Form 8-K ACCURAY INC For: Oct 26

Accuray Innovation Driven Growth Strategy Investor Day October 26, 2020 EXHIBIT 99.1

Safe Harbor Statement Statements in this presentation (including the oral commentary that accompanies it) that are not statements of historical fact are forward-looking statements and are subject to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this presentation relate, but are not limited, to: expectations regarding new product enhancements or offerings, including the expected timing of product launches and releases; our growth drivers and strategic priorities, including expectations and plans to execute upon such drivers and priorities; expectations regarding the radiotherapy and neurosurgery market opportunity; expectations regarding our installed base; expectations related to the market opportunity in China and its ability to grow our business; expectations related to our joint venture in China; expectations regarding the trend toward ultra-hypofractionation and our ability to capitalize on those trends; our ability to continue to innovate and execute on our product roadmap; our ability to expand the addressable market of our products; our expectations regarding the Radiation Oncology Alternative Payment Model as well as reimbursement trends and our ability to capitalize on the same; expectations regarding system revenue contributions from China; our belief that our products offer clinicians and patients significant benefits over other radiation therapy systems in the market; and our expectations regarding long-term market expansion opportunities. Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “may,” “will be,” “will continue,” “will likely result,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from expectations. These risks and uncertainties include, but are not limited to: the effects of the COVID-19 pandemic on our business, financial condition, results of operations or cash flows; our ability to achieve widespread market acceptance of our products, including new product offerings and improvements; our ability to develop new products or enhance existing products to meet customers’ needs and compete favorably in the market; our ability to effectively integrate and execute the joint venture; our ability to realize the expected benefits of the joint venture; risks and uncertainties related to future Type A and B license announcements in China; risks inherent in international operations; our ability to effectively manage our growth; our ability to maintain or increase our gross margins on product sales and services; delays in regulatory approvals or the development or release of new offerings; our ability to meet the covenants under our credit facilities; our ability to convert backlog to revenue; and other risks identified under the heading “Risk Factors” in our annual report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on August 25, 2020, and as updated periodically with our other filings with the SEC. Forward-looking statements speak only as of the date the statements are made and are based on information available to Accuray at the time those statements are made and/or management’s good faith belief as of that time with respect to future events. Accuray assumes no obligation to update forward-looking statements to reflect actual performance or results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. Accordingly, investors should not place undue reliance on any forward-looking statements. Medical Advice Disclaimer Accuray Incorporated as a medical device manufacturer cannot and does not recommend specific treatment approaches. Individual results may vary. Financial Disclosure The information contained in this presentation provided by radiation oncologists and other healthcare professionals, including any accompanying oral commentary, represent the genuine experience of such healthcare professionals and may not necessarily represent the views of Accuray Incorporated or the institutions with which such healthcare professionals are affiliated. An honorarium was provided to such healthcare professionals for their participation. Forward Looking Statements This presentation is intended exclusively for investors. It is not intended for use in Sales or Marketing

Welcome Company Vision and Growth Strategy Market Dynamics and Long-Term Growth Catalysts Enabling Technology and Product Roadmap Q & A Agenda

Powerful Non-Invasive Easy Patient Treatment Experience Potential for Improved Outcomes and Quality of Life New Therapeutic Option Hope Radiation Therapy…

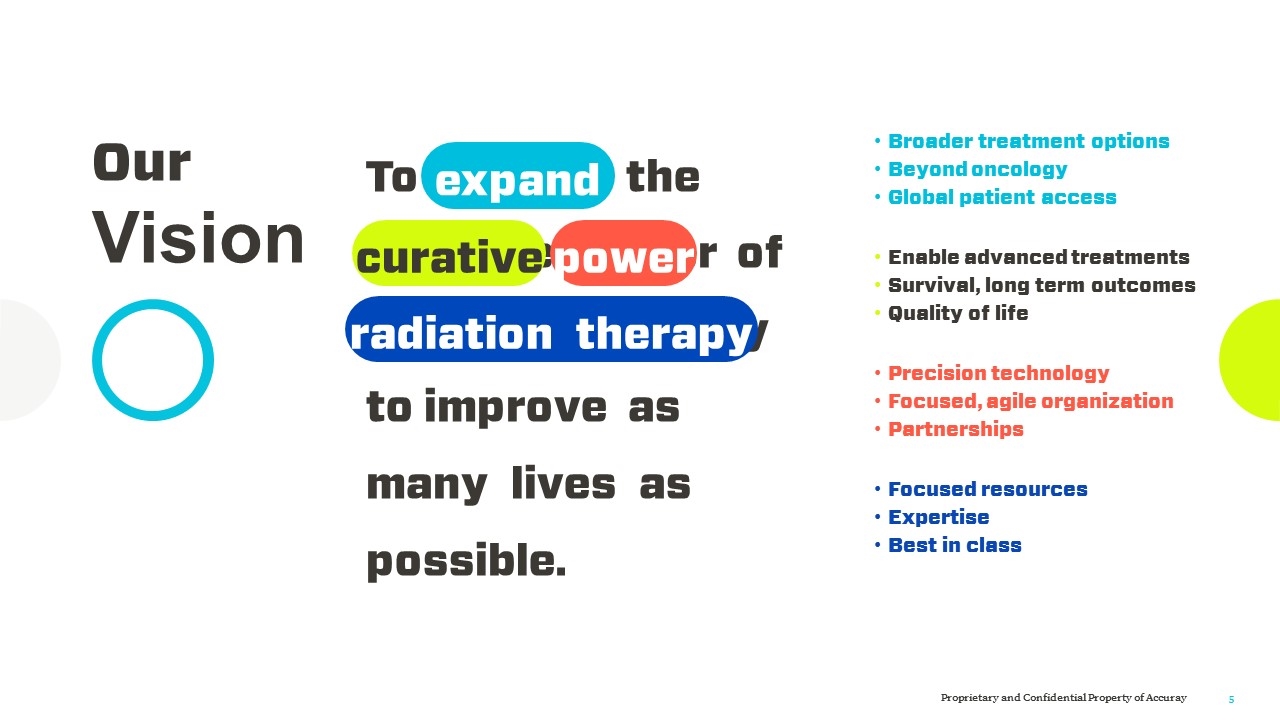

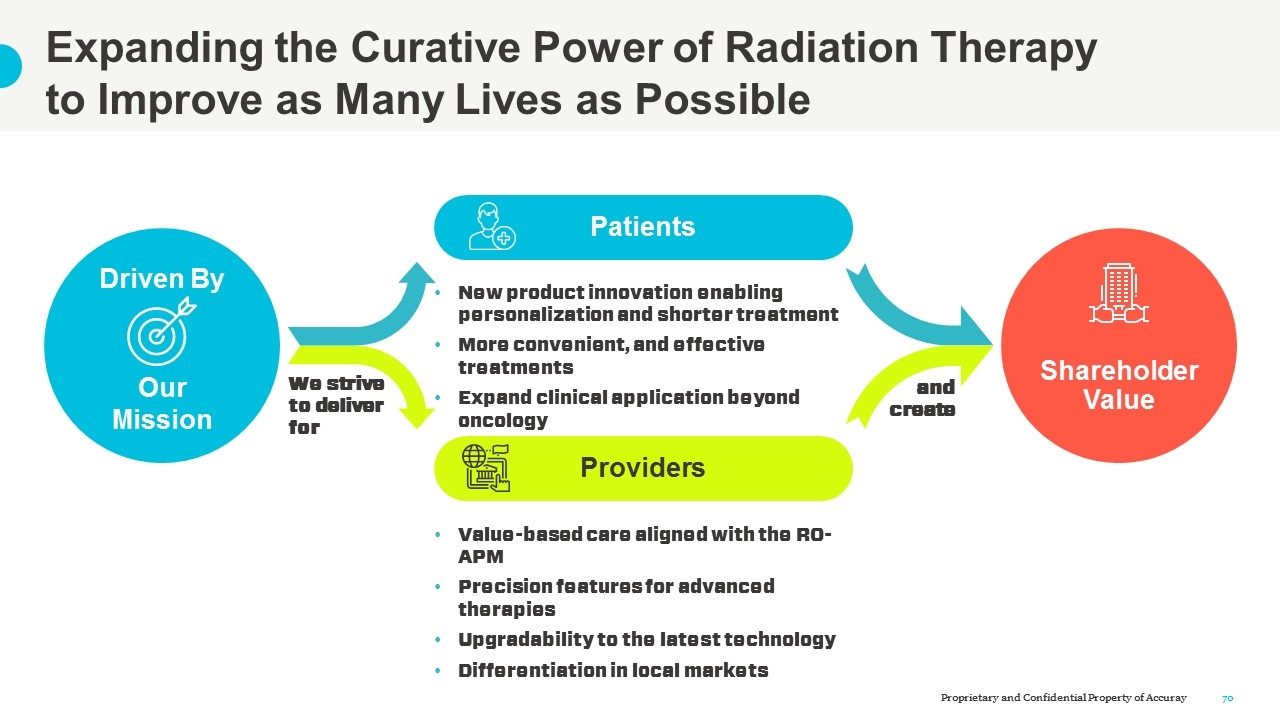

To expand the curative power of radiation therapy to improve as many lives as possible. Our Vision Broader treatment options Beyond oncology Global patient access expand Enable advanced treatments Survival, long term outcomes Quality of life curative Precision technology Focused, agile organization Partnerships power Focused resources Expertise Best in class radiation therapy

Accuray Growth Strategy: Deliver More. Better. Faster. Experienced leadership team Focused R&D investment to drive innovation Differentiated go-to-market strategy in China Growing operational leverage Unique, ultra-precision platforms Robotic, non-coplanar delivery Helical imaging and delivery Advanced dual-platform technologies Synchrony® New ClearRT™ imaging VOLO™ Exciting future product roadmap Underpenetrated global market Increased use of shorter, higher dose treatments/new reimbursement Aging installed base ripe for new system upgrade China market acceleration Strong Favorable Market Catalysts Strong Foundation for Long-Term Growth Differentiated Solutions

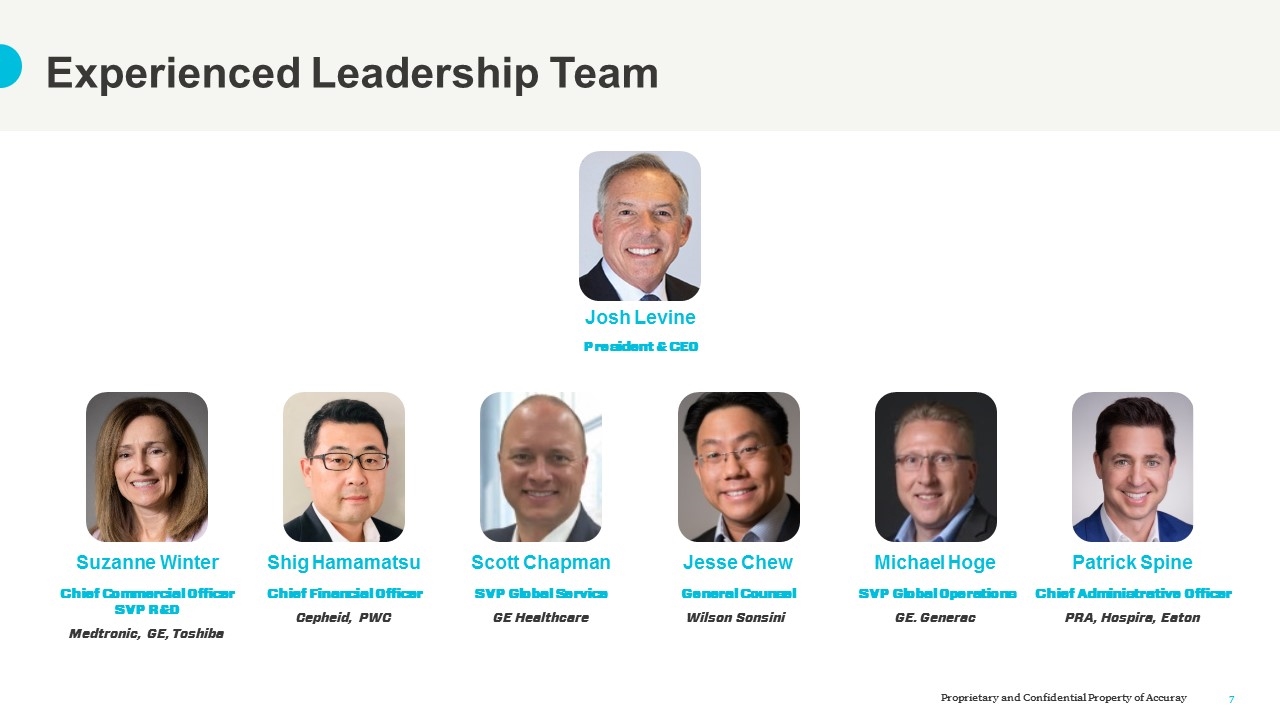

Experienced Leadership Team Suzanne Winter Chief Commercial Officer SVP R&D Medtronic, GE, Toshiba Shig Hamamatsu Chief Financial Officer Cepheid, PWC Scott Chapman SVP Global Service GE Healthcare Jesse Chew General Counsel Wilson Sonsini Michael Hoge SVP Global Operations GE. Generac Patrick Spine Chief Administrative Officer PRA, Hospira, Eaton Josh Levine President & CEO

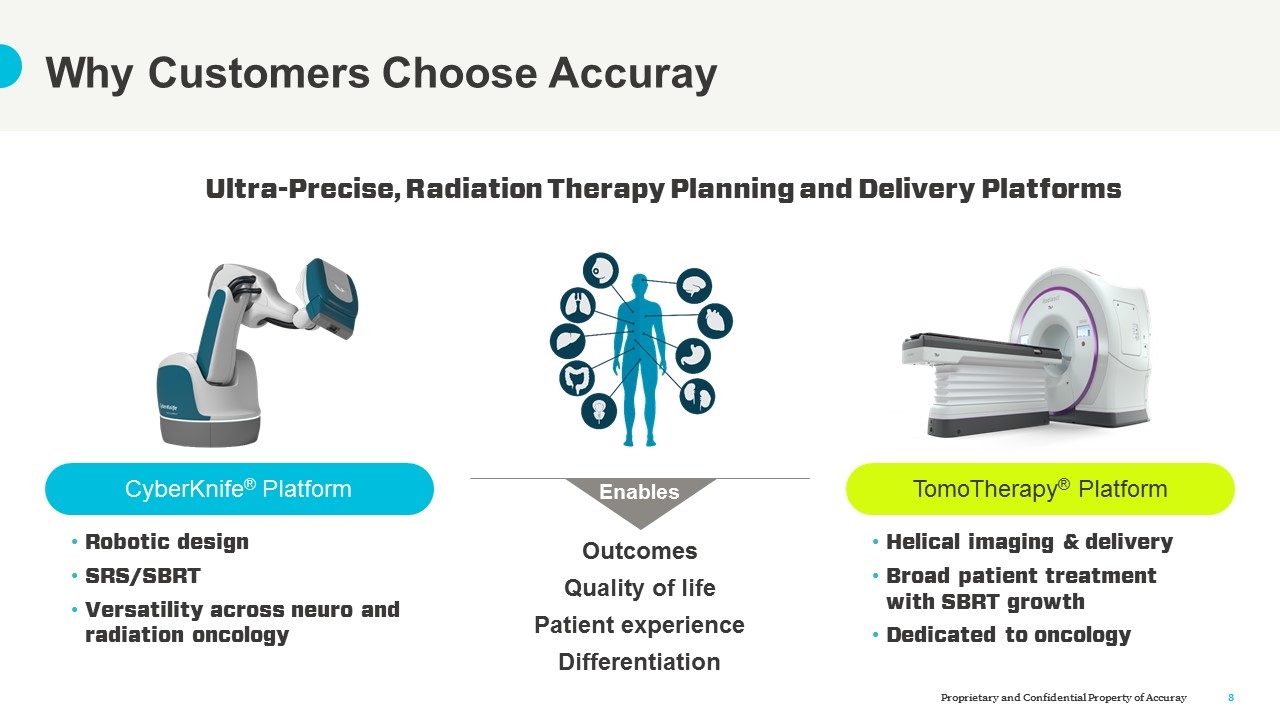

Enables Why Customers Choose Accuray Ultra-Precise, Radiation Therapy Planning and Delivery Platforms CyberKnife® Platform Robotic design SRS/SBRT Versatility across neuro and radiation oncology Helical imaging & delivery Broad patient treatment with SBRT growth Dedicated to oncology Outcomes Quality of life Patient experience Differentiation TomoTherapy® Platform

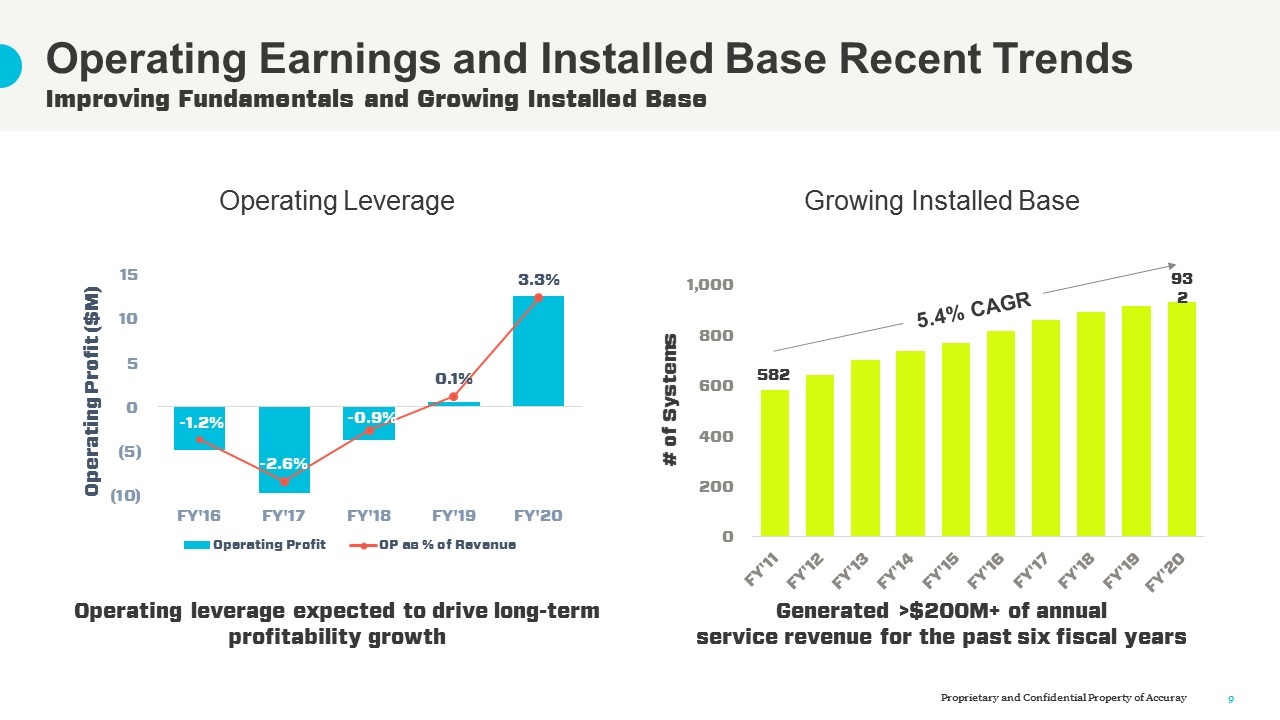

Operating Earnings and Installed Base Recent Trends Improving Fundamentals and Growing Installed Base Operating Leverage Growing Installed Base 582 932 5.4% CAGR Operating leverage expected to drive long-term profitability growth Generated >$200M+ of annual service revenue for the past six fiscal years

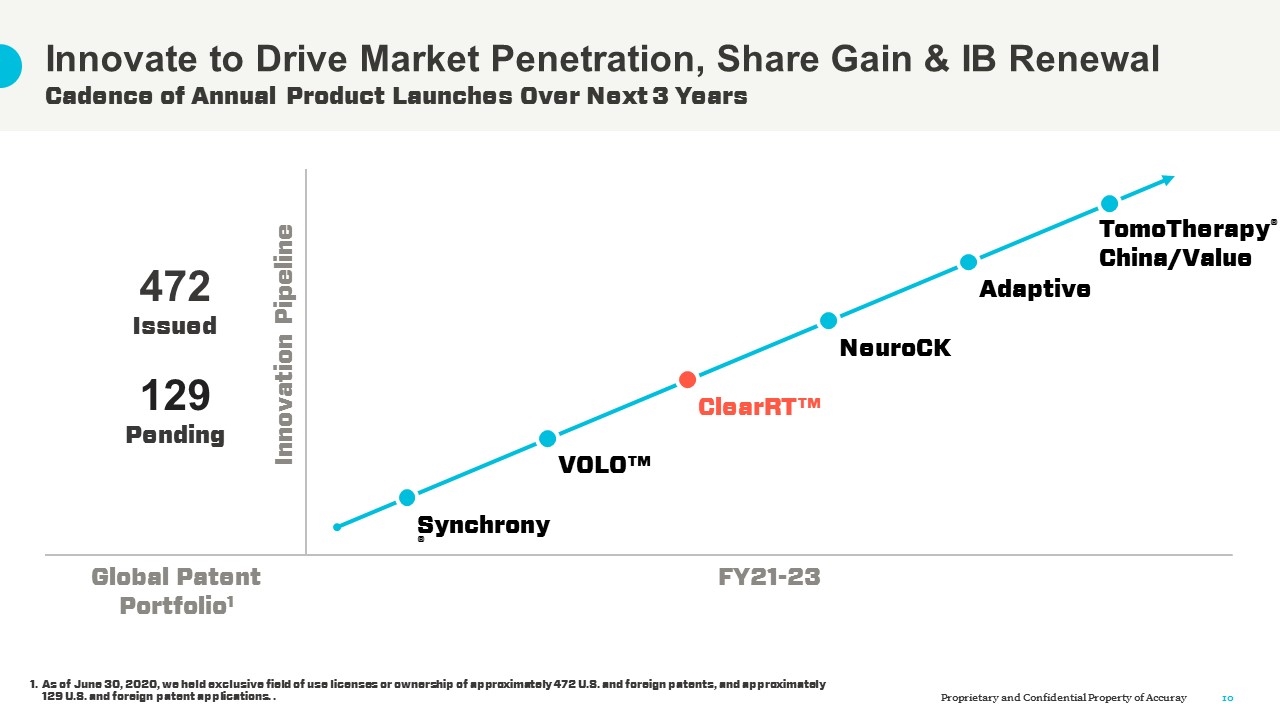

VOLO™ NeuroCK ClearRT™ Adaptive TomoTherapy® China/Value FY21-23 Synchrony® Global Patent Portfolio1 472 Issued 129 Pending As of June 30, 2020, we held exclusive field of use licenses or ownership of approximately 472 U.S. and foreign patents, and approximately 129 U.S. and foreign patent applications. . Innovation Pipeline Innovate to Drive Market Penetration, Share Gain & IB Renewal Cadence of Annual Product Launches Over Next 3 Years

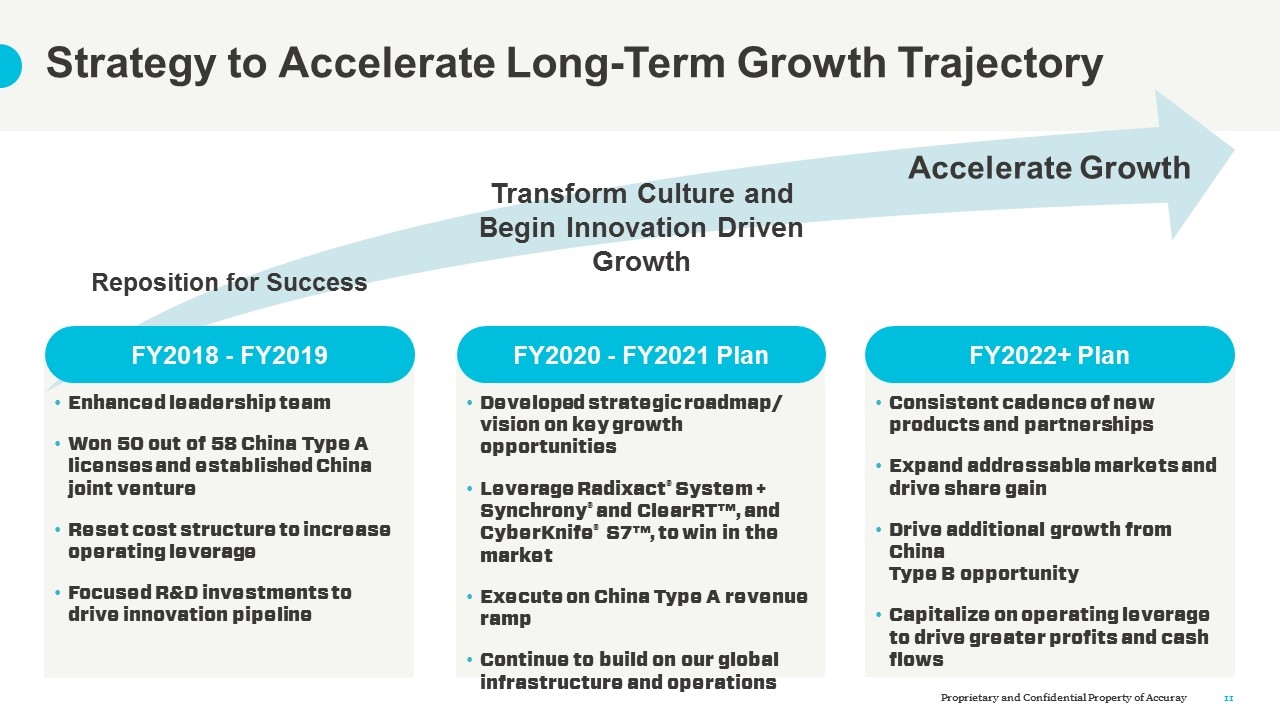

Strategy to Accelerate Long-Term Growth Trajectory FY2018 - FY2019 FY2022+ Plan FY2020 - FY2021 Plan Transform Culture and Begin Innovation Driven Growth Enhanced leadership team Won 50 out of 58 China Type A licenses and established China joint venture Reset cost structure to increase operating leverage Focused R&D investments to drive innovation pipeline Developed strategic roadmap/ vision on key growth opportunities Leverage Radixact® System + Synchrony® and ClearRT™, and CyberKnife® S7™, to win in the market Execute on China Type A revenue ramp Continue to build on our global infrastructure and operations Reposition for Success Consistent cadence of new products and partnerships Expand addressable markets and drive share gain Drive additional growth from China Type B opportunity Capitalize on operating leverage to drive greater profits and cash flows Accelerate Growth

Favorable Market Dynamics and Long-Term Growth Catalysts Suzanne Winter Chief Commercial Officer Senior Vice President, R&D

Favorable Market Dynamics and Long-Term Growth Catalysts Global Radiotherapy Market Overview China Market Opportunity and our Differentiated Strategy Treatment Modality Trend (SBRT vs. Conventional) RO-APM Update / How Accuray will Benefit

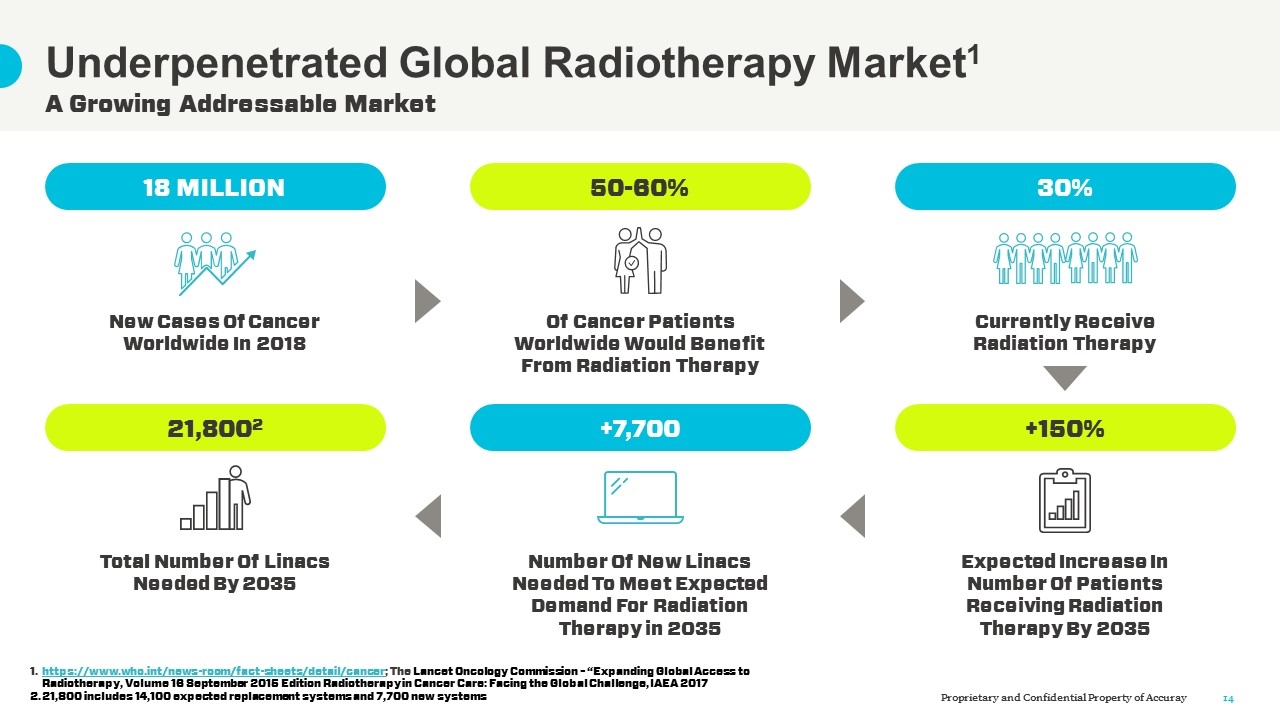

A Growing Addressable Market Underpenetrated Global Radiotherapy Market1 18 MILLION 50-60% 30% 21,8002 +7,700 +150% New Cases Of Cancer Worldwide In 2018 Of Cancer Patients Worldwide Would Benefit From Radiation Therapy Currently Receive Radiation Therapy Total Number Of Linacs Needed By 2035 Number Of New Linacs Needed To Meet Expected Demand For Radiation Therapy in 2035 Expected Increase In Number Of Patients Receiving Radiation Therapy By 2035 https://www.who.int/news-room/fact-sheets/detail/cancer; The Lancet Oncology Commission – “Expanding Global Access to Radiotherapy, Volume 16 September 2015 Edition Radiotherapy in Cancer Care: Facing the Global Challenge, IAEA 2017 21,800 includes 14,100 expected replacement systems and 7,700 new systems

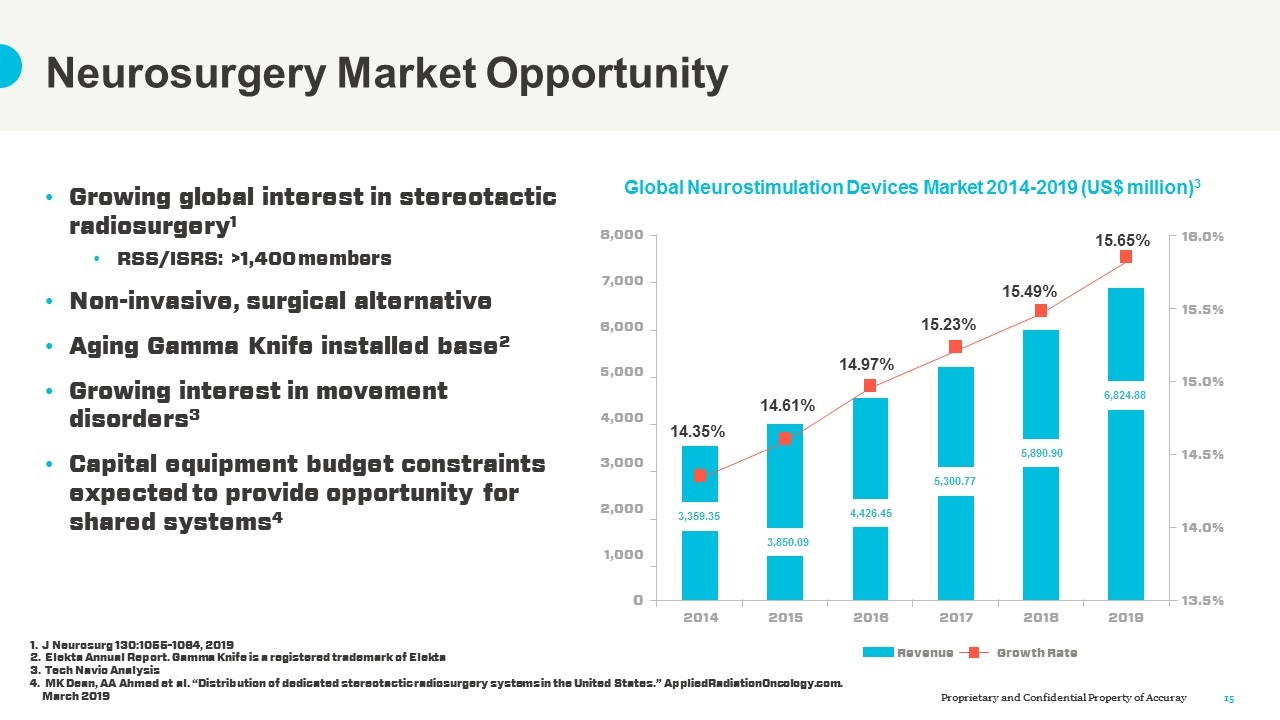

Growing global interest in stereotactic radiosurgery1 RSS/ISRS: >1,400 members Non-invasive, surgical alternative Aging Gamma Knife installed base2 Growing interest in movement disorders3 Capital equipment budget constraints expected to provide opportunity for shared systems4 Neurosurgery Market Opportunity Global Neurostimulation Devices Market 2014-2019 (US$ million)3 Revenue Growth Rate 8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 16.0% 15.5% 15.0% 14.5% 14.0% 13.5% 2014 2015 2016 2017 2018 2019 14.35% 14.61% 14.97% 15.23% 15.49% 15.65% 3,359.35 3,850.09 4,426.45 5,300.77 5,890.90 6,824.88 J Neurosurg 130:1055–1064, 2019 Elekta Annual Report. Gamma Knife is a registered trademark of Elekta Tech Navio Analysis MK Dean, AA Ahmed et al. “Distribution of dedicated stereotactic radiosurgery systems in the United States.” AppliedRadiationOncology.com. March 2019

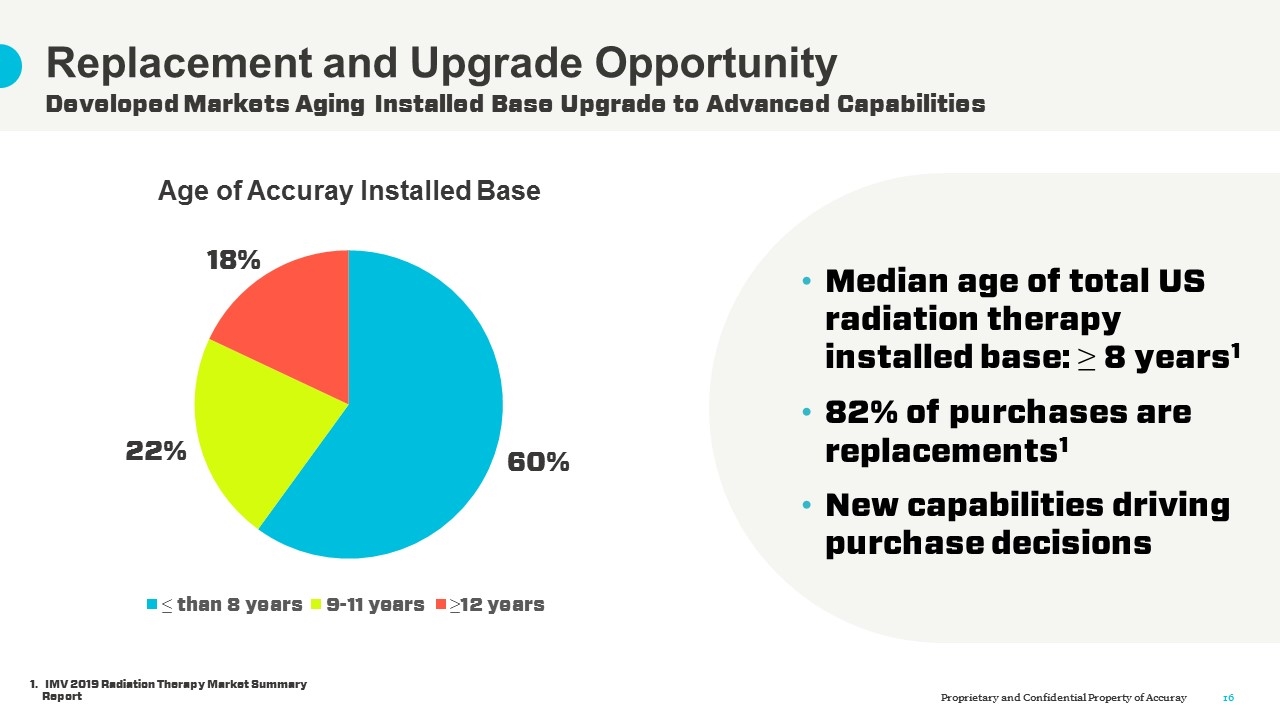

Developed Markets Aging Installed Base Upgrade to Advanced Capabilities Replacement and Upgrade Opportunity Age of Accuray Installed Base Median age of total US radiation therapy installed base: ≥ 8 years1 82% of purchases are replacements1 New capabilities driving purchase decisions IMV 2019 Radiation Therapy Market Summary Report

China

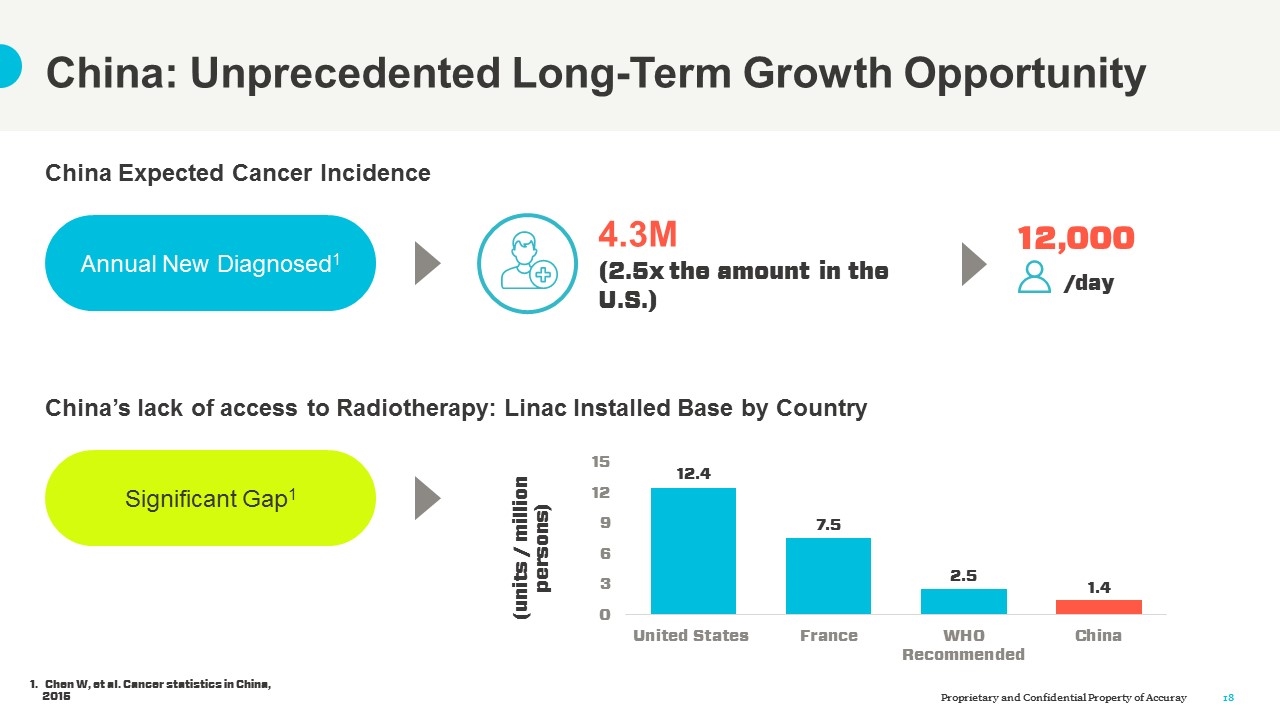

China: Unprecedented Long-Term Growth Opportunity China Expected Cancer Incidence Annual New Diagnosed1 12,000 4.3M (2.5x the amount in the U.S.) /day China’s lack of access to Radiotherapy: Linac Installed Base by Country Significant Gap1 Chen W, et al. Cancer statistics in China, 2015

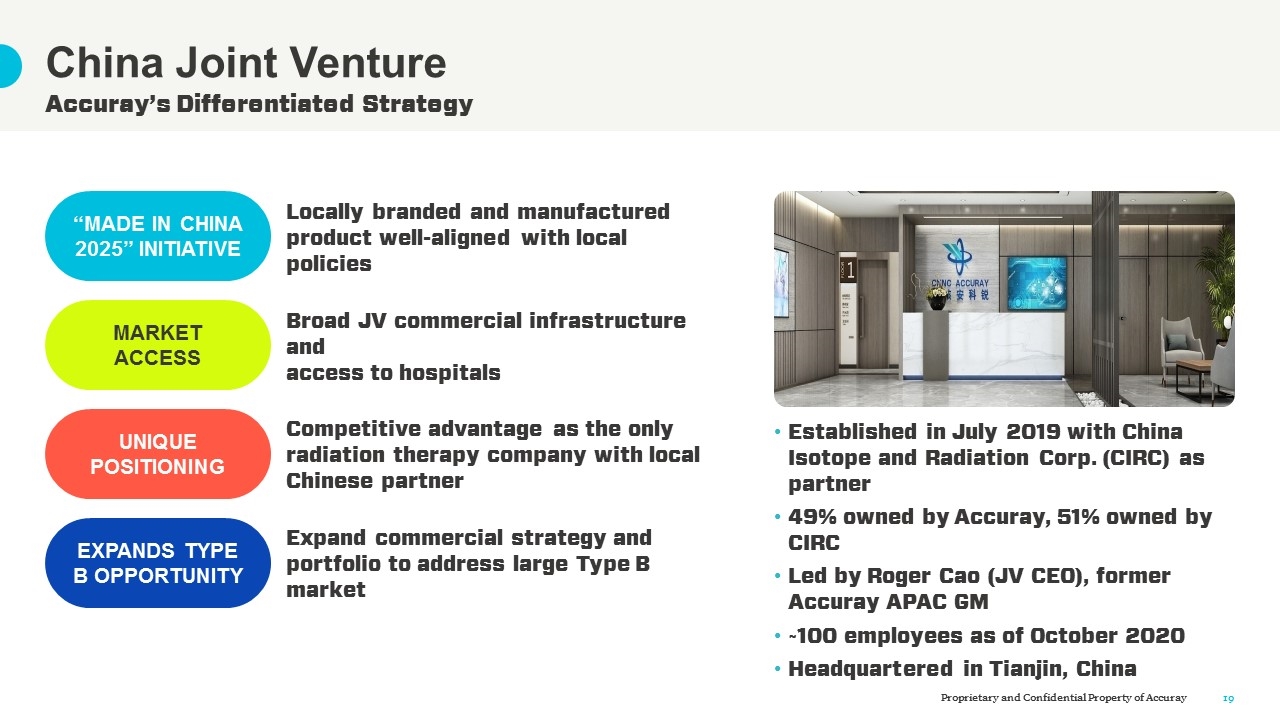

Accuray’s Differentiated Strategy China Joint Venture “MADE IN CHINA 2025” INITIATIVE MARKET ACCESS UNIQUE POSITIONING EXPANDS TYPE B OPPORTUNITY Locally branded and manufactured product well-aligned with local policies Broad JV commercial infrastructure and access to hospitals Competitive advantage as the only radiation therapy company with local Chinese partner Expand commercial strategy and portfolio to address large Type B market Established in July 2019 with China Isotope and Radiation Corp. (CIRC) as partner 49% owned by Accuray, 51% owned by CIRC Led by Roger Cao (JV CEO), former Accuray APAC GM ~100 employees as of October 2020 Headquartered in Tianjin, China

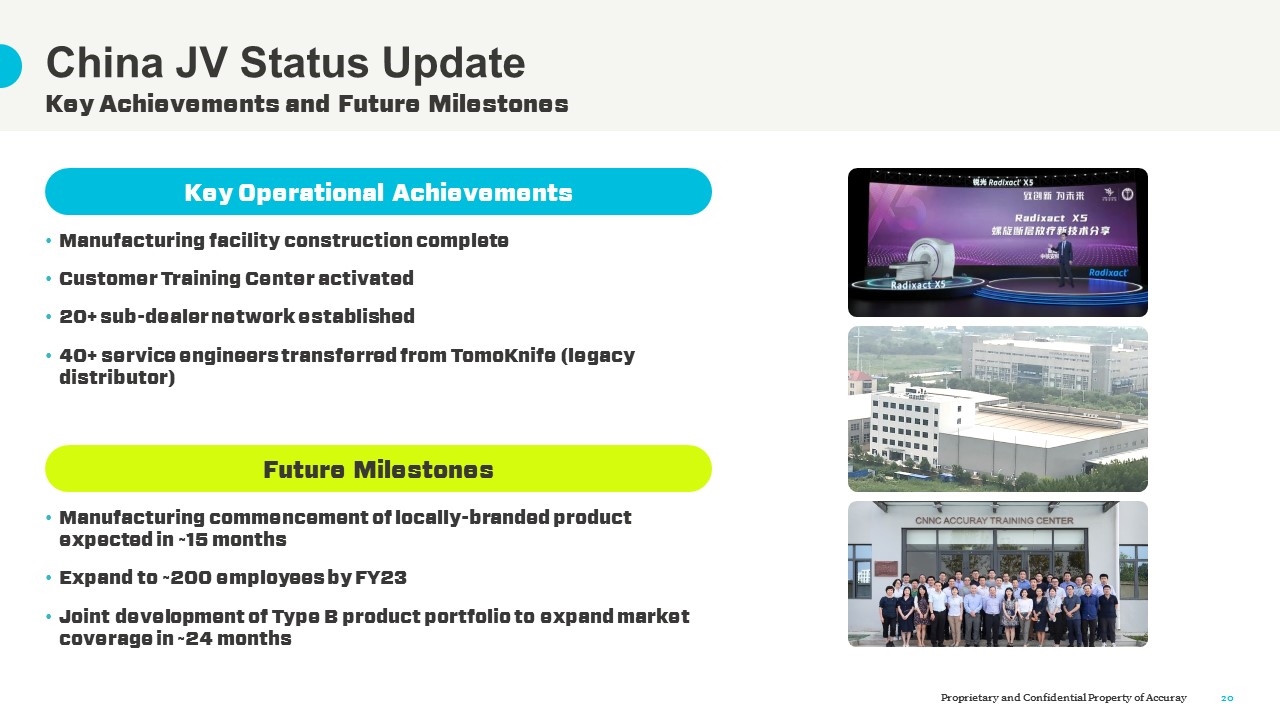

Key Achievements and Future Milestones China JV Status Update Key Operational Achievements Manufacturing facility construction complete Customer Training Center activated 20+ sub-dealer network established 40+ service engineers transferred from TomoKnife (legacy distributor) Future Milestones Manufacturing commencement of locally-branded product expected in ~15 months Expand to ~200 employees by FY23 Joint development of Type B product portfolio to expand market coverage in ~24 months

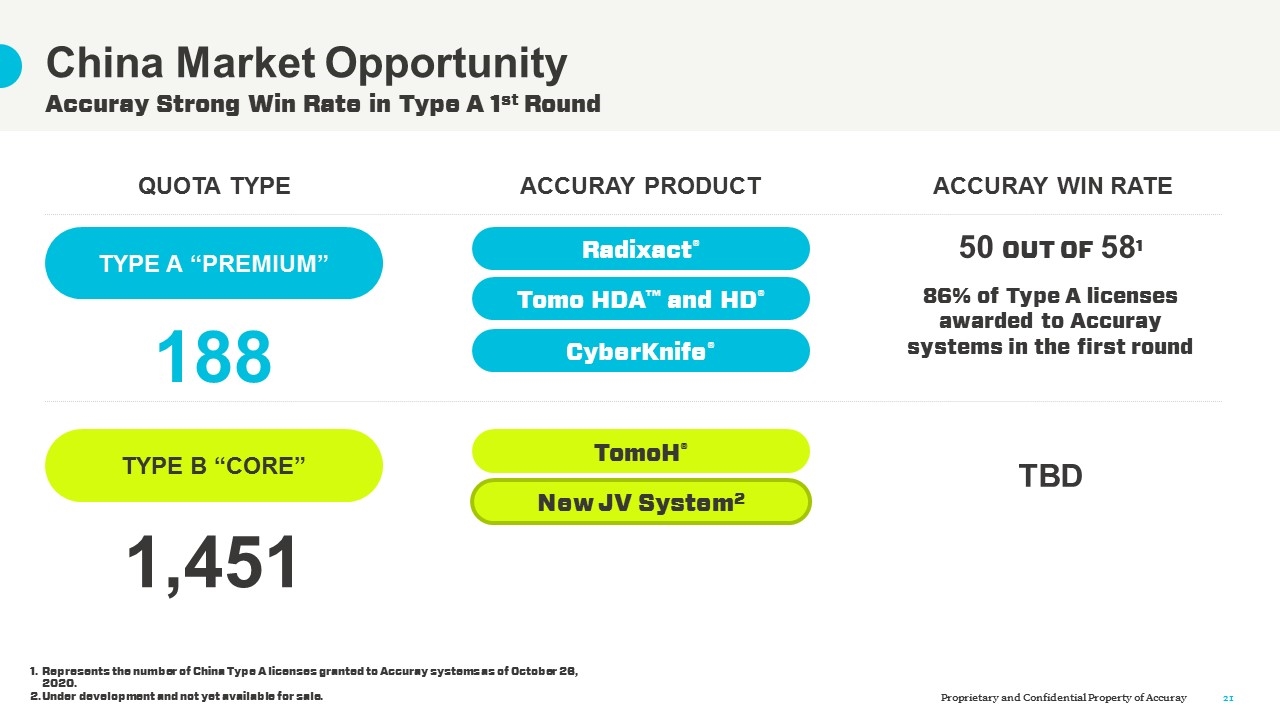

Accuray Strong Win Rate in Type A 1st Round China Market Opportunity TYPE A “PREMIUM” TYPE B “CORE” QUOTA TYPE 188 1,451 Radixact® ACCURAY PRODUCT Tomo HDA™ and HD® CyberKnife® TomoH® New JV System2 ACCURAY WIN RATE 50 OUT OF 581 86% of Type A licenses awarded to Accuray systems in the first round TBD Represents the number of China Type A licenses granted to Accuray systems as of October 26, 2020. Under development and not yet available for sale.

Clinical Trends Toward Ultra-Hypofractionation

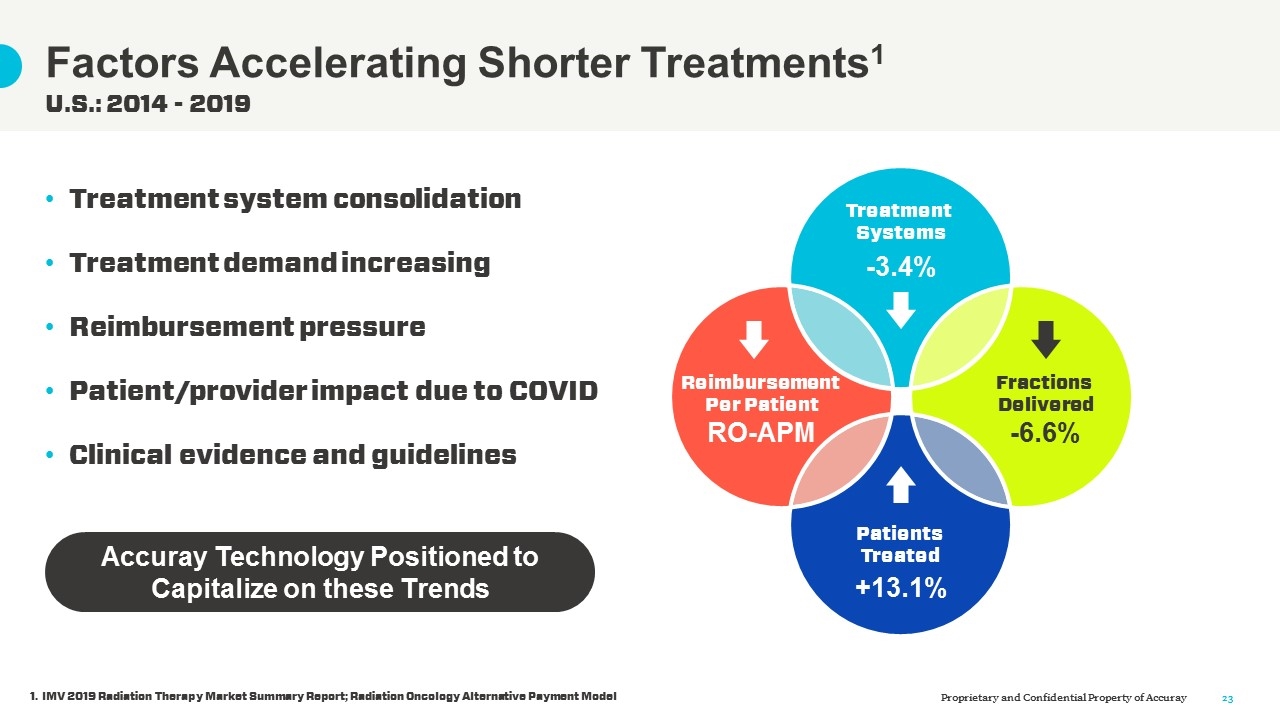

IMV 2019 Radiation Therapy Market Summary Report; Radiation Oncology Alternative Payment Model Treatment system consolidation Treatment demand increasing Reimbursement pressure Patient/provider impact due to COVID Clinical evidence and guidelines U.S.: 2014 - 2019 Factors Accelerating Shorter Treatments1 Treatment Systems -3.4% Patients Treated +13.1% Reimbursement Per Patient RO-APM Fractions Delivered -6.6% Accuray Technology Positioned to Capitalize on these Trends

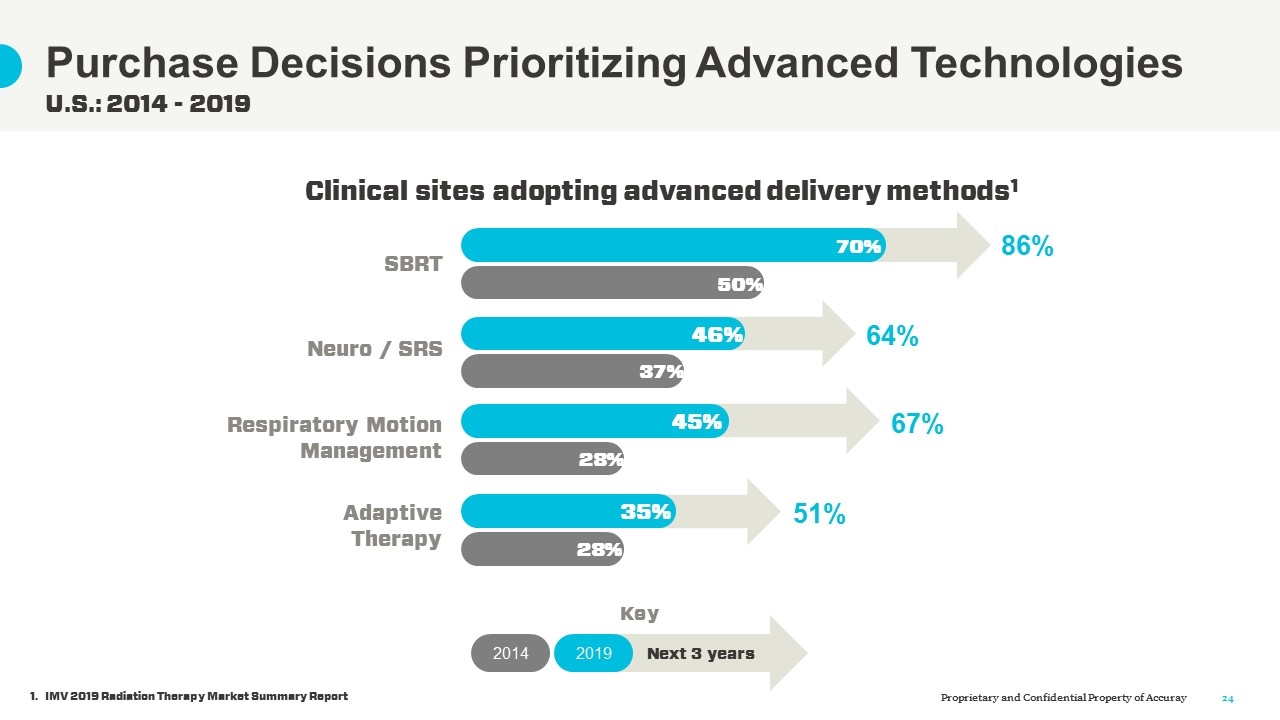

IMV 2019 Radiation Therapy Market Summary Report U.S.: 2014 - 2019 Purchase Decisions Prioritizing Advanced Technologies Clinical sites adopting advanced delivery methods1 SBRT Respiratory Motion Management Adaptive Therapy Neuro / SRS 46% 45% 35% 70% 50% 37% 28% 28% 86% 64% 67% 51% Next 3 years 2019 Key 2014

Reimbursement Changes Radiation Oncology Alternative Payment Model (RO-APM) Shawn Prince Senior Director, Patient Access

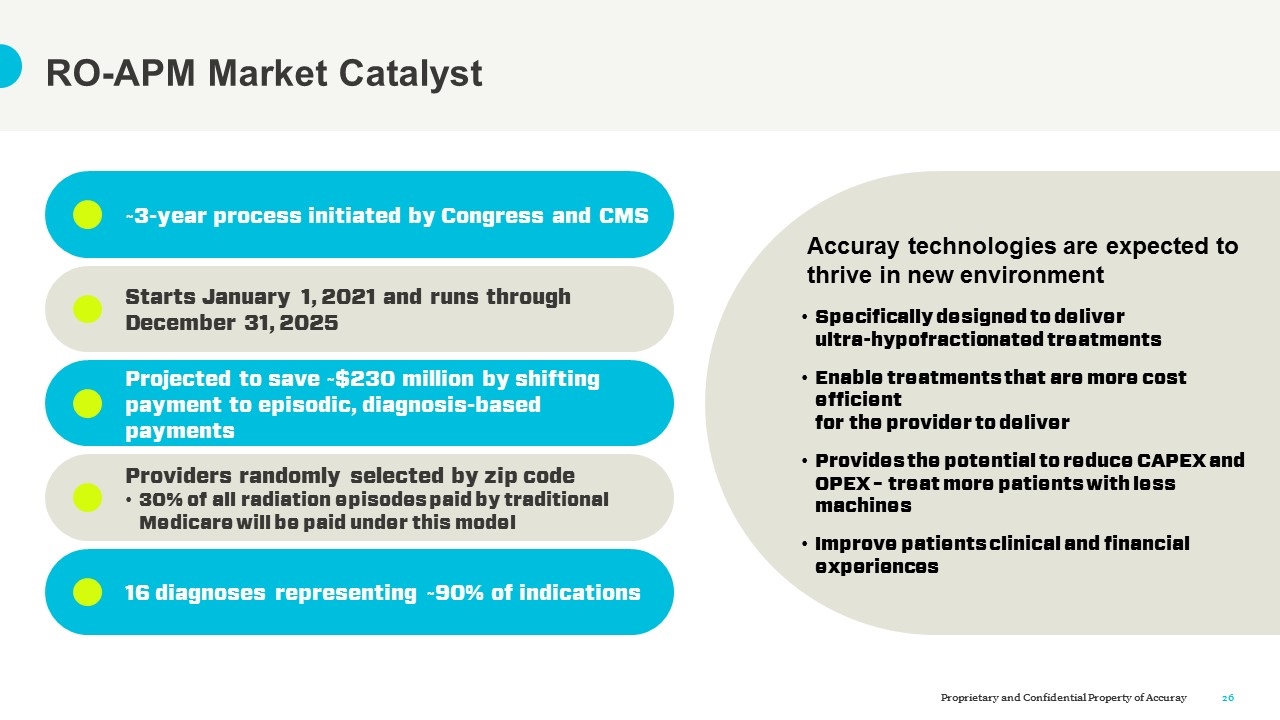

RO-APM Market Catalyst Accuray technologies are expected to thrive in new environment Specifically designed to deliver ultra-hypofractionated treatments Enable treatments that are more cost efficient for the provider to deliver Provides the potential to reduce CAPEX and OPEX – treat more patients with less machines Improve patients clinical and financial experiences ~3-year process initiated by Congress and CMS Starts January 1, 2021 and runs through December 31, 2025 Projected to save ~$230 million by shifting payment to episodic, diagnosis-based payments Providers randomly selected by zip code 30% of all radiation episodes paid by traditional Medicare will be paid under this model 16 diagnoses representing ~90% of indications

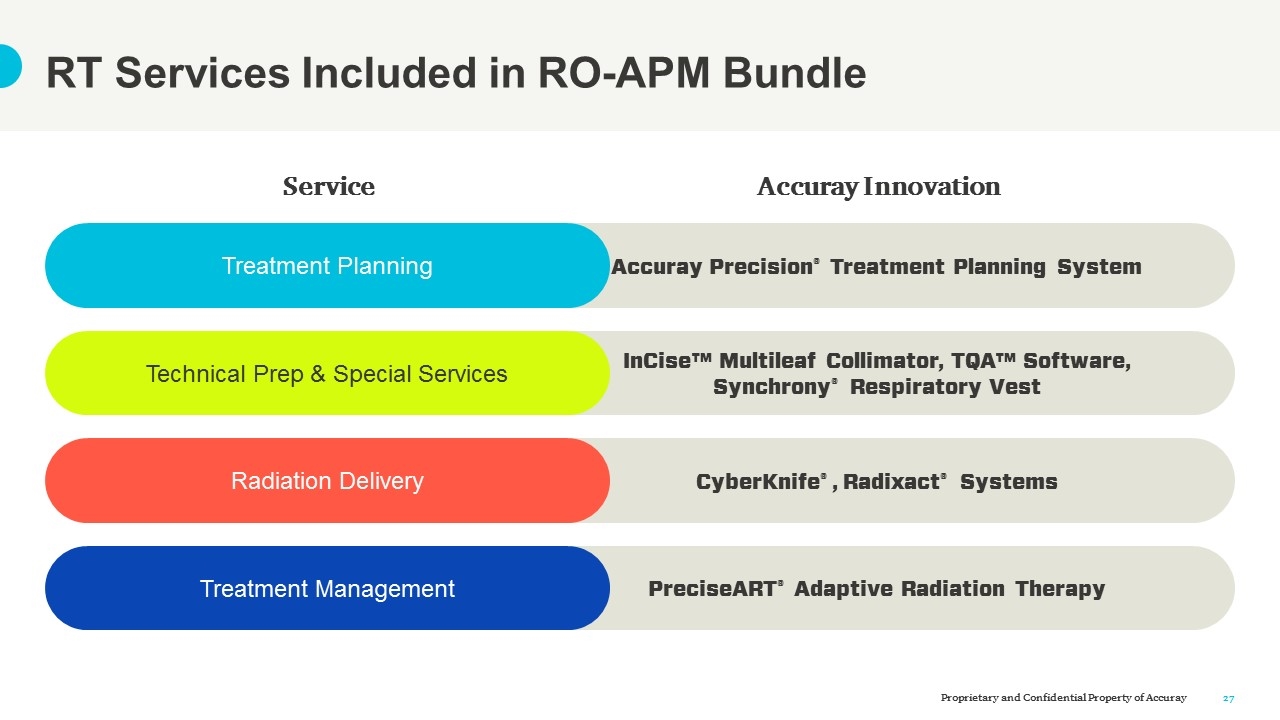

RT Services Included in RO-APM Bundle InCise™ Multileaf Collimator, TQA™ Software, Synchrony® Respiratory Vest CyberKnife® , Radixact® Systems PreciseART® Adaptive Radiation Therapy Accuray Precision® Treatment Planning System Treatment Planning Technical Prep & Special Services Radiation Delivery Treatment Management Service Accuray Innovation

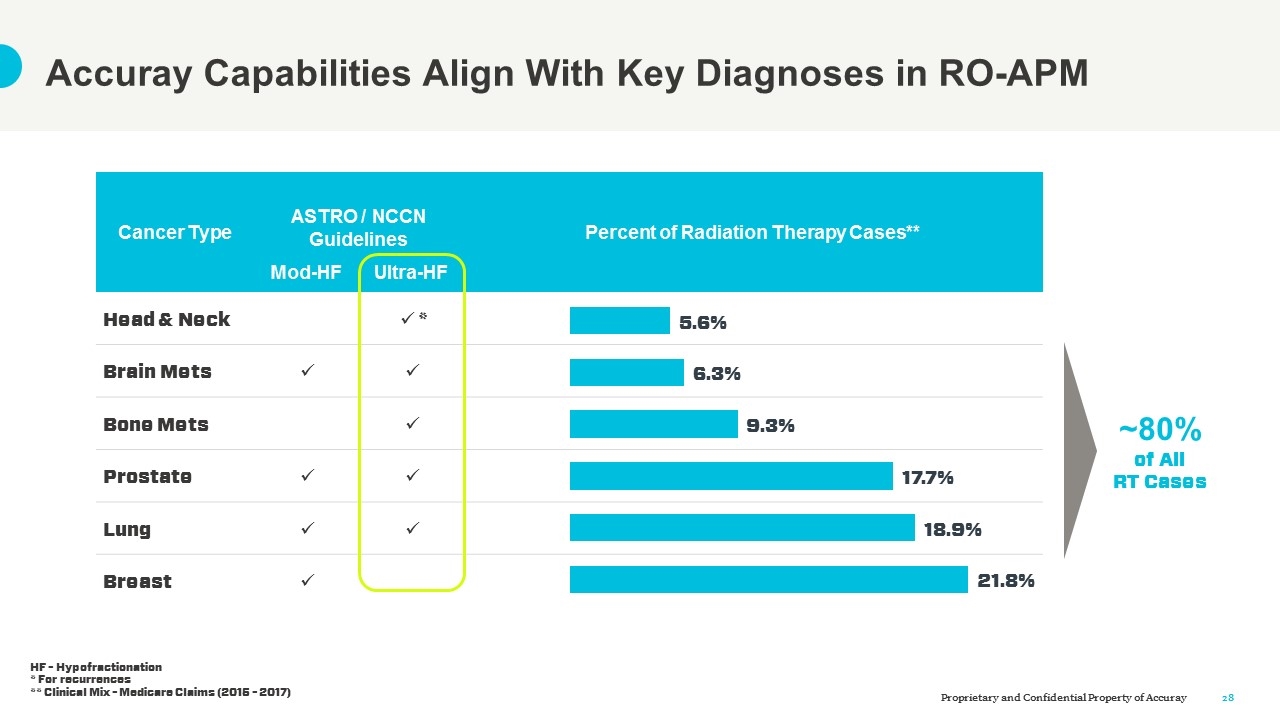

Accuray Capabilities Align With Key Diagnoses in RO-APM Cancer Type ASTRO / NCCN Guidelines Percent of Radiation Therapy Cases** Mod-HF Ultra-HF Head & Neck * Brain Mets Bone Mets Prostate Lung Breast ~80% of All RT Cases HF – Hypofractionation * For recurrences ** Clinical Mix – Medicare Claims (2015 – 2017)

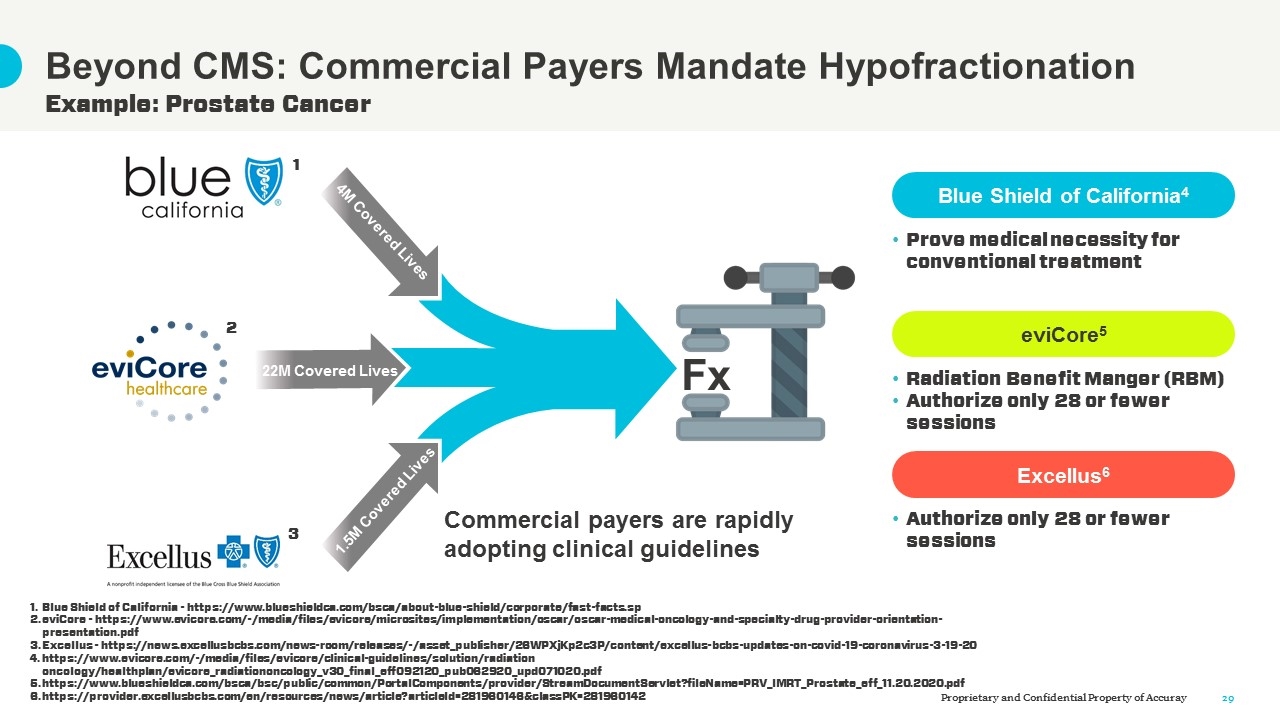

Example: Prostate Cancer Beyond CMS: Commercial Payers Mandate Hypofractionation 4M Covered Lives 22M Covered Lives 1.5M Covered Lives Fx Commercial payers are rapidly adopting clinical guidelines Blue Shield of California4 Prove medical necessity for conventional treatment eviCore5 Radiation Benefit Manger (RBM) Authorize only 28 or fewer sessions Excellus6 Authorize only 28 or fewer sessions 1 2 3 Blue Shield of California - https://www.blueshieldca.com/bsca/about-blue-shield/corporate/fast-facts.sp eviCore - https://www.evicore.com/-/media/files/evicore/microsites/implementation/oscar/oscar-medical-oncology-and-specialty-drug-provider-orientation-presentation.pdf Excellus - https://news.excellusbcbs.com/news-room/releases/-/asset_publisher/26WPXjKp2c3P/content/excellus-bcbs-updates-on-covid-19-coronavirus-3-19-20 https://www.evicore.com/-/media/files/evicore/clinical-guidelines/solution/radiation oncology/healthplan/evicore_radiationoncology_v30_final_eff092120_pub062920_upd071020.pdf https://www.blueshieldca.com/bsca/bsc/public/common/PortalComponents/provider/StreamDocumentServlet?fileName=PRV_IMRT_Prostate_eff_11.20.2020.pdf https://provider.excellusbcbs.com/en/resources/news/article?articleId=281960146&classPK=281960142

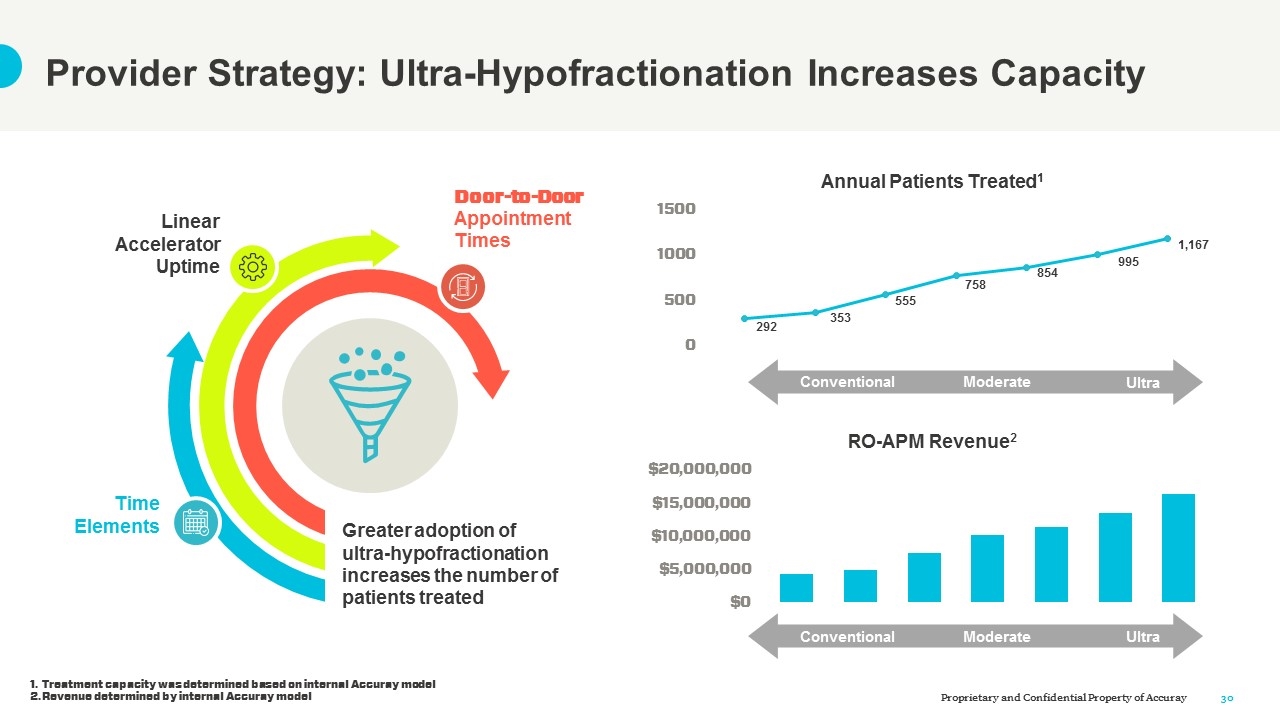

Provider Strategy: Ultra-Hypofractionation Increases Capacity SOME HEADING GOES HERE Door-to-Door Appointment Times Time Elements Linear Accelerator Uptime Conventional Moderate Ultra Conventional Moderate Ultra Greater adoption of ultra-hypofractionation increases the number of patients treated Treatment capacity was determined based on internal Accuray model Revenue determined by internal Accuray model

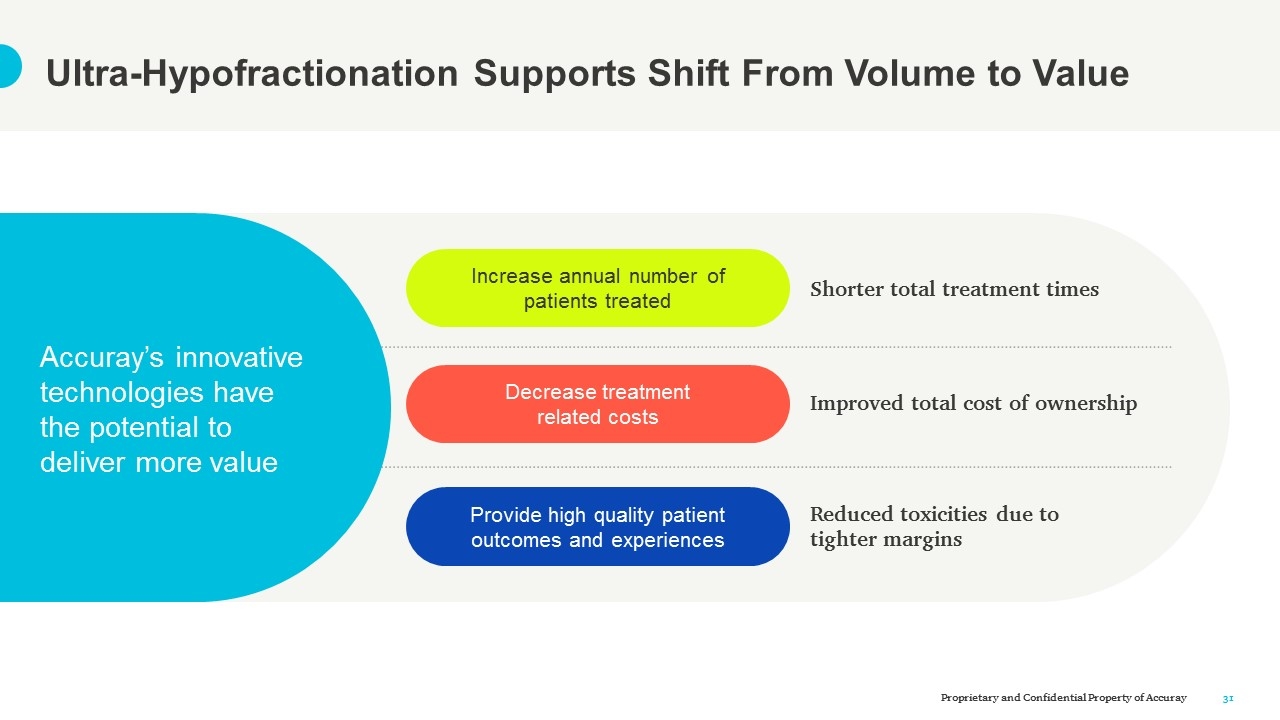

Ultra-Hypofractionation Supports Shift From Volume to Value Increase annual number of patients treated Shorter total treatment times Decrease treatment related costs Improved total cost of ownership Provide high quality patient outcomes and experiences Reduced toxicities due to tighter margins Accuray’s innovative technologies have the potential to deliver more value

Enabling Technology and Product Roadmap Corey Lawson Vice President, Product Strategy

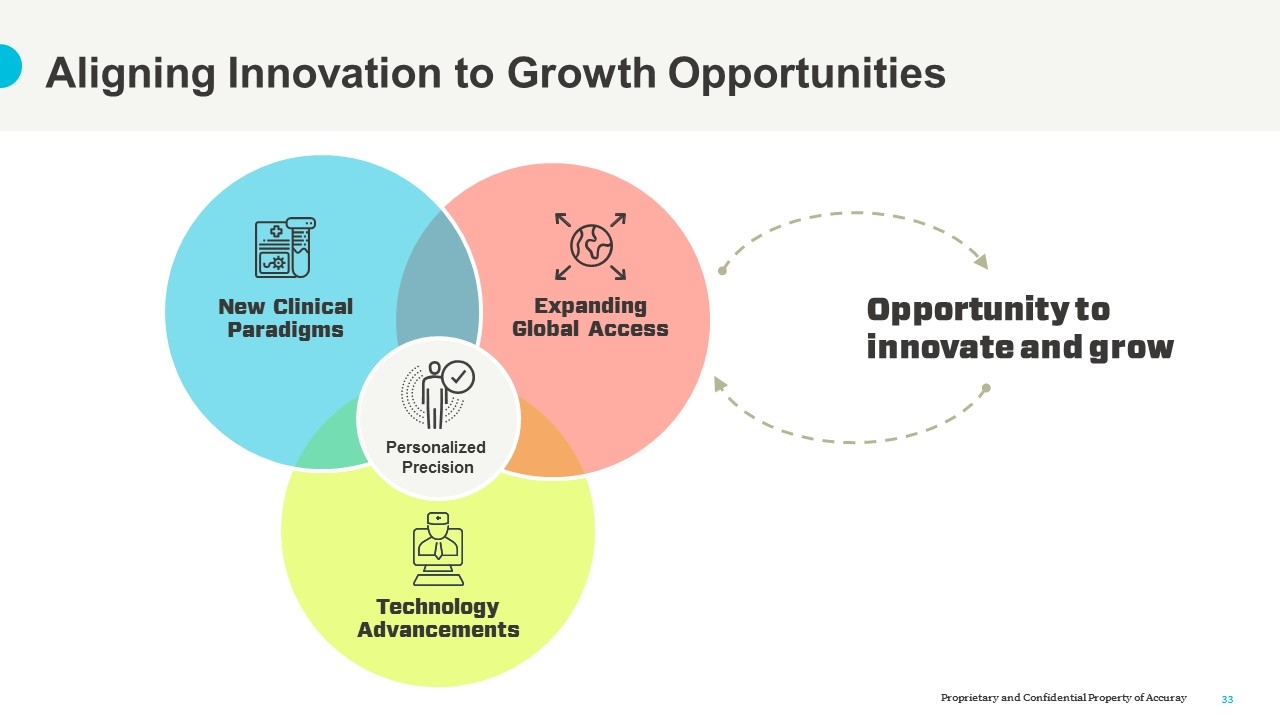

Aligning Innovation to Growth Opportunities New Clinical Paradigms Expanding Global Access Technology Advancements Personalized Precision Opportunity to innovate and grow

Radixact® Roadmap Programs

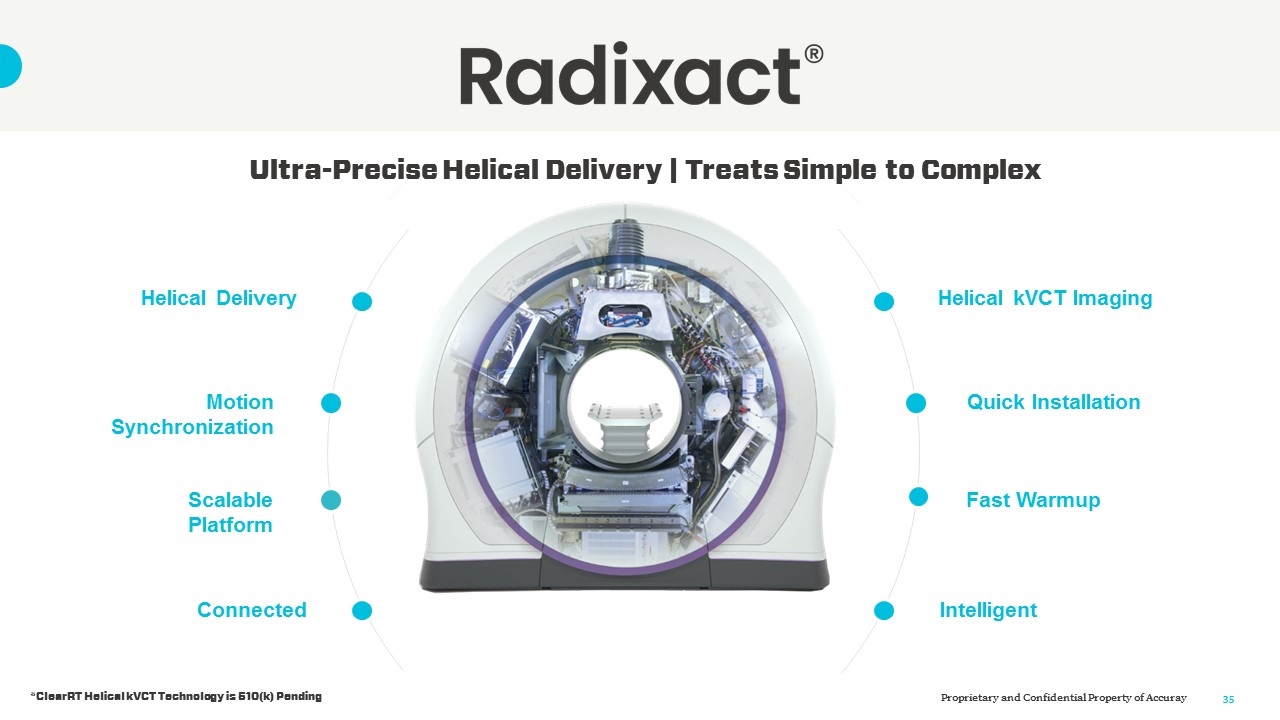

*ClearRT Helical kVCT Technology is 510(k) Pending Fast Warmup Intelligent Helical kVCT Imaging Quick Installation Helical Delivery Scalable Platform Motion Synchronization Connected Ultra-Precise Helical Delivery | Treats Simple to Complex

Synchrony®

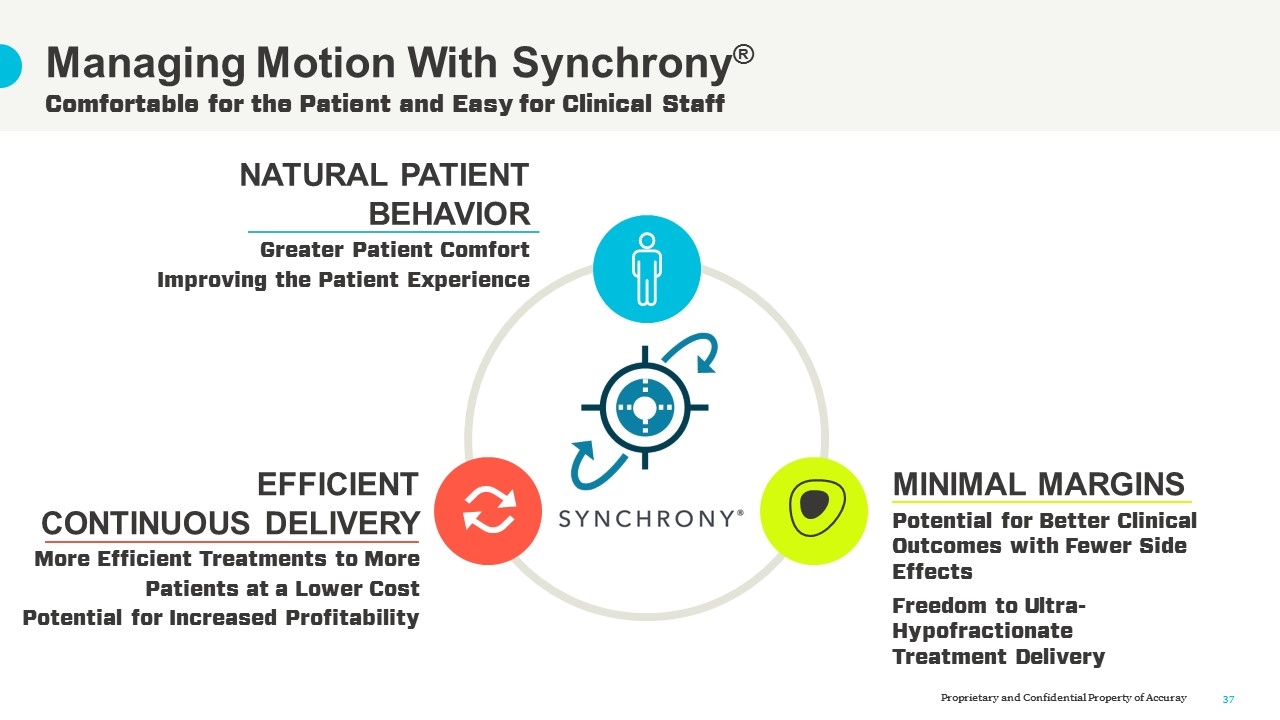

Comfortable for the Patient and Easy for Clinical Staff Managing Motion With Synchrony® NATURAL PATIENT BEHAVIOR Greater Patient Comfort Improving the Patient Experience MINIMAL MARGINS Potential for Better Clinical Outcomes with Fewer Side Effects Freedom to Ultra-Hypofractionate Treatment Delivery EFFICIENT CONTINUOUS DELIVERY More Efficient Treatments to More Patients at a Lower Cost Potential for Increased Profitability

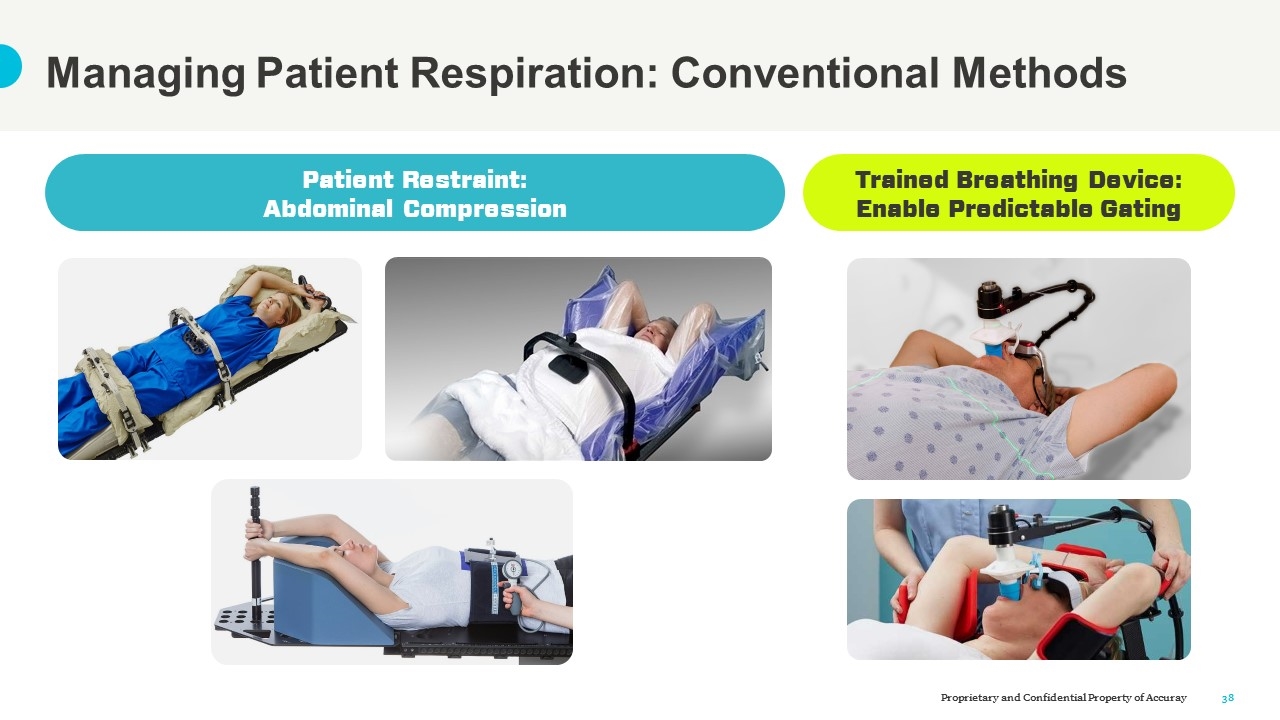

Managing Patient Respiration: Conventional Methods Patient Restraint: Abdominal Compression Trained Breathing Device: Enable Predictable Gating

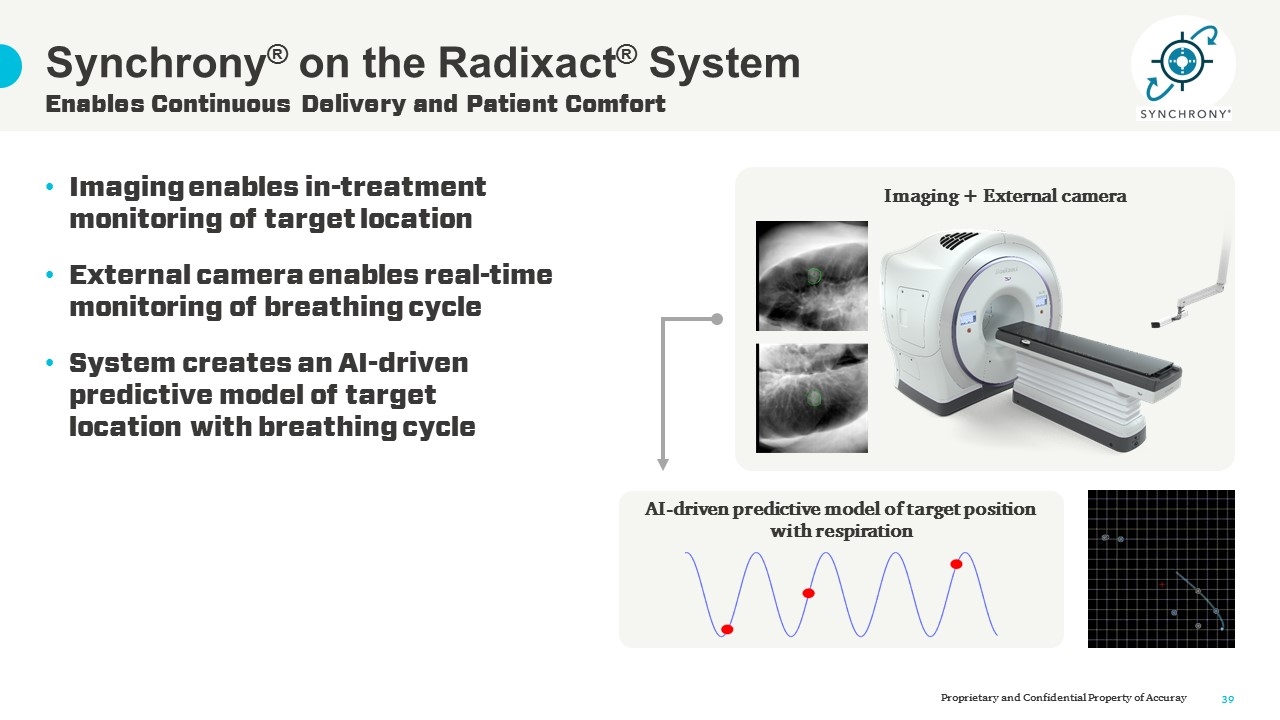

Imaging + External camera AI-driven predictive model of target position with respiration Imaging enables in-treatment monitoring of target location External camera enables real-time monitoring of breathing cycle System creates an AI-driven predictive model of target location with breathing cycle Enables Continuous Delivery and Patient Comfort Synchrony® on the Radixact® System

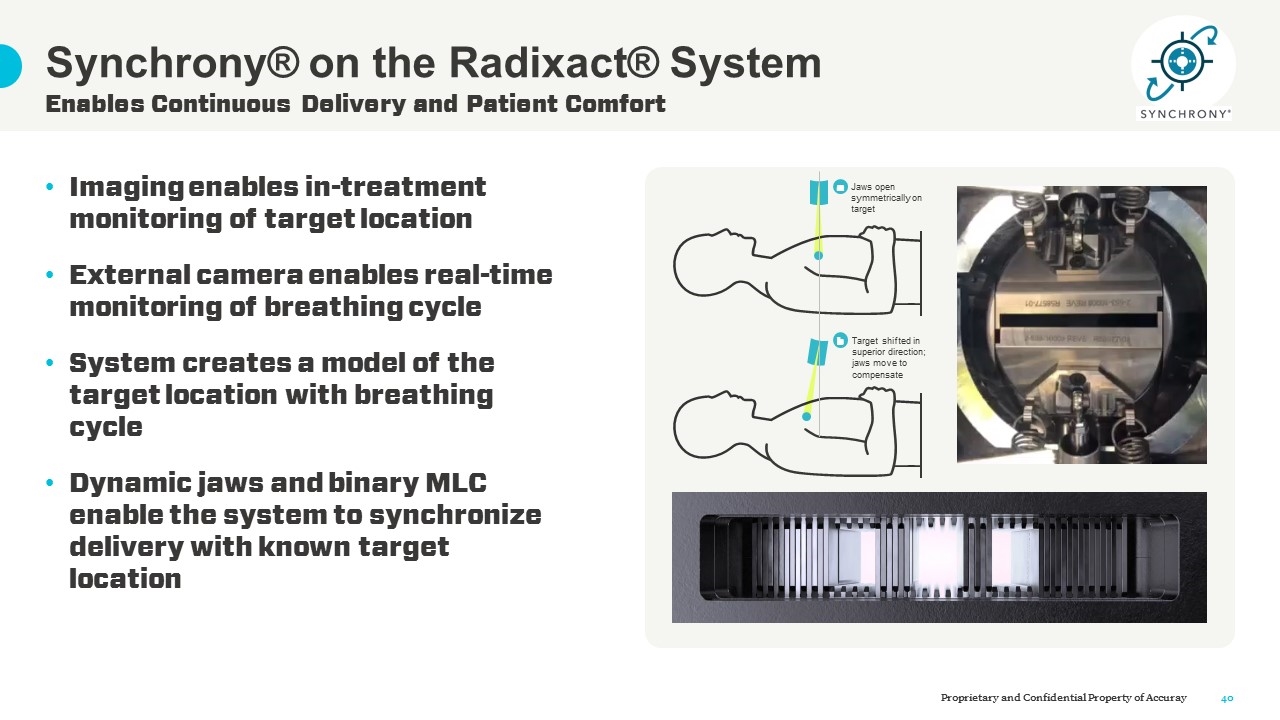

Imaging enables in-treatment monitoring of target location External camera enables real-time monitoring of breathing cycle System creates a model of the target location with breathing cycle Dynamic jaws and binary MLC enable the system to synchronize delivery with known target location Enables Continuous Delivery and Patient Comfort Synchrony® on the Radixact® System Jaws open symmetrically on target a Target shifted in superior direction; jaws move to compensate b

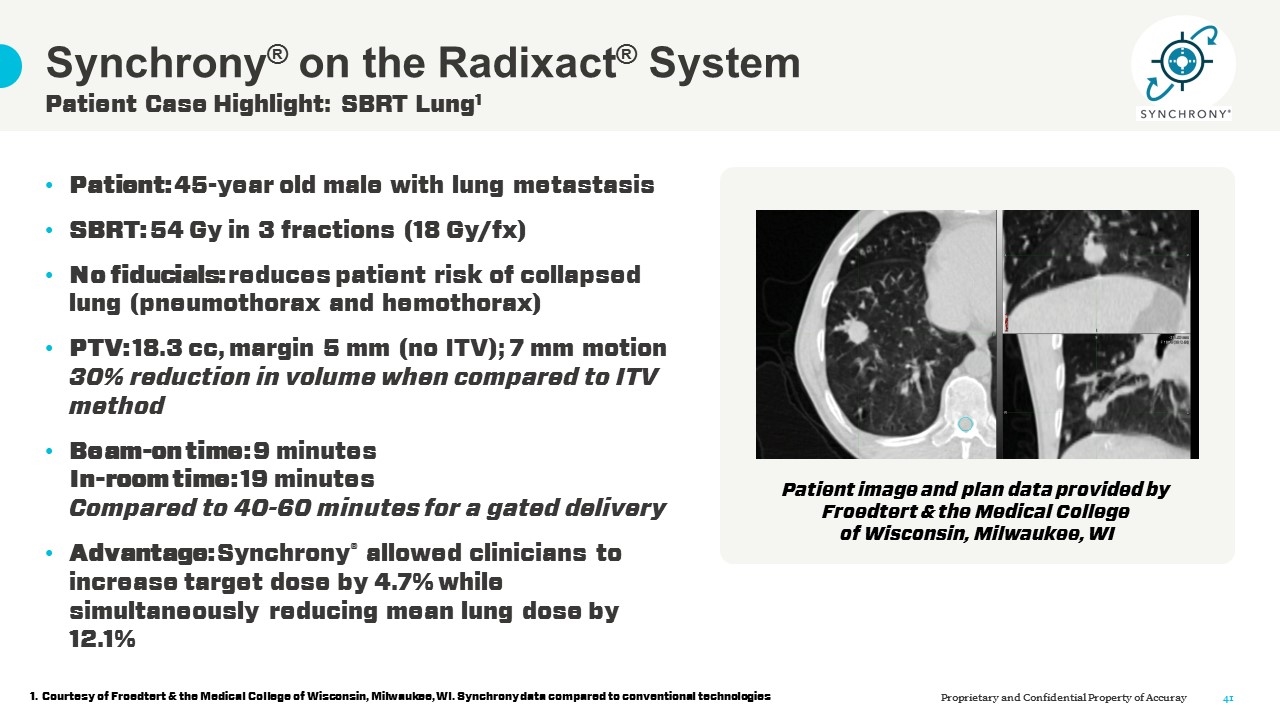

Courtesy of Froedtert & the Medical College of Wisconsin, Milwaukee, WI. Synchrony data compared to conventional technologies Patient Case Highlight: SBRT Lung1 Synchrony® on the Radixact® System Patient: 45-year old male with lung metastasis SBRT: 54 Gy in 3 fractions (18 Gy/fx) No fiducials: reduces patient risk of collapsed lung (pneumothorax and hemothorax) PTV: 18.3 cc, margin 5 mm (no ITV); 7 mm motion 30% reduction in volume when compared to ITV method Beam-on time: 9 minutes In-room time: 19 minutes Compared to 40-60 minutes for a gated delivery Advantage: Synchrony® allowed clinicians to increase target dose by 4.7% while simultaneously reducing mean lung dose by 12.1% Patient image and plan data provided by Froedtert & the Medical College of Wisconsin, Milwaukee, WI

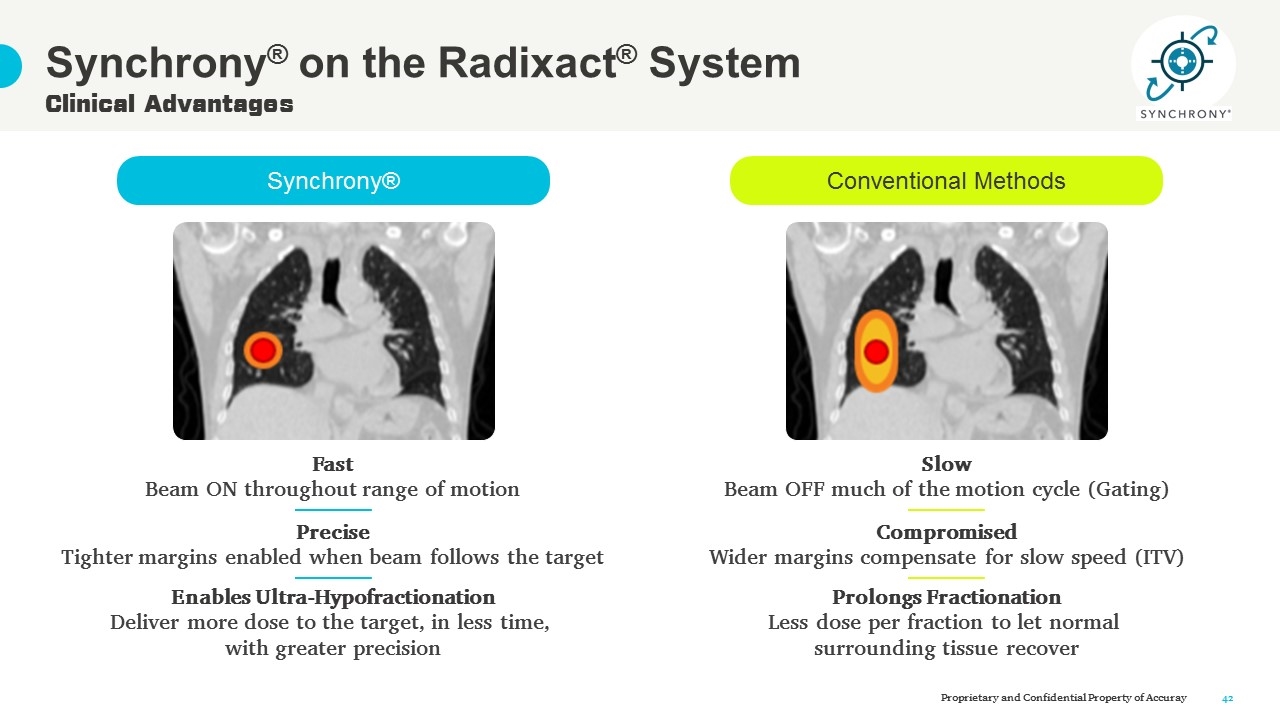

Conventional Methods Clinical Advantages Synchrony® on the Radixact® System Fast Beam ON throughout range of motion Slow Beam OFF much of the motion cycle (Gating) Compromised Wider margins compensate for slow speed (ITV) Precise Tighter margins enabled when beam follows the target Enables Ultra-Hypofractionation Deliver more dose to the target, in less time, with greater precision Prolongs Fractionation Less dose per fraction to let normal surrounding tissue recover Synchrony®

Prof. Umberto Ricardi Chairman of Radiation Oncology and Dean of the School of Medicine at the University of Turin in Turin Italy, as well as the Director of the Department of Oncology at Health and Science Academic Hospital in Turin. Today, he’s using Radixact with Synchrony to deliver extremely precise lung SBRT treatments to the most fragile lung cancer patients using tight margins to preserve healthy lung tissues — without the use of fiducials in most cases.

Dr. Chikao Sugie Completed clinical training in the Department of Radiology at the Graduate School of Medical Sciences and Medical School, Nagoya City University. He then went on to become an Associate Professor in the Department of Radiology at Nagoya City University. He pursued research on radiation biology and lung cancer radiation as subspecialties. He is currently the Vice Director of the Department of Radiology at the Japanese Red Cross Nagoya Daini Hospital, a leading center providing advanced radiation treatments in Japan.

ClearRT™ Imaging for the Radixact® System 510(k) Pending *ClearRT Helical kVCT technology is 510(k) pending - This does not reflect a commitment to deliver products, software, features, functionality, or upgrades, and should not be relied upon in making purchasing decisions.

ClearRT Helical kVCT Technology is 510(k) Pending Experienced and Knowledgeable Team Imaging Center of Excellence Strategic investment in imaging High density of imaging companies and expertise Significant impact with iterative reconstruction and Synchrony® development programs Introduction of ClearRT™ Helical kVCT Imaging1 Cleveland Ohio

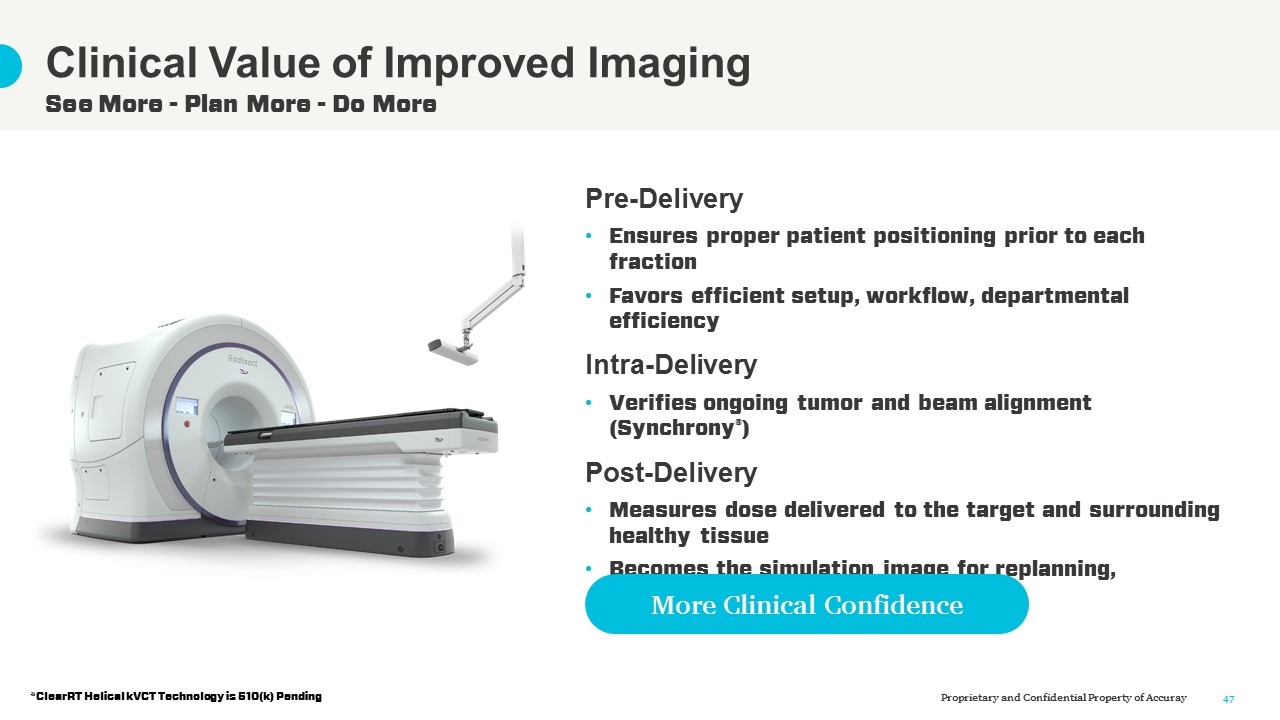

Pre-Delivery Ensures proper patient positioning prior to each fraction Favors efficient setup, workflow, departmental efficiency Intra-Delivery Verifies ongoing tumor and beam alignment (Synchrony®) Post-Delivery Measures dose delivered to the target and surrounding healthy tissue Becomes the simulation image for replanning, when required See More - Plan More - Do More Clinical Value of Improved Imaging More Clinical Confidence *ClearRT Helical kVCT Technology is 510(k) Pending

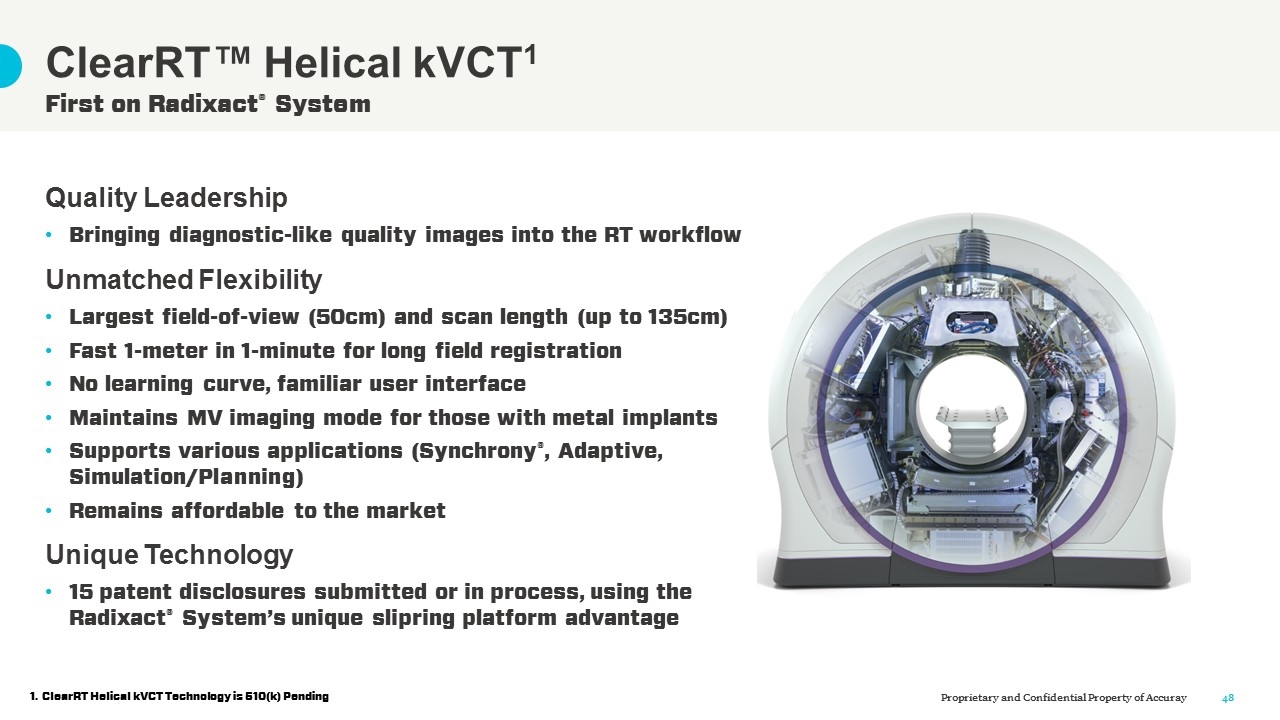

ClearRT Helical kVCT Technology is 510(k) Pending Quality Leadership Bringing diagnostic-like quality images into the RT workflow Unmatched Flexibility Largest field-of-view (50cm) and scan length (up to 135cm) Fast 1-meter in 1-minute for long field registration No learning curve, familiar user interface Maintains MV imaging mode for those with metal implants Supports various applications (Synchrony®, Adaptive, Simulation/Planning) Remains affordable to the market Unique Technology 15 patent disclosures submitted or in process, using the Radixact® System’s unique slipring platform advantage First on Radixact® System ClearRT™ Helical kVCT1

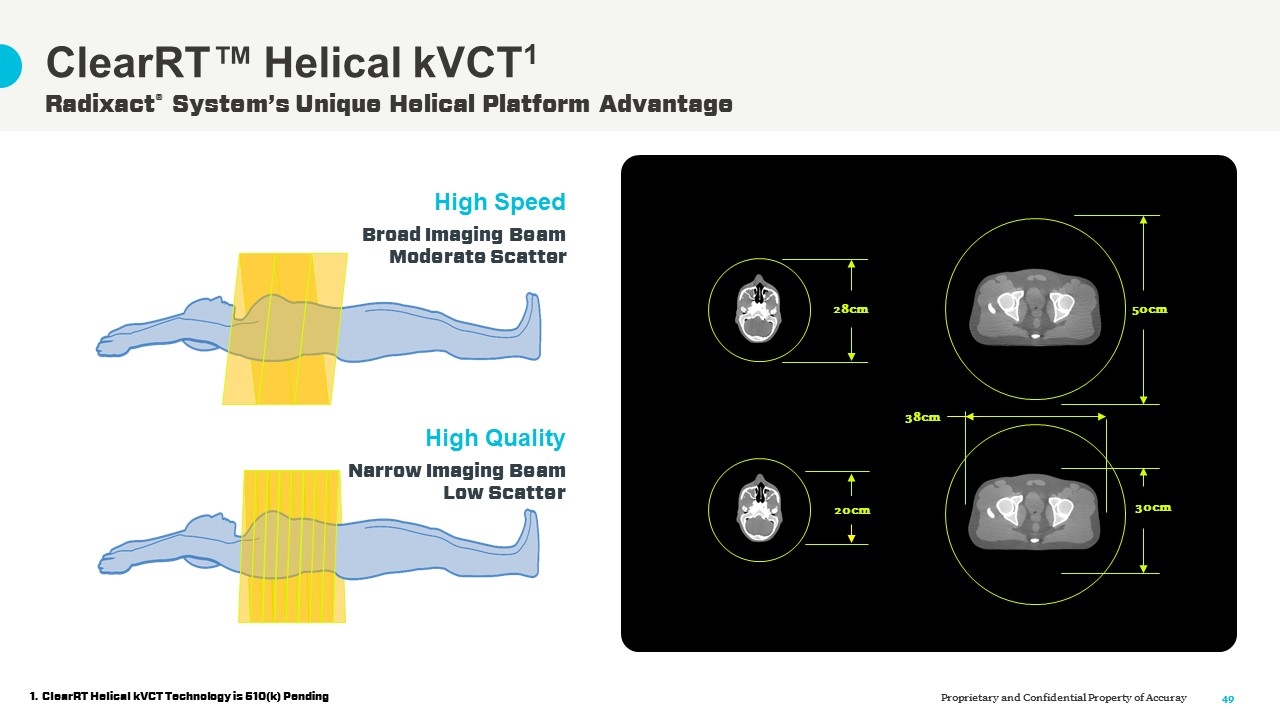

Radixact® System’s Unique Helical Platform Advantage ClearRT™ Helical kVCT1 28cm 20cm 50cm 30cm 38cm High Speed Broad Imaging Beam Moderate Scatter High Quality Narrow Imaging Beam Low Scatter ClearRT Helical kVCT Technology is 510(k) Pending

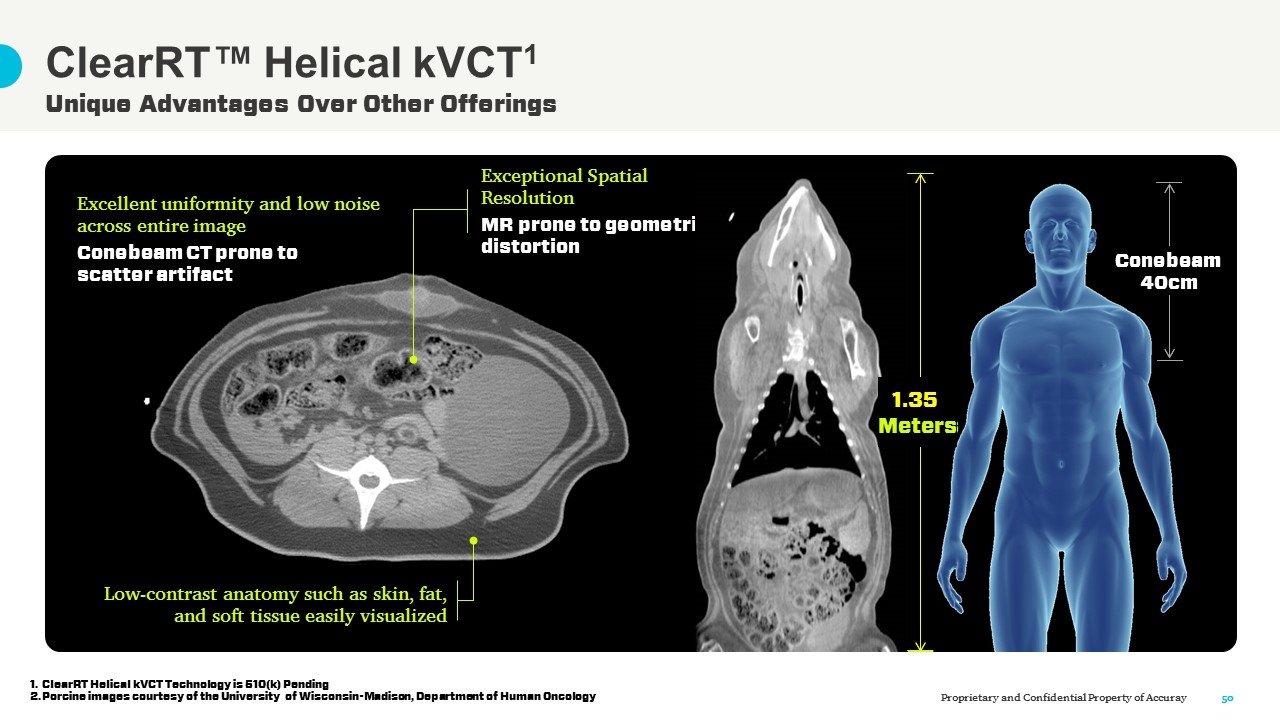

Unique Advantages Over Other Offerings ClearRT™ Helical kVCT1 Conebeam 40cm 1.35 Meters Exceptional Spatial Resolution MR prone to geometric distortion Excellent uniformity and low noise across entire image Conebeam CT prone to scatter artifact Low-contrast anatomy such as skin, fat, and soft tissue easily visualized ClearRT Helical kVCT Technology is 510(k) Pending Porcine images courtesy of the University of Wisconsin-Madison, Department of Human Oncology Conebeam 40cm 1.35 Meters

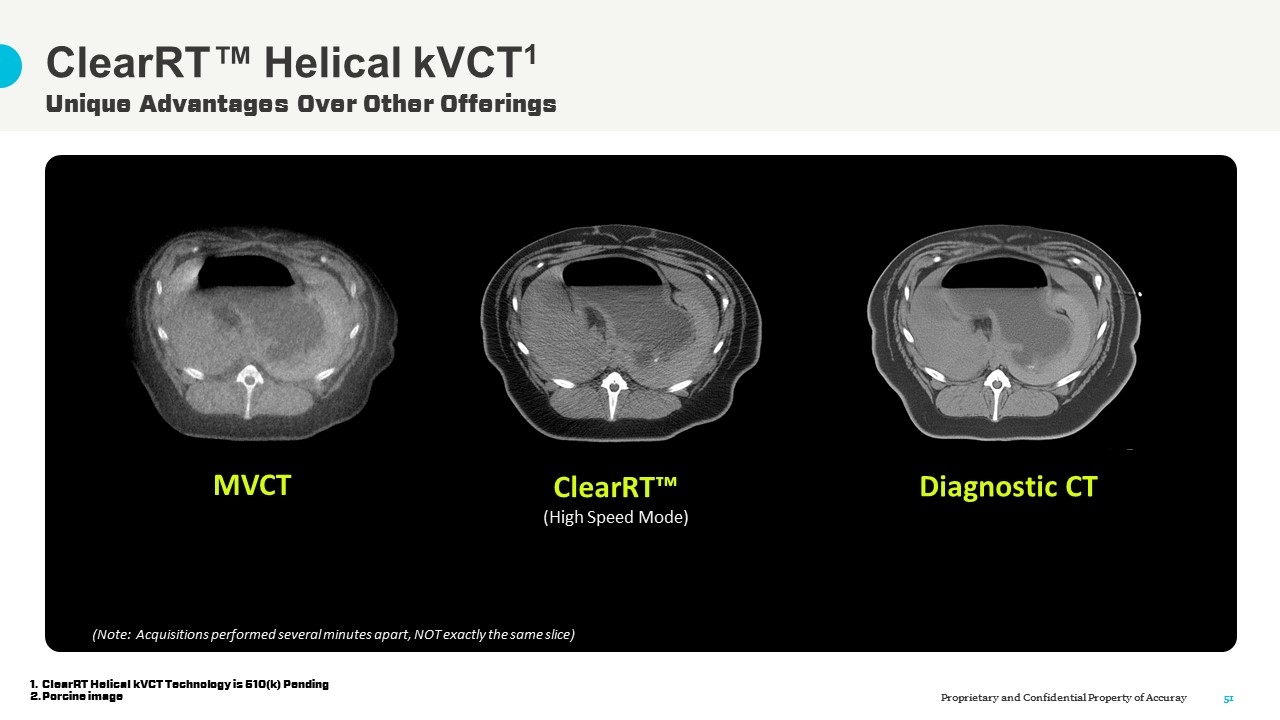

Unique Advantages Over Other Offerings ClearRT™ Helical kVCT1 MVCT ClearRT™ (High Speed Mode) Diagnostic CT (Note: Acquisitions performed several minutes apart, NOT exactly the same slice) ClearRT Helical kVCT Technology is 510(k) Pending Porcine image

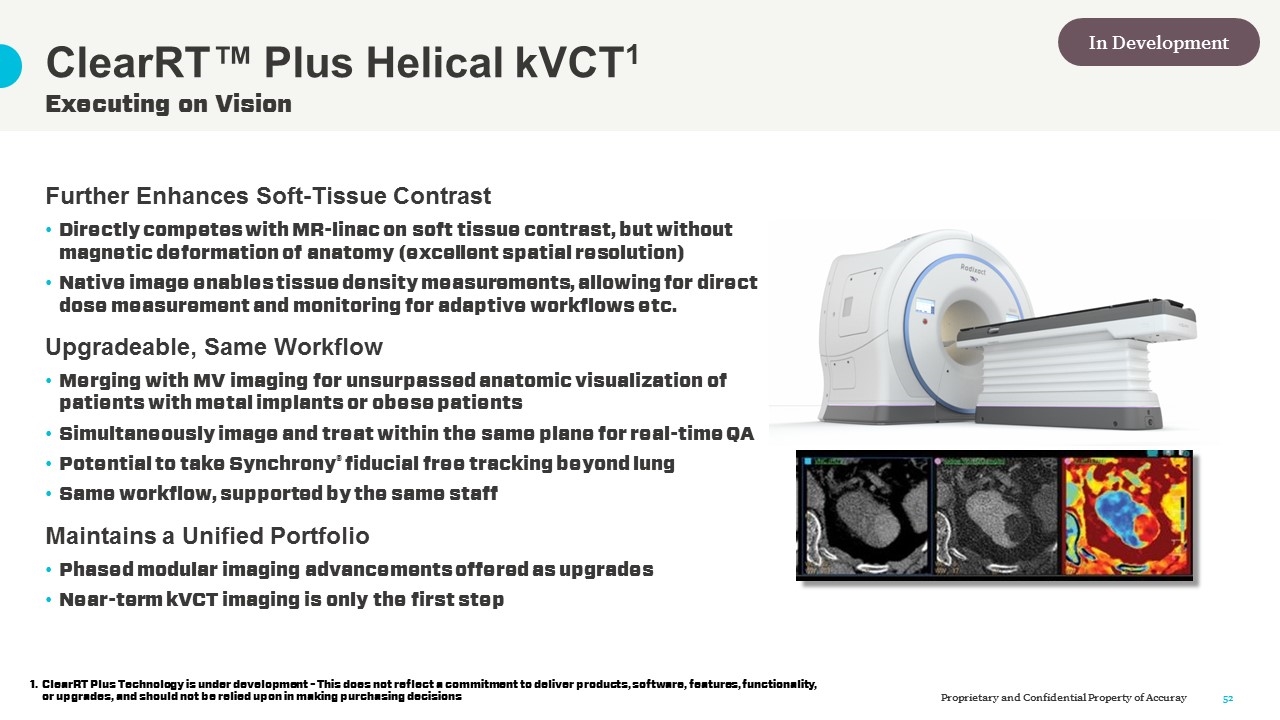

ClearRT Plus Technology is under development – This does not reflect a commitment to deliver products, software, features, functionality, or upgrades, and should not be relied upon in making purchasing decisions Further Enhances Soft-Tissue Contrast Directly competes with MR-linac on soft tissue contrast, but without magnetic deformation of anatomy (excellent spatial resolution) Native image enables tissue density measurements, allowing for direct dose measurement and monitoring for adaptive workflows etc. Upgradeable, Same Workflow Merging with MV imaging for unsurpassed anatomic visualization of patients with metal implants or obese patients Simultaneously image and treat within the same plane for real-time QA Potential to take Synchrony® fiducial free tracking beyond lung Same workflow, supported by the same staff Maintains a Unified Portfolio Phased modular imaging advancements offered as upgrades Near-term kVCT imaging is only the first step Executing on Vision ClearRT™ Plus Helical kVCT1 In Development

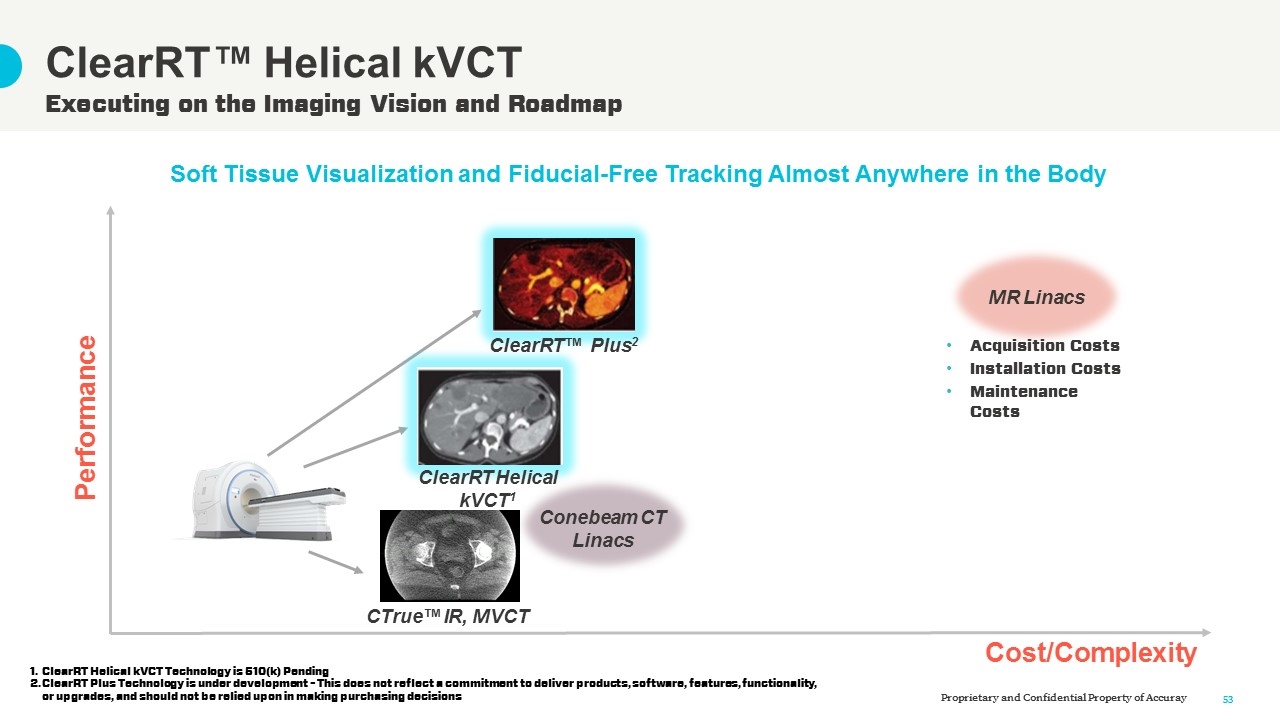

Conebeam CT Linacs Soft Tissue Visualization and Fiducial-Free Tracking Almost Anywhere in the Body Performance Cost/Complexity MR Linacs Executing on the Imaging Vision and Roadmap ClearRT™ Helical kVCT CTrue™ IR, MVCT ClearRT Helical kVCT1 ClearRT™ Plus2 Acquisition Costs Installation Costs Maintenance Costs ClearRT Helical kVCT Technology is 510(k) Pending ClearRT Plus Technology is under development – This does not reflect a commitment to deliver products, software, features, functionality, or upgrades, and should not be relied upon in making purchasing decisions

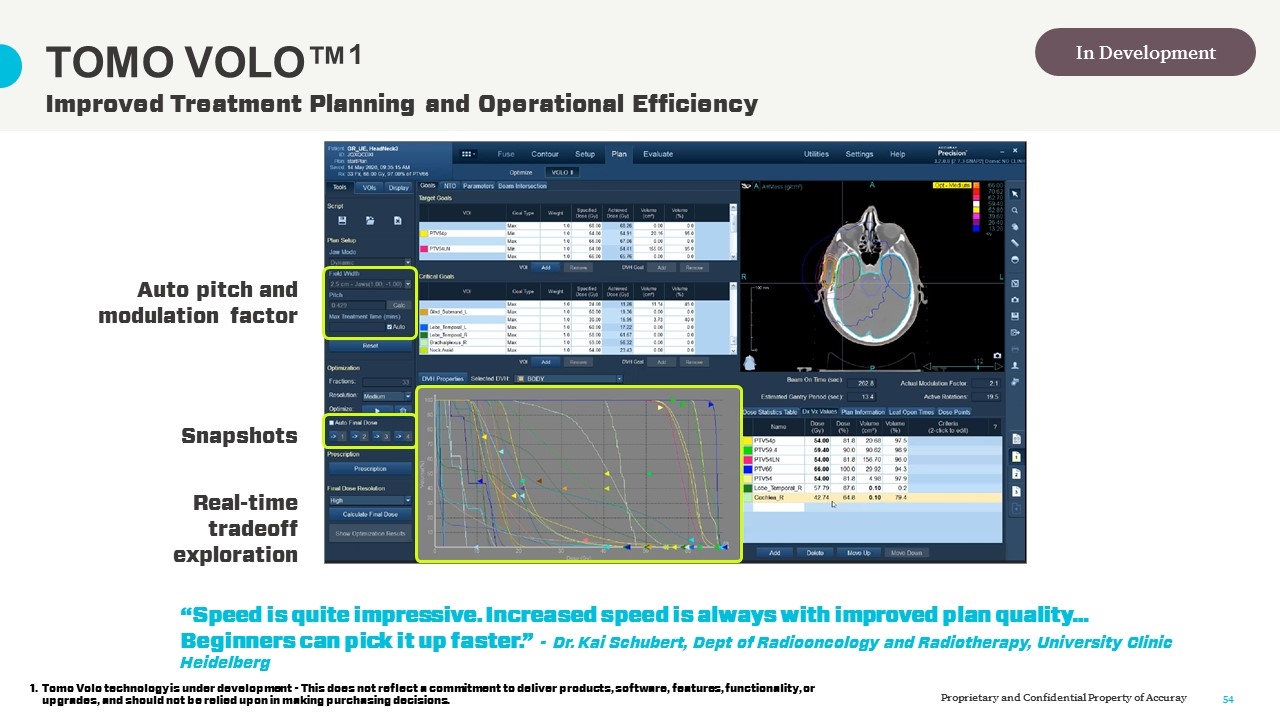

Tomo Volo technology is under development - This does not reflect a commitment to deliver products, software, features, functionality, or upgrades, and should not be relied upon in making purchasing decisions. Improved Treatment Planning and Operational Efficiency TOMO VOLO™1 Snapshots Auto pitch and modulation factor Real-time tradeoff exploration “Speed is quite impressive. Increased speed is always with improved plan quality… Beginners can pick it up faster.” - Dr. Kai Schubert, Dept of Radiooncology and Radiotherapy, University Clinic Heidelberg In Development

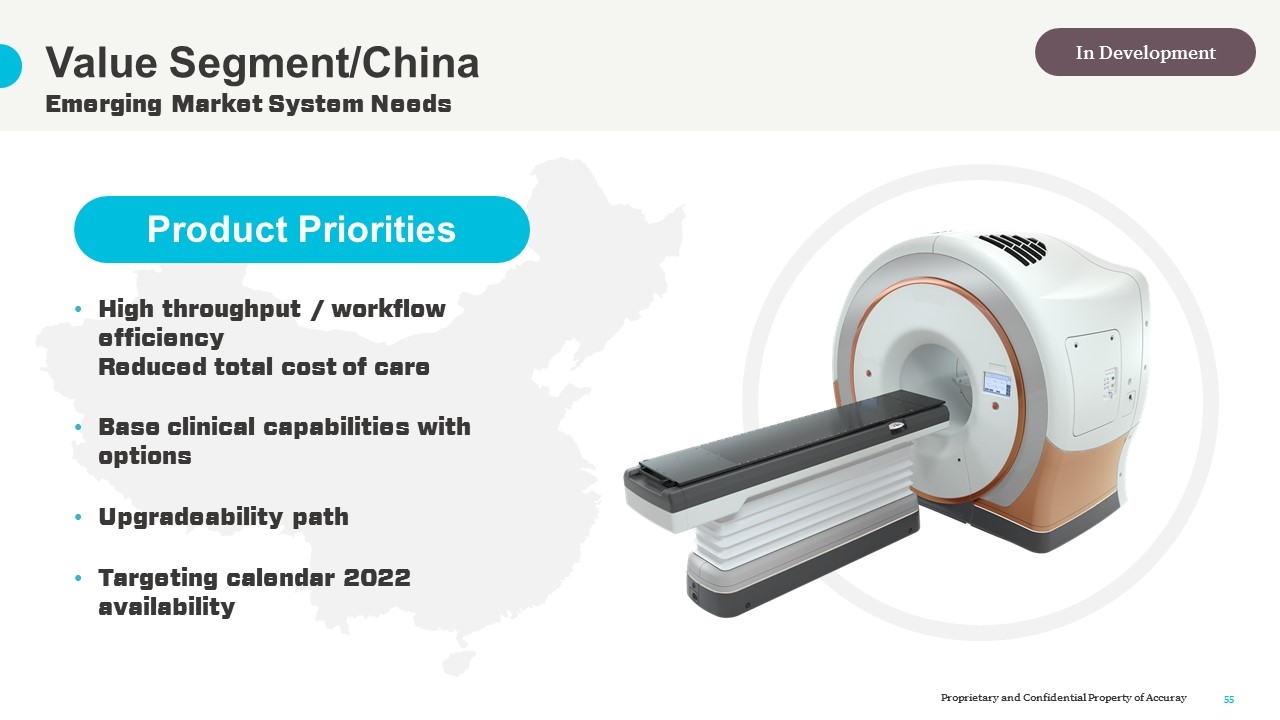

Emerging Market System Needs Value Segment/China High throughput / workflow efficiency Reduced total cost of care Base clinical capabilities with options Upgradeability path Targeting calendar 2022 availability Product Priorities In Development

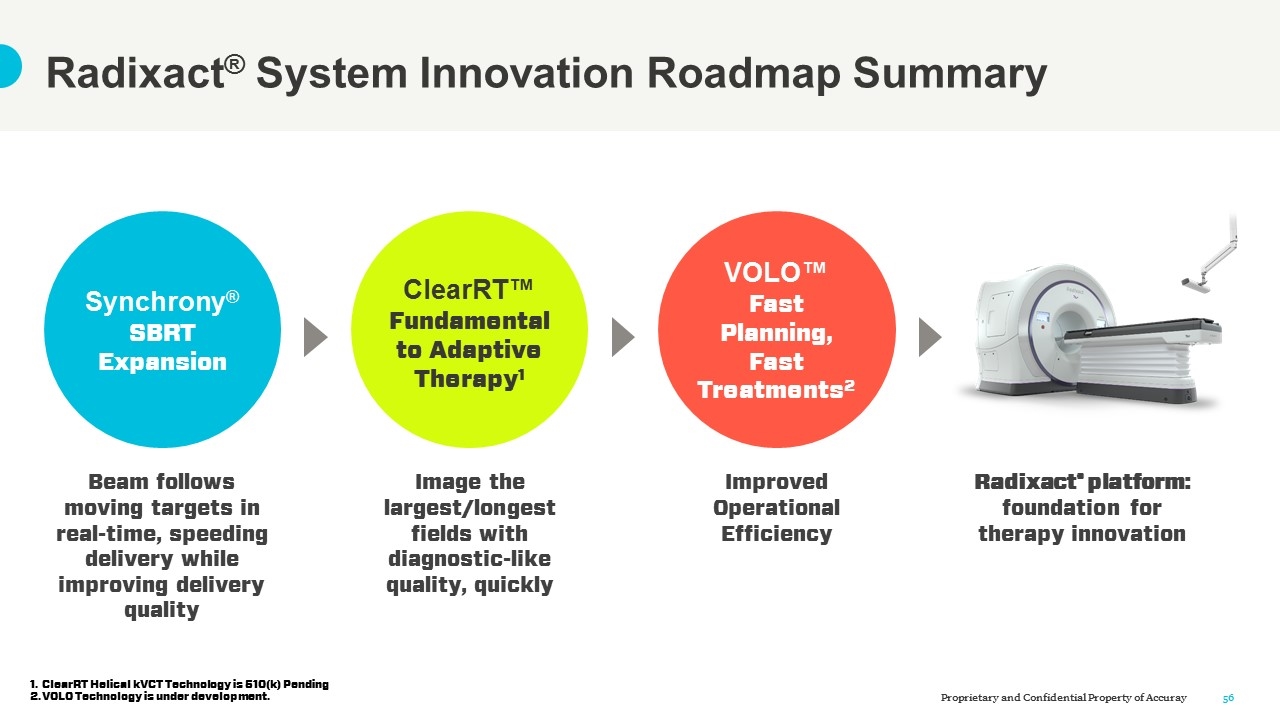

Synchrony® SBRT Expansion ClearRT™ Fundamental to Adaptive Therapy1 VOLO™ Fast Planning, Fast Treatments2 Beam follows moving targets in real-time, speeding delivery while improving delivery quality Improved Operational Efficiency Radixact® platform: foundation for therapy innovation Image the largest/longest fields with diagnostic-like quality, quickly Radixact® System Innovation Roadmap Summary ClearRT Helical kVCT Technology is 510(k) Pending VOLO Technology is under development.

CyberKnife® Roadmap Programs

Quick Installation Industry-Leading Uptime Fast Treatment Planning Fast Treatment Delivery Unique Robotic Platform Moving or Stationary Targets Dose Minimization To Organs At Risk Flexible Dose Sculpting Industry-Leading Precision | Confident, Effective SRS And SBRT Treatment Delivery

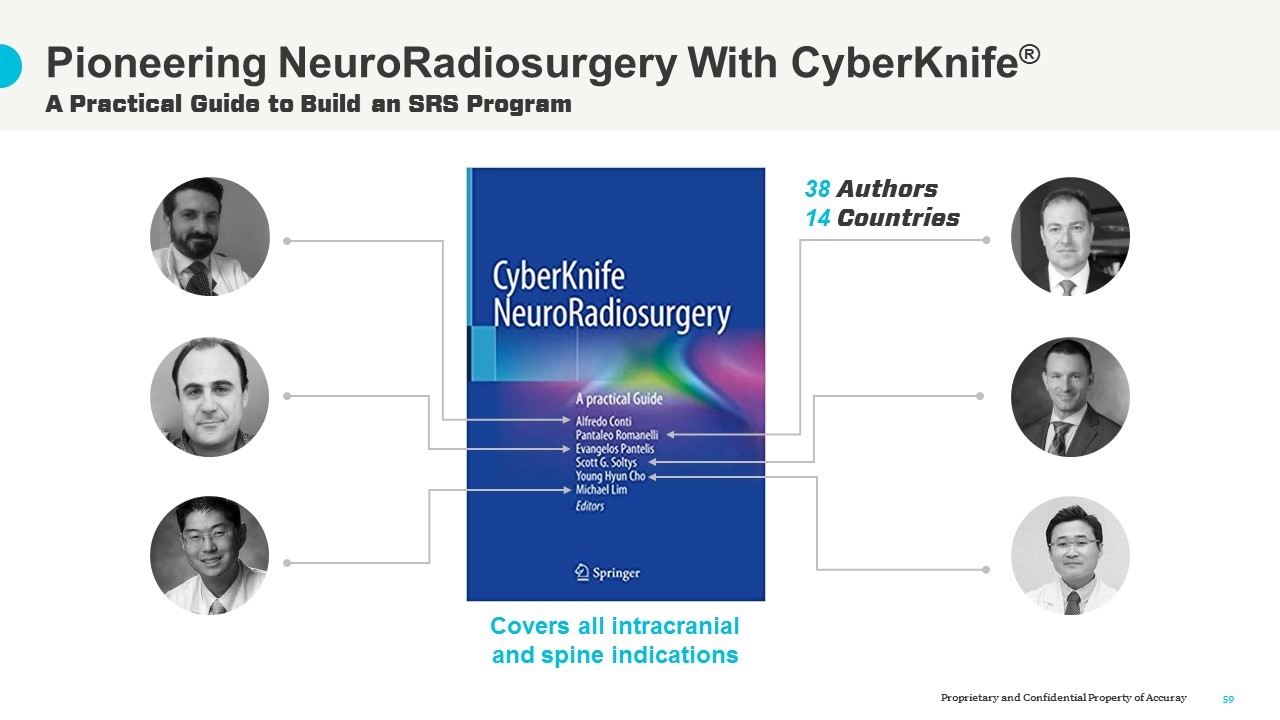

A Practical Guide to Build an SRS Program Pioneering NeuroRadiosurgery With CyberKnife® Covers all intracranial and spine indications 38 Authors 14 Countries

Frameless or Frame-Based1 Choose based upon clinical need; maintain familiarity to those transitioning from other delivery systems Neuro Planning Integrates workflows and planning conventions recognized by neurosurgeons Oligometastatic Treatment Ability to treat multifocal disease with greater efficiency Collimation Tailored to common neurosurgical case demands Neuro Package CyberKnife® S7™ System Frame-based Neuro Technology is under development - This does not reflect a commitment to deliver products, software, features, functionality, or upgrades, and should not be relied upon in making purchasing decisions. Neuro Package In Development

Integrated 3D Volumetric Imaging Planning Supports efficient same-day simulation / plan / treat workflow Registration Enables imaging the patient in treatment position, increasing speed and confidence in initial setup and registration Advanced Adaptive Opens the door to advanced Adaptive features, taking into account patient changes throughout the course of therapy Availability Targeting calendar 2023 ClearRT™ Volumetric Imaging1 CyberKnife® S7™ System CyberKnife ClearRT Volumetric Imaging Technology is under development - This does not reflect a commitment to deliver products, software, features, functionality, or upgrades, and should not be relied upon in making purchasing decisions. Volumetric Imaging In Development

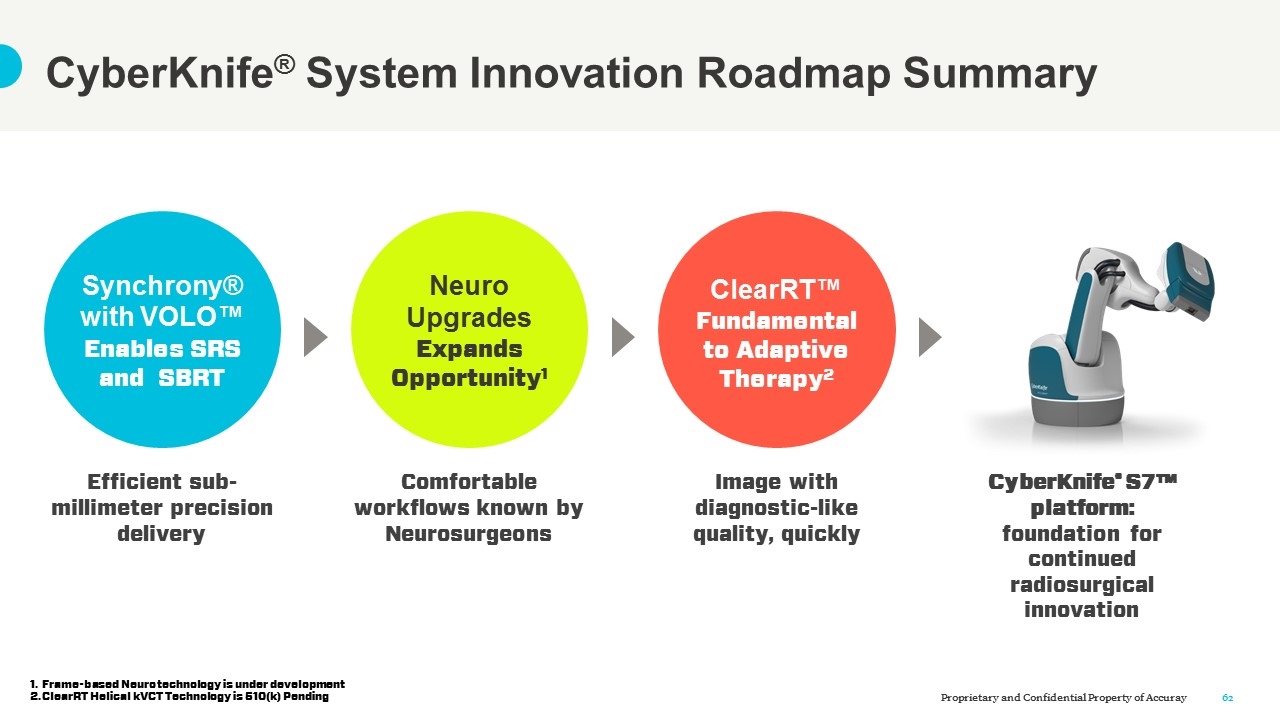

CyberKnife® System Innovation Roadmap Summary Synchrony® with VOLO™ Enables SRS and SBRT Neuro Upgrades Expands Opportunity1 ClearRT™ Fundamental to Adaptive Therapy2 Efficient sub-millimeter precision delivery Image with diagnostic-like quality, quickly CyberKnife® S7™ platform: foundation for continued radiosurgical innovation Comfortable workflows known by Neurosurgeons Frame-based Neuro technology is under development ClearRT Helical kVCT Technology is 510(k) Pending

Dr. Chris Loiselle Board-certified Radiation Oncologist who practices at the Swedish Medical center in Seattle WA. Dr. Loiselle received his medical degree from John’s Hopkins University and completed his residency in Radiation Oncology from the University of Washington Medical Center. Dr. Loiselle currently serves as the Director of Radiosurgery at the Swedish Medical Center.

Adaptive Therapy Innovation Convergence

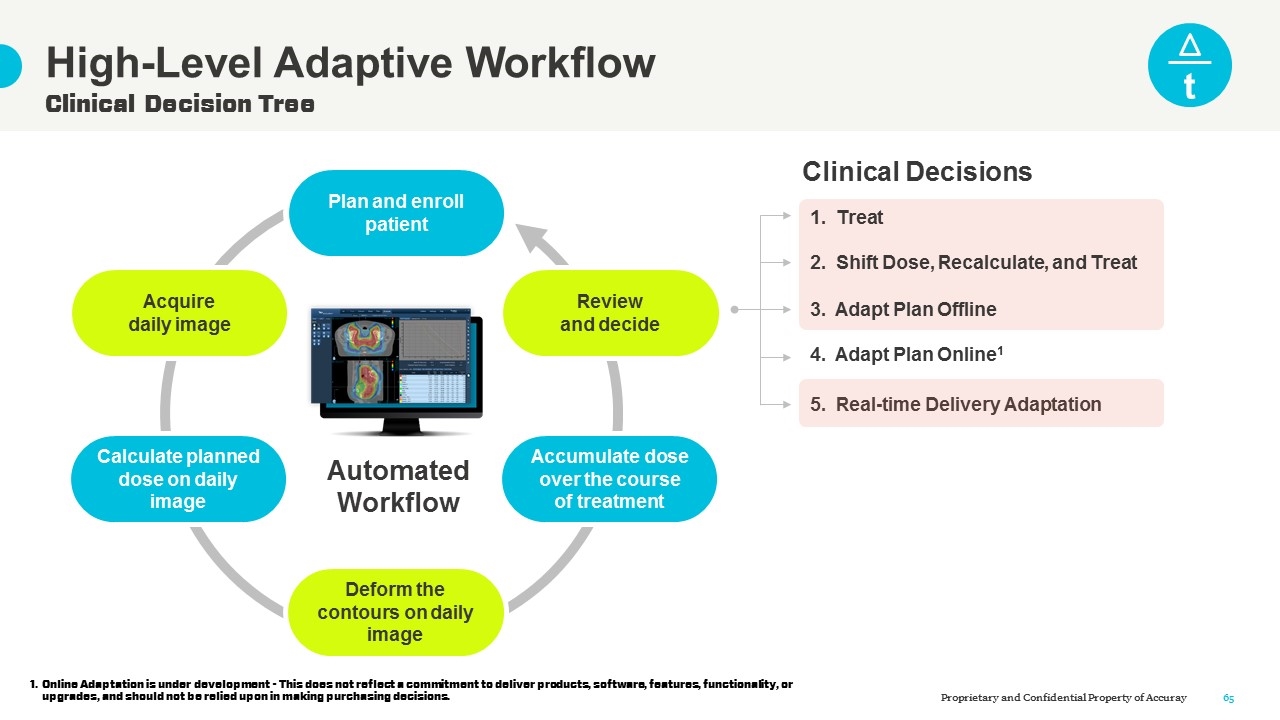

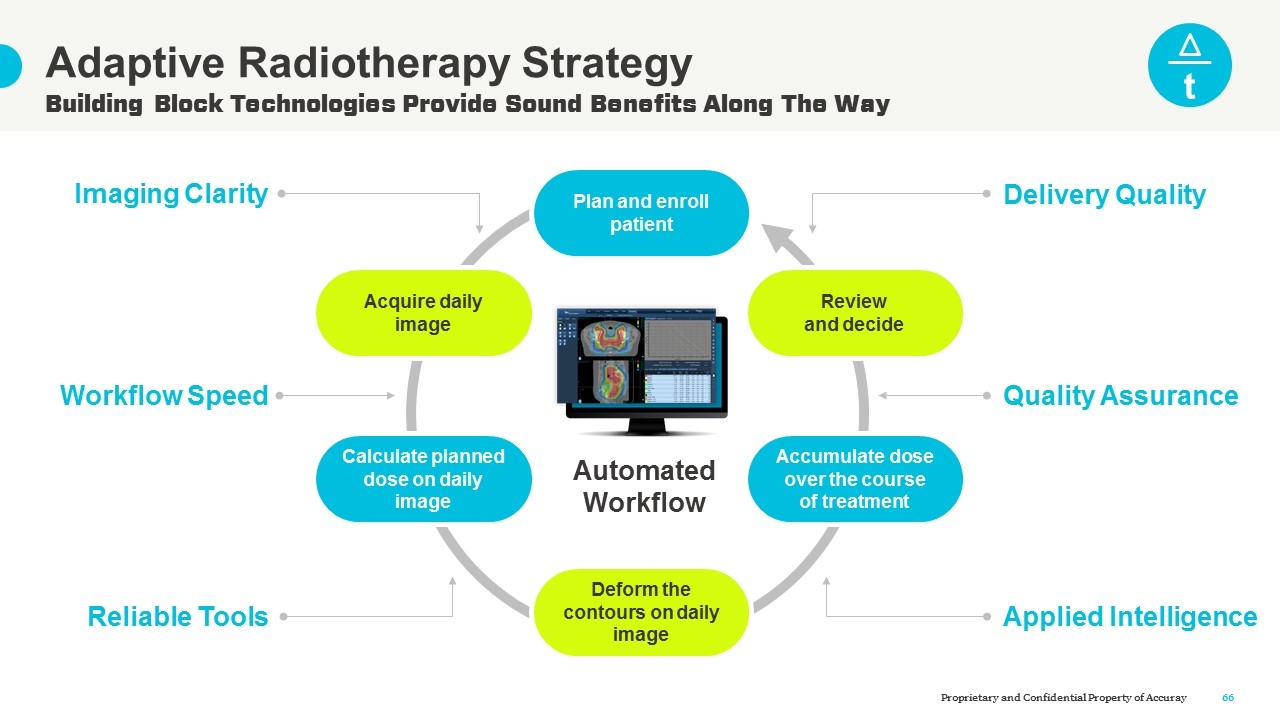

Clinical Decision Tree High-Level Adaptive Workflow Plan and enroll patient Accumulate dose over the course of treatment Deform the contours on daily image Calculate planned dose on daily image Acquire daily image Automated Workflow Clinical Decisions 1. Treat Review and decide 2. Shift Dose, Recalculate, and Treat 3. Adapt Plan Offline 4. Adapt Plan Online1 5. Real-time Delivery Adaptation t Online Adaptation is under development - This does not reflect a commitment to deliver products, software, features, functionality, or upgrades, and should not be relied upon in making purchasing decisions. Plan and enroll patient Accumulate dose over the course of treatment Calculate planned dose on daily image Acquire daily image Review and decide

Building Block Technologies Provide Sound Benefits Along The Way Adaptive Radiotherapy Strategy Plan and enroll patient Review and decide Accumulate dose over the course of treatment Deform the contours on daily image Calculate planned dose on daily image Acquire daily image Automated Workflow Imaging Clarity Workflow Speed Reliable Tools Delivery Quality Quality Assurance Applied Intelligence t

Oncology Information Systems Ensure connectivity between Accuray products and established / establishing OIS offerings Treatment Planning Expand interoperability with RaySearch’s RayStation Collaborative Effort Support customers’ demand for best-in-class treatment systems that aggregate information into a contiguous patient record Hospital Information System (HIS) Through Partnerships Powerful Partnerships for Customer Ease of Integration Commitment to Seamless Integration

Q&A

Closing Remarks

Expanding the Curative Power of Radiation Therapy to Improve as Many Lives as Possible Shareholder Value New product innovation enabling personalization and shorter treatment More convenient, and effective treatments Expand clinical application beyond oncology Patients Providers Value-based care aligned with the RO-APM Precision features for advanced therapies Upgradability to the latest technology Differentiation in local markets We strive to deliver for and create Driven By Our Mission