Form 8-K EVANS BANCORP INC For: Oct 29

Exhibit 99.1

Third Quarter 2020 Financial Results October 29, 2020.

This presentation includes "forward looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements concerning future business, revenue and earnings. These statements are not historical facts or guarantees of future performance, events or results. There are risks, uncertainties and other factors that could cause the actual results of Evans Bancorp to differ materially from the results expressed or implied by such statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include the impacts from COVID-19, competitive pressures among financial services companies, interest rate trends, general economic conditions, changes in legislation or regulatory requirements, effectiveness at achieving stated goals and strategies, and difficulties in achieving operating efficiencies. These risks and uncertainties are more fully described in Evans Bancorp’s Annual and Quarterly Reports filed with the Securities and Exchange Commission. Forward-looking statements speak only as of the date they are made. Evans Bancorp undertakes no obligation to publicly update or revise forward-looking information, whether as a result of new, updated information, future events or otherwise.

This presentation includes "forward looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements concerning future business, revenue and earnings. These statements are not historical facts or guarantees of future performance, events or results. There are risks, uncertainties and other factors that could cause the actual results of Evans Bancorp to differ materially from the results expressed or implied by such statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include the impacts from COVID-19, competitive pressures among financial services companies, interest rate trends, general economic conditions, changes in legislation or regulatory requirements, effectiveness at achieving stated goals and strategies, and difficulties in achieving operating efficiencies. These risks and uncertainties are more fully described in Evans Bancorp’s Annual and Quarterly Reports filed with the Securities and Exchange Commission. Forward-looking statements speak only as of the date they are made. Evans Bancorp undertakes no

Q3 2020 Review

Net income of $4.5 million or $0.84 per diluted share

Results include $0.5 million of remaining merger costs and elevated loan loss provision of $1.9 million to reserve for well-defined weakness in the hospitality industry

Net interest income up 15% to $15.6 million reflecting the Fairport Savings Bank (“FSB”) acquisition and fees earned in connection with Paycheck Protection Program (“PPP”) lending

Significant deposit growth of $522 million or 41%

Completed a private placement of $20 million of subordinated notes in July

FSB integration progressing: completed system/customer conversion and branch rebranding

Evans continues to meet the challenges of this unique and uncertain operating environment

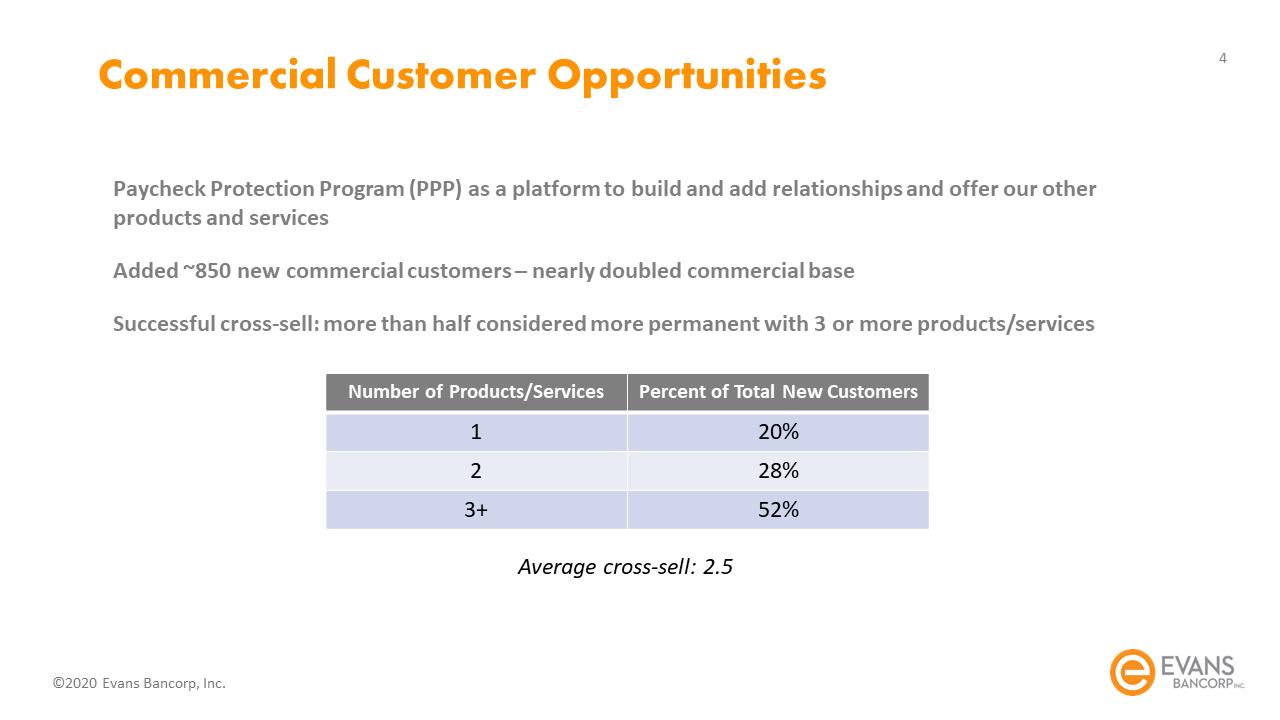

Commercial Customer Opportunities

Paycheck Protection Program (PPP) as a platform to build and add relationships and offer our other products and services

Added ~850 new commercial customers – nearly doubled commercial base

Successful cross-sell: more than half considered more permanent with 3 or more products/services

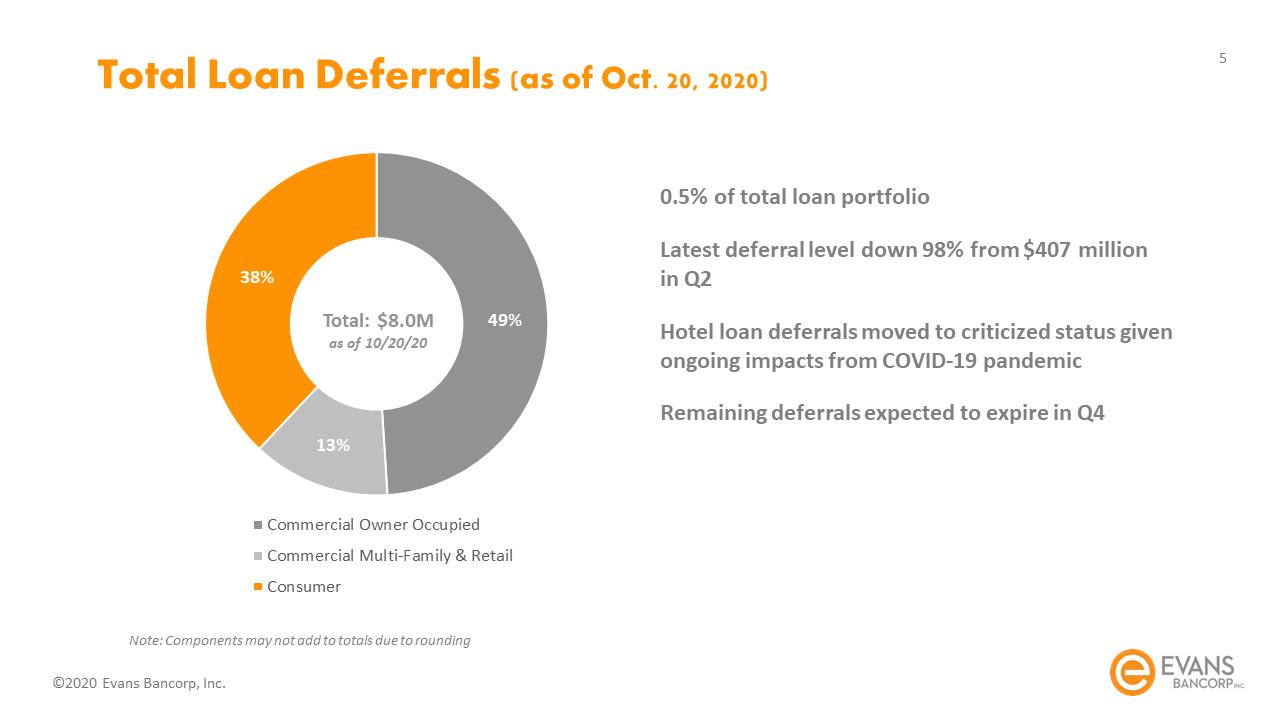

Total Loan Deferrals (as of Oct. 20, 2020)

0.5% of total loan portfolio

Latest deferral level down 98% from $407 million

in Q2

Hotel loan deferrals moved to criticized status given ongoing impacts from COVID-19 pandemic

Remaining deferrals expected to expire in Q4

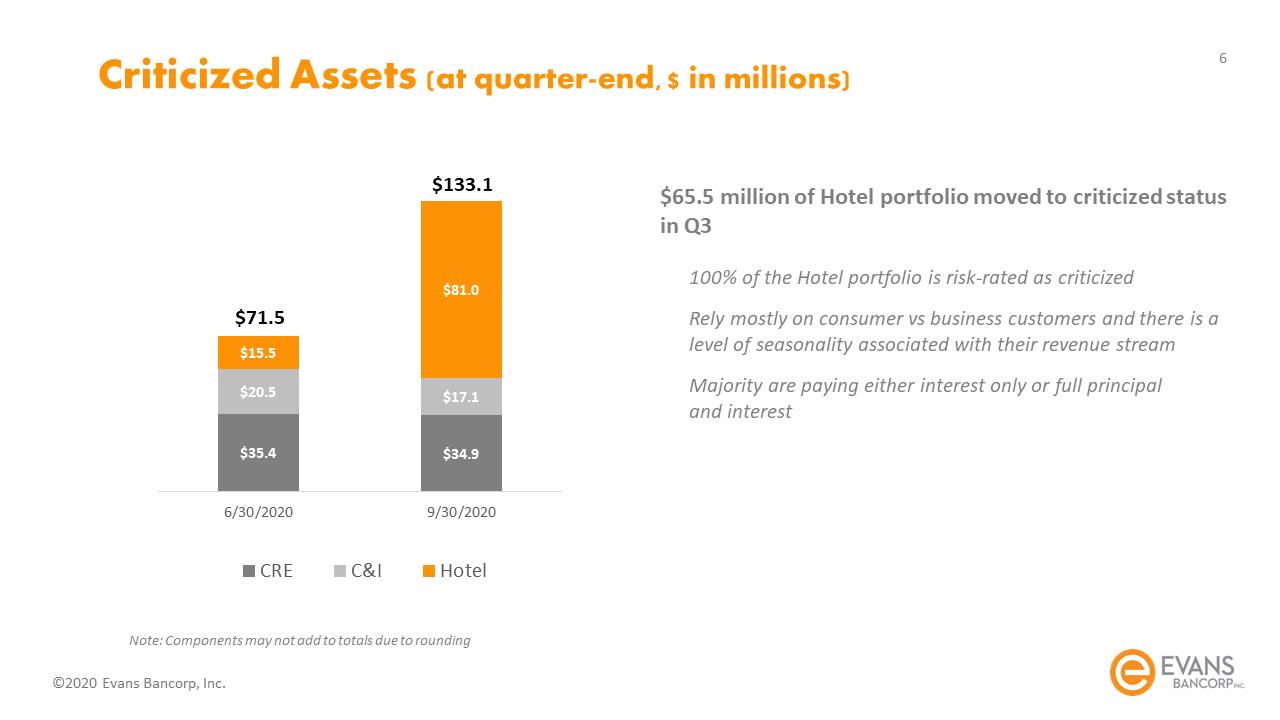

Criticized Assets (at quarter-end, $ in millions)

$65.5 million of Hotel portfolio moved to criticized status in Q3

100% of the Hotel portfolio is risk-rated as criticized

Rely mostly on consumer vs business customers and there is a level of seasonality associated with their revenue stream

Majority are paying either interest only or full principal

and interest

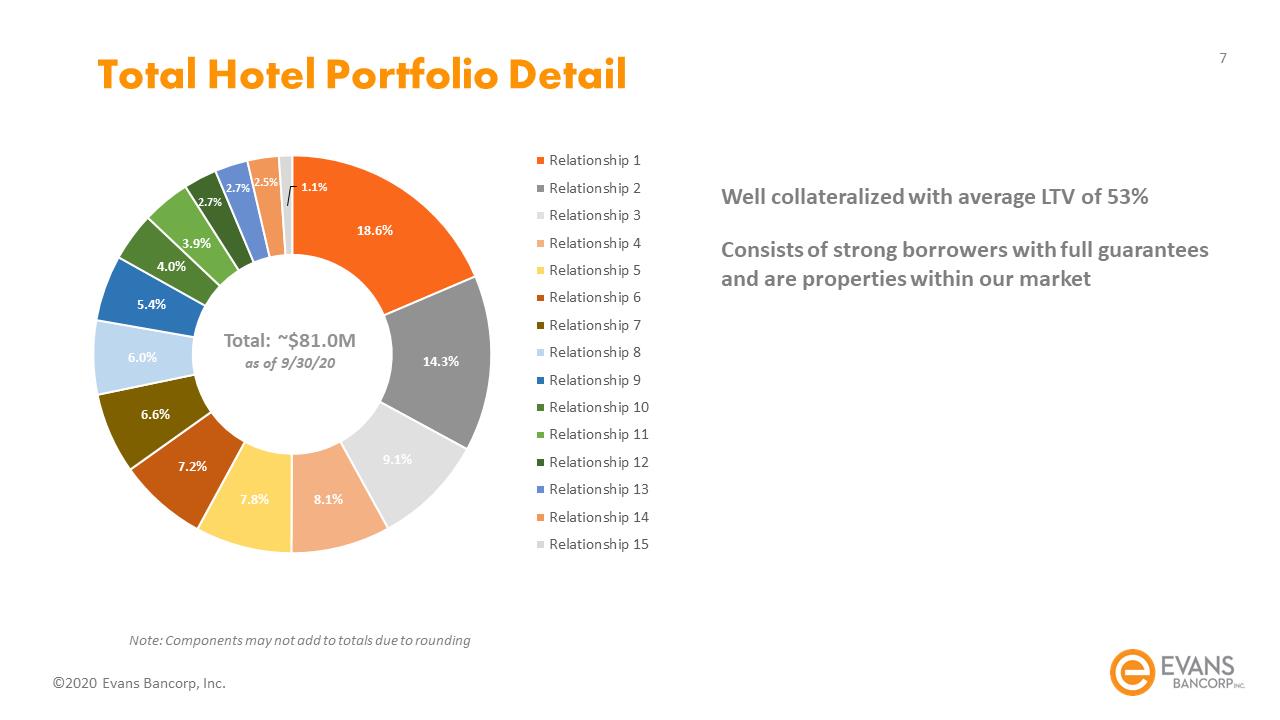

Total Hotel Portfolio Detail

Well collateralized with average LTV of 53%

Consists of strong borrowers with full guarantees and are properties within our market

Conference Call and Webcast Playback

Replay Number: 412-317-6671 passcode: 5583559

Telephone replay available through Thursday, November 5, 2020

Webcast / Presentation / Replay available at www.evansbancorp.com

Transcript, when available, at www.evansbancorp.com