Form 8-K LIGAND PHARMACEUTICALS For: Oct 20

Exhibit 99.1 INVESTOR & ANALYST DAY INNOVATION DRIVING VALUE OCTOBER 20, 2020 Nasdaq:1 LGND Copyright © 2020 Ligand. All Rights Reserved.

2 SAFE HARBOR STATEMENT The following presentation contains forward-looking statements by Ligand and its partners that involve risks and uncertainties and reflect Ligand's and it’s partners’ judgment as of the date of this presentation. Words such as “plans,” “believes,” “expects,” “projects,” “could,” “anticipates,” and “will,” and similar expressions, are intended to identify forward-looking statements. These forward-looking statements include, without limitation, financial projections and outlook, remdesivir projections, expectations regarding research and development programs, potential uses of capital, the timing of the initiation or compilation of preclinical studies and clinical trials by Ligand and its partners, and expectations regarding product approvals and launches by Ligand or its partners and the timing thereof. Actual events or results may differ from Ligand’s expectations due to risks and uncertainties inherit in Ligand’s business, including: [Ligand may be unable to successfully integrate operations from acquired businesses, including Pfenex, or may face other difficulties as a result of acquisitions such as strain on operational resources]; additional disruptions to Ligand’s or its partners’ business as a result of the COVID 19 pandemic; the risk that the closing conditions of the transaction to divest the Vernalis business may not be satisfied; Ligand has wide discretion on its use of capital and may choose not to engage in any share repurchases, declare any dividends or pursue acquisitions or internal develop programs; Ligand may not achieve its guidance in 2020 or thereafter; Kyprolis®, EVOMELA® and Zulresso™ may not perform as expected; Ligand relies on collaborative partners for milestone and royalty payments, royalties, materials revenue, contract payments and other revenue projections; the possibility that Ligand's and its partners’ drug candidates might not be proved to be safe and efficacious and uncertainty regarding the commercial performance of Ligand's and/or its partners’ products; and other risks and uncertainties described in its public filings with the Securities and Exchange Commission, available at www.sec.gov. Additional risks may apply to forward-looking statements made in this presentation. Information regarding partnered products and programs comes from information publicly released by our partners. This presentation describes the typical roles and responsibilities of Ligand and our partners and is not intended to be a complete description in all cases. Our trademarks, trade names and service marks referenced herein include Ligand, Captisol, OmniAb, OmniChicken, OmniRat, OmniMouse, OmniFlic, OmniClic and OmniTaur . Each other trademark, trade name or service mark appearing in this presentation belongs to its owner. The process for reconciliation between the non-GAAP adjusted financial numbers presented on slides 103 through 109 and the corresponding GAAP figures is shown in the Q4’19 and Q2’20 press releases available at https://investor.ligand.com/press releases. However, other than with respect to total revenues, the Company only provides financial guidance on an adjusted basis and does not provide reconciliations of such forward-looking adjusted measures to GAAP due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation. Ligand disclaims responsibility for any statement by a person other than its employees and the views expressed by persons other than Ligand employees do not necessarily reflect the views of Ligand. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect our good faith beliefs (or those of the indicated third parties) and speak only as of the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, and Ligand undertakes no obligation to revise or update this presentation to reflect events or circumstances or update third party research numbers after the date hereof. This caution is made under the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934.

3 AGENDA Eastern Time Business Overview 11:00 a.m. – 11:20 a.m. John Higgins, CEO Technologies, OmniAb and Internal R&D 11:20 a.m. – 11:35 a.m. Matt Foehr, President and COO Vince Antle, PhD, SVP Technical Captisol Updates 11:35 a.m. – 11:40 a.m. Operations and Quality Assurance Monica Tijerina, PhD, Executive Remdesivir and the Role of Captisol 11:40 a.m. – 11:50 a.m. Director, Formulations and Process Development - Gilead Sciences Matt Davis, PharmD, Infectious COVID-19 Treatment Landscape and Diseases Clinical Pharmacist - 11:50 a.m. – 12:10 p.m. Guidelines UCLA Ronald Reagan Medical Center Patrick Lucy, SVP and CBO Protein Protein Expression Business Review 12:10 p.m. – 12:30 p.m. Expression Business Financial Overview and Outlook 12:30 p.m. – 12:45 p.m. Matt Korenberg, CFO Q&A

BUSINESS OVERVIEW John Higgins CEO 4 Copyright © 2020 Ligand. All Rights Reserved.

5 ABOUT LIGAND Medical research and technology Robust platform of company discovering medicines, discovery tools and improving safety and reducing technologies needed to manufacturing costs solve industry challenges PEOPLE & TECHNOLOGY INNOVATION INNOVATION DRIVING VALUE Superior support and High growth and strong cash engagement with pharmaceutical flows; projected 60% revenue partners for a wide range of growth and 57% earnings medical and health needs growth in 2020 over 2019, continued strong outlook PARTNERS FINANCIALS

6 LIGAND ADDS VALUE . . . . . . JUST ASK OUR 130 PARTNERS Our research and technology help partners… Discover medicines Ligand’s technology and R&D support entitles us to share Improve safety in revenue of partners through Reduce costs royalties

7 SELECT PARTNERS VALUABLE LICENSE AGREEMENTS AND PARTNERSHIPS Kyprolis JZP-458 Sparsentan Parempanel IV IMVT-1401 Teriparatide Ensifentrine Teclistamab Evomela Veklury Pevonedistat Zimberelimab PTX-022 Sugemalimab V114 Pneumosil

8 LIGAND’S OPERATIONS Company headquarters Recent R&D expansion 158 employees 4 U.S. sites where major changing to Bay Area to support the OmniAb 58 with PhDs R&D platforms operate (Emeryville) in 2021 and Captisol businesses OmniAb Captisol Protein Ion Channel Expression Company footprint has evolved over past year with 4 U.S. acquisitions and investment in the business

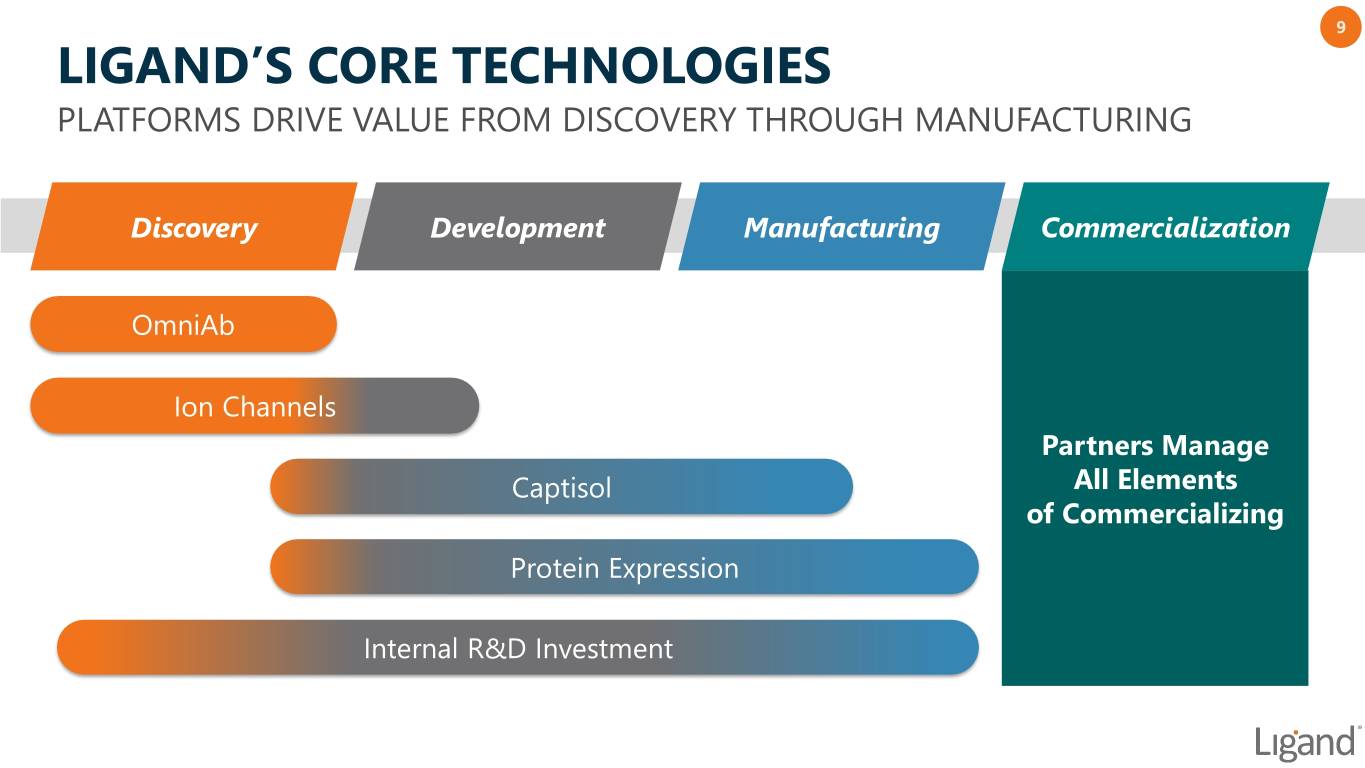

9 LIGAND’S CORE TECHNOLOGIES PLATFORMS DRIVE VALUE FROM DISCOVERY THROUGH MANUFACTURING Discovery Development Manufacturing Commercialization OmniAb Ion Channels Partners Manage Captisol All Elements of Commercializing Protein Expression Internal R&D Investment

10 ACCELERATING GROWTH

11 THREE-YEAR OUTLOOK FOR THE YEAR 2023 • Three core segments of revenue • All projected to grow meaningfully over next few years on modest cost structure • Forecast for significantly increasing operating cash flow 2020 2023

12 STRONG GROWTH DRIVEN BY ROYALTY REVENUE

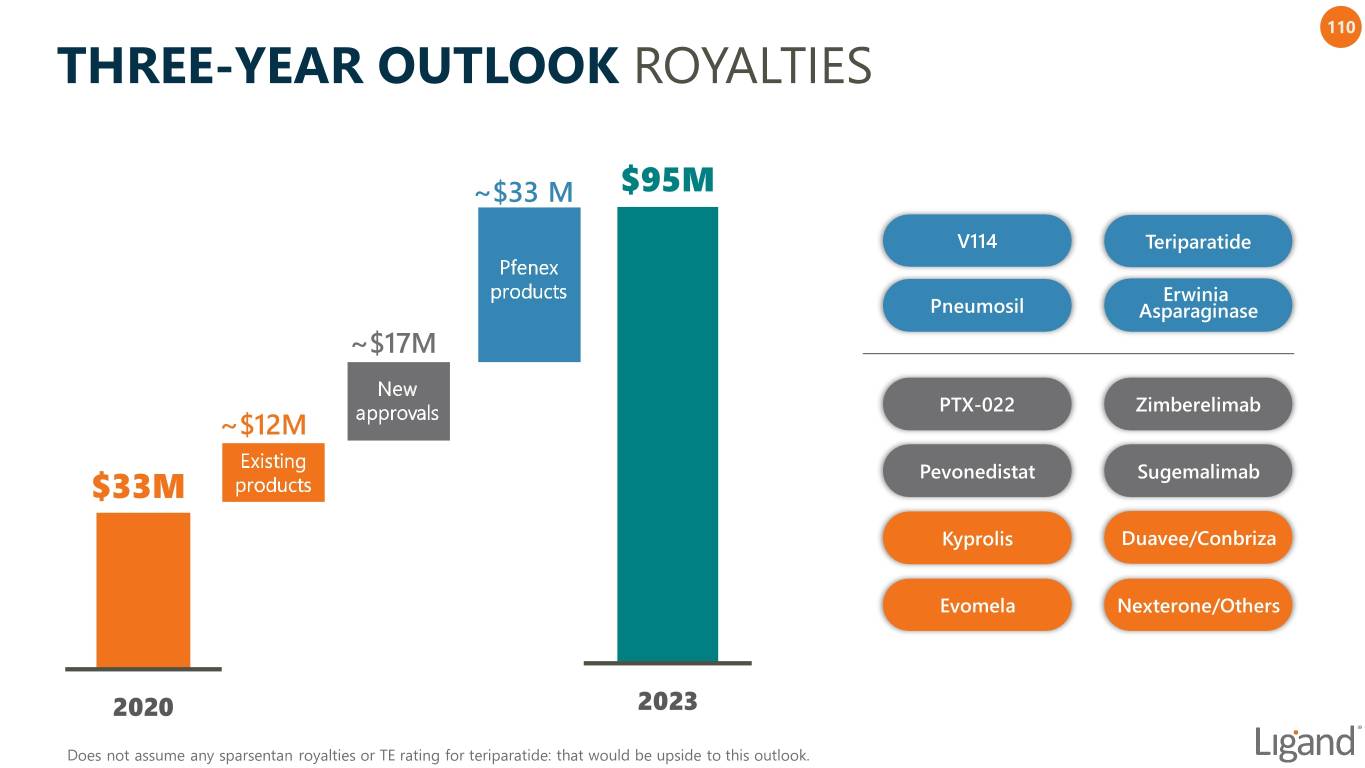

13 FINANCIAL OUTLOOK: ROYALTY REVENUE LIGAND FORECASTS ROYALTY REVENUE WILL TRIPLE OVER NEXT THREE YEARS ~$33M $95M Pfenex ~1/3 from products Pfenex ~$17M New ~$12M approvals Existing $33M products ~2/3 Core Ligand Royalties 2020 2023 Does not assume any sparsentan royalties or TE rating for teriparatide: that would be expected upside to this outlook.

14 STRONGEST PIPELINE IN COMPANY’S HISTORY

15 PARTNERED PIPELINE BROAD PORTFOLIO WITH OVER 130 DIFFERENT PARTNERS PROTEIN EXPRESSION PROPRIETARY Acquired platform October 2020 COMPOUNDS / OTHER More deals this year than any other First approvals expected in 2021

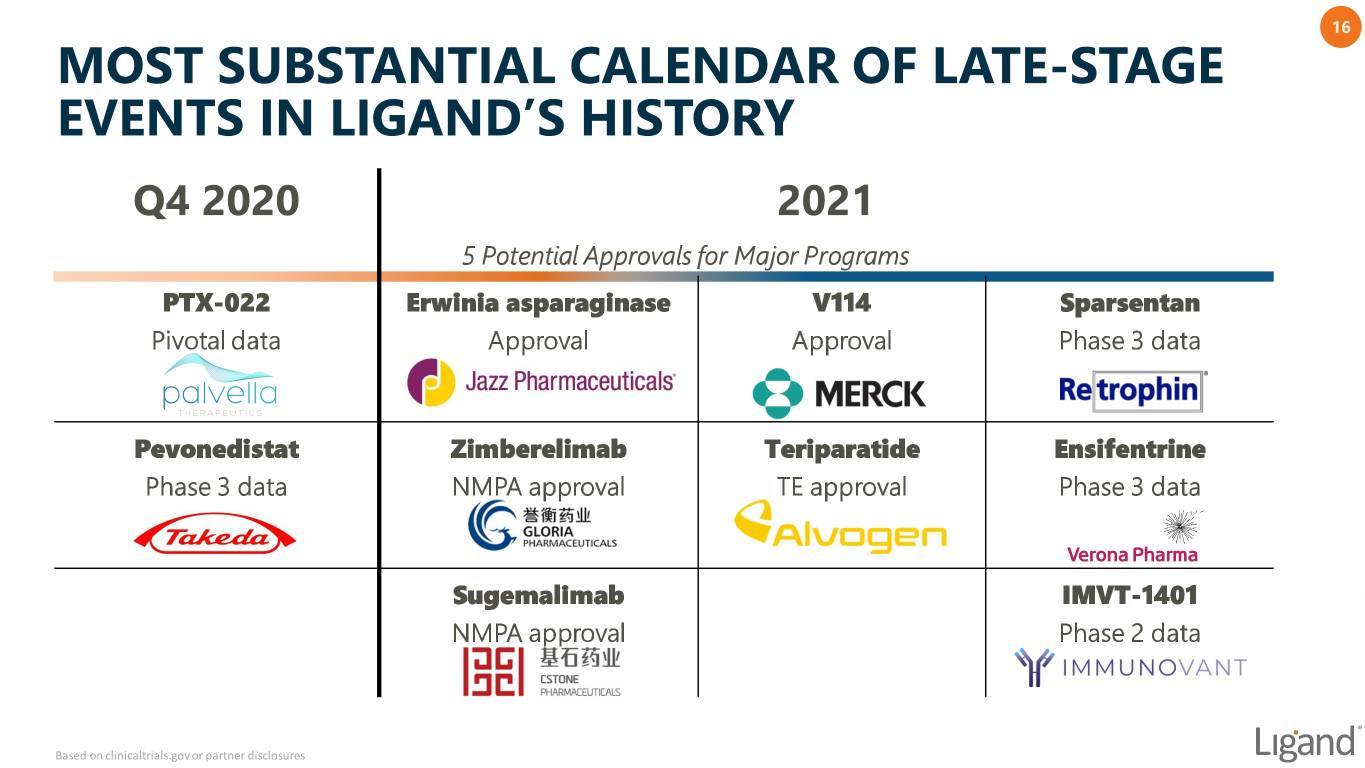

16 MOST SUBSTANTIAL CALENDAR OF LATE-STAGE EVENTS IN LIGAND’S HISTORY Q4 2020 2021 5 Potential Approvals for Major Programs PTX-022 Erwinia asparaginase V114 Sparsentan Pivotal data Approval Approval Phase 3 data Pevonedistat Zimberelimab Teriparatide Ensifentrine Phase 3 data NMPA approval TE approval Phase 3 data Sugemalimab IMVT-1401 NMPA approval Phase 2 data Based on clinicaltrials.gov or partner disclosures

17 INVESTING IN OUR FUTURE TO DRIVE GROWTH - Internal R&D investment - Technology acquisitions - Tuck-in M&A - Transformative M&A

18 OVER $2 BILLION DEPLOYED - Return of capital to shareholders - M&A

19 GROWING ESG INITIATIVES • At Ligand we strive to be good citizens of the communities where we do business and we take our Environmental, Social and Governance responsibilities seriously ‒ Committed to regular ESG reporting and disclosure; annual report and additional materials available on corporate website Environmental Internal and community efforts on recycling, water conservation, reduced emissions Social Committed to diversity, safety and well-being of our team; engaged in community programs Governance Diverse Board of Directors; all directors, aside from CEO, independent including the Chairman; transparency with stakeholders

20 LIGAND INDEPENDENT DIRECTORS John Kozarich, PhD John LaMattina, PhD Sunil Patel Sarah Boyce Chairman Former President of Public & Private Biotech Executive CEO, Avidity Biosciences Merck Research Executive Research, Pfizer, Inc. Past companies include: Abgenix, Past companies include: CEO, ActivX Biosciences Biotech Advisor and Board Gilead, BiPar and OncoMed Akcea Therapeutics, Ionis Alkermes, Chemistry Professor Member Protein/mAb Researcher Pharmaceuticals, Forest Labs Jason Aryeh Todd Davis Nancy Gray, PhD Stephen Sabba, MD Life-Sciences Fund Manager Biotech / Restructuring CEO, CEO, Gordon Research Institutional Investor Benuvia Therapeutics Biotech Advisor and Board Conferences BioTech Fund Manager Private Equity Executive Member Executive at American Gastroenterologist Biopharmaceutical Board Member Chemical Society and Researcher at Exxon

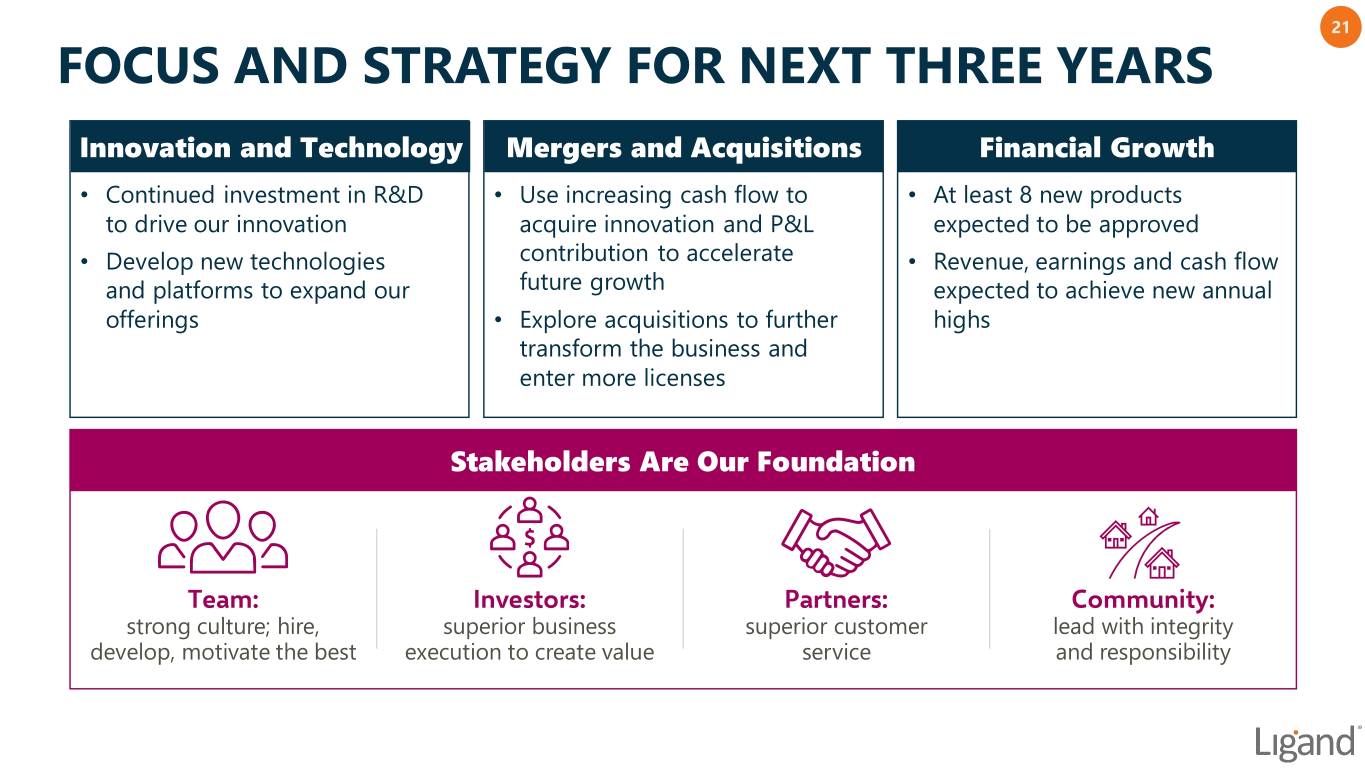

21 FOCUS AND STRATEGY FOR NEXT THREE YEARS Innovation and Technology Mergers and Acquisitions Financial Growth • Continued investment in R&D • Use increasing cash flow to • At least 8 new products to drive our innovation acquire innovation and P&L expected to be approved • Develop new technologies contribution to accelerate • Revenue, earnings and cash flow and platforms to expand our future growth expected to achieve new annual offerings • Explore acquisitions to further highs transform the business and enter more licenses Stakeholders Are Our Foundation Team: Investors: Partners: Community: strong culture; hire, superior business superior customer lead with integrity develop, motivate the best execution to create value service and responsibility

TECHNOLOGIES, OMNIAB, AND INTERNAL R&D Matt Foehr President and COO 22 Copyright © 2020 Ligand. All Rights Reserved.

PLATFORM TECHNOLOGIES 23 Copyright © 2020 Ligand. All Rights Reserved.

24 THREE PRIMARY TECHNOLOGY PLATFORMS CUTTING-EDGE, ROYALTY-BEARING TECHNOLOGIES THAT MAKE MAJOR LIFE- SAVING GLOBAL DRUGS POSSIBLE Antibody Discovery Formulation Manufacturing/CMC Protein Expression Technology Delivering fully human antibodies Enabling the creation of new products Making production possible Ligand’s business model is based on providing drug discovery platforms, completing early stage drug development and partnering

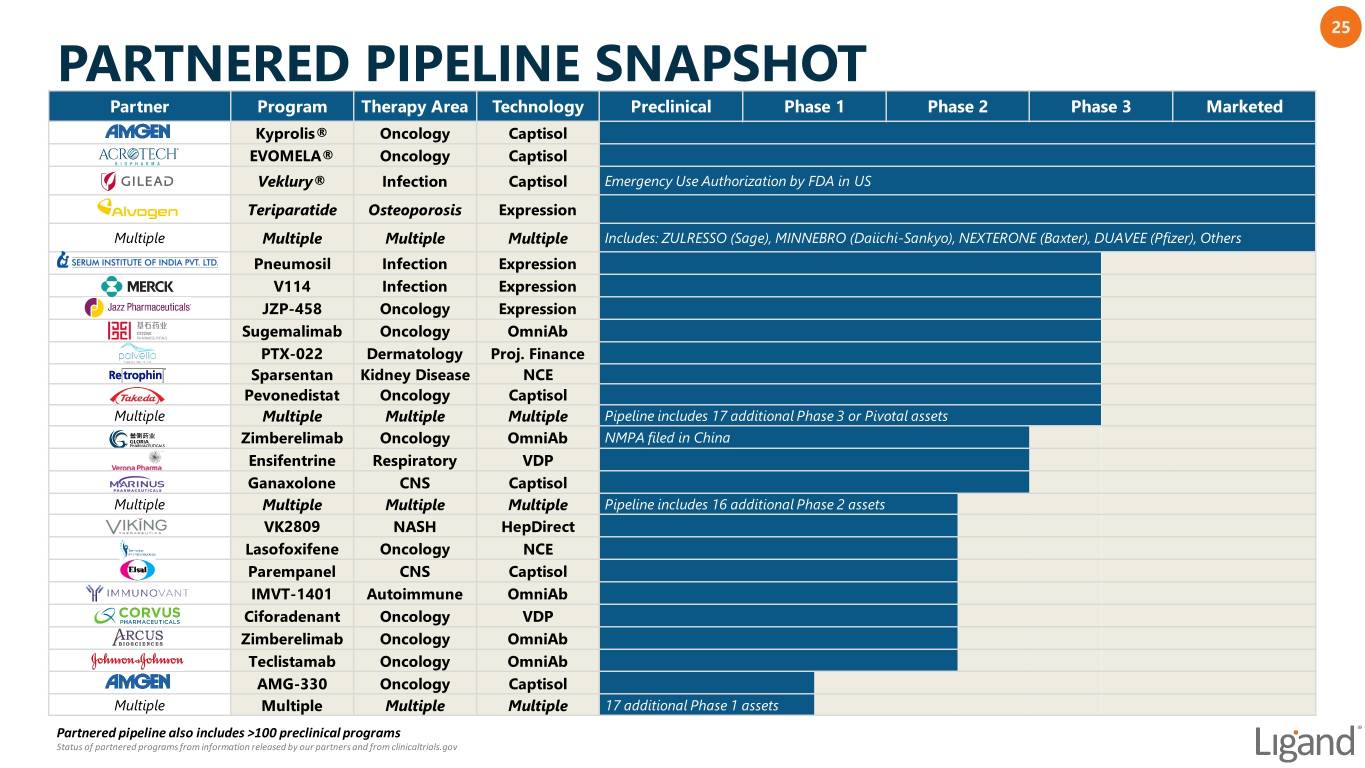

25 PARTNERED PIPELINE SNAPSHOT Partner Program Therapy Area Technology Preclinical Phase 1 Phase 2 Phase 3 Marketed Kyprolis® Oncology Captisol EVOMELA® Oncology Captisol Veklury® Infection Captisol Emergency Use Authorization by FDA in US Teriparatide Osteoporosis Expression Multiple Multiple Multiple Multiple Includes: ZULRESSO (Sage), MINNEBRO (Daiichi-Sankyo), NEXTERONE (Baxter), DUAVEE (Pfizer), Others Pneumosil Infection Expression V114 Infection Expression JZP-458 Oncology Expression Sugemalimab Oncology OmniAb PTX-022 Dermatology Proj. Finance Sparsentan Kidney Disease NCE Pevonedistat Oncology Captisol Multiple Multiple Multiple Multiple Pipeline includes 17 additional Phase 3 or Pivotal assets Zimberelimab Oncology OmniAb NMPA filed in China Ensifentrine Respiratory VDP Ganaxolone CNS Captisol Multiple Multiple Multiple Multiple Pipeline includes 16 additional Phase 2 assets VK2809 NASH HepDirect Lasofoxifene Oncology NCE Parempanel CNS Captisol IMVT-1401 Autoimmune OmniAb Ciforadenant Oncology VDP Zimberelimab Oncology OmniAb Teclistamab Oncology OmniAb AMG-330 Oncology Captisol Multiple Multiple Multiple Multiple 17 additional Phase 1 assets Partnered pipeline also includes >100 preclinical programs Status of partnered programs from information released by our partners and from clinicaltrials.gov

OMNIAB UPDATES 26 Copyright © 2020 Ligand. All Rights Reserved.

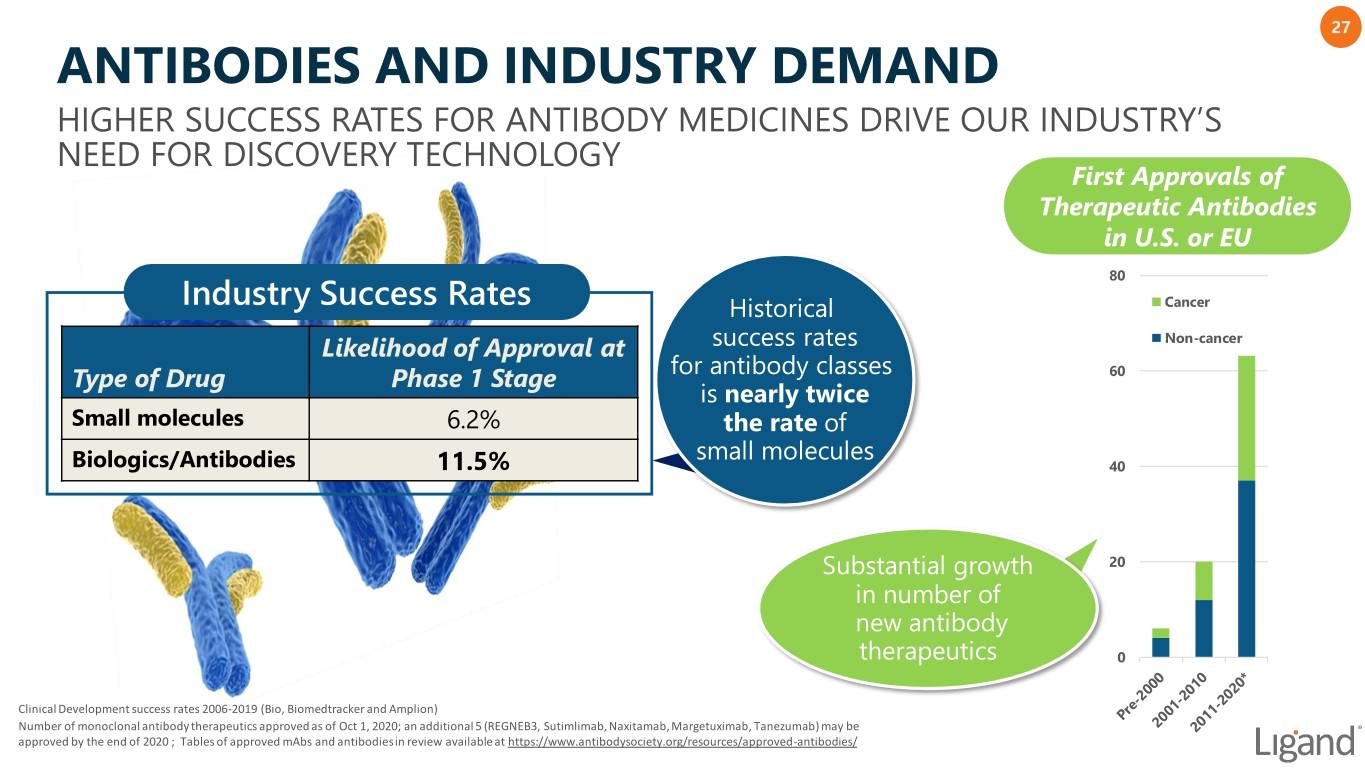

27 ANTIBODIES AND INDUSTRY DEMAND HIGHER SUCCESS RATES FOR ANTIBODY MEDICINES DRIVE OUR INDUSTRY’S NEED FOR DISCOVERY TECHNOLOGY First Approvals of Therapeutic Antibodies in U.S. or EU 80 Industry Success Rates Historical Cancer Likelihood of Approval at success rates Non-cancer for antibody classes 60 Type of Drug Phase 1 Stage is nearly twice Small molecules 6.2% the rate of small molecules Biologics/Antibodies 11.5% 40 Substantial growth 20 in number of new antibody therapeutics 0 Clinical Development success rates 2006-2019 (Bio, Biomedtracker and Amplion) Number of monoclonal antibody therapeutics approved as of Oct 1, 2020; an additional 5 (REGNEB3, Sutimlimab, Naxitamab, Margetuximab, Tanezumab) may be approved by the end of 2020 ; Tables of approved mAbs and antibodies in review available at https://www.antibodysociety.org/resources/approved-antibodies/

28 THE OMNIAB TECHNOLOGY SUITE CONTINUING OUR BEST-IN-CLASS STATUS WITH INNOVATION AND TECHNOLOGY OFFERING EXPANSION The only three- species platform High demand for bispecific antibodies Industry-first ultralong CDR-H3s Bispecific platforms Industry-leading broadest offering Antigen generation for Ultralong challenging CDR-H3 Proven success therapeutic humanized targets binding domains Ultra-high resolution, high-speed automated Ab selection

29 OMNIAB PERFORMANCE Partner and Program Growth Ligand has more than tripled number of OmniAb 100 80 agreements since 2012, driving substantial Partners 60 program growth Programs 40 Novel Antibody Patents 20 filed by our Partners 0 Approaching 40 patent filings 40 by our partners claiming an 30 OmniAb-derived antibody as 20 primary invention, with expiries 10 up to 2040 0 Partner patent Partner applications patent Patents include: WO2015167293A1, WO2017020291A1, WO2017024515A1, WO2017024146A1, WO2017031104A1, WO2017053748A2, WO2017059196A2, WO2017059243A2, WO2017079121A2, WO2017178493A1, WO2017223111A1, WO2018054241A1, WO2018057802 A1, WO2018069500A2, WO2018091661A1, WO2018095932A1, WO2018119016A1, WO2018119246A1, WO2018162749A1 WO2019094265A1, WO2019158645A1, WO2019164891A1, WO2019165982A1, WO2019179391A1, WO2019179422A1, WO2019196868A1, WO2019202041A1, WO2019214624A1, WO2019224711A2 WO2019224713A2, WO2019224717A2, WO2020028479A1, WO2020093023A1, WO2020093024A2, WO2020119719A1, WO2020202097A1

30 OMNIAB PERFORMANCE CLINICAL TRIALS AND PARTNER PROGRESSION Clinical Trial Starts by Year 60 Substantial growth in clinical Phase 1 programs in 2020 Phase 2 Over 8,500 clinical Phase 3 patients have been or are 40 planned to be treated Upcoming new clinical starts from J&J with OmniAb and Merck antibodies 20 Based on partner progression, now projecting as many as 10 OmniAb marketing approvals by 2025 0 2016 2017 2018 2019 2020

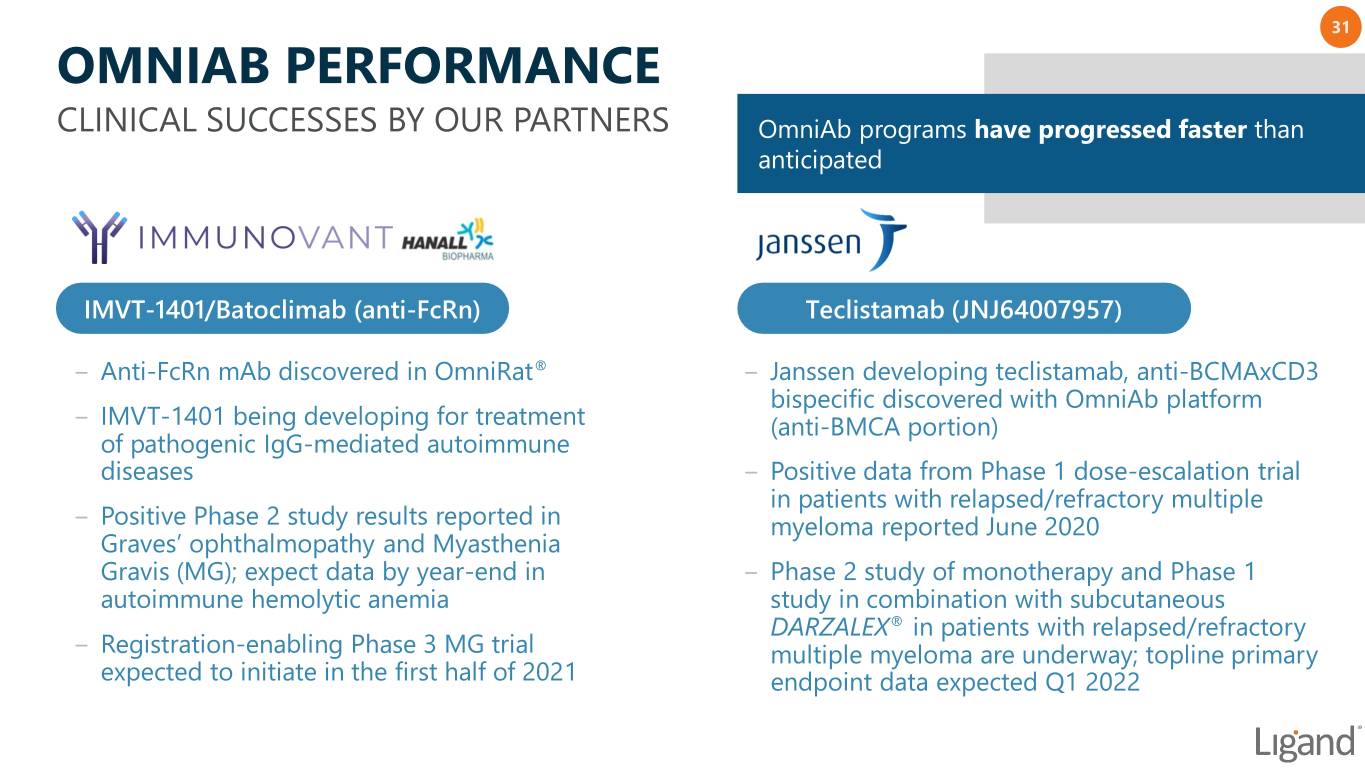

31 OMNIAB PERFORMANCE CLINICAL SUCCESSES BY OUR PARTNERS OmniAb programs have progressed faster than anticipated IMVT-1401/Batoclimab (anti-FcRn) Teclistamab (JNJ64007957) ‒ Anti-FcRn mAb discovered in OmniRat® ‒ Janssen developing teclistamab, anti-BCMAxCD3 bispecific discovered with OmniAb platform ‒ IMVT-1401 being developing for treatment (anti-BMCA portion) of pathogenic IgG-mediated autoimmune diseases ‒ Positive data from Phase 1 dose-escalation trial in patients with relapsed/refractory multiple ‒ Positive Phase 2 study results reported in myeloma reported June 2020 Graves’ ophthalmopathy and Myasthenia Gravis (MG); expect data by year-end in ‒ Phase 2 study of monotherapy and Phase 1 autoimmune hemolytic anemia study in combination with subcutaneous DARZALEX® in patients with relapsed/refractory ‒ Registration-enabling Phase 3 MG trial multiple myeloma are underway; topline primary expected to initiate in the first half of 2021 endpoint data expected Q1 2022

32 OMNIAB PERFORMANCE CLINICAL SUCCESSES BY OUR PARTNERS Major commercial deals centered on OmniAb antibodies, first two approvals expected in 2021 Sugemalimab (anti-PD-L1) Zimberelimab (anti-PD-1) ‒ mAb targeting PD-L1 discovered in OmniRat ‒ anti-PD-1 mAb discovered using OmniRat ‒ Positive results announced in August in 1st-line ‒ Gloria filed NMPA in China for recurrent/ stage IV NSCLC; marketing application in China refractory classical Hodgkin’s lymphoma; (NMPA) planned for Q4 2020 approval anticipated 1H 2021 ‒ Positive results announced for Phase 2 study in ‒ Arcus conducting Phase 2 study in 1st-line natural killer cell/T-cell lymphoma and Phase 1b metastatic NSCLC in combo with an anti-TIGIT study in gastric/gastroesophageal junction mAb and adenosine receptor antagonist cancer in combo with XELOX ‒ Arcus and Gilead formed a 10-year partnership ‒ CStone and Pfizer recently formed strategic to develop and commercialize Arcus’ product collaboration for the development and candidates including zimberelimab commercialization in China

33 OMNIAB TECHNOLOGY Best-in-Class technology for antibody discovery meeting a growing need in the industry Partners continue to have success with OmniAb- derived antibodies First OmniAb-derived commercial products now projected in 2021

INTERNAL R&D PROGRAMS 34 Copyright © 2020 Ligand. All Rights Reserved.

35 INTERNAL R&D LIGAND SELECTIVELY INVESTS IN INTERNAL R&D TO DRIVE PARTNERING EVENTS WITH UPSIZED LICENSING TERMS • Current internal R&D investments are focused on three initiatives OmniChicken Antibody Programs PF810 Initiating potentially Five antibody programs Recently-acquired next pivotal trial to leveraging OmniChicken generation peptide participate in $1.5 are primed for future therapeutic in billion existing U.S. partnering events endocrinology contrast agent market

36 PLANNED PIVOTAL TRIAL DIFFERENTIATED LABEL-ENABLING CLINICAL STUDY • Trial to demonstrate reduction in incidence of contrast-induced acute kidney injury (CI-AKI) and equivalence of image quality following administration of CE-Iohexol compared to GE’s Omnipaque® ‒ ~540-subject clinical trial, projected to initiate in December 2020 • Adaptive design, randomized, multicenter, double-blind, parallel group study in patients with impaired renal function undergoing invasive coronary angiography ‒ To include pre-specified interim analysis of rate of CI-AKI, performed for futility after 60% accrual of patient data • Significant reduction in rate of CI-AKI and demonstration of image equivalence may allow for a 505(b)(2) approval of CE-Iohexol with label including risk reduction of CI-AKI

37 RECENT MARKET RESEARCH PRIMARY MARKET RESEARCH WITH U.S.-BASED HOSPITAL PAYERS FURTHER DEMONSTRATES THE NEED AND OPPORTUNITY FOR CE-IOHEXOL • Gained perspective from hospital payers on key issues Select Payer Feedback associated with CI-AKI including clinical approaches, the cost burden, and current and emerging treatments “CI-AKI is not always reimbursed and it’s a big ‒ Research conducted late 2020 hit to our ledger. Our data shows managing CI- AKI is 3-day length of stay at least.” Key Findings “No one has good renal function anymore. The Mitigation strategies are viewed as way I see it, almost every patient is high-risk.” insufficient in managing CI-AKI, particularly at the health system level where data is aggregated “We do about 650 cardiovascular imaging procedures a day and our EMR has identified CE-Iohexol seen as an innovation of that at least 15% of patients that come into our significant value network are high-risk.”

38 OMNICHICKEN ANTIBODY PROGRAMS FIVE PROGRAMS NOW PRIMED FOR FUTURE PARTNERING EVENTS ANTIBODY PROGRAM STATUS Initial Biochem and Patent Target Discovery Cellular Assays* Filings Differentiating competitive benchmark data now generated B7-H3 ✔️ ✔️ June 2020 CD38 ✔️ ✔️ June 2020 Three programs currently under TIGIT ✔️ ✔️ August 2020 research evaluation by commercial interest parties via non-exclusive TIM3 ✔️ ✔️ December 2019 agreements BDNF ✔️ ✔️ June 2020 * With differentiating competitive benchmark comparison data

39 PF810 RECENTLY-ACQUIRED PROGRAM • PF810 program recently acquired with Pfenex • Next-generation peptide therapeutic program focused on endocrinology ‒ Leverages extensive CMC and clinical know-how • Proof-of-concept established in two species, including non-human primates • Significant near-term value creation opportunity, with IND filing now targeted for 2021

CAPTISOL UPDATES Vince Antle, PhD SVP Technical Operations and Quality Assurance 40 Copyright © 2020 Ligand. All Rights Reserved.

41 CAPTISOL TECHNOLOGY Addresses consistent and enduring industry need: formulation solubility and stability ‒ An estimated 40% of small molecule drug candidates have low solubility Clinical and regulatory success, combined with vast safety database have significantly increased awareness, visibility and use of the technology and positioned it for growth Ligand continually focuses on quality, reliability and customer service Reference: Sanches & Ferreira, Int. J. of Pharmaceutics, 2019

42 CAPTISOL KEY TECHNOLOGY FEATURES Manufacturing, Global Reach Intellectual Property Drug Master Files Quality & Scale Captisol-enabled drugs are Substantial know-how Type 4 and 5 DMFs in U.S. with Manufacturing is conducted marketed in >70 countries >20,000 pages containing in cGMP plants via validated >40 partners have Captisol- Patents extend until 2033* manufacturing, safety data processes, distribution out of enabled drugs in development (IV, inhaled, SubQ, oral, etc.) multiple facilities Also have DMFs in Japan, China and Canada Substantial capacity increases recently completed * Ligand maintains a broad global patent portfolio for Captisol with more than 400 issued patents worldwide relating to the technology (including 37 in the U.S.) and with the latest expiration date in 2033. Other patent applications covering methods of making Captisol, if issued, extend to 2040.

43 CAPTISOL NEW AGREEMENTS IN 2020 • Increased visibility for the platform has New New Research Use Clinical/Commercial driven new agreements to highest levels Agreements Agreements ever for the technology 135 12 120 10 105 90 8 75 6 60 45 4 30 2 15 0 0 2018 2019 2020 2018 2019 2020

44 CAPTISOL IN 2020 DELIVERY ROUTES EXPANSION OF SAFETY DATA IN DMF’S HAS DIVERSIFIED THE DELIVERY ROUTES THAT CAPTISOL PARTNERS PURSUE Delivery Route Used by • While all currently approved Captisol-enabled products are IV, a Clinical/Commercial Partners growing number of partners are using the technology in new routes of delivery, driving potential Captisol needs higher SubQ, 9% • Recent investments in safety data have enabled broadened use Inhalation, 10% • Notable non-IV Captisol-enabled clinical programs include: Oral, 18% IV, 63% Trametinib Remdesivir Furosemide Pediatric Inhaled Sub-Cutaneous Oral Solution Solution

45 CAPTISOL OPERATIONAL DEVELOPMENTS Now have cGMP manufacturing operations at four sites, including one in the U.S. Over the past 6 months, Ligand has completed work to Increased efficiency of processing, testing and batch release significantly increase efficiencies and Captisol output Currently leveraging intellectual property and know how around a proprietary continuous manufacturing process

46 CAPTISOL TECHNOLOGY Enabling new life-saving drugs Meeting significant industry needs Positioned for substantial growth

Monica Tijerina is an Executive Director in Formulation and Process Development at Gilead Sciences where she leads a team managing clinical drug product outsource manufacturing, clinical supplies chain management, and drug product pilot plant and GMP warehouse. Prior to joining Gilead, Monica held positions at Merck and Novartis. Monica received her Ph.D. in Pharmaceutical Chemistry from the University of Utah, Salt Lake City, in Dr. Jindřich Kopeček’s laboratory, where her research focused on developing novel anticancer polymeric delivery systems. She received her B.S. in Chemistry from the University of Nevada, Las Vegas. 47

Remdesivir for the Treatment of Covid-19 and the Role of Captisol® Monica Tijerina, PhD Executive Director, Formulation and Process Development October 20, 2020 48

Remdesivir Is a Broad-spectrum Antiviral Agent • Warren TK, et al. Nature 2016;531:381-5. • Lo MK, et al. Sci Reports 20177:43395. • Sheahan TP, et al. Sci Transl Med 2017; 9:eaal3653. • Agostini ML, et al. Mbio 2018;9(2):e00221-18. 49

Captisol® Increases Solubility of Remdesivir free API goes to site of action free Captisol eliminated remdesivir Simulation of complexation Captisol Pipkin, et al., Drug Development and Delivery, June 2020, Vol. 20, No. 5, p 42-47 50

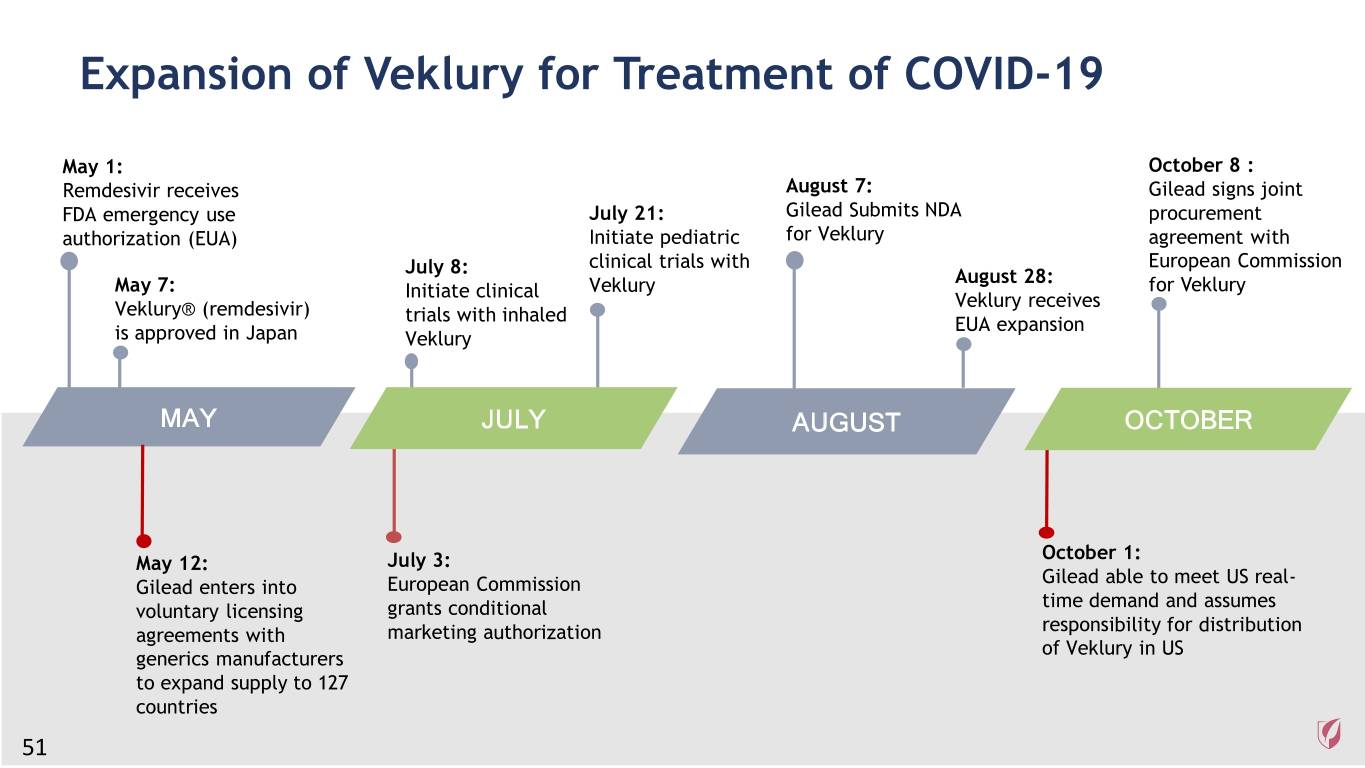

Expansion of Veklury for Treatment of COVID-19 May 1: October 8 : Remdesivir receives August 7: Gilead signs joint FDA emergency use July 21: Gilead Submits NDA procurement authorization (EUA) Initiate pediatric for Veklury agreement with clinical trials with European Commission July 8: August 28: May 7: Initiate clinical Veklury for Veklury Veklury® (remdesivir) Veklury receives trials with inhaled EUA expansion is approved in Japan Veklury MAY JULY AUGUST OCTOBER October 1: May 12: July 3: Gilead able to meet US real- Gilead enters into European Commission time demand and assumes voluntary licensing grants conditional responsibility for distribution agreements with marketing authorization of Veklury in US generics manufacturers to expand supply to 127 countries 51

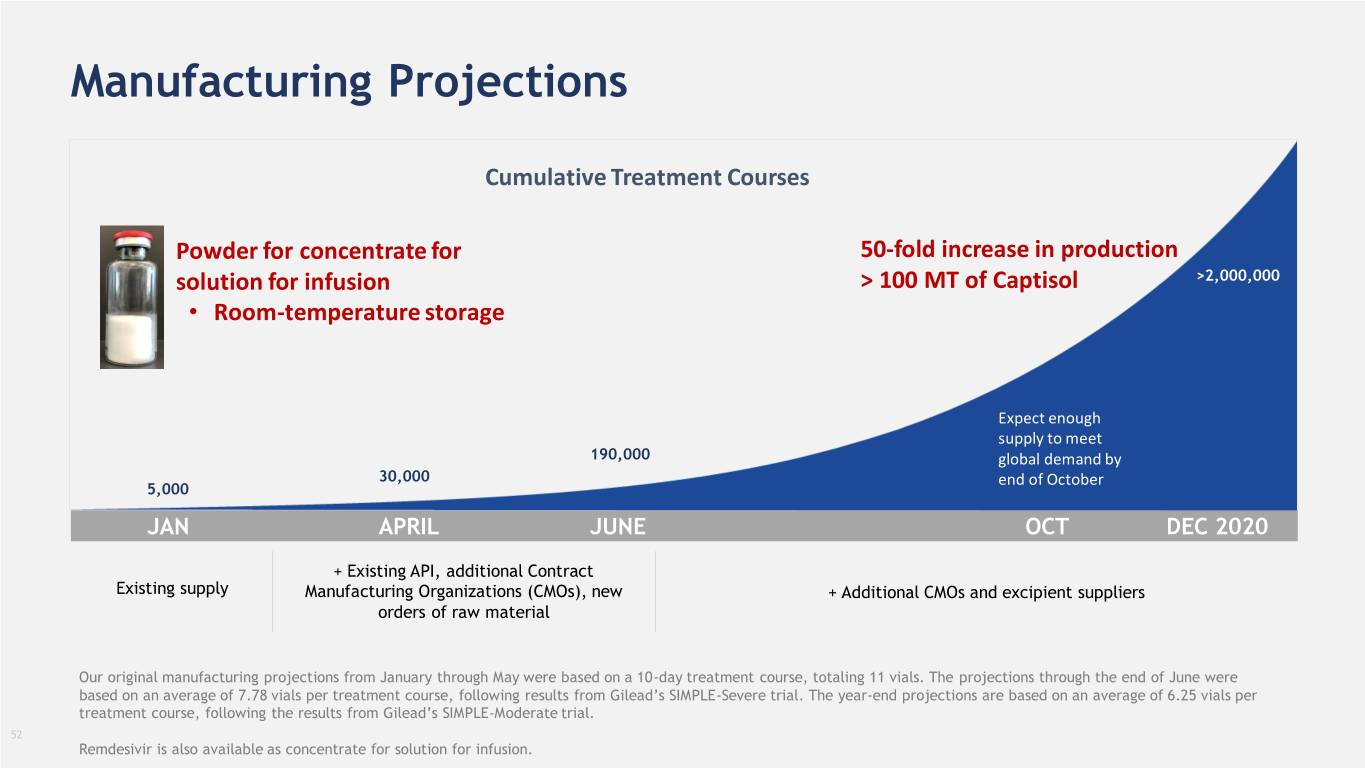

Manufacturing Projections Cumulative Treatment Courses Powder for concentrate for 50-fold increase in production solution for infusion > 100 MT of Captisol >2,000,000 • Room-temperature storage Expect enough supply to meet 190,000 global demand by 30,000 end of October 5,000 JAN APRIL JUNE OCT DEC 2020 + Existing API, additional Contract Existing supply Manufacturing Organizations (CMOs), new + Additional CMOs and excipient suppliers orders of raw material Our original manufacturing projections from January through May were based on a 10-day treatment course, totaling 11 vials. The projections through the end of June were based on an average of 7.78 vials per treatment course, following results from Gilead’s SIMPLE-Severe trial. The year-end projections are based on an average of 6.25 vials per treatment course, following the results from Gilead’s SIMPLE-Moderate trial. 52 Remdesivir is also available as concentrate for solution for infusion.

COVID-19 THERAPEUTIC APPROACHES INTRODUCTION TO DR. MATT DAVIS, PHARMD 53 Copyright © 2020 Ligand. All Rights Reserved.

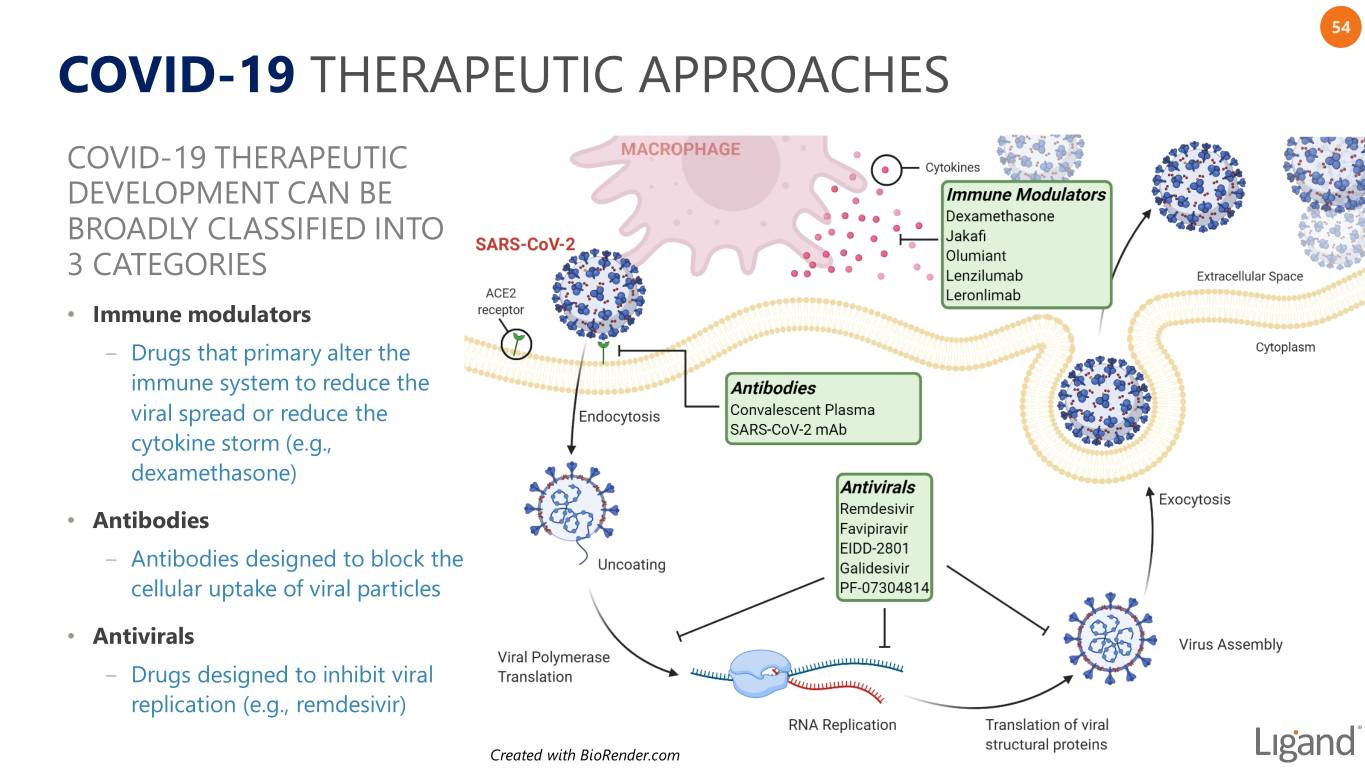

54 COVID-19 THERAPEUTIC APPROACHES COVID-19 THERAPEUTIC DEVELOPMENT CAN BE BROADLY CLASSIFIED INTO 3 CATEGORIES • Immune modulators ‒ Drugs that primary alter the immune system to reduce the viral spread or reduce the cytokine storm (e.g., dexamethasone) • Antibodies ‒ Antibodies designed to block the cellular uptake of viral particles • Antivirals ‒ Drugs designed to inhibit viral replication (e.g., remdesivir) Created with BioRender.com

COVID-19 Treatment Landscape and Guidelines R e m d e s i v i r Matt Davis, PharmD Infectious Disease Clinical Pharmacy Specialist UCLA Ronald Reagan Medical Center [email protected] @Mattdavis138 55

Transparency Declaration • No disclosures related to Ligand or Gilead 56

Outline Pre-Clinical Data Clinical Data Pharmacology Randomized Trial Data Structure-Activity Relationship Guideline Recommendations In vitro Data Place in Therapy/Future Directions 57

Remdesivir Pharmacology Mechanisms: 1. Interference with RNA-dependent RNA polymerase → delayed termination of RNA transcription 2. Template incorporation inhibiting complementary base addition/replication Status: COVID-19 clinical trials ongoing; multiple phase III trials completed EUA granted 5/1/2020; Standard of care designation Formulation: Intravenous only, inhalational formulation in early trials Dosing: 200 mg IV loading dose, then 100 mg IV daily for 5-10 days Pediatric Dosing: 5 mg/kg IV loading dose (max 200 mg), then 2.5 mg/kg IV daily (max 100 mg) Manufacturer: Gilead Sciences Tchesnokov; Viruses 2019. DOI: 10.3390/v11040326 Tchesnokov; J BiolChem 2020. DOI: 10.1074/jbc.AC120.015720 58

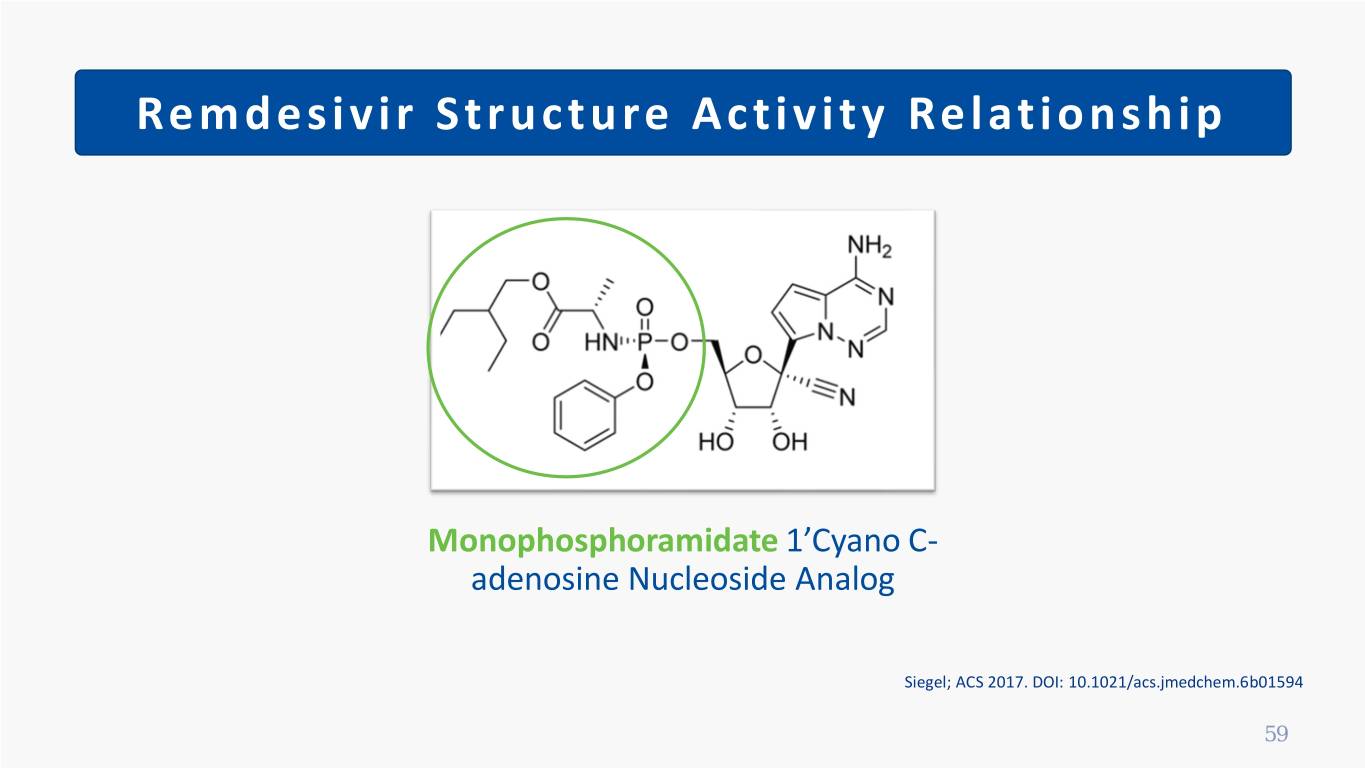

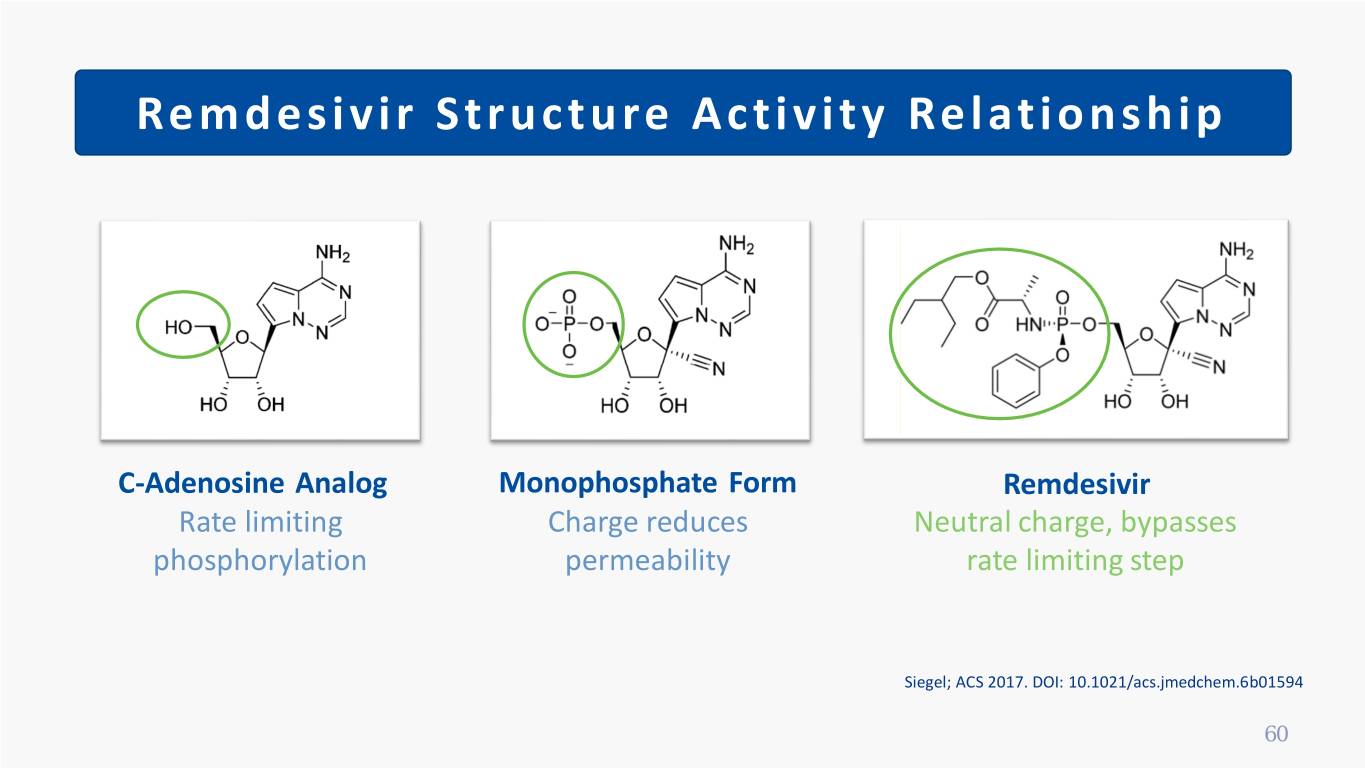

Remdesivir Structure Activity Relationship Monophosphoramidate 1’Cyano C- adenosine Nucleoside Analog Siegel; ACS 2017. DOI: 10.1021/acs.jmedchem.6b01594 59

Remdesivir Structure Activity Relationship C-Adenosine Analog Monophosphate Form Remdesivir Rate limiting Charge reduces Neutral charge, bypasses phosphorylation permeability rate limiting step Siegel; ACS 2017. DOI: 10.1021/acs.jmedchem.6b01594 60

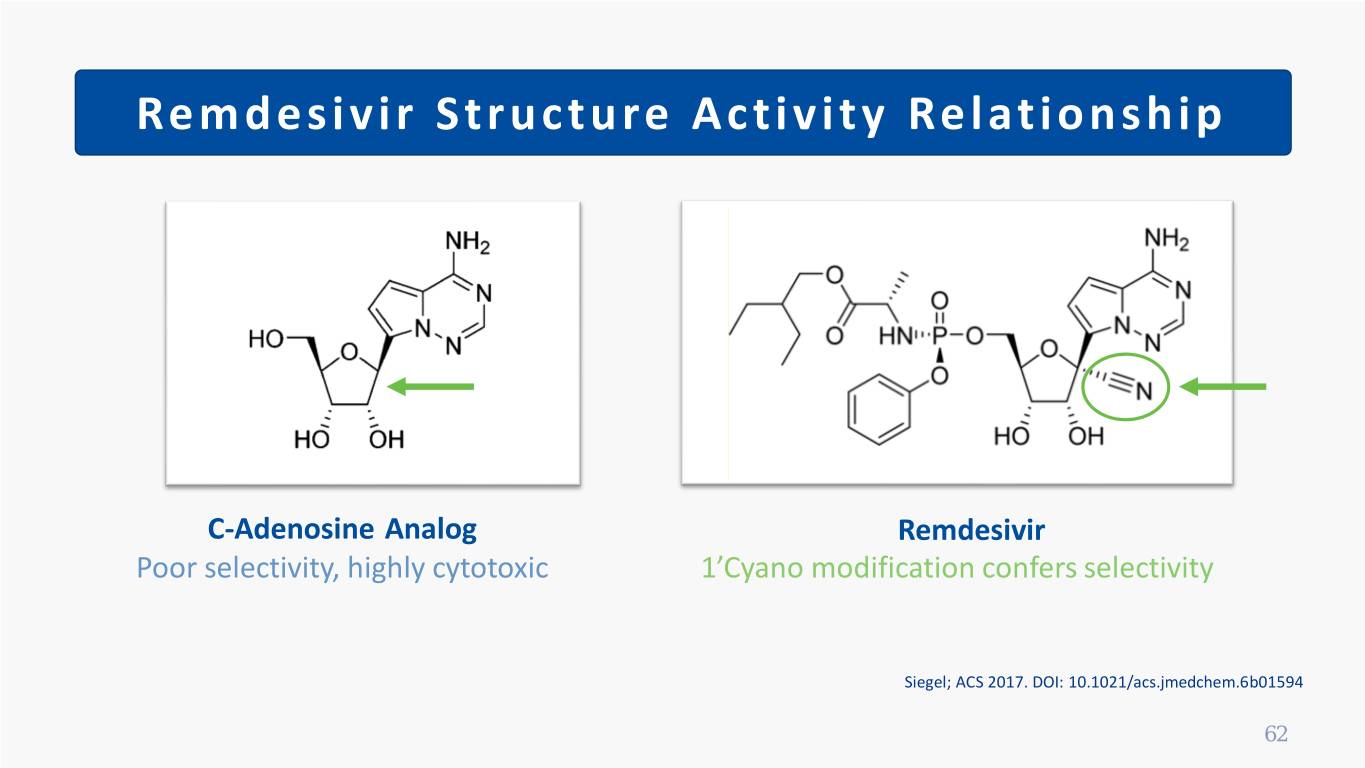

Remdesivir Structure Activity Relationship Monophosphoramidate 1’Cyano C- adenosine Nucleoside Analog Siegel; ACS 2017. DOI: 10.1021/acs.jmedchem.6b01594 61

Remdesivir Structure Activity Relationship C-Adenosine Analog Remdesivir Poor selectivity, highly cytotoxic 1’Cyano modification confers selectivity Siegel; ACS 2017. DOI: 10.1021/acs.jmedchem.6b01594 62

Safety – Phase I • Multiple-dose, 5-14 days • Any TEAE - 56-72%; All Grade 1-2 • ALT/AST increase • Onset 5-25 days; resolution 3-47 days • Phlebitis • Extremity pain • Nausea • Constipation • Dyspepsia • Headache 63

In vitro Activity Filoviridae Paramyxoviridae Pneumoviridae Orthocoronaviridae ● Ebola ● Measles ● Respiratory ● HCoV-NL63 ● Marburg ● Mumps Syncytial Virus ● HCoV-OC43 ● Nipah ● Human ● HCoV-229E ● Hendra Metapneumovirus ● HCoV-HKU1 ● MERS ● SARS-CoV-1 HCoV = Human Coronavirus; MERS = Middle East Respiratory Syndrome; ● SARS-CoV-2 SARS = Severe Acute Respiratory Syndrome Brown; Antivir Res 2019. DOI: 10.1016/j.antiviral.2019.104541 Lo; Sci Rep 2017. DOI: 10.1038/srep43395 Sheahan; Sci Transl Med 2017. DOI: 10.1126/scitranslmed.aal3653 64

In vitro Activity Virus EC50 (cells) CC50 (cells) Selectivity Index SARS-CoV-2 0.01 µM (HAE) >100 µM (HAE) >1000 SARS-CoV-1 0.069 µM (HAE) > 10 µM (HAE) >144 MERS 0.074 µM (HAE) > 10 µM (HAE) >135 Ebola 0.086 µM (MCr) 6.1 (Hep-2) N/A EC50 = 50% effective concentration; CC50 = 50% cytotoxic concentration; Selectivity Index = CC50/EC50; Vero E6 = African monkey kidney cells; HAE = human airway epithelial cells; MCr = macrophages; Hep-2 = human epithelial type 2 cells Pruijssers; Cell Reports 2020. DOI: 10.1016/j.celrep.2020.107940 Gordon; J Bio Chem 2020. DOI: 10.1074/jbc.AC120.013056 Sheahan; Sci Transl Med 2017. DOI: 10.1126/scitranslmed.aal3653 Agostini; Am Soc Micro 2018. DOI: 10.1128/mBio.00221-18 Yao; CID 2020. DOI:10.1093/cid/ciaa237 65

In vitro Activity Virus EC50 (cells) CC50 (cells) Selectivity Index SARS-CoV-2 0.01 µM (HAE) >100 µM (HAE) >1000 SARS-CoV-1 0.069SARS- CoVµM -(HAE)2 EC50 > 10 µM (HAE) >144 Ribavirin 109.5 µM MERS 0.074 µM (HAE) > 10 µM (HAE) >135 Penciclovir 95.96 µM Favipiravir 61.9 µM Ebola 0.086 µM (MCr) 6.1 (Hep-2) N/A Pruijssers; Cell Reports 2020. DOI: 10.1016/j.celrep.2020.107940 Gordon; J Bio Chem 2020. DOI: 10.1074/jbc.AC120.013056 Sheahan; Sci Transl Med 2017. DOI: 10.1126/scitranslmed.aal3653 Agostini; Am Soc Micro 2018. DOI: 10.1128/mBio.00221-18 Yao; CID 2020. DOI:10.1093/cid/ciaa237 66

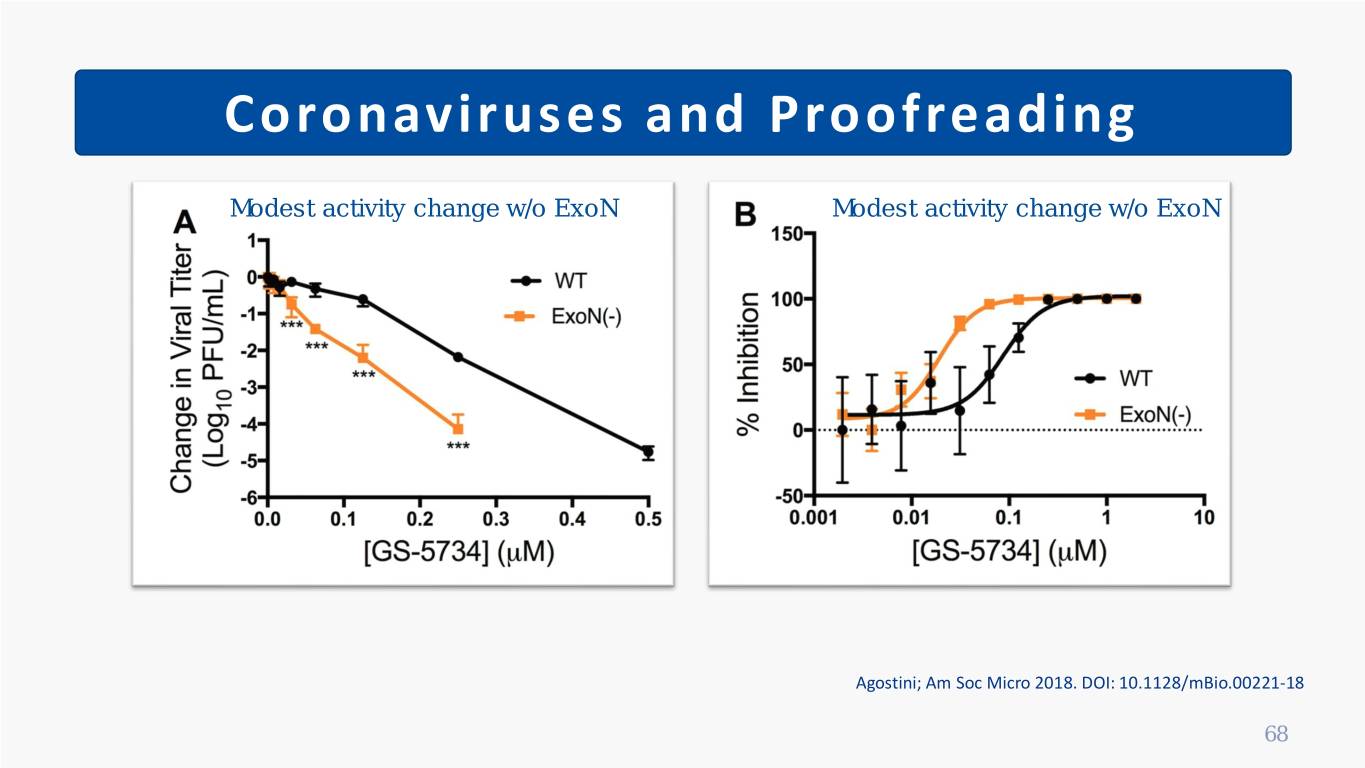

Coronaviruses and Proofreading Removed by proofreading Ribavirin Penciclovir Favipiravir Maintains activity; high fitness cost Remdesivir Agostini; Am Soc Micro 2018. DOI: 10.1128/mBio.00221-18 Smith; PLoS Pathog 2013. DOI: 10.1371/journal.ppat.1003565 Wang; Cell Res 2020. DOI: 10.1038/s41422-020-0282-0 Jordan; AAC 2018. DOI: 10.1177/2040206618764483. 67

Coronaviruses and Proofreading Modest activity change w/o ExoN Modest activity change w/o ExoN Agostini; Am Soc Micro 2018. DOI: 10.1128/mBio.00221-18 68

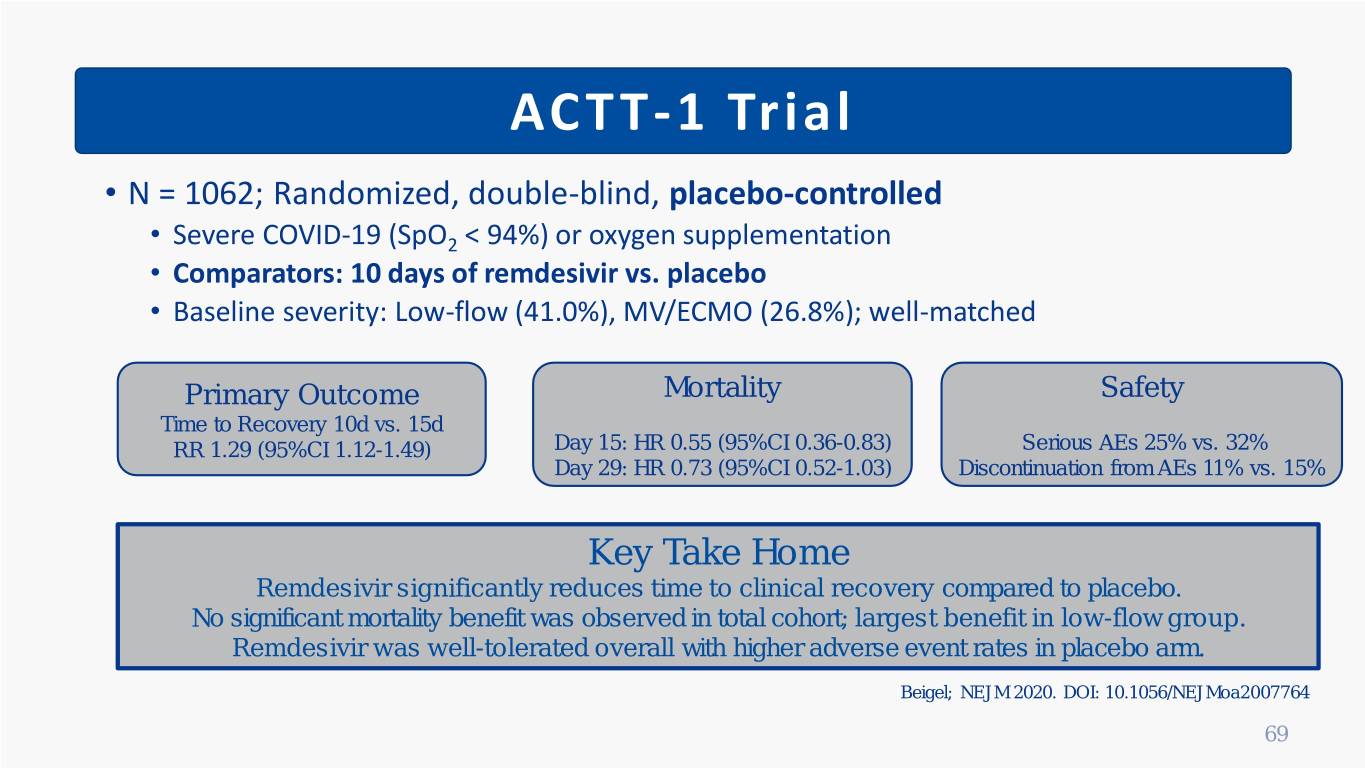

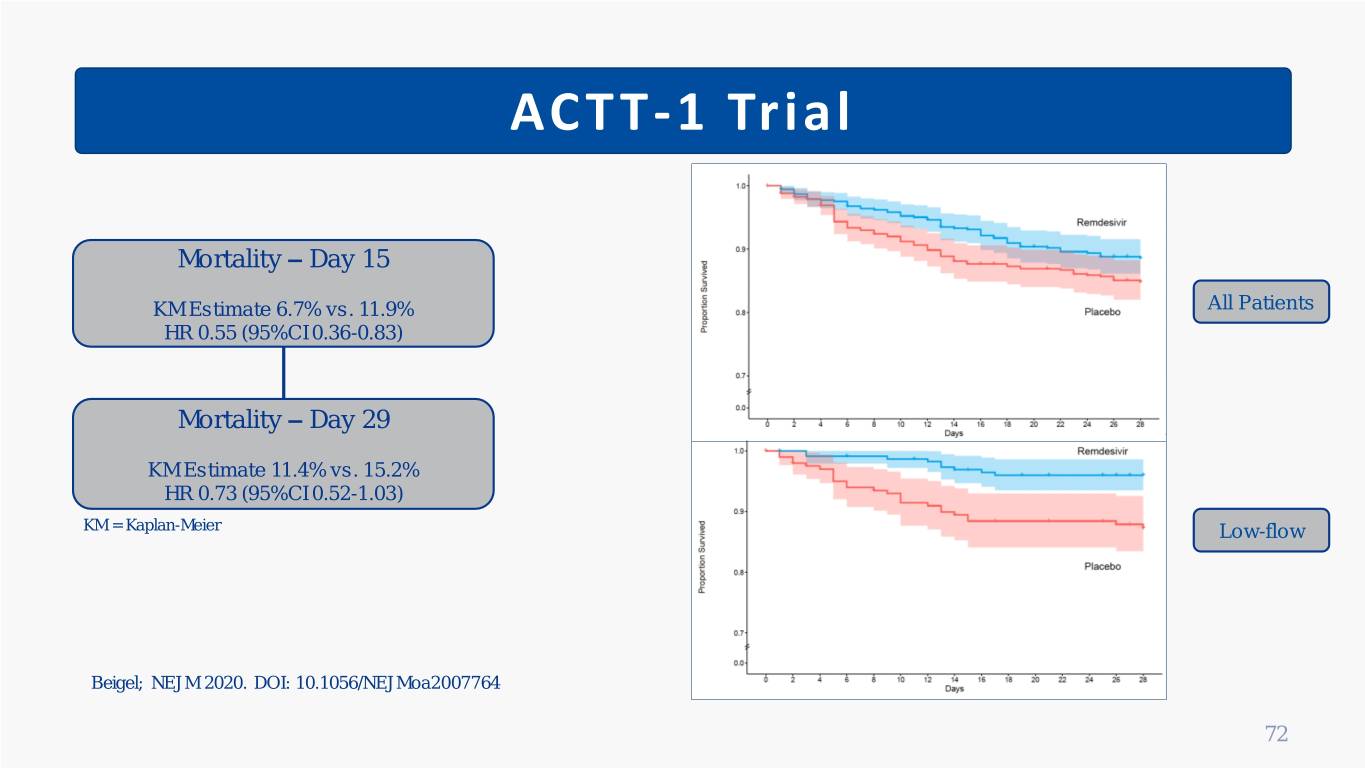

ACTT-1 Trial • N = 1062; Randomized, double-blind, placebo-controlled • Severe COVID-19 (SpO2 < 94%) or oxygen supplementation • Comparators: 10 days of remdesivir vs. placebo • Baseline severity: Low-flow (41.0%), MV/ECMO (26.8%); well-matched Primary Outcome Mortality Safety Time to Recovery 10d vs. 15d RR 1.29 (95%CI 1.12-1.49) Day 15: HR 0.55 (95%CI 0.36-0.83) Serious AEs 25% vs. 32% Day 29: HR 0.73 (95%CI 0.52-1.03) Discontinuation from AEs 11% vs. 15% Key Take Home Remdesivir significantly reduces time to clinical recovery compared to placebo. No significant mortality benefit was observed in total cohort; largest benefit in low-flow group. Remdesivir was well-tolerated overall with higher adverse event rates in placebo arm. Beigel; NEJM 2020. DOI: 10.1056/NEJMoa2007764 69

ACTT-1 Trial Time to Recovery Ambient Air Low-flow Remdesivir 10 d vs. Placebo 15 d RR 1.29 (95%CI 1.12-1.49; P<0.001) High-flow MV/ECMO Beigel; NEJM 2020. DOI: 10.1056/NEJMoa2007764 70

ACTT-1 Trial Day 15 Clinical Worsening – Remdesivir vs. Placebo Ambient Air High-flow 8.3% vs. 15.7% 30.5% vs. 36.7% Low-flow MV/ECMO 10.4% vs. 23.6% 10.7% vs. 13.6% Beigel; NEJM 2020. DOI: 10.1056/NEJMoa2007764 71

ACTT-1 Trial Mortality – Day 15 KM Estimate 6.7% vs. 11.9% All Patients HR 0.55 (95%CI 0.36-0.83) Mortality – Day 29 KM Estimate 11.4% vs. 15.2% HR 0.73 (95%CI 0.52-1.03) KM = Kaplan-Meier Low-flow Beigel; NEJM 2020. DOI: 10.1056/NEJMoa2007764 72

ACTT-1 Trial Adverse Events Remdesivir (n = 541) Placebo (n = 522) Generally well tolerated overall Serious – n (%) 131 (25) 163 (32) Acute kidney injury 9 (1.7) 17 (3.3) Higher rates of adverse events in Resp failure/distress 64 (12) 100 (19.4) placebo arm than remdesivir; High Hypotension/shock 9 (1.7) 11 (2.2) morbidity of disease Non-Serious 276 (51.9) 295 (57.2) Anemia/Hgb decrease 42 (7.9) 52 (10.1) No difference in acute kidney injury Acute kidney injury 55 (10.3) 74 (12.0) AST/ALT elevation 30 (5.7) 57 (11.1) Lymphocyte decrease 44 (8.3) 54 (10.5) Hgb = hemoglobin 73

SIMPLE-1 Severe Trial • N = 397; Randomized, open-label, no placebo • Severe COVID-19 (SpO2 < 94%); Excluded MV/ECMO • Comparators: 5 vs. 10 days of remdesivir • 10-day group significantly sicker at baseline (P = 0.02) Primary Outcome Secondary Outcomes Serious AEs 14-Day Clinical Status Time to Recovery & Improvement Higher in 10-day (21% vs. 35%) P=0.14, no significant difference No significant difference Sicker vs. greater exposure Key Take Home No significant difference between 5 vs. 10 days of remdesivir in severe COVID-19 Goldman; NEJM 2020. DOI: 10.1056/NEJMoa2015301 74

SIMPLE-1 Severe Trial Caution: • Post-hoc analysis • Small subgroups • Inconsistent trends Goldman; NEJM 2020. DOI: 10.1056/NEJMoa2015301 75

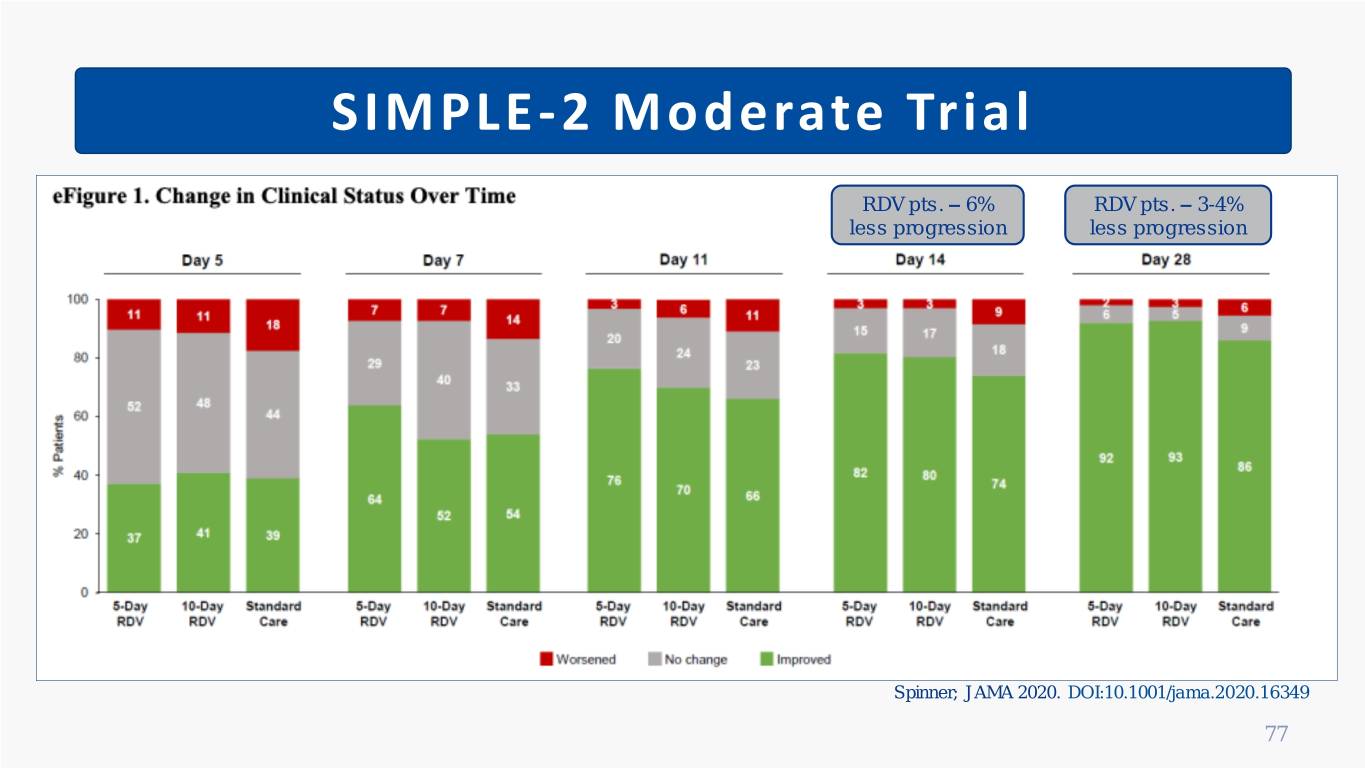

SIMPLE-2 Moderate Trial • N = 596; Randomized, open-label, controlled • Moderate COVID-19 (SpO2 > 94%); ≥ 80% on room air • Comparators: 5 vs. 10 days of remdesivir vs. standard care (insufficient placebo) • Patients well-matched on baseline severity and comorbidities Primary Outcome Secondary Outcomes Safety Day-11 Clinical Status Day-14 Status: 5-day vs. SOC (p=0.02) 5 vs. SOC (p=0.03) Grade ≥ 3 AEs: 10-day vs. SOC (p=0.18) 10 vs. SOC (p=0.03) 5 (10%) vs. 10 (12%) vs. SOC (12%) Key Take Home 5-day course of remdesivir significantly improved day 11 clinical status vs. SOC; Not seen with 10-day (potential influence by open-label) Spinner; JAMA 2020. DOI:10.1001/jama.2020.16349 76

SIMPLE-2 Moderate Trial RDV pts. – 6% RDV pts. – 3-4% less progression less progression Spinner; JAMA 2020. DOI:10.1001/jama.2020.16349 77

Clinical Summary • Remdesivir significantly reduces time to clinical recovery • Benefit most apparent in low-flow patients; modest benefit for moderate disease • Minimal/no benefit observed in high-flow, mechanically ventilated, ECMO • Clinically, but not statistically significant mortality reduction in ACTT-1 • In patients who derive benefit, 5-days = 10-days • Serious and non-serious adverse events similar/lower than placebo • Well-tolerated overall 78

Guideline Recommendations Infectious Diseases Society of America • The panel suggests against remdesivir for routine treatment of moderate COVID-19 (oxygen saturation >94% and no supplemental oxygen); strongly urges continued recruitment into trials. • The panel suggests remdesivir for severe COVID-19 (SpO2 ≤ 94%, oxygen support) over no antiviral treatment. • Among patients with severe COVID-19 on supplemental oxygen but not on mechanical ventilation/ECMO, the panel suggests 5 days of remdesivir rather than 10 days. The duration is of treatment is 10 days in patients on mechanical ventilation/ECMO. Bhimraj; CID 2020. DOI: 10.1093/cid/ciaa478 79

Guideline Recommendations National Institutes of Health • Outpatient or inpatient ambient air (moderate): No specific antiviral recommended; The panel recommends against dexamethasone • Low-flow (severe): Remdesivir plus dexamethasone; dexamethasone alone if remdesivir unavailable • High-flow (severe): Dexamethasone plus remdesivir OR dexamethasone alone • Mechanical ventilation/ECMO (critical): Dexamethasone OR dexamethasone plus remdesivir for patients who have recently been intubated https://www.covid19treatmentguidelines.nih.gov/. 80

Role in Therapeutic Landscape remdesivir, plasma, immune globulins remdesivir, dexamethasone, baracitinib Clinical trials Adapted from: Siddiqi; JHLT 2020. DOI: 10.1016/j.healun.2020.03.012 81

Severity Spectrum Severity (n = 44,415) Mild/Mod 81% Severe 14% remdesivir Critical 5% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Wu; JAMA 2020. DOI:10.1001/jama.2020.2648 82

Current Investigations Trial Sponsor Population Intervention ACTT-3 NIAID SpO2 ≤ 94% RDV + IFN ß-1a vs. RDV + PCB DisCoVeRy Inserm SpO2 < 94% RDV vs. HCQ vs. IFN-ß vs. LPV/r vs. SOC Solidarity WHO Hospitalized RDV vs. HCQ vs. LPV/r vs. IFN-ß1a REMDACTA Roche/Gil > 6L NC RDV + tocilizumab vs. RDV + PCB ead Outpatient Gilead ≥ 1 RF; Sx ≤ 7 d RDV vs. PCB RDV TICO NIAID Hospitalized RDV + LY3819253 vs. RDV + PCB Inhaled RDV Gilead SpO2 > 94% Inhaled RDV vs. PCB (Phase 1b/2a) RDV = remdesivir; PCB = placebo; HCQ = hydroxychloroquine; LPV/r = lopinavir/ritonavir; IFN-ß = interferon beta; Source: ClinicalTrials.gov 83

BUSINESS OVERVIEW Patrick Lucy SVP and CBO Protein Expression Business 85 Copyright © 2020 Ligand. All Rights Reserved.

86 SOLVING OUR INDUSTRY’S PROTEIN PRODUCTION CHALLENGES Our Expression Technology Platform uniquely enables complex protein drug production with quality and efficiency • The global therapeutic protein market is estimated to be $100B+ and is growing • Clinical and commercial success achieved with protein therapeutics is increasing demand for technologies that deliver competitively positioned products with desired properties • Protein therapeutics are often of a physical size that is orders of magnitude larger than small-molecule drugs and exhibit complex secondary and tertiary structures that must be maintained in production

87 OUR EXPRESSION TECHNOLOGY PLATFORM One of the most comprehensive prokaryotic protein production platforms in the biopharmaceutical industry Applies to broad range of protein types, differentiated in state-of-the-art binding modalities Approved products from platforms expected to drive expanded use and future deals Global manufacturers have had consistent success with the platform Focused on unique opportunities to drive enhanced deal economics

88 A UNIQUE VALUE-DRIVING PLATFORM • Industrial legacy in the labs of Mycogen Corp and The Dow Chemical Company Expression Platform has given rise to approved products and has maintained a success rate of over 80% in expressing a variety of “lead” protein candidates • Platform delivers significant competitive advantages to our partners, including: ✓ Speed to identifying a viable production strain ✓ Success rates resulting in the minimization of time and cost of development ✓ Efficient production ✓ Decreased long-term cost-of-goods • Significant institutional knowledge of protein production developed over nearly two decades

89 THE INDUSTRY'S DEEPEST PROKARYOTIC PROTEIN PRODUCTION PLATFORM P. fluorescens: A GRAM-NEGATIVE, NON-PATHOGENIC, METABOLICALLY VERSATILE ORGANISM ‒ Genome sequenced, leveraged to engineer host strains and design expression plasmids ‒ Animal origin and used with antibiotic-free processes ‒ High-throughput growth and test methods ‒ Rapid, effective, fermentation and purification expedite development timelines Clinically and recently commercially validated with approved therapeutics and vaccines

90 EXPRESSION TECHNOLOGY PLATFORM OUR EXTENSIVE TOOLBOX • Enables parallel, high-throughput, Codon Optimized Genes combinatorial assessment of protein Plasmids expression based on thousands of Elements plasmid/host strain combinations combined to Transcriptional Promoters generate >100 rapid cloning, • Licensing to partners enables use with RBS/ Translation Initiation Strengths off-the-shelf the platform tools expression P. fluorescens Native Signal Peptides vectors • Further expansion of the toolbox via Folding Helper Overexpression Host Strains platform R&D ongoing Protease Deletion Host Strains

91 EXPRESSION TECHNOLOGY PLATFORM AUTOMATION • Automation allows high throughput parallel construction and screening of thousands of expression strains ‒ Lead strain engineering: All strains are expressing the same gene/protein ‒ Discovery mode: A subset of strains are expressing putative lead proteins (e.g., variants) to enable rapid isolation, assessment and selection of lead candidate

92 EXPRESSION TECHNOLOGY PLATFORM OUR STRAIN SCREENING APPROACH • Combinatorial screening approach can assess thousands of unique expression strains in parallel • Speed, Quality and Yield create significant advantages and minimization of time and cost Automation-enabled HTP Strain Construction, Expression and Analysis HTP STRAIN CONSTRUCTION HTP EXPRESSION HTP HARVEST & ANALYSIS + + 96 deep well growth and electroporate and plasmids host strains expression growtransformants in selective media 0.5 ml culture per well, induce 24 hrs. OD600 30-50 at harvest (Seed Cultures)

93 EXPRESSION TECHNOLOGY PLATFORM INTELLECTUAL PROPERTY Protein Expression & Recovery Platform supported by 27 issued U.S. patents 3 Patent Families (last expiry 2030) Substantial know-how also supports the Tools for Protein Expression platform 6 Patent Families (last expiry 2036) High-Throughput Screening Methods 2 Patent Families (last expiry 2029) Product-Specific Processes 8 Patent Families (last expiry 2038)

94 EXPRESSION TECHNOLOGY PLATFORM VAST EXPERIENCE DEMONSTRATES PLATFORM VERSATILITY AND SUCCESS Protein Type Our Improvements Alternative Host Yeast: Fab 10-20x yield improvement, high quality at 1L scale Quality issues Low yield Microbial Outer E. coli: Soluble active expression 20 g/L Completely insoluble expression Membrane Protein Poor quality Yeast: 20x yield improvement at 96-well scale Low yield Growth Factor High quality and active Degradation Glycosylation E. coli: 10x yield improvement: Undesirable isoforms Therapeutic Enzyme No isoform issues Quality issues E. coli: Soluble active expression: Inclusion bodies Human Cytokine Elimination of refold step No soluble expression Multimeric Antibody 20x yield improvement: CHO: Derivative Soluble active protein, scaled to 1L in 8 weeks Low expression (<10 mg/L) Native organism: 10x yield improvement Vaccine Antigen Cost issues

95 CASE STUDY: JAZZ PHARMACEUTICALS PARTNERSHIP POSITIONED TO MAINTAIN STRONG ASPARAGINASE LEADERSHIP Challenges for Jazz Our Solution Successful Results • PBL, the owner and sole • Experience in protein expression of • PF743 (JZP-458) – successfully manufacturer of Erwinaze, continues enzymes made us ideal partner to transferred to Jazz cGMP to have quality and manufacturing develop recombinant Erwinia manufacturer in Dec 2017; currently issues asparaginase in pivotal Phase 2/3 study for • Our expertise in expression ALL/LBL • Significant shortages of Erwinaze, an technology allowed for rapid important part of the treatment development of: • PF745 (JZP-341) – transferred to a regimen for patients with ALL/LBL • PF743 (JZP-458) – recombinant Jazz cGMP manufacturer in 2020 Erwinia asparaginase • Jazz sought to develop a • PF745 (JZP-341) – long-acting • Jazz has an option to license the recombinant Erwinia asparaginase to Erwinia asparaginase recombinant pegaspargase provide reliable and high-quality • Previous experience in expression of supply asparaginase for biosimilars yielded compelling production performance • First BLA filing projected Q4 2020 Up to $224.5M in upfront and potential milestone payments, plus tiered royalties on net sales Up to $162.5M in milestones remaining; $3.5M development, $34M regulatory, $125M sales

96 CONCEPT TO PIVOTAL PHASE 2/3 STUDY IN ~2.5 YEARS JZP-458: DRIVEN BY PATIENT NEED FOR RELIABLE, LIFE-SAVING THERAPY Significant need for reliable, Global expansion opportunities — Treatment population consistent, high-quality supply Europe and Japan expansion OBJECTIVE: Agreement with Pivotal launch mid- Initial discussions with COG and FDA Phase 2/3 BLA 2021 FDA on concept of a on clinical study first submission recombinant product development plan Phase 1 patient as early as initiated enrolled year-end 2020 2016 2017 2018 2019 2020 2021 IND Filing Jazz collaboration Phase 1 completed Rapid progression from Phase 1 to pivotal study in <12 months Adapted from Jazz Corporate Presentation September 2020

97 TERIPARATIDE INJECTION PARTNERSHIP • First FDA approved 505(b)(2) therapeutic equivalent candidate to Forteo® ‒ Approved for treatment of osteoporosis in certain patients at high risk for fracture ‒ $1.8B global anabolic market • Launched in June 2020 in U.S. ‒ EU approval August 2020, ROW in-progress • Alvogen marketing initiatives focused on prescribers and patients including co-pay support and dedicated sales force • Pursuing Therapeutic Equivalence (TE) designation from FDA that may allow for automatic substitution in many states

98 EXPRESSION TECHNOLOGY PARTNERSHIPS HIGHLIGHTING OUR CRM197 OPPORTUNITY CRM197 is a non-toxic mutant of diptheria toxin, used as a carrier protein in vaccines Platform rights to use CRM197 in up to 4 Commercial license exclusive to a production vaccine products strain for CRM197 for use in any SII products • V114 • Pneumosil® ‒ Next-generation pneumococcal vaccine ‒ Pneumosil is a 10-valent pneumococcal containing 15 serotypes, 2 more than vaccine developed for middle-income Pfizer’s Prevnar13® countries and developing world ‒ Commercial license exclusive to a ‒ Pneumosil launched, first UNICEF tender in production strain capable of producing June 2020; India Marketing Authorization CRM197 carrier protein received; royalty flow begins in 2020 ‒ If approved, V114 will compete directly ‒ Phase 3 trial for Pentavalent Meningococcal with Prevnar13, with 2019 worldwide conjugate vaccine ongoing sales of $5.8B ‒ BLA submission expected Q4 2020

99 EXPRESSION TECHNOLOGY PLATFORM COMPETITIVE ADVANTAGE Pfenex Expression Technology Platform Has a Legacy of Success and Value Creation Platform has long history of successful production strain identification with unprecedented speed, while maintaining a success rate of >80% with complex proteins Expression Technology Platform Benefits Toolbox diversity and automation enables rapid and broad exploration of expression strategies, enabling success with even the most challenging and complex proteins Speed and success rate have direct impact on development cost and time Significant reduction of long-term cost-of-goods Platform has enabled integration of several modifications via genetic manipulation (e.g., site-specific pegylation (Ambrx), pasylation (XL-protein), fusions (teriparatide)) which typically negatively impact production efficiency Track record of successful expression of novel modalities positions the platform to enable state-of-the-art drugs relevant to the industry today and in the future

FINANCIAL OVERVIEW & OUTLOOK Matt Korenberg CFO 100 Copyright © 2020 Ligand. All Rights Reserved.

101 OVERVIEW Q3 Captisol M&A and Results; Outlook to Capital Updated 2020 2023 Allocation and 2021 Guidance

102 Q3 CAPTISOL REVENUE & UPDATED 2020 OUTLOOK • Booked $23 million of Captisol revenue in Q3 • 2020 full-year Captisol sales guidance: $92 million, increased from $90 million; implies $23 million for Q4 2020 • Royalty outlook for 2020 of $33 million, increased from $32 million ‒ Stable outlook for legacy Ligand royalty streams; adding Teriparatide and Pneumosil in Q4 • Contract revenue outlook for 2020 of $45 million, increased from $43 million ‒ Vernalis sale reduces Service by ~$1 million in Q4; legacy Ligand increasing by ~$3 million ‒ Combining Contract and Service into one line given sale of Vernalis and forward impact

103 2020 UPDATED GUIDANCE INCLUDING IMPACT OF PFENEX, ICAGEN, TAURUS, XCELLA ACQUISITIONS AND VERNALIS DIVESTITURE $170 All revenue lines contributing to million increased guidance Total Revenue Gross margin in-line with 80% - 85% previous guidance 55%+ Gross Margin 2020 revenue and adjusted $73 - $75 Cash operating expenses include EPS growth over 2019* million Icagen, Pfenex, Taurus, xCella for Cash Expenses portion of year Improved revenue offset by M&A $3.95 deal and new operating expenses Adjusted EPS * 2019 revenue excludes revenue from Q1 2019 Promacta royalty

104 2021 REVENUE GUIDANCE $285 MILLION TOTAL REVENUE Royalties Kyprolis Evomela Core Revenue of $130 Million Growth of Kyprolis and Teriparatide Evomela with addition Other of Pfenex portfolio $40 Contract Material Sales Commercial Strong outlook with Clinical $45 sales driven by existing Royalties and new customers $45 Material Contract Service Rebound of contract payments to pre-COVID Contract Plus current forecast of ~$155 million levels offset by sale of of Captisol to supply for manufacturing Vernalis of remdesivir, if needed, by partners

105 2021 P&L GUIDANCE 2021 TOTAL REVENUE AN ALL-TIME HIGH FOR LIGAND 2020G 2021G • 68% revenue growth over 2020 Revenue $170 $285 • Royalty growth in core assets and addition of four new royalty streams Gross Margin 80% - 85% 75% - 80% ‒ 2021 launches for JZP-458 and Merck V114 Cash R&D $43 to $45 $45 to $50 ‒ PNEUMOSIL and Teriparatide already Cash G&A $30 to $32 $35 to $40 marketed Cash Expenses $73 to $75 $80 to $85 • Contract revenue growth despite sale of Vernalis (~$12 to $15 million annual Other Income $5 to $8 $3 to $5 revenue) Tax Rate 21% to 23% 21% to 23% ‒ Milestones recover to pre-COVID levels and service Adjusted EPS $3.95 $6.00 • Q1 2021 Captisol estimated to be $45 million based on current information and Share Count 17.0 17.2 orders from customers In millions other than gross margin, tax rate and adjusted EPS.

106 2021 P&L GUIDANCE MARGINS STRONG EVEN WITH IMPACT OF MIX SHIFT 2020G 2021G • Royalty and Contract lines 100% gross Revenue $170 $285 margins Gross Margin 80% - 85% 75% - 80% • Captisol is a more significant portion of Cash R&D $43 to $45 $45 to $50 revenue in 2021 driving increased dollar value of COGS Cash G&A $30 to $32 $35 to $40 Cash Expenses $73 to $75 $80 to $85 ‒ Higher volumes will also require more expensive supply chain components Other Income $5 to $8 $3 to $5 Tax Rate 21% to 23% 21% to 23% Adjusted EPS $3.95 $6.00 Share Count 17.0 17.2 In millions other than gross margin, tax rate and adjusted EPS.

107 2021 P&L GUIDANCE CASH OPERATING EXPENSES ADJUSTED FOR M&A 2020G 2021G • Addition of full year of Pfenex team and Revenue $170 $285 spend in 2021 Gross Margin 80% - 85% 75% - 80% • CE-Iohexol trial costs impact 2021 Cash R&D $43 to $45 $45 to $50 • Vernalis costs removed from 2021 Cash G&A $30 to $32 $35 to $40 Cash Expenses $73 to $75 $80 to $85 • Internal OmniAb development continues Other Income $5 to $8 $3 to $5 Tax Rate 21% to 23% 21% to 23% Adjusted EPS $3.95 $6.00 Share Count 17.0 17.2 In millions other than gross margin, tax rate and adjusted EPS.

108 2021 P&L GUIDANCE EPS GROWTH SIGNIFICANT OVER 2020 2020G 2021G • 52% adjusted EPS growth over 2020 Revenue $170 $285 Gross Margin 80% - 85% 75% - 80% • Share count not currently assuming any share repurchase in 2021 Cash R&D $43 to $45 $45 to $50 Cash G&A $30 to $32 $35 to $40 Cash Expenses $73 to $75 $80 to $85 Other Income $5 to $8 $3 to $5 Tax Rate 21% to 23% 21% to 23% Adjusted EPS $3.95 $6.00 Share Count 17.0 17.2 In millions other than gross margin, tax rate and adjusted EPS.

109 THREE-YEAR OUTLOOK TOTAL REVENUE ~$62M $220M Royalty outlook does not include contribution $170M* Royalty ~$35M ~3X Royalty from Sparsentan or Increase Teriparatide TE approval Contract ~$10M $113M Captisol ~2X Contract Increase 2023 does not include ~30% Captisol any contribution from Growth remdesivir 2020 2023 * Total revenue including Captisol sales for remdesivir.

110 THREE-YEAR OUTLOOK ROYALTIES ~$33 M $95M V114 Teriparatide Pfenex products Erwinia Pneumosil Asparaginase ~$17M New PTX-022 Zimberelimab ~$12M approvals Existing Pevonedistat Sugemalimab $33M products Kyprolis Duavee/Conbriza Evomela Nexterone/Others 2020 2023 Does not assume any sparsentan royalties or TE rating for teriparatide: that would be upside to this outlook.

111 THREE-YEAR OUTLOOK CAPTISOL Approved commercial product growth driven by Kyprolis and Nexterone Steady growth with significant potential Clinical trials and pipeline approvals upside from high add incrementally in near-term use programs like CE-Iohexol if Research partners and new license approved deals add long-term

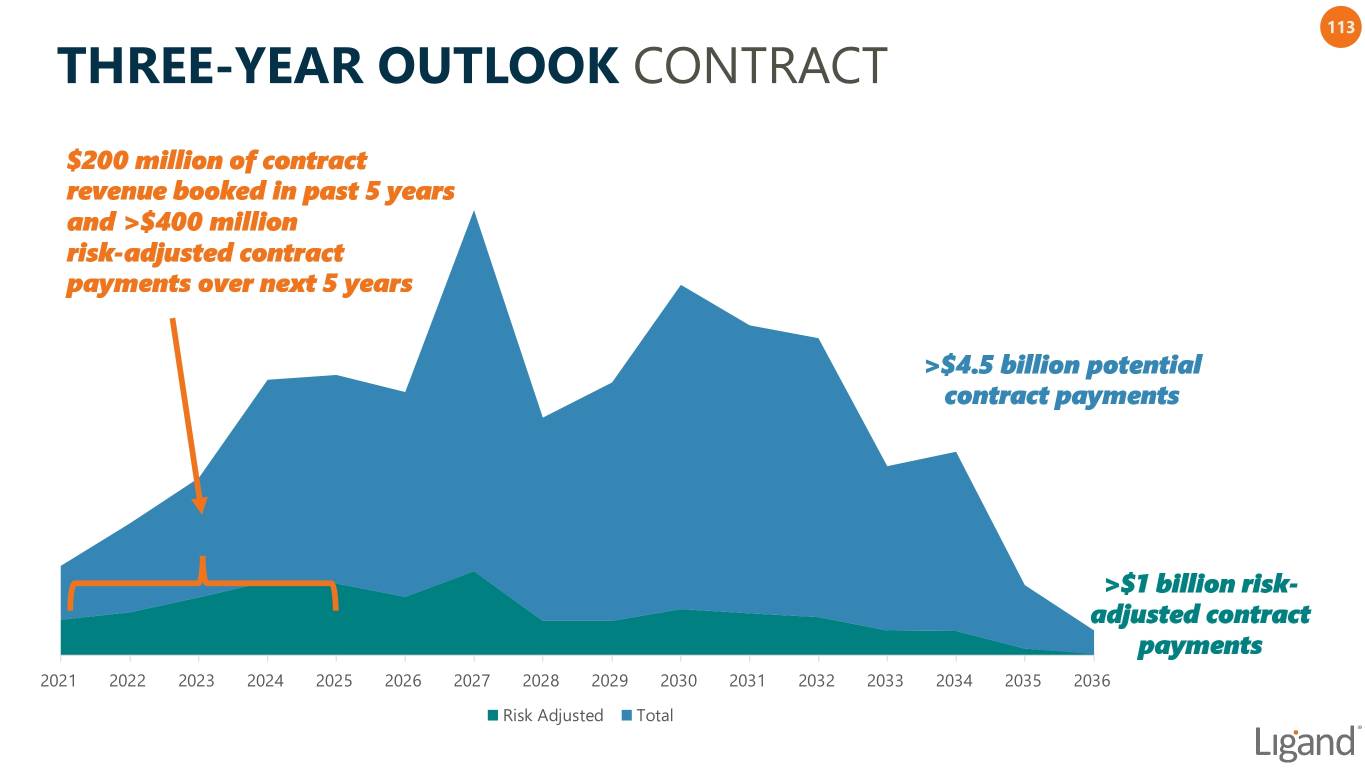

112 THREE-YEAR OUTLOOK CONTRACT PROPRIETARY COMPOUNDS / OTHER Total Potential Contractual Payments in excess of PROTEIN $4.5 Billion EXPRESSION

113 THREE-YEAR OUTLOOK CONTRACT $200 million of contract revenue booked in past 5 years and >$400 million risk-adjusted contract payments over next 5 years >$4.5 billion potential contract payments >$1 billion risk- adjusted contract payments 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 Risk Adjusted Total

114 PORTFOLIO INFORMATION MANAGEMENT SYSTEM FACILITATING THE MANAGEMENT AND TRACKING OF OVER 1500 COMPANIES AND EVENTS Lead Science Database Reporting Review Collaboration and Partner reports and Dedicated Science lead data share through contracts linked to for each program cloud-based technology programs in database Audit trail for information Facilitates SEC reporting and Quarterly status reviews changes and updates investor communication

115 CAPTISOL AND THE COVID-19 PANDEMIC Three stages of world need may drive demand for supply of Captisol Ligand’s View Ligand forecasts Large Captisol Urgent demand now as pandemic continues higher Captisol quantities supplied needs for in 2020 as 5 to 30 countries might stockpile manufacturing manufacturing Could take over a year to develop COVID-19 ramps up treatments in Virus not going away, even with vaccines 2021 Meeting Acute Need Stockpiling Supportive Annual Care 2020 | 2021 | 2022 | 2023 | 2024+ Reference: Koonin and Patel, Amer. J. of Public Health, Vol. 108, No. 53, 2018.

116 CAPTISOL AND THE COVID-19 PANDEMIC • In 2004, the U.S. and other countries began stockpiling antiviral medications, namely Tamiflu® (Roche) and Relenza® (GSK) ‒ Roche supplied ~350 million treatment courses (3.5 billion doses) of Tamiflu to governments between 2004 and 20091 • Typically each year, 1.4 to 8.7 million antiviral drug courses are prescribed to treat seasonal influenza2 ‒ Since 2009, average yearly revenues for influenza antivirals have been ~$600 million for Tamiflu (now generic) and ~$100 million for Relenza3 $3,000 $1,200 Tamiflu Relenza $2,500 $1,000 $2,000 $800 $1,500 $600 $1,000 $400 $500 $200 $0 $0 2009 2013 2005 2009 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2010 2011 2012 2014 2015 2016 2017 2018 2019 1999 2000 2001 2002 2003 2004 2006 2007 2008 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2009-2010 H1N1 Pandemic 1Security Dialogue 2014, Vol. 45(5) 440–457 2Am J Public Health. 2018;108:S215–S220; 3Thomson Reuters Cortellis 3GoodRx. Flu medications. 2020

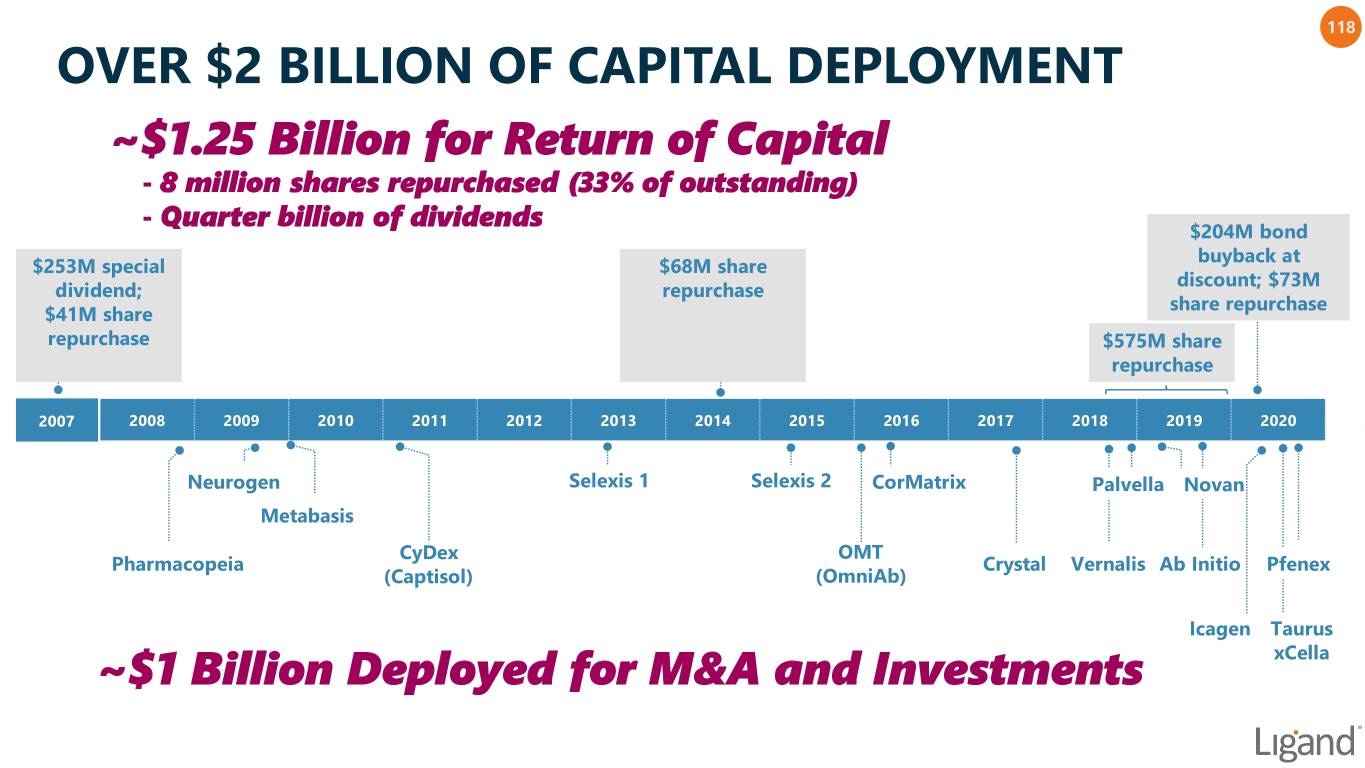

117 CAPITAL DEPLOYMENT TRACK RECORD OF SUCCESSFULLY DEPLOYING CAPITAL • Ligand is a company devoted to science and patient care that has exhibited an outstanding track record of deploying capital ‒ High-growth financial business ‒ Lean operating model ‒ Disciplined financial managers • Over the past 13 years, operating under our current business model, we have deployed over $2 billion of capital ‒ ~$1 billion used for M&A and building the current portfolio ‒ >$1 billion returned to shareholders through share repurchase and special dividends • Evaluating additional return of capital through quarterly dividends, special dividends, debt repurchase and/or share repurchase

118 OVER $2 BILLION OF CAPITAL DEPLOYMENT ~$1.25 Billion for Return of Capital - 8 million shares repurchased (33% of outstanding) - Quarter billion of dividends $204M bond buyback at $253M special $68M share discount; $73M dividend; repurchase share repurchase $41M share repurchase $575M share repurchase 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Neurogen Selexis 1 Selexis 2 CorMatrix Palvella Novan Metabasis CyDex OMT Pharmacopeia Crystal Vernalis Ab Initio Pfenex (Captisol) (OmniAb) Icagen Taurus ~$1 Billion Deployed for M&A and Investments xCella

119 CAPITAL DEPLOYMENT CAPITAL-DEPLOYMENT STRATEGY REMAINS UNCHANGED • M&A is a primary focus of our capital- Capital deployment deployment strategy allocation over time • Funding cycles and our business model create ample M&A opportunities M&A 50% • Share buybacks and bond repurchases have been primary form of return of Return of capital; likely to continue 50% Capital • Special dividend and regular dividends could be potential forms of capital return in the future Expect to continue to effectively deploy significant amounts of capital

QUESTIONS 120 Copyright © 2020 Ligand. All Rights Reserved.

APPENDIX Selected Partnered Program Highlights 121 Copyright © 2020 Ligand. All Rights Reserved.

122 KYPROLIS AMGEN PRODUCT UTILIZING CAPTISOL Sales (in millions) ® US ROW • Kyprolis viewed as superior proteasome inhibitor for multiple Japan myeloma (MM) $325 $300 • Developed and marketed by Amgen, sold in Japan by Ono $275 Pharmaceuticals $250 $225 ‒ Utilizes Ligand’s Captisol technology $200 $175 • Amgen/Ono reported combined 2019 revenue of $1.1 B; revenue $150 through 1H 2020 of $558 m $125 $100 ® ® • FDA recently approved KYPROLIS combination with DARZALEX $75 in both once- and twice-weekly dosing regimens for treatment of $50 patients with relapsed/refractory multiple myeloma $25 $0 ‒ Amgen has submitted marketing applications globally Q1 Q2 Q3 Q4 Q1 Q2 2019 2020

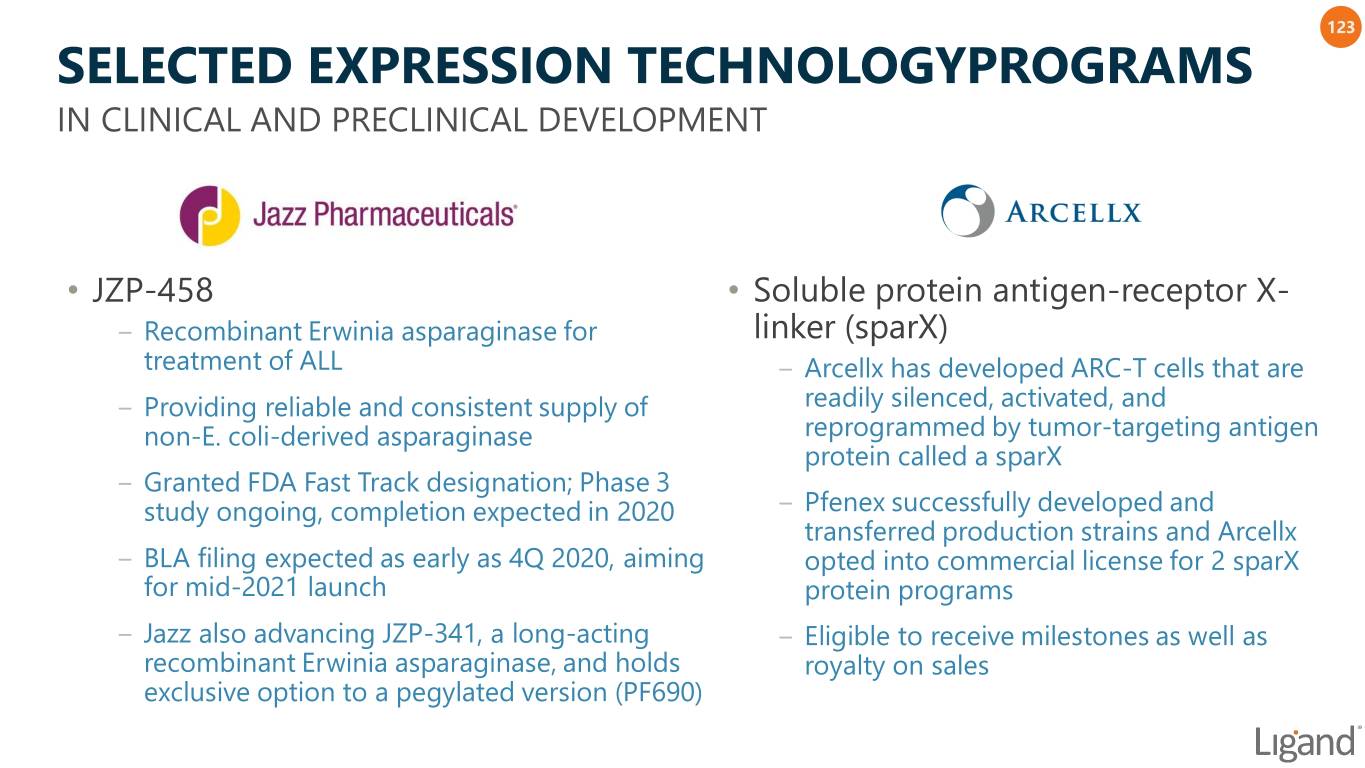

123 SELECTED EXPRESSION TECHNOLOGYPROGRAMS IN CLINICAL AND PRECLINICAL DEVELOPMENT • JZP-458 • Soluble protein antigen-receptor X- ‒ Recombinant Erwinia asparaginase for linker (sparX) treatment of ALL ‒ Arcellx has developed ARC-T cells that are ‒ Providing reliable and consistent supply of readily silenced, activated, and non-E. coli-derived asparaginase reprogrammed by tumor-targeting antigen protein called a sparX ‒ Granted FDA Fast Track designation; Phase 3 study ongoing, completion expected in 2020 ‒ Pfenex successfully developed and transferred production strains and Arcellx ‒ BLA filing expected as early as 4Q 2020, aiming opted into commercial license for 2 sparX for mid-2021 launch protein programs ‒ Jazz also advancing JZP-341, a long-acting ‒ Eligible to receive milestones as well as recombinant Erwinia asparaginase, and holds royalty on sales exclusive option to a pegylated version (PF690)

124 SELECTED OMNIAB PROGRAMS IN CLINICAL DEVELOPMENT • APVO436 • GEN1046 (DuoBody®-PD-L1x4-1BB) ‒ Bispecific antibody targeting CD123 and ‒ Bispecific antibody, jointly owned by Genmab CD3 for the potential treatment of and BioNTech hematological malignancies ‒ Targets PD-L1 and 4-1BB, selected to block ‒ Aptevo conducting a Phase 1b study of inhibitory PD-1/PD-L1 axis and APVO436 for the treatment of acute simultaneously activate essential co- myeloid leukemia (AML) and stimulatory activity via 4-1BB myelodysplastic syndrome (MDS) ‒ Phase 1/2 clinical study in solid tumors ‒ APVO436 was discovered in part with the ongoing OmniAb platform technology (anti-CD123 portion)

125 SELECTED CAPTISOL PROGRAMS IN LATE-STAGE DEVELOPMENT • Pevonedistat (TAK-924) • IV Ganaxolone ‒ Captisol-enabled™ Nedd8-Activating ‒ Captisol-enabled, positive allosteric Enzyme Inhibitor for the IV treatment of modulator of GABAA receptor myelodysplastic syndromes (MDS) ‒ Phase 3 RAISE trial in refractory status ‒ Demonstrated promising clinical activity in epilepticus (RSE) to begin enrollment in combination with azacitidine in a Phase 2 October; top-line data anticipated in study of patients with higher-risk (HR) MDS, 1H 2022 chronic myelomonocytic leukemia (HR- CMML), and acute myeloid leukemia (AML) ‒ Recently awarded a BARDA contract by the U.S. government to develop IV ganaxolone ‒ Phase 3 PANTHER trial underway in HR- for the treatment of RSE caused by nerve MDS, CMML and AML; readout in late 2020 agent exposure ‒ Potential NDA filing in 2021

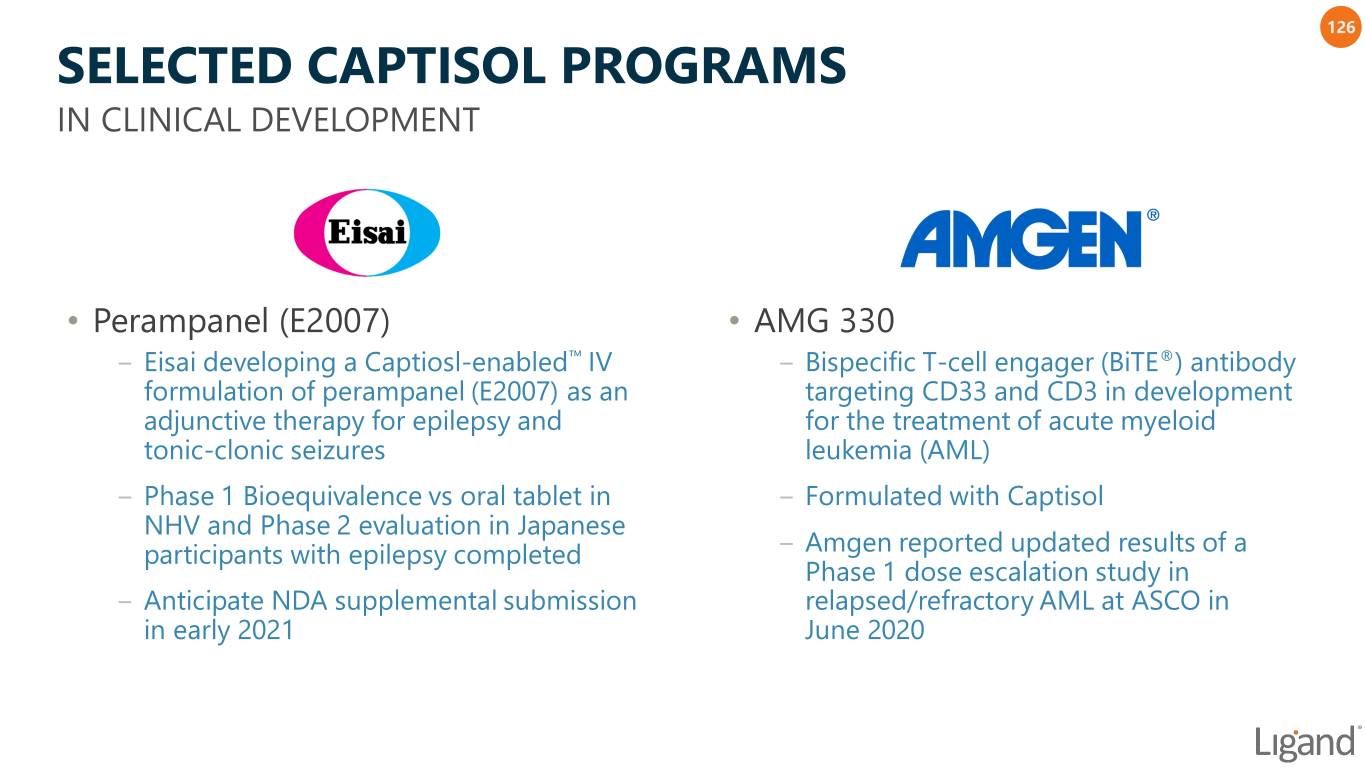

126 SELECTED CAPTISOL PROGRAMS IN CLINICAL DEVELOPMENT • Perampanel (E2007) • AMG 330 ‒ Eisai developing a Captiosl-enabled™ IV ‒ Bispecific T-cell engager (BiTE®) antibody formulation of perampanel (E2007) as an targeting CD33 and CD3 in development adjunctive therapy for epilepsy and for the treatment of acute myeloid tonic-clonic seizures leukemia (AML) ‒ Phase 1 Bioequivalence vs oral tablet in ‒ Formulated with Captisol NHV and Phase 2 evaluation in Japanese participants with epilepsy completed ‒ Amgen reported updated results of a Phase 1 dose escalation study in ‒ Anticipate NDA supplemental submission relapsed/refractory AML at ASCO in in early 2021 June 2020

127 SELECTED PARTNER PIPELINE PROGRAMS IN LATE-STAGE DEVELOPMENT • Sparsentan • PTX-022 ‒ Novel, topical formulation of rapamycin ‒ Dual inhibitor of angiotensin and ™ endothelin receptors in development for (QTORIN 3.9% rapamycin anhydrous gel) severe kidney diseases in development to treat pachyonychia congenita (PC) ‒ Pivotal Phase 3 DUPLEX Study in focal segmental glomerulosclerosis (FSGS) ‒ PC is a serious, chronically debilitating, underway; topline proteinuria data for monogenic rare skin disease with no potential accelerated approval expected approved treatment in 1Q 2021 ‒ Multi-center Phase 2/3 pivotal VALO Study ‒ Pivotal Phase 3 PROTECT Study in IgA underway with topline data expected in nephropathy (IgAN) also underway; 4Q 2020 topline proteinuria data expected in 3Q ‒ Ligand acquired economics rights to PTX- 2021 022 from Palvella in Dec. 2018

128 SELECTED PARTNER PIPELINE PROGRAMS IN CLINICAL DEVELOPMENT • Ensifentrine (RPL554) • Lasofoxifene ‒ Dual PDE3 and PDE4 enzyme inhibitor for ‒ Nonsteroidal selective estrogen receptor the treatment of respiratory disease modulator (SERM) with novel activity in ER gene mutations, prevalent in patients with ‒ Phase 3 ENHANCE 1 and 2 trials initiated in ER+ metastatic breast cancer Sept. with nebulized ensifentrine added onto a single bronchodilator for the ‒ Phase 2 ELAINE1 study underway in maintenance treatment of COPD; topline postmenopausal women with locally data in 2022 advanced or metastatic ER+/HER2- breast cancer with an ER mutation; top-line data ‒ Significant improvements in lung function expected in 1H 2021 reported for nebulized ensifentrine, as well as dry powder inhaled (DPI) and ‒ Collaboration with Eli Lilly initiated to study pressurized metered-dose inhaler (MDI) lasofoxifene in combination FDA-approved formulations, in Phase 2 studies in COPD CDK 4/6 inhibitor, Verzenio® (abemaciclib), patients in Phase 2 ELAINE2 study

129 SELECTED PARTNER PIPELINE PROGRAMS IN CLINICAL DEVELOPMENT • VK-2809 • Pradefovir ‒ Selective, liver-targeted TRβ agonist, for ‒ HepDirect prodrug of the nucleoside the treatment of metabolic disorders, analog adefovir for the treatment of including non-alcoholic steatohepatitis hepatitis B virus (HBV) infection (NASH) ‒ Xi’an XinTong obtained China rights for ‒ Phase 2b VOYAGE trial underway in HBV treatment in its merger with Chiva in patients with biopsy-confirmed NASH; 2015 topline data expected in 1H 2021 ‒ Phase 3 clinical trial in China initiated in ‒ 12-week Phase 2 study successfully July in patients with HBV infection; trial will achieved primary and secondary efficacy include 73 clinical sites and over a endpoints, demonstrating median thousand patients relative reductions in liver fat ranging from 53.8% to approximately 60%, and response rates of up to 100%

130 SELECTED PARTNER PIPELINE PROGRAMS IN CLINICAL DEVELOPMENT • Ciforadenant (CPI-444) • ECF843 ‒ Small molecule inhibitor of the ‒ Recombinant human lubricin for the adenosine A2A receptor treatment of dry eye and other ophthalmic indications ‒ Corvus reported positive results at ASCO 2020 from a Phase 1b/2 study in in ‒ In a Phase 2 study, ECF843 showed the patients with advanced refractory renal potential to provide instant relief of cell carcinoma (RCC) treated with symptoms and improve signs of dry eye ciforadenant monotherapy or in combination with Genentech’s Tecentriq® ‒ Novartis conducting second Phase 2 study (atezolizumab) in subjects with moderate to severe dry eye disease (DED); topline data expected in ‒ Phase 1/1b clinical trials are ongoing in 1H 2021 patients with a wide range of advanced solid tumors

131 OTHER COMMERCIAL CAPTISOL ASSETS • Captisol-enabled formulation • Reported product sales of • Marketed by Acrotech in of melphalan approved for use $25.5 million in 2019 US and CASI in multiple myeloma Pharmaceuticals in China • Captisol-enabled IV product • EU/Asia partner, Menarini, • Marketed by Melinta and indicated for acute bacterial conducting Phase 4 study partners in US, UK, Middle- skin infections and community- in EU for patients with East, MX and 5 countries in acquired pneumonia surgical wound infections South America • Captisol-enabled IV • Under the license agreement with Baxter, Ligand earns formulation of amiodarone revenue from Captisol material sales and royalties on approved in 2008 for sales of Nexterone® through early 2033 arrhythmias • Captisol-enabled IV • FDA approval in March • 60-hour infusion formulation of and launched by Sage administered in certified allopregnanolone for Therapeutics in July 2019 health facilities under postpartum depression REMS program