Form 8-K DEVON ENERGY CORP/DE For: Oct 29

Exhibit 99.1

|

|

Devon Energy Corporation 333 West Sheridan Avenue Oklahoma City, OK 73102-5015 |

Devon Energy Reports Third-Quarter 2020 Financial and Operational Results

OKLAHOMA CITY – Oct. 29, 2020 – Devon Energy Corp. (NYSE: DVN) today reported financial and operational results for the third-quarter 2020. Supplemental financial tables for third-quarter results along with updated 2020 guidance are available on the company’s website at www.devonenergy.com.

KEY FINANCIAL AND OPERATIONAL HIGHLIGHTS

| • | Third-quarter oil production totaled 146,000 barrels per day, exceeding midpoint guidance by 6,000 barrels per day |

| • | Delaware Basin efficiency gains drove capital expenditures below midpoint guidance in the quarter |

| • | Production expenses were below guidance, improving 8 percent year over year |

| • | Operating cash flow expanded quarter over quarter to $427 million |

| • | Free cash flow generation reached $223 million in the third quarter |

| • | Barnett Shale asset divestiture was completed on Oct. 1 |

| • | Paid $100 million special dividend in conjunction with Barnett divestiture |

| • | Announced transformational merger of equals with WPX Energy on Sept. 28, creating a leading U.S. energy company |

“Devon is executing at a very high level on all aspects of our disciplined cash-return business model,” said Dave Hager, president and CEO. “Our third-quarter performance was highlighted by record-setting well productivity and capital efficiency gains in the Delaware Basin that drove oil production well above guidance with a total capital investment that was below forecast. Furthermore, this strong operational performance, coupled with significant improvements in our corporate cost structure, positioned us to generate $223 million of free cash flow in the quarter.”

“With our operations successfully scaled to generate free cash flow, our advantaged financial position allows us to accelerate the return of capital to shareholders,” Hager said. “In conjunction with the recent closing of the Barnett Shale divestiture, we rewarded our shareholders with a $100 million special dividend. This action further demonstrates our commitment to the cash-return business model, which moderates growth, emphasizes capital efficiencies, prioritizes free cash flow and returns increasing amounts of cash to shareholders.”

OPERATING RESULTS

Net production from Devon’s retained assets averaged 326,000 oil-equivalent barrels (Boe) per day during the third quarter. Oil production averaged 146,000 barrels per day, exceeding the company’s midpoint guidance by 6,000 barrels per day. Third-quarter oil production benefited from strong well productivity in the Delaware Basin and better-than-expected base production performance across the portfolio.

Upstream capital spending in the third quarter was $195 million, or 3 percent below midpoint guidance. This positive variance was attributable to efficiency gains in the Delaware Basin and improvements in service-cost pricing. Devon averaged nine operated drilling rigs and three completion crews in the third quarter, all residing in the Delaware Basin.

Devon’s production expense totaled $271 million in the third quarter, an 8 percent improvement year over year. The largest component of production expense is lease operating expense and gathering, processing and transportation costs, which totaled $225 million in aggregate, or $7.49 per Boe in the quarter. Effective cost management efforts and efficient field-level operations drove per-unit rates 8 percent below guidance expectations for the quarter.

The company also improved its general and administrative (G&A) cost structure during the quarter. G&A expenses totaled $75 million in the third quarter, a 30 percent improvement from the third quarter of 2019. The lower overhead costs were primarily driven by reduced personnel expense.

1

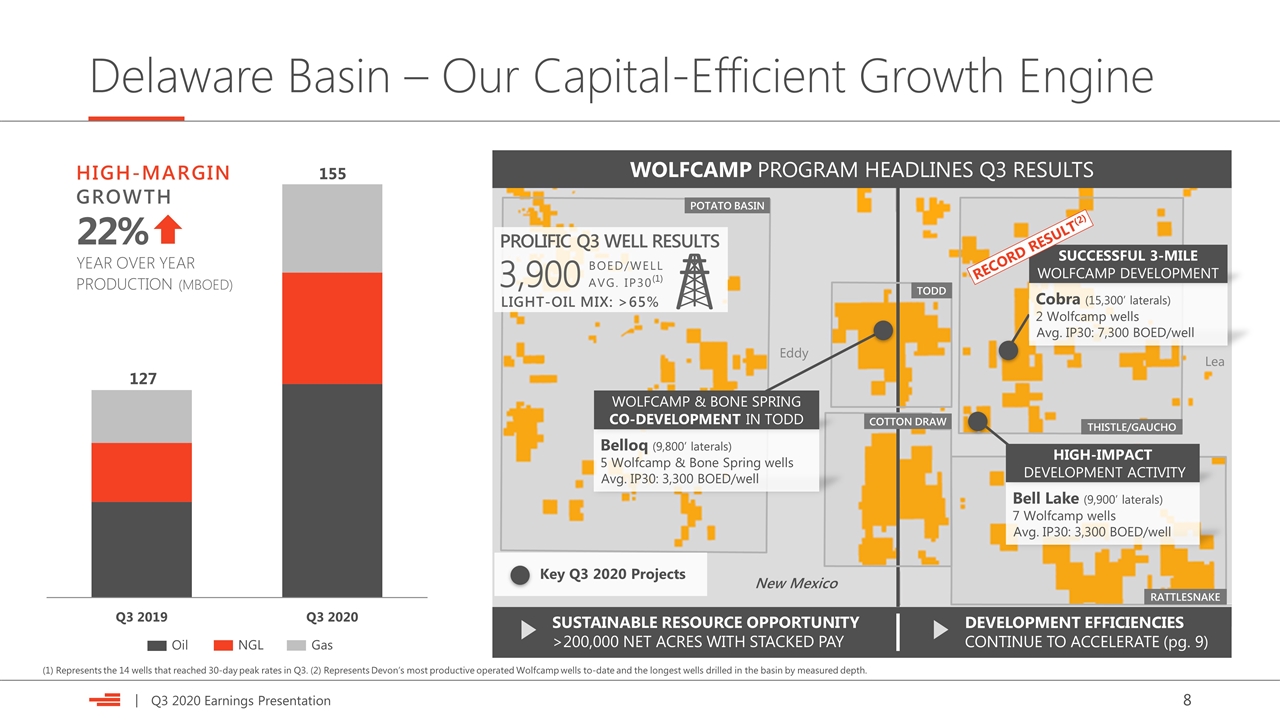

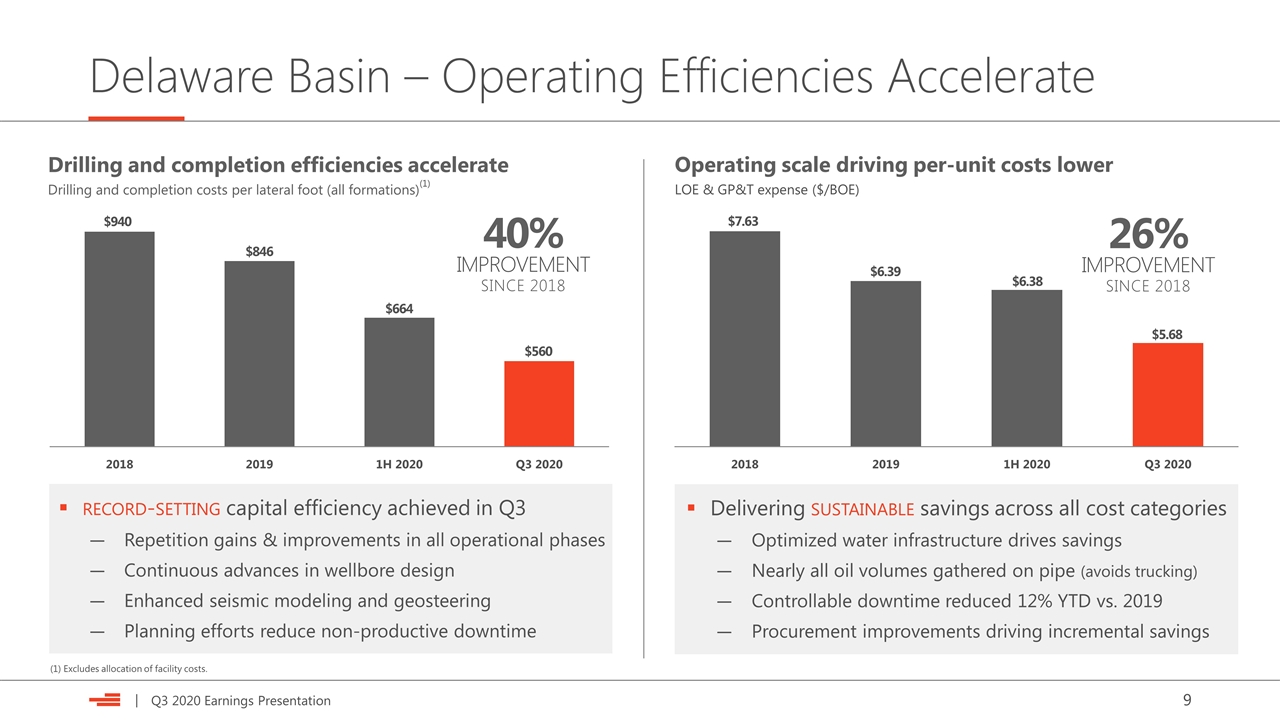

Delaware Basin: Net production averaged 155,000 Boe per day, a 22 percent increase compared to the year-ago period. Activity in the quarter was highlighted by the company’s Cobra project in Lea County. This 3-mile lateral development, consisting of the longest wells ever drilled in the basin, set a company record for Wolfcamp well productivity, with 30-day rates averaging 7,300 Boe per day per well. Overall, Devon’s Wolfcamp-oriented capital program brought 32 operated wells online across Southeast New Mexico, including 14 wells that reached 30-day peak rates in the quarter. Completed well costs improved to a record low $560 per lateral foot in the third quarter, a 40 percent improvement compared to 2018.

Powder River Basin: Production averaged 28,000 Boe per day, of which 76 percent was oil. This represents a 9 percent increase in production compared to the year-ago period, driven by 9 wells that commenced first production in the quarter. In addition to higher production, Devon also made significant progress improving its per-unit field-level operating costs, which declined 20 percent year over year.

Eagle Ford: Third-quarter net production averaged 46,000 Boe per day, an 11 percent decline compared to average rates in the first half of 2020. To conserve capital, Devon and its partner did not pursue any drilling and completion activity in the quarter. The partnership has 22 high-impact uncompleted wells in its inventory and expects to resume capital activity in early 2021.

Anadarko Basin: Net production averaged 89,000 Boe per day in the third quarter, essentially flat compared to the previous quarter. The company did not operate any rigs or complete any new wells in the quarter. The success in holding production flat reflects ongoing focus on base production optimization and downtime reduction across the field. With the recent improvement in natural gas prices, Devon is evaluating the resumption of activity in early 2021 through its $100 million drilling carry with Dow.

FINANCIAL RESULTS

Devon reported a net loss of $92 million, or $0.25 per diluted share, in the third quarter. Adjusting for items analysts typically exclude from estimates, Devon had a core loss of $12 million, or $0.04 per diluted share. In the third quarter, the company’s operating cash flow from continuing operations totaled $427 million, funding all capital requirements and generating $223 million of free cash flow in the quarter.

The company’s financial position continues to remain exceptionally strong with excellent liquidity and low leverage. Devon exited the third quarter with $1.9 billion of cash (inclusive of restricted cash) and an undrawn credit facility of $3 billion. At the end of the quarter, the company had an outstanding debt balance of $4.3 billion with no debt maturities occurring until late 2025.

On Oct. 1, Devon completed the sale of its Barnett Shale assets. The company received a cash payment of $320 million at closing, after adjusting for a $170 million deposit received in April and other purchase-price adjustments. Devon has the opportunity for contingent cash payments of up to $260 million based upon future commodity prices, with upside participation beginning at either a $2.75 Henry Hub natural gas price or a $50 West Texas Intermediate oil price.

In conjunction with the Barnett closing, Devon paid a $100 million special dividend to shareholders. The special dividend was paid on Oct. 1 in the amount of $0.26 per share.

UPDATED 2020 GUIDANCE

For the second consecutive quarter, Devon is raising its full-year 2020 oil production forecast to a range of 152,000 to 154,000 barrels per day. The improved outlook is due to better than expected well productivity and strong base production performance across its asset portfolio. In the fourth-quarter 2020, oil production is forecasted to average 148,000 to 153,000 barrels per day, a 7,000 barrel per day improvement versus prior guidance expectations.

Devon expects to deliver this improved oil growth outlook with less capital than previously projected. The company is lowering the top end of its full-year 2020 E&P capital expenditure guidance by $10 million to a range of $950 million to $990 million in 2020. This improvement is driven by capital efficiency gains in the Delaware Basin. Fourth-quarter upstream capital is expected to range from $160 million to $200 million.

Additionally, the company is lowering its 2020 lease operating expense and gathering, processing and transportation costs outlook by 6 percent compared to previous expectations. The details of Devon’s updated forward-looking guidance for the fourth quarter and full-year 2020 are available on the company’s website at www.devonenergy.com.

2

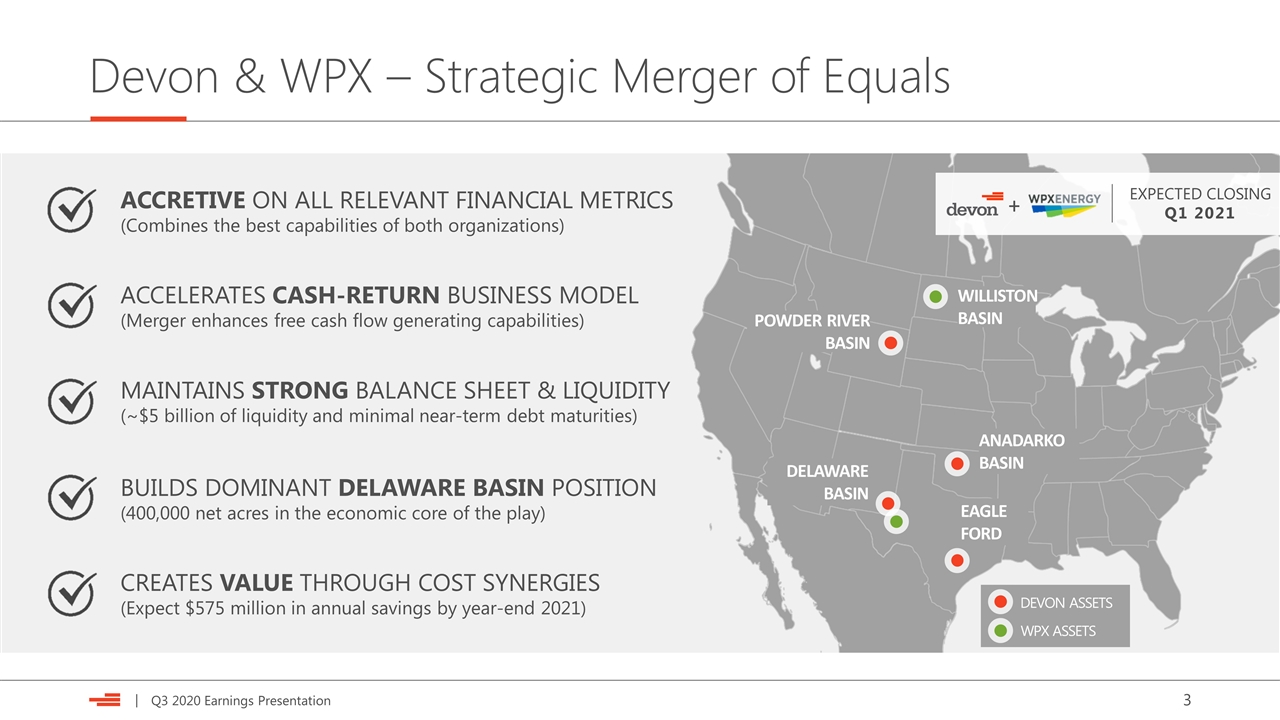

STRATEGIC MERGER OF EQUALS WITH WPX ENERGY

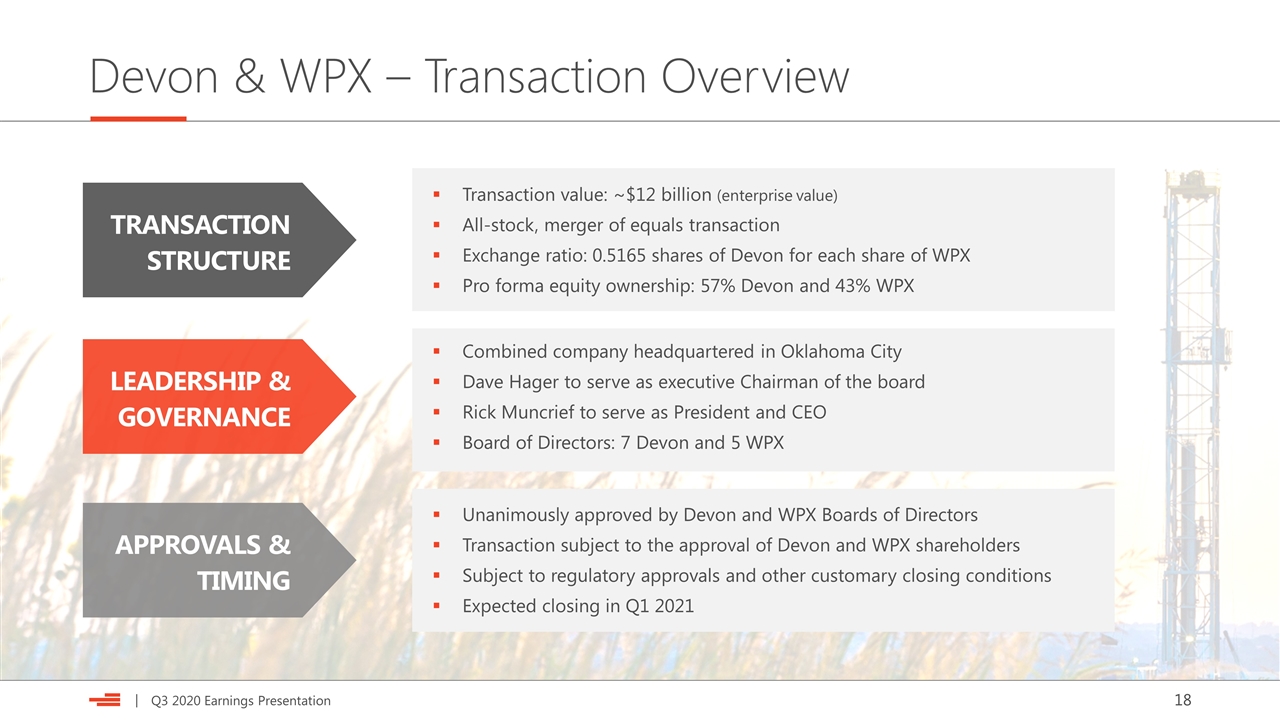

On Sept. 28, 2020, Devon announced that it had entered into an agreement to combine in an all-stock merger of equals transaction with WPX Energy. The strategic combination will create a leading unconventional oil producer in the U.S., with an asset base underpinned by a premium acreage position in the economic core of the Delaware Basin. The combined company, which will be named Devon Energy, will benefit from enhanced scale, improved margins, higher free cash flow and the financial strength to accelerate the return of cash to shareholders through an industry-first “fixed plus variable” dividend strategy.

The transaction is expected to close in the first quarter of 2021. Upon completion of the transaction, Devon shareholders will own approximately 57 percent of the combined company and WPX shareholders will own approximately 43 percent of the combined company on a fully diluted basis.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

Devon strives to deliver results that balance economic growth, environmental stewardship, strong governance and social responsibility. For access to Devon’s 2020 sustainability report, please visit www.devonenergy.com/sustainability. This report highlights the company’s commitment to operating a responsible, safe and ethical business while providing transparent reporting to all stakeholders.

CONFERENCE CALL WEBCAST AND SUPPLEMENTAL EARNINGS MATERIALS

Also provided with today’s release is the company’s detailed earnings presentation that is available on the company’s website at www.devonenergy.com. The company’s third-quarter conference call will be held at 9:30 a.m. Central (10:30 a.m. Eastern) on Friday, Oct. 30, 2020, and will serve primarily as a forum for analyst and investor questions and answers.

ABOUT DEVON ENERGY

Devon Energy is a leading independent energy company engaged in finding and producing oil and natural gas. Based in Oklahoma City and included in the S&P 500, Devon operates in several of the most prolific oil and natural gas plays in the U.S. with an emphasis on achieving strong corporate-level returns and capital-efficient cash-flow growth.

| Investor Contacts | Media Contact | |||

| Scott Coody, 405-552-4735 | Lisa Adams, 405-228-1732 | |||

| Chris Carr, 405-228-2496 |

NON-GAAP DISCLOSURES

This press release includes non-GAAP (generally accepted accounting principles) financial measures. Such non-GAAP measures are not alternatives to GAAP measures, and you should not consider these non-GAAP measures in isolation or as a substitute for analysis of results as reported under GAAP. Reconciliations of these non-GAAP measures and other disclosures are provided within the supplemental financial tables that are available on the company’s website and in the related Form 10-Q filed with the SEC.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed merger (the “Proposed Transaction”) of Devon Energy Corporation (“Devon”) and WPX Energy, Inc. (“WPX”), Devon will file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 to register the shares of Devon’s common stock to be issued in connection with the Proposed Transaction. The registration statement will include a document that serves as a prospectus of Devon and a proxy statement of each of Devon and WPX (the “joint proxy statement/prospectus”), and each party will file other documents regarding the Proposed Transaction with the SEC. INVESTORS AND SECURITY HOLDERS OF DEVON AND WPX ARE ADVISED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT DEVON, WPX, THE PROPOSED TRANSACTION AND RELATED MATTERS. A definitive joint proxy statement/prospectus will be sent to the stockholders of each of Devon and WPX when it becomes available. Investors and security holders will be able to obtain copies of the registration statement and the joint proxy statement/prospectus and other documents containing important information about Devon and WPX free of charge from the SEC’s website when it becomes available. The documents filed by Devon with the SEC may be obtained free of charge at Devon’s website at www.devonenergy.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from Devon by requesting them by mail at Devon, Attn: Investor Relations, 333 West Sheridan Ave, Oklahoma City, OK 73102. The documents filed by WPX with the SEC may be obtained free of charge at WPX’s website at www.wpxenergy.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from WPX by requesting them by mail at WPX, Attn: Investor Relations, P.O. Box 21810, Tulsa, OK 74102.

3

PARTICIPANTS IN THE SOLICITATION

Devon, WPX and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from Devon’s and WPX’s stockholders with respect to the Proposed Transaction. Information about Devon’s directors and executive officers is available in Devon’s Annual Report on Form 10-K for the 2019 fiscal year filed with the SEC on February 19, 2020, and its definitive proxy statement for the 2020 annual meeting of shareholders filed with the SEC on April 22, 2020. Information about WPX’s directors and executive officers is available in WPX’s Annual Report on Form 10-K for the 2019 fiscal year filed with the SEC on February 28, 2020 and its definitive proxy statement for the 2020 annual meeting of shareholders filed with the SEC on March 31, 2020. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statement, the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the Proposed Transaction when they become available. Stockholders, potential investors and other readers should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions.

NO OFFER OR SOLICITATION

This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

FORWARD LOOKING STATEMENTS

This communication includes “forward-looking statements” as defined by the SEC. Such statements include those concerning strategic plans, Devon’s and WPX’s expectations and objectives for future operations, as well as other future events or conditions, and are often identified by use of the words and phrases such as “expects,” “believes,” “will,” “would,” “could,” “continue,” “may,” “aims,” “likely to be,” “intends,” “forecasts,” “projections,” “estimates,” “plans,” “expectations,” “targets,” “opportunities,” “potential,” “anticipates,” “outlook” and other similar terminology. All statements, other than statements of historical facts, included in this communication that address activities, events or developments that Devon or WPX expects, believes or anticipates will or may occur in the future are forward-looking statements. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond Devon’s and WPX’s control. Consequently, actual future results could differ materially from Devon’s and WPX’s expectations due to a number of factors, including, but not limited to: the risk that Devon’s and WPX’s businesses will not be integrated successfully; the risk that the cost savings, synergies and growth from the Proposed Transaction may not be fully realized or may take longer to realize than expected; the diversion of management time on transaction-related issues; the effect of future regulatory or legislative actions on the companies or the industries in which they operate, including the risk of new restrictions with respect to hydraulic fracturing or other development activities on Devon’s or WPX’s federal acreage or their other assets; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect; the risk that Devon or WPX may be unable to obtain governmental and regulatory approvals required for the Proposed Transaction, or that required governmental and regulatory approvals may delay the Proposed Transaction or result in the imposition of conditions that could reduce the anticipated benefits from the Proposed Transaction or cause the parties to abandon the Proposed Transaction; the risk that a condition to closing of the Proposed Transaction may not be satisfied; the length of time necessary to consummate the Proposed Transaction, which may be longer than anticipated for various reasons; potential liability resulting from pending or future litigation; changes in the general economic environment, or social or political conditions, that could affect the businesses; the potential impact of the announcement or consummation of the Proposed Transaction on relationships with customers, suppliers, competitors, management and other employees; the ability to hire and retain key personnel; reliance on and integration of information technology systems; the risks associated with assumptions the parties make in connection with the parties’ critical accounting estimates and legal proceedings; the volatility of oil, gas and natural gas liquids (NGL) prices; uncertainties inherent in estimating oil, gas and NGL reserves; the impact of reduced demand for our products and products made from them due to governmental and societal actions taken in response to the COVID-19 pandemic; the uncertainties, costs and risks involved in Devon’s and WPX’s operations, including as a result of employee misconduct; natural disasters, pandemics, epidemics (including COVID-19 and any escalation or worsening thereof) or other public health conditions; counterparty credit risks; risks relating to Devon’s and WPX’s indebtedness; risks related to Devon’s and WPX’s hedging activities; competition for assets, materials, people and capital; regulatory restrictions, compliance costs and other risks relating to governmental regulation, including with respect to environmental matters; cyberattack risks; Devon’s and WPX’s limited control over third parties who operate some of their respective oil and gas properties; midstream capacity constraints and potential interruptions in production; the extent to which insurance covers any losses Devon or WPX may experience; risks related to investors attempting to effect change; general domestic and international economic and political conditions, including the impact of COVID-19; and changes in tax, environmental and other laws, including court rulings, applicable to Devon’s and WPX’s business.

In addition to the foregoing, the COVID-19 pandemic and its related repercussions have created significant volatility, uncertainty and turmoil in the global economy and Devon’s and WPX’s industry. This turmoil has included an unprecedented supply-and-demand imbalance for oil and other commodities, resulting in a swift and material decline in commodity prices in early 2020. Devon’s and WPX’s future actual results could differ materially from the forward-looking statements in this communication due to the COVID-19 pandemic and related impacts, including, by, among other things: contributing to a sustained or further deterioration in commodity prices; causing takeaway capacity constraints for production, resulting in further production shut-ins and additional downward pressure on impacted regional pricing differentials; limiting Devon’s and WPX’s ability to access sources of capital due to disruptions in financial markets; increasing the risk of a downgrade from credit rating agencies; exacerbating counterparty credit risks and the risk of supply chain interruptions; and increasing the risk of operational disruptions due to social distancing measures and other changes to business practices. Additional information concerning other risk factors is also contained in Devon’s and WPX’s most recently filed Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other SEC filings.

Many of these risks, uncertainties and assumptions are beyond Devon’s or WPX’s ability to control or predict. Because of these risks, uncertainties and assumptions, you should not place undue reliance on these forward-looking statements. Nothing in this communication is intended, or is to be construed, as a profit forecast or to be interpreted to mean that earnings per share of Devon or WPX for the current or any future financial years or those of the combined company will necessarily match or exceed the historical published earnings per share of Devon or WPX, as applicable. Neither Devon nor WPX gives any assurance (1) that either Devon or WPX will achieve their expectations, or (2) concerning any result or the timing thereof, in each case, with respect to the Proposed Transaction or any regulatory action, administrative proceedings, government investigations, litigation, warning letters, consent decree, cost reductions, business strategies, earnings or revenue trends or future financial results.

All subsequent written and oral forward-looking statements concerning Devon, WPX, the Proposed Transaction, the combined company or other matters and attributable to Devon or WPX or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Devon and WPX assume no duty to update or revise their respective forward-looking statements based on new information, future events or otherwise.

4

October 29, 2020 Q3 2020 Earnings Presentation Exhibit 99.2

Key Takeaways From Our Presentation Q3 RESULTS DRIVE IMPROVED 2020 OUTLOOK Favorable to guidance on all production, capital & operating costs FREE CASH FLOW GROWTH ACCELERATES Cost discipline and efficiency gains expand margins BALANCE SHEET CONTINUES TO STRENGTHEN Free cash flow generation and Barnett closing bolsters cash balance CASH-RETURN BUSINESS MODEL BUILDING MOMENTUM $100 million special dividend paid in conjunction with Barnett closing TRANSFORMATIONAL MERGER OF EQUALS WITH WPX Creates a leading U.S. producer & builds a dominant Delaware position #1 #2 #3 #4 #5

Devon & WPX – Strategic Merger of Equals BUILDS DOMINANT DELAWARE BASIN POSITION (400,000 net acres in the economic core of the play) ACCRETIVE ON ALL RELEVANT FINANCIAL METRICS (Combines the best capabilities of both organizations) CREATES VALUE THROUGH COST SYNERGIES (Expect $575 million in annual savings by year-end 2021) MAINTAINS STRONG BALANCE SHEET & LIQUIDITY (~$5 billion of liquidity and minimal near-term debt maturities) ACCELERATES CASH-RETURN BUSINESS MODEL (Merger enhances free cash flow generating capabilities) POWDER RIVER BASIN ANADARKO BASIN EAGLE FORD DELAWARE BASIN WILLISTON BASIN EXPECTED CLOSING Q1 2021 + WPX ASSETS DEVON ASSETS

Our Disciplined Cash-Return Business Model “Devon’s cash-return business model is designed to moderate growth, optimize capital efficiencies and prioritize cash returns to shareholders. These principles will position Devon to be a prominent and consistent builder of economic value through the cycle.” Dave Hager President & CEO PROGRESSIVE GROWTH STRATEGY disciplined oil growth targets: up to 5% annually Growing margins through operational & corporate cost reductions REDUCED REINVESTMENT RATES Targeting reinvestment rates of 70%-80% of operating cash flow Disciplined returns-driven strategy to generate higher free cash flow MAINTAIN LOW LEVERAGE Targeting net debt-to-EBITDAX ratio: ~1.0x Strong liquidity & hedging provide substantial margin of safety PRIORITIZE CASH RETURNS Deploying free cash flow to dividends, debt reduction & buybacks Implementing a “fixed plus variable” dividend strategy PURSUE ESG EXCELLENCE Committed to delivering top-tier ESG performance ESG initiatives incorporated into compensation structure

Committed to Top-Tier ESG Performance ENVIRONMENT SOCIAL & SAFETY GOVERNANCE achieved methane intensity target of 0.28% in 2019 Lowered GHG emissions intensity rate 19% year over year Increased water recycling ~300% over the past three years Provided STEM resources across our communities, impacting 17,000 students Safety & incident rate performance consistently above industry average Progressive actions and practices in place to advance inclusion & diversity ESG incorporated into compensation structure (including safety & emissions metrics) board-level oversight of ESG goal-setting, performance & outreach Committed to diverse, independent, experienced and highly-skilled board − David Harris, EVP, Exploration and Production “At Devon we are providing energy the world needs, and we take pride in doing so reliably and responsibly. Among other achievements, I’m most proud of our significant reduction in greenhouse gas emissions.” 2020 Sustainability Report NOW AVAILABLE Find the full report complete with metrics and in-depth stories on our website

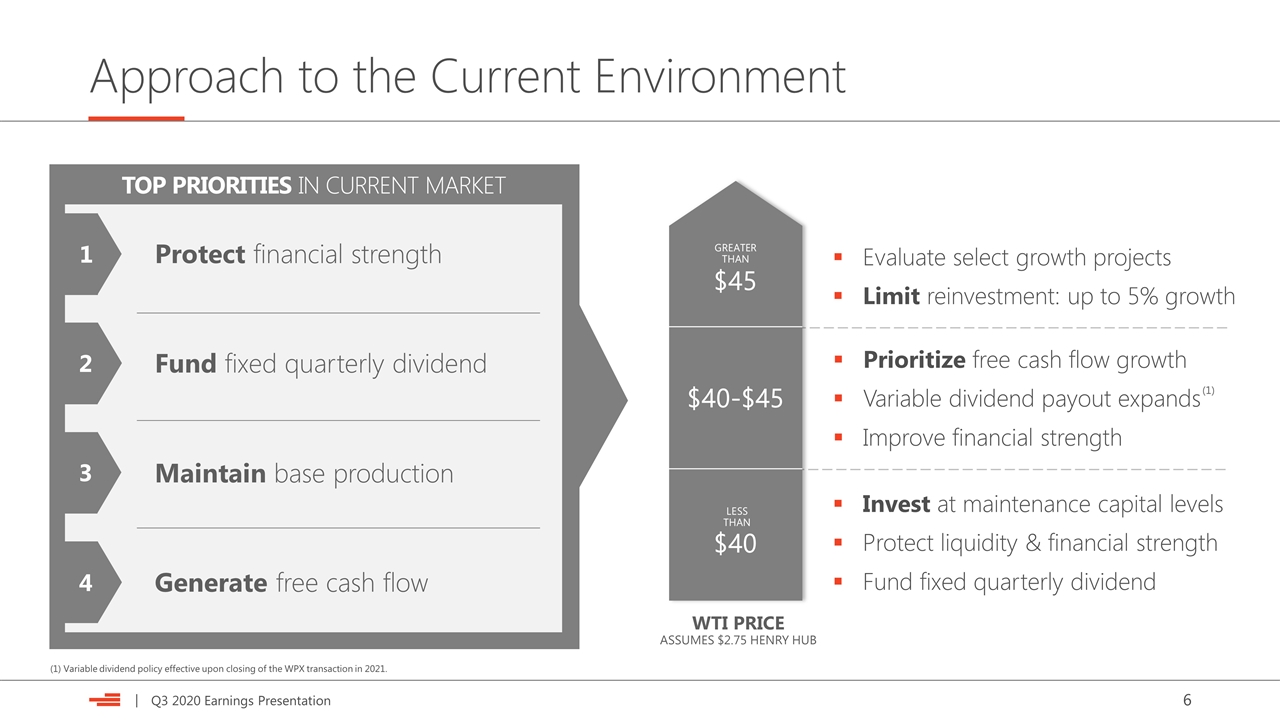

Approach to the Current Environment Evaluate select growth projects Limit reinvestment: up to 5% growth GREATER THAN $45 $40-$45 $40 Invest at maintenance capital levels Protect liquidity & financial strength Fund fixed quarterly dividend Prioritize free cash flow growth Variable dividend payout expands Improve financial strength WTI PRICE ASSUMES $2.75 HENRY HUB 1 2 3 4 TOP PRIORITIES IN CURRENT MARKET Protect financial strength Maintain base production Generate free cash flow Fund fixed quarterly dividend 1 2 3 4 LESS THAN (1) (1) Variable dividend policy effective upon closing of the WPX transaction in 2021.

Q3 2020 – Executing on Our Disciplined Strategy Capital spending results 3% below midpoint guidance Cost discipline enhances operating cash flow (Q3: $427 million) Generated $223 million of free cash flow in third quarter Liquidity & financial strength improves with Barnett sale Key Messages G&A EXPENSES LOE & GP&T EXPENSES OIL PRODUCTION $7.49 per BOE RESILIENT PRODUCTION $75 million OPERATIONAL IMPROVEMENTS IMPROVING COST STRUCTURE 6 MBOD ABOVE GUIDANCE 8% BELOW GUIDANCE 30% YEAR-OVER-YEAR 146 MBOD RAISING 2020 OUTLOOK SEE PAGE 11 FOR DETAILS

Delaware Basin – Our Capital-Efficient Growth Engine Eddy New Mexico Lea POTATO BASIN THISTLE/GAUCHO RATTLESNAKE COTTON DRAW TODD WOLFCAMP PROGRAM HEADLINES Q3 RESULTS SUSTAINABLE RESOURCE OPPORTUNITY >200,000 NET ACRES WITH STACKED PAY DEVELOPMENT EFFICIENCIES CONTINUE TO ACCELERATE (pg. 9) Cobra (15,300’ laterals) 2 Wolfcamp wells Avg. IP30: 7,300 BOED/well SUCCESSFUL 3-MILE WOLFCAMP DEVELOPMENT Key Q3 2020 Projects PROLIFIC Q3 WELL RESULTS 3,900 AVG. IP30 BOED/WELL LIGHT-OIL MIX: >65% Belloq (9,800’ laterals) 5 Wolfcamp & Bone Spring wells Avg. IP30: 3,300 BOED/well WOLFCAMP & bone SPRING CO-DEVELOPMENT IN TODD Bell Lake (9,900’ laterals) 7 Wolfcamp wells Avg. IP30: 3,300 BOED/well HIGH-IMPACT development ACTIVITY Gas NGL Oil HIGH-MARGIN GROWTH 22% PRODUCTION (MBOED) YEAR OVER YEAR RECORD RESULT(2) (1) Represents the 14 wells that reached 30-day peak rates in Q3. (2) Represents Devon’s most productive operated Wolfcamp wells to-date and the longest wells drilled in the basin by measured depth. (1)

Delaware Basin – Operating Efficiencies Accelerate Drilling and completion efficiencies accelerate Drilling and completion costs per lateral foot (all formations) Operating scale driving per-unit costs lower LOE & GP&T expense ($/BOE) Delivering sustainable savings across all cost categories Optimized water infrastructure drives savings Nearly all oil volumes gathered on pipe (avoids trucking) Controllable downtime reduced 12% YTD vs. 2019 Procurement improvements driving incremental savings record-setting capital efficiency achieved in Q3 Repetition gains & improvements in all operational phases Continuous advances in wellbore design Enhanced seismic modeling and geosteering Planning efforts reduce non-productive downtime (1) Excludes allocation of facility costs. $940 $846 $664 $560 40% SINCE 2018 IMPROVEMENT $5.68 $6.39 $7.63 $6.38 26% SINCE 2018 IMPROVEMENT (1)

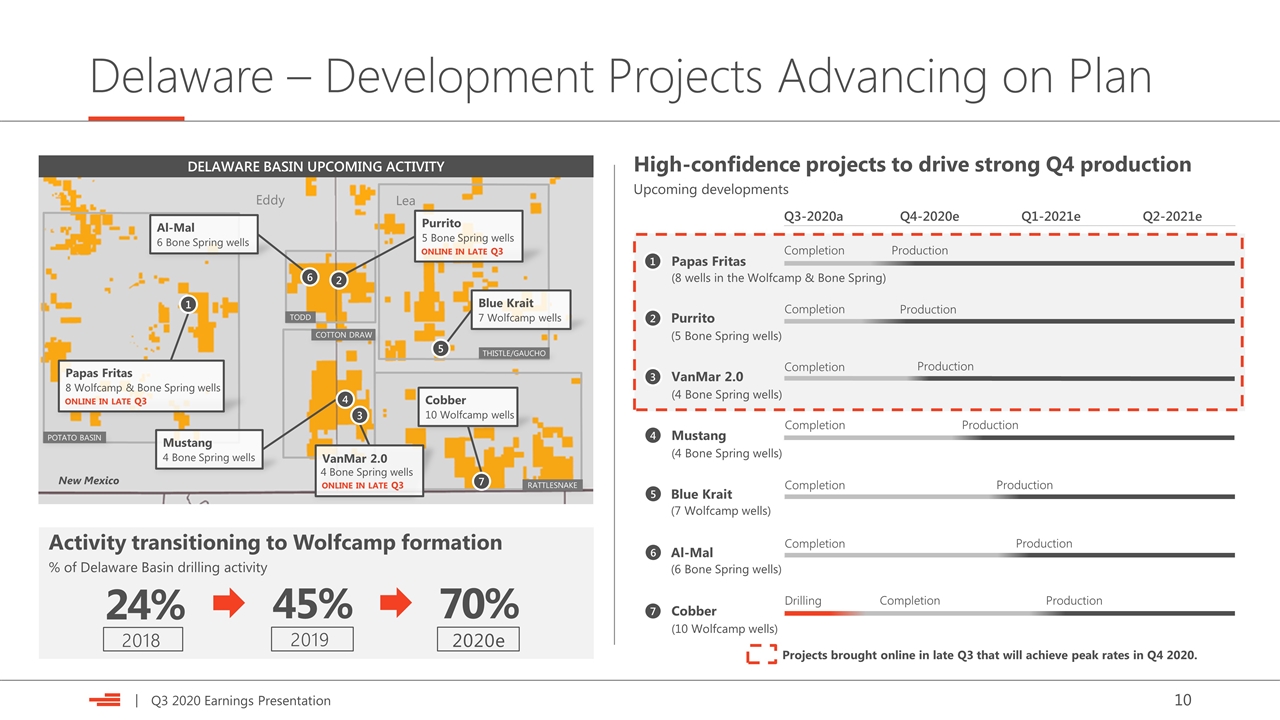

Delaware – Development Projects Advancing on Plan POTATO BASIN TODD COTTON DRAW THISTLE/GAUCHO RATTLESNAKE Eddy Lea New Mexico DELAWARE BASIN UPCOMING ACTIVITY Activity transitioning to Wolfcamp formation % of Delaware Basin drilling activity 24% 45% 70% 2018 2019 2020e VanMar 2.0 4 Bone Spring wells online in late Q3 Blue Krait 7 Wolfcamp wells Purrito 5 Bone Spring wells online in late Q3 Papas Fritas 8 Wolfcamp & Bone Spring wells online in late Q3 Mustang 4 Bone Spring wells Q3-2020a Q4-2020e Q1-2021e Q2-2021e Completion VanMar 2.0 (4 Bone Spring wells) Completion Purrito (5 Bone Spring wells) Mustang (4 Bone Spring wells) Completion Completion Papas Fritas (8 wells in the Wolfcamp & Bone Spring) Production Production Blue Krait (7 Wolfcamp wells) Completion Production Al-Mal (6 Bone Spring wells) Completion Production Projects brought online in late Q3 that will achieve peak rates in Q4 2020. Production Production High-confidence projects to drive strong Q4 production Upcoming developments 1 2 3 4 5 6 5 Cobber 10 Wolfcamp wells Al-Mal 6 Bone Spring wells Cobber (10 Wolfcamp wells) Drilling Production 7 Completion 6 1 4 2 7 3

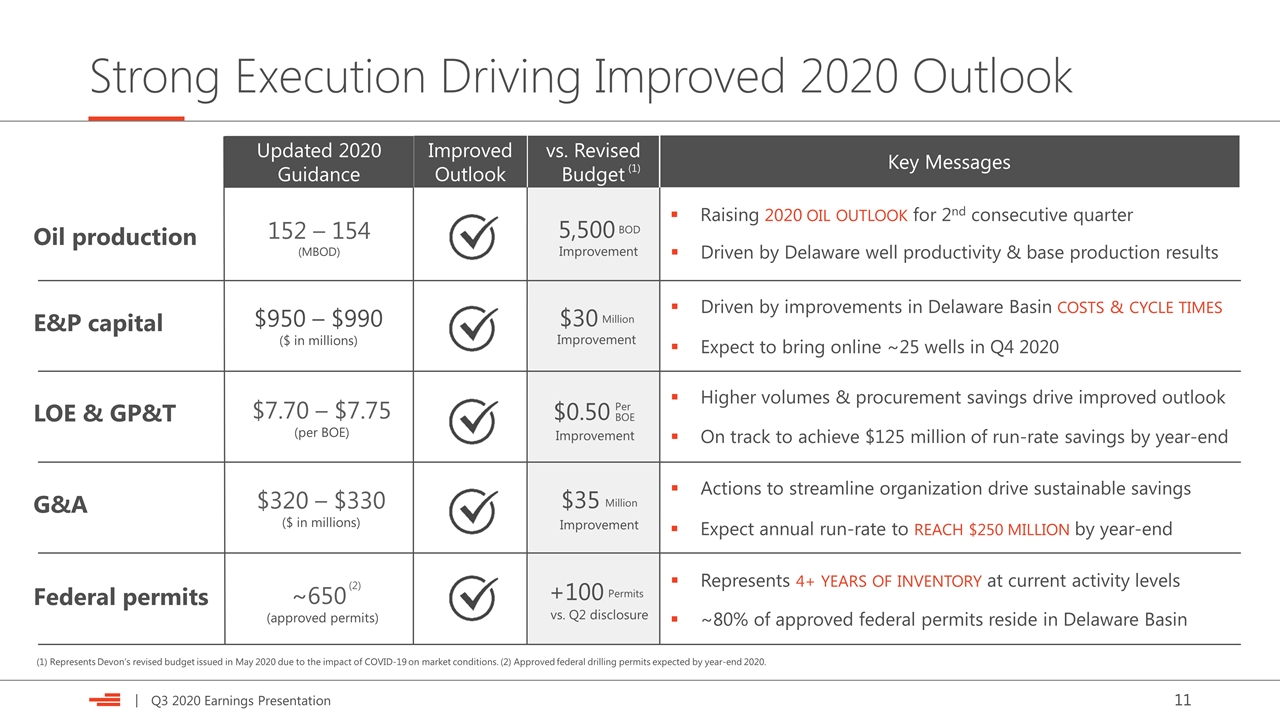

Strong Execution Driving Improved 2020 Outlook Raising 2020 oil outlook for 2nd consecutive quarter On track to achieve $125 million of run-rate savings by year-end Actions to streamline organization drive sustainable savings Oil production LOE & GP&T G&A Higher volumes & procurement savings drive improved outlook Driven by Delaware well productivity & base production results Expect to bring online ~25 wells in Q4 2020 Driven by improvements in Delaware Basin costs & cycle times E&P capital Represents 4+ years of inventory at current activity levels Federal permits ~80% of approved federal permits reside in Delaware Basin Updated 2020 Guidance $950 – $990 ($ in millions) vs. Revised Budget Key Messages (1) Represents Devon’s revised budget issued in May 2020 due to the impact of COVID-19 on market conditions. (2) Approved federal drilling permits expected by year-end 2020. Expect annual run-rate to reach $250 million by year-end (1) 152 – 154 (MBOD) $7.70 – $7.75 (per BOE) $320 – $330 ($ in millions) Improvement Million $30 5,500 BOD Improvement Per BOE Improvement $0.50 Improvement Million $35 ~650 (approved permits) vs. Q2 disclosure +100 Permits (2) Improved Outlook

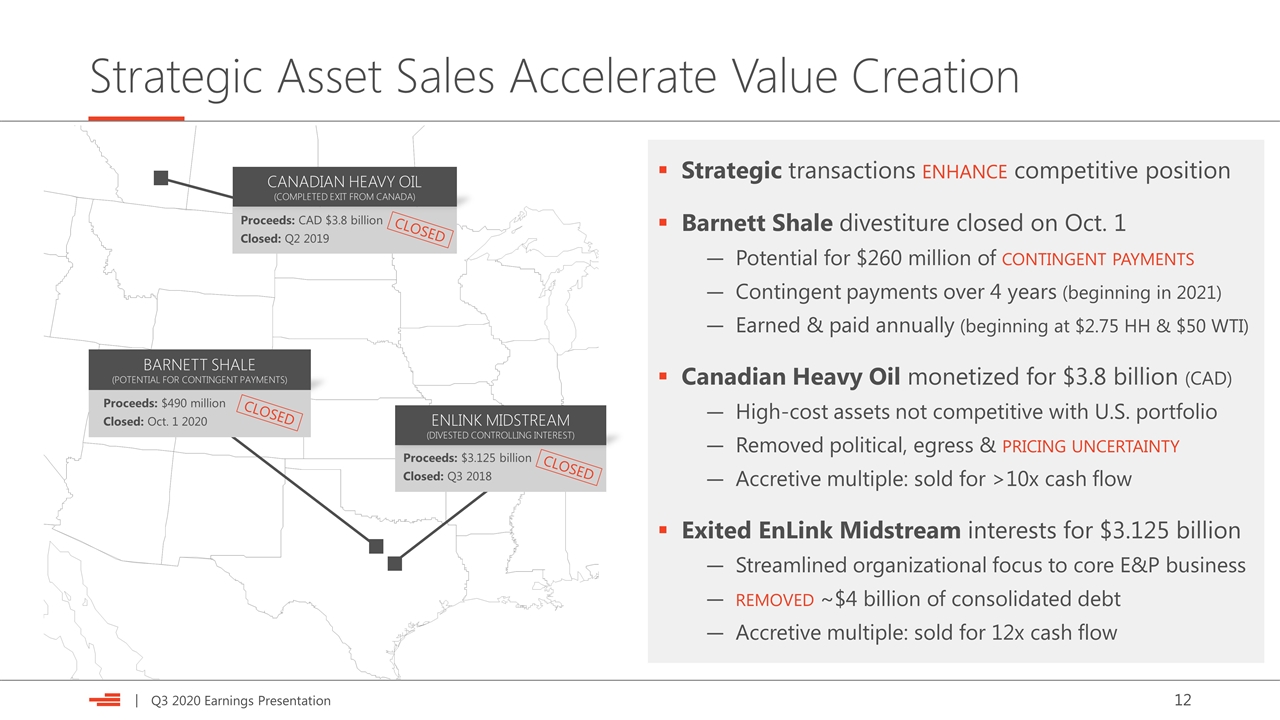

Strategic Asset Sales Accelerate Value Creation Strategic transactions enhance competitive position Barnett Shale divestiture closed on Oct. 1 Potential for $260 million of contingent payments Contingent payments over 4 years (beginning in 2021) Earned & paid annually (beginning at $2.75 HH & $50 WTI) Canadian Heavy Oil monetized for $3.8 billion (CAD) High-cost assets not competitive with U.S. portfolio Removed political, egress & pricing uncertainty Accretive multiple: sold for >10x cash flow Exited EnLink Midstream interests for $3.125 billion Streamlined organizational focus to core E&P business removed ~$4 billion of consolidated debt Accretive multiple: sold for 12x cash flow Proceeds: CAD $3.8 billion Closed: Q2 2019 Proceeds: $3.125 billion Closed: Q3 2018 BARNETT SHALE (Potential for contingent payments) CLOSED ENLINK MIDSTREAM (DIVESTED CONTROLLING INTEREST) CANADIAN HEAVY OIL (COMPLETED EXIT FROM CANADA) CLOSED Proceeds: $490 million Closed: Oct. 1 2020 CLOSED

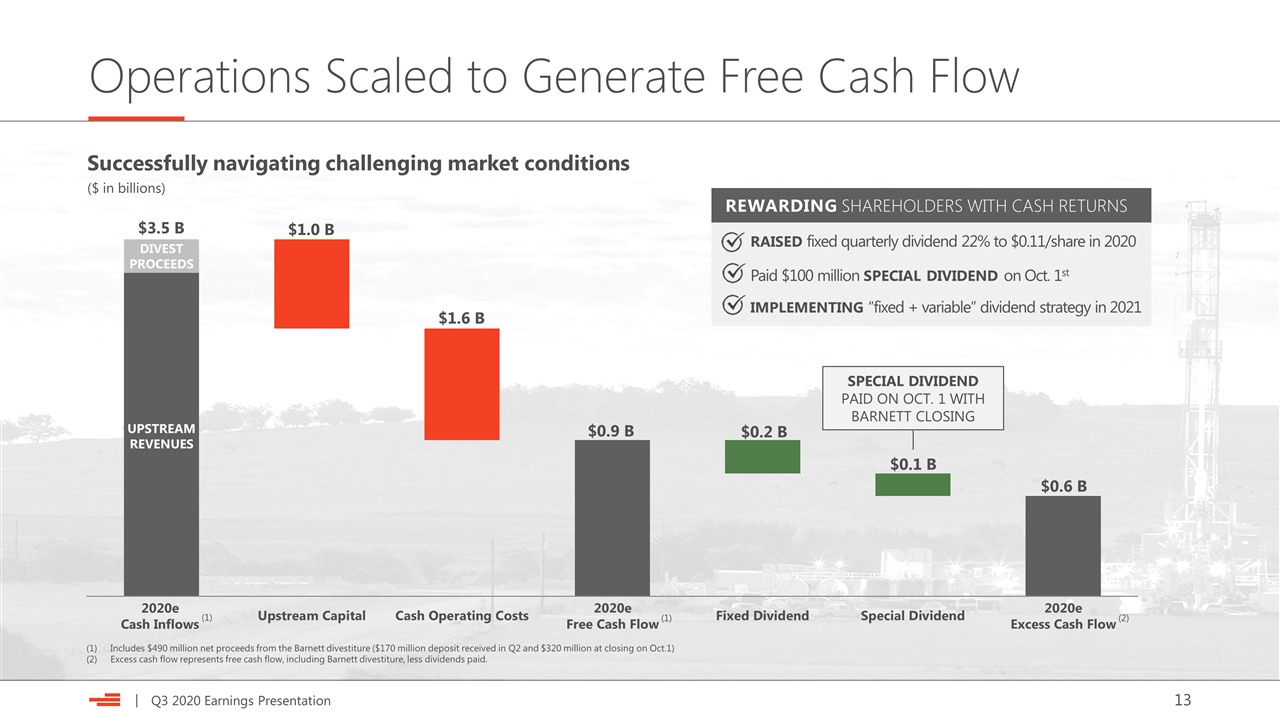

Operations Scaled to Generate Free Cash Flow Successfully navigating challenging market conditions ($ in billions) $1.0 B $3.5 B $1.6 B $0.6 B UPSTREAM REVENUES DIVEST PROCEEDS $0.2 B SPECIAL DIVIDEND PAID ON OCT. 1 WITH BARNETT CLOSING Includes $490 million net proceeds from the Barnett divestiture ($170 million deposit received in Q2 and $320 million at closing on Oct.1) Excess cash flow represents free cash flow, including Barnett divestiture, less dividends paid. (2) raised fixed quarterly dividend 22% to $0.11/share in 2020 Paid $100 million special dividend on Oct. 1st implementing “fixed + variable” dividend strategy in 2021 rewarding shareholders with cash returns $0.1 B $0.9 B (1) 2020e Cash Inflows 2020e Free Cash Flow 2020e Excess Cash Flow (1)

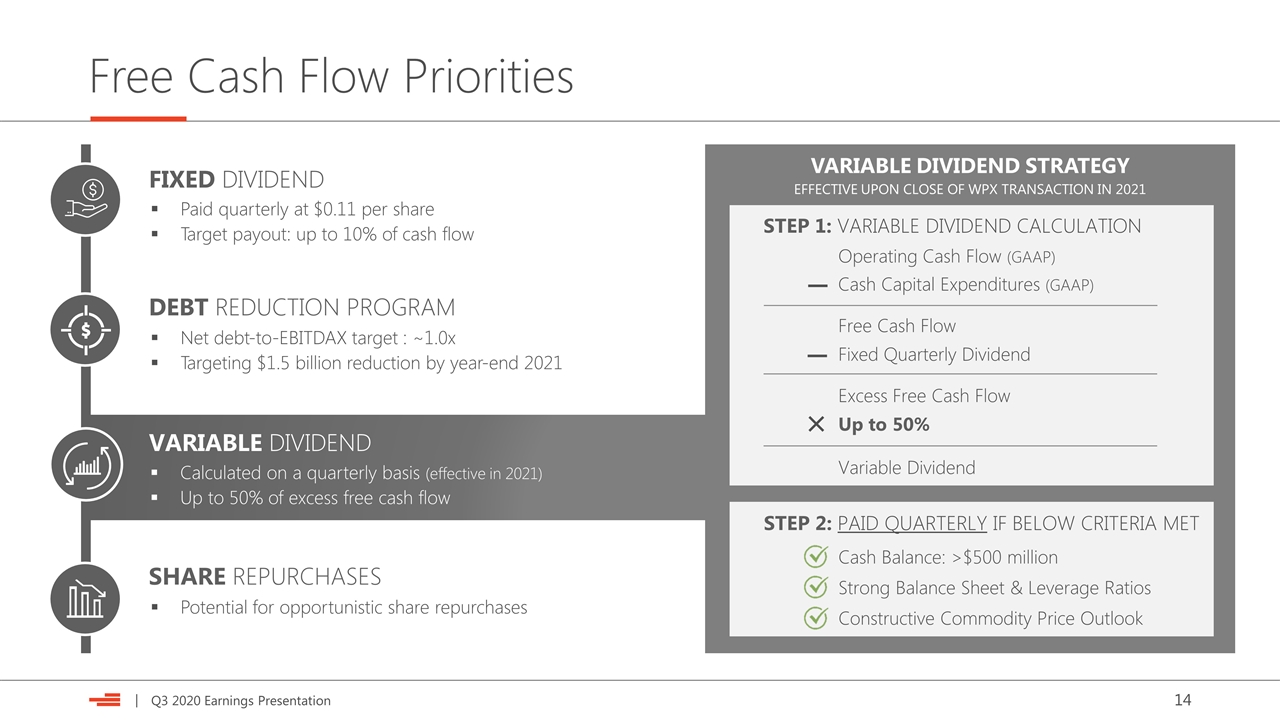

Free Cash Flow Priorities VARIABLE DIVIDEND STRATEGY EFFECTIVE UPON CLOSE OF WPX TRANSACTION IN 2021 STEP 1: VARIABLE DIVIDEND CALCULATION Operating Cash Flow (GAAP) − Cash Capital Expenditures (GAAP) Free Cash Flow − Fixed Quarterly Dividend Excess Free Cash Flow × Up to 50% Variable Dividend STEP 2: PAID QUARTERLY IF BELOW CRITERIA MET Cash Balance: >$500 million Strong Balance Sheet & Leverage Ratios Constructive Commodity Price Outlook FIXED DIVIDEND Paid quarterly at $0.11 per share Target payout: up to 10% of cash flow VARIABLE DIVIDEND Calculated on a quarterly basis (effective in 2021) Up to 50% of excess free cash flow DEBT REDUCTION PROGRAM Net debt-to-EBITDAX target : ~1.0x Targeting $1.5 billion reduction by year-end 2021 SHARE REPURCHASES Potential for opportunistic share repurchases

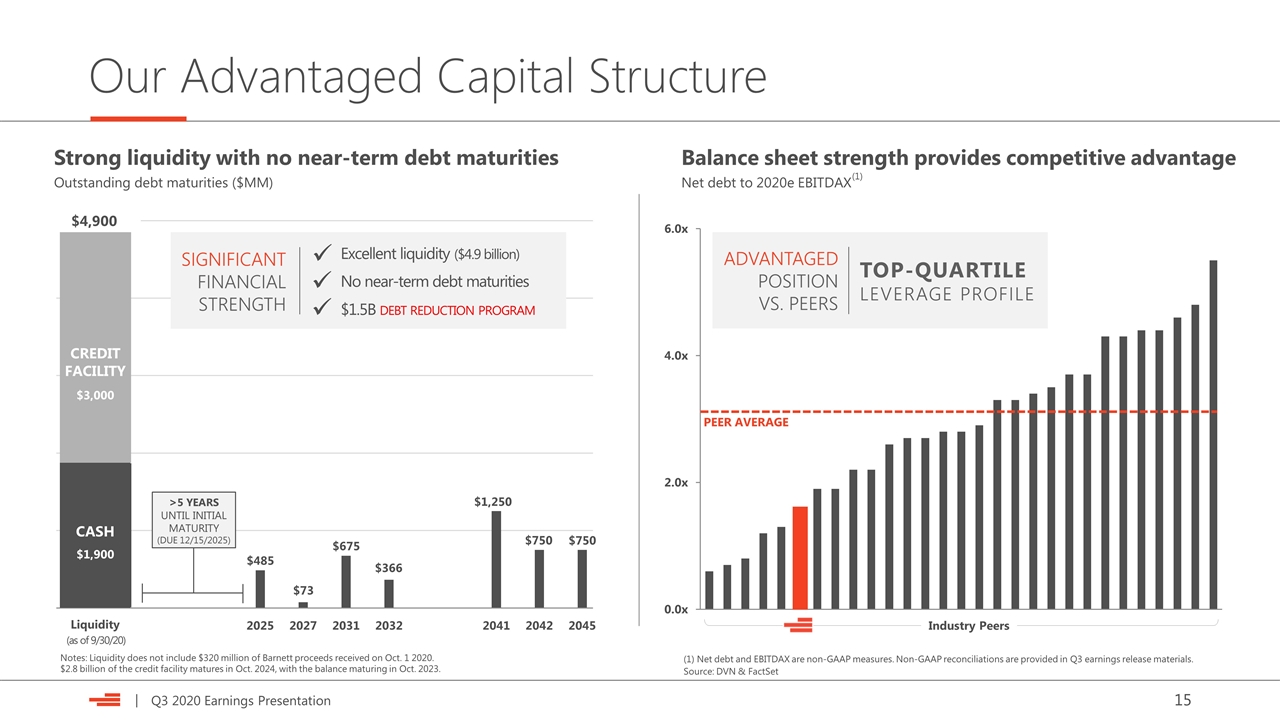

Our Advantaged Capital Structure $73 Strong liquidity with no near-term debt maturities Outstanding debt maturities ($MM) $4,900 Liquidity CREDIT FACILITY $3,000 $1,900 CASH $485 >5 YEARS UNTIL INITIAL MATURITY (DUE 12/15/2025) (as of 9/30/20) PEER AVERAGE Source: DVN & FactSet Balance sheet strength provides competitive advantage Net debt to 2020e EBITDAX Industry Peers TOP-QUARTILE LEVERAGE PROFILE ADVANTAGED POSITION VS. PEERS (1) Net debt and EBITDAX are non-GAAP measures. Non-GAAP reconciliations are provided in Q3 earnings release materials. Excellent liquidity ($4.9 billion) No near-term debt maturities $1.5B debt reduction program ü ü ü SIGNIFICANT FINANCIAL STRENGTH (1) Notes: Liquidity does not include $320 million of Barnett proceeds received on Oct. 1 2020. $2.8 billion of the credit facility matures in Oct. 2024, with the balance maturing in Oct. 2023.

Why Own the Go-Forward Devon? PREMIER MULTI-BASIN PORTFOLIO DISCIPLINED RETURNS-DRIVEN STRATEGY DELIVERING TOP-TIER OPERATING RESULTS SIGNIFICANT FINANCIAL STRENGTH & LIQUIDITY COMMITTED TO RETURNING CASH TO SHAREHOLDERS

Devon and WPX Merger Appendix NYSE: DVNdevonenergy.com NYSE: WPXwpxenergy.com

Devon & WPX – Transaction Overview Transaction value: ~$12 billion (enterprise value) All-stock, merger of equals transaction Exchange ratio: 0.5165 shares of Devon for each share of WPX Pro forma equity ownership: 57% Devon and 43% WPX Combined company headquartered in Oklahoma City Dave Hager to serve as executive Chairman of the board Rick Muncrief to serve as President and CEO Board of Directors: 7 Devon and 5 WPX Unanimously approved by Devon and WPX Boards of Directors Transaction subject to the approval of Devon and WPX shareholders Subject to regulatory approvals and other customary closing conditions Expected closing in Q1 2021 APPROVALS & TIMING LEADERSHIP & GOVERNANCE TRANSACTION STRUCTURE

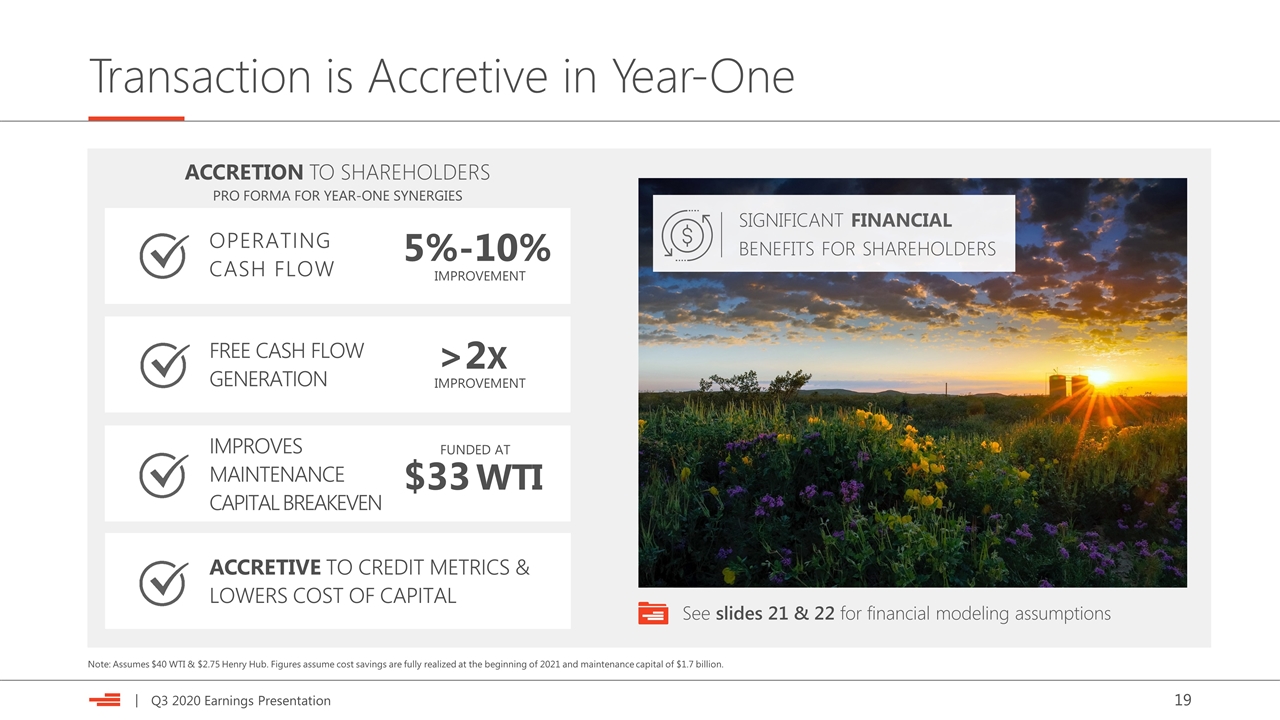

Transaction is Accretive in Year-One ACCRETION TO SHAREHOLDERS OPERATING CASH FLOW ACCRETIVE TO CREDIT METRICS & LOWERS COST OF CAPITAL FREE CASH FLOW GENERATION 5%-10% >2x IMPROVES MAINTENANCE CAPITAL BREAKEVEN $33 WTI PRO FORMA FOR YEAR-ONE SYNERGIES See slides 21 & 22 for financial modeling assumptions Note: Assumes $40 WTI & $2.75 Henry Hub. Figures assume cost savings are fully realized at the beginning of 2021 and maintenance capital of $1.7 billion. FUNDED AT IMPROVEMENT IMPROVEMENT significant financial benefits for shareholders

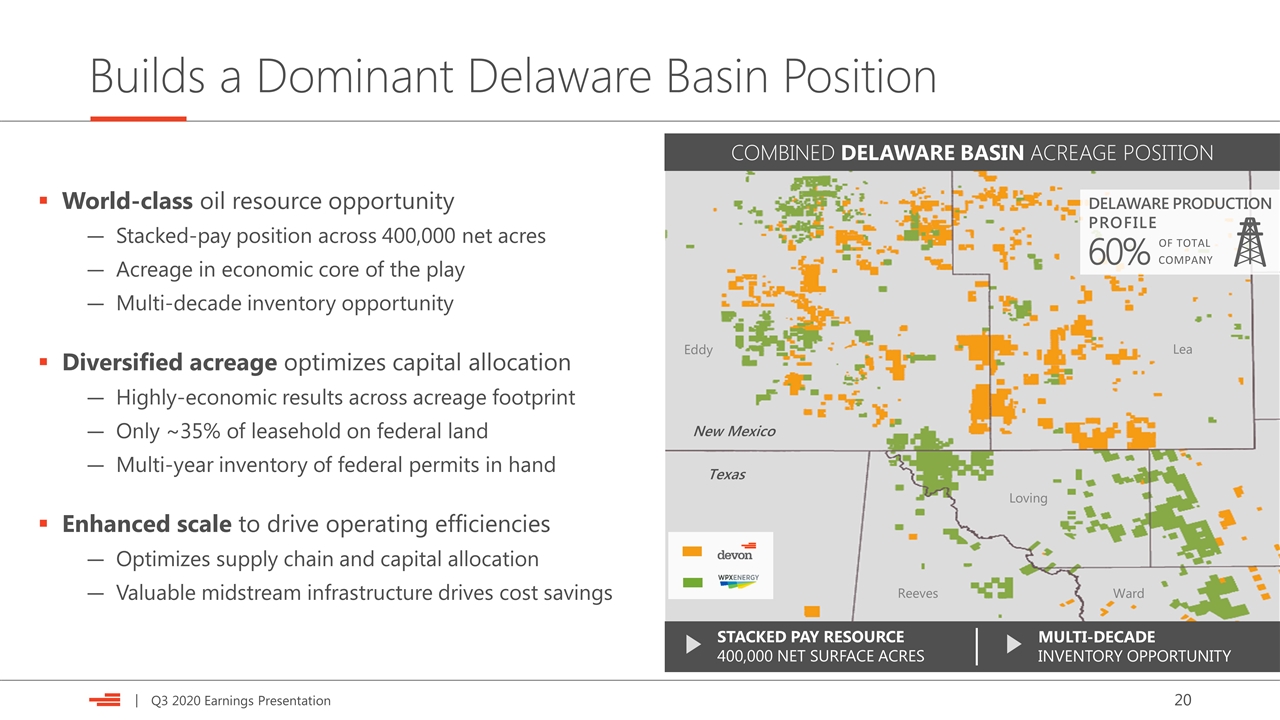

Builds a Dominant Delaware Basin Position COMBINED DELAWARE BASIN ACREAGE POSITION New Mexico Texas Eddy Lea Loving Ward Reeves Reeves STACKED PAY RESOURCE 400,000 NET SURFACE ACRES MULTI-DECADE INVENTORY OPPORTUNITY World-class oil resource opportunity Stacked-pay position across 400,000 net acres Acreage in economic core of the play Multi-decade inventory opportunity Diversified acreage optimizes capital allocation Highly-economic results across acreage footprint Only ~35% of leasehold on federal land Multi-year inventory of federal permits in hand Enhanced scale to drive operating efficiencies Optimizes supply chain and capital allocation Valuable midstream infrastructure drives cost savings DELAWARE PRODUCTION PROFILE 60% COMPANY OF TOTAL

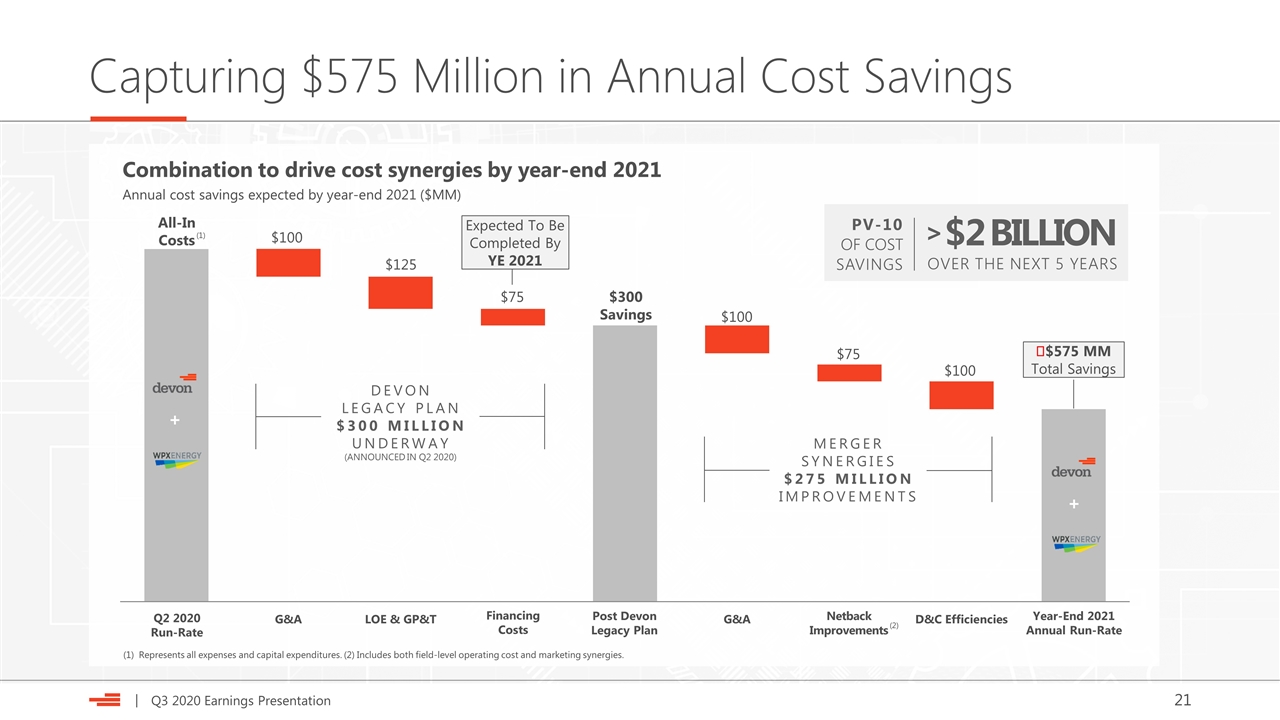

Capturing $575 Million in Annual Cost Savings Combination to drive cost synergies by year-end 2021 Annual cost savings expected by year-end 2021 ($MM) All-In Costs $300 Savings $575 MM Total Savings MERGER SYNERGIES $275 MILLION IMPROVEMENTS DEVON LEGACY PLAN $300 MILLION UNDERWAY $75 $100 $75 $100 $125 (ANNOUNCED IN Q2 2020) $2 BILLION OVER THE NEXT 5 YEARS PV-10 OF COST SAVINGS Netback Improvements $100 Financing Costs Post Devon Legacy Plan Year-End 2021 Annual Run-Rate (1) Represents all expenses and capital expenditures. (2) Includes both field-level operating cost and marketing synergies. (1) (2) + > + Q2 2020 Run-Rate Expected To Be Completed By YE 2021

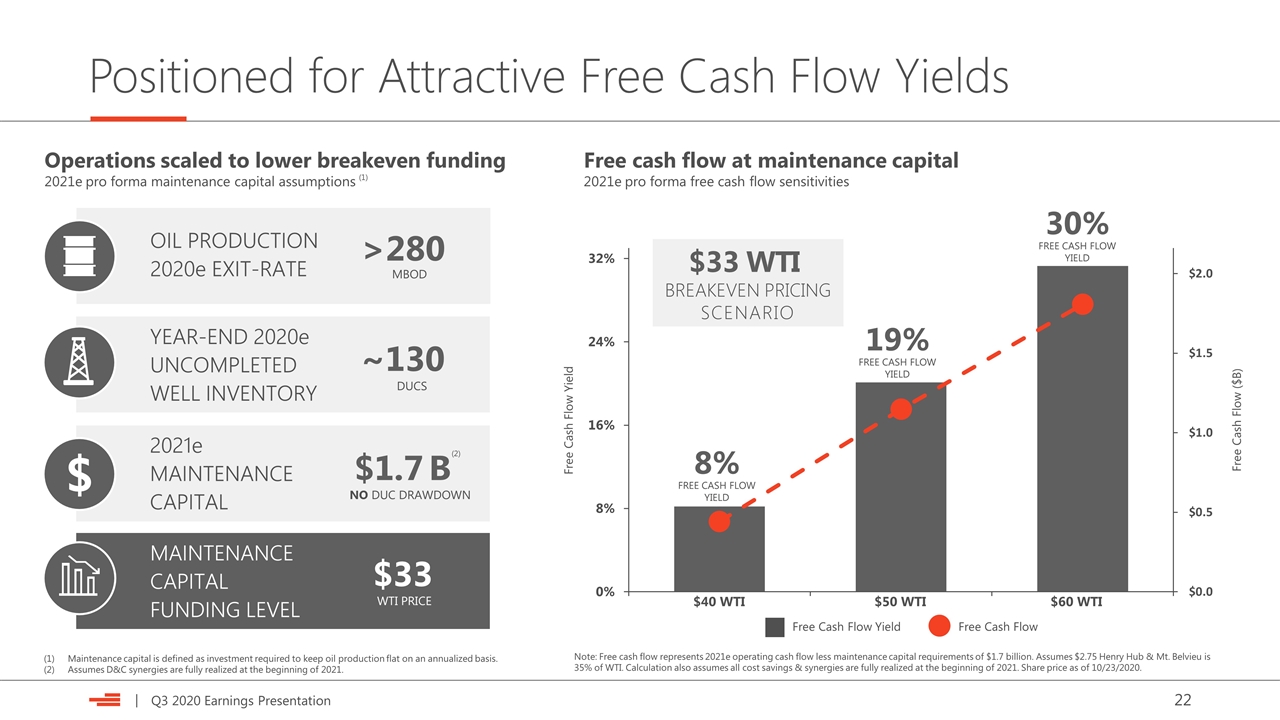

Positioned for Attractive Free Cash Flow Yields OIL PRODUCTION 2020e EXIT-RATE MAINTENANCE CAPITAL FUNDING LEVEL >280 $33 YEAR-END 2020e UNCOMPLETED WELL INVENTORY ~130 MBOD DUCS WTI PRICE 2021e MAINTENANCE CAPITAL $ $1.7 B (2) Operations scaled to lower breakeven funding 2021e pro forma maintenance capital assumptions Note: Free cash flow represents 2021e operating cash flow less maintenance capital requirements of $1.7 billion. Assumes $2.75 Henry Hub & Mt. Belvieu is 35% of WTI. Calculation also assumes all cost savings & synergies are fully realized at the beginning of 2021. Share price as of 10/23/2020. $40 WTI $50 WTI Free cash flow at maintenance capital 2021e pro forma free cash flow sensitivities $60 WTI 8% FREE CASH FLOW YIELD 19% FREE CASH FLOW YIELD 30% FREE CASH FLOW YIELD Free Cash Flow Free Cash Flow Yield Free Cash Flow Yield Free Cash Flow ($B) BREAKEVEN PRICING SCENARIO $33 WTI Maintenance capital is defined as investment required to keep oil production flat on an annualized basis. Assumes D&C synergies are fully realized at the beginning of 2021. (1) NO DUC DRAWDOWN

A Proven Team Committed to Value Creation Dave Hager Executive Chairman Rick Muncrief President & CEO Jeff Ritenour EVP & Chief Financial Officer Clay Gaspar EVP & Chief Operating Officer David Harris EVP & Chief Corporate Development Officer Dennis Cameron EVP & General Counsel Tana Cashion SVP of Human Resources

Q3 2020 Results Appendix

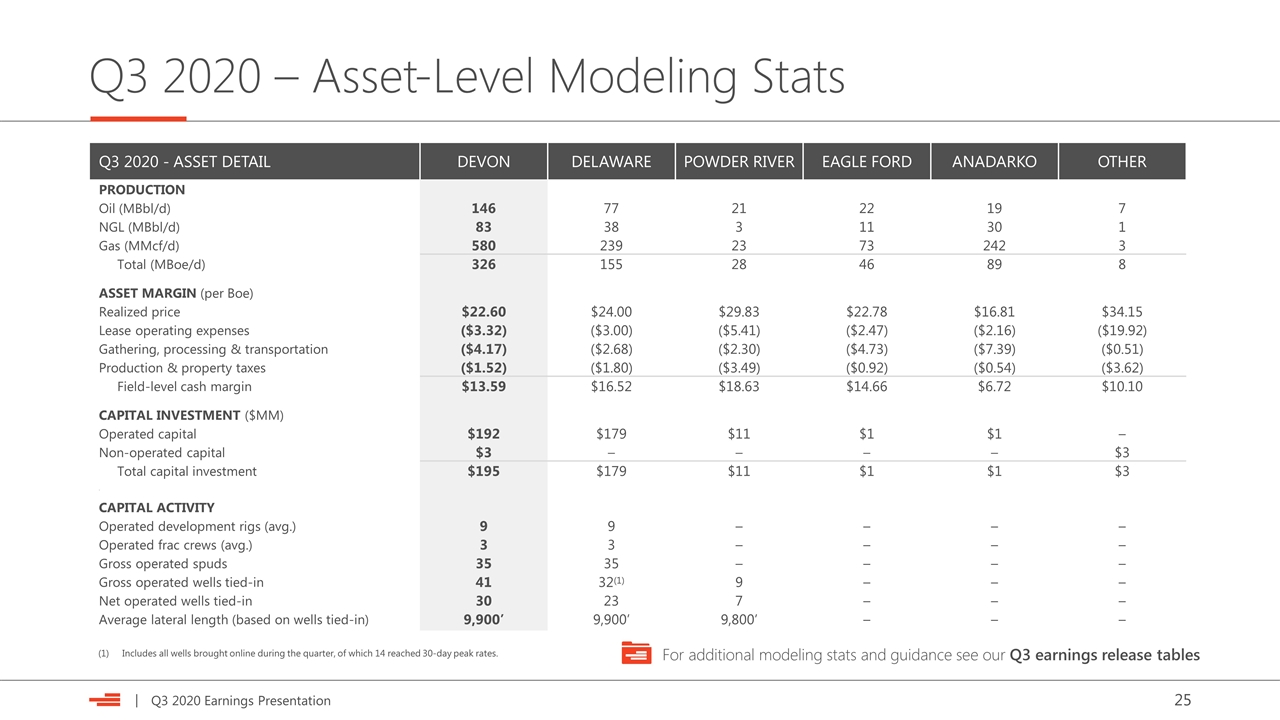

Q3 2020 - ASSET DETAIL DEVON DELAWARE POWDER RIVER EAGLE FORD ANADARKO OTHER PRODUCTION Oil (MBbl/d) 146 77 21 22 19 7 NGL (MBbl/d) 83 38 3 11 30 1 Gas (MMcf/d) 580 239 23 73 242 3 Total (MBoe/d) 326 155 28 46 89 8 ASSET MARGIN (per Boe) Realized price $22.60 $24.00 $29.83 $22.78 $16.81 $34.15 Lease operating expenses ($3.32) ($3.00) ($5.41) ($2.47) ($2.16) ($19.92) Gathering, processing & transportation ($4.17) ($2.68) ($2.30) ($4.73) ($7.39) ($0.51) Production & property taxes ($1.52) ($1.80) ($3.49) ($0.92) ($0.54) ($3.62) Field-level cash margin $13.59 $16.52 $18.63 $14.66 $6.72 $10.10 CAPITAL INVESTMENT ($MM) Operated capital $192 $179 $11 $1 $1 – Non-operated capital $3 – – – – $3 Total capital investment $195 $179 $11 $1 $1 $3 . CAPITAL ACTIVITY Operated development rigs (avg.) 9 9 – – – – Operated frac crews (avg.) 3 3 – – – – Gross operated spuds 35 35 – – – – Gross operated wells tied-in 41 32(1) 9 – – – Net operated wells tied-in 30 23 7 – – – Average lateral length (based on wells tied-in) 9,900’ 9,900’ 9,800’ – – – Q3 2020 – Asset-Level Modeling Stats For additional modeling stats and guidance see our Q3 earnings release tables Includes all wells brought online during the quarter, of which 14 reached 30-day peak rates.

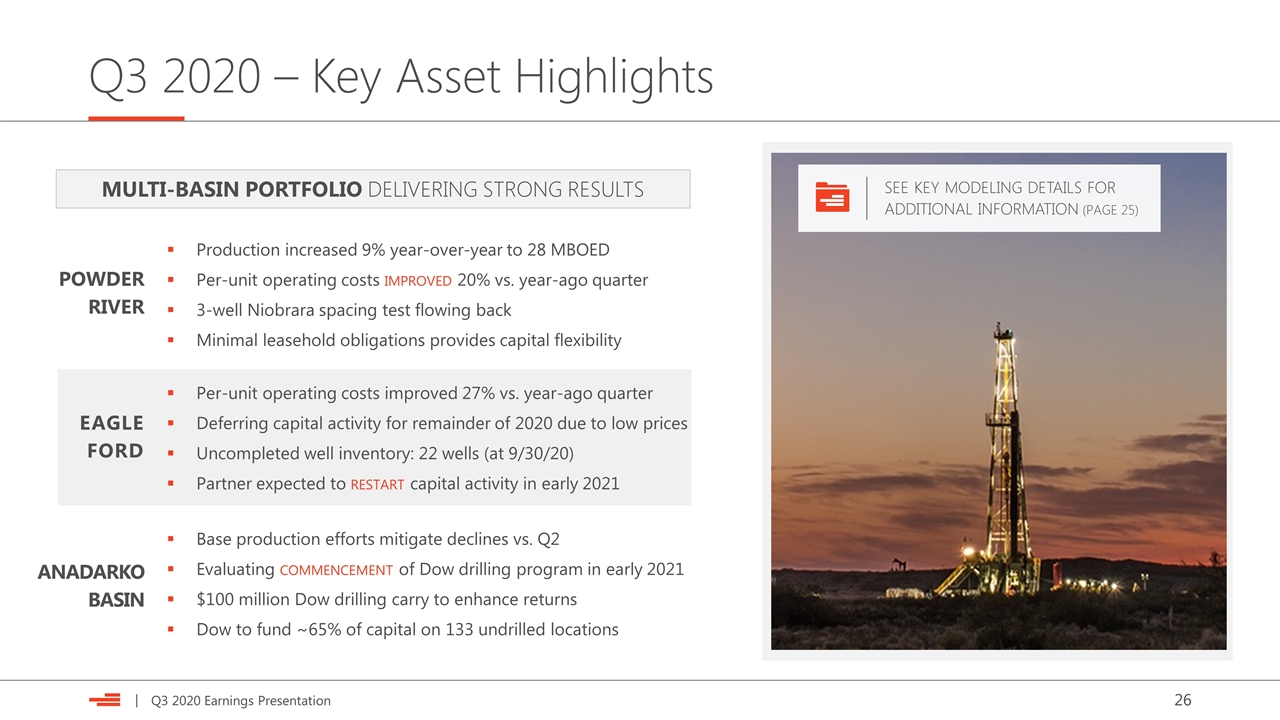

Q3 2020 – Key Asset Highlights POWDER RIVER EAGLE FORD ANADARKO BASIN MULTI-BASIN PORTFOLIO DELIVERING STRONG RESULTS Production increased 9% year-over-year to 28 MBOED Per-unit operating costs improved 20% vs. year-ago quarter 3-well Niobrara spacing test flowing back Minimal leasehold obligations provides capital flexibility Per-unit operating costs improved 27% vs. year-ago quarter Deferring capital activity for remainder of 2020 due to low prices Uncompleted well inventory: 22 wells (at 9/30/20) Partner expected to restart capital activity in early 2021 Base production efforts mitigate declines vs. Q2 Evaluating commencement of Dow drilling program in early 2021 $100 million Dow drilling carry to enhance returns Dow to fund ~65% of capital on 133 undrilled locations see key modeling details for additional information (PAGE 25)

Investor Contacts & Notices Additional Information and Where To Find It In connection with the proposed merger (the “Proposed Transaction”) of Devon Energy Corporation (“Devon”) and WPX Energy, Inc. (“WPX”), Devon will file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 to register the shares of Devon’s common stock to be issued in connection with the Proposed Transaction. The registration statement will include a document that serves as a prospectus of Devon and a proxy statement of each of Devon and WPX (the “joint proxy statement/prospectus”), and each party will file other documents regarding the Proposed Transaction with the SEC. INVESTORS AND SECURITY HOLDERS OF DEVON AND WPX ARE ADVISED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT DEVON, WPX, THE PROPOSED TRANSACTION AND RELATED MATTERS. A definitive joint proxy statement/prospectus will be sent to the stockholders of each of Devon and WPX when it becomes available. Investor Notices Investors and security holders will be able to obtain copies of the registration statement and the joint proxy statement/prospectus and other documents containing important information about Devon and WPX free of charge from the SEC’s website when it becomes available. The documents filed by Devon with the SEC may be obtained free of charge at Devon’s website at www.devonenergy.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from Devon by requesting them by mail at Devon, Attn: Investor Relations, 333 West Sheridan Ave, Oklahoma City, OK 73102. The documents filed by WPX with the SEC may be obtained free of charge at WPX’s website at www.wpxenergy.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from WPX by requesting them by mail at WPX, Attn: Investor Relations, P.O. Box 21810, Tulsa, OK 74102. Participants in the Solicitation Devon, WPX and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from Devon’s and WPX’s stockholders with respect to the Proposed Transaction. Information about Devon’s directors and executive officers is available in Devon’s Annual Report on Form 10-K for the 2019 fiscal year filed with the SEC on February 19, 2020, and its definitive proxy statement for the 2020 annual meeting of shareholders filed with the SEC on April 22, 2020. Information about WPX’s directors and executive officers is available in WPX’s Annual Report on Form 10-K for the 2019 fiscal year filed with the SEC on February 28, 2020 and its definitive proxy statement for the 2020 annual meeting of shareholders filed with the SEC on March 31, 2020. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statement, the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the Proposed Transaction when they become available. Stockholders, potential investors and other readers should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. No Offer or Solicitation This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Use of Non-GAAP Information This presentation may include non-GAAP (generally accepted accounting principles) financial measures. Such non-GAAP measures are not alternatives to GAAP measures, and you should not consider these non-GAAP measures in isolation or as a substitute for analysis of our results as reported under GAAP. For additional disclosure regarding such non-GAAP measures, including reconciliations to their most directly comparable GAAP measure, please refer to Devon’s third-quarter 2020 earnings materials and Form 10-Q filed with the SEC. Investor Relations Contacts Scott CoodyChris Carr VP, Investor RelationsManager, Investor Relations 405-552-4735405-228-2496 Email: [email protected]

Forward-Looking Statements Forward-Looking Statements This communication includes “forward-looking statements” as defined by the SEC. Such statements include those concerning strategic plans, Devon’s and WPX’s expectations and objectives for future operations, as well as other future events or conditions, and are often identified by use of the words and phrases such as “expects,” “believes,” “will,” “would,” “could,” “continue,” “may,” “aims,” “likely to be,” “intends,” “forecasts,” “projections,” “estimates,” “plans,” “expectations,” “targets,” “opportunities,” “potential,” “anticipates,” “outlook” and other similar terminology. All statements, other than statements of historical facts, included in this communication that address activities, events or developments that Devon or WPX expects, believes or anticipates will or may occur in the future are forward-looking statements. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond Devon’s and WPX’s control. Consequently, actual future results could differ materially from Devon’s and WPX’s expectations due to a number of factors, including, but not limited to: the risk that Devon’s and WPX’s businesses will not be integrated successfully; the risk that the cost savings, synergies and growth from the Proposed Transaction may not be fully realized or may take longer to realize than expected; the diversion of management time on transaction-related issues; the effect of future regulatory or legislative actions on the companies or the industries in which they operate, including the risk of new restrictions with respect to hydraulic fracturing or other development activities on Devon’s or WPX’s federal acreage or their other assets; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect; the risk that Devon or WPX may be unable to obtain governmental and regulatory approvals required for the Proposed Transaction, or that required governmental and regulatory approvals may delay the Proposed Transaction or result in the imposition of conditions that could reduce the anticipated benefits from the Proposed Transaction or cause the parties to abandon the Proposed Transaction; the risk that a condition to closing of the Proposed Transaction may not be satisfied; the length of time necessary to consummate the Proposed Transaction, which may be longer than anticipated for various reasons; potential liability resulting from pending or future litigation; changes in the general economic environment, or social or political conditions, that could affect the businesses; the potential impact of the announcement or consummation of the Proposed Transaction on relationships with customers, suppliers, competitors, management and other employees; the ability to hire and retain key personnel; reliance on and integration of information technology systems; the risks associated with assumptions the parties make in connection with the parties’ critical accounting estimates and legal proceedings; the volatility of oil, gas and natural gas liquids (NGL) prices; uncertainties inherent in estimating oil, gas and NGL reserves; the impact of reduced demand for our products and products made from them due to governmental and societal actions taken in response to the COVID-19 pandemic; the uncertainties, costs and risks involved in Devon’s and WPX’s operations, including as a result of employee misconduct; natural disasters, pandemics, epidemics (including COVID-19 and any escalation or worsening thereof) or other public health conditions; counterparty credit risks; risks relating to Devon’s and WPX’s indebtedness; risks related to Devon’s and WPX’s hedging activities; competition for assets, materials, people and capital; regulatory restrictions, compliance costs and other risks relating to governmental regulation, including with respect to environmental matters; cyberattack risks; Devon’s and WPX’s limited control over third parties who operate some of their respective oil and gas properties; midstream capacity constraints and potential interruptions in production; the extent to which insurance covers any losses Devon or WPX may experience; risks related to investors attempting to effect change; general domestic and international economic and political conditions, including the impact of COVID-19; and changes in tax, environmental and other laws, including court rulings, applicable to Devon’s and WPX’s business. In addition to the foregoing, the COVID-19 pandemic and its related repercussions have created significant volatility, uncertainty and turmoil in the global economy and Devon’s and WPX’s industry. This turmoil has included an unprecedented supply-and-demand imbalance for oil and other commodities, resulting in a swift and material decline in commodity prices in early 2020. Devon’s and WPX’s future actual results could differ materially from the forward-looking statements in this communication due to the COVID-19 pandemic and related impacts, including, by, among other things: contributing to a sustained or further deterioration in commodity prices; causing takeaway capacity constraints for production, resulting in further production shut-ins and additional downward pressure on impacted regional pricing differentials; limiting Devon’s and WPX’s ability to access sources of capital due to disruptions in financial markets; increasing the risk of a downgrade from credit rating agencies; exacerbating counterparty credit risks and the risk of supply chain interruptions; and increasing the risk of operational disruptions due to social distancing measures and other changes to business practices. Additional information concerning other risk factors is also contained in Devon’s and WPX’s most recently filed Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other SEC filings. Many of these risks, uncertainties and assumptions are beyond Devon’s or WPX’s ability to control or predict. Because of these risks, uncertainties and assumptions, you should not place undue reliance on these forward-looking statements. Nothing in this communication is intended, or is to be construed, as a profit forecast or to be interpreted to mean that earnings per share of Devon or WPX for the current or any future financial years or those of the combined company will necessarily match or exceed the historical published earnings per share of Devon or WPX, as applicable. Neither Devon nor WPX gives any assurance (1) that either Devon or WPX will achieve their expectations, or (2) concerning any result or the timing thereof, in each case, with respect to the Proposed Transaction or any regulatory action, administrative proceedings, government investigations, litigation, warning letters, consent decree, cost reductions, business strategies, earnings or revenue trends or future financial results. All subsequent written and oral forward-looking statements concerning Devon, WPX, the Proposed Transaction, the combined company or other matters and attributable to Devon or WPX or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Devon and WPX assume no duty to update or revise their respective forward-looking statements based on new information, future events or otherwise.

Exhibit 99.3

Devon Energy Third-Quarter 2020

Supplemental Tables

| TABLE OF CONTENTS: | PAGE: | |||

| Income Statement |

2 | |||

| Cash Flow Statement |

3 | |||

| Balance Sheet |

4 | |||

| Production by Asset |

5 | |||

| Capital and Well Activity by Asset |

6 | |||

| Realized Price by Asset |

7 | |||

| Per-Unit Cash Margin by Asset |

8 | |||

| Non-GAAP Core Earnings (Loss) |

9 | |||

|

Non-GAAP EBITDAX, Net Debt, Net Debt-to-EBITDAX and Free Cash Flow |

10 | |||

| CONSOLIDATED STATEMENTS OF EARNINGS | ||||||||||||||||||||

| (in millions, except per share amounts) | 2020 | 2019 | ||||||||||||||||||

| Quarter 3 | Quarter 2 | Quarter 1 | Quarter 4 | Quarter 3 | ||||||||||||||||

| Oil, gas and NGL sales |

$ | 678 | $ | 424 | $ | 807 | $ | 1,035 | $ | 919 | ||||||||||

| Oil, gas and NGL derivatives (1) |

(87 | ) | (361 | ) | 720 | (116 | ) | 127 | ||||||||||||

| Marketing and midstream revenues |

476 | 331 | 560 | 670 | 700 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

1,067 | 394 | 2,087 | 1,589 | 1,746 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Production expenses (2) |

271 | 263 | 318 | 324 | 294 | |||||||||||||||

| Exploration expenses |

39 | 12 | 112 | 29 | 18 | |||||||||||||||

| Marketing and midstream expenses |

478 | 339 | 578 | 665 | 684 | |||||||||||||||

| Depreciation, depletion and amortization |

299 | 299 | 401 | 382 | 381 | |||||||||||||||

| Asset impairments |

— | — | 2,666 | — | — | |||||||||||||||

| Asset dispositions |

— | — | — | — | (1 | ) | ||||||||||||||

| General and administrative expenses |

75 | 79 | 102 | 119 | 107 | |||||||||||||||

| Financing costs, net |

66 | 69 | 65 | 64 | 60 | |||||||||||||||

| Restructuring and transaction costs |

32 | — | — | 11 | 10 | |||||||||||||||

| Other expenses |

— | 13 | (48 | ) | 16 | 3 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total expenses |

1,260 | 1,074 | 4,194 | 1,610 | 1,556 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings (loss) from continuing operations before income taxes |

(193 | ) | (680 | ) | (2,107 | ) | (21 | ) | 190 | |||||||||||

| Income tax expense (benefit) |

(90 | ) | (3 | ) | (417 | ) | (33 | ) | 54 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net earnings (loss) from continuing operations |

(103 | ) | (677 | ) | (1,690 | ) | 12 | 136 | ||||||||||||

| Net earnings (loss) from discontinued operations, net of taxes |

13 | 9 | (125 | ) | (652 | ) | (27 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net earnings (loss) |

(90 | ) | (668 | ) | (1,815 | ) | (640 | ) | 109 | |||||||||||

| Net earnings attributable to noncontrolling interests |

2 | 2 | 1 | 2 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net earnings (loss) attributable to Devon |

$ | (92 | ) | $ | (670 | ) | $ | (1,816 | ) | $ | (642 | ) | $ | 109 | ||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic net earnings (loss) per share: |

||||||||||||||||||||

| Continuing operations |

$ | (0.29 | ) | $ | (1.80 | ) | $ | (4.48 | ) | $ | 0.03 | $ | 0.34 | |||||||

| Discontinued operations |

0.04 | 0.02 | (0.34 | ) | (1.73 | ) | (0.07 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic net earnings (loss) per share |

$ | (0.25 | ) | $ | (1.78 | ) | $ | (4.82 | ) | $ | (1.70 | ) | $ | 0.27 | ||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted net earnings (loss) per share: |

||||||||||||||||||||

| Continuing operations |

$ | (0.29 | ) | $ | (1.80 | ) | $ | (4.48 | ) | $ | 0.03 | $ | 0.34 | |||||||

| Discontinued operations |

0.04 | 0.02 | (0.34 | ) | (1.73 | ) | (0.07 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted net earnings (loss) per share |

$ | (0.25 | ) | $ | (1.78 | ) | $ | (4.82 | ) | $ | (1.70 | ) | $ | 0.27 | ||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average common shares outstanding: |

||||||||||||||||||||

| Basic |

383 | 383 | 383 | 383 | 397 | |||||||||||||||

| Diluted |

383 | 383 | 383 | 385 | 399 | |||||||||||||||

| (1) OIL, GAS AND NGL DERIVATIVES | ||||||||||||||||||||

| (in millions) | 2020 | 2019 | ||||||||||||||||||

| Quarter 3 | Quarter 2 | Quarter 1 | Quarter 4 | Quarter 3 | ||||||||||||||||

| Derivative cash settlements |

$ | 10 | $ | 232 | $ | 101 | $ | 42 | $ | 71 | ||||||||||

| Derivative valuation changes |

(97 | ) | (593 | ) | 619 | (158 | ) | 56 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Oil, gas and NGL derivatives |

$ | (87 | ) | $ | (361 | ) | $ | 720 | $ | (116 | ) | $ | 127 | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (2) PRODUCTION EXPENSES | ||||||||||||||||||||

| (in millions) | 2020 | 2019 | ||||||||||||||||||

| Quarter 3 | Quarter 2 | Quarter 1 | Quarter 4 | Quarter 3 | ||||||||||||||||

| Lease operating expense |

$ | 100 | $ | 108 | $ | 126 | $ | 120 | $ | 118 | ||||||||||

| Gathering, processing & transportation |

125 | 123 | 130 | 131 | 112 | |||||||||||||||

| Production taxes |

42 | 25 | 56 | 69 | 58 | |||||||||||||||

| Property taxes |

4 | 7 | 6 | 4 | 6 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Production expenses |

$ | 271 | $ | 263 | $ | 318 | $ | 324 | $ | 294 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

2

| CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||||||||||||||||

| (in millions) | 2020 | 2019 | ||||||||||||||||||

| Quarter 3 | Quarter 2 | Quarter 1 | Quarter 4 | Quarter 3 | ||||||||||||||||

| Cash flows from operating activities: |

||||||||||||||||||||

| Net earnings (loss) |

$ | (90 | ) | $ | (668 | ) | $ | (1,815 | ) | $ | (640 | ) | $ | 109 | ||||||

| Adjustments to reconcile net earnings (loss) to net cash from operating activities: |

||||||||||||||||||||

| Net (earnings) loss from discontinued operations, net of income taxes |

(13 | ) | (9 | ) | 125 | 652 | 27 | |||||||||||||

| Depreciation, depletion and amortization |

299 | 299 | 401 | 382 | 381 | |||||||||||||||

| Asset impairments |

— | — | 2,666 | — | — | |||||||||||||||

| Leasehold impairments |

36 | 3 | 110 | 3 | 13 | |||||||||||||||

| Accretion on discounted liabilities |

8 | 8 | 8 | 8 | 8 | |||||||||||||||

| Total (gains) losses on commodity derivatives |

87 | 361 | (720 | ) | 116 | (127 | ) | |||||||||||||

| Cash settlements on commodity derivatives |

10 | 232 | 101 | 41 | 71 | |||||||||||||||

| Gains on asset dispositions |

— | — | — | — | (1 | ) | ||||||||||||||

| Deferred income tax expense (benefit) |

— | — | (311 | ) | (27 | ) | 52 | |||||||||||||

| Share-based compensation |

31 | 19 | 20 | 23 | 23 | |||||||||||||||

| Other |

1 | 4 | — | 2 | 3 | |||||||||||||||

| Changes in assets and liabilities, net |

58 | (99 | ) | (56 | ) | 18 | 36 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net cash from operating activities - continuing operations |

427 | 150 | 529 | 578 | 595 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash flows from investing activities: |

||||||||||||||||||||

| Capital expenditures |

(204 | ) | (307 | ) | (425 | ) | (408 | ) | (526 | ) | ||||||||||

| Acquisitions of property and equipment |

— | (1 | ) | (4 | ) | (3 | ) | (5 | ) | |||||||||||

| Divestitures of property and equipment |

1 | 3 | 25 | 43 | 9 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net cash from investing activities - continuing operations |

(203 | ) | (305 | ) | (404 | ) | (368 | ) | (522 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash flows from financing activities: |

||||||||||||||||||||

| Repurchases of common stock |

— | — | (38 | ) | (103 | ) | (561 | ) | ||||||||||||

| Dividends paid on common stock |

(43 | ) | (42 | ) | (34 | ) | (34 | ) | (35 | ) | ||||||||||

| Contributions from noncontrolling interests |

1 | 6 | 5 | 116 | — | |||||||||||||||

| Distributions to noncontrolling interest |

(4 | ) | (3 | ) | (3 | ) | — | — | ||||||||||||

| Shares exchanged for tax withholdings and other |

— | — | (17 | ) | (2 | ) | (1 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net cash from financing activities - continuing operations |

(46 | ) | (39 | ) | (87 | ) | (23 | ) | (597 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net change in cash, cash equivalents and restricted cash of continuing operations |

178 | (194 | ) | 38 | 187 | (524 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash flows from discontinued operations: |

||||||||||||||||||||

| Operating activities |

45 | (43 | ) | (131 | ) | (9 | ) | (94 | ) | |||||||||||

| Investing activities |

1 | 171 | (1 | ) | — | (5 | ) | |||||||||||||

| Financing activities |

— | — | — | — | (1,571 | ) | ||||||||||||||

| Effect of exchange rate changes on cash |

4 | 8 | (23 | ) | 10 | (3 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net change in cash, cash equivalents and restricted cash of discontinued operations |

50 | 136 | (155 | ) | 1 | (1,673 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net change in cash, cash equivalents and restricted cash |

228 | (58 | ) | (117 | ) | 188 | (2,197 | ) | ||||||||||||

| Cash, cash equivalents and restricted cash at beginning of period |

1,669 | 1,727 | 1,844 | 1,656 | 3,853 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash, cash equivalents and restricted cash at end of period |

$ | 1,897 | $ | 1,669 | $ | 1,727 | $ | 1,844 | $ | 1,656 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Reconciliation of cash, cash equivalents and restricted cash: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 1,707 | $ | 1,474 | $ | 1,527 | $ | 1,464 | $ | 1,375 | ||||||||||

| Cash restricted for discontinued operations |

190 | 195 | 200 | 380 | 280 | |||||||||||||||

| Restricted cash included in other current assets |

— | — | — | — | 1 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total cash, cash equivalents and restricted cash |

$ | 1,897 | $ | 1,669 | $ | 1,727 | $ | 1,844 | $ | 1,656 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

3

| CONSOLIDATED BALANCE SHEETS | ||||||||

| (in millions) | September 30, | December 31, | ||||||

| 2020 | 2019 | |||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 1,707 | $ | 1,464 | ||||

| Cash restricted for discontinued operations |

190 | 380 | ||||||

| Accounts receivable |

493 | 832 | ||||||

| Current assets associated with discontinued operations |

728 | 896 | ||||||

| Other current assets |

359 | 279 | ||||||

|

|

|

|

|

|||||

| Total current assets |

3,477 | 3,851 | ||||||

| Oil and gas property and equipment, based on successful efforts accounting, net |

4,553 | 7,558 | ||||||

| Other property and equipment, net |

1,003 | 1,035 | ||||||

|

|

|

|

|

|||||

| Total property and equipment, net |

5,556 | 8,593 | ||||||

| Goodwill |

753 | 753 | ||||||

| Right-of-use assets |

226 | 243 | ||||||

| Other long-term assets |

233 | 196 | ||||||

| Long-term assets associated with discontinued operations |

81 | 81 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 10,326 | $ | 13,717 | ||||

|

|

|

|

|

|||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 415 | $ | 428 | ||||

| Revenues and royalties payable |

562 | 730 | ||||||

| Current liabilities associated with discontinued operations |

463 | 459 | ||||||

| Other current liabilities |

269 | 310 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

1,709 | 1,927 | ||||||

|

|

|

|

|

|||||

| Long-term debt |

4,297 | 4,294 | ||||||

| Lease liabilities |

245 | 244 | ||||||

| Asset retirement obligations |

398 | 380 | ||||||

| Other long-term liabilities |

372 | 426 | ||||||

| Long-term liabilities associated with discontinued operations |

157 | 185 | ||||||

| Deferred income taxes |

— | 341 | ||||||

| Stockholders’ equity: |

||||||||

| Common stock |

38 | 38 | ||||||

| Additional paid-in capital |

2,750 | 2,735 | ||||||

| Retained earnings |

351 | 3,148 | ||||||

| Accumulated other comprehensive loss |

(116 | ) | (119 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity attributable to Devon |

3,023 | 5,802 | ||||||

| Noncontrolling interests |

125 | 118 | ||||||

|

|

|

|

|

|||||

| Total equity |

3,148 | 5,920 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | 10,326 | $ | 13,717 | ||||

|

|

|

|

|

|||||

| Common shares outstanding |

383 | 382 | ||||||

4

| PRODUCTION TREND | ||||||||||||||||||||

| 2020 | 2019 | |||||||||||||||||||

| Quarter 3 | Quarter 2 | Quarter 1 | Quarter 4 | Quarter 3 | ||||||||||||||||

| Oil (MBbls/d) |

||||||||||||||||||||

| Delaware Basin |

77 | 79 | 84 | 84 | 70 | |||||||||||||||

| Powder River Basin |

21 | 18 | 21 | 20 | 18 | |||||||||||||||

| Eagle Ford |

22 | 27 | 26 | 23 | 22 | |||||||||||||||

| Anadarko Basin |

19 | 21 | 24 | 27 | 32 | |||||||||||||||

| Other |

7 | 8 | 8 | 9 | 9 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

146 | 153 | 163 | 163 | 151 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Natural gas liquids (MBbls/d) |

||||||||||||||||||||

| Delaware Basin |

38 | 29 | 37 | 32 | 28 | |||||||||||||||

| Powder River Basin |

3 | 2 | 3 | 2 | 2 | |||||||||||||||

| Eagle Ford |

11 | 12 | 9 | 9 | 11 | |||||||||||||||

| Anadarko Basin |

30 | 25 | 30 | 30 | 37 | |||||||||||||||

| Other |

1 | 1 | 1 | 1 | 1 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

83 | 69 | 80 | 74 | 79 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gas (MMcf/d) |

||||||||||||||||||||

| Delaware Basin |

239 | 241 | 244 | 234 | 167 | |||||||||||||||

| Powder River Basin |

23 | 20 | 29 | 28 | 28 | |||||||||||||||

| Eagle Ford |

73 | 87 | 86 | 76 | 75 | |||||||||||||||

| Anadarko Basin |

242 | 262 | 272 | 295 | 317 | |||||||||||||||

| Other |

3 | 4 | 3 | 4 | 4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

580 | 614 | 634 | 637 | 591 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total oil equivalent (MBoe/d) |

||||||||||||||||||||

| Delaware Basin |

155 | 149 | 162 | 154 | 127 | |||||||||||||||

| Powder River Basin |

28 | 24 | 29 | 27 | 25 | |||||||||||||||

| Eagle Ford |

46 | 53 | 50 | 45 | 45 | |||||||||||||||

| Anadarko Basin |

89 | 90 | 98 | 107 | 121 | |||||||||||||||

| Other |

8 | 9 | 9 | 10 | 10 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

326 | 325 | 348 | 343 | 328 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 2020 | 2019 | |||||||||||||||||||

| Quarter 3 | Quarter 2 | Quarter 1 | Quarter 4 | Quarter 3 | ||||||||||||||||

| Barnett divest assets (discontinued operations) |

||||||||||||||||||||

| Oil (MBbls/d) |

— | — | — | — | — | |||||||||||||||

| Natural gas liquids (MBbls/d) |

28 | 28 | 31 | 30 | 30 | |||||||||||||||

| Gas (MMcf/d) |

391 | 401 | 408 | 408 | 414 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total oil equivalent (MBoe/d) |

93 | 95 | 99 | 98 | 100 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

5

| UPSTREAM CAPITAL EXPENDITURES | ||||||||||||||||||||

| (in millions) | 2020 | 2019 | ||||||||||||||||||

| Quarter 3 | Quarter 2 | Quarter 1 | Quarter 4 | Quarter 3 | ||||||||||||||||

| Delaware Basin |

$ | 179 | $ | 148 | $ | 220 | $ | 170 | $ | 262 | ||||||||||

| Powder River Basin |

11 | 39 | 90 | 89 | 89 | |||||||||||||||

| Eagle Ford |

1 | 10 | 70 | 65 | 90 | |||||||||||||||

| Anadarko Basin |

1 | 3 | 4 | 38 | 67 | |||||||||||||||

| Other |

3 | 3 | 7 | 12 | 12 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total upstream capital |

$ | 195 | $ | 203 | $ | 391 | $ | 374 | $ | 520 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| GROSS OPERATED SPUDS | ||||||||||||||||||||

| 2020 | 2019 | |||||||||||||||||||

| Quarter 3 | Quarter 2 | Quarter 1 | Quarter 4 | Quarter 3 | ||||||||||||||||

| Delaware Basin |

35 | 27 | 38 | 24 | 38 | |||||||||||||||

| Powder River Basin |

— | — | 12 | 19 | 14 | |||||||||||||||

| Eagle Ford |

— | — | 10 | 25 | 18 | |||||||||||||||

| Anadarko Basin |

— | — | — | — | 4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

35 | 27 | 60 | 68 | 74 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| GROSS OPERATED WELLS TIED-IN | ||||||||||||||||||||

| 2020 | 2019 | |||||||||||||||||||

| Quarter 3 | Quarter 2 | Quarter 1 | Quarter 4 | Quarter 3 | ||||||||||||||||

| Delaware Basin |

32 | 22 | 32 | 36 | 34 | |||||||||||||||

| Powder River Basin |

9 | 4 | 14 | 19 | 18 | |||||||||||||||

| Eagle Ford |

— | 13 | 30 | 21 | — | |||||||||||||||

| Anadarko Basin |

— | — | 4 | 9 | 16 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

41 | 39 | 80 | 85 | 68 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET OPERATED WELLS TIED-IN | ||||||||||||||||||||

| 2020 | 2019 | |||||||||||||||||||

| Quarter 3 | Quarter 2 | Quarter 1 | Quarter 4 | Quarter 3 | ||||||||||||||||

| Delaware Basin |

23 | 18 | 25 | 25 | 30 | |||||||||||||||

| Powder River Basin |

7 | 4 | 10 | 15 | 13 | |||||||||||||||

| Eagle Ford |

— | 7 | 14 | 11 | — | |||||||||||||||

| Anadarko Basin |

— | — | 3 | 7 | 7 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

30 | 29 | 52 | 58 | 50 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| AVERAGE LATERAL LENGTH | ||||||||||||||||||||

| (based on wells tied-in) | 2020 | 2019 | ||||||||||||||||||

| Quarter 3 | Quarter 2 | Quarter 1 | Quarter 4 | Quarter 3 | ||||||||||||||||

| Delaware Basin |

9,900’ | 9,100’ | 8,000’ | 8,000’ | 9,700’ | |||||||||||||||

| Powder River Basin |

9,800’ | 8,100’ | 9,100’ | 9,700’ | 9,500’ | |||||||||||||||

| Eagle Ford |

— | 5,900’ | 5,400’ | 6,600’ | N/A | |||||||||||||||

| Anadarko Basin |

— | — | 9,800’ | 11,200’ | 9,600’ | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

9,900’ | 7,900’ | 7,300’ | 8,400’ | 9,600’ | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

6

| BENCHMARK PRICES | ||||||||||||||||||||

| (average prices) | 2020 | 2019 | ||||||||||||||||||

| Quarter 3 | Quarter 2 | Quarter 1 | Quarter 4 | Quarter 3 | ||||||||||||||||

| Oil ($/Bbl) - West Texas Intermediate (Cushing) |

$ | 40.86 | $ | 28.42 | $ | 46.44 | $ | 57.02 | $ | 56.34 | ||||||||||

| Natural Gas ($/Mcf) - Henry Hub |

$ | 1.98 | $ | 1.71 | $ | 1.95 | $ | 2.50 | $ | 2.23 | ||||||||||

| NGL ($/Bbl) - Mont Belvieu Blended |

$ | 16.69 | $ | 12.57 | $ | 14.39 | $ | 18.69 | $ | 16.18 | ||||||||||

| REALIZED PRICES | ||||||||||||||||||||

| 2020 | 2019 | |||||||||||||||||||

| Quarter 3 | Quarter 2 | Quarter 1 | Quarter 4 | Quarter 3 | ||||||||||||||||

| Oil (Per Bbl) |

||||||||||||||||||||

| Delaware Basin |

$ | 39.19 | $ | 22.70 | $ | 45.18 | $ | 56.23 | $ | 53.85 | ||||||||||

| Powder River Basin |

35.39 | 24.03 | 41.14 | 52.02 | 52.50 | |||||||||||||||

| Eagle Ford |

33.68 | 15.30 | 44.90 | 55.11 | 57.77 | |||||||||||||||

| Anadarko Basin |

37.88 | 19.52 | 45.32 | 55.71 | 54.47 | |||||||||||||||

| Other |

37.33 | 25.45 | 44.53 | 55.14 | 54.02 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Realized price without hedges |

37.56 | 21.25 | 44.59 | 55.41 | 54.40 | |||||||||||||||

| Cash settlements |