Form 8-K SOUTH STATE Corp For: Oct 29

Exhibit 99.1

For Immediate ReleaseMedia Contact: Jackie Smith (803) 231-3486

South State Corporation Reports Third Quarter 2020 Results

And Declares Quarterly Cash Dividend

WINTER HAVEN, FL—October 29, 2020—South State Corporation (NASDAQ: SSB) today released its unaudited results of operations and other financial information for the three-month and nine-month period ended September 30, 2020.

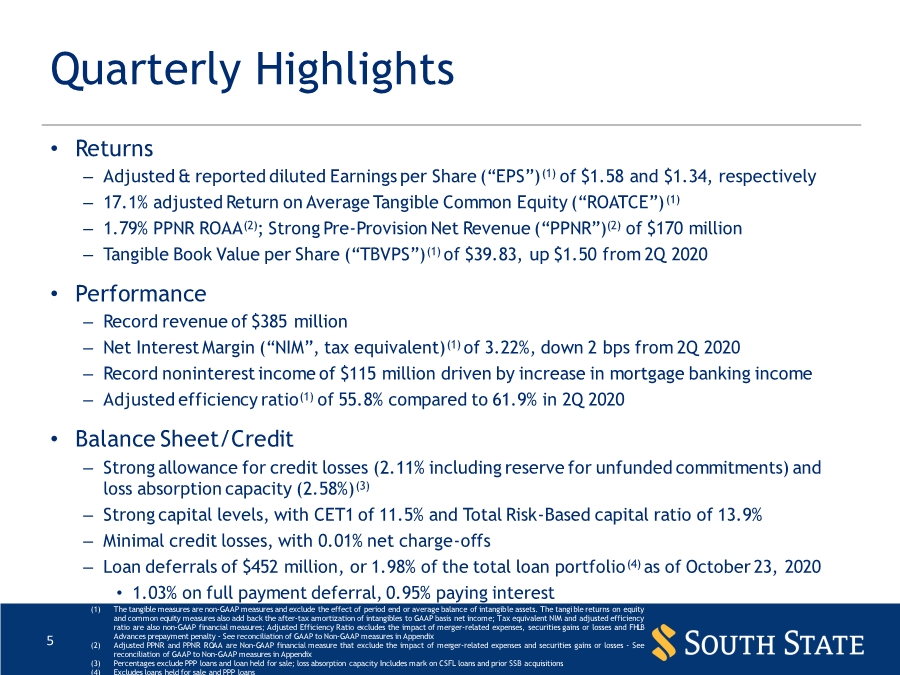

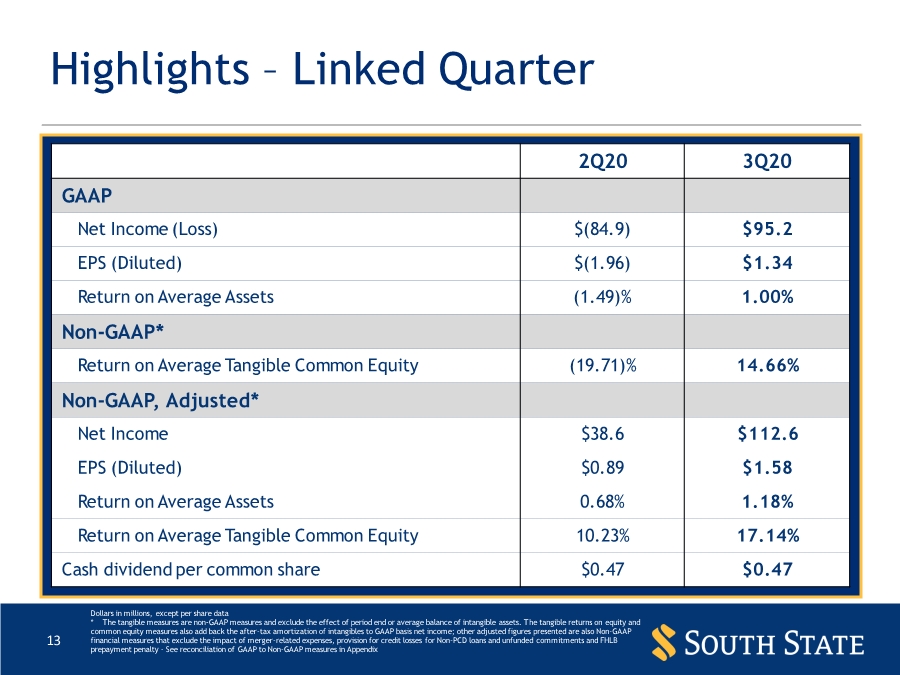

The Company reported consolidated net income of $1.34 per diluted common share for the three months ended September 30, 2020, compared to net loss of ($1.96) per diluted common share for the three months ended June 30, 2020, and compared to $1.50 per diluted common share one year ago. Contributing to the net loss in the second quarter of 2020 was the initial provision for credit losses (“PCL”) recorded on acquired non-purchase credit deteriorated (“NonPCD”) loans and unfunded commitments (“UFC”) which totaled $119.1 million, pre-tax, and merger-related costs of $40.3 million, pre-tax related to the June 7, 2020 merger with CenterState Bank Corporation (“CSFL”).

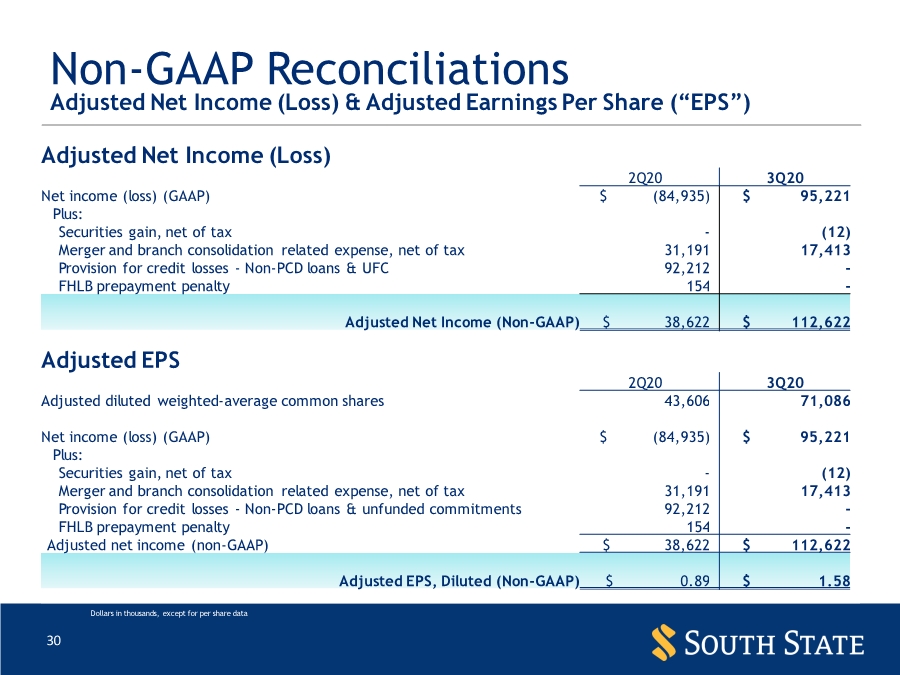

Adjusted net income (non-GAAP) totaled $1.58 per diluted share for the three months ended September 30, 2020, compared to $0.89 per diluted share, in the second quarter of 2020, and compared to $1.49 per diluted share in the year ago period. Adjusted net income in the third quarter of 2020 removes $17.4 million of merger-related costs, after-tax; and in the second quarter of 2020 removed two primary adjustments: (1) the initial PCL on NonPCD loans and UFC of $92.2 million, after-tax, and (2) merger-related costs of $31.2 million, after-tax.

Highlights of the third quarter included:

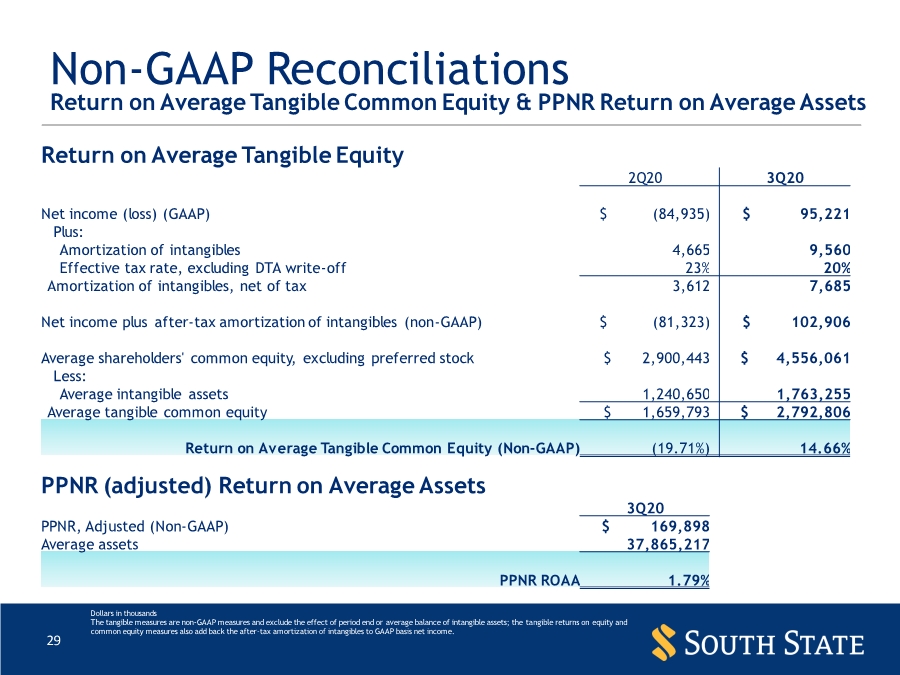

| ● | Return on Average Equity of 8.3%. |

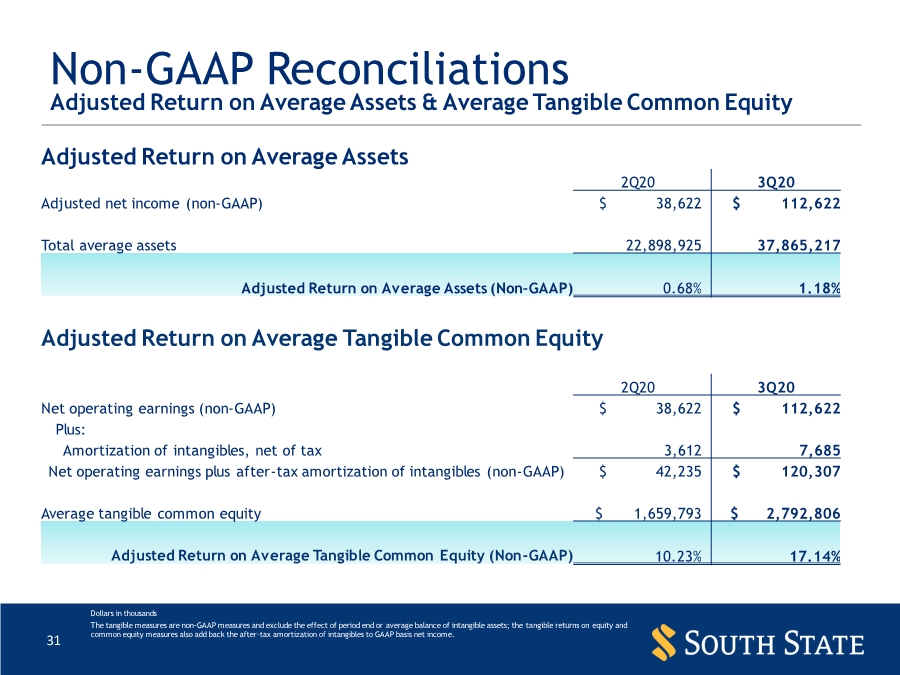

| ● | Return on Average Tangible Common Equity of 14.7% (Non-GAAP); Adjusted Return on Average Tangible Common Equity of 17.1% (Non-GAAP). |

| ● | Return on Average Assets (“ROAA”) of 1.00%, and Adjusted ROAA of 1.18% (Non-GAAP). |

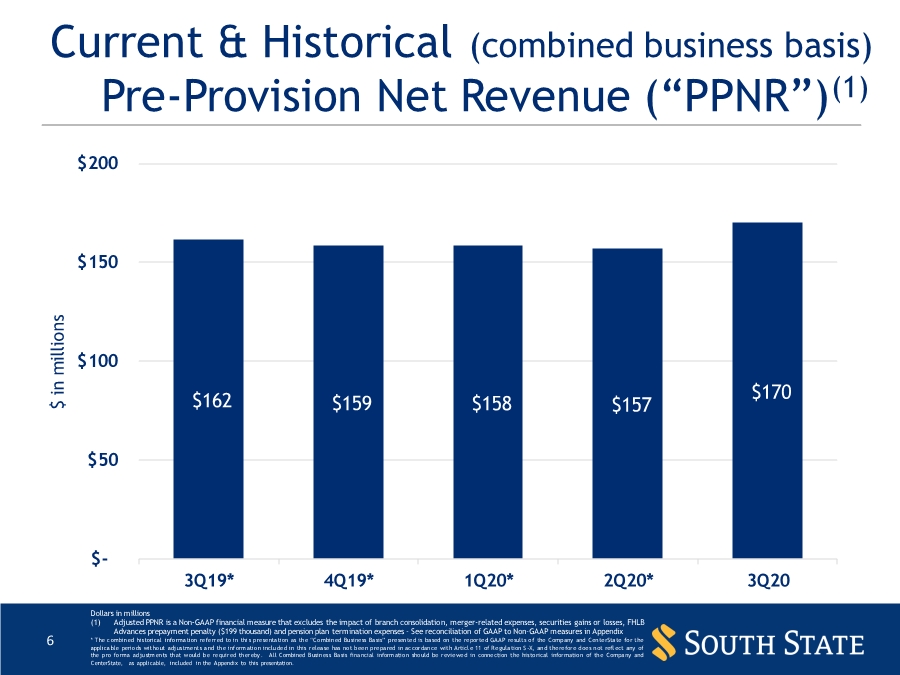

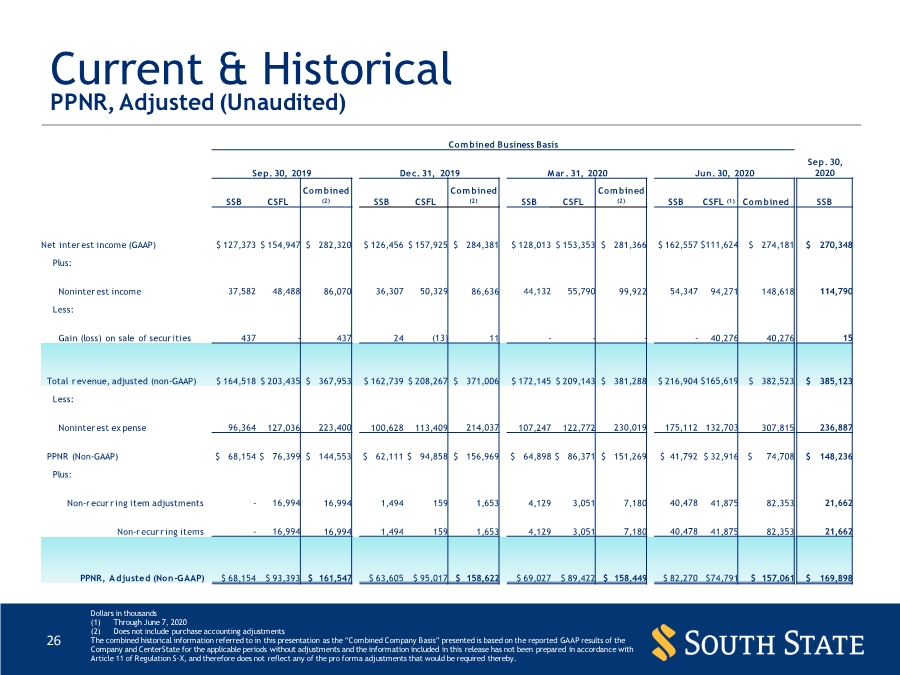

| ● | Third quarter of 2020 Pre-Provision Net Revenue (“PPNR ”) was $170 million, or 1.79% PPNR ROAA. This compares to the second quarter of 2020, where on a combined historical basis (as if the companies had been merged for the full quarter, Non-GAAP), PPNR of $157 million, or 1.68% PPNR ROAA. The second quarter’s results only include the operations of CSFL for the final 23 days of the quarter. |

| ● | Book value per share of $64.34 increased by $0.99 per share from 2Q 2020. |

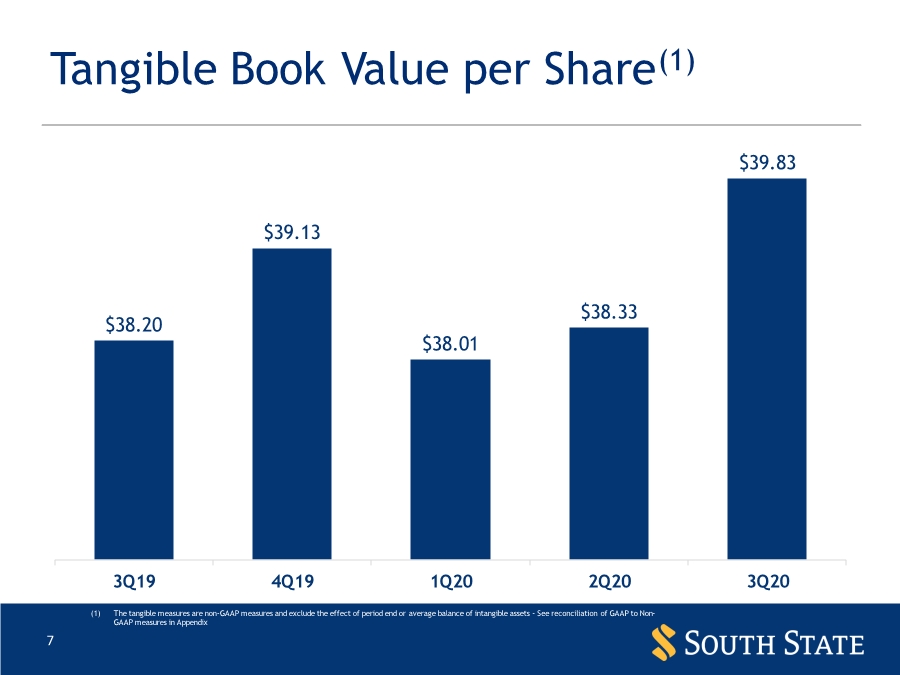

| ● | Tangible book value (“TBV”) per share of $39.83, up $1.50 from 2Q 2020 (Non-GAAP). |

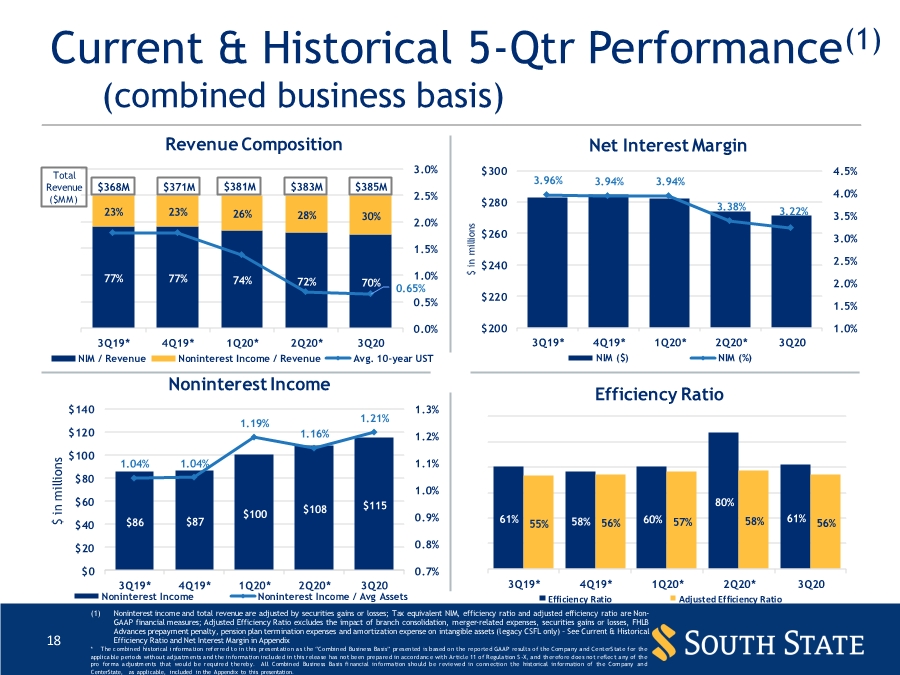

| ● | Record quarterly revenue of $385 million (compared to actual prior period and combined historical basis). |

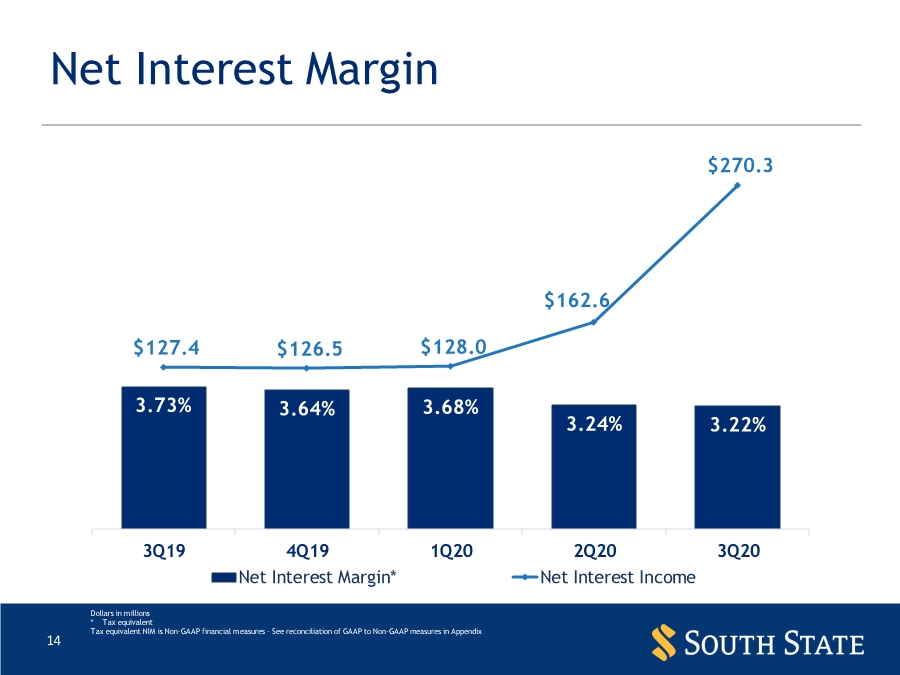

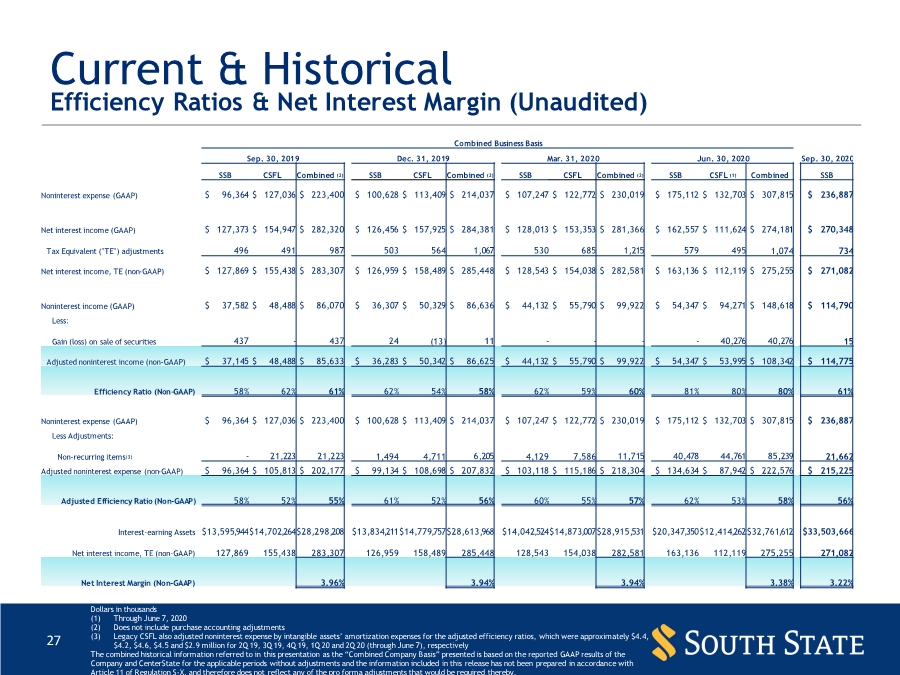

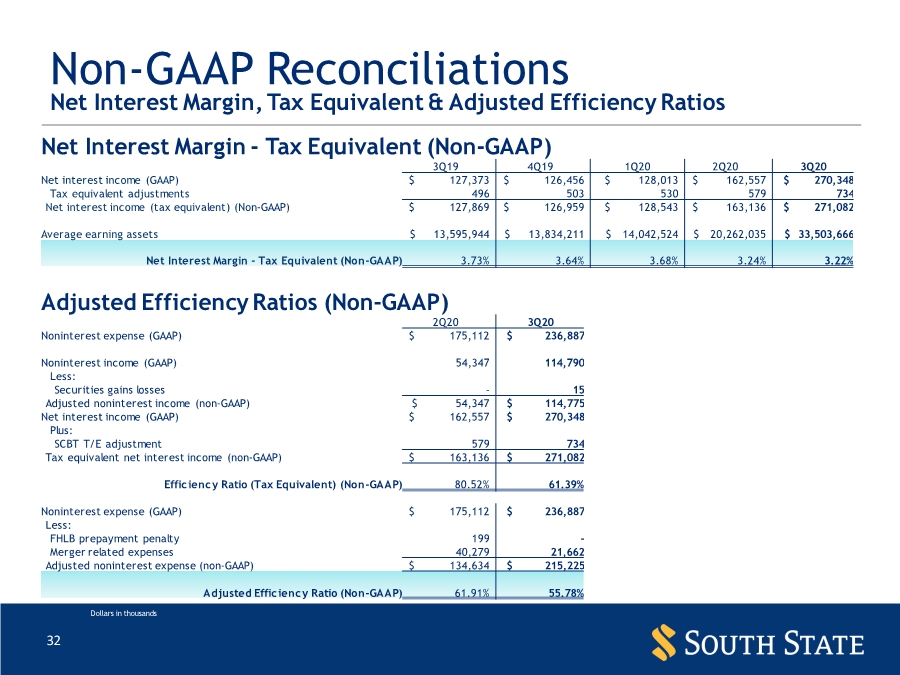

| ● | Net interest margin, declined by 2 basis points to 3.22% during 3Q 2020 from 2Q 2020. |

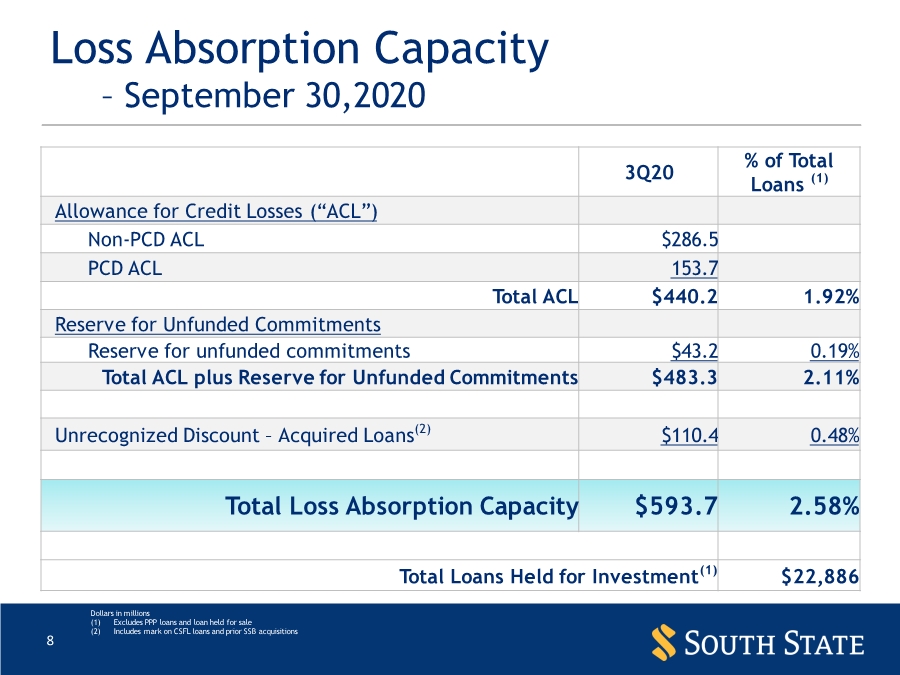

| ● | Significant allowance for credit losses and credit marks on the balance sheet representing 2.58% of total loans (excluding PPP loans). |

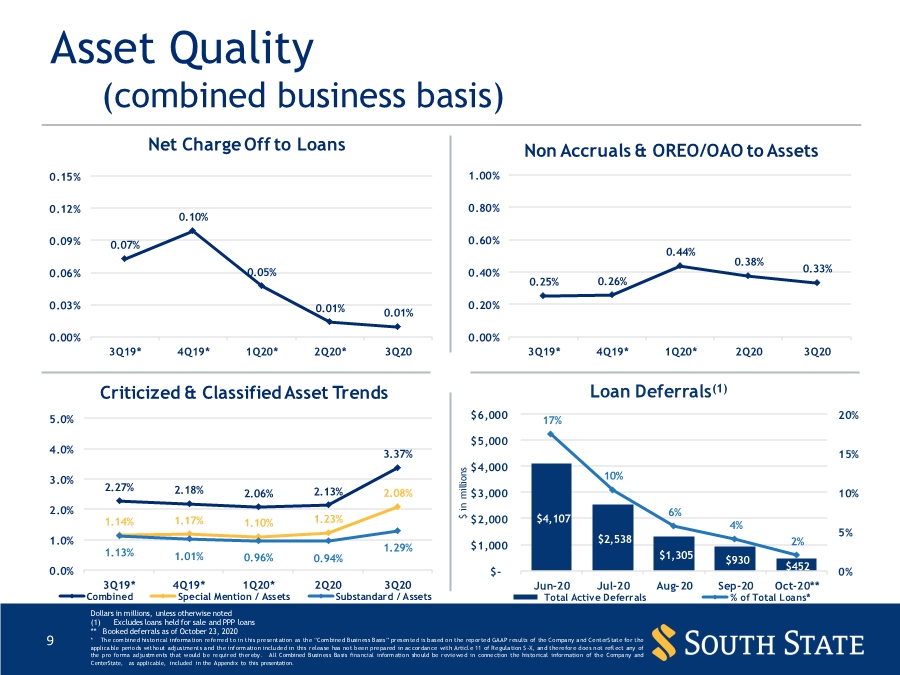

| ● | Net charge-offs of $594,000, or 0.01% annualized. |

| ● | As of 10/23/2020, loan deferrals totaled $452.4million, or 1.98% of the total loan portfolio, excluding PPP loans and held for sale loans. |

“After closing our merger late in the second quarter, we are pleased with our first full quarter of operations as a combined company”, said John C. Corbett, Chief Executive Officer. “Our fee businesses continue to perform well, leading us to another record quarter of revenue. While the current environment includes challenges and uncertainties, we look forward to the future with great optimism.”

Robert R. Hill, Jr., Executive Chairman added, “The CenterState and South State partnership is about the long-term but you can clearly see the progress being made in the short-term. Progress with technology, products, efficiency, and talent all have us uniquely positioned. We are off to a solid start.”

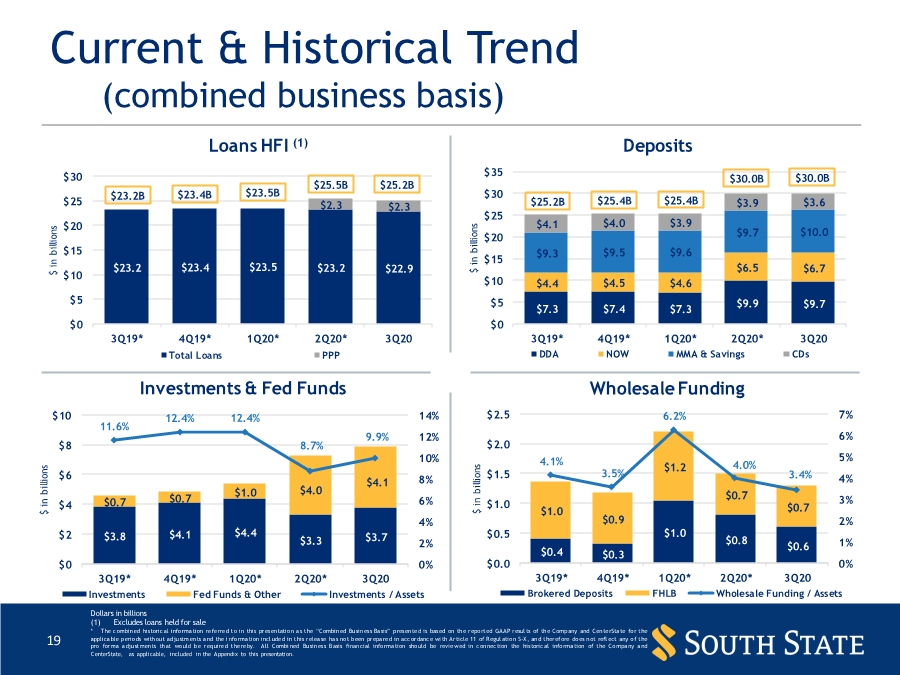

Loan / Deposit Growth

As of September 30, 2020, we have assisted customers with nearly 20,000 Paycheck Protection Program (“PPP”) loans and have an outstanding balance of $2.4 billion. We have recognized $8.5 million in deferred loan fees, net of costs in the income statement during the third quarter of 2020, and $15.9 million on a YTD basis. $53.3 million of net deferred fees remains to be recognized over the life of these loans. During the third quarter, loans (nonacquired and acquired) declined by $261.3 million, or 4.1% annualized. The third quarter decline in loans was centered in construction and development loans and single-family residential mortgage loans. Total deposits increased $12.7 million with core deposit growth totaling $310.6 million, or 4.8% annualized.

Quarterly Cash Dividend

The Company’s Board of Directors declared a common stock dividend of $0.47 per share, payable on November 20, 2020 to shareholders of record as of November 13, 2020.

Third Quarter 2020 Financial Performance

| | Three Months Ended | | | |||||||||||||||||

(Dollars in thousands, except per share data) | | Sept. 30, | | June 30, | | Mar. 31, | | Dec. 31, | | Sept. 30, | | Nine Months Ended | |||||||||

INCOME STATEMENT |

| 2020 |

| 2020 |

| 2020 |

| 2019 |

| 2019 |

| 2020 |

| 2019 | |||||||

Interest income | | | | | | | | | |||||||||||||

Loans, including fees (6) | | $ | 280,825 | $ | 167,707 | $ | 133,034 | $ | 132,615 | $ | 134,953 | $ | 581,566 | $ | 402,175 | ||||||

Investment securities, federal funds sold and securities | | | | | | | | | |||||||||||||

purchased under agreements to resell | | | 14,469 | | 12,857 | | 14,766 | | 14,839 | | 15,048 | | 42,092 | | 41,198 | ||||||

Total interest income | | | 295,294 | | 180,564 | | 147,800 | | 147,454 | | 150,001 | | 623,658 | | 443,373 | ||||||

Interest expense | | | | | | | | | |||||||||||||

Deposits | | | 15,154 | | 12,624 | | 14,437 | | 15,227 | | 16,655 | | 42,215 | | 50,693 | ||||||

Federal funds purchased, securities sold under agreements | | | | | | | | | |||||||||||||

to repurchase, and other borrowings | | | 9,792 | | 5,383 | | 5,350 | | 5,771 | | 5,973 | | 20,525 | | 14,861 | ||||||

Total interest expense | | | 24,946 | | 18,007 | | 19,787 | | 20,998 | | 22,628 | | 62,740 | | 65,554 | ||||||

Net interest income | | | 270,348 | | 162,557 | | 128,013 | | 126,456 | | 127,373 | | 560,918 | | 377,819 | ||||||

Provision for credit losses ("PCL") | | | 29,797 | | 151,474 | | 36,533 | | 3,557 | | 4,028 | | 217,804 | | 9,220 | ||||||

Net interest income after provision for loan losses | | | 240,551 | | 11,083 | | 91,480 | | 122,899 | | 123,345 | | 343,114 | | 368,599 | ||||||

Noninterest income | | | 114,790 | | 54,347 | | 44,132 | | 36,307 | | 37,582 | | 213,269 | | 107,258 | ||||||

Pre-tax operating expense | | | 215,225 | | 134,634 | | 103,118 | | 99,134 | | 96,364 | | 452,977 | | 291,158 | ||||||

Merger and/or branch consolid. expense | | | 21,662 | | 40,279 | | 4,129 | | 1,494 | | -- | | 66,070 | | 3,192 | ||||||

Federal Home Loan Bank advances prepayment fee | | | -- | | 199 | | -- | | -- | | -- | | 199 | | 134 | ||||||

Pension plan termination expense | | | -- | | -- | | -- | | -- | | -- | | -- | | 9,526 | ||||||

Total noninterest expense | | | 236,887 | | 175,112 | | 107,247 | | 100,628 | | 96,364 | | 519,246 | | 304,010 | ||||||

Income (loss) before provision for income taxes | | | 118,454 | | (109,682) | | 28,365 | | 58,578 | | 64,563 | | 37,137 | | 171,847 | ||||||

Provision for income taxes | | | 23,233 | | (24,747) | | 4,255 | | 9,487 | | 12,998 | | 2,741 | | 34,455 | ||||||

Net income (loss) | | $ | 95,221 | $ | (84,935) | $ | 24,110 | $ | 49,091 | $ | 51,565 | $ | 34,396 | $ | 137,392 | ||||||

| | | | | | | | ||||||||||||||

Adjusted net income (non-GAAP) (3) | | | | | | | | | |||||||||||||

Net income (loss) (GAAP) | | $ | 95,221 | $ | (84,935) | $ | 24,110 | $ | 49,091 | $ | 51,565 | $ | 34,396 | $ | 137,392 | ||||||

Securities gains, net of tax | | | (12) | | -- | | -- | | (20) | | (349) | | (12) | | (2,152) | ||||||

FHLB prepayment penalty | | | -- | | 154 | | -- | | -- | | -- | | 154 | | 107 | ||||||

Pension plan termination expense, net of tax | | | -- | | -- | | -- | | -- | | -- | | -- | | 7,641 | ||||||

Initial provision for credit losses - NonPCD loans and UFC | | | -- | | 92,212 | | -- | | -- | | -- | | 92,212 | | -- | ||||||

Merger and/or branch consolid. expense | | | 17,413 | | 31,191 | | 3,510 | | 1,252 | | — | | 52,114 | | 2,449 | ||||||

Adjusted net income (non-GAAP) | | $ | 112,622 | $ | 38,622 | $ | 27,620 | $ | 50,323 | $ | 51,216 | $ | 178,864 | $ | 145,437 | ||||||

| | | | | | | | ||||||||||||||

Basic earnings (loss) per common share | | $ | 1.34 | $ | (1.96) | $ | 0.72 | $ | 1.46 | $ | 1.51 | $ | 0.70 | $ | 3.94 | ||||||

Diluted earnings (loss) per common share | | $ | 1.34 | $ | (1.96) | $ | 0.71 | $ | 1.45 | $ | 1.50 | $ | 0.69 | $ | 3.92 | ||||||

Adjusted net income per common share - Basic (non-GAAP) (3) | | $ | 1.59 | $ | 0.89 | $ | 0.82 | $ | 1.49 | $ | 1.50 | $ | 3.63 | $ | 4.17 | ||||||

Adjusted net income per common share - Diluted (non-GAAP) (3) | | $ | 1.58 | $ | 0.89 | $ | 0.82 | $ | 1.48 | $ | 1.49 | $ | 3.60 | $ | 4.15 | ||||||

Dividends per common share | | $ | 0.47 | $ | 0.47 | $ | 0.47 | $ | 0.46 | $ | 0.43 | $ | 1.41 | $ | 1.21 | ||||||

Basic weighted-average common shares outstanding | | | 70,905,027 | | 43,317,736 | | 33,566,051 | | 33,677,851 | | 34,056,771 | | 49,330,267 | | 34,858,503 | ||||||

Diluted weighted-average common shares outstanding | | | 71,075,866 | | 43,317,736 | | 33,804,908 | | 33,964,216 | | 34,300,206 | | 49,635,882 | | 35,068,610 | ||||||

Adjusted diluted weighted-average common shares outstanding * | | | 71,075,866 | | 43,606,333 | | 33,804,908 | | 33,964,216 | | 34,300,206 | | 49,635,882 | | 35,068,610 | ||||||

Effective tax rate | | | 19.61% | | 22.56% | | 15.00% | | 16.20% | | 20.13% | | 7.38% | | 20.05% | ||||||

*Adjusted diluted weighted average common shares was calculated with the result of adjusted net income (non-GAAP).

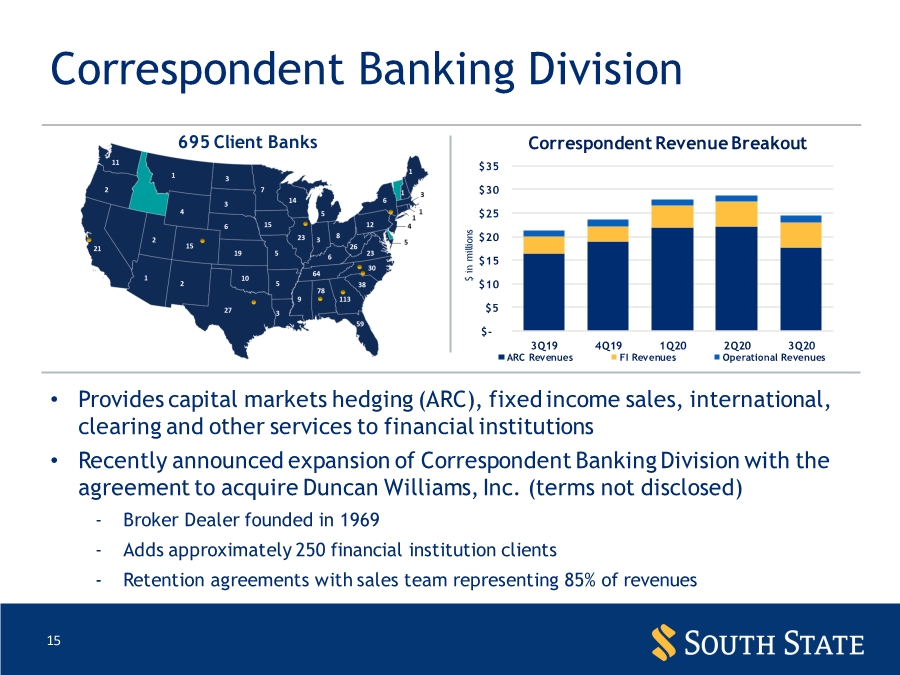

The Company reported consolidated net income of $95.2 million, or $1.34 per diluted common share for the three-months ended September 30, 2020, an increase of $180.2 million, or $3.30 per diluted common share, from the second quarter of 2020. The net loss in the second quarter of 2020 was the result of the initial PCL recorded on the acquired NonPCD loans and the merger-related cost incurred from the merger with CSFL. Weighted-average diluted shares increased by 27.8 million shares, or 64.1%, compared to the second quarter of 2020, due primarily to the merger with CSFL in early June, in which the Company issued 37.3 million shares. These shares were outstanding all of the third quarter of 2020 compared to only 23 days in the second quarter of 2020. Net interest income increased by $107.8 million in the third quarter of 2020, compared to the second quarter of 2020, due to the full quarter impact of the merger with CSFL in the third quarter of 2020 compared to only 23 days in the second quarter of 2020. Interest income on acquired loans included $22.4 million of loan accretion. The PCL decreased by $121.7 million, due to the PCL on NonPCD loans and unfunded commitments associated with CSFL merger that were recognized in the second quarter of 2020. Noninterest income in was up $60.4 million compared to second quarter of 2020 to $114.8 million in the third quarter of 2020, due to the strong results from mortgage banking (primarily within the secondary market) and correspondent banking and capital markets income. Correspondent banking was added to the Company from the merger with CSFL and contributed $24.4 million in the third quarter of 2020 compared to $8.3 million in the month of June during the second quarter of 2020. Noninterest expense was higher in the third quarter of 2020 compared to the second quarter of 2020 by $61.8 million due primarily to the full quarter impact of the expenses of CSFL. Merger-related expense were lower by $18.6 million compared to the second quarter of 2020 when all professional services were incurred at legal close in early June of 2020. Adjusted noninterest expense was up approximately 59.9% over second quarter 2020, which relates directly to the addition of CSFL operating expense for all of the third quarter of 2020. The efficiency ratio (Non-GAAP) and adjusted efficiency ratio were 61.4% and 55.8% in 3Q 2020, respectively, compared to 80.5% and 61.9% in 2Q 2020, respectively.

Current Expected Credit Losses (“CECL”)

Effective January 1, 2020, the Company adopted ASU 2016-13 (“CECL”), which impacts the allowance for credit losses and the liability for UFC. Below is a table showing the roll forward of the ACL and UFC for the third quarter of 2020:

| | Allowance for Credit Losses ("ACL & UFC") | ||||||||||

| NonPCD ACL |

| PCD ACL |

| Total |

| UFC | |||||

Ending balance 6/30/2020 | $ | 280,301 | | $ | 154,307 | | $ | 434,608 | $ | 21,051 | ||

Measurement period adj - PCD loans from CSFL merger | | | | (1,542) | | | (1,542) | | ||||

Charge offs | | (1,897) | | | | | (1,897) | | ||||

Acquired charge offs | | (886) | | | (1,859) | | | (2,745) | | |||

Recoveries | | 1,220 | | | | | 1,220 | | ||||

Acquired recoveries | | 691 | | | 2,137 | | | 2,828 | | |||

Provision for credit losses | | 7,077 | | | 610 | | | 7,687 | | 22,110 | ||

Ending balance 9/30/2020 | $ | 286,506 | | $ | 153,653 | | $ | 440,159 | $ | 43,161 | ||

| | | | | | |||||||

Period end loans (includes PPP Loans) | $ | 22,094,095 | | $ | 3,143,720 | | $ | 25,237,815 | | N/A | ||

Reserve to Loans (includes PPP Loans) | | 1.30% | | | 4.89% | | | 1.74% | | N/A | ||

Period end loans (excludes PPP Loans) | $ | 19,742,374 | | $ | 3,143,720 | | $ | 22,886,094 | | N/A | ||

Reserve to Loans (excludes PPP Loans) | | 1.45% | | | 4.89% | | | 1.92% | | N/A | ||

Unfunded commitments (off balance sheet) * | | | | | | $ | 4,584,160 | |||||

Reserve to unfunded commitments (off balance sheet) | | | | | | | 0.94% | |||||

* | Unfunded commitments excludes unconditionally cancelable commitments and letters of credit. |

The ACL related to all loans totals $440.2 million compared to $434.6 million at June 30, 2020, and was recorded as a contra asset on its own line within the balance sheet, while the liability for UFC of $43.2 million was recorded on its own line in the liabilities section of the balance sheet. The total provision for credit losses recorded in the third quarter of 2020 was $29.8 million, including $22.1 million related to the liability for unfunded commitments (which was the result of a change in the methodology with the merger of CSFL and the Company). In the second quarter of 2020, (including the initial provision for credit losses related to acquired NonPCD loans and UFC from CSFL) the total provision for credit losses was $151.5 million.

Income Tax Expense

During the third quarter of 2020, our effective tax rate decreased to 19.61% from 22.56% in the second quarter of 2020 and from 20.13% in the third quarter of 2019. The primary reason for the decline relates to the fact that the Company was back in a pre-tax income position in 3Q 2020 compared to a pre-tax loss position in 2Q 2020, and the impact of the rate reducing items on the effective tax rate. The lower effective tax rate in 3Q 2020 compared to 3Q 2019 was mainly due to an increase in federal tax credits, as well as additional tax-exempt income resulting from the merger with CSFL. Lastly, an additional income tax benefit was recorded when legacy South State’s deferred taxes were revalued as a result of the merger. This was slightly offset by an increase in pre-tax income compared to the same period in 2019.

Balance Sheet and Capital

(dollars in thousands, except per share and share data) | | Ending Balance | |||||||||||||

| Sept. 30, |

| June 30, |

| Mar. 31, |

| Dec. 31, |

| Sept. 30, | ||||||

BALANCE SHEET | | 2020 | 2020 | 2020 | 2019 | 2019 | |||||||||

Assets | | | | | | | |||||||||

Cash and cash equivalents | | $ | 4,471,639 | $ | 4,363,708 | $ | 1,262,836 | $ | 688,704 | $ | 719,194 | ||||

Investment securities: | | | | | | | |||||||||

Securities available for sale, at fair value | | | 3,561,929 | | 3,137,718 | | 1,971,195 | | 1,956,047 | | 1,813,134 | ||||

Other investments | | | 185,199 | | 133,924 | | 62,994 | | 49,124 | | 49,124 | ||||

Total investment securities | | | 3,747,128 | | 3,271,642 | | 2,034,189 | | 2,005,171 | | 1,862,258 | ||||

Loans held for sale | | | 456,141 | | 603,275 | | 71,719 | | 59,363 | | 87,393 | ||||

Loans: | | | | | | | |||||||||

Acquired - PCD | | | 3,143,761 | | 3,323,754 | | 311,271 | | 356,782 | | 390,714 | ||||

Acquired - NonPCD | | | 10,557,968 | | 11,577,833 | | 1,632,700 | | 1,760,427 | | 1,965,603 | ||||

Non-acquired | | | 11,536,086 | | 10,597,560 | | 9,562,919 | | 9,252,831 | | 8,928,512 | ||||

Less allowance for loan losses | | | (440,159) | | (434,608) | | (144,785) | | (56,927) | | (54,937) | ||||

Loans, net | | | 24,797,656 | | 25,064,539 | | 11,362,105 | | 11,313,113 | | 11,229,892 | ||||

Bank property held for sale | | | 24,504 | | 25,541 | | 5,412 | | 5,425 | | 8,424 | ||||

Other real estate owned ("OREO") | | | 13,480 | | 18,016 | | 7,432 | | 6,539 | | 4,991 | ||||

Premises and equipment, net | | | 626,259 | | 627,943 | | 312,151 | | 317,321 | | 323,506 | ||||

Bank owned life insurance | | | 556,475 | | 556,807 | | 233,849 | | 234,567 | | 233,206 | ||||

Deferred tax asset | | | 107,500 | | 107,532 | | 46,365 | | 31,316 | | 27,844 | ||||

Mortgage servicing rights | | | 34,578 | | 25,441 | | 26,365 | | 30,525 | | 28,674 | ||||

Core deposit and other intangibles | | | 171,637 | | 170,911 | | 46,809 | | 49,816 | | 53,083 | ||||

Goodwill | | | 1,566,524 | | 1,603,383 | | 1,002,900 | | 1,002,900 | | 1,002,900 | ||||

Other assets | | | 1,245,845 | | 1,286,618 | | 230,779 | | 176,332 | | 170,717 | ||||

Total assets | | $ | 37,819,366 | $ | 37,725,356 | $ | 16,642,911 | $ | 15,921,092 | $ | 15,752,082 | ||||

| | | | | | ||||||||||

Liabilities and Shareholders’ Equity | | | | | | | |||||||||

Deposits: | | | | | | | |||||||||

Noninterest-bearing | | $ | 9,681,095 | $ | 9,915,700 | $ | 3,367,422 | $ | 3,245,306 | $ | 3,307,532 | ||||

Interest-bearing | | | 20,288,859 | | 20,041,585 | | 8,977,125 | | 8,931,790 | | 8,716,255 | ||||

Total deposits | | | 29,969,954 | | 29,957,285 | | 12,344,547 | | 12,177,096 | | 12,023,787 | ||||

Federal funds purchased and securities | | | | | | | |||||||||

sold under agreements to repurchase | | | 706,723 | | 720,479 | | 325,723 | | 298,741 | | 269,072 | ||||

Other borrowings | | | 1,089,637 | | 1,089,279 | | 1,316,100 | | 815,936 | | 815,771 | ||||

Reserve for unfunded commitments | | | 43,161 | | 21,051 | | 8,555 | | 335 | | 335 | ||||

Other liabilities | | | 1,446,478 | | 1,445,411 | | 326,943 | | 255,971 | | 292,161 | ||||

Total liabilities | | | 33,255,953 | | 33,233,506 | | 14,321,868 | | 13,548,079 | | 13,401,126 | ||||

| | | | | | ||||||||||

Shareholders’ equity: | | | | | | | |||||||||

Preferred stock - $.01 par value; authorized 10,000,000 shares | | | -- | | -- | | -- | | -- | | -- | ||||

Common stock - $2.50 par value; authorized 160,000,000 shares | | | 177,321 | | 177,268 | | 83,611 | | 84,361 | | 84,757 | ||||

Surplus | | | 3,764,482 | | 3,759,166 | | 1,584,322 | | 1,607,740 | | 1,617,004 | ||||

Retained earnings | | | 604,564 | | 542,677 | | 643,345 | | 679,895 | | 646,325 | ||||

Accumulated other comprehensive income | | | 17,046 | | 12,739 | | 9,765 | | 1,017 | | 2,870 | ||||

Total shareholders’ equity | | | 4,563,413 | | 4,491,850 | | 2,321,043 | | 2,373,013 | | 2,350,956 | ||||

Total liabilities and shareholders’ equity | | $ | 37,819,366 | $ | 37,725,356 | $ | 16,642,911 | $ | 15,921,092 | $ | 15,752,082 | ||||

| | | | | | ||||||||||

Common shares issued and outstanding | | | 70,928,304 | | 70,907,119 | | 33,444,236 | | 33,744,385 | | 33,902,726 | ||||

At September 30, 2020, the Company’s total assets were $37.8 billion, an increase of $94.0 million from June 30, 2020. Below are highlights of certain line items:

| 1. | Cash and cash equivalents increased by $107.9 million to $4.5 billion. |

| 2. | Investment securities portfolio increased by $476.0 million, and totaled $3.7 billion, representing 9.9% of total assets, an increase from 8.7% at June 30, 2020. |

| 3. | Total loans decreased by $261.3 million, with non-acquired loans increasing by $938.5 million and acquired loans decreasing by $1.2 billion. |

| 4. | Goodwill decreased by $36.9 million from measurement period adjustments related to fair value mark of loans (reduced loan discount) totaling $29.8 million, an intangible related to correspondent banking business acquired in the CSFL merger of $10.0 million, fair value adjustments to bank property of $6.0 million, and reduced deferred tax asset of $9.0 million |

| 5. | Non-interest bearing deposits decreased by $234.6 million. |

| 6. | Interest bearing deposits grew by $247.3 million. |

| 7. | Equity increased by $71.6 million during the third quarter from the following: (a) net income of $95.2 million, (b) other comprehensive income increasing by $4.3 million and (c) impact of equity awards increasing capital by $5.4 million, which were all partially offset by (d) dividends of $33.3 million. |

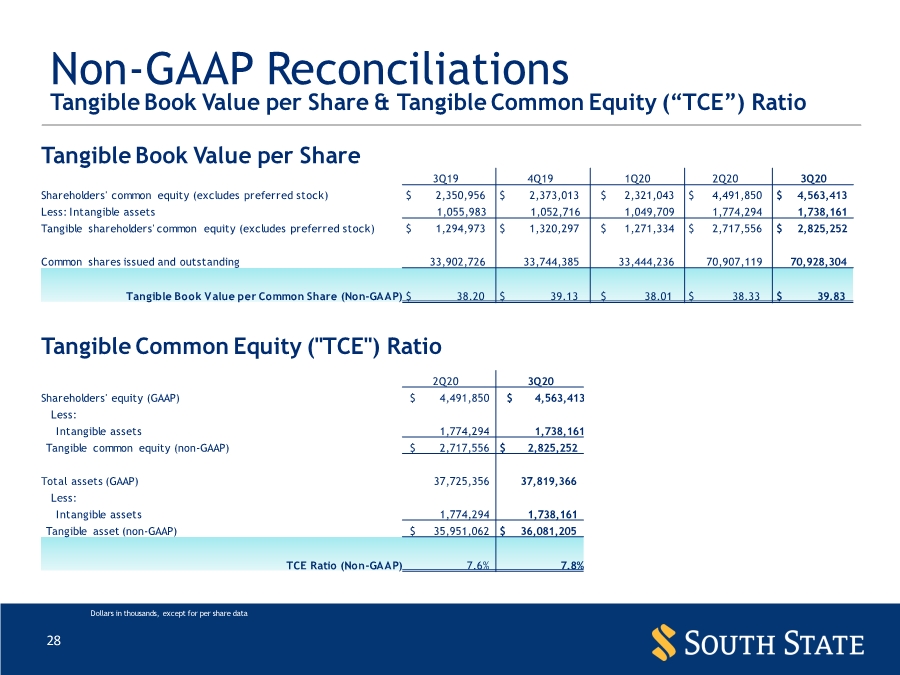

The Company’s book value per common share increased to $64.34 per share at September 30, 2020, compared to $63.35 per share at June 30, 2020 and decreased compared to $69.34 at September 30, 2019. TBV per common share increased by $1.50 per share to $39.83 at September 30, 2020, compared to $38.33 at June 30, 2020, and increased by $1.63 per share, or 4.28%, from $38.20 at September 30, 2019. Total tangible equity (capital) increased by $107.7 million in the third quarter of 2020.

The following table presents a summary of the loan portfolio by type (dollars in thousands):

| | Ending Balance | |||||||||||||

| | Sept. 30, | | June 30, | | March 31, | | Dec. 31, | | Sept. 30, | |||||

LOAN PORTFOLIO |

| 2020 |

| 2020 |

| 2020 |

| 2019 |

| 2019 | |||||

| | | | | | | | | | | |||||

Construction and land development | | $ | 1,840,111 | | $ | 1,999,062 | | $ | 1,105,308 | | $ | 1,016,692 | | $ | 1,024,627 |

Commercial non-owner occupied real estate | | | 5,936,372 | | | 6,021,317 | | | 2,371,371 | | | 2,322,590 | | | 2,356,335 |

Commercial owner occupied real estate | | | 4,846,020 | | | 4,762,520 | | | 2,177,738 | | | 2,158,701 | | | 2,093,795 |

Consumer owner occupied real estate | | | 4,311,186 | | | 4,421,247 | | | 2,665,405 | | | 2,704,405 | | | 2,757,424 |

Home equity loans | | | 1,347,798 | | | 1,378,406 | | | 758,482 | | | 758,020 | | | 773,363 |

Commercial and industrial | | | 5,419,120 | | | 5,341,363 | | | 1,418,421 | | | 1,386,303 | | | 1,261,527 |

Other income producing property | | | 629,497 | | | 650,237 | | | 327,696 | | | 346,554 | | | 361,879 |

Consumer non real estate | | | 900,171 | | | 916,623 | | | 674,791 | | | 662,883 | | | 654,422 |

Other | | | 7,540 | | | 8,372 | | | 7,678 | | | 13,892 | | | 1,457 |

Total loans | | $ | 25,237,815 | | $ | 25,499,147 | | $ | 11,506,890 | | $ | 11,370,040 | | $ | 11,284,829 |

The following table presents a summary of the deposit types (dollars in thousands):

| | Ending Balance | |||||||||||||

| | Sept. 30, | | June 30, | | March 31, | | Dec. 31, | | Sept. 30, | |||||

DEPOSITS |

| 2020 |

| 2020 |

| 2020 |

| 2019 |

| 2019 | |||||

| | | | | | | | | | | |||||

Type | | | | | | | | | | | | | | | |

Demand deposits | | $ | 9,681,095 | | $ | 9,915,700 | | $ | 3,367,422 | | $ | 3,245,306 | | $ | 3,307,532 |

Interest bearing deposits | | | 6,414,905 | | | 6,192,915 | | | 2,963,679 | | | 2,989,467 | | | 2,812,912 |

Savings | | | 2,618,877 | | | 2,503,514 | | | 1,337,730 | | | 1,309,896 | | | 1,317,705 |

Money market | | | 7,404,299 | | | 7,196,456 | | | 3,029,769 | | | 2,977,029 | | | 2,869,217 |

Time deposits | | | 3,850,778 | | | 4,148,700 | | | 1,645,947 | | | 1,655,398 | | | 1,716,421 |

| | | | | | | | | | | | | | | |

Total deposits | | $ | 29,969,954 | | $ | 29,957,285 | | $ | 12,344,547 | | $ | 12,177,096 | | $ | 12,023,787 |

| | | | | | | | | | | | | | | |

Core deposits (excludes CDs) | | | 26,119,176 | | | 25,808,585 | | | 10,698,600 | | | 10,521,698 | | | 10,307,366 |

Merger with CSFL

The merger with CSFL closed on June 7, 2020. The Company issued 37,271,069 shares using an exchange ratio of 0.3001. The total purchase price was $2.262 billion. The initial (preliminary) allocation of the purchase price to the fair value of assets and liabilities

acquired was completed as of June 30, 2020. Below is a table that reflects that initial allocation of the purchase price and additional measurement period adjustments recorded during the third quarter of 2020:

South State Corporation | | | | | | | | Fair Value of | ||||

CenterState Bank Corporation | | | | | | | | Net Assets | ||||

Merger Date of June 7, 2020 | | | | | | Measurement | | Acquired at | ||||

| | As Recorded | | Fair Value | | Period | | Date of | ||||

(Dollars in thousands) |

| by CSFL |

| Adjustments |

| Adjustments |

| Acquisition | ||||

Assets | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 2,566,450 | | $ | -- | | $ | 2,566,450 | | | |

Investment securities | | | 1,188,403 | | | 5,507 | | | -- | | | 1,193,910 |

Loans held for sale | | | 453,578 | | | -- | | | 453,578 | | | |

Loans | | | 12,969,091 | | | (48,342) | | | 29,834 | | | 12,950,583 |

Premises and equipment | | | 324,396 | | | 2,392 | | | 5,999 | | | 332,787 |

Intangible assets | | | 1,294,211 | | | (1,163,349) | | | 10,000 | | | 140,862 |

Other real estate owned and repossessed assets | | | 10,849 | | | (791) | | | (49) | | | 10,009 |

Bank owned life insurance | | | 333,053 | | | -- | | | 333,053 | | | |

Deferred tax asset | | | 54,122 | | | (8,681) | | | (8,952) | | | 36,489 |

Other assets | | | 1,061,136 | | | (604) | | | 26 | | | 1,060,558 |

Total assets | | $ | 20,255,289 | | $ | (1,213,868) | | $ | 36,858 | | $ | 19,078,279 |

| | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | |

Deposits: | | | | | | | | | | | | |

Noninterest-bearing | | $ | 5,291,443 | | $ | -- | | $ | -- | | $ | 5,291,443 |

Interest-bearing | | | 10,312,370 | | | 19,702 | | | -- | | | 10,332,072 |

Total deposits | | | 15,603,813 | | | 19,702 | | | -- | | | 15,623,515 |

Federal funds purchased and securities sold under agreements to repurchase | | | 401,546 | | | -- | | | -- | | | 401,546 |

Other borrowings | | | 278,900 | | | (7,401) | | | -- | | | 271,499 |

Other liabilities | | | 1,088,048 | | | (4,592) | | | -- | | | 1,083,456 |

Total liabilities | | | 17,372,307 | | | 7,709 | | | -- | | | 17,380,016 |

Net identifiable assets acquired over liabilities assumed | | | 2,882,982 | | | (1,221,577) | | | 36,858 | | | 1,698,263 |

Goodwill | | | | | | 600,483 | | | (36,858) | | | 563,625 |

Net assets acquired over liabilities assumed | | $ | 2,882,982 | | $ | (621,094) | | $ | -- | | $ | 2,261,888 |

| | | | | | | | | | | | |

Consideration: | | | | | | | | | | | | |

South State Corporation common shares issued | | | | | | | | | | | | 37,271,069 |

Purchase price per share of the Company’s common stock | | | | | | | | | | | $ | 60.27 |

Company common stock issued and cash exchanged for fractional shares | | | | | | | | | | | $ | 2,246,401 |

Stock Option Conversion | | | | | | | | | | | | 8,080 |

Restricted Stock Conversion | | | | | | | | | | | | 7,407 |

Fair value of total consideration transferred | | | | | | | | | | | $ | 2,261,888 |

The measurement period adjustments related to the merger between the Company and CSFL include the following:

| ● | Goodwill was reduced by $36.9 million with the measurement period adjustments recorded during the third quarter of 2020, resulting in total goodwill from the merger with CSFL of $563.6 million. |

| ● | Lower loan mark (discount) of $29.8 million from an updated loan valuation ($28.3 million) and revised lower loan marks on certain PCD loans ($1.5 million). |

| ● | The fair value adjustments for certain premises where updated appraisals were received and totaled $6.0 million. |

| ● | Identification of an intangible related to the correspondent banking business totaling $10.0 million. |

| ● | Deferred tax liability recorded for each of these adjustments totaling $9.0 million. |

In addition, with respect to the merger and conversion:

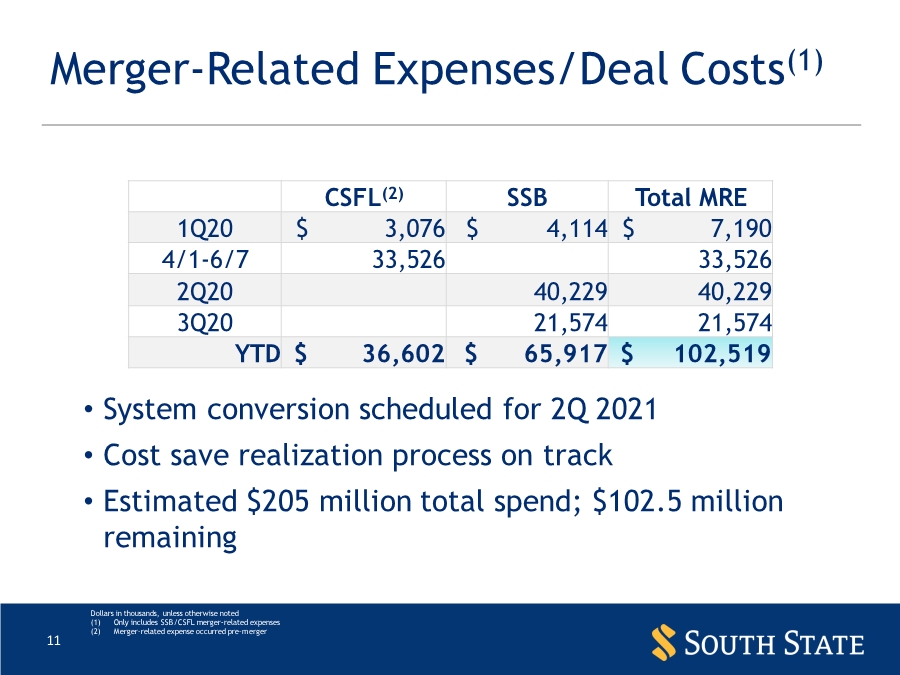

| ● | Merger cost incurred during the third quarter was as expected at $21.7 million, and included contract terminations, professional fees, and severance and support incentives to personnel. |

| ● | The merger integration, conversion, and cost savings identification process continues to be on schedule. |

Performance and Capital Ratios

|

| Three Months Ended |

| Nine Months Ended |

| |||||||||||||||

| | Sept. 30, | | June 30, | | Mar. 31, | | Dec. 31, | | Sept. 30, | | Sept. 30, | | Sept. 30, | | |||||

PERFORMANCE RATIOS | | 2020 | | 2020 | | 2020 | | 2019 | | 2019 | | 2020 | | 2019 | | |||||

Return on average assets (annualized) | | | 1.00 | % | | -1.49 | % | | 0.60 | % | | 1.23 | % | | 1.31 | % | 0.18 | % | 1.20 | % |

Adjusted return on average assets (annualized) (non-GAAP) (3) | | | 1.18 | % | | 0.68 | % | | 0.69 | % | | 1.26 | % | | 1.30 | % | 0.93 | % | 1.27 | % |

Return on average equity (annualized) | | | 8.31 | % | | -11.78 | % | | 4.15 | % | | 8.26 | % | | 8.70 | % | 1.41 | % | 7.76 | % |

Adjusted return on average equity (annualized) (non-GAAP) (3) | | | 9.83 | % | | 5.36 | % | | 4.75 | % | | 8.47 | % | | 8.64 | % | 7.31 | % | 8.22 | % |

Return on average tangible common equity (annualized) (non-GAAP) (5) | | | 14.66 | % | | -19.71 | % | | 8.35 | % | | 15.79 | % | | 16.62 | % | 3.51 | % | 14.88 | % |

Adjusted return on average tangible common equity (annualized) (non-GAAP) (3) (5) | | | 17.14 | % | | 10.23 | % | | 9.45 | % | | 16.17 | % | | 16.51 | % | 13.58 | % | 15.71 | % |

Efficiency ratio (tax equivalent) | | | 61.39 | % | | 80.52 | % | | 62.11 | % | | 61.64 | % | | 58.40 | % | 66.82 | % | 62.82 | % |

Adjusted efficiency ratio (non-GAAP) (7) | | | 55.78 | % | | 61.91 | % | | 59.72 | % | | 60.73 | % | | 58.40 | % | 58.29 | % | 60.19 | % |

Dividend payout ratio (2) | | | 35.01 | % | | N/A | | | 65.70 | % | | 31.62 | % | | 28.48 | % | 188.71 | % | 30.70 | % |

Book value per common share | | $ | 64.34 | | $ | 63.35 | | $ | 69.40 | | $ | 70.32 | | $ | 69.34 | | | | | |

Tangible common equity per common share (non-GAAP) (5) | | $ | 39.83 | | $ | 38.33 | | $ | 38.01 | | $ | 39.13 | | $ | 38.20 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

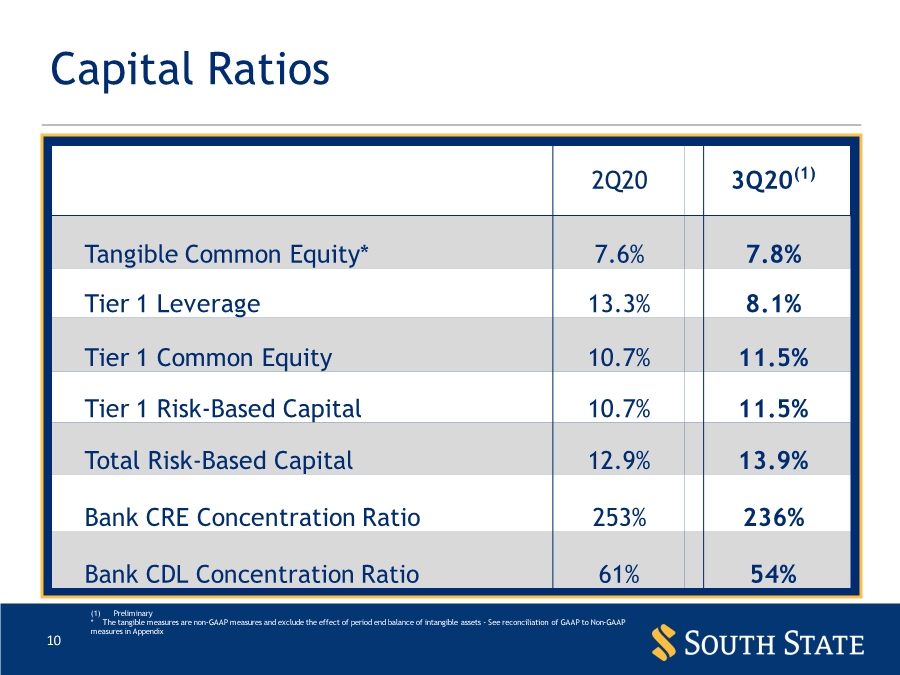

CAPITAL RATIOS | | | | | | | | | | | | | | | | | | | | |

Equity-to-assets | | | 12.07 | % | | 11.91 | % | | 13.95 | % | | 14.90 | % | | 14.92 | % | | | | |

Tangible equity-to-tangible assets (non-GAAP) (5) | | | 7.83 | % | | 7.56 | % | | 8.15 | % | | 8.88 | % | | 8.81 | % | | | | |

Tier 1 common equity (4) * | | | 11.5 | % | | 10.7 | % | | 11.0 | % | | 11.3 | % | | 11.2 | % | | | | |

Tier 1 leverage (4) * | | | 8.1 | % | | 13.3 | % | | 9.5 | % | | 9.7 | % | | 9.7 | % | | | | |

Tier 1 risk-based capital (4) * | | | 11.5 | % | | 10.7 | % | | 12.0 | % | | 12.3 | % | | 12.2 | % | | | | |

Total risk-based capital (4) * | | | 13.9 | % | | 12.9 | % | | 12.7 | % | | 12.8 | % | | 12.7 | % | | | | |

| | | | | | | | | | | | | | | | | | | | |

OTHER DATA | | | | | | | | | | | | | | | | | | | | |

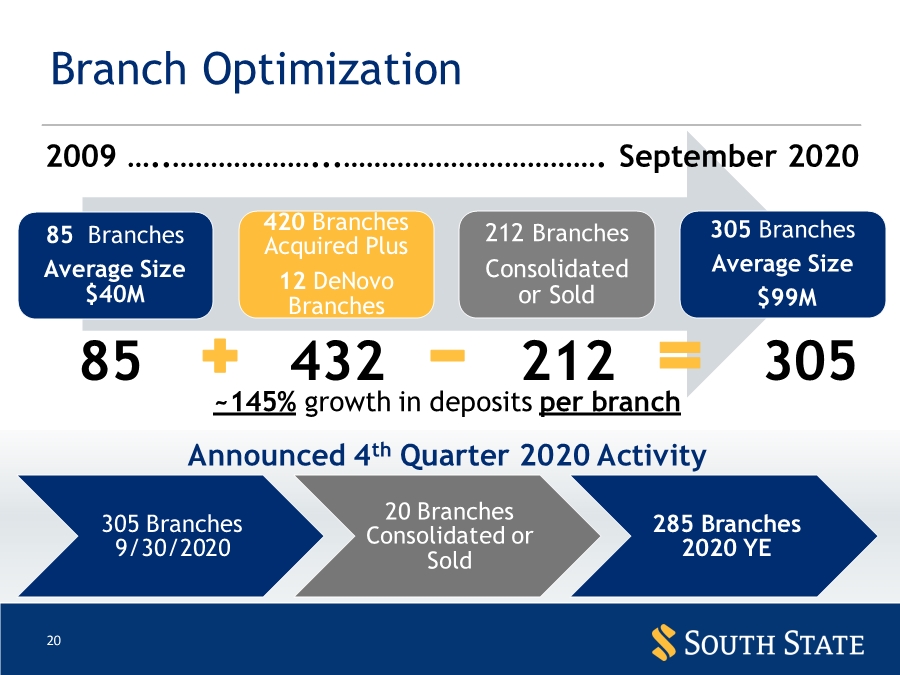

Number of branches | | | 305 | | | 305 | | | 155 | | | 155 | | | 157 | | | | | |

Number of employees (full-time equivalent basis) | | | 5,266 | | | 5,369 | | | 2,583 | | | 2,547 | | | 2,544 | | | | | |

*The regulatory capital ratios presented above include the assumption of the transitional method relative to the CAREs Act in relief of COVID-19 pandemic on the economy and financial institutions in the United States. The referenced relief allows a total five-year “phase in” of the CECL impact on capital and relief over the next two years for the impact on the allowance for credit losses resulting from COVID-19.

Asset Quality

| | | | | | | | | | | | | | | | |

|

| Ending Balance |

|

|

|

|

|

|

| |||||||

| | Sept. 30, | | June 30, | | Mar. 31, | | Dec. 31, | | Sept 30, | | |||||

(Dollars in thousands) | | 2020 | | 2020 | | 2020 | | 2019 | | 2019 | | |||||

NONPERFORMING ASSETS: | | | | | | | | | | | | | | | | |

Non-acquired | | | | | | | | | | | | | | | | |

Non-acquired nonperforming loans | | $ | 22,463 | | $ | 22,883 | | $ | 23,912 | | $ | 22,816 | | $ | 19,187 | |

Non-acquired OREO and other nonperforming assets | | | 825 | | | 1,689 | | | 941 | | | 1,011 | | | 1,464 | |

Total non-acquired nonperforming assets | | | 23,288 | | | 24,572 | | | 24,853 | | | 23,827 | | | 20,651 | |

Acquired | | | | | | | | | | | | | | | | |

Acquired nonperforming loans (2019 periods acquired non-credit impaired loans only) * | | | 89,974 | | | 100,399 | | | 32,791 | | | 11,114 | | | 9,596 | |

Acquired OREO and other nonperforming assets | | | 12,904 | | | 16,987 | | | 6,802 | | | 5,848 | | | 7,207 | |

Total acquired nonperforming assets | | | 102,878 | | | 117,386 | | | 39,593 | | | 16,962 | | | 16,803 | |

Total nonperforming assets * | | $ | 126,166 | | $ | 141,958 | | $ | 64,446 | | $ | 40,789 | | $ | 37,454 | |

| | | | | | | | | | | | | | | | |

|

| | Three Months Ended |

| | |

| | |

| | | | |||

| | | Sept. 30, | | June 30, | | Mar. 31, | | Dec. 31, | | Sept 30, | | ||||

| | | 2020 | | 2020 | | 2020 | | 2019 | | 2019 | | ||||

ASSET QUALITY RATIOS: | | | | | | | | | | | | | | | | |

Allowance for non-acquired loan losses as a | | | | | | | | | | | | | | | | |

percentage of non-acquired loans (1) | | | N/A | | | N/A | | | N/A | | | 0.62 | % | | 0.62 | % |

Allowance for credit losses as a percentage of loans | | | 1.74 | % | | 1.70 | % | | 1.26 | % | | N/A | | | N/A | |

Allowance for credit losses as a percentage of loans, excluding PPP loans | | | 1.92 | % | | 1.88 | % | | N/A | | | N/A | | | N/A | |

Allowance for non-acquired loan losses as a | | | | | | | | | | | | | | | | |

percentage of non-acquired nonperforming loans | | | N/A | | | N/A | | | N/A | | | 249.50 | % | | 286.32 | % |

Allowance for credit losses as a percentage of nonperforming loans * | | | 391.47 | % | | 352.53 | % | | 255.34 | % | | N/A | | | N/A | |

Net charge-offs on non-acquired loans as a percentage of average (annualized) (1) | | | N/A | | | N/A | | | N/A | | | 0.06 | % | | 0.05 | % |

Net charge-offs as a percentage of average loans (annualized) | | | 0.01 | % | | 0.00 | % | | 0.05 | % | | N/A | | | N/A | |

Net charge-offs on acquired loans as a percentage | | | | | | | | | | | | | | | | |

of average acquired loans (annualized) (1) | | | N/A | | | N/A | | | N/A | | | -0.01 | % | | 0.15 | % |

Total nonperforming assets as a percentage | | | | | | | | | | | | | | | | |

of total assets * | | | 0.33 | % | | 0.38 | % | | 0.39 | % | | 0.26 | % | | 0.24 | % |

Nonperforming loans as a percentage of period end loans * | | | 0.45 | % | | 0.48 | % | | 0.49 | % | | 0.30 | % | | 0.25 | % |

*Total nonperforming assets now include nonaccrual loans that are purchase credit deteriorated (“PCD loans”). In prior periods, these loans, which were called acquired credit impaired (“ACI”) loans, were excluded from nonperforming assets. The adoption of CECL resulted in the discontinuation of the pool-level accounting for ACI loans and replaced it with loan-level evaluation for PCD nonaccrual status. The Company’s nonperforming loans increased by $21.0 million in the first quarter of 2020 from these loans. The Company has not assumed or taken on any additional risk relative to these assets. With the merger with CSFL, the amount of acquired nonaccruals loans increased by approximately $69.9 million.

Total nonperforming assets decreased by $15.8 million to $126.2 million, representing 0.33% of total assets, a decrease of 5 basis points compared to June 30, 2020. The decrease was due primarily to the reduction in nonperforming assets acquired, both in loans ($10.4 million) and in OREO ($4.1 million). Non-acquired non-performing assets decreased by $1.3 million during the third quarter of 2020 to $23.3 million at September 30, 2020. The ACL as a percentage of total nonperforming loans was 391% at September 30, 2020, up from 353% of total nonperforming loans at June 30, 2020.

At September 30, 2020, the ACL was $440.2 million, or 1.74%, of period end loans. Additionally, unfunded commitments have a reserve of $43.2 million, or 0.94% of unfunded commitments (off balance sheet). The ACL was $434.6 million, or 1.70%, of period end loans at June 30, 2020. Net charge-offs totaled $594,000, or 0.01%, annualized of average total loans, in the third quarter of 2020 compared to $101,000, or 0.00%, annualized in the second quarter of 2020.

During the third quarter of 2020, the provision for credit losses totaled $29.8 million for the loan portfolio compared to $151.5 million for the provision for credit losses in the second quarter of 2020. The significant provision in the second quarter of 2020 was the result of the merger with CSFL and the initial provision for credit losses recorded on NonPCD loans acquired, the unfunded commitment liability related to CSFL, and the additional PCL related to non-acquired South State loans totaled $28.4 million. This initial PCL on NonPCD acquired loans and UFC totaled $119.1 million. The total provision for credit losses of $29.8 million recorded in the third

quarter of 2020 included $22.1 million related to the liability for unfunded commitments and $7.7 million from the expected lifetime losses of loans outstanding. Prior to the merger, each of CSFL and the Company ran separate CECL models. The CECL calculation at June 30, 2020 was the result of combining the results of the two models. During the third quarter, the Company consolidated into one CECL model. This change led to an increase in the reserve for unfunded commitments since the consolidated model used a differing methodology from that used for 2Q 2020.

Total OREO decreased during the third quarter of 2020 to $13.5 million, a $4.5 million decrease from the balance at June 30, 2020.

Net Interest Income and Margin

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | ||||||||||||||||||||||

| | September 30, 2020 | | June 30, 2020 | | September 30, 2019 | | ||||||||||||||||||

(Dollars in thousands) | | Average | | Income/ | | Yield/ | | Average | | Income/ | | Yield/ | | Average | | Income/ | | Yield/ | | ||||||

YIELD ANALYSIS |

| Balance |

| Expense |

| Rate |

| Balance |

| Expense |

| Rate |

| Balance |

| Expense |

| Rate | | ||||||

Interest-Earning Assets: | | | | | | | | | | | | | | | | | | | | | | | | | |

Federal funds sold, reverse repo, and time deposits | | $ | 4,406,376 | | $ | 1,215 | | 0.11 | % | $ | 2,033,910 | | $ | 432 | | 0.09 | % | $ | 491,627 | | $ | 2,676 | | 2.16 | % |

Investment securities (taxable) | | | 2,792,649 | | | 11,118 | | 1.58 | % | | 2,109,609 | | | 10,920 | | 2.08 | % | | 1,638,461 | | | 10,785 | | 2.61 | % |

Investment securities (tax-exempt) | | | 435,339 | | | 2,136 | | 1.95 | % | | 197,862 | | | 1,505 | | 3.06 | % | | 181,434 | | | 1,587 | | 3.47 | % |

Loans held for sale | | | 556,670 | | | 4,151 | | 2.97 | % | | 203,267 | | | 1,498 | | 2.96 | % | | 58,829 | | | 541 | | 3.65 | % |

Loans | | | 25,312,632 | | | 276,674 | | 4.35 | % | | 15,717,387 | | | 166,209 | | 4.25 | % | | 11,225,593 | | | 134,412 | | 4.75 | % |

Total interest-earning assets | | | 33,503,666 | | | 295,294 | | 3.51 | % | | 20,262,035 | | | 180,564 | | 3.58 | % | | 13,595,944 | | | 150,001 | | 4.38 | % |

Noninterest-earning assets | | | 4,361,551 | | | | | | | | 2,636,890 | | | | | | | | 2,014,172 | | | | | | |

Total Assets | | $ | 37,865,217 | | | | | | | $ | 22,898,925 | | | | | | | $ | 15,610,116 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-Bearing Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | |

Transaction and money market accounts | | $ | 13,671,430 | | $ | 7,853 | | 0.23 | % | $ | 8,132,276 | | $ | 5,096 | | 0.25 | % | $ | 5,581,057 | | $ | 8,932 | | 0.63 | % |

Savings deposits | | | 2,570,500 | | | 584 | | 0.09 | % | | 1,699,377 | | | 336 | | 0.08 | % | | 1,323,377 | | | 1,027 | | 0.31 | % |

Certificates and other time deposits | | | 4,007,542 | | | 6,717 | | 0.67 | % | | 2,321,684 | | | 7,192 | | 1.25 | % | | 1,730,567 | | | 6,696 | | 1.54 | % |

Federal funds purchased and repurchase agreements | | | 710,369 | | | 509 | | 0.29 | % | | 415,304 | | | 391 | | 0.38 | % | | 272,900 | | | 612 | | 0.89 | % |

Other borrowings | | | 1,089,399 | | | 9,283 | | 3.39 | % | | 1,216,884 | | | 4,992 | | 1.65 | % | | 816,188 | | | 5,361 | | 2.61 | % |

Total interest-bearing liabilities | | | 22,049,240 | | | 24,946 | | 0.45 | % | | 13,785,525 | | | 18,007 | | 0.53 | % | | 9,724,089 | | | 22,628 | | 0.92 | % |

Noninterest-bearing liabilities | | | 11,259,916 | | | | | | | | 6,212,957 | | | | | | | | 3,534,873 | | | | | | |

Shareholders’ equity | | | 4,556,061 | | | | | | | | 2,900,443 | | | | | | | | 2,351,154 | | | | | | |

Total Non-IBL and shareholders’ equity | | | 15,815,977 | | | | | | | | 9,113,400 | | | | | | | | 5,886,027 | | | | | | |

Total liabilities and shareholders’ equity | | $ | 37,865,217 | | | | | | | $ | 22,898,925 | | | | | | | $ | 15,610,116 | | | | | | |

Net interest income and margin (NON-TAX EQUIV.) | | | | | $ | 270,348 | | 3.21 | % | | | | $ | 162,557 | | 3.23 | % | | | | $ | 127,373 | | 3.72 | % |

Net interest margin (TAX EQUIVALENT) | | | | | | | | 3.22 | % | | | | | | | 3.24 | % | | | | | | | 3.73 | % |

Total Deposit Cost of Funds | | | | | | | | 0.20 | % | | | | | | | 0.29 | % | | | | | | | 0.56 | % |

Overall Cost of Funds (including demand deposits) | | | | | | | | 0.31 | % | | | | | | | 0.37 | % | | | | | | | 0.69 | % |

The net interest margin (“NIM”) declined by 2 basis points to 3.22% at September 30, 2020, from 3.24% at June 30, 2020, and declined from 3.73% from September 30, 2019. These declines were the result of the current low interest rate environment from the COVID-19 pandemic and the stimulus from the CARES Act. The yield on the acquired loan portfolio declined to 4.76% compared 5.08% in the second quarter of 2020, while the non-acquired loan portfolio only declined 1 basis point to 3.83% from 3.84% in the second quarter of 2020. Deposit cost declined by 9 basis points to 20 basis points in the third quarter of 2020. Including the impact of noninterest bearing deposits, the Company’s overall cost of funds declined to 31 basis points for the third quarter of 2020 compared to 37 basis points in the second quarter of 2020, and decreased from 69 basis points in the year ago period. The average balances for each category and the totals increased significantly in the third quarter of 2020, due primarily from the full quarter impact of the CSFL merger compared to only 23 days included in the second quarter of 2020.

Acquired Loans and Loan Accretion

With the adoption of CECL, loan accretion, accretable yield, and the related discounts are now consistently accounted for within the balance sheet and income statement. Acquired loans reflected the following results in the third quarter of 2020:

| ● | Contractual interest income totaled $146.3 million, or 4.13% yield. |

| ● | Loan accretion totaled $22.4 million, compared to $10.1 million in the second quarter of 2020. The amount of accretion recognized in third quarter from the CSFL acquired loan portfolio totaled $14.7 million compared to $2.9 million in the second quarter which only included 23 days from the merger closing date. |

| ● | Including the loan accretion, total interest income was $168.8 million on acquired loans resulting in 4.76% yield during the third quarter of 2020, down from 5.08% in the second quarter of 2020. |

The table below reflects the remaining discount on acquired loans, which will be accreted into loan interest income over the contractual life of the loan and includes the discount recorded from the merger with CSFL, including a third quarter of 2020 measurement period adjustment primarily related to an updated loan valuation (dollars in thousands):

Unrecognized discount on acquired loans |

|

| |

Beginning balance, June 30, 2020 | | $ | 160,802 |

Measurement period adjustment of discount from the CSFL merger | | | (27,996) |

Loan accretion recognized in 3Q 2020 | | | (22,445) |

Ending balance, September 30, 2020 | | $ | 110,361 |

Noninterest Income and Expense

| | Three Months Ended | | Nine Months Ended | |||||||||||||||||

| | Sept. 30, | | June 30, | | Mar. 31, | | Dec. 31, | | Sept. 30, | | Sept. 30, | | Sept. 30, | |||||||

(Dollars in thousands) |

| 2020 |

| 2020 |

| 2020 |

| 2019 |

| 2019 |

| 2020 |

| 2019 | |||||||

Noninterest income: | | | | | | | | | | | | | | | |||||||

Fees on deposit accounts | | $ | 24,346 | | $ | 16,679 | | $ | 18,141 | | $ | 19,161 | | $ | 19,725 | | $ | 59,166 | | $ | 56,274 |

Mortgage banking income | | | 48,022 | | | 18,371 | | | 14,647 | | | 3,757 | | | 6,115 | | | 81,040 | | | 13,807 |

Trust and investment services income | | | 7,404 | | | 7,138 | | | 7,389 | | | 6,935 | | | 7,320 | | | 21,931 | | | 22,309 |

Securities gains, net | | | 15 | | | -- | | | -- | | | 24 | | | 437 | | | 15 | | | 2,687 |

Correspondent banking and capital market income | | | 26,432 | | | 10,067 | | | 493 | | | 1,357 | | | 690 | | | 36,992 | | | 1,536 |

Bank owned life insurance income | | | 4,127 | | | 1,381 | | | 2,530 | | | 1,361 | | | 1,498 | | | 8,038 | | | 4,399 |

Recoveries of fully charged off acquired loans | | | -- | | | -- | | | -- | | | 2,232 | | | 1,401 | | | -- | | | 4,615 |

Other | | | 4,444 | | | 711 | | | 932 | | | 1,480 | | | 396 | | | 6,087 | | | 1,631 |

Total noninterest income | | $ | 114,790 | | $ | 54,347 | | $ | 44,132 | | $ | 36,307 | | $ | 37,582 | | $ | 213,269 | | $ | 107,258 |

| | | | | | | | | | | | | | | | | | | | | |

Noninterest expense: | | | | | | | | | | | | | | | | | | | | | |

Salaries and employee benefits | | $ | 134,919 | | $ | 81,720 | | $ | 60,978 | | $ | 58,218 | | $ | 59,551 | | $ | 277,617 | | $ | 176,529 |

Pension plan termination expense | | | -- | | | -- | | | -- | | | -- | | | -- | | | -- | | | 9,526 |

Occupancy expense | | | 23,845 | | | 15,959 | | | 12,287 | | | 12,113 | | | 11,883 | | | 52,091 | | | 35,344 |

Information services expense | | | 18,855 | | | 12,155 | | | 9,306 | | | 8,919 | | | 8,878 | | | 40,316 | | | 26,558 |

FHLB prepayment penalty | | | -- | | | 199 | | | -- | | | -- | | | -- | | | 199 | | | 134 |

OREO expense and loan related | | | 1,146 | | | 1,107 | | | 587 | | | 1,013 | | | 597 | | | 2,840 | | | 2,229 |

Business development and staff related | | | 2,599 | | | 1,447 | | | 2,244 | | | 2,905 | | | 2,018 | | | 6,290 | | | 6,477 |

Amortization of intangibles | | | 9,560 | | | 4,665 | | | 3,007 | | | 3,267 | | | 3,268 | | | 17,232 | | | 9,817 |

Professional fees | | | 4,385 | | | 2,848 | | | 2,494 | | | 2,862 | | | 2,442 | | | 9,727 | | | 7,463 |

Supplies, printing and postage expense | | | 2,755 | | | 1,610 | | | 1,505 | | | 1,464 | | | 1,418 | | | 5,870 | | | 4,417 |

FDIC assessment and other regulatory charges | | | 2,849 | | | 2,403 | | | 2,058 | | | 1,327 | | | 228 | | | 7,310 | | | 3,218 |

Advertising and marketing | | | 1,203 | | | 531 | | | 814 | | | 1,491 | | | 1,052 | | | 2,548 | | | 2,818 |

Other operating expenses | | | 13,109 | | | 10,189 | | | 7,838 | | | 5,555 | | | 5,029 | | | 31,136 | | | 16,422 |

Branch consolid. or merger / convers related exp. | | | 21,662 | | | 40,279 | | | 4,129 | | | 1,494 | | | -- | | | 66,070 | | | 3,058 |

Merger and branding related expense | | | -- | | | -- | | | -- | | | -- | | | -- | | | -- | | | -- |

Total noninterest expense | | $ | 236,887 | | $ | 175,112 | | $ | 107,247 | | $ | 100,628 | | $ | 96,364 | | $ | 519,246 | | $ | 304,010 |

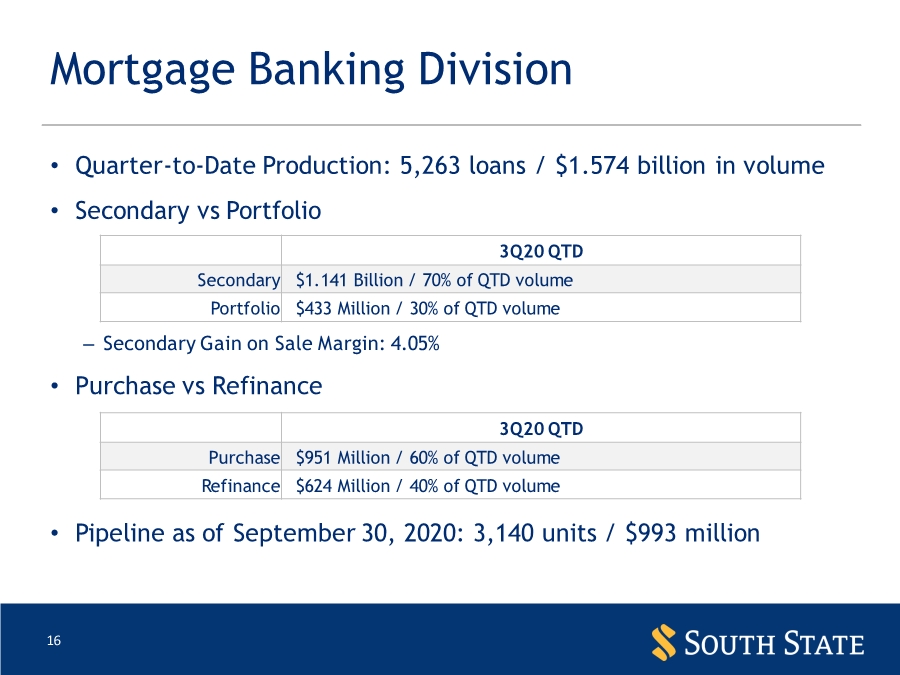

Noninterest income totaled $114.8 million for the third quarter of 2020 compared to $54.3 million in the second quarter of 2020, an increase of $60.4 million. This large increase within all categories was due to the inclusion of income for the full quarter from the merger with CSFL compared to only 23 days in the second quarter of 2020. The largest increases were $29.7 million in mortgage banking income and $16.4 million in correspondent banking and capital markets income. Mortgage banking income improved by $23.5 million from the gains within the secondary market, net of commissions; and from $6.2 million of income associated with the MSR, net of the hedge.

Compared to the third quarter of 2019, noninterest income increased by $77.2 million due to the impact of merger with CSFL. Correspondent banking and capital markets income discussed above improved by $25.7 million and mortgage banking income increased by $41.9 million. Secondary market mortgage income was up $39.9 million from the increase in the gain on sale of mortgage loans,

from both higher volume of loans and at higher margins. The other categories of noninterest income all increased, except for recoveries from acquired loans, which now flow through the allowance for credit losses, and resulted in a $1.4 million decrease.

Noninterest expense was $236.9 million in the third quarter of 2020, an increase of $61.8 million from $175.1 million in the second quarter of 2020. The increase was related to the full quarter impact of expense associated with the merger with CSFL (compared to only 23 days in 2Q 2020). Merger-related costs totaled $21.7 million for the quarter and was a decrease of $18.6 million from the second quarter of 2020. Adjusted noninterest expense totaled $215.2 million in 3Q 2020, which was $80.6 million higher than second quarter of 2020, and resulted in an adjusted efficiency ratio of 55.8% compared to 61.9%, in second quarter of 2020.

Compared to the third quarter of 2019, noninterest expense was higher by $140.5 million. The increase was due to the merger with CSFL in June 2020, and the inclusion of the combined company expenses for all of the third quarter of 2020. In addition, the third quarter of 2020 includes $21.7 million of additional merger-related cost. Adjusted noninterest expense (non-GAAP) increased $118.9 million, compared to the third quarter of 2019.

Conference Call

The Company will announce its third quarter 2020 earnings results in a news release after the market closes on October 29, 2020. At 10:30 a.m. Eastern Time on October 30, 2020, the Company will host a conference call to discuss its third quarter results. Callers wishing to participate may call toll-free by dialing 877-506-9272. Participants may also pre-register for the conference by navigating to https://dpregister.com/sreg/10148509/da2c128419. A dial in number and unique PIN will be provided upon completion of registration. Alternatively, individuals may listen to the live webcast of the presentation by visiting the link at the Company’s website at www.SouthStateBank.com. An audio replay of the live webcast is expected to be available by the evening of October 30, 2020 through the Investor Relations section of www.SouthStateBank.com.

***************

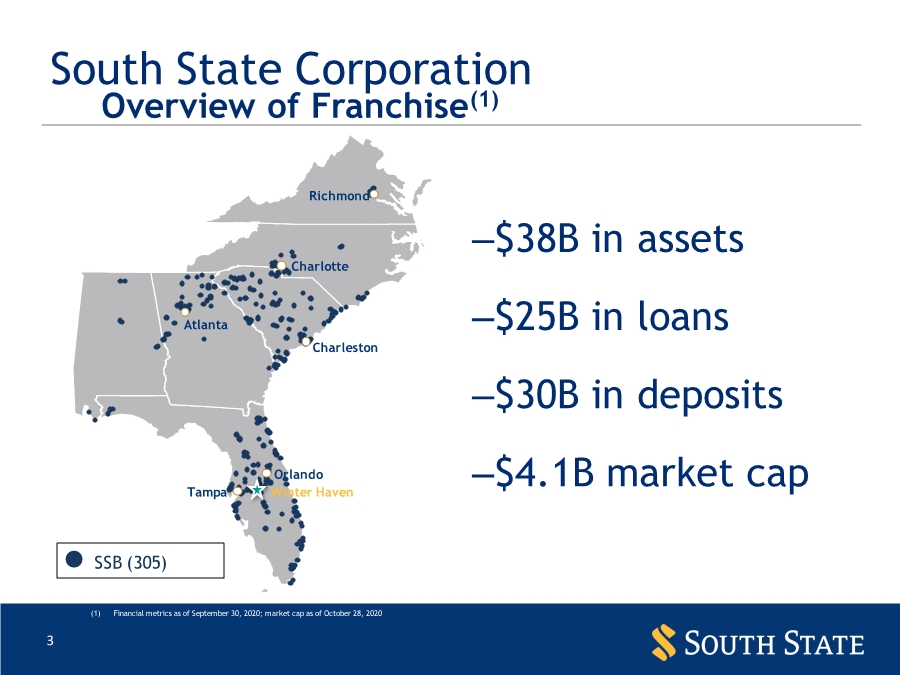

South State Corporation is a financial services company headquartered in Winter Haven, Florida. South State Bank, N.A., the company’s nationally chartered bank subsidiary, provides consumer, commercial, mortgage and wealth management solutions to more than one million customers throughout Florida, Alabama, Georgia, the Carolinas and Virginia. The bank also serves clients coast to coast through its correspondent banking division. Additional information is available at SouthStateBank.com.

Non-GAAP Measures

Statements included in this press release include non-GAAP measures and should be read along with the accompanying tables that provide a reconciliation of non-GAAP measures to GAAP measures. Management believes that these non-GAAP measures provide additional useful information, which allows readers to evaluate the ongoing performance of the Company. Non-GAAP measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider the company’s performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the company. Non-GAAP measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the company’s results or financial condition as reported under GAAP.

Pre-provision net revenue (in thousands) | | Sept. 30, 2020 | | June 30, 2020 |

| ||

| | | | | | ||

Net income (loss) (GAAP) | | $ | 95,221 | | $ | (84,935) | |

PCL legacy SSB | | | 29,797 | | | 31,259 | |

PCL legacy CSB NonPCD and UFC - Day 1 | | | - | | | 119,079 | |

PCL legacy CSB for June | | | - | | | 1,136 | |

Tax provision (benefit) | | | 23,233 | | | (24,747) | |

Merger-related costs | | | 21,662 | | | 40,279 | |

Securities gain | | | (15) | | | - | |

FHLB advance prepayment cost | | | - | | | 199 | |

CSB pre-merger PPNR | | | - | | | 74,791 | |

| | | | | | | |

Pre-provision net revenue (PPNR) Non-GAAP | | $ | 169,898 | | $ | 157,061 | |

| | | | | | | |

SSB average asset balance (GAAP) | | $ | 37,865,217 | | $ | 22,898,925 | |

CSB average asset balance pre-merger | | | | | | 14,604,081 | |

Total average balance June 30, 2020 (Non-GAAP) | | | | | $ | 37,503,006 | |

| | | | | | | |

ROAA PPNR | | | 1.79 | % | | 1.68 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended | | |||||||||||||||||

(Dollars in thousands, except per share data) | | Sept. 30, | | June 30, | | Mar. 31, | | Dec. 31, | | Sept. 30, | | Sept. 30, | | Sept. 30, | | |||||||

RECONCILIATION OF GAAP TO Non-GAAP |

| 2020 |

| 2020 |

| 2020 |

| 2019 |

| 2019 |

| 2020 |

| 2019 | | |||||||

Adjusted net income (non-GAAP) (3) | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) (GAAP) | | $ | 95,221 | | $ | (84,935) | | $ | 24,110 | | $ | 49,091 | | $ | 51,565 | | $ | 34,396 | | $ | 137,392 | |

Securities gains, net of tax | | | (12) | | | -- | | | -- | | | (20) | | | (349) | | | (12) | | | (2,152) | |

PCL - NonPCD loans & unfunded commitments | | | -- | | | 92,212 | | | -- | | | -- | | | -- | | | 92,212 | | | -- | |

Pension plan termination expense, net of tax | | | -- | | | -- | | | -- | | | -- | | | -- | | | -- | | | 7,641 | |

FHLB prepayment penalty, net of tax | | | -- | | | 154 | | | -- | | | -- | | | -- | | | 154 | | | 107 | |

Merger and branch consolidation/acq. expense, net of tax | | | 17,413 | | | 31,191 | | | 3,510 | | | 1,252 | | | -- | | | 52,114 | | | 2,449 | |

Adjusted net income (non-GAAP) | | $ | 112,622 | | $ | 38,622 | | $ | 27,620 | | $ | 50,323 | | $ | 51,216 | | $ | 178,864 | | $ | 145,437 | |

| | | | | | | | | | | | | | | | | | | | | | |

Adjusted net income per common share - Basic (3) | | | | | | | | | | | | | | | | | | | | | | |

Earnings (loss) per common share - Basic (GAAP) | | $ | 1.34 | | $ | (1.96) | | $ | 0.72 | | $ | 1.46 | | $ | 1.51 | | $ | 0.70 | | $ | 3.94 | |

Effect to adjust for securities gains | | | (0.00) | | | -- | | | -- | | | (0.01) | | | (0.01) | | | (0.00) | | | (0.06) | |

Effect to adjust for PCL - NonPCD loans & unfunded commitments | | | -- | | | 2.13 | | | -- | | | -- | | | -- | | | 1.87 | | | -- | |

Effect to adjust for pension plan termination expense, net of tax | | | -- | | | -- | | | -- | | | -- | | | -- | | | -- | | | 0.22 | |

Effect to adjust for FHLB prepayment penalty, net of tax | | | -- | | | 0.00 | | | -- | | | -- | | | -- | | | 0.00 | | | -- | |

Effect to adjust for merger & branch consol./acq expenses, net of tax | | | 0.25 | | | 0.72 | | | 0.10 | | | 0.04 | | | -- | | | 1.06 | | | 0.07 | |

Adjusted net income per common share - Basic (non-GAAP) | | $ | 1.59 | | $ | 0.89 | | $ | 0.82 | | $ | 1.49 | | $ | 1.50 | | $ | 3.63 | | $ | 4.17 | |

| | | | | | | | | | | | | | | | | | | | | | |

Adjusted net income per common share - Diluted (3) | | | | | | | | | | | | | | | | | | | | | | |

Earnings (loss) per common share - Diluted (GAAP) | | $ | 1.34 | | $ | (1.96) | | $ | 0.71 | | $ | 1.45 | | $ | 1.50 | | $ | 0.69 | | $ | 3.92 | |

Effect to adjust for securities gains | | | (0.00) | | | -- | | | -- | | | (0.01) | | | (0.01) | | | (0.00) | | | (0.06) | |

Effect to adjust for PCL - NonPCD loans & unfunded commitments | | | -- | | | 2.11 | | | -- | | | -- | | | -- | | | 1.86 | | | -- | |

Effect to adjust for pension plan termination expense, net of tax | | | -- | | | -- | | | -- | | | -- | | | -- | | | -- | | | 0.22 | |

Effect to adjust for FHLB prepayment penalty, net of tax | | | -- | | | 0.00 | | | -- | | | -- | | | -- | | | 0.00 | | | -- | |

Effect to adjust for merger & branch consol./acq expenses, net of tax | | | 0.24 | | | 0.72 | | | 0.11 | | | 0.04 | | | -- | | | 1.05 | | | 0.07 | |

Effect of adjusted weighted ave shares due to adjusted net income | | | -- | | | 0.02 | | | | | | | | | | | | -- | | | | |

Adjusted net income per common share - Diluted (non-GAAP) | | $ | 1.58 | | $ | 0.89 | | $ | 0.82 | | $ | 1.48 | | $ | 1.49 | | $ | 3.60 | | $ | 4.15 | |

| | | | | | | | | | | | | | | | | | | | | | |

Adjusted Return of Average Assets (3) | | | | | | | | | | | | | | | | | | | | | | |

Return on average assets (GAAP) | | | 1.00 | % | | -1.49 | % | | 0.60 | % | | 1.23 | % | | 1.31 | % | | 0.18 | % | | 1.20 | % |

Effect to adjust for securities gains | | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | -0.01 | % | | 0.00 | % | | -0.02 | % |

Effect to adjust for PCL - NonPCD loans & unfunded commitments | | | 0.00 | % | | 1.62 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.48 | % | | 0.00 | % |

Effect to adjust for pension plan termination expense, net of tax | | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.07 | % |

Effect to adjust for FHLB prepayment penalty, net of tax | | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % |

Effect to adjust for merger & branch consol./acq expenses, net of tax | | | 0.18 | % | | 0.55 | % | | 0.09 | % | | 0.03 | % | | 0.00 | % | | 0.27 | % | | 0.02 | % |

Adjusted return on average assets (non-GAAP) | | | 1.18 | % | | 0.68 | % | | 0.69 | % | | 1.26 | % | | 1.30 | % | | 0.93 | % | | 1.27 | % |

| | | | | | | | | | | | | | | | | | | | | | |

Adjusted Return of Average Equity (3) | | | | | | | | | | | | | | | | | | | | | | |

Return on average equity (GAAP) | | | 8.31 | % | | -11.78 | % | | 4.15 | % | | 8.26 | % | | 8.70 | % | | 1.41 | % | | 7.76 | % |

Effect to adjust for securities gains | | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | -0.06 | % | | 0.00 | % | | -0.12 | % |

Effect to adjust for PCL - NonPCD loans & unfunded commitments | | | 0.00 | % | | 12.79 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 3.77 | % | | 0.00 | % |

Effect to adjust for pension plan termination expense, net of tax | | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.43 | % |

Effect to adjust for FHLB prepayment penalty, net of tax | | | 0.00 | % | | 0.02 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.01 | % | | 0.01 | % |

Effect to adjust for merger & branch consol./acq expenses, net of tax | | | 1.52 | % | | 4.33 | % | | 0.60 | % | | 0.21 | % | | 0.00 | % | | 2.12 | % | | 0.14 | % |

Adjusted return on average equity (non-GAAP) | | | 9.83 | % | | 5.36 | % | | 4.75 | % | | 8.47 | % | | 8.64 | % | | 7.31 | % | | 8.22 | % |

Adjusted Return on Average Common Tangible Equity (3) (5) | | | | | | | | | | | | | | | | | | | | | | |

Return on average common equity (GAAP) | | | 8.31 | % | | -11.78 | % | | 4.15 | % | | 8.26 | % | | 8.70 | % | | 1.41 | % | | 7.76 | % |

Effect to adjust for securities gains | | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | -0.06 | % | | 0.00 | % | | -0.12 | % |

Effect to adjust for PCL - NonPCD loans & unfunded commitments | | | 0.00 | % | | 12.79 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 3.77 | % | | 0.00 | % |

Effect to adjust for pension plan termination expense, net of tax | | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.43 | % |

Effect to adjust for FHLB prepayment penalty, net of tax | | | 0.00 | % | | 0.02 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.01 | % | | 0.01 | % |

Effect to adjust for merger & branch consol./acq expenses, net of tax | | | 1.52 | % | | 4.32 | % | | 0.60 | % | | 0.21 | % | | 0.00 | % | | 2.13 | % | | 0.14 | % |

Effect to adjust for intangible assets | | | 7.31 | % | | 4.88 | % | | 4.70 | % | | 7.70 | % | | 7.87 | % | | 6.26 | % | | 7.49 | % |

Adjusted return on average common tangible equity (non-GAAP) | | | 17.14 | % | | 10.23 | % | | 9.45 | % | | 16.17 | % | | 16.51 | % | | 13.58 | % | | 15.71 | % |

| | | | | | | | | | | | | | | | | | | | | | |

Adjusted efficiency ratio (5) | | | | | | | | | | | | | | | | | | | | | | |

Efficiency ratio | | | 61.39 | % | | 80.52 | % | | 62.11 | % | | 61.64 | % | | 58.40 | % | | | | | | |

Effect to adjust for merger and branch consolidation related expenses | | | -5.61 | % | | -18.61 | % | | -2.39 | % | | -0.91 | % | | 0.00 | % | | | | | | |

Adjusted efficiency ratio | | | 55.78 | % | | 61.91 | % | | 59.72 | % | | 60.73 | % | | 58.40 | % | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Tangible Book Value Per Common Share (5) | | | | | | | | | | | | | | | | | | | | | | |

Book value per common share (GAAP) | | $ | 64.34 | | $ | 63.35 | | $ | 69.40 | | $ | 70.32 | | $ | 69.34 | | | | | | | |

Effect to adjust for intangible assets | | | (24.51) | | | (25.02) | | | (31.39) | | | (31.19) | | | (31.14) | | | | | | | |

Tangible book value per common share (non-GAAP) | | $ | 39.83 | | $ | 38.33 | | $ | 38.01 | | $ | 39.13 | | $ | 38.20 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Tangible Equity-to-Tangible Assets (5) | | | | | | | | | | | | | | | | | | | | | | |

Equity-to-assets (GAAP) | | | 12.07 | % | | 11.91 | % | | 13.95 | % | | 14.90 | % | | 14.92 | % | | | | | | |

Effect to adjust for intangible assets | | | -4.24 | % | | -4.35 | % | | -5.80 | % | | -6.02 | % | | -6.11 | % | | | | | | |

Tangible equity-to-tangible assets (non-GAAP) | | | 7.83 | % | | 7.56 | % | | 8.15 | % | | 8.88 | % | | 8.81 | % | | | | | | |

Footnotes to tables:

| (1) | Loan data excludes mortgage loans held for sale. |

| (2) | The dividend payout ratio is calculated by dividing total dividends paid during the period by the total net income for the same period. |

| (3) | Adjusted earnings, adjusted return on average assets, and adjusted return on average equity are non-GAAP measures and exclude the after-tax effect of gains on acquisitions, gains or losses on sales of securities, and merger and branch consolidation related expense. Management believes that non-GAAP adjusted measures provide additional useful information that allows readers to evaluate the ongoing performance of the company. Non-GAAP measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider the company’s performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the company. Non-GAAP measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the company’s results or financial condition as reported under GAAP. Adjusted earnings and the related adjusted return measures (non-GAAP) exclude the following from net income (GAAP) on an after-tax basis: (a) pre-tax merger and branch consolidation related expense of $21.7 million, $40.3 million, $4.1 million, and $1.5 million, for the quarters ended September 30, 2020, June 30, 2020, March 31, 2020, and December 31, 2019, respectively; (b) securities (losses) gains, net of $15,000, $24,000, and $437,000, for the quarters ended September 30, 2020, December 31, 2019, and September 30, 2019, respectively; and (c) FHLB prepayment penalty of $199,000 for the quarter ended June 30, 2020. |

| (4) | September 30, 2020 ratios are estimated and may be subject to change pending the final filing of the FR Y-9C; all other periods are presented as filed. |

| (5) | The tangible measures are non-GAAP measures and exclude the effect of period end or average balance of intangible assets. The tangible returns on equity and common equity measures also add back the after-tax amortization of intangibles to GAAP basis net income. Management believes that these non-GAAP tangible measures provide additional useful information, particularly since these measures are widely used by industry analysts for companies with prior merger and acquisition activities. Non-GAAP measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider the company’s performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the company. Non-GAAP measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the company’s results or financial condition as reported under GAAP. The sections titled "Reconciliation of Non-GAAP to GAAP" provide tables that reconcile non-GAAP measures to GAAP. |

| (6) | Includes loan accretion (interest) income related to the discount on acquired loans of $22.4 million, $10.1 million, $10.9 million $7.4 million, and $8.1 million, respectively, during the five quarters above. |

| (7) | Adjusted efficiency ratio is calculated by taking the noninterest expense excluding branch consolidation cost and merger cost, pension plan termination and the FHLB prepayment penalty divided by net interest income and noninterest income excluding securities gains (losses). |

Cautionary Statement Regarding Forward Looking Statements

Statements included in this communication, which are not historical in nature are intended to be, and are hereby identified as, forward looking statements for purposes of the safe harbor provided by Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward looking statements are based on, among other things, management’s beliefs, assumptions, current expectations, estimates and projections about the financial services industry, the economy and South State. Words and phrases such as “may,” “approximately,” “continue,” “should,” “expects,” “projects,” “anticipates,” “is likely,” “look ahead,” “look forward,” “believes,” “will,” “intends,” “estimates,” “strategy,” “plan,” “could,” “potential,” “possible” and variations of such words and similar expressions are intended to identify such forward-looking statements. South State cautions readers that forward looking statements are subject to certain risks, uncertainties and assumptions that are difficult to predict with regard to, among other things, timing, extent, likelihood and degree of occurrence, which could cause actual results to differ materially from anticipated results. Such risks, uncertainties and assumptions, include, among others, the following: (1) economic downturn risk, potentially resulting in deterioration in the credit markets, greater than expected noninterest expenses, excessive loan losses and other negative consequences, which risks could be exacerbated by potential negative economic developments resulting from federal spending cuts and/or one or more federal budget-related impasses or actions; (2) controls and procedures risk, including the potential failure or circumvention of our controls and procedures or failure to comply with regulations related to controls and procedures; (3) potential deterioration in real estate values; (4) the impact of competition with other financial institutions, including pricing pressures (including those resulting from the CARES Act) and the resulting impact, including as a result of compression to net interest margin; (5) credit risks associated with an obligor’s failure to meet the terms of any contract with the bank or otherwise fail to perform as agreed under the terms of any loan-related document; (6) interest risk involving the effect of a change in interest rates on the bank’s earnings, the market value of the bank’s loan and securities portfolios, and the market value of South State’s equity; (7) liquidity risk affecting the bank’s ability to meet its obligations when they come due; (8) risks associated with an anticipated increase in South State’s investment securities portfolio, including risks associated with acquiring and holding investment securities or potentially determining that the amount of investment securities South State desires to acquire are not available on terms acceptable to South State; (9) price risk focusing on changes in market factors that may affect the value of traded instruments in “mark-to-market” portfolios; (10) transaction risk arising from problems with service or product delivery; (11) compliance risk involving risk to earnings or capital resulting from violations of or nonconformance with laws, rules, regulations, prescribed practices, or ethical standards; (12) regulatory change risk resulting from new laws, rules, regulations, accounting principles, proscribed practices or ethical standards, including, without limitation, the possibility that regulatory agencies may require higher levels of capital above the current regulatory-mandated minimums and including the impact of the recently enacted CARES Act, the Consumer Financial Protection Bureau rules and regulations, and the possibility of changes in accounting standards, policies, principles and practices, including changes in accounting principles relating to loan loss recognition (CECL); (13) strategic risk resulting from adverse business decisions or improper implementation of business decisions; (14) reputation risk that adversely affects earnings or capital arising from negative public opinion; (15) terrorist activities risk that results in loss of consumer confidence and economic disruptions; (16) cybersecurity risk related to the dependence of South State on internal computer systems and the technology of outside service providers, as well as the potential impacts of third party security breaches, subjects each company to potential business disruptions or financial losses resulting from deliberate attacks or unintentional events; (17) greater than expected noninterest expenses; (18) noninterest income risk resulting from the effect of regulations that prohibit financial institutions from charging consumer fees for paying overdrafts on ATM and one-time debit card transactions, unless the consumer consents or opts‑in to the overdraft service for those types of transactions; (19) excessive loan losses; (20) failure to realize synergies and other financial benefits from, and to limit liabilities associated with, the merger with CSFL within the expected time frame, and ownership dilution risk associated with potential acquisitions in which South State’s stock may be issued as consideration for an acquired company; (21) potential deposit attrition, higher than expected costs, customer loss and business disruption associated with the merger with CSFL integration, including, without limitation, and potential difficulties in maintaining relationships with key personnel; (22) the risks of fluctuations in market prices for South State common stock that may or may not reflect economic condition or performance of South State; (23) the payment of dividends on South State common stock is subject to regulatory supervision as well as the discretion of the board of directors of South State, South State’s performance and other factors; (24) operational, technological, cultural, regulatory, legal, credit and other risks associated with the exploration, consummation and integration of potential future acquisition, whether involving stock or cash consideration; (25) major catastrophes such as earthquakes, floods or other natural or human disasters, including infectious disease outbreaks, including the recent outbreak of the COVID-19 coronavirus, and the related disruption to local, regional and global economic activity and financial markets, and the impact that any of the foregoing may have on South State and its customers and other constituencies; and (26) other risks related to the merger of South State and CSFL including, among others, (i) the risk that the cost savings and any revenue synergies from the merger may not be fully realized or may take longer than anticipated to be realized, (ii) the risk that the integration of each party’s operations will be materially delayed or will be more costly or difficult than expected or that the parties are otherwise unable to successfully integrate each party’s businesses into the other’s businesses, (iii) the amount of the costs, fees, expenses and charges related to the merger, (iv) reputational risk and the reaction of each company’s customers, suppliers, employees or other business partners to the merger, and (27) other factors that may affect future results of South State and CenterState, as disclosed in South State’s Annual Report on Form 10-K, as amended, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, and CenterState’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, in each case filed by South State or CenterState, as applicable, with the U.S. Securities and Exchange Commission (“SEC”) and available on the SEC’s website at http://www.sec.gov, any of which could cause actual results to differ materially from future results expressed, implied or otherwise anticipated by such forward-looking statements.

All forward-looking statements speak only as of the date they are made and are based on information available at that time. South State does not undertake any obligation to update or otherwise revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements.

Exhibit 99.2

| Earnings Call 3Q 2020 Friday, October 30, 2020 Exhibit 99.2 |