Form 8-K Bank7 Corp. For: Oct 29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

October 29, 2020

Bank7 Corp.

(Exact name of registrant as specified in its charter)

|

Oklahoma

|

001-38656

|

20-0764349

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

1039 N.W. 63rd Street, Oklahoma City, Oklahoma 73116

(Address of principal executive offices) (Zip Code)

(405) 810-8600

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading

Symbol(s)

|

Name of each exchange on which

registered

|

|

Common Stock, $0.01 par value

|

BSVN

|

The NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR

§240.12b-2).

|

|

Emerging growth company ☑

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

| Item 2.02. |

Results of Operations and Financial Condition

|

| Item 7.01 |

Regulation FD Disclosure

|

On October 29, 2020, Bank7 Corp. (the “Company”), the holding company for Bank7, issued a press release announcing its results of operation and financial condition for the three and nine month periods ended September

30, 2020. A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The Company is conducting a conference call on October 29, 2020 at 4:30 pm ET to discuss its third quarter 2020 financial results. A copy of the presentation slides to be used during the earnings call is attached

to this Current Report on Form 8-K as Exhibit 99.2 and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed “filed” for the purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act except as shall be expressly set

forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits

|

| (d) |

Exhibits.

|

The following exhibits are filed herewith:

|

Item

|

Description

|

|

|

Press Release dated October 29, 2020

|

||

|

Third Quarter 2020 Investor Presentation

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

BANK7 CORP.

|

||

|

Date: October 29, 2020

|

By:

|

/s/ Kelly J. Harris

|

|

Kelly J. Harris

|

||

|

Senior Vice President and Chief Financial Officer

|

||

Exhibit 99.1

BSVN 3Q 2020EARNINGS RELEASEOctober 29, 2020

1 BSVN – A Strong Value Proposition Company Highlights Positioned in a very dynamic market, with a

commercial banking emphasis that delivers services via a branch-lite model.Experienced and talented bankers focused on high-touch personalized service.Strong credit culture that adheres to a robust risk management framework resulting in

excellent credit quality, with a history of very low loan losses.Adherence to low expense levels resulting in a consistently low efficiency ratio.Shareholder alignment due to 70% insider ownership(1), with zero insider sales.Dividend is

strong with a current annualized yield of 4.25%(2). Healthy Capital and Strong Book Value Compounder CET1 of 12.84%, RBC of 14.09%, even after cash dividends of $8.8 million and stock buybacks of $7.2 million over the last four

quarters.Post IPO – over a two year period, our book value has increased 40%, and when paid cash dividends are considered, the total absolute return to shareholders exceeds 50%.(3)Disciplined buyback strategy: 985,654(1) shares were

repurchased at an average price of $8.70, which was immediately accretive and averaged approximately 82% of book value at time of purchase. Superior Core Earnings Despite struggling industry margins, we have consistently produced strong

PPE.(4)PPE strength far greater than peers: 3.36% PPE to average assets vs. peer average of 1.52%.(5) All data as of September 30, 2020 except for share buyback information, unless indicated otherwise.Data as of October 5, 2020.Annualized

dividend yield based on $0.10 quarterly dividend divided by quarter-end share price of $9.40.See full calculation on slide 3.Pre-tax pre-provision earnings (PPE) is a non-GAAP financial measure. See Appendix for reconciliation to its most

comparable GAAP measure.As of 2Q 2020. Peer group is defined as 192 exchange-traded banks nationwide with assets between $500 million and $5 billion, see slide 7.

2 3Q Overview Strong Asset Quality Continued Strong Performance Excellent PPE quarter of $7.4

million. YTD PPE of $22.9 million compared to $20.5 million(1) for YTD 2019, an increase of 11.6%.YTD TBV increase of $1.43 per share, which is a 19.5% annualized return. Enhanced DFAST Stress Test Reinforces Strength As disclosed in our

2Q 8-K:DFAST stress test results show continued ability to withstand pandemic-induced stress scenarios.Hypothetical loan losses during the DFAST timeframe totaled $27.5 million; nonetheless, over the same period it reflects our ability to

continue paying our regular dividend. Remarkably, CET1 increases to 16.40%, and total RBC increases to 17.65%. These hypothetical results further illustrate the advantage of our superior PPE levels. Continued strong focus on credit

discipline while increasing our ALLL reserve by 42% YTD.Energy loans in the moderate risk and elevated risk categories have improved from 2Q.Very few hospitality loans remain on payment deferral. Dollars are in millions. Pro Forma 2019 net

income is a non-GAAP financial measure which adds back the one-time, extraordinary compensation expense related to the non-cash executive stock transaction that took place during the period. See Pro Forma Net Income reconciliation table for

detailed calculation of this measure.

3 Outstanding Book Value Appreciation Since IPO Tangible Book Value We have provided a 40.16% book

value per share increase to shareholders since our IPO.When including the cash dividends, BSVN has produced a 51.23% overall return since our IPO. Dollars are in thousands, except for per share data

A Continuation of BSVN Exceptional Performance Return on Average Assets (1)(2) Return on Average

Tangible Common Equity (1) (2) Dollars are in millionsFinancial data is as of or for the twelve months ended December 31 of each respective year or for the nine months ended September 30, 2020.Profitability metrics are tax-adjusted as if the

Company were a C Corporation at the estimated tax rates for the respective periods. Pro Forma YTD ROAA, ROATCE, efficiency ratio, and noninterest expense to average assets ratio are non-GAAP financial measures. See non-GAAP reconciliation

table for reconciliation to their most comparable GAAP measures.Excludes the one-time, extraordinary compensation expense related to the non-cash executive stock transaction that took place during the period. See Pro Forma Net Income

reconciliation table for detailed calculation of this measure Efficiency Ratio(2) Even with the significant increase to our ALLL reserve, we continue to produce strong ROAA and ROATCE: 2.07% and 19.47% YTD, respectively. We have improved

upon our excellent efficiency ratio, which dropped from 37.1% in 3Q 19(3) to 36.3% at 3Q 20. 4 5-year average: 2.17% 5-year average: 22.7% Pro Forma Pro Forma Pro Forma 38.3% 2.51% 20.9%

Dollars are in millions. Financial data is as of or for the twelve months ended December 31 of each

respective year or the nine months ended September 30, 2020.Profitability metrics are tax-adjusted as if the Company were a C Corporation at the estimated tax rates for the respective periods. Combined federal and state effective tax rates

for the nine months ended September 30, 2019 and 2020 were 25.8% and 57.2% respectively. Pro Forma 2019 net income is a non-GAAP financial measure which adds back the one-time, extraordinary compensation expense related to the non-cash

executive stock transaction that took place during the period. See Pro Forma Net Income reconciliation table for detailed calculation of this measure. 11.7% increase YoY Strong Organic Growth and PPE PPE(1)(2) Total Assets 5 Pro

Forma $26.8 $20.5 Pro Forma We continue leveraging our employee base by combining technology with our branch-lite model.A history of strong organic growth.Consistently strong PPE. Leveraging Our Employee Base(2) 3.56%Actual Pro

Forma

6 Income Statement as a Percentage of Average Assets Dollars are in thousandsPeer group is defined as

exchange-traded banks nationwide with assets between $500mm-$5bn (192 banks); Source: S&P Global Market Intelligence.Excludes one-time, non-cash executive stock transfer compensation expense of $11,796.As of Q2 2020, the latest data

available. PPE to Average Assets – Much stronger than peers (3)

7 Earnings-driven cushion far exceeds regulatory minimums as illustrated over two years Dollars are

in millionsThe above assumes no cash dividends and is simply an illustration and should not be considered a projection or forward-looking guidance of any kind. Excess capital to target ratio expressed in % is the difference between the actual

ratio and regulatory minimum divided by the regulatory minimum.Excess capital to target ratio expressed in $ is the excess capital % multiplied by either average assets or risk-weighted assets, assuming a static balance sheet over the next 24

months. Trailing twelve months PPE of $29.23 million extrapolated over two years. Strong PPE Provides Excellent Shock-Absorption

Net Interest Margin Strength Financial data is as of or for the twelve months ended December 31 of

each respective year, and as of the three or nine month periods ended September 30, 2020.Net interest margin (excluding loan fee income) is a non-GAAP financial measure. See Appendix for reconciliation to their most comparable GAAP

measures. Net Interest Margin Despite the pandemic-induced stress which has temporarily reduced new loan opportunities, our margin continues to show strength. 8

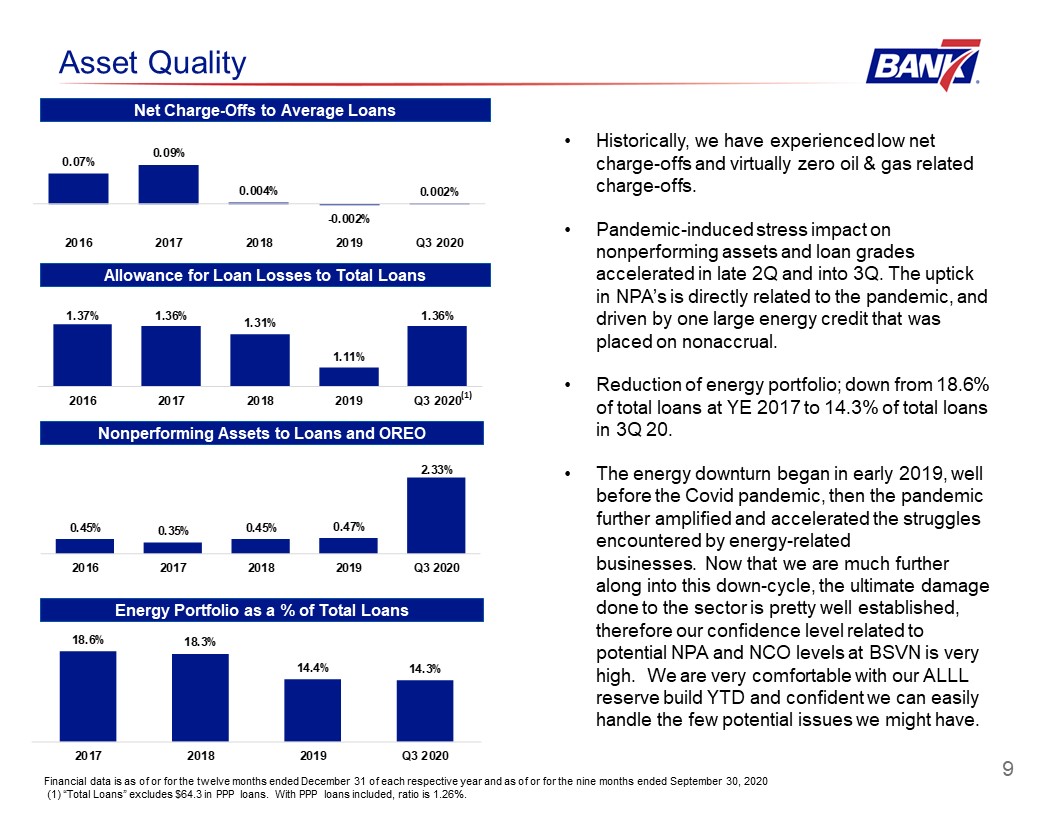

9 Allowance for Loan Losses to Total Loans Nonperforming Assets to Loans and OREO Asset Quality Net

Charge-Offs to Average Loans Financial data is as of or for the twelve months ended December 31 of each respective year and as of or for the nine months ended September 30, 202020. (1) “Total Loans” excludes $64.3 in PPP loans. With PPP

loans included, ratio is 1.26%. Historically, we have experienced low net charge-offs and virtually zero oil & gas related charge-offs.Pandemic-induced stress impact on nonperforming assets and loan grades accelerated in late 2Q and

into 3Q. The uptick in NPA’s is directly related to the pandemic, and driven by one large energy credit that was placed on nonaccrual. Reduction of energy portfolio; down from 18.6% of total loans at YE 2017 to 14.3% of total loans in 3Q

20.The energy downturn began in early 2019, well before the Covid pandemic, then the pandemic further amplified and accelerated the struggles encountered by energy-related businesses. Now that we are much further along into this down-cycle,

the ultimate damage done to the sector is pretty well established, therefore our confidence level related to potential NPA and NCO levels at BSVN is very high. We are very comfortable with our ALLL reserve build YTD and confident we can

easily handle the few potential issues we might have. (1) Energy Portfolio as a % of Total Loans

COVID-19 Loan Deferrals Dollars are in millions. Data as of September 30, 2020. All data excludes PPP

loans. COVID-19 Loan Deferrals – 2Q vs. 3Q 10 23 loans with outstanding balances of $121 million were on active payment deferrals as of 3Q. A decrease of 61% or $192 million from 2Q. Six loans with outstanding balances of $4 million are on

the first payment deferral with the remaining $117 million on continued deferment and/or modification. Hospitality loans represent 55% of the loans on active payment deferral with Other Income Producing CRE representing 26% of the remaining

deferred loan balances. There are no retail, restaurant or consumer loans in deferral as of 3Q and energy and ag loans represent 1% of loans on deferral with outstanding total balances of $401,000 and $870,000, respectively. Deferrals by

Loan Category 61.3% decrease QoQ

Hospitality Loan Portfolio Detail as of 3Q 20 11 Blue collar portfolio that is better protected by

the “cycle-down” effect of a recession. 28 out of 35 operating properties had returned to amortizing payments as of 9/30/20. Experienced owner/operators with decades of history that spans multiple recessions. Our operators only need 45-55%

occupancy to amortize debt. Average occupancy for the 28 amortizing properties was 61% for 3Q. Diversified exposure to many reputable brands.Concentrated in “Drive-To” markets with no exposure to “Gateway” cities.No exposure to towns or

cities that are heavily dependent on the energy space. Dollars are in millions.

12 Hospitality Loan Portfolio Detail as of 3Q 20 Equity advantage – Average loan per room is $45,400

vs. estimated replacement cost of $115,000 per room.Consistent underwriting fundamentals with disciplined equity requirements, minimum DCR hurdles, personal recourse, and rapid amortization. Portfolio Metrics – 35 Operating

Properties(1) Dollars are in millions except per room data. Data as of September 30, 2020.(1) Includes one hotel with a loan balance of $10.0 million that opened in August 2020, which has not yet reported its operating results.

13 Dollars are in millions. Data as of September 30, 2020. Energy Loan Portfolio Energy Portfolio as

a % of Total Loans Approximately 17% of outstanding energy loan balances received temporary payment relief during 2Q, but that number was down to one loan with a balance of $0.4 million as of 9/30/2020. The improvement was driven by

continued downsizing within our service company portfolio. Several borrowers have completed downsizing through asset sales and others are well into the process. As a result of the right-sizing efforts and improved activity levels, all but one

loan has returned to normal payments.E&P borrowers were impacted by lower prices; however, the few we have continue to perform at a high level, primarily due to their production consisting of more natural gas versus oil, hedging, and

minimal leverage. Midstream borrowers continue to be heavily impacted by reduced oilfield activity and COVID-related shutdowns, both of which have reduced or delayed revenue opportunities. Work backlogs and visibility improved marginally

during 3Q.Mineral/Royalty borrowers have experienced lower monthly revenues but they are operating with less leverage, therefore they were able to withstand temporary price declines with no payment modifications needed through 3Q. The overall

outstanding balance in this segment is expected to continue to contract.We are well into the energy downturn and we remain comfortable with our ALLL reserve levels.

Dollars are in millions Energy Portfolio Potential Exposure 14

Appendix 15

16 2019 Pro Forma Net Income Reconciliation On September 5, 2019, our largest shareholders, the

Haines Family Trusts, contributed approximately 6.5% of their shares (656,925 shares) to the Company. Subsequently, the Company immediately issued those shares to certain executive officers, which was charged as compensation expense of $11.8

million, including payroll taxes, through the income statement of the Company. Additionally, at the discretion of the employees receiving shares to assist in paying tax withholdings, 149,425 shares were withheld and subsequently canceled,

resulting in a charge to retained earnings of $2.6 million.

17 Bank7 Corp. Financials Net income and earnings per share are tax-adjusted as if the Company were a

C Corporation at the estimated tax rates for the respective periods. EPS calculation is based on diluted shares. Combined federal and state effective tax rates for the nine months ended September 30, 2019 and 2020 were 25.8% and 57.2%,

respectively. Represents a non-GAAP financial measure. See non-GAAP reconciliations table for reconciliation to its more comparable GAAP measure. All pro forma amounts relate to the one-time, non-cash executive stock transfer which occurred

in September 2019. These amounts remove the compensation expense and related tax impact from net income. See detail and reconciliation on slide 16 of this presentation.

18 Bank7 Corp. Financials Return on average assets and shareholders’ equity are tax-adjusted as if

the Company were a C Corporation at the estimated tax rates for the respective periods.Efficiency ratio is calculated by dividing noninterest expense by the sum of net interest income on a tax equivalent basis and noninterest income.

Represents a non-GAAP financial measure. See non-GAAP reconciliations table for reconciliation to its more comparable GAAP measure. Ratios are based on Bank level financial information rather than consolidated information. At September 30,

2020, Tier 1 leverage ratio, Tier 1 risk based capital ratio, and total risk-based capital ratios were 10.72%, 12.84%, and 14.09% respectively for the Company.All pro forma amounts relate to the one-time, non-cash executive stock transfer

which occurred in September 2019. These amounts remove the compensation expense and related tax impact from net income. See detail and reconciliation on slide 16 of this presentation.

19 Non-GAAP Reconciliations

Loan Portfolio Distribution Dollars are in millions. Data as of September 30, 2020. Gross Loan

Portfolio Composition by Purpose Type 20

Deposit Composition Historical Deposit Growth Compound Annual Growth Rate = 11.8% Deposit

Composition as of September 30, 2020 83.6% of our loan customers also had a deposit relationship with us as of September 30, 2020.Core Deposits(1)Total organic core deposit growth YOY was $178.8M, or 27.9%. Core deposits totaled $820.3

million as of September 30, 2020 compared to $641.5 million as of September 30, 2019. Dollars are in millions.Financial data is as of or for the twelve months ended December 31 of each respective year and as of or for the nine months ended

September 30, 2020.(1) We define core deposits as deposits obtained directly from the depositor and exclude deposits obtained from listing services and brokered deposits that are obtained through an intermediary. 28.4% Commentary 21

22 Important Presentation Information The 2020 Dodd-Frank Act Annual Stress Test Results Disclosure

(the “Stress Test Results”) included herein has not been prepared under accounting principles generally accepted in the United States of America (“GAAP”). The Stress Test Results present certain forward-looking projected financial measures

for the Company under the hypothetical severely adverse economic and market scenario, and required assumptions described herein. The Stress Test Results are not forecasts of actual financial results for the Company. Investors in securities

issued by the Company should not rely on the Stress Test Results as being indicative of expected future results or as a measure of the solvency or actual financial performance or condition of the Company. The stress testing of financial

institutions conducted by the Board of Governors of the Federal Reserve System (“FRB”) is based on models and methodologies developed or employed by the FRB. The FRB does not disclose all details of its models and methodologies. Therefore,

the Company may not be able to explain certain variances between the FRB’s projections and the Company’s Stress Test Results included herein.The Company’s financial information, prepared under GAAP, is available in reports filed with the

Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2019.Amounts presented are rounded to the nearest significant digit, as indicated or stated. Immaterial differences arising from the

effect of rounding are not adjusted.

23 Stress Test Methodology & Assumptions Stress Test Results Resulted in cumulative loan losses

over the DFAST period of $27.5 million, which is 3.69% of loans.Dividend payout was unaffected and continues to be paid. Annualized actual ROATCE through 3Q 20 was 19.8%, which declines to approximately 8% for the full year ending

2021.Capital ratios continue to grow: Applied the FRB’s DFAST methodology, and also used their projected losses by segment, as illustrated.Immediately reduced NIM to 4%, which was held flat.Significant non-accrual increase beginning now and

peaking in 2Q 21 to reach almost 9% of total loans.Averaged the recent FRB Covid U,V, and W shaped recovery scenarios which resulted in projected loan losses of 9.5%, then subtracted the consumer and trading & securities segments, as we

have virtually no exposure to those. Our scenario is also more severe than the 6.8% actual loan losses incurred during the global financial crisis, as reported in the June 2020 FRB Covid event. Those results were then tested against our

incurred loss model and individual credit reviews. DFAST projected losses - severely adverse scenario

24 Legal Information and Disclaimer This presentation and oral statements made regarding the subject

of this presentation contain forward-looking statements. These forward-looking statements are subject to significant uncertainties because they are based upon: the amount and timing of future changes in interest rates, market behavior, and

other economic conditions; future laws, regulations, and accounting principles; changes in regulatory standards and examination policies, and a variety of other matters. These other matters include, among other things, the impact of COVID-19

on the United States economy and our operations, the direct and indirect effect of economic conditions on interest rates, credit quality, loan demand, liquidity, and monetary and supervisory policies of banking regulators. These

forward-looking statements reflect Bank7 Corp.’s current views with respect to, among other things, future events and Bank7 Corp.’s financial performance. Any statements about Bank7 Corp.’s expectations, beliefs, plans, predictions,

forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “believes,”

“can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words or phrases. Any or all of the forward-looking statements in (or conveyed orally

regarding) this presentation may turn out to be inaccurate. The inclusion of or reference to forward-looking information in this presentation should not be regarded as a representation by Bank7 Corp. or any other person that the future plans,

estimates or expectations contemplated by Bank7 Corp. will be achieved. Bank7 Corp. has based these forward-looking statements largely on its current expectations and projections about future events and financial trends that Bank7 Corp.

believes may affect its financial condition, results of operations, business strategy and financial needs. Bank7 Corp.’s actual results could differ materially from those anticipated in such forward-looking statements as a result of risks,

uncertainties and assumptions that are difficult to predict. If one or more events related to these or other risks or uncertainties materialize, or if Bank7 Corp.’s underlying assumptions prove to be incorrect, actual results may differ

materially from what Bank7 Corp. anticipates. You are cautioned not to place undue reliance on forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made and Bank7 Corp. undertakes no

obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as may be required by law. All

forward-looking statements herein are qualified by these cautionary statements. Within this presentation, we reference certain market, industry and demographic data, forecasts and other statistical information. We have obtained this data,

forecasts and information from various independent, third party industry sources and publications. Nothing in the data, forecasts or information used or derived from third party sources should be construed as advice. Some data and other

information are also based on our good faith estimates, which are derived from our review of industry publications and surveys and independent sources. We believe that these sources and estimates are reliable, but have not independently

verified them. Statements as to our market position are based on market data currently available to us. Although we are not aware of any misstatements regarding the economic, employment, industry and other market data presented herein, these

estimates involve inherent risks and uncertainties and are based on assumptions that are subject to change. This presentation includes certain non-GAAP financial measures, including pro forma net income, tax-adjusted net income, tax-adjusted

earnings per share, tax-adjusted return on average assets and tax-adjusted return on average shareholders’ equity. These non-GAAP financial measures and any other non-GAAP financial measures that we discuss in this presentation should not be

considered in isolation, and should be considered as additions to, and not substitutes for or superior to, measures of financial performance prepared in accordance with GAAP. There are a number of limitations related to the use of these

non-GAAP financial measures versus their nearest GAAP equivalents. For example, other companies may calculate non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the

usefulness of Bank7 Corp.’s non-GAAP financial measures as tools for comparison. See the table on Slide 19 of this presentation for a reconciliation of the non-GAAP financial measures used in (or conveyed orally during) this presentation to

their most directly comparable GAAP financial measures.

Exhibit 99.2

FOR IMMEDIATE RELEASE: Bank7 Corp. Announces 3Q 2020 Earnings

Oklahoma City, OK, October 29, 2020 – Bank7 Corp. (NASDAQ: BSVN) ("the Company"), the parent company of Oklahoma City-based Bank7 (the "Bank"), today reported unaudited results for the fiscal quarter ended September 30, 2020. “We are pleased

with our third quarter results. Clearly, the pandemic and election dynamics continue to create extreme uncertainty and that is why we continue to increase our loan loss reserves. With that being said, we have a high degree of confidence in our

asset quality, and we know our strong PPE will carry us through the few potential issues we might encounter,” said Thomas L. Travis, President and CEO of the Company.

Three months ended September 30, 2020 compared to three months ended September 30, 2019:

| - |

Pre-tax, pre-provision earnings of $7.4 million, an increase of 7.57%, excluding the one-time, non-cash executive stock transaction expense in Q3 2019.

|

| - |

Interest income on loans, including loan fee income, totaled $12.8 million, an increase of 4.91%

|

| - |

Total assets of $973.4 million, an increase of 17.72%

|

| - |

Total loans of $869.4 million, an increase of 30.40%

|

| - |

Total deposits of $863.7 million, an increase of 14.02%

|

Nine months ended September 30, 2020 compared to nine months ended September 30, 2019:

| - |

Pre-tax, pre-provision earnings of $22.9 million, an increase of 11.63%, excluding the one-time, non-cash executive stock transaction expense in Q3 2019.

|

| - |

Interest income on loans, including loan fee income, totaled $39.3 million, an increase of 9.38%

|

| - |

Cost of funds was 0.81%, a decrease of 42.56%

|

| - |

Average loans of $807.1 million, an increase of 30.73%

|

| - |

Core deposits of $820.3 million, an increase of 27.87%

|

Both the Bank’s and the Company’s capital levels continue to be significantly above the minimum levels required to be designated as “well-capitalized” for regulatory purposes. At September 30, 2020 the Tier 1 leverage ratio, Tier 1 risk based

capital ratio, and total risk-based capital ratios were 10.72%, 12.85%, and 14.10% respectively for the Bank. At September 30, 2020 the Tier 1 leverage ratio, Tier 1 risk based capital ratio, and total risk-based capital ratios were 10.72%,

12.84%, and 14.09% respectively for the Company on a consolidated basis. Designation as a well-capitalized institution under regulations does not constitute a recommendation or endorsement by bank regulators.

Pre-tax, pre-provision earnings is defined as income before taxes and provision for loan losses. We believe the most directly comparable GAAP financial measure is income before taxes. Disclosure of this measure enables

you to compare our operations to those of other banking companies before consideration of taxes and provision expense. We calculate our tax-adjusted net income, return on average assets, and return on average equity, and per share amounts by using

a combined effective tax rate for federal and state income taxes of 27.3% and (31.4%) in the third quarter of 2020 and 2019, respectively. We acknowledge that our non-GAAP financial measures have a number of limitations. As such, you should not

view these disclosures as a substitute for results determined in accordance with GAAP, and they are not necessarily comparable to non-GAAP financial measures that other banking companies use. Other banking companies may use names similar to those

we use for non-GAAP financial measures we disclose, but may calculate them differently. You should understand how we and other companies each calculate their non-GAAP financial measures when making comparisons. The following reconciliation table

provides a more detailed analysis of these non-GAAP financial measures:

|

Three months ended

September 30,

|

Nine months ended

September 30,

|

|||||||||||||||

|

(Dollars in thousands, except per share data)

|

2020

|

2019

|

2020

|

2019

|

||||||||||||

|

Loan interest income (excluding loan fees)

|

||||||||||||||||

|

Total loan interest income, including loan fee income

|

$

|

12,777

|

$

|

12,179

|

$

|

39,268

|

$

|

35,902

|

||||||||

|

Loan fee income

|

(1,078

|

)

|

(841

|

)

|

(3,969

|

)

|

(3,498

|

)

|

||||||||

|

Loan interest income excluding loan fee income

|

$

|

11,699

|

$

|

11,338

|

$

|

35,299

|

$

|

32,404

|

||||||||

|

Average total loans

|

$

|

847,076

|

$

|

651,186

|

$

|

807,134

|

$

|

617,398

|

||||||||

|

Yield on loans (including loan fee income)

|

6.00

|

%

|

7.42

|

%

|

6.50

|

%

|

7.77

|

%

|

||||||||

|

Yield on loans (excluding loan fee income)

|

5.49

|

%

|

6.91

|

%

|

5.84

|

%

|

7.02

|

%

|

||||||||

|

Pre-tax, pre-provision net earnings

|

||||||||||||||||

|

Net income before income taxes

|

$

|

6,101

|

$

|

(4,963

|

)

|

$

|

19,567

|

$

|

8,688

|

|||||||

|

Plus: Provision (reversal of) for loan losses

|

(1,250

|

)

|

-

|

(3,300

|

)

|

-

|

||||||||||

|

Pre-tax, pre-provision net earnings

|

$

|

7,351

|

$

|

(4,963

|

)

|

$

|

22,867

|

$

|

8,688

|

|||||||

|

Adjusted provision for income tax

|

||||||||||||||||

|

Net income before income taxes

|

$

|

6,101

|

$

|

(4,963

|

)

|

$

|

19,567

|

$

|

8,688

|

|||||||

|

Total effective adjusted tax rate

|

27.2

|

%

|

-31.4

|

%

|

25.8

|

%

|

57.2

|

%

|

||||||||

|

Adjusted provision for income taxes

|

$

|

1,661

|

$

|

1,556

|

$

|

5,040

|

$

|

4,965

|

||||||||

|

Tax-adjusted net income

|

||||||||||||||||

|

Net income before income taxes

|

$

|

6,101

|

$

|

(4,963

|

)

|

$

|

19,567

|

$

|

8,688

|

|||||||

|

Adjusted provision for income taxes

|

1,661

|

1,556

|

5,040

|

4,965

|

||||||||||||

|

Tax-adjusted net income

|

$

|

4,440

|

$

|

(6,519

|

)

|

$

|

14,527

|

$

|

3,723

|

|||||||

|

Pro Forma Pre-tax, pre-provision net earnings

|

||||||||||||||||

|

Net income before income taxes

|

$

|

6,101

|

$

|

(4,963

|

)

|

$

|

19,567

|

$

|

8,688

|

|||||||

|

Plus: Provision (reversal of) loan losses

|

(1,250

|

)

|

-

|

(3,300

|

)

|

-

|

||||||||||

|

Plus: Stock Transfer Compensation Expense

|

-

|

11,797

|

-

|

11,797

|

||||||||||||

|

Pro Forma Pre-tax, pre-provision net earnings

|

$

|

7,351

|

$

|

6,834

|

$

|

22,867

|

$

|

20,485

|

||||||||

|

Tax-adjusted ratios and per share data

|

||||||||||||||||

|

Tax-adjusted net income (numerator)

|

$

|

4,440

|

$

|

(6,519

|

)

|

$

|

14,527

|

$

|

3,723

|

|||||||

|

Average assets (denominator)

|

$

|

967,044

|

$

|

806,440

|

$

|

937,849

|

$

|

782,694

|

||||||||

|

Tax-adjusted return on average assets

|

1.83

|

%

|

-3.21

|

%

|

3.11

|

%

|

0.64

|

%

|

||||||||

|

Average shareholders' equity (denominator)

|

$

|

102,929

|

$

|

100,012

|

$

|

101,377

|

$

|

95,655

|

||||||||

|

Tax-adjusted return on average shareholders' equity

|

17.16

|

%

|

-25.86

|

%

|

19.14

|

%

|

5.20

|

%

|

||||||||

|

Average tangible common equity (denominator)

|

$

|

101,269

|

$

|

98,145

|

$

|

99,667

|

$

|

93,736

|

||||||||

|

Tax-adjusted return on average tangible common equity

|

17.44

|

%

|

-26.35

|

%

|

19.47

|

%

|

5.31

|

%

|

||||||||

|

Weighted average common shares outstanding basic (denominator)

|

9,228,128

|

10,149,007

|

9,483,540

|

10,174,528

|

||||||||||||

|

Tax-adjusted net income per common share--basic

|

$

|

0.48

|

$

|

(0.64

|

)

|

$

|

1.53

|

$

|

0.37

|

|||||||

|

Weighted average common shares outstanding diluted (denominator)

|

9,228,128

|

10,161,778

|

9,483,540

|

10,176,360

|

||||||||||||

|

Tax-adjusted net income per common share--diluted

|

$

|

0.48

|

$

|

(0.64

|

)

|

$

|

1.53

|

$

|

0.37

|

|||||||

|

Tangible assets

|

||||||||||||||||

|

Total assets

|

$

|

973,354

|

$

|

826,821

|

||||||||||||

|

Less: Goodwill and intangibles

|

(1,634

|

)

|

(1,840

|

)

|

||||||||||||

|

Tangible assets

|

$

|

971,720

|

$

|

824,981

|

||||||||||||

|

Tangible shareholders' equity

|

||||||||||||||||

|

Total shareholders' equity

|

$

|

105,230

|

$

|

100,615

|

||||||||||||

|

Less: Goodwill and intangibles

|

(1,634

|

)

|

(1,840

|

)

|

||||||||||||

|

Tangible shareholders' equity

|

$

|

103,596

|

$

|

98,775

|

||||||||||||

|

Tangible shareholders' equity

|

||||||||||||||||

|

Tangible shareholders' equity (numerator)

|

$

|

103,596

|

$

|

98,775

|

||||||||||||

|

Tangible assets (denominator)

|

$

|

971,720

|

$

|

824,981

|

||||||||||||

|

Tangible common equity to tangible assets

|

10.66

|

%

|

11.97

|

%

|

||||||||||||

|

End of period common shares outstanding

|

9,241,689

|

10,057,506

|

||||||||||||||

|

Book value per share

|

$

|

11.39

|

$

|

10.00

|

||||||||||||

|

Tangible book value per share

|

$

|

11.21

|

$

|

9.82

|

||||||||||||

|

Total shareholders' equity to total assets

|

10.81

|

%

|

12.17

|

%

|

||||||||||||

| Net Interest Margin Excluding Loan Fee Income | ||||||||||||||||||||||||

| For the Three Months Ended September 30, |

||||||||||||||||||||||||

| 2020 | 2019 | |||||||||||||||||||||||

|

Average

Balance

|

Interest

Income/

Expense

|

Average

Yield/

Rate

|

Average

Balance

|

Interest

Income/

Expense

|

Average

Yield/

Rate

|

|||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||

|

Interest-earning assets:

|

||||||||||||||||||||||||

|

Short-term investments(1)

|

$

|

111,019

|

$

|

147

|

0.53

|

%

|

$

|

145,147

|

$

|

888

|

2.43

|

%

|

||||||||||||

|

Investment securities(2)

|

1,138

|

2

|

0.70

|

1,069

|

4

|

1.48

|

||||||||||||||||||

|

Loans held for sale

|

425

|

—

|

0.00

|

265

|

—

|

0.00

|

||||||||||||||||||

|

Total loans(3)

|

847,076

|

11,699

|

5.49

|

651,186

|

11,338

|

6.91

|

||||||||||||||||||

|

Total interest-earning assets

|

959,658

|

11,848

|

4.91

|

797,667

|

12,230

|

6.08

|

||||||||||||||||||

|

Noninterest-earning assets

|

7,386

|

8,773

|

||||||||||||||||||||||

|

Total assets

|

$

|

967,044

|

$

|

806,440

|

||||||||||||||||||||

|

Funding sources:

|

||||||||||||||||||||||||

|

Interest-bearing liabilities:

|

||||||||||||||||||||||||

|

Deposits:

|

||||||||||||||||||||||||

|

Transaction accounts

|

$

|

381,572

|

545

|

0.57

|

%

|

$

|

287,241

|

1,234

|

1.70

|

%

|

||||||||||||||

|

Time deposits

|

200,961

|

780

|

1.54

|

220,935

|

1,237

|

2.22

|

||||||||||||||||||

|

Total interest-bearing deposits

|

582,533

|

1,325

|

0.90

|

508,176

|

2,471

|

1.93

|

||||||||||||||||||

|

Other borrowings

|

—

|

—

|

0.00

|

—

|

—

|

0.00

|

||||||||||||||||||

|

Total interest-bearing liabilities

|

582,533

|

1,325

|

0.90

|

508,176

|

2,471

|

1.93

|

||||||||||||||||||

|

Noninterest-bearing liabilities:

|

||||||||||||||||||||||||

|

Noninterest-bearing deposits

|

276,219

|

193,785

|

||||||||||||||||||||||

|

Other noninterest-bearing liabilities

|

5,363

|

4,467

|

||||||||||||||||||||||

|

Total noninterest-bearing liabilities

|

281,582

|

198,252

|

||||||||||||||||||||||

|

Shareholders’ equity

|

102,929

|

100,012

|

||||||||||||||||||||||

|

Total liabilities and shareholders’ equity

|

$

|

967,044

|

$

|

806,440

|

||||||||||||||||||||

|

Net interest income including loan fee income

|

$

|

10,523

|

$

|

9,759

|

||||||||||||||||||||

|

Net interest spread including loan fee income(4)

|

4.01

|

%

|

4.15

|

%

|

||||||||||||||||||||

|

Net interest margin including loan fee income

|

4.36

|

%

|

4.85

|

%

|

||||||||||||||||||||

|

Net Interest Margin With Loan Fee Income

|

||||||||||||||||||||||||

|

For the Three Months Ended September 30,

|

||||||||||||||||||||||||

| 2020 | 2019 | |||||||||||||||||||||||

|

Average

Balance

|

Interest

Income/

Expense

|

Average

Yield/

Rate

|

Average

Balance

|

Interest

Income/

Expense

|

Average

Yield/

Rate

|

|||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||

|

Interest-earning assets:

|

||||||||||||||||||||||||

|

Short-term investments(1)

|

$

|

111,019

|

$

|

147

|

0.53

|

%

|

$

|

145,147

|

$

|

888

|

2.43

|

%

|

||||||||||||

|

Investment securities(2)

|

1,138

|

2

|

0.70

|

1,069

|

4

|

1.48

|

||||||||||||||||||

|

Loans held for sale

|

425

|

—

|

0.00

|

265

|

—

|

0.00

|

||||||||||||||||||

|

Total loans(3)

|

847,076

|

12,777

|

6.00

|

651,186

|

12,179

|

7.42

|

||||||||||||||||||

|

Total interest-earning assets

|

959,658

|

12,926

|

5.36

|

797,667

|

13,071

|

6.50

|

||||||||||||||||||

|

Noninterest-earning assets

|

7,386

|

8,773

|

||||||||||||||||||||||

|

Total assets

|

$

|

967,044

|

$

|

806,440

|

||||||||||||||||||||

|

Funding sources:

|

||||||||||||||||||||||||

|

Interest-bearing liabilities:

|

||||||||||||||||||||||||

|

Deposits:

|

||||||||||||||||||||||||

|

Transaction accounts

|

$

|

381,572

|

545

|

0.57

|

%

|

$

|

287,241

|

1,234

|

1.70

|

%

|

||||||||||||||

|

Time deposits

|

200,961

|

780

|

1.54

|

220,935

|

1,237

|

2.22

|

||||||||||||||||||

|

Total interest-bearing deposits

|

582,533

|

1,325

|

0.90

|

508,176

|

2,471

|

1.93

|

||||||||||||||||||

|

Other borrowings

|

—

|

—

|

0.00

|

—

|

—

|

0.00

|

||||||||||||||||||

|

Total interest-bearing liabilities

|

582,533

|

1,325

|

0.90

|

508,176

|

2,471

|

1.93

|

||||||||||||||||||

|

Noninterest-bearing liabilities:

|

||||||||||||||||||||||||

|

Noninterest-bearing deposits

|

276,219

|

193,785

|

||||||||||||||||||||||

|

Other noninterest-bearing liabilities

|

5,363

|

4,467

|

||||||||||||||||||||||

|

Total noninterest-bearing liabilities

|

281,582

|

197,252

|

||||||||||||||||||||||

|

Shareholders’ equity

|

102,929

|

100,012

|

||||||||||||||||||||||

|

Total liabilities and shareholders’ equity

|

$

|

967,044

|

$

|

806,440

|

||||||||||||||||||||

|

Net interest income excluding loan fee income

|

$

|

11,601

|

$

|

10,600

|

||||||||||||||||||||

|

Net interest spread excluding loan fee income(4)

|

4.45

|

%

|

4.57

|

%

|

||||||||||||||||||||

|

Net interest margin excluding loan fee income

|

4.81

|

%

|

5.27

|

%

|

||||||||||||||||||||

| (1) |

Includes income and average balances for fed funds sold, interest-earning deposits in banks and other miscellaneous interest-earning assets.

|

| (2) |

Includes income and average balances for FHLB and FRB stock.

|

| (3) |

Non-accrual loans are included in loans.

|

| (4) |

Net interest spread is the average yield on interest-earning assets minus the average rate on interest-bearing liabilities.

|

|

Net Interest Margin Excluding Loan Fee Income

|

||||||||||||||||||||||||

|

For the Nine Months Ended September 30,

|

||||||||||||||||||||||||

| 2020 | 2019 | |||||||||||||||||||||||

|

Average

Balance

|

Interest

Income/

Expense

|

Average

Yield/

Rate

|

Average

Balance

|

Interest

Income/

Expense

|

Average

Yield/

Rate

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

Interest-earning assets:

|

||||||||||||||||||||||||

|

Short-term investments(1)

|

$

|

120,909

|

$

|

701

|

0.77

|

%

|

$

|

155,073

|

$

|

2,785

|

2.40

|

%

|

||||||||||||

|

Investment securities(2)

|

1,109

|

21

|

2.53

|

1,062

|

27

|

3.40

|

||||||||||||||||||

|

Loans held for sale

|

258

|

—

|

0.00

|

219

|

—

|

0.00

|

||||||||||||||||||

|

Total loans(3)

|

807,134

|

35,299

|

5.84

|

617,398

|

32,404

|

7.02

|

||||||||||||||||||

|

Total interest-earning assets

|

929,410

|

36,021

|

5.18

|

773,752

|

35,216

|

6.09

|

||||||||||||||||||

|

Noninterest-earning assets

|

8,439

|

8,942

|

||||||||||||||||||||||

|

Total assets

|

$

|

937,849

|

$

|

782,694

|

||||||||||||||||||||

|

Funding sources:

|

||||||||||||||||||||||||

|

Interest-bearing liabilities:

|

||||||||||||||||||||||||

|

Deposits:

|

||||||||||||||||||||||||

|

Transaction accounts

|

$

|

366,162

|

2,259

|

0.82

|

%

|

$

|

289,306

|

3,924

|

1.81

|

%

|

||||||||||||||

|

Time deposits

|

208,650

|

2,769

|

1.77

|

206,575

|

3,254

|

2.11

|

||||||||||||||||||

|

Total interest-bearing deposits

|

574,812

|

5,028

|

1.17

|

495,881

|

7,178

|

1.94

|

||||||||||||||||||

|

Other borrowings

|

—

|

—

|

0.00

|

—

|

—

|

0.00

|

||||||||||||||||||

|

Total interest-bearing liabilities

|

574,812

|

5,028

|

1.17

|

495,881

|

7,178

|

1.94

|

||||||||||||||||||

|

Noninterest-bearing liabilities:

|

||||||||||||||||||||||||

|

Noninterest-bearing deposits

|

256,429

|

186,379

|

||||||||||||||||||||||

|

Other noninterest-bearing liabilities

|

5,231

|

4,779

|

||||||||||||||||||||||

|

Total noninterest-bearing liabilities

|

261,660

|

191,158

|

||||||||||||||||||||||

|

Shareholders’ equity

|

101,377

|

95,655

|

||||||||||||||||||||||

|

Total liabilities and shareholders’ equity

|

$

|

937,849

|

$

|

782,694

|

||||||||||||||||||||

|

Net interest income including loan fee income

|

$

|

30,993

|

$

|

28,038

|

||||||||||||||||||||

|

Net interest spread including loan fee income(4)

|

4.01

|

%

|

4.15

|

%

|

||||||||||||||||||||

|

Net interest margin including loan fee income

|

4.45

|

%

|

4.84

|

%

|

||||||||||||||||||||

|

Net Interest Margin With Loan Fee Income

|

||||||||||||||||||||||||

|

For the Nine Months Ended September 30,

|

||||||||||||||||||||||||

| 2020 | 2019 | |||||||||||||||||||||||

|

Average

Balance

|

Interest

Income/

Expense

|

Average

Yield/

Rate

|

Average

Balance

|

Interest

Income/

Expense

|

Average

Yield/

Rate

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

Interest-earning assets:

|

||||||||||||||||||||||||

|

Short-term investments(1)

|

$

|

120,909

|

$

|

701

|

0.77

|

%

|

$

|

155,073

|

$

|

2,785

|

2.40

|

%

|

||||||||||||

|

Investment securities(2)

|

1,109

|

21

|

2.53

|

1,062

|

27

|

3.40

|

||||||||||||||||||

|

Loans held for sale

|

258

|

—

|

0.00

|

219

|

—

|

0.00

|

||||||||||||||||||

|

Total loans(3)

|

807,134

|

39,268

|

6.50

|

617,398

|

35,902

|

7.77

|

||||||||||||||||||

|

Total interest-earning assets

|

929,410

|

39,990

|

5.75

|

773,752

|

38,714

|

6.69

|

||||||||||||||||||

|

Noninterest-earning assets

|

8,439

|

8,942

|

||||||||||||||||||||||

|

Total assets

|

$

|

937,849

|

$

|

782,694

|

||||||||||||||||||||

|

Funding sources:

|

||||||||||||||||||||||||

|

Interest-bearing liabilities:

|

||||||||||||||||||||||||

|

Deposits:

|

||||||||||||||||||||||||

|

Transaction accounts

|

$

|

366,162

|

2,259

|

0.82

|

%

|

$

|

289,306

|

3,924

|

1.81

|

%

|

||||||||||||||

|

Time deposits

|

208,650

|

2,769

|

1.77

|

206,575

|

3,254

|

2.11

|

||||||||||||||||||

|

Total interest-bearing deposits

|

574,812

|

5,028

|

1.17

|

495,881

|

7,178

|

1.94

|

||||||||||||||||||

|

Other borrowings

|

—

|

—

|

0.00

|

—

|

—

|

0.00

|

||||||||||||||||||

|

Total interest-bearing liabilities

|

574,812

|

5,028

|

1.17

|

495,881

|

7,178

|

1.94

|

||||||||||||||||||

|

Noninterest-bearing liabilities:

|

||||||||||||||||||||||||

|

Noninterest-bearing deposits

|

256,429

|

186,379

|

||||||||||||||||||||||

|

Other noninterest-bearing liabilities

|

5,231

|

4,779

|

||||||||||||||||||||||

|

Total noninterest-bearing liabilities

|

261,660

|

191,158

|

||||||||||||||||||||||

|

Shareholders’ equity

|

101,377

|

95,655

|

||||||||||||||||||||||

|

Total liabilities and shareholders’ equity

|

$

|

937,849

|

$

|

782,694

|

||||||||||||||||||||

|

Net interest income excluding loan fee income

|

$

|

34,962

|

$

|

31,536

|

||||||||||||||||||||

|

Net interest spread excluding loan fee income(4)

|

4.58

|

%

|

4.75

|

%

|

||||||||||||||||||||

|

Net interest margin excluding loan fee income

|

5.02

|

%

|

5.45

|

%

|

||||||||||||||||||||

Bank7 Corp.

Consolidated Balance Sheets

|

Dollars in thousands, exceper per share data

|

Unaudited as of

|

|||||||||||

|

Assets

|

September 30,

|

December 31,

|

||||||||||

|

2020

|

2019

|

2019

|

||||||||||

|

Cash and due from banks

|

$

|

60,718

|

$

|

110,594

|

$

|

117,128

|

||||||

|

Interest-bearing time deposits in other banks

|

23,384

|

31,890

|

30,147

|

|||||||||

|

Loans, net

|

869,448

|

666,755

|

699,458

|

|||||||||

|

Loans held for sale

|

315

|

-

|

1,031

|

|||||||||

|

Premises and equipment, net

|

9,387

|

8,395

|

9,624

|

|||||||||

|

Nonmarketable equity securities

|

1,165

|

1,072

|

1,100

|

|||||||||

|

Foreclosed assets held for sale

|

-

|

77

|

0

|

|||||||||

|

Goodwill and intangibles

|

1,634

|

1,840

|

1,789

|

|||||||||

|

Interest receivable and other assets

|

7,303

|

6,198

|

6,115

|

|||||||||

|

Total assets

|

$

|

973,354

|

$

|

826,821

|

$

|

866,392

|

||||||

|

Liabilities and Shareholders’ Equity

|

||||||||||||

|

Deposits

|

||||||||||||

|

Noninterest-bearing

|

$

|

272,008

|

$

|

202,989

|

$

|

219,221

|

||||||

|

Interest-bearing

|

591,661

|

519,145

|

538,262

|

|||||||||

|

Total deposits

|

863,669

|

722,134

|

757,483

|

|||||||||

|

Income taxes payable

|

565

|

-

|

357

|

|||||||||

|

Interest payable and other liabilities

|

3,890

|

4,072

|

8,426

|

|||||||||

|

Total liabilities

|

868,124

|

726,206

|

766,266

|

|||||||||

|

Common stock

|

92

|

101

|

101

|

|||||||||

|

Additional paid-in capital

|

92,960

|

92,353

|

92,391

|

|||||||||

|

Retained earnings

|

12,178

|

8,161

|

7,634

|

|||||||||

|

Total shareholders’ equity

|

105,230

|

100,615

|

100,126

|

|||||||||

|

|

||||||||||||

|

Total liabilities and shareholders’ equity

|

$

|

973,354

|

$

|

826,821

|

$

|

866,392

|

||||||

Bank7 Corp.

Consolidated Statements of Income

|

Unaudited as of

|

||||||||||||||||

|

Three Months Ended

|

Nine Months Ended

|

|||||||||||||||

|

September 30,

|

September 30,

|

|||||||||||||||

|

Dollars in thousands, exceper per share data

|

2020

|

2019

|

2020

|

2019

|

||||||||||||

|

Interest Income

|

||||||||||||||||

|

Loans, including fees

|

$

|

12,777

|

$

|

12,179

|

$

|

39,268

|

$

|

35,902

|

||||||||

|

Interest-bearing time deposits in other banks

|

124

|

500

|

419

|

1,414

|

||||||||||||

|

Interest-bearing deposits in other banks

|

26

|

392

|

303

|

1,398

|

||||||||||||

|

Total interest income

|

12,927

|

13,071

|

39,990

|

38,714

|

||||||||||||

|

Interest Expense

|

||||||||||||||||

|

Deposits

|

1,326

|

2,471

|

5,028

|

7,178

|

||||||||||||

|

Total interest expense

|

1,326

|

2,471

|

5,028

|

7,178

|

||||||||||||

|

Net Interest Income

|

11,601

|

10,600

|

34,962

|

31,536

|

||||||||||||

|

Provision for Loan Losses

|

1,250

|

-

|

3,300

|

-

|

||||||||||||

|

Net Interest Income After Provision for Loan Losses

|

10,351

|

10,600

|

31,662

|

31,536

|

||||||||||||

|

Noninterest Income

|

||||||||||||||||

|

Secondary market income

|

57

|

69

|

134

|

146

|

||||||||||||

|

Service charges on deposit accounts

|

104

|

110

|

318

|

279

|

||||||||||||

|

Other

|

173

|

330

|

513

|

602

|

||||||||||||

|

Total noninterest income

|

334

|

509

|

965

|

1,027

|

||||||||||||

|

Noninterest Expense

|

||||||||||||||||

|

Salaries and employee benefits

|

2,505

|

14,256

|

7,576

|

18,792

|

||||||||||||

|

Furniture and equipment

|

224

|

229

|

658

|

606

|

||||||||||||

|

Occupancy

|

543

|

436

|

1,417

|

1,157

|

||||||||||||

|

Data and item processing

|

276

|

276

|

821

|

814

|

||||||||||||

|

Accounting, marketing and legal fees

|

135

|

218

|

338

|

507

|

||||||||||||

|

Regulatory assessments

|

164

|

31

|

281

|

94

|

||||||||||||

|

Advertising and public relations

|

62

|

71

|

360

|

349

|

||||||||||||

|

Travel, lodging and entertainment

|

50

|

153

|

146

|

287

|

||||||||||||

|

Other

|

625

|

402

|

1,463

|

1,269

|

||||||||||||

|

Total noninterest expense

|

4,584

|

16,072

|

13,060

|

23,875

|

||||||||||||

|

Income Before Taxes

|

6,101

|

(4,963

|

)

|

19,567

|

8,688

|

|||||||||||

|

Income tax expense

|

1,661

|

1,556

|

5,040

|

4,965

|

||||||||||||

|

Net Income

|

$

|

4,440

|

$

|

(6,519

|

)

|

$

|

14,527

|

$

|

3,723

|

|||||||

|

Earnings per common share - basic

|

$

|

0.48

|

$

|

(0.64

|

)

|

$

|

1.53

|

$

|

0.37

|

|||||||

|

Diluted earnings per common share

|

0.48

|

(0.64

|

)

|

1.53

|

0.37

|

|||||||||||

|

Weighted average common shares outstanding - basic

|

9,228,128

|

10,149,007

|

9,483,540

|

10,174,528

|

||||||||||||

|

Weighted average common shares outstanding - diluted

|

9,228,128

|

10,161,778

|

9,483,540

|

10,176,360

|

||||||||||||

About Bank7 Corp.

We are Bank7 Corp., a bank holding company headquartered in Oklahoma City, Oklahoma. Through our wholly-owned subsidiary, Bank7, we operate nine locations in Oklahoma, the Dallas/Fort Worth, Texas metropolitan area and

Kansas. We are focused on serving business owners and entrepreneurs by delivering fast, consistent and well-designed loan and deposit products to meet their financing needs. We intend to grow organically by selectively opening additional branches

in our target markets as well as pursue strategic acquisitions.

Conference call

Bank7 Corp. has scheduled a conference call to discuss its first quarter results, which will be broadcast live over the Internet, on Thursday, October 29, 2020 at 4:30 p.m. Eastern Time. To participate in the call, dial 1-888-348-6421, or access

it live over the Internet at https://www.webcaster4.com/Webcast/Page/2179/38169. For those not able to participate in the live call, an archive of the webcast will be available at https://www.webcaster4.com/Webcast/Page/2179/38169

shortly after the call for 1 year.

Cautionary Statements Regarding Forward-Looking Information

This communication contains a number of forward-looking statements. These forward-looking statements reflect Bank7 Corp.’s current views with respect to, among other things, future events and Bank7 Corp.’s financial performance. Any statements

about Bank7 Corp.’s expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use

of words or phrases such as “anticipate,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words or phrases. Any or all of the

forward-looking statements in (or conveyed orally regarding) this presentation may turn out to be inaccurate. The inclusion of or reference to forward-looking information in this presentation should not be regarded as a representation by Bank7

Corp. or any other person that the future plans, estimates or expectations contemplated by Bank7 Corp. will be achieved.

These forward-looking statements are subject to significant uncertainties because they are based upon: the amount and timing of future changes in interest rates, market behavior, and other economic conditions; future laws, regulations, and

accounting principles; changes in regulatory standards and examination policies, and a variety of other matters. These other matters include, among other things, the impact of COVID-19 on the United States economy and our operations, the direct

and indirect effect of economic conditions on interest rates, credit quality, loan demand, liquidity, and monetary and supervisory policies of banking regulators. Bank7 Corp. has based these forward-looking statements largely on its current

expectations and projections about future events and financial trends that Bank7 Corp. believes may affect its financial condition, results of operations, business strategy and financial needs. Bank7 Corp.’s actual results could differ materially

from those anticipated in such forward-looking statements as a result of risks, uncertainties and assumptions that are difficult to predict. If one or more events related to these or other risks or uncertainties materialize, or if Bank7 Corp.’s

underlying assumptions prove to be incorrect, actual results may differ materially from what Bank7 Corp. anticipates. You are cautioned not to place undue reliance on forward-looking statements. Further, any forward-looking statement speaks only as

of the date on which it is made and Bank7 Corp. undertakes no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of

unanticipated events, except as may be required by law. All forward-looking statements herein are qualified by these cautionary statements.

About Non-GAAP Financial Measures

This communication includes certain non-GAAP financial measures, including tax-adjusted net income, tax-adjusted earnings per share, tax-adjusted return on average assets and tax-adjusted return on average shareholders’ equity. These non-GAAP

financial measures and any other non-GAAP financial measures that we discuss in this presentation should not be considered in isolation, and should be considered as additions to, and not substitutes for or superior to, measures of financial

performance prepared in accordance with GAAP. There are a number of limitations related to the use of these non-GAAP financial measures versus their nearest GAAP equivalents. For example, other companies may calculate non-GAAP financial measures

differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of Bank7 Corp.’s non-GAAP financial measures as tools for comparison. See the table above in this communication for a reconciliation of

the non-GAAP financial measures used in (or conveyed orally during) this communication to their most directly comparable GAAP financial measures.

Contact:

Thomas Travis

President & CEO

(405) 810-8600