Form DEF 14A BROADRIDGE FINANCIAL For: Nov 19

UNITED STATES

| ☐ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| ☒ |

Definitive Proxy Statement

|

| ☐ |

Definitive Additional Materials

|

| ☐ |

Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

☒

|

No fee required.

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the form or schedule and the date of its filing.

|

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, schedule or registration statement no.:

|

|

|

(3)

|

Filing party:

|

|

|

(4)

|

Date filed:

|

|

Dear Stockholders

| You are cordially invited to attend the 2020 Annual Meeting of Stockholders of Broadridge Financial Solutions, Inc. Our 2020 Annual Meeting will be held on Thursday, November 19, 2020, at 9:00 a.m. Eastern Time. |

You can attend our virtual 2020 Annual Meeting online, vote, and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/BR20.

Broadridge delivered strong fiscal year 2020 operating and financial results in a challenging time. As we all know, the Covid-19 pandemic has thrown the world’s economies and markets into disarray, and its impact on people and communities, including our own, has been profound and continues to be felt. Add to that an increasing focus on the issue of racial injustice, and it is clear that we are in the midst of a unique moment in our history.

This is a moment that is testing the strength and resilience of both individuals and companies, and it has been inspiring to see Broadridge’s associates around the world stepping up, supporting our co-workers, clients, and families while staying engaged in our communities. While the pandemic prevented in-person annual shareholder meetings, Broadridge’s Virtual Shareholder Meeting solution enabled over 1,500 companies to hold their meetings this year.

At our 2020 Annual Meeting, our stockholders will elect our Board of Directors and vote on several other important items. I will report on our fiscal year 2020 financial performance at the meeting, and the members of the Board and I will also answer questions from our stockholders.

Whether or not you plan to attend the 2020 Annual Meeting, please read our 2020 Proxy Statement for important information on each of the proposals, and our practices in the areas of corporate governance and executive compensation. Our 2020 Annual Report to Stockholders contains information about our financial performance.

Please provide your voting instructions by telephone or the Internet, or by returning a proxy card or voting instruction form. Your vote is important to us and our business and we strongly urge you to cast your vote.

I look forward to our annual meeting, and I hope you will join us to hear more about Broadridge.

| Sincerely, | |

|

|

| Timothy C. Gokey | |

| Chief Executive Officer |

October 6, 2020

Notice of Annual Meeting of Stockholders

The 2020 Annual Meeting of Stockholders of Broadridge Financial Solutions, Inc., a Delaware corporation, will be held on Thursday, November 19, 2020, at 9:00 a.m. Eastern Time.

You can attend the 2020 Annual Meeting online, vote your shares, and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/BR20. Be sure to have the Control Number we have provided to you to join the meeting.

| At the meeting, stockholders will be asked to vote on the following: | |||

| ● | Election of 10 nominees to the Board of Directors to serve until the 2021 annual meeting of stockholders and until their successors are duly elected and qualified | ||

| ● | Advisory vote to approve the compensation of our Named Executive Officers | ||

| ● | Ratify the appointment of Deloitte & Touche LLP as our independent registered public accountants for the fiscal year ending June 30, 2021 | ||

| ● | Stockholder Proposal on Political Disclosures | ||

| In addition, the Board of Directors may transact such other business as may properly come before the meeting and any adjournment or postponement thereof. | |||

Stockholders of record at the close of business on September 24, 2020 are entitled to vote at the 2020 Annual Meeting.

We began distributing a Notice of Internet Availability of Proxy Materials, the 2020 Proxy Statement, the 2020 Annual Report to Stockholders, and proxy card/voting instruction form, as applicable, to stockholders on October 6, 2020.

| By Order of the Board of Directors, | |

|

|

| Maria Allen | |

| Secretary |

October 6, 2020

| Table of Contents |

| BROADRIDGE 2020 PROXY STATEMENT | 1 |

| Proxy Statement for Annual Meeting of Stockholders |

This Proxy Statement is furnished to the stockholders of Broadridge Financial Solutions, Inc. (the “Company” or “Broadridge”) in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board of Directors” or the "Board") for use at the 2020 Annual Meeting of Stockholders of the Company (the "2020 Annual Meeting" or the "Annual Meeting"), for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders.

| Annual

Meeting of Stockholders |

Time and Date | 9:00 a.m. Eastern Time, November 19, 2020 | |

| Attend Virtual Meeting | www.virtualshareholdermeeting.com/BR20 | ||

| Record Date | September 24, 2020 | ||

| Voting | Stockholders as of the Record Date are entitled to vote. Each share of the Company's common stock, par value $0.01 per share (the "Common Stock”) is entitled to one vote for each director nominee and one vote for each of the other proposals. There is no cumulative voting. |

The Annual Meeting will be a completely virtual meeting. You can attend online, vote, and submit questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/BR20.

| Voting Information |

We hope you will exercise your rights and fully participate as a stockholder. It is very important that you vote to play a part in the future of our Company. You do not need to attend the Annual Meeting to vote your shares.

If you hold your shares through a broker, bank or nominee, your broker is not permitted to vote on your behalf on the election of directors and other matters to be considered at the Annual Meeting (except on the ratification of the appointment of our independent registered public accountants for fiscal year 2021), unless you provide specific instructions by completing and returning the voting instruction form or following the instructions provided to you to vote your shares by telephone or the Internet. For your vote to be counted, you will need to communicate your voting decisions to your broker, bank or nominee before the date of the Annual Meeting.

The following table summarizes the proposals to be considered at the Annual Meeting and the Board's voting recommendation with respect to each proposal.

| PROPOSALS |

MORE INFORMATION |

BOARD’S RECOMMENDATION | BROKER DISCRETIONARY VOTING ALLOWED? | ABSTENTIONS AND BROKER NON-VOTES | VOTES REQUIRED FOR APPROVAL | |

| PROPOSAL 1 | Election of Directors | Page 13 | FOR Each Nominee | No | Do not count for all four proposals (no effect) | Majority of votes cast required for each proposal |

| PROPOSAL 2 | Advisory Vote to Approve the Compensation of our Named Executive Officers | Page 49 | FOR | No | ||

| PROPOSAL 3 | Ratification of Appointment of Independent Registered Public Accountants for Fiscal Year 2021 | Page 94 | FOR | Yes | ||

| PROPOSAL 4 | Stockholder Proposal on Political Disclosures | Page 97 | AGAINST | No |

| 2 | BROADRIDGE 2020 PROXY STATEMENT |

Vote Right Away

Advance Voting Methods and Deadlines

Even if you plan to attend our virtual Annual Meeting, please read this Proxy Statement with care and vote right away using one of the following methods.

| You will need the Control Number included on your proxy card, voting instruction form or Notice of Internet Availability of Proxy Materials. |

The telephone and Internet voting facilities will close at 11:59 p.m. Eastern Time on November 18, 2020.

If your shares are held in a brokerage account or by a bank or other nominee, your ability to vote by telephone or the Internet depends on your broker’s voting process. Please follow the directions provided to you by your broker, bank or nominee.

Voting During the Annual Meeting

You may also vote during the virtual Annual Meeting by visiting www.virtualshareholdermeeting.com/BR20 and following the instructions. You will need the Control Number included on your proxy card, voting instruction form or Notice of Internet Availability of Proxy Materials.

Questions and Answers About the Annual Meeting and Voting

Please see the section entitled “About the Annual Meeting and These Proxy Materials” beginning on page 102 for answers to common questions on the rules and procedures about the proxy and annual meeting process.

| BROADRIDGE 2020 PROXY STATEMENT | 3 |

| Proxy Statement Summary |

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. Page references are supplied to help you find further information in this Proxy Statement.

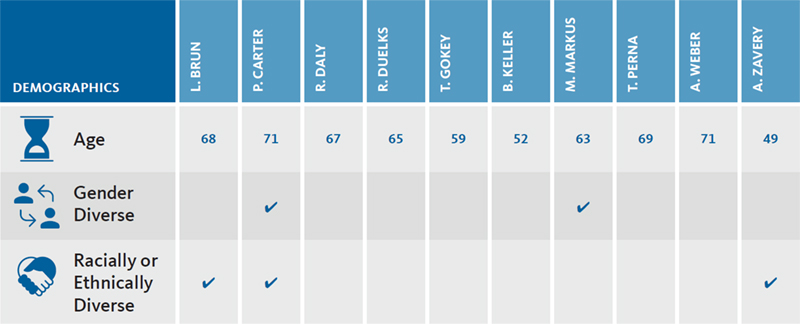

Information about our Board Nominees (page 18)

The following table provides summary information about each Board nominee. Each director stands for election annually. Detailed information about each nominee’s background, skill set and areas of experience can be found beginning on page 18 of this Proxy Statement.

| DIRECTOR | PRIMARY OCCUPATION | COMMITTEE MEMBERSHIPS |

DIRECTOR SINCE |

|

|

Leslie A. Brun

|

Chairman and Chief Executive Officer, SARR Group, LLC | Lead Independent Director | 2007 |

|

Pamela L. Carter

|

Retired President, Cummins Distribution Business, division of Cummins Inc. |

Audit—Chair

Governance and Nominating

|

2017 |

|

Richard J. Daly | Executive Chairman, Broadridge | 2007 | |

|

Robert N. Duelks

|

Former Executive, Accenture plc |

Audit

Governance and Nominating—Chair

|

2009 |

|

Timothy C. Gokey | Chief Executive Officer, Broadridge | 2019 | |

|

Brett A. Keller

|

Chief Executive Officer, priceline.com LLC |

Audit

Compensation

|

2015 |

|

Maura A. Markus

|

Former President and Chief Operating Officer, Bank of the West |

Audit

Compensation

|

2013 |

|

Thomas J. Perna

|

Chairman of the Board of Trustees, Amundi Pioneer Mutual Fund Group |

Audit

Governance and Nominating

|

2009 |

|

Alan J. Weber

|

Chief Executive Officer, Weber Group LLC |

Audit

Compensation—Chair

|

2007 |

|

Amit K. Zavery

|

Vice President and Head of Platform for Google Cloud, Google, LLC | Audit | 2019 |

| 4 | BROADRIDGE 2020 PROXY STATEMENT |

| Proxy Statement Summary |

Board Nominee Information Matrix

Our Board strives to maintain a highly independent, balanced and diverse group of directors that collectively possess the expertise to ensure effective oversight and be responsible stewards of our stockholders' interests.

| BROADRIDGE 2020 PROXY STATEMENT | 5 |

| Proxy Statement Summary |

|

Race or Ethnicity: Mr. Brun, Ms. Carter and Mr. Zavery self-identify as racially or ethnically diverse. Mr. Brun identifies as Black/African American, Ms. Carter identifies as Black/African American, and Mr. Zavery identifies as Indian/South Asian. |

| 6 | BROADRIDGE 2020 PROXY STATEMENT |

| Proxy Statement Summary |

Our Corporate Governance Policies Reflect Best Practices (page 31)

The Company believes good governance is integral to achieving long-term stockholder value. We are committed to governance policies and practices that serve the interests of the Company and its stockholders. The Board of Directors monitors developments in governance best practices to assure that it continues to meet its commitment to thoughtful and independent representation of stockholder interests.

The following table summarizes certain corporate governance practices and facts including certain highlighted enhancements approved in 2020:

|

Board of Directors |

| • | Strong Independent Board Leadership |

| • | Majority Independent Directors—8 of the 10 Director Nominees are Independent |

| • | Annual Election of Directors by Majority of Votes Cast |

| • | Required to Offer to Resign if Do Not Receive Majority of Votes Cast |

| • | Robust Stock Ownership Guidelines and Holding Period Requirements |

| • | Annual Board and Committee Evaluation Process |

| • | Mandatory Retirement Age of 72 |

| • | Annual Board Compensation Limits |

| • | Audit Committee Members Cannot Serve on More Than Three Public Company Audit Committees |

| • | Expected to Attend the Annual Meeting of Stockholders |

| • | Lead Independent Director Available to Major Stockholders |

|

Stockholder Rights |

| • | Proxy Access |

| • | No Poison Pill |

| • | Stockholders Owning 20% of the Voting Power of Outstanding Shares of Common Stock are able to Call Special Meeting |

|

Executive Compensation |

| • | Annual Say on Pay Stockholder Vote |

| ► | Comprehensive Clawback Policy applicable in circumstances beyond financial restatements |

| • | Prohibition on Hedging, Pledging and Short Sales of our Securities |

| • | Double-trigger Change in Control Plan Requires Termination Following Change in Control (“CIC”) |

| ► | Amended Change in Control Plan to Shorten Protection Period |

| • | No Repricing of or Discount Stock Options |

| • | No Dividends or Dividend Equivalents on Unvested Equity Awards |

| • | Robust Stock Ownership Guidelines and Retention and Holding Period Requirements |

| • | No Employment Agreements |

| • | No Excise Tax Gross-ups |

| • | Restrictive Covenant Agreements |

| • | Modest Perquisites |

| • | Significant Portion of Named Executive Officers’ Target Total Direct Compensation (“TDC”) is Performance Based |

| BROADRIDGE 2020 PROXY STATEMENT | 7 |

| Proxy Statement Summary |

Covid-19 Response

As we navigate the Covid-19 pandemic, the well-being of our associates and our ability to fulfill our client service commitments are our highest priorities. We have taken numerous steps in support of these priorities, the most substantive of which are described below.

Our response began with a work-from-home policy at our Asia-Pacific facilities. As the pandemic became more widespread, we activated our global business continuity plan and instituted work-from-home mandates for all of our non-production associates worldwide. At the same time, we also took strong measures to ensure the safety of our production associates. Working closely with our on-site medical teams and third-party experts, we implemented the most stringent safety and disinfecting measures in our facilities to mitigate the spread of the virus. We removed economic pressure to work by providing extended leave for those who are ill, quarantined, or have a family member in a high-risk group.

Our resilient technology platforms processed remarkable market volumes and seamlessly managed extreme volatility during March and April, supporting our clients. We also supported companies’ commitment to get timely communications and disbursements to their customers and shareholders. From distributing billions of dollars of dividend checks, to sending and receiving voting information, to providing investors with timely trade confirmations and account statements, Broadridge kept open the essential flow of information from our clients to their customers.

Also, while the pandemic prevents in-person annual shareholder meetings, our technology and associates ensure that companies can conduct their annual meeting safely to enable continued shareholder engagement. Broadridge’s Virtual Shareholder Meeting solution enabled over 1,500 companies to hold their meetings during 2020.

This year, in response to the impact the Covid-19 pandemic and the global recession have had on the communities in which we operate, we have committed to make $1.5 million in charitable donations. Of that amount, we have made $1 million in grants to support charities and schools globally in 12 of our largest operating regions. These funds focus on organizations targeting hunger relief for vulnerable populations, as well as critical medical services and equipment and school equipment for remote learning. The remaining $500,000 supported the charitable giving of our associates to double-match charitable donations they made to Covid-19 related causes.

Sustainability (page 41)

Our sustainability framework includes strong corporate governance practices and policies in fostering a culture of integrity, managing a better performing and sustainable business and achieving long-term stockholder value, investment in our communities, promoting inclusion and diversity across our organization and among our vendors, combatting slavery and human trafficking in our operations and supply chains, and promoting a sustainable environment through efficient business initiatives and alternatives all of which benefit our clients, stakeholders and associates. Through this sustainability framework, we further our commitment to conducting our business effectively and with uncompromising honesty and integrity and find meaningful ways to engage with our communities.

Our 2020 Sustainability Report and information on our environmental, social and governance (“ESG”) efforts are available on our website at www. broadridge.com/about/sustainability. Information contained on our website is not incorporated into or a part of this Proxy Statement.

| 8 | BROADRIDGE 2020 PROXY STATEMENT |

| Proxy Statement Summary |

Select Performance Highlights (page 53)

For more complete information about our financial performance, please review the Company’s annual report for the fiscal year ended June 30, 2020 on Form 10-K (the “2020 Form 10-K”).

In fiscal year 2020, despite the impact of the Covid-19 pandemic on our operations and the economic downturn, we achieved another year of strong financial performance, including 10% recurring fee revenue growth, 8% Non-GAAP Adjusted earnings per share (“EPS”) growth, and record closed sales results. These strong financial results enabled the Company to generate total shareholder return of 76% for the three-year period ended June 30, 2020, resulting in performance within the top quartile of companies in the S&P 500® Index (“S&P 500”) over the three-year period.

Company Performance Snapshot

|

(1)

|

Note that the adjusted measures presented in this section are not presented in accordance with U.S. generally accepted accounting principles (“Non-GAAP”).

For information on the Company’s use of Non-GAAP financial measures, see ‘‘Non-GAAP Financial Measures’’ on page 75 of this Proxy Statement.

|

| (2) |

Our performance-based compensation uses Non-GAAP financial measures that are further adjusted as set forth in the 2018 Omnibus Award Plan. We refer to these measures as “Compensation Adjusted” measures. For information on the Company’s

use of Compensation Adjusted metrics, see pages 75-76 of this Proxy Statement.

|

| BROADRIDGE 2020 PROXY STATEMENT | 9 |

| Proxy Statement Summary |

| 10 | BROADRIDGE 2020 PROXY STATEMENT |

| Proxy Statement Summary |

Actual Performance-Based Compensation of Named Executive Officers

As a result of the Company’s strong financial performance in fiscal years 2019 and 2020, the Company’s executive officers listed in the Summary Compensation table of this Proxy Statement (“Named Executive Officers” or “NEOs”) earned the following performance-based cash incentive award and long-term equity incentive award payouts (excluding stock options) in fiscal year 2020 reflecting the Company’s performance.

The compensation presented in this table differs from the compensation presented in the Summary Compensation table, which can be found on page 78 of this Proxy Statement, and is not a substitute for such information.

| NAME | CASH INCENTIVE | LONG-TERM INCENTIVE | ||||||

| Cash

Incentive Target ($) |

Achievement

as % of Target |

Cash

Incentive Payout ($) |

Target

at Time of Grant ($) |

Target Units Granted October 1, 2018 |

Long-Term Incentive (“LTI”) Achievement (%) |

LTI

Units Vesting April 1, 2021 |

Restricted |

|

|

Timothy C. Gokey Chief Executive Officer (“CEO”) |

$1,350,000 | 109% | $1,468,800 | $2,106,250 | 16,630(2) | 120% | 19,956 | $2,518,248 |

|

James M. Young Corporate Senior Vice President (“SVP”) and Chief Financial Officer (“CFO”)(4) |

$ 611,573 | 105% | $ 642,457 | $ 975,000 | 7,552 | 120% | 9,062 | $1,143,534 |

| Richard

J. Daly Executive Chairman |

$ 937,500 | 109% | $1,020,000 | $3,500,000 | 27,112(3) | 120% | 32,534 | $4,105,465 |

| Christopher

J. Perry President |

$ 896,974 | 116% | $1,043,630 | $ 445,000 | 3,447 | 120% | 4,136 | $ 521,922 |

|

Robert Schifellite Communication Solutions (“ICS”) |

$ 729,230 | 117% | $ 856,299 | $ 666,500 | 5,163 | 120% | 6,195 | $ 781,747 |

| (1) | Based on the closing price of our Common Stock of $126.19 per share on June 30, 2020. |

| (2) | Mr. Gokey was appointed CEO in January 2019. Mr. Gokey’s long-term incentive target includes an award of 10,070 annual performance-based RSUs ($1,300,000) granted on October 1, 2018, while he was serving as Chief Operating Officer (“COO”), and an award of 6,560 performance-based RSUs ($806,250) granted on November 8, 2018, in recognition of his promotion to the role of CEO. |

| (3) | Mr. Daly’s October 1, 2018 annual performance-based RSU grant reflects the award granted while he was serving as CEO. |

| (4) | Mr. Young left the Company on August 31, 2020, therefore all of his unvested equity awards have been forfeited. |

| BROADRIDGE 2020 PROXY STATEMENT | 11 |

| Proxy Statement Summary |

Pay is Aligned to Company Performance (page 49)

Broadridge’s compensation programs are designed to align the interests of our executives with the interests of our stockholders. For this reason, the mix of compensation elements for the Named Executive Officers, and particularly for the CEO, is heavily weighted towards variable, performance-based compensation.

As discussed in the 2020 Financial Performance Highlights section beginning on page 53 of this Proxy Statement, despite the operational challenges and general economic headwinds experienced as a result of the Covid-19 pandemic, Broadridge demonstrated another year of solid growth in fiscal year 2020.

In line with the Company’s strong overall financial performance in fiscal year 2020, the annual cash incentive payments for the Named Executive Officers ranged from 105% to 117% of their targets. In addition, because of our strong EPS performance in fiscal years 2019 and 2020, performance-based RSU awards were earned at 120% of their target amounts.

|

Each year, the Company provides stockholders with an opportunity to cast an advisory vote on the compensation of the Named Executive Officers (the “Say on Pay Vote”). At the 2019 annual meeting of stockholders (the “2019 Annual Meeting”), stockholders continued their strong support of our executive compensation program with approximately 95% of the votes cast in favor of the proposal (excluding broker non-votes).

Based on the outcome of the annual Say on Pay Vote, the Compensation Committee believes that the Company’s current executive compensation program is aligned with the interests of the Company’s stockholders. Accordingly, the Compensation Committee decided to retain the core elements and pay-for-performance design of our executive compensation program for fiscal year 2020. |

|

|

| 12 | BROADRIDGE 2020 PROXY STATEMENT |

Proposal 1—Election of Directors

|

Upon the recommendation of the Governance and Nominating Committee, our Board has nominated the 10 directors identified on the following pages for election at the 2020 Annual Meeting. Each nominee has consented to be nominated and, if elected, to serve on the Board until the next annual meeting of stockholders and until their successors are elected and qualified or until their death, resignation, retirement or removal.

All of the nominees are currently Broadridge directors who were elected by stockholders at the 2019 Annual Meeting.

|

|

Directors are elected annually by a majority of the votes cast at the annual meetings of stockholders. In an uncontested election, any incumbent director who fails to receive a majority of the votes cast is required to promptly submit an offer to resign from the Board. The Governance and Nominating Committee will recommend to the Board whether to accept or reject the director's offer to resign. The Board will act on the offer to resign within 90 days from the date of the certification of election results.

|

|

When seeking candidates as Board members, the Governance and Nominating Committee may solicit suggestions from incumbent directors, management or stockholders. The Committee will consider director candidates proposed by stockholders, provided that the stockholder recommendation complies with the provisions of the Company's Amended and Restated By-laws (the "By-laws") requiring that stockholder submissions be submitted to the Company's Secretary at 5 Dakota Drive, Lake Success, New York 11042 or emailing our Secretary at [email protected], in a timely manner and include the information called for in the By-laws concerning (a) the potential nominee, and (b) the person proposing the nomination. The Governance and Nominating Committee will apply the same standards in considering candidates submitted by stockholders as it uses for any other potential nominee.

The By-laws provide that under certain circumstances, a stockholder, or group of up to 50 stockholders, who have maintained continuous ownership of at least three percent of our Common Stock for at least three years may nominate and include a specified number of director nominees in our annual meeting proxy statement. The number of stockholder-nominated candidates appearing in our annual meeting proxy statement cannot exceed 25% of the number of directors then serving on the Board.

From time to time, the Governance and Nominating Committee may retain a search firm to assist the Company with identifying and evaluating Board candidates who have the backgrounds, skills and experience that the Governance and Nominating Committee has identified as desired in director candidates.

The Board's membership criteria and nomination procedures are set forth in the Corporate Governance Principles. The Corporate Governance Principles do not provide for a fixed number of directors but provide that the optimum size of the Board is 8 to 12 directors.

After conducting an initial evaluation of a potential candidate, the Governance and Nominating Committee will interview that candidate if it believes such candidate might be suitable to be a director. The candidate may also meet with other members of the Board. At the candidate's request, they may also meet with management. If the Governance and Nominating Committee believes a candidate would be a valuable addition to the Board, it will recommend that candidate's election to the full Board.

| BROADRIDGE 2020 PROXY STATEMENT | 13 |

| Proposal 1—Election of Directors |

Under the Company's Corporate Governance Principles, a majority of the Board must be comprised of directors who are independent based on the applicable rules of the New York Stock Exchange ("NYSE") and the Securities and Exchange Commission (“SEC”). The NYSE rules provide that the Board is required to affirmatively determine which directors are independent and to disclose such determination for each annual meeting of stockholders. No director will be deemed to be independent unless the Board affirmatively determines that the director has no material relationship with the Company, either directly or as an officer, stockholder or partner of an organization that has a relationship with the Company. In its review of director independence, the Board considers all relevant facts and circumstances, including without limitation, all commercial, banking, consulting, legal, accounting, charitable or other business relationships any director may have with the Company in conjunction with the Corporate Governance Principles and Section 303A of the NYSE's Listed Company Manual (the "NYSE Listing Standards").

On August 4, 2020, the Board reviewed each director's relationship with us and affirmatively determined that all of the directors, other than Mr. Gokey and Mr. Daly, are independent under the NYSE Listing Standards. Mr. Gokey and Mr. Daly were determined to not be independent due to their positions as our CEO and our Executive Chairman, respectively.

The Board and Governance and Nominating Committee consider the following factors and principles in evaluating and selecting director nominees:

RELEVANT EXPERIENCE: The Board should include individuals with experience in areas relevant to the strategy and operations of the Company's businesses such as technology services, or industries that Broadridge serves such as banking and financial services

HIGH-LEVEL MANAGERIAL EXPERIENCE: Directors should have established strong professional reputations and experience in positions with a high degree of responsibility or be leaders in the companies or institutions with which they are affiliated

CHARACTER AND INTEGRITY: Directors should be individuals with a reputation for integrity and with sufficient time available to devote to the affairs of the Company in order to carry out their responsibilities

DIVERSE BACKGROUND: The Board should have a diverse composition, which could include members with diverse backgrounds and perspectives, including diverse professions, race, culture, ethnicity, gender and sexual orientation

SKILLS COMPLEMENT EXISTING BOARD EXPERTISE: The interplay of a nominee's background and expertise with that of other Board members and the extent to which a candidate may make contributions to the Board or a committee should be considered

Board Nominee Information Matrix

The following matrix provides information regarding our Board nominees including demographic information such as whether they are gender, racially, or ethnically diverse, and certain types of knowledge, skills, experiences and attributes possessed by one or more of our directors which our Board believes are relevant to our business and industry. While our Governance and Nominating Committee considers the knowledge, skills, experiences and attributes listed below in the director nomination process, the matrix does not encompass all of the knowledge, skills, experiences or attributes of our Board nominees, and the fact that a particular knowledge, skill, experience or attribute is not listed does not mean that a Board nominee does not possess it. In addition, our Governance and Nominating Committee retains the right to modify such knowledge, skills, experiences and attributes it considers in the Board nomination process from time to time as it deems appropriate.

| 14 | BROADRIDGE 2020 PROXY STATEMENT |

| Proposal 1—Election of Directors |

| BROADRIDGE 2020 PROXY STATEMENT | 15 |

| Proposal 1—Election of Directors |

|

Knowledge, Skills and Experience |

|

|

Independence: "Independent" pursuant to the applicable rules of the NYSE and the SEC. |

|

Other Public Company Board: Experience is important in understanding the various and complex reporting responsibilities of public reporting companies and understanding corporate governance trends and commonly faced issues of public companies. |

|

Financial Services: Experience assists our directors in understanding and reviewing our business and strategy and providing insight into our financial services clients. |

|

Technology: Experience is important in understanding our business and strategy and providing insight into the needs of our clients and target markets. |

|

Financial Expertise/Literacy: Experience assists our directors in understanding, monitoring and overseeing our financial reporting and internal controls and understanding our operating and strategic performance. |

|

Sales/Marketing: Experience is important in understanding our business and strategy and relevant in identifying and developing the markets for our products and services. |

|

International Business: Experience operating in a global context by managing international enterprises, residence abroad, and studying other cultures enables oversight of how the Company navigates a global marketplace, and helps the Board understand diverse business environments, economic conditions and cultures and assess global business opportunities. |

|

Corporate Governance: Experience supports our goals of strong Board and management accountability, transparency, protection of stockholder interests and provides insight into developing practices consistent with our commitment to excellence in corporate governance. |

|

Legal/Regulatory/Government: Experience assists our directors in understanding and reviewing the context in which our services are provided and supports our Board's oversight of our regulated businesses. |

|

Associations/Public Policy: Experience supports our Board's oversight in analyzing public policy and regulation relevant to the Company's business and operations. |

| 16 | BROADRIDGE 2020 PROXY STATEMENT |

| Proposal 1—Election of Directors |

|

Race or Ethnicity: Mr. Brun, Ms. Carter and Mr. Zavery self-identify as racially or ethnically diverse. Mr. Brun identifies as Black/African American, Ms. Carter identifies as Black/African American, and Mr. Zavery identifies as Indian/South Asian. |

Each of the director nominees for election at the 2020 Annual Meeting holds or has held senior executive positions in large, complex organizations, and many hold or have held the role of chief executive officer. This experience demonstrates their ability to perform at the highest levels. In these positions, they have gained experience in core business skills, such as strategic and financial planning, public company financial reporting, compliance, risk management, leadership development, and marketing. This experience enables them to provide sound judgment concerning the issues facing a large public corporation in today's environment, provide oversight of these areas at the Company and evaluate our performance.

The Corporate Governance Principles provide that the Board take diversity into account in determining the Company's slate of nominees. In keeping with this commitment to diversity, four of our eight independent director nominees are women or racially or ethnically diverse individuals.

| The Governance and Nominating Committee and the Board have evaluated each of the director nominees against the factors and principles used to select director nominees. Based on this evaluation, they have concluded that it is in the best interests of the Company and its stockholders for each of the proposed director nominees on pages 18-27 below to continue to serve as a director of the Company. |

| BROADRIDGE 2020 PROXY STATEMENT | 17 |

| Proposal 1—Election of Directors |

Information About the Nominees

|

Leslie A. Brun

Age 68, is our Lead Independent Director since 2019 and has been a member of our Board since 2007. Mr. Brun served as our Chairman of the Board from 2011 to 2019.

Lead Independent Director

Mr. Brun has been the Chairman and Chief Executive Officer of SARR Group, LLC, an investment holding company, since 2006. He is currently Senior Advisor of G100 Companies, a unique business partnership that combines the world's best C-level learning communities with premier professional services firms. From 2011 to 2013, he was a Managing Director at CCMP Capital, a global private equity firm. Previously, from 1991 to 2005, Mr. Brun served as founder, Chairman and Chief Executive Officer of Hamilton Lane Advisors, a private markets investment firm. From 1988 to 1990, he served as co-founder and Managing Director of the investment banking group of Fidelity Bank. Mr. Brun is a former trustee of Widener University, the University at Buffalo Foundation, Inc. and The Episcopal Academy in Merion, Pennsylvania. |

|

Specific Experience, Qualifications, Attributes or Skills: | ||||

| • | Extensive finance, management, and financial advisory experience | ||||

| • | Operating, executive and management experience, including as chief executive officer of an investment holding company | ||||

| • | Financial expertise and financial literacy | ||||

| • | Financial services and technology industry experience and knowledge | ||||

| • | International business experience | ||||

| • | Corporate governance experience | ||||

|

Other Public Company Directorships: | ||||

| Current | |||||

| • | CDK Global, Inc., Non-Executive Chairman (since 2014) | ||||

| • |

Merck & Co., Inc. - Director (since 2008) - Lead Independent Director (since 2014) |

||||

| • | Corning, Inc., Director (since 2018) | ||||

| Former | |||||

| • |

Automatic Data Processing, Inc. ("ADP") -Director (2003-2015) -Chairman of the Board of Directors (2007-2015) |

||||

| • | Hewlett Packard Enterprise Company, Director (2015-2018) | ||||

| 18 | BROADRIDGE 2020 PROXY STATEMENT |

| Proposal 1—Election of Directors |

|

Pamela L. Carter

Age 71, is the Chair of the Audit Committee and a member of the Governance and Nominating Committee. Ms. Carter has been a member of our Board since 2017.

Independent Director

Ms. Carter is the retired President of Cummins Distribution Business, a division of Cummins Inc., a global manufacturer of diesel engines and related technologies. She assumed that role in 2008 and served in that position until she retired in 2015. She previously served as President—Cummins Filtration, then as Vice President and General Manager of Europe, Middle East and Africa business and operations for Cummins Inc. since 1999. Ms. Carter served as Vice President and General Counsel of Cummins Inc. from 1997 to 1999. Prior to joining Cummins Inc., she served as the Attorney General for the State of Indiana from 1993 to 1997. In 2010, Ms. Carter was appointed to the Export-Import Bank of the U.S. Sub-Saharan Africa Advisory Council. |

|

Specific Experience, Qualifications, Attributes or Skills: | ||||

| • | Extensive global management, operational and executive experience | ||||

| • | Financial services experience | ||||

| • | Financial expertise and financial literacy | ||||

| • | International business experience | ||||

| • | Corporate governance experience | ||||

| • | Legal/regulatory/government experience | ||||

| • | Association/public policy experience | ||||

|

Other Public Company Directorships: | ||||

| Current | |||||

| • | Enbridge Inc., Director (since 2017) | ||||

| • | Hewlett Packard Enterprise Company, Director (since 2015) | ||||

| Former | |||||

| • | Spectra Energy Corp., Director (2007-2017) | ||||

| • | CSX Corp., Director (2010-2020) | ||||

| BROADRIDGE 2020 PROXY STATEMENT | 19 |

| Proposal 1—Election of Directors |

|

Richard J. Daly

Age 67, is our Executive Chairman since 2019 and has been a member of our Board since 2007.

Management

Mr. Daly served as our CEO from 2007 to 2019, and as our President from 2014 to 2017. Prior to the 2007 spin-off of Broadridge from ADP, Mr. Daly served as Group President of the Brokerage Services Group of ADP ("BSG"), as a member of the Executive Committee and a Corporate Officer of ADP since June 1996. In his role as President at ADP, he shared the responsibility of running BSG and was directly responsible for our ICS business, Broadridge's largest business. Mr. Daly joined ADP in 1989, as Senior Vice President of BSG, following ADP's acquisition of the proxy services business he founded. He is a member of the Advisory Board of the National Association of Corporate Directors, and the Board of Directors of the SIFMA Foundation. |

|

Specific Experience, Qualifications, Attributes or Skills: | ||||

| • | Former CEO experience brings unique perspective and insights into the Company, including its businesses, relationships, competitive, financial and regulatory positioning, senior leadership and strategic opportunities and challenges | ||||

| • | Founder of the ICS business | ||||

| • | Extensive financial services and technology industry experience and knowledge | ||||

| • | Financial expertise and financial literacy | ||||

| • | Sales and marketing experience | ||||

| • | International business experience | ||||

| • | Corporate governance experience | ||||

|

Other Public Company Directorships: | ||||

| Former | |||||

| • | The ADT Corporation, Director (2014-2016) | ||||

| 20 | BROADRIDGE 2020 PROXY STATEMENT |

| Proposal 1—Election of Directors |

|

Robert N. Duelks

Age 65, is the Chair of the Governance and Nominating Committee and a member of the Audit Committee. Mr. Duelks has been a member of our Board since 2009.

Independent Director

Mr. Duelks is a former executive of Accenture plc, having served for 27 years in various capacities until his retirement in 2006. Throughout his tenure at Accenture, Mr. Duelks held multiple roles and had responsibilities, including and ranging from local client service, regional operations management to management of global offerings. While at Accenture, he served on multiple leadership committees, including the Board of Partners, the Management Committee and the Executive and Operating Committee for the Global Financial Services Operating Group. Mr. Duelks has served as an advisor to the senior executives of Tree Zero, a manufacturer of 100% tree free paper products since 2010. He is the former Chairman and a current Emeritus Trustee of the Board of Trustees of Gettysburg College, and he previously served as a member of the Advisory Board for the Business School at Rutgers University. |

|

Specific Experience, Qualifications, Attributes or Skills: | ||||

| • | Extensive experience in the management and operation of a technology and consulting services business | ||||

| • | Financial services and technology industry experience and knowledge | ||||

| • | Financial expertise and financial literacy | ||||

| • | Extensive experience in global sales and marketing | ||||

| • | International business experience | ||||

| BROADRIDGE 2020 PROXY STATEMENT | 21 |

| Proposal 1—Election of Directors |

|

Timothy C. Gokey

Age 59, is our CEO and has been a member of our Board since 2019.

Management

Mr. Gokey has been our CEO and a member of our Board since January 2019. Mr. Gokey joined Broadridge in 2010 as Chief Corporate Development Officer, with responsibility for the Company's growth initiatives, including sales and marketing, strategy, mergers and acquisitions, partnerships, and other growth-related activities. From 2012 to 2019, he served as Broadridge's Chief Operating Officer with responsibility for all Broadridge business units, technology, and operations in India. Mr. Gokey was appointed President of Broadridge in 2017. Prior to joining Broadridge, Mr. Gokey was President of the Retail Tax business at H&R Block from 2004. Previously, he was at McKinsey & Company, a global consulting firm, where he led McKinsey's North American Financial Services Sales and Marketing Practice. Mr. Gokey is a member of the board of directors of the Partnership for New York City. He has also served on the board of vestry of St. John's Episcopal Church, Cold Spring Harbor, New York. |

|

Specific Experience, Qualifications, Attributes or Skills: | ||||

| • | CEO's unique perspective and insights into the Company, including its businesses, relationships, competitive and financial positioning, senior leadership and strategic opportunities and challenges | ||||

| • | Operating, executive and management experience at a major global company | ||||

| • | Financial services and technology industry experience and knowledge | ||||

| • | Financial expertise and financial literacy | ||||

| • | Sales and marketing experience | ||||

| • | International business experience | ||||

|

Other Public Company Directorships: | ||||

| Current | |||||

| • | C.H. Robinson Worldwide, Inc., Director (since 2017) | ||||

| 22 | BROADRIDGE 2020 PROXY STATEMENT |

| Proposal 1—Election of Directors |

|

Brett A. Keller

Age 52, is a member of the Audit Committee and the Compensation Committee. Mr. Keller has been a member of our Board since 2015.

Independent Director

Mr. Keller is the Chief Executive Officer of priceline.com LLC ("priceline.com"), a leading provider of online travel services, and a subsidiary of Booking Holdings, Inc., a position he has held since 2016. Prior to his appointment as Chief Executive Officer, he served as priceline.com's Chief Operating Officer in 2016, and as its Chief Marketing Officer from 2002 to 2015. Mr. Keller joined priceline.com in 1999 and has played a central role in the company's evolution. As Chief Operating Officer, he was responsible for all marketing, technology, and product development areas of the business. As Chief Marketing Officer, he oversaw all global and strategic branding, marketing, distribution, product development and customer led data initiatives for priceline.com. Prior to joining priceline.com, Mr. Keller served as a director of online travel services for Cendant, a consumer services holding company. Mr. Keller sits on the National Advisory Council for the Marriott School of Management at Brigham Young University. |

|

Specific Experience, Qualifications, Attributes or Skills: | ||||

| • | Operating, executive and management experience as a chief executive officer and chief operating officer | ||||

| • | Extensive experience in global consumer marketing and sales, including branding, communications, online merchandising, and scaled consumer acquisition | ||||

| • | Digital and technology industry knowledge, including significant management of search engine marketing, social media, affiliate, user interface and user experience design development, big data, and programmatic disciplines | ||||

| • | Financial expertise and financial literacy | ||||

| • | International business experience | ||||

| BROADRIDGE 2020 PROXY STATEMENT | 23 |

| Proposal 1—Election of Directors |

|

Maura A. Markus

Age 63, is a member of the Audit Committee and the Compensation Committee. Ms. Markus has been a member of our Board since 2013.

Independent Director

Ms. Markus is the former President and Chief Operating Officer of Bank of the West, a role she held from 2010 through 2014. She is also a former member of the Board of Directors of Bank of the West and BancWest Corporation, and the Bank's Executive Management Committee. Before joining Bank of the West, Ms. Markus was a 22-year veteran of Citigroup, having most recently served as Head of International Retail Banking in Citibank's Global Consumer Group. She held a number of additional domestic and international management positions including President, Citibank North America from 2000 to 2007. In this position, she also served as Chairman of Citibank West. Ms. Markus also served as Citibank's European Sales and Marketing Director in Brussels, Belgium, and as President of Citibank's consumer business in Greece. Ms. Markus is a former member of The Financial Services Roundtable. She is a member of Year Up Bay Area's Talent and Opportunity Board and is a trustee for the College of Mount Saint Vincent in New York. Ms. Markus is a former board member of Catholic Charities CYO of San Francisco and New York, and Junior Achievement New York. |

|

Specific Experience, Qualifications, Attributes or Skills: | ||||

| • | Operating, executive and management experience, including as chief operating officer of a large financial services company | ||||

| • | Extensive experience in the financial services industry | ||||

| • | Financial expertise and financial literacy | ||||

| • | Extensive experience in global sales and marketing | ||||

| • | International business experience | ||||

| • | Associations/public policy experience | ||||

|

Other Public Company Directorships: | ||||

| Current | |||||

| • | Stifel Financial Corp., Director (since 2016) | ||||

| 24 | BROADRIDGE 2020 PROXY STATEMENT |

| Proposal 1—Election of Directors |

|

Thomas J. Perna

Age 69, is a member of the Audit Committee and the Governance and Nominating Committee. Mr. Perna has been a member of our Board since 2009.

Independent Director

Mr. Perna has served as the Chairman of the Board of Trustees of the Amundi Pioneer Mutual Fund Group since 2012. Prior to this appointment, he served as a member of the Board of Trustees of the Pioneer Funds from 2006, overseeing approximately 57 open-end and closed-end investment companies in a mutual fund complex. Mr. Perna joined Quadriserv, Inc., a technology products company in the securities lending industry, in 2005, and served in several roles including as Chairman and Chief Executive Officer until 2014. Previously, Mr. Perna served as Senior Executive Vice President of The Bank of New York, now known as The Bank of New York Mellon, in its Financial Institutions Banking, Asset Servicing and Broker Dealer Services sectors, where he was responsible for over 6,000 employees globally. He also served as a Commissioner on the New Jersey Civil Service Commission from 2011 to 2015. Mr. Perna previously served on the Boards of Directors of the Depository Trust & Clearing Corporation, Euroclear Bank S.A., Euroclear Clearance System PLC, and Omgeo PLC. He is a member of a number of banking and securities industry associations. |

|

Specific Experience, Qualifications, Attributes or Skills: | ||||

| • | Operating, executive and management experience, including as chief executive officer of a provider of technology products to the securities industry | ||||

| • | Technology industry experience and knowledge | ||||

| • | Financial expertise and financial literacy | ||||

| • | Sales and marketing experience | ||||

| • | International business experience, including management of a global financial services firm | ||||

| • | Corporate governance experience | ||||

| • | Government and regulatory experience | ||||

| • | Association/public policy experience | ||||

|

Other Public Company Directorships: | ||||

| Current | |||||

| • | Amundi Pioneer Mutual Funds, Chairman of the Board of Trustees (since 2006) | ||||

| BROADRIDGE 2020 PROXY STATEMENT | 25 |

| Proposal 1—Election of Directors |

|

Alan J. Weber

Age 71, is the Chair of the Compensation Committee and a member of the Audit Committee. Mr. Weber has been a member of our Board since 2007.

Independent Director

Mr. Weber has served as the Chief Executive Officer of Weber Group LLC, a private investment firm, since 2008. Mr. Weber retired as Chairman and Chief Executive Officer of U.S. Trust Corporation and as a member of the executive committee of the Charles Schwab Corporation in 2005. Previously, he was the Vice Chairman and Chief Financial Officer of Aetna Inc., where he was responsible for corporate strategy, capital management, information technology, investor relations and financial operations. He also held a number of senior level positions at Citibank N.A., where he worked from 1971 to 1998, including as Chairman of Citibank International and Executive Vice President of Citibank. During his tenure at Citibank, Mr. Weber oversaw operations in approximately 30 countries, including assignments in Japan, Italy and Latin America. He is also on the Board of Directors of Street Diligence LLC, a private company and was, until the sale of the company in 2018, the Chairman of the Board of Managers of KGS Holdings, LP. In addition, Mr. Weber serves as a member of the Board of Directors of DCTV, a New York based charitable organization. |

|

Specific Experience, Qualifications, Attributes or Skills: | ||||

| • | Operating, executive and management experience, including as chief executive officer and chief financial officer of global financial services firms | ||||

| • | Expertise in finance, financial reporting, compliance and controls | ||||

| • | Audit Committee Financial Expert | ||||

| • | Experience in information technology businesses | ||||

| • | International business experience | ||||

|

Other Public Company Directorships: | ||||

| Former | |||||

| • | Diebold Nixdorf Inc., Director (2005–2019) | ||||

| • | SandRidge Energy, Inc. (2013–2016) | ||||

|

|

|||||

| 26 | BROADRIDGE 2020 PROXY STATEMENT |

| Proposal 1—Election of Directors |

|

Amit K. Zavery

Age 49, is a member of the Audit Committee. Mr. Zavery has been a member of our Board since 2019.

Independent Director

Mr. Zavery is a Vice President and Head of Platform for Google Cloud at Google, LLC, a position he has held since March 2019. Previously, he served in numerous senior leadership roles during his 24 years at Oracle Corporation. Most recently, he was Executive Vice President and General Manager of Oracle Cloud Platform and Middleware products. He led Oracle's product vision, design, development, operations and go-to-market strategy for its cloud platform, middleware and analytics portfolio, and oversaw a global team of more than 4,500 engineers. |

|

Specific Experience, Qualifications, Attributes or Skills: | ||||

| • | Global operating, executive and management experience | ||||

| • | Digital and technology industry knowledge | ||||

| • | Financial expertise and financial literacy | ||||

| • | Extensive experience in global sales and marketing | ||||

| • | International business experience | ||||

Required Vote

Each director nominee receiving a majority of the votes cast at the 2020 Annual Meeting, in person or by proxy, and entitled to vote in the election of directors, will be elected, provided that a quorum is present. Abstentions and broker non-votes will be included in determining whether there is a quorum. In determining whether such nominees have received the requisite number of affirmative votes, abstentions will have no effect on the outcome of the vote. Pursuant to NYSE regulations, brokers do not have discretionary voting power with respect to this proposal, and broker non-votes will have no effect on the outcome of the vote.

Recommendation of the Board of Directors

|

The Board of Directors Recommends that you Vote FOR the Election of All Nominees |

| BROADRIDGE 2020 PROXY STATEMENT | 27 |

| Director Compensation |

Fiscal Year 2020 Non-Management Director Compensation

The compensation of our non-management directors is determined by the Compensation Committee upon review of recommendations from the Compensation Committee’s independent compensation consultant, Frederic W. Cook & Co., Inc. (“FW Cook”).

All of our directors are non-management directors, other than Mr. Gokey and Mr. Daly, who are our CEO and our Executive Chairman, respectively. The compensation paid to Mr. Gokey and Mr. Daly is reflected in the Summary Compensation table on page 78 of this Proxy Statement. Mr. Gokey and Mr. Daly do not receive any additional cash or equity compensation for their participation on the Board.

Non-Management Director Compensation Structure

|

(1)

|

The directors may defer their cash compensation under the Broadridge Director Deferred Compensation Plan (the “Deferred Compensation Plan”)

into DSUs.

|

| (2) |

DSUs and stock options vest at grant. |

| (3) |

Lead Independent Director additional retainer is paid $72,500 in cash and $57,500 in equity (split evenly between DSUs and stock options). Committee chair retainers

are paid in cash. |

Cash Compensation. Non-management directors received an annual retainer and meeting fees for each Board meeting and each committee meeting attended as a committee member. All retainers and meeting fees are paid in cash on a quarterly basis.

Directors may participate in the Deferred Compensation Plan which allows them to defer cash compensation into grants of DSUs that settle in shares of Common Stock. The number of DSUs awarded is determined by dividing the quarterly cash payment by the closing price of the Common Stock on the day before cash payments are made. This election is made annually prior to the beginning of the calendar year in which the retainers and fees are earned and is irrevocable for the entire calendar year. Accounts are credited with dividend equivalents in the form of additional DSUs on a quarterly basis as dividends are declared by the Board. Participants’ DSUs convert to shares of Common Stock upon their departure from the Board in either a lump sum amount or installments for up to five years, as previously elected by the director.

Equity Compensation. Non-management directors received annual grants of stock options and DSUs under the 2018 Omnibus Award Plan (the “2018 Omnibus Plan”) approved by the Company’s stockholders at the 2018 Annual Meeting. The number of shares comprising each director’s equity awards is determined at the time of grant based on a 30-day average stock price prior to the distribution of meeting materials, and, for stock options, the binomial stock option valuation method.

| 28 | BROADRIDGE 2020 PROXY STATEMENT |

| Director Compensation |

| ● | All stock options are granted with an exercise price equal to the closing price of Common Stock on the date of grant. All stock options granted to our non-management directors are fully vested upon grant and have a term of 10 years. Following separation from service on the Board, stock options held by directors expire at the earlier of the expiration of the option term and three years. |

| ● | All DSUs are granted at the same time as stock options, are fully vested upon grant, and will settle as shares of Common Stock upon the director’s separation from service on the Board. DSUs are credited with dividend equivalents in the form of additional DSUs on a quarterly basis as dividends are declared by the Board. |

Stockholder-Approved Cap on Pay. Our stockholders approved a cap on non-management director pay as part of the 2018 Omnibus Plan. The cap imposes an annual limit of $750,000 on cash fees paid and equity awards that may be granted to any non-management director during the fiscal year. Our current compensation program for non-management directors is well below this limit.

Stock Ownership Guidelines. The stock ownership guidelines for the non-management directors provide that each non-management director is expected to accumulate an amount of Common Stock or DSUs equal in value to 10 times their annual cash retainer. Stock option awards and cash-settled phantom stock will not count as shares of Common Stock for purposes of this calculation.

In addition, the guidelines provide that:

| ● | A non-management director should retain at least 50% of the net profit shares realized after the exercise of stock options until the 10 times annual cash retainer ownership level is reached. Net profit shares are the shares remaining after the sale of shares to fund payment of the stock option exercise price, tax liability and transaction costs owed due to exercise. |

| ● | After the ownership level is met, the non-management director must continue to hold at least 50% of future net profit shares for one year. |

Due to the holding requirement, there is no minimum time period in which the directors are required to achieve the stock ownership multiple.

All of our non-management directors have met the stock ownership multiple, other than Mr. Keller, Ms. Carter and Mr. Zavery, who joined the Board in 2015, 2017 and 2019, respectively, and are making progress toward meeting the multiple.

Other Compensation. Non-management directors may participate in the Broadridge Matching Gift Program (the “Matching Gift Program”) up to a maximum Company contribution of $10,000 per calendar year.

The non-management directors are also reimbursed for their reasonable expenses in connection with attending Board and committee meetings and other Company events.

| BROADRIDGE 2020 PROXY STATEMENT | 29 |

| Director Compensation |

The table below sets forth the compensation paid to our non-management directors in fiscal year 2020:

| Name | Fees Earned or Paid in Cash ($)(1) |

Stock Awards ($)(2) |

Option Awards ($)(3) |

All Other Compensation ($)(4) |

Total ($) |

| Leslie A. Brun | $162,500 | $105,046 | $97,018 | — | $364,564 |

| Pamela L. Carter | $128,750 | $ 77,352 | $71,367 | $10,000 | $287,469 |

| Robert N. Duelks | $120,750 | $ 77,352 | $71,367 | $10,000 | $279,469 |

| Brett A. Keller | $109,500 | $ 77,352 | $71,367 | $ 2,500 | $260,719 |

| Stuart R. Levine(5) | $ 60,000 | — | — | $ 6,500 | $ 66,500 |

| Maura A. Markus | $113,250 | $ 77,352 | $71,367 | $10,000 | $271,969 |

| Thomas J. Perna | $111,000 | $ 77,352 | $71,367 | — | $259,719 |

| Alan J. Weber | $128,250 | $ 77,352 | $71,367 | $20,000 | $296,969 |

| Amit K. Zavery | $102,750 | $ 77,352 | $71,367 | $ 7,000 | $258,469 |

| (1) | Represents the amount of cash compensation paid for fiscal year 2020 Board and committee service. Several directors deferred fiscal year 2020 cash compensation under the Deferred Compensation Plan: 525 DSUs (Mr. Keller), 1,479 DSUs (Ms. Markus), 1,679 DSUs (Mr. Weber), and 909 DSUs (Mr. Zavery). |

| (2) | Represents the aggregate grant date fair value of the annual DSU awards granted during fiscal year 2020 (excluding DSUs granted under the Deferred Compensation Plan), computed in accordance with Financial Accounting Standards Board’s Accounting Standards Codification 718, Compensation—Stock Compensation (“FASB ASC Topic 718”). See Note 15, “Stock-Based Compensation” to the Consolidated Financial Statements in our 2020 Form 10-K (“2020 Consolidated Financial Statements”) for the relevant assumptions used to determine the valuation of these awards. The total number of DSUs outstanding for each non-management director as of June 30, 2020 is as follows: 23,319 (Mr. Brun); 2,196 (Ms. Carter); 16,190 (Mr. Duelks); 5,172 (Mr. Keller); 10,152 (Ms. Markus); 16,190 (Mr. Perna); 16,190 (Mr. Weber); and 653 (Mr. Zavery). These amounts include DSUs credited during fiscal year 2020 and exclude DSUs granted pursuant to deferral elections under the Deferred Compensation Plan. |

| (3) | Represents the aggregate grant date fair value of option awards granted during fiscal year 2020 computed in accordance with FASB ASC Topic 718. See Note 15, “Stock-Based Compensation” to the 2020 Consolidated Financial Statements for the relevant assumptions used to determine the valuation of these awards. The total number of stock options outstanding for each non-management director as of June 30, 2020, all of which are exercisable, is as follows: 97,875 (Mr. Brun); 9,565 (Ms. Carter); 67,324 (Mr. Duelks); 23,176 (Mr. Keller); 26,558 (Ms. Markus); 67,324 (Mr. Perna); 67,324 (Mr. Weber); and 2,657 (Mr. Zavery). |

| (4) | Represents Company-paid contributions made to qualified tax-exempt organizations under the Matching Gift Program on behalf of the non-management directors. Amounts shown reflect total Company matching contributions in each fiscal year, and therefore may be greater than the calendar year maximum. |

| (5) | Due to an age limitation for election to the Board in our Corporate Governance Principles, Mr. Levine did not seek re-election to the Board and retired from the Board effective as of the 2019 Annual Meeting. |

| 30 | BROADRIDGE 2020 PROXY STATEMENT |

| Corporate Governance |

Our Corporate Governance Principles provide that directors are expected to attend regular Board meetings, and to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities. Our Board met 10 times during fiscal year 2020. Each of our directors attended 100% of the meetings of the Board and of the committees on which they served during fiscal year 2020.

Our Corporate Governance Principles do not specify a policy with respect to the separation of the positions of Chairman and CEO or with respect to whether the Chairman should be a member of management or a non-management director. The Board recognizes that there is no single, generally accepted approach to providing Board leadership, and given the dynamic and competitive environment in which we operate, the Board’s leadership structure may vary as circumstances warrant.

The Board determined that the leadership of the Board is currently best conducted by a Chairman. The Chairman provides overall leadership to the Board in its oversight function, while the CEO provides leadership with respect to the day-to-day management and operation of our business. We believe the separation of the offices allows the Chairman to focus on managing Board matters and allows the CEO to focus on managing our business. To further enhance the objectivity of the Board, the directors, other than Mr. Gokey and Mr. Daly, are independent.

| EXECUTIVE CHAIRMAN |

||

|

Mr. Daly serves as our Executive Chairman. The Board believes Mr. Daly’s service in this role as our former CEO enhances management continuity and provides a valuable resource for Mr. Gokey in his role as CEO.

The Executive Chairman has the following duties and responsibilities as Chairman of the Board: |

||

| Calling

Board and stockholder meetings |

Presiding

at Board and stockholder meetings |

Establishing

Board meeting agendas, subject to approval of the Lead Independent Director |

||||

| In addition, Mr. Daly is an advisor to the CEO on important initiatives including regulatory matters, digital adoption and retail shareholder engagement. | ||||||

| BROADRIDGE 2020 PROXY STATEMENT | 31 |

| Corporate Governance |

| LEAD INDEPENDENT DIRECTOR |

||||

|

Given that Mr. Daly is not an independent director under applicable NYSE and SEC rules, Mr. Brun serves as Lead Independent Director to maintain the strong leadership of independent directors. The Board believes that this structure provides the Company and the Board with strong leadership, continuity of experience given Mr. Daly’s role, and appropriate independent oversight. The Board believes that having a Lead Independent Director vested with key duties and responsibilities and three independent Board committees chaired by independent directors provides a formal structure for strong independent oversight of the Executive Chairman and the Company’s management team.

The Lead Independent Director’s duties and responsibilities include: |

||||

| Presiding at all

meetings of the Board at which the Executive Chairman is not present, including executive sessions of the independent directors |

||

| Serving as liaison between the Executive Chairman and the independent directors | ||

| Approving meeting schedules, agendas and materials for the Board | ||

| The authority to call meetings of the independent directors | ||

| Acting as liaison between the independent directors and the CEO | ||

| If requested by major

stockholders, ensuring his or her availability for consultation and direct communication |

||

| 32 | BROADRIDGE 2020 PROXY STATEMENT |

| Corporate Governance |

The Board has three standing committees, each of which is comprised solely of independent directors and is led by an independent Chair: Audit Committee, Compensation Committee, and Governance and Nominating Committee.

| Audit Committee | |||

| Number of Meetings

in 2020: 7 Committee Chair: Pamela L. Carter |

|||

| CURRENT MEMBERS: | PRIMARY RESPONSIBILITIES | ||

|

Pamela L. Carter Robert N. Duelks Brett A. Keller Maura A. Markus Thomas J. Perna Alan J. Weber (Financial Expert) Amit K. Zavery

|

The Audit Committee has a charter under which its responsibilities and authorities include assisting the Board in overseeing the following:

• The Company’s systems of internal controls regarding finance, accounting, legal and regulatory compliance

• The Company’s auditing, accounting and financial reporting processes generally

• The integrity of the Company’s financial statements and other financial information provided by the Company to its stockholders and the public

• The Company’s compliance with legal and regulatory requirements

• The performance of the Company’s Internal Audit Department and independent registered public accountants |

||

|

In addition, in the performance of its oversight duties and responsibilities, the Audit Committee also reviews and discusses with management the Company’s quarterly financial statements and earnings press releases as well as financial information and earnings guidance included therein; reviews periodic reports from management covering changes, if any, in accounting policies, procedures and disclosures; reviews management’s assessment of the effectiveness of internal control over financial reporting to ensure compliance with Section 404 of the Sarbanes-Oxley Act of 2002; and reviews and discusses with the Company’s internal auditors and with its independent registered public accountants the overall scope and plans of their respective audits.

INDEPENDENCE AND FINANCIAL EXPERT

The Board has determined that each of the members of the Audit Committee is independent as defined by NYSE Listing Standards and the rules of the SEC applicable to audit committee members. The Board has determined that Mr. Weber qualifies as an audit committee financial expert as defined in the applicable SEC rules, and that all Audit Committee members are financially literate. Audit Committee members are prohibited from serving on more than three public company audit committees. |

|||

| BROADRIDGE 2020 PROXY STATEMENT | 33 |

| Corporate Governance |

| Compensation Committee | |||

| Number of Meetings

in 2020: 6 Committee Chair: Alan J. Weber |

|||

| CURRENT MEMBERS: | PRIMARY RESPONSIBILITIES | ||

|

Brett A. Keller Maura A. Markus Alan J. Weber

|

The Compensation Committee has a charter under which its responsibilities and authorities include:

• Reviewing the Company’s compensation strategy

• Reviewing the performance of senior management

• Reviewing the risks associated with the Company’s compensation programs

• Approving the compensation of the CEO, Executive Chairman and all other executive officers

• Reviewing and making recommendations to the Board regarding the director compensation program |

||

|

In addition, the Compensation Committee administers the Company’s equity-based compensation plans and takes such other action as may be appropriate or as directed by the Board to ensure that the compensation policies of the Company are reasonable and fair.

As necessary, the Compensation Committee consults with FW Cook as its independent compensation consultant to advise on matters related to our executive officers’ and directors’ compensation and general compensation programs.

INDEPENDENCE

The Board has determined that each member of the Compensation Committee is independent as defined by NYSE Listing Standards. In addition, each member of the Compensation Committee is independent for purposes of the applicable SEC and tax rules. |

|||

| 34 | BROADRIDGE 2020 PROXY STATEMENT |

| Corporate Governance |

| Governance and Nominating Committee | |||

| Number of Meetings in 2020: 3 Committee Chair: Robert N. Duelks |

|||

| CURRENT MEMBERS: | PRIMARY RESPONSIBILITIES | ||

|

Pamela L. Carter Robert N. Duelks Thomas J. Perna

|

The Governance and Nominating Committee has a charter, under which its responsibilities and authorities include:

• Identifying individuals qualified to become Board members and recommending that the Board select a group of director nominees for each of the Company’s annual meeting of stockholders

• Ensuring that the Audit, Compensation and Governance and Nominating Committees have the benefit of qualified and experienced independent directors

• Developing and recommending to the Board a set of effective corporate governance policies and procedures applicable to the Company

• Receiving reports from and advising management on the Company’s ESG strategy, policies and programs |

||

|

INDEPENDENCE

The Board has determined that each member of the Governance and Nominating Committee is independent as defined by NYSE Listing Standards. |

|||

Executive Sessions of Independent Directors

The independent directors hold regularly scheduled executive sessions of the Board and its committees without Company management present. These executive sessions are chaired by the Lead Independent Director at Board meetings or by the independent Committee Chairs at committee meetings. The independent directors met in executive session at all of the regularly scheduled Board and committee meetings held in 2020. In addition, at least once a year, our independent directors meet to review the Compensation Committee’s annual review of the CEO and Executive Chairman.

Annual Board and Committee Evaluation Process

The Board conducts an evaluation of its performance and effectiveness as well as that of the three committees on an annual basis. The purpose of the evaluation is to track progress in certain areas targeted for improvement from year to year and to identify ways to enhance the Board’s and committees’ effectiveness. As part of the evaluation, each director completes a written questionnaire developed by the Governance and Nominating Committee to provide feedback on the effectiveness of the Board, the committees on which they serve, as well as each individual director’s own contributions. The collective ratings and comments of the directors are compiled and then presented to the Governance and Nominating Committee by its Chair, and to the full Board for discussion and action.

| BROADRIDGE 2020 PROXY STATEMENT | 35 |

| Corporate Governance |

The Board’s Role in Risk Oversight

The responsibilities of the Board include oversight of the Company’s risk management processes. The Board has two primary methods of overseeing risk. The first method is through the Company’s Enterprise Risk Management (“ERM”) process which allows for full Board oversight of the most significant risks facing the Company. The second is through the functioning of the Board’s committees.

|

Enterprise Risk Management Process

The goal of the ERM process is to provide an ongoing procedure, effected at all levels of the Company across each business unit and corporate function, to identify and assess risk, monitor risk, and agree on mitigating action. Central to Broadridge’s risk management process is its Risk Committee, which oversees management’s identification and assessment of the key risks in the Company and reviews the controls management has in place with respect to these risks. The Risk Committee is comprised of executive officers and senior executives of the Company.