Form 425 INPHI Corp Filed by: MARVELL TECHNOLOGY GROUP LTD

Filed by Marvell Technology Group Ltd.

(Commission File No. 000-30877)

pursuant to Rule 425 under the Securities Act of 1933, as amended

and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934, as amended

Subject Company: Inphi Corporation

(Commission File No. 001-34942)

The following presentation was issued by Marvell Technology Group Ltd. (“Marvell”) and Inphi Corporation (“Inphi”) on October 29, 2020.

Special All-Employee Meeting October 29, 2020 Inphi Confidential Internal Audiences Only

Important Information for Investors and Shareholders Cautionary Statement Regarding Forward Looking Statements This presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the proposed transaction between Marvell, Inphi and the newly formed company which will become the holding company of Marvell and Inphi following the transaction (“HoldCo”), including statements regarding the benefits of the transaction, the anticipated timing of the transaction and the products and markets of each company. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: (i) the completion of the proposed transaction on anticipated terms and timing, including obtaining shareholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities and other conditions to the completion of the transaction; (ii) failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the transaction or HoldCo’s ability to integrate the businesses of Marvell and Inphi or due to unexpected costs, liabilities or delays; (iii) the ability of the parties to obtain or consummate financing or refinancing related to the transactions upon acceptable terms or at all; (iv) potential litigation relating to the proposed transaction that could be instituted against Marvell, HoldCo or Inphi or their respective directors; (v) the risk that disruptions from the proposed transaction will harm Marvell or Inphi’s business, including current plans and operations; (vi) the ability of Marvell or Inphi to retain and hire key personnel; (vii) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction; (viii) risks relating to the value of the HoldCo shares to be issued in the transaction; (ix) risks associated with third party contracts containing consent and/or other provisions that may be triggered by the proposed transaction; (x) the impact of public health crises, such as pandemics (including coronavirus (COVID-19)) and epidemics and any related company or government policies and actions to protect the health and safety of individuals or government policies or actions to maintain the functioning of national or global economies and markets; (xi) legislative, regulatory and economic developments affecting Marvell or Inphi’s businesses; (xii) general economic and market developments and conditions; (xiii) the evolving legal, regulatory and tax regimes under which Marvell, HoldCo and Inphi operate; (xiv) potential business uncertainty, including changes to existing business relationships, during the pendency of the proposed transaction that could affect Marvell’s and/or Inphi’s financial performance; (xv) restrictions during the pendency of the proposed transaction that may impact Marvell’s or Inphi’s ability to pursue certain business opportunities or strategic transactions; (xvi) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as Marvell’s and Inphi’s response to any of the aforementioned factors; (xvii) failure to receive the approval of the securityholders of Marvell and/or Inphi; and (xviii) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the businesses of Marvell and Inphi described in the “Risk Factors” section of their respective Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed by either of them from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Marvell and Inphi assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise. Neither Marvell nor Inphi gives any assurance that either Marvell or Inphi will achieve its expectations.

Important Information for Investors and Shareholders Additional Information and Where to Find It This communication relates to a proposed transaction between Marvell and Inphi. In connection with the proposed transaction, Marvell and Inphi will cause the newly formed company which will become the holding company of Marvell and Inphi following the transaction (“HoldCo”) to file a registration statement on Form S-4 with the Securities and Exchange Commission (the “SEC”), which will include a document that serves as a joint proxy statement of Marvell and Inphi and a prospectus of HoldCo referred to as a joint proxy statement/prospectus. A joint proxy statement/prospectus will be sent to all Inphi stockholders and all Marvell shareholders. Each party also will file other documents regarding the proposed transaction with the SEC. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF INPHI AND INVESTORS AND SECURITY HOLDERS OF MARVELL ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors, Marvell shareholders and Inphi stockholders may obtain free copies of the Joint Proxy Statement/Prospectus (when available) and other documents that are filed or will be filed with the SEC by Marvell, Inphi or HoldCo through the website maintained by the SEC at www.sec.gov. The documents filed by Marvell with the SEC also may be obtained free of charge at Marvell’s website at www.marvell.com or upon written request to Marvell Technology Group Ltd. at 5488 Marvell Lane, Santa Clara, CA 95054. The documents filed by Inphi with the SEC also may be obtained free of charge at Inphi’s website at www.inphi.com or upon written request to Inphi Corporation at 110 Rio Robles, San Jose, California 95134. Participants in the Solicitation Marvell and Inphi and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Inphi’s stockholders and from Marvell’s shareholders in connection with the proposed transaction. Information about Inphi’s directors and executive officers and their ownership of Inphi’s common stock is set forth in Inphi’s proxy statement for its 2020 Annual Meeting of Stockholders on Schedule 14A filed with the SEC on April 21, 2020. Information about Marvell’s directors and executive officers is set forth in Marvell’s proxy statement for its 2020 Annual General Meeting of Shareholders on Schedule 14A filed with the SEC on May 28, 2020. To the extent that holdings of Inphi’s or Marvell’s securities have changed since the amounts printed in Inphi’s or Marvell’s proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the proxy statement/prospectus regarding the proposed transaction when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph. No Offer or Solicitation This presentation is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. Non-GAAP Measures This presentation includes non-GAAP financial measures as defined under SEC rules. Reconciliations of non-GAAP to GAAP are included at the end of this presentation.

Inphi is doing great on our own: Q3, Q4, 2021, and beyond Q3: $180.7M record revenue, 29.5% non-GAAP operating profit Q4 and 2021: “as is” despite Huawei ban, due to strength of cloud customers Strong ASP points to continued leadership in electro-optics interconnects We’re not selling. We are starting the new era of Inphi 3.0 under Marvell brand Shared vision of “Accelerate the transition to the digital world” Double down on “Move”, complements “Store, Process and Secure” Very synergistic product portfolio, teams and customers $23B SAM in CY’23 at 12% CAGR Creates 4 new combined $100M+ cloud customers right away Accelerates our growth and leadership in cloud, 5G, and opens up automotive Combining best of both teams May be 12 mos. to close: critical to operate “business as usual”, continue to execute Inphi + Marvell = Infrastructure Powerhouse, for Cloud and 5G

Inphi to Combine with Marvell Creating a U.S. Semiconductor Powerhouse Positioned for Growth and Leadership in Cloud and 5G Infrastructure

Matt Murphy President and CEO Marvell Semiconductor

Marvell and Inphi share a vision of data infrastructure We develop and deliver semiconductor solutions that move, store, process and secure the world’s data faster and more reliably than anyone else. Inphi is the leader in data movement interconnects between and inside data centers. We move big data fast, around the globe, with high quality and reliability.

Overview Company founded 1995 FY20 revenue $2.7B Employees 5,000+ Located in Santa Clara, CA R&D centers in US, Israel, India, Germany, China Patents worldwide 10,000+

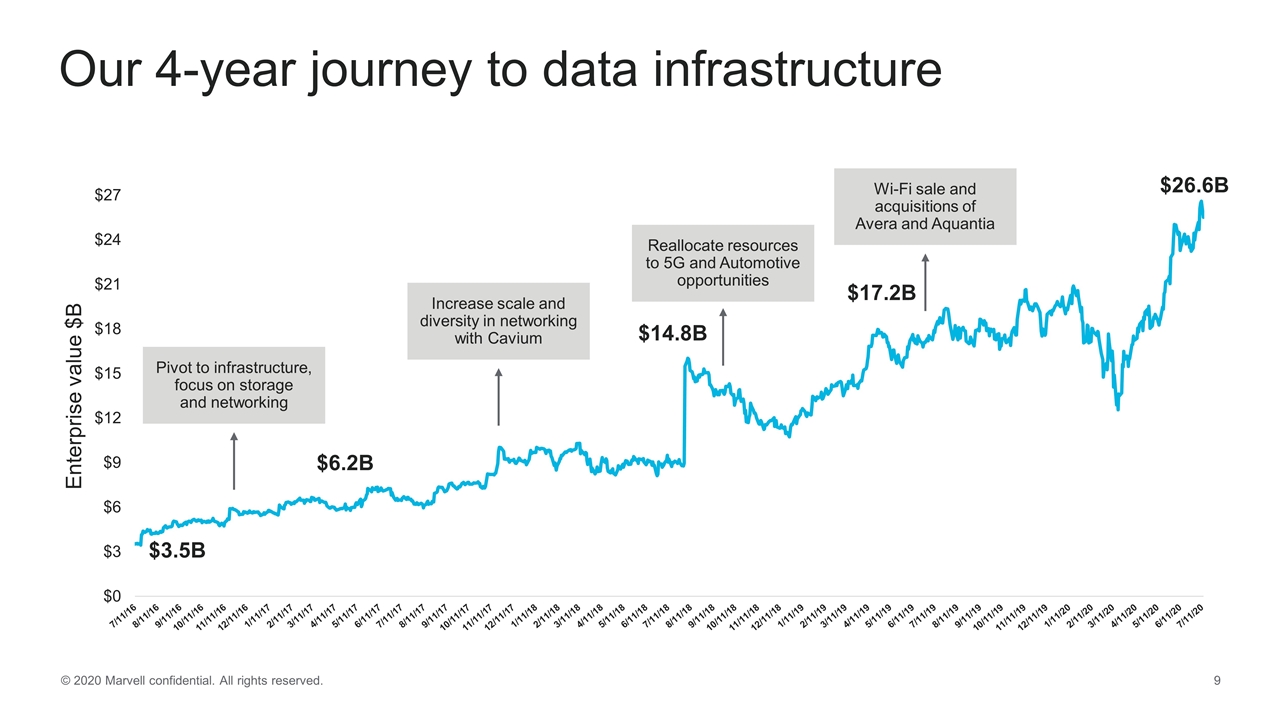

Our 4-year journey to data infrastructure Enterprise value $B Pivot to infrastructure, focus on storage and networking Increase scale and diversity in networking with Cavium Reallocate resources to 5G and Automotive opportunities Wi-Fi sale and acquisitions of Avera and Aquantia $17.2B $14.8B $3.5B $6.2B $26.6B

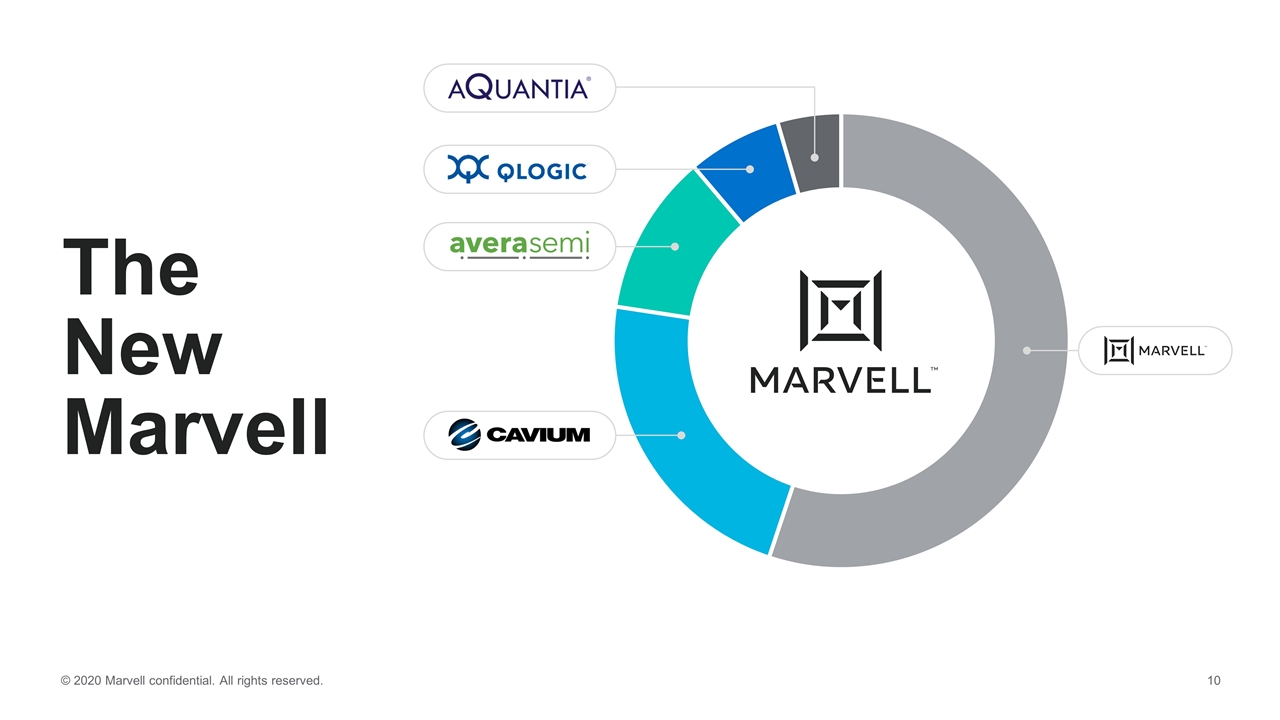

The New Marvell

Act with integrity and treat everyone with respect Say what you mean, do what you say Be inclusive and embrace the diversity of people and opinions Lying and arrogance are unacceptable Innovate to solve customer needs Understand the customer’s needs and focus innovation to make them successful Be creative – take calculated risks and learn from failures Build close and trusted customer relationships and easy to do business with Execute with thoroughness and rigor Make decisions objectively based on data Strive for excellence and minimize waste, delays and inconsistency Deliver superior quality on time Help others achieve their objectives One Marvell - Put Marvell objectives ahead of individual or team objectives Act like an owner of the entire business Share information, resources, technology and opportunities across the organization Culture: Marvell’s Core Behaviors

Focused on enabling data infrastructure We specialize in semiconductor solutions across four end markets. Carrier Enterprise Automotive Data Center

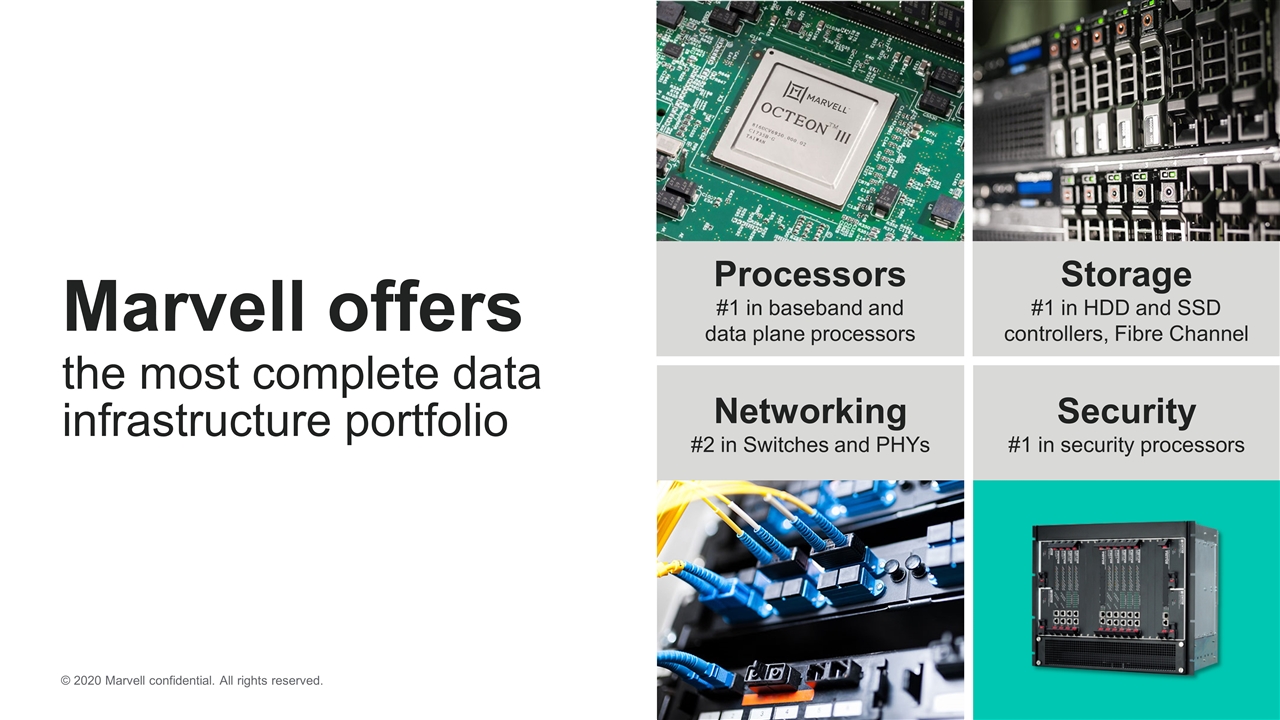

Storage #1 in HDD and SSD controllers, Fibre Channel Security #1 in security processors Networking #2 in Switches and PHYs Marvell offers the most complete data infrastructure portfolio Processors #1 in baseband and data plane processors

Working with leading companies

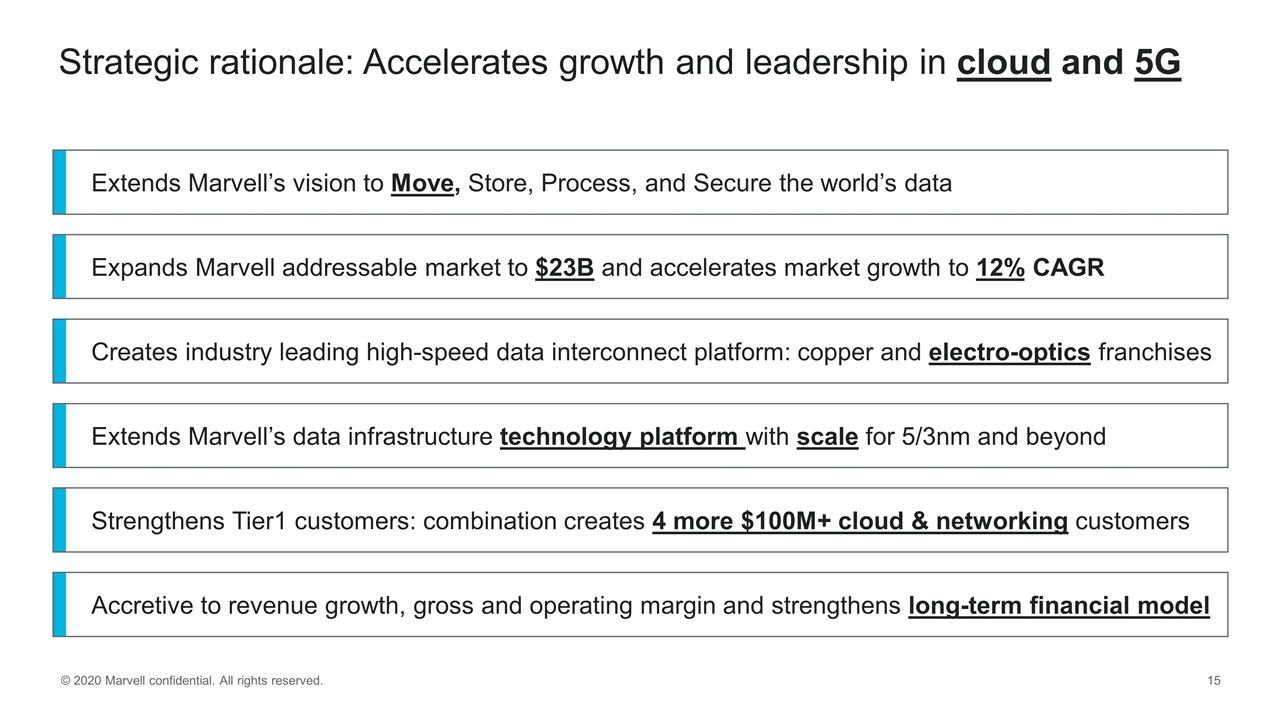

Strategic rationale: Accelerates growth and leadership in cloud and 5G Extends Marvell’s vision to Move, Store, Process, and Secure the world’s data Expands Marvell addressable market to $23B and accelerates market growth to 12% CAGR Creates industry leading high-speed data interconnect platform: copper and electro-optics franchises Extends Marvell’s data infrastructure technology platform with scale for 5/3nm and beyond Strengthens Tier1 customers: combination creates 4 more $100M+ cloud & networking customers Accretive to revenue growth, gross and operating margin and strengthens long-term financial model

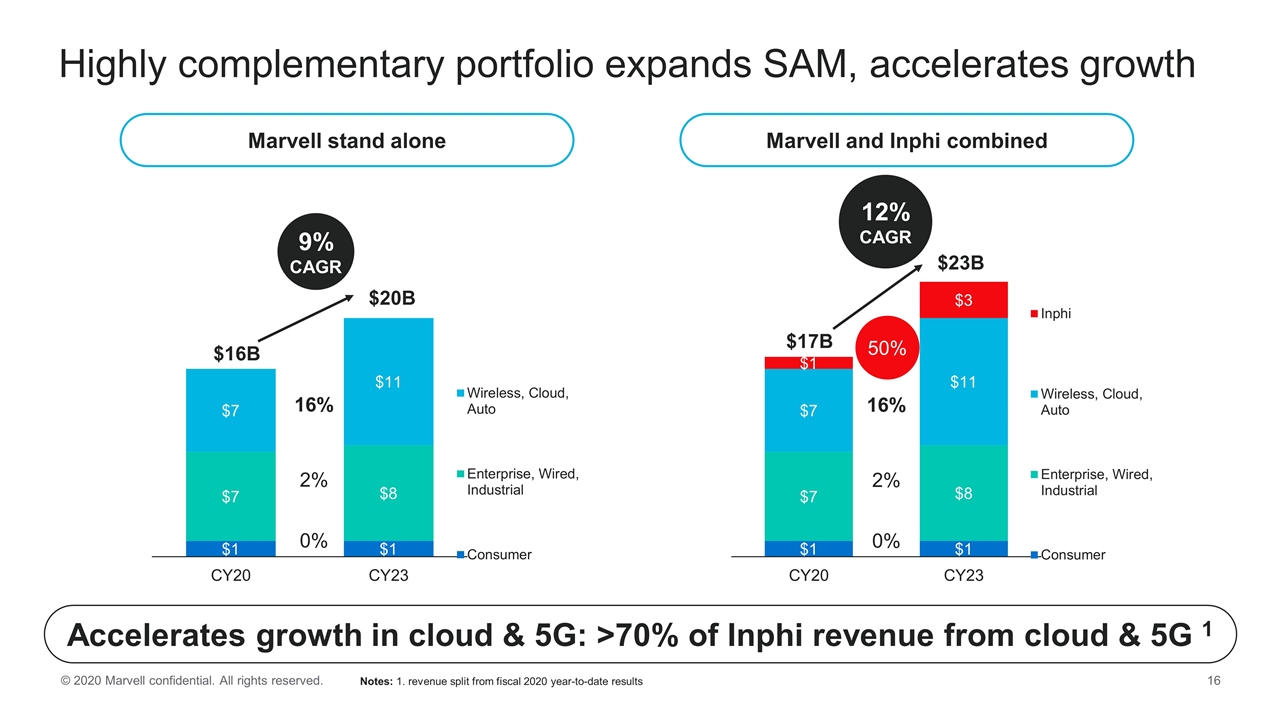

Highly complementary portfolio expands SAM, accelerates growth $20B $16B 16% 2% 0% $23B $17B 12% CAGR 9% CAGR 50% Accelerates growth in cloud & 5G: >70% of Inphi revenue from cloud & 5G 1 Marvell stand alone 16% 2% 0% Marvell and Inphi combined Notes: 1. revenue split from fiscal 2020 year-to-date results

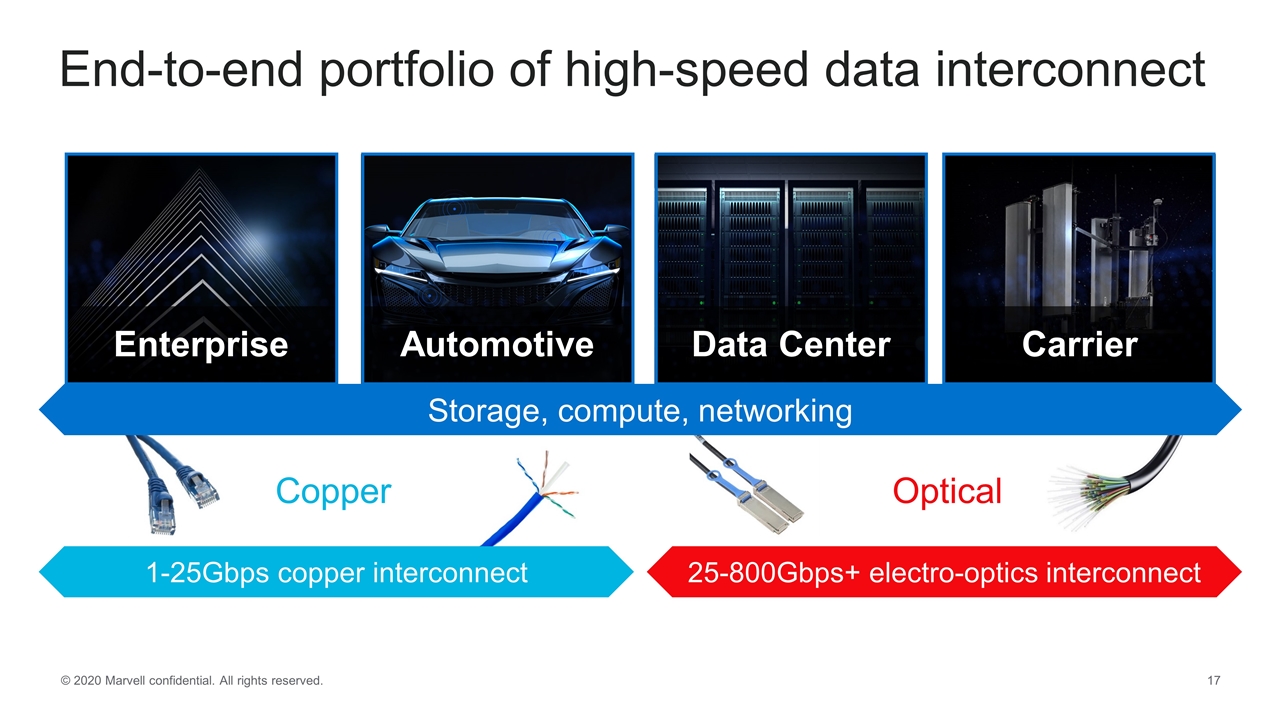

End-to-end portfolio of high-speed data interconnect Storage, compute, networking 1-25Gbps copper interconnect 25-800Gbps+ electro-optics interconnect Copper Carrier Automotive Enterprise Data Center Optical

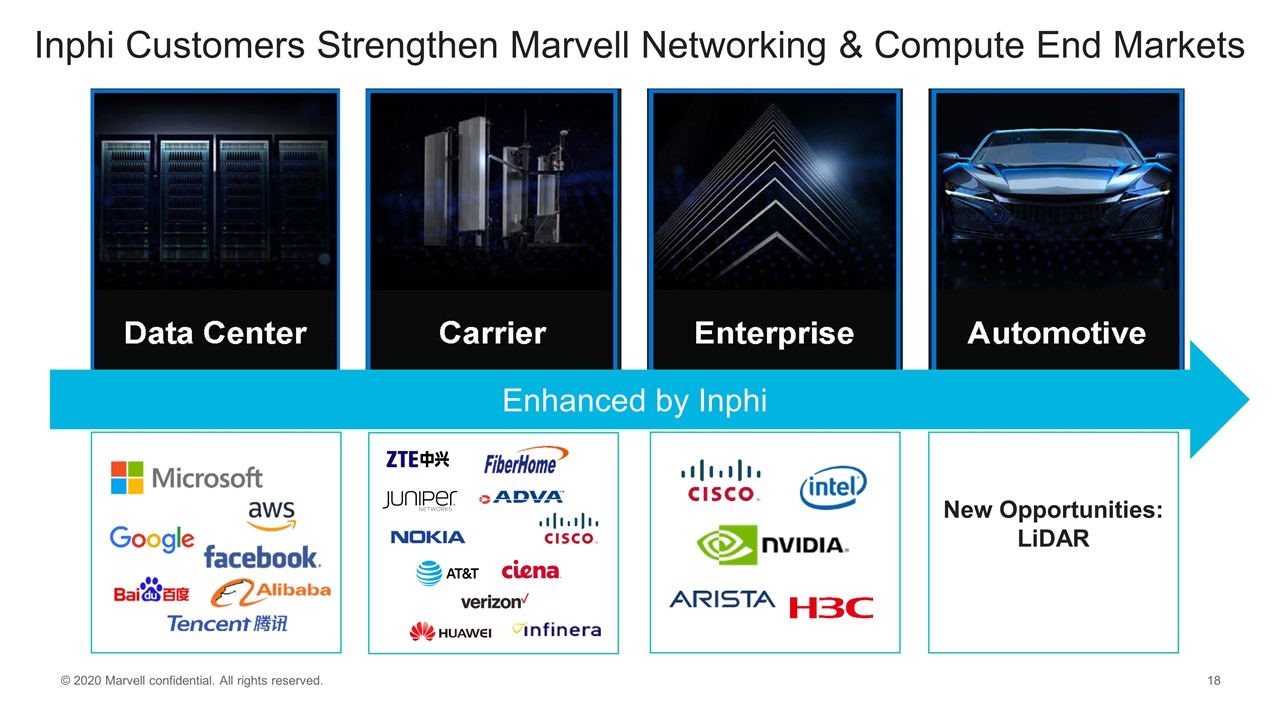

New Opportunities: LiDAR Inphi Customers Strengthen Marvell Networking & Compute End Markets Enhanced by Inphi

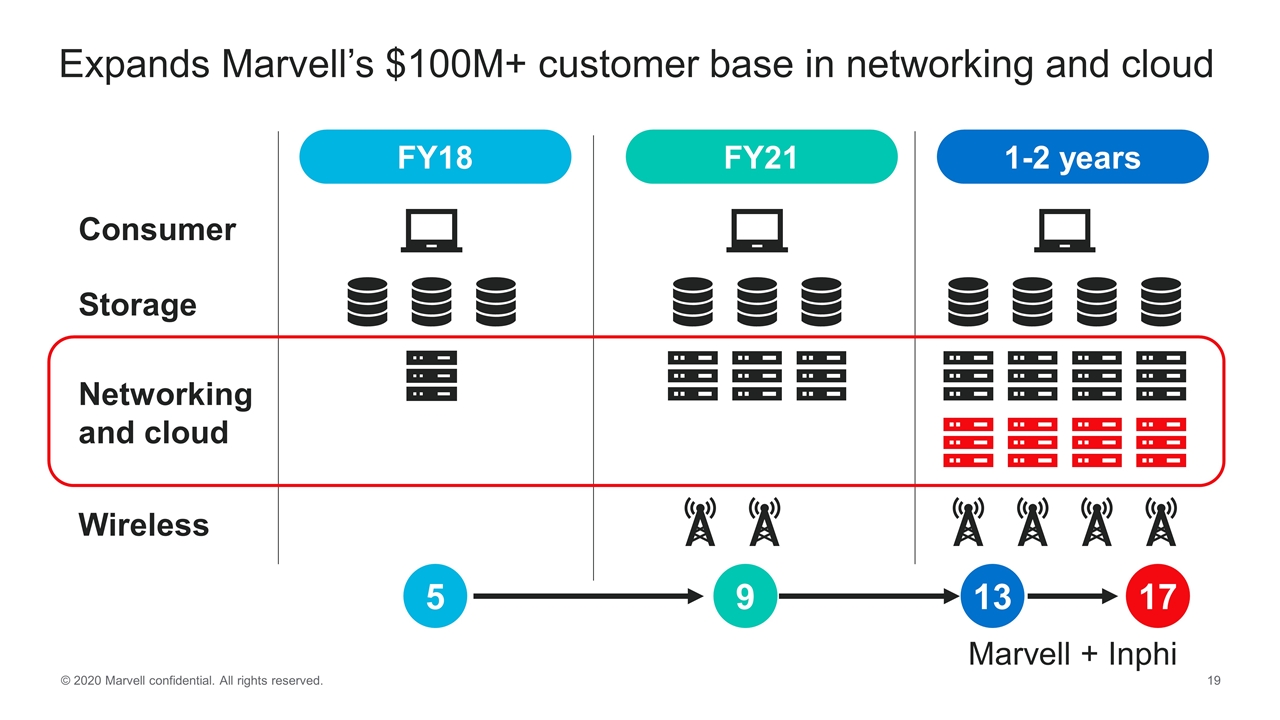

Expands Marvell’s $100M+ customer base in networking and cloud FY18 Consumer Storage Networking and cloud Wireless 5 FY21 9 1-2 years 17 13 Marvell + Inphi

Accelerates Marvell’s strategic growth drivers Compute and high-speed data interconnect leadership for 5G and cloud Marvell leads with base station compute Compute sets the bandwidth bar and cadence Inphi adds Fronthaul and backhaul interconnect Inphi leads with electro-optics interconnect Inside and between cloud data centers Optical fabric sets the bandwidth bar and cadence Marvell adds DPU – data centric compute in the network Storage – optimized solutions for hot & cold storage 5G wireless infrastructure Cloud data centers

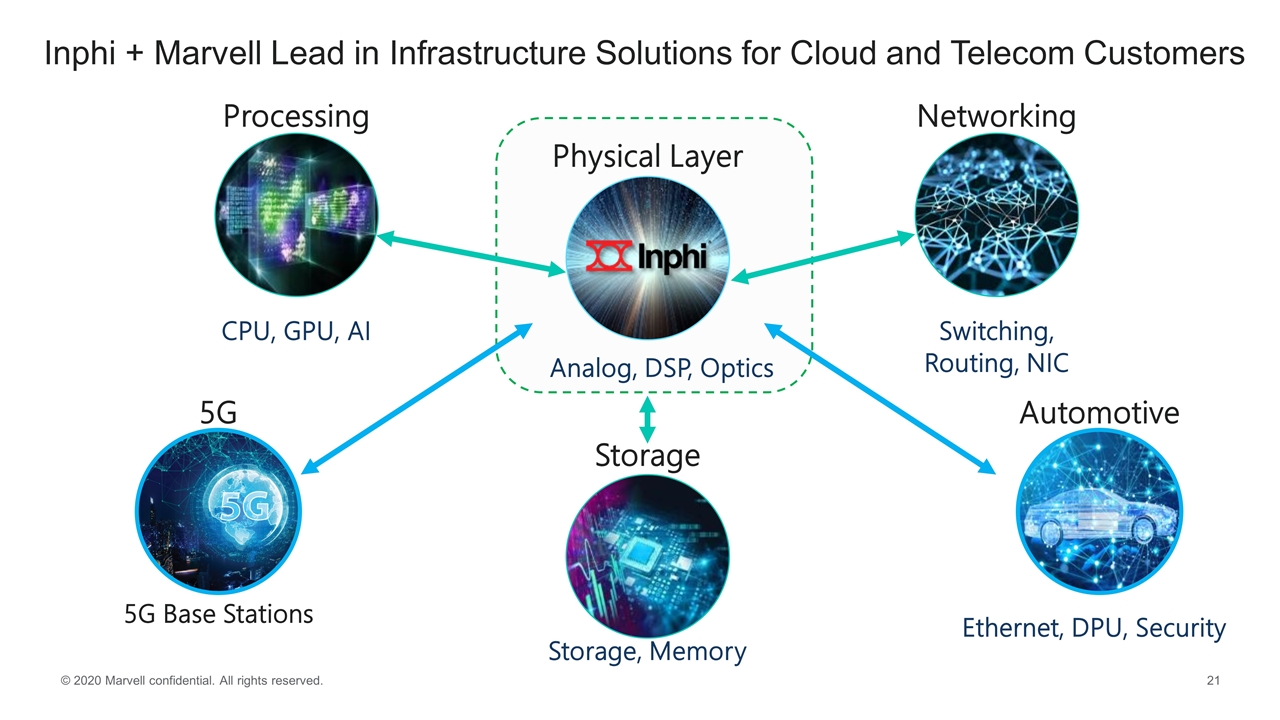

Inphi + Marvell Lead in Infrastructure Solutions for Cloud and Telecom Customers Analog, DSP, Optics Processing Storage Networking Switching, Routing, NIC CPU, GPU, AI Physical Layer Storage, Memory Ethernet, DPU, Security Automotive 5G Base Stations 5G

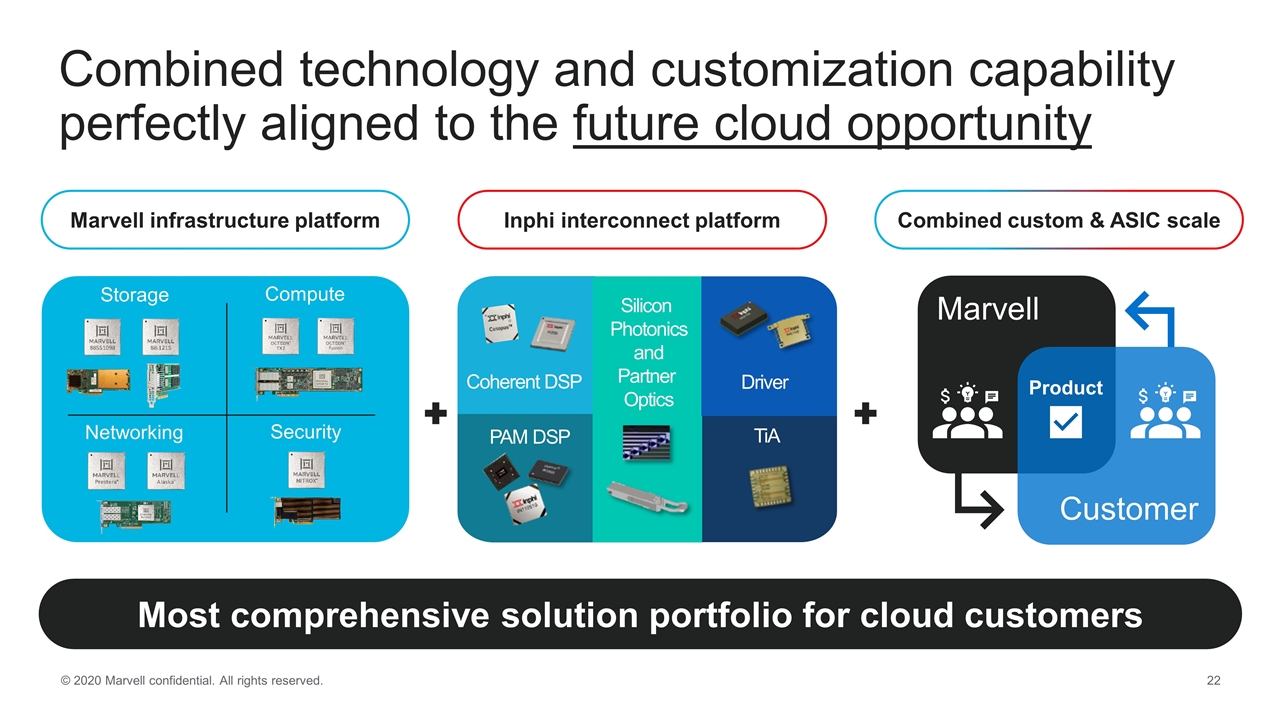

Combined technology and customization capability perfectly aligned to the future cloud opportunity Most comprehensive solution portfolio for cloud customers PAM DSP Coherent DSP Silicon Photonics and Partner Optics Driver TiA Marvell infrastructure platform Inphi interconnect platform Combined custom & ASIC scale Storage Security Networking Compute Customer Marvell Product

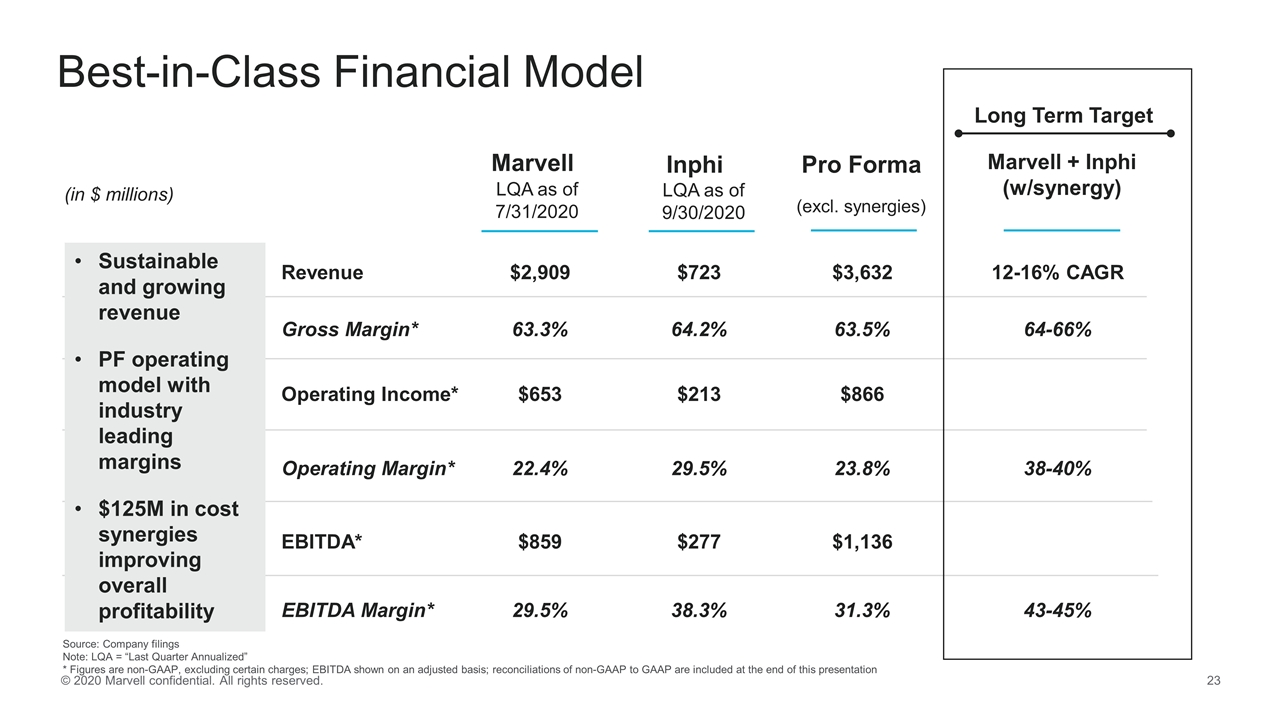

Marvell + Inphi (w/synergy) Best-in-Class Financial Model (in $ millions) Pro Forma Inphi Marvell Source: Company filings Note: LQA = “Last Quarter Annualized” * Figures are non-GAAP, excluding certain charges; EBITDA shown on an adjusted basis; reconciliations of non-GAAP to GAAP are included at the end of this presentation Sustainable and growing revenue PF operating model with industry leading margins $125M in cost synergies improving overall profitability Revenue $2,909 $723 $3,632 12-16% CAGR Gross Margin* 63.3% 64.2% 63.5% 64-66% Operating Income* $653 $213 $866 Operating Margin* 22.4% 29.5% 23.8% 38-40% EBITDA* $859 $277 $1,136 EBITDA Margin* 29.5% 38.3% 31.3% 43-45% Long Term Target LQA as of 7/31/2020 LQA as of 9/30/2020 (excl. synergies)

Next Steps

Timeline Public announcement (Oct. 29) Inphi and Marvell employee meetings (Oct. 29-Nov. 2) Begin integration planning (early Dec.) Transaction expected to close second half of calendar 2021 We will keep you informed of our ongoing progress

Our Approach to Integration Combining the best of both teams Strategy first, then team, then structure Consolidating facilities in common locations Honor reputation of both companies Deliver on our commitments to customers and other stakeholders

Need to continue operating as two separate and independent companies

Discussion of Non-GAAP Financial Measures Inphi and Marvell believe that the presentation of non-GAAP financial measures provides important supplemental information to management and investors regarding financial and business trends relating to Inphi and Marvell's respective financial condition and results of operations. While Inphi and Marvell use non-GAAP financial measures as a tool to enhance understanding of certain aspects of each company’s financial performance and provide investors with additional perspective and a more meaningful understanding of each company’s ongoing operating performance, Inphi and Marvell do not consider these measures to be a substitute for, or superior to, financial measures calculated in accordance with GAAP. Consistent with this approach, Inphi and Marvell believe that disclosing non-GAAP financial measures to the readers of their financial statements provides such readers with useful supplemental data that, while not a substitute for GAAP financial measures, allows for greater transparency in the review of its financial and operational performance. Inphi and Marvell management believe that investors may find non-GAAP financial measures useful in their assessment of Inphi and Marvell's operating performance, respectively, and the valuation of each company. Non-GAAP financial measures have limitations in that they do not reflect all of the costs associated with the operations of Inphi or Marvell's business as determined in accordance with GAAP. As a result, you should not consider these measures in isolation or as a substitute for analysis of Inphi or Marvell's results as reported under GAAP. The exclusion of the below items from Inphi and Marvell’s GAAP financial metrics does not necessarily mean that these costs are unusual or infrequent. Non-GAAP financial metrics should only be used to evaluate Inphi and Marvell’s results of operations in conjunction with the corresponding GAAP measures. Inphi’s non-GAAP financial measures of non-GAAP operating income and earnings before interest, taxes, depreciation and amortization (“EBITDA”) are shown on an adjusted basis and exclude stock-based compensation, legal, transition costs and other expenses, purchase price fair value adjustments related to acquisitions, non-cash interest expense and loss on extinguishment related to convertible debt, unrealized gain or loss on equity investments, lease expense on building not occupied and deferred tax asset valuation allowance. Marvell’s non-GAAP financial measures of non-GAAP operating income and EBITDA are shown on an adjusted basis and exclude the effect of share-based compensation expense, amortization of the inventory fair value adjustment associated with the Aquantia and Avera acquisitions, amortization of acquired intangible assets, acquisition and divestiture-related costs, restructuring and other related charges (including, but not limited to, asset impairment charges, employee severance costs, and facilities related charges), resolution of legal matters, and certain expenses and benefits that are driven primarily by discrete events that management does not consider to be directly related to Marvell's core business.

Non-GAAP Reconciliation Quarter Ended Last Quarter Annualized Jul-20 Sep-20 Jul-20 Sep-20 ($mm) Marvell Inphi Combined Marvell Inphi Combined GAAP Net Income / (Loss) ($157.9) ($3.4) ($161.3) ($631.6) ($13.5) ($645.1) Stock-Based Compensation 62.6 29.0 91.6 250.3 116.2 366.5 Restructuring Related Charges2 120.6 0.0 120.6 482.4 0.0 482.4 Amortization of Inventory Step-Up 0.0 0.1 0.1 0.0 0.6 0.6 Amortization of Intangibles 111.6 14.9 126.5 446.3 59.5 505.8 Depreciation on Step-Up Values of Fixed Assets 0.0 (0.1) (0.1) 0.0 (0.3) (0.3) Acquisition Related Expenses 0.0 2.6 2.6 0.0 10.4 10.4 Expense on Lease That Was Not Yet Occupied 0.0 0.5 0.5 0.0 1.8 1.8 Accretion and Amortization Expense on Convertible Debt 0.0 6.7 6.7 0.0 26.6 26.6 Loss on Extinguishment of Convertible Debt 0.0 0.1 0.1 0.0 0.6 0.6 Net Realized and Unrealized Loss (Gain) on Equity Investment 0.0 (0.2) (0.2) 0.0 (0.8) (0.8) Loss on Retirement of Certain Property and Equipment from Acquisitions 0.0 0.4 0.4 0.0 1.6 1.6 Other Cost of Goods Solds1 11.6 0.0 11.6 46.5 0.0 46.5 Other Operating Expenses3 8.1 0.0 8.1 32.5 0.0 32.5 Other Income Tax Effects and Adjustments4 (16.2) (2.8) (19.0) (64.9) (11.0) (75.9) Non-GAAP Net Income $140.4 $47.9 $188.3 $561.6 $191.7 $753.3 GAAP Operating Profit / (Loss) ($151.3) $6.2 ($145.0) ($605.1) $25.0 ($580.1) Stock-Based Compensation 62.6 29.0 91.6 250.3 116.2 366.5 Restructuring Related Charges2 120.6 0.0 120.6 482.4 0.0 482.4 Amortization of Inventory Step-Up 0.0 0.1 0.1 0.0 0.6 0.6 Amortization of Intangibles 111.6 14.9 126.5 446.3 59.5 505.8 Depreciation on Step-Up Values of Fixed Assets 0.0 (0.1) (0.1) 0.0 (0.3) (0.3) Acquisition Related Expenses 0.0 2.6 2.6 0.0 10.4 10.4 Expense on Lease That Was Not Yet Occupied 0.0 0.5 0.5 0.0 1.8 1.8 Other Cost of Goods Solds1 11.6 0.0 0.0 46.5 0.0 46.5 Other Operating Expenses3 8.1 0.0 8.1 32.5 0.0 32.5 Non-GAAP Operating Profit $163.2 $53.3 $204.9 $653.0 $213.2 $866.2 Depreciation and Amortization 51.6 16.0 67.6 206.4 64.0 270.4 Amortization of Inventory Step-Up 0.0 (0.1) (0.1) 0.0 (0.6) (0.6) Adjusted EBITDA $214.8 $69.2 $272.4 $859.4 $276.7 $1,136.1 Source: Company filings 1 includes inventory write-downs and amortization of acquired inventory fair value adjustments; 2 includes asset impairment charges (including asset impairment charges due to the scope of the server processor product line), employee severance costs, facilities related charges, and other; 3 includes integration costs associated with recent acquisitions; 4 relates to tax provision based on a Non-GAAP income tax rate of 5.0% for Marvell, and represents valuation allowance and tax effect of the adjustments above from GAAP to Non-GAAP for Inphi

Ashish