debt - One property in Washington, DC 4.800% 4.190% 23,795 6/1/2023 22,584 2.7 Subtotal / weighted average 3.887% 4.212% 171,475 168,370 2.5 Total / weighted average 4.626% 4.687% $ 2,243,475 $ 2,240,370 8.1 See accompanying notes on the following page. Office Properties Income Trust 12 Supplemental Operating and Financial Data, September 30, 2020

DEBT MATURITY SCHEDULE (1) (dollars in thousands) As of September 30, 2020 $700,000 $25,518 $600,000 $500,000 $400,000 $650,000 $300,000 $600,000 $472,000 DEBT MATURITY SCHEDULE (d ollars in thousands) $200,000 $350,000 $100,000 (7) (7) $143,784 $632 $1,541 $0 2020 2021 2022 2023 2024 2025 2026 and thereafter (6) Unsecured Floating Rate Debt Unsecured Fixed Rate Debt Secured Fixed Rate Debt (1) Excludes two mortgage notes with an aggregate principal balance of $82,000 which are secured by three properties owned by two unconsolidated joint ventures in which we own 51% and 50% interests. See page 17 for additional information regarding these joint ventures and related mortgage notes. (2) Reflects the interest rate stated in, or determined pursuant to, the contract terms. (3) Includes the effect of mark to market accounting for certain mortgages and discounts on senior unsecured notes. Excludes the effect of debt issuance costs amortization. (4) We are required to pay interest on borrowings under our revolving credit facility at a rate of LIBOR plus a premium of 110 basis points per annum. We also pay a facility fee of 25 basis points per annum on the total amount of lending commitments under our revolving credit facility. Both the interest rate premium and facility fee are subject to adjustment based upon changes to our credit ratings. The interest rate listed is as of September 30, 2020 and excludes the 25 basis point facility fee. Subject to the payment of an extension fee and meeting certain other conditions, we may extend the maturity date of our revolving credit facility for two additional six month periods. (5) The maximum aggregate borrowing availability under the credit agreement governing our revolving credit facility may be increased to up to $1,950,000 in certain circumstances. (6) Represents the amount, if any, outstanding under our revolving credit facility at September 30, 2020. (7) Represents Secured Fixed Rate Debt payments in 2020 and 2021 and mortgage debt maturing in 2021 that has a principal balance of $694 at September 30, 2020. Office Properties Income Trust 13 Supplemental Operating and Financial Data, September 30, 2020

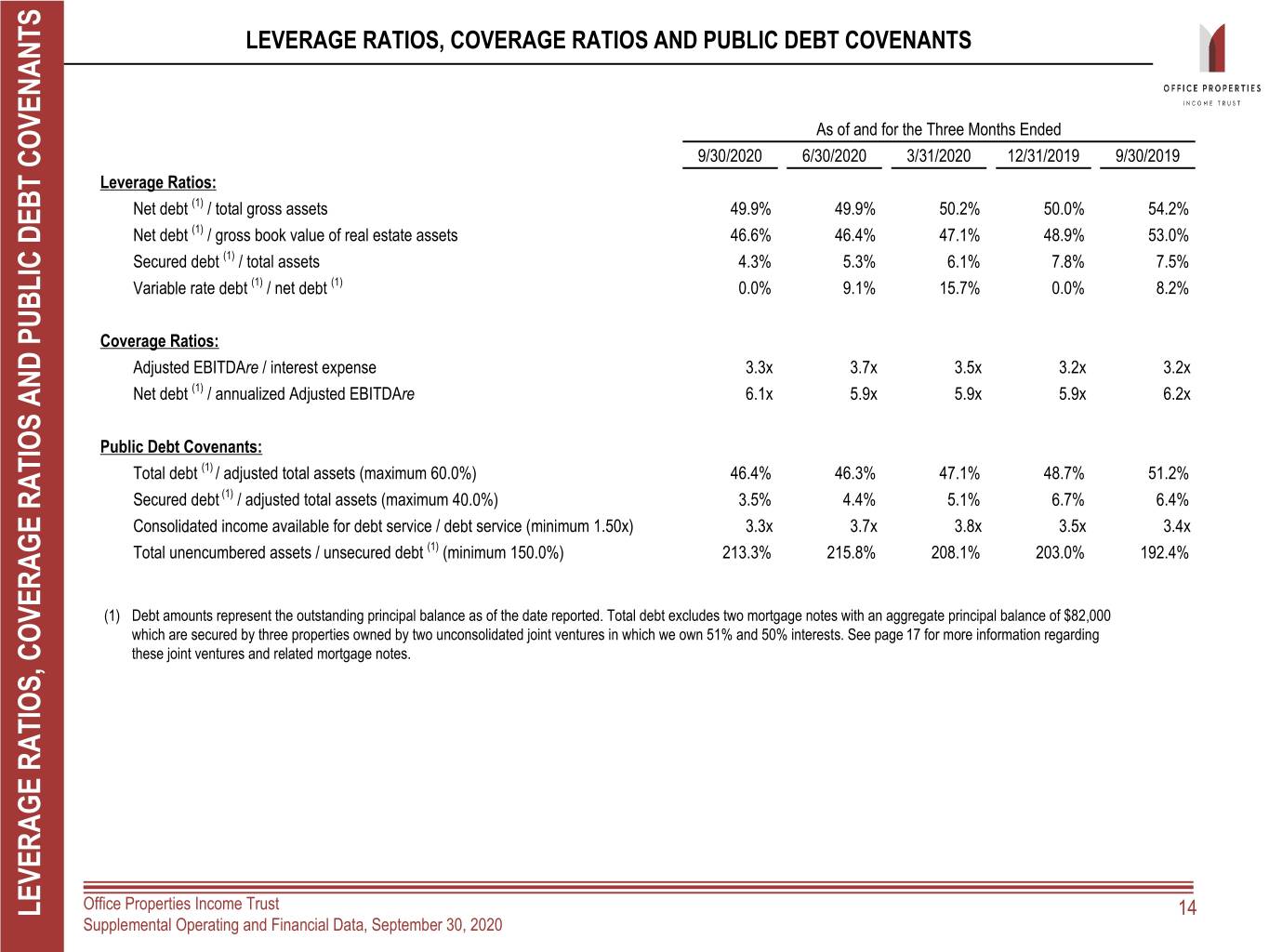

LEVERAGE RATIOS, COVERAGE RATIOS AND PUBLIC DEBT COVENANTS As of and for the Three Months Ended 9/30/2020 6/30/2020 3/31/2020 12/31/2019 9/30/2019 Leverage Ratios: Net debt (1) / total gross assets 49.9% 49.9% 50.2% 50.0% 54.2% Net debt (1) / gross book value of real estate assets 46.6% 46.4% 47.1% 48.9% 53.0% Secured debt (1) / total assets 4.3% 5.3% 6.1% 7.8% 7.5% Variable rate debt (1) / net debt (1) 0.0% 9.1% 15.7% 0.0% 8.2% Coverage Ratios: Adjusted EBITDAre / interest expense 3.3x 3.7x 3.5x 3.2x 3.2x Net debt (1) / annualized Adjusted EBITDAre 6.1x 5.9x 5.9x 5.9x 6.2x Public Debt Covenants: Total debt (1) / adjusted total assets (maximum 60.0%) 46.4% 46.3% 47.1% 48.7% 51.2% Secured debt (1) / adjusted total assets (maximum 40.0%) 3.5% 4.4% 5.1% 6.7% 6.4% Consolidated income available for debt service / debt service (minimum 1.50x) 3.3x 3.7x 3.8x 3.5x 3.4x Total unencumbered assets / unsecured debt (1) (minimum 150.0%) 213.3% 215.8% 208.1% 203.0% 192.4% (1) Debt amounts represent the outstanding principal balance as of the date reported. Total debt excludes two mortgage notes with an aggregate principal balance of $82,000 which are secured by three properties owned by two unconsolidated joint ventures in which we own 51% and 50% interests. See page 17 for more information regarding these joint ventures and related mortgage notes. Office Properties Income Trust LEVERAGE RATIOS, COVERAGE RATIOS AND PUBLIC DEBT COVENANTS 14 Supplemental Operating and Financial Data, September 30, 2020

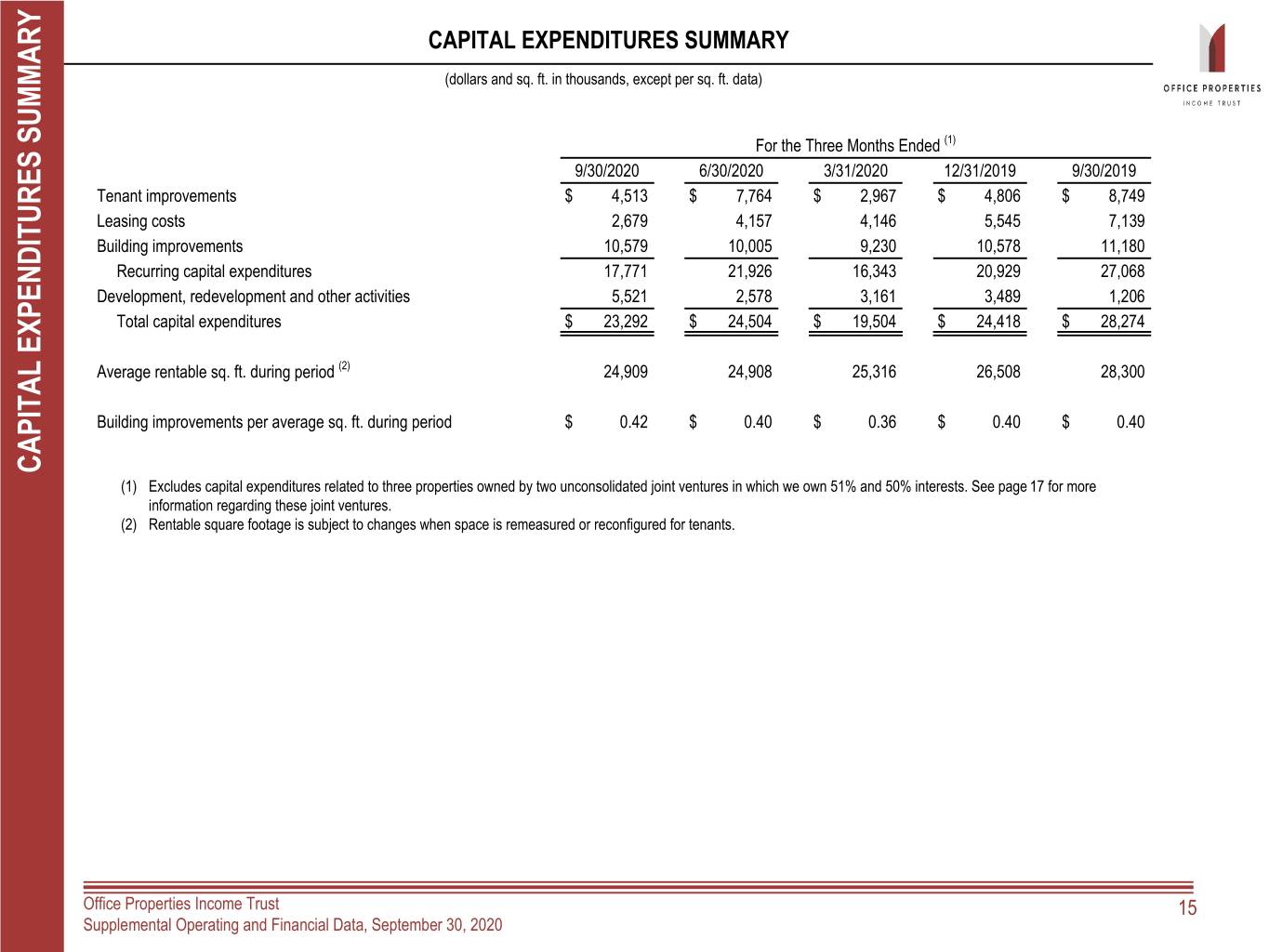

CAPITAL EXPENDITURES SUMMARY (dollars and sq. ft. in thousands, except per sq. ft. data) For the Three Months Ended (1) 9/30/2020 6/30/2020 3/31/2020 12/31/2019 9/30/2019 Tenant improvements $ 4,513 $ 7,764 $ 2,967 $ 4,806 $ 8,749 Leasing costs 2,679 4,157 4,146 5,545 7,139 Building improvements 10,579 10,005 9,230 10,578 11,180 Recurring capital expenditures 17,771 21,926 16,343 20,929 27,068 Development, redevelopment and other activities 5,521 2,578 3,161 3,489 1,206 Total capital expenditures $ 23,292 $ 24,504 $ 19,504 $ 24,418 $ 28,274 Average rentable sq. ft. during period (2) 24,909 24,908 25,316 26,508 28,300 Building improvements per average sq. ft. during period $ 0.42 $ 0.40 $ 0.36 $ 0.40 $ 0.40 CAPITAL EXPENDITURES SUMMARY (1) Excludes capital expenditures related to three properties owned by two unconsolidated joint ventures in which we own 51% and 50% interests. See page 17 for more information regarding these joint ventures. (2) Rentable square footage is subject to changes when space is remeasured or reconfigured for tenants. Office Properties Income Trust 15 Supplemental Operating and Financial Data, September 30, 2020

PROPERTY ACQUISITIONS AND DISPOSITIONS INFORMATION SINCE JANUARY 1, 2020 (dollars and sq. ft. in thousands) ACQUISITIONS: On February 21, 2020, we acquired a property adjacent to a property we own in Boston, MA for a purchase price of $11,500, excluding acquisition related costs. DISPOSITIONS: Date Number of Gross Sold Location Properties Sq. Ft. Sales Price 1/8/2020 Stafford, VA 2 65 $ 14,063 1/24/2020 Windsor, CT 1 97 7,000 2/28/2020 Lincolnshire, IL 1 223 12,000 3/11/2020 Trenton, NJ 1 267 30,100 3/19/2020 Fairfax, VA 1 83 22,200 10/19/2020 Fairfax, VA 4 171 25,100 Total 10 906 $ 110,463 Office Properties Income Trust 16 PROPERTY ACQUISITIONS AND DISPOSITIONS INFORMATION SINCE JANUARY 1, 2020 Supplemental Operating and Financial Data, September 30, 2020

INVESTMENTS IN UNCONSOLIDATED JOINT VENTURES (dollars in thousands) Unconsolidated Joint Ventures: Weighted Average OPI OPI Investment at Number of Square Occupancy at Lease Term at Joint Venture Ownership September 30, 2020 Properties Location Feet September 30, 2020 September 30, 2020 (1) Prosperity Metro Plaza 51% $ 22,080 2 Fairfax, VA 328,655 83.1% 3.4 years 1750 H Street, NW 50% 16,453 1 Washington, D.C. 115,411 98.1% 0.5 years Total / Weighted Average $ 38,533 3 444,066 87.0% 2.2 years Outstanding Unconsolidated Debt: Principal Balance OPI Share of OPI Interest Maturity at September 30, Annualized Principal Balance (4) Joint Venture Ownership Rate (2) Date 2020 (3) Debt Service Balance at Maturity (3) at September 30, 2020 Prosperity Metro Plaza (5) 51% 4.090% 12/1/2029 $ 50,000 $ 2,045 $ 45,246 $ 25,500 1750 H Street, NW 50% 3.690% 8/1/2024 32,000 1,181 32,000 16,000 Total / Weighted Average 3.934% $ 82,000 $ 3,226 $ 77,246 $ 41,500 Results of Operations - Unconsolidated Joint Ventures: (6) For the Three Months Ended September 30, 2020 For the Nine Months Ended September 30, 2020 Prosperity 1750 H Prosperity 1750 H Metro Plaza Street, NW Total Metro Plaza Street, NW Total Equity in earnings (losses) of affiliates $ 31 $ (310) $ (279) $ 5 $ (820) $ (815) Depreciation and amortization 596 648 1,244 1,758 1,964 3,722 Other expenses, net (7) 258 176 434 764 510 1,274 NOI (8) 885 514 1,399 2,527 1,654 4,181 Lease value amortization included in rental income (9) (1) 34 33 (3) 102 99 Non-cash straight line rent adjustments included in rental income (9) — 21 21 (3) 45 42 Cash Basis NOI (8) $ 884 $ 569 $ 1,453 $ 2,521 $ 1,801 $ 4,322 Distributions received by OPI $ 255 $ — $ 255 $ 408 $ — $ 408 (1) Lease term is weighted based on annualized rental income. Annualized rental income is calculated using the annualized contractual base rents from the unconsolidated joint ventures' tenants pursuant to the lease agreements as of September 30, 2020, plus straight line rent adjustments and estimated recurring expense reimbursements to be paid to the joint ventures by their tenants, and excluding lease value amortization. INVESTMENTS IN UNCONSOLIDATED JOINT VENTURES (2) Includes the effect of interest rate protection and mark to market accounting. (3) Reflects the entire balance of the debt secured by the properties and is not adjusted to reflect the part of the joint venture arrangement interests we do not own. (4) Reflects our proportionate share of the principal debt balances based on our ownership percentage of the applicable joint venture; none of the debt is recourse to us. (5) The mortgage loan requires interest-only payments through December 2024, at which time the loan requires principal and interest payments through its maturity date. (6) Reflects our proportionate share of operating results for the three and nine months ended September 30, 2020 based on our ownership percentage of the respective joint ventures. (7) Includes interest expense, net of other income. (8) We calculate NOI and Cash Basis NOI for our unconsolidated joint ventures in the same manner that we calculate Property NOI and Property Cash Basis NOI. (9) Our unconsolidated joint ventures report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income also includes expense reimbursements, tax escalations, parking revenues, service income and other fixed and variable charges paid to the unconsolidated joint ventures by their tenants, as well as the net effect of non- cash amortization of intangible lease assets and liabilities. Office Properties Income Trust 17 Supplemental Operating and Financial Data, September 30, 2020

CALCULATION AND RECONCILIATION OF PROPERTY NOI AND PROPERTY CASH BASIS NOI (1) (dollars in thousands) For the Three Months Ended For the Nine Months Ended 9/30/2020 6/30/2020 3/31/2020 12/31/2019 9/30/2019 9/30/2020 9/30/2019 Calculation of Property NOI and Property Cash Basis NOI: Rental income $ 145,806 $ 145,603 $ 149,885 $ 160,184 $ 167,411 $ 441,294 $ 518,220 Property operating expenses (50,043) (46,769) (49,699) (57,026) (58,718) (146,511) (171,936) Property NOI 95,763 98,834 100,186 103,158 108,693 294,783 346,284 Non-cash straight line rent adjustments included in rental income (3,912) (3,468) (5,583) (8,142) (6,904) (12,963) (19,365) Lease value amortization included in rental income 1,312 1,405 1,432 82 35 4,149 2,628 Lease termination fees included in rental income (2) (3) (3) (2) (22) (8) (9,183) Non-cash amortization included in property operating expenses (2) (121) (121) (121) (121) (121) (363) (363) Property Cash Basis NOI $ 93,040 $ 96,647 $ 95,911 $ 94,975 $ 101,681 $ 285,598 $ 320,001 Reconciliation of Net Income (Loss) to Property NOI and Property Cash Basis NOI: Net income (loss) $ (3,797) $ 1,299 $ 10,840 $ 65,029 $ (3,939) $ 8,342 $ (34,694) Equity in net losses of investees 279 260 276 686 196 815 573 Income tax expense (benefit) (54) 235 39 269 156 220 509 Income (loss) before income tax expense (benefit) and equity in net losses of investees (3,572) 1,794 11,155 65,984 (3,587) 9,377 (33,612) Loss on early extinguishment of debt — 557 3,282 — 284 3,839 769 Interest expense 27,097 25,205 27,159 30,032 32,367 79,461 104,848 Interest and other income (2) (30) (706) (198) (358) (738) (847) Loss on equity securities, net — — — — — — 44,007 Dividend income — — — — — — (1,960) Gain on sale of real estate — (66) (10,756) (71,593) (11,463) (10,822) (33,538) General and administrative 7,059 7,204 7,109 7,271 7,990 21,372 25,457 Acquisition and transaction related costs — — — — — — 682 Loss on impairment of real estate 2,954 — — 8,150 8,521 2,954 14,105 Depreciation and amortization 62,227 64,170 62,943 63,512 74,939 189,340 226,373 Property NOI 95,763 98,834 100,186 103,158 108,693 294,783 346,284 Non-cash amortization included in property operating expenses (2) (121) (121) (121) (121) (121) (363) (363) Lease termination fees included in rental income (2) (3) (3) (2) (22) (8) (9,183) Lease value amortization included in rental income 1,312 1,405 1,432 82 35 4,149 2,628 Non-cash straight line rent adjustments included in rental income (3,912) (3,468) (5,583) (8,142) (6,904) (12,963) (19,365) Property Cash Basis NOI $ 93,040 $ 96,647 $ 95,911 $ 94,975 $ 101,681 $ 285,598 $ 320,001 (1) Excludes three properties owned by two unconsolidated joint ventures in which we own 51% and 50% interests. See page 17 for more information regarding these joint ventures. (2) We recorded a liability for the amount by which the estimated fair value for accounting purposes exceeded the price we paid for our former investment in RMR Inc. common stock in June 2015. A portion of this liability is being amortized on a straight line basis through December 31, 2035 as a reduction to property management fees expense, which are included in property operating expenses. Office Properties Income Trust 18 CALCULATION AND RECONCILIATION OF PROPERTY NOI CASH BASIS Supplemental Operating and Financial Data, September 30, 2020