Form 8-K DRIL-QUIP INC For: Oct 29

Exhibit 99.1

DRIL-QUIP, INC. ANNOUNCES THIRD QUARTER 2020 RESULTS

HOUSTON, October 29, 2020 — Dril-Quip, Inc. (NYSE: DRQ), (the “Company” or “Dril-Quip”) today reported operational and financial results for the third quarter of 2020.

Key highlights for the third quarter of 2020 included:

| • | Delivered $91.3 million of revenue from increased product volumes, primarily driven by improved production output and product mix in Asia Pacific and the U.S.; |

| • | Reported third quarter net income of $14.3 million, or $0.41 per share, an improvement of $28.5 million, or $0.81 per share, from the second quarter of 2020 primarily driven by federal income tax benefits; |

| • | Increased adjusted EBITDA to $10.2 million, or 11.1% of revenue, from improved product margins and lower costs; |

| • | Generated net cash provided by operating activities of $13.9 million and increased cash position by $13.4 million to $359.2 million with no debt; |

| • | Executed on an additional $7.0 million of annualized cost saving actions resulting in a year-to-date cumulative cost savings of $18.5 million annualized; |

| • | Selling, general and administrative expense declined $2.5 million in the third quarter compared to the second quarter of 2020 and $8.3 million from the third quarter of 2019; |

Blake DeBerry, Dril-Quip’s Chief Executive Officer, commented, “Our third quarter results reflect the progress we are making as an organization in managing the continued challenges to our operations and the overall commodity price environment brought about by the COVID-19 pandemic and the associated oil and gas demand declines. I am proud of our employees in the manner in which they have remained productive and efficient in our manufacturing plants, aftermarket services and remote work locations. Our third quarter performance was a result of their efforts.”

“We were able to improve our adjusted EBITDA by nearly 70% sequentially on mostly flat revenue as we executed on our previously announced cost reductions in response to the current market environment. We generated free cash flow due to improved collection efforts and a federal income tax refund related to COVID-19 relief legislation. We also saw our quarterly product bookings improve to $50.2 million during the third quarter. These bookings included several subsea tree awards in Europe and Asia and set us on a path toward achieving our $200 million bookings target for the full year 2020.”

“While we have been able to manage the many difficulties and disruptions posed by the global pandemic, we still face obstacles that are out of our control, including in particular, the demand destruction for oil and natural gas stemming from the global economic slowdown associated with the pandemic. Our customers are in the process of evaluating their portfolio of opportunities and determining how to allocate budgets for projects in the coming year. Additionally, they are seeking to delay some current projects to a future period of more stable commodity prices, resulting in higher inventory levels. Consequently, this has had an estimated quarterly impact on cash flow generation of $10 to $15 million and also has affected our ability to grow our bookings.”

1

“While we have an experienced management team with a track record of navigating through these types of challenges, our expectation is that they will persist into 2021 as the global economy works to regain its footing and commodity prices begin to stabilize. Despite the potential for ongoing headwinds, we remain in a strong financial position that lets us capitalize on opportunities as they arise. This flexibility allows us to evaluate potential acquisitions within our strategic planning framework, which includes profitably expanding market share through consolidation while maintaining a strong balance sheet. We are also actively exploring alternative approaches towards monetizing our innovative technology. We believe the potential to manufacture and deliver subsea tree and wellhead technology to other offshore equipment providers represents a unique opportunity to expand our customer base, participate in more operator projects, help reduce costs and further consolidate capacity in our industry. The pursuit of these strategic initiatives gives me optimism about Dril-Quip’s long-term future and its ability to generate value for all stakeholders.”

In conjunction with today’s release, the Company posted a new investor presentation entitled “Third Quarter 2020 Supplemental Earnings Information” to its website, www.dril-quip.com, on the “Events & Presentations” page under the Investors tab. Investors should note that Dril-Quip announces material financial information in Securities and Exchange Commission (“SEC”) filings, press releases and public conference calls. Dril-Quip may use the Investors section of its website (www.dril-quip.com) to communicate with investors. It is possible that the financial and other information posted there could be deemed to be material information. Information on Dril-Quip’s website is not part of this release.

Operational and Financial Results

Revenue, Cost of Sales and Gross Operating Margin

Consolidated revenue for the third quarter of 2020 was $91.3 million, up $0.8 million from the second quarter of 2020 and down $16.9 million from the third quarter of 2019. The sequential increase in revenue was driven by increased product volumes, particularly progress on subsea tree projects awarded in the third quarter, partially offset by aftermarket service declines in Asia Pacific. The decrease in revenue year-over-year was primarily due to oil and gas demand declines caused primarily by impacts of the COVID-19 pandemic.

Cost of sales for the third quarter of 2020 was $67.2 million, an increase of $0.3 million sequentially and a decrease of $8.8 million compared to the prior year. Gross operating margin for the third quarter of 2020 was 26.4%, mostly flat compared to the second quarter of 2020 and a decrease from 29.8% in the third quarter of 2019. Gross margin sequentially remained flat due to an improvement in product margins driven primarily by improved product mix in the Western Hemisphere, which was partially offset by a decrease in aftermarket services revenue related to resolution of a one-time customer dispute on rental equipment in Asia Pacific. The decline in gross margin year-over-year was primarily related to increased costs associated with COVID-19 pandemic related costs comprising staggered shifts, supply chain disruptions, additional freight charges and more extensive cleaning and sanitization of workstations as well as unfavorable product mix compared to the third quarter of 2019.

2

Selling, General and Administrative Expenses

Selling, general and administrative (“SG&A”) expenses for the third quarter of 2020 were $20.8 million, a decrease of $2.5 million compared to the second quarter of 2020 and a decrease of $8.3 million compared to the third quarter of 2019. The sequential and year-over-year decline in SG&A was primarily due to lower corporate overhead from cost saving actions completed in the second and third quarters. Engineering and product development expenses for the third quarter of 2020 were $1.4 million lower compared to the second quarter of 2020 and $0.2 million higher compared to the third quarter of 2019. The decrease sequentially was driven by cost reduction actions including reprioritization of projects and the transfer of our controls product line to Proserv. The modest increase in expense year-over-year was related to increased research and development costs, primarily related to the VXTe subsea tree commercialization.

Net Income, Adjusted EBITDA and Free Cash Flow

For the third quarter of 2020, the Company reported net income of $14.3 million, or $0.41 per share, compared to a net loss of $14.1 million, or $0.40 per share, for the second quarter of 2020 and a net loss of $1.3 million, or $0.04 per diluted share, for the third quarter of 2019. The sequential and year-over-year increase in net income was a result of decreased SG&A expenses from the execution of cost reduction actions and a federal income tax benefit related to U.S. COVID-19 pandemic relief.

Adjusted EBITDA totaled $10.2 million for the third quarter of 2020 compared to $6.0 million for the second quarter of 2020 and $15.3 million for the third quarter of 2019. The sequential increase in adjusted EBITDA results from improved product margin mix and cost reductions associated with the realignment of manufacturing operations and lower engineering spend. This was partially offset by a decrease in aftermarket services related to resolution of a one-time customer dispute on rental equipment in Asia Pacific. The decrease in adjusted EBITDA year-over-year was due to declines in product and leasing revenues as a result of a weaker market.

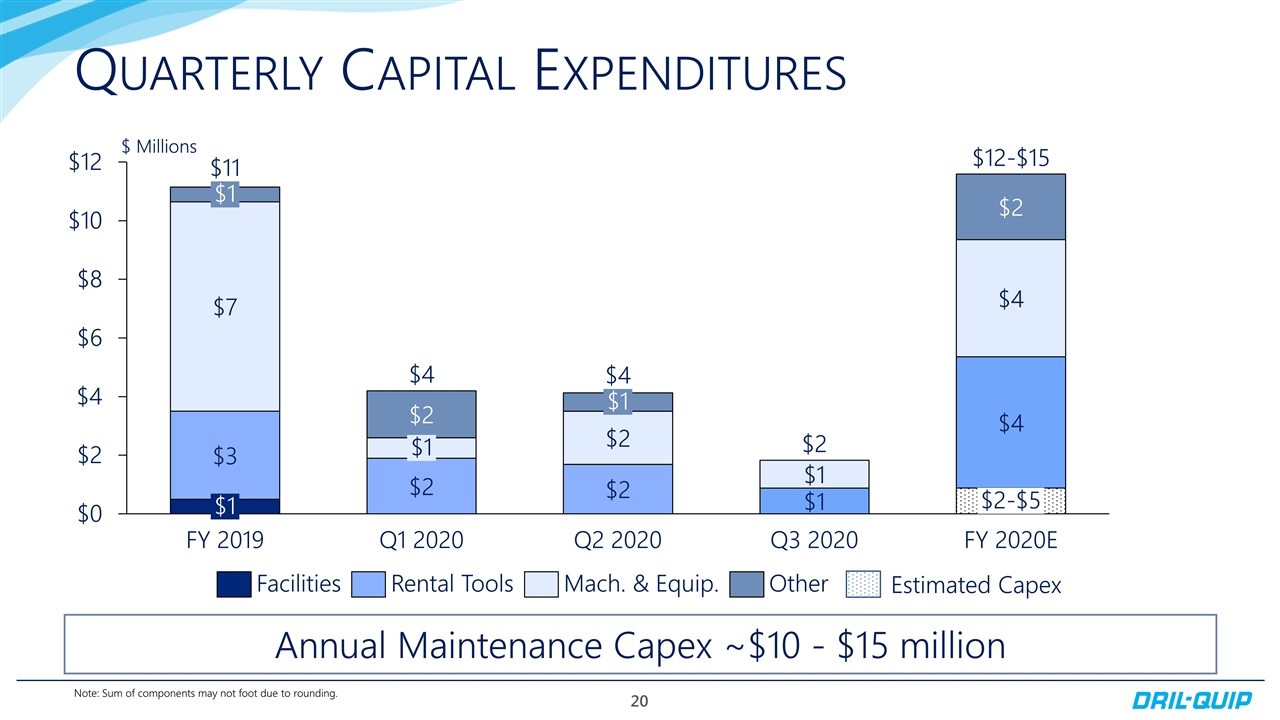

Net cash provided by operations was $13.9 million and free cash flow was approximately $12.0 million for the third quarter of 2020. The improvement in net cash provided by operations of $10.8 million compared to the second quarter of 2020 was primarily driven by a federal income tax benefit, improved collections of receivables and successful negotiation of extended supplier payment terms, partially offset by increases in stocking program inventory and timing of deliveries due to logistical disruptions and delays caused by the global pandemic. Capital expenditures in the third quarter of 2020 were approximately $1.9 million, the majority of which was related to machinery and equipment spend consolidating our Aberdeen manufacturing operations into Houston.

Cost Saving Initiatives

In the first quarter of 2020, the Company announced its plans to achieve $20 million in annualized cost savings in response to the deteriorating market conditions in 2020. These actions will span manufacturing, supply chain, SG&A, engineering and research and development and better align our organization with anticipated market activity. During the third quarter, the Company executed on approximately $7.0 million of these annualized cost saving actions, resulting in a total of $18.5 million annualized year to date 2020. The remainder of the full $20 million in annualized cost savings are expected to be completed in the fourth quarter of 2020.

3

Balance Sheet and Liquidity

Dril-Quip’s cash on hand as of September 30, 2020 was $359.2 million, which, together with amounts available under the asset-based lending (ABL) facility, resulted in approximately $403.8 million of available liquidity. The Company’s strong liquidity position, combined with a debt-free balance sheet, provides both financial and operational flexibility. The Company intends to use its financial strength to pursue strategic acquisitions and collaborations that differentiate its products offerings and continue investing in the rapid commercialization of new technologies. The Company expects to generate positive free cash flow for the full year 2020. In addition, inclusive of received and expected cash tax benefits as a result of the CARES Act, the Company is targeting to achieve close to a neutral year-end cash balance in 2020 compared to 2019.

Share Repurchases

For the three-month period ended September 20, 2020, the Company did not purchase shares under its share repurchase plan authorized by the Board of Directors in February of 2019. For the first nine months ended September 30, 2020, the Company purchased 808,389 shares under the share repurchase plan at an average price of approximately $30.91 per share totaling approximately $25.0 million and retired such shares. The Company has purchased approximately $51 million of the $100 million authorized. The Company continues to evaluate the amount and timing of its share repurchases and intends for the total amount of shares repurchased in 2020 to not exceed its full year free cash flow generation.

About Dril-Quip

Dril-Quip is a leading manufacturer of highly engineered drilling and production equipment for use onshore and offshore, which is particularly well suited for use in deep-water, harsh environments and severe service applications.

Forward-Looking Statements

Statements contained herein relating to future operations and financial results that are forward-looking statements, including those related to the effects of COVID-19 pandemic, market conditions, anticipated project bookings, expected timing of completing the strategic restructuring, anticipated timing of delivery of new orders, anticipated revenues, costs, cost synergies and savings, possible acquisitions, new product offerings and related revenues, share repurchases and expectations regarding operating results, are based upon certain assumptions and analyses made by the management of the Company in light of its experience and perception of historical trends, current conditions, expected future developments and other factors. These statements are subject to risks beyond the Company’s control, including, but not limited to, the impact of the ongoing COVID-19 pandemic, the effects of actions taken by third parties, including, but not limited to, governmental authorities, customers, contractors and suppliers, in response to the COVID-19 pandemic, the impact of the recent significant decline in oil and natural gas prices, the volatility of oil and natural gas prices and cyclicality of the oil and gas industry, declines in investor and lender sentiment with respect to, and new capital investments in, the oil and gas industry, project terminations, suspensions or scope adjustments to contracts, uncertainties regarding the effects of new governmental regulations, the Company’s international operations, operating risks, and other factors detailed in the Company’s public filings with the SEC. Investors are cautioned that any such statements are not guarantees of future performance and actual outcomes may vary materially from those indicated.

4

Non-GAAP Financial Information

Adjusted Net Income (Loss), Adjusted Diluted EPS, Free Cash Flow and Adjusted EBITDA are non-GAAP measures.

Adjusted Net Income (Loss) and Adjusted Diluted EPS are defined as net income (loss) and earnings per share, respectively, excluding the impact of foreign currency gains or losses as well as other significant non-cash items and certain charges and credits.

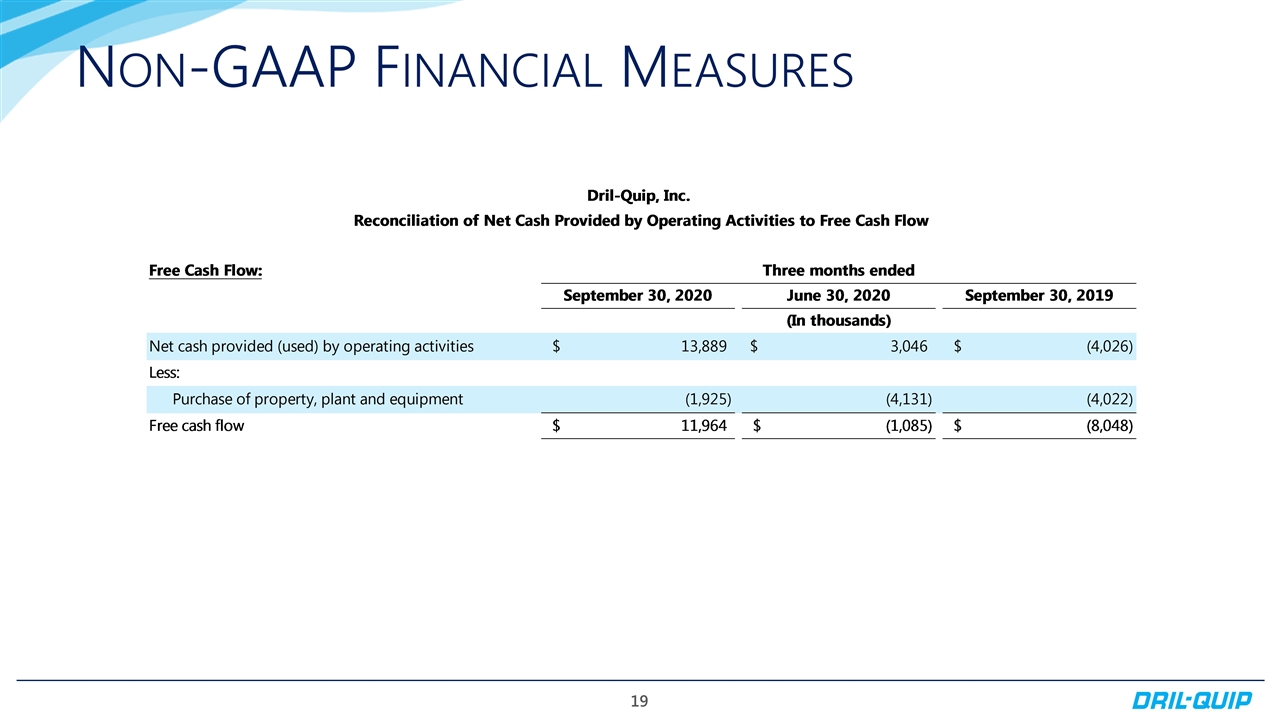

Free Cash Flow is defined as net cash provided by operating activities less net cash used in the purchase of property, plant and equipment.

Adjusted EBITDA is defined as net income excluding income taxes, interest income and expense, depreciation and amortization expense, non-cash gains or losses from foreign currency exchange rate changes as well as other significant non-cash items and items that can be considered non-recurring.

The Company believes that these non-GAAP measures enable it to evaluate and compare more effectively the results of our operations period over period and identify operating trends by removing the effect of its capital structure from its operating structure. In addition, the Company believes that these measures are supplemental measurement tools used by analysts and investors to help evaluate overall operating performance, ability to pursue and service possible debt opportunities and make future capital expenditures. Adjusted Net Income (Loss), Adjusted EBITDA and Free Cash Flow do not represent funds available for our discretionary use and are not intended to represent or to be used as a substitute for net income or net cash provided by operating activities, as measured under U.S. generally accepted accounting principles (“GAAP”).

See “Unaudited Non-GAAP Financial Measures” below for additional information concerning non-GAAP financial information, including a reconciliation of the non-GAAP financial information presented in this press release to the most directly comparable financial information presented in accordance with GAAP. Non-GAAP financial information supplements and should be read together with, and is not an alternative or substitute for, the Company’s financial results reported in accordance with GAAP. Because non-GAAP financial information is not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures.

Investor Relations Contact

Blake Holcomb, Director of Investor Relations and Corporate Planning

(713) 939-7711

5

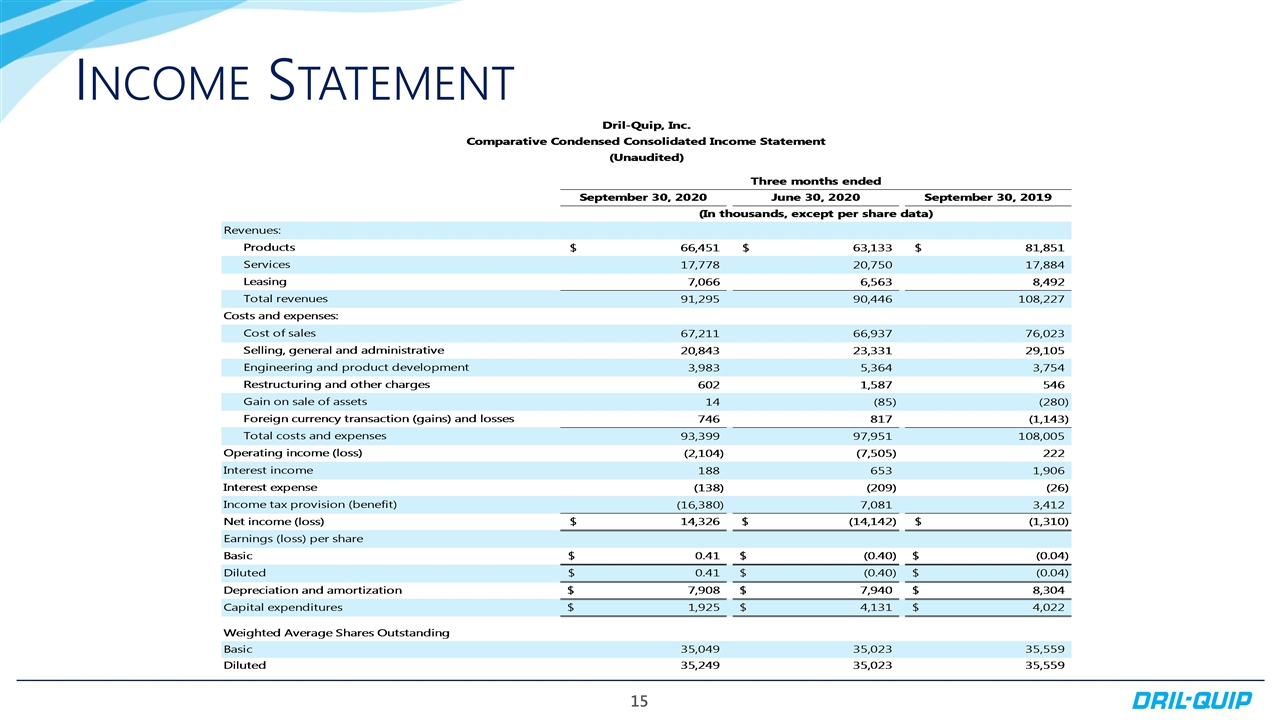

Dril-Quip, Inc.

Comparative Condensed Consolidated Income Statement

(Unaudited)

| Three months ended | ||||||||||||

| September 30, 2020 |

June 30, 2020 |

September 30, 2019 |

||||||||||

| (In thousands, except per share data) | ||||||||||||

| Revenues: |

||||||||||||

| Products |

$ | 66,451 | $ | 63,133 | $ | 81,851 | ||||||

| Services |

17,778 | 20,750 | 17,884 | |||||||||

| Leasing |

7,066 | 6,563 | 8,492 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total revenues |

91,295 | 90,446 | 108,227 | |||||||||

| Costs and expenses: |

||||||||||||

| Cost of sales |

67,211 | 66,937 | 76,023 | |||||||||

| Selling, general and administrative |

20,843 | 23,331 | 29,105 | |||||||||

| Engineering and product development |

3,983 | 5,364 | 3,754 | |||||||||

| Restructuring and other charges |

602 | 1,587 | 546 | |||||||||

| Gain on sale of assets |

14 | (85 | ) | (280 | ) | |||||||

| Foreign currency transaction (gains) and losses |

746 | 817 | (1,143 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Total costs and expenses |

93,399 | 97,951 | 108,005 | |||||||||

| Operating income (loss) |

(2,104 | ) | (7,505 | ) | 222 | |||||||

| Interest income |

188 | 653 | 1,906 | |||||||||

| Interest expense |

(138 | ) | (209 | ) | (26 | ) | ||||||

| Income tax provision (benefit) |

(16,380 | ) | 7,081 | 3,412 | ||||||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) |

$ | 14,326 | $ | (14,142 | ) | $ | (1,310 | ) | ||||

|

|

|

|

|

|

|

|||||||

| Earnings (loss) per share |

||||||||||||

| Basic |

$ | 0.41 | $ | (0.40 | ) | $ | (0.04 | ) | ||||

|

|

|

|

|

|

|

|||||||

| Diluted |

$ | 0.41 | $ | (0.40 | ) | $ | (0.04 | ) | ||||

|

|

|

|

|

|

|

|||||||

| Depreciation and amortization |

$ | 7,908 | $ | 7,940 | $ | 8,304 | ||||||

|

|

|

|

|

|

|

|||||||

| Capital expenditures |

$ | 1,925 | $ | 4,131 | $ | 4,022 | ||||||

|

|

|

|

|

|

|

|||||||

| Weighted Average Shares Outstanding |

||||||||||||

| Basic |

35,049 | 35,023 | 35,559 | |||||||||

| Diluted |

35,249 | 35,023 | 35,559 | |||||||||

6

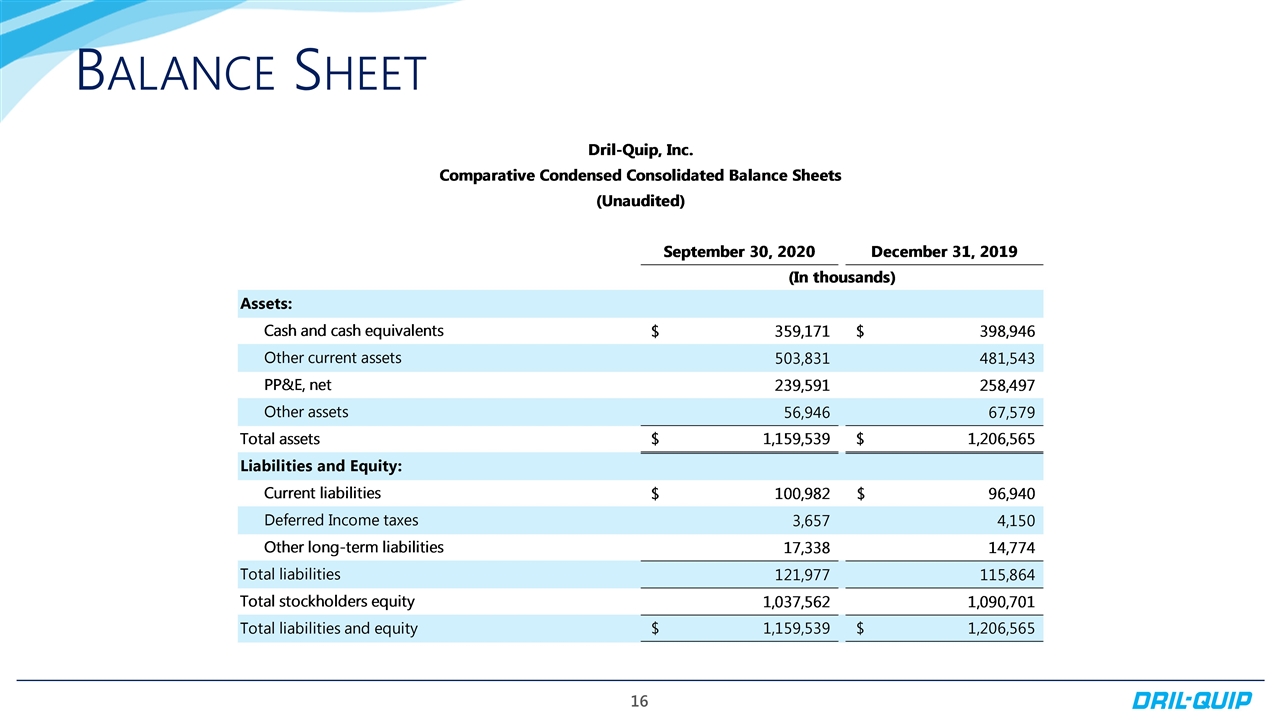

Dril-Quip, Inc.

Comparative Condensed Consolidated Balance Sheets

(Unaudited)

| September 30, 2020 |

December 31, 2019 |

|||||||

| (In thousands) | ||||||||

| Assets: |

||||||||

| Cash and cash equivalents |

$ | 359,171 | $ | 398,946 | ||||

| Other current assets |

503,831 | 481,543 | ||||||

| PP&E, net |

239,591 | 258,497 | ||||||

| Other assets |

56,946 | 67,579 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 1,159,539 | $ | 1,206,565 | ||||

|

|

|

|

|

|||||

| Liabilities and Equity: |

||||||||

| Current liabilities |

$ | 100,982 | $ | 96,940 | ||||

| Deferred Income taxes |

3,657 | 4,150 | ||||||

| Other long-term liabilities |

17,338 | 14,774 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

121,977 | 115,864 | ||||||

|

|

|

|

|

|||||

| Total stockholders equity |

1,037,562 | 1,090,701 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | 1,159,539 | $ | 1,206,565 | ||||

|

|

|

|

|

|||||

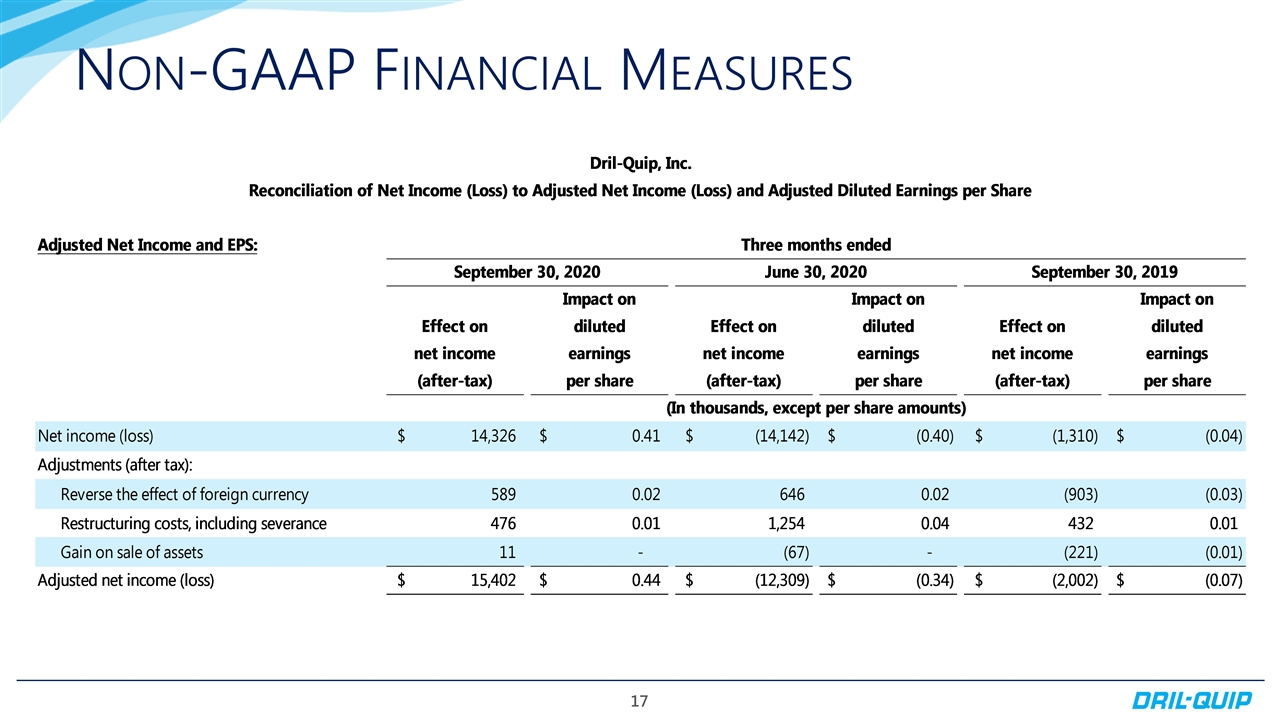

Dril-Quip, Inc.

Reconciliation of Net Income (Loss) to Adjusted Net Income (Loss) and Adjusted Diluted Earnings per Share

| Adjusted Net Income and EPS: |

Three months ended | |||||||||||||||||||||||

| September 30, 2020 | June 30, 2020 | September 30, 2019 | ||||||||||||||||||||||

| Effect on net income (after-tax) |

Impact on diluted earnings per share |

Effect on net income (after-tax) |

Impact on diluted earnings per share |

Effect on net income (after-tax) |

Impact on diluted earnings per share |

|||||||||||||||||||

| (In thousands, except per share amounts) | ||||||||||||||||||||||||

| Net income (loss) |

$ | 14,326 | $ | 0.41 | $ | (14,142 | ) | $ | (0.40 | ) | $ | (1,310 | ) | $ | (0.04 | ) | ||||||||

| Adjustments (after tax): |

||||||||||||||||||||||||

| Reverse the effect of foreign currency |

589 | 0.02 | 646 | 0.02 | (903 | ) | (0.03 | ) | ||||||||||||||||

| Restructuring costs, including severance |

476 | 0.01 | 1,254 | 0.04 | 432 | 0.01 | ||||||||||||||||||

| Gain on sale of assets |

11 | — | (67 | ) | — | (221 | ) | (0.01 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted net income (loss) |

$ | 15,402 | $ | 0.44 | $ | (12,309 | ) | $ | (0.34 | ) | $ | (2,002 | ) | $ | (0.07 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

7

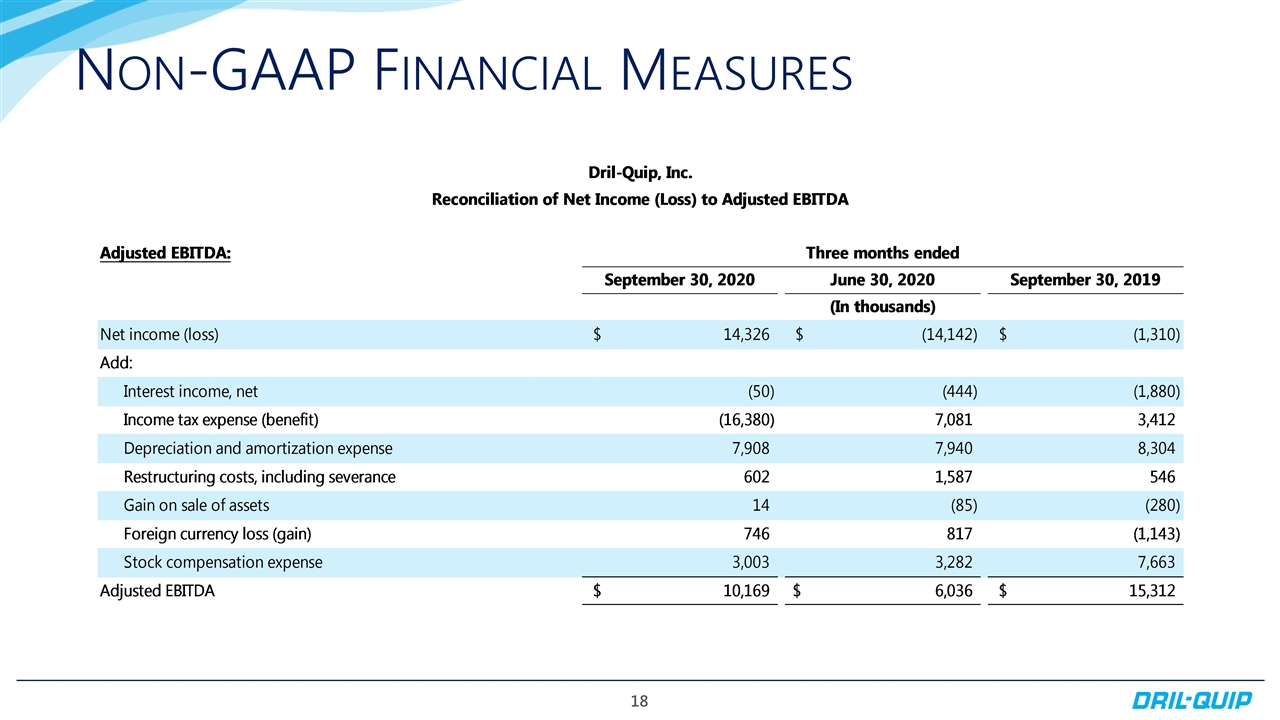

Dril-Quip, Inc.

Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow

| Free Cash Flow: |

Three months ended | |||||||||||

| September 30, 2020 |

June 30, 2020 |

September 30, 2019 |

||||||||||

| (In thousands) | ||||||||||||

| Net cash provided (used) by operating activities |

$ | 13,889 | $ | 3,046 | $ | (4,026 | ) | |||||

| Less: |

||||||||||||

| Purchase of property, plant and equipment |

(1,925 | ) | (4,131 | ) | (4,022 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Free cash flow |

$ | 11,964 | $ | (1,085 | ) | $ | (8,048 | ) | ||||

|

|

|

|

|

|

|

|||||||

Dril-Quip, Inc.

Reconciliation of Net Income (Loss) to Adjusted EBITDA

| Adjusted EBITDA: |

Three months ended | |||||||||||

| September 30, 2020 |

June 30, 2020 |

September 30, 2019 |

||||||||||

| (In thousands) | ||||||||||||

| Net income (loss) |

$ | 14,326 | $ | (14,142 | ) | $ | (1,310 | ) | ||||

| Add: |

||||||||||||

| Interest income, net |

(50 | ) | (444 | ) | (1,880 | ) | ||||||

| Income tax expense (benefit) |

(16,380 | ) | 7,081 | 3,412 | ||||||||

| Depreciation and amortization expense |

7,908 | 7,940 | 8,304 | |||||||||

| Restructuring costs, including severance |

602 | 1,587 | 546 | |||||||||

| Gain on sale of assets |

14 | (85 | ) | (280 | ) | |||||||

| Foreign currency loss (gain) |

746 | 817 | (1,143 | ) | ||||||||

| Stock compensation expense |

3,003 | 3,282 | 7,663 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | 10,169 | $ | 6,036 | $ | 15,312 | ||||||

|

|

|

|

|

|

|

|||||||

8

Third Quarter 2020 Supplemental Earnings Information dril-quip.com | NYSE: DRQ Exhibit 99.2

Forward-Looking Statements The information furnished in this presentation contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements include the effects of the COVID-19 pandemic, and the effects of actions taken by third parties including, but not limited to, governmental authorities, customers, contractors and suppliers, in response to the COVID-19 pandemic, goals, projections, estimates, expectations, market outlook, forecasts, plans and objectives, including revenue and new product revenue, capital expenditures and other projections, project bookings, bidding and service activity, acquisition opportunities, forecasted supply and demand, forecasted drilling activity and subsea investment, liquidity, cost savings, and share repurchases and are based on assumptions, estimates and risk analysis made by management of Dril-Quip, Inc. (“Dril-Quip”) in light of its experience and perception of historical trends, current conditions, expected future developments and other factors. No assurance can be given that actual future results will not differ materially from those contained in the forward-looking statements in this presentation. Although Dril-Quip believes that all such statements contained in this presentation are based on reasonable assumptions, there are numerous variables of an unpredictable nature or outside of Dril-Quip’s control that could affect Dril-Quip’s future results and the value of its shares. Each investor must assess and bear the risk of uncertainty inherent in the forward-looking statements contained in this presentation. Please refer to Dril-Quip’s filings with the Securities and Exchange Commission (“SEC”) for additional discussion of risks and uncertainties that may affect Dril-Quip’s actual future results. Dril-Quip undertakes no obligation to update the forward-looking statements contained herein. Use of Non-GAAP Financial Measures Adjusted Net Income, Adjusted Diluted EPS, Adjusted EBITDA and Free Cash Flow are non-GAAP measures. Adjusted Net Income and Adjusted Diluted EPS are defined as net income (loss) and earnings per share, respectively, excluding the impact of foreign currency gains or losses as well as other significant non-cash items and certain charges and credits. Adjusted EBITDA is defined as net income excluding income taxes, interest income and expense, depreciation and amortization expense, non-cash gains or losses from foreign currency exchange rate changes as well as other significant non-cash items and items that can be considered non-recurring. Free Cash Flow is defined as net cash provided by operating activities less net cash used in the purchase of property, plant and equipment. We believe that these non-GAAP measures enable us to evaluate and compare more effectively the results of our operations period over period and identify operating trends by removing the effect of our capital structure from our operating structure and certain other items including those that affect the comparability of operating results. In addition, we believe that these measures are supplemental measurement tools used by analysts and investors to help evaluate overall operating performance, ability to pursue and service possible debt opportunities and make future capital expenditures. These measures do not represent funds available for our discretionary use and are not intended to represent or to be used as a substitute for net income or net cash provided by operating activities, as measured under U.S. generally accepted accounting principles (“GAAP”). Non-GAAP financial information supplements should be read together with, and is not an alternative or substitute for, our financial results reported in accordance with GAAP. Because non-GAAP financial information is not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures. Reconciliations of these non-GAAP measures to the most directly comparable GAAP measure can be found in the appendix. Use of Website Investors should note that Dril-Quip announces material financial information in SEC filings, press releases and public conference calls. Dril-Quip may use the Investors section of its website (www.dril-quip.com) to communicate with investors. It is possible that the financial and other information posted there could be deemed to be material information. Information on Dril-Quip’s website is not part of this presentation. Cautionary Statement

Dril-Quip Investment Highlights Leading Manufacturer of Highly Engineered Drilling & Production Equipment Technically Innovative Products & First-class Service Strong Financial Position Historically Superior Margins to Peers Results Driven Management Team

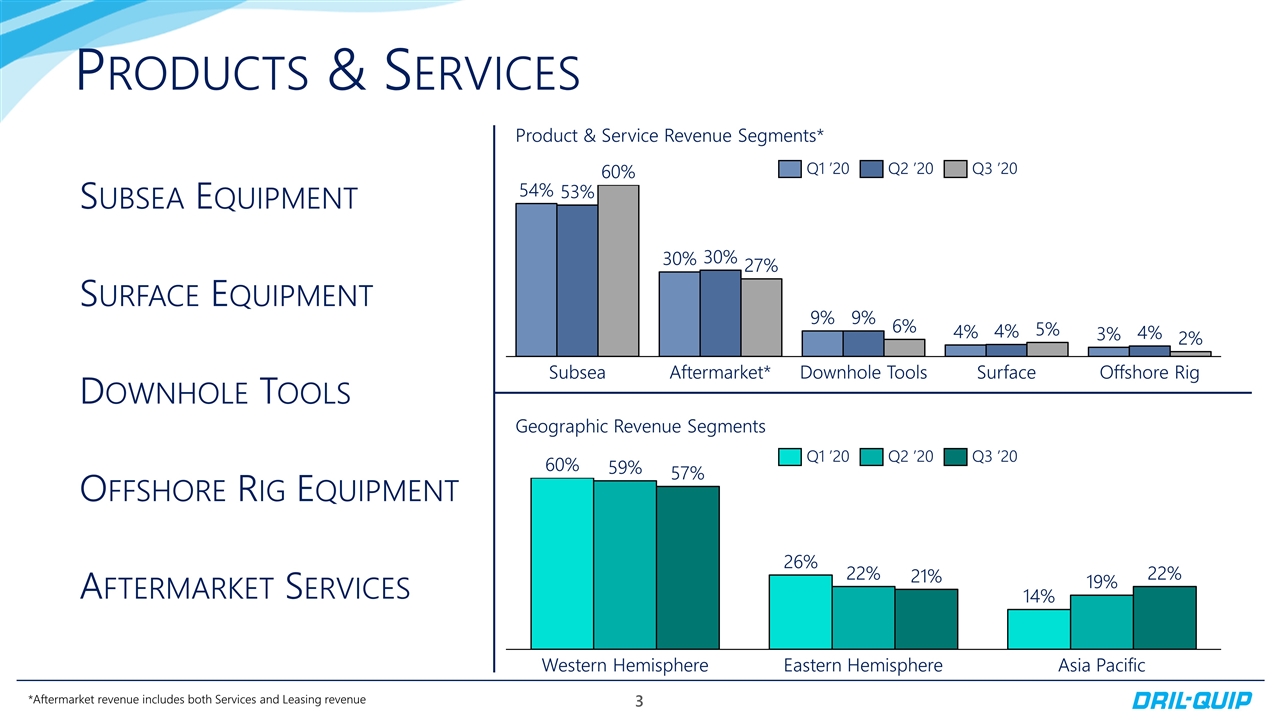

Products & Services Product & Service Revenue Segments* Geographic Revenue Segments *Aftermarket revenue includes both Services and Leasing revenue Subsea Equipment Surface Equipment Downhole Tools Offshore Rig Equipment Aftermarket Services

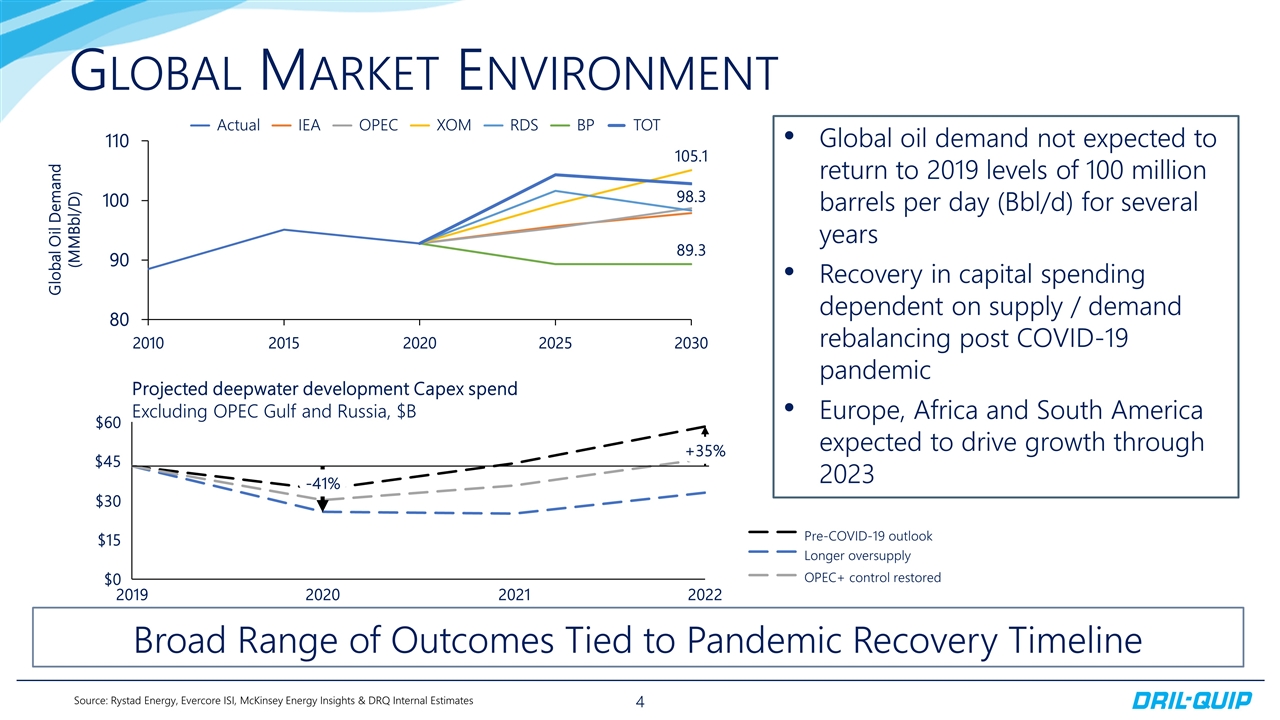

Global Market Environment Source: Rystad Energy, Evercore ISI, McKinsey Energy Insights & DRQ Internal Estimates Broad Range of Outcomes Tied to Pandemic Recovery Timeline Global oil demand not expected to return to 2019 levels of 100 million barrels per day (Bbl/d) for several years Recovery in capital spending dependent on supply / demand rebalancing post COVID-19 pandemic Europe, Africa and South America expected to drive growth through 2023 Pre-COVID-19 outlook Longer oversupply OPEC+ control restored Projected deepwater development Capex spend Excluding OPEC Gulf and Russia, $B Global Oil Demand (MMBbl/D)

Strategy for Managing the Current Environment Maintaining Strong Balance Sheet is a Key Priority Focus on Cash Flow Resource Planning / Manage Costs Flex Center of Excellence Manufacturing Output Monitor Leading Indicators Working Capital Management

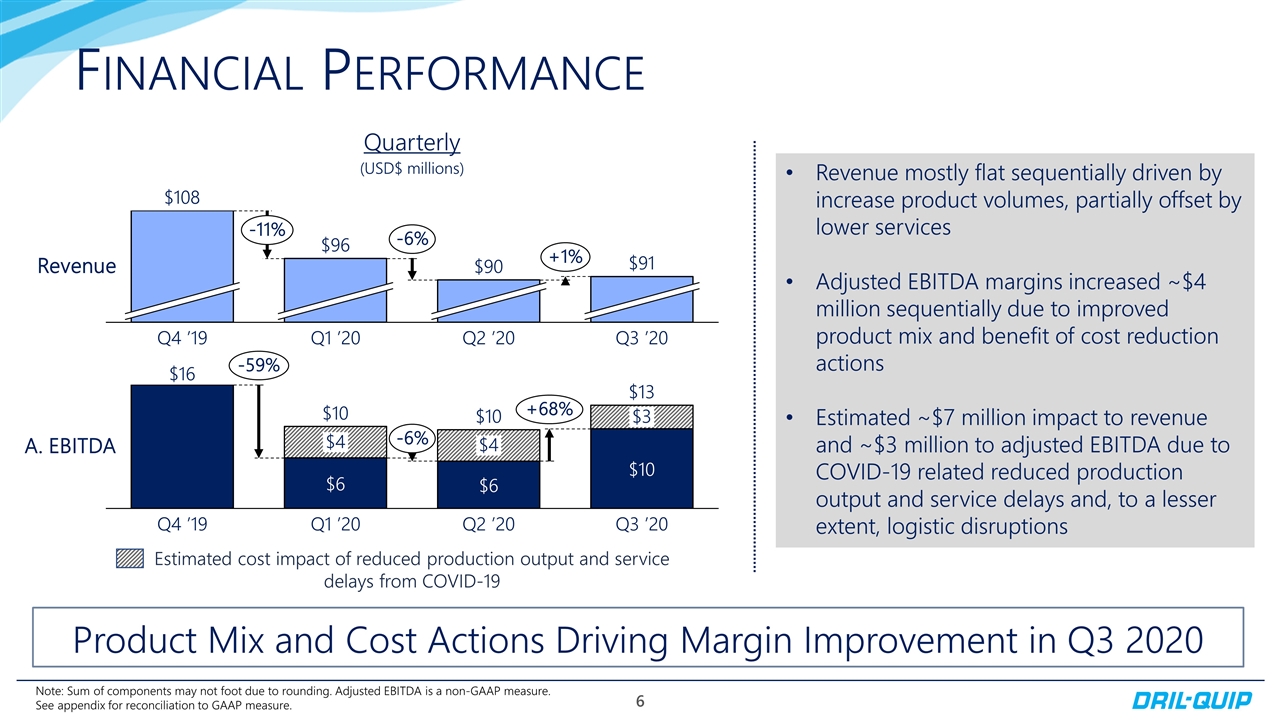

Financial Performance (USD$ millions) Product Mix and Cost Actions Driving Margin Improvement in Q3 2020 Quarterly Note: Sum of components may not foot due to rounding. Adjusted EBITDA is a non-GAAP measure. See appendix for reconciliation to GAAP measure. Revenue mostly flat sequentially driven by increase product volumes, partially offset by lower services Adjusted EBITDA margins increased ~$4 million sequentially due to improved product mix and benefit of cost reduction actions Estimated ~$7 million impact to revenue and ~$3 million to adjusted EBITDA due to COVID-19 related reduced production output and service delays and, to a lesser extent, logistic disruptions $10 Estimated cost impact of reduced production output and service delays from COVID-19

Q3 2020 Highlights Delivered $91.3 million of revenue from increased product volumes, primarily driven by improved production output and product mix in Asia Pacific and the U.S.; Reported third quarter net income of $14.3 million, or $0.41 per share, an improvement of $28.5 million, or $0.81 per share, from the second quarter of 2020 primarily driven by federal income tax benefits; Increased adjusted EBITDA to $10.2 million, or 11.1% of revenue, from improved product margins and lower costs; Generated net cash provided by operating activities of $13.9 million and increased cash position by $13.4 million to $359.2 million with no debt; Executed on an additional $7.0 million of annualized cost saving actions resulting in a year-to-date cumulative cost savings of $18.5 million annualized; Selling, general and administrative expense declined $2.5 million in the third quarter compared to the second quarter of 2020 and $8.3 million from the third quarter of 2019 Adjusted EBITDA is a non-GAAP measure. See appendix for reconciliation to GAAP measure.

2020 Transformation Update Additional $7.0 million in cost savings executed in Q3 2020, primarily in Eastern Hemisphere Year-to-date actions represent approximately $18.5 million in annualized savings Control what we can control: Continue to monitor market conditions and assess need for further cost saving actions Expected Operational Transformation Cumulative Annualized Cost Savings ($M) 2020 Transformation Well on Track to Deliver $20 Million in Annualized Savings $11.5 $20.5 Executed through Q2 2020 Executed through Q3 2020

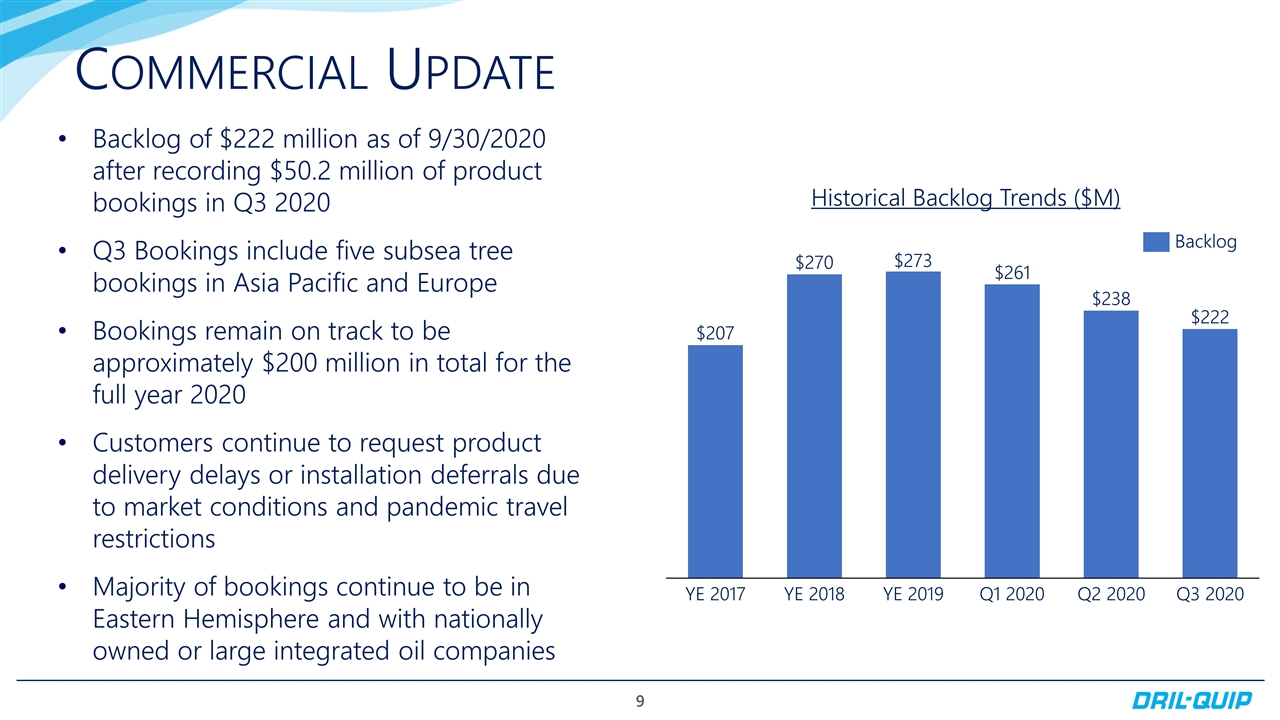

Commercial Update Backlog of $222 million as of 9/30/2020 after recording $50.2 million of product bookings in Q3 2020 Q3 Bookings include five subsea tree bookings in Asia Pacific and Europe Bookings remain on track to be approximately $200 million in total for the full year 2020 Customers continue to request product delivery delays or installation deferrals due to market conditions and pandemic travel restrictions Majority of bookings continue to be in Eastern Hemisphere and with nationally owned or large integrated oil companies Historical Backlog Trends ($M)

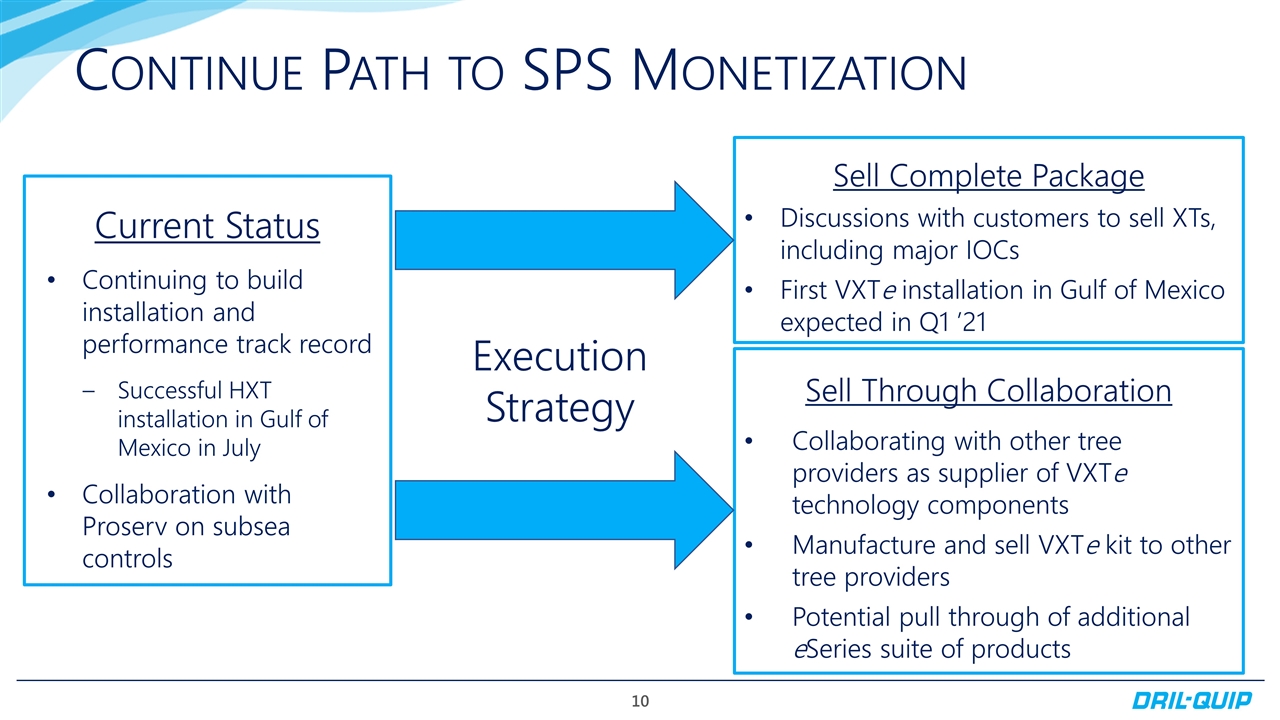

Continue Path to SPS Monetization Current Status Continuing to build installation and performance track record Successful HXT installation in Gulf of Mexico in July Collaboration with Proserv on subsea controls Sell Complete Package Discussions with customers to sell XTs, including major IOCs First VXTe installation in Gulf of Mexico expected in Q1 ’21 Sell Through Collaboration Collaborating with other tree providers as supplier of VXTe technology components Manufacture and sell VXTe kit to other tree providers Potential pull through of additional eSeries suite of products Execution Strategy

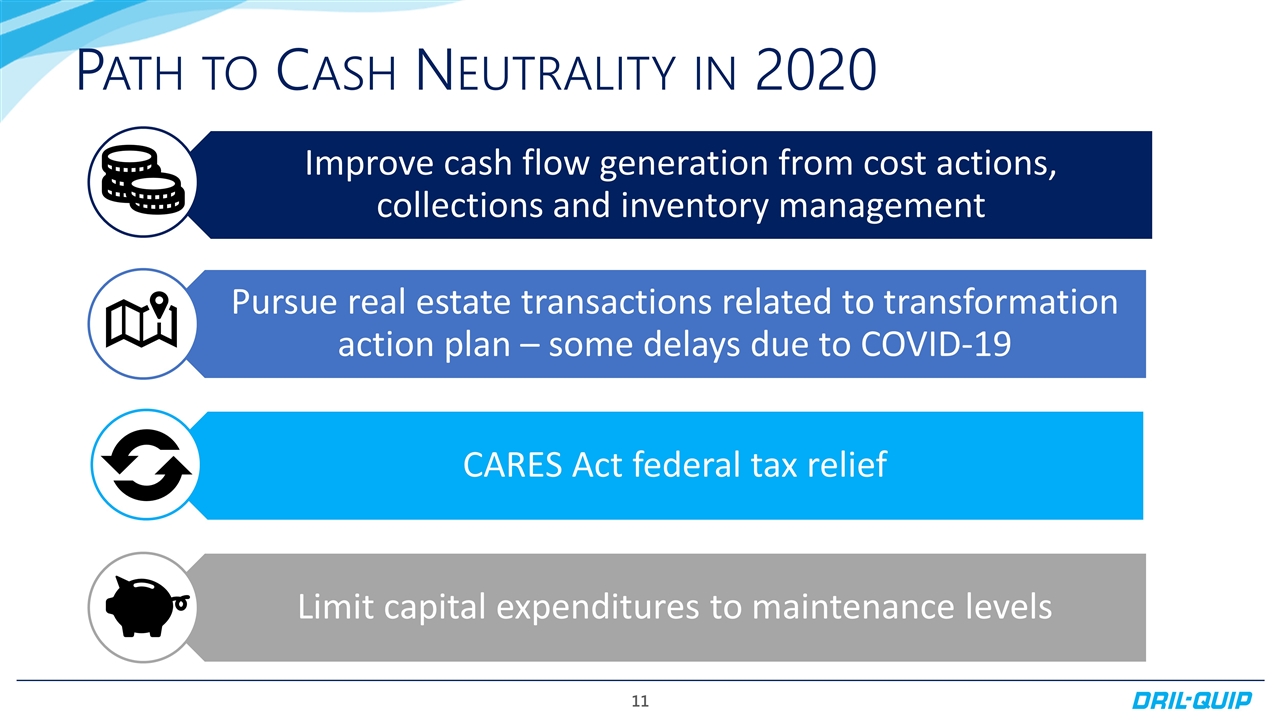

Path to Cash Neutrality in 2020 Improve cash flow generation from cost actions, collections and inventory management Pursue real estate transactions related to transformation action plan – some delays due to COVID-19 Limit capital expenditures to maintenance levels CARES Act federal tax relief

dril-quip.com | NYSE: DRQ APPENDIX

Optimizing Operational Footprint Executed Sales from Start of Transformation to YTD 2020 Six facilities sold for a total of approximately $7.8M Potential Additional Sales in 2020 Currently Listed Four facilities currently for sale with estimated value of $15 to $17 million Closing of transactions delayed due to COVID-19 continued disruptions Taking steps to further consolidate footprint to improve operational efficiency Facilities sold Facilities for sale Singapore

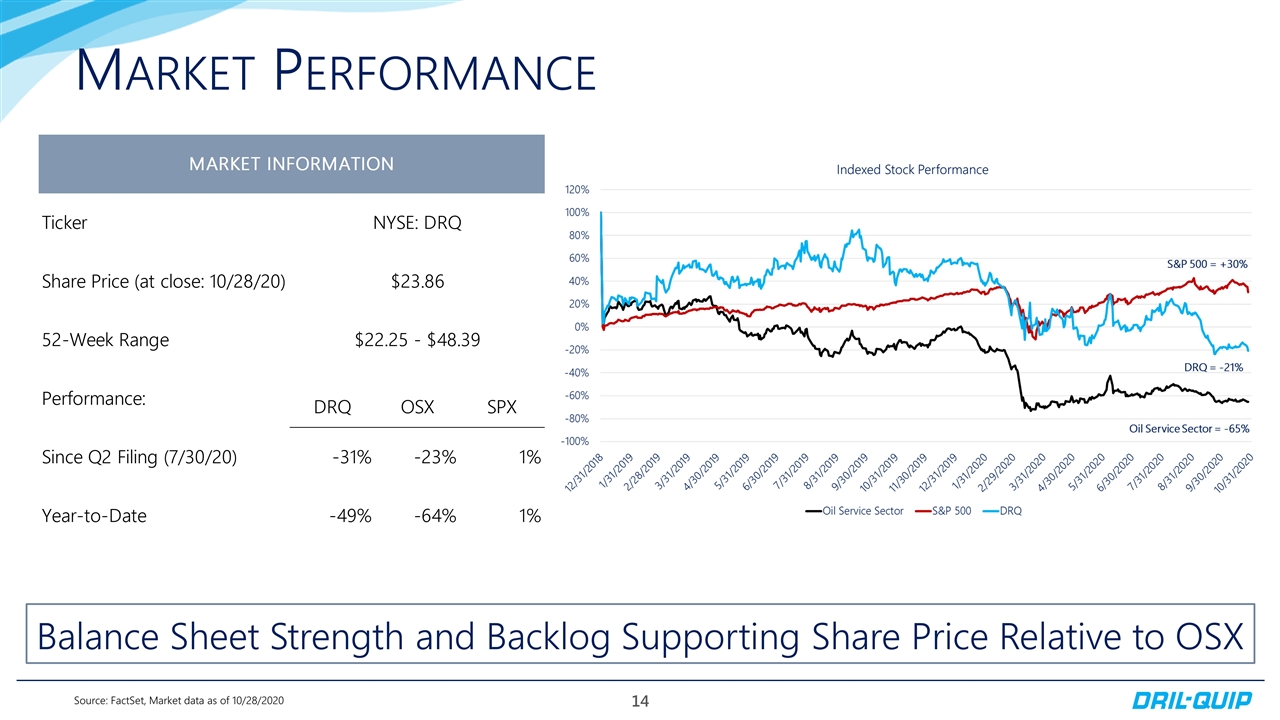

Market Performance Source: FactSet, Market data as of 10/28/2020 Balance Sheet Strength and Backlog Supporting Share Price Relative to OSX

Income Statement

Balance Sheet

Non-GAAP Financial Measures

Non-GAAP Financial Measures

Non-GAAP Financial Measures

Quarterly Capital Expenditures $2-$5 $12-$15 $2 Annual Maintenance Capex ~$10 - $15 million Note: Sum of components may not foot due to rounding. $ Millions Estimated Capex

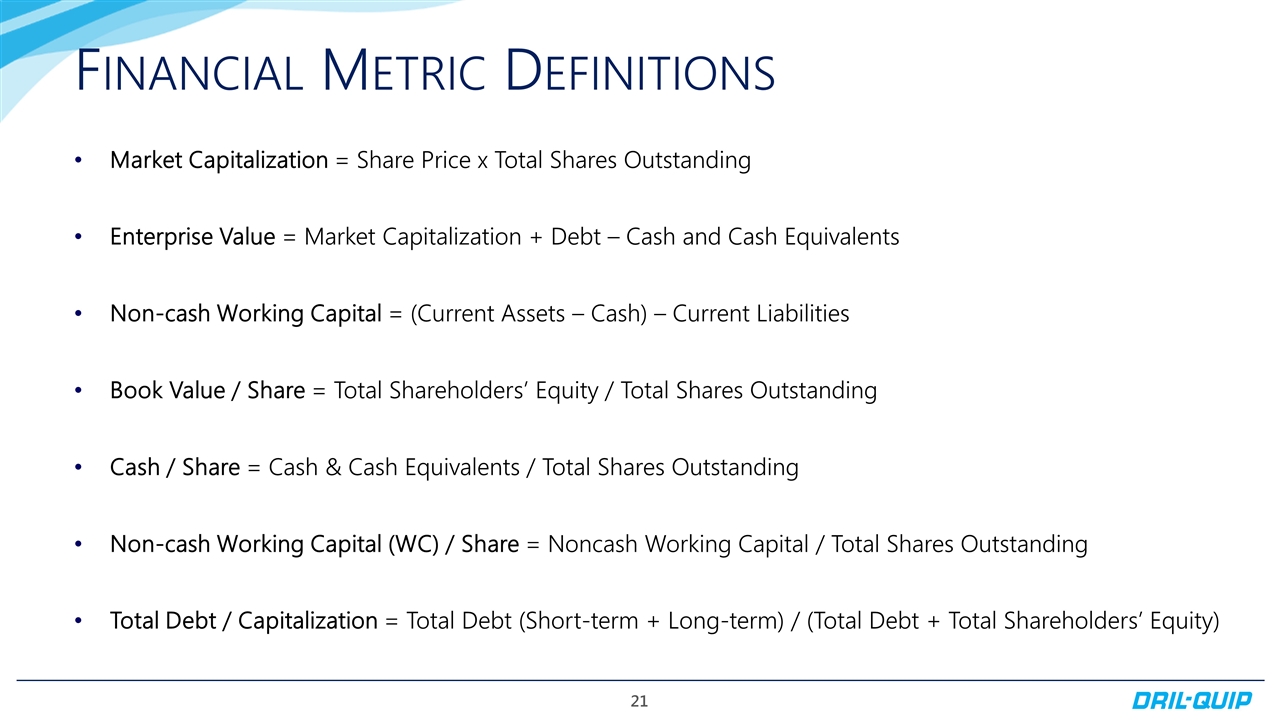

Financial Metric Definitions Market Capitalization = Share Price x Total Shares Outstanding Enterprise Value = Market Capitalization + Debt – Cash and Cash Equivalents Non-cash Working Capital = (Current Assets – Cash) – Current Liabilities Book Value / Share = Total Shareholders’ Equity / Total Shares Outstanding Cash / Share = Cash & Cash Equivalents / Total Shares Outstanding Non-cash Working Capital (WC) / Share = Noncash Working Capital / Total Shares Outstanding Total Debt / Capitalization = Total Debt (Short-term + Long-term) / (Total Debt + Total Shareholders’ Equity)